Trade Radar, Italy long bond - 14th May James Rice @ Astor Ridge

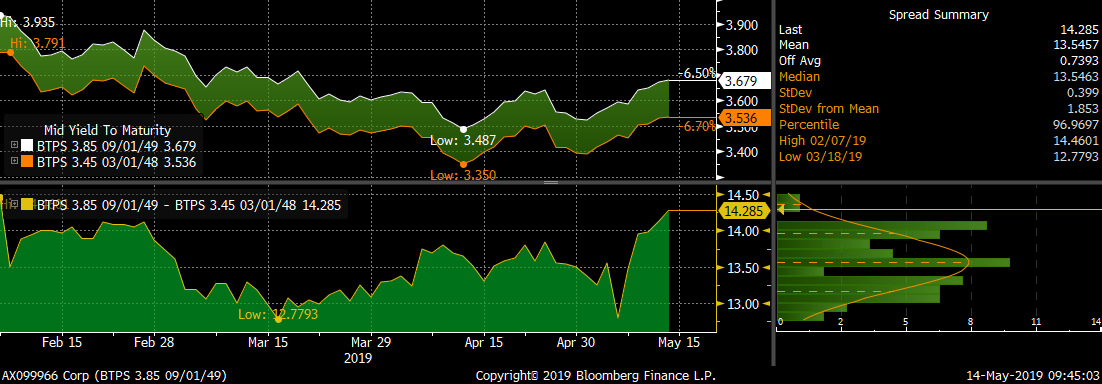

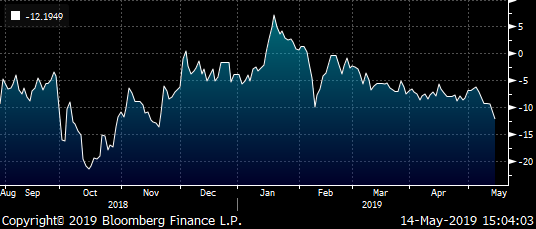

– just some thoughts on the Italian 30y today

– this is a 7/10 conviction for me – trade is generally good in RV terms but in mitigation is that we’re buying a tap bond that will remain so

Italian Tap – Tuesday 14th May

€ 1 – 1,5 Bln Sep49s

Recent cheap on yield spread

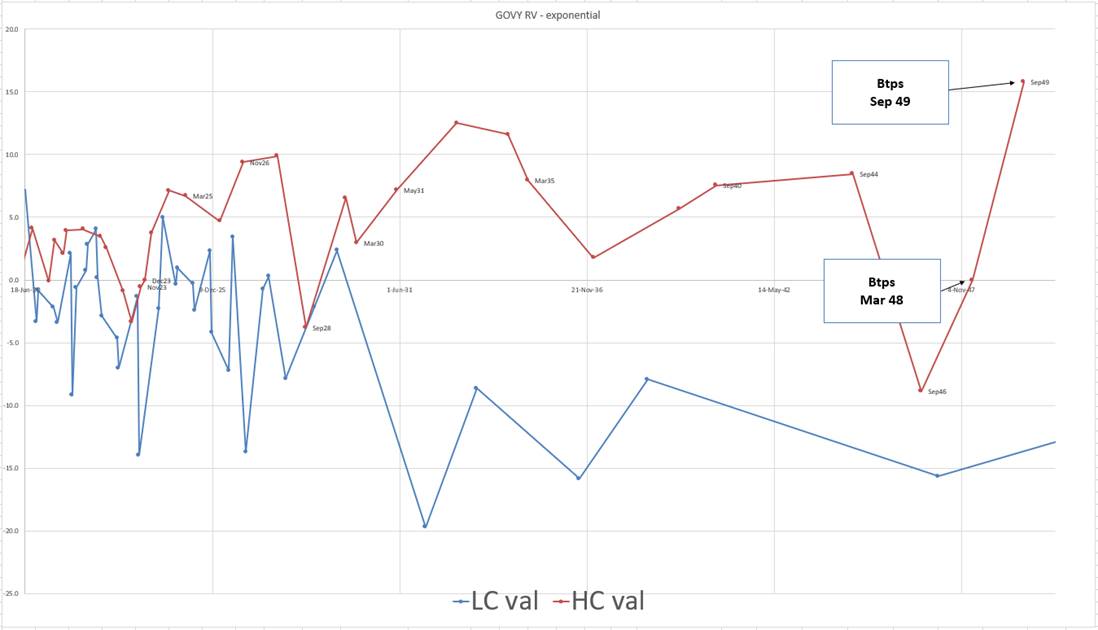

Cheap on Anomaly (BBG exponential spline)

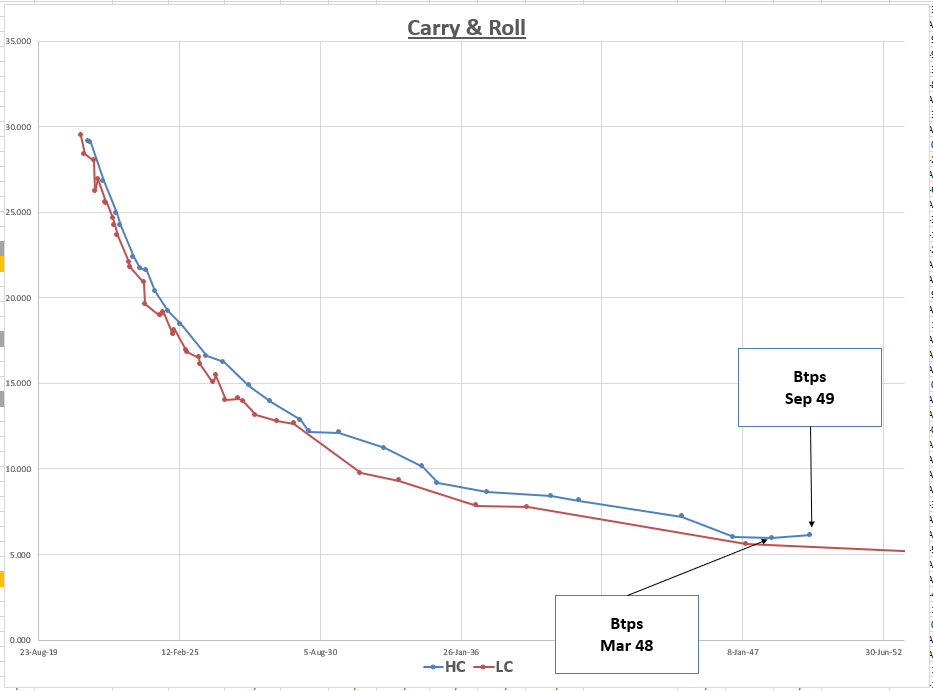

Slight positive Roll and Carry (@same repo) in a curve that is generally a give to extend

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: Trade Radar 2 , - 14th May James Rice @ Astor Ridge

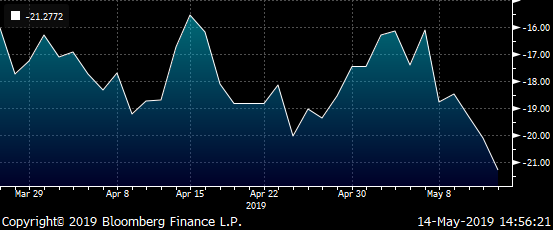

Italy 5s10s too flat

vs 2s30s

Italy 5s10s has out-flattened 2s30s

Trade

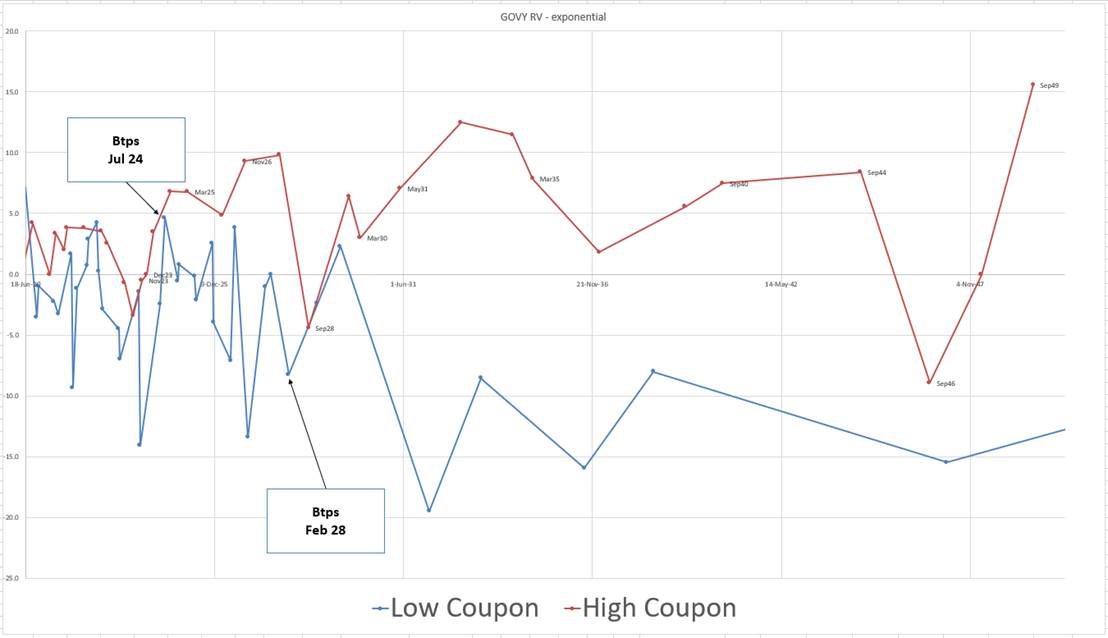

Sell €50k Btps 2% Feb 28, €65,6MM

Buy €50k Btps 1% 7/22, €163,4MM

Hedge with 25% risk in 2s30s…(based on curve shape)

Buy €12,5k Btps 3.85% sep49, €6,8MM

Sell €12,5k BTSA Italian 2 yr futures contract, 528 lots (CTD Btps 3.75% Aug21)

Entry: -21.3bp

Add: -24bp

Target: -10bp

Stop: -27bp

Roll and Carry:

History

Using actual issues

100 * ((YIELD[BTPS 2 02/01/28 Corp] - YIELD[BTPS 1.75 07/01/24 Corp]) - 0.25 * (YIELD[BTPS 3.85 09/01/49 Corp] - YIELD[BTPS 3.75 08/01/21 Corp]))

Using older issues

very approx. 1y older

oct20 / oct23 / jun27 / mar48

100 * ((YIELD[BTPS 2.2 06/01/27 Corp] - YIELD[BTPS 2.45 10/01/23 Corp]) - 0.25 * (YIELD[BTPS 3.45 03/01/48 Corp] - YIELD[BTPS 0.2 10/15/20 Corp]))

Using CMBS

Italy 5s10s has out-flattened 2s30s

Use this move to express some anomaly trades without having to take significant curve risk

put on a steepener 5s10s with a smaller 2s30s flattener to hedge the generic curve risk

In simple terms the sum of two flys,

long 2s5s10s plus short 5s10s30s gives us

-0.33* 2y + 5y -10y -0.33*30y

100 * ((RV0005P 10Y BLC Curncy - RV0005P 5Y BLC Curncy) - 0.33 * (RV0005P 30Y BLC Curncy - RV0005P 2Y BLC Curncy))

Very long term history…

Anomalous Issues, anomaly in your favour – Jul 24 and Feb 28

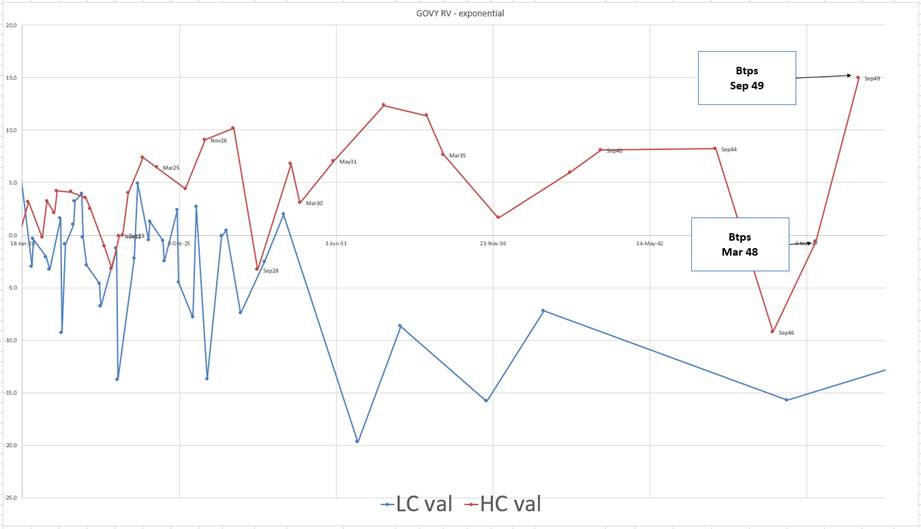

Bloomberg GOVY Spline Spread values – Exponential Fit

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

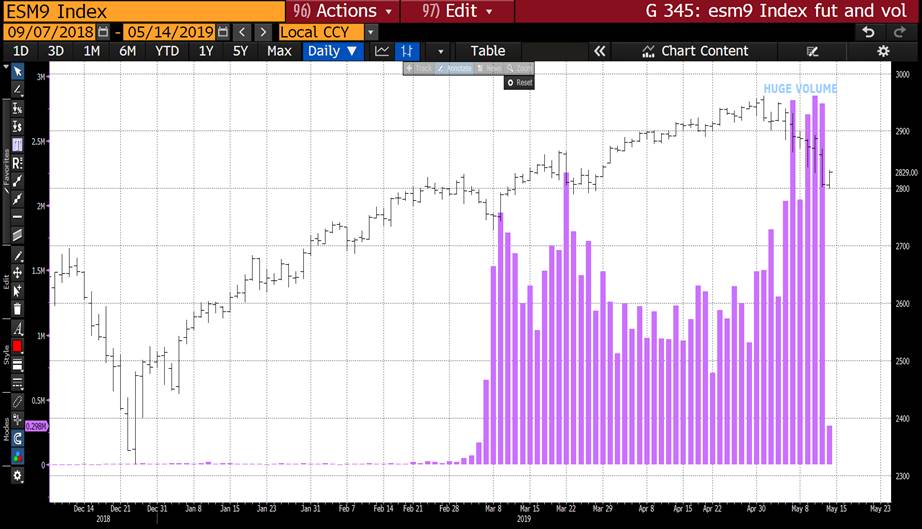

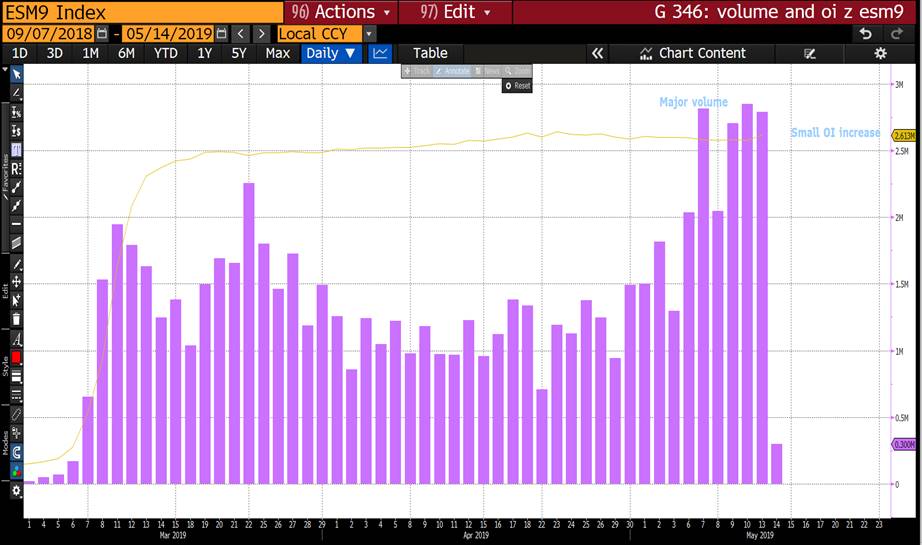

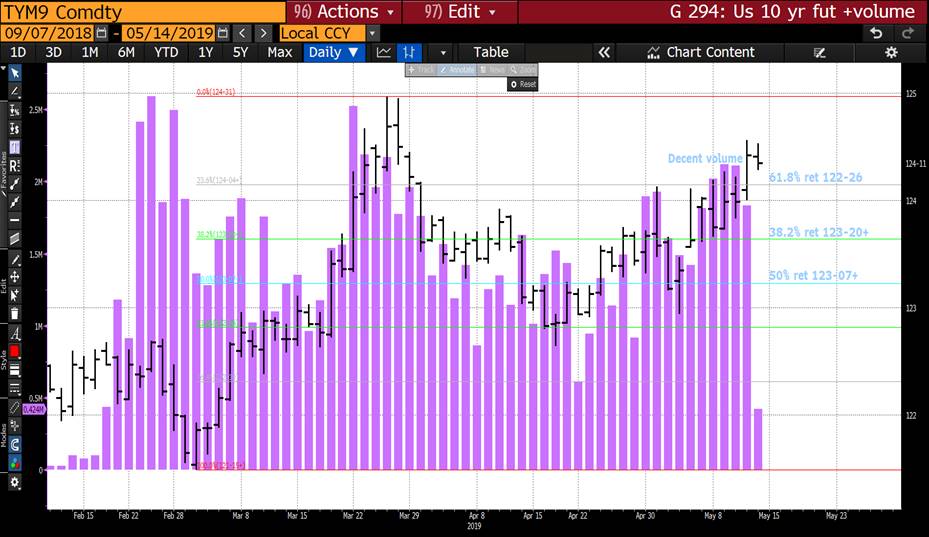

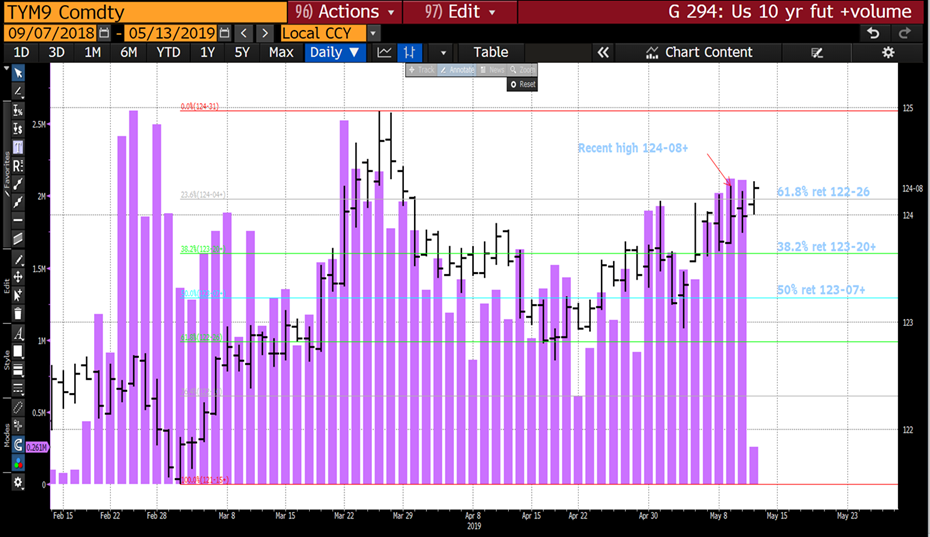

SPECIAL BOND AND EQUITY PIECE : VOLUMES AND OPEN INTEREST UPDATE, EQUITY VOLUME EXPLOSION.

SPECIAL BOND PIECE : VOLUMES AND OPEN INTEREST UPDATE, EQUITY VOLUME EXPLOSION.

EQUITY VOLUMES EXPLODED OVER THE LAST FEW DAYS BUT FAILED TO REFLECT IN THE “UNCHANGED” OPEN INTEREST.

BONDS CONTINUE TO SEE INCREASED VOLUME-OPEN INTEREST CORRESPONING TO ANY NEW HIGHS, AIDED BY CTA’S. US 10YR HAS SEEN THE BIGGEST VOLUME AND OI INCREASE RECENTLY.

I AM SURE THIS WILL SUBSEQUENTLY EFFECT THE DIRECTIONAL BIAS OF THE ROLL PERIOD, REAL MONEY WILL HAVE TO SELL THE ROLL IF THE BOND RALLY PERSISTS.

KEY : OI = OPEN INTEREST.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

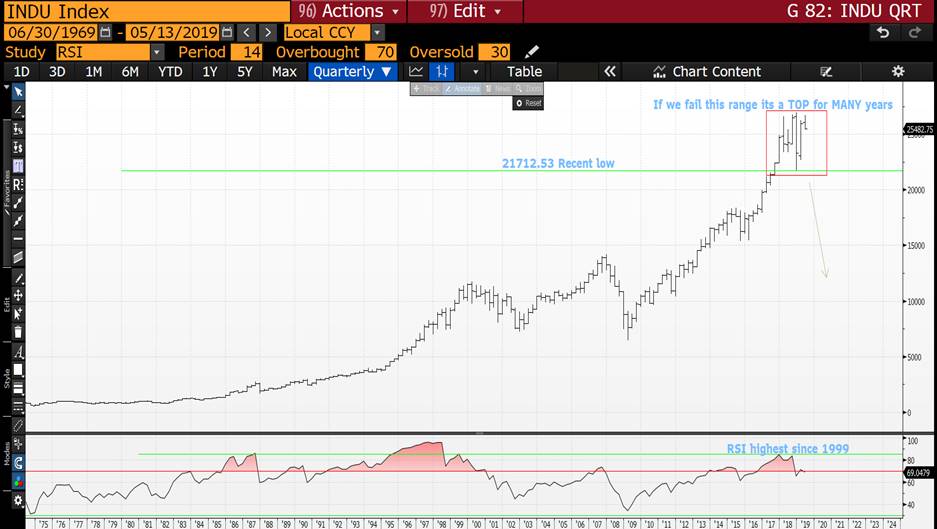

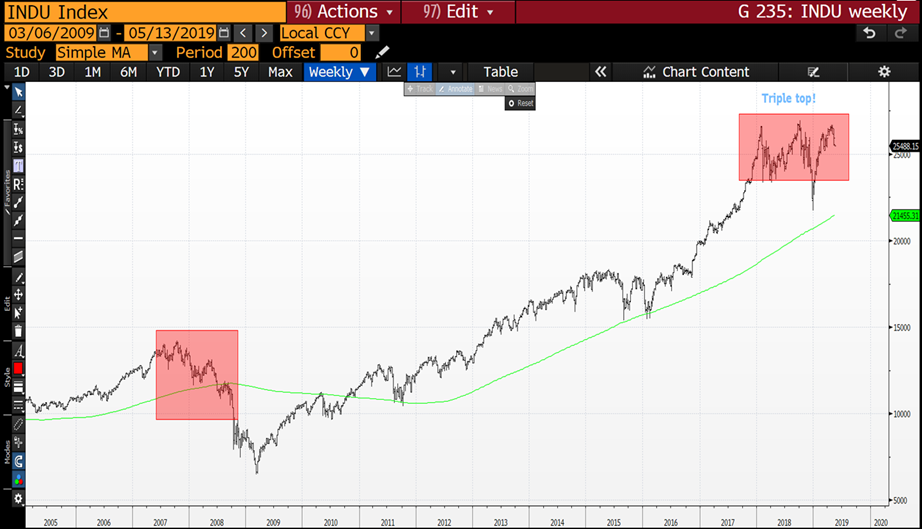

** PLEASE READ ** EQUITIES SPECIAL : POST THE FALLOUT, THE DAMAGE IS DONE.

EQUITIES SPECIAL : POST THE FALLOUT, THE DAMAGE IS DONE.

Some temporary support levels to note but remember in a significant number of cases the major damage has already been done. I have added moving averages across ALL charts as MANY notable ones have been breached.

Whilst bond yields continue their much publicized path lower, stocks are now showing signs of fatigue. Ultimately the very vocal and obstinate Mr Trump is helping matters, this definitely won’t end well.

UBER maybe a reflection of the “VALUE” stock, given its post IPO performance.

I HAVE INCLUDED BOTH US AND CHINA SINGLE STOCKS TO HIGHLIGHT DOWNSIDE POTENTIAL, APPLE BEING A FAVOURITE CHART, PAGE 23.

** THE US STOCK MARKET REMAINS THE MOST VULNERABLE GIVEN ITS RECENT PERFORMANCE. **

An interesting time, with a DOW chart forming a potential TRIPLE TOP, page 13.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

FW: Today's BREXIT BARRAGE... Here we go again...

BBG: May Seeks Support for Brexit Plan as Cross-Party Talks Falter

BBG: Nigel Farage’s Brexit Party Is Forecast to Win Big. But EU Populists May Still Fall Flat

FT: Theresa May to press ahead with Labour talks on Brexit

FT: Private equity cools on the UK over Brexit uncertainty

FT: Pro-Remain voters drift away from Labour as Brexit feud rages on

FT: Theresa May serves no one by clinging on to power

FT: The darkening gloom around Theresa May

BBC: Brexit: PM’s negotiator to explore changes to future EU relations

TEL: Theresa May considering ‘definitive votes’ as last throw of dice to break Brexit deadlock

TEL: Jeremy Corbyn warned Labour is haemorrhaging support as he agrees to simplify Brexit message

TEL: Cometh the hour, cometh the man – it’s time for the Tories to send for Boris

TEL: Thanks to the Brexit Party, the Conservatives can expect their worst ever result next week

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

** PLEASE READ ** EQUITIES SPECIAL : Trade talk turmoil! The failure of equity markets up at recent highs could form a very terminal outlook.

EQUITIES SPECIAL : Trade talk turmoil! The failure of equity markets up at recent highs could form a very terminal outlook.

Whilst bond yields continue their much publicized path lower, stocks are now showing signs of fatigue. Ultimately the very vocal and obstinate Mr Trump is helping matters, this definitely won’t end well.

UBER maybe a reflection of the “VALUE” stock, given its post IPO performance.

I HAVE INCLUDED BOTH US AND CHINA SINGLE STOCKS TO HIGHLIGHT DOWNSIDE POTENTIAL, APPLE BEING A FAVOURITE CHART, PAGE 22.

** THE US STOCK MARKET REMAINS THE MOST VULNERABLE GIVEN ITS RECENT PERFORMANCE. **

An interesting time, with a DOW chart forming a potential TRIPLE TOP, page 12.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BOND YIELD (SHORT-TERM) UPDATE : A POSITIVE START FROM US BOND FUTURES PUSHING NEW HIGHS, ULTIMATLEY KEEPING YIELDS ON THE LONGTERM TRAJECTORY LOWER!

BOND YIELD (SHORT-TERM) UPDATE : A POSITIVE START FROM US BOND FUTURES PUSHING NEW HIGHS, ULTIMATLEY KEEPING YIELDS ON THE LONGTERM TRAJECTORY LOWER!

US BOND FUTURES HAVE NEW HIGHS TODAY PROMPTING CTA’S TO BUY CONTACTS FOR THE REMAINDER OF THE DAY.

THE LONGTERM CHARTS CONTINUE TO CALL FOR MUCH LOWER YIELDS AND AN ACCELERATION POINT HAS BEEN REACHED.

EQUITIES CONTINUE TO BE DRAWN INTO FOCUS THANKS TO MR TRUMP AND THEY ALSO ARE SITTING ON MAJOR ACCELERATION POINTS.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Today's FARAGE BARRAGE... Nigel wants control...

Farage is back in the spotlight in a major way as his Brexit Party gains a commanding share of expected vote on May 23…

BBG: May Aims to Reopen Brexit Talks With EU to Win Corbyn’s Support

BBG: The White Walkers of Brexit Ride Again

BBG: London Housing Is Taking the Hardest Brexit Hit, Acadata Says

BBG: No-Deal Brexit Risk Bigger Than Firms Think, Business Chief Says

FT: Pressure mounts on Theresa May to quit as Tory support collapses

FT: Britain’s Remainers are too divided

TEL: Jeremy Corbyn under fresh pressure as Tom Watson and Keir Starmer demand second Brexit referendum

TEL: Nikki Page on why she has ditched the Tories for the Brexit Party after 45 years

TEL: Our complacent MPs should be prepared for a political earthquake

TEL: ‘You’re in denial’: Furious Nigel Farage lashes out at BBC for ‘ridiculous’ Marr interview

TEL: Raab infuriating the EU with demands May ‘never dared’ make shows why he should be PM, allies say

TEL: The Conservative Party faces a Canada-style death blow

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

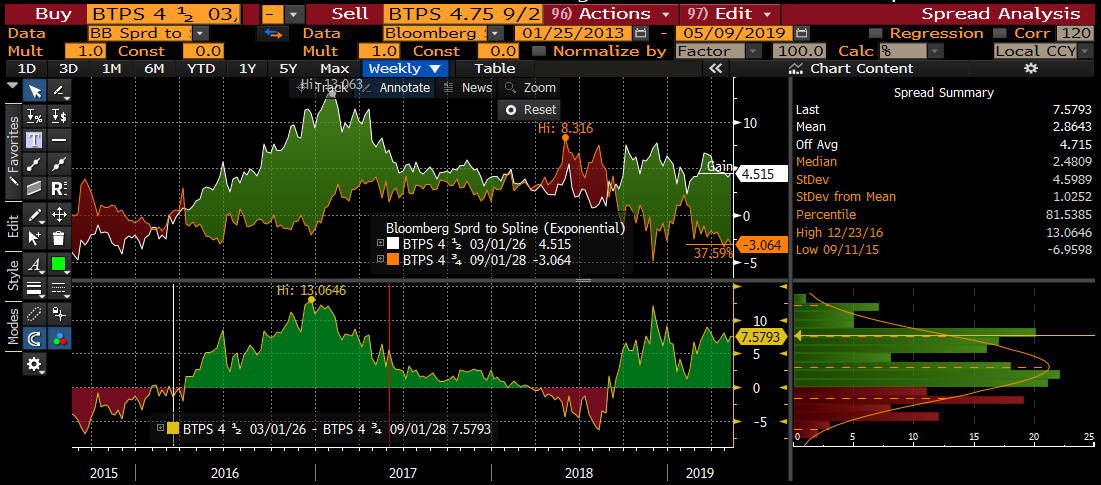

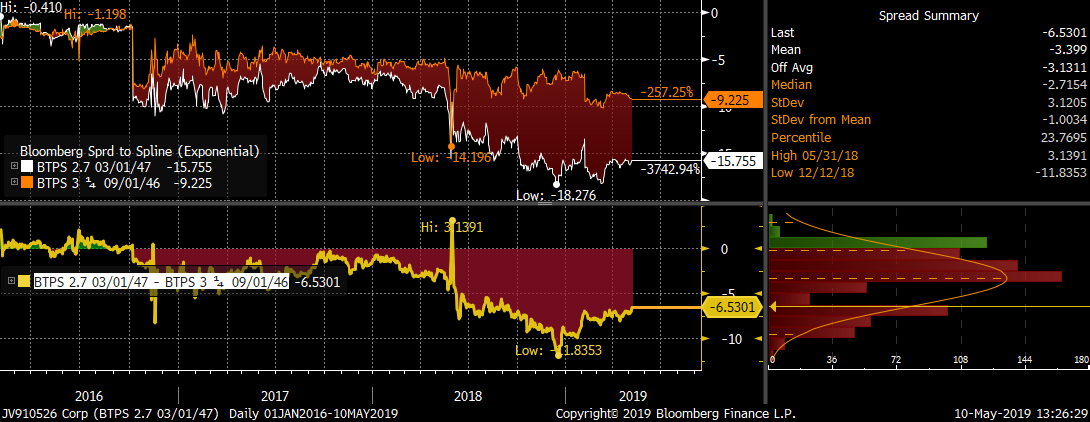

IK delivery - James Rice @Astor Ridge

What happens to a bond dropping out of Ik Delivery?

How can we profit from understanding the drop out process for the CTD to the IK?

What happened to Btps Mar26 and what do we expect for Btps Sep28?

Method

I have compared the Bloomberg spline Spread (exponential) here to remove some coupon effect and all the risk free curve component

Conclusions

- A current CTD can trade +2 to +13bp vs old LC issues

- They have traded cheap at the back end of their delivery cycle

- They have richened after dropping out – up to -6.5bp through the current CTD

- Sep 28 look to have already done what Mar26 did when it dropped out (trade approx 5bp richer than the incoming CTD)

Trade theme

Expect a cheapness as a CTD, Expect a richness out of the basket

However Sep28 confounds – it has already travelled its journey..

- Sep28 is already (and has been flat in RV to slightly short LC issues

- Sep28 is already trading as rich in drop out terms to the next CTD Mar30

Here’s how delivery looked historically in terms of CTDs

|

Yrs to mat. |

|||||

|

contract |

delivery |

ctd |

1-Mar-26 |

1-Sep-28 |

1-Mar-30 |

|

Mar-16 |

10-Mar-16 |

1-Mar-26 |

9.97 |

12.48 |

13.97 |

|

Jun-16 |

10-Jun-16 |

1-Mar-26 |

9.72 |

12.23 |

13.72 |

|

Sep-16 |

12-Sep-16 |

1-Mar-26 |

9.46 |

11.97 |

13.46 |

|

Dec-16 |

12-Dec-16 |

1-Mar-26 |

9.22 |

11.72 |

13.22 |

|

Mar-17 |

10-Mar-17 |

1-Mar-26 |

8.98 |

11.48 |

12.98 |

|

Jun-17 |

12-Jun-17 |

1-Mar-26 |

8.72 |

11.22 |

12.72 |

|

Sep-17 |

11-Sep-17 |

1-Sep-28 |

8.47 |

10.97 |

12.47 |

|

Dec-17 |

11-Dec-17 |

1-Sep-28 |

8.22 |

10.72 |

12.22 |

|

Mar-18 |

12-Mar-18 |

1-Sep-28 |

7.97 |

10.47 |

11.97 |

|

Jun-18 |

11-Jun-18 |

1-Sep-28 |

7.72 |

10.23 |

11.72 |

|

Sep-18 |

10-Sep-18 |

1-Sep-28 |

7.47 |

9.98 |

11.47 |

|

Dec-19 |

10-Dec-19 |

1-Sep-28 |

6.22 |

8.73 |

10.22 |

|

Mar-20 |

10-Mar-20 |

1-Mar-30 |

5.97 |

8.48 |

9.97 |

|

|

|

|

|

|

|

NB

|

Underlying Instrument: |

|

Notional long-term debt instruments issued by the Republic of Italy with an original maturity of no longer than 16 years and a remaining time of maturity of 8.5 to 11 years and a coupon of 6 percent |

Btps 4.5% Mar26 – CTD Mar 2016 (estimated) – exited the delivery basket after Jun 17

vs OLD 8YR bond

- Here’s BBG RV spread value vs the old on the run bond (dec25)

- bond richened as it lost its CTD status in June 2017

- it NEVER traded through (low of about +2bp) vs the olds

- it did not cheapen on that metric until the credit blow up H2 2018

- Max +13bp, min +2bp

Vs incoming CTD Sep28

- bond cheapened vs the incoming CTD from mar 2016 to mid 2016 – but it started to richen at hallway through its delivery cycle

- After it dropped out in Jun 2017 it continued to richen all the way to Q3 2018

- The cheapest the bond got to on RV anomaly spread was +13bp, the richest was -6.4bp

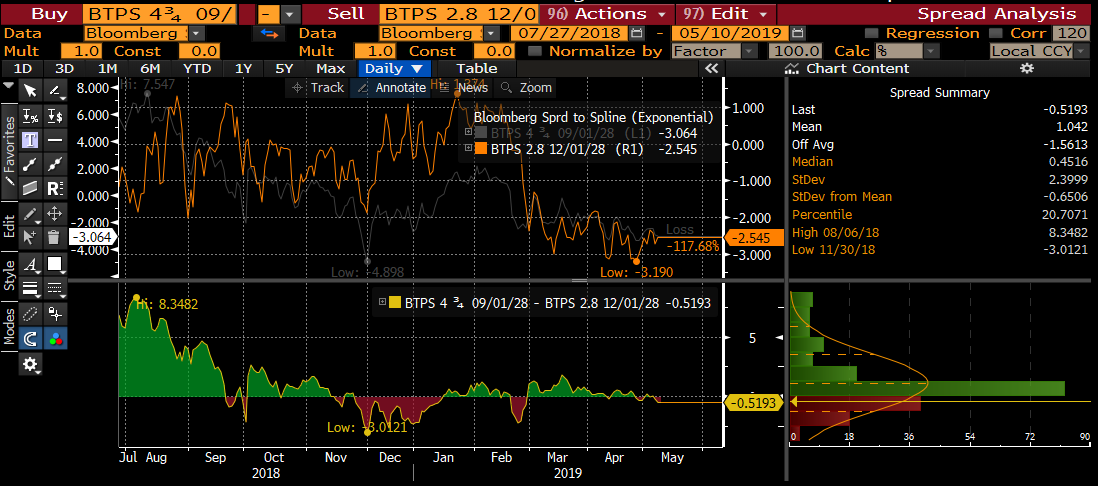

Btps 4.75% Sep28 – CTD Sep 2017 – expecting to exit the delivery basket after Dec 19

vs old local LC bond (Dec28) – the bond has traded fairly ‘flat’ in Rv terms throughout the last 9 months since Oct

I would expect the sep 28 to be bounded vs Dec28 at -3bp – another 2.5bp richer from where we are

Vs incoming CTD

The bond is already 5 richer then the incoming CTD – Mar30!

Let me know

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

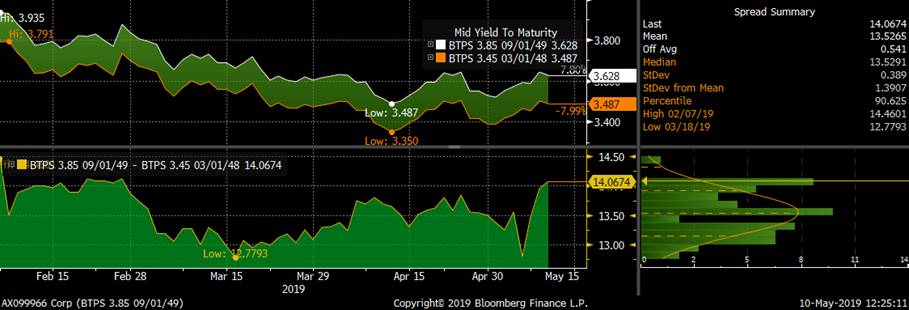

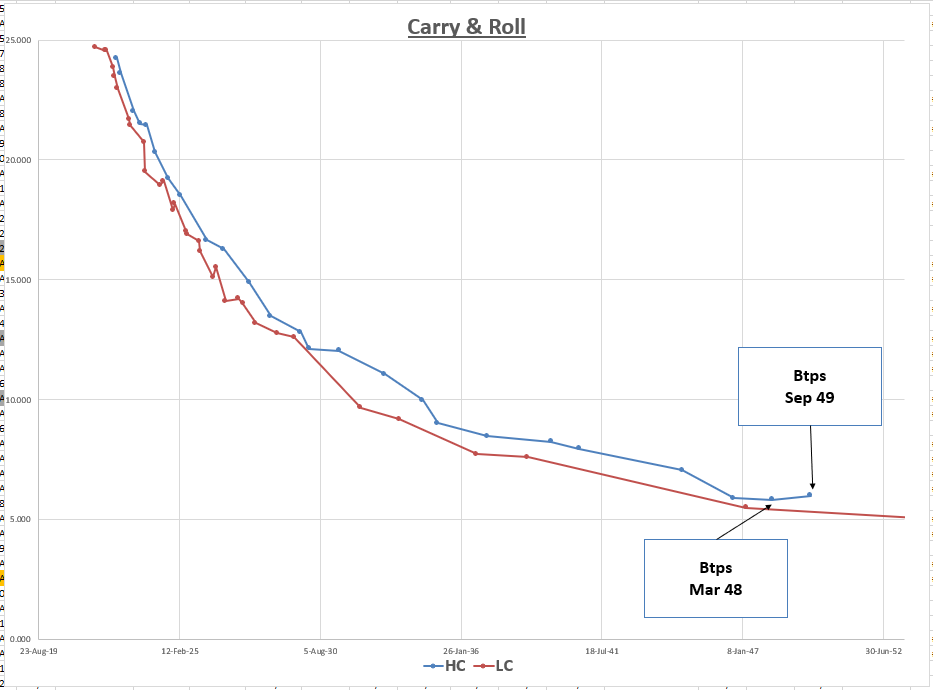

Italian long bond Roll - James Rice @Astor Ridge

Italian Long Bond Roll Trade

Sell Btps 3.45% Mar48, €56.1MM (€100k/bp)

Buy Btps 3.85% Sep49, €53.7mm (€100k/bp)

+14.1bp

Bbg History

Currently @+14.1bp,

Add @ +15.6bp

Average entry +14.85bp

Long Term Target +9bp (PnL 5.85bp)

Stop @ +17.3bp (Loss to Avg – 2.45bp)

Italy announced on Thursday 10th May a tap of the Italian 30y

Btps 3.85 % Sep49 - €1 -1.5 bln

The bond looks cheap on RV – Bloomberg Spline Exponential Spread values

Roll and Carry is slightly positive (@same repo) for a curve where the context is giving carry and roll to extend…

As with buying cheap tap issues the key is determining NOT that they trade cheap but how cheap is too much…

Let’s look at the prior two thirty year issuances.. btps 3.45% Mar 48 and Btps 2.7 Mar 47

The question we pose is

‘During the whole issuance cycle and beyond, how cheap can the 30y role run get?’

Method

We use the Bloomberg spline exponential Spread value between two issues.

This gives an accurate anomaly value that we can compare old vs new 30y

Btps 47 vs Btps 48

The widest this spread anomaly got to is +24.3bp (at the recent wide in It/Ge spreads) – for an increase in coupon of 75bp

Btps 46 vs Btps 47

The wide this actually got to a pick-up of only 3.1bp – because here we were surrendering 55bp in coupon

Interpolation to figure out the right value for the coupon change…

If we linearly interpolate these two point we can estimate what we expect the extreme might be (in BBG spline spread terms) we might observe

Btps 48s -> 49s +40bp in coupon, max spread ??

Btps 47s -> 48s +75bp coupon, max spread +24.3bp

Btps 46s -> Btps 47s -55bp coupon, max spread +3.1bp

so by linear interpolation …

Theoretical Max Spread for 48s 49s to be

+18.6bp, which equates to a yield spread right now of +17.1bp

– stop positioned @ +17.3bp

NB the current yield spread equates to a BBG spline spread of another 1.3bp

Hence

Yield Spread +14.1bp ≡ Spline Spread +15.4bp

For further details please let me know

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796