MACROCOSM: US/UK/EUR Rates Supply This Week > Quick Preview

SUPPLY This week! Attached rundown (below) is the US/EGB/UK supply for this week.

USTs are quiet with just a tap of 10yr TIPS.

EGBs busier with DBRs, SPGBs and OATS.

No UKT supply until Oct 1 tap of the 1T37s.

High grade USD corporates supply in the US shld be brisk again at $27bn - but well below the last two weeks' levels.

Eurozone issuance will be firm too at €25bn+.

UK’s APF reinvestments continue to support gilts at the margin.

With the Middle East heating up, the market still digesting last week's ECB meeting's impact, a FOMC and BOE meeting AND Brexit still lurking on the horizon, it should be another eventful week.

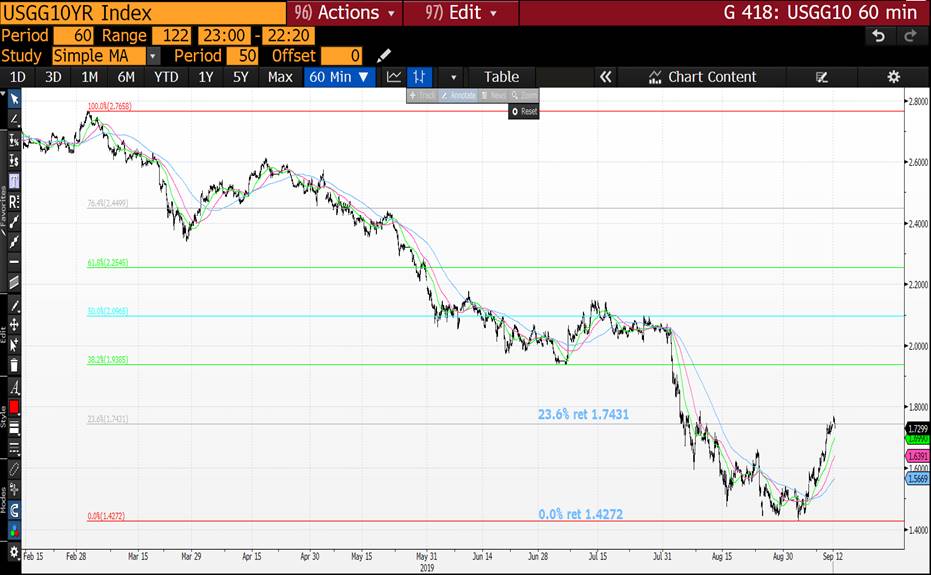

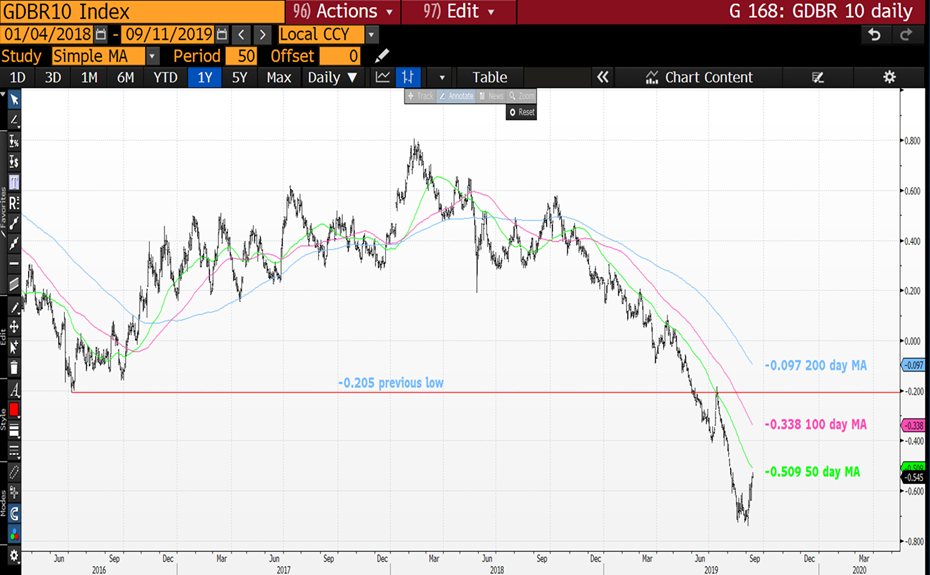

Our bearish/defensive macro-bias on US/EUR/UK rates remains intact and while we will be nimble into this week, the market still trades with a heavy bias. MOMENTUM indicators, however, suggest this is the CHEAPEST 10yr BUNDS have been since October 2018 which, from a technical standpoint, suggests we should take profits on half our shorts here.

DBR 10yrs – Rates still at low levels but this has been a sharp move….

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - Sep16, James Rice @Astor Ridge

Trade Radar – Euro RV structures for the week

Italy – ‘No Default Buyers run to the other side of the ship’ – Very low cost default structures…

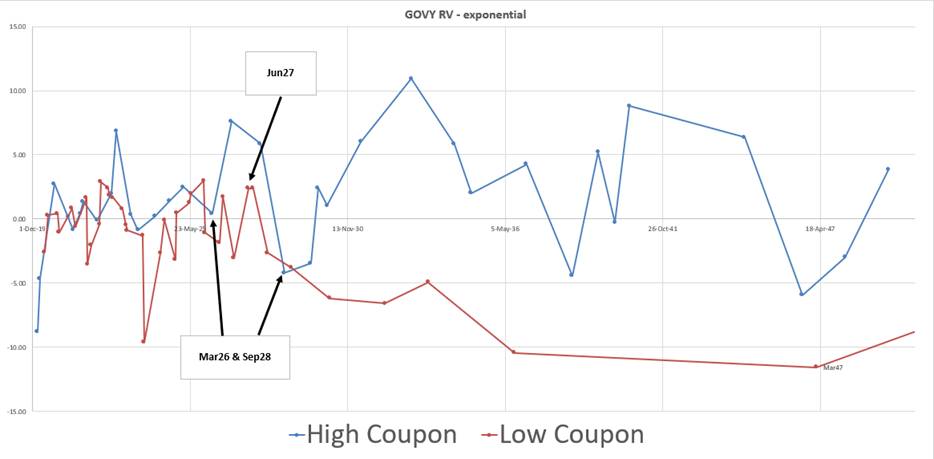

Buy Italy Low coupon Btps June27 to sell Btps mar26 and IKZ9 (CTD Btps 4.75% Sep28)

The tightening of Italy over August and Sep implies low default and/or redenomination probabilities

- This rising tide has lifted higher coupons much faster than low and mediums

- Euro RV is often about intelligently, sifting through the wreckage of broad, sweeping themes and finding robust nuggets of value

One such, is the boundary condition for High vs Low coupons. Typically in simple, IRR yield space, we see that high coupons already trade through the low coupon curve. So the tendency is to assume that there is no boundary condition. We assume that buying low coupon bonds with a lower mitigating lost to recovery (under default) does not underpin the value of low coupons any more

Students of RM flows over the long haul will observe cash for cash switches, that signal that a broad rationale that still prefers low coupon bonds but that timing is everything

The problem is not that this metric is broken, it’s that we need to view it through the right lens – if we discount all the cashflows at an appropriate rate for the Italian curve we get a much better perspective of RV value than by using yield. Luckily we can bootstrap onto the Bloomberg GOVY curve

Here is the Bloomberg GOVY exponential stripped cashflow anomaly graph…

The trade…

History on CIX…

- (YIELD[BTPS 2.2 06/01/27 Corp] - 0.5 * YIELD[BTPS 4.5 03/01/26 Corp] - 0.5 * YIELD[BTPS 4.75 09/01/28 Corp])

Risks

- The shorts go more special on Repo

- The trade doesn’t turn while running at negative carry

- RE-steepening will favour the high coupons (they receive cashflow earlier and benefit from a steeper gradient in the bond curve ,when viewed in value terms)

Under this new narrow scenario for Italy we’re gonna see opportunities like this. Am scouring through looking for the best carry (taking out cash will almost always be slightly negative) – but that’s just the theta on the trade. The nugget is that the stripped value is better for the low coupon than the high

Take a look

let me know

Have a fab week

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: BEARS RULE EVEN WITH MORE QE! Quick Comment...

Well, I’ll be damned… Maybe the market’s coming to its senses after all!

Draghi rolled out Eur 20bn of QE a month forever, cut the depo-rate 10bps, gave banks a bit of a break with some tiering and monkeyed around with the T-LTRO term for good measure and bunds have sold off 270 ticks since the post-announcement highs. Even BTPS are weaker on the day (but still outperforming core Europe) after a rather impressive tightening spree yesterday.

The outcome of the ECB meeting isn’t the only game in town, however. There’s fur flying all over the place – contributing to the bearish tone in rates. Let’s try to list them…

- Corporate issuance continues at an alarming pace with $47bn in the US alone this week, following last week’s $78bn bonanza.

- US retail sales solid and U of Mich on tap.

- USTs demand was spotty at best at this week’s 3s, 10s and 30s. All three auctions tailed – first time in a while that happened.

- Stocks are back to the highs with S&Ps just 8.5 ticks off the Jul 26 highs.

- BUBA’s Weidmann is on the war path: ECB - WEIDMANN: WILL MAKE SURE RATE HIKES AREN'T DELAYED FOR TOO LONG

ECB WENT OVER BOARD WITH LATEST STIMULUS PACKAGE. No major surprise but he’s got company from France, Holland and Austria.

- Fiscal measures are talked up all over the place, Barclays strategists cautious on European long-ends for fear of additional issuance of EGBs.

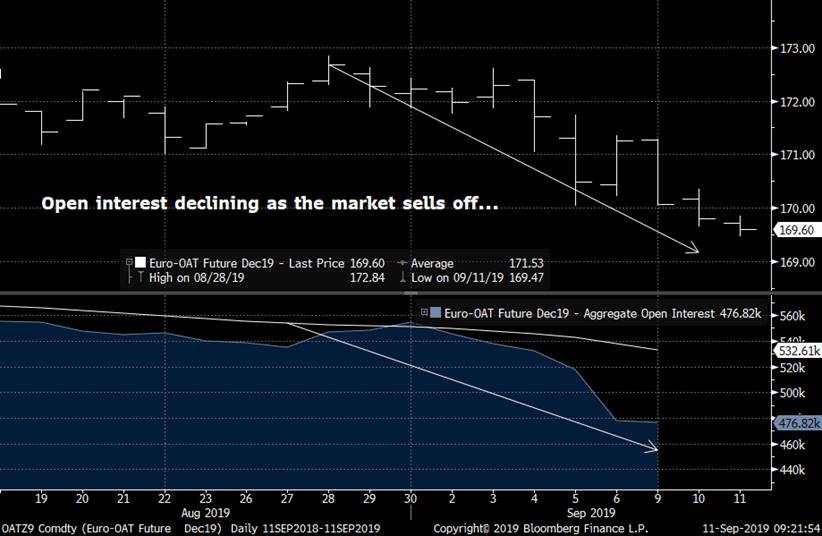

- Even after the declines in EGB and UKT rates contracts open interest, the market still trades long. Dealers’ appetites for risk this week has been poor and the drop in liquidity has contributed to the selling pressure.

- Cable has broken out with 14 day RSIs closing in on overbought. That’s not supposed to happen with Brexit still in the works.

- Dutch story about fiscal stimulus still making the rounds, tax cuts and a 50bn infrastructure fund. Link here

- Overtures from Trump that maybe they can postpone the Chinese tariffs a bit – getting the market’s attention.

Not an exhaustive list but you get the point. The note we wrote recently (see attached) still applies – beware higher rates and steeper curves.

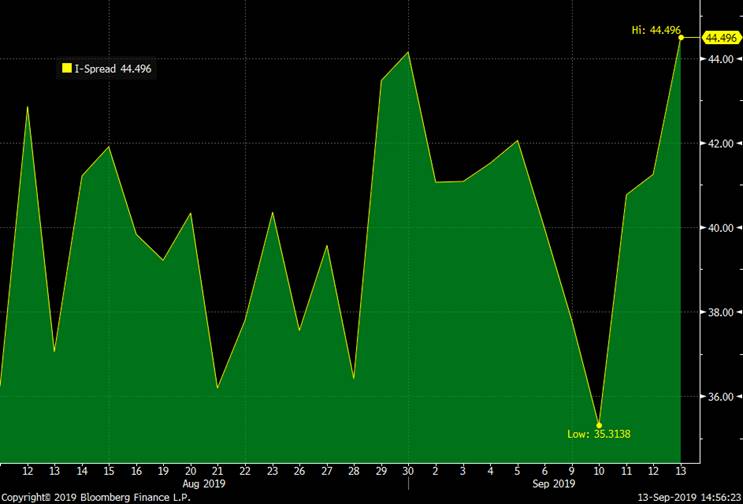

Cable bouncing

UST 30yr swap sprds snap wider, reflecting waning demand for cash bonds here…

More to come – feedback welcome…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND DILEMA : CRUNCH TIME, SO FAR SO GOOD.

BOND DILEMA : CRUNCH TIME, SO FAR SO GOOD.

WE HAVE REJECTED “MOST” 50 DAY MOVING AVERAGES AND TONIGHTS US SUPPLY COULD SET UP A SIZEABLE BOND BASE.

WHILST MOST CTA’S REMAIN LONG BONDS AM SURE A FEW ADDED YESTERDAY.

AS EVER THE RELIABLE DBR 46 HELPED THE CAUSE MASSIVELY BY HOLDING ITS RELIABLE MOVING AVERAGE, REPLICATING ALL PREVIOUS INSTANCES.

GILTS ARE THE ONLY EXCEPTION WHERE THE 50 DAY HAS BEEN BREACHED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Bloomberg Bond News Summary > Thur Sep 12

The following are today's top stories from Bloomberg on your My News Page categories:

Business Briefing

1) Trump to Move China Tariff Increase to Oct. 15 From Oct. 1

Story to Follow

2) Oracle 1Q Adjusted Revenue Misses Lowest Est.; Shares Fall 2.4%

Oracle reported adjusted revenue for the first quarter that missed the lowest analyst estimate.

- 1Q adjusted revenue $9.22 billion, +0.2% y/y, estimate $9.29 billion (range $9.25 billion to $9.36 billion) (Bloomberg data)

- 1Q adjusted EPS 81c vs. 71c y/y, estimate 81c (range 78c to 83c) (BD)

- 1Q service revenue $786 million, -3.3% y/y, estimate $807.9 million (Bloomberg MODL) ...

3) Eric Vallat to Join Rémy Cointreau as New Group CEO

Rémy Cointreau announces that Eric Vallat will join the group as its CEO.

- He will take up his duties on December 1 and succeed Valérie Chapoulaud-Floquet on this date

To view the source of this information click here

4) Barclays Activist Slams British Bank’s ‘Destructive Strategy’

Barclays Plc’s activist investor Edward Bramson has taken a fresh swipe at the bank, telling his investors that its new chairman must address the lender’s “destructive strategy.” Bramson, who became one of Barclays’s top investors last year, said in a recent letter seen by Bloomberg News that the securities unit is still far from competitive. However, it’s ...

5) Bouygues Plans to Sell 13% Stake in Alstom

Bouygues says it will sell a 13% stake in Alstom.

- After the stake sale, Bouygues will own a 14.7% stake in Alstom

- Co. to sell Alstom shares through accelerated book build

World News Briefing

6) China, U.S. Are Showing a Little Good Will as Trade Talks Near

The U.S. and China are taking baby steps to ease tensions in their trade war, as negotiators prepare for the resumption of face-to-face talks in Washington in the coming weeks. On Wednesday, U.S. President Donald Trump said he was postponing the imposition of 5% extra tariffs on Chinese goods by two weeks, meaning Chinese officials can celebrate their Oct. 1 ...

7) U.K. Warns of Protests, Chaotic Border Scenes in No-Deal Brexit

The full scale of the damage a no-deal Brexit could cause to the U.K. was revealed when Boris Johnson’s government published its worst-case scenario -- a document it tried to keep secret. The paper warned of food and fuel shortages, disruption to the supply chain, public disorder and intense pressure to return to the negotiating table if the U.K. crashes out ...

8) Trump Administration Can Curb Asylum Bids, Supreme Court Says

Bolstering President Donald Trump on one of his signature issues, the U.S. Supreme Court cleared his administration to enforce a new rule designed to sharply limit who can apply for asylum at the U.S.-Mexico border. The justices said Wednesday the administration can apply the policy while a legal challenge goes forward. A series of lower court rulings had put ...

9) Purdue Opioid Plan Pits State Against State on Epidemic Cost

Purdue Pharma LP, maker of the highly addictive Oxycontin painkiller, is pitting state against state with its offer of about $12 billion to resolve the company’s liability for the massive public-health crisis tied to opioid abuse that’s swept the U.S. Almost half of the states that are part of the consolidated litigation against Purdue and its billionaire ...

10) Attacks on Chinese-Australian MP Show Fears of Beijing’s Sway

Australia’s first Chinese-born lawmaker is under intense political scrutiny over her former ties with Communist Party-linked groups -- a saga that reveals growing sensitivities about Beijing’s perceived meddling in national affairs. Gladys Liu, who’s lived in Australia for more than 30 years and was elected to parliament in May, this week acknowledged she ...

Bonds

11) Longest Slide in India Credit Quality Since 2014 Pressures Modi

The financial health of Indian firms is worsening, adding pressure on Prime Minister Narendra Modi to come up with more measures to kick-start a sputtering economy. Debt quality deteriorated for the fourth straight month in August, the Care Ratings Debt Quality Index showed. That’s the longest losing streak for the gauge that tracks 1,601 domestic firms since ...

12) Neiman Marcus Secures $100 Million FILO to Pay Down Revolver

Neiman Marcus Group Inc. completed a $100 million first-in-last-out facility that it will use to pay down the company’s revolver. The luxury retailer plans to use proceeds from the facility, also known as a FILO, to reduce its revolving credit facility and create $100 million in liquidity the company can access in the future, according to people familiar with ...

13) New Zealand Bond Sale Draws Lowest Demand in Eight Months: Chart

Demand at a New Zealand bond sale fell to an eight-month low Thursday with investors deterred by the outlook for further kiwi dollar weakness and shrinking yield premiums. The auction of NZ$250 million ($161 million) of debt due in April 2029 drew a bid-cover ratio of 1.32, the least for any tenor since January, based on data from the nation’s debt management office. While New Zealand’s bonds have ...

14) Stearns Bondholders Approve Blackstone-Backed Bankruptcy Plan

Stearns Holdings LLC’s largest bondholders have agreed to support a tweaked reorganization plan backed by Blackstone Group Inc. for the bankrupt mortgage lender. Pending court approval of the plan, Blackstone will contribute $65 million in new capital to Stearns -- a $5 million increase -- plus more cash to pay down claims in exchange for full ownership, ...

15) China Tianjin LGFV Pays Up in Dollar Bond Sale Amid Debt Worries

A Chinese local government financing vehicle from Tianjin succeeded selling dollar bonds this week, but not before investors extracted big price concessions from the borrower. Tianjin Binhai New Area Construction & Investment Group Co, priced a $300 million three-year dollar note Wednesday at 6%, a considerably higher premium compared with other LGFV ...

16) Meet the Lone Wolf Who’s Skeptical About Gold’s Bullish Outlook

In a world awash with gold bulls, Guy Wolf is something of a lone wolf when it comes to bullion. The global head of market analytics at Marex Spectron is skeptical about the precious metal’s appeal as it doesn’t pay yields and is battling against the headwind of a rising dollar. “During the financial crisis, it was seen very much as a safe haven,” Wolf said in an ...

Central Banks

17) Trump Delays China Tariff Increase as Trade Talks Approach

President Donald Trump said he was postponing the imposition of 5% extra tariffs on Chinese goods by two weeks, a move that delays the next escalation of the trade war and brightens the backdrop for upcoming negotiations. “At the request of the Vice Premier of China, Liu He, and due to the fact that the People’s Republic of China will be celebrating their ...

18) Turkey Can Go Big on Rate Cut Without Erdogan’s Iconoclast Nudge

Don’t just blame President Recep Tayyip Erdogan if Turkey’s central bank decides again to err on the side of lowering interest rates more than anticipated. Governor Murat Uysal may not quite match the record cut he delivered during his first meeting at the helm in July. Most of the economists surveyed by Bloomberg forecast a reduction of 275 basis points on ...

19) Fed Loath to Follow ECB on Negative Rates Despite Trump’s Demand

Federal Reserve Chairman Jerome Powell and his colleagues are loath to follow Europe and Japan into negative interest rate territory -- no matter what President Donald Trump might want or how bad the U.S. economy might get. Not only could such a move be deemed illegal, it’s also unclear how much of an economic gain it would yield given the likely disruption ...

20) Serb Central Bank Poised for Tight Rate Call: Decision Day Guide

Europe’s most unpredictable central bank is leaving investors on tenterhooks again as they wonder if Serbia’s interest-rate decision augurs the third surprise cut in as many months. The prospect of two down and one to go would leave policy makers repeating a feat of confounding economists’ predictions last achieved in ...

21) Europe Fiscal Hopes May Revive Trump Trade Playbook: Macro View

A sea change in European fiscal stimulus would see a continental redux of the Trump trade, and sharpen investor focus on machine-makers, industrial commodities and banks.

- Look beyond Mario Draghi’s penultimate European Central Bank meeting and toward the reign of Christine Lagarde, who seems to view a push for fiscal spending as core to her strategy

- And governments appear to be listening. In Germany, the bastion of fiscal prudence, ...

22) Five Things You Need to Know to Start Your Day

(Bloomberg) -- Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. It's European Central Bank day, the trade war front is looking slightly brighter and Operation Yellowhammer is here for all to peruse. Here’s what’s moving markets. We don’t always get to say this, but today’s European Central Bank meeting is one to get ...

Economic News

23) Draghi Gears Up for ECB Showdown on Stimulus: Decision Day Guide

Mario Draghi faces one of the most contentious policy meetings of his European Central Bank presidency on Thursday as he prepares to ramp up monetary stimulus again despite skepticism from the euro area’s biggest economies. The mood is expected to be tense when the 25-member Governing Council discusses how to respond to fading growth and inflation, according ...

24) Piketty Is Back With 1,200-Page Guide to Abolishing Billionaires

Thomas Piketty’s last blockbuster helped put inequality at the center of economic debates. Now he’s back with an even longer treatise that explains how governments should fix it –- by upending capitalism. The French edition of “Capital and Ideology,’’ weighing in at 1,232 pages, comes out on Thursday (English speakers will have to wait till next year for a ...

25) Nice Gesture, But a Delay in Tariff Hike Not Enough: Economics

(Bloomberg Economics) -- OUR TAKE: President Donald Trump’s decision to delay by two weeks an increase in tariffs on $250 billion of imports from China raises some hope for progress in upcoming trade talks. The yen’s drop and yuan’s rise in the wake of Trump’s tweeted announcement suggests that market players are, for now, looking on the bright side. The track record in the negotiations, though, suggests it’s prudent to ...

26) China, Malaysia Agree to Deepen Belt and Road Cooperation

The two countries will “properly handle” disputes to maintain stability, Chinese Foreign Minister Wang Yi says as he and Malaysian counterpart Saifuddin Abdullah brief in Beijing during Abdullah’s visit to China.

- Two sides will work for peace, stability in South China Sea: Wang

- They will step up multilateral cooperation: Wang

- China happy to see Malaysia play greater role in China-Asean relations: Wang ...

European Central Bank

27) Traders Pin Hopes on Draghi for the Next Leg of EM’s Bond Rally

What emerging-market bonds do next depends on whether Mario Draghi plays ball. Provided the European Central Bank president lowers borrowing costs deeper into negative territory and restarts a bond-buying program, high-yielding debt in the developing world may see its popularity soar among investors desperate for returns, according to Union Bancaire Privee. ...

28) European Banks Seen in Need of ECB Break to Sustain Month’s Gain

European bank investors anticipate the European Central Bank will take measures Thursday to soften the impact of an interest-rate cut on lenders. If that help isn’t forthcoming, an 8.6% rally in the sector’s equities this month may be abruptly halted. Bank stocks are the best-performing sector in September as rising bond yields fueled a rotation of investment ...

29) ECB PREVIEW: One More Round of QE for the Road

(Bloomberg Economics) -- The European Central Bank Governing Council was unusually forthright when it met in July about its intention to introduce a large stimulus package in September. We expect it will deliver on that promise by cutting the deposit rate and announce a new round of asset purchases. Hawkish policy makers may not be on board, but the central bank has enough reason to act anyway. ...

30) JAPAN INSIGHT: Euro/Yen - More Prone to Move as ECB Meets

(Bloomberg Economics) -- Keep an eye on the euro/yen – the cross rate has the most potential to move with major central banks lined up to make policy decisions in the days ahead. Our exchange rate model indicates that the yen is more sensitive these days to changes in Japan’s yield differentials with Germany than with the U.S. This means the European Central Bank’s policy decision ...

31) ECB day is upon us, only one thing to say.........

Little more to say this morning ahead of the ECB event of the year, with markets assured of action, and confident also of their ability to adjust curves and rates rapidly following the announcement to compensate for any disappointment, or pleasant overshoot. Having covered the elements of potential actions comprehensively in yesterdays’ e-mail ...

Federal Reserve

32) Fed Wary of Negative Rates, Thailand Currency Challenge: Eco Day

Welcome to Thursday, Asia. Here’s the latest news and analysis from Bloomberg Economics to help get your day started:

- Federal Reserve Chairman Jerome Powell and his colleagues are loath to follow Europe and Japan into negative interest rate territory -- no matter what President Donald Trump might want

- Meanwhile, Trump triggered a swift and skeptical reaction with his demand Wednesday for ...

33) Senate Advances Nomination of Bowman for Full 14-Year Fed Term

The U.S. Senate advances the nomination of Federal Reserve Gov. Michelle Bowman to serve a full 14-year term on the central bank’s Board of Governors.

- Vote to limit debate is 62-31; move sets up final confirmation vote

- NOTE: Bowman, a former Kansas banking regulator, was confirmed last year to fill a seat on the board that expires in 2020

- NOTE: The Senate next votes to advance the nomination of Thomas Feddo to be assistant ...

34) Trump Calls for Fed’s ‘Boneheads’ to Slash Interest Rates Below Zero

(New York Times) -- WASHINGTON — President Trump urged Wednesday for the Federal Reserve to cut interest rates to zero or even usher in negative rates, suggesting a last-ditch monetary policy tactic tested abroad but never in America. His comments came just one day before European policymakers are widely expected to cut a key rate further into negative ...

35) How Presidents Should Talk About the Fed: Narayana Kocherlakota

Donald Trump’s persistent attacks on the Federal Reserve raise an important question: What should and shouldn’t presidents say about the central bank? The key is to understand the difference between the concepts of independence and accountability. It’s crucial that the Fed enjoy independence from elected officials in deciding how to pursue the goals that ...

First Word FX News Foreign Exchange

36) Yen Falls to 6-Week Low on Goodwill Trade Gestures: Inside G-10

The yen dropped to a six-week low and Treasuries declined amid signs of improving goodwill between the U.S. and China before they resume trade talks in coming weeks.

- Japan’s currency weakened beyond 108 per dollar for the first time since Aug. 1 after President Donald Trump said he would delay the introduction of extra tariffs on Chinese imports by two weeks, ...

37) Trump Says China Tariff Increase Moved to Oct. 15 from Oct. 1

“We have agreed, as a gesture of good will, to move the increased Tariffs on 250 Billion Dollars worth of goods (25% to 30%), from October 1st to October 15th,” Trump says on Twitter.

38) Treasuries Drop, Aussie Climbs on China Goodwill Trade Offering

Treasuries and the yen extend losses and risk-sensitive currencies such as Aussie gain following a report China is considering allowing companies to resume purchases of U.S. farm products in a show of goodwill before trade talks between the two countries.

- Treasury 10-year yields rise 2bps to 1.76%. Treasury futures drop 8 ticks

- USD/JPY gains as much as 0.3%; AUD climbs 0.4%; S&P E-mini futures tick higher ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND DILEMA : CRUNCH TIME. IT ALL NEEDS TO HAPPEN TODAY, YIELDS HAVE TO FAIL OR WE ARE INTO A PERIOD OF HIGHER YIELDS.

BOND DILEMA : CRUNCH TIME. IT ALL NEEDS TO HAPPEN TODAY, YIELDS HAVE TO FAIL OR WE ARE INTO A PERIOD OF HIGHER YIELDS!

WHILST MOST CTA’S REMAIN LONG BONDS AM SURE WE ARE CLOSE TO THE FINAL ADD OR THROWING IN THE TOWEL, HENCE TODAY IS VERY CRITICAL. MANY 50 DAY MOVING AVERAGES ARE OFFERING SIZEABLE RESISTANCE WHILST THE RELIABLE DBR 46 IS HOLDING SUPPORT.

GILTS ARE THE ONLY EXCEPTION WHERE THE 50 DAY HAS BEEN BREACHED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MACROCOSM: EGB/UKT Futures Open Interest As Sentiment Barometer

EGBs - FUTURES OI Levels - canary in the coalmine?

> One potentially mitigating factor in our bearish call in EGBs and UKTs is the sharp decline we've seen in aggregate open interest in Europe. This decline doesn't mean the market isn't vulnerable to a sell-off, it just means the 'weak hands' may have already bolted for the exits.

Here are some numbers:

> RXA 1.507mm > lowest level in 5yrs and off 14.8% since early Sep.

> OEA 1.102mm > lowest since June 2016 and off 16.8% in Sep.

> DUA 1.52mm > back to early Aug levels and off 9.3% in Sep.

> UBA 222k > lowest since Oct 2018 and off 21%.

> OATA 476.8k > lowest level since Mar 2018 and off |15% in Sep.

> IKA 419k > lowest since Feb 19 and off 24.8% since early Sep highs.

> G A 680k > still within the 650k-700k range that's held for most of Mar-Sep period but off 19% from the pre-roll spike.

These % changes were skewed somewhat by volumes into the Sep-Dec roll but the current levels remove that distortion and in most cases are well below pre-roll levels. In other words, we've cleared the decks a bit - the next move in an increase in OI could be rising spec shorts.

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: TECHNICALS Still TILTED BEARISH Into ECB Tomorrow

EGBs... TECHNICALS Still TILTED BEARISH into tomorrow's ECB meeting.

> Between the double-top in 10yr DBRs, the grind cheaper of DBRs vs swaps, the bear steepening of 10-30s from the Aug lows and the grind wider of EGB core vs semi/periphs spreads, it's clear the market's been in profit taking mode after an extraordinary rally.

> While the moves thus far have merely been corrective in nature, they are still largely in line with the theme of my note from last week, calling for higher rates and steeper curves (see attached).

> Tons of articles opining on the outcome of tomorrow's ECB meeting with sentiment still leaning cautiously for more stimulus. We'd be surprised if Draghi did nothing, however, we maintain the odds of disappointment outweigh the dovish calls.

> Last night’s US 3yr note auction tailed, G Z9 sold off into the close post 1F54s tap (which went well by all accounts) and we still have 10s, 30s, BTPS and IRISH paper to digest. It'll be interesting to see what demand is like for the BTPS pre-ECB tomorrow.

> PGBs this am - 29s and 34s - bids go in at 10:30am.

10yr DBR Yields – Fibo level at -43bps. 30-day RSI still overbought…

FRTR 10-30s

But BTPS spreads to DBRs still tight, with 30yr supply coming tomorrow…

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND AND EQUITY DILEMA : BOND YIELDS LOWER FROM TODAY OR MAXIMUM TOMORROW!

BOND AND EQUITY DILEMA : BOND YIELDS LOWER FROM TODAY OR MAXIMUM TOMORROW!

TO ME IT SEEMS WE ARE NOW AWAITING THE NEXT PIECE OF NEWS, THE BOND TREND SEEMS TO BE “FULLY INTACT” EVEN THOUGH STOCKS HAVE BOUNCED.

BONDS :

THE LONGTERM YIELD CHARTS CONTINUE TO CALL FOR “ONE LAST” BIG DROP. MANY 60 MINUTE CHARTS LOOK TOPPY WHILST THE RELIABLE DBR 46 IS HOLDING MOVING AVERAGE SUPPORT 167.876 (PAGE 25).

EQUITY :

ALSO THE EQUITY STORY IS FAR FROM FINISHED!

MR TRUMP HAS YET TO RESOLVE MANY ISSUES WITH CHINA AND THAT LEANS TOWARD MUCH LOWER STOCKS, ASSITING THE “ONE MORE MONTH” ARGUMENT FOR LOWER YIELDS. THAT ALL SAID THEY NEED TO TOP OUT THIS WEEK.

** A TENSE TIME, EVERYTHING EVENTUALLY CIRCLING BACK ROUND TO MR TRUMP AS ALWAYS. **

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

FW: GERMAN Insurers Exiting Bund Mkt - Quick Colour

From: Mark Funsch <mark.funsch@astorridge.com>;

Sent: 06 September 2019 07:47

Subject: GERMAN Insurers Exiting Bund Mkt - Quick Colour

Good note from one of our dealers worth passing along.

{GE} Bunds: In a research piece yesterday, Commerzbank highlights that German life insurers are increasingly turning their back on German Bunds due to negative yields. Both Allianz’s CEO and Talanx’s CFO have expressed in recent newspaper interviews that German Bunds are no longer a viable investment option for them. Another insurer, Munich Re has also highlighted their disinterest in buying Bunds at these yields while the chief economist of the German Insurance Association stated in a recent interview that ‘hardly any German insurers are buying Bunds anymore’ and he highlighted that some are insurers are presently investigating the potential of simply storing money in safes as an alternative.

The piece also highlights that German life insurer’s back book guaranteed rate is 2.8% while the Zinszusatzreserve (ZZR) which is approximately €65bn for the industry reduces that rate to about 2%. Buying Fixed Income securities that have negative yield is simply not compatible with their required returns. The research piece highlights that assets such SSA’s such as KFW, corporate bonds and promissory notes (Schuldscheindarlehen) are all benefitting from the move away from negative yielding assets but even these now have yields that are too low for the insurers to meet their desire return requirements. Mortgage bonds and alternative asset classes are now targeted.

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796