GERMAN Insurers Exiting Bund Mkt - Quick Colour

Good note from one of our dealers worth passing along.

{GE} Bunds: In a research piece yesterday, Commerzbank highlights that German life insurers are increasingly turning their back on German Bunds due to negative yields. Both Allianz’s CEO and Talanx’s CFO have expressed in recent newspaper interviews that German Bunds are no longer a viable investment option for them. Another insurer, Munich Re has also highlighted their disinterest in buying Bunds at these yields while the chief economist of the German Insurance Association stated in a recent interview that ‘hardly any German insurers are buying Bunds anymore’ and he highlighted that some are insurers are presently investigating the potential of simply storing money in safes as an alternative.

The piece also highlights that German life insurer’s back book guaranteed rate is 2.8% while the Zinszusatzreserve (ZZR) which is approximately €65bn for the industry reduces that rate to about 2%. Buying Fixed Income securities that have negative yield is simply not compatible with their required returns. The research piece highlights that assets such SSA’s such as KFW, corporate bonds and promissory notes (Schuldscheindarlehen) are all benefitting from the move away from negative yielding assets but even these now have yields that are too low for the insurers to meet their desire return requirements. Mortgage bonds and alternative asset classes are now targeted.

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: SIGNIFICANT Further Correction in G-7 RATES on TAP > Quick Rundown

BEARISH Tone PERSISTS...

- What started as a pre-supply concession this AM is gathering steam. As noted in the attached rundowns, this week’s resumption of supply was a key litmus test for the market. Demand this morning, despite a reasonable concession from the open until the bids went in at 9:30 for the Bonos, was sketchy with bid to cover ratios sub-par. Were it not for the Spanish Tesoro’s announcement right after the bids went in that their net debt issuance will decline by another 10bn in 2019, SPGBs would likely have languished too.

- Dealers are reporting significant selling across the EGB universe this afternoon, especially in the ‘core’ countries – Germany, France and Italy – where their futures contracts are providing vital liquidity. The charts below show just how significant these moves are in technical terms as this two day pullback in RX contracts is the biggest we’ve seen since March. We’ve taken out key supports in the process and perhaps most importantly, aggregate open interest in RXA contracts has fallen almost 5.5% as core longs hoping to be rescued by the ECB next week throw in the towel.

- Here’s ammo for the bears:

- Boris Johnson is losing and his No-Deal leverage is gone. BoE now suggesting there’s no need to cut rates.

- ECB continues to beat their ‘no more QE drum’ with Muller and Villeroy joining the chorus this week.

- Trump planning to meet China to talk trade and even extending an olive branch to Iran. Could change in a heartbeat but stocks like it.

- Supply in rates continues unabated with US 3s, 10s and 30s, the UKT 54s syndication and Netherlands, Italy, Portugal, and Irish all next week with the ECB meeting Sep 12.

- Deutsche Bank’s CEO says another rate cut will hurt European banks further.

- FT article bemoans the untradeable German bund market.

- What to expect next, in our view >

- Bear steepening across most curves, liquidations in most significant in the 10yr point given futures longs.

- BTPS and OATs will come under fire if the ECB decides to not extend QE, even if the consensus has shifted more neutral now. We like ‘blends’ that underweight them (long NETHER vs DBR/OAT, long SPGBs vs OATs and BTPS).

- Swaps curves should bear steepen too, 5-10s in GBP is way too flat if this no-deal trade comes unglued. It’s already on its way.

- The pummelling of GBP will reverse course further, with the EUR joining in.

- The ‘Yang’ to the ‘Yin’ above?

- Cash flows in the UK are very supportive for the UKT market over the next 4-5 weeks. Best to express bearish views in Sonia or GBP swaps. The 30yr sector in the UK has gotten VERY cheap and if gilts get hit, 10-30s could bear flatten post 54s tap.

- The ECB dangles the carrot – no QE or rate cut but a message of ‘significant maybe’ that prevents a complete dump of risk. Not sure even Draghi’s up to that challenge…

- Liquidity will get worse. Keep it simple.

- Trump and Bojo wave their magic hair tongs and create more mischief and we’re back to where we started.

- At the very least, it’s time to take profits on longs.

More to come – comments always welcome…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Euro RV - Sep 5th James Rice : Astor Ridge

Some RV thoughts for Euro RV

Italian curve 5s7s10s – not quite there but mid-month supply may offer the trade to us

5s7s10s is also a reflection of the forwards

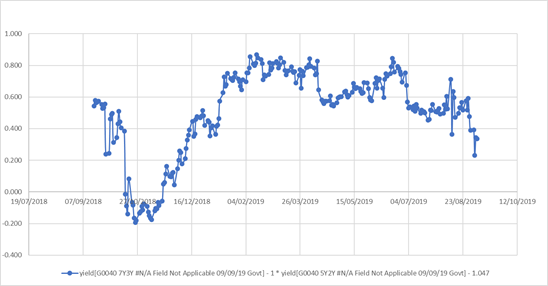

5y2y vs 7y3y

In straight spread space that looks as follows…

Generic Italian BBG CMB forwards:

7y3y – 5y2y

In regression space it looks a little more compelling…

Generic Italian BBG CMB forwards:

7y3y – 0.83* 5y2y – 1.047

So in cash terms the approximate expression of

-5y +7y -10y should look good

let’s issue select….

- On the short 5y years side am looking at selling the recently rich nov24

- On the 7y the jul26 looks decent value but has had some erroneous price closes of late

- On the ten yr I have moved the short to the feb28 – they drop out without being CTD and were only rich in absence of other low coupons – that’s no longer the case now that we have btps 1.35% Apr30

BBG Cix:

200 * (YIELD[BTPS 2.1 07/15/26 Corp] - 0.5 * YIELD[BTPS 1.45 11/15/24 Corp] - 0.5 * YIELD[BTPS 2 02/01/28 Corp])

Levels

Curr: @+17bp

Target Entry: @ +20bp

Supply mid-month in 7y

Exit: +13bp

Stop: +23bp

Supply

Thursday 12th – announcement on 9th September

Risks

The ten year retains a bid

The 7y as a tap point stays offered

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

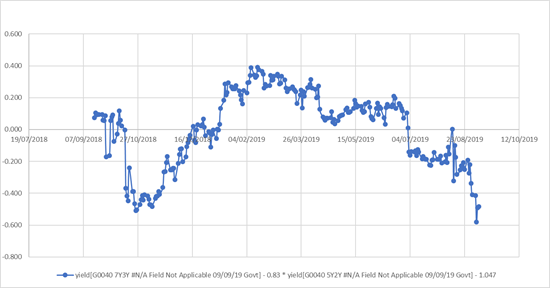

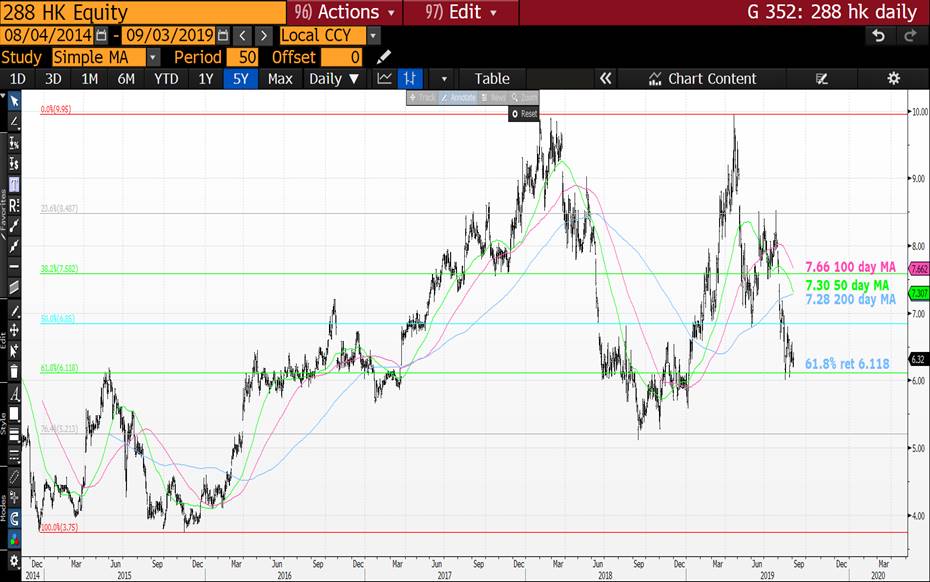

US EQUITY OPEN UPDATE : NOW US STOCKS ARE OPEN THE PICTURE LOOKS EVEN MORE GRAVE.

US EQUITY OPEN UPDATE : NOW US STOCKS ARE OPEN THE PICTURE LOOKS EVEN MORE GRAVE.

**EUROPEAN AND ASIAN STOCKS REMAIN HEAVY. **

SO MANY STOCK BOUNCES ARE FAILING THEIR 50-100 DAY MOVING AVERAGES.

MR TRUMP REMAINS A TARRIFF THREAT GIVEN MANY ASPECTS REMAIN UNRESOLVED.

STOCKS HAVE HELD MANY 200 DAY MOVING AVERAGES BUT IF BREACHED IT GETS VERY MESSY.

THE HENG SENG HAS OPENED THE MONTH JUST SUB A VITAL 23.6% ret 25601.22- MOVING AVERAGE.

*** SINGLE STOCKS REMAIN HEAVY ***

A REAL MONEY MANAGER TOLD ME ONCE THEIR BEST RETURNS EMULATED FROM

200 DAY MOVING AVERAGES, HENCE THEY ARE KEY!!!!!!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Europe RV Trade Radar : James Rice @Astor Ridge

Euro RV on my radar – Sep 3rd

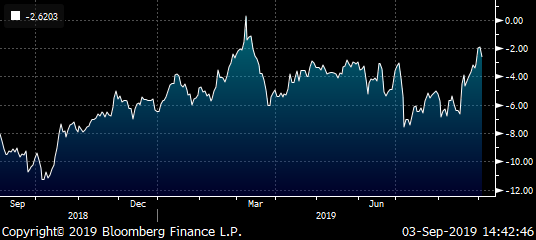

Italy, still short IK vs +/-1y

CIX: 200 * (YIELD[BTPS 4.75 09/01/28 Corp] - 0.5 * YIELD[BTPS 2.05 08/01/27 Corp] - 0.5 * YIELD[BTPS 3 08/01/29 Corp])

- Rich IK, Ctd one more time (Dec)

- Wings Cheap

- Bullet is high cpn (futures CTD)

Risks

- The ctd holds this premium into year end

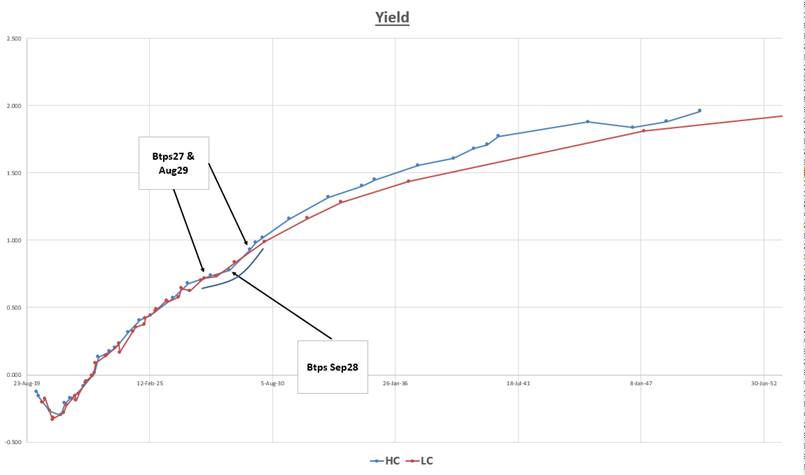

Buying HC French 15y vs wings going into Low Coupon taps on Thursday

-Frtr nov28, +2* Frtr Apr35, –Frtr May48

CIX: 200 * (yield[FRTR 4.75 04/25/35 Govt]-0.55*yield[FRTR 0.75 11/25/28 Govt]-0.45*yield[FRTR 2 05/25/48 Govt])

- -OATZ9, -Frtr Apr35, -Frtr May48

Ctd is Nov28

- French taps on Thursday are:

OAT Tap May-29, May-34, Jun-39, May-50 for EUR10.5bn

- The high coupons traditionally trade rich in France but this one is unusually cheap

- Flat carry even at 10bp repo spread

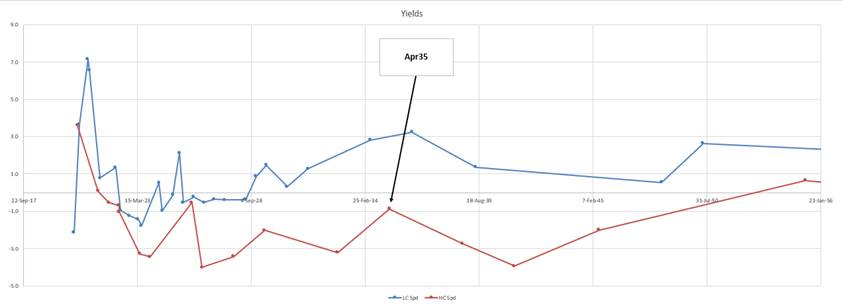

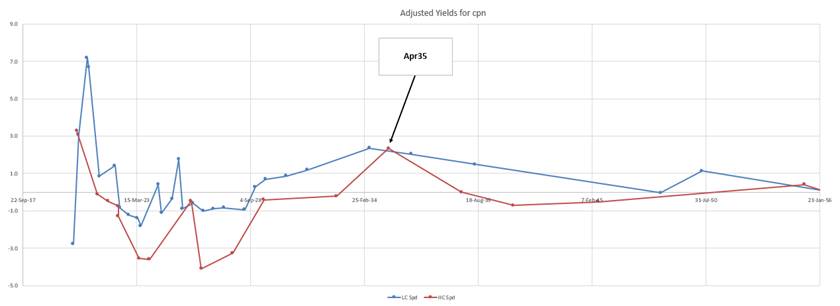

Yields

Yields, estimating coupon value in steep curve (by subtracting Swap spread and adding Z spread )

Risks

A wholesale cheapening of the 15-20y sector causes the Apr35 to cheapen further

Spain High Coupon 32s achieve apotheosis… but now seem rich

+Spgb Apr28, -2* Spgb Jul32, +HC Spgb Jul41

CIX: 200 * (yield[SPGB 5.75 07/30/32 Govt]-0.6*yield[SPGB 1.4 04/30/28 Govt]-0.4*yield[SPGB 4.7 07/30/41 Govt])

Fitted curve anomalies

- The HC Spain curve has done well, perhaps with expectations of QE buying – but yield levels of the market suggest we have travelled to that destination without intervention

- The apr41 high coupon provide some funding balance to the trade

- The Apr28 Spain was a short but has re-priced back into the curve

Risks

- Carry still negative (-0.5bp /3mo, with a 5bp repo spread)

- The 32s as an older issue don’t cheapen due to lower turnover and selling flows

Best

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

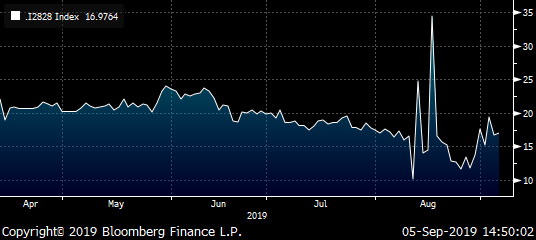

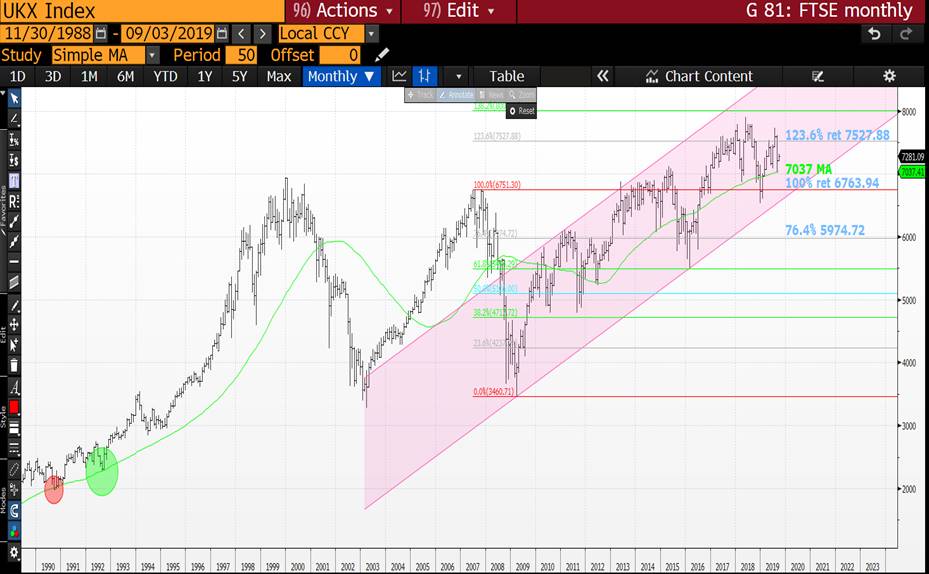

PRE US OPEN UPDATE : ITS DECISION TIME, ESPECIALLY GIVEN BOND YIELDS ARE TO SEE A DRAMATIC FALL.

PRE US OPEN UPDATE : ITS DECISION TIME, ESPECIALLY GIVEN BOND YIELDS ARE TO SEE A DRAMATIC FALL.

**EUROPEAN AND ASIAN STOCKS REMAIN HEAVY AND WILL UPDATE THIS PIECE WHEN US STOCKS ARE LIVE. **

SO MANY STOCK BOUNCES ARE FAILING THEIR 50-100 DAY MOVING AVERAGES.

MR TRUMP REMAINS A TARRIFF THREAT GIVEN MANY ASPECTS REMAIN UNRESOLVED.

STOCKS HAVE HELD MANY 200 DAY MOVING AVERAGES BUT IF BREACHED IT GETS VERY MESSY.

THE HENG SENG HAS OPENED THE MONTH JUST SUB A VITAL 23.6% ret 25601.22- MOVING AVERAGE.

*** SINGLE STOCKS REMAIN HEAVY ***

A REAL MONEY MANAGER TOLD ME ONCE THEIR BEST RETURNS EMULATED FROM

200 DAY MOVING AVERAGES, HENCE THEY ARE KEY!!!!!!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BOND UPDATE : **IT’S ALL ABOUT TO GET VERY MESSY. 2008 STYLE **

BOND UPDATE : **IT’S ALL ABOUT TO GET VERY MESSY. **

IT IS NOW LOOKING LIKE WE HAVE ONE MORE MAJOR DROP IN BOND YIELDS. IF WE FOLLOW SCRIPT FROM 2008 AND 2011 THEN ITS GOING TO BE VERY AGGRESSIVE. CONFIRMATION WILL COME WHEN THE US JOINS EUROPE WITH FRESH YIELD LOWS.

THE TREND CONTINUES DESPITE THE POOR YIELDS OFFERED IN SOME COUNTRIES YET MANY MAY GO FURTHER, (ESPECIALLY THE US). STOCKS REMAIN A WORRY GIVEN THEIR BOUNCE IN MANY CASES HAS JUST BEEN TO THE TOP OF THE RECENT RANGE.

ANY STOCK MARKET FAILURE WILL FORCE A FURTHER YIELD RUSH, THIS DESPITE SOME HUGE HISTOICAL RSI DISLOCATIONS.

LOOKS LIKE WE HAVE ONE MORE MONTH OF EXTENDED YIELD DROP, THEN WE FINALLY BASE. (SEE PAGE 2).

PAGE 3 NEATLY HIGHLIGHTS THAT THE DROP NEXT MONTH SHOULD EMULATE FROM THE PREVIOUS MONTHS CLOSE AND NO HIGHER. BASICALLY IF WE ARE GOING TO GO LOWER AGAIN THEN IT WILL BE AN IMMEDIATE REJECTION.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

FW: Taking Profits on 4y Austria and 4y Finland vs Germany. Taking profits on 9y Austria vs Germany/France 75%/25% wtd

Subject: Taking Profits on 4y Austria and 4y Finland vs Germany. Taking profits on 9y Austria vs Germany/France 75%/25% wtd

Stephen Creaturo

![]()

O: +44 (0) 203 - 143 - 4800

D: +44 (0) 203 - 143 - 4175

M: +44 (0) 780 – 957 - 5890

E: Stephen.Creaturo@AstorRidge.com

UK: Dowgate Hill House, 14-16 Dowgate Hill, London, EC4R 2SU

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

This marketing was prepared by Stephen Creaturo. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a research recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

PLEASE READ TECHNICAL UPDATE US Breakevens and USGGT. Breakevens are they telling us something !

TECHNICAL UPDATE : US Breakevens and USGGT.

Breakevens have based at some significant long-term retracements thus are they telling us something about where YIELDS GO?

ALL Breakeven charts have performed extremely well, recovering from numerous technical retracements. Does this imply stocks and bond yields base, preference would be to wait for month end.

USGGT10y seems about the best one to focus on given the RSI’s are stretched and HIT of the REGULAR 23.6% ret 0.0198 level.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris