MACROCOSM: EGBs - RV Implications of April Index Extensions

- April’s large coupon and redemption flows always help to generate large index shifts in EGBs, especially in France and Germany. This month’s no exception as tomorrow’s monster C&R flows of Eur 43bn in France lead a large liquidity wave into the market. (Spain’s 22.4/5.1 redemption/cpns related to their maturing SPGB 2.75 4/30/19s are too late to be included in April’s #s for some index providers like BARX but make it into others. Either way, there’s a tail-wind in SPGBs too, coming just after Spain’s elections on Sunday.)

- Here’s the latest data from BARX for the EGB issuers most affected this month. What’s relevant to us is not just the size of the duration move but the shift in the duration ‘bogey’ that could impact which underlying issue benefits most in the revised benchmark. We can also see that there are shifts in % country allocation that could impact net demand, especially from passive index accounts. The Apr/May Bench is the issue on the curve that most closely matches the duration bogey of the index. The last two columns are the curve sectors that are most affected by these index shifts.

|

Country |

% weight Apr |

% Weight May |

Apr Duration |

May Duration |

Apr Bench |

May Bench |

Curve sector 1 |

Curve Sector 2 |

|

Germany |

16.55 |

16.42 |

7.64 |

7.78 |

DBR .25 7/27 |

DBR .25 7/27 |

16+ +0.84yr |

4-7 +.35yr |

|

France |

25.15 |

24.95 |

8.13 |

8.33 |

FRTR 5.5 4/29 |

FRTR 5.5 4/29 |

16+ +1.57yr |

7-11 +1.30yr |

|

Italy |

22.02 |

22.29 |

6.55 |

6.55 |

BTPS 1.6 6/26 |

BTPs 1.6 6/26 |

7-11 +.71yr |

11-16 +.45yr |

|

Spain |

14.38 |

14.59 |

7.46 |

7.46 |

SPGB 1.5 4/27 |

SPGB 1.5 4/27 |

16+ .55yr |

7-11 +.52yr |

|

Netherlands |

4.87 |

4.92 |

8.27 |

8.28 |

DSL 5.5 1/28 |

DSL 5.5 1/28 |

7-11 +.30yr |

16+ +.13yr |

|

Portugal |

2.29 |

2.31 |

6.44 |

6.53 |

PGB 2.875 7/26 |

PGB 2.875 7/26 |

16+ +.15yr |

7-11 +.13yr |

|

Ireland |

1.95 |

1.78 |

7.37 |

8.02 |

IRE 1 5/26 |

IRE .9 5/28 |

N/A |

N/A |

|

Finland |

1.57 |

1.48 |

6.87 |

7.44 |

RFGB .5 4/26 |

RFGB .5 8/27 |

16+ .22yr |

4-7 +07yr |

- Observations:

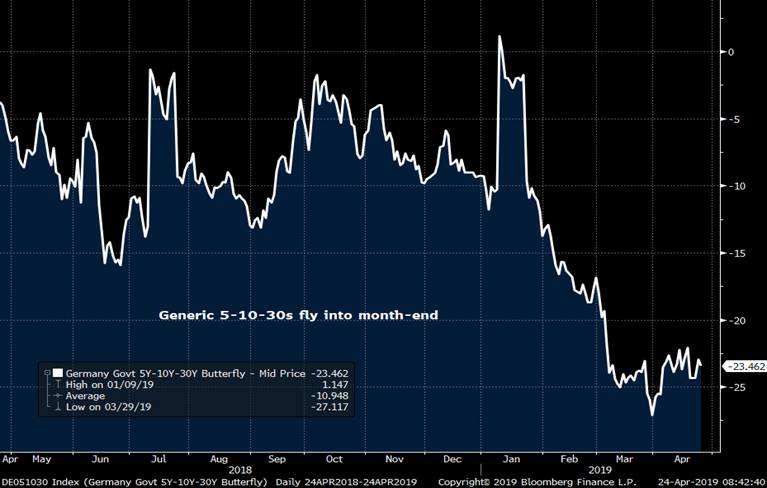

- Germany’s % of the broad index dips a bit but the duration extension is significant. The benchmark is unched but the sector shifts argue for a short 5-10-30s fly into month-end. See graph below.

- France remains the largest component of the broad EGB index, even with the .2% decline in their % allocation. The 0.2yr index extension is significant in risk terms (given how big they are), however, price action to start the week suggests the market was well positioned for the Apr seasonal rally in OATs. The benchmark issue is an old high-cpn off the run issue that, while large at Eur 35.6bn+, has had 2.7bn of them stripped and is prone to bouts of illiquidity. More importantly for us, however, is the issue has richened 4.5bps vs the FRTR 5/28s and FRTR 5/30s since late March, reflecting the richening/tightening of OATs and this large index move.

- Italy’s share of the index rises .27% in May with duration #s that are unched. The BTPS 1.6 6/26s have been perennially rich to the BTPS curve, due to their ‘safe haven’ status as a low cpn issue but also their usefulness as a BTPS index barometer. Chunky curve extension of .71yrs in the 7-11yr sector argues for a curve-flattener into month-end although this week’s bumpy performance in IKM9 adds an element of risk here. Perhaps micro flatteners like the BTPS 1.25 12/26 into BTPS 2.05 8/27s makes sense, still close to the wides on a Z-sprd box…

- Spain’s situation is similar to Italy’s with a bit of a twist. While Spain’s duration is unched (at least for BARX’s index), their share of the broad index rises .21% and there’s a nice Eur 27.5bn boost coming on Apr 30th from the maturing SPGB 4/30/19s. We’ve been big fans of SPGBs this year given Spain’s bright outlook within the Eurozone and the still relatively generous spreads they trade at vs OATs. That said, this Sunday’s elections in Spain could be a speed bump on their road to prosperity that we’re happy to be sidelined for. A benign outcome will have us jumping on long SPGB vs OATs and BTPS blends and curve flatteners in Spain. The SPGB 7/33 vs FRTR 5/34s spread we’ve been in and out of (took profits on our narrower at 70bps mid last week) is now back to 75.75bps and hopefully on its way to the +80bps zone where we’ll be buyers again.

- Holland’s stats are pretty benign all told. At under 5% of the index NETHER paper could be considered an after-thought by the big players. That said, it’s solid credit rating and spread nestled between DBRs and OATs makes them an interesting play. The benchmark issue is an old high cpn issue that doesn’t trade much so we would imagine most have a blend of NETHER 7/27s and 7/28s. We’re still long NETHER 7/28s vs DBR 2/28s and FRTR 5/28s.

- Portugal, Ireland and Finland barely surpass Holland’s share of the index, making them more tactical plays than core positions. We’ve seen over the last couple months that their bonds can offer nice opportunities given one has the patience to keep a close eye on them. The duration extension in Ireland this month has been well prepared for with the 5/26-5/29 spread at its lows and IRISH-FRTR 10yr spreads narrowing 18+bps this year, now at 16.4bps, just off the lows seen last June. Brexit is still a worry for Ireland but you’d never know it from the way their bonds trade. Finland’s index move this month is substantial enough to cause a shift longer in their bogey but, as with IRISH, this is largely priced in.

- Graphs:

DBR 5-10-30s fly – still rich…

FRTR 5/28-4/29-5/30 fly – Richening into April’s seasonal bias

BTPS 1.25 12/26 vs BTPS 2.05 8/27 MMS box

SPGB 7/33 vs FRTR 5/34s sprd has bounced since we took profits last week – looking to get back in around +80bps…

We’ll be in touch.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

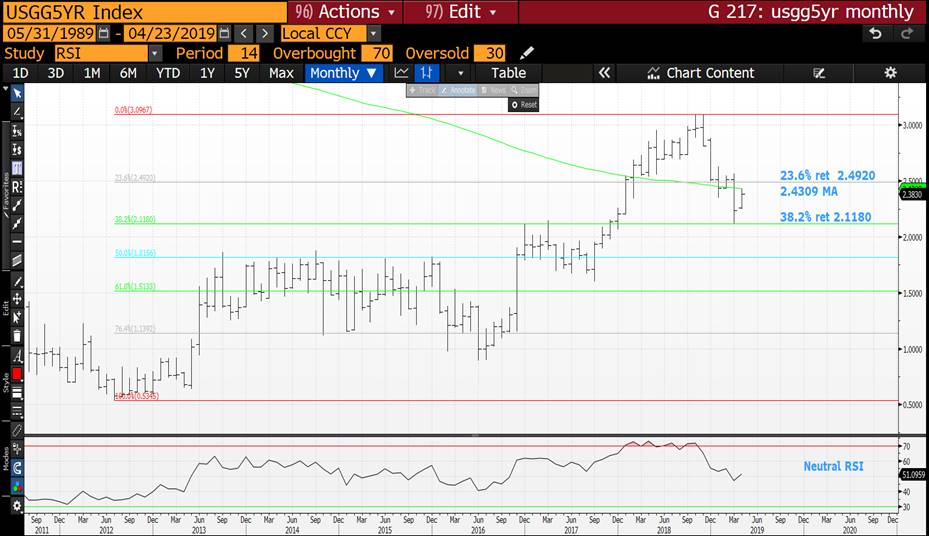

BOND YIELD (SHORT-TERM) UPDATE : YIELDS LOWER AGAIN : It looks like yesterday vindicated and continues the yield call LOWER, we just need to capitalise on that into the week-month end!

BOND YIELD (SHORT-TERM) UPDATE : YIELDS LOWER AGAIN :

It looks like yesterday vindicated and continues the yield call LOWER, we just need to capitalise on that into the week-month end!

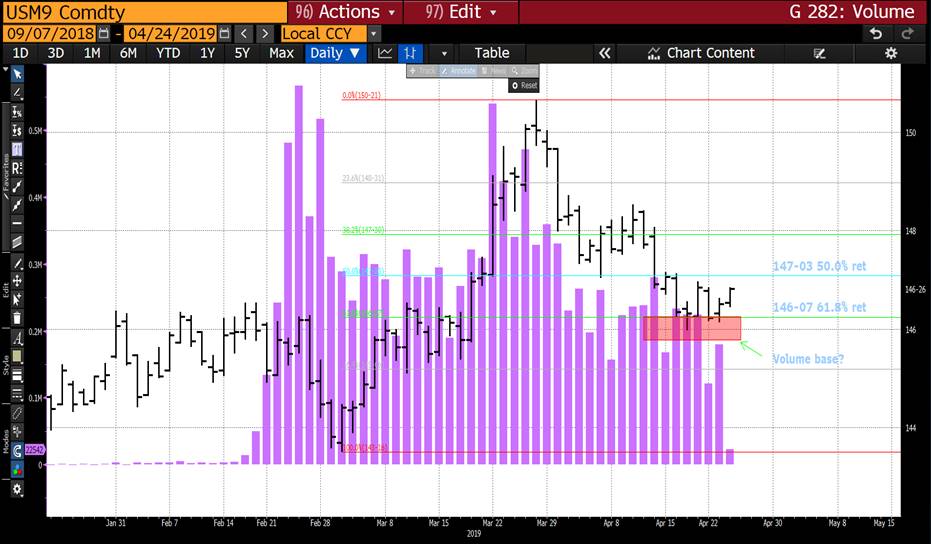

The US has seen the biggest VOLUME buying at the lows on last week’s DIP compared to Europe.

It does feel we will have a concentration of activity around a month end!

We also need to extend some of the MINOR ranges we currently have.

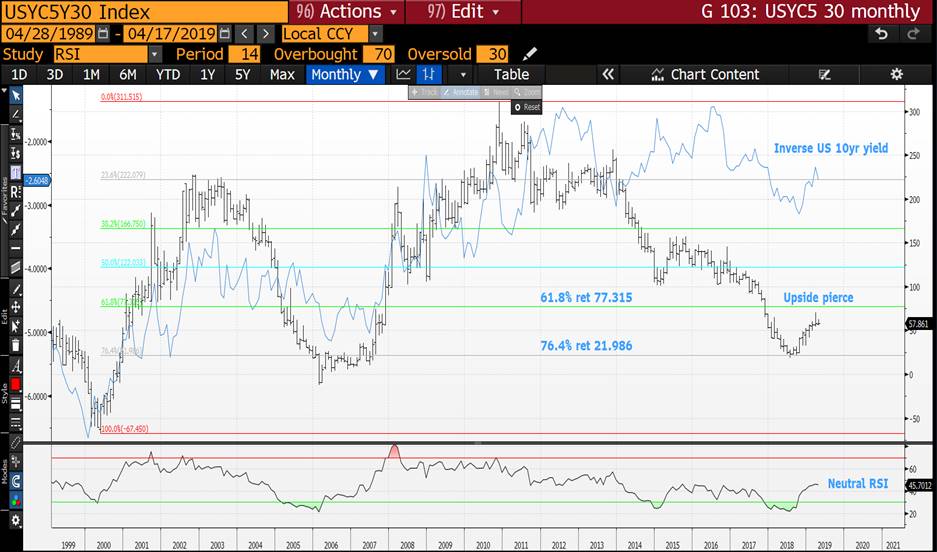

The best contract to highlight KEY resistance across all maturities is US 5yr yields, failing MOST moving averages. We do need new yield lows on todays close.

Yields will need to fail into month end OR the BIGGER YIELD call lower will “PAUSE”.

The LONGTERM charts remain unaffected BUT the recent daily volumes indicate significant profit taking especially in Germany.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Today's BREXIT BARRAGE...

FT: Conservative grandees warn Theresa May her time is almost up

FT: Theresa May plans new Commons Brexit vote in high-stakes move

FT: Hedge funds warm up to the prospect of a pound rally

FT: Bad news for the ‘Global Britain’ Brexiters

FT: Remainers look as fractured as they did in 2016

FT: London commercial property starts to feel Brexit chill

BBG: May Considers Latest Gamble to Get Brexit Done Within Next Month

BBG: Brexit ‘Rules of the Game’ Urgently Needed, U.K.’s Bailey Says

TEL: Theresa May told by Cabinet ministers to dump talks with Labour and sort out her Brexit deal

TEL: Why a rule change by the 1922 Committee to remove Theresa May could backfire on Conservatives

TEL: Small wonder that central banks, including the Bank of England, find their independence under threat

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

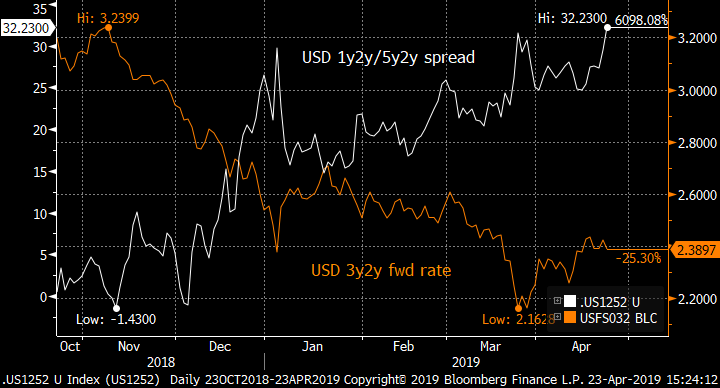

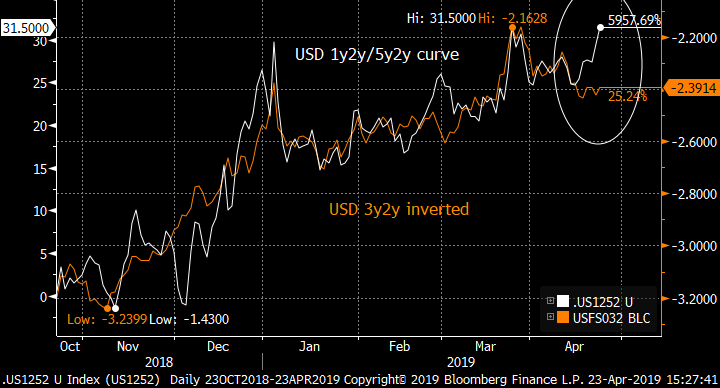

Swap curve RV: USD 1y2y/5y2y is too steep compared to 3y2y

Bottom line: A straightforward swap RV trade in USD, where the forward curve of 2y rates looks too steep for the level of rates. The dislocations have been short-lived historically, so this is a tactical trade: though pleasingly the hedged flattener has positive curve rolldown.

Trade:

Pay USD 525mm 1y2y swap

Receive USD 572mm 5y2y swap

Receive USD 165mm 3y2y swap

Bloomi CIX: 100 * (USFS052 Curncy - USFS012 Curncy + 0.3 * USFS032 Curncy)

Entry at 103bp, target 97bp

3m rolldown index at 97.3bp

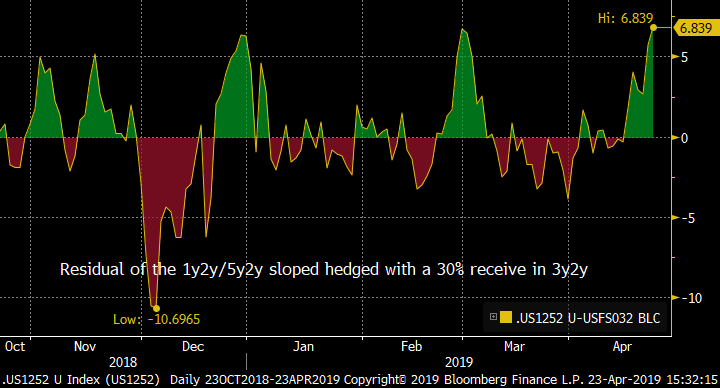

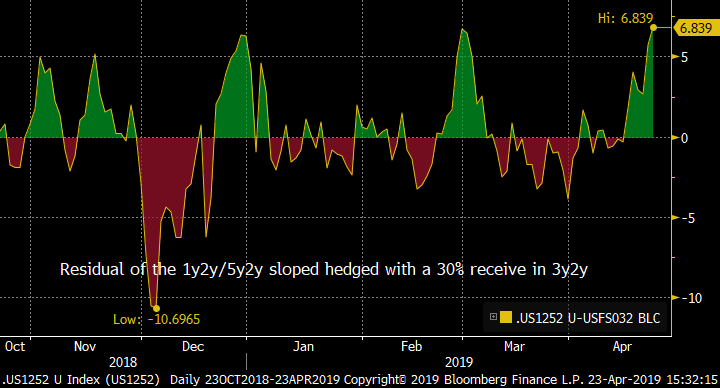

Residual of the swap package:

Rationale: I have been running a screener for some time now on USD, EUR and GBP forward swap curves to detect short-term dislocations on curve directionality. I scan the surface in each currency for segments where the slope is out of line with the level of rates, using an intermediate forward rate as the hedge. Given the regime shift in the US in November last year, this screening process has not been yielding much fruit for USD, as the curve directionality has been unsteady. As the market settles into the new mode of reduced Fed activity, the filter is starting to detect some short term anomalies.

The screening is based on three criteria:

- The regression statistic of the curve segment vs rate (R*2): 90% or better

- The residual (in bp) of the regression: at least +/- 5bp

- The number of standard deviations from the average: at least 2.0 standard deviations

Further to these, I also monitor the historical highs and lows of the residual and the final ‘nice-to-have’ which is the rolldown of the trade (though most of the residuals are rapidly mean-reverting so roll is less of an issue).

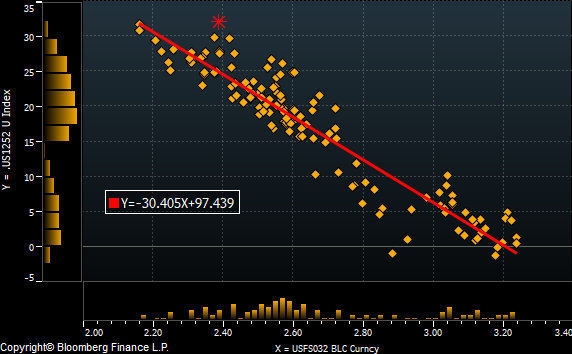

The filter is highlighting the 1y2y vs 5y2y curve segment, using the intermediate 3y2y rate as the hedge. Using the past 6m of history, the hedge ratio is 30% of the 3y2y (in DV01 terms).

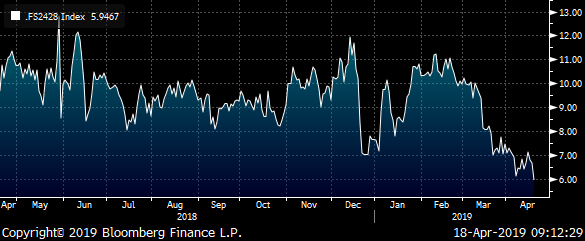

The relationship is easier to see when the 3y2y rate is inverted: the 1y2y/5y2y curve has moved out of line with the level of rates:

This is the regression between the 1y2y/5y2y slope (y-axis) and the 3y2y rate (x-axis). Again the curve appears too steep given the level of rates by around 6bp.

Thus we can create a hedged package of a 1y2y/5y2y flattener combined with an additional long (receive) in 3y2y with a weighting of 30%. The next chart has the residual, which shows good mean reversion and is currently at an extreme, matching the two previous highs. On the 6 month history, this signal is 2.1 standard deviations from the mean.

One final kicker is the curve rolldown. On the given hedge weighting, this trade rolls positively by just under 6bp over the first 3 months.

The main risk to this trade (as to all RV trades) is that history is not a guide to the future, and the curve regime changes. This is intended as a tactical trade on a short-term dislocation with other market conditions remaining stable. Should Fed expectations change markedly then the regression on which the weights are based will break down (either in the trade’s favour or against).

As always, your feedback is appreciated!

Best wishes

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND YIELD (SHORT-TERM) UPDATE : THERE REMAINS TIME FOR YIELDS TO FALL GIVEN MONTH END APPROACHES AND QUARTERLY CHARTS STRUGGLING AGAINST HISTORICAL MOVING AVERAGE RESISTANCE!

BOND YIELD (SHORT-TERM) UPDATE : THERE REMAINS TIME FOR YIELDS TO FALL GIVEN MONTH END APPROACHES AND QUARTERLY CHARTS STRUGGLING AGAINST HISTORICAL MOVING AVERAGE RESISTANCE!

The best contract to highlight KEY resistance across all maturities is US 5yr yields, failing MOST moving averages.

It does feel we will have a concentration of activity around a month end!

Yields will need to fail into month end OR the BIGGER YIELD call lower will “PAUSE”.

This has been a quiet month given the recent volume liquidation.

The LONGTERM charts remain unaffected BUT the recent daily volumes indicate significant profit taking especially in Germany.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Today's BREXIT BARRAGE... Same as it ever was...

Looks like the Tories have spent their Easter break sharpening their knives…

BBG: May Returns to Face Brexit Crisis as Leadership Pressure Grows

BBG: Paris Is Going All Out for London’s Brexit Exiles

BBG: Britain Turns to Politics of Protest as Brexit Drift Persists

BBC: Brexit: Cross-party talks to resume

BBC: Brexit: Labour must back another referendum – Tom Watson

FT: Brexit shows flaws of ‘nationalistic’ politics, says Greek PM

FT: Britain told it is losing influence in Washington

FT: Brexit-backing Tory activists to seek Theresa May’s resignation

FT: Is there any hope left for Theresa May’s Brexit deal?

FT: Brexit has a chance to kick-start a period of radical change

TEL: No mainstream party is safe from the march of populism

Enjoy!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Astor Ridge Data, Supply and Events Calendars for Apr 22-26

From: Mark Funsch

Sent: 18 April 2019 09:59

Subject: Astor Ridge Data, Supply and Events Calendars for Apr 22-26

Generally speaking, it’ll be a pretty quiet week for data, supply and events post Easter.

UST 2, 5 and 7s supply on tap and just DBR 2/29s in Europe.

Data’s pretty thin too – see attached.

Enjoy your long weekend!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Taking down French supply - Thursday 18th -James Rice @Astor Ridge

Tomorrow, Thursday brings the mid-month French Supply

€7.75 – 9.25 Bln of

New Issue Frtr 0% Mar-25

Expecting > €4bln of the Frtr 25

&

Frtr 1.75% May23

Frtr 0% Feb22

Trade Mechanics

Sell OATA contracts to buy Frtr 0% 3/25 vs MMS

-3bp

target -8bp

stop: flat

Value

The new French Mar-25 is priced on the roll at +12.8bp over the outgoing 5y, Mar-24

As with most core, Euro on the runs, this makes it looks cheap

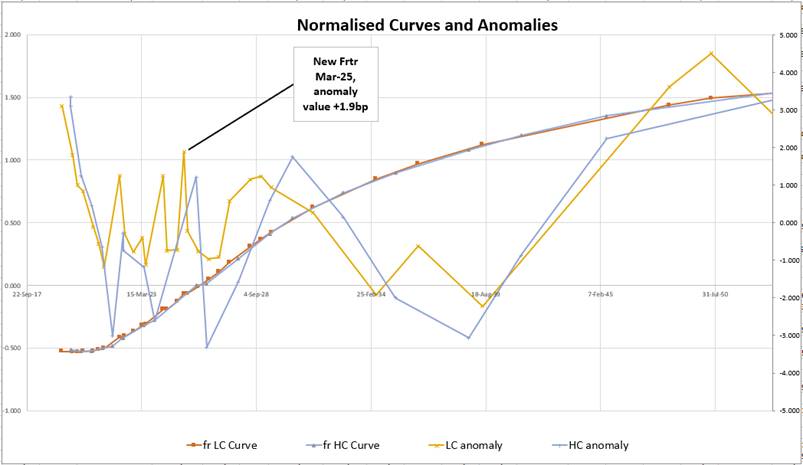

Here’s the French anomaly values versus a fitted curve…

Graph 1 – French Anomaly Values vs fitted curve

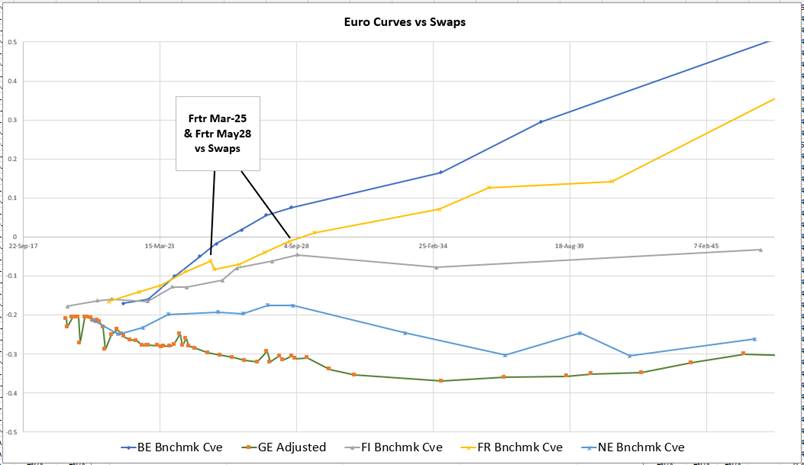

Relative to Swaps

- Shorter French bonds have seen a significant cheapening vs longer tenors relative to the swap curve in the run up to this supply

- To the extent that despite the French curve being steeper than the swap curve – parts of the 2025 to 2028 curve appear anomalously flat

May28 back into Mar25 is a give of just 4p relative to the swap curve

- Here’s the history of selling OAT contracts and buying the Frtr May25 (older bond and hence has history) vs swaps

(SP210[FRTR 0.75 5/28 Corp] - SP210[FRTR .5 5/25 Corp])

For more levels and details drop me a line or call

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

US CURVES UPDATE : I should of read more into the curve call and realised it was definitely associated with a directional change. Technically the curve calls working well.

US CURVES UPDATE : I should of read more into the curve call and realised it was definitely associated with a directional change. Technically the curve calls working well.

The focus has definitely shifted toward frontend steepeners.

Frontend curves have finally BASED JUST as the 5-30 and 10-30 fail MAJOR multiyear resistance.

I think the timing is perfect right now for that switch-fly trade.

The flies themselves have major multiyear dislocations and retracement support.

**A LOT OF THESE CURVE CHARTS HAVE HAD AN AMAZING TECHNICAL PERFORMANCE HENCE THINK ITS WELL WORTH A LOOK AND DISCUSSION.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Today's BREXIT Rundown... No News Used to Be Good News...

BBG: Brexit Bulletin: Taking a Breath

BBG: Brexit Jobs Spur Dublin Real Estate Boom

BBG: Brexit Delay Spurs U.K. Booking Frenzy for Summer Holidays in EU

BBG: Brexit Shreds Margaret Thatcher’s Tory Legacy

FT: What does Brexit delay mean for EU elections?

FT: The UK teeters on the verge of a Brexit breakdown

FT: Moderate Conservatives eye challenge for party leadership

FT: Efforts to forge anti-Brexit electoral alliance fail

TEL: Take back control? Brexit does not go far enough, says top economist Raghuram Rajan

TEL: Britain’s good news story on jobs hides a deeper economic shame that is not going away

TEL: The City hasn’t really been thrown under the bus by Brexit

Enjoy!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796