MACROCOSM: Quick TECHNICALS Update > Rates Bears Gored As Rally Resumes

- Well, so much for our bearish ‘rounding top’ formation in G-7 rates markets. Continued jitters over the outcome of the UK’s impending leadership vacuum, a wobble in commodities and some softer data helped to spark renewed buying across the rates universe, taking USTs to their richest levels since 2017 and inverting sectors of the UST curve in the bull flattening move.

- RXM9 > The slowing momentum and topping formation that we highlighted in RXM9 from mid last week was looking prophetic until Wednesday’s test of bottom of the bull channel (in place since mid-April – see chart) held, attracting some bottom-feeders and we’re now back to the highs. Open interest has risen and even though we’re still trying to make new highs, the performance of sister markets is making the bears antsy to say the least. The 167.50 level still looms large (~-22.5bps in DBR 2/28s) so until we’ve taken that out emphatically, we’ll stay sidelined as we chop around in this 25 tick range between 167.25-50.

- USM9 > To quote Kung Fu Panda: ‘Ska-Doooooojjjj! That is one very emphatic break of the highs that had held like a rock, dragging shorts kicking and screaming to cover. That said, we are struggling to build on that very bullish close this morning as USTs sell-off on the back of the bounce in stocks. Open interest has surged 12.5% since the start of May which CFTC data shows are new non-comml longs. So, the market is getting longer as we rally, driving the bull flattening of the curve. RSIs remain overbought and momentum, in general, is bullish. Today’s price action will be very important as we head into a long weekend when the market typically likes to be flat to long…

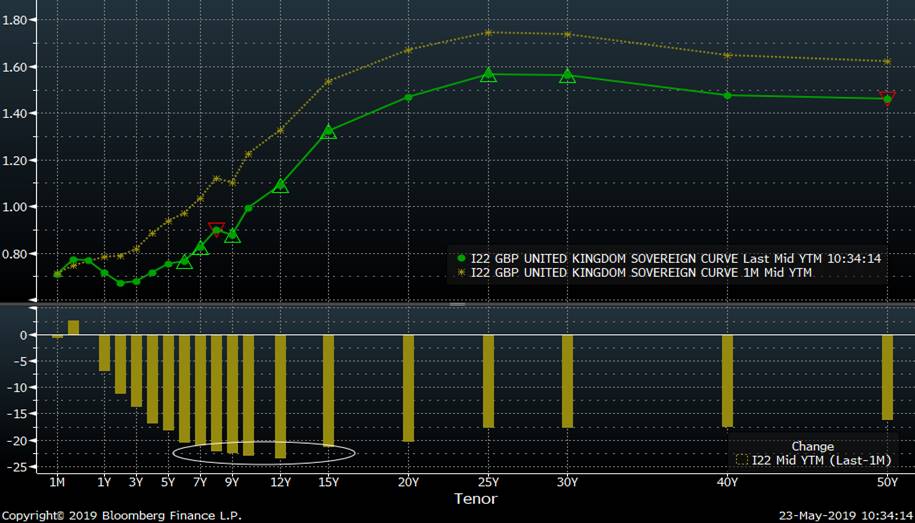

- GM9 > May-hem at the helm helped to spark the latest round of buying in gilts as they outperformed most other sovereign markets the last couple sessions. With a long-weekend on tap and a big gap between Wednesday’s close and Thursday’s open, we’ll be watching price action closely here too. RSIs are back to their richest levels since Mar 22nd and volumes in G M9 yesterday were the highest since G M9 kicked off. Open interest has been pretty stable with a modest upward bias and even though the contract is making new highs, the 1F28s (CTD) aren’t at their richest levels vs 26s and 30s. The bull flattening of the short-end of the GBP curve has begun to price in small odds of a rate-cut with Aug’19 v Mar’20 MPC meeting sprd now -3.1bps mid. So, as above, we’re overbought, at nosebleed levels and at extremes on the curve. Lots of bad news built into gilts now.

- OIL slid lower in a dramatic bet that global demand will wane as growth slows. The chart below tells a lot of stories. We broke the 200 day MA – BIG SUPPORT which held for almost 2 months, open interest has shot higher in what looks like new spec shorts and RSIs are back into oversold territory. This was a flash-sale that caught the market napping and will need a continuation of this bearish bias to turn this into a bonafide bear market. Expect a response from what’s left of OPEC soon.

More to come….

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... May Finally Gets the Joke

With headlines in the UK press this morning pleading with Theresa May’s husband Phil to convince her to resign, it looks like a time table for her departure is in the works. We still think this outcome should be seen as positive for the markets as it sets us on a course to finally complete this agonisingly painful Brexit process, however, Cable continues to flounder.

FT: Theresa May to give firm departure date as Brexit deal founders

FT: Fragile May hunkers down to plan Downing Street exit

FT: Theresa May rewrites Brexit deal to head off cabinet revolt

FT: Boris Johnson acted in ‘dishonest’ way in Brexit poll, court told

FT: Pound approaches 2019 low as pressure on Theresa May intensifies

FT: Theresa May attracts derision in UK, pity and mockery in Europe

FT: Leadership hopefuls look for swift start to contest

BBG: Theresa May Set to Announce Timetable to Quit as Tory Leader

BBG: May Faces Her Exit as Farage Laughs Again: Postcard from London

BBG: Boris Is the Bogeyman Stalking Pound as Leadership Contest Looms

BBG: Gaffes, Duplicity and Ballots: How the Tory Party Picks a Leader

TEL: Theresa May’s day of destiny arrives after Jeremy Hunt withdraws support for Brexit Bill

TEL: Why won’t Theresa May quit? Is it ‘vicar’s daughter complex’ or the perks of power?

TEL: The day Theresa May was left in no doubt she had run out of road

TEL: Conservative leadership: the 1922 Committee’s secret ballot gambit is far from a sure bet

TEL: Smart, capable and diplomatic: Rory Stewart is the leader the Tories – and the nation – needs

TEL: Rage over Brexit is swamping out answers to the great challenges of our time

*** I will be out next week, spending half-term with my family. These updates will resume a week from Monday…

Enjoy!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: GILTs, GBP and Brexit... Are Things Really That Bad?

- Readers of our AM Brexit Barrage updates will be well aware of our frustration, exasperation and astonishment regarding all things Brexit-related. After all the twists and turns in this saga, we’ve become de-sensitized and, as you can tell from the nosedive Cable has taken, the market’s had enough.

- What we find a bit surprising, however, is the selling of GBP/USD has accelerated as Theresa May’s departure draws closer, even if she does have ‘her sofa against the door’ (well, at least according to the pundits at the BBC, et al). May was given one job when she took over as PM in the summer of 2016 – get the UK out of the EU on time and in one piece. She has failed miserably and her cabinet has called for her immediate departure.

- The question we have is, ‘Shouldn’t May’s departure be considered a step forward, rather than a source of angst?’. What’s more distressing for us is the idea of banging our collective heads against a wall while we watch May dust off her much-maligned deal for yet another epic defeat.

- The pool of PM hopefuls is large enough to further confuse both the markets and those UK citizens most affected by the Brexit outcome. But in reality, however, there are just a handful of Tories who have the gravitas, support and experience to become PM. This article in the Telegraph from last night: Who could be the next Prime Minister after Theresa May? discusses this in detail. While BoJo is considered the favourite at this point, there’s a significant number of MPs who despise the man, even if he managed to rejuvenate the Brexit process. He’s just got too much baggage. Dominic Raab is second favourite, has fewer skeletons in his closet and is committed to delivering Brexit, unlike former Remainers who are now professing their commitment to the deal like Sajid David and Jeremy Hunt. Leadsom, Rudd and Mordaunt are also in the mix but they don’t seem to have the same broad appeal – yet at least.

- The point here is May’s tenure has been a source of stress for all involved – particularly the markets – and in our view, a move to replace her with a Brexiteer with the same moderate/centrist approach the Tories are known for, should be seen as a positive step towards a resolution.

- If our take on this is correct, wouldn’t Cable at 1.26 seem too cheap? Conversely, wouldn’t that make 10yr gilts sub 1.00% too rich?

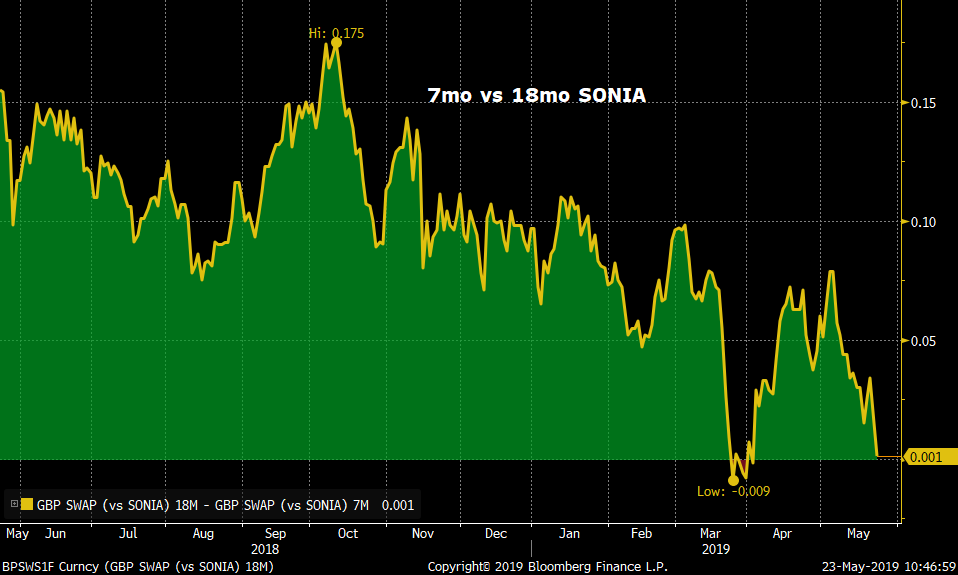

The SONIA curve has pancaked, the 7mo-18mo sprd (for ex) is slightly negative and MPC dates out to next August are virtually identical. So, unless you think the MPC is likely to cut rates some time in the next 18 months, it’s tempting to have a steepener on here. Pick your poison.

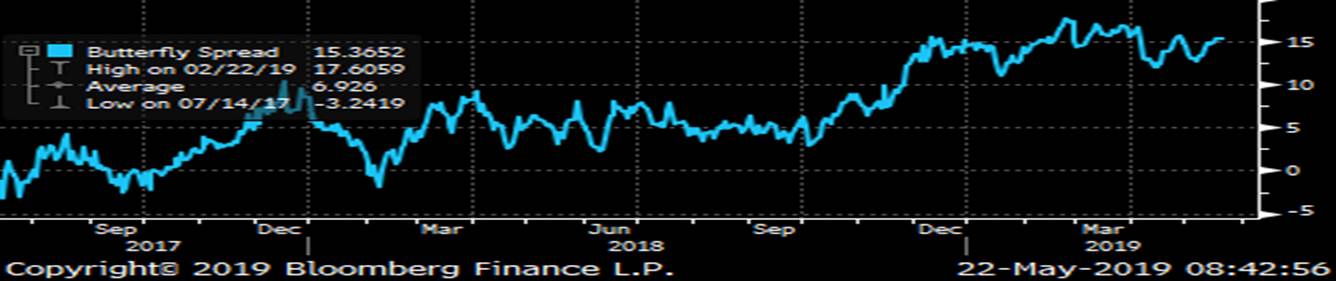

UKT 0H22-4Q27-1T37 fly – making new all time highs (belly richest)…

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: Today's BREXIT BARRAGE... 'She's got the sofa against the door'

What ever happened to dignity?

TEL: Has the Bank of England lost its credibility with the markets?

TEL: Theresa May urged to quit now over new Brexit deal – what happens when the Prime Minister resigns?

TEL: Theresa May is the epitome of all that is wrong with British politics

TEL: This is a sorry end for a Prime Minister who never believed in Brexit

FT: Conservative MPs expect Theresa May to be gone within days

FT: Theresa May cuts a lonely figure as her authority evaporates

FT: Theresa May’s premiership is all over bar the shouting

FT: Andrea Leadsom resignation delivers hefty blow to May

BBG: May’s Premiership Hangs by Thread as Leadsom Quits Over Brexit

BBG: Pound Investors Are Bailing Out With Brexit Chaos Back on the Radar

BBG: Brussels Edition: Game of EU Thrones

Meanwhile… How’s this for a bit of monkeying around…?

Bold baboons in backstroke break-in

https://www.bbc.co.uk/newsround/48353253

Enjoy!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MULTI ASSET UPDATE : Mr Trump has given us a lot to worry about and never before at such a critical juncture.

MULTI ASSET UPDATE : Mr Trump has given us a lot to worry about and never before at such a critical juncture.

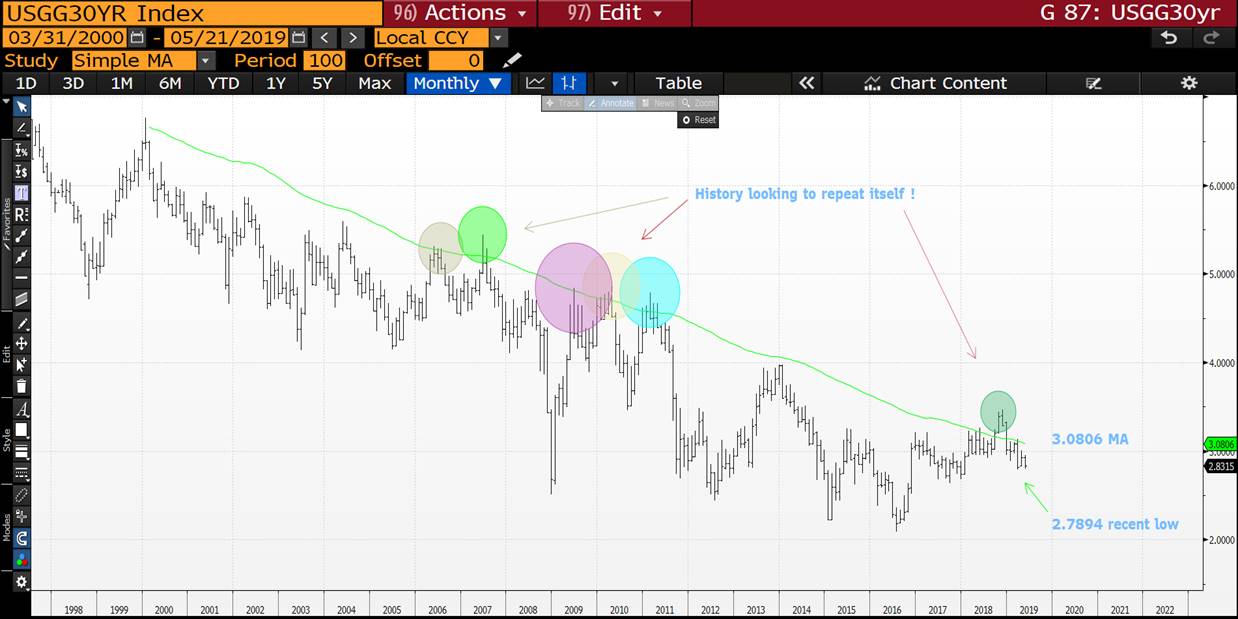

Bond yields : Most yield charts have HELD the previous lows of LATE March creating a short term obstacle.

The biggest issue over the last 2 weeks has been the flattening US 5-30 curve, again in March this prompted yields to POP. We just need to breach those March yield lows.

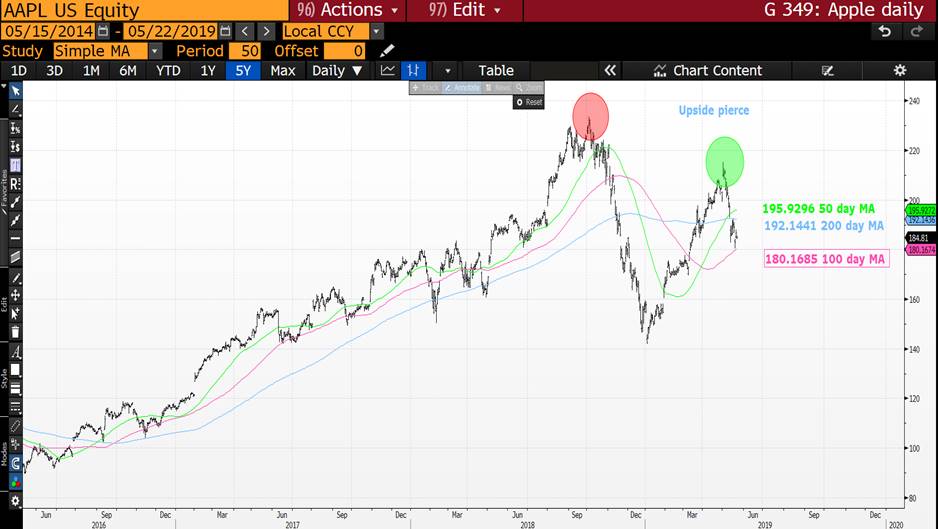

EQUITIES : Mr Trump has muddied the waters and that has left many stocks on a NEGATIVE TACK for once.

Sadly we await the Chinese response but many SINGLE stocks are terminally damaged already.

US CURVES : As highlighted the KEY focus is the US 5-30, does it FLATTEN if so then bond yield should rise similar to March 2019.

FX : This has been a relatively quiet area given the USD and EURO have had limited movement. The EURO remains a long-term bearish view.

EM FX : The latest USD pop has limited the EM performance flagged previously.

OIL and GOLD : Oil now looks to have topped whilst gold is very sideways.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Gilt fly-1h26s super-rich..Sell into 7/23s & 4t30s before a revaluation!!

Subject: Gilt fly-1h26s super-rich..Sell into 7/23s & 4t30s before a revaluation!!

Gilts are reacting positively again to the dire Political posturing as PM may did everything yesterday but sing"My way" & then resign,with the recent volatility the market has richened the futures area with 1f28s starting to perform & the rich 1h26s holding a bid in spite of no imminent QE re-investments & coupons paid on the 7th favouring the over 15yr bucket with £1.6bn paid x-BOE holdings. The trade I propose here is to sell 1h26s which will soon be in the 3-7yr maturity bucket,which has a variety of issues the BOE can buy & note they hold only 6% of the 7/23s & almost zero in the ct5s 1 24,the issues I would buy out of 1h26s are 7/23s which later this year will be the shortest issue in the 3-7yr BOE buyback bucket & benefit as 2 20 go under 1yr maturity late July & the longer issue the 4t30s which are second ctd & post the dec contract likely to be ctd for around 9 contracts in spite of the launch of the new 10/29s which with a low coupon likely 1/1.125% would sit 3rd ctd for sep & dec.the 4t30s have trade well as they approach a new era though as the older ctd high coupons are mostly 70% held by the BOE they offer value in repo with the small freefloat,so previous history I think is misleading as they enter the new arena .. Entry 15.3bps or better : Stop 17.5. Early target 8/9 Longer term zero.... Carry 0.4 assuming 5bps repo diff..4t30s likely to trade through gc History below :

This marketing was prepared by George Whitehead, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

<< "The Past Is The Future Back To Basics" 02031434182-www.astorridge.com >>

MACROCOSM: Quick Rates Technicals Update > Looking for a Catalyst

- The rounding top formations that have marked slowing bullish momentum and modest profit taking since last Thursday appear to have run their course. Rates markets have bounced a bit this morning, especially gilts, as disappointment that May’s deal won’t fly (again!) and the Fed’s Bullard (arch-dove) comment (“I am concerned we may have slightly overdone it with our December rate hike but I was pleased that the committee pivoted.”) got the bears scrambling to cover shorts.

- So, while we maintain the view that there’s a lot of bad news built into prices across the G-7 right now, reducing the need for another push to new highs, it seems likely that we’ll settle into a relatively narrow range where vol takes another hit, EGBs spreads tighten further (tomorrow’s SPGB supply is all but done and dusted) and we await the outcome of the European elections which kick off tomorrow.

- RXM9 > Settling down here…

- TYM9 > A bit of ‘blood-letting’ from the highs has stalled at the 38.2% retracement. Positioning is still net-long (from the non-comml hedgers perspective) and RSIs still on the richer side of fair but we need some new data/news to direct us here.

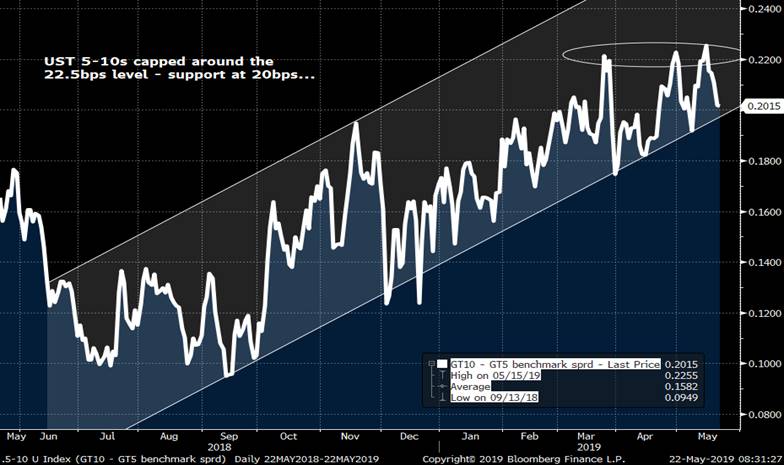

- UST 5-10s Curve > Medium-term steepening bias has run out of steam – steepening channel still intact – barely…

- GBP/Sonia > The song remains the same here. GBP bounced and G M9 sold off yesterday PM on hopes that May’s deal might offer a Brexit breakthrough but that didn’t last long as GBP has resumed it’s move lower and 1y1y SONIA rallied back.

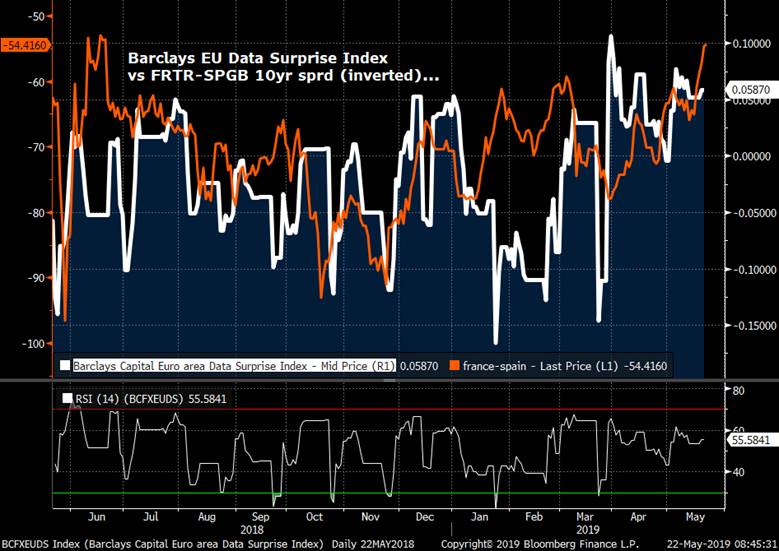

- Here’s one out of left field for you… EU Data Surprise index (BARC’s BCFXEUDS) vs FRTR-SPGB 10yr sprds (inverted)… Correlation is by no means 99% but this chart is still instructive. It tells me that not only have estimates of European activity been too pessimistic but the pace of economic growth has been solid enough that spreads like SPGB-FRTR will have little fundamental reason to NOT narrow further.

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... Just when I thought it was a waste of time...

So, I pull the plug on my Brexit Barrages yesterday and lo and behold, Theresa May lays another egg in a last-ditch attempt to save her legacy.

This will make one helluva mini-series someday.

Give me strength…!

BBG: May Faces Pressure to Abandon Vote on Brexit Law and Resign

BBG: What English Soccer Says About Immigration and Brexit

BBG: May’s Desperate Gamble on a New Brexit Referendum Falls Flat

BBG: Theresa May Offers Vote on Second Brexit Referendum

BBG: May’s Latest Brexit Deal Is Already an Ex-Deal

BBG: Theresa May’s Swan Song Sadly Falls Flat

BBG: Tory Grandee Chris Patten Calls Boris Johnson ‘Mendacious’ and ‘Incompetent’

FT: Northern Ireland party seeks Brexit breakthrough

FT: Explainer: The main points in May’s new Brexit offer

FT: May critics waste little time in thumbs-down for new Brexit push

FT: Pound is being buffeted by global and domestic headwinds

FT: Theresa May offers vote on second Brexit referendum

TEL: Theresa May’s plan leaves MPs with a choice of uncertainty of chaos

TEL: Farage v Cable: The Brexit Debate – live at 9am today

Enjoy!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

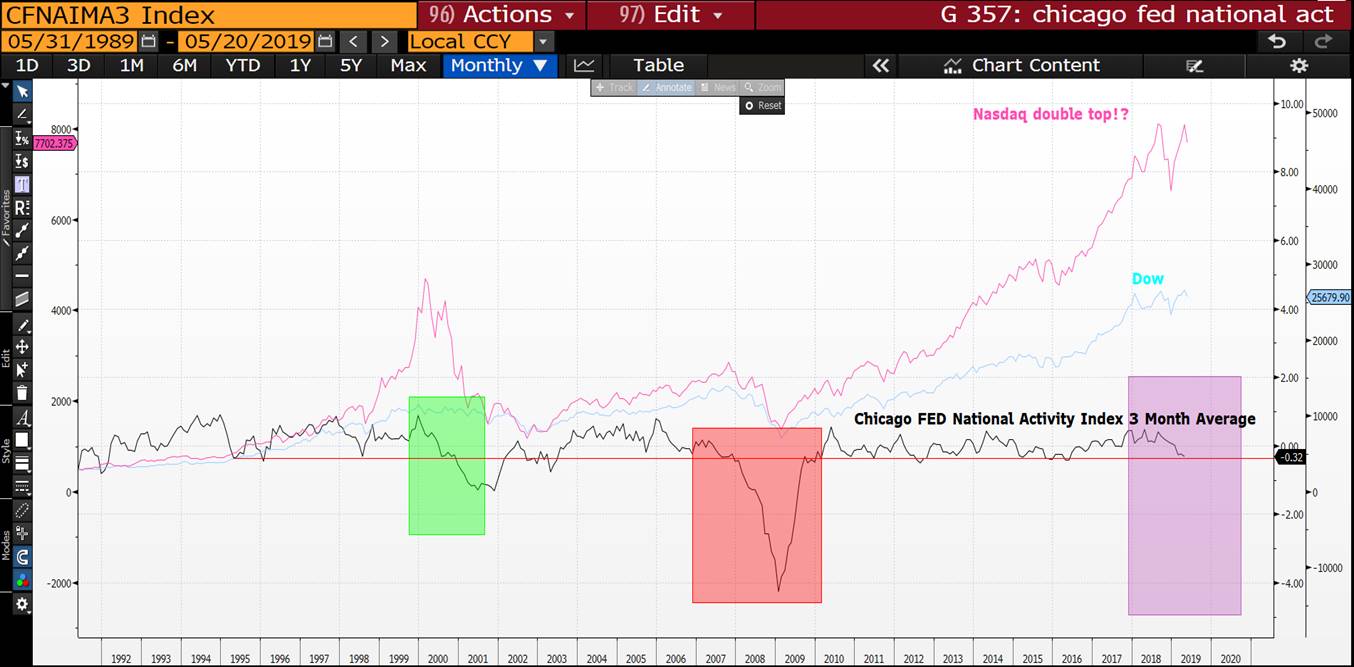

** Chicago Fed National Activity Index : Stocks could be in a lot of trouble if this index cannot recover, some time soon. **

Chicago Fed National Activity Index : Stocks could be in a lot of trouble if this index cannot recover, sometime soon.

Chicago Fed National Activity Index designed to gauge overall economic activity and related inflationary pressure. The CFNAI is released at 8:30 a.m. ET on scheduled days, normally toward the end of each calendar month.

Chicago's website says that it has a 95% success rate in forecasting downturns. It's current at -0.32. In 2012 we had QE3. In 2007 when they eased the available (August) number was -0.34. On January 3 2000 it was November's -0.26. In 1998 it went negative in the July and they eased in September. In 1995 it was -0.08 in Nov and they cut in Dec. In 1989 it was at -0.31 in May and they eased in June. If one follows the track record then the FOMC should cut. (Chart care of a friend and in the public domain).

The Chicago Fed National Activity Index (CFNAI) was –0.45 in April, down from +0.05 in March.

https://www.chicagofed.org/publications/cfnai/index

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BOND AND US CURVE UPDATES : Yields are currently in a HOLDING pattern with the LONGTERM view remaining much LOWER, all thanks to Mr Trump’s negotiating tactics!

BOND AND US CURVE UPDATES : Yields are currently in a HOLDING pattern with the LONGTERM view remaining much LOWER, all thanks to Mr Trump’s negotiating tactics! Overall the threat of higher yields has diminished as the weaker stocks element is back, this has always been that MISSING ADDED DIMENSION.

Last week one major concern for the yield lower call was the US 5-30 stalling at a familiar level from March which prompted a yield rally at the time, this time it appears the stock turmoil is hampering any major bond yield rally.

This is a worrying statement given our current location but the path of least resistance is definitely lower and STOCKS MAY HELP!

CTA’S continue to add on any new futures highs driving yields lower, volumes up and increasing open interest daily. IF we do have a “run” on yields globally then the “LONG ONLY” OPEN INTEREST could provide for some interesting CALENDAR ROLLS.

US 5-30 curve weekly : This chart highlights last week’s concerns of a MARCH repeat, the pink line is an INVERTED US 10yr yield.

Should stocks FAIL then yields will plummet despite many offering a minimal returns.

Should stocks FAIL then yields will plummet despite many offering a minimal returns.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris