**PLEASE READ ** EQUITIES : NEVER HAVE 200 DAY MOVING AVERAGES BEEN MORE CRITICAL!

EQUITIES : NEVER HAVE 200 DAY MOVING AVERAGES BEEN MORE CRITICAL!

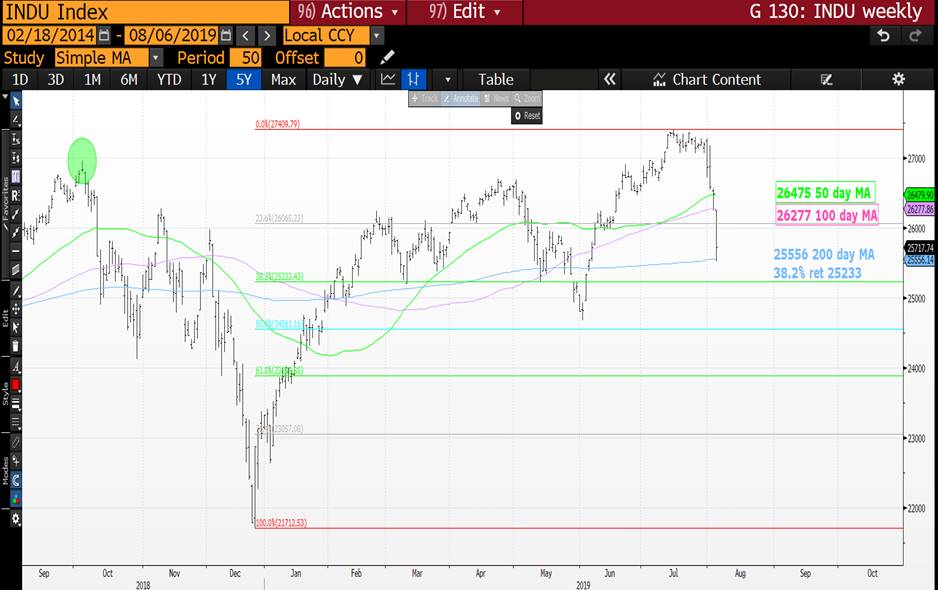

Equities have made life very easy by holding many 200 day moving averages and thus KEY if breached.

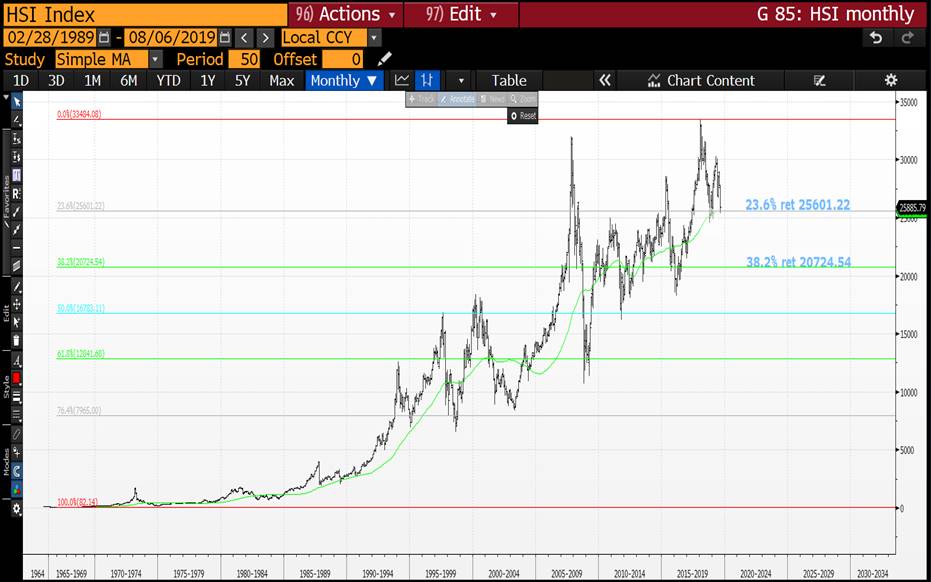

MANY MONTHLY CHARTS NOW HIGHLIGHT THE WORRYING IMPLICATIONS IF SUPPORT FAILS.

It has been a tortuous few days for many but as highlighted previously it may just be the start. Conveniently we have held NUMEROUS 200 day moving averages so if breached its free fall time.

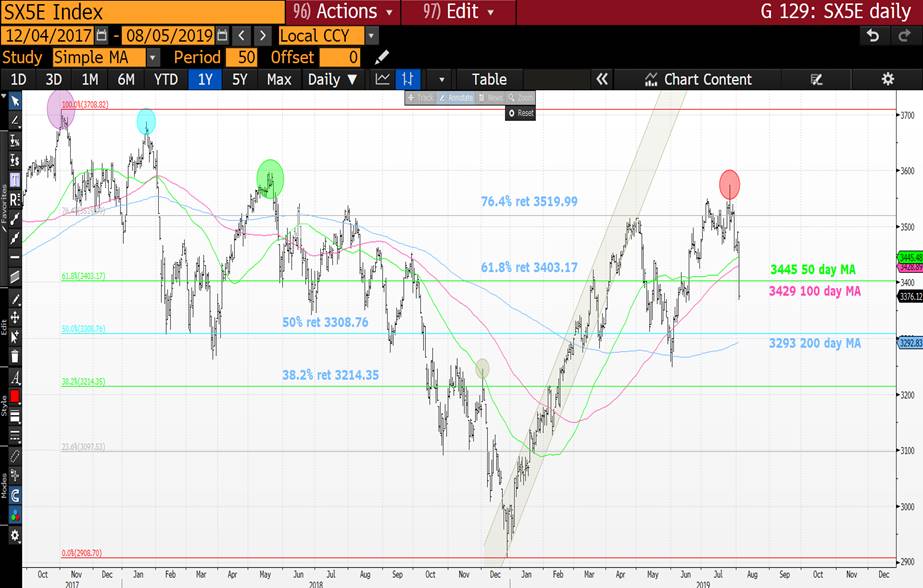

Most of Europe is on its last line of support, NUMEROUS 200 day moving averages have held BUT the longer duration charts are now VERY NEGATIVE!

Asia obviously has more issues and it has failed ALL moving averages in most cases.

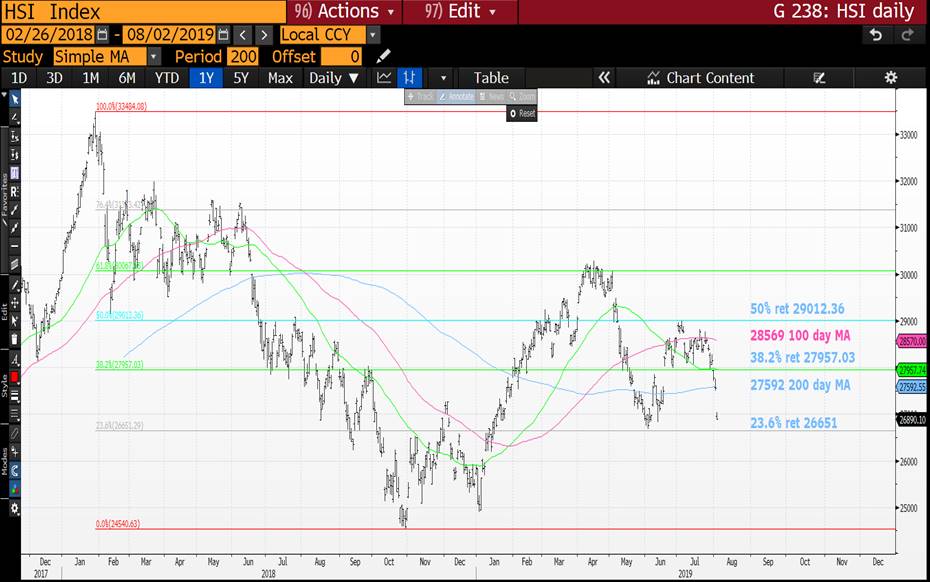

The HANG SENG is sitting on VITAL retracement support, should it be breached its meltdown time!

*** SINGLE STOCKS REMAIN HEAVY ***

The BIG PICTURE ultimately remains lower, similar to the yield call.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

EQUITIES THEY STILL HAVE MORE ROOM : Equities are now on a MAJOR path lower, many stocks in Asia are below ALL major moving averages.

EQUITIES THEY STILL HAVE MORE ROOM : Equities are now on a MAJOR path lower, many stocks in Asia are below ALL major moving averages.

Europe is holding in better but many daily charts have breached their 50 and 100 day moving averages.

Asia obviously has more issues and it has failed ALL moving averages in most cases.

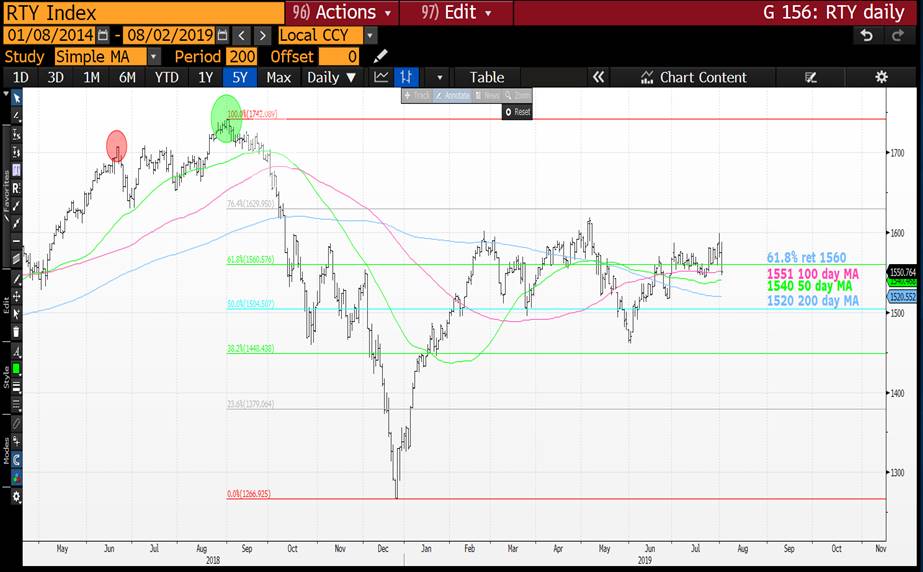

Equities in the US have new highs on many fronts but the HAND SENG and RUSSELL remain damaged goods.

*** SINGLE STOCKS REMAIN HEAVY ***

The BIG PICTURE ultimately remains lower, similar to the yield call.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

EQUITIES BACK ON THE RADAR : Equities are very close to their OWN agenda given yesterday we breached many KEY levels.

EQUITIES BACK ON THE RADAR : Equities are very close to their OWN agenda given yesterday we breached many KEY levels.

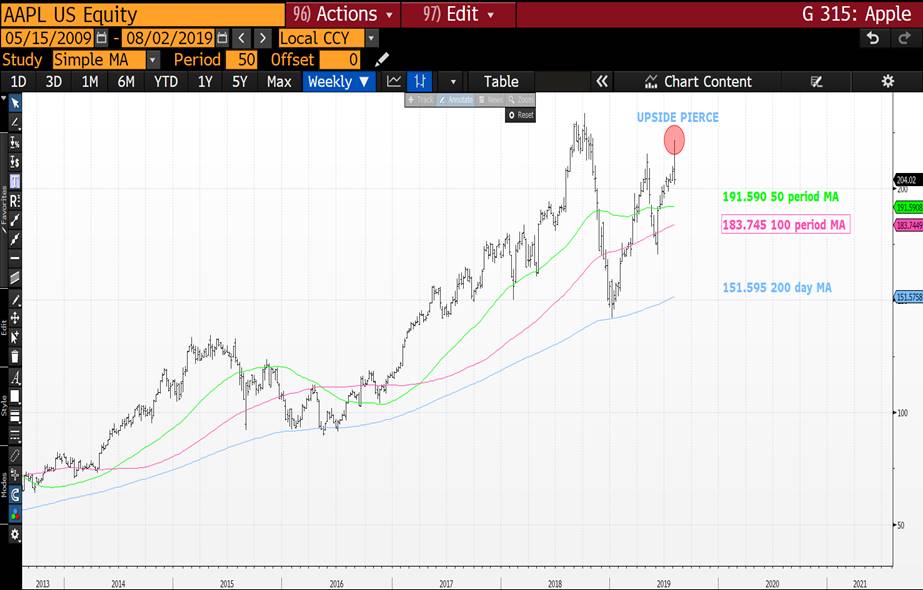

Equities in the US have new highs on many fronts but the HAND SENG and RUSSELL remain damaged goods.

* ** SINGLE STOCKS REMAIN HEAVY ***

** SINGLE STOCKS REMAIN HEAVY ***

The BIG PICTURE ultimately remains lower, similar to the yield call.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

POST FED MULTI ASSET UPDATE : KEY POINTS ARE : BOND MONTH END CLOSES WERE AT THEIR YIELD LOWS, THE EURO IS FAILING AND STOCKS COULD JUST BE ABOUT TO FAIL IN A MAJOR WAY.

POST FED MULTI ASSET UPDATE : KEY POINTS ARE : BOND MONTH END CLOSES WERE AT THEIR YIELD LOWS, THE EURO IS FAILING AND STOCKS COULD JUST BE ABOUT TO FAIL IN A MAJOR WAY.

BONDS IDEALLY WE NEED TO SEE THE NON-FARM DATA BUT WE HAVE YET ANOTHER MONTHLY CLOSE AT THE YIELD LOWS.

EQUITIES : SOME MAJOR REVERSAL YESTERDAY WITH THE CHINESE STOCKS STRUGGLING! MANY SINGLE STOCKS REMAIN DAMAGED GOODS.

US CURVES : THEY CONTINUE TO FRUSTRATE AND AS MENTIONED BEFORE WOULD REMAIN FLAT. HENCE NOT INCLUDED.

FX : THE EURO IS BREACHING SOME VERY MAJOR LEVELS WITH 1.0865 THE NEXT MAJOR OBSTACLE.

OIL and GOLD : Oil has a decision given we are SAT at the convergence of 50 and 200 day moving averages. (Page 59).

Gold continues to be the safe haven AND HAS WORKED OFF ITS overbought state.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: FRTR & SPGB Supply This AM... Quick Colour

EGBs - FRTR & SPGB Taps

- This am we'll get the last scheduled supply from both France and Spain until September given cancellation of their mid-month auctions.

- Yesterday's rally into the month-end index extensions saw strong outperformance of Spain and Italy vs core and a powerful bull flattening move, 10-30s OATs another 3bps flatter, just off the cycle lows.

- With the FED sending mixed messages last night (muddled press conf and 2 dissenters, calling for no cut) and the tailwinds of index demand behind us, this am's SPGB and FRTR supply isn't the slam dunk it could have been, especially given the yield levels and DV01 of about 90k RXU9.

- SPGBs have some room to tighten further given where sprds were in early July but further richening in absolute yield levels will need some help from the data, PMIs released this am pre-taps.

- FRTR 10/27s remain rich on the curve and the FRTR 5/30s basis has richened to new highs as the FRTR 5/28s cheapened on the curve. The 5/28-5/30 Z-sprd box has room to flatten further, however, so we could see HF interest on this. Needless to say, no ‘free lunches’ this am and there’s a real risk those who needed to buy the mkt have already done so.

FRTR-SPGB Sprds

FRTR 5/28-5/30 Z-sprd box – decent flattening but more room to go…

Data this AM…

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Quick RATES/FX Techs into FOMC Day... Charts

“What a long, strange trip it’s been…” – The Grateful Dead

- Today’s month-end and, more importantly, likely to be the first time the FOMC cuts rates in 10yrs. Here’s a snapshot across the major US, UK and EUR markets into this morning. We’ll stick to the ‘keep it simple’ method.

- But first, here’s a good BBG opinion article that provides an excellent summary (in my view) of the situation facing the market and where sentiment is going into the big event. Fed Day Has Bond Traders Feeling Giddy: Robert Burgess The bottom-line is the market’s pretty pumped up for continued accommodation after today and not just from the FED.

USA

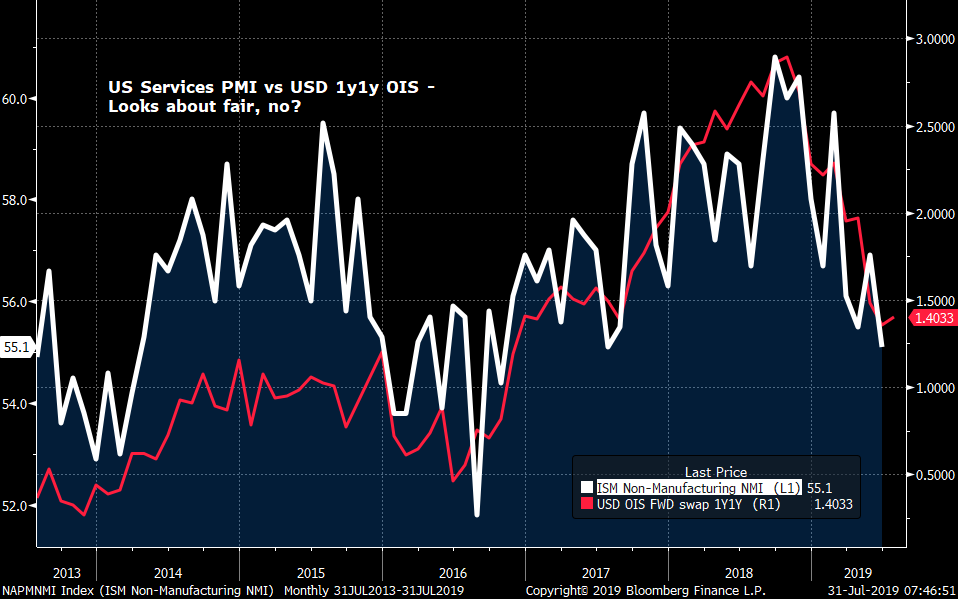

- The US is primarily a services economy, right? Here’s USD 1y1y OIS vs US services PMI.

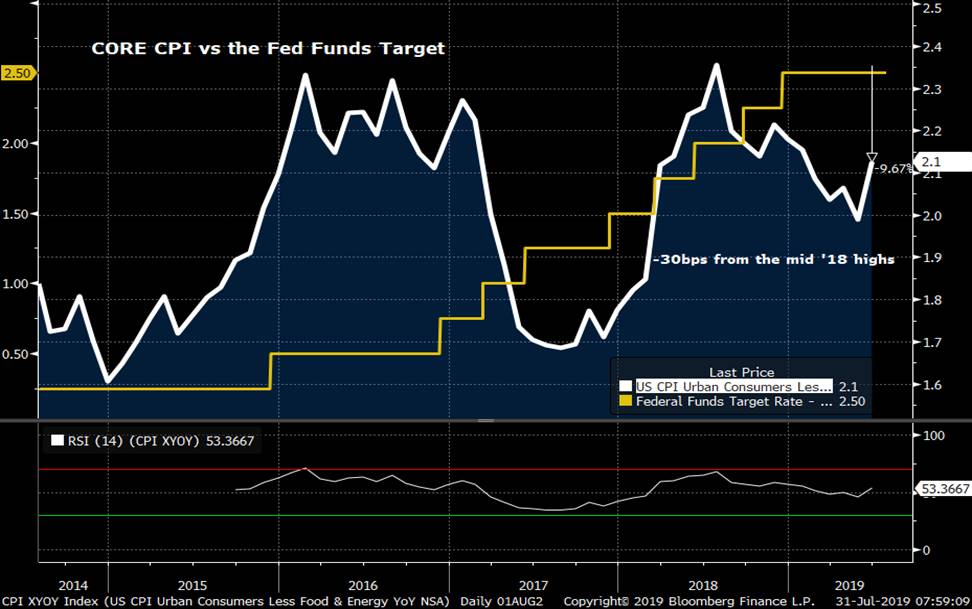

- Core CPI vs the Fed Funds target rate. The Fed’s ‘new and improved’ inflation analysis method is meant to provide them with more flexibility around their target funds rate. We get that. Unless we see a reversal in this latest bounce in core YOY CPI (and GDP, consumer confidence and retail sales!) we will struggle with the idea that the FED should be embarking on a rate cut cycle. Dudley could be right – maybe this is a one-and-done 25bps cut?

- Our back of the envelope measure of UST positioning shows that the market was in shorts-reduction mode as TYA rallied but when the rally stopped, the market got short (hence the divergence in the chart), anticipating a pull-back. Perhaps we’re better positioned for disappointment on the rate cut front from Powell than we thought?

- S&P 500 vs the Fed Funds target rate… Over simplification? Maybe not.

Europe

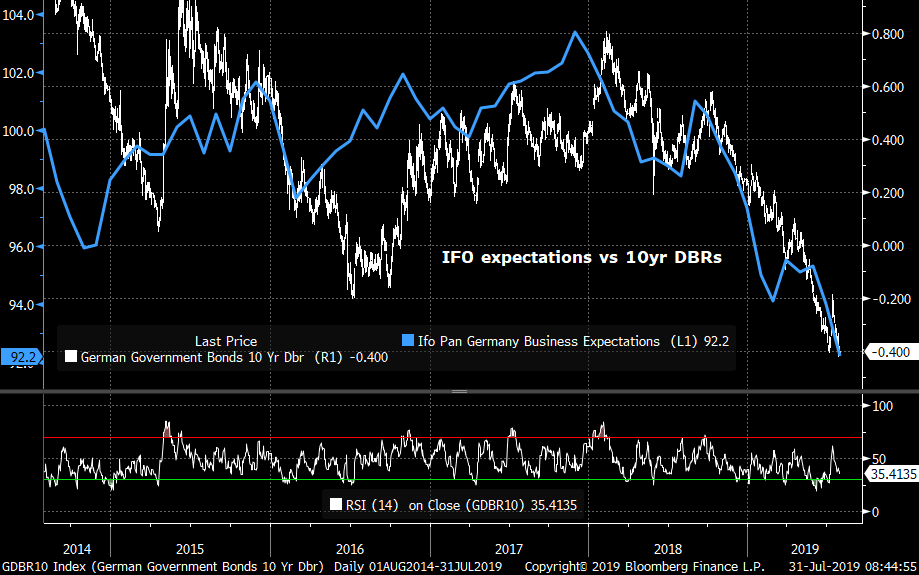

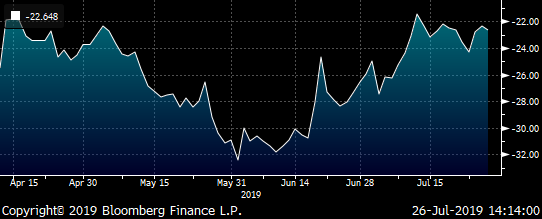

- Germany’s rapid decline has been the most alarming element in the recent erosion of European activity. This IFO expectations index (blue) vs 10yr DBRs suggests that these yield levels are justified given the previous correlation.

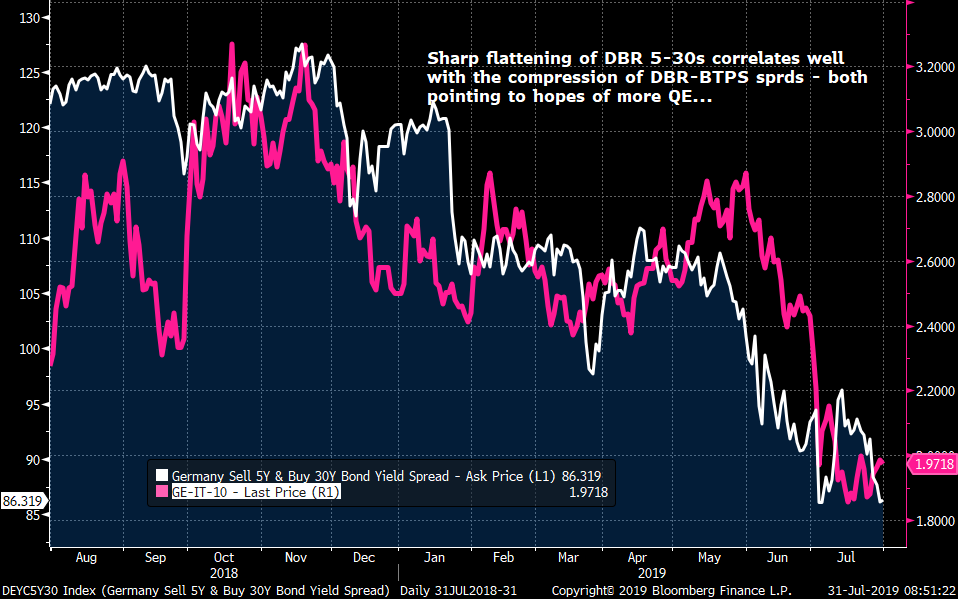

- DBR 5-30s sprd vs DBR-BTPS 10yr sprds… No great shock that these are well correlated, however, they both point to a market that’s dying for more QE and already well-priced for it.

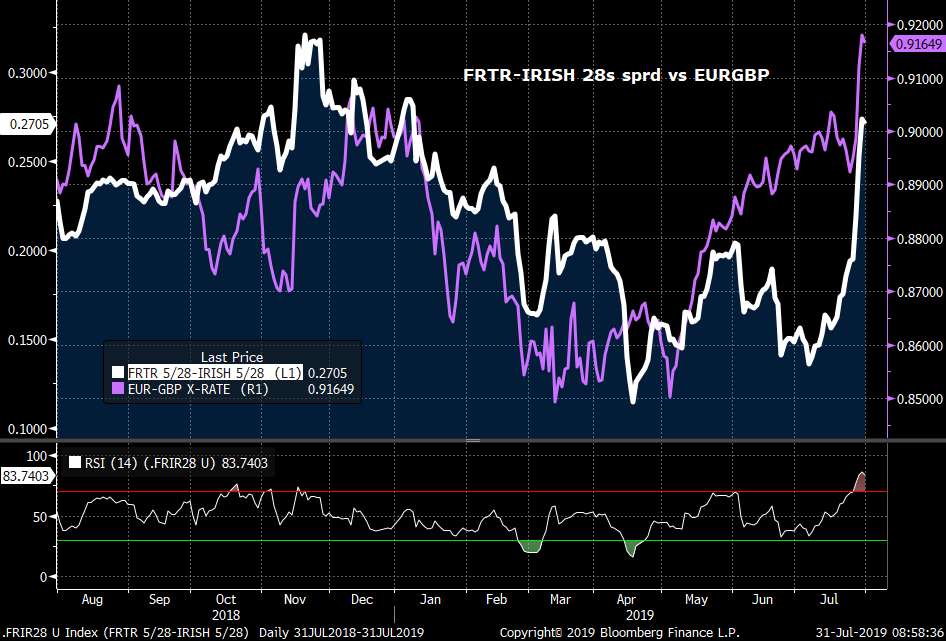

- EGBs immune from the Brexit mess? Well, not if you live in Dublin…

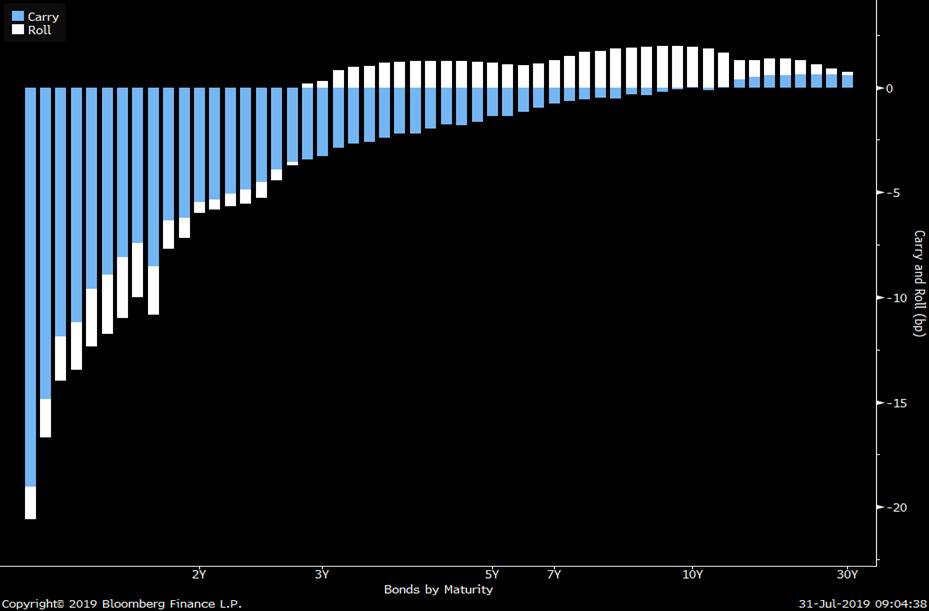

- Here’s the carry and roll chart of the DBR curve. No wonder why we don’t spend more time on DBR RV…

- Eonia out to Mar 2020 pricing in almost two 10bps cuts to the depo rate… We’re not convinced that’ll do much but it would help alleviate some of the neg carry issues above…

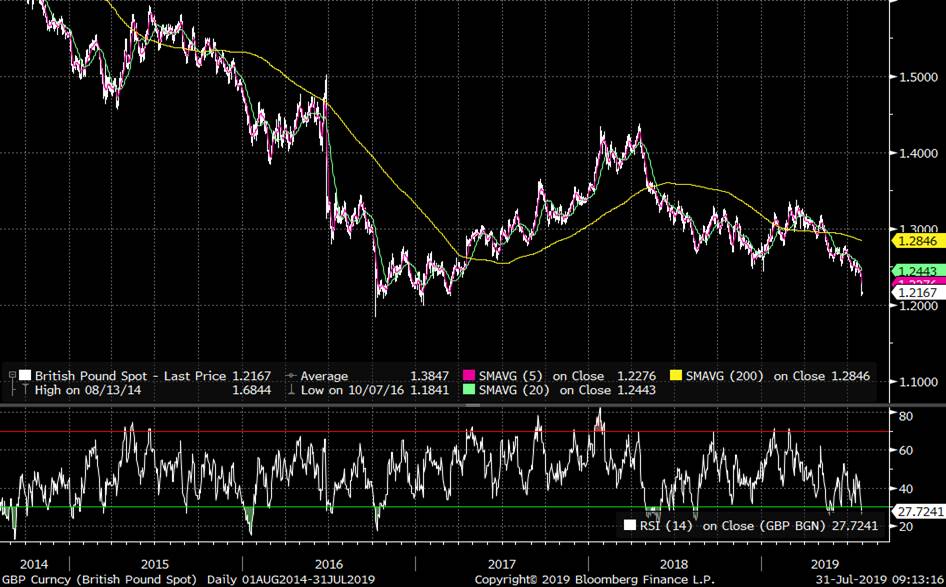

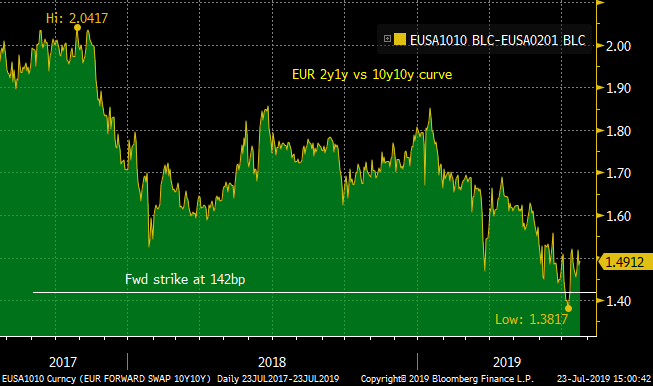

United Kingdom

- Right now, this is the only chart that you need to assess the state of the UK’s outlook. Boris Johnson’s ‘come hell or high water’ approach to the Oct 31 deadline has driven a dramatic selloff in cable that has taken us back within a sneeze of the post-Brexit lows in 2016.

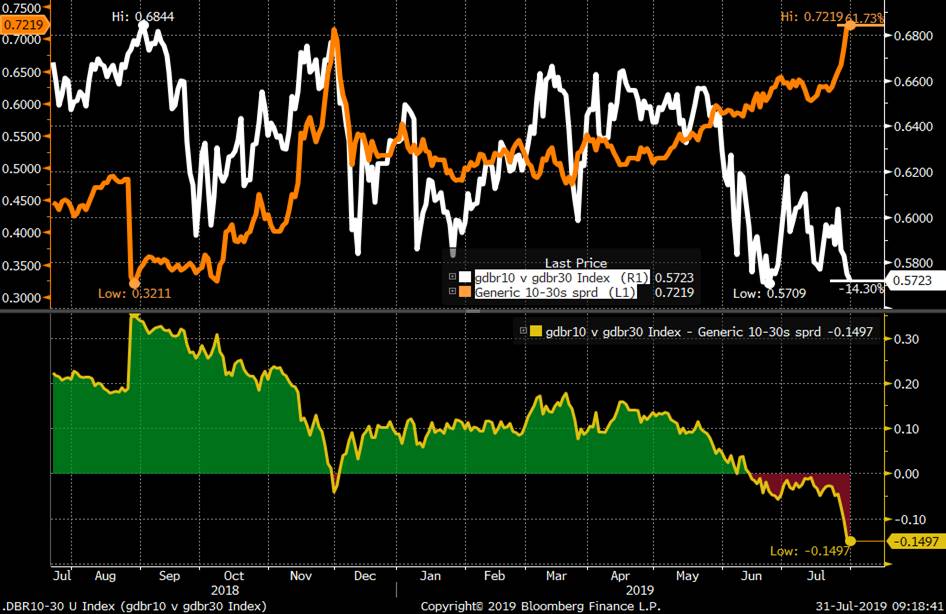

- The weaker pound, hopes of help from the BoE if things get ugly and talk of a dramatic round of fiscal spending this autumn (more cops, tax cuts, NHS spending, etc) that would mean more gilts issuance have combined to drive a relentless steepening of the gilts curve, in start contrast to the flattening in Europe. As noted previously, this looks stretched but there seems little desire to fade either leg of this box yet.

DBR 10-30 vs UKT 10-30

We will be in touch to discuss…

Thanks

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EQUITIES BACK ON THE RADAR : Ahead of next weeks Trump-XI meet its is worth noting all major levels, ANYTHING can happen and European stocks are flailing.

EQUITIES BACK ON THE RADAR : Ahead of next week’s Trump-XI meet it is worth noting all major levels, ANYTHING can happen and European stocks are flailing.

Equities in the US have new highs on many fronts but the HAND SENG and RUSSELL remain damaged goods.

*** SINGLE STOCKS REMAIN HEAVY ***

The BIG PICTURE ultimately remains lower, similar to the yield call.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Update on Italian curve supply and RV implications

Hi,

Just doing some work on the Italian curve in preparation for RV themes over the next few months

- Italy Supply normally: 3y & 7y mid-month and 5y and 10y at end of month

- Italy cancelled mid-August 3y and 7y auctions

- End of June, Tesoro announced two new issues for Q3;

A new 10y Btps 01-Apr-2030

A new 3y Btps 01-Jan-2023

- The current 10y Aug29 (€16bln) is close to the sizes of prior benchmarks (Dec28 - €19,2Bln & Feb28 €22,5Bln)

So we expect the last tap to be the end of July – still scheduled - In August & September respectively, we expect the new 10y and the new 3y to come and to have a v low coupon of approx. 1.60% and 0.4% (estimated)

So what does this mean for Italy RV?

- New issues typically trade cheap on the curve

Not only in yield, but even when we look at the value of a high coupon in a steep curve (short modified duration)

- The new issues will have a double whammy of value..

The recent rally means that from a default perspective they could have tremendous value –

good yield, stripped value, reasonable carry but most of all strong default value due to their low coupons

New bond Insertion

As new issues have come cheaper than ‘fair’, I’ve tried to postulate the cheapest levels that these bonds could come at

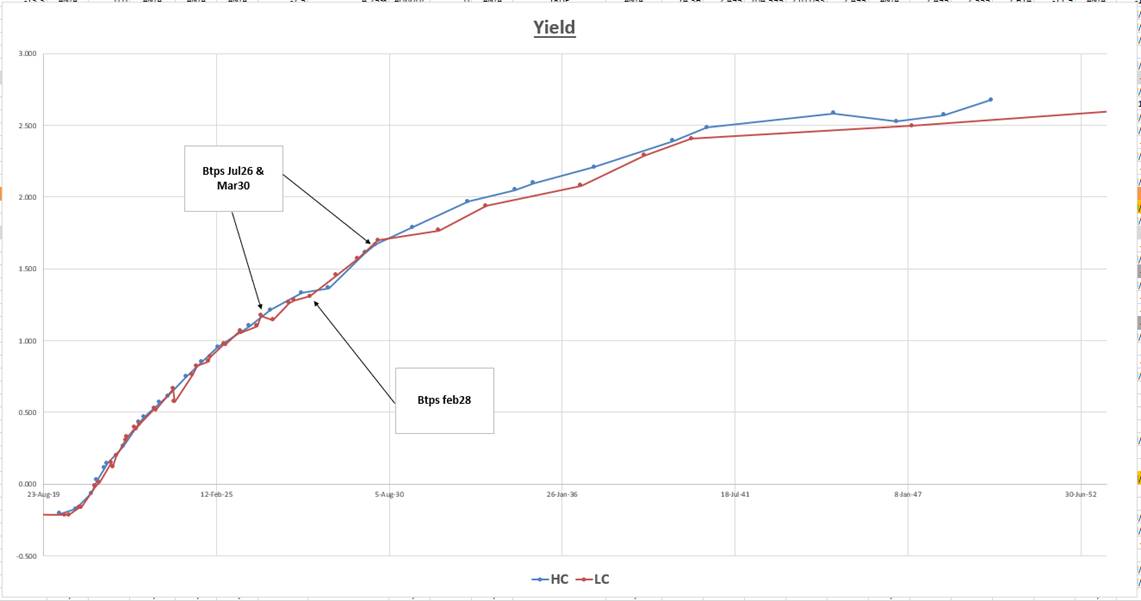

This should help us see more clearly the effect on the existing term and anomaly structure

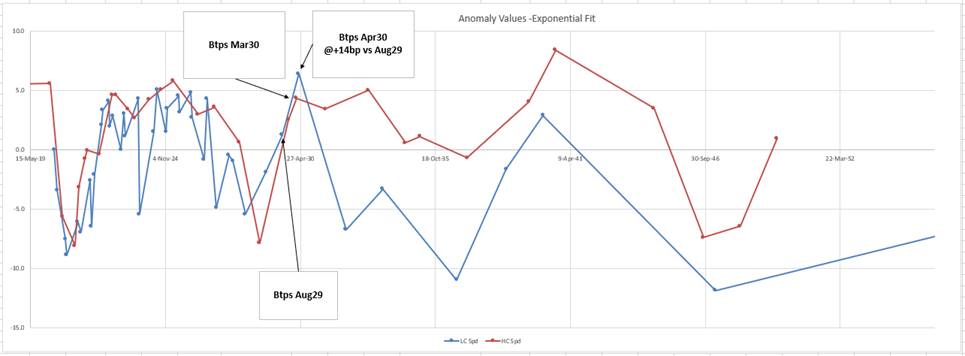

here’s a graph of the yield (bp) anomalies of the Italian curve vs a smooth, double-exponential, fitted curve…

So I have two observations

- if, as before, the new issue comes cheap vs local High Coupons (such as Mar30) then until it does we can treat them as a ‘proxy purchase’ for the forthcoming new 10y

- The VLC (very low coupon) nature of this new ten year, should act to contain & suppress the value of other low coupons – we want to be short the Btps 1.65% Mar32 and the Btps 1.25% Dec26

Trades on my radar…

Italy

+7y -current 10y +Mar30

- The 7y Btps Jul26 has no tap during August

- The 10y Aug29 has ‘travelled’ a long way since issuance

- The Mar30, we are treating as a proxy for the new Apr30 10y

- Carry is slightly positive: +0.1bp /3mo @5bp repo spread

In mitigation we can only assume that the new 10y will come +14bp to the Aug29 and +3bp to the Mar30 –

E.G

Recent Btps Mar40 are +1.7bp over HC Btps 5% Aug39

Recent Btps Jul26 are +7.4bp over the HC Btps 4.5% Mar26

Relatively recent Btps Dec28 are +9.2bp vs the Sep28 (admittedly this is a rich CTD to the IK contract)

Weights: +.15 / -1 / +.85

Cix:

200 * (yield[BTPS 3 08/01/29 Govt]-0.15*yield[BTPS 2.1 07/15/26 Govt]-0.85*yield[BTPS 3.5 03/01/30 Govt])

Graph (BBG)

Italy

+7y -Feb28 +Mar30

- Similar logic to the prior trade but more balanced in terms of weightings 50/50

- Not so strong in terms of history – expect Feb28 to continue to cheapen due to low coupons getting ‘suppressed’ by the new 10y

- Positive Carry: +0.7bp /3mo @5bp repo spread

- ‘looks’ more anomalous in terms of generally shape of the curve

Yield Curve High & Low coupons - Italy

200 * (yield[BTPS 2 02/01/28 Govt]-0.5*yield[BTPS 2.1 07/15/26 Govt]-0.5*yield[BTPS 3.5 03/01/30 Govt])

Any thoughts let me know

Best

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MULTI ASSET UPDATE : BOND YIELDS CONTINUE TO FALL AND IN SOME CASES HAVE POSTED NEW YEAR LOWS, THE MONTHLY TREND REMAINS.

MULTI ASSET UPDATE : BOND YIELDS CONTINUE TO FALL AND IN SOME CASES HAVE POSTED NEW YEAR LOWS, THE MONTHLY TREND REMAINS. FURTHER FOCUS MUST BE GIVEN TO A VERY VULNERABLE EURO, TECHNICALLY IT IS ON THE VERGE OF A VERY MAJOR FAILURE.

BONDS LEVEL HITS :

- US 30YR YIELD DAILY HAS HIT ITS 50 DAY MOVING AEVRAGE 2.6701.

- GERMAN 10YR YIELD DAILY HIT ITS 50 DAY MOVING AVERAGE-PREVIOUS LOW -0.203.

-

- GERMAN 46’S A RELIABLE BOND HITS AND HOLDS CHANNEL SUPPORT AT 155.00.

HOPEFULLY POST THE US AUCTIONS THEY FOLLOW THE PATH OF LOWER EUROPEAN YIELDS.

EQUITIES : STILL A PAIN IN MANY INSTANCES BUT MR TRUMP IS IN CHYNA NEXT WEEK.

FX : THE EURO IS A MAJOR CONCERN NOW THAT BORIS JOHNSON IN THE BREXIT HOT SEAT, THE EURO IS POISED TO FAIL AND FAIL IN SOME STYLE.

OIL and GOLD : Oil has a decision given we are SAT at the convergence of 50 and 200 day moving averages. (Page 65).

Gold continues to be the safe haven AND HAS WORKED OFF ITS over bought state.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trade: Position for QE disappointment from the ECB, using mid-curve payers

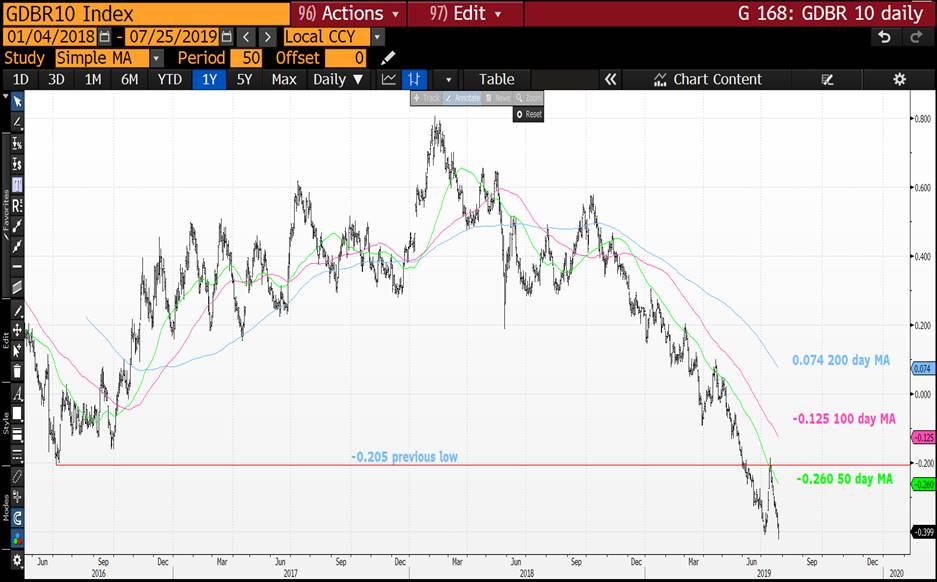

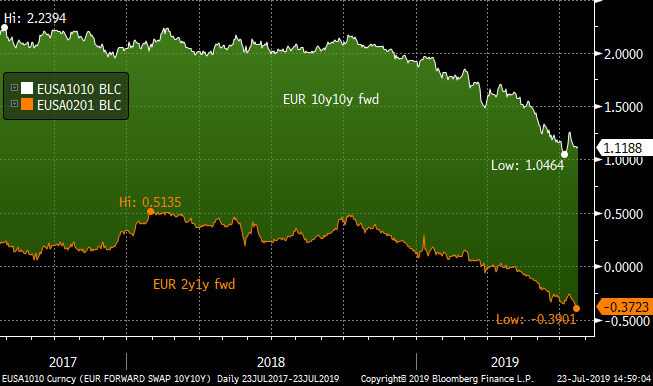

Bottom line: The market is getting excited on the prospect of a new QE programme, but what if it is disappointed and the ECB baulks at a meaningful purchasing volume (as this requires politically and technically difficult rule changes)? This leveraged trade in mid-curve payers positions for a steepening outcome where the ECB cuts rates as priced by the market but prevaricates on QE. The trade rolls positively by 3bp over the first 3 months.

Trade:

Sell EUR 980mm 6m2y1y mid-curve payer ATMF (k=-0.30%)

Buy EUR 105mm 6m10y10y mid-curve payer spread ATMF / ATMF+25bp (k=1.12% / 1.37%)

For premium take-out of 0.5bp running (mid indication)

Fwd 2y1y/10y10y curve entry at 142bp

Spot curve at 149bp.

Charts:

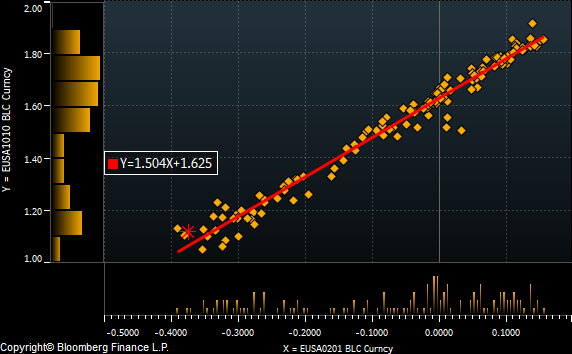

The 2y1y/10y10y curve has been reliably directional: the 10y10y rates moves approximately 1.5bp for every 1bp that 2y1y moves (chart). This ratio is mirrored in the implied volatilities of the mid-curve options. Hence the curve has been bull-flattening and bear-steepening.

Scenarios:

- ECB cuts rates 10bp and signals significant QE: all rates rally, curve flattens, and all payers expire out-of-the-money for zero P&L.

- ECB cuts rates 10bp, but disappoints on QE programme: 2y1y moves little, but 10y10y vulnerable to a sell-off: trades makes up to 25bp.

- ECB does nothing on rates or QE: all rates sell-off but 10y10y moves more. As long as 2y1y does not sell-off more than 25bp, the trade has a positive P&L.

- ECB doesn’t cut rates, but announces sizeable QE programme: 2y1y sells off, while 10y10y could rally, and the trade loses money.

The main risk to the trade is that the ECB chooses to disappoint on rates, but deliver on QE. As I outline below, I see the barrier to re-launching QE to be much higher than a simple rate cut.

Trade Roll (on rate and vol surface):

Time PV Change

Inception 0

After 1m +1 bp

After 2m +1.7 bp

After 3m +3.4 bp

After 4m +4.0 bp

After 5m +4.4 bp

Expiry 0 bp

This is perhaps the most aggressive and leveraged expression of the QE disappointment view. One alternative is to have a payer spread on both legs:

Sell EUR 980mm 6m2y1y mid-curve payer spread ATMF / ATMF+25bp (k=-0.30% / k=-0.05%)

Buy EUR 105mm 6m10y10y mid-curve payer spread ATMF / ATMF+25bp (k=1.12% / 1.37%)

For an upfront premium of 2.3bp

3m rolldown: +1.3 bp

This caps the downside in a large-scale reversal of ECB expectations which takes cuts completely off the table (and more). However if ECB cuts and QE is delivered, the premium is forfeit.

Rationale: For my part, the central expectation for the ECB over the coming months is a cut of 10bp in the deposit rate at the September meeting and some move on QE in December. However around that, there are plenty of permutations, and I want to explore the possibility that QE is either not restarted, or is done so at an anaemic rate.

What might make the Governing Council pause for thought before re-starting new QE purchases? The main issue is that in some countries the stock of available government and agency bonds for purchasing is restricted by the issue limit of 33%. This limit was imposed early in the programme on desire to avoid a situation in which a National Central Bank could use its bondholding to block any restructuring proposal of that nation’s debt. The model collective action clauses added to European government bonds following the sovereign debt crisis have this 33% threshold written in. Since Germany accounts for 18% of purchases by value under the Capital Key, it is often used held up as the exemplar of this restriction, but other countries also have limited stock.

I put out a piece last week on the estimates from my Maximum Likelihood model for what the Bundesbank currently holds, and what headroom it has for further purchases. The table below summarizes the possible rate of ECB total monthly purchasing, and the estimated number of months that the Bundesbank could adhere to this remit under the current Capital Key allocation.

|

PSPP2 Monthly Net Purchases (EUR bn/month) |

Existing 33% |

Non-CAC @ 50% |

All @ 50% |

|

80 |

8 |

17 |

44 |

|

60 |

11 |

24 |

71 |

|

30 |

30 |

56 |

Unlimited |

|

10 |

Unlimited |

Unlimited |

Unlimited |

Thus the ECB is somewhat caught … it could restart QE at 30bn / month and continue for at least two years without changing the rules, but 30bn is fairly lacklustre (given the original programme was 80bn / month at its height) and could be interpreted by the market as neither one thing nor the other (30bn was part of the tapering of purchases as the programme was being wound down). Perhaps the ECB would be content with this “symbolic” measure, not least because it doesn’t require the thorny decision-making on how to amend the QE rules, but they run the risk of leaving the market disappointed. To restart at a higher rate would require either adjustments to the per-issue holding limit, or some tinkering with the Capital Key allocation to individual National Central Banks, neither of which approaches are free of technical, legal and not the least political considerations. This is where the timing of the ascension of Mme Lagarde to the ECB Presidency comes into play: would the Governing Council contemplate such tricky and possibly divisive manoeuvres in advance of a new regime? BREXIT, with the new deadline of 31st October, is another consideration as the ramifications of a messy divorce provide a headwind to the prospects for the Euro area economy. Wider trade worries have the potential to be exacerbated or mitigated in coming months and this is yet another source of timing uncertainty.

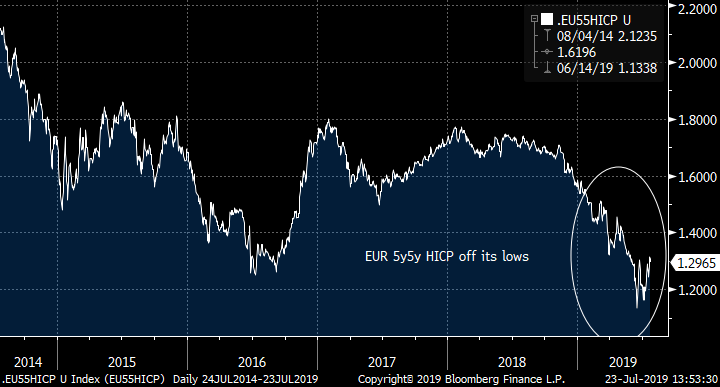

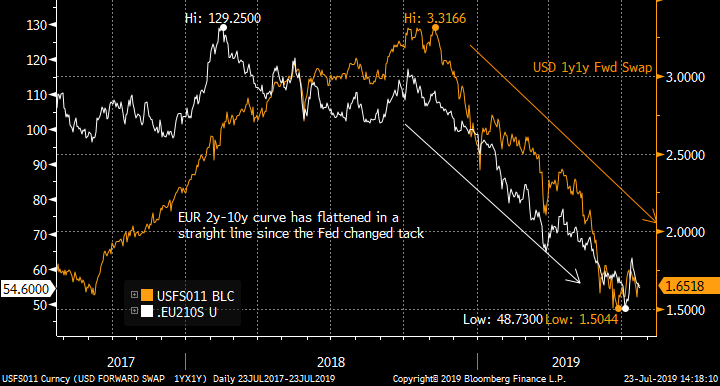

It has been suggested that Mario Draghi (and the GC as a whole) has been spooked by the rapid collapse in long-dated inflation expectations (as exemplified by the 5y5y HICP ZC rate above). These have recovered in recent days, so some may question the urgency of the need to take action which might expose political divisions, while others might suggest that this is the market pricing imminent and effective ECB action. European rates have been on a downward trend since before the start of the year, as the market prices cuts from the FOMC, so why should the ECB look to flatten the curve further via QE when the rally in the belly of the curve has done much already? The EUR 2y-10y swap curve has flattened almost 50bp this year in pretty much a straight line tracking Fed expectations, and this flattening speed was essentially constant even when a re-started QE programme came into view.

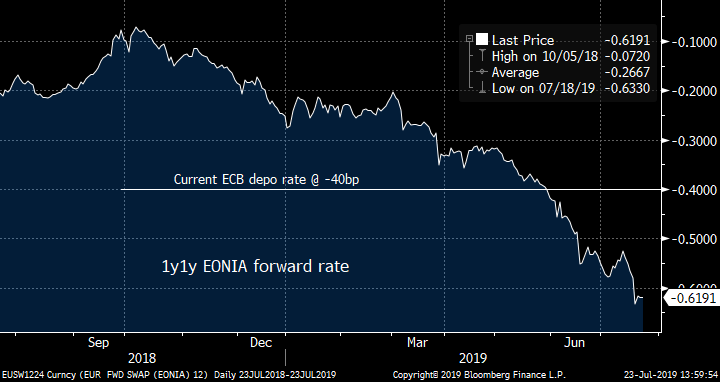

At the short end, ECB rates are now pricing cuts, with 1y1y EONIA now at -60bp suggesting two cuts of 10bp over the coming year. So now, if the ECB is to impress the market with its resolution to raise inflation expectations, these cuts start to look like the minimum the ECB has to deliver.

So the essence of my thesis is that the ECB will find it easier to cut rates in order to “do something”, and that the more arduous task of re-starting QE at a meaningful rate will be postponed. Thus the market’s expectations on the short end evolution of rates will be met, but it will be liable to disappointment on prospects for a flatter curve.

As ever, I would love to hear your thoughts!

Best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796