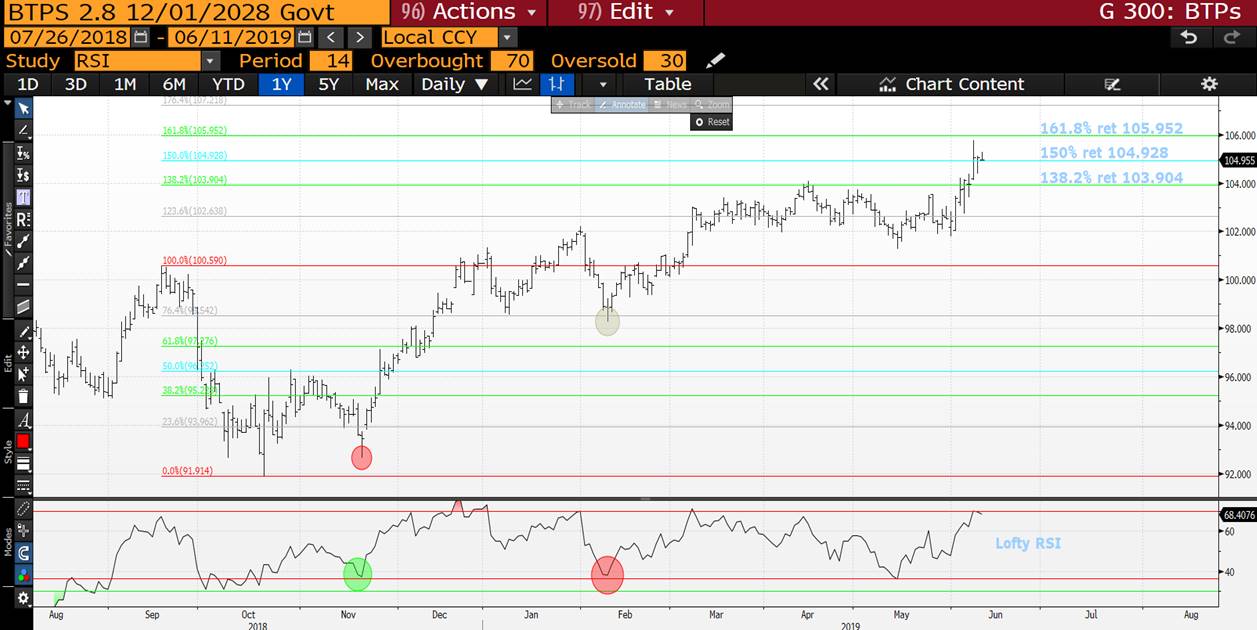

BOND UPDATE : Yields have based at the appropriate level and poised to accelerate the move HIGHER. Oh and BTPS look to have stalled.(Page 23).

BOND UPDATE : Yields have based at the appropriate level and poised to accelerate the move HIGHER. Oh and BTPS look to have stalled.(Page 23).

The BIGGEST issue this month is the WEEKLY CHARTS, they are forecasting a pretty major YIELD BOUNCE INCONTRAST to the monthly having ALREADY made a NEW YEAR low, this implying a very volatile period. We still need to close at or near the yield lows at month end.

Previously :

All US weekly yield charts have REDICULOUS RSI’s so anyone buying bonds here is challenging major historical dislocation. (See pages 3,7,11,15). This is the difficultly as previous yield rallies from this extension have been sizeable, highlighted by the LAST rectangle on each chart. Additionally most have hit and HELD SOLID retracement levels. The daily charts also compliment the call for higher yields.

**I finally think it is worth SHORTTING bonds, ideally with stops above yesterday’s highs OR preferred at recent yield retracement, listed on the weekly charts **

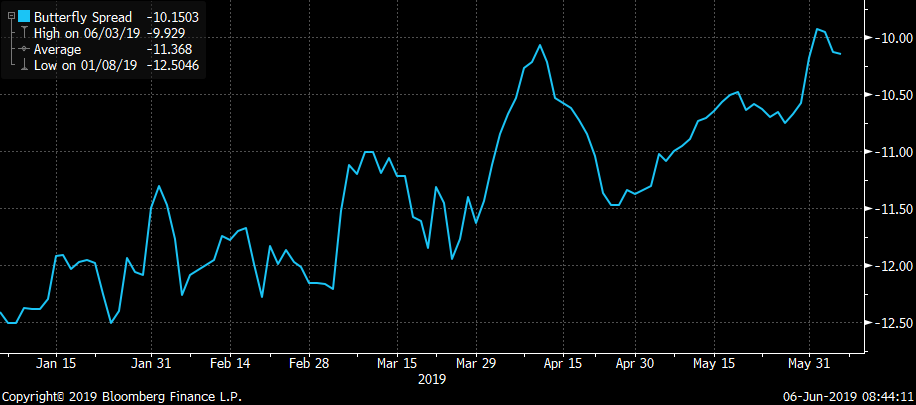

US 5-30 curve

This was the quickest stop out (post yesterday’s recommendation) BUT do think it is worth one last flattening attempt. Stop at 82 initially to be on the safe side and ADD significantly on a close sub 74.701. The RSI is now on side.

Also remember ALL CTA s have rolled and are long given ALL major spreads have sold off.

** Remember this is only “TIME OUT” in a bigger historical yield fall. **

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Today's BREXIT BARRAGE... Let the Games Begin!

Given Gove’s confession of misbehaviour, it appears the field for the next PM is rapidly narrowing with Johnson, Hunt and possibly Raab leading the field. The first leadership ballot is Thursday so expect a lot of jockeying the next couple days.

FT: Labour at war as MPs line up to lambast Corbyn’s leadership

FT: Johnson comes under relentless attack in Tory leadership race

FT: Ten Tory MPs join race to replace May in Downing St

FT: Hunt launches Tory leadership bid with veiled attack on Johnson

FT: Tory contenders pledge looser purse strings to woo party

FT: How the Conservative party is choosing Britain’s next prime minister

FT: Labour campaigners for second Brexit referendum to press Corbyn

BBG: Record Field of Tories Bid to Succeed May as U.K. Leader

TEL: Michael Gove tries to deflect cocaine row with ‘desperate’ attack on Boris Johnson

TEL: The £39bn question: could ‘PM Boris’ withhold the UK’s Brexit divorce payment?

TEL: Four contenders could be battling it out for the Tory leadership – here’s why

TEL: Who are the Tory candidates hoping to become the next Prime Minister?

TEL: Can the economy recover from its ‘Brexit hangover’?

TEL: Only Boris Johnson as leader can address voters’ anger by repairing trust and delivering Brexit

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar Euro RV, James Rice @Astor Ridge - correction

Errata – second graph on French 5y – did get to +7.5bp cheap (prior graph was Frtr Mar23)

Trade Radar – Euro RV

Week starting June 10th

Short Italian Bond futures vs 1y wings

Short Sep28

Long Aug27 and Aug29

200 * (YIELD[BTPS 4.75 09/01/28 Govt] - 0.4 * YIELD[BTPS 2.05 08/01/27 Govt] - 0.6 * YIELD[BTPS 3 08/01/29 Govt])

Italian 5s10s Steepener Regression Hedged

Short IK (Sep 28), Long 80% delta Btps May24

- 5y & 10y no till end of month – market struggling to absorb the last on the run five yr

- flat carry regression weighted

- weakness in stocks should produce weakness in Italy and targeting selling of the ik contract

YIELD[BTPS 4.75 09/01/28 Govt] - 0.8 * YIELD[BTPS 1.85 05/15/24 Govt]

German steepener 10s30s

Short30y, Long 10y regression weighted in Futures

+1k RXA, -388 UBA

- Long Euro forwards have collapsed in tandem with both the US rally and the theme that the ECB may try various methods to force a flatter curve

- Feels like an overshoot and any bounce in stocks could cause a rebound

- After Wednesday’s 10y tap we have a tap of Dbr 2046 next week

YIELD[DBR 2.5 07/04/44 Govt] - 0.95 * YIELD[DBR 0.25 08/15/28 Govt]

Spain

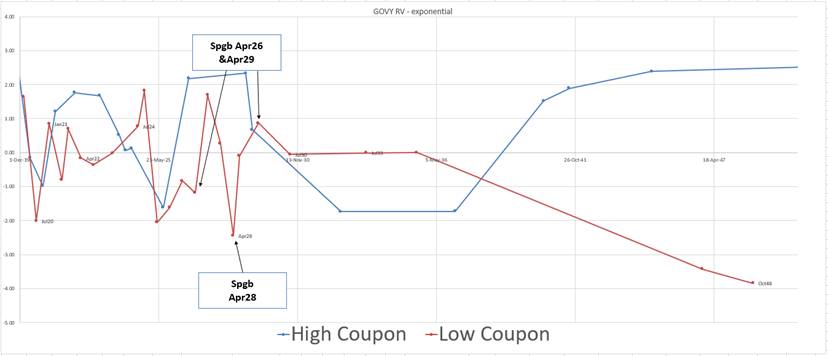

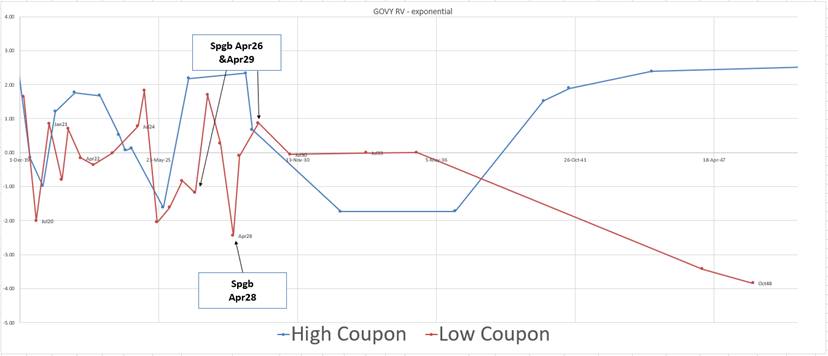

Sell anomalously rich Apr28 vs 26 and 29

-100% Spgb Apr28

+30% Apr26, +70% Apr29

- Simple anomaly on the Spanish Curve

- -0.1bp R&C @ same repo

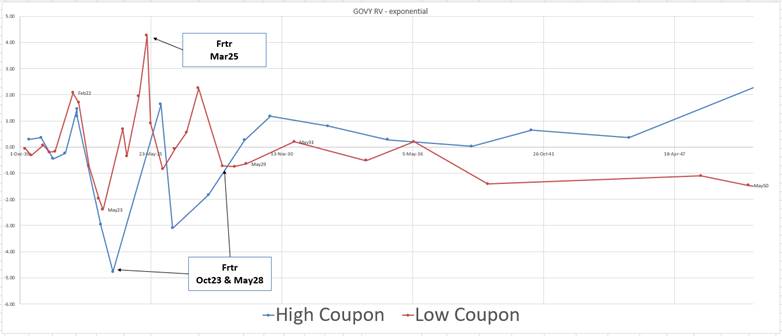

Bloomberg GOVY Anomaly Spreads (exponential) - Spain

Long cheap French 5y vs Oct23 and Oat contracts

+Frtr Mar25

-70% Oct23, -30%OATA contracts (Ctd Frtr May28)

- Bond looks cheap vs oct23 and some long OAT anchor

- Current anomaly is >+4bp

- Prior issue, Mar 24s got to max cheap was +7.5bp anomaly, after which it richened

200 * (YL017[FRTR 0 03/25/25 Govt] - 0.7 * YL017[FRTR 4.25 10/25/23 Govt] - 0.3 * YL017[FRTR 0.75 05/25/28 Govt])

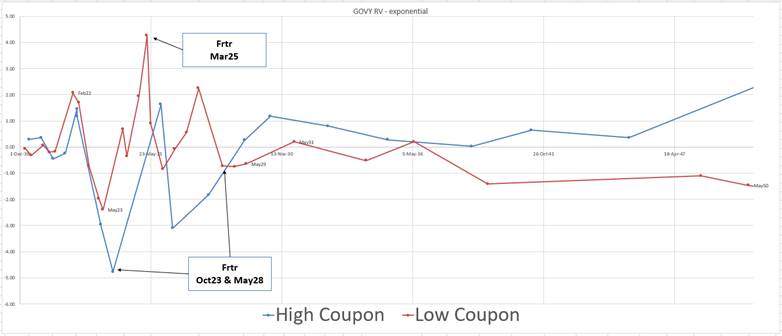

French Govy RV anomalies – Exponential Spline Spread

History of Frtr Mar25 anomaly spread…

Graph of prior 5y Mar24 and its long term historical R/C spread anomaly value

Any feedback or thoughts are warmly welcomed

Let me know

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar Euro RV, James Rice @Astor Ridge

Trade Radar – Euro RV

Week starting June 10th

Short Italian Bond futures vs 1y wings

Short Sep28

Long Aug27 and Aug29

200 * (YIELD[BTPS 4.75 09/01/28 Govt] - 0.4 * YIELD[BTPS 2.05 08/01/27 Govt] - 0.6 * YIELD[BTPS 3 08/01/29 Govt])

Italian 5s10s Steepener Regression Hedged

Short IK (Sep 28), Long 80% delta Btps May24

- 5y & 10y no till end of month – market struggling to absorb the last on the run five yr

- flat carry regression weighted

- weakness in stocks should produce weakness in Italy and targeting selling of the ik contract

YIELD[BTPS 4.75 09/01/28 Govt] - 0.8 * YIELD[BTPS 1.85 05/15/24 Govt]

German steepener 10s30s

Short30y, Long 10y regression weighted in Futures

+1k RXA, -388 UBA

- Long Euro forwards have collapsed in tandem with both the US rally and the theme that the ECB may try various methods to force a flatter curve

- Feels like an overshoot and any bounce in stocks could cause a rebound

- After Wednesday’s 10y tap we have a tap of Dbr 2046 next week

YIELD[DBR 2.5 07/04/44 Govt] - 0.95 * YIELD[DBR 0.25 08/15/28 Govt]

Spain

Sell anomalously rich Apr28 vs 26 and 29

-100% Spgb Apr28

+30% Apr26, +70% Apr29

- Simple anomaly on the Spanish Curve

- -0.1bp R&C @ same repo

Bloomberg GOVY Anomaly Spreads (exponential) - Spain

Long cheap French 5y vs Oct23 and Oat contracts

+Frtr Mar25

-70% Oct23, -30%OATA contracts (Ctd Frtr May28)

- Bond looks cheap vs oct23 and some long OAT anchor

- Current anomaly is >+4bp

- Prior issue, Mar 24s got to max cheap was +5bp anomaly, 4 months prior to its last tap in Mar 2019. After which it richened

200 * (YL017[FRTR 0 03/25/25 Govt] - 0.7 * YL017[FRTR 4.25 10/25/23 Govt] - 0.3 * YL017[FRTR 0.75 05/25/28 Govt])

French Govy RV anomalies – Exponential Spline Spread

History of Frtr Mar25 anomaly spread…

Graph of prior 5y Mar24 and its long term historical R/C spread anomaly value

Any feedback or thoughts are warmly welcomed

Let me know

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... '"But I didn't inhale..."

Papers this morning have a summary of ‘who did what’ among the 11 challengers for the PM job. From the way Brexit has been handled, one might think they were all on one drug or another…! You just can’t make this stuff up…

FT: ‘Reckless’ Boris Johnson leaves Europe unimpressed

FT: EU to warn business not to expect help over a no-deal Brexit

FT: Sweeping reform needed after Brexit, says French regulator

FT: Brexit uncertainty drives investment boost for other EU countries

FT: South Korea agrees deal with UK for post-Brexit trade

FT: Michael Gove battles to save Conservative leadership bid

FT: The Tories badly need an honest debate on Brexit

BBG: Johnson Woos Hard Brexiters as Gove Eclipsed by Cocaine Woes

BBG: Boris Johnson to Cut Business, Individual Taxes If Elected PM

BBG: Macho Men and the Cabinet Bad Boy: Tory Leadership Round-Up

BBG: Johnson Hardens Brexit Rhetoric as Opponents Launch Campaigns

BBG: U.K. Economy Set for Slowdown as Brexit Stockpiling Boost Fades

TEL: Michael Gove suffers new blow as Amber Rudd endorses Jeremy Hunt for Tory leadership

TEL: Boris Johnson wins over Tory Eurosceptics with ‘clean Brexit’ pledge

TEL: Michael Gove promises to scrap VAT after Brexit to boost economy in radical manifesto

TEL: Our electoral system won’t survive Brexit. Mark my words

Enjoy!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Mon Jun 10th

Business Briefing

1) United Technologies, Raytheon to Combine as Defense Giant

United Technologies Corp. agreed to buy Raytheon Co. in an all-stock deal, forming an aerospace and defense giant with $74 billion in sales in one of the industry’s biggest transactions ever. The new entity will be called Raytheon Technologies Corp. when the deal closes in the first half of 2020, after United Technologies completes the separation of its Otis elevator and Carrier air-conditioner businesses, the companies said in a statement Sunday. While ...

2) Stocks Gain With Treasury Yields on Mexico Relief: Markets Wrap

Asian stocks and U.S. equity futures climbed on Monday after President Donald Trump suspended his plans for U.S. tariffs on Mexico. Treasuries fell as demand for havens sank. The Mexican peso jumped the most in almost a year after the U.S.-Mexico agreement that was unveiled late Friday. Japanese, South Korean and Hong Kong stocks rose, as did crude oil prices. Gold fell. China’s shares also rose as the country’s markets reopened after a long weekend. ...

3) Hong Kong Vows to Pursue Extradition Bill Despite Huge Protest

Hong Kong’s leader pledged to press ahead with Beijing-backed legislation easing extraditions to China despite one of Hong Kong’s largest protests since the former British colony’s return more than two decades ago. Chief Executive Carrie Lam told reporters Monday that the government “could see people are still concerned about the bill,” which would allow Hong Kong to enter into one-time agreements with places such as mainland China and ...

4) Trump Hints at Details; Mexico Still Baffled by Farm Claim

President Donald Trump hinted at additional measures between the U.S. and Mexico, a day after he vowed that Mexico would soon make “large” agricultural purchases from the U.S. as part of a deal on border security and illegal immigration that allowed Mexico to avoid U.S. tariffs. “Some things not mentioned in yesterday’s press release, one in particular, were agreed on. That will be announced at the appropriate time,” Trump said Sunday ...

5) Ten-Year Treasury Yield Is Poised to Fall Below 2%: Markets Live

World News Briefing

6) Hong Kong's Leader Says Beijing Not Behind Proposed Law: TOPLive

7) Johnson Hardens Brexit Rhetoric as Opponents Launch Campaigns

Boris Johnson, the front-runner to succeed Theresa May as U.K. prime minister, hardened his rhetoric on Brexit and unveiled a tax-cut plan as the other leading candidates prepared to start their campaigns on Monday. Johnson, who quit May’s cabinet last year over her deal with the European Union, said he would scrap the Irish border backstop, withhold 39 billion pounds ($50 billion) owed to the bloc until an agreement is reached and leave on Oct. 31 -- even if ...

8) Bruins Force Stanley Cup Game 7 With 5-1 Win Over Blues

Facing elimination in an oh-so-hostile environment, Tuukka Rask and Brad Marchand stepped up for the Boston Bruins once again. The Stanley Cup Final is heading to Game 7 because two of Boston's biggest stars love the biggest moments. Rask made 28 saves, Marchand had a goal and an assist, and the Bruins beat the St. Louis Blues 5-1 on Sunday night to even the bruising, physical final at three games apiece. David Pastrnak had one of Boston's four goals ...

Bonds

9) Japanese Sell $17 Billion of French Bonds After Record Purchases

Japanese investors sold a record amount of French sovereign bonds in April after purchases reached an all- time high the previous month, as yields on the securities tumbled amid a global debt rally. Key Insights * Investors of the Asian nation sold an unprecedented net 1.87 trillion yen ($17.2 billion) of French debt, after buying a record 3.05 trillion yen in March, according to balance-of- payments data released by ...

10) Yen Slides With Treasuries as Mexico Avoids Tariffs: Inside G-10

The yen fell with the Swiss franc after the U.S. suspended its plan to place tariffs on Mexico, damping demand for havens. The Treasury yield curve bear flattened, while the dollar rose as the tariff suspension damped bets on U.S. rate cuts. * Haven assets slipped from the start of Asian trade after President Donald Trump announced the decision to delay the tariffs indefinitely late on Friday. The yen extended losses after Governor Haruhiko ...

11) Bullish Long-End JGBs, Barclays Says Hedge Against BOJ Rate Cuts

Rates strategists are bullish long-end JGBs as the sector is expected to witness increased investor interest amid the hunt for yield, with JPMorgan and Morgan Stanley continuing to recommend holding flatteners. * Markets recently priced-in over 10bps of BOJ rate cuts over the next year. JPMorgan now forecasts a 20bps reduction for September, and sees rate-cut discounts remaining in the front- end, while Barclays recommends using swaptions to hedge against such a ...

12) Mexican Peso Gains on U.S.-Mexico Truce as Haven Currencies Slip

Mexico’s peso rebounded following a deal to avert new U.S. tariffs on the Latin American country, while a retreat from haven assets weighed on the Japanese yen and the Swiss franc. The Mexican peso rose as much as 2.1% to 19.2256 per dollar after U.S. President Donald Trump said late Friday that plans for a 5% tariff on Mexican goods had been “indefinitely suspended.” The yen weakened as much as 0.4% to 108.67 per dollar, while a gauge of Asian ...

13) Emerging Markets Weekly Podcast: Mexico Reprieve, China Data

In today’s emerging markets podcast, Tomoko Yamazaki discusses the latest moves in the Mexican peso after U.S. President Donald Trump suspended his plans for tariffs. She also takes a look at what to expect from the latest trade data from China and what to look out for on central banks meetings in Russia, Turkey and Peru. Christine Burke hosts. Listen to EM Podcast, here. To contact the reporter on this story: Christine Burke in Dubai at ...

14) EU CREDIT DAYBOOK: U.K. Reports GDP Numbers; Italy Production

The U.K. will report April GDP numbers, which may suffer due to disruptions following the original Brexit date. Other economic releases include Italian industrial output. Local holidays may damp bond sales. MANDATES/UPDATES: * BayWa EUR benchmark 5Y-7Y green this week * ReAssure plans three-tranche GBP subordinated offering: Fitch * Save the Date EUR HY Pharmaceuticals FRN HEADLINES: * Barclays Says AT1 Buffer Is Big Enough for September CoCo Calls * What ...

Central Banks

15) Kuroda Says BOJ Has Enough Ammunition, Wary of Side Effects

The Bank of Japan can deliver more big monetary stimulus if necessary, but needs to take care with its side effects on the financial system, said Governor Haruhiko Kuroda. The BOJ will ease further if momentum toward its 2% inflation target is lost, Kuroda said in an interview with Bloomberg TV’s Kathleen Hays in Fukuoka, Japan, where central bankers and finance chiefs from the Group of 20 met over the weekend. The governor emphasized that ...

16) As Tensions Escalate, China Snaps Up Gold in Six-Month Spree

China extended its gold-buying spree, adding to reserves for a sixth straight month, as the protracted trade war with the U.S. hurts growth expectations and boosts demand for a portfolio diversifier. The People’s Bank of China increased its bullion reserves to 61.61 million ounces in May from 61.10 million a month earlier, according to data released on Monday. In tonnage terms that’s a rise of 15.86 tons, after almost 58 tons of gold were added to the ...

17) China Central Banker Says No Specific Yuan Level Important

People’s Bank of China Governor Yi Gang said last week that no specific level for the yuan is important, and indicated confidence it will continue to be “relatively strong” once the noise of the trade war subsides. “There is obviously a link between the trade war and the movements of renminbi,” Yi said in an exclusive interview in Beijing, using the official term for China’s currency. “Recently, it’s a little bit weaker, because of the ...

18) Johnson Woos Hard Brexiters as Gove Eclipsed by Cocaine Woes

Boris Johnson, the front-runner to succeed Theresa May as U.K. prime minister, pledged a hard line on Brexit -- including the option of leaving without a deal -- as contenders to lead the Conservative Party sought support before the list of candidates is finalized on Monday. Johnson, who also said he would scrap the Irish border backstop and withhold 39 billion pounds ($50 billion) owed to the European Union until an agreement is reached, was helped by the ...

19) Russia May Tap Wealth Fund for Investment as Foreigners Pull Out

Russia may start spending its National Wellbeing Fund on local projects next year as the Kremlin struggles to attract foreign investment for its $400 billion stimulus package to boost economic growth. As the Finance Ministry moves to ease the budget rule, it will review any investments that make use of the fund with the central bank in order to assess any possible monetary impact, First Deputy Prime Minister Anton Siluanov told reporters ...

20) Fed Rate Cut Looks More Likely: Question Is When and by How Much

Federal Reserve Chairman Jerome Powell and his colleagues face three decisions when it comes to reducing interest rates: whether to do it, when to do it, and by how much. Fed watchers say an unexpectedly weak reading on the U.S. jobs market in May makes it increasingly likely that the central bank will lower rates this year -- in spite of President Donald Trump’s decision late Friday to call off his threatened tariffs on Mexico. What’s ...

Economic News

21) CHINA REACT: Exports Aided by Pre-Existing Orders

OUR TAKE: The higher-than-expected reading on China’s May exports offers cold comfort. Pre-existing orders and some shipments rushed ahead of U.S. tariff increases may have helped blunt the hit in May from weaker external demand. The outlook is for further deterioration in China’s trade in the coming months in absence of a clear path for resolving the China-U.S. trade war. * Exports managed a 1.1% expansion year on ...

22) ITALY INSIGHT: Investors Can’t Ignore Brussels Warning Forever

The European Commission recommended launching an excessive deficit procedure for Italy last week. The Italian Treasury disagrees with many of the charges coming from Brussels. The bond markets have largely ignored the announcement. However, a tussle between the EC and Italy still lies ahead and investors’ patience is eventually likely to be tested. * Brussels doesn’t believe the government will carry through on its ...

23) JAPAN REACT: Capex Boost Welcome But Economy Hardly in Clear

OUR TAKE: The second reading on Japan’s 1Q GDP sent a reassuring message, as expected -- growth was a tick stronger than the preliminary figure, with an increase in private capital expenditure helping to drive the expansion. This should all but put to rest speculation that the government will delay a sales-tax hike slated for October. * GDP expanded 2.2% from 4Q (seasonally adjusted, annualized), up from the preliminary 2.1% expansion. That ...

24) ASIA WEEK AHEAD: China Trade, Credit, Production; India CPI

China data in the week ahead will show how the economy is holding up in the face of higher U.S. tariffs. * China’s activity, trade and credit data for May will help in assessing the impact of the trade war on the economy and the strength of the stimulus response. Consumer and producer price data are also due. * In Japan, 1Q GDP growth is likely to be revised upward on stronger capex. Machine orders and service-sector activity data will give a ...

25) CHINA REACT: PBOC Hints That Yuan Breaching 7 Is Possible

The most important takeaway we took from the People’s Bank of China Governor Yi Gang’s exclusive Bloomberg interview is the yuan breaching 7 per dollar is not unthinkable. This is in line with our view that this is even possible in 2019 should the U.S. and China fail to reach a trade deal. In this case, though, the PBOC is likely to take measures to avoid capital outflows. * Governor Yi suggested it’s not the case that "any number is more ...

European Central Bank

26) Visco Says ECB Will ‘Certainly’ Act to Support Growth If Needed

The European Central Bank will take further steps to support the region’s economy if trade or other risks threaten the economic outlook, Governing Council member Ignazio Visco said. “If things somehow do not go as predicted, we will certainly act, there is no question,” Visco, who is also Bank of Italy Governor, said Sunday in an interview with Bloomberg Television on the sidelines of the meeting of finance and central ...

27) Top Europe Stock ETF Sees Trader Exodus After ECB Meeting: Chart

European Central Bank President Mario Draghi’s comments did little to assuage the concerns of investors in the region’s largest exchange-traded fund. The Vanguard FTSE Europe ETF suffered outflows of $81 million, the first redemption since March, on the day of the rate decision. Lenders, the biggest sector in the ETF, came under pressure after the ECB said Thursday it expects the key rates to remain at their present levels at least through the first half of ...

28) Investors Seeking Clues Get Fresh Global Insight: Economy Week

Investors worried about the wobbliness of the world economy will get a swathe of insights this week that will allow them to better assess the outlook for global growth and monetary policy amid the escalating trade war. In the U.S., Federal Reserve officials are going quiet ahead of their June 18-19 meeting, but the government will be churning out key reports. Those on consumer prices, retail sales and industrial production will be key to expectations on how ...

29) Ignazio Visco Says ECB Will `Certainly' Act to Support Growth if Needed (Video)

The European Central Bank will take further steps to support the region’s economy if trade or other risks threaten the economic outlook says governing council member Ignazio Visco. He spoke with Bloomberg's Kathleen Hays exclusively on the sideline of the G-20 meeting in Fukuoka. To contact the editor responsible for this story: Matthew Leuzzi at mleuzzi@bloomberg.net

30) Germany’s Olaf Scholz Sees Weidmann as a ‘Very Good’ ECB Candidate (Video)

Everybody acknowledges that Bundesbank chief Jens Weidmannis a talented central banker, said German Finance Minister Olaf Scholz, indicating his support for Weidmann as a candidate to lead the European Central Bank. To contact the editor responsible for this story: Matthew Leuzzi at mleuzzi@bloomberg.net

Federal Reserve

31) Fed considers July rate cut after sharp drop in jobs growth

Will inflation data give the Fed a good reason to cut rates? Consumer price inflation data released on Wednesday could provide justification for the US... <p>The full story is available on Bloomberg to Financial Times corporate subscribers.</p>

32) Fed considers change of tack in defining maximum employment

Patrick Dujakovich looked like the only person in the room who could change a truck tyre. A firefighter for 28 years, with a steel plate in his neck from... <p>The full story is available on Bloomberg to Financial Times corporate subscribers.</p>

33) Fed rates, trade tensions will drive market sentiment

Last week, regional markets saw some reprieve from last month's slide, starting this month on hopes that the United States Federal Reserve would subscribe to rate cuts. With that in mind, investor sentiment over the Fed's possible moves is likely to remain a central theme driving markets this week, especially with the relatively weak US job data reading released last Friday. Charles Schwab Singapore managing director Greg Baker noted that ...

34) Duy's Fed Watch: Data Beginning to Clear the Way for a Rate Cut

Central Takeaway If You Don’t Have Any Time This Morning Click here for newsletter version! The Fed hastily delivered a soothing message last week by promising to act appropriately to maintain the expansion. It was hard not to read that as dovish. That combined with the employment data puts a rate hike in play this summer. Things That You Should Already Know About The Trump administration announced that Mexico had agreed to help stem the flow of immigrants into the U.S. In return, the threat of ...

35) China Daily: Federal Reserve may cut interest rates

Photo taken on Aug 7, 2007 shows the US Federal Reserve building in Washington, D.C. US. [Photo/IC] The US Federal Reserve may cut interest rates to boost the economy amid a slowdown in domestic hiring, sluggish global growth and continuing trade tensions with other countries. The US economy added just 75,000 jobs in May for the 104th consecutive month of employment gains but hiring slowed. Analysts had expected companies to add 180,000 jobs. The unemployment rate remained unchanged at 3.6 percent, a ...

First Word FX News Foreign Exchange

36) Kuroda Says BOJ Has Enough Ammunition, Is Wary of Side Effects

The Bank of Japan can deliver more big monetary stimulus if necessary, but needs to take care with its side effects on the financial system, said Governor Haruhiko Kuroda. The BOJ will ease further if momentum toward its 2% inflation target is lost, Kuroda said in an interview with Bloomberg TV’s Kathleen Hays in Fukuoka, Japan, where central bankers and finance chiefs from the Group of 20 met over the weekend. The governor emphasized that ...

37) ECB Risks Loss of Faith With Investors Over Inflation Control

Fears are mounting at the European Central Bank that investors are losing faith in the inflation outlook, in a self-reinforcing spiral that could force the institution to dig deeper into its stimulus toolkit. Staff at the euro zone’s national central banks are worried that inflation expectations are becoming “deanchored,” according to officials familiar with the matter. They cited bets on the outlook for consumer prices, which fell to the ...

38) China May Exports Rise 1.1% Y/y in Dollar Terms; Est. -3.9%

China customs administration announces data in dollar terms in statement; median est. 3.8% fall y/y (range -8% to +7%, 22 economists). * May imports dropped 8.5% y/y; median est. -3.5% (range -10% to +11.4%, 23 economists) * May trade surplus $41.65b; median est. $22.3b surplus (range $6.2 deficit to $32.58b surplus, 20 economists) To contact Bloomberg News staff for this story: Jing Jin in Shanghai at jjin32@bloomberg.net To contact the editor responsible for ...

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's TGIF BREXIT BARRAGE! Go Bo-Jo!

Raab seems to have shot himself in the foot, Gove’s still in the mix but the polls love Bojo… Meanwhile, Farage got a much-needed poke in the eye in Peterborough…

BBG: Labour Wins U.K. By-Election in Blow to Farage’s Brexit Party

BBG: Don’t Try to Sideline Parliament on Brexit, Speaker Warns Tories

BBG: Top Tory Donor Backs Boris Johnson to Be Next U.K. Prime Minister

BBG: Brussels Edition: Passing the Brexit Baton

FT: Hammond resists May’s plan for £10bn parting gift

FT: UK’s next prime minister – who are the lead candidates?

FT: New skyscraper tests appetite for office space amid Brexit

FT: Fund groups add Mifid top-ups as Brexit fears persist

FT: Consultants reap rewards of Whitehall’s Brexit scramble

TEL: John Bercow rules out Dominic Raab’s plan to force through no-deal proroguing Parliament

TEL: The Peterborough by-election result was terrible for the Tories – but good for Boris Johnson

TEL: The next Tory leader will owe far more to Cameron than Thatcher

Bon weekend!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

** PLEASE READ ** BOND UPDATE : Yields remain TOO low and we WILL bounce!

BOND UPDATE : Yields remain TOO low and we WILL bounce!

Ideally the PROCESSS for the month needs to be, a YIELD RALLY post NON FARM, (“front load” the month with a yield higher BIAS), then late on DROP BACK to close at the LOWS ALREADY in place.

We shall see, but this would be the optimum game plan, plus too many think they can manipulate the FED.

All US weekly yield charts have REDICULOUS RSI’s so anyone buying bonds here is challenging major historical dislocation. (See pages 3,7,11,15).

This is the difficultly as previous yield rallies from this extension have been sizeable, highlighted by the LAST rectangle on each chart. Additionally most have hit and HELD SOLID retracement levels. The daily charts also compliment the call for higher yields.

**I finally think it is worth SHORTTING bonds, ideally with stops above yesterday’s highs OR preferred at recent yield retracement, listed on the weekly charts **

US 5-30 curve

This was the quickest stop out (post yesterday’s recommendation) BUT do think it is worth one last flattening attempt. Stop at 82 initially to be on the safe side and ADD significantly on a close sub 74.701. The RSI is now on side.

Also remember ALL CTA s have rolled and are long given ALL major spreads have sold off.

** Remember this is only “TIME OUT” in a bigger historical yield fall. **

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: SPGB and FRTR Supply This AM - Quick RV Colour...

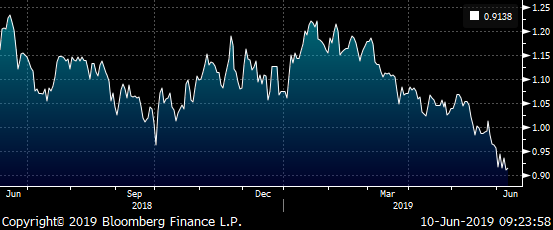

- We all know Spain’s been on quite a tear since the start of 2019, outperforming core/semi-core names en masse amid broad international buying. This am’s 2-3bn SPGB 10/21s and SPGB 7/24s taps were a bit of a surprise as they lacked 10yr+ supply as part of the package. Given the Tesoro’s history of June syndications, that’s gotten the market looking for a new 10yr some time in the next couple weeks. With the 10yr sector of the Bonos curve at historically rich levels (which has prompted a dramatic flattening of 10-15/20s and now 15/20-30s) we are seeing solid interest to move into the 5yr and 30yr wings.

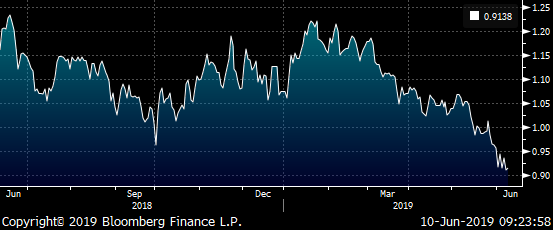

The FRTR 3/24-SPGB 7/24 sprd has been a closely watched, chopping sideways for the last 10 sessions as demand for SPGBs shifts longer. With the FRTR 3/24s ending their cycle and the SPGB 7/24s still rather young, this switch could take time to resume its tightening, however, with the ECB expected to be periphs-friendly today, we’re expecting this sprd to resume tightening post this am’s tap.

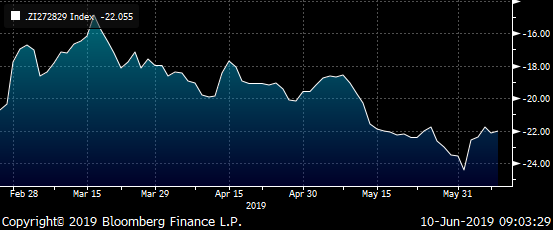

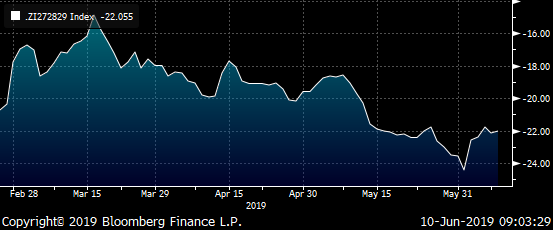

- OATs have been caught between a rock and a hard place of late. They’re at multi-year yield lows and are heavily owned by Japan where OATs hedged back into JPY has nosedived into rich territory on the RSIs. In addition, blends like FRTR 5/28s vs DBR 2/28s and SPGB 7/28s have cheapened sharply on the back of the SPGBs move which, on paper, could be a good fade if the tide turns on this sprd narrowing move.

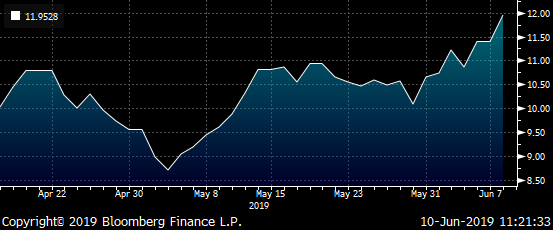

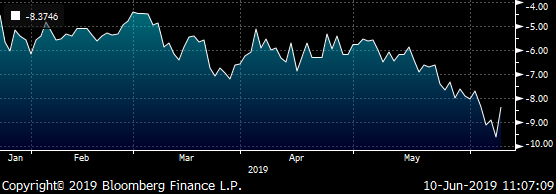

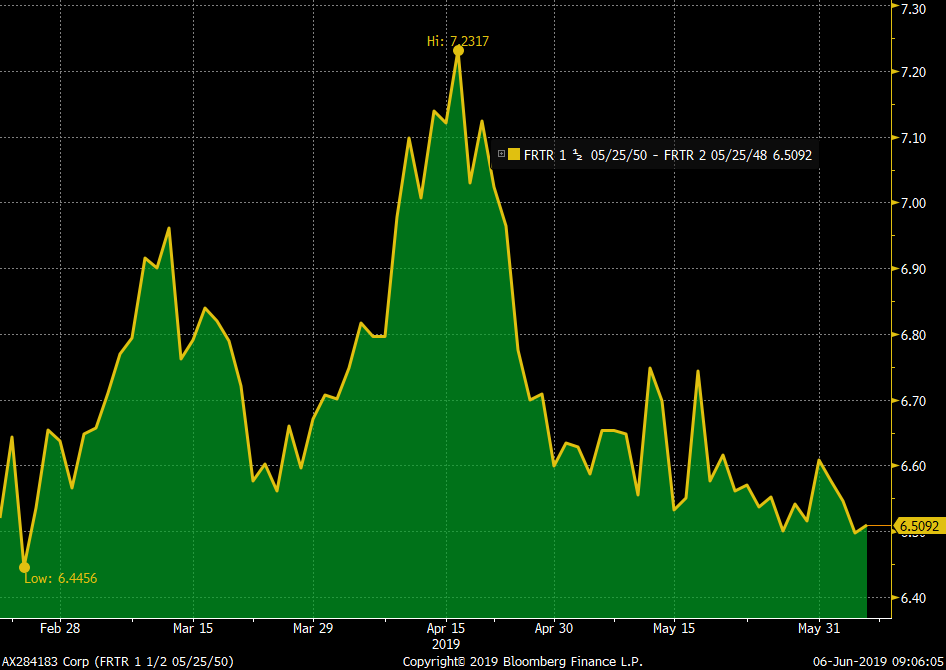

10yr OATs back into JPY

- FRTR 10/27s > If you were brave enough to sell this ex-CTD vs 5/27s and 5/28s you were vindicated somewhat but even after this tap, the issue still looks rich with the 5/27-10/27 leg still close to even yield. This is likely a technical tap that’s probably targeting dealers.

- FRTR 5/29s > Still have a few taps left before they’re replaced. July’s a big C&R month for OATs but there’s some wood to chop here. The FRTR 5/27=5/29-5/31 fly has been remarkably stable given the mega-bid to EGBs of late.

- FRTR 1.25 36 > Here’s a nice chart… SPGB 4/29-7/35 sprd – FRTR 5/29-5/36 sprd. Pretty close maturity-wise and a solid barometer of what’s happening with their curves. We’ve basically removed most of the credit premium the SPGBs curve is supposed to have vs OATs here with the sprd at just 5.5bps.

On a more micro-basis, however, we like the FRTR 1.5 5/31 into FRTR 1.25 5/36 flattener into this 5/36s tap. The sprd is showing signs of turning but remains at the cheap end of it’s range.

- FRTR 1.5 5/50 > They look pretty well priced for an issue that’s got a lot more taps to come. They will become more valuable to the real money community as they grow, however, there’s ample OATs supply out there and demand for 30yr paper has been tepid which could continue unless the ECB promises some 30yr-friendly changes to their post-QE reinvestments.

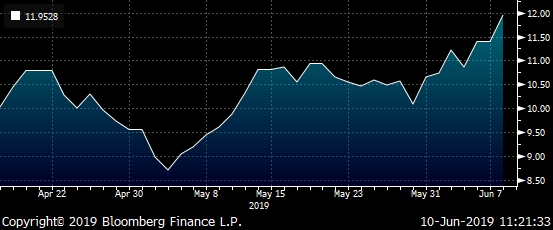

FRTR 5/48-5/50 sprd

SPGBs bids in at 9:30, OATs at 9:50.

More soon.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

US curves a once in a lifetime opportunity? BUT A TOUGH CALL AS TO WHICH ONE, GIVEN ALL STEEPENING.

US curves a once in a lifetime opportunity? BUT A TOUGH CALL AS TO WHICH ONE, GIVEN ALL STEEPENING.

Firstly the US 5-30 flattener idea of yesterday would have been stopped and proves one thing, ALL curves want to steepen!

I have mentioned in the past favouring a more FRONTEND orientated steepeners, these have now BASED and poised for a sharp rapid steepening.

US 2-10 about to breach an multiyear 76.4% ret 26.639 (Page 3).

Previously :

** The BACK END ideas have had a good run so maybe time to get long US 2-5 and 2-10 steepener.

All generally have low RSI’s, MANY at 2006 levels.

REMEMBER ALL RSI’s ARE EXTENDED AND MANY HAVE HIT MULTI YEAR 76.4% RETRACEMENTS, SO DON’T IGNORE THEM!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris