Trade Radar - Euro RV - James Rice, Astor Ridge

Trade Radar Euro RV – Monday Jul15th

Continued from Friday…

Some trades on my radar in Europe

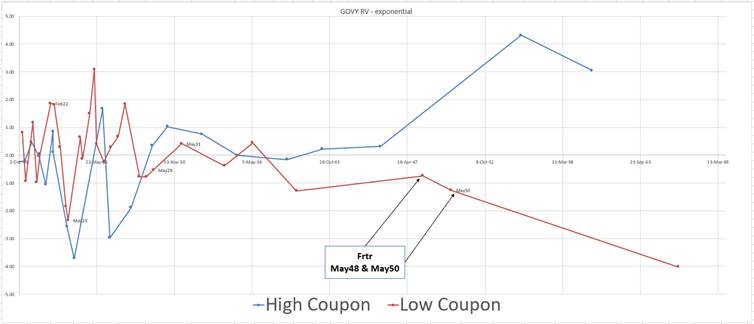

France, Reverse Roll 30y

Long May48, Short May50

May48 better carry & better cashflow value (see BBG GOVY spread values).

France will continue to tap the May50

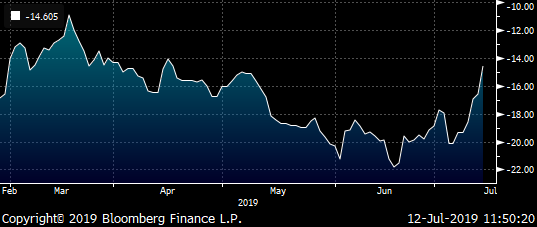

BBG Govy Spread values - spline exponential

Not a huge amount in it @-6.4bp

maybe 1bp but certainly if it gets to -5.75bp

I’d look to add

R&C +0.1bp @same repo

aggress ahead of next long end tap..

cix:

-yield[FRTR 1.5 05/25/50 Govt]+yield[FRTR 2 05/25/48 Govt]

Also in France

Long Oat contracts, short Jun39 Green Bond, Long old 30y

+OATA -20y +old30y

weights +.25 / -1 / +.75

R&C: -0.3 /3mo

the 20y trades rich but we at the ex...

Cix in swap space:

2 * (sp210[FRTR 1.75 06/25/39 Govt]-0.25*sp210[FRTR 0.75 05/25/28 Govt]-0.75*sp210[FRTR 2 05/25/48 Govt])

BBG History

Any thoughts feedback welcome

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Belgium vs France 25s vs 34s ASW Box

For those leaning on credit curve should be theoretically positively sloped and particularly in semi-core when tensions build, BELGIUM/FRANCE 25s vs 34s ASW Box back through ZERO(levels we saw pre-Italy blow out move back in mid 2018). Soft way for those thinking markets have been too far ahead of Policy response yet to come and need larger correction.(I believe supports MF's trade earlier in the week - Buying 15y France vs Belgium). Here's the chart

Stephen Creaturo

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

O: +44 (0) 203 - 143 - 4800

D: +44 (0) 203 - 143 - 4175

M: +44 (0) 780 – 957 - 5890

E: Stephen.Creaturo@AstorRidge.com

UK: Dowgate Hill House, 14-16 Dowgate Hill, London, EC4R 2SU

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

This marketing was prepared by Stephen Creaturo. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a research recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

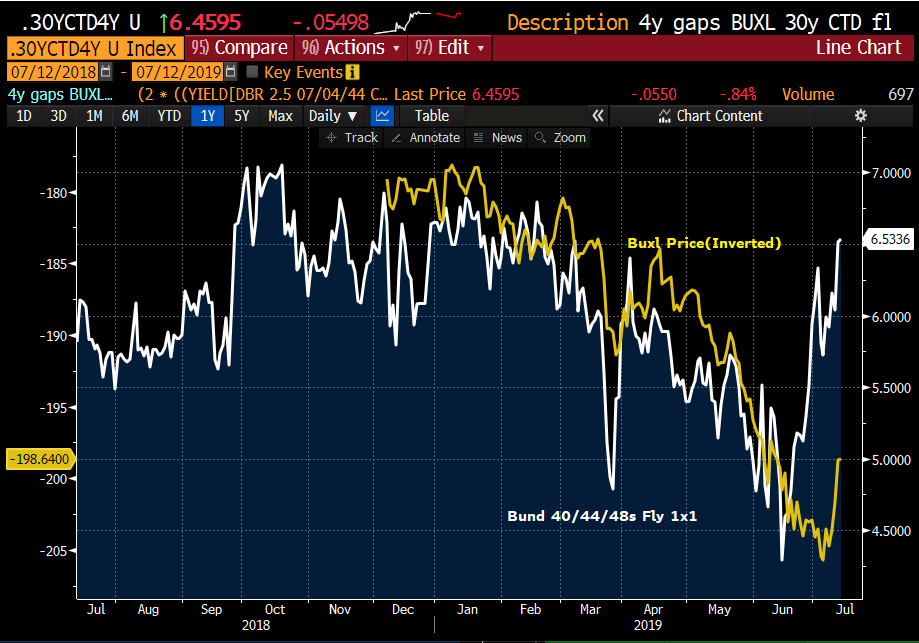

Trade: buxl 4y gap fly

Micro RV - Market sell-off/correction over the past several days has been clearly sharper/faster than the previous grind higher we experienced over the month. The grind higher has been so orderly and lacked volatility we did not see much in dislocations surrounding FUTURES contracts in micro-gaps on the way up(Ex IK-still rich). But on the sell-off BUXL has taken the brunt of pressure with many hedging delta(3/8 retrace so far) and curvature. Of all the futures in EGBs, BUXL 2y and 4y Gaps producing largest reversals - even outpacing level of market. Much of the work here is 40/44s steepening. Worth having a look at shorting 40s basis and or the FLY 40/44(ctd)/48s either 1x1 or 55/45wtd.

Stephen Creaturo

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

O: +44 (0) 203 - 143 - 4800

D: +44 (0) 203 - 143 - 4175

M: +44 (0) 780 – 957 - 5890

E: Stephen.Creaturo@AstorRidge.com

UK: Dowgate Hill House, 14-16 Dowgate Hill, London, EC4R 2SU

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

This marketing was prepared by Stephen Creaturo. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a research recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: OATs RV - What About the FRTR 10/27s? RV in the 5-10yr Sector

From: Mark Funsch <mark.funsch@astorridge.com>;

Sent: 11 July 2019 12:03

Subject: MICROCOSM: OATs RV - What About the FRTR 10/27s? RV in the 5-10yr Sector

Importance: High

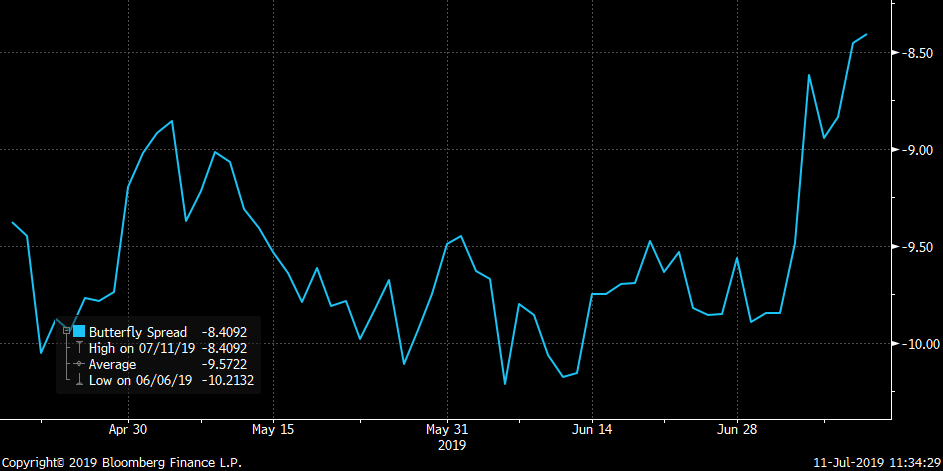

- Our RV guys have been asking whether the FRTR 2.75 10/27s will cheapen on the Z-sprd curve, normalizing to where the lower coupon issues trade. There are a few angles here worth examining, both in terms of how we got here and, more importantly, where we’re going.

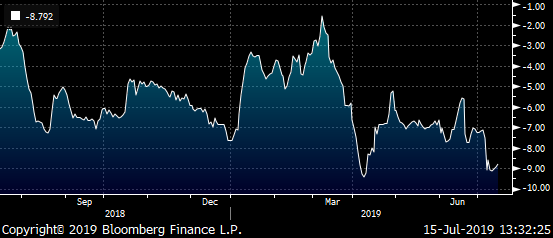

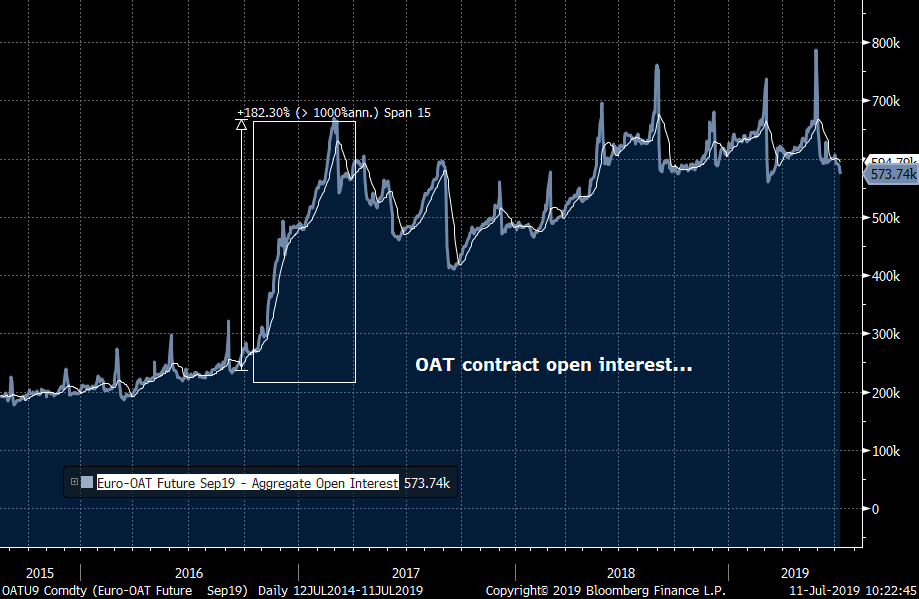

- The fun started with the FRTR 3.5 4/26s. From October 2016 to February 2017, open interest in OATA contract rose an extraordinary 182% while the FRTR 3.5 4/26s were CTD. The first few deliveries into the OATM6-OATZ6 contracts were modest, from 3k to about 12k contracts. By March 2017, however, we saw an extraordinarily huge delivery of 62,411 contracts, followed by 26,373 in June and another huge 53,746 in September before falling out of the basket into OATZ7. Talk about going out with a bang! Not only did the FRTR 3.5 4/26s repo trade at extraordinarily rich levels but the issue became very difficult to trade and remains rich to the curve almost 2yrs after the last delivery.

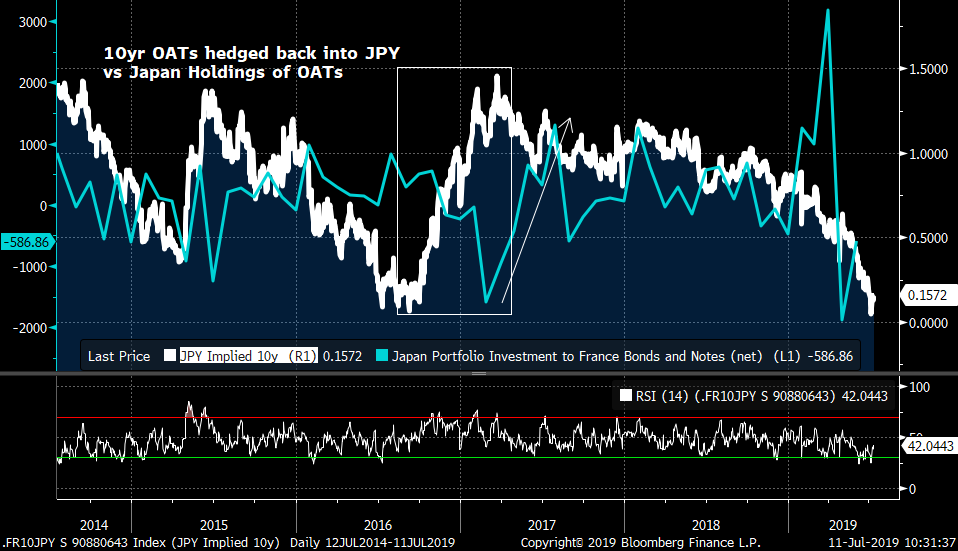

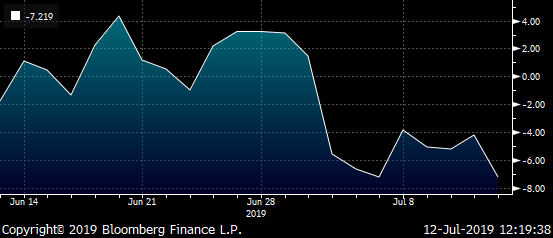

- We can assume from the chart below that the bulk of the demand for OAT contracts (and by extension the FRTR 4/26s) emanated out of Japan. The dramatic cheapening of 10yr OATs vs JPY in the late ’16 to early ’17 period coincides almost perfectly with the sharp rise in open interest and the huge deliveries into the contract which we’d have to presume were held in the accounts of Japan’s pensions.

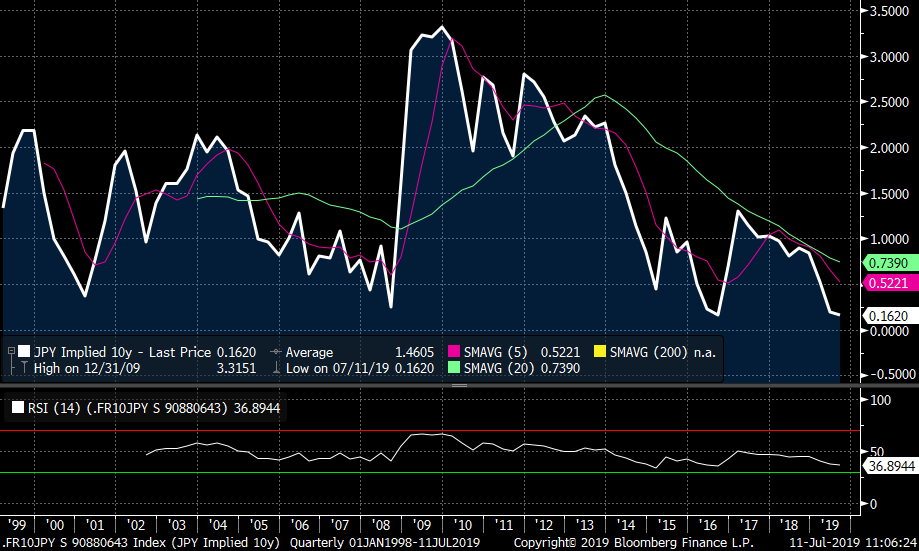

- Over the course of the ensuing 18 months, open interest has risen and fallen but remains about where it peaked in early 2017 at ~600k contracts. Deliveries of the FRTR 2.75 10/27s from late 2017 and in 2018 were fairly modest, peaking at 26.4k in September which foreshadowed a rally in OATs vs JPY (see above). That big spike in holdings of OATS in the 1st qtr of 2019, however, not only presaged a 50-60bps richening of OATs vs JPY but culminated with a delivery of 33,911 FRTR 2.75 10/27s. The chart below shows the performance of the FRTR 5/25-10/27-5/30 fly with the OATA deliveries highlighted. We can see rather clearly that the 33k delivery helped generate further outperformance of the FRTR 2.75 10/27s on the curve and an overall richening vs JPY.

- In both cases, we have Japanese investors with long-term investment horizons controlling large blocks of high coupon issues on a curve with current coupons that are at least 200bps richer than the bonds they own. From a tactical perspective, these CTDs also had a duration that, at the time, was +/- .5yrs of the duration of most OATs indexes. Even now, most indexes have a duration of around 8.75yrs which is just longer than the soon to depart FRTR 5/28s and a touch shorter than the new CTD into OATZ9 FRTR 11/28s.

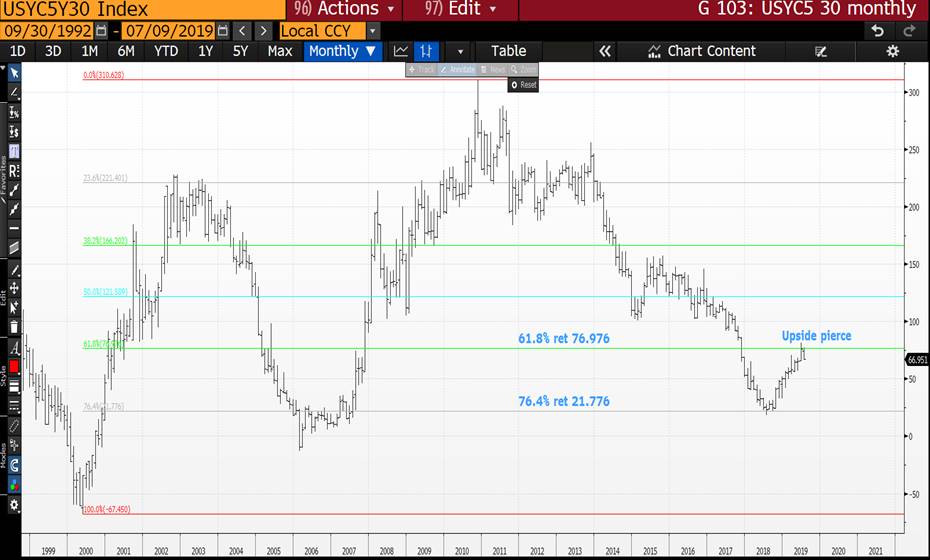

- So, given the experience of the FRTR 3.5 4/26s – which have consistently traded 3-5bps rich to the lower cpn Z-sprd curve – and what we presume to be substantial holdings of the FRTR 2.75 10/27s, it seems to us best chance of these issues cheapening meaningfully on the curve would happen if Japanese investors have a reason to sell them. From the long-term chart below of 10yr OATs into JPY, we can see that we’re back to the richest levels they’ve traded in the last 20yrs which could prompt one of two things: outright selling on a profit taking move if the ECB disappoints and the rate cut cycle isn’t as aggressive as hoped OR continued recycling of OATs into SPGBs and even BTPS as the race to the bottom continues. The odds of one of these outcomes occurring have risen in our view and either will spell trouble for the FRTR 10/27s.

- From a micro-perspective, shorting these high coupon issues isn’t as costly as it once was. Repo, especially short dates, is close to GC so the incentive to ‘feed the monster’ isn’t there anymore. In addition, we expect the FRTR 5/28s to trade better on the curve as they fall out of the basket, prompting some extensions out of both the FRTR 11/26s and FRTR 10/27s into them. The FRTR 5/27s stand out as one of the cheapest issues in the sector, as do the FRTR 0 3/25s (new 5yrs) . On the other side of the curve, the higher coupon FRTR 2.5 5/30s will be on the market’s radar as they’ll likely be CTD into the June 2020 contract and as we’ve seen from the 4/26s and 10/27s, these high cpn issues attract attention (even considering its big size).

- So, if you’ve got a longer term horizon and are willing to bet the directional bid won’t surge sharply richer again, then check out this fly:

Sell FRTR 2.75 10/27 to buy FRTR 0 3/25 and FRTR 2.5 5/30 . The chart below is of the .8/-2.0/1.2 weighted position that has shown signs of turning.

History of FRTR 10/27 vs FRTR 0.5 5/25 and FRTR 2.5 5/30 for longer history:

FRTR 10/27 vs FRTR 0 3/25 and FRTR 2.5 5/30 in a .8/-2.0/1.2 weighting – we see this cheapening move continuing.

- On a cross-market basis, we’ve been fans of the DBR-NETHER-FRTR blends as a way of isolating EGB spread narrowing/tightening moves with relatively low beta. With the FRTR 10/27s still rich on the curve we can sell DBRs and FRTRs to buy NETHER in a sprd weighting of -.7/2.0/-1.3 that makes NETHER look cheap, even with DBR-NETHER sprds near their tightest levels. We think this is an interesting way to fade the spread narrowing trend and is at historically cheap levels.

We’ll be in touch to discuss.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - Euro RV - James Rice, Astor Ridge

Trade radar Euro RV – Friday Jul12th

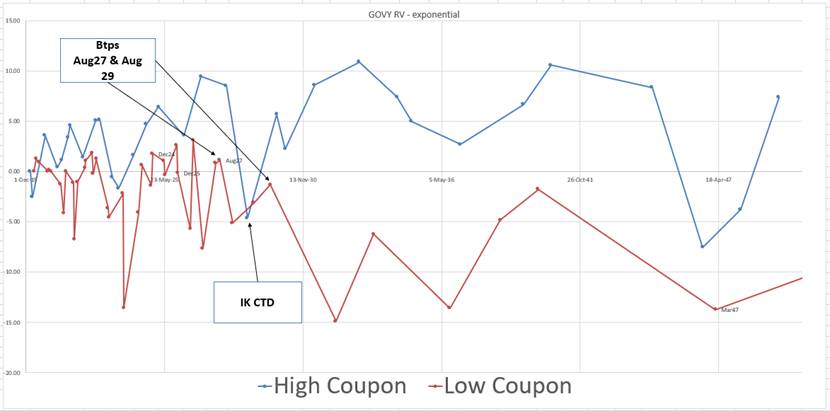

Italy 10y contract rich – ON HOLD, working

+ Btps Aug27, -IK (Btps Sep29 CTD), Long Btps Aug29

Weights: +0.5 / -1 / +0.5

R&C: -0.4

cix:

200 * (yield[BTPS 4.75 09/01/28 Govt]-0.5*yield[BTPS 2.05 08/01/27 Govt]-0.5*yield[BTPS 3 08/01/29 Govt])

BBG history

RV: Anomaly values – full cashflow, BBG GOVY RB exponential fit

Possible mutation in prep for 10y supply,

+old 7y –10y +old 20y

+nov25 -aug29 +sep38

Weights: +.55 / -1 / +.45

R&C: -0.2 bp/3mo

cix: 200 * (yield[BTPS 3 08/01/29 Govt]-0.55*yield[BTPS 2.5 11/15/25 Govt]-0.45*yield[BTPS 2.95 09/01/38 Govt])

BBG History

More to follow Spain etc…

Any thoughts feedback welcome

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

QUICK BONDS PRE WEEKEND UPDATE : WITH YIELDS BACKING UP THIS WEEK 3 MARKETS HAVE ALREADY HIT SIGNIFICANT LEVELS, COULD BE AN OPPORTUNITY FOR FAST MONEY.

QUICK BONDS PRE WEEKEND UPDATE : WITH YIELDS BACKING UP THIS WEEK 3 MARKETS HAVE ALREADY HIT SIGNIFICANT LEVELS, COULD BE AN OPPORTUNITY FOR FAST MONEY.

HITS :

- US 30YR YIELD DAILY HAS HIT ITS 50 DAY MOVING AEVRAGE 2.6701. (PAGE 4).

-

- GERMAN 10YR YIELD DAILY HIT ITS 50 DAY MOVING AVERAGE-PREVIOUS LOW -0.203. (PAGE 18).

-

3. GERMAN 46’S A RELIABLE BOND HITS AND HOLDS CHANNEL SUPPORT AT 155.00. (PAGE 19).

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MACROCOSM: Quick Technicals > Powell's On Board So Why the USTs Selling?

- Quick Macro/Technicals Rundown > Rates Markets in Transition

- Powell all but cut rates at the H-H testimony this week yet the rates markets have taken the ‘buy the rumour, sell the fact’ approach as yesterday’s CPI came in firmer than ests, following the robust June payrolls report. Maybe 3 25bps rate cuts is a bridge too far?

- A dovish FOMC should, in theory, help grease the wheels of renewed accommodation for the ECB yet 10yr DBRs are off almost 20bps in the last week, taking RSIs from overbought to oversold.

- Issuance in rates/SSA/corp markets has been huge with 100yr RAGBs and 50yr BTPS weighing on the long-end. UST 10-30s went from bull-flattening to bear steepening since Tuesday as last night’s UST 30yr tap tailed 3bps and closed the day 8bps cheaper.

- Cable continues to flirt with a break of the 1.25 level but SONIA’s grind higher off the lows suggests GBP longs are safe for now. Market certainly feels like it’s long here…

- Despite a barrage of corp/SSA supply, the ITRX index continues it’s risk-on rally, helping to drive yet more tightening of BTPS vs DBRs. A few well placed comments from Italian officials and the hopes of renewed QE have certainly helped. BTPS have gone from zeros to heros in short order.

- Our closely watched blend of SPGBs vs FRTR and BTPS (CIX = (YIELD[SPGB 1.4 7/28 Corp]) - (.7 * YIELD[FRTR 2.75 10/27 Corp] + .3 * YIELD[BTPS 4.75 9/28 Corp])) has seen a dramatic shift from SPGBs rich to cheap on RSIs as the BTPS leg has shifted into overdrive. We suspect that another 10bps of cheapening on this blend will attract renewed buying of Bonos.

Charts:

10yr DBRs

UST 30yrs struggling…

USU9 open interest grinding lower as the curve steepened…

USD DXY Index – Looking shaky…

Cable and 1y1y SONIA attached at the hip – SONIA off the lows…

DBR-BTPS 10yr sprd vs ITRX XOVER index – hand in hand and on a tear…

SPFRIT28 blend – big cheapening of Spain as BTPS rally…

- The conclusion here is that while the FED/MPC/ECB may end up being accommodative, the market is showing tell-tale signs that’s it’s been caught too long for its own good and demand for the additional paper at these levels has waned. Until there’s more definitive confirmation from the ECB and MPC on the path of rates and/or QE, it feels like we’ve seen the highs for the next couple weeks as we await the meetings at the end of this month.

Best,

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

** PLEASE READ ** BOND UPDATE : HOW HIGH DOES THE YIELD BOUNCE GO? THE ANSWER ISNT EASY NOR AN EXACT SCIENCE, AS HISTORY PORTRAYS IN THE FOLLOWING CHARTS.

BONDS : HOW HIGH DOES THE YIELD BOUNCE GO? THE ANSWER ISNT EASY NOR AN EXACT SCIENCE, AS HISTORY PORTRAYS IN THE FOLLOWING CHARTS.

WE HAVE BEEN IN THIS SITUATION BEFORE WHERE WE HAVE A NEW YEARLY YIELD LOW YET WEEKLY RSI’S REMAIN EXTENDED. IT FEELS LIKE WE NEED A YIELD BOUNCE FIRST BUT REMEMBER IT HAS TO BE REVERSED BY MONTH END. THE BOUNCE ALSO NEEDS TO BE “QUICK” TO FRONT LOAD THE MONTH AND WRONG FOOT EVERYONE.

TODAYS BOND SELL OFF EVOKES THE VIEW THAT MANY LEFT “STOPS” IN THE MARKET AND MENTIONED PREVIOUSLY, REAL MONEY EXITIED SEVERAL WEEKS AGO.

FINDING THE “YIELD BOUNCE VOLLEY” WONT BE EASY NOR MIGHT NOT BE THE RIGHT THING IF DON’T HEAD LOWER INTO MONTH END. IT IS THEREFORE TOUGH TO CALL, IT’S A QUESTION OF BEING FLAT NOW AND REMAINING ON HIGH ALERT!

ANOTHER POTENTIAL PROBLEM IS SHOULD STOCKS FAIL, THEN SO DO YIELDS.

*** AM HAPPY TO DISCUSS GIVEN THIS ISNT THE USUAL STAUNCH LEVELS AND IT DEFINITELY NEEDS SOME EXPLAINING. ***

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Today's BREXIT BARRAGE... It's BAAAAACK!

It’s been relatively quiet on the future PM/Brexit mess front lately (hence the hiatus), although we’re closing in on the final vote so thought time to send an update…

FT: Ireland steps up cross-border plans for no-deal Brexit

FT: No-deal Brexit poses ‘real risk’ of break-up of United Kingdom, cabinet told

FT: Tory leadership rivals face off in combative head-to-head TV debate

FT: Corbyn’s second referendum move a ‘shaft of summer sunlight’

FT: Jeremy Corbyn backs second referendum on Brexit

FT: Boris Johnson declares ‘good relationship’ with Donald Trump

FT: Boris Johnson vs Jeremy Hunt: who will be Britain’s next PM?

BBG: U.K. Parliament Flexes Muscle as Johnson Doubles Down on No-Deal

BBG: U.K.’s Johnson Refuses to Back Envoy in Role Amid Diplomatic Row

BBG: U.K. Seeks Brexit Concessions, Saying Dublin Has the Most to Lose

TEL: Chris Grayling’s no-deal Brexit ferry debacle cost taxpayers £85m, watchdog finds

TEL: Brexit secretary warns EU that no-deal will hurt Ireland more than UK

TEL: Boris Johnson’s lead over Jeremy Hunt looks unassailable

TEL: Corbyn’s grip on Labour – along with his constructive ambiguity on Brexit – is starting to unravel

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MULTI ASSET UPDATE : EVEN NOW I AM CONFUSED. WE NEED MORE PRICE MOVEMENT TO ACHIEVE CLARITY.

MULTI ASSET UPDATE : EVEN NOW I AM CONFUSED. WE NEED MORE PRICE MOVEMENT TO ACHIEVE CLARITY. THE ISSUE IS : STOCKS FINALLY LOOK LIKE TOPPING WHILST YIELD CHARTS PRESENT AN EXTREMLY “CONFLICTING” PICTURE.

BONDS : BOND YIELDS ARE A PROBLEM CALL HERE. WEEKLY YIELDS LOOK LIKE HEADING “HIGHER” WHILST THE MONTHLY CALL REMAINS ON TRACK FOR LOWER. WE NEED MORE PRICE ACTION, I STILL FEEL STOCKS AND BOND YIELDS EVENTUALLY HEAD LOWER, SO A COMPLEX SITUATION CURRENTLY.

THE US 2YR CHART IS HOLDING THE MULTI YEAR 23.6% RET 1.7448 (PAGE 13).

EQUITIES : THE DOOR IS WIDE OPEN FOR A TOP GIVEN THE HANG SENG IS STALLING ALONG WITH MANY SINGLE STOCKS, THINGS COULD GET MESSY THIS WEEK. HAVE LABOURED A RECENT POINT ABOUT THE OVER BOUGHT DAILY RSI’S.

US CURVES : THE US 5-30 IS A PROBLEM, IT IS FORECASTING A MAJOR FLATTENING.

FX : DXY is the key element here should it breach the long-term 50% ret 95.859 then its free fall time, aiding AUD, CAD and most USD EM ideas. (Page 52).

OIL and GOLD : Oil has a decision given we are SAT at the convergence of 50 and 200 day moving averages. (Page 65).

Gold continues to be the safe haven AND HAS WORKED OFF ITS overbought state.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris