MICROCOSM: GILTS Market Set to Kick Into Overdrive > Colour & TRADES

As they say on TV, ‘Don’t touch that dial!’ Fans of the gilts market won’t want to miss what’s coming over the next couple months. See below for our take on the strategy angle here…

Let’s focus on the market dynamics we know are happening – and leave Brexit to the end…

GILTS SUPPLY

- Supply for the Oct-Dec qtr will be announced tomorrow morning. There are no conventional syndications expected with uncertainty surrounding whether they will announce plans for a new 20yr benchmark or another tap of the UKT 1T37s. The maturity of a new 20yr is likely to be 2041 which, at current yield levels, would give it a coupon sub-1% and duration/convexity in 4Q46 territory. 2040-42 gilts trade cheap in anticipation.

- Sajid David’s speech Sep 4th will be closely watched to see how big a cheque the new government is willing to write to appease the masses ahead of what could be a No-Deal Brexit on Oct 31. The bigger the cheque, the more gilts we’ll get which could mean the sizes of the auctions next qtr and beyond will be increased. We’d expect modest increases on a per-auction basis across the curve rather than a few lumpy syndications that could test demand for gilts at a sensitive time for the market. This could be one of the reasons the current 5yr and 10yr benchmarks trade cheap to the curve.

- Gilts supply from Sep 3-10 will be the largest concentration of risk this fiscal year so far:

- Sep 3rd – UKT 0F25s £3bn tap 15,000 G Z9 equivalents

- Sep 5th - UKT 0S29 £2.75bn tap 24,100 “ “

- Sep 10th – UKT 1F54 Est £4.5bn Syndicated tap 128,500 “ “

- Totalling 167,600 G Z9.

- If we’re wrong about the syndication date, the next likely slot is Sep 23rd which changes the risk dynamics above.

- Last scheduled gilts conventionals supply this qtr is Sep 5th so no supply post the 54s tap.

- The next tap of the UKT 0S29s isn’t expected until mid-October.

SEPTEMBER C&R AND INDEX MOVES

- You’ve read this before but here are the numbers you need to know:

- £28.7bn redemption of the 3T19 generates a £15.2bln cash APF that means 3 operations per week of £1,268bn per operation from Sep 9 until Oct 2nd.

- Coupon payments for Mar/Sep maturities (today’s the ex-div date) will total £7.59bn (conv and linkers) which is the largest cpn flow for the rest of this fiscal year. The 0-7yr sector benefits most with £5.2bn of the cash hitting the sector. When we combine the redemption flows we can see why GEMMS are seeing consistent buying of the 1H26s.

- September’s cpn date also coincides with significant basket-shifts as issues roll down the curve. The UKT 1T22 roll sub-3yrs, UKT 2T24 roll sub-5yrs, UKT 4H34s roll sub-15yrs and the UKT 4Q39s roll sub-20yrs. This will drive a FTSE all stocks index shift of +.24yrs with the 0-5yr extending 0.35yrs, 5-15yr extending 0.83yrs and 15yr+ index extending 0.64yrs.

- These issue-specific shifts matter to different investors depending upon their mandate. Central banks and money-mkt accounts care most about the 0-5yr while pensions are 15yr+. Either way, these shifts can be bullish or bearish for the issues that shift, depending upon the basket. Typically speaking, for example, an issue falling sub 15yrs would underperform the curve as pensions no longer need them but in this case, the UKT 4H34s fall into the intermediates APF basket and add a significant £6bn of free float to a small number of issues which has brought in significant demand for them from the leveraged community.

- Historically speaking, there’s a seasonality to these flows as one would expect. The 2yr and 5yr benchmarks typically outperform the swaps curve in the 2-3 weeks leading into the event then begin cheapening about half-way through the APF.

PARLIAMENT, BORIS and BREXIT

- These are the best articles I’ve read on the latest drama on Parliament, Brexit and Bojo:

- FT: Parliament is about to be suspended: what happens next?

- FT: What is Boris Johnson trying to achieve?

- FT: Boris Johnson’s move to prorogue parliament is forcing the hands of no-deal Brexit opponents

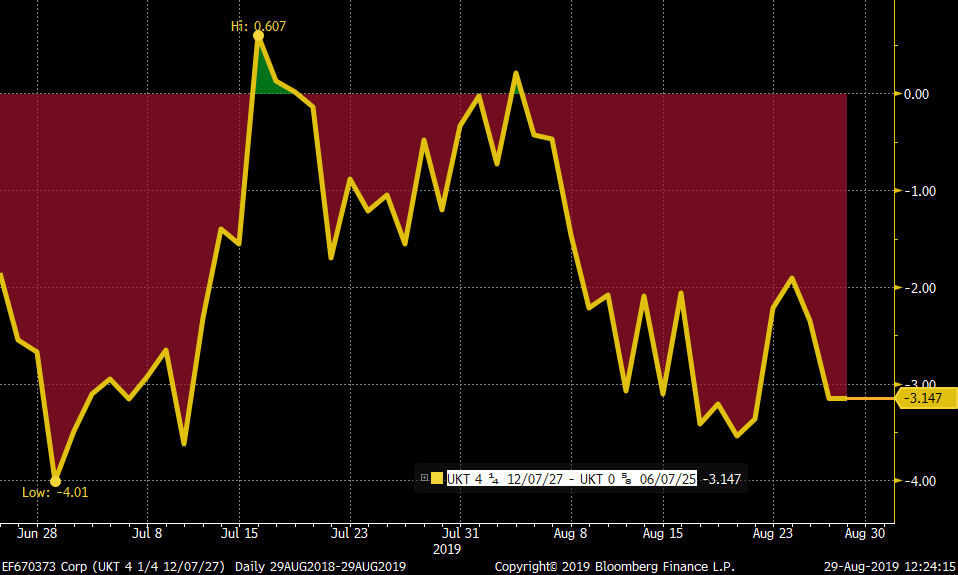

- Over the past week 1y1y SONIA has rallied 9bps, GBP/USD has cheapened a couple ticks and the betting shops now put the odds of a no-deal Brexit at 44%. We should know by the time of the UKT 1F54 syndication whether Johnson’s Parliamentary shenanigans are as benign and he insists or if they carry the anti-democratic, sinister intentions that the opponents of a No-Deal outcome are so convinced of. That could have implications for all the UK’s markets but especially gilts and FX where the markets have been leaning ‘worst case scenario’ for the last two months. The fact is, with Gilts repo general collateral around 70bps and 7yr gilts yielding ~25bps, there’s a vested interest in not having the whole curve at negative carry. Add to that a rather large short base in Cable and one could see an impressive bolt for the exits if the signs begin to point towards a deal. In other words, we’ve got a lot of bad news built into the market.

1y1y SONIA

STRATEGY ANGLES

- So, to summarize:

- Cash flows very supportive for gilts over the next 6 weeks, especially the 0-7yr sector.

- Index moves lend a flattening bias that could be mitigated by increased fiscal spending.

- GBP markets are pricing in a lot of bad news and feel positioned for it.

- The shift in sentiment since Johnson became PM makes a smooth Brexit outcome the outlier.

- With cash flows most supportive for the front-end (where the carry and roll is most negative), risks of increased gilts supply, bflies like the UKT 23-28-37 fly at their richest and positioning long, we think the most prudent positioning over the next couple weeks is a steepener, preferably 5s-10s.

The tap of the cheap 0F25s next Tuesday could provide a nice entry point to buy them versus issues like the 1F28s, 0S29s or even the 4T30s where the Z-sprd boxes have flattened sharply and although carry and roll is costly, the potential volatility over the next several weeks makes the C&R dynamics a footnote here in our view.

UKT 0T23-1F28-1T37 fly

UKT 0F25 vs UKT 1F28 Z-sprd box

UKT 0F25 vs UKT 4Q27 Z-sprd

I’ll be in touch to discuss…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: ITALIA! Politics and Supply... Quick Rundown

ITALIA! Politics & Supply

> Mattarella gives Conte a mandate to form a new govt - with Salvini nowhere to be seen...

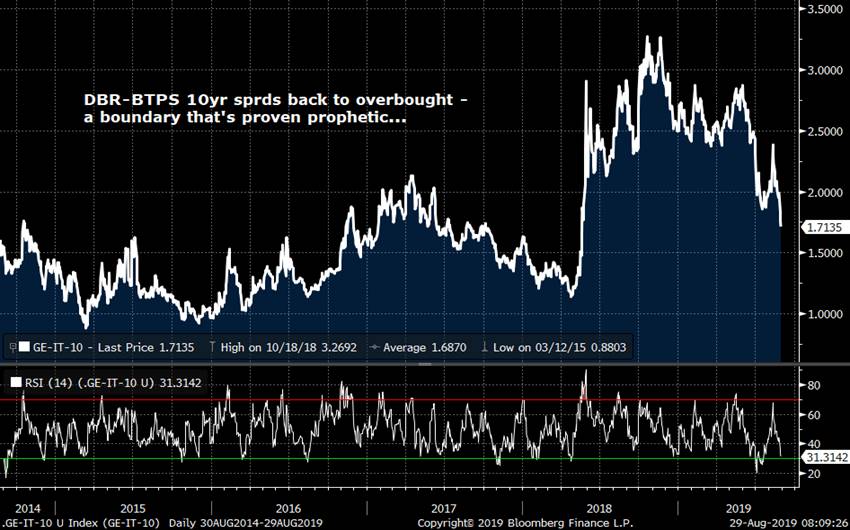

> Keeping Salvini at bay became a priority and so far they've managed to pull it off. The sense of relative stability has been VERY bullish for BTPS, driving a 28bps tightening of 10yr sprds to DBRs since the start of this week.

> FINAL EGB supply of August comes this am as Italy taps €2.25bn of the BTPS 1.75% 7/24 and €4bn of a new BTPS 1.35% 4/30.

> BTPS 7/24s have rallied almost 80bps since Aug 9th and have richened about 8bps on the 23-24-25 fly. On a micro-basis 24-25s looks too steep to us, especially if we bull flatten into the sprd tightening, but as this is a relatively small tap and the benchmark is sought after, they should go fine.

BTPS 10/23-7/24-6/25 fly

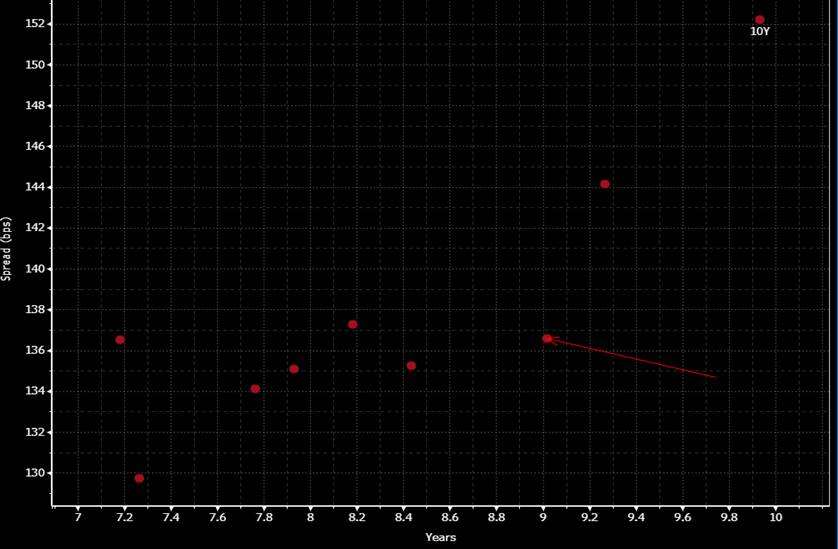

> The NEW BTPS 1.35 4/30s started off at +14bps vs the BTPS 8/29s in the gray mkt on Monday (although not many traded) and have tightened all the way to 10.5bps at last night's close. We expect this issue TO TRADE VERY WELL as it's the second lowest cpn ever which makes them attractive from a credit/dur/convexity perspective. They won't be tapped until late Sep either. Don't be surprised if the roll is well inside 10bps by tomorrow's close. There’s also been a considerable debate over whether it’s time to take profits on IKU9 (BTPS 4.75 9/28s) longs after a demand-for-liquidity driven richening on the curve and in anticipation of the impending Sep expiration. The short answer is ‘YES’ in our view – in half your long. There’s been evidence that some of the delivery game has already happened given the moves in the basis, however, there could be a reasonably large delivery into this contract and with just one more cycle before it leaves the basket, taking delivery of a big chunk of these BTPS 4.75 9/28s would be a fairly simple way of getting one’s hand on a large chunk of Italian debt in a spread narrowing environment. We saw the Japanese do it with the OATs contract so why not IKA?

BTPS 7-10yr sector Z-sprds – (arrow points to BTPS 4.75 9/28s)

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Forward Rates between bonds - James Rice @ Astor ridge

Life is full of questions… (particularly Btps)

How good is any anomaly in Italy?

What does it really mean?

How does that compare to other expression?

What do rates have to do for me to break even?

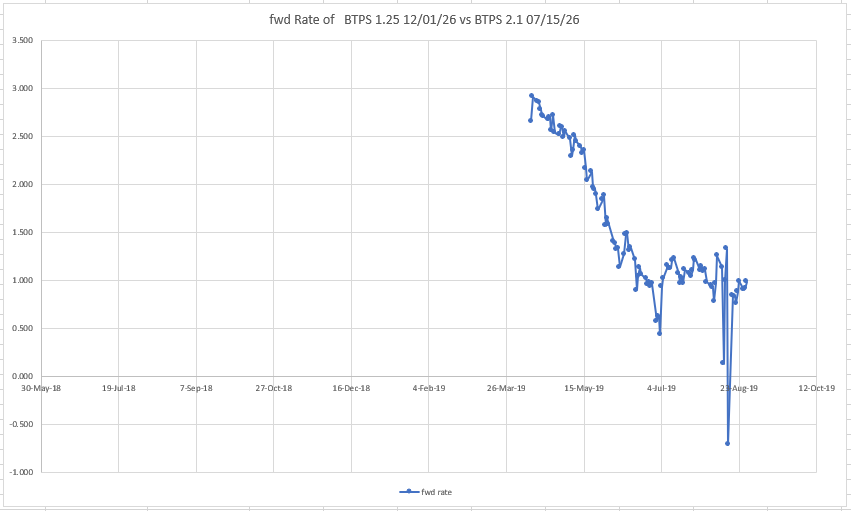

Team - I have built a proper forward calculator for Btps (can add other issuers)

Essentially my thinking is…

1) we trade the curve (bond spreads) - but really we want to express sets of forward rates versus others – we’re really expressing a view on where an intervening forward rate can be for us to breakeven

2) to compare forward rates - we need to accurately compute the histories..

3) once we can accurately assess the coupon differences in terms of forward rates - some of the pricing could make more sense

4) I am beta testing at the moment - but my intention is to be able to look at any pair of bonds - in terms of forward rates and compare them to any other pair or compare them to the fitted curve on FWCM (Bloomberg) this should be a more accurate way of proving and finding anomalies

5) please let me know of you have any thoughts about how you might use this analysis or any avenues you'd like to see developed

In the meantime some of the output – still very much checking the data…

Attached is feb28 vs mar48 forward with the FWCM generic CMB fwd of 10y20 above

Have a think – tell me if any of this stuff is of use and what you might like to see. I’ll build something to look at any given forward minus the generic fwd – hence a true representation of the value of an anomaly

one of the interesting things for Italy could be – that some anomalies cannot imply forwards lower then the eonia rate for that period – as that would imply a zero probability of default. The beauty of this method is we can see the actual forwards that we trade rather than the generics – which don’t factor bond anomaly values

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND UPDATE : DESPITE SOME VERY MAJOR RSI DISLOCATIONS YIELDS LOOK POISED TO CONTINUE LOWER, MAINTAINING THE SUBSTANTIAL HISTORICAL TREND.

BOND UPDATE : DESPITE SOME VERY MAJOR RSI DISLOCATIONS YIELDS LOOK POISED TO CONTINUE LOWER, MAINTAINING THE SUBSTANTIAL HISTORICAL TREND.

DESPITE MONTH END LOOMING WE HAVE ALREADY POSTED NEW YIELD LOWS, CTA’S CONTINUE TO ADD TO FUTURES LONGS.

THE TREND CONTINUES DESPITE THE POOR YIELDS OFFERED IN SOME COUNTRIES YET MANY MAY GO FURTHER, (ESPECIALLY THE US) IF STOCKS GO THE WAY OF THE PREVIOUS PRESENTATION.

ANY STOCK MARKET FAILURE WILL FORCE A FURTHER YIELD RUSH, THIS DESPITE SOME HUGE HISTOICAL RSI DISLOCATIONS.

LOOKS LIKE WE HAVE ONE MORE MONTH OF EXTENDED YIELD DROP, THEN WE FINALLY BASE. (SEE PAGE 2).

PAGE 3 NEATLY HIGHLIGHTS THAT THE DROP NEXT MONTH SHOULD EMULATE FROM THE PREVIOUS MONTHS CLOSE AND NO HIGHER. BASICALLY IF WE ARE GOING TO GO LOWER AGAIN THEN IT WILL BE AN IMMEDIATE REJECTION.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

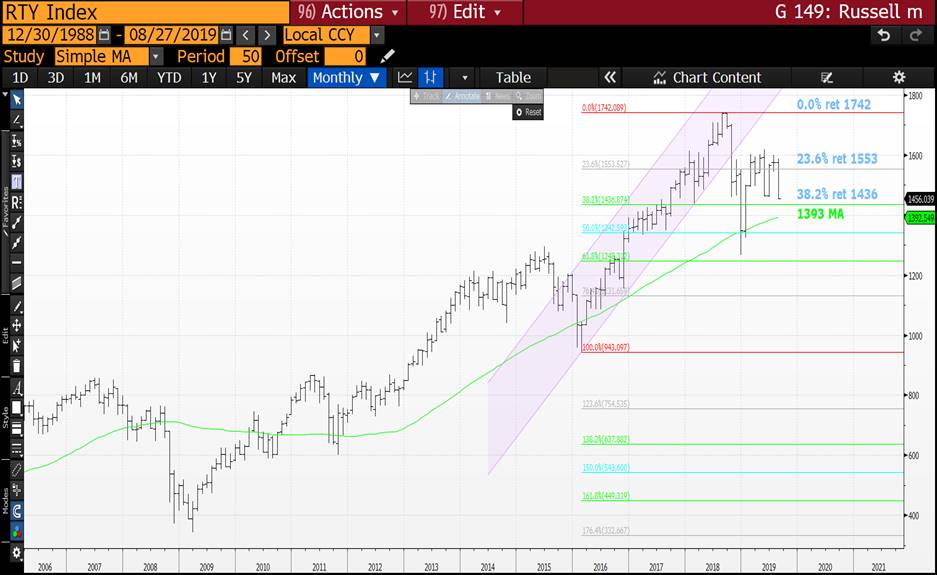

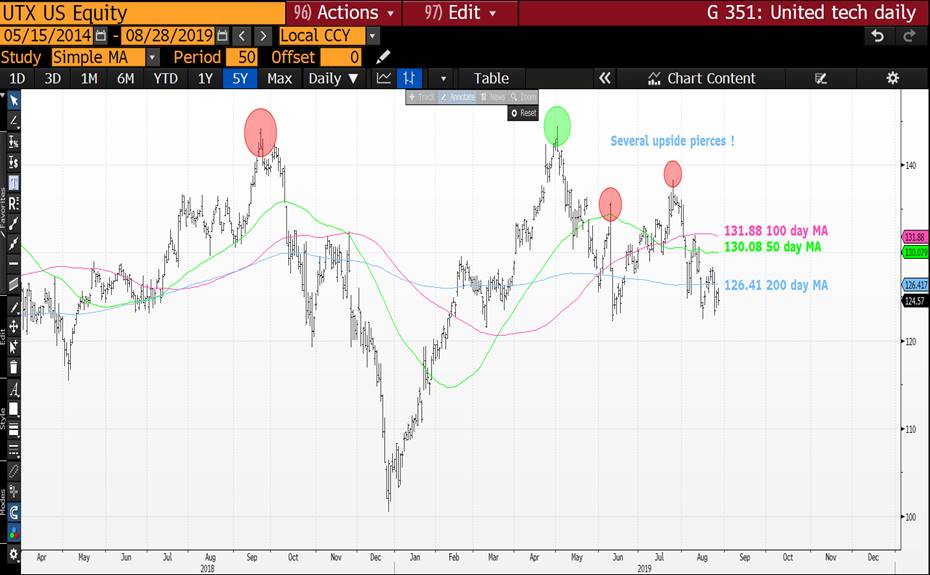

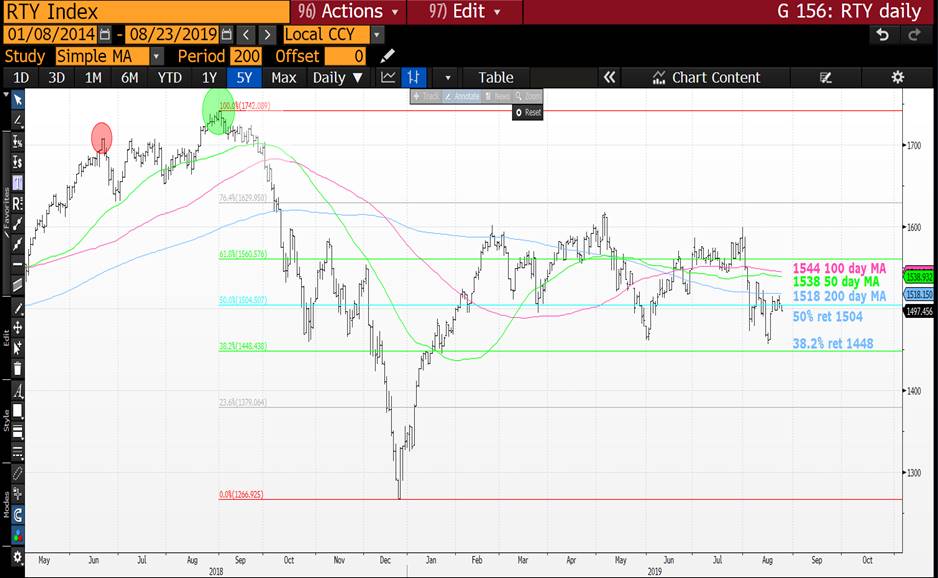

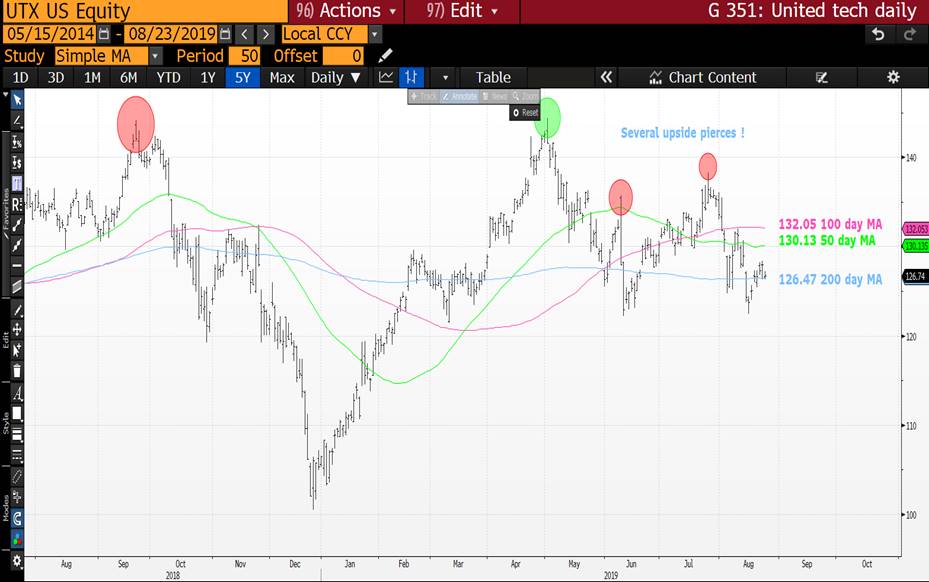

EQUITY UPDATE : ITS TIME TO FOCUS ON THE EQUITY MARKET. WE ARE ON THE VERGE OF MAJOR STRUCTURAL FAILURES AS MONTH END APPROACHES.

EQUITY UPDATE : ITS TIME TO FOCUS ON THE EQUITY MARKET. WE ARE ON THE VERGE OF MAJOR STRUCTURAL FAILURES AS MONTH END APPROACHES.

SO MANY 200 DAY MOVING AVERAGES ARE ABOUT TO BE BREACHED.

BONDS WANT TO CONTINUE THEIR TREND AND POST NEW YIELD LOWS.

TARIFF TIME, ADDING MAJOR CONCERNS TO A VERY LAME SET OF BOUNCES.

STOCKS HAVE HELD MANY OF THE PREVIOUSLY MENTIONED 200 DAY MOVING AVERAGES BUT NOW EVEN THOSE LOOK VULNERABLE.

MANY MARKETS HAVE ALREADY POSTED NEW LOWS THE RESULT IS THEY ARE DAMAGED GOODS. THAT WEAKNESS NEEDS TO BE CONFIRMED BY WEAK MONTH END CLOSES.

MANY MONTHLY CHARTS HIGHLIGHT THE WORRYING IMPLICATIONS IF THE 200 DAY MOVING AVERAGE EVENTUALLY FAIL.

*** SINGLE STOCKS REMAIN HEAVY ***

A REAL MONEY MANAGER TOLD ME ONCE THEIR BEST RETURNS EMULATED FROM

200 DAY MOVING AVERAGES, HENCE THEY ARE KEY!!!!!!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BOND UPDATE : SIMILAR TO PREVIOUS MONTH ENDS WE ARE CLOSING AT THE YIELD LOWS!

BOND UPDATE : SIMILAR TO PREVIOUS MONTH ENDS WE ARE CLOSING AT THE YIELD LOWS!

THE MONTH ISNT OVER YET BUT IT APPEARS THE TREND REMAINS WELL AND TRULY IN PLACE. THIS SHOULD AFFORD THAT “ONE MORE” YEILD DROP NEXT MONTH.

FOR ME EQUITES STILL SEEM TO BE THAT FAVOURED ACCELERANT, MR TRUMP HASN’T FINISHED WITH CHINA YET.

*** THE LOWER YIELD PREDICTION CONTINUES DESPITE SOME VERY DISLOCATED WEEKLY RSI’S. **

ALL US CALENDAR ROLLS THUS FAR HAVE BEEN SOLD, WITH A GREATER URGENCY THAT NORMAL. THIS INDICATES CTA’S-ASSET MANGERS ETC ARE WILLING TO BET THE TREND FOR LOWER YIELD CONTINUES.

Here are the speeds of the U.S. Rolls (as of the close on Monday, August 26):

TU 49% done (16% faster than the past 20 cycles)

FV 44% done (11% faster...)

TY 40% done (13% faster...)

UXY 42% done (6% faster...)

US 43% done (14% faster...)

WN 54% done (20% faster...) (Thanks Chris Brighton for the data).

CHART 1 THE US 30YR YIELD MONTHLY PREDICTS ANOTHER MONTH REPLICATING THIS AUGUSTS RANGE, THEN THE LOWS IN, OH WHAT A WORRY!

***THE OTHER ISSUE SIMILAR TO BEFORE IS THAT WE HAVE POSTED A NEW YEAR YIELD LOW THIS LATE IN THE MONTHLY CYCLE WHICH DOESN’T BODE WELL.***

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

**** PLEASE READ ***** EQUITY UPDATE : STOCKS ARE ABOUT TO TAKE A MAJOR NOSE DIVE!

EQUITY UPDATE : STOCKS ARE ABOUT TO TAKE A MAJOR NOSE DIVE!

BONDS SEEM TO WANT IT VIA THEIR BOUNCE TODAY.

TARIFF TIME, ADDING MAJOR CONCERNS TO A VERY LAME SET OF BOUNCES.

STOCKS HAVE HELD MANY OF THE PREVIOUSLY MENTIONED 200 DAY MOVING AVERAGES BUT NOW EVEN THOSE LOOK VULNERABLE.

MANY MARKETS HAVE ALREADY POSTED NEW LOWS THE RESULT IS THEY ARE DAMAGED GOODS. THAT WEAKNESS NEEDS TO BE CONFIRMED BY WEAK MONTH END CLOSES.

MANY MONTHLY CHARTS HIGHLIGHT THE WORRYING IMPLICATIONS IF THE 200 DAY MOVING AVERAGE EVENTUALLY FAIL.

*** SINGLE STOCKS REMAIN HEAVY ***

A REAL MONEY MANAGER TOLD ME ONCE THEIR BEST RETURNS EMULATED FROM

200 DAY MOVING AVERAGES, HENCE THEY ARE KEY!!!!!!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trade: Markets running in one direction: position for a repeat of the "Bund Tantrum"

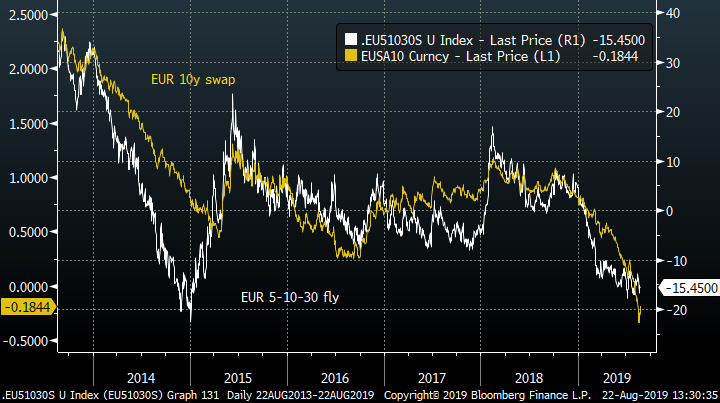

Bottom line: As a parent of a 6-yr old boy on the autistic spectrum, tantrums are a fact of life. In my experience, there are two complementary strategies for coping: first understanding the warning signs and triggers that precede a possible meltdown; and second being prepared to ride out the subsequent storm. With 10y yields in the Eurozone making new lows, swirling talk of a new ECB accommodation, and a gloomy economic assessment, one could argue that the precursors are again in place for a “behavioural episode” in yields and a repeat of the Bund tantrum of April 2015. Here, I suggest ways to pay the EUR 5y-10y-30y fly conditionally as a way to position for a sharp sell-off, without overexposure to the chance that the rally continues unabated.

Trades:

A: Payer swaptions

Sell EUR 200mm 3m5y ATMF payer (k=-0.443%)

Buy EUR 200mm 3m10y ATMF payer (k=-0.179%)

Sell EUR 35mm 3m30y ATMF payer (k=+0.214%)

For a premium take out of 0.3bp (mid indicative)

ATMF strike at -12.9bp. Spot at -15.5 bp.

Equivalent to EUR 100k/bp underlying on the wings.

B: CMS Curve caps

Buy EUR 1bn 3m SL cap on CMS 10-5 ATMF (k=26.3bp)

Sell EUR 1bn 3m SL cap on CMS 30-10 ATMF (k=41.2bp)

For a premium take out of 1.3bp (mid indicative)

ATMF strike at -14.9bp. Spot at -15.5bp.

Equivalent to EUR 100k/bp underlying on the wings

C: CMS Curve caps with correlation overlay

Buy EUR 2bn 3m SL cap on CMS 10-5 ATMF (k=26.3bp)

Sell EUR 1bn 3m SL cap on CMS 30-5 ATMF (k=68.4bp)

For a premium take out of 0.25bp (mid indicative)

Rationale. In April 2015, a year-long rally was dramatically interrupted by near 100bp sell-off in Bund yields. In hindsight this allowed the longs to reload and yields subsequently found new lows a year later, but it did constitute an abrupt awakening for the markets. Being long the EUR bond market had been a lucrative position in 2014 as the prospects for QE from the ECB moved from a possibility to a reality. This positioning also likely exacerbated the correction as investors rushed to get flat to book profit.

Generic German 10y yield:

The current situation has many parallels with 2015: yields have been falling for a year, and there are profits to be taken; and the market is pricing ECB deposit rate cuts, while the possibility of new QE purchases is to some extent also priced. The tantrum in 2015 did not occur until QE had actually begun in March, so the current uncertainty could persist and prevent any major move until at least after the September ECB meeting. So rumours of the demise of the rally could be premature, but that does not preclude buying insurance against such a move if the premium is attractive.

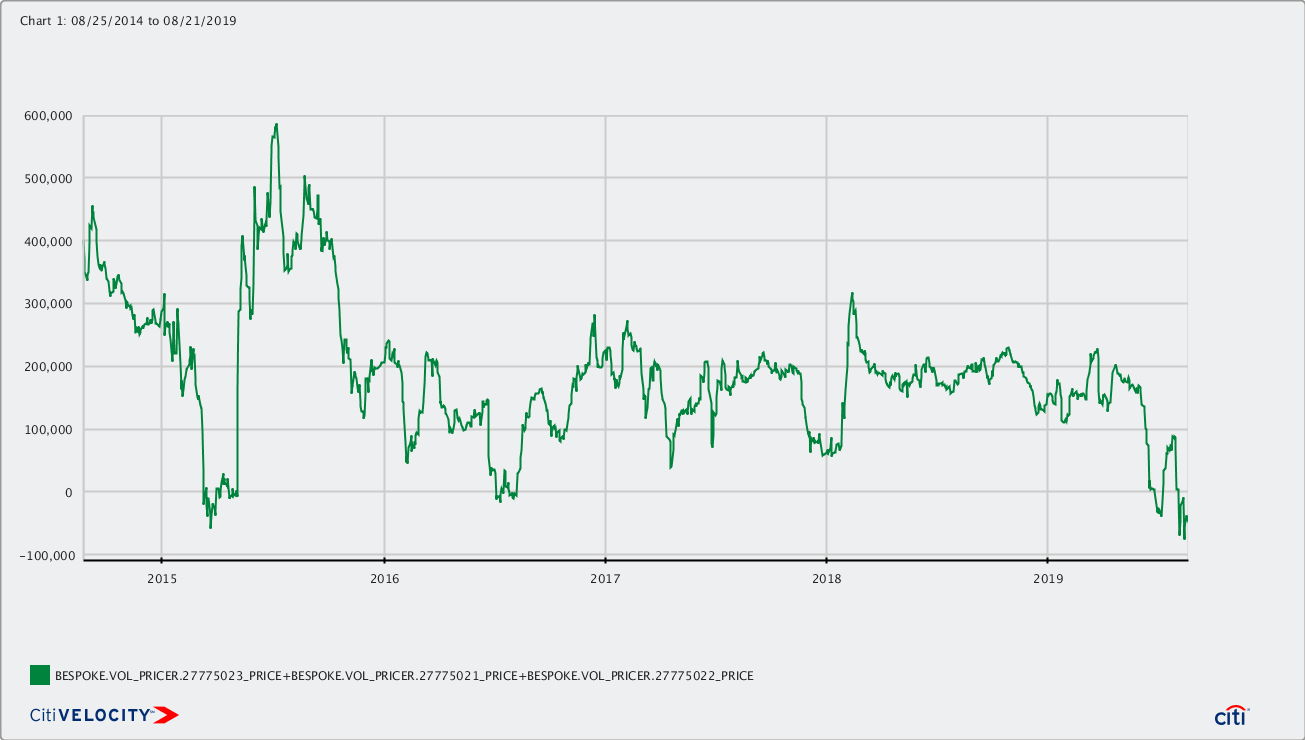

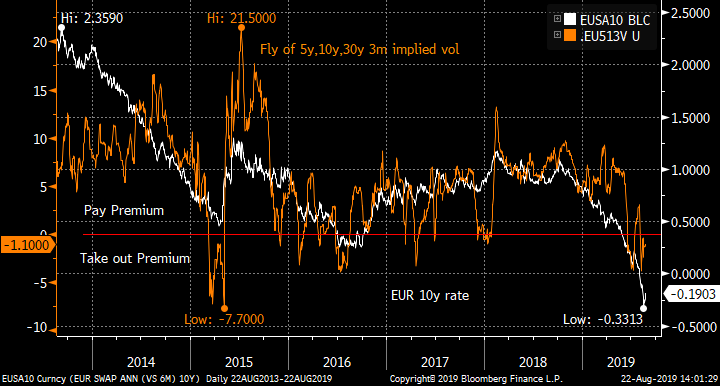

One indicator which saw an even larger relative swing was EUR curvature. The chart shows the 5-10-30 swap fly, compared to the belly 10y rate. The belly rallied consistently vs the wings for all of 2014, then began to reverse at the start of 2015. For most of this year, the fly headed lower in line with rates, and even though the pace of the fall has reduced, we are still close to the historical low of end-14. Certainly we could expect that a sharp sell-off in rates would send the fly higher. Thus a pay position in the 5-10-30 fly is a bearish position in the event of a large sell off.

Even if one is convinced of the likelihood of a reversal, the abrupt rally begs the question of when to set the position. Given that the ECB has not made a definitive move yet, and the FOMC could yet deliver significant cuts, the rally may have further to go. This suggests we should be looking at a conditional version of this fly using payers (buy payers on 10y, sell them on 5y and 30y). Usually this would require some upfront net premium to be paid, which mitigates against the trade, especially given the negative carry of ATMF strikes versus spot levels. However, recently there has been a strong bid on 30y tails in the volatility market: the chart shows the fly of the 5y,10y and 30y implied vols in orange, which has dropped through zero.

This is the premium of the ATMF 3m payer fly (for 100k/bp underlying wings), which, at -0.25bp, is pretty much the lowest level for the past five years.

One of the detriments of paying the 5-10-30 in vanilla swaps is the negative carry: 2.6bp over the first 3 months. This is still present in the payer fly version. The forward fly is struck at -12.8bp vs the spot swap fly at -15.4bp. However, given that the fly topped out at around +20bp at the peak of the 2015 Bund tantrum, there is still a decent potential P&L.

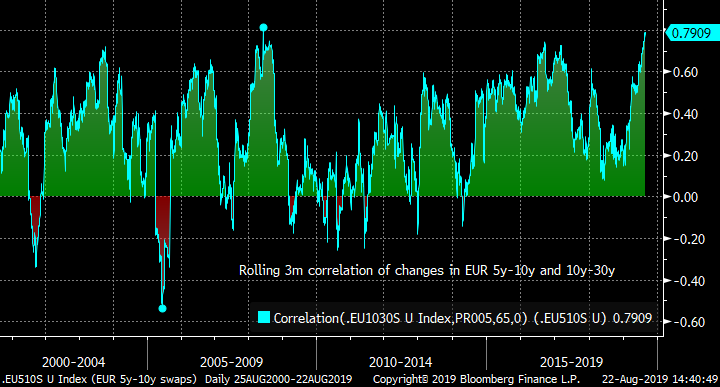

Another point to note is the rarity of the current curve situation in EUR. The chart is the rolling 3m (65 business day) correlation between the 5y-10y and 10y-30y curve segments (as the 5-10-30 fly is the difference of the two slopes). This correlation is very much at anomalously high levels, which means that the 5-10-30 fly is unusually stable. Any move lower in correlation implies that the 5-10-30 fly should move.

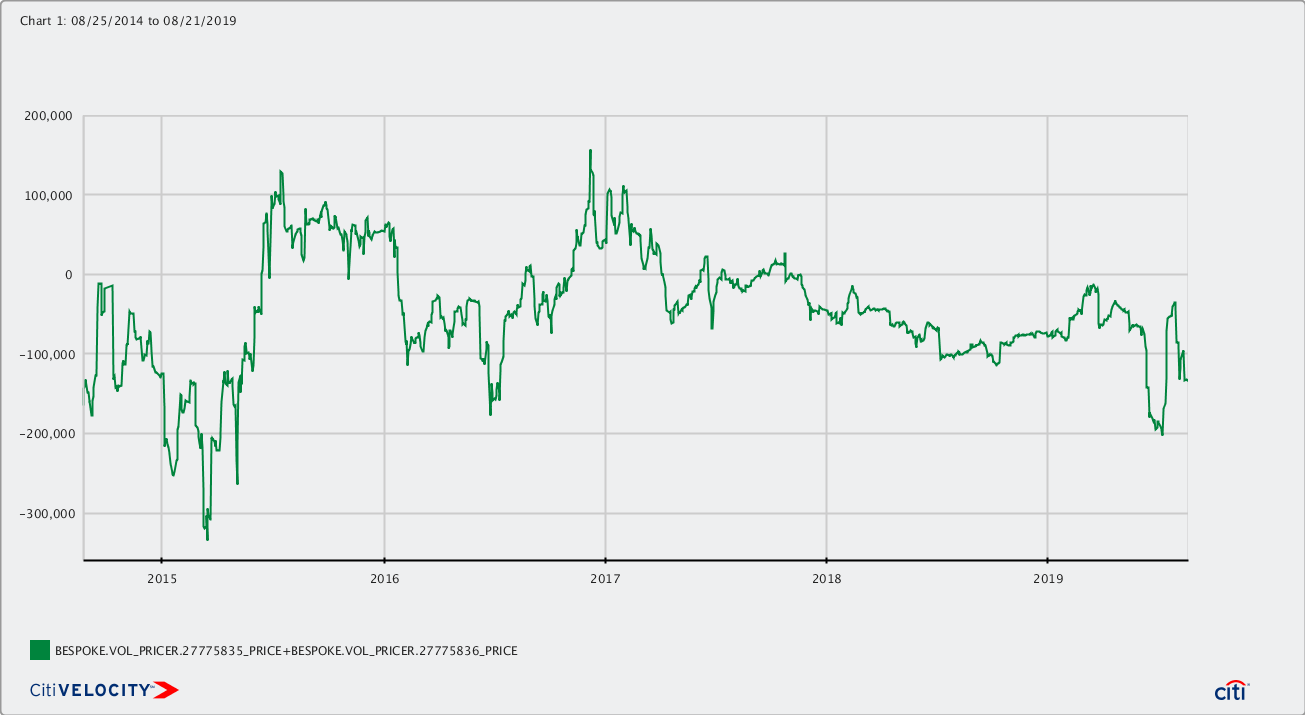

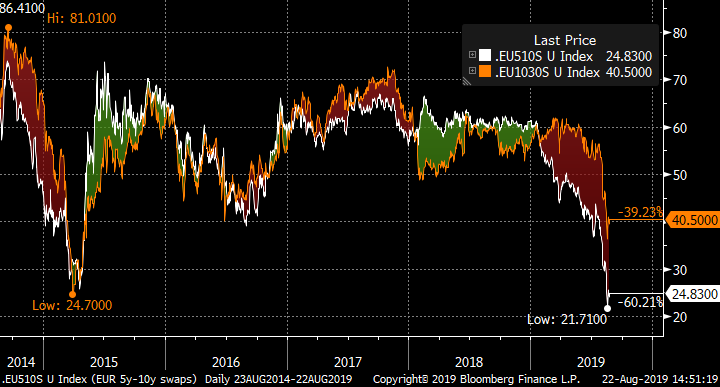

In a re-run of the 2015 Bund tantrum, both the 5y-10y and 10y-30y curve segments steepened sharply, but the 5y-10y segment led the way, taking the 5-10-30 fly rapidly higher. Thus an alternative to using payer swaptions is to use the spread of two CMS caps: buying a cap on 5y-10y and selling one on 10y-30y. The current implied volatility levels allow a premium take-out. The paper carry position is also improved by the CMS convexity adjustment on the caps. The historical net premium is shown in the next chart.

Chart of premium of CMS 3m caps on 5y-10y vs 10y-30y.

As a final suggestion, one can fade the high level of implied correlation between 5y-10y and 10y-30y with this structure:

Buy 1bn 3m SL cap on 10-5

Buy 1bn 3m SL cap on 30-10

Sell 1bn 3m SL cap on 30-5

If the two sectors were perfectly correlated, then the cost of this structure should approach zero. Right now it costs around 0.8bp, which is the maximum loss on the structure. Hence a further version of the 5-10-30 payer would be to combine the curve cap trade with this correlation play. The net result would be this trade:

Buy 2bn 3m SL cap on 10-5

Sell 1bn 3m SL cap on 30-5

For a premium take-out of 0.25bp (mid indicative)

These are all zero cost trades … what’s the catch? The primary risk of these trades is an anomalous sell-off in 30y rates ie: the 5-10-30 fly heads lower in a sell-off, and 10-30 out-steepens 5-10. Were the ECB to rule out QE, then 30y yields would rise, but the whole curve will steepen, and history suggests that 5y-10y would steepen faster as the belly leads the sell-off, but this is not guaranteed. A further pickup of implied volatility on 30y tails compared to 10y would give a negative mark-to-market, as would a further rally (although this would move all strikes out of the money).

There are several more permutations … let me know if you want to hear more!

Best wishes,

David

David Sansom

![]()

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND, EQUITY AND BREAKEVEN DILEMA ** ONE TO DISCUSS IF POSSIBLE **

BOND, EQUITY AND BREAKEVEN DILEMA ** ONE TO DISCUSS IF POSSIBLE **

WHEN PUTTING TOGETHER YESTERDAYS BREAKEVEN PIECE IT THREW UP A MAJOR DILEMA, INCREASING THE EXPLOSIVE ELEMENT TO THE START OF NEXT MONTH.

BONDS :

THE LONGTERM YIELD CHARTS CONTINUE TO CALL FOR “ONE LAST” BIG DROP YET IN COMPLETE CONTRAST TO THE WEEKLY RSI’S-BREAKEVEN CHARTS. I PERSONALLY HAVE NEVER SEEN SUCH DIAMETRICALLY OPPOSED OPINION. IT FORMULATES FOR AN EXPLOSIVE TIME THAT WILL ONLY BECOME CLEAR NEXT MONTH!

EQUITY :

ALSO THE EQUITY STORY IS FAR FROM FINISHED! MR TRUMP HAS YET TO RESOLVE MANY ISSUES WITH CHINA AND THAT LEANS TOWARD MUCH LOWER STOCKS, ASSITING THE “ONE MORE MONTH” ARGUMENT FOR LOWER YIELDS. MANY SINGLE STOCKS REMAIN SUB MEANIGFUL MOVING AEVRAGES.

US BREAKEVENS AND USGGT :

GIVEN THE NATURAL CORRELATION WITH CORE YIELDS THE DILEMA IS WHETHER YIELDS BOUNCE HERE AIDED BY THE BREAKEVEN SUPPORT OR WE HEAD LOWER (IN YIELD) ONE LAST TIME.

** A TENSE TIME, EVERYTHING EVENTUALLY CIRCLING BACK ROUND TO MR TRUMP AND THE FED! **

WE SHALL SEE BUT NEXT MONTHS START “SHOULD” GIVE US A MAJOR HINT.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

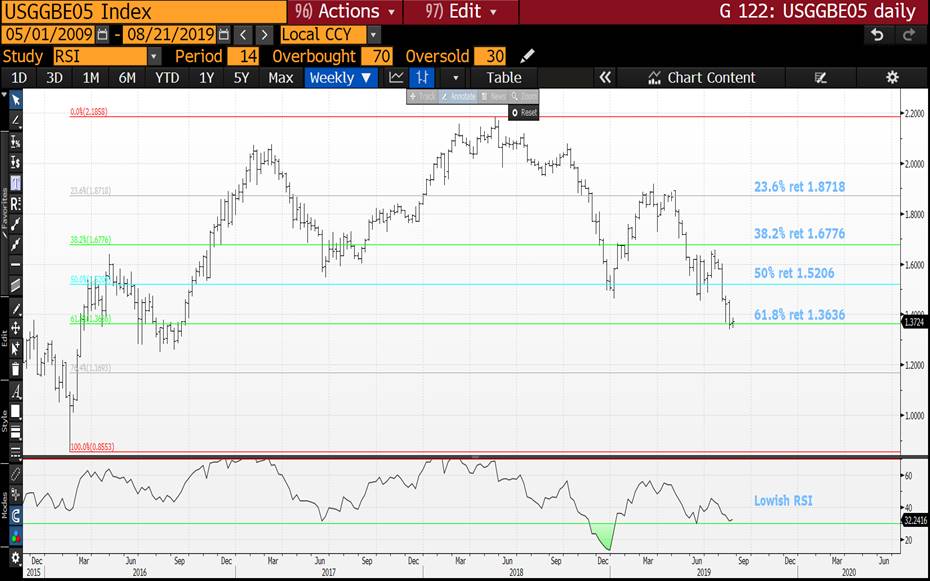

TECHNICAL UPDATE ONLY : US Breakevens and USGGT.

TECHNICAL UPDATE ONLY : US Breakevens and USGGT.

USGGT10y seems about the best one to focus on given the RSI’s are stretched and HIT of the REGULAR 23.6% ret 0.0198 level.

USGGBE10Y and USGGBE05Y seem to be the most likely to BASE given the RSI and 61.8% ret hit.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris