MICROCOSM: GILTS > Preview of Tuesday's UKT 0F25s Tap

GILTS > 0F25s Tap Preview

- £3bn tap on Tuesday takes the issue to ~16bn (after post-auction takeup) which likely leaves 2 more taps before a new 5yr in Mar/Apr.

- The surprise announcement of the UKT 225s tap on Dec 17 sparked a sharp cheapening of 225s vs 0F25s from ~-7bps to -6.0bps where it is this am.

- While this additional 225s supply should be net-bearish short-term, the additional £3bn supply means the issue will be eligible for the reinvestment of the APF account’s ~15.4bn (face value) of the UKT 4T20s after falling out of the basket post September’s operation. This puts the issue back ‘in play’ for both GEMMs and RV players and will likely delay any further cheapening of the issue in repo and/or on Z-sprd. It also means the UKT 1H26s won’t be ‘the only game in town’ and could/should cheapen them up a touch in response. So, bottom line is this cheapening of the 225s looks like a buying opportunity to us, despite how rich the issue still appears on the curve.

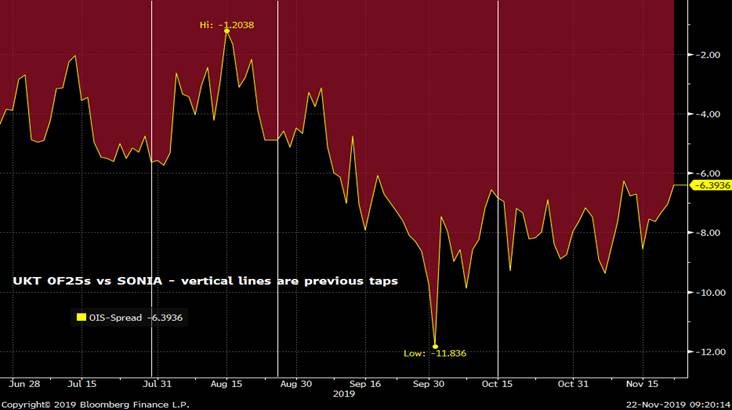

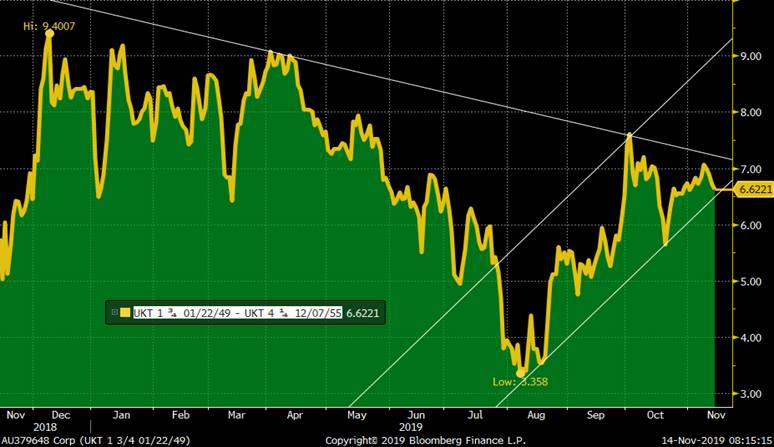

- On its own merits, however, the UKT 0F25s didn’t show signs of an obvious auction concession vs SONIA until the last two taps (see chart below) and it looks like we’ll likely take them down at similar levels to where we were at October’s tap.

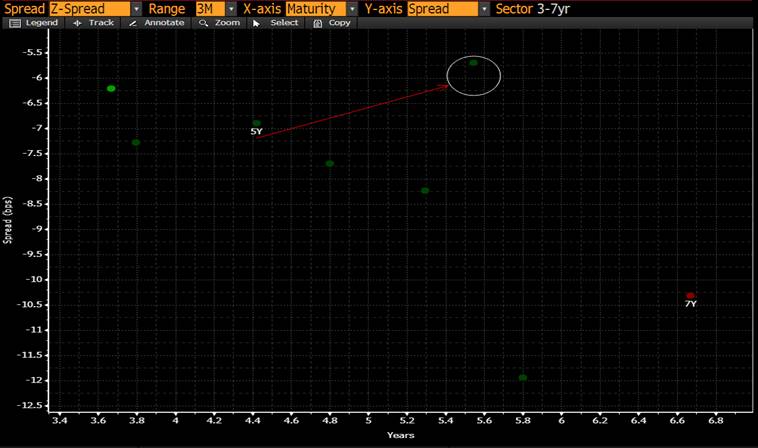

We can see from the BBG Z-Sprd chart of the 3-7yr sector below that the 0F25s remain the cheapest issue in the sector by a comfortable margin which should eventually tighten in close to where the 124s trade. With 3 more taps left (including Tues) and an APF on the horizon where the BoE owns none of the issue, this event is approaching and won’t go unnoticed by the central banks community who drive much of the demand in the 1-5yr sector.

Some wood to chop before Tuesday but it looks to us like this tap should go smoothly…

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: BUSY Morning for Spain and France - Quick RV Colour

SPAIN & FRANCE

- BUSY morning for mostly intermediate sector in Spain and France with the following supply on tap:

09:30am Ldn - Bonos - 3-4bn of:

SPGB 0.25% 7/24

SPGB 0.60% 10/29

SPGB 3.45% 7/66

09:50am Ldn - OATs - 7-8.5bn of:

FRTR 0% 3/23

FRTR 0% 3/24

FRTR 0% 3/25

Quick RV:

- SPGB 7/24s have cheapened 10+bps vs OBLs and 11bps vs swaps post Spain's election which could be a source of demand this am. We've also seen a nice cheapening of SPGB 7/24s vs 7/23s and 4/25s, the fly back to its widest since May/Aug.

7/23-7/24-4/25 fly

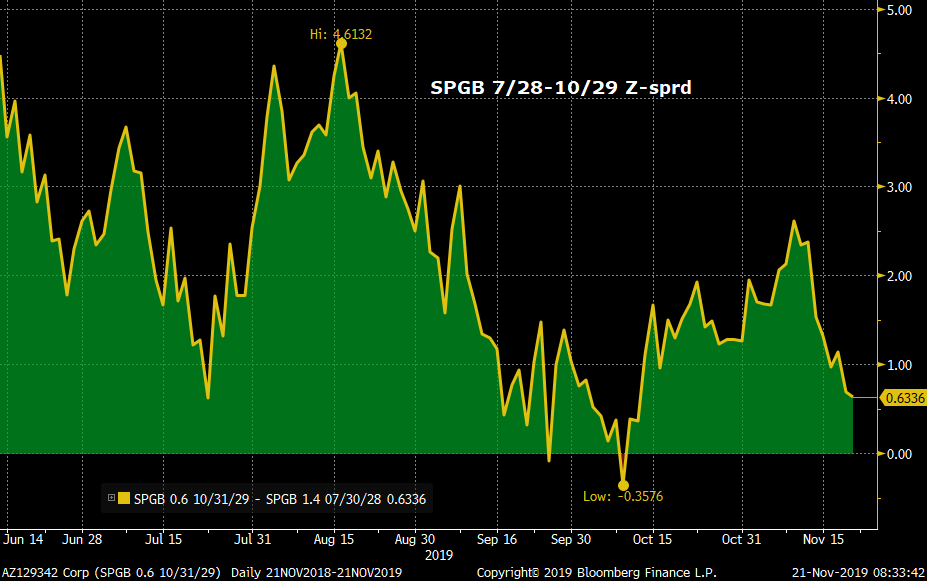

- While the SPB 7/24s look a bit cheap, the SPGB 0.6% 10/29s have richened on the curve into this am’s tap. The SPGB 7/28-10/29 sprd has flattened 2.25bps in both yield and Z-sprd and while we’re nearing the end of their issuance cycle (1-2 more taps left), these SPGB 10/29s have no auction concession priced in, relying on their benchmark status for demand.

- 50yr+ EGBs from Spain, France, Italy, Belgium and Austria have been popular longs vs 28-30yrs as defensive positions on both yield and spread space. While the BTPS sprd remains elevated, we’ve seen a reasonable correction in these spreads in the other countries and we expect that this momentum will attract demand for this morning’s SPGB 66s tap, the last we’ll likely see for the next 4-6 mos.

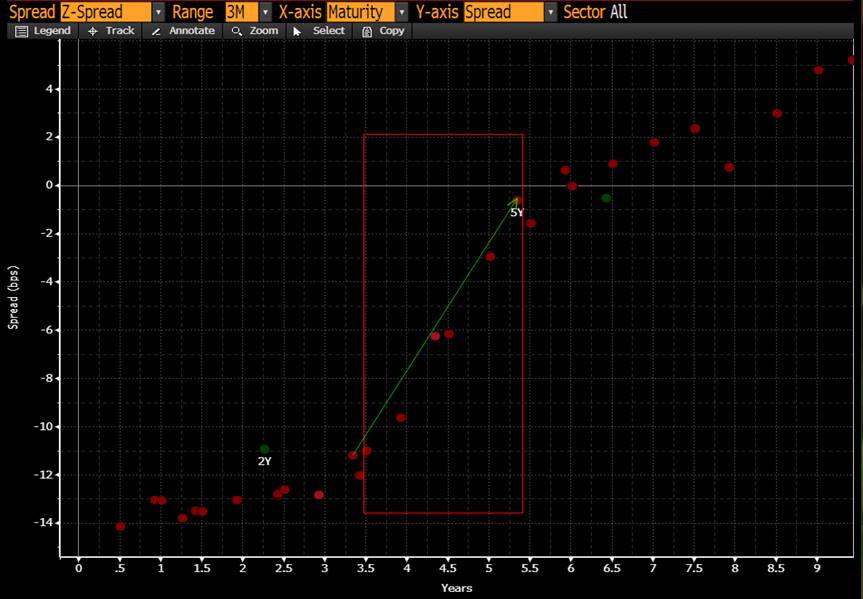

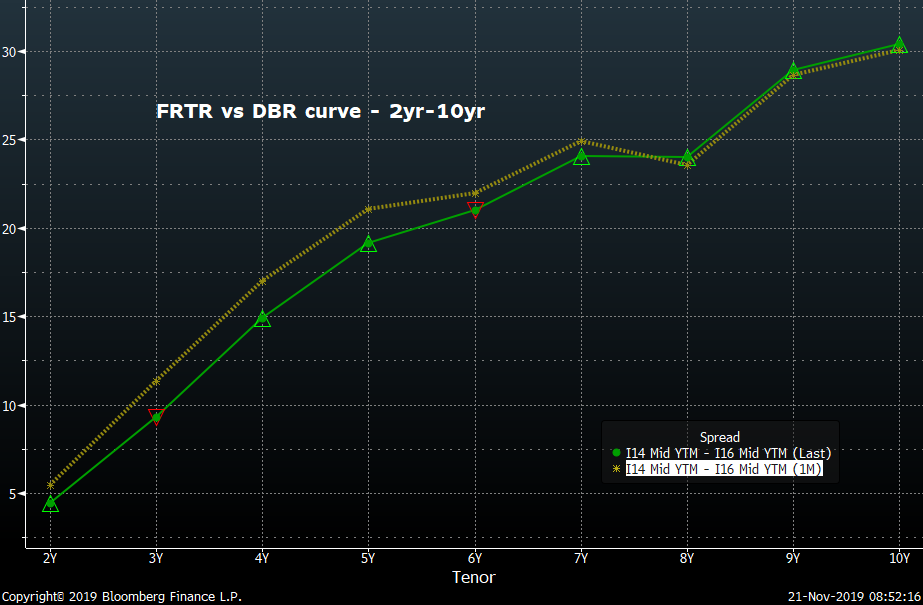

- The BBG chart below of the French Z-sprd curve out to 9yrs shows this am’s OATs supply is coming in the steepest part of the curve, which helps explain why the FRTR 3/24s and FRTR 3/25s have been well bid lately. As one would expect, carry and roll is attractive and with the curve steep vs DBRs, we expect to see interest in FRTR flatteners vs DBRs. We expect these to be the last taps of the FRTR 3/23s and 3/24s and the penultimate tap of the FRTR 3/25s.

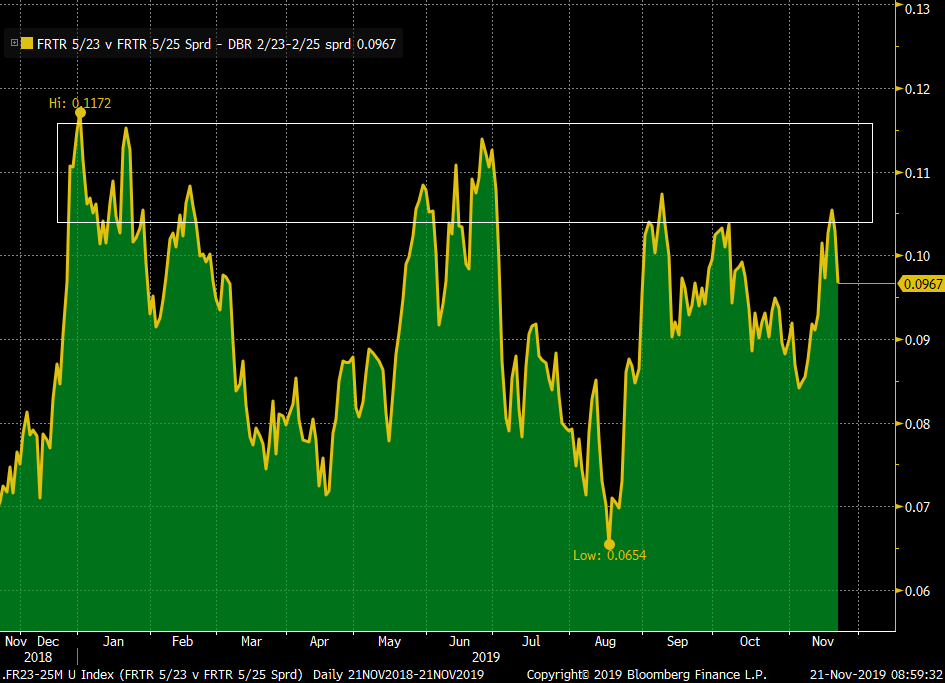

DBR 2/23-2/25 vs FRTR 3/23-3/25 sprd box

More to come…

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND AND BREAKEVEN DILEMA : A SIDEWAYS PERFORMANCE OF LATE BUT US BOND YILEDS CONTINUE TO HOLD SUPPORT.

BOND AND BREAKEVEN DILEMA : A SIDEWAYS PERFORMANCE OF LATE BUT US BOND YILEDS CONTINUE TO HOLD SUPPORT. ALL US DAILY CHARTS ARE SITTING ON 100 DAY MOVING AVERAGE YIELD SUPPORT.

GERMANY :THE RELIABLE DBR 46 IS STALLING AGAINST MAJOR RESISTANCE 163.575 AND POISED TO FALL.

BONDS :

WE ARE HOLDING MANY RELIABLE MOVING AVERAGES IN THE US, SO KEY YIELDS BOUNCE FROM HERE AND INTO MONTH END.

US BREAKEVENS AND USGGT :

GIVEN THE HIGH CORRELATION WITH YIELDS ALL ARE NOW BASING AND LIKE YIELDS POISED TO STRETCH THEIR LEGS.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BOND AND BREAKEVEN DILEMA : ** A KEY DAY ** YIELDS NEED TO HOLD HERE TO MAINTIAN THE ESTABLISHED YIELD RECOVERY, THE RESPECTIVE MOVING AVERAGES SHOULD ASSIST.

BOND AND BREAKEVEN DILEMA : ** A KEY DAY ** YIELDS NEED TO HOLD HERE TO MAINTIAN THE ESTABLISHED YIELD RECOVERY, THE RESPECTIVE MOVING AVERAGES SHOULD ASSIST.

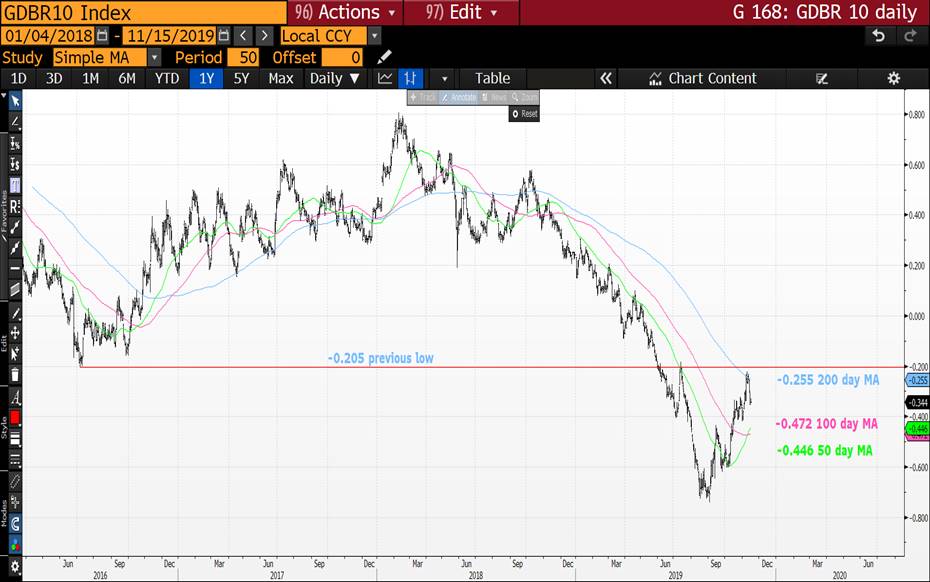

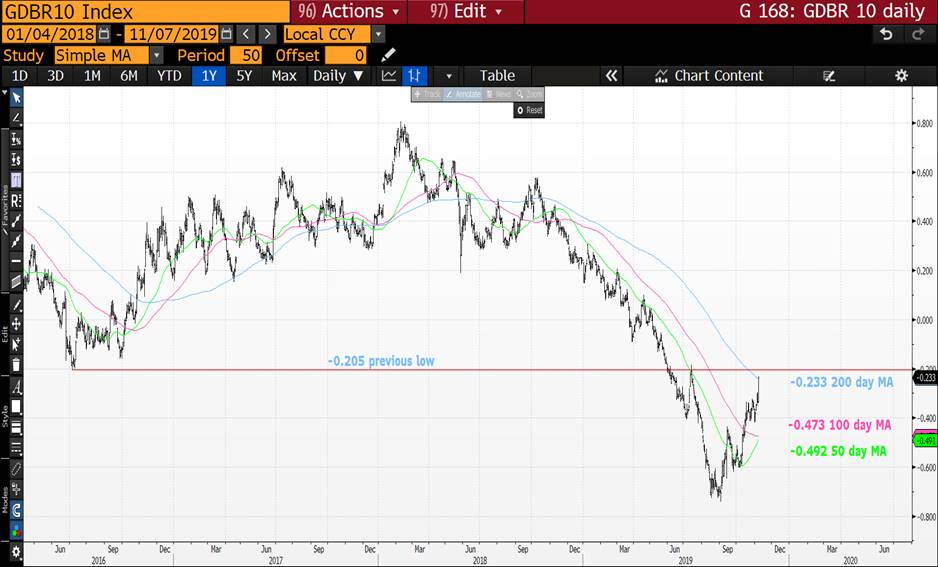

GERMANY CERTAINLY THE LEAD CONTRACT GIVEN IT INITIALLY FAILED THE 200 DAY MOVING AVERAGE, THAT NOW NEEDS TO BE BREACHED.

THE BIGGEST FOCUS CHART. We have failed the 200 day moving average -0.255 but ideally need to POP the previous low -0.205

We need to remain below the 100% ret 163.575 and head lower.

BONDS :

WE ARE HOLDING MANY RELIABLE MOVING AVERAGES IN THE US, SO KEY YIELDS BOUNCE FROM HERE AND INTO MONTH END.

US BREAKEVENS AND USGGT :

GIVEN THE HIGH CORRELATION WITH YIELDS ALL ARE NOW BASING AND LIKE YIELDS POISED TO STRETCH THEIR LEGS.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: £2.25bn UKT 1T49s Tap at 10:30am - CHEAP Enough to Go Well - Ideas

GILTs... 1T49s Tap @ 10:30

> £2.25bn tap is worth ~53k G Z9 and is the last scheduled tap of the issue this year - unless they decide to tap them again in Dec (in lieu of 54s or 71s, etc).

> Yield levels have risen, the 1T49s are a touch cheaper vs swaps but 10-30s looks a tad flatter than rate levels would suggest.

> On a micro level, we think these 1T49s look attractive here.

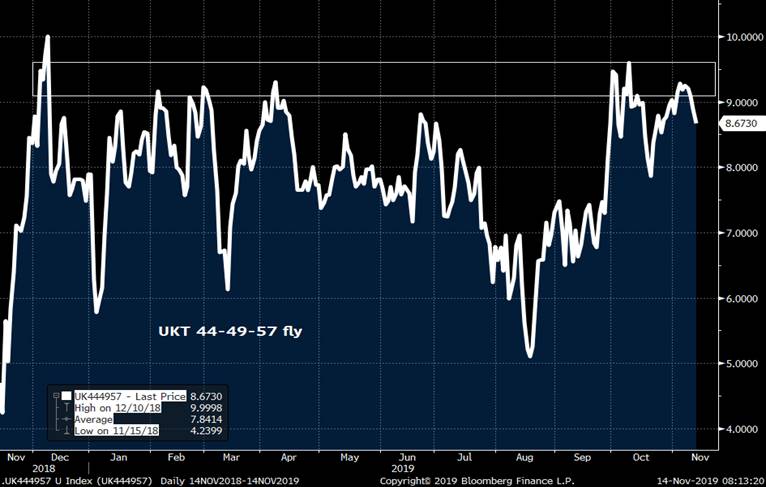

- The UK 44-49-57 fly we highlighted a few times in the last week has richened from +9.3bps to 8.7bps this am - still room to richen tho.

An even more micro fly - the UK 47-49=52 fly also looks good, holding the 4.5bps level and richening a touch.

- A simplified position that is still at attractive levels is the 1T49 steepener vs 1F54s -1F71 issues which will keep us in a core steepener into the election but should also do well if the DMO decides to tap the 54s or 71s in Dec. Here's 4Q55 into 1T49 as an example...

More closer to the time…

Best,

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: How Much Is Enough? Quick Rates Rundown W/Charts

- Well, that didn’t go so well now, did it? Yesterday morning’s SPGB and FRTR supply – all ~150k RXZ9s worth – was taken down with aplomb, only to be regurgitated by a market caught long and wrong as we took out key supports in RXZ9, OATZ9 and IKZ9. Even the rally in G Z9 on the MPC’s surprise dovish dissention (7-2 vote with dissenters calling for a rate cut) didn’t last as new intraday lows traded into the close. BTPS were battered badly, despite the risk-on tone, closing 8bps cheaper to DBRs in the move as longs were cut across the curve. Volumes on the day were far larger than usual – a combination of supply hedging and stops triggered. It’ll be interesting to see whether open interest levels changed much yesterday.

- It wasn’t all carnage yesterday though. After the hefty intraday concession the shiny new T 2.375 11/49s sputtered out of the gates with a small tail but roared ahead into the NY close, rallying 4+bps, the bid has continuing into this morning, 10-30s another bp flatter this morning.

- So, how much is enough? This age-old conundrum is no easier to answer now than ever, especially given the opaque nature of the market-moving influences we’ve got to contend with. That said, we can venture an educated guess based on some objective measures and perhaps come up with some trade ideas.

- Let’s take a look at some charts:

DBR 10yr yield chart with ZEW indicators. Handful of things worth a mention here:

- Current situation index remains depressed – which was well correlated with the rally in DBRs.

- The expectations bounce off the lows has, arguably, been a solid driver of this pullback in DBRs., however.

- We’re now at the 200 day MA and momentum indicators like RSIs are at their cheapest levels since Sept 2018.

DBR 10yrs vs DBR 5yr-10yr sprd. The cheapening of DBRs hasn’t been met with a commensurate steepening of the curve which suggests RXZ9 et al are too rich here. If we stay up here the curve should steepen over time, even with QE resuming. DBR 10yr supply on tap next week too.

Japan’s been at the heart of much of this year’s rally in rates, driving the spread tightening of SPGBs too. Chart below of 10yr benchmarks hedged back into JPY is interesting as it shows USTs (green) have cheapened most, followed by OATs and then Bonos. A ‘buy the dip’ move in EGBs would likely target OATs here. Even after the ~35bps tightening of 10yr USTs vs OATs since July, one would have to think it’ll continue though.

SPAIN has a big election coming up on Sunday and there are pundits who are concerned it could get messy. We’re going into the event with 10yr SPGB-DBR/FRTR spreads at their tightest levels of 2019 after an extraordinary performance this year. The chart below of FRTR 5/29s vs DBR 2/29s and SPGB 4/29s shows OATs remain at their cheapest on this blend since March but showing signs of a modest reversal. We’ve got 22.2bn FRTR redemption on Nov 25th and 10.1bn SPGB redemption Nov 30th. A shift out of SPGBs into OATs is a natural profit taking move into year-end if things get dicey.

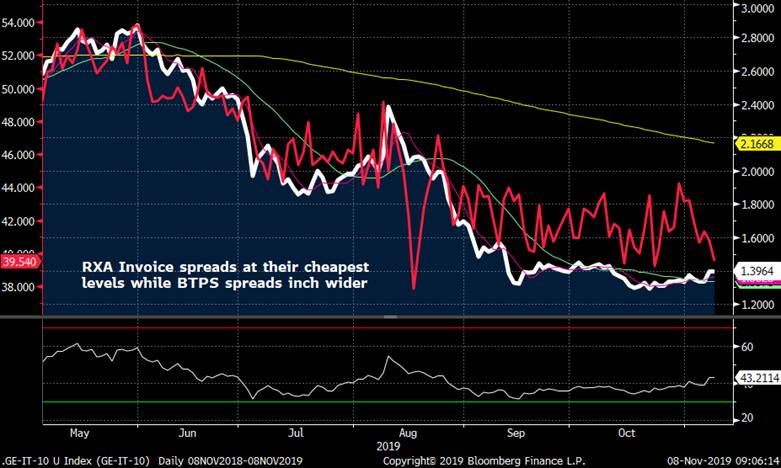

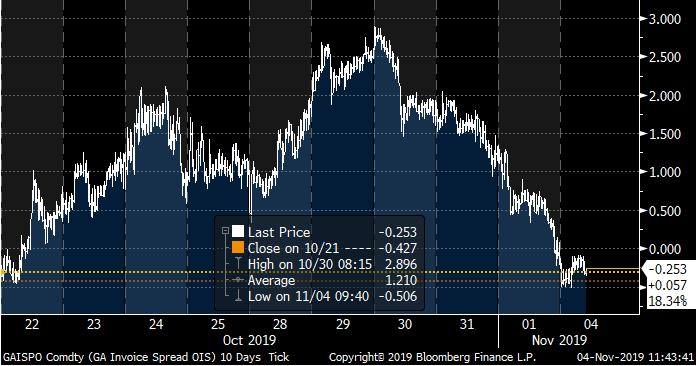

RXZ9 invoice spreads are well correlated with DBR-BTPS 10yr spreads. We’re currently back to the cheapest level in RXA invoice spreads this year. DBR-BTPS spreads are showing classic signs of bottoming out on the charts – yesterday’s 8bps widening seemed ominous. If BTPS start to wobble, get long invoice spreads as a low balance sheet, more liquid proxy. Given the flatness of the curve, BOBL spreads make more sense here.

Gilts have cheapened nicely over the past few weeks but the divergence with Cable remains intact. We’re seeing some signs this could converge but we need to take out the 1.28 support in GBP and/or the 0.70% yield level.

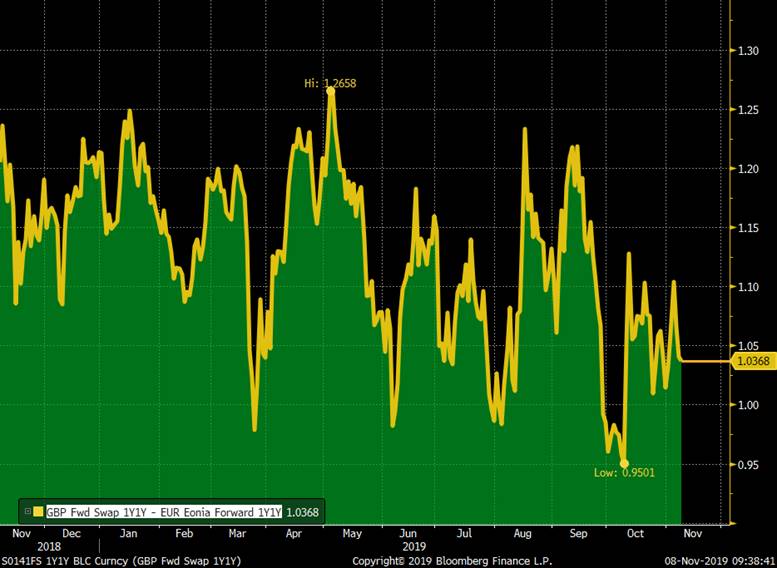

Is the dissension within the MPC mean a rate cut is in the cards? Not necessarily, but it wouldn’t hurt to be positioned for it. SONIA 1y1y has been capped by the 60bps level in this recent pullback and while the back-up in EONIA 1y1y makes the location of the narrower trade (REC GBP 1y1y vs PAY EUR 1y1y) less than optimal given the recent range, a 25bps rate cut would certainly tighten this spread through the 95bps lows seen in early Oct.

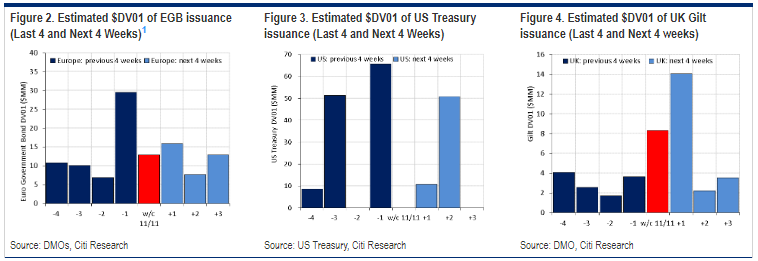

Rates supply much less busy next week with no USTs, 1-2bln NETHER 29s, some BKO 12/21s, DBR 29s, intermediate maturity BTPS and a tap of the UKT 1T49s, the last 10yr+ supply of 2019. Nice chart from our friends at CITI below. At the very least, this week’s selloff should provide some enticement for those who need to buy the mkt. Italy has a 12.4bn redemption next Friday.

UKT 1T49s – last long-end supply of 2019 next Thursday. As noted in my note earlier this week, we think they’re cheap on the curve and like buying them vs UKT 44s and 57s – 1-2-1 or curve weighted.

DBR-UKT spreads – 10yr vs 30yr sprds… Both spreads are just north of 100bps…

USZ9 back to their cheapest levels on momentum indicators like Bollingers. Open interest surged higher here too… The 10-30s flattening move post 30yr auction makes sense here.

Thanks for reading…! Feedback always welcome…

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND, EQUITY AND BREAKEVEN DILEMA : THE YIELD RALLY IS ABOUT TO STRETCH ITS LEGS, FINALLY LOOKING LIKE CAPITULATION DAY.

BOND, EQUITY AND BREAKEVEN DILEMA :

THE YIELD RALLY IS ABOUT TO STRETCH ITS LEGS, FINALLY LOOKING LIKE CAPITULATION DAY.

I’LL SEND OUT A VOLUME PIECE TOMORROW TO ASSIST IN ASSESSING THE DAMAGE DONE.

BONDS :

IT HAS BEEN A MAJOR TURN AROUND BUT YIELDS CAN NOW GO A LOT HIGHER LED BY GERMANY, INTERESTING THIS IS THE FIRST TO TEST A MAJOR 200 DAY MOVING AVERAGE.

EQUITY :

GIVEN THE YIELD RALLY STOCKS HAVE FINALLY PERFORMED BUT SOME AREAS REMAIN SLUGGISH.

US BREAKEVENS AND USGGT :

GIVEN THE HIGH CORRELATION WITH YIELDS ALL ARE NOW BASING AND LIKE YIELDS POISED TO STRETCH THEIR LEGS.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

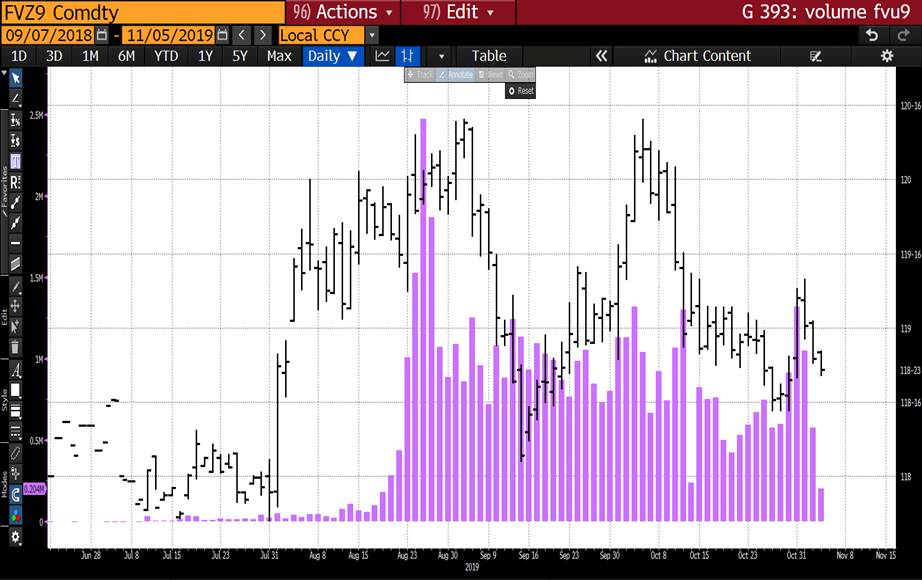

VOLUME SPECIAL : VOLUMES IN LATE OCTOBER WERE ENORMOUS DEPICTING A SHIFT FROM LONGS INTO SHORT FUTURES.

VOLUME SPECIAL : VOLUMES IN LATE OCTOBER WERE ENORMOUS DEPICTING A SHIFT FROM LONGS INTO SHORT FUTURES.

AS A RESULT THE BIAS IS FOR CTA’S TO BE ADDING ON ANY NEW FUTURES LOWS.

GERMANY IS LEADING THE WAY AS IT DID ON THE BOND RALLY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BOND AND BREAKEVEN : YIELDS TO HEAD HIGHER! AFTER A PAUSE YIELDS ARE LOOKING LIKE HEADING HIGHER AGAIN. THIS TIME BREAKEVENS HAVE BASED.

BOND AND BREAKEVEN : YIELDS TO HEAD HIGHER! AFTER A PAUSE YIELDS ARE LOOKING LIKE HEADING HIGHER AGAIN. THIS TIME BREAKEVENS HAVE BASED. WE ARE VERY CLOSE TO A FULL-ON YIELD RALLY.

IT DOES APPEAR WE WILL HEAD HIGHER IN YIELD FOR SOME PERIOD OF TIME.

BONDS :

IT IS NOW LOOKING LIKE A REASONABLE YIELD BASE HAS GONE IN AIDED BY THE BREAKEVEN SECTOR. FUTURES LOOK SET TO HEAD LOWER AGAIN LED BY GERMANY.

US BREAKEVENS AND USGGT :

GIVEN THE NATURAL CORRELATION WITH CORE YIELDS THE MARKET SHOULD BOUNCE ALONG WITH YIELDS.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Gilt Spread Update

The Gilt invoice spread has cheapened 3 bps from last week’s highs as polls show Labour closing the gap (and Gilt spreads take over GBP as election risk metric):

https://www.thesun.co.uk/news/10269205/election-boris-johnson-jeremy-corbyn-poll/

Campaign promises from both Labour and Conservative parties call for large fiscal stimulus and deficit spending

(2023-24 spending projections: Conservatives 41.3% GDP / Labour 43.3% GDP, vs long term average of 37.4%):

Parties’ spending plans signal the return of ‘1970s-sized state’

https://www.ft.com/content/cbc2d55a-fccc-11e9-a354-36acbbb0d9b6

Corbyn Scares U.K. Market Hooked on ‘Kindness’ of Strangers

The Monetary Policy Report (which is expected to be dovish) followed by the OBR updated March forecasts on Thursday at 930am (which may highlight the need for more long end supply) could be a potential catalyst for further spread cheapening and curve steepening into year end.

Seasonals could also exert downward pressure on spreads given balance sheet reduction coupled with anticipated swapped corporate issuance in Q1 2020.

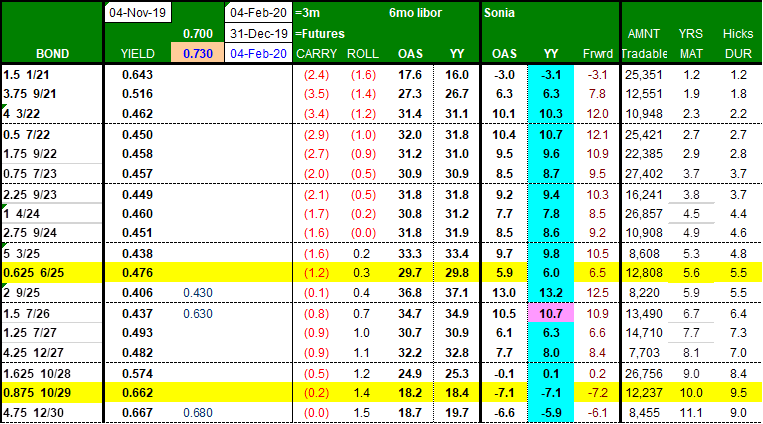

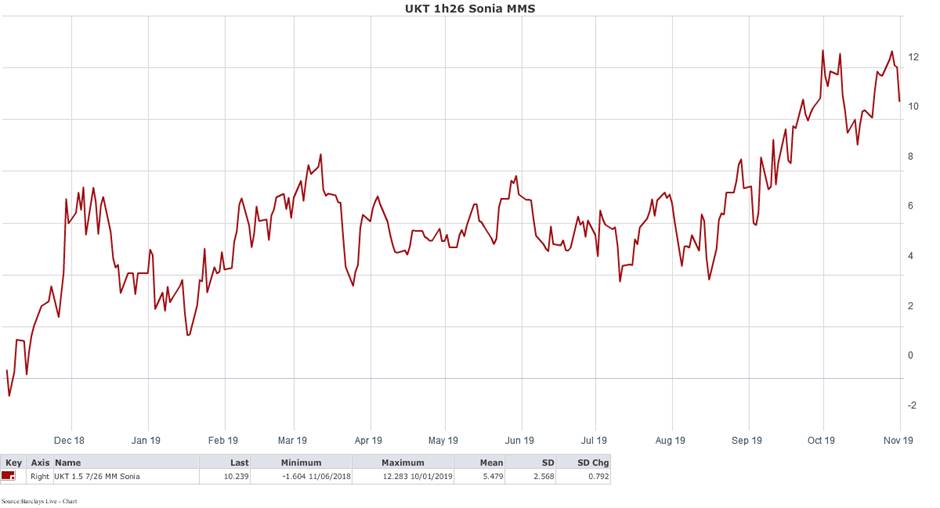

Looking at the Spread curve below (excluding the 2 9/25 which are perennially rich in repo), the 1.5 7/26 represents the peak of the curve:

Short 7yr Sonia MMS rolls and carries positively;

even short Gilt-Sonia invoice spreads are no longer negative carry given their recent convergence to the Sonia-repo spread (~2 bps):

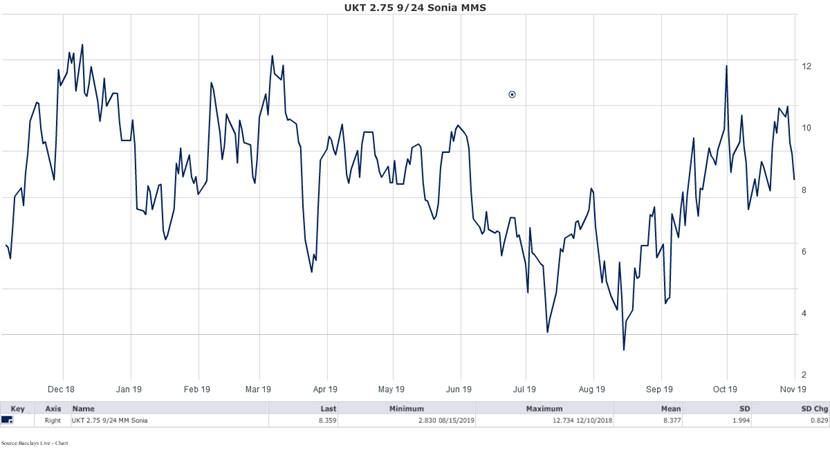

Further in the curve, we see that UKT 2.75 9/24 Sonia MMS has been unable to breach 12 bps – given the spread should ultimately converge to the Sonia-Repo spread:

Richness of the 10yr point on the spread curve:

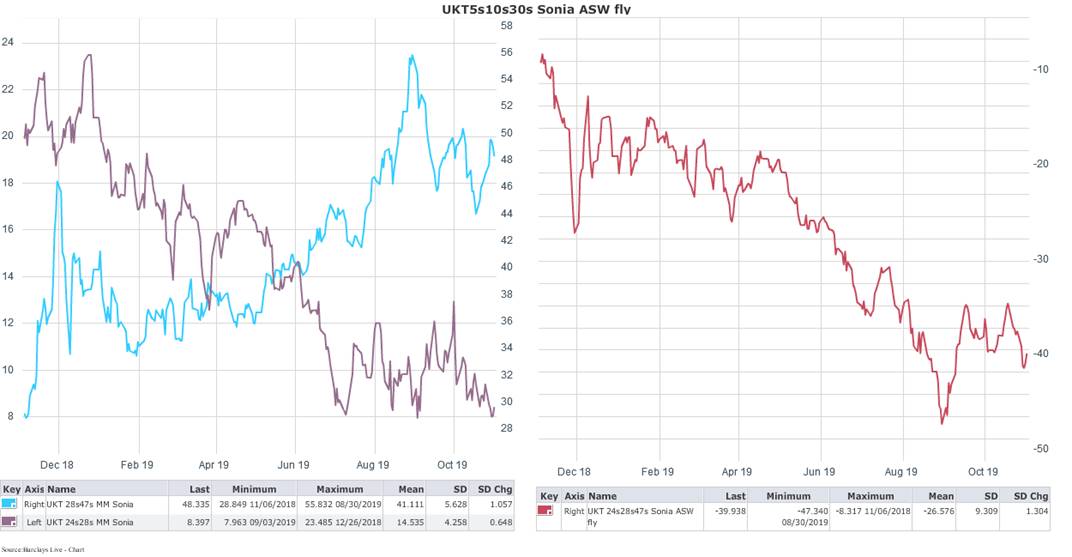

10yr Gilt spreads seem unlikely to retest their recent 40bp peak to trough richening on the 5s10s30s ASW fly in August (caused by distressed convexity driven 30yr receiving):

Left Graph: UKT 5s10s Sonia ASW box (purple / left axis) Right Graph: UKT 5s10s30s Sonia ASW fly

UKT 10s30s Sonia ASW box (blue / right axis)

Over the past year, the 5s10s Sonia ASW box has flattened 14 bps, 8bps more than implied by the ASW roll on 1.625 10/28 (= 6bp/yr).

==============================================================================================================

How did 10yr spreads get here given the recent sell-off in rates and fiscal stimulus on the horizon?

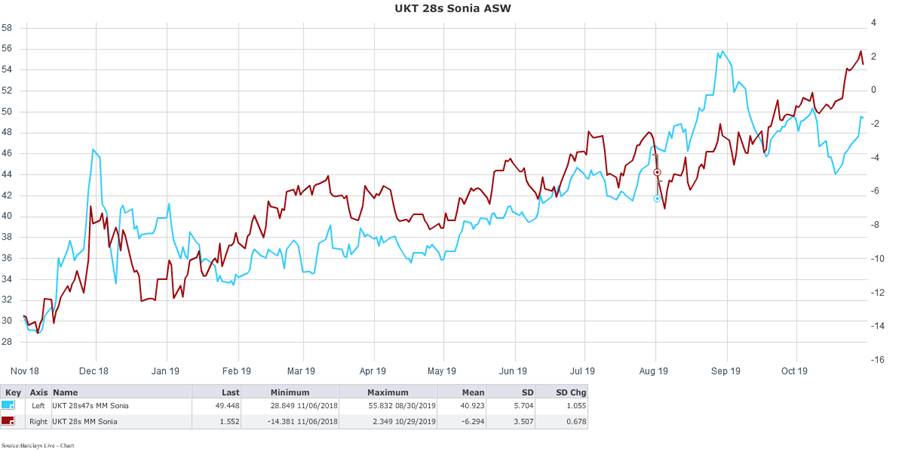

The recent richening in Gilt long end ASWs could be dragging 10yr ASWs richer; typically 10s30s ASW box bull steepens, but in this latest episode, the 10-30yr ASW box has stayed relatively flat:

Gilt Sonia Invoice (red / right axis)

Gilt 10s30s Sonia ASW box (blue / left axis)

The UK government is reviewing the relaxation of Solvency II requirements for UK insurers post Brexit (e.g. this might allow insurers to hedge liabilities with Gilts rather than swaps without incurring a capital charge); insurers are largely hedged in the 20-30yr sector, so some of the recent LDI buying of long end Gilt ASW could be some provisional switching from Sonia into long Gilts, which trade 40-50bps higher in yield. These flows, at the margin, could be suppressing any long end ASW repricing on fiscal easing.

There may also be some short positioning in 10-15yr ASWs by bank treasuries (source: Barclays).

Short Spread Expressions:

- Gilt-Sonia invoice spread – the most liquid and transparent expression – has the disadvantage of punitive roll and less favourable carry given the absolute level is 11bps cheaper than the 7yr point.

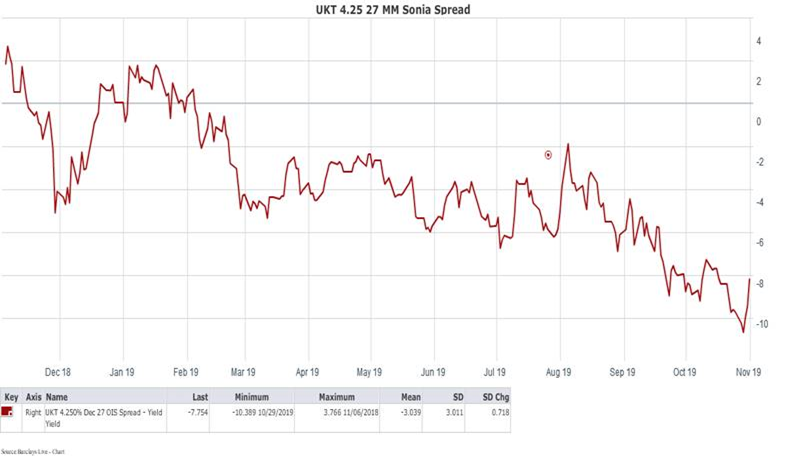

Moreover, the CTD 1.625 10/28 will roll out of the futures basket in Dec. When the UKT 4.25 12/27 rolled out of the basket in March 2019, the spread richened 6 bps into the roll and stayed rich:

With short interest in Gilt futures rising in the latest selloff, the calendar spread could richen into the roll.

- UKT 1.5 7/26 Sonia MMS: Rather than sell the Gilt invoice spread, which rolls up a steep portion of the spread curve, sell spreads further in the curve which are trading closer to the 10-12bps upper boundary. Specifically the UKT 1.5 7/26 are rich on the curve and at Sonia - 11bps are trading near the upper boundary of the Sonia ASW spread curve:

Moreover, the UKT 1.5 7/26 are also rich on the cash curve; the 2T24-1H26 curve = -0.5 bps, while the 1H26-1F28 curve = +14.5 bps, putting the 24s26s28s bfly @ -15.0 bps:

Jim Lockard

Founder / Managing Partner

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796