Btps switch -feb28 +Aug27: James Rice @Astor Ridge

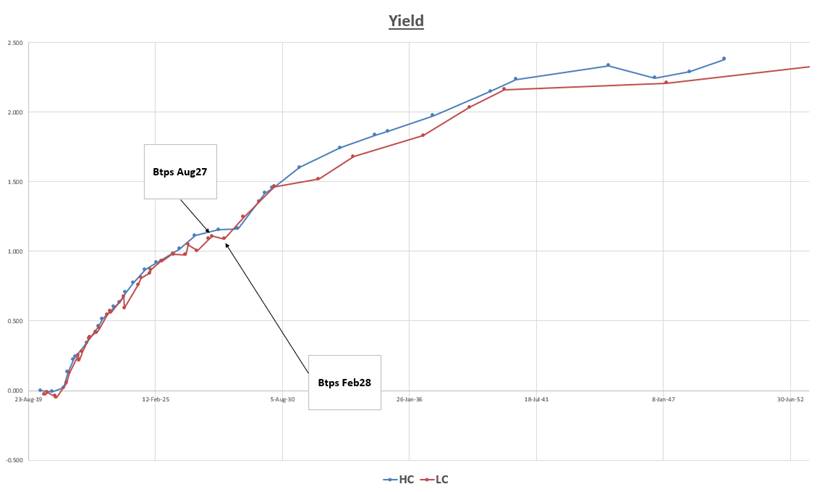

Btps Steepener 8y vs 8 ½ y

Sell feb28 to buy Aug27

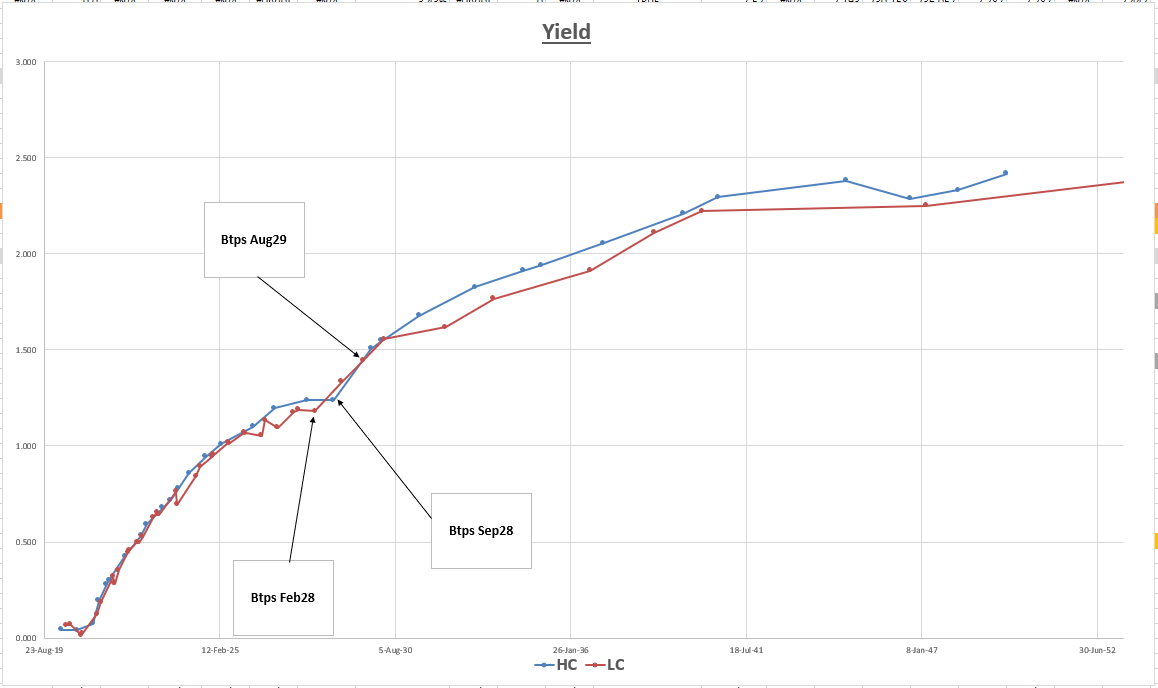

Italian Yield curve: 3mo forward

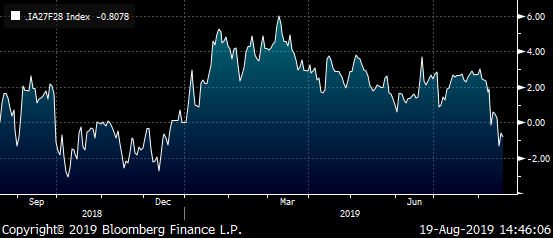

Trade History:

100 * (YIELD[BTPS 2 02/01/28 Corp] - YIELD[BTPS 2.05 08/01/27 Corp])

Rationale

- There will potentially be a new cheap 10y coming end of August (Mar30) with a low coupon

- The coupon differential is only 5bp

- The Feb28 are potentially only rich because they are close to the even richer CTD – Btps Sep28

- There has been a recent wholesale flattening of the Italian curve, which has impacted a segment already very flat from an anomaly perspective

- Trade also looks good when compared to other wider flatteners in Italy – see vs (wider curve hedge)

Feb28 vs Aug27

& 5% hedge -old5y vs +old20y

100 * ((yield[BTPS 2 02/01/28 Govt]-yield[BTPS 2.05 08/01/27 Govt])-0.05 * (yield[BTPS 2.95 09/01/38 Govt]-yield[BTPS 1.85 05/15/24 Govt]))

Carry and Roll

- Carry: +0.2bp /3mo

- Roll: +0.2bp /3mo

Risks

- Feb 28 continue to be bid in tandem with the IK contract during delivery and into the Dec expiry

- Negative news for Italy causes further flattening

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND UPDATE : DESPITE SOME VERY MAJOR RSI DISLOCATIONS YIELDS LOOK POISED TO “HEAD LOWER ALREADY”, MAINTAINING THE SUBSTANTIAL TREND.

BOND UPDATE : DESPITE SOME VERY MAJOR RSI DISLOCATIONS YIELDS LOOK POISED TO “HEAD LOWER ALREADY”, MAINTAINING THE SUBSTANTIAL TREND. IDEALLY BUY BONDS ON A NEW HIGH. THE WEEK ISNT OVER BUT YIELDS ARE ALREADY HEADING LOWER.

PREVIOUSLY :

LOOKS LIKE WE HAVE ONE MORE MONTH OF EXTENDED YIELD DROP, THEN WE FINALLY BASE. (SEE PAGE 2).

PAGE 3 NEATLY HIGHLIGHTS THAT THE DROP NEXT MONTH SHOULD EMULATE FROM THE PREVIOUS MONTHS CLOSE AND NO HIGHER. BASICALLY IF WE ARE GOING TO GO LOWER AGAIN THEN IT WILL BE AN IMMEDIATE REJECTION.

PREVIOUSLY :

EVEN I, WHO HAS BEEN ADVOCATING LOWER YIELDS MIGHT THINK THINGS HAVE GONE TOO FAR. HOWEVER, THIS STATEMENT DOESN’T MAKE SENSE GIVEN, STOCKS ARE ONLY JUST BREAKING AND DAILY FUTURES POST NEW HIGHS. GIVE IT A MONTH.

** ONE THING TO BEAR IN MIND IS, ALL YIELD CHARTS REMAIN BELOW THEIR MOVING AVERAGES. **

THE OTHER ISSUE IS AS LONG AS FUTURES POST NEW HIGHS CTA’S WILL BUY. BASICALLY THE NAME OF THE GAMES REMAINS TAKING PROFITS NOT RELINQUISHING LONGS.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Bloomberg Bond News Summary > Tue Aug 20th

Business Briefing

1) China Just Made Borrowing Costs a Tiny Bit Cheaper for Companies

Loans will get a little cheaper for Chinese companies after officials introduced a revamped market benchmark rate for the first time. China’s new one-year reference rate for bank loans will start at 4.25%, according to a statement from the central bank on Tuesday. That compares to the 4.24% median estimate in a Bloomberg survey of 11 traders and analysts. The ...

2) Twitter, Facebook Say China Fake Accounts Targeted Hong Kong

Twitter Inc. found and deleted hundreds of accounts it said China used to undermine the Hong Kong protest movement and calls for political change. The company said it took down 936 accounts that originated within China and attempted to manipulate perspectives on the pro-democracy movement in Hong Kong. Facebook Inc., acting on a tip from Twitter, said it also ...

3) White House Dismisses Payroll Tax Cuts as Slowdown Prevention

The White House dismissed the idea that the administration is looking to cut payroll taxes as a way to bolster consumer spending, as economic indicators increasingly point to a potential downturn. More tax cuts for individuals are being discussed, but payroll taxes aren’t under consideration at present, a White House official said Monday. ...

4) Finance Is Looking for Bankers Who Work Well With Robots

Today, it’s not just humans competing for work in banking. Machines are becoming a threat to warm-blooded number crunchers worldwide. Indeed, almost one-third of financial-services jobs could be displaced by automation by the mid-2030s, according to a report by PricewaterhouseCoopers LLP last year. Despite those stark forecasts, some optimists argue that the rise of machines at banks ...

5) Pursuits in Brief: Superyachts, Kylie Jenner, Bugatti Centodieci

This is a Bloomberg Pursuits look at luxury. As summer comes to a close, the superrich are squeezing the last rays out of it on superyachts. Italy currently has more than 100 yachts nestled in coves along Sardinia’s scenic Costa Smeralda, with the Amalfi Coast the second-most-popular location, according to Bloomberg’s ...

World News Briefing

6) Boris Johnson’s Bid to Renegotiate Brexit Starts on Irish Border

U.K. Prime Minister Boris Johnson made his first public attempt to renegotiate the Brexit deal by telling the European Union he wants to explore different ways to prevent a hard border on the island of Ireland. In a letter to European Council President Donald Tusk, Johnson said he wants to replace the so-called backstop provision in the divorce agreement with ...

7) Donald Trump Is Coming for Europe’s Most Important Alliance

In the end, they papered over the cracks. After months of increasingly acrimonious sniping, Emmanuel Macron and Angela Merkel set aside some of their differences last month, pushing through a deal on the next head of the European Commission. The rapprochement arrived just in time, with Donald Trump coming to Europe this week for the Group of Seven summit in ...

8) Epstein’s 11th-Hour Executor Says He Won’t Serve for Estate

Jeffrey Epstein had very few people he could turn to in his final days. When he needed a backup to handle his estate, he named a little-known biotech venture capitalist named Boris Nikolic in his will. But apparently without Nikolic’s knowledge. Nikolic said he was “shocked” after hearing from Bloomberg News of his inclusion in Epstein’s will. “I was not ...

9) Trump Speaks With Leaders of India, Pakistan as Tensions Simmer

U.S. President Donald Trump spoke separately on Monday with the leaders of India and Pakistan in a bid to calm tensions between the nuclear-armed neighbors over a territorial dispute. Indian Prime Minister Narendra Modi has kept Kashmir under lockdown for more than two weeks after scrapping the region’s autonomy, a move condemned by Pakistani Prime Minister Imran Khan ...

10) U.K. ‘Extremely Concerned’ by Reports Staffer Held on China Trip

The U.K. said it was “extremely concerned” by reports that a Hong Kong consulate worker was detained during a recent trip to mainland China, a case that threatens to add to strains between Beijing and London. The statement came after news site HK01 reported that the U.K. consular employee, Simon Cheng, 28, was reported missing after failing to return from an ...

Bonds

11) Getting Harder to Make Easy Money in Asia Bonds as Junk Hit

It’s getting harder to make easy profits in Asia’s bond market as the trade war and geopolitical tensions drag down junk debt. Speculative-grade bonds from the region have lost money for three straight weeks, their worst streak since late last year. That trend is threatening payouts for the rest of 2019, given that fund managers had loaded up on the riskier ...

12) Global Bond Rally Sidesteps India as Deficit Fears Mount

India’s fixed-income traders have swung from joy to misery within the span of two weeks as the global bond rally passes them by. Rupee-denominated sovereign bonds have lost more than half the gains they made since the government’s July 5 budget, as concern rises that authorities may sell more debt to finance further fiscal stimulus. ...

13) Omens of Another Asian Debt Crisis Seen by McKinsey in Stresses

More than two decades since the Asia debt crisis gripped the region, global consulting firm McKinsey & Co. is warning that signs of a rerun are “ominous.” Increased indebtedness, stresses in repaying borrowing, lender vulnerabilities and shadow banking practices are some of the concerns cited by McKinsey in an August report. Whether building pressures are ...

14) Trade Angst, More than a Reluctant Fed, Is Buoying the Dollar

Donald Trump has blamed the stubbornly strong dollar on the Federal Reserve’s reluctance to slash interest rates further. But real yields suggest investors fearful of the president’s trade war are what’s keeping the greenback strong. Consider the evidence: the U.S. currency has advanced against seven of 10 major peers this year even as the premium on ...

15) FX Volatility Drops as Investors Await Jackson Hole: Inside G-10

Volatility in major currencies declined as investors await the release of U.S. jobs data and a speech by Federal Reserve Chairman Jerome Powell in Jackson Hole, Wyoming later this week for more cues.

- JPMorgan G-7 Volatility Index closed at 7.72 on Monday, lowest since Aug. 8. Traders are waiting to see if Thursday’s jobless claims figures add to optimism over ...

16) HNA Group Repays Dollar Bond After Missing Yuan Note Payment

HNA Group Co. repaid a dollar-denominated bond on Monday amid a report China’s provincial government offered to help the debt-laden conglomerate meet payments to its offshore creditors. HNA Group International, a unit of HNA Group, repaid a $300 million bond due Aug. 18, a company spokesperson told Bloomberg, saying “we remain committed to meeting our ...

Central Banks

17) Turkey to Reward Banks That Lend More With Looser Reserve Rules

The Turkish central bank unveiled regulatory changes that determine the amount of cash lenders have to put aside as reserves depending on how much credit they extend. Required reserve ratios for banks with loan growth of 10% to 20% will be set at 2% -- with some exceptions -- while remaining unchanged for other banks, according to a statement on Monday. The ...

18) Trump Urges Fed Cut of 100 Basis Points, Cites World Economy

President Donald Trump stepped up his assault on the Federal Reserve, urging it to cut interest rates by a full percentage point to aid global growth while complaining the “dollar is so strong that it is sadly hurting other parts of the world.” “The Fed Rate, over a fairly short period of time, should be reduced by at least 100 basis points, with perhaps some ...

19) Fed’s Rosengren Wants Evidence of Slowdown to Justify Rate Cut

Federal Reserve Bank of Boston President Eric Rosengren continued to push back against further interest-rate cuts by the central bank, arguing he’s not convinced that slowing trade and global growth will significantly dent the U.S. economy. “We’re likely to have a second half of the year that’s much closer to 2% growth,” Rosengren said Monday in an interview ...

20) Trump Calls for ‘At Least 100 Basis Points’ Cut by Fed

President Trump kept up his criticism of the Federal Reserve, calling for the central bank to cut rates by “at least 100 basis points.”

- Trump also says the dollar is “so strong that it is sadly hurting other parts of the world”

21) GERMANY INSIGHT: Scholz Must Spend More or Risk Fresh Crisis

(Bloomberg Economics) -- Germany’s economy has hit the skids and risks a protracted downturn that reverses years of progress, especially in the labor market. The time for Olaf Scholz, Germany’s finance minister, to open the floodgates is now, not when a recession has already set in -- unfortunately, an early boost is verboten.

- We forecast that Germany will narrowly avoid a recession, but that depends on the services ...

22) Whiff of Baltic Noir Wafts Over Another Latvia Bank Suspension

The Baltic banking industry, ravaged by what’s become Europe’s biggest money-laundering scandal, has suffered another shock. The Latvian financial regulator suspended the operations of AS PNB Banka after the European Central Bank found that it had “significant capital shortfalls” and warned that it’s at the risk of failing. Latvia is confident it’s an ...

Economic News

23) PBOC’s Lower LPR Flags Material Easing On the Way: Economics

(Bloomberg Economics) -- OUR TAKE: The People’s Bank of China signaled intent to reduce borrowing costs to buttress growth, setting its new one-year Loan Prime Rate below the previous benchmark in the debut announcement. We see further room for the LPR to decline in the coming months, aided by other policy easing measures.

- The 1-year LPR recorded 4.25% on the first day under the new interest rate regime. That is ...

24) IMF Rumors May Be the Scare That South Africa Needs for Action

The threat of an International Monetary Fund bailout, unthinkable a few years ago, may force South Africa’s government to push through the reforms it needs to rescue the economy. An expanded bailout for struggling power utility Eskom Holdings SOC Ltd. and calls from other state companies for support have strained the nation’s budget, prompting business groups ...

25) Philippines Sets Record 2020 Borrowing Amid Infrastructure Push

Philippines President Rodrigo Duterte plans a record-high borrowing of 1.4 trillion pesos ($26.7 billion) for 2020, keeping a strategy of sourcing bulk of it locally to avoid foreign exchange risks. Next year’s proposed borrowing compares with 1.19 trillion pesos in fresh debt planned for this year. Of the total 2020 borrowing, about 1.05 trillion pesos or ...

26) Asia Stocks Rise as Trade Talks, Stimulus Mulled: Markets Wrap

Most Asian stocks posted modest gains Tuesday as investors digested signs of progress on trade negotiations and speculation of government stimulus to shore up economic growth. Treasuries rose and the dollar traded near the year’s high. Shares pushed higher in Tokyo, Sydney and Seoul, and fluctuated in Hong Kong and Shanghai. S&P 500 Index futures edged ...

European Central Bank

27) ECB Added Three New Securities to CSPP With One Note Called

The ECB added three new securities to its CSPP program during the week ended August 16, according to central bank data analyzed by Bloomberg.

- One security was called and the value of the CSPP portfolio increased by EU77m, at amortized cost

New Holdings Redeemed Holdings

- CSPP ISINs as determined by Bloomberg using ECB website data at 2:45pm London on August 19 ...

28) Higher Bund Yields Need ECB, German Fiscal Easing Acting in Sync

German fiscal hopes and diminished tactical risk-reward on long-end USTs have halted the rally in bunds.

- It makes sense for Germany to be proactive and engage in fiscal easing to get ahead of the curve, which would be a powerful ingredient when combined with easing by the ECB to chase down the elusive inflation target

- However, immediate hopes should fade given it requires a change in fiscal rules, with the ...

29) Operation Twist Is Making Comeback as Option for ECB Stimulus

The European Central Bank would get more bang for its buck if it plowed its reinvestment into bonds with a longer maturity rather than restarting quantitative easing, according to Bank of America Merrill Lynch. An operation twist -- as a swap from short-term bonds into longer-dated securities is commonly referred to -- would allow policy makers to maintain a ...

30) ECB Says the Next European Bank Hack Is Just a Matter of Time

(Bloomberg) -- A senior official at the European Central Bank warned that banks embracing external data storage and other digital technology need to face an uncomfortable truth: there’s a good chance they’ll get hacked. “There will be accidents, especially in the cloud,” Korbinian Ibel, a director general at the ECB’s supervisory arm, said in an interview. “It’s not that ...

31) Bank of America Sees ECB Relaunching QE, Raising Bond Limits

Bank of America Merill Lynch predicts the European Central Bank will restart its quantitative easing program and cut forecasts for euro-area economic growth, its economist Ruben Segura-Cayuela and strategist Sphia Salim say in a note.

- Bank of America expects “small” QE program of 30 billion euros per months for 9-12 months and the ECB to raise its 33% limit ...

First Word FX News Foreign Exchange

32) Rupee Bond Selloff Deepens as Deficit Worries Rise: Inside India

Sovereign bonds decline for a second day on concerns the government may end up selling more debt as speculation increases over a potential stimulus package.

- Benchmark 10-year yields rises 2bps to 6.61% on Tuesday, adding to an increase of more than 20 basis points over the past two weeks

- READ: Global Bond Rally Sidesteps India as Deficit Fears Mount

- “The dichotomy between Indian bonds and the global rally can be attributed to local supply ...

33) Equities Steady as Hong Kong Leader Seeks Dialogue: Macro Squawk

S&P futures reverse early losses as Asian stocks grind higher; MSCI Asia Pacific index 0.5% firmer. Hang Seng steady after Carrie Lam pledges new effort at dialogue over Hong Kong protests. Treasury 10-year yield near 1.59%; Australian curve modestly steeper as 10-year yield edges 3bps higher. Bloomberg dollar index hovers near 2019 highs; Aussie better bid after RBA minutes. Onshore yuan 0.2% ...

34) Germany to Test Haven Demand as Ultra-Long Bond Coupon Set at 0%

Germany will sell an ultra-long bond at a 0% percent coupon for the first time on Wednesday, in a flurry of debt sales in the next two weeks offering negative rates. The nation has previously only sold debt with a 0% coupon up to 10 years of maturity, including sales in the past month during a global debt rally. This week’s 30-year auction will test the ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND UPDATE : WE HAVE FORMED A YIELD BASE AND THE BURNING QUESTION IS HOW HIGH WE BOUNCE?

BOND UPDATE : WE HAVE FORMED A YIELD BASE AND THE BURNING QUESTION IS HOW HIGH WE BOUNCE? DO THINK THAT DECISION NEEDS TO BE MADE NEARER MONTH END AND AFTER A MORE SOLID CONCLUSION RE THE “TRADE DEAL”.

LOOKS LIKE WE HAVE ONE MORE MONTH OF EXTENDED YIELD DROP, THEN WE FINALLY BASE. (SEE PAGE 2).

PAGE 3 NEATLY HIGHLIGHTS THAT THE DROP NEXT MONTH SHOULD EMULATE FROM THE PREVIOUS MONTHS CLOSE AND NO HIGHER. BASICALLY IF WE ARE GOING TO GO LOWER AGAIN THEN IT WILL BE AN IMMEDIATE REJECTION.

PREVIOUSLY :

EVEN I, WHO HAS BEEN ADVOCATING LOWER YIELDS MIGHT THINK THINGS HAVE GONE TOO FAR. HOWEVER, THIS STATEMENT DOESN’T MAKE SENSE GIVEN, STOCKS ARE ONLY JUST BREAKING AND DAILY FUTURES POST NEW HIGHS. GIVE IT A MONTH.

** ONE THING TO BEAR IN MIND IS, ALL YIELD CHARTS REMAIN BELOW THEIR MOVING AVERAGES. **

THE OTHER ISSUE IS AS LONG AS FUTURES POST NEW HIGHS CTA’S WILL BUY. BASICALLY THE NAME OF THE GAMES REMAINS TAKING PROFITS NOT RELINQUISHING LONGS.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

EQUITY UPDATE : STOCKS ARE CURRENTLY HOLDING MANY OF THE PREVIOUSLY MENTIONED 200 DAY MOVING AVERAGES.

EQUITY UPDATE : STOCKS ARE CURRENTLY HOLDING MANY OF THE PREVIOUSLY MENTIONED 200 DAY MOVING AVERAGES.

AGAIN IT’S THE US WITH BETTER “BOUNCE” POTENTIAL, WHILST EUROPE AND ASIA CONTINUE TO STRUGGLE.

MANY MARKETS HAVE ALREADY POSTED NEW LOWS AND AS A RESULT ARE DAMAGED GOODS. THAT WEAKNESS NEEDS TO BE CONFIRMED BY MONTH END CLOSES.

ASIA IS THE MAIN FOCUS GIVEN THE HANG SENG IS TEASING THE MULTI YEAR 23.6% RET 25601.22.

MANY MONTHLY CHARTS NOW HIGHLIGHT THE WORRYING IMPLICATIONS IF THE 200 DAY MOVING AVERAGE EVENTUALLY FAIL.

*** SINGLE STOCKS REMAIN HEAVY ***

A REAL MONEY MANAGER TOLD ME ONCE THEIR BEST RETURNS EMULATED FROM

200 DAY MOVING AVERAGES, HENCE THEY ARE KEY!!!!!!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

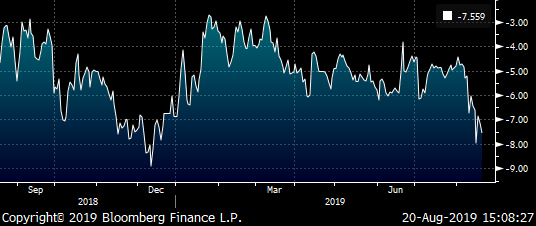

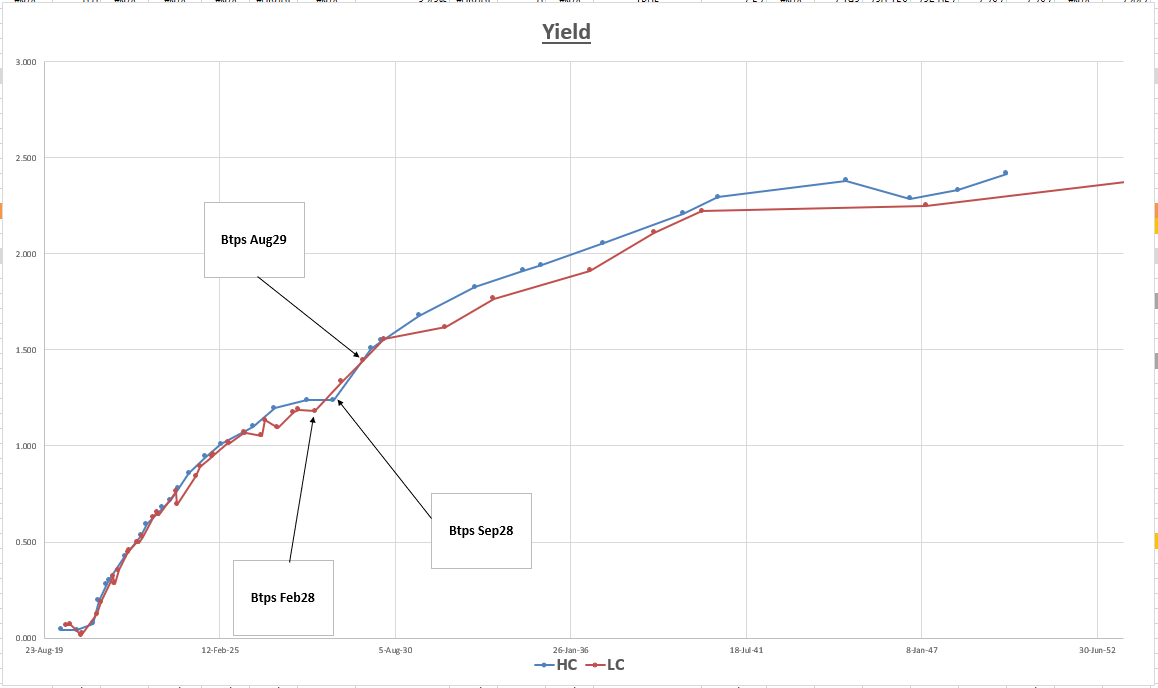

FW: Btp - roll - IKU9 vs IKZ9

Apols amendment – implied is -0.65%

Buy the Cash Btp Sep28 vs back months – implied @-0.48%

On balance buy the Btp Futures roll – some at each level @1.85

IKU9 / IKZ9

We’re coming up to the Btp roll – IKU9 going off the board and IKZ9 coming on as front month

Roll - @1.85, having been as low as 1.76 in July

To September

Implied Repo +0.25%

(not so meaningful this close to delivery)

Net basis using -0.40% repo, -3.6 cents net

- Thoughts: wait for more negative basis

– to me – ‘the double boxing condition’ –

where I buy the net basis, lend past delivery and then am prepared to very aggressively borrow back the bonds over the delivery window - that is when the nett gets to -8 cents

Only then would I would sell more front month in other structures, when that ‘pressure valve’ is tested (waiting to see -8 cents nett)

To December (using roll at 1.85)

Implied Repo -0.42%

Net basis using -0.60%, -4.8 cents net

Bond may well be cheap to contracts, but is rich spot and forward – hence the repo and maybe the implied should richen

Thoughts – buy cash bond implied to the back month

Seems that the Sep28 are still rich forward to Dec - so the back month looks rich

So the for the bond to cheapen forward then the repo and/or the repo can richen

Forward yield Curve (3 months) using 15bp special repo for sep28…

Any questions or thoughts as to how we can help with any structures – please give me a shout

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Btp - roll - IKU9 vs IKZ9

Buy the Cash Btp Sep28 vs back months – implied @-0.48%

On balance buy the Btp Futures roll – some at each level @1.85

IKU9 / IKZ9

We’re coming up to the Btp roll – IKU9 going off the board and IKZ9 coming on as front month

Roll - @1.85, having been as low as 1.76 in July

To September

Implied Repo +0.25%

(not so meaningful this close to delivery)

Net basis using -0.40% repo, -3.6 cents net

- Thoughts: wait for more negative basis

– to me – ‘the double boxing condition’ –

where I buy the net basis, lend past delivery and then am prepared to very aggressively borrow back the bonds over the delivery window - that is when the nett gets to -8 cents

Only then would I would sell more front month in other structures, when that ‘pressure valve’ is tested (waiting to see -8 cents nett)

To December (using roll at 1.85)

Implied Repo -0.42%

Net basis using -0.60%, -4.8 cents net

Bond may well be cheap to contracts, but is rich spot and forward – hence the repo and maybe the implied should richen

Thoughts – buy cash bond implied to the back month

Seems that the Sep28 are still rich forward to Dec - so the back month looks rich

So the for the bond to cheapen forward then the repo and/or the repo can richen

Forward yield Curve (3 months) using 15bp special repo for sep28…

Any questions or thoughts as to how we can help with any structures – please give me a shout

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Recall: Btp - roll - IKU9 vs IKZ9

James Rice would like to recall the message, "Btp - roll - IKU9 vs IKZ9".

Btp - roll - IKU9 vs IKZ9

Buy the Cash Btp Sep28 vs back months – implied @-0.48%

On balance buy the Btp Futures roll – some at each level @1.85

IKU9 / IKZ9

We’re coming up to the Btp roll – IKU9 going off the board and IKZ9 coming on as front month

Roll - @1.85, having been as low as 1.76 in July

To September

Implied Repo +0.25%

(not so meaningful this close to delivery)

Net basis using -0.40% repo, -3.6 cents net

- Thoughts: wait for more negative basis

– to me – ‘the double boxing condition’ –

where I buy the net basis, lend past delivery and then am prepared to very aggressively borrow back the bonds over the delivery window - that is when the nett gets to -8 cents

Only then would I would sell more front month in other structures, when that ‘pressure valve’ is tested (waiting to see -8 cents nett)

To December (using roll at 1.85)

Implied Repo -0.42%

Net basis using -0.60%, -4.8 cents net

Bond may well be cheap to contracts, but is rich spot and forward – hence the repo and maybe the implied should richen

Thoughts – buy cash bond implied to the back month

Seems that the Sep28 are still rich forward to Dec - so the back month looks rich

So the for the bond to cheapen forward then the repo and/or the repo can richen

Forward yield Curve (3 months) using 15bp special repo for sep28…

Any questions or thoughts as to how we can help with any structures – please give me a shout

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's Post-Holiday BREXIT BARRAGE! Less than 11 weeks to go...

Thought I’d send over a quick recap of recent developments in my post-holiday effort to get caught up…

FT: On the brink: Britain’s economy braces for Brexit ‘shock’

FT: Jeremy Corbyn will do ‘everything necessary’ to stop no-deal Brexit

FT: Business groups admit many companies are ill-prepared for no-deal Brexit

FT: Boris Johnson prepares to make debut as PM on world stage

FT: Leaked no-deal Brexit report should focus MPs’ minds

FT: UK chancellor backs away from stamp duty reform bill

FT: Punishing Ireland’s economy will backfire on Brexiters

BBG: Corbyn Gears Up for Election as Chaotic Brexit Fears Escalate

BBG: Johnson to Raise Brexit Stakes in Visits to Germany and France

BBG: U.K. Faces Fuel, Food Shortages, Port Delays Post-Brexit

BBG: Pound Wins Holiday From Selloff on Resistance to No-Deal Brexit

TEL: Boris Johnson accuses Philip Hammond and other ex-ministers of undermining Brexit ahead of EU trip

TEL: Forty Tory MPs ready to back Philip Hammond and David Gauke to stop no-deal Brexit

TEL: Firms told of new export opportunities in Brexit PR blitz

TEL: Britain should be more careful playing hardball on US trade

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796