Bloomberg Bond News Summary > Thus Dec 5th

Business Briefing

1) RBI Governor Das Sees Some Green Shoots in Investments: TOPLive

2) Stocks Mixed as Trade Talks Mulled; Yields Dip: Markets Wrap

(Bloomberg) -- U.S. and European stock futures were little changed after a mostly positive session in Asia as investors monitor prospects for removing a scheduled American tariff hike on China later this month. Treasuries advanced, clawing back some of their losses from Wednesday, when a report indicated the U.S. and China were closer to a deal that would avoid the next ...

3) GM to Start Battery Venture With LG in Ohio, Reuters Says (1)

(Bloomberg) -- General Motors Co. and LG Chem Ltd. are starting a joint venture in Ohio to make batteries for electric cars, Reuters reported, citing people familiar with the matter. The 50-50 joint venture is set to be announced Thursday, Reuters said. The U.S. carmaker and the South Korean battery giant will each invest more than $1 billion in the planned facility in ...

4) South African Airways to Enter Into Bankruptcy Protection (3)

(Bloomberg) -- South Africa’s government will place the national airline under a local form of bankruptcy protection as a last-ditch measure to try and prevent its total collapse. State-owned South African Airways is entering a business-rescue process to allow a “radical restructuring” under which the carrier will receive 4 billion rand ($274 million) in funding, Public ...

World News Briefing

5) U.S., China Move Closer to Trade Deal Despite Harsh Rhetoric

(Bloomberg) -- The U.S. and China are moving closer to agreeing on the amount of tariffs that would be rolled back in a phase-one trade deal despite tensions over Hong Kong and Xinjiang, people familiar with the talks said. The people, who asked not to be identified, said that U.S. President Donald Trump’s comments Tuesday downplaying the urgency of a deal shouldn’t be ...

6) Senate Defies China Threat, Smoothing Path for Human Rights Bill

(Bloomberg) -- The U.S. Senate is rushing to approve a bill to punish China for the oppression of a Muslim ethnic group, with a bipartisan pair of senators maneuvering to get the measure to President Donald Trump as soon as possible. Republican Senator John Cornyn and Democrat Mark Warner introduced legislation Wednesday that would control exports to China of surveillance ...

7) Warren Is Drafting U.S. Legislation to Reverse ‘Mega Mergers’

(Bloomberg) -- U.S. Senator Elizabeth Warren is drafting a bill that would call on regulators to retroactively review about two decades of “mega mergers” and ban such deals going forward. Warren’s staff recently circulated a proposal for sweeping anti-monopoly legislation, which would deliver on a presidential campaign promise to check the power of Big Tech and other ...

8) Merkel’s Survival Hinges on Election Threat of Greens, Far-Right

(Bloomberg) -- If Angela Merkel sees out her fourth term as German chancellor, fear may likely play a greater role than political skill. Merkel’s Christian Democrats have been plagued by a fierce leadership struggle and the Social Democrats, her junior coalition partner, are toying with the idea of exiting the coalition. Yet with the surge in popularity of the Greens and ...

9) Macron Faces Dreaded Test of French Presidents as Unions Strike

(Bloomberg) -- Emmanuel Macron’s push to transform France’s sclerotic economy is facing the ultimate test of presidents past: “la greve.” In what has been the undoing of previous French governments, unions representing everyone from transport workers to lawyers, doctors, teachers and students are going on an indefinite “greve,” or strike, starting Thursday. The strike will ...

Bonds

10) Asia Dollar Bond Sales Hit Record as Deals Keep Coming: Chart

(Bloomberg) -- Sales of Asian dollar bonds have hit an annual record of almost $322 billion as companies leap at cheaper money on offer from yield-starved investors. A handful of issuers are in the market Thursday, which should add to yearly totals. Returns on Asian dollar bonds are on track for their best year in five. Debates are heating up on the outlook for next year, as concerns about defaults in China and ...

11) End of Imaginary Stimulus May Be a Real Risk to Markets in 2020

(Bloomberg) -- The Federal Reserve may be inadvertently setting the stage for more market turmoil in 2020 because it can’t persuade investors to ignore its multitrillion-dollar balance sheet. The Fed’s withdrawal from “non-QE” is the biggest risk facing investors next year, according to strategists from John Hancock Investment Management. They say the central bank’s ...

12) Kiwi Rises as Rate-Cut Bets Fall, Data Hits Aussie: Inside G-10

(Bloomberg) -- New Zealand’s dollar climbed to a four-month high as investors trimmed bets on interest-rate cuts after the central bank gave local lenders more time to meet capital requirements. The Australian dollar fell after weak retail sales data.

- Kiwi gained for a sixth day after Reserve Bank of New Zealand Governor Adrian Orr said monetary policy was currently in a ...

13) Bond Rout That Didn’t Happen in Japan Casts Stimulus Doubt

(Bloomberg) -- A stimulus package worth more than $200 billion would have led to a bond rout in any market. Not in Japan, where the yield curve held at its flattest level in three months. The reason? Traders don’t expect Prime Minister Shinzo Abe’s government to actually spend the headline figure of 26 trillion yen ($239 billion), which means there won’t be massive debt ...

14) Time for Unconventional RBI Measures, Bond Manager Says

(Bloomberg) -- It’s time for the Reserve Bank of India to take unconventional policy measures as rate cuts are failing to stimulate the economy, according to the head of fixed income at IDFC Asset Management Co. The central bank, which reviews policy on Thursday, should look to pull down long-term yields by selling short-tenor bonds and reinvesting in longer-term ones, said ...

15) The Utility Behind Fukushima Disaster Is Mulling Green Debt

(Bloomberg) -- A new subsidiary of the Japanese power company behind the worst nuclear disaster since Chernobyl is considering funding hydro and wind energy projects with green or sustainable bonds. Almost nine years since a major earthquake and tsunami crippled Tokyo Electric Power Co. Holdings Inc.’s Fukushima plant, Japan’s biggest utility is shifting its renewable ...

Central Banks

16) TOPLive Starts: Follow RBI's Monetary Policy Decision, Briefing

17) India Stocks Fall as RBI Cuts Growth Forecast, Holds Rate

(Bloomberg) -- The S&P BSE Sensex declined as much as 0.3% after Reserve Bank of India cut its forecast for economic growth while unexpectedly keeping its key policy rate unchanged.

- HDFC Bank contributed the most to the Sensex decline, falling 0.8%, while Yes Bank had the largest drop, decreasing 2.3%

- Fourteen of 19 sector sub-indexes compiled by BSE Ltd. fell, led by a gauge of telecom ...

18) India’s Central Bank Unexpectedly Holds Rate as Inflation Spikes

(Bloomberg) -- India’s central bank unexpectedly kept its benchmark interest rate unchanged as headline inflation breached its medium-term target for the first time in more than a year. The repurchase rate was left at 5.15%, the Reserve Bank of India said in a statement on Thursday. None of the 43 economists surveyed by Bloomberg predicted the move, with all expecting a ...

Economic News

19) Japan Leans on Fiscal Stimulus to Keep Recession at Bay

(Bloomberg) -- Japan’s Prime Minister Shinzo Abe announced stimulus measures to support growth in an economy contending with an export slump, natural disasters and the fallout from a recent sales tax increase. The total stimulus package amounts to around 26 trillion yen ($239 billion) spread over the coming years, with fiscal measures around half that figure, according to a ...

20) India’s RBI Unexpectedly Holds Key Rate as Inflation Spikes

(Bloomberg) -- India’s central bank unexpectedly kept its benchmark interest rate unchanged as headline inflation breached its medium-term target for the first time in more than a year. The repurchase rate was left at 5.15% in a unanimous decision, the Reserve Bank of India said in a statement on Thursday. None of the 43 economists surveyed by Bloomberg predicted the move, ...

21) ECB Resolve on Negative Interest Rates Is Waning Under Lagarde

(Bloomberg) -- Five weeks since Mario Draghi retired from running the European Central Bank, finding an outright fan of his legacy of negative interest rates has become a lot harder. Governing Council members, who collectively lowered the key rate to minus 0.5% shortly before Draghi’s term ended, are increasingly portraying it as a necessary evil that shouldn’t be ...

22) France’s Prospects Rest on Working Smarter Not Longer: Economics

(Bloomberg Economics) -- President Emmanuel Macron has vowed to reform the French pension system where many of his predecessors have failed in the face of fierce public resistance. Again, unions plan a series of strikes this winter. His reforms aim to make the pension system financially sustainable. They would also mean gradually raising the retirement age, supporting GDP growth for decades to come. That’s a help, but our ...

23) The Making of the Man Europe Picked to Confront Trump on Trade

(Bloomberg) -- Terms of Trade is a daily newsletter that untangles a world embroiled in trade wars. Sign up here. When Phil Hogan was fighting for his political life, he knew just who to turn to: his enemy. Battling a party rebellion before Ireland’s 2011 election, Hogan reached out to an old contact among the plotters, one of the ...

European Central Bank

24) The ECB's Already Acting Against Negative Rates: Marcus Ashworth

(Bloomberg Opinion) -- Euro zone finance minsters are pushing back against the negative rate regime of the European Central Bank just as Christine Lagarde takes the reins from Mario Draghi. This is yet another rerun of the battle between the economically strongest (essentially northern) European nations and their weaker partners over who should shoulder the burden for maintaining ...

25) ECB Says It May Need Own Digital Euro If Payment Drive Fails (1)

(Bloomberg) -- The European Central Bank is willing to develop its own digital currency if the private sector can’t make cross-border payments faster and cheaper. In an internal document obtained by Bloomberg on Wednesday, the ECB argues that technological innovation is quickly transforming the way retail payments are made, including a decline in the use of cash. The ...

26) Knot Says Inflation Goal Always First as ECB Mulls Climate Risks

(Bloomberg) -- Dutch governor Klaas Knot joined his European Central Bank colleagues in arguing that efforts to fight climate change can’t come at the expense of the institution’s main focus on inflation. Speaking in Amsterdam on Wednesday, Knot said transitioning away from environment-polluting energy sources is the most important challenge for euro-area economies. While ...

27) ECB’s Visco Charts Italian Compromise on Europe’s Debt Conundrum

(Bloomberg) -- Bank of Italy Governor Ignazio Visco on Wednesday sketched out a possible compromise that could help complete a long-delayed drive to shore up the European Union’s financial system. Visco signaled his willingness to agree to limits on how much sovereign debt banks can hold without provisions -- something that Italy, with Europe’s largest debt burden, has so ...

Federal Reserve

28) Quarles Concedes Fed Might Be Part of the Problem in Repo Crunch

(Bloomberg) -- The Federal Reserve’s banking regulation chief granted that Wall Street may have been right that the agency shares blame in September’s alarming strain in money markets. Vice Chairman Randal Quarles agreed Wednesday that Fed supervisors have potentially created an impression that banks should prize cash reserves over stockpiled Treasuries when the firms try ...

29) Quarles Cites Liquidity Stress Tests for Adding To Repo Strain

(Bloomberg) -- Federal Reserve Vice Chairman for Supervision Randal Quarles says stricter post-crisis banking rules might have contributed to money-market strain in September, though they were probably not the prime cause of the turmoil.

- “There were a complex set of factors that contributed to those events in September. Not all of them were related to our regulatory ...

30) Fed Watch: Summary of Recent Remarks by Fed Policy Makers

(Bloomberg) -- This is Fed Watch, a summary of remarks since the Oct. 29-30 policy meeting:

- Next rate decision: Dec. 11

- Federal Open Market Committee portal, click HERE

- For upcoming events, click HERE

31) Fed partly blames stress tests for spike in borrowing costs

Preview text not available for this story.

First Word FX News Foreign Exchange

32) Tories Pledge Brexit and Budget in 100 Days: U.K. Campaign Trail

(Bloomberg) -- U.K. Prime Minister Boris Johnson pledged to deliver Brexit and a budget within 100 days if he wins the Dec. 12 election, and contrasted that with the “gridlock and uncertainty” that would result from the “very real possibility” of a hung Parliament. With a week to go until the vote, the Tories said their first 100 days would include a defense review, more ...

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

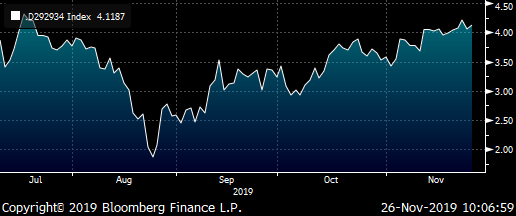

**BONDS, BREAKEVEN AND EQUITIES : COULD STOCKS HOLD THE KEY TO THE NEXT MOVE IN BOND YIELDS? **

BONDS, BREAKEVEN AND EQUITIES : COULD STOCKS HOLD THE KEY TO THE NEXT MOVE IN BOND YIELDS? AGREED WE HAVE BEEN HERE BEFORE BUT DO KEEP AN EYE ON STOCK PERFORMANCE INTO YEAR END.

THIS IS A VERY CRUCIAL MONTH GIVEN NEARLY ALL WEEKLY AND DAILY RSI’S ARE NEUTRAL, DIRECTION IS LIKELY TO BE REFLECTED IN THE MONTHLY CLOSES. AN ADDITIONAL FACTOR IS THAT STOCKS MAYBE TOPPING WHICH SHOULD IN THEORY FORCE BOND YIELDS LOWER, WE SHALL SEE ON BOTH COUNTS.

BONDS :

THE MARKETS HAVE LOST A LOT OF THEIR AUGUST RSI DISLOCATION AND MANY WEEKLY-DAILY EXTREMES ARE NOPW NEUTRAL. GIVEN THIS FACT THE NEXT MOVE IS LIKELY TO BE REFLECTED IN THE YEAR END CLOSES. THE 2 YR YIELD CHARTS ARE KEY AS THEY LACKJ ANYU BOUNCE AND PREDICT FROM END YIELDS TO HEAD LOWER.

US BREAKEVENS AND USGGT :

BREAKEVENS DO STILL SEEM TO WANT TO BOUNCE AND MOVE HIGHHER.

EQUITIES : I HAVE LEFT THESE OF LATE GIVEN THEIR LACK OF INFLUENCE ON THE BOND YIELD BOUNCE BUT THEY MAY NOW BE TOPPING FORCING A POTENTIAL YIELD DROP?

FTSE (PAGE 35) LOOK LONGTERM VERY TOPPISH.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

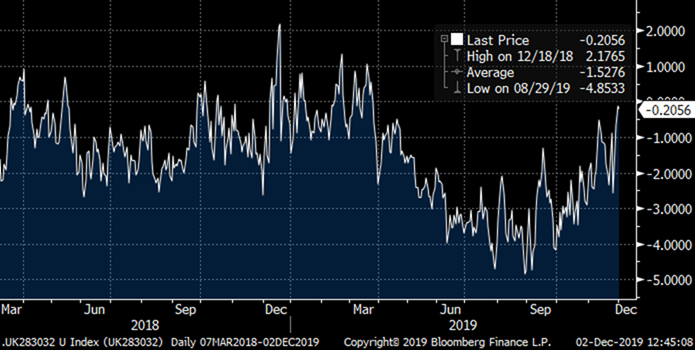

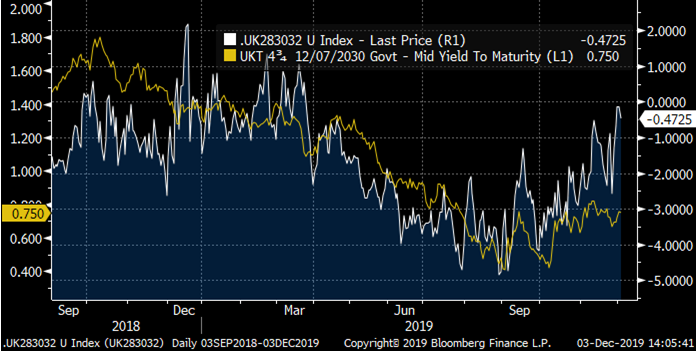

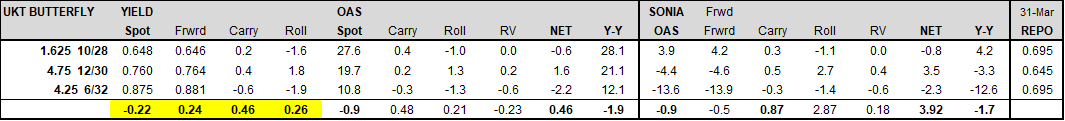

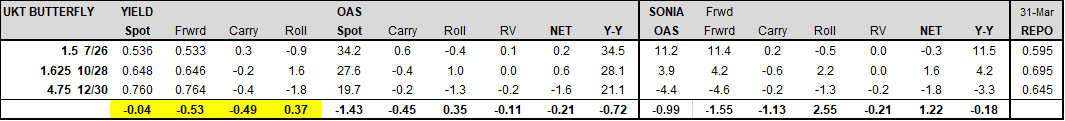

Long belly trade - buy UKT 28s30s32s

(FYI I’ve been able to buy the belly on this fly below -0.5 bps this morning – it has richened 0.3 bps since the open)

There are now attractive opportunities to go long belly of the new CTD 4.75 12/30 – this bond cheapened into the calendar spread as shorts rolled from Dec to Mar (as we also witnessed the richening of the 1.625 10/28 outgoing CTD on ASW) – however this bond has little float and will be CTD for 9 cycles, so should trade with some repo premium, similar to 4q27.

TRADE: Buy belly of UKT 28s30s32s @ -0.5 bps:

ADD: +0.5 bps

STOP: +2.0 bps

TARGET: -4.0 bps

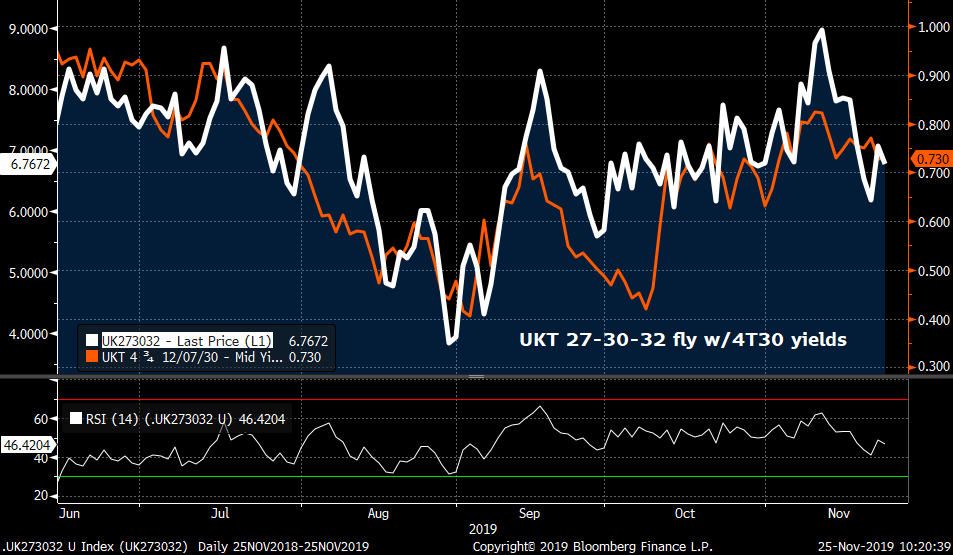

FAIR VALUE VS THE LEVEL OF RATES:

While being long the CTD on bflys can have a directional bias, one can see from the chart below that the 28s30s32s fly looks 2.5 bps cheap to the level of 30s yield:

CARRY: The position enjoys 0.4 bp carry per quarter (assuming 4t30s trade only 5 bps special; the risk is that it trades more special, improving carry).

ROLL: Looking at 2yr wings further in the curve, we see that 26s28s30s is close to flat, while 24s26s28s are much richer:

PREVIOUS HIGH COUPON CTD PERFORMANCE: The 4q27s became CTD in Sep 2017 (vs G Z9); the 25s27s30s fly cheapened Q1 2018 on 1) squeeze of 2 9/25, and 2) Feb 2018 APF (which excluded 4q27).

Thereafter it richened even after it fell out of the futures basket in March 2019:

Best,

Jim

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

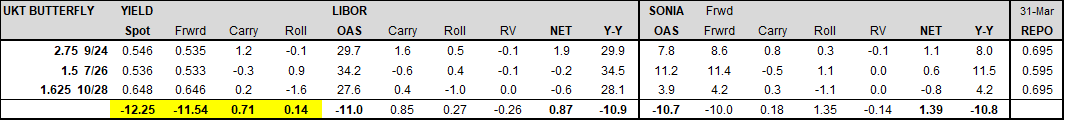

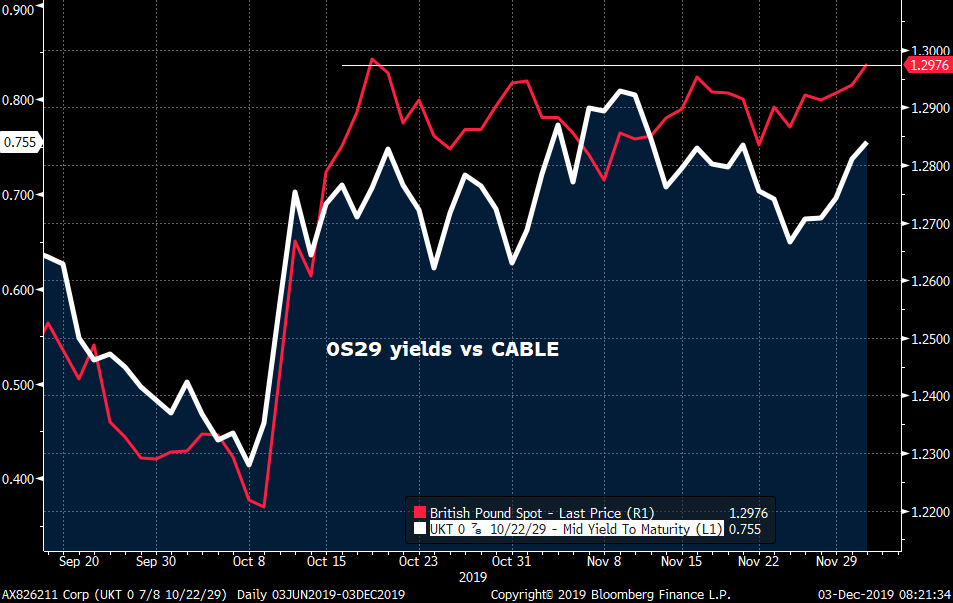

MICROCOSM: GILTS > UKT 0S29 Tap at 10:30am

GILTS > UKT 0S29s @ 10:30

> Real mixed bag for this one.

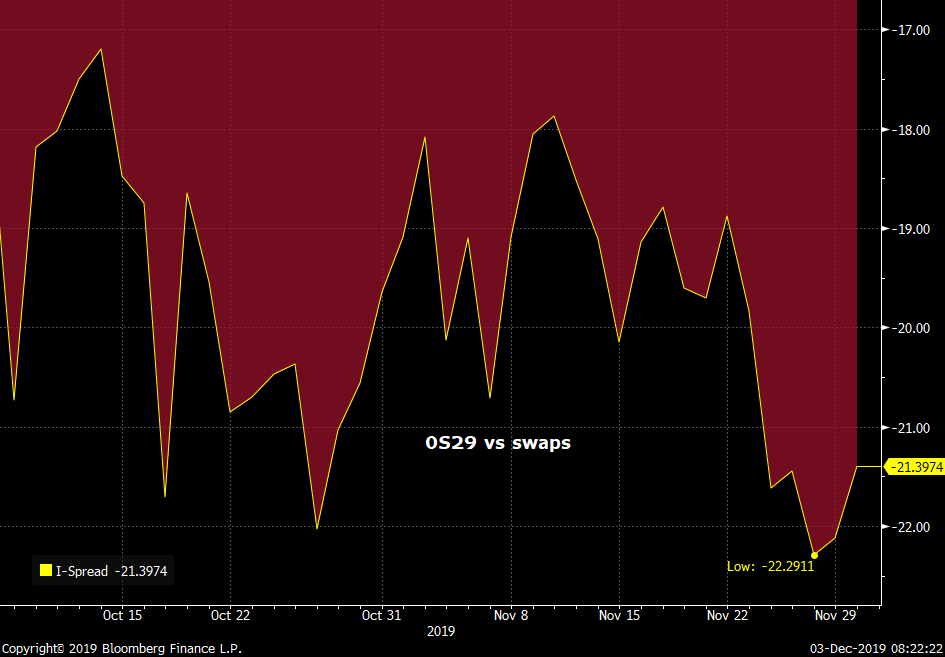

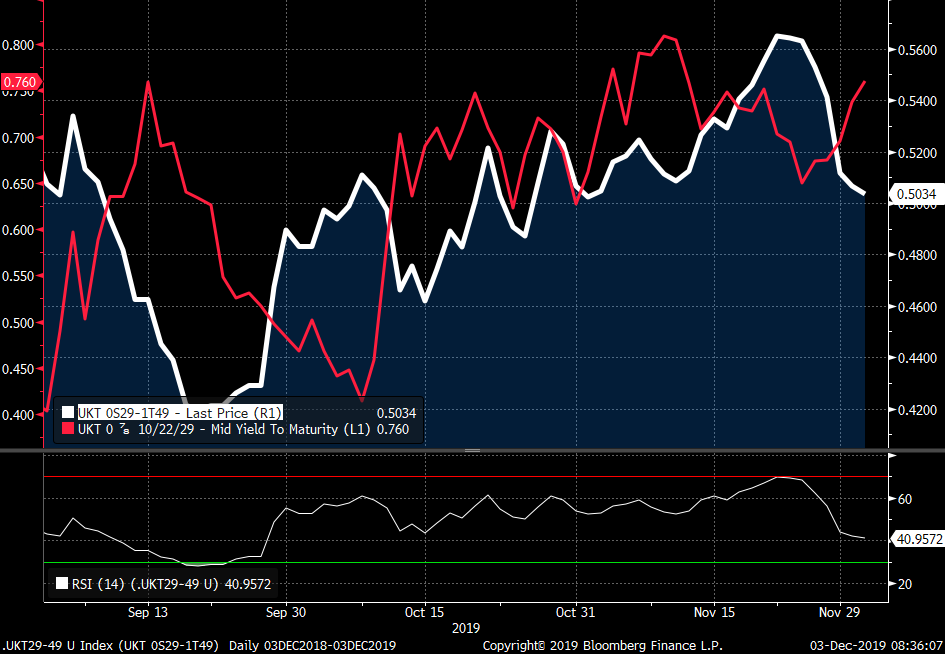

> 0S29 yields have risen about 9bps in the past week but these 29s have richened 2.4bps to swaps and just 1bp off their richest ever.

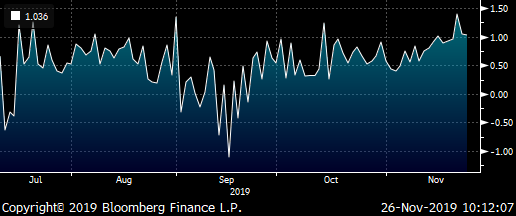

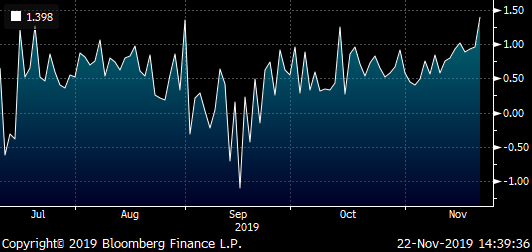

0S29s vs swaps

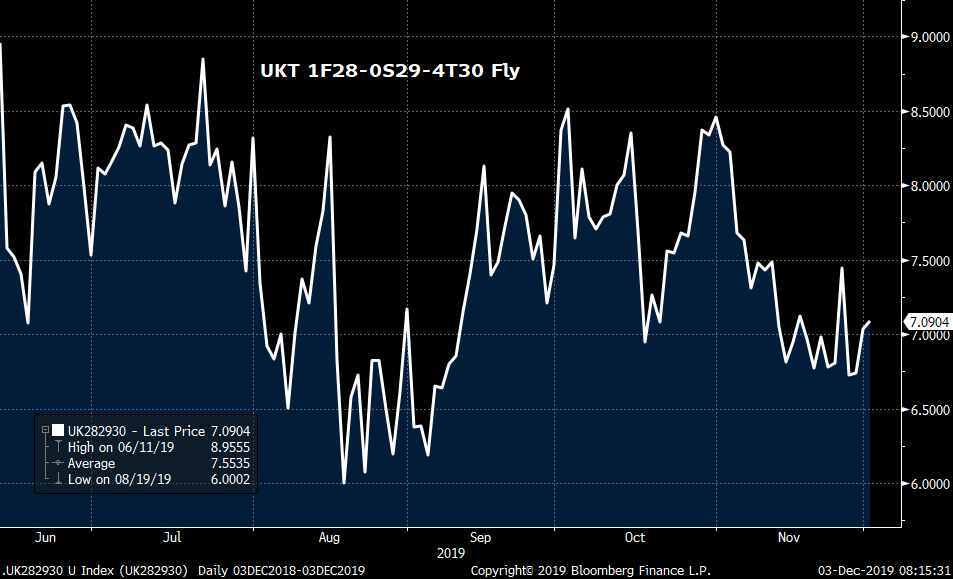

> The 0S29s have done well on the curve in Nov, quietly outperforming 1F28s and 4T30s on the fly (+8.8 to +6.6 before late move to 7.2bps) as the mkt focused on the Z9-H0 calendar sprd. After today’s tap there are two more scheduled next year (Jan 7 and Feb 25) which will likely open the door for a new benchmark in Mar/Apr. So, we’re closing in on the end of their cycle and although they won’t be CTD, they’re cheap enough that they should grind richer over the next quarter.

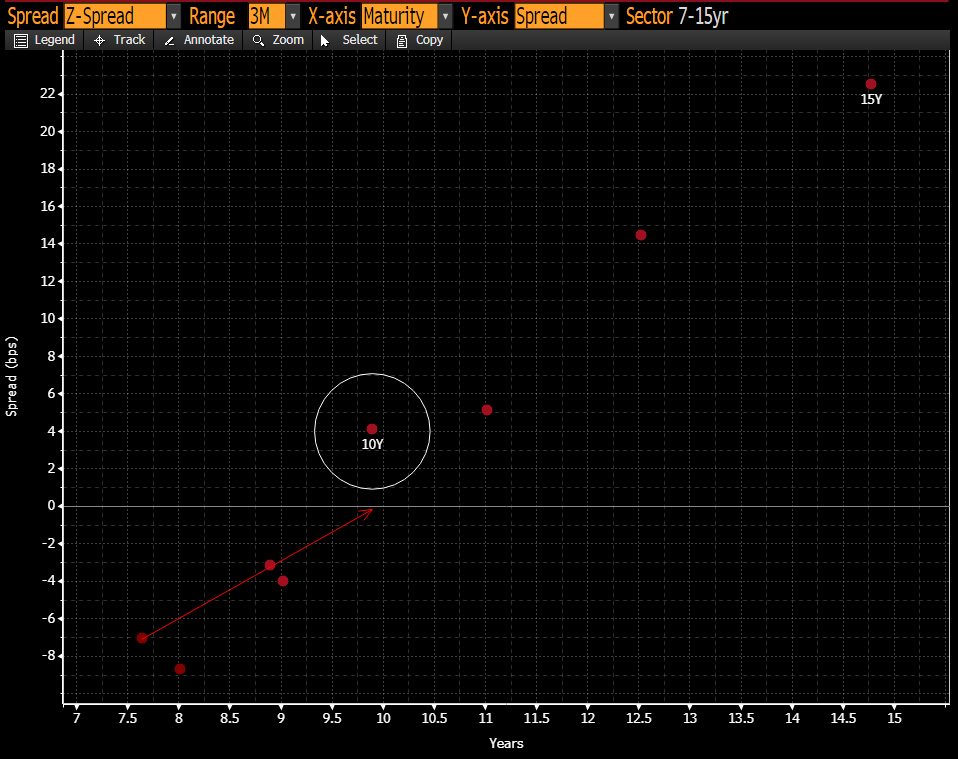

7-15yr sector Z-sprd curve… If we take a linear approach to the low cpn issues, one could argue these 0S29s are still ~3bps too cheap.

> UKT 29s-49s has flattened sharply over the last week (from +56.5 to 51.4 this am) which reflects not just the back up in gilts yields but anticipated cpn flows Dec 7th that favour Dec maturities from 15yr+ (£666mm 7-15yr but £1.343bn 15-30yrs).

> Cable has been knocking on 1.30 since mid-Oct which is looking like formidable resistance with the election looming next week. Moody’s is out with some cautious remarks on the UK’s outlook this morning:

{GB} Reuters: MOODY'S SAYS UK BANKING OUTLOOK CHANGES TO NEGATIVE FROM STABLE AS OPERATING ENVIRONMENT WEAKENS

- MOODY'S -PERSISTENTLY LOW INTEREST RATES & INCREASED MORTGAGE MARKET COMPETITION ARE ERODING NET INTEREST MARGINS OF MOST UK LENDERS

- MOODY'S SAYS UK'S ECONOMY IS WEAKENING, MAKING IT MORE SUSCEPTIBLE TO SHOCKS, PROLONGED UNCERTAINTY OVER BREXIT HAS REDUCED GROWTH PROSPECTS

> Net-net, this isn't a slam-dunk for us risk-wise so we're playing this one from the cautious side, especially as it feels the market’s been in risk-reduction mode. We may get another crack at this supply at cheaper levels.

More to come…

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > Q4 2019/20 Supply Calendar Announced!

GILTS> Q4 FY '19-20 SUPPLY ANNOUNCED!

> Jan 7 - 0S29 Tap

> Jan 9 - Linker 28 Tap

> Jan 14 - 0F25 Tap

> Jan 21 - NEW 10/41 BENCHMARK (Finally!)

> Feb 4 - Linker 36 tap

- Feb 20 week - long conventionals syndication (likely an ultra - 54s, 71s, etc)

> Feb 25 - 0S29 Tap (perhaps its last)

> Mar 4 - 0F25 Tap

> Mar 12 - Linker 28 Tap

> Mar 17 - 1T49 Tap

Comments:

> These are roughly what we were expecting, especially the new 2041s. We've seen a nice steepening of 37s-42s into this announcement which could get another nudge wider in response. That said, 37-42-49s was looking on the cheap side.

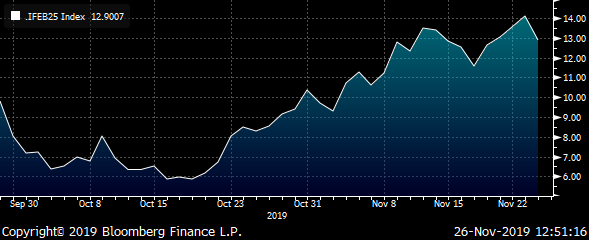

> Big gap between taps of the 1T49s - after next Thursday's 49s it'll be over 3 months due to the ultras syndic. The 1T49s are worth a look if they cheapen further into next week's tap

Charts:

More to come!

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: OATs - 'Bearish Dec Seasonals' Note Update

OATS... 'Bearish Dec Seasonals' Note Update

> Last Friday's note highlighted the seasonal bias for wider OATs sprds vs DBRs/NETHER for most of the last 10yrs (attached).

> With the end of Nov looming and spreads still at compressed levels, we still think the theme/bias still makes sense from both a profit-taking stance for OATs longs and/or a tactical short into year-end.

> The FRTR 5/26-11/28 sprd has flattened in both yield and Z-sprd, the box back close to 2019 lows. (chart)

> FRETR 5/28-NETHER 7/28 sprd continues to hover at/near the 2019 lows at 10.5bps and the FRTR 5/27-NETHER 7/27s version is off it's tightest but is still just +8.9bps.

> Broadly speaking, these low-beta credit spreads reflect overall credit biases (like ITRX XOVER) so a broader widening would certainly help, however, OATs issuance in January tends to be substantial which is often the impetus for the Dec widening.

More to come…

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar 2 - RV trades in Europe 26th Nov, James Rice @Astor Ridge

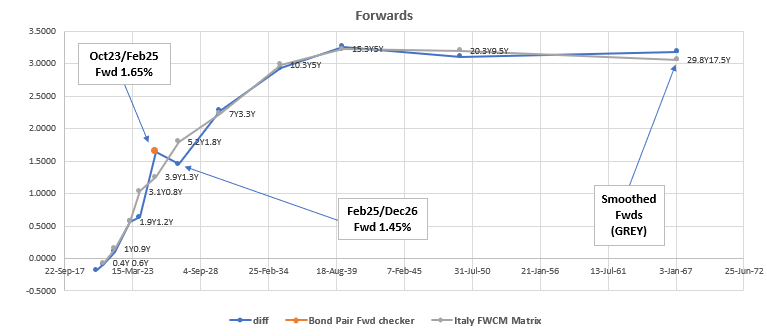

Trade – {IT} Italy... - Absorbing cheap 5y Italian supply on Thursday

5s are cheap on the curve and in micro too.,,

Italy taps the 0.35% feb25 along with the 10y on Thursday

Trade Structure

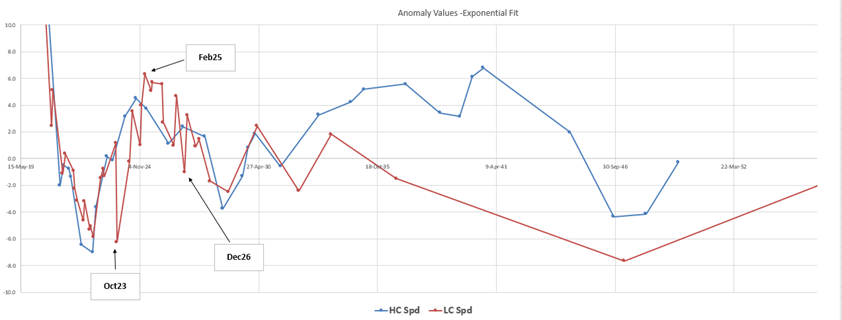

The anomaly

{IT} Italy

-LowCpn Oct23/+feb25/-Dec26

Weights (x2) : -.5 / +1 / -.5

Cix (x 200): (YIELD[BTPS 0.35 02/01/25 Corp] - 0.5 * YIELD[BTPS 0.65 10/15/23 Corp] - 0.5 * YIELD[BTPS 1.25 12/01/26 Corp])

BBG history

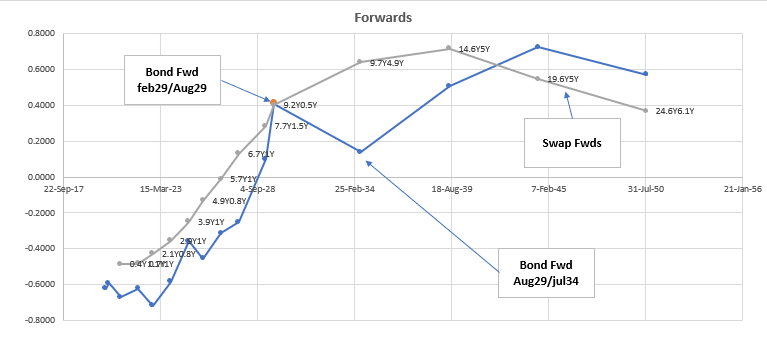

Bond forwards vs Eonia Forwards (using relative bond maturities for exact comparison)

Swap forwards are for Eonia (BBG Page - FWCM)

Rationale

- Feb25 and 5yrs in general trading cheap ahead of Thanksgiving and light dealer inventories

- Low coupon Oct23 now represent an anomaly that is as rich as the 2yr sector

- Previously sought after low coupons (oct23 and dec26) can be supplanted by recent low coupons in a default/widening scenario

- The relative forwards suggest this anomaly is among the most extreme in the context of the curve

(*forwards are calculated using the two bond yields only, assuming a flat curve structure as a first approximation)

Curve Anomaly Values:

Proprietary double exponential fit

Levels

Current Fly level: +13bp

Entry: +13bp

Add: +17bp

Target short term: +6bp

Target long term: -5bp

Carry and Roll

Carry: +0.4bp @ 5bp repo spread

Roll: 0bp

Risks

- As a tap bond the feb25 stay offered

- The oct23 and dec26 stay rich as anomalous and well-placed issues

- The repo on the short sides gets sticky over yr end or beyond

Any feedback is welcome

Speak Soon

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

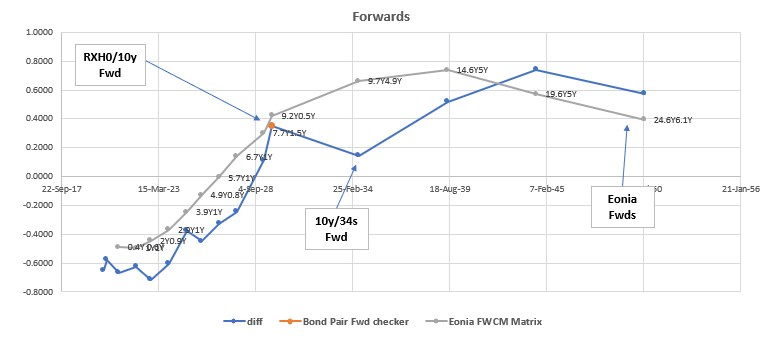

Trade Radar - RV trades in Europe 26th Nov, James Rice @Astor Ridge

Trade – Steep supply gradient is forcing the 9Y6M bond forward* too close to Eonia…

(*Bond forwards are calculated from yields – discounting using the first and the second yield only)

Trade Structure

Sell dbr Feb29 & dbr Jul34

Buy dbr Aug29

Weights: -0.9 / +1 / -0.1

Cix: 200 * (yield[DBR 0 08/15/29 Govt]-0.9*yield[DBR 0.25 02/15/29 Govt]-0.1*yield[DBR 4.75 07/04/34 Govt])

BBG history

Bond forwards vs Eonia Forwards (using relative bond maturities for exact comparison)

Swap forwards are for Eonia (BBG Page - FWCM)

Rationale

The supply profile of negative yielding bonds in Germany forces the on the run segment to be cheap and 9s10s to be very steep

RV in Europe is often a ‘clean-up in aisle 3’ exercise, where we need to find the boundary condition for cheap, recent issues

- The Aug29 will be tapped by €3bln on the 4th Dec – This year the Finanzagentur started 2019 with a new 10y. Similarly we expect in January 2020 a new 10y, allowing the Aug29 to roll down the curve with only this one last tap event

- Cash / repo often gets tight over year end – hence the optimal expression of this trade is to sell Back Month RX (RXH0 – ctd feb29) & Dbr jul34 as a blend vs the long of Dbr Aug29

- The dbr jul34 as it heads into the 25y space starts to look rich vs the extrapolation of shorter tenors, but is a relatively small component of the short blend

- Other expressions would be -RXH0 +dbr Aug29 vs MMS – see graph

- On the run 10y has the capacity to be scarce in December with a lighter issuance schedule

Cix: (SP210[DBR 0 08/15/29 Corp] - SP210[DBR 0.25 02/15/29 Corp])

SP210 is the BBG code for Swap spread (MMS)

- If we look at how this has behaved in the past – (a 6m Gap vs HC 15y trade) that would be 3.5yrs shorter…

-Aug25 / +Feb26 / -Jan31

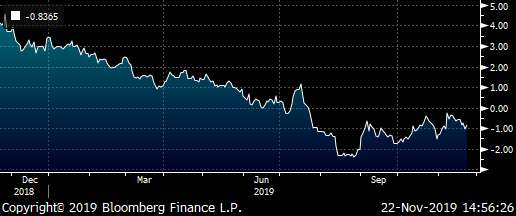

This fly is currently -0.8bp and evolved as follows…

Hence the Long Terms target of -1bp

Levels

Current Fly level: +4.1bp

Entry: +3.8bp

Add: +5bp

Target short term: +2bp

Target Long Term: -0.5bp

Carry and Roll

Carry: +0.1bp @same repo

Roll: 0bp

Risks

- Back month contracts stay bid into December and beyond

- The on the run ten year stays cheap

Any feedback is most welcome

Speak Soon

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > Z9-H0 Rolls & a Busy DEC on Tap - Quick RV

- GILTS > Calendar Sprds 10yrs and other Stuff…

- Reminder - first notice day for G Z9 is Nov 28th and 1st delivery Mon Dec 2. With the US Thanksgiving holiday on Thurs, we'd expect much of the Z9-H0 flows to be wrapped up by Wed's close. We'll get the updated OI levels at 11am for Friday's close but as of Fri's open there was still 743.6k Z9 outstanding, leaving lots of wood to chop.

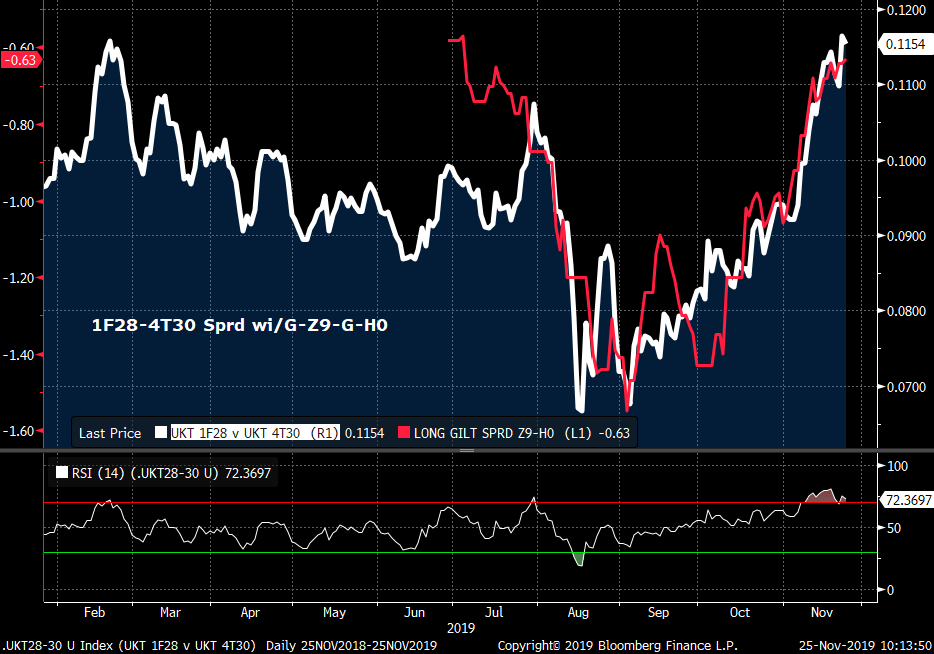

- As we highlighted late last week, recent flows in the sector (sellers of 4T30s basis, for ex), helped to drive a sharp increase in G Z9 open interest, peaking just above the 800,000 contracts level. These recent flows appeared to shift the G Z9 contract from a leveraged net-short to a more neutral stance, muddying the waters on where ‘fair value’ really is on the spread (currently -62 ticks), the richest so far.

- Aside from the implications for the futures side of the equation, shifts in the calendar spread are driving moves in the underlying cash spread and their basis. The charts below show that there has been a knock-on effect of the calendar spread that impact parts of the curve that don’t involve the UKT 1F28s (G Z9 CTD) or even the new CTD, the UKT 4T30s. There has been a modest directionality over the last 4-5 sessions, 1F28s outperforming in a rally, however, we’re seeing signs that current yield spread levels in the 1F28s-4T30s (+11.5/6) and 0S29-4T30 (+2.3/4) are proving ‘sticky’, offering attractive location to scale into flatteners.

- Spicing up the outlook for gilts some more, we’ve got a very busy December on tap after tomorrow’s 0F25s tap, just in time for the markets’ shift into balance-sheet reduction mode.

- Nov 26 - £3.00bn tap of the 0F25s

- Dec 3 - £2.75bn tap of the 0S29s (Size TBC)

- Dec 5 - £2.25bn tap of the 1T49s (Size TBC)

- Dec 7 - £3.2bn cpn payments due Dec 7th

- Dec 11 - £2.25bn tap of the UKTi 48s (Size TBC)

- Dec 12 – Parliamentary Election

- Dec 17 - £3.00bn tap of the UKT 225s

UKT 1T37s have sprung back to life, our UKT 37-42s steepener now 8.8bps mid vs ~6.0bps area entry. That’s richened the 32-37-42 fly 2.2bps in the last couple weeks and the UKT 1F28-4Q32-1T37 fly is off its cheapest but still sharply cheaper than it was 2 weeks ago.

4Q32 vs 1F28/1T37

The announcement of more 1T49s on Dec 17th granted a reprieve to UKT 52s-71s longs who were concerned ultras could be tapped. We’ve seen a re-inversion of the 1T49 vs 52s/54s/57s sprds ion response, taking 49s-52s back to the recent richest at -4.2bps which has been solid support on the charts.

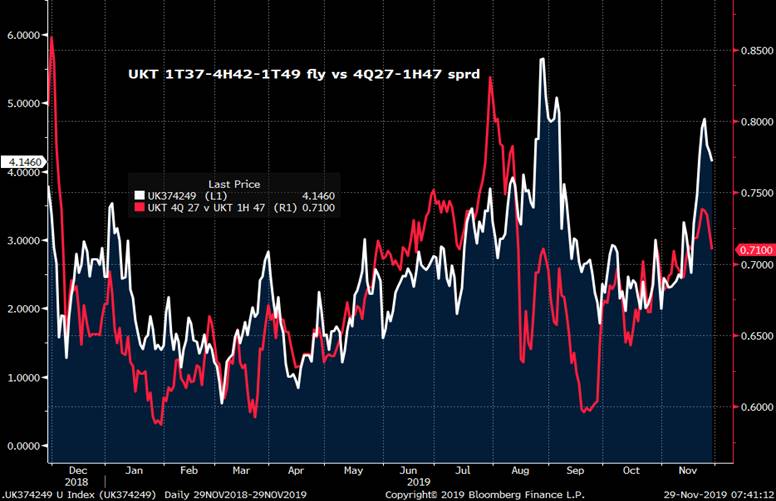

Take a look at 1T49s vs 1H47s and 3T52s – back to their cheapest levels since August. The fly has cheapened more than the level of rates would imply.

More to come!

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - RV trades in Europe, James Rice @Astor Ridge

Trade – Steep supply gradient is forcing the 9Y6M bond forward* too close to Eonia…

(*Bond forwards are calculated from yields – discounting using the first and the second yield only)

Trade Structure

Sell dbr Feb29 & dbr Jul34

Buy dbr Aug29

Weights: -0.9 / +1 / -0.1

Cix: 200 * (yield[DBR 0 08/15/29 Govt]-0.9*yield[DBR 0.25 02/15/29 Govt]-0.1*yield[DBR 4.75 07/04/34 Govt])

BBG history

Bond forwards vs Eonia Forwards (using relative bond maturities for exact comparison)

Swap forwards are for Eonia (BBG Page - FWCM)

Rationale

The supply profile of negative yielding bonds in Germany forces the on the run segment to be cheap and 9s10s to be very steep

RV in Europe is often a ‘clean-up in aisle 3’ exercise, where we need to find the boundary condition for cheap, recent issues

- The Aug29 will be tapped by €3bln on the 4th Dec – This year the Finanzagentur started 2019 with a new 10y. Similarly we expect in January 2020 a new 10y, allowing the Aug29 to roll down the curve with only this one last tap event

- Cash / repo often gets tight over year end – hence the optimal expression of this trade is to sell Back Month RX (RXH0 – ctd feb29) & Dbr jul34 as a blend vs the long of Dbr Aug29

- The dbr jul34 as it heads into the 25y space starts to look rich vs the extrapolation of shorter tenors, but is a relatively small component of the short blend

- Other expressions would be -RXH0 +dbr Aug29 vs MMS – see graph

- On the run 10y has the capacity to be scarce in December with a lighter issuance schedule

Cix: (SP210[DBR 0 08/15/29 Corp] - SP210[DBR 0.25 02/15/29 Corp])

SP210 is the BBG code for Swap spread (MMS)

- If we look at how this has behaved in the past – (a 6m Gap vs HC 15y trade) that would be 3.5yrs shorter…

-Aug25 / +Feb26 / -Jan31

This fly is currently -0.8bp and evolved as follows…

Hence the Long Terms target of -1bp

Levels

Current Fly level: +4.1bp

Entry: +3.8bp

Add: +5bp

Target short term: +2bp

Target Long Term: -0.5bp

Carry and Roll

Carry: +0.1bp @same repo

Roll: 0bp

Risks

- Back month contracts stay bid into December and beyond

- The on the run ten year stays cheap

Any feedback is most welcome

Speak Soon

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796