MACROCOSM: Quick Rates Technicals Update - A Top In the Works...

Quick Rates Technicals:

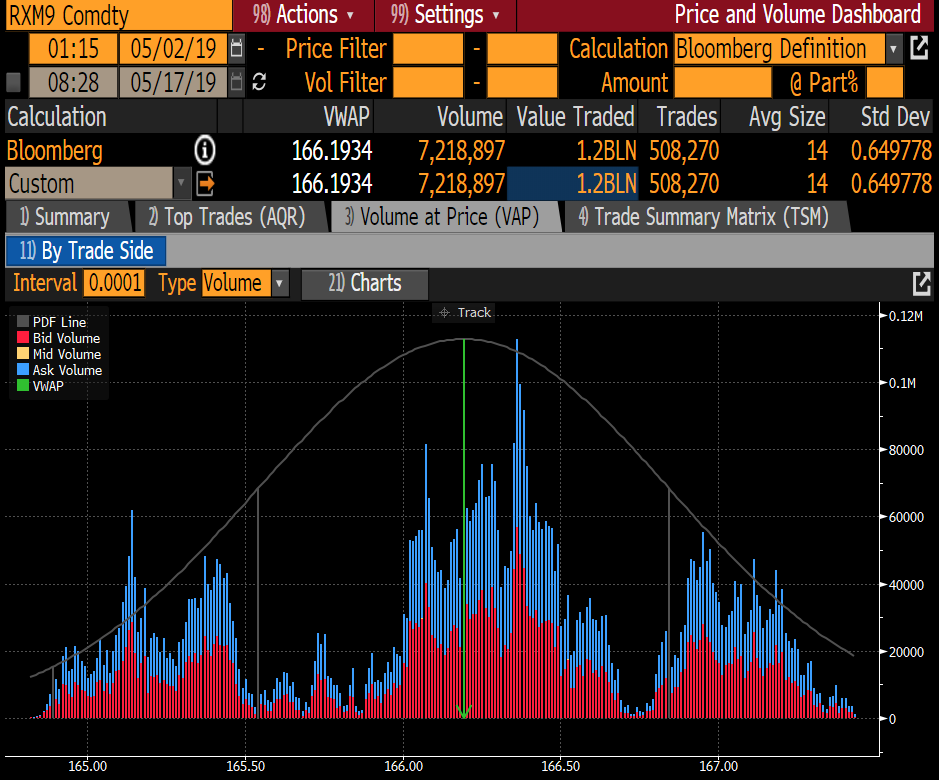

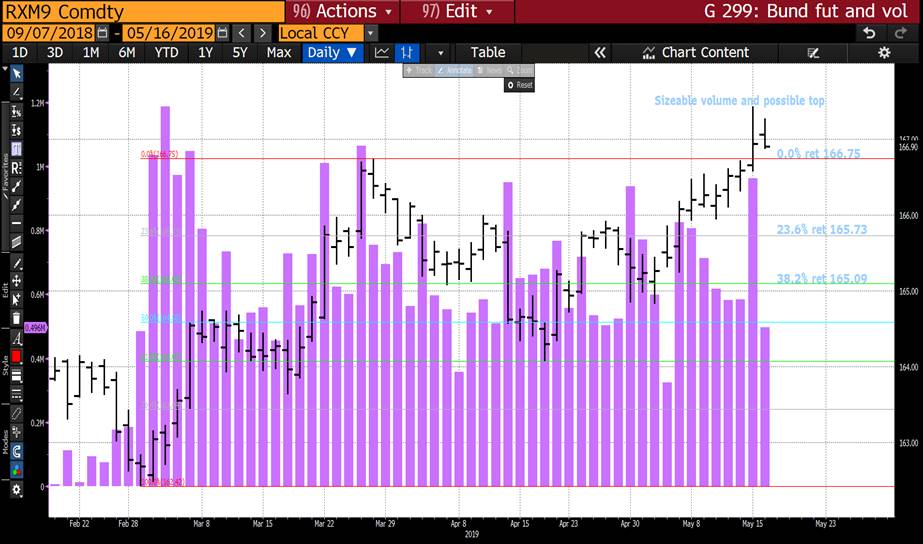

- RXM9 > Bullish break through H&S neckline resistance dragged in the last of the weak shorts but momentum has slowed as value has built around the 166.90-167.05 area. Two consecutive lower closes at overbought RSIs has the look of a top being formed and this morning’s open suggests it could have legs. At the very least, we'd take profits on half our longs here if you've caught the move. (Chart below)

- IKM9 > Last night’s note about the bullish ‘Dragon Fly Doji’ (see attached) seems to have wings (sorry, couldn’t resist) as this am’s open has IKM9 rallying 29 ticks, driving a bull flattening move. With no BTPS supply for the next couple weeks we’re in a nice little pocket risk-wise that could drive a handsome rally, especially if the elections next week come and go without any fireworks.

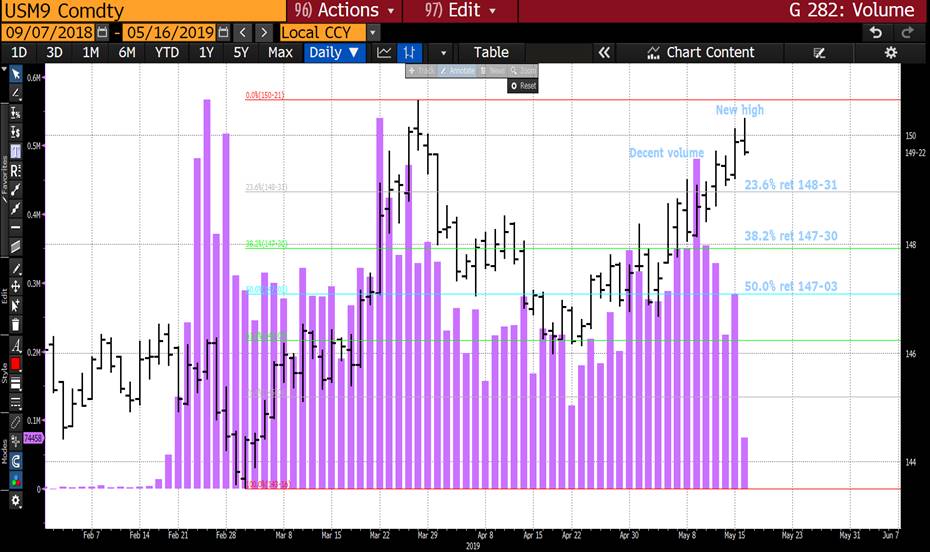

- USM9 failed at the March highs and is testing the bull channel support… RSIs are overbought here too – and as above – we’re inclined to lighten up here.

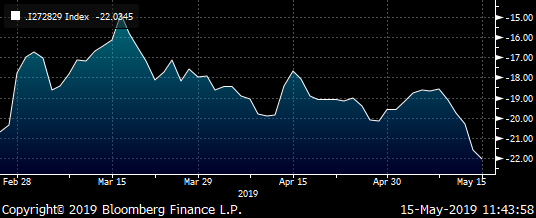

- SONIA 1y1y vs GBP/USD… The on-again, off-again correlation of 1y1y SONIA to GBP is back on again. Since Apr 15th the correlation has been very high, SONIA rallying as Cable comes under pressure. This is the ‘right’ relationship, one would think, especially since GBP was defying gravity for much of March despite the melee in Parliament. Perhaps May’s departure will produce some sort of breakthrough – or better yet – give the market an excuse to be optimistic. Either way, momentum has been negative here and we’ve seen little sign of relenting yet.

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... May Day on the Way

Not sure if we’re supposed to be relieved, saddened or elated about the news Theresa May’s finally on her way out… I am leaning ‘elated’.

BBG: Frustrated and Upset, Theresa May Was Told Her Time Is Up

BBG: Here Are All the Rivals Queuing Up to Try to Replace Theresa May

BBG: Boris Johnson Is Slim, Trimmed and Ready to Fight for Power

BBG: The EU Won’t Shed a Tear Over May’s Demise Amid the Brexit Mess

BBG: U.K. Brexit Drama Hurts European Car Sales for Eighth Month

BBG: Brexit Bulletin: The Final Days of May

FT: Theresa May’s allies insist cross-party Brexit talks are continuing

FT: Corbyn’s Labour squeezed by ardent Brexiters and Remainers

FT: UK Treasury prepared currency war chest for Brexit, says BofA

FT: Sterling strikes three-month low on flare-up in Brexit angst

FT: Theresa May offers herself up to save Brexit deal

FT: Channel 4 News claims Arron Banks funded Nigel Farage’s lifestyle

TEL: How the ‘men in grey suits’ called time on Theresa May’s premiership

TEL: Cross-party talks with Labour set to end without agreement

TEL: The Brexit Party: What do they stand for, and who are the MEP candidates running for election?

TEL: Tearful Theresa May forced to agree to stand down: PM out by June 30 at the latest

TEL: Theresa May leaves No 10 the way she ran it: in a cloud of mystery

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

US 5-30 CURVE : The last time this curve flattened, yields bounced.

US 5-30 CURVE : The last time this curve flattened, yields bounced. Given the previous bond presentation this might be worth noting as BONDS could be forming a TOP TODAY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

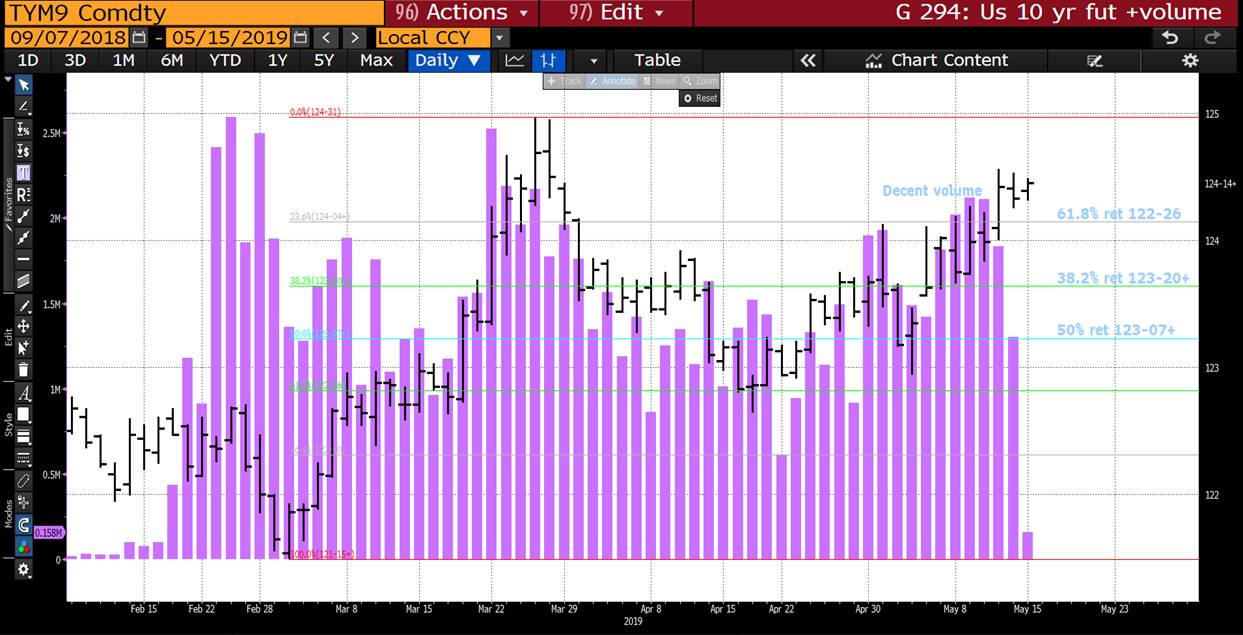

** PLEASE READ ** BOND YIELD (SHORT-TERM) UPDATE : Given it is SUCH an IMPORTANT day for EQUITIES it is worth mentioning some CRITICAL BOND LEVELS.

BOND YIELD (SHORT-TERM) UPDATE : Given it is SUCH an IMPORTANT day for EQUITIES it is worth mentioning some CRITICAL BOND LEVELS. It is also a poignant reminder that ALL daily yield charts are below their 50-100-200 moving averages.

I have excluded all long-term charts as the theme remains the same, this update is merely to highlight levels, should stocks rally, if they do take some profits. Bunds witnessed major high volume on what could be construed to be a reversal day, this partially prompted the interim update.

US BOND FUTURES HAVE NEW HIGHS TODAY PROMPTING CTA’S TO BUY CONTACTS FOR THE REMAINDER OF THE DAY, SO SHOULD ENABLE US TO CLOSE STRONG.

THE LONGTERM CHARTS CONTINUE TO CALL FOR MUCH LOWER YIELDS AND AN ACCELERATION POINT HAS BEEN REACHED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

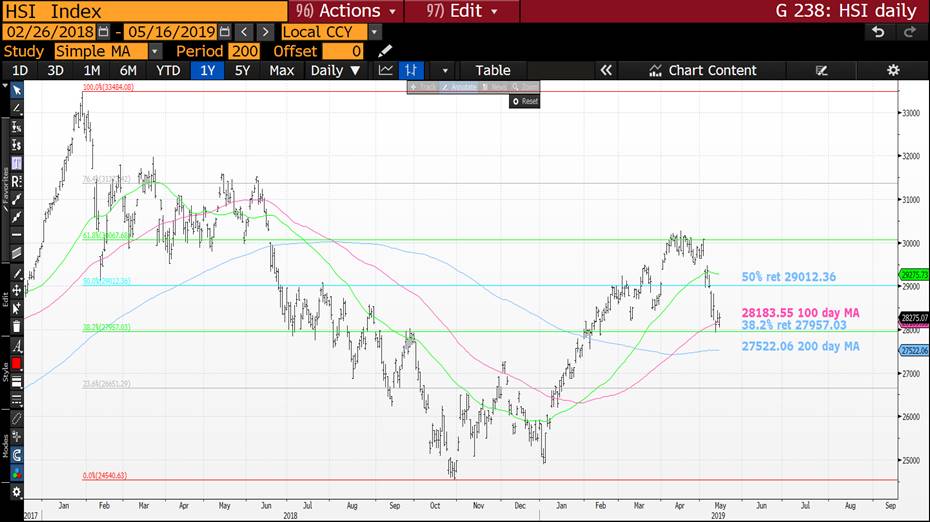

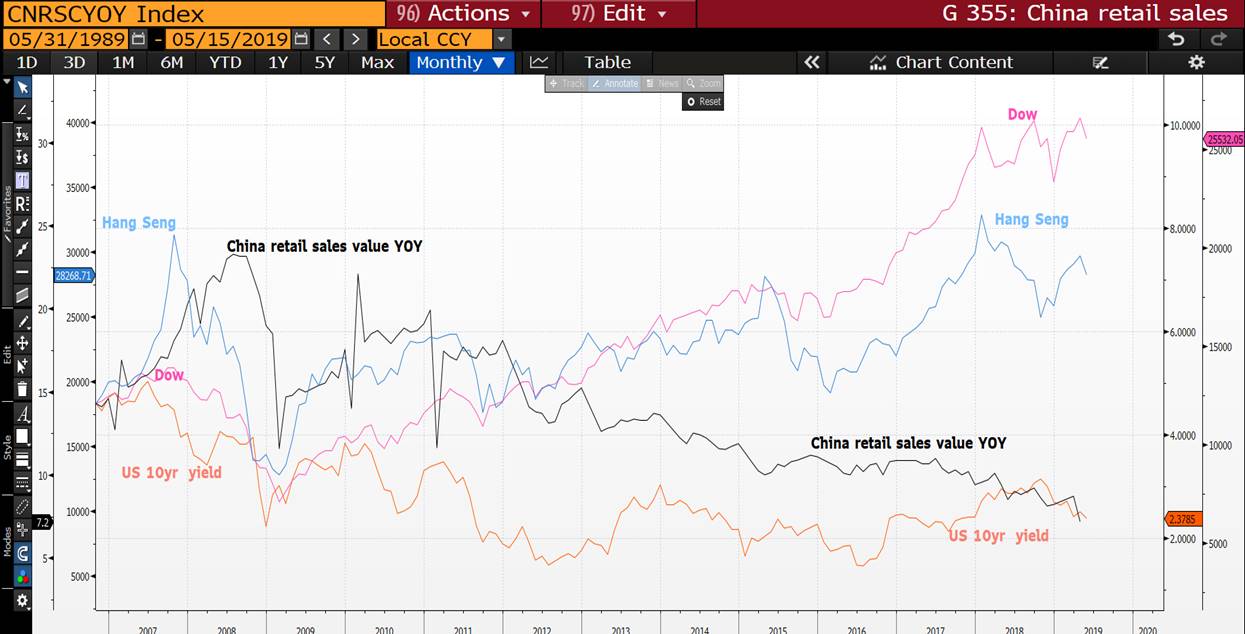

EQUITIES SPECIAL UPDATE : We are off the lows on many of last weeks oversold situations, question is do we now fail, the signals are mixed.

EQUITIES SPECIAL UPDATE : We are off the lows on many of last week’s oversold situations, question is do we now fail, the signals are mixed. Ideally we do need to fail to continue the momentum.

** CHINA JUST CAN’T BOUNCE (SEE PAGE 17)! **

A key day as many 50 day moving averages are offering resistance, it would be a nice failure level hinting at a WEAK BOUNCE.

Whilst bond yields continue their much publicized path lower, stocks are now showing signs of fatigue. Ultimately the very vocal and obstinate Mr Trump is helping matters, this definitely won’t end well.

I HAVE INCLUDED BOTH US AND CHINA SINGLE STOCKS TO HIGHLIGHT DOWNSIDE POTENTIAL, APPLE BEING A FAVOURITE CHART, PAGE 18.

An interesting time, with a DOW chart forming a potential TRIPLE TOP, page 10.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Today's BREXIT BARRAGE... Kicking and Screaming From No.10...

Theresa May’s political lynch-mob’s calls for her ousting are reaching a fever-pitch with her decision to call yet another vote on her unpopular Brexit plan. May’s clearly determined to stay put, which any sane person would be tempted to ask ‘Why?” at this point. The proverbial glutton for punishment.

BBC: Theresa May due to meet Tory MPs over leadership

BBC: European Elections: Conservative’s Liz Truss on a no-deal Brexit (TV)

BBC: Theresa May says MPs ‘have duty’ to support bill

BBC: Theresa May has set herself a huge test

BBC: Brexit Secretary Stephen Barclay says PM’s deal is ‘dead’ if bill fails

FT: What does Corbynism mean for the future of Britain?

FT: Tory grandees renew calls for May to set departure date

FT: Why Theresa May faces defeat on her flagship Brexit bill

FT: Labour warns Theresa May it will not back her Brexit deal in crunch vote

BBG: U.K.’s Theresa May Faces New Push to Oust Her as Brexit Heads to Endgame

BBG: Britain’s Businesses Have Already Lost, Brexit or Not Brexit

BBG: Utility Nationalization Plan Outlined by U.K. Opposition Party

BBG: Brexit Paralysis Creates ‘Zombie’ Parliament With Little to Do

BBG: War Gaming Europe’s Next Big Political Accident

TEL: European Parliament: Everything you ever wanted to know (but were scared to ask)

TEL: UK-taught developer ‘devised software Russia used to try to swap Brexit vote’

TEL: Emmanuel Macron infuriates NATO allies by freezing UK firms out of EU defence contracts after Brexit

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

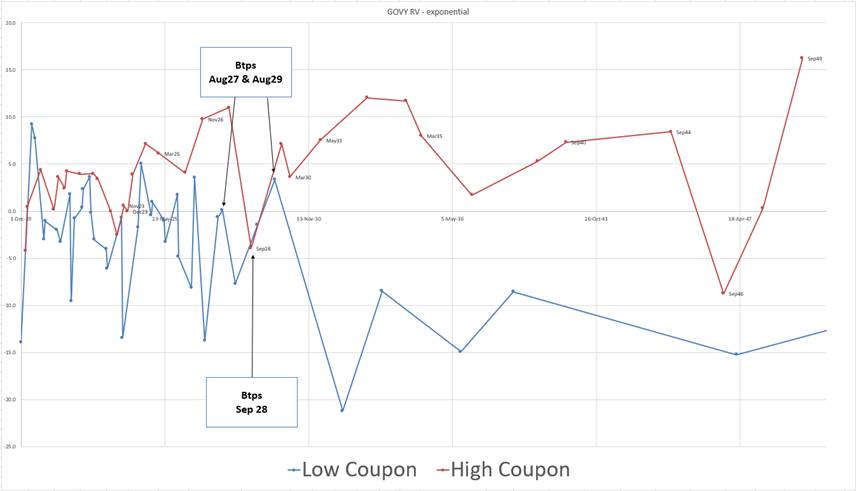

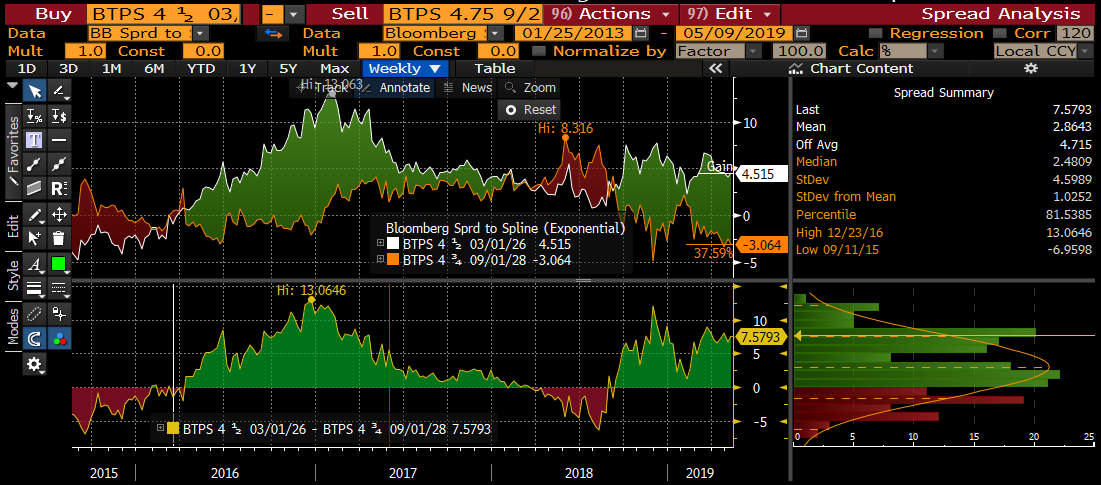

Trade Radar #3 - James Rice, Astor Ridge

IK contracts rich vs neighbouring bonds

Ongoing CTD for 2 more contract months – some chance of a squeeze, but looks rich as a high coupon in a down market

Mechanics

Short IKM9 – ctd btps 4.75% 9/28

Long Aug27 and Aug29

Rationale

- The Ik contract is a rich high coupon bond

- The aug29 are an on the run issue that trade cheap

- The aug27 provide a curve ‘anchor’ to the trade

- The Ik contract could squeeze more between now and the end of year (falls out of the basket after Dec19)

- On the basis of point 1. But mitigated by point 4. I would scale into this trade in approx. <15% of my total size at this point as the squeeze risk in delivery could cause Sep28s to richen further

Weightings: +.4 / -1 / +.6

Cix: 200 * (YIELD[BTPS 4.75 09/01/28 Corp] - 0.4 * YIELD[BTPS 2.05 08/01/27 Corp] - 0.6 * YIELD[BTPS 3 08/01/29 Corp])

Carry & Roll

-1.3bp /3mo (using 10bp repo spread)

Caution the sep28 may get richer on repo over the delivery cycle

Anomaly Value – BBG GOVY exponential 3mo spline

Anything else needed, pls let me know

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND AND US CURVE UPDATES : Yields continue to head lower and the long-term charts CALL for an OVERDUE ACCELERATION!

BOND AND US CURVE UPDATES :

Yields continue to head lower and the long-term charts CALL for an OVERDUE ACCELERATION!

This is a worrying statement given our current location but the path of least resistance is definitely lower and STOCKS MAY HELP!

CTA’S continue to add on any new futures highs driving yields lower, volumes up and increasing open interest daily. IF we do have a “run” on yields globally then the “LONG ONLY” OPEN INTEREST could provide for some interesting CALENDAR ROLLS.

Should stocks FAIL then yields will plummet despite many offering a minimal returns.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Today's BREXIT BARRAGE... Nooooooo, not again!

BBG: Brexit Bulletin: One Last Gamble

BBG: May to Bring Brexit Deal Back to Parliament at Start of June

BBG: May and Corbyn Meet as Cross-Party Talks Go On: Brexit Update

FT: May delivers Brexit deal ultimatum to Corbyn

FT: Timeline: how long can Theresa May last as PM?

FT: Tories try to avoid long term crisis as European election disaster looms

FT: Boris Johnson could face private prosecution over alleged Brexit bus claim

TEL: Theresa May to face PMQs after vowing to put deal to MPs in early June

TEL: Why people like me are flocking to the Brexit Party

TEL: Theresa May could have neutralised Nigel Farage. Now he’s her worst nightmare

TEL: Theresa May and her ministers still want to deliver Brexit, but they don’t know how

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

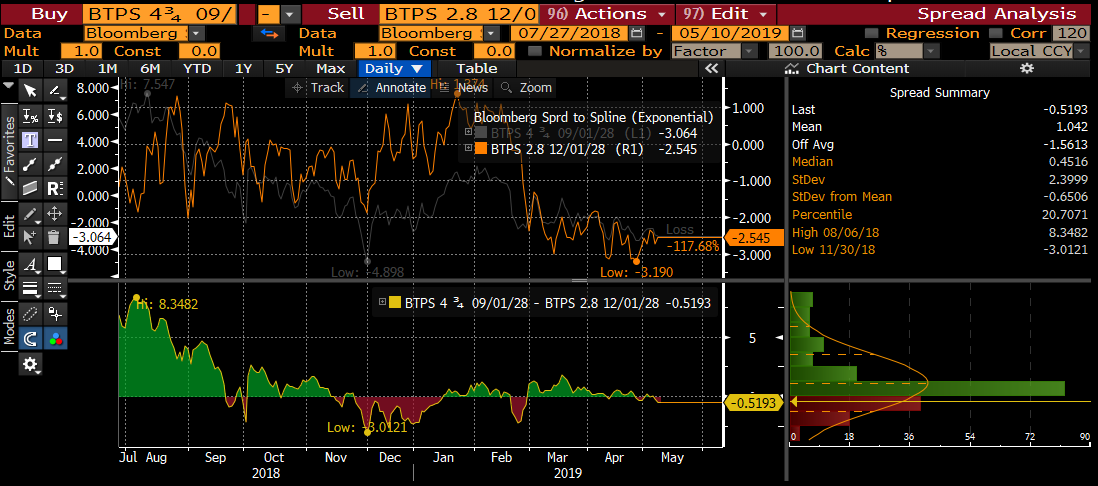

IK delivery #2 - James Rice @Astor Ridge

Hi Greg and Dan,

Updated the IK delivery analysis to include the LC bonds as deliverable –

the NEW info is marker lower AFTER the bar lower (like the one below this line) in the message that reads AMENDED PORTION, but give the whole thing a read through if you can pls

can I follow up with a call next few days?

What happens to a bond dropping out of Ik Delivery?

How can we profit from understanding the drop out process for the CTD to the IK?

What happened to Btps Mar26 and what do we expect for Btps Sep28?

Method

I have compared the Bloomberg spline Spread (exponential) here to remove some coupon effect and all the risk free curve component

Conclusions

- A current CTD has traded +2 to +13bp vs old LC issues

- They have traded cheap at the back end of their delivery cycle

- They have richened after dropping out – up to -6.5bp through the current CTD , but not vs other non – ctd’s

- Sep 28 look to have already done more than what Mar26 did when it dropped out (trade 1.2 bp richer than Dec28)

Trade theme

We got used to the theme…

expect a cheapness as a CTD, Expect a richness out of the basket – but that is contextual to neighbouring bonds

but that was dominated by the prevailing ik/rx mood and the use of ik as a hedging mechanism

Sep28 confounds – it has already travelled its journey..

- Sep28 is already (and has been flat in RV to slightly shorter LC issues

- Sep28 is already trading as rich in drop out terms to the next CTD Dec28

Hence the theme can be two parts

- when is the delivery ‘pull’ of ik over for sep28

- how can dec29, Aug29, Mar30 trade v each other when they constitute three deliverables that are quite close

- Ergo - Storm warning for the Dec/Mar futures roll

- Feb28 become the soft underbelly if the 9-10y market as they are unlikely ever to make CTD

Here’s how delivery looked historically in terms of CTDs

|

Yrs to mat. For each bond |

||||||||

|

contract |

delivery |

poss ctd |

1-Mar-26 |

1-Feb-28 |

1-Sep-28 |

1-Dec-28 |

1-Aug-29 |

1-Mar-30 |

|

Mar-16 |

10-Mar-16 |

1-Mar-26 |

9.97 |

11.89 |

12.48 |

12.73 |

13.39 |

13.97 |

|

Jun-16 |

10-Jun-16 |

1-Mar-26 |

9.72 |

11.64 |

12.23 |

12.47 |

13.14 |

13.72 |

|

Sep-16 |

12-Sep-16 |

1-Mar-26 |

9.46 |

11.38 |

11.97 |

12.22 |

12.88 |

13.46 |

|

Dec-16 |

12-Dec-16 |

1-Mar-26 |

9.22 |

11.14 |

11.72 |

11.97 |

12.63 |

13.22 |

|

Mar-17 |

10-Mar-17 |

1-Mar-26 |

8.98 |

10.90 |

11.48 |

11.73 |

12.39 |

12.98 |

|

Jun-17 |

12-Jun-17 |

1-Mar-26 |

8.72 |

10.64 |

11.22 |

11.47 |

12.14 |

12.72 |

|

Sep-17 |

11-Sep-17 |

1-Sep-28 |

8.47 |

10.39 |

10.97 |

11.22 |

11.89 |

12.47 |

|

Dec-17 |

11-Dec-17 |

1-Sep-28 |

8.22 |

10.14 |

10.72 |

10.97 |

11.64 |

12.22 |

|

Mar-18 |

12-Mar-18 |

1-Sep-28 |

7.97 |

9.89 |

10.47 |

10.72 |

11.39 |

11.97 |

|

Jun-18 |

11-Jun-18 |

1-Sep-28 |

7.72 |

9.64 |

10.23 |

10.47 |

11.14 |

11.72 |

|

Sep-18 |

10-Sep-18 |

1-Sep-28 |

7.47 |

9.39 |

9.98 |

10.23 |

10.89 |

11.47 |

|

Dec-19 |

10-Dec-19 |

1-Sep-28 |

6.22 |

8.14 |

8.73 |

8.98 |

9.64 |

10.22 |

|

Mar-20 |

10-Mar-20 |

1-Dec-28 |

5.97 |

7.89 |

8.48 |

8.73 |

9.39 |

9.97 |

|

Jun-20 |

10-Jun-20 |

1-Aug-29 |

5.72 |

7.64 |

8.23 |

8.47 |

9.14 |

9.72 |

|

Sep-20 |

10-Sep-20 |

1-Aug-29 |

5.47 |

7.39 |

7.97 |

8.22 |

8.89 |

9.47 |

|

Dec-20 |

10-Dec-20 |

1-Mar-30 |

5.22 |

7.14 |

7.72 |

7.97 |

8.64 |

9.22 |

|

Mar-21 |

10-Mar-21 |

1-Mar-30 |

4.98 |

6.90 |

7.48 |

7.73 |

8.39 |

8.98 |

NB

|

Underlying Instrument: |

|

Notional long-term debt instruments issued by the Republic of Italy with an original maturity of no longer than 16 years and a remaining time of maturity of 8.5 to 11 years and a coupon of 6 percent |

Btps 4.5% Mar26 – CTD Mar 2016 (estimated) – exited the delivery basket after Jun 17

vs OLD 8YR bond – see white line and red line

- As a CTD it never traded rich cs the older 10y

- It actually got to +13bp cheap as CTD – the was at the wide of the ik/rx spread

- Out of the basket it richened to other off the runs – but did not trade through (bond richened as it lost its CTD status in June 2017)

- Max +13bp, min +2bp

Vs incoming CTD Sep28

- bond cheapened vs the sep28 from mar 2016 to mid 2016 – but it started to richen at hallway through its delivery cycle. Again I think this is more a function of ik/rx

- After it dropped out in Jun 2017 it continued to richen all the way to Q3 2018

- Q3 of 2018 mar26 was richest to sep28 – again this is a function in my mid of sep 28 suffering as a hedge instrument with a wide ik/rx

Btps 4.75% Sep28 – CTD Sep 2017 – expecting to exit the delivery basket after Dec 19

vs old local LC bond (Dec28) – the bond has traded fairly ‘flat’ in Rv terms throughout the last 9 months since Oct

I would expect the sep 28 to be bounded vs Dec28 at -3bp – another 2.5bp richer from where we are

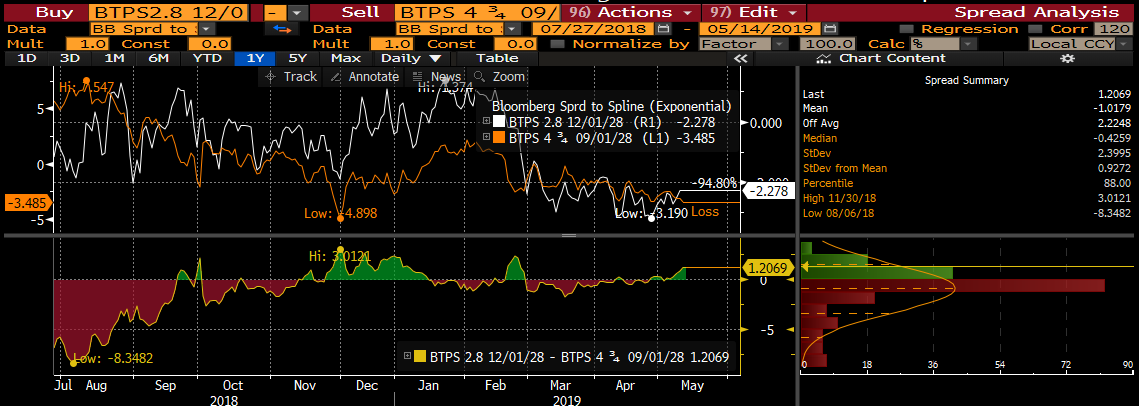

AMENDED PORTION….

So now we see that in all likelihood the Dec28 will be the next CTD

Vs incoming CTD

The bond is slightly rich to the Dec28, but with the exception of the fact that the former is high coupon and the latter is low – this could distend further

Delivery Structure -

Let’s take a look at the delivery structure into Dec – with exception of sep 28 which drop out in dec – the relative desirability of delivery will be

(*with the market at the current levels – there is directionality in the basis and curve and anomaly optionality – all of which makes the Mar2020 contract in determinate in its value – negatively convex)

Btps Dec28 clear CTD at the moment

Btps Aug29 25 cents richer than CTD (≈ 3bp)

Btps Mar30 50 cents richer the CTD (≈ 6bp)

*estimated from the dec19 delivery structure

SO……..

What does this mean?

Essential

- Sep 28 as an off the run are rich

- Mar26 richened because they were uber cheap as a CTD

- Mar26 NEVER traded through the low coupons once they dropped out

- Sep28 are through the low coupons now

- Sep28 are CTD for two more contracts – sep19 and dec19 – NB xmas CTD will be tough to short over the turn possibly

- The mar 30 will not be CTD unless things change hugely until Mar2021

- The Mar20 contract will have 3 CTDS that are a lot closer on CTD status than the jun, sep & dec contracts this year

- The Mar20 contract is riddled with indeterminacy – increasing the chances of a dec/mar roll squeeze

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796