Bloomberg Bond News Summary > Wed Apr 17th

Business Briefing

1) China’s Economic Growth Unexpectedly Held Up in First Quarter

China’s economy unexpectedly held up in the first three months of the year as stimulus measures kicked in, helping stabilize sentiment rattled by trade tensions with the U.S. Gross domestic product rose 6.4 percent in the first quarter from a year earlier, exceeding economist estimates and matching the previous three months. In March, factory output jumped 8.5 percent from a year earlier, much higher than forecast. Retail sales expanded 8.7 percent, while ...

2) Asia Stocks Mixed After China Data; Dollar Slips: Markets Wrap

Stocks in Asia fluctuated after positive data on China’s economy raised doubts over additional stimulus. The 10-year Treasury yield ticked higher and the dollar pared gains. Japanese shares climbed while stocks in Hong Kong and Shanghai swung between gains and losses. China’s economic growth figures were above expectations, as was industrial production and retail sales data. The yield on China’s 10-year sovereign notes climbed to its highest level since ...

3) Apple Puts Need for 5G Ahead of Legal Fight in Qualcomm Deal

Apple Inc. put its flagship product, the iPhone, ahead of distaste for the way Qualcomm Inc. does business in settling a bitter, two-year legal dispute with the chipmaker. Apple needs chips that will connect the iPhone to the new, fifth-generation wireless networks being introduced now or risk falling behind its rivals. The company had bet on Intel Corp., but recently decided its would-be 5G supplier wasn’t up to the task. That led Apple back ...

4) Mario Draghi’s Finally Giving Up the Hardest Job in the World

If you’re looking for the world’s hardest job, then search no farther than Frankfurt. The president of the European Central Bank must oversee an institution that sets monetary policy for a currency area with 19 member states. Since 2014 the ECB has also been the main banking supervisor for the monetary union, with duties that include demanding capital increases for lenders and closing down failing institutions from Italy to Latvia. ...

5) Aussie Assets Know Good News When They See It: Markets Live

World News Briefing

6) Trump Vetoes Measure Barring U.S. Role in Saudi-Led Yemen War

President Donald Trump vetoed on Tuesday a bipartisan measure passed by Congress earlier this month demanding that he withdraw U.S. support for the Saudi-led war in Yemen, the White House said in a statement. “This resolution is an unnecessary, dangerous attempt to weaken my constitutional authorities, endangering the lives of American citizens and brave service members, both today and in the future,” Trump said in a message to ...

7) Student Sues JD.com and CEO Liu for Damages Over Alleged Rape

The University of Minnesota undergraduate student who accused Chinese billionaire Richard Liu of raping her filed a civil suit against the chief executive officer of e- commerce giant JD.com Inc. and the company itself, seeking monetary damages almost four months after prosecutors decided not to press criminal charges. Jingyao Liu, a 21-year-old student at the time of the incident, charged the Chinese company and its employees played a key role in the alleged ...

8) Reform Landscape for Next Five Years at Stake: Indonesia Votes

Indonesians began voting in a presidential election that’s seen jobs and the cost of living at the heart of the sometimes bitter fight for control of Southeast Asia’s biggest economy. Polling stations opened at 7 a.m. in eastern and central Indonesia, with about 193 million people eligible to vote. Unofficial quick count results by private pollsters are expected shortly after polls close at 1 p.m. Jakarta time. Read more: How Indonesia ...

9) On Ukraine’s ‘Contact Line,’ Bureaucracy and Death Stalk the Old

For the full experience visit: <a href="https://www.bloomberg.com/features/2019-ukraine-russia-separatists-war-front/">Bureaucracy and Death Stalk Ukraine’s ‘Contact Line’</a> International aid groups call it the “contact line,” but the divide between government-controlled Ukraine and the separatist east is in fact a 300-mile-long militarized border that regularly morphs into a battlefield—replete with gunfire, shelling and casualties. What ...

10) FAA Board Sees No Need for New Boeing 737 Max Simulator Training

A board of pilot experts appointed by U.S. aviation regulators has reviewed Boeing Co.’s proposed software fix for the grounded 737 Max aircraft and concluded that pilots won’t need additional simulator training once the plane is returned to service. The report by a Federal Aviation Administration Flight Standardization Board is an important first step in reviewing the still-unfinished upgrade to the 737 Max family of aircraft. It was ...

Bonds

11) Cash-Rich Japan Insurers Plot Strategy Amid Sinking Yields

The global debt rally this year is posing a challenge for Japan’s life insurers. The companies, among the nation’s biggest buyers of overseas bonds, are set to lay out their asset allocation plans for the coming 12 months over the next week or so. Their announcements come against the backdrop of a decline in yields worldwide, after worries of slowing growth spurred the Federal Reserve to lead a dovish tilt among central banks. There’s ...

12) Asian Dollar Bond Spreads Tread Water After Issuance Bonanza

A steep drop in Asian credit spreads this year helped absorb the biggest dollar bond supply the market has ever seen, leaving investors questioning if there is room for a further rally. Average spreads on Asian dollar bonds tumbled about 65 basis points so far this year, contributing to a total return of 5.1 percent in the first quarter, the best gain in the three- month period since September 2010, Bloomberg Barclays Indexes ...

13) Bond Outflows From Korea Raise Doubts Over Rate-Cut Bets

Are bond traders having second thoughts about the prospects of an interest-rate cut in South Korea? Global funds have been selling the nation’s debt before Bank of Korea’s policy decision on Thursday, with yields on the three-year bond climbing about 9 basis points from a 21-month low to hover just above the key policy rate. Market expectations that the BOK will cut rates have grown as indicators including exports, inflation and factory output showed an ...

14) Speaking of EM: Ukraine May Cast a Comic as President (Podcast)

Five years after a pro-European revolution, Ukraine is set to elect a comedian as its next president. Volodymyr Zelenskiy leads incumbent Petro Poroshenko by a margin of 2 to 1 before Sunday’s ballot, on track to assume the role he’s played on television as a caricature of Kiev’s corrupt elite. If elected, investors will be closely watching how Zelenskiy deals with the reality of a heavy debt load and a pro- Russian insurgency in the country’s east. The ...

15) Treasuries Drift Lower Before Walmart Pricing; China Data Loom

Treasuries declined gradually during U.S. session Tuesday, pushing 10-year yields above 2.59% to highest level since March 20 FOMC meeting. Walmart’s $4b bond offering appeared to weigh on Treasuries after it was announced, while Wednesday’s scheduled deluge of Chinese economic data was an incentive to hedge. * Yields cheapened by ~3.5bp in 7- to 10-year sectors, less at front end and long end, cheapening the 5s10s30s fly by 1.5bp; 10-year ended slightly ...

16) The Dollar Looks Poised to Wreak Some Havoc: Robert Burgess

There’s been a lot of talk lately about how the global currency market has become stuck in a tight range, with volatility collapsing and no clear trends emerging. Judging by the performance of the dollar, this is no time to be complacent, . The Bloomberg Dollar Spot Index rallied on Tuesday despite a disappointing report from the Federal Reserve on March industrial production and capacity utilization. And that’s the point: the dollar has shown ...

Central Banks

17) Powell Adopts Whites-of-the-Eyes Inflation Stance Yellen Shunned

Federal Reserve Chairman Jerome Powell and his colleagues have made an important shift in their strategy for dealing with inflation in a prelude to what could be a more radical change next year. The central bank has backed off the interest-rate hikes it had been delivering to avoid a potentially dangerous rise in inflation that economic theory says could result from the hot jobs market. Instead, Powell & Co. have put policy on hold until sub-par ...

18) China Borrowing Cost Rises to Four-Year High on Cash Demand

The overnight borrowing cost in China’s money market rose to a four-year high as cash supply tightened just as tax payments increased demand for liquidity. The overnight repurchase rate rose 11 basis points to 3.0001 percent as of noon in Shanghai, the first time it’s reached that level in line since April 2015. The measure has jumped 35 basis points in three sessions, and is higher than the seven-day rate, which fell to 2.7351 percent. The People’s Bank ...

19) Noose Tightens at Central Bank Besieged by Italy’s Populists

Bank of Italy Governor Ignazio Visco is feeling the weight of a populist onslaught against the country’s entire financial sector, with his institution in the middle of it. The central bank chief has endured repeated meddling from the ruling coalition of the Five Star Movement and the League, who weighed in on board nominations and cast doubt on ownership of its $100 billion stash of gold. An extended assault is now imminent as parliament ...

20) Inflation Surprise Leaves Argentina Seeking to Shore Up Peso

Argentina’s central bank tightened monetary policy on Tuesday for the third time in a month after inflation blew past expectations. Prices climbed 4.7 percent in March from the month before, the fastest pace since October and exceeding all eight forecasts in a Bloomberg survey. Annual inflation accelerated to 54.7 percent from 51.3 percent, putting President Mauricio Macri’s re-election bid further at risk. An hour after the numbers were reported, ...

21) White House Talking to Candidates to Replace Cain, Moore for Fed

The White House is interviewing candidates to potentially replace Herman Cain and Stephen Moore as Donald Trump’s picks for the Federal Reserve Board, the president’s top economic adviser said. Cain, the former pizza company executive who ran for the 2012 Republican presidential nomination, must decide for himself whether to withdraw from consideration for a Fed job, Larry Kudlow said Tuesday at the White House. “At the end of the day, it will ...

22) BCRA is Said to Study Reserve Requirement Changes to Boost Rates

Argentina’s central bank is said to be analyzing increasing the size of remunerated reserve requirements that banks hold on time deposits, in a bid to encourage banks to pay a higher rate to their clients, said three people with direct knowledge of the matter. * The change aims to maintain the current level of reserve requirements, but change their composition ** It would allow banks to invest a greater proportion of the reserve requirements on fixed-term ...

Economic News

23) Global Trade Tracker Shows Ports Start to See Brighter Days

For the full experience visit: <a href="https://www.bloomberg.com/graphics/global-trade-indicators/"><strong>Global Trade Tracker Shows Ports Start to See Brighter Days</strong></a> Shipping data offer the latest signs of reprieve for global trade as the U.S. and China inch toward an agreement and the world's No. 2 economy stabilizes. Singapore and Hong Kong port figures rebounded in March, while Los Angeles cargo—the ...

24) CHINA REACT: PBOC’s Mini MLF Leaves Door Open for 2Q RRR Cut

OUR TAKE: The People’s Bank of China’s smaller-than-expected liquidity injection Wednesday still leaves the door for another RRR cut in April, though we now see a greater likelihood that it is delayed until 2Q. * The PBOC injected 200 billion yuan via a medium-term lending facility -- less than the 366.5 billion that was drained from the banking system Wednesday with the maturity of a separate operation. * We have been ...

25) Singapore Exports Slump on Worst Electronics Drop Since 2013

Singapore’s electronics exports slumped in March by the most since 2013, an ominous sign that it will take longer for the city state to shake off a regional demand slowdown from earlier this year. Electronics shipments dropped 26.7 percent from a year ago, weighing down overall non-oil domestic exports, which fell 11.7 percent. That was far worse than the 2.2 percent contraction forecast by economists in a Bloomberg survey. The ...

26) EURO-AREA INSIGHT: Risks Mounting for Inflation Prospects

Inflation in the euro area has slowed in recent months and the European Central Bank has slashed its own forecasts. Our central scenario is for inflation to accelerate as higher wages feed into prices. But lower prospects for economic growth, especially in Germany, are creating downside risks to this scenario. * Lower inflation can be largely attributed to the decline in global oil prices at the end of last year and the temporary impact of an ...

27) New Zealand Inflation Slows More Than Forecast; Kiwi Slumps

New Zealand inflation slowed more than economists forecast in the first quarter, prompting traders to increase bets on an interest-rate cut and sending the local dollar plunging by more than one U.S. cent. Consumer prices gained 1.5 percent from a year earlier, Statistics New Zealand said Wednesday in Wellington, slower than the 1.9 percent pace in the fourth quarter and the 1.7 percent median forecast of economists. Prices rose 0.1 percent from three months ...

European Central Bank

28) Investors Fretting Anemic Europe Inflation Bet on Lower Yields

Investors are betting the European Central Bank will fall short of its inflation goal in coming years, entrenching lower yields in the region. Expectations for euro-area inflation in the swap market is holding near the lowest in two years, ahead of a consumer-price readout Wednesday. That’s giving fuel to traders buying bonds amid signs policy makers haven’t agreed a course of action to back up ECB President Mario Draghi’s recent dovish ...

29) ECB’s Nowotny Says No Official Plans on Interest Rate Tiering

Tiering “is an issue that has been discussed in the public, but there are no official plannings and perspectives to be seen,” European Central Bank Governing Council member Ewald Nowotny told reporters in New York. “We have announced recently a new line of forward guidance that means that we will keep interest rates unchanged till end of this year,” Nowotny said. “I personally see no reason to change it.” “We are a bit in ...

30) ECB’s Nowotny Says U.S., China Exports Are Germany’s Weakness

“What we have seen is that Germany’s strength -- exports -- is also its weakness,” ECB Governing Council member Ewald Nowotny tells investors in New York. * That’s “mainly because it’s specialized on U.S. and China” * Austria also has trade surplus, “Germany is our biggest business partner, but we’ve had remarkable diversification” * “There has been some nervousness in Washington about European developments,” referring to ...

31) ECB Officials Are Said to Lack Enthusiasm for Sub-Zero Tiering

European Central Bank officials lack enthusiasm for any revamp of their negative-interest rate tool and some doubt it will actually happen when an analysis of the policy is completed, according to people with knowledge of the matter. ECB policy makers aren’t opposed to President Mario Draghi’s move to examine the impact of the measure but many don’t yet see merit in a switch to so-called tiering to exempt some bank excess reserves from the deposit rate, ...

32) The Cable- ECB, Nexi, and China GDP (Podcast)

Hosts Jonathan Ferro and Guy Johnson speak with Paul Dobson, European Markets Managing Editor, about Nexi’s IPO and the European Central Bank. They also speak with Michael McKee, international economics and policy correspondent for Bloomberg, about China GDP and look at the week ahead. Running time 43:27 -0- Apr/16/2019 21:54 GMT

Federal Reserve

33) Big Banks Lean on Main Street for Profit Before Fed’s Pause Hits

The biggest U.S. banks have leaned on retail banking businesses to offset a prolonged slump in trading and drive record profits. Now comes the question of whether they can keep it up. The lenders, led by JPMorgan Chase & Co. and Bank of America Corp., are delivering on the promise that the stockpiles of deposits they spent years attracting would pay off once the Federal Reserve started hiking rates. Analysts see two threats ...

34) CNN: Larry Kudlow: White House still talking to backup Fed candidates

(CNN)Top White House economic adviser Larry Kudlow said Tuesday that "we're talking to a number of candidates" for two open seats on the Federal Reserve board, even though President Donald Trump's two named picks are still in the vetting process. Trump recently said he plans to nominate former Republican presidential candidate Herman Cain and former 2016 campaign adviser Stephen Moore to the Fed's interest rate-setting committee -- the most powerful monetary policy jobs in the world. Both men have drawn ...

35) Fed Watch: Summary of Recent Remarks by Fed Policy Makers

This is Fed Watch, a summary of remarks since the March 19-20 policy meeting: * Next rate decision: May 1 * Federal Open Market Committee portal, click HERE * For upcoming events, click HERE * For historical database of Fed speeches, click HERE April 15 SPEAKER: Eric Rosengren, president Boston Fed, voter in 2019 * VENUE: Davidson College in North Carolina * COMMENT: “Despite some deceleration from last ...

36) Early Returns: Does Anyone Support Stephen Moore at the Fed?

What’s worse than damning with faint praise? How about damning with no praise at all. Stephen Moore’s campaign for a seat on the Federal Reserve Board of Governors got a little boost on Monday with the publication of a letter of support from 105 economists and conservative activists. We’ve all seen this kind of thing before: A president’s nomination for an important position gets in trouble, and either the nominee, the administration or a ...

37) Trump's pick of US Fed Board of Governors against the will of

Stephen Moore, US president Donald Trump's pick as the presidential nominee in the Federal Reserve Board of Governors, is almost too "radical"- a description Moore uses for himself-to handle. He has been a trenchant critic of taxes, calling the laws that created the country's income tax system the "most evil" law passed, CNN reports. He has even called for shutting ...

First Word FX News Foreign Exchange

38) China Growth Demonstrates Beauty of Stimulus Mosaic: Macro View

China equities are well placed to extend their 2019 gains, following the economy’s blockbuster first- quarter performance. * China’s carefully assembled stimulus mosaic is nearing completion and it’s already getting a standing ovation from stock markets * 1Q GDP growth of 6.4% exceeded the market consensus, while March industrial production surged to levels unseen since 2014 * An improving economy and 2019’s impressive equities rally have convinced the ...

39) Currencies Anchored by China GDP, Ringgit Slides: Inside Asia

Asian currencies were stable, led by the yuan, after China reported GDP data that beat estimates. Regional stocks advanced for a fourth day, while bonds fell. Malaysia’s ringgit was the biggest loser as investors weigh the potential fallout if the nation’s bonds are dropped from a global index. * China’s economy unexpectedly held up in the first three months as policy makers boosted stimulus measures GLOBAL MARKETS: * Bloomberg ...

40) Goldman CEO Sees Less U.S. Recession Risk Than in Jan.: CNBC

Goldman Sachs CEO David Solomon said in an interview with CNBC Wednesday that the chances of U.S. economy entering a recession by end-2020 are lower now than earlier this year. * Says he doesn’t "see any data in any way, shape or form" that leads him to believe that chance of recession is speeding * “I think the U.S. economy is chugging along pretty well. I think the U.S. economy is growing at trend at the moment" * Says central banks globally have become "more ...

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

The Fortnight Ahead 16th - 26th April

A few brief ideas on my Radar for the next fortnight…

+UK 10y vs Short Germany and Short US

Political and Brexit pressure abound in UK FI, but for those who see it as a value asset in the context of Europe and US FI…

UK 10 years looking cheap historically vs RXA & old US ten yr

CIX: YIELD[UKT 1.625 10/22/28 Corp] - 0.75 * YIELD[DBR 0.5 02/15/28 Corp] - 0.25 * YIELD[T 2.75 02/15/28 Govt] - 0.483

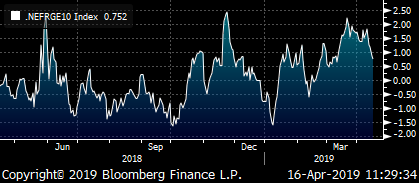

+Nether 10y vs -France (OATA) and -Germany (RXA)

Holland went through supply today with good demand for a rare issuer - this one is close to fair and taking off…

CIX: 100 * (YIELD[NETHER 0.75 07/15/28 Corp] - 0.3 * YIELD[FRTR 0.75 05/25/28 Corp] - 0.7 * YIELD[DBR 0.5 02/15/28 Corp] - 0.074)

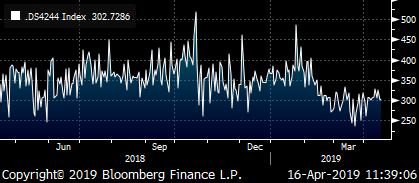

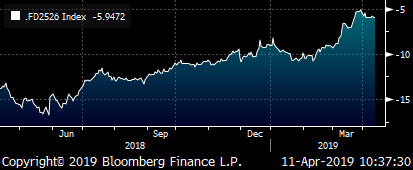

+German Buxl CTD Dbr Jul44 vs Short old Ctd Dbr – supply in the jul44 on Wednesday 17th April

Looks good on stripped value in the context of the rest of the anomaly curve

CIX: 100 * (YIELD[DBR 2.5 7/44 Corp] - YIELD[DBR 3.25 7/42 Corp])

However the swap/z-spread is not on the high a am a bit more greedy on the level – from the graph below on the spread of z-spreads then we need another .75 – 1bp on the yield spread or spread of spreads

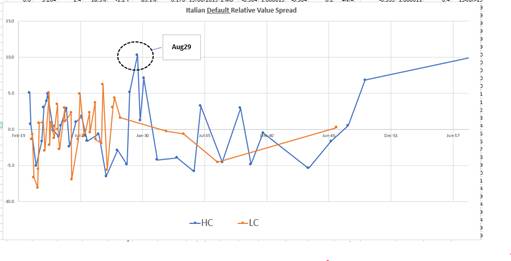

Italy – Long Aug29, Short Feb28, with 10% hedge in Long Italian 2y and short Italian 30y

With the carry curve almost flat between these two the only detractor for the cheaper Aug29 is the fact it’s an on-going tap issue

But under almost any metric and particularly under my default model (each cashflow weighted by the probability of receipt or default payment) then Aug 29 are a fantastic value, long in a down market with a relatively low coupon

CIX: 100 * ((YIELD[BTPS 3 08/01/29 Corp] - YIELD[BTPS 2 02/01/28 Corp]) - 0.1 * (YIELD[BTPS 3.45 03/01/48 Corp] - YIELD[BTPS 3.75 08/01/21 Corp]))

Any clawback into month end 10y supply (30th April) is a possible buying opportunity

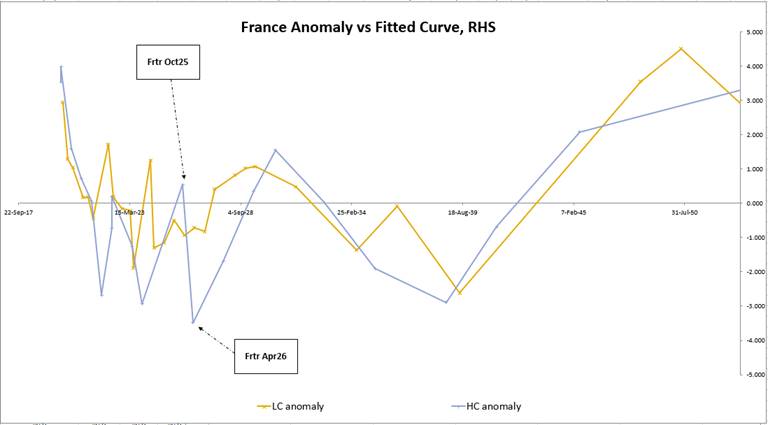

Long HC Oct25 France (or new long 5r, frtr Mar25 coming on Thursday)

Short Old CTD frtr Apr26

Plus curve Hedge 10% of -oea/+rxa

Straightforward cashflow discounted anomaly – the HC oct25 are cheap & the Apr26 remain rich since their CTD status in the pre-Macron era

Cix: 100 * ((YIELD[FRTR 6 10/25/25 Corp] - YIELD[FRTR 3.5 04/25/26 Corp]) - 0.1 * (YIELD[DBR 0.5 02/15/28 Corp] - YIELD[DBR 1.75 02/15/24 Corp]))

For full details, sizing and levels drop me a note

Best

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND YIELD (SHORT-TERM) UPDATE : ITS NOW OR NEVER. Yields need to start falling or the BIGGER YIELD call lower will “PAUSE”.

BOND YIELD (SHORT-TERM) UPDATE : ITS NOW OR NEVER.

WE ARE ON THE EDGE OF THE LIQUIDATION CLIFF. Yields need to start falling or the BIGGER YIELD call lower will “PAUSE”.

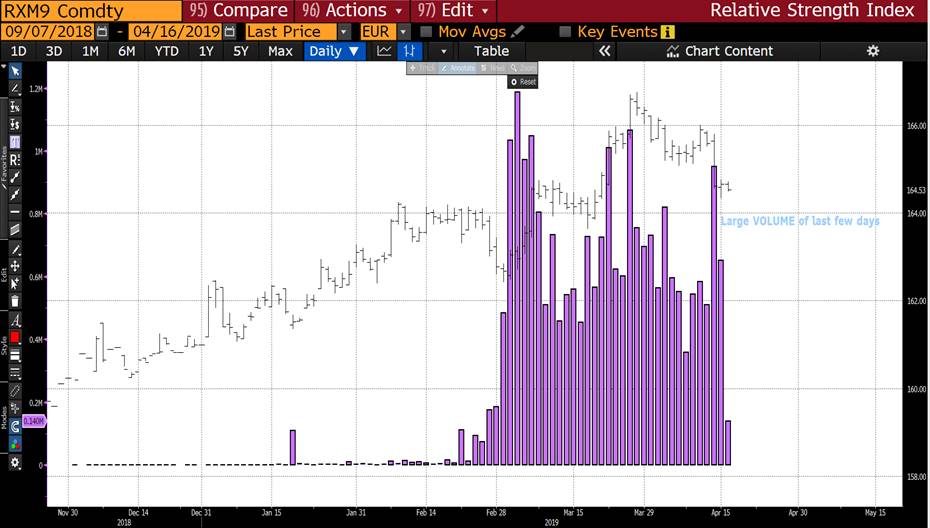

The LONGTERM charts remain unaffected BUT the recent daily volumes indicate significant profit taking especially in Germany.

Ideally we need to hold below yesterday’s YIELD HIGHS and close LOWER today.

Daily charts have persisted in remaining sub numerous 50 day moving averages, so HELPFUL.

On paper the quarterly and monthly charts are obvious, its MUCH lower yields. We are failing MANY RARE 50 and 100 period moving averages aided by RSI dislocations that date back to 1980’s. The formations are staggering given the previous upsets in and around 2000 - 2007.

It seems from a chart perspective everyone is convinced rates are going MUCH HIGHER based on the HISTORICAL RSI dislocations. Expectation and positioning is way too optimistic.

The weekly charts are more optimistic for a HOLD but daily negate that almost instantly.

The long-term quarterly-monthly charts continue to forecast MUCH lower yields and little obstacles in their path!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Today's BREXIT Recap... Calm before the storm...

Brexit news flow has slowed considerably since last week so this is more of a recap than a barrage…

BBG: Corbyn Government as Bad for Banks as a Hard Brexit, Citi Says

FT: Germany warns Britain cannot have further Brexit extension

FT: Manufacturers fear flipside of no-deal Brexit boom

FT: Tories and Labour jittery at prospect of Euro poll

TEL: Local elections 2019: When are they and what will we learn after the polls?

TEL: Labour doesn’t want to solve Brexit, it only wants to destroy the Tories

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Tue Apr 16th

Business Briefing

1) House Democrats Subpoena Deutsche Bank, Others Amid Trump Probe

Congressional Democrats issued subpoenas to Deutsche Bank AG and other banks to obtain long-sought documents indicating whether foreign nations tried to influence U.S. politics, signaling an escalation of their probes into President Donald Trump’s finances and any dealings with Russians. House Intelligence Chairman Adam Schiff said his panel made the requests Monday in coordination with the House Financial Services Committee, according to a statement. Both ...

2) Asia Stocks Mixed on Earnings; Dollar Ticks Higher: Markets Wrap

Asian stocks stalled near six-month highs Tuesday as investors weighed earnings in the U.S. and the region. Treasuries steadied and the dollar edged higher. Shares gained in China and Hong Kong, drifted in Tokyo and were little changed in Seoul. Earlier, the S&P 500 Index slipped from a six-month high, halting a three-day advance, as earnings season kicked into high gear. Sentiment was hit after Goldman Sachs Group Inc. missed estimates for sales and trading ...

3) French President Vows to Rebuild Notre Dame After Horrific Fire

President Emmanuel Macron vowed to rebuild Notre-Dame Cathedral in central Paris after a massive fire ravaged the 850-year-old Gothic monument and left France in shock over the extensive damage to one of the nation’s most iconic landmarks. The blaze raged for more than four hours on Monday evening before Macron declared the two bell towers and facade had been saved. Flames had engulfed the roof, snaking ...

4) As Currency Hedge Funds Bleed Out, a Few Survivors Still Stand

Currency-only hedge funds were once a hot corner of the investment world. From 2000 to 2008 the tally of currency funds tracked by the BarclayHedge Currency Traders Index almost tripled, to 145. Now they’re looking more like an endangered species, with just 49 in operation. Managers who try to play trends in foreign-exchange rates—swapping dollars for pesos or euros for yen—have been victims of a long run of relative ...

5) Trade War's Surprise Winner Could Be Indian Rupee: Markets Live

World News Briefing

6) Mueller’s Report Is Likely to Be Released on Thursday, DOJ Says

Attorney General William Barr is expected to send Special Counsel Robert Mueller’s report to Congress and make it public on Thursday morning, an event two years in the making that could provide new revelations damaging to President Donald Trump or reinforce his claims of vindication. The likely timing was announced Monday by Justice Department spokeswoman Kerri Kupec. Those following Mueller’s investigation will pore over the report’s almost 400 pages ...

7) Foxconn’s Terry Gou Mulling Run for Taiwan Presidency

Billionaire Foxconn founder Terry Gou said he was considering a run for Taiwan’s presidency, adding a powerful symbol of Chinese business ties to the field of potential challengers against the island’s leader. Gou, who amassed a personal fortune of about $4.4 billion building iPhones on the mainland, said on the sidelines of a security forum in Taipei that he was weighing a bid to oust Taiwanese President Tsai Ing-wen. He would seek the nomination of the ...

8) YouTube Flags Notre Dame Cathedral Fire as 9/11 Conspiracy

Soon after a fire engulfed Notre Dame cathedral in Paris on Monday, news outlets began streaming live broadcasts on YouTube. Below several of the clips was an odd box of text: A snippet from Encyclopedia Britannica about the Sept. 11 terrorist attacks. YouTube, a division of Alphabet Inc.’s Google, introduced this text box feature last year to combat the spread of conspiracy theories, including those that question the 9/11 attacks. On Monday, ...

Bonds

9) Receive RBNZ June OIS vs RBA as Pricing Too Close, JPMorgan Says

Markets aren’t pricing in enough risk of imminent rate cuts in New Zealand, JPMorgan says, recommending investors receive June 2019 RBNZ OIS versus RBA OIS. * “The market does not appear to make enough of a distinction between the RBNZ, which has an explicit easing bias and a Governor seemingly in favor of lower rates and the RBA, which does not have an explicit easing bias and has publicly stated a desire to see more data,” Sally Auld, senior strategist for ...

10) China Corporate Bonds Slump Amid Signs Economy Is Bouncing Back

A sell-off in Chinese corporate bonds is accelerating as signs of a stabilizing economy bears down on the debt market. In the first two weeks of April, the average yield for three-year AAA rated corporate notes surged 23 basis points in the steepest bi-weekly gain since November 2017, Bloomberg- compiled data show. The yield for similar five-year debentures jumped the most since last August in comparison. Meanwhile, the five-year government yield surged to a ...

11) Aussie Falls After RBA Discussed Rate-Cut Scenario: Inside G-10

Australia’s dollar dropped against all of its Group-of-10 peers after central bank minutes showed policy makers discussed interest-rate cuts at this month’s board meeting. * AUD/USD slid as much as 0.5% to 0.7140 as the minutes confirmed the Reserve Bank of Australia’s recent dovish shift, even though it concluded there was no “strong case” for a rate cut in the near term. The U.S. dollar and Treasuries both rose for a second day * ...

12) EU CREDIT DAYBOOK: U.K. Unemployment, Netherlands to Sell Bonds

U.K. unemployment figures due; the Netherlands is among countries due to sell bonds. MANDATES/UPDATES: * Auchan EUR Benchmark 6Y Bond Roadshow * Co-Operative Bank Finance GBP200m WNG 10NC5 T2 Note * Europcar EU450m 7NC3 Bond Roadshow * SFIL SA $Benchmark 3Y Reg S MS+19 Area * TD Bank EUR Bmark 5Y Senior Bond * Tokyo Hires Banks for Potential USD or EUR 3-7Y Bond HEADLINES: * Citigroup Bond Traders Eke Out Win in Market That Stung JPMorgan * Ex-VW CEO ...

13) U.S. Tax Day May Have Implications for Bill Supply, Debt Ceiling

Individual U.S. income tax payments due on Monday may help determine the path of Treasury bill issuance and the eventual debt-ceiling deadline. * “We are heading into the most uncertain week in terms of deficits/cash balance, which could significantly change the trajectory of bill issuance and the x-date,” Citi strategist Steve Kang said in April 12 note ** Citi sees “slight” upside risks to the fed funds rate as tax payments spur reserve demand; however, ...

14) A 48-Hour Reporting Delay Could Be Coming for Corporate Debt

The Financial Industry Regulatory Authority will likely test the market impact of delaying the disclosure of large corporate bond trades after some of the biggest investors argued that such a move would improve liquidity. Finra last week proposed running a pilot program that would give traders 48 hours before having to reveal their so-called block trades to other investors. The effort would allow the industry-funded brokerage regulator, which is ...

Central Banks

15) Veteran Investor With Family Pedigree Slams BOJ’s ETF Buying

The Bank of Japan should stop buying exchange-traded funds as the purchases will ruin the stock market’s ability to allocate capital efficiently, according to the chairman of Commons Asset Management Inc. Ken Shibusawa, who has more than three decades of investment experience at firms including Goldman Sachs Group Inc. and JPMorgan Chase & Co., said the BOJ’s trillions of yen in ETF purchases since 2010 will make Japan’s stock market ...

16) RBA Discussed Rate-Cut Scenario, Saw No Near-Term Need to Adjust

Australia’s central bank discussed interest- rate cuts in a review of policy scenarios at its April 2 board meeting and concluded there was “not a strong case” for an adjustment in the near term. The Reserve Bank conceded rates were unlikely to need to rise in the period ahead and decided standing pat would allow it to be “a source of stability and confidence.” It acknowledged the impact of further easing would be “smaller than in the past” ...

17) Euro’s Fortunes Renewed as Spring Brings Economic Green Shoots

The euro’s stagnant start to the year might be ending as signs emerge that Europe’s economic growth is reviving. Traders are unwinding bets against the common currency in the options market, with a gauge of sentiment and positioning over one year now the least negative in 11 months. Europe’s recovering economy, coupled with optimism surrounding China’s trade, will help push the euro more than 4 percent higher in coming months, according to UBS Group AG ...

18) Austrian Central Bank Clashes With Loeger on Bank Oversight

Austrian Finance Minister Hartwig Loeger clashed with Governor Ewald Nowotny on Monday over the government’s plans for a sweeping revamp of banking supervision that would strip the central bank of its oversight role. Loeger said he wants to make banking supervision more “service-oriented,” less costly and more concerned with domestic interests, according to a draft law he submitted to Austrian parliament for public comments today. Nowotny dismissed the ...

19) Pressure Increases on Bank of Israel After Inflation Surprise

Israel’s consumer prices rose faster than expected in March, boosting the chances the country’s central bank will raise rates soon and potentially aiding the shekel’s strengthening trend. Prices rose 1.4 percent in March compared to a year ago, while economists surveyed by Bloomberg expected a rise of 1.3 percent. CPI increased 0.5 percent from February, matching economists’ expectations. Key Insights * The 1.4 on-year figure is the quickest rise ...

20) Namibian Central Bank Less Optimistic on Growth Than Government

Namibia’s central bank has cut its economic growth forecast for the year as it now sees less expansion for diamonds, uranium and metals than it did in December. The Bank of Namibia projects gross domestic product will expand 0.3 percent in 2019 compared with the 1.5 percent it forecast four months ago. The new estimate is also below the forecast of 1 percent that Finance Minister Calle Schlettwein presented to lawmakers last month. The economy of the ...

Economic News

21) Five Clues on Whether China’s Economic Upturn has Staying Power

The Chinese economy likely stabilized in the first quarter of this year, but a closer look under the hood will be needed to tell whether that’s just a temporary improvement or if the economy has hit bottom and is rebounding. There’s been plenty of positive news in the world’s second largest economy in recent weeks, with an export rebound, a surge in credit, and improved business sentiment coming in March. The gross domestic product data, along with ...

22) The Modernizer Trying to Rebuild the Bank of Spain’s Reputation

The scaffolding that obscured the Bank of Spain for a major renovation was removed recently, revealing a newly-clean edifice. The bank’s chief is working to ensure those changes go more than skin deep. Pablo Hernandez de Cos and his team are on a mission to repair the reputation of the central bank, still disparaged for its failure to crack down on a credit binge that culminated in a property crash and 2012 bailout. The economist, who’s proven ...

23) INDIA REACT: Mildly Weak Rainfall Won’t Lift Food Inflation

OUR TAKE: A slight deficit in India’s monsoon season rainfall this year is unlikely to have any significant inflationary impact on food prices. We continue to expect food prices to be subdued and headline inflation to stay below the Reserve Bank of India’s 4% target in the year ahead. India’s Meteorological Department, through its SEFS forecasting model, has projected rainfall for the June-September southwest monsoon at 96% of the ...

24) PACIFIC INSIGHT: Divergent RBNZ, RBA Signals – Similar Growth

A look at macro data, policy implied rates and signals from the central banks in Australia and New Zealand raises a question -- who’s right, the market or the central bankers? For Australia, we think it could come down to how a May election plays into business sentiment and whether the U.S. and China find a resolution on trade. * Growth and inflation in Australia and New Zealand are behaving almost exactly the same. * Market implied ...

25) CHINA INSIGHT: Trade Deal – Catalyst for Monumental Reform?

President Donald Trump has said a “monumental” trade deal with China is in the works. If, as we expect, the two sides strike an agreement that binds China to opening its markets further and strengthening protections on intellectual property rights, it could turn out to have just that sort of impact -- a long-term positive for China’s economy. That said, any deal is unlikely to mark a full resolution to the myriad ...

European Central Bank

26) Villeroy Says Overall Effect of ECB’s Subzero Rate Is Positive

Francois Villeroy de Galhau, the European Central Bank Governing Council member who pressed hardest for a review of the institution’s negative interest-rate policy, said the benefits of the measure still outweigh the drawbacks. “We are convinced that as a whole negative interest rates are positive,” Villeroy told an audience in New York on Monday. “If there are any side effects on bank intermediation we could study what we call mitigating measures, if ...

27) ECB Bought Fresenius and Siemens Bonds via CSPP Last Week

The ECB purchased at least two new corporate securities under its CSPP program during the week ended April 12, according to central bank data analyzed by Bloomberg. New Holdings *T ================================================================ | | | | |Amount | | | | |o/s (EU ISIN | Issuer | Ticker | Coupon |Maturity | m) ...

28) Decline in inflation outlook raises pressure on ECB to act

A technical measure of eurozone investors' inflation expectations has fallen to its lowest level for three years, putting pressure on the European... <p>The full story is available on Bloomberg to Financial Times corporate subscribers.</p>

29) Dawn (PK): ‘ECB to keep policy accommodative until inflation recovers’

NEW YORK: The European Central Bank is committed to keeping monetary policy loose until inflation returns to its target, ECB policymaker Francois Villeroy de Galhau said on Monday. Villeroy, who is also governor of the Bank of France, said that eurozone inflation was expected to ease over the course of this year before it begins to gradually recover. “We are clearly determined to maintain an ample degree of monetary accommodation for as long as necessary to reach our target of inflation below but ...

30) Mpls Star-Trib: A year of high drama begins to unfold at the European Central Bank

The headquarters of the European Central Bank towers over the river Main in Frankfurt, Germany. The institution has been equally imposing in the life of Europe's monetary union. As its only policymaker, it rescued the euro from financial and sovereign-debt crises, and powered a recovery in 2015 to 2017. But it cannot rest on its laurels. This year promises to be one of high drama. Three of its six-strong executive board will depart, notably its president, Mario Draghi, and its chief economist, Peter ...

Federal Reserve

31) Evans Says Fed Rate Cut Could Be Needed If Core Inflation Fell

The Federal Reserve may need to cut interest rates if U.S. inflation falls, said Chicago Fed President Charles Evans, who currently sees rates on hold until the fall of 2020. “If core inflation were to move down to, let’s just say, 1.5 percent," that would indicate that monetary policy “is actually restrictive in holding back inflation, and so that would naturally call for a lower funds rate," Evans told reporters Monday after a speech in New York. “I ...

32) Summers Calls Fed Monetary Policy ‘Broadly Appropriate’ for Now

Former Treasury Secretary Lawrence Summers backed the Federal Reserve’s current monetary policy stance while suggesting that its next interest rate move will probably be down. With financial markets betting that the Fed is “considerably more likely’’ to reduce rates than hike them, “that’s as far as I would think it should go in an expansionary direction today,’’ Summers said on Monday at the Peterson Institute for International Economics in ...

33) Fed’s Rosengren Doesn’t See Recession But Inflation Under Goal

Federal Reserve Bank of Boston President Eric Rosengren says “despite some deceleration from last year, the pace of growth in economic activity will be enough to bring further reductions in the unemployment rate in the near term, so a recession is not my modal forecast.” * Says economy doing quite well but inflation is “slightly below” the Fed’s 2% target * “One reason for the policy committee’s decision to be patient in determining future rate ...

34) Fed’s Evans Would Like to See Inflation Up Before Hiking Again

Federal Reserve Bank of Chicago President Charles Evans says “I’m probably at the point where I’d like to see actual inflation move up” before tightening again. * “We need to actually see inflation more consistent with our objective, not just a forecast” * Asked by reporters after giving speech in New York if he would consider rate cuts to support inflation, Evans says “I think the answer has to be yes. It depends on what the scenario is. ” * “If ...

35) Fed’s Evans: Being Symmetric on 2% Inflation Goal Would Aid Fed

Federal Reserve Bank of Chicago President Charles Evans says “I’m one of the few participants who routinely goes out and says, we’re symmetric.” * “Every 50 basis points is helpful in having added capacity before we have to do more difficult and politically charged actions. And I would say that’s why we have to be symmetric,” he says, referring to Fed’s 2% inflation goal * Evans answers audience questions after giving speech in New York * “I have ...

First Word FX News Foreign Exchange

36) Aussie Drops After Minutes Show Rate Cut Discussed: Inside G-10

Australia’s dollar fell versus all its Group-of-10 peers after central bank minutes showed policy makers discussed rate cuts in a review of scenarios at this month’s board meeting. * AUD/USD slid as much as 0.5% to 0.7140 as the minutes helped confirm the Reserve Bank of Australia’s recent dovish shift, even though the central bank concluded there was no “strong case” for a rate cut in the near term. The U.S. dollar and Treasuries both ...

37) Orr Says RBNZ Easing Bias Remains in Place for Now, Reuters Says

New Zealand central bank governor Adrian Orr said the bank’s easing bias remains in place for now, Reuters reported, citing an interview. * “It remains, but it remains to be challenged by the data that we have seen,” Reuters quotes Orr as saying * Orr says RBNZ still assessing data and broad economic conditions for next rate decision on May 8: Reuters * Orr says NZ dollar is trading around a “happy space”: Reuters To contact the reporter on this ...

38) SGD Bonds Await Supply Announcement This Week: Inside Singapore

Singapore bond investors are preparing for a central bank announcement later this week on the amount of 10- year notes to be sold on April 26. * Yield on May 2028 debt rose 4bps to 2.14% on Monday following an increase in 3bps on Friday * Monetary Authority of Singapore will announce on Thursday how many of these reopened securities are to be auctioned * UOB estimates the auction size at S$2b to S$2.3b, strategists Victor Yong and Heng Koon How wrote in note on ...

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

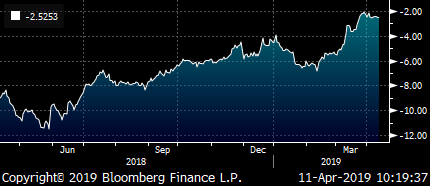

**MULTI ASSET UPDATE : ALL ABOUT THE US YIELDS FAILING CRITICAL 50 DAY MOVING AVERAGES!**

MULTI ASSET UPDATE : ALL ABOUT THE US YIELDS FAILING CRITICAL 50 DAY MOVING AVERAGES!

WHATS CHANGED :

BOND YIELDS HAVE POPPED AND MANY TODAY ARE TESTING 50 DAY MOVING AVERAGES SO KEY FOR THE LONGERTERM VIEW, THEY FAIL.

US CURVES CONTINUE TO SEE THE PERFORMANCE SHIFT MORE TO THE FRONT END AND THE us 2-5 HAS A NICE BASE.

FX WATCH THE EURO AS A SUSTAINTED TIME AROUND THE MULTI YEAR 1.1241 RETRACEMENT IS “NOT HEALTHY”. DXY CONTINUESTO PUT IN A LAME PERFORMANCE.

EM FX, THIS CONTINUES TO ENDORSE FURTHER EM STRENGTH CONTINUING, WITH THE EXCEPTION OF TURKEY.

EQUITIES, THESE ARE THE BIGGEST PAIN! THEY CONTINUE TO GRIND HIGHER WHICH IS AT ODDS WITH THE MORE LONGTERM CHARTS. GIVEN EARNINGS SEASON IS UPON US I STILL REMAIN VERY SCEPTICAL ABOUT RESULTS AND FORWARD PROJECTIONS, ITS GOING TO BE A TOUGH YEAR FOR MANY.

***THEY REMAIN A NIGGLE AND STILL BELIEVE THERE IS A NEGATIVE SURPRISE LOOMING.***

OIL IS POISED TO STALL AS GOLD HOLDS A MAJOR RETRACEMENT.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

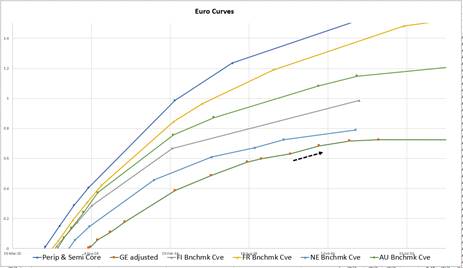

New French 6y James Rice @Astor Ridge

France announced this am supply for next Thursday

Including

New Frtr 0% Mar25 – 6 yr Bond

The challenge is how will this fit into the curve and what opportunities will it throw up?

From the French Tresor page TREX on Bloomberg…

OAT OAT OAT

| 18/04/19 | 18/04/19 | 18/04/19 |

| 0.00%02/22 | 1.75%05/23 | 0.00%03/25 |

| 24/04/19 | 24/04/19 | 24/04/19 |

| 25/02/22 | 25/05/23 | 25/03/25 |

|7750ME<==== | ========== |===>9250ME |

The Frtr 0% of Mar25 is a new issue and will roll into being the benchmark 5y in the same way that the prior 5y, Frtr mar24 was launched in June 2018 also with almost 6 year to maturity

The tap bonds typically trade cheap and I’m starting my pricing / valuation as follows…

Mar23 vs Mar23 is +12bp

Pricing

Mar24 vs Mar25 @ +12bp

Valuation

- See Graph of coupon adjusted yields * - (yield is adjusted for H/L coupon by removing the swap spread and adding the z-spread)

- Adjusted yields are then plotted vs a fitted curve

Suggest Trade

- So one potential trade is the new cheap long 5yr (almost 6 yrs) will have an impact on the richer bonds in the 6y-7y sector

- The Frtr 3.25% Apr26 was cheap (given its coupon as a CTD two years ago, and has richened after dropping out of the basket

- it’s only relatively recently the Apr26 been fully priced or indeed rich after factoring its coupon

- Short the Apr 26 and long the OAT contract seems to capture that expression that 7 yrs should cheapen on the back of this new issue

Trade Mechanics

For further details and trade mechanics gimme a shout…

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... Well, at least it's Friday...

BBG: Brexit Exposes Painful Disconnect Between England and Britain

BBG: Carney Says Brexit Delay Could Make a No-Deal Less Disruptive

BBG: What Brexit Will Cost Some of Britain’s Leading Companies

BBG: Brexit Bulletin: Will May U-Turn on Customs?

TEL: Civil servants ordered to wind down emergency plans for no-deal with ‘immediate effect’

TEL: Theresa May facing renewed calls to resign amid fresh talks with Labour

TEL: Five great British reasons to be cheerful despite the Brexit drama

TEL: Geoffrey Cox says ministers will ‘listen’ to demands for second Brexit referendum

TEL: I was against a second Brexit referendum. Now it’s the only way of fixing this almighty mess

TEL: Emmanuel Macron might just have rescued Brexit – and the rest of the EU with it

FT: Carney says managed no-deal less costly than crashing out

FT: What happens now that Theresa May has obtained a Brexit delay?

FT: Theresa May doubles down on Brexit talks with Labour

Best

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: Trade Radar - James Rice @Astor Ridge

From: James Rice

Sent: 11 April 2019 11:05

Subject: Trade Radar - James Rice @Astor Ridge

Trade –

Short France 3.25% Apr26

Long Frtr 6% Oct25

Potential for curve hedge also

10% short bobl contract / long bund contract

Graph 1 – yield spread

CIX: 100 * ( YIELD[FRTR 6 10/25/25 Corp] -YIELD[FRTR 3.5 04/25/26 Corp] )

Graph 2 – yield spread hedged with -oea/+rxa

CIX: 100 * ((YIELD[FRTR 6 10/25/25 Corp] - YIELD[FRTR 3.5 04/25/26 Corp]) - 0.1 * (YIELD[DBR 0.5 02/15/28 Corp] - YIELD[DBR 1.75 02/15/24 Corp]))

Mechanics

Buy €50k Frtr 6% Oct25

Sell €50k Frtr 3.25% Apr26

€5k short Bobl (-79 cts) / long Bund (+35 cts)

Levels on regular spread

Enter: -2.8bp

Target: -6.5bp

Stop: -1bp

Rationale

- Frtr 26 moved into an anomalous, rich period after losing CTD status – The more recent drop out CTD Oct27 can now assume that roll and tenor

- On anomaly the oct25 trade cheap (coupon adjusted) – see graph

- The high coupon in the Oct25 gives it good funding characteristics

Graph 3 – France Anomalies vs Fitted Curve

Carry and Roll

Frtr spread (5bp repo spread)

Carry: -0.1bp /3mo

Roll: Flat

German Contract Hedge

Carry: +0.1bp /3mo

Roll: Flat

Risks

- The Frtr Apr26 continue to trade anomalously

- The Repo on Frtr Apr26 richens further

- The Frtr Oct25 cheapen further on the curve

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com