BOND AND BREAKEVEN DILEMA : YIELDS TO HEAD HIGHER! WE ARE VERY CLOSE TO FULL COMFIRMATION.

BOND AND BREAKEVEN DILEMA : YIELDS TO HEAD HIGHER! WE ARE VERY CLOSE TO FULL COMFIRMATION.

IT DOES APPEAR WE WILL HEAD HIGHER IN YIELD FOR SOME PERIOD OF TIME.

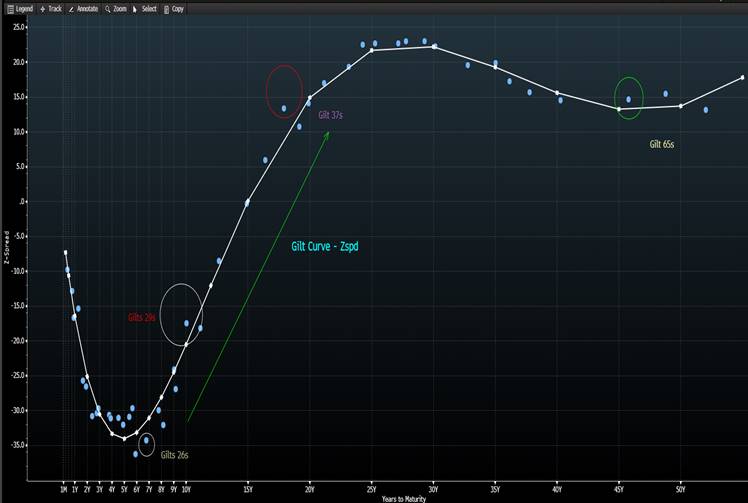

BONDS :

IT IS NOW LOOKING LIKE A REASONABLE YIELD BASE HAS GONE IN AIDED BY THE BREAKEVEN SECTOR.

US BREAKEVENS AND USGGT :

GIVEN THE NATURAL CORRELATION WITH CORE YIELDS THE MARKET SHOULD BOUNCE ALONG WITH YIELDS.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trade Radar: October 15th 2019

Trade Radar: 14th Oct

Belgium

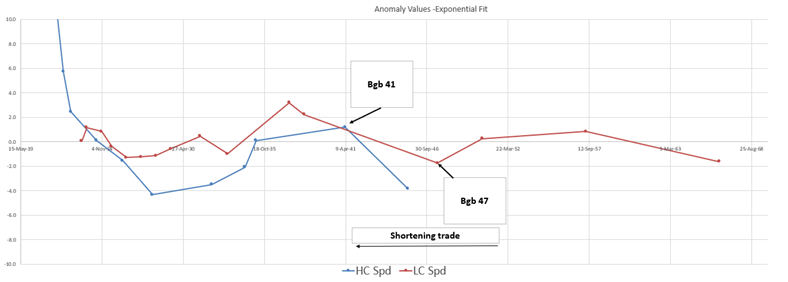

Sell BGB 47s to buy BGB 41s @-16bp

Levels:

@-16bp

100 * (YIELD[BGB 1.6 06/22/47 Corp] - YIELD[BGB 4.25 03/28/41 Corp])

Stop @-18bp

Profit: @-20bp

Carry: +0.2bp /3mo (@5bp repo spread)

- On the run 30y trades rich

- The 41s as a high coupon is cheap

- The 41s have strong positive carry due to their high coupon

- The HC 41s also have a better anomaly value when viewed on a ‘Z’ style basis - (high coupons have enhanced value in a positively sloped curve vs Low)

- Trade is on recent best terms on both yield and spread of spreads

Anomalies vs Fitted Curve

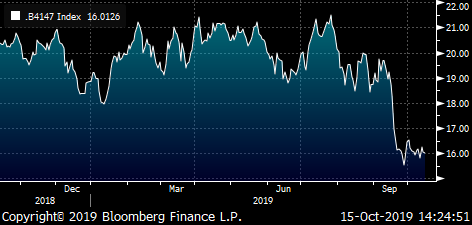

History of Spread vs MMS

(SP210[BGB 1.6 06/22/47 Corp] - SP210[BGB 4.25 03/28/41 Corp]) – *erroneous data eoy 2018

Friction

- Enter on an order around -16bp yld spread

- Expect 3/4bp friction on exit

Risks

- 10s30s continues to flatten in Belgium

- The Repo on Bgb 47s starts to tighten – get expensive

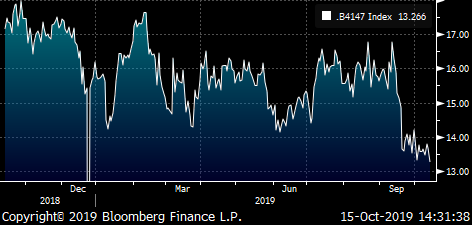

France

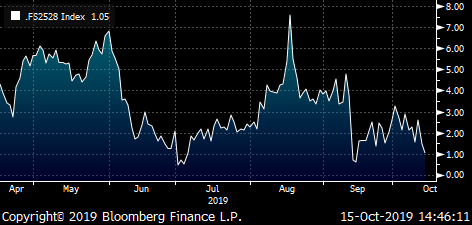

Thursdays 2y & 5y supply has 5s10s almost flat to Eonia

SP210[FRTR 0.75 5/28 Corp] - SP210[FRTR 0 3/25 Corp]

Trade:

Buy Frtr Mar25, Sell Frtr May28

vs MMS

Level: -1bp

Target: -5bp

Stop: +1bp

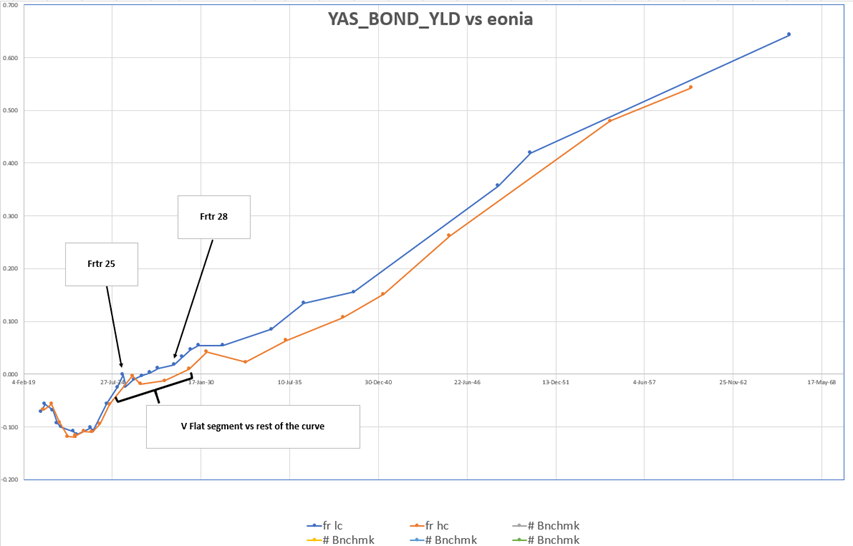

French Curves (High and Low coupon vs Eonia) vs Eonia

Rationale

- 5s10s looks v flat relative the rest of the curve

- 5s10s flat historically

- 5s roll down aggressively – will prob cease tapping Q1 next yr

Risks:

- The whole French curve continues to flatten

- The Repo on the French May28s gets tight - €33,3 Bln issue

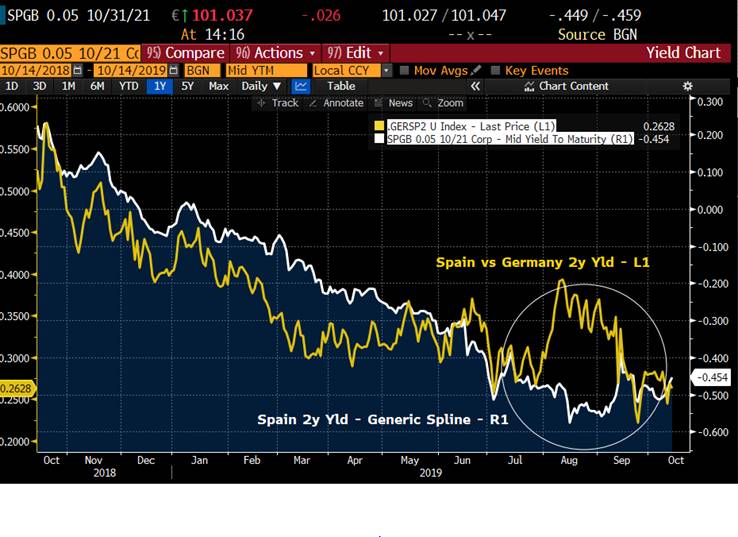

Spain

trade working

Spanish curve a ‘straight line’ – 10y rich vs 8y and 15y

Trade:

Sell Spgb Oct29

Buy 65% Apr27, Buy 35% jul35

* curve weighted according to curve shape

Cix:

200 * (YIELD[SPGB 0.6 10/31/29 Corp] - 0.65 * YIELD[SPGB 1.5 04/30/27 Corp] - 0.35 * YIELD[SPGB 1.85 07/30/35 Corp])

Graph of Spanish Anomalies – exponential fit to adjusted* yields

(*adjusted for coupon by removing the swap spread and adding the z-spread)

This is a trade from a couple of weeks ago – it’s working nicely and we stick with it

Rationale:

- Just looking at the shape of the Spanish curve – the rally has removed any ‘curvature’ from expectations –

- The Oct29 is €14,6bln in size, it will continue to be tapped as the prior Apr29s is €21bln in size

Risks

Oct29 stays tight on repo with no post tap ease

A continued bullish edge to Spain benefits the 10y sector more than others

Speak soon

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EGB Supply - Week of 14/10/19 - A few Thoughts, Ideas

EGB Supply this week:

Germany: 2y Shatz 9/21 - 4bl & Old 30y 8/48s - 1bl

Spain: combination of 10/21, 7/24 & 10/29 - total 3.5bl

France: combination of 2/22, 3/25 & 5/26 - up to 9bl

UK: 10y Gilts - 10d/29s - 2.75bl

My take on German Supply:

2y Shatz 9/21s:

* Shatz roll - tight range -1.3 vs -3bps, currently -1.5bps - no value

* Outright yld - off richest levels from Aug. Ecb meeting(-93bps), currently at -72bps(carry and roll negative and in need of more clarity from ECB - rate cuts vs QE etc).

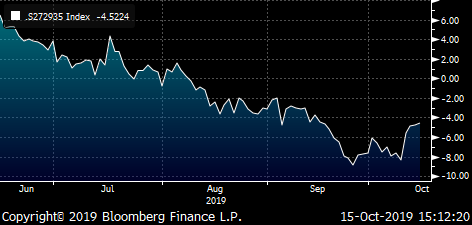

* 2y Invoice spreads at the cheaper end of the range at -30bps - maybe worth a stab on the long side but risk is understanding tiering impact on funding in the next statement period.

* 2/5y curve is flat - both rates anchored in current environment - carry marginally negative for the steepener, but level looks attractive but my guess is we need a large sell off to realise steeping bias.

30y OTR - 1.25% 48s:

* 30y Roll - also very tight range - 2.7bps to 3.4bps - currently 2.9bps - no concession

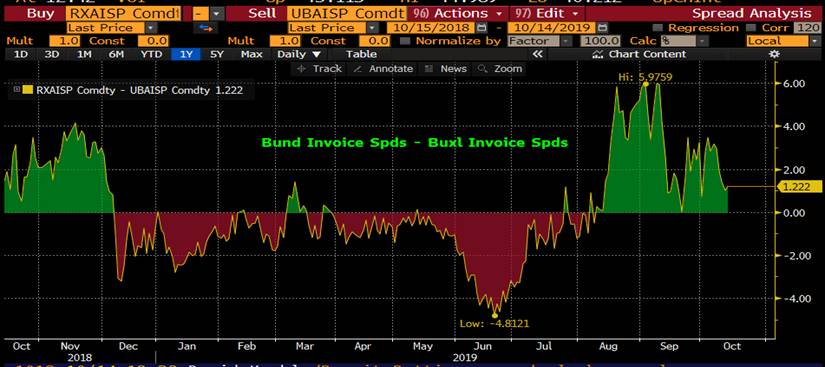

* ASW- Invoice sprd(proxy) - bounce off the lows from 35bps to current level near 40.5bps, ASW Box vs 10yrs has been volatile of late in a wide range btwn +5 and -5bps. Currently +1.5bps(10yrs wider). I would look to sell 30yrs spreads vs 10yr - nearer flat to slightly negative.

* 10/30y Curve - lower end of the range - lacking inspiration as to next move.

* 10/20/30 Fly vs Zspd - 20yrs flagging expensive(will depend on QE bonds targeted)- spread curve very flat beyond 10yrs- would favour shorting 20yr vs buying 10yrs and 30yrs. (ie 0.25 2/29 x 4.75 7/40 x 1.25 8/48(carry neg. small at -.3bps/mos assuming 10bps repo diff)

My take on French Supply:

* Fairly advanced for the year ~90%. Cash Flows this month very positive per seasonal input(well flagged) - mostly see the positive performance in FRTR 15-10days prior to the 25th, Oct.. At this level of yields not sure we get as much uplift this time around - generally worth 3-4bps vs core markets on spread.

FRTR 2/22 OAT: (26bl outstanding, 6 taps to date)

* Roll vs 5/21 at -2bps - uninspiring - should be flat to positive but spread curve inverted, in need of some structural changes to the front end

* C+R for the front end also negative just shy of 1bps/mos - difficult to hold, need more clarity on tiering and funding

* Like the front end of Germany - either outright yield or ASW have come back off their low prints from mid-august, but I fail to understand why the ECB will push for lower short rates – it’s not the solution in my opinion to Europe's structural problems.

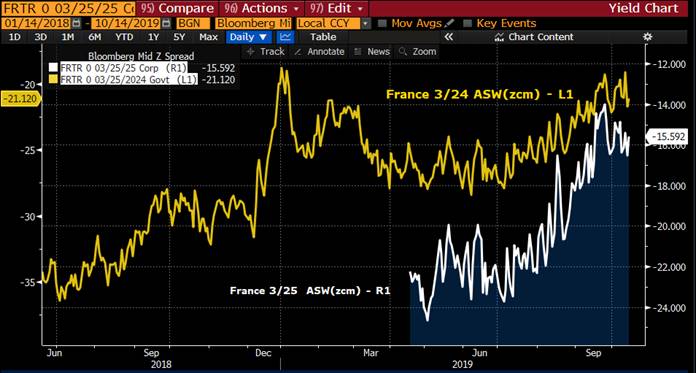

FRTR 3/25 OAT: (20.3bl outstanding, 5 taps to date)

* Roll vs 3/24 is at +9.6bps up from a low at 7.2bps should find support for the issue vs shorter bonds.

* Roll down on the Spread curves still looks attractive as well. ASW(zspd) has come back to -15.5bps from a low in the summer months at -23.5bps. - worth having a look.

* 2/5/10 Curve - 5yrs at the top of the range while market has more or less grinded lower in yield and 2y/5yrs yields in EGB have anchored. Need to be bearish to support 2/5/10.

FRTR 5/26 OAT: (33bl outstanding, 8 taps to date)

* In my opinion 5/26s are spot on FV on the French Curve - been in a very tight 1bps range vs spline curve via just shorter and longer maturities. I see nothing to do here unless someone knows more about the repo, I am just not sure why the street asked for the bond.

UK Gilt supply:

UK Gilts 0.875% 10/29s - (Currently 9bl outstanding, 3 taps)

* Yields have backed up some 20bps over the last week, including today's move ~ 7bps richer. 10y Gilts building a base at .40bps but overall direction remains tied to the outcome of Brexit. Either way, Gilts should remain volatile over the short to medium term with valuation poor.

* Supply for the Fiscal Q3 will see continued taps of both 10/29s and 6/25s with the balance made up from a tap of longs -49s and potential for either a syndicated long conventional or linker.

* Benchmark 10y 10/29 in Micro RV - roll vs 10/28s at +8.15bps has had a range +9.5 to + 6.5bps.

* Micro Fly either 27/29/32, 27/29/30 or 28/29/30 are fairly range bound. We still feel that as far as issue specific, 12/27 expensive and while 12/30s is slightly expensive, they will be the next CTD and still have good value on the curve. So for time being, similar to 6/25s, 10/29s should remain

cheap with ongoing taps for the balance of the QTR and most likely start to perform on the curve as we get closer to QTR end and into the next part of the last Fiscal Qtr.

* Trades we continue to favour are in ASW terms(sonia) and taking advantage of the steepness of the curve between 5yrs and 15/20yrs.

Spain Supply:

* Funding well advanced at 87% but more or less on par with last years funding.

* October is also very positive cash flow month for Spain coming at the very end of the month.

SPGB 10/21 (17.8bl oustanding, 12 taps to date)

* Outright level stuck at the bottom of the range - Interesting that the spread vs core markets has become richer since the summer months, much of this performance is coming from Germany ylds higher

SPGB 7/24 (10.8bl outstanding, 8 taps to date)

* 5y Roll - 7/23 vs 7/24 has made a small concession into supply, currently at +7.4bps from a low 5.1bps 1 week ago.

* 3/5/7y Spain curve back to the top of the range - looking at 4/24 x 7/24 x 10/26 close to flat looks good value.

SPGB 10/29 - (14.6bl outstanding, 4 taps to date)

* After a fantastic run in performance this year led by strong buying from the far east region, Spain has taken a breather but mostly on a relative basis to other credit markets such as Italy or Portugal. The 10y credit blend back to top of the range amid strong performance in BTPs and Portugal through the summer months. Worth having a look at credit fly(not vol. Adj) Germany/Spain/Italy 1x2x1 or France/Spain/Italy with a bit of vol. Wtd 70%x/30%.Both spreads have come back from very rich levels prior to August ECB meeting.

Bloomberg Bond News Summary > Mon Oct 14th

Business Briefing

1) Tencent Airs Two NBA Games as Chinese State TV Blackout Persists

Tencent Holdings Ltd. live-streamed two National Basketball Association games played outside of China Monday, even as the nation’s top broadcaster shuns the league because of a controversy around Hong Kong’s pro-democracy movement. The Chinese social media giant aired a game between the Chicago Bulls and Toronto Raptors and another between Maccabi Tel Aviv ...

2) Ecuador Reverses Fuel Price Hikes After Eleven Days of Violence

Ecuador will reverse the fuel price rises which triggered nearly two weeks of violent unrest, while the leaders of the nation’s indigenous organizations called off protests which have paralyzed swathes of the country. The government of President Lenin Moreno agreed to repeal its Oct. 1 decree to end subsidies on diesel and gasoline, said Arnaud Peral, a UN ...

3) Assad’s Forces Move North Amid Turkish Incursion: Syria Update

Syria said forces loyal to President Bashar al-Assad deployed northward on Sunday in response to Turkish troop movements. President Donald Trump said the U.S. is ready to impose sanctions if Turkey does anything off-limits in its cross-border operation in northeastern Syria. The Turkish army captured Tal Abyad, a strategic town, while reaching its target of ...

4) WeWork Is Said to Weigh Bailout That Hands Control to SoftBank

WeWork is considering a bailout that will hand control of the co-working giant to SoftBank Group Corp., according to a person familiar with the matter, one of two main options to rescue the once high-flying startup. The Japanese investment powerhouse controlled by billionaire Masayoshi Son is convinced it can turn around the cash-strapped American company ...

5) Santos Targets Asia LNG Growth With $1.4 Billion Conoco Deal

Santos Ltd. agreed to buy ConocoPhillips’ northern Australia business for $1.4 billion in a deal that will boost the Adelaide-based oil and gas producer’s position in the growing Asian liquefied natural gas market. The transaction may allow Santos to become the country’s largest independent energy producer and capitalize on a push by Asian consumers, ...

World News Briefing

6) Johnson Stumbles in Bid for Brexit Deal as EU Demands Answers

Boris Johnson’s attempt to secure a Brexit deal ran into trouble after the European Union warned the talks were still a long way from a breakthrough and the British prime minister’s political allies distanced themselves from his plans. The pound fell. After a weekend of intensive negotiations in Brussels, the EU’s chief Brexit negotiator, Michel Barnier, ...

7) Trump Says ‘Ready to Go’ on Turkey Sanctions as Troops Leave

President Donald Trump said the U.S. is “ready to go” with more sanctions on Turkey in response to its incursion into Syria, after his defense secretary said the president ordered a deliberate withdrawal of troops from northern Syria to keep them out of harm’s way. Trump said in a Sunday tweet that he’s dealing with Republican Senator Lindsey Graham of South ...

8) Hong Kong Police Officer Slashed in Neck as Violence Continues

A Hong Kong police officer was slashed in the neck by a protester as clashes continued following an escalation of violence earlier this month in demonstrations that began in June. Demonstrators spread out across 18 districts on Sunday in scattered, pop-up protests to pressure the government to meet their remaining demands, including the right to choose and ...

9) As One Massive Blackout Ends, California Is Bracing for Next

An unprecedented blackout that plunged millions of Californians into the darkness for days is over. And nobody can say when the next will hit. Even as PG&E Corp. declared an end to last week’s shutoffs -- a deliberate move to keep power lines from sparking the kind of blazes that forced the utility into bankruptcy -- ...

10) Video of Fake Trump Shooting Media, Critics Shown at His Resort

(New York Times) -- WASHINGTON — A video depicting a macabre scene of a fake President Trump shooting, stabbing and brutally assaulting members of the news media and his political opponents was shown at a conference for his supporters at his Miami resort last week, according to footage obtained by The New York Times. Several of Mr. Trump’s top surrogates — including his son Donald Trump Jr., his former ...

Bonds

11) Looming Rate Cut, Foreign Inflows, Belie Weakness in Korea Bonds

Huge foreign inflows into South Korean bonds belie returns that are among the lowest in Asia -- and an expected interest rate cut by the central bank may not be enough to change the picture anytime soon. Despite a consumer price index that’s dropped below zero, most economists see the Bank of Korea standing pat after a likely reduction in benchmark borrowing ...

12) Treasury Futures Gain, Dip Buying Emerges in Aussie Bonds

Treasury futures tick higher as yen climbs and S&P E-mini futures unwind initial gains. Volumes are low with cash markets closed. Aussie bond futures rise amid heavy volumes, suggesting appetite to buy the dip after yields rose at the open while long-end remains supported.

- UST yields implied by futures are around 1bp lower across the curve. Futures volumes ...

13) Singapore’s Central Bankers Know Something We Don’t: Daniel Moss

Singapore offers a small ray of light in a faltering global economy. The country that's so intimately tied to the rhythms of global commerce dodged a recession in the third quarter, figures Monday showed. Singapore simultaneously eased monetary policy, the first such step since 2016, as anticipated. That it did so cautiously suggests at least some of the ...

14) LEBANON INSIGHT: Doomsday Clock Ticking Louder for Currency Peg

(Bloomberg Economics) -- Lebanon is flashing red. Average dollar yields have almost doubled since February and are well into distressed territory. Financial markets are right to be worried -- the country could deplete its international reserves within 10-24 months if it doesn’t get financial support from the Gulf.

- The peg between Lebanon’s pound and the dollar is under threat: international reserves can ...

15) U.S.-China Trade Deal: JPM Sees Stocks Upside, BofA Watches Yuan

The U.S. and China agreed Friday to the contours of a partial trade deal that Presidents Donald Trump and Xi Jinping could sign as soon as next month, but there’s still a lot for investors to chew on. Questions remain on everything from whether the deal will actually be completed to the import taxes on all remaining Chinese shipments due to start Dec. 15. ...

16) Money Market Funds Still Pay a Pretty Decent Yield: Macro View

Stocks are struggling to reclaim their highs. Bonds are looking blah. A lot is probably priced into markets: Brexit, slowing global growth, a Fed rate cut this month, a partial trade deal -- all things we’ve been talking about for weeks or months. One place to look now: money market funds.

- By some measures, the flight to safety is in full swing. Commercial bank holdings of ...

Central Banks

17) Pound Slides From Three-Month High on EU Warning: Inside G-10

The pound dropped from a three-month high after European Union negotiators said U.K. Prime Minister Boris Johnson’s plans were not yet good enough to form the basis of an exit agreement.

- Sterling fell versus all its major peers after Chief EU Brexit negotiator Michel Barnier was said to have briefed the bloc’s government envoys that the U.K.’s proposals were ...

18) EM Review: U.S-China Trade Accord Halts Three-Week Stock Decline

Emerging-market stocks halted a three-week slide last week and currencies rose as the U.S. and China agreed on the outline of a partial trade accord. As part of the deal, China will significantly step up purchases of U.S. agricultural commodities, while the U.S. will delay a tariff increase due this week. President Donald Trump said the deal was the first phase of a broader agreement. ...

19) Sizzling Onion Prices Unlikely to Alter India’s Easy Rate Cycle

A more than 200% surge in onion prices is expected to push India’s headline inflation rate to its highest level in more than a year, but is unlikely to keep Asia’s most aggressive rate cutter from further easing monetary policy. The price-spike is likely to add at least 30 basis points to September’s headline inflation. A Bloomberg survey ahead of a report ...

20) Finance Chiefs Head to IMF Amid Slowdown Concerns: Economy Week

The guardians of the world economy head to Washington this week under the cloud of a slowing world economy. The annual meetings of the International Monetary Fund and World Bank kick off with the new leaders of both expressing concern over the outlook. IMF Managing Director Kristalina Georgieva is already hinting her economists will on Tuesday cut their ...

21) China’s Daily Yuan Fixing Hasn’t Been This Steady Since 2011

China’s central bank is continuing to keep its yuan fix flat as signs of progress emerge in trade talks with the U.S., with strategists divided on how the currency will fare. The People’s Bank of China set the daily reference rate around 7.073 per dollar for a fifteenth straight trading day on Monday, pushing the fixing’s 10-day volatility to the lowest since ...

Economic News

22) Is the World Economy Sliding Into First Recession Since 2009?

The global economy is wobbling and whether it topples over is the big question in financial markets, executive suites and the corridors of power. Investors cheered Friday as the U.S. struck a partial trade agreement with China and there were even signs the U.K. may strike a divorce deal with the European Union. But the debate over how close the world is to ...

23) Singapore Central Bank Signals More Easing as Growth Risks Mount

Singapore’s central bank signaled it’s ready to adjust monetary policy further after easing Monday for the first time since 2016 as risks to the economic growth outlook persist. The Monetary Authority of Singapore, which uses the exchange rate as its main policy tool, reduced “slightly the rate of appreciation” of the currency band and said it’s prepared to ...

24) Finance Chiefs Head to IMF Amid Slowdown: Economy Week

The guardians of the world economy head to Washington this week under the cloud of a slowing world economy. The annual meetings of the International Monetary Fund and World Bank kick off with the new leaders of both expressing concern over the outlook. IMF Managing Director Kristalina Georgieva is already hinting her economists will on Tuesday cut their ...

25) China Trade Slumps, Mini-Deal Yet to Lift Outlook: Economics

(Bloomberg Economics) -- China’s September trade data showed greater contractions as the U.S. imposed further tariffs on Chinese exports from the month. Both exports and imports undershot expectations. The ‘phase one deal’ between the U.S. and China raises hopes for a de-escalation in the trade war, but doesn’t materially change China’s trade outlook yet.

- Exports fell 3.2% year-on-year in September, bigger than the 1.0% drop in August. This was ...

26) China’s Imports, Exports Both Worse Than Expected in September

China’s exports and imports shrank more than expected in September, as existing U.S. tariffs and the ongoing slowdown in global trade combined to undercut demand. Exports decreased 3.2% in dollar terms from a year earlier while imports declined 8.5%, leaving a trade surplus of $39.65 billion, the customs administration said Monday. Economists had forecast ...

European Central Bank

27) ECB’s Holzmann Says Draghi’s QE Policy Is Counterproductive

Several members of the European Central Bank’s Governing Council are against the ECB buying more bonds, the Austrian central bank Governor Robert Holzmann said. “The view was that the attempt to inject even more liquidity isn’t good, even counterproductive,” Holzmann told Austrian public TV broadcaster ORF in an interview. “Several governors didn’t consider ...

28) Jean-Claude Trichet Mario Draghi critics [...]

Preview text not available for this story.

29) Draghi's critics are misguided

Preview text not available for this story.

4-hour timeframe Amplitude of the last 5 days (high-low): 43p - 39p - 55p - 37p - 64p. Average volatility over the past 5 days: 48p (average). The European currency in the confrontation with the US dollar ended the week of October 7-11, relatively calmly, with an increase, but not too strong. In total, the bulls managed to push the pair away from two-year lows by almost 200 points. Yes, this is not ...

As Mario Draghi’s tenure at the helm of the ECB draws to a close, he becomes (slightly) more pointed and looser with his public statements. On Friday (October 11, 2019), he gave a speech – Policymaking, responsibility and uncertainty – at the Università Cattolica in Milan on the occasion of receiving the Laurea Honoris Causa (honorary degree). He broadened the scope of his policy ambit by saying ...

Federal Reserve

32) Yield Curve Flips to Positive Again. Celebrate?: John Authers

To get John Authers' newsletter delivered directly to your inbox, sign up here. A real scientist has some big advantages over economists and investors. None is bigger than the ability to conduct a controlled experiment — hold all other variables equal and see what happens when one is changed. Such an experiment would have been very useful at the end of last week when several things ...

33) Risk Appetite Diminishing as Trade Woes, Recession Worries Bite

(Bloomberg Intelligence) -- Growing fears of a U.S. recession and the nation's ongoing trade woes with China are suppressing the appetite for risk. Global crude is the worst-performing asset, while energy stocks on MSCI Asia Pacific lag constituent peers.

Real Time Economics

@WSJecon

Minneapolis Fed leader Neel Kashkari said the time has probably passed for to use a supersize rate cut to boost the economy, but he remains on board with the idea that cheaper borrowing costs are still warranted on.wsj.com/2pkY8II

Sent via SocialFlow. View original tweet.

35) Fed New York: Repo and Reverse Repo Operations - 2019-10-14 - XML

First Word FX News Foreign Exchange

36) China Sept. Exports -0.7% Y/y in Yuan Terms; Est. 1.5%

China customs administration announces data in yuan terms in statement; median est. +1.5% y/y (range -0.1% to +1.6%, 4 economists).

- Sept. imports dropped 6.2% y/y; median est. -2.3% (range -3.8% to -1.4%, 4 economists)

- Customs didn’t give Sept. trade balance figures in yuan

37) Trade Truce Welcome in Asia, EU Cools Brexit Hopes: Macro Squawk

Shanghai Composite jumps 1.4% and MSCI Asia ex-Japan index gains 1.2% as markets chew over U.S.-China trade progress; S&P futures edge up 0.3%. Onshore yuan strengthens 0.5% against the dollar and China’s 10-year yield hits three-month high. Bloomberg dollar index rises for first time in four days as cable retreats 0.5% after EU negotiators pour cold water on Boris Johnson’s Brexit proposals. ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

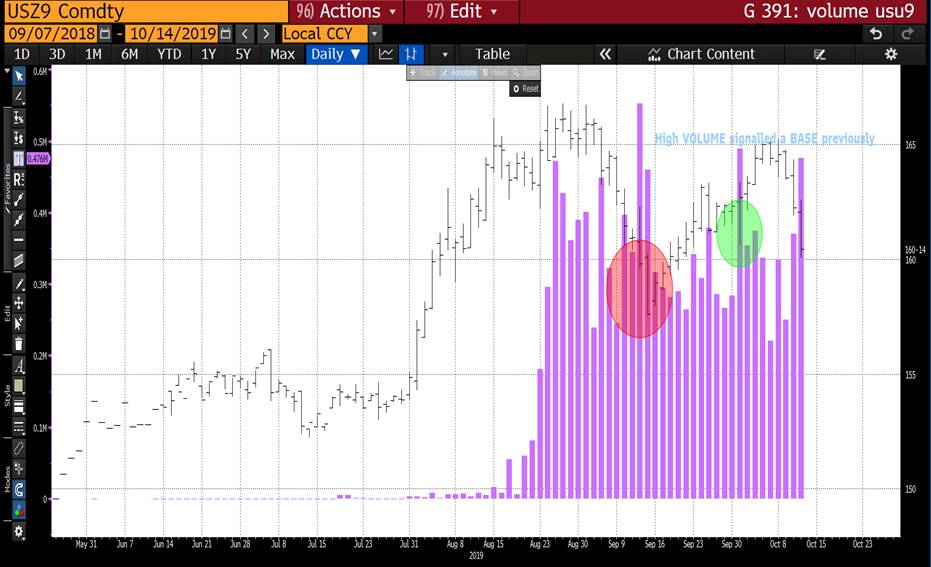

VOLUME SPECIAL : VOLUMES THURSDAY-FRIDAY WERE ABNORMAL.

VOLUME SPECIAL : VOLUMES THURSDAY-FRIDAY WERE ABNORMAL. ITS WORTH MENTIONING THAT VOLUME AND A SUBSEQUENT OPEN INTEREST DROP SHOULD FLAG UP WHEN THE CTA’S HAVE DITCHED THEIR YEAR LONG POSITIONS.

ONE THING VERY EVIDENT LAST WEEK WAS THE INCREASED SPIKE IN VOLUME?!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MACROCOSM: Astor Ridge Rates Supply Calendar - Week of Oct 14-18

US holiday on Monday

Next week's US, EUR and UK Rates Supply Calendar.

> US sees 5yr TIPS

> GER, FRA and SPA busy with supply across the curve (SPA issues TBC)

> 10yr Gilts tap coming

More colour shortly…

M

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

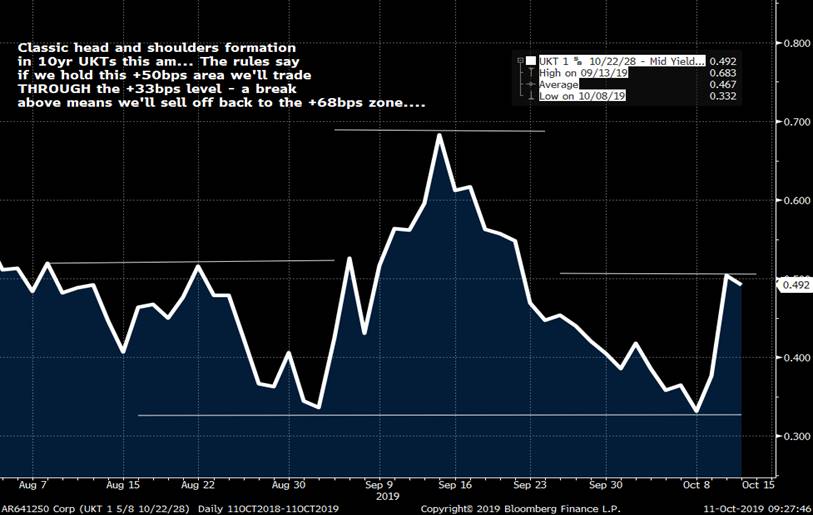

MICROCOSM: Chart Du Jour > 10yr GILTS Yield > Head & Shoulders

BIG level at 0.50%... M

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

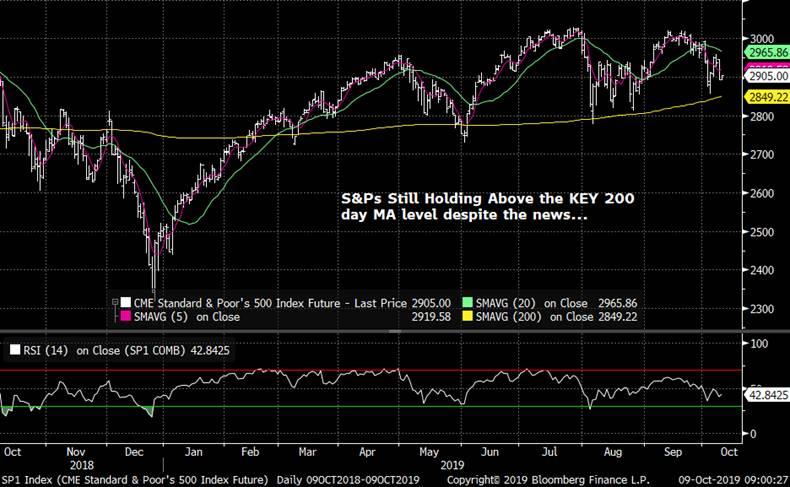

BOND, EQUITY AND BREAKEVEN DILEMA : YIELDS ARE TO BASE. WE MAY JUST BE SEEING THE YIELD BASE GOING IN, REVERSING THE YEAR LONG TREND.

BOND, EQUITY AND BREAKEVEN DILEMA : YIELDS ARE TO BASE.

WE MAY JUST BE SEEING THE YIELD BASE GOING IN, REVERSING THE YEAR LONG TREND. NOTHING IS CONFIRMED BUT BY MONTHEND WE SHOULD KNOW MORE.

BONDS :

IT IS NOW LOOKING LIKE A POSSIBLE YIELD BASE IS GOING IN AIDED BY THE BREAKEVEN SECTOR.

EQUITY :

THESE CONTINUE TO BE A PAIN AND SHOULD RALLY ALONG WITH BOND YIELDS, HOWEVER ASIA REMAINS HEAVY.

US BREAKEVENS AND USGGT :

GIVEN THE NATURAL CORRELATION WITH CORE YIELDS THE DILEMA IS WHETHER YIELDS BOUNCE HERE, ITS LOOKING LIKELY.

WE SHALL SEE BUT NEXT MONTHS START “SHOULD” GIVE US A MAJOR HINT.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

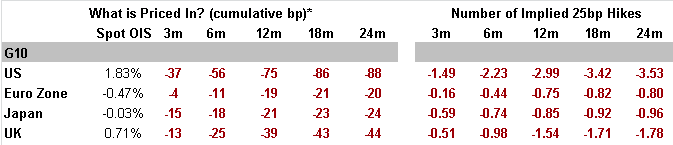

MACROCOSM: G-10 Pessimism Persists > Quick News/Technicals

It’s getting pretty tough to get out of bed in the morning for us rates market folks. There’s no sugar-coating the news out of the US, China, UK and the central banks community – things look pretty lousy.

In the last 24hrs hopes of a breakthrough in the US-China talks this Thurs/Fri have been dashed with stories like these hitting the tapes:

The U.S. – China Relationship Is Swiftly Deteriorating by the Day

Only Donald Trump Can Save the Global Economy

U.S. Farms Face Long-Term Losses From Trump Trade War, BCG Warns

Then there’s the fiasco in London as the finger-pointing kicks off with a mere 22 days to go before the Brexit deadline:

Johnson steps up election preparations as hopes fade for Brexit

Tories face split over any no-deal election manifesto

Boris Johnson Plays a Shameless Game With Merkel

Irish PM Says ‘Very Difficult’ to Seal Brexit Deal Next Week

And now the FED’s talking about resuming purchases of T-bills – but it’s not QE! And the ECB’s a mess as Draghi’s tenure comes to a close…

Powell Sees Fed Resuming Balance-Sheet Growth, But It’s Not QE

Former Draghi Lieutenant Appeals for Calm in ECB Stimulus Row

Christine Lagarde Has a German Problem

So, when we throw all of this rubbish into a blender, we get the following:

Which leaves us with:

What’s remarkable is, despite the rather depressing tone of the Brexit chatter, the betting lines continue to price in low odds of a no-deal Brexit.

Ostensibly, the market’s betting that there will be another extension of the deadline, despite Johnson’s assertions otherwise.

Brexit betting from betfair..surprisingly little change (7 Oct in brackets)

Article 50 to be revoked? 29% (28%)

No Deal Brexit in 2019? 18% (16%)

EU referendum before 2020? 1.5% (1.5%)

UK to Leave on or before 31 Oct 2019? 19% (20%)

Stocks still defying gravity…

But BTPS remain at their richest level vs DBRs this year as ITRX pulls back…

More to come….!

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

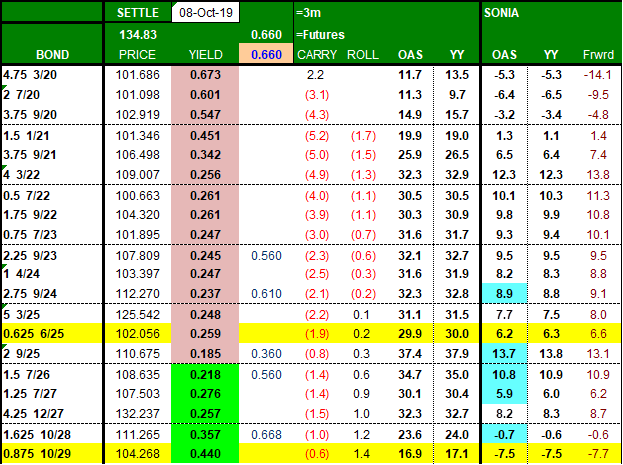

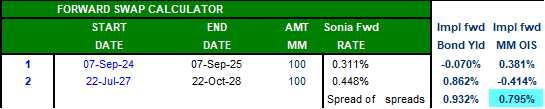

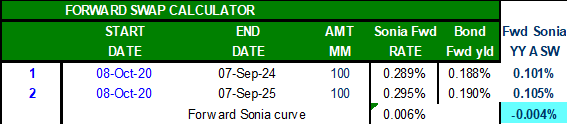

UKT Curve - V deepening to distressed levels

The UKT 6mo-10yr curve is extremely V shaped:

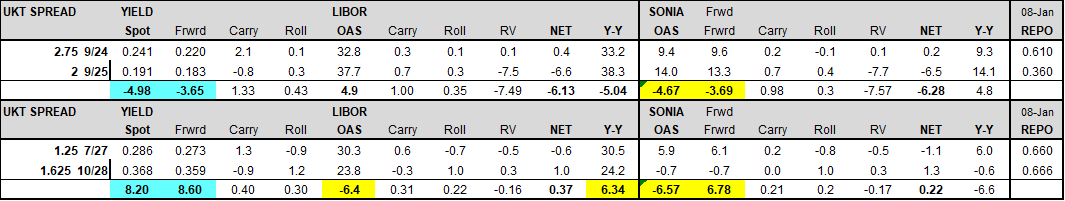

6mo-6yr (4.75 3/20 – 2 9/25): -49 bps

6yr-10yr (2 9/25–0.875 10/29): +25.5 bps

The 2 9/25 yield @ 0.19 (56 bps through base rate) is pricing a distressed Brexit outcome, and even assuming 1yr repo of Sonia – 30bps, can be shorted for flat carry.

As a result, the UKT 1.5 7/26 looks extremely rich on 24s26s28s fly but only modestly rich on the tighter 25s26s27s fly.

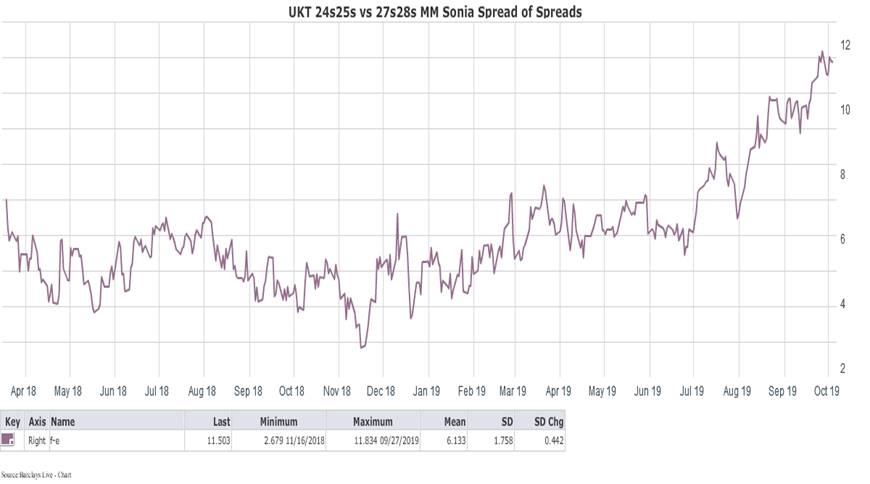

UKT 24s26s28s – plumbing new depths:

UKT 25s26s27s – in the middle of its long term range:

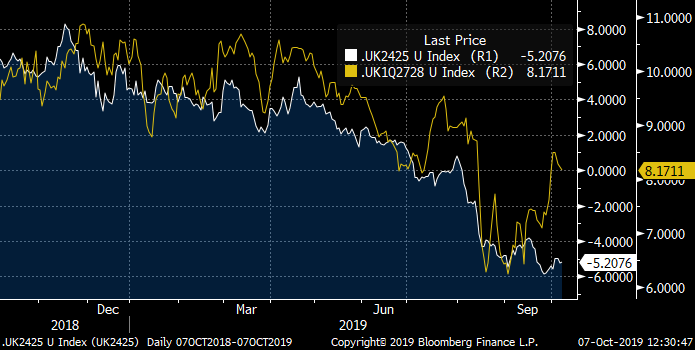

The difference is UKT 24s25s inverting (-5.25 bps) while 27s28s curve steepening (+8.15 bps):

UKT 9/24-9/25 vs 7/27-10/28 overlaid – 27s28s decoupling steeper:

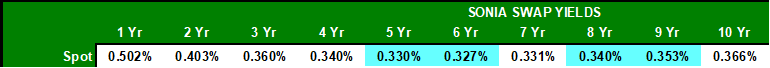

The Sonia 5s6s and 8s9s curves are relatively flat, so the anomaly is strictly on the Gilt curve:

I.e. UKT 24s25s vs 27s28s Sonia box is also at elevated levels:

- UKT 9/24-9/25 steepener vs 7/27-10/28 flattener is an optimal way to fade the V shape of the UKT 2s5s10s curve

=====================================================================================================================================

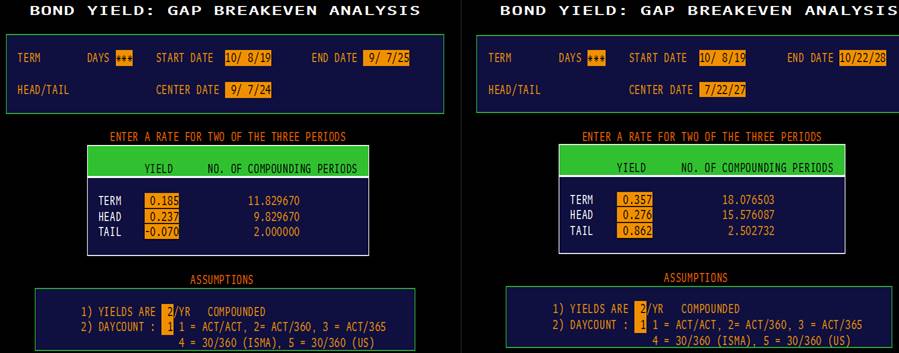

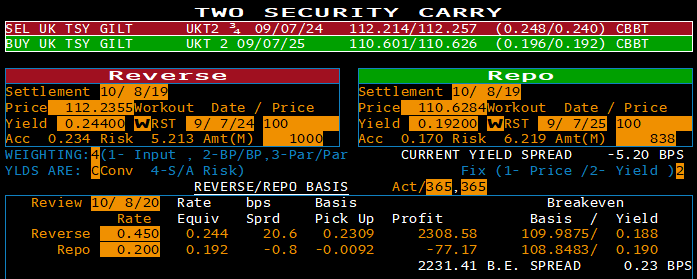

IMPLIED FORWARDS:

UKT 27s28s implied forward yield is 93 bps cheap to 24s25s implied forward:

UKT 24s25s: -.07 implied forward yield UKT 27s28s: +.862 implied forward yield (+93 bps vs 24s25s)

Compare this to similar matched maturity 1yr buckets on the Sonia curve (5y1y vs 8y1y) = +13.7 bps:

- I.e. there is an 80bps gap between 5y1y and 8y1y MM Sonia spreads.

Caveats – UKT 2 9/25 have been trading perennially rich in repo – currently ~ 30bps thru GC for short dates

Assuming the 2 9/25 trades 25bps thru GC for an entire year (unlikely now that it is ineligible for APF), the 9/24-9/25 forward spread is 5.4 bps steeper than spot (i.e. the forward yield spread is close to flat):

The 1yr forward 9/24-9/25 MM Sonia curve = +0.6bps, meaning the forward Sonia ASW box is STILL inverted:

Consensus short positioning is the main risk to being short 2 9/25 or 1.5 7/26…..the latter bond will still be eligible for the March 2020 APF so could stay rich in yield and on repo for an extended period.

Jim Lockard

Founder / Managing Partner

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796