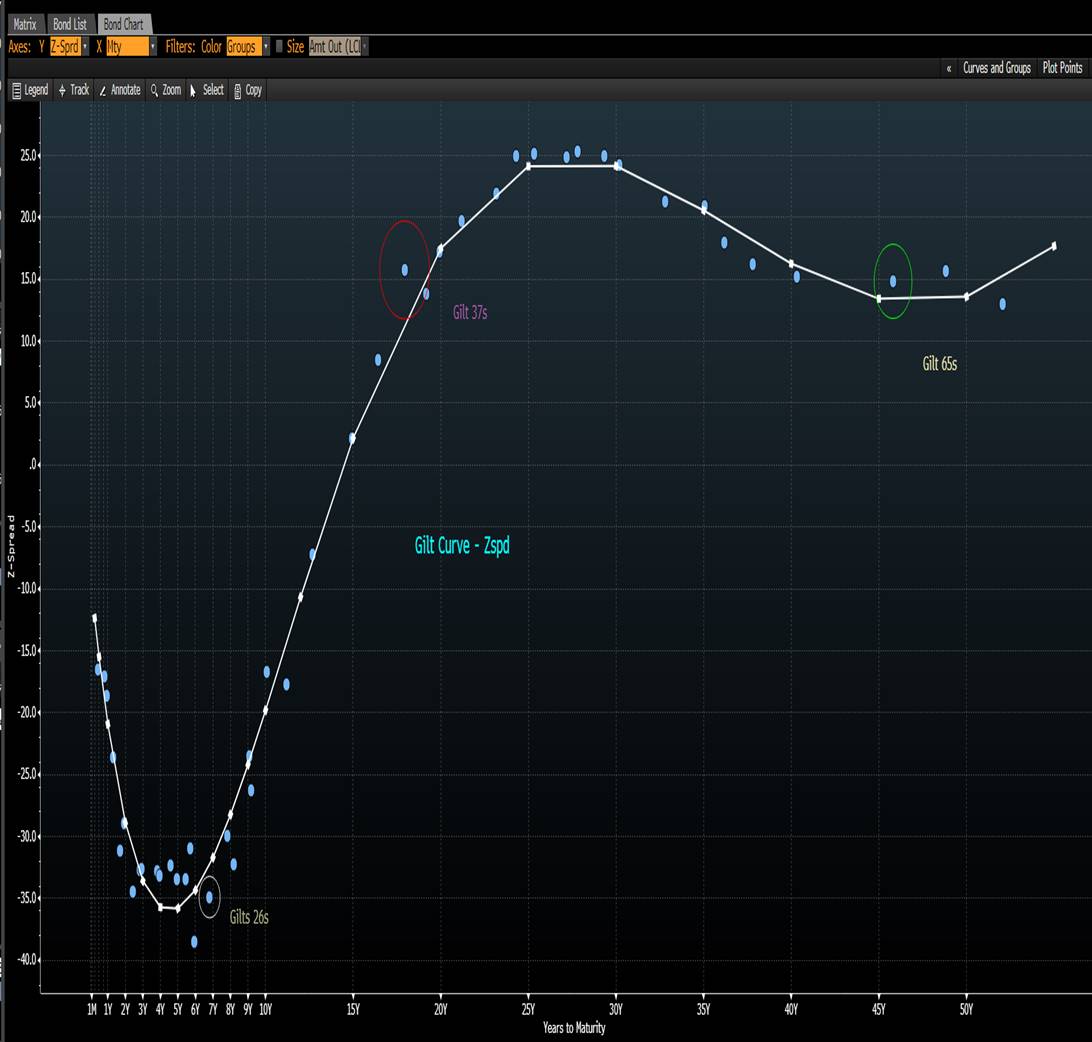

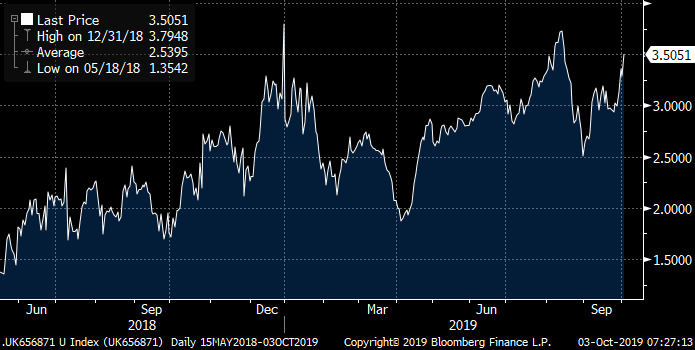

UK Gilt Trade: Wide Fly vs Sonia - 26s/37s/65s ~50bps

Trade: Gilt Fly: 1x2x1 wtd vs Sonia – buying the belly – 1.5% 7/26 x 1.75% 9/37 x 2.5% 7/65

Level: +49.85bps

Stop: +54bps

Target: +40bps

Carry: ~0.6bps postive/mo

Rationale:

- Last tap of the 37s which should make room for new 20y next year.

- 37s - Carry + Roll down best part of the Gilt curve.

- 15y or 20y vs ultra long curve has re-inverted – Pension dynamics/de-risking, RPI ruling still outstanding etc.

- APF done till Q2 next year, supply for the balance of 2019 will see one more longs - 49s in early Nov., and either

a linker or conventional syndicated deal some time in Nov. Growing belief is more likely a conventional

for one or the other - 54s or 71s.

- Potential for more Gilt Issuance on the back of Fiscal Relaxation should lend itself to more long end supply.

We like the trade better vs Sonia – at the highs near +50bps. In bond yld terms(+63bps), more volatility, larger range and recent correlation with directional input

could see the fly cheapen further before finding resistance.

- 20y vs 45y Gilts Disinversion back to the lows.

- Carry & Roll – 15y – 20y Part of the Gilt Curve represent the highest levels.

- May want to have a look at 47 vs 37s to own in the belly, but our thinking is that there is still the 49s to come before year end and then a syndicated tap of 54s or 71s.

If 54s, could see congestion in 30yr sector – hence preference at this time for more 15yrs.

MICROCOSM: GILTS - UKT 1H26s Repo - Our thoughts

Thanks to GW for pitching in on this one…

GILTS > UKT 1H26s Repo

> RV guys we talk to have been watching 1H26s repo levels like hawks over the last 3-4 weeks as the issue has shown '225-esrue' behaviour, trading at GC-25 or more at times.

> The issue is trading GC-20bps this am so, while still well through GC, it's the first sign that the issue may not vanish from the mkt.

> Given the decline in the float of the issue to £13.5bn after the Sep/Oct APF purchases some are suggesting this will present a major problem going fwd and accounts are loathe to be short these 26s.

> We'd counter this view with the following:

1) It's no coincidence that the 1H26s repo heated up over the last 3 weeks of the APF. You know why? It's because THE BOE CAN NOT BE FAILED to. If you sell an issue to them during the APF you'd better come up with the bonds.

2) Here are some actively traded issues that have smaller floats than the 26s and show little sign of repo value:

2T24 £10.9bn

4Q27 £7.7bn

4T30 £7.8bn (H0 CTD)

4H34 £12.75bn

4Q36 £12.9bn

1T49 £8bn (tap soon)

4Q55 £11.8bn

1F71 £9.2bn

3) The next APF is in Mar/Apr '20 where the 26s will likely feature again. However, by then the 0F25s will be at/close to the end of the cycle and a new 26s issue will be on the horizon. No scarcity of eligible issues for the APF in 3-7yr bucket.

4) Lastly, the 1H26s's repo bid has been a relatively new phenomenon, contrary to the perma-bid the 225s have had. This is a different situation which we see as unlikely to be repeated, even with the 1H26s' proximity to the 225s.

So, if you're long the 1H26s because you expect them to stay rich in repo, we'd suggest it's time to lighten up.

Thanks,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

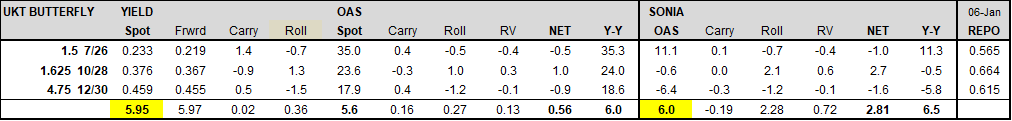

UKT 26s28s30s - Belly Cheap

TRADE: Buy belly of UKT 26s28s30s @ +6bps (with 0.25bp discretion):

Stop: +8 bps

Target: +2 bps

Rationale: Recent richening of UKT 26s and 30s in micro RV has left the UKT 28s looking cheap on bfly. With the severe concavity in the UKT 5s7s9s curve, the 9yr point stands out as very cheap given sharp rolldown, especially in the current reach for yield environment.

UKT 26s28s30s bfly – recent trend correction:

Drivers:

UKT 2.75 9/24–1.5 7/26–1.625 10/28 bfly – 26s richening into APF selling:

UKT28s30s32s – 30s also trending richer as they become CTD to March 2020 contract for 9 cycles:

The 26s28s30s will roll down to the the 24s26s28s in 2 years time – which trades over 21bps richer and is near recent wides:

UKT 26s28s30s bfly minus 24s26s28s bfly:

Carry on the UKT 26s28s30s fly is relatively flat assuming a repo spread of -11bps and -6bps on each wing.

Jim Lockard

Founder / Managing Partner

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

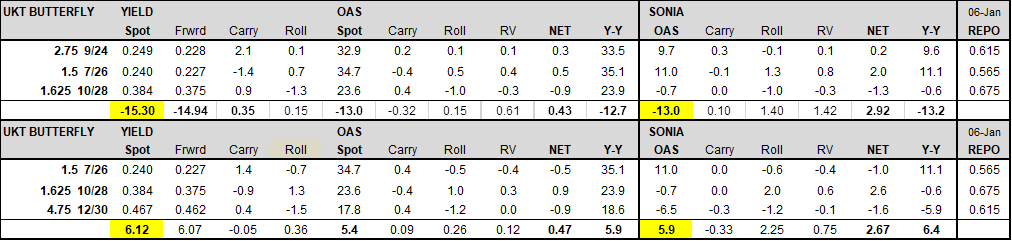

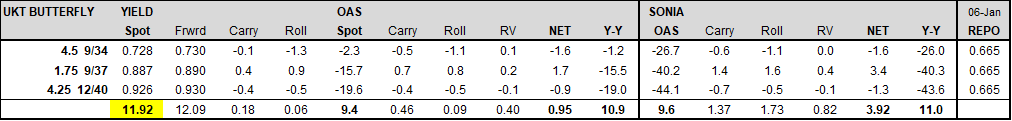

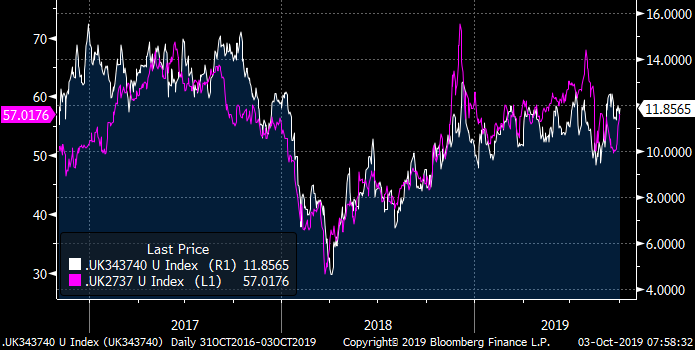

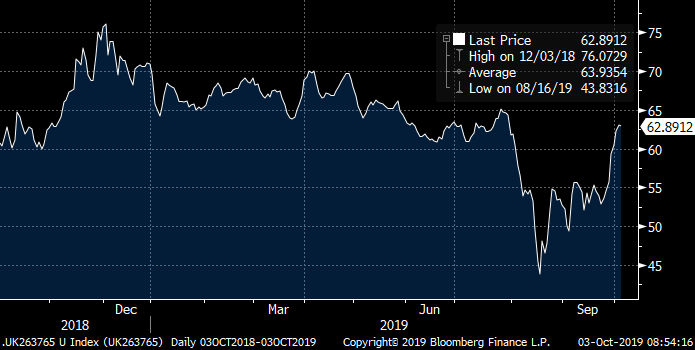

UK ultra long richening driving bellies cheap

LDI de-risking activity (see below) in the ultra long end coupled with recent 37s supply and yesterday’s 7-15yr final APF have caused the 20-30yr sector to look cheap, as well as micro RV dislocations in the 50yr sector.

“Allied Domecq agrees £3.8bn buy-in with Rothesay Life to take 2019 deals past £30bn”:

“This week has been a significant week for the insurer, as it announced two mammoth bulk annuity transactions, one of which is the biggest ever transaction to date. It announced yesterday that it agreed a £4.7bn buyout of the GEC 1972 plan, which made 2019 officially, a record-breaking year. Meanwhile, today it agreed a £3.8bn buy-in with the Allied Domecq Pension Fund in the market's largest deal to cover both pensioner and deferred members.”

UKT 30s50s (47s71s) reinverting to 1yr lows, conversely at much lower yield levels:

TRADES (in order of VAR):

- Buy belly of UKT 65s68s71s @ +3.3 bps:

Stop: 4bps

Target: 2bps

Rationale: In DMO consultations we recommend a nominal syndication (likely week 18 Nov) in 54s or 71s, either of which could cheapen the wings to the belly of this fly, which has been relatively stable and near multiyear extremes. The recent richening of 71s is likely due to pension de-risking and shifting out of RPI (linkers) into nominals. Given recent rise in mortality rates, flexible drawdown pensions, uncertainty around the future of RPI, and the scope to upsize 71s, I view the recent richening as an event driven aberration which presents an opportunity to fade.

- Buy belly of UKT 34s37s40s @ +11.75 bps:

Stop: 13 bps

Target: 8 bps

Rationale: We have seen the last tap of 37s which will eventually make room for a new 20yr. The 37s roll down a very steep part of the 10s30s curve and should be favoured in the current reach for yield environment. Location – the fly is approaching Nov 2018 highs, when UK cabinet resignations caused FTQ bid in 10yr futures at the same time as a 37s tap drove the 10s20s curve sharply steeper (purple line below). The fly is near Nov 2018 highs despite 15 bps flattening in 4q27s37s curve since then.

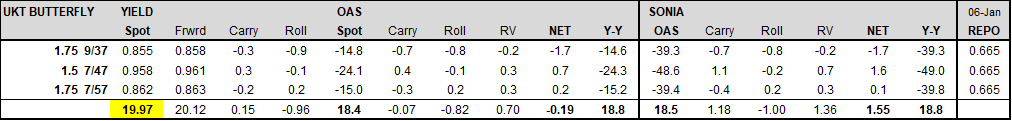

- Buy belly of 37s47s57s @ +19.75 bps:

Stop: 21.25 bps

Target: 16.5 bps

Rationale: The 47s are even cheaper than the 37s on this fly, due to recent richening of 50yr sector. Location – we are near all time highs of 21 bps, which occurred during FTQ and supply driven steepening of 10s30s in Nov 2018 coupled with year end de-risking in 50yrs (white line below). UKT 37s47s57s is also cheap to the 37s47s wing (yellow line below). In 2019, the fly has shown mean reverting tendencies; over the last 6 months the fly has traded in a well defined 16-20 bps range:

The UKT 47s57s leg of this fly is also approaching 1yr extremes:

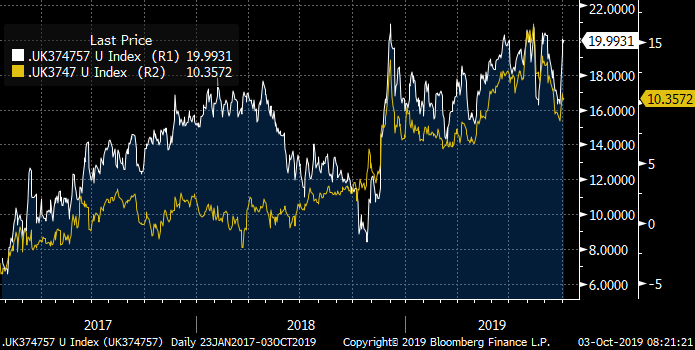

- Buy belly of UKT 26s37s65s bfly @ +62.5 bps:

Stop: 66 bps

Target: 55 bps

Rationale: The 26s37s65s fly has cheapened nearly 20bps from August lows, much of it in the last 1.5 weeks, due to 37s tap (and exclusion from last 2 APFs) coupled with recent LDI de-risking in the 50yr sector. We are back near the 65 bps level which has held since May. The fly also enjoys positive carry of close to 8bps per annum.

Jim Lockard

Founder / Managing Partner

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: FRTRs and SPGBs > Busy Morning on Tap - Quick Charts

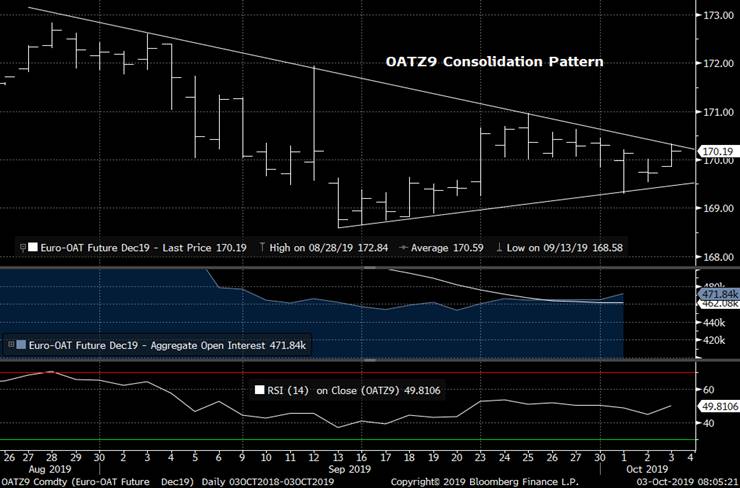

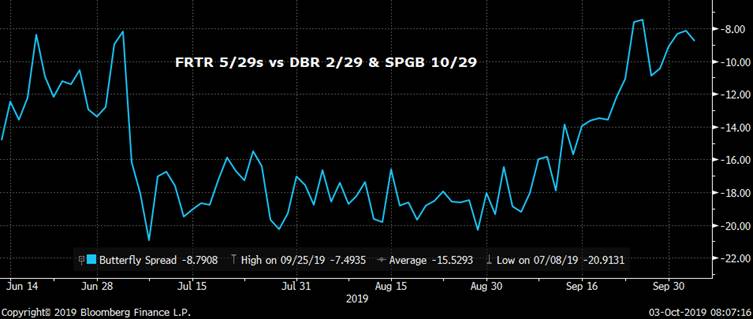

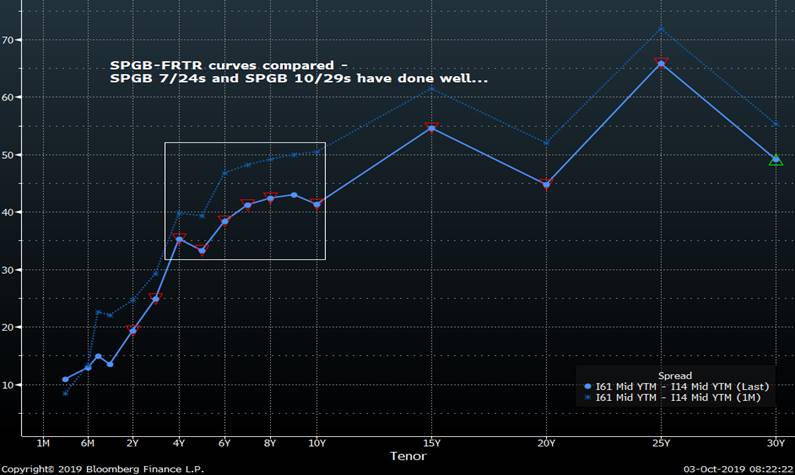

OATs/SPGBs Into Supply - Few charts for you:

- OATZ9 daily - pennant formation after a period of consolidation. Current levels are first resistance before 171.00 and support at 169.50 before 168.60 area.

- FRTR 5/29s vs DBR 2/29s and SPGB 10/29s... Here's a chart of the 1-2-1 fly for brevity's sake (s/b -1.1/2.0/-.9 but close enough) - shows OATs are back to the cheapest levels since June. Between Oct and Nov the OATs market will have 60bn in redemptions and ~25bn in cpns to digest.

- FRTR 5/26-5/29-5/34 fly – The 10yr sector has been trading on the cheap side of fair for the last couple weeks as the market anticipates a new 10yr. This should help attract some demand for this am’s new FRTR 11/29s (which have been trading around +4bps on the roll thus far).

- Spain has been grinding tighter vs DBR/FRTRs/NETHER, etc since their upgrade. One would think positioning is pretty long by now and with equities struggling to hold, we’re a tad concerned credit worries could surface, attracting profit taking sales. Check out this chart of the SPGB 4/26-10/29-7/33 fly – similar to the OATs one above. Looks like 10yr Spain is a tad richer, no?

- SPGB vs FRTR curves compared… Bull flattening in SPGBs more pronounced from 5-10s than in France…

We’ll be in touch…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

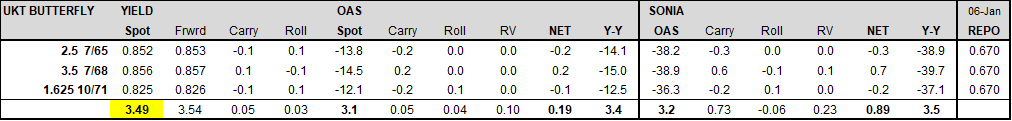

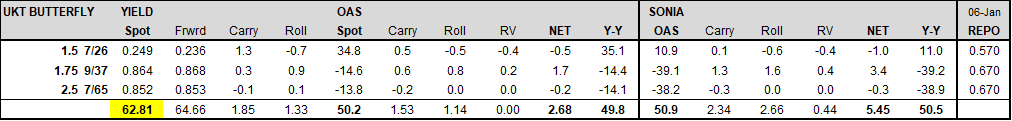

MICROCOSM: GILTS > UKT 1T37s Tap This AM and Last 15yr+ APF This PM... RV Colour

GILTS... 1T37 Tap & Last 15yr+ APF Today...

- Last Tuesday we sent out a note entitled 'Time to Start Buying UKT 1T37s' into this am's tap (see attached).

- Since then...

UKT 37-38s went from +3.4bp to +2.2bps this am

UKT 4Q27-1T37-4Q46 wtd fly richened from +1.9bps to +.8bps

UKT 4Q36 into 1T37 z-sprd flattened from +8 to +7.6bps

UKT 4H34-1T37-4Q46 fly (-.8/2.0/-1.2) has richened from +2.6bps to +1.0bps this am.

DESPITE these richening moves we still think there's further room for the 1T37s to richen from here.

1) 1T37s still have the best C&R on the curve.

2) Last week's 15yr+ APF operation saw selling of 38s and 39s which appear to have been shifted into 37s.

3) This is likely to be the last tap of the 1T37s before a new 20yr is announced.

4) Fiscal spending chatter should keep the 30yr point under pressure into Oct/Nov.

5) Nov syndication should be long-end conventional in our view.

6) Tomorrow's last 27-34s APF is likely to be the last hurrah for 34s in our view.

- The last 15yr+ APF is a crapshoot in our view. The RICHEST issues from the 4Q36s and longer are the 4H42s, 3Q44, 1T57s and 4 60. To date, none of these issues have featured at all in this 3T19 APF operation and with the 1T37s tap looming, there are several directions we could take: Sell MORE 47s>49s to raise some money to shift down the curve into 37s (and hope the curve doesn’t steepen much between 10:30am and 2:45pm); Sell more 38s and 39s, adding to last week’s totals; pre-empt the conventional syndication by dumping some 1F54s (even if they still look cheapish). Regardless of the direction the market takes, this is clearly the last time the market can dump a big chunk of UKTs DV01 onto the BoE before the Oct 31 Brexit deadline and the resumption of the DMO’s supply calendar.

Still like:

1) Selling 34s and 36s into 37s (yield flattener or boxed vs swaps)

2) Buy 37s vs .30 4Q27 and 11.7 X 46s... Still elevated given where 10y5y Sonia trades.

3) buy 1T37s vs 4Q36 & 4Q40 on 1-2-1 fly, Still cheap vs SONIA even with 1bp+ richening.

Charts below.

We’ll be in touch…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary >Tues Oct 1st

Business Briefing

1) Credit Suisse COO Bouee Resigns, Names James Walker COO

Story to follow

2) WeWork Bonds Hit Record Low After Company Pulls IPO Prospectus

WeWork bonds dropped to their lowest level on record Monday after the company said it’s formally withdrawing its prospectus for its initial public offering.

- The office-sharing company’s 7.875% notes due 2025 fell as much as 2.2 cents on the dollar to 85 cents, according to Trace

- At current level, bonds yield 11.3%

- NOTE: WeWork Puts ‘Official Pause’ on IPO to Focus on Core Business

3) Holiday Shoppers Weighing Carbon Footprint in Delivery Decisions

Mother Nature is figuring into consumers’ holiday spending plans this year. The environmental impact of fast-delivery options, which may include using planes and shipping multiple items separately, is a concern resonating with Americans, according to Accenture’s Annual Holiday Shopping Survey. Half of respondents said they’d choose options that leave a ...

4) Trump Allies Giuliani, Pompeo, Barr Drawn Into Impeachment Focus

Donald Trump’s personal lawyer, Rudy Giuliani, his Secretary of State Michael Pompeo and Attorney General William Barr were all drawn deeper into the House impeachment inquiry after new details of the administration’s foreign contacts emerged on Monday. Three House committees said they had subpoenaed Giuliani for records of his dealings with Ukraine on ...

5) U.S. Utility That Overcharged $380 Million Now Wants to Spend It

Dominion Energy Inc., the U.S. utility giant that came under fire a month ago for overcharging its customers by almost $380 million, wants to keep the money and spend it on grid upgrades. On late Monday, the Virginia power company proposed to use some of the extra cash to help install almost a million smart meters, create an online “customer information ...

World News Briefing

6) Xi Says China’s Rise Unstoppable in Face of Protests, Trade War

President Xi Jinping declared that no force could stop China’s rise, exuding confidence during a key anniversary as he faced unprecedented challenges from protesters in Hong Kong and Donald Trump’s trade war. Speaking at the start of grand parade marking 70 years since the founding of the People’s Republic, Xi called for stability in Hong Kong, unity among ...

7) Giuliani Subpoenaed by House Democrats in Impeachment Inquiry

President Donald Trump’s personal attorney Rudy Giuliani was subpoenaed for documents Monday by Democrats on the House Intelligence Committee, as the impeachment inquiry into the president accelerates. The Democratic chairmen of the House committees on foreign affairs, intelligence and oversight gave Giuliani a deadline of Oct. 15 to turn over documents he ...

8) Johnson Confronts Moment of Truth for U.K.’s Brexit Strategy

British Prime Minister Boris Johnson is facing the moment of truth for his Brexit strategy as he prepares to present his blueprint for a deal to the European Union in days. The reception his plan receives in Brussels and among pro-Brexit members of his ruling Conservative Party will determine whether there is any hope of securing an orderly exit for the U.K. ...

9) Tens of Thousands Take to Hong Kong Streets for Holiday Protests

Hong Kong pro-democracy protesters began gathering for a series of protests, including a march through the city center, hours after celebrations for a holiday marking 70 years of Communist rule in China began in Beijing. President Xi Jinping oversaw a military parade through the center of the capital that featured some of China’s most advanced weaponry, ...

10) Trump Taps FERC General Counsel for Republican Seat on Regulator

President Donald Trump has nominated the general counsel of the Federal Energy Regulatory Commission to one of two open seats on the panel, which oversees the U.S. power grid, approves utility mergers and grants permits for natural gas pipelines. If confirmed, James Danly, the general counsel, would fill the Republican slot on the commission, which has been ...

Bonds

11) Investors Binge on Record $308 Billion of Company Bond Sales

Companies globally sold a record amount of bonds in September as investors hungry for yield poured into debt, betting that major central banks can keep the global economy out of a recession and the worst can be avoided in the U.S.-China trade war. Firms from Apple Inc. to Japan’s SoftBank Group Corp. sold more than $308 billion of notes, the first time ever ...

12) Japan’s GPIF Positions Itself for More Foreign Debt Buying

The world’s biggest pension fund is giving itself leeway to buy billions of dollars more of bonds outside its home market, as negative rates in Japan drive down returns. Japan’s Government Pension Investment Fund will consider currency-hedged overseas bond holdings as similar to domestic debt investments, it said in a statement on Tuesday. This will allow ...

13) Indiabulls Seeks Earlier Hearing After Record Share Slide

Indiabulls Housing Finance Ltd., a major Indian shadow lender that’s caught in the crosshairs of the troubles plaguing the industry, is seeking to bring forward a court hearing on fraud allegations after a record share slide. The development represents an effort to get out ahead of recent headlines that contributed to its share price losing about 8% today ...

14) Bond Traders Sound Alarm in Japan With Weakest Auction in Years

Japan’s government bonds slid across the curve Tuesday following weak demand at a 10-year note sale amid concern the nation’s central bank and pension fund will cut purchases. Ten-year bond futures slumped as much as 0.76 yen to 154.26, triggering a margin call at the Japan Securities Clearing Corp. The auction drew the lowest bid-to-cover ratio since 2016 ...

15) Aussie Sinks as RBA Cements Bets for Further Easing: Inside G-10

Australia’s dollar fell against all its major peers after the Reserve Bank lowered interest rates and signaled it may ease again. The greenback climbed as mixed U.S. economic data cast doubt on the need for more rate cuts.

- Aussie dropped to a one-month low as option desks and macro funds sold the currency after the central bank said it’s prepared to ease ...

16) World’s Biggest Money Manager to Add Indian Bonds After Selloff

BlackRock Inc., the world’s largest money manager, plans to add to its holdings of Indian bonds, lured by one of the highest yields among emerging Asian nations and the promise of more monetary easing. “We are looking at some stabilization and would potentially look for adding exposure” after the risks from the likely increase in federal borrowings settle, Neeraj Seth ...

Central Banks

17) Australia Cuts Key Rate as Global Threats, Unemployment Rise

Australia’s central bank lowered interest rates for the third time this year as it tries to shield the economy from a slew of offshore risks, and signaled it may cut even further. Reserve Bank chief Philip Lowe reduced the cash rate by 25 basis points to 0.75%, as predicted by money markets and most economists, edging closer to a level where unconventional ...

18) Back to School: Program Offers Masters Degree in Central Banking

The work of central banking has become ever more complicated since the global financial crisis ushered in an era of unconventional policy tools a decade ago. Now the Kuala Lumpur-based Asia School of Business is launching a full-time Master of Central Banking degree to help meet the challenges. Aimed at mid-career central bank officials, the year-long residential program, slated to ...

19) Gloomier Japanese Manufacturers Unlikely to Move Needle at BOJ

Fears over the global economy and the impact of a sales tax have made Japanese manufacturers gloomier about business conditions, but not likely by enough to push the Bank of Japan closer to extra stimulus later this month. Confidence among the country’s biggest product makers, which include household names such as Toyota, Sony and Canon, fell to 5 from 7, ...

20) European Jobs Offer Some Joy Amid Manufacturing, Inflation Gloom

Europe’s job market is giving some hope to the region’s economic story, which has been dominated by a deepening slump in manufacturing that’s tipped Germany close to recession. Figures Monday showed the euro-area unemployment rate fell to 7.4% in August, the lowest in over 11 years. Italy reported an unexpected drop to 9.5% and Germany saw the number of people ...

21) RBA Cuts Key Rate to 0.75%, as Seen by Most Economists Surveyed

Reserve Bank of Australia announces policy decision in Melbourne Tuesday.

- Governor Philip Lowe: “It is reasonable to expect that an extended period of low interest rates will be required in Australia to reach full employment and achieve the inflation target. The Board will continue to monitor developments, including in the labour market, and is prepared to ...

22) TOPLive Starts: Follow Reserve Bank of Australia's Rate Decision

Economic News

23) Asia Factory Sentiment Remains Brittle Ahead of U.S.-China Talks

Manufacturing sentiment throughout Asia remained mostly bleak in September amid trade tensions and waning global demand. Purchasing manager indexes for South Korea, Japan, and Indonesia were still in contraction territory, with South Korea’s slipped by one point to 48. Elsewhere, the gauges largely lingered at subdued levels, with Taiwan proving to be the ...

24) Japan’s Abe Rolls the Dice on His Political Legacy With Tax Hike

Shinzo Abe will almost certainly become Japan’s longest-serving prime minister next month. Whether he’ll be remembered as a success could well hinge on how the country’s economy weathers what happens today. Legislation raising Japan’s sales tax to 10% from 8% took effect Tuesday, a long-planned step intended to help the government rein in the world’s largest ...

25) RBA Sees Economy Reaching ‘Gentle Turning Point’: TOPLive

26) India’s Big Fiscal Boost Leaves Many Questions Still Unanswered

India’s Finance Minister Nirmala Sitharaman has been announcing fiscal steps almost every week since August to help industries hit by the economy’s slowdown: from tax benefits for vehicle purchases to easing foreign investment rules. Yet while cheered by businesses, the moves have left investors with several unanswered questions and worries about the fiscal deficit ...

European Central Bank

27) Lane Blames Trade Unease as Key Factor for Slower Europe Growth

The euro area economy will keep expanding, though more slowly, as it’s held back in large measure by global trade uncertainty, according to the European Central Bank’s chief economist, Philip Lane. “For several quarters now, we have been facing a slowdown that can, in part, be ascribed to external factors,” Lane said in a speech in Los Angeles on Monday ...

28) EURO-AREA PREVIEW: Low Inflation to Support ECB’s Stimulus Plan

(Bloomberg Economics) -- Inflation in the euro-area will probably remain obstinately weak in September. The headline rate is likely to slip below 1%, lending support to the European Central Bank’s decision to restart bond purchases from November. The data has also taken on an added significance since the ECB chose in September to directly link its forward guidance to developments in realized inflation. ...

29) Draghi Says ECB Has Room to Do More, But Needs Fiscal Backup

European Central Bank President Mario Draghi said the institution can do more if needed to boost inflation, and repeated his call for euro-area governments to support this effort with fiscal spending. “All instruments from interest rates to asset purchases, to forward guidance are ready to be calibrated,” he told the Financial Times in an interview. He also ...

30) Lagarde Inherits ECB Tinged by Bitterness of Draghi Stimulus

When Christine Lagarde takes charge of the European Central Bank, she’ll inherit the policy disputes of her predecessors -- now with even deeper scars. The new president will have to confront the aftermath of an unprecedented revolt among officials over Mario Draghi’s plan to reactivate quantitative easing. In a move probably linked to that, Germany’s Sabine Lautenschlaeger ...

31) Draghi Calls for More Government Spending to Support Growth

Draghi was quoted Monday by the Financial Times as saying: ...

Federal Reserve

32) Bankers Advising Fed Board Describe Libra as a Monetary Threat

The Federal Reserve asked some of the nation’s biggest banks about Libra, the digital currency proposed by Facebook Inc., and the answer was simple: They don’t like it. “Facebook is potentially creating a digital monetary ecosystem outside of sanctioned financial markets -- or a ‘shadow banking’ system,” banks said, according to minutes of this month’s ...

33) U.S. Sept. Dallas Fed Manufacturing Outlook Survey (Table)

Following is a summary of Texas manufacturing activity from the Federal Reserve Bank of Dallas. Diffusion Index: Six Months From: To compare the Dallas Fed General Business Activity and ISM Manufacturing: see G ECO 64 <GO>. NOTE: Diffusion indexes represent the percentage of respondents indicating an increase ...

34) FastFT: US repo market pressure eases after Fed interventions

Preview text not available for this story.

35) Fed’s Williams Sees Need for More Reserves After Repo Spike (1)

New York Federal Reserve President John Williams said bank reserves will probably need to be higher in the future to limit the risk of money markets repeating their recent turmoil, the New York Times reported, citing an interview. “Despite there being a lot of reserves in the system, they weren’t moving around. They’re lumpy’’ Williams told the newspaper. “We ...

First Word FX News Foreign Exchange

36) Credit Suisse Says No Indication CEO Approved Khan Observation

Investigation by law firm Homburger found no indication that CEO Tidjane Thiam had approved the observation of star banker Iqbal Khan nor that he was aware of it before September 18, after observation was aborted, Credit Suisse says in statement.

- COO Pierre-Olivier Bouee resigns; to be succeeded by James Walker

- Bouee told investigation he alone initiated observation of Iqbal Khan; did not discuss it ...

37) Peru’s President Dissolves Congress as Opposition Cries Foul

President Martin Vizcarra dissolved Peru’s opposition-controlled Congress and called a parliamentary election after months of confrontation over anti-corruption measures boiled over. Vizcarra said Monday he used his constitutional right to dissolve Peru’s unicameral Congress after his cabinet lost a vote of confidence over the government’s bid to halt the ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar: for the week 30th September, James Rice @Astor Ridge

Trade Radar: 30th Sep – 4th Oct

Italy

High coupons at extremely stretched levels

Trade:

- Sell Mar26s High coupon old CTD

- Buy and/or Nov25s / Jul26

Cix:

200 * (YIELD[BTPS 4.5 03/01/26 Corp] - 0.55 * YIELD[BTPS 2.5 11/15/25 Corp] - 0.45 * YIELD[BTPS 2.1 07/15/26 Corp])

Rationale

- The rally in Btps vs core has lifted all the high coupons

- Valuation of the boundary condition vs Low coupons is not clear – in that at the same yield and no default, High Coupons still have extra value – due to their modified duration in an upward sloping curve

Risks

- The repo goes tight on the Mar26

- High coupons continue to outperform in a Italy credit-positive scenario

France

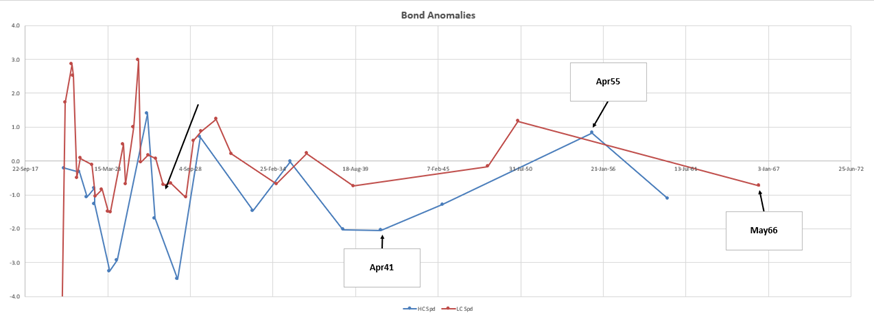

Thursday’s tap in Apr55’s offers chance to get cheap high coupons

Trade:

Buy Frtr Apr55s

Sell 25% Apr41, Sell 75% May66

* curve weighted according to curve shape

Cix:

200 * (YIELD[FRTR 4 04/25/55 Corp] - 0.25 * YIELD[FRTR 4.5 04/25/41 Corp] - 0.75 * YIELD[FRTR 1.75 05/25/66 Corp])

History:

Rationale

- On a fitted curve basis (*adjusting for the benefit of H/L coupons in positive curve) the Apr55s show up as cheap and conversely the May66 and Apr41 are rich

- Positive carry +0.4bp /3mo @same repo (+0.2bp @10bp repo spread)

- Apr55s are a little cheap just from supply but were possibly a request from the dealer market which may still be short

Levels

- Enter at 0bp

- Target -3.5bp (loss of relative anomaly value vs wings)

- Stop @ +2bp

Risks:

- Apr 55’s stay offered

- A much steeper curve means this level of curvature could persist

Spain

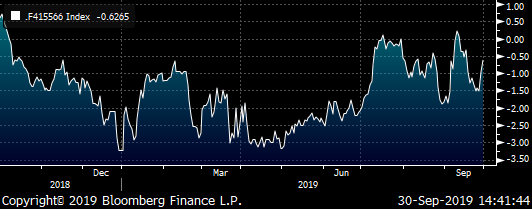

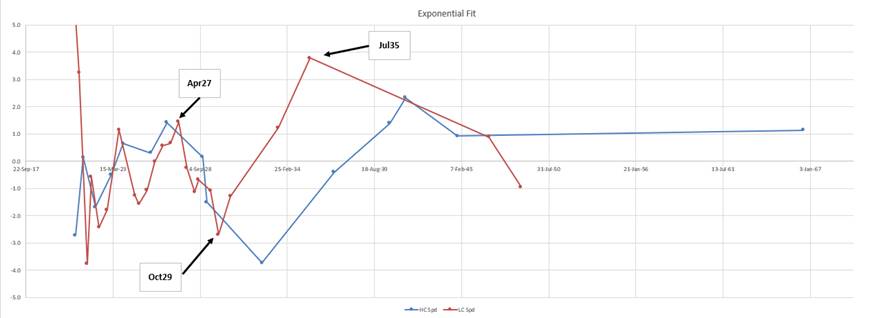

Spanish rally makes the curve a ‘straight line’ – 10y rich vs 8y and 15y

Trade:

Sell Spgb Oct29

Buy 65% Apr27, Buy 35% jul35

* curve weighted according to curve shape

Cix:

200 * (YIELD[SPGB 0.6 10/31/29 Corp] - 0.65 * YIELD[SPGB 1.5 04/30/27 Corp] - 0.35 * YIELD[SPGB 1.85 07/30/35 Corp])

Graph of Spanish Anomalies – exponential fit to adjusted* yields

(*adjusted for coupon by removing the swap spread and adding the z-spread)

Carry:

Repo has ben tight on the Spgb oct29 -

@ repo spread of -20bp the trade is -0.8bp /3mo carry – expectin gthe repo to ease with the next supply

@ same repo the trade is negative carry of -0.3bp /3mo

Rationale:

- Just looking at the shape of the Spanish curve – the rally has removed any ‘curvature’ from expectations –

- Apr27 to Oct29 is +6.3 bp /yr

Oct29 to Jul35 is +7.2bp /yr

generally the longer tenor gaps should be flatter than the shorter ones - The Oct29 is €12bln in size, it will continue to be tapped as the prior Apr29s is €21bln in size

Risks

Oct29 stays tight on repo with no post tap ease

A continued bullish edge to Spain benefits the 10y sector more than others

Hope this is interesting

Speak soon

James Rice

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

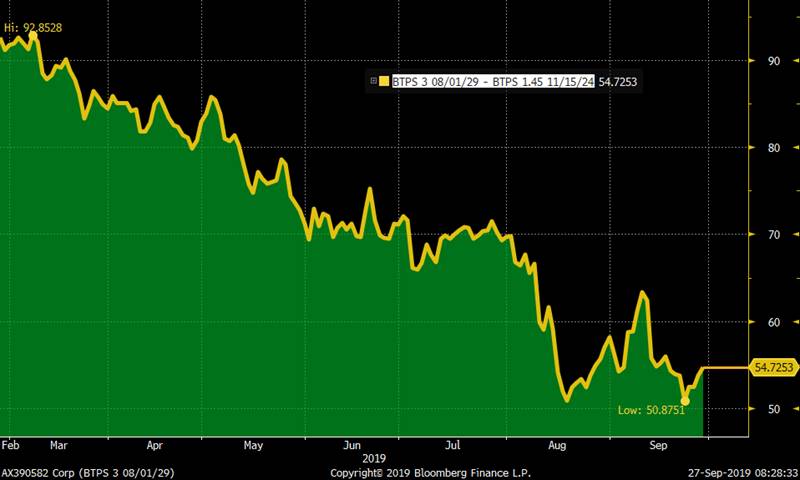

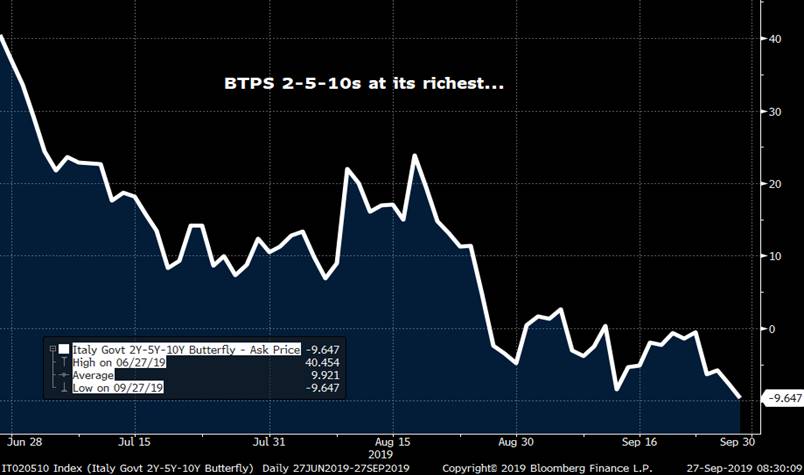

MICROCOSM: BTPS - 5yr and 10yr Supply at 10am - Quick Thoughts

BTPS... 5yr & 10yr Supply

> BTPS 7/24-2/25 5yr roll traded 150mm times in the bookies yesterday at +8.5bps which is around the +8/9 area we pegged in our preview. It's opening at +9.0bps this am which we think will be ample enticement for buyers, at least for the RV community.

> A few dealers are calling FV in the 5yr roll +7bps this am (bit of a moveable feast) with some thinking there's a chance of a tightening post auction like we saw in the new 10yr. With 2-5-10s at the rich end of its range, however, we may need a bit of a yield/curve concession to get RM involved. We still like selling some of the high cpn neighbours (like 3.75 9/24s and/or BTPS 2.5 11/25s) into this new issue.

> BTPS 1.35 4/30s have stabilized on the curve the last couple days, the roll vs 8/29s at 8.1bps. The compression of BTPS 3/30s vs 4/30s has also stalled, now -.6bps. Profit taking in SPGBs emerged yesterday and BTPS sprds tightening to DBRs have stalled (contrary to ITRX cheapening) so, from a broader perspective, it's unclear whether there's pent-up demand for BTPs here other than RV...

BTPS 11/24-8/29 sprd at/near its flattest into this am’s supply…

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Rates/FX/Equities Technicals Rundown

- We’re closing in on the end of Q3 of what’s been a fascinating year in the markets – rightly or wrongly! Politics and policy continue to drive the markets, the unpredictability this creates driving volatility that has created opportunities but also impaired liquidity and the economic outlook. As we head into Q4, here are the market’s primary focal points (in no particular order):

- TRUMP! “A trade deal with China is closer than you think!” Uh-huh. Impeachment imminent?

- Brexit’s just 35 days away and we still have no idea what the outcome will be.

- Boris Johnson’s been rebuked but soldiers on. Election soon?

- The ECB has kick started QE amid remarkable resistance and, as of this am, resignations. Fiscal stimulus on tap in Europe and UK?

- Economic momentum has plummeted in Europe, the UK’s been softening and the US holding on for dear life as Fed members say “No more rate cuts!”

- Equities continue to defy gravity – and logic – the S&P 500 lingering just off the all-time highs. Is this sustainable?

- The Euro’s sub-$1.10, Cable’s recent reversal looking ominous. Will Trump force intervention to weaken the USD?

- Corporates/credit issuance has been massive – where is this money going and is this leverage a worry if recession looms?

- Ratings upgrades in Europe driving further spread narrowing in Spain et al…

- Charts:

- It’s no mystery that Trump’s positive US-China trade tweets can help his ratings – see below.

- Cable/Sonia continue to wax and wane with events in Parliament – the recent bounce failing at 50% retracement.

- Bull flattening across EGB curves in advance of QE as Mftg PMIs sink…

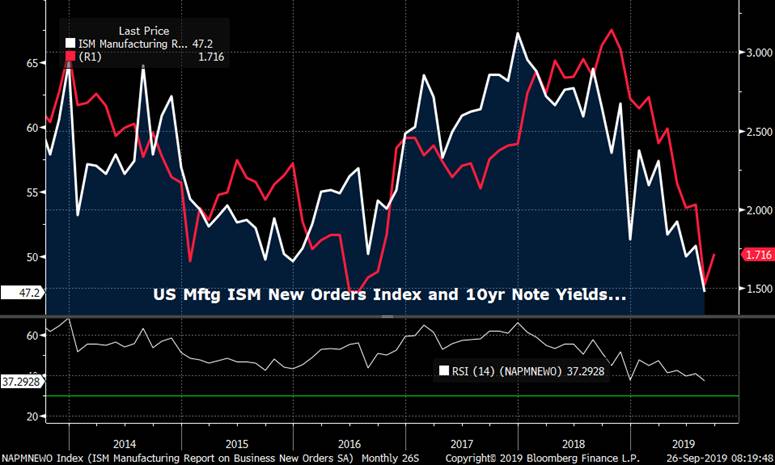

- UST 10yr yields and ISM Mftg New Orders… ‘What? Me Worry?’

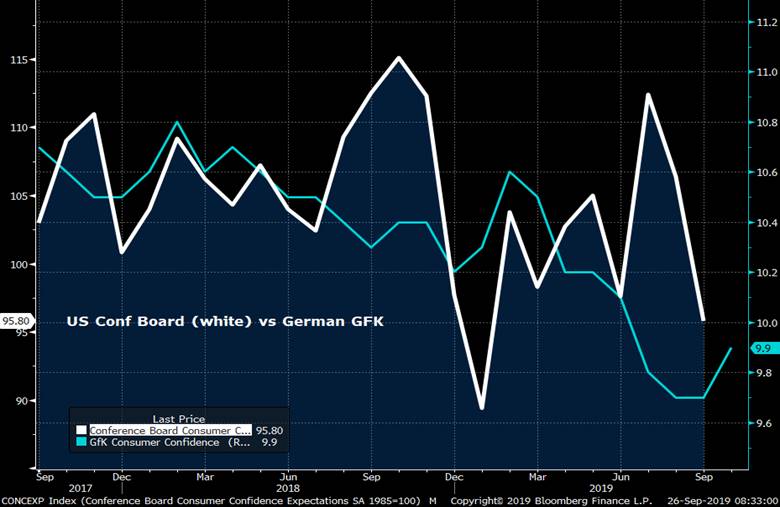

- Will the consumer save the day? Not so sure – German consumer confidence #s leading the US lower…

- ITRX Eur 10yr XOVER index has thundered tighter this year but the post-summer surge in issuance has brought in some spread widening. BTPS remain at their tightest speads, however, amid soft data that has bull flattened EGB curves.

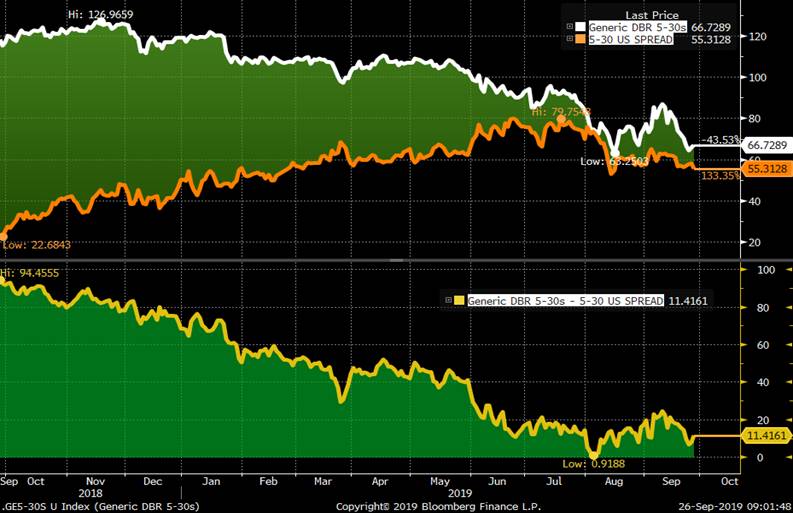

- A tale of two curves… Convergence between US and GER 5-30s curves has come from two different angles. What impact does the fiscal outlook have on this relationship?

More to come!

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796