Bloomberg Bond News Summary > Fri Mar 15th

The following are today's top stories from Bloomberg on your My News categories:

Business Briefing

1) Stocks Recover Last Week’s Loss; Yields Stay Low: Markets Wrap

Asian stocks headed to recoup much of the losses last week that were the worst so far this year. U.S. futures also edged up as worries about the global slowdown appeared to ebb, though there was no change in narrative for bonds, where yields remain low. Japan’s equities led gains at the start on Friday with little obvious trigger, and China’s domestic shares also jumped before paring gains in the afternoon. Chinese Premier Li Keqiang announced tax cuts that ...

2) Piece of Crash Wreckage Is Said to Show Jet Was Set to Dive

A screw-like device found in the wreckage of the Boeing Co. 737 Max that crashed last Sunday in Ethiopia indicates the plane was configured to dive, a piece of evidence that helped convince U.S. regulators to ground the model, a person familiar with the investigation said late Thursday night. Federal Aviation Administration chief Daniel Elwell on Wednesday cited unspecified evidence found at the crash scene as part of the justification for the agency to reverse ...

3) A Subdued Elon Musk Unveils New, Cheaper SUV Model

Tesla Inc. Chief Executive Officer Elon Musk unveiled a cheaper electric crossover SUV, the Model Y, in a bid to regain momentum after a rough start to the year. Taking the stage at the company’s design studio in Hawthorne, California, Musk showed off a blue prototype of the mid-sized SUV, which is roughly 10 percent roomier than its best-selling sedan. Three higher-end versions of the new vehicle will start delivery in Fall 2020, with a standard one available in ...

4) Terror Attacks on New Zealand Mosques Kill 40 People: TOPLive

5) Senate Rejects Trump Border Emergency, Setting Up Veto Showdown

The Senate voted to block President Donald Trump’s declaration of a national emergency to pay for a wall at the border with Mexico, setting up his first veto and highlighting a growing willingness by Republicans in the chamber to split with their president. The 59-41 vote Thursday was short of the 67 needed to override a veto. It’s already clear that Trump’s rejection of the measure would be sustained in the Democratic-led House, which lacked a two-thirds ...

World News Briefing

6) New Zealand's `Darkest Day' Sees Multiple People Shot: TOPLive

7) May Wins Some Time for a Final Push on Her Rejected Brexit Deal

Prime Minister Theresa May kept her deal with the European Union on life support by winning the backing of British politicians to seek a delay to Brexit just 48 hours after her plan looked dead and buried. In a rare good day for the U.K. leader, the House of Commons on Thursday voted 412 to 202 to endorse her motion, buying her time to try and persuade doubters in her own Conservative Party to back her proposal or risk a lengthy postponement ...

8) Kim Jong Un Rethinking U.S. Nuclear Talks, Set to Make Statement

North Korean leader Kim Jong Un will soon make an announcement on whether to halt nuclear disarmament talks with the U.S., a move that comes after his February summit with Donald Trump broke down over Pyongyang’s demand to remove sanctions on its economy. North Korean Vice Foreign Minister Choe Son Hui, who was at the summit in Hanoi, told a news conference in Pyongyang Friday that North Korea has no intention to make concessions to the U.S. and much less the ...

9) Fury at EU’s Worst Highways Fuels New Kind of Protest in Romania

Sick of driving on the European Union’s worst roads, one Romanian businessman has found a new way to vent his anger. Stefan Mandachi, a restaurateur in northeastern town of Suceava, wants people across the Black Sea nation to stop what they’re doing for 15 minutes at 3 p.m. on March 15 as a signal to the government that frustration is widespread. In an act of defiance this month that made him famous, he spent 4,500 euros ($5,100) to build ...

Bonds

10) King of India Bond Sales Warns of Worst Crisis Since Lehman

Shashikant Rathi, who has dominated India’s local bond underwriting business for over a decade at Axis Bank, says the industry now faces its biggest challenge since the global financial crisis. Shock defaults since last year by shadow bank IL&FS group and a new electronic bidding platform have disrupted the $108 billion market where underwriters like Rathi help companies raise money by selling debt securities. Sales of rupee corporate bonds ...

11) Secret China Distressed-Debt Deals Start Unfreezing Trading

After record defaults on China’s bonds, there’s now record interest in trading the country’s distressed debt. An arm of the central bank that runs the biggest bond- trading platform last month conducted the third auction of distressed securities since July. This one had the biggest participation yet, spanning 43 institutions. While prices of the trades were published by the China Foreign Exchange Trade System, the counterparties’ names were kept secret ...

12) Treasury Futures Climb as North Korea Mulls Suspending Talks

Treasury futures and the yen swing into gains after Tass reports that North Korea is mulling the suspension of denuclearization talks with U.S. * Risk-off moves rippled through markets, as Tass says N. Korean leader set to make announcement on talks * Aussie bonds lag the move as AUD holds gains after China Premier Li Keqiang announced plans to cut value-added tax from April 1 To contact the reporter on this story: Stephen Spratt in Hong Kong at ...

13) USTs Futures Slip as Xinhua Reports More Trade Talk Progress

Treasury futures erase early gains as China’s official Xinhua news agency reports that the nation and U.S. have made substantial progress on document wording of a trade agreement following calls between top officials. * Pockets of selling emerges in 10-year futures, including 3k sale at 122-21 as futures slide to lows ** S&P e-mini futures edge higher as USD/JPY extends climb To contact the reporter on this story: Stephen Spratt in Hong Kong at ...

14) Aberdeen Likes Asian Bonds, Expects More Volatility Globally

Aberdeen Standard Investments sees good opportunities in Asian dollar bonds now as China takes steps to boost its economy. The securities look more attractive now than in late 2018 compared with U.S. corporate notes, which have outperformed this year, Craig MacDonald, global head of fixed income at Aberdeen Standard Investments, said in an interview in Tokyo. Global debt markets will likely become more volatile and investors are under-pricing the risk of ...

15) EUROPE CREDIT DAYBOOK: Europe Auto Sales, CPI; U.K. Offers Bills

Data includes Europe new-car registrations and euro-zone inflation. U.K. to sell bills. MANDATES/UPDATES: * Banco BPI EU500M WNG 5Y covered bond * Caverion Min. EU75m 3Y-4Y bond roadshow * Home Group GBP benchmark min. 20Y bond roadshow * PPF Arena1 EUR benchmark 4Y-6Y bond Roadshow * Bank of Georgia $sub-benchmark AT1 roadshow HEADLINES: * First Asian Schuldschein Moves Into Sight as Reliance Seeks Deal * Power Solutions Documentation Still ‘Weak’ ...

Central Banks

16) ‘Panic’ Triggered by Laundering Scandals Draws a Nordic Warning

Once considered the safest of them all, Nordic banks are now navigating a world dominated by allegations of laundering. Danske Bank A/S, Swedbank AB and Nordea Bank Abp, often via their Baltic operations, have all been tainted by claims that they handled vast amounts of money associated with crime. But the big risk now lies in the response, according to the head of the Financial Supervisory Authority in Finland, who oversees Nordea. ...

17) Kuroda Says Japan Needs to Achieve 2% Inflation Target: TOPLive

18) JAPAN REACT: BOJ Holds - Exports Hurt, Not at Pain Threshold

OUR TAKE: Weakening global growth is making life tougher for the Bank of Japan, as the downgrade in its economic assessment acknowledges. Even so, we think it will aim to ride out any mild economic turbulence within its current framework. There’s pressure from policy board member Goushi Kataoka to increase stimulus. Governor Haruhiko Kuroda, though, probably won’t feel inclined to oblige -- as long as he’s confident that reflation ...

19) RBA: The RBA has issued a media release - Bilateral Local Currency Swap Agreement with the Bank of Japan - https

RBA @RBAInfo The RBA has issued a media release - Bilateral Local Currency Swap Agreement with the Bank of Japan - bit.ly/2VZlIWo Sent via Sprout Social. View original tweet. Twitter profile information as of March 15, 2019 Description: We conduct monetary policy, work to maintain a strong financial system and issue the nation’s banknotes. Join us on Facebook: https://t.co/LdU04rXd79 Tweets: 1560 Following: 0 Followers: 39492 Tweeting Since: October 15, 2010

20) BOJ Takes Dimmer View of Economy While Keeping Policy Unchanged

The Bank of Japan left its monetary stimulus program unchanged as it downgraded its assessment of exports, factory output and overseas economies. The BOJ’s decision to maintain its policy interest rates and asset purchases was predicted by all 46 experts surveyed by Bloomberg. Its gloomier take on the economy was also largely expected after a raft of weak data over the past month. Most analysts still expect the BOJ to stay the course ...

21) Aussie Gains With Kiwi on China Stimulus Optimism: Inside G-10

The Australian and New Zealand dollars rose after China said it would cut value-added taxes to support growth. * The two currencies extended this week’s advance as China’s Premier Li Keqiang said the country would also lower social security contribution rates to address downward pressure on the economy. The yen swung to a gain as North Korea was said to consider pulling out of denuclearization talks with the U.S. * “Headlines about more ...

Economic News

22) Draghi’s Salvo May Avert Trichet-Style Bequest of Policy U-Turn

Mario Draghi’s latest stimulus salvo means his successor as European Central Bank chief may not be confronted by the kind of monetary policy U-turn he once faced. The president, who began his eight-year term reversing course on a recent interest-rate increase by his predecessor, has set in place the conditions to keep the euro zone in easing mode until he leaves office. That saves his successor from having to restart stimulus that Draghi concluded last year, ...

23) China, U.S. Said to Delay Trump-Xi Meeting to at Least April

A meeting between President Donald Trump and President Xi Jinping to sign an agreement to end their trade war won’t occur this month and is more likely to happen in April at the earliest, three people familiar with the matter said. Despite claims of progress in talks by both sides, a hoped- for summit at Trump’s Mar-a-Lago resort will now take place at the end of April if it happens at all, according to one of the people. ...

24) China Vows to Stick to Targeted Stimulus Amid Jobless Pressure

China will stick to its current targeted economic support strategy and resist the temptation to engage in large-scale stimulus like quantitative easing or a massive expansion in public spending, Premier Li Keqiang said. “We certainly need to take strong measures to face the downward pressure,” Li told a news conference Friday at the close of the annual National People’s Congress session in Beijing. “Such an indiscriminate approach may work in the short ...

25) Indonesia Posts Surprise Trade Surplus on Sharp Slump in Imports

Indonesia posted its first trade surplus in five months in February after imports fell sharply, easing pressure on policy makers who have been trying to rein in a ballooning current- account deficit. Southeast Asia’s biggest economy posted a trade surplus of $330 million last month, beating estimates in a Bloomberg survey for a $782 million deficit. Still, exports declined for a fourth month, the statistics office said Friday, falling 11.3 ...

26) China Growth Mystery Scares Global Economy in Weakest Shape in Years

Follow the latest global economic news and analysis @economics. The growing mystery of where China’s rapid slowdown is headed may become the biggest risk on the horizon, even as Brexit and a solution to U.S.-China trade tensions are kicked into the long grass. Here’s our weekly wrap of what’s going on in the world economy.Recession Watch The global economy’s in its weakest shape since the financial crisis a decade ago, Bloomberg ...

European Central Bank

27) Modern Monetary Theory Is Getting No Love From ECB Policy Makers

Benoit Coeure added his voice to the European Central Bank’s skepticism about Modern Monetary Theory and its alternative views on fiscal spending. The Frenchman, a member of the ECB’s Executive Board, told students in Milan on Wednesday evening that MMT is “a theory of fiscal dominance” that runs counter to the kind of “monetary dominance” practiced in Europe. “It’s a good discussion to have because it challenges the ...

28) ECB Near End of Road Seeks Government Backup to Help Economy

The European Central Bank’s latest round of stimulus is being accompanied by renewed calls on governments to step up their game in nurturing the economy. It’s an acknowledgment by President Mario Draghi and fellow policy makers that they’ll do what they can -- but their options are sorely depleted if the current economic weakness worsens. That puts the focus on reforms to make economies more resilient, and even fiscal stimulus, despite high debt in a ...

29) ECB to Publish First €STR Short-Term Rate on Oct. 2, 2019

ECB will start publishing €STR as of Oct. 2, 2019, reflecting the trading activity of 1 October 2019, it says in statement on website. * ECB will also provide computation of a one-off spread between the €STR and EONIA To contact the reporter on this story: Carolynn Look in Frankfurt at clook4@bloomberg.net To contact the editors responsible for this story: Fergal O'Brien at fobrien@bloomberg.net Jana Randow

30) Yahoo! Finance: ECB rate-hike prospects before next downturn are fading: Poll

Bengaluru: The European Central Bank (ECB) may have missed its opportunity to raise interest rates before the next downturn, according to a Reuters poll that shows a majority of central bank policy watchers aren’t confident they will. In a poll taken after the ECB said it would offer new long-term loans to banks later this year, nearly 90 per cent of economists who answered an extra question also said it would not conduct any more asset purchases until at least the end of 2020. That comes even though ...

31) Times of Malta: Is a recession on the horizon? - Lawrence Zammit

Last week, the president of the European Central Bank, Mario Draghi, announced two initiatives aimed at prologing the loose monetary policy stance that the bank has adopted in recent years. Initially, the ECB had initiated a quantitative easing programme through the purchase of sovereign debt, thereby injecting cash into the eurozone economy. Simultaneously it pushed interest rates downwards − a move, whose objective is to stimulate investment and consumption spending. The low interest rate regime was ...

Federal Reserve

32) Zero Hedge: $1 Billion Hedge Fund Shuttering Due To Collapse In Volatility

The Fed's active vol suppression (or, to paraphrase Fed Chair Powell circa 2012, the Fed's "short volatility position") has claimed its latest casualty: Argentiere Capital's flagship $940 million fund is returning capital to investors after years of failed bets on rising market volatility. The fund, which was founded by former JPMorgan top trader Deepak Gulati in 2013, will continue to manage a modest $250 million in other strategies. What is odd is that the Zug, Switzerland-based investment firm ...

33) ASX ends jittery week lower ahead of FOMC meeting

Australian shares closed a mixed week of trading slightly lower after the Brexit uncertainty and mixed US and China trade news caused jitters. The S&P/ASX 200 Index fell 28.6 points, or 0.5 per cent, to 6175.2 while the broader All Ordinaries slid 22 points, or 0.3 per cent, to 6265.1. Investors were this week focused on a series of votes in British parliament over the future of Brexit and mixed news coming from trade negotiations ...

34) First Midwest Receives Federal Reserve Approval for Acquisition of Bridgeview Bancorp, Inc.

First Midwest Receives Federal Reserve Approval for Acquisition of Bridgeview Bancorp, Inc. Business Wire CHICAGO -- March 14, 2019 First Midwest Bancorp, Inc. (“First Midwest”), the parent company of First Midwest Bank, today announced it has received approval from the Federal Reserve to acquire Bridgeview Bancorp, Inc. (“Bridgeview”) and its wholly owned subsidiary, Bridgeview Bank Group. “We are very pleased to have received Federal Reserve approval for our proposed acquisition of ...

35) DD News: US official lone candidate for presidency: World Bank

The World Bank confirmed Thursday that senior US Treasury official David Malpass was the lone candidate nominated to take over the helm of the development aid institution. Nominations closed Thursday morning, and the World Bank board said it will conduct a formal interview and make a decision before the Spring meetings of the World Bank and International Monetary Fund, which are to be held April 12-14. The surprise early departure of World Bank President Jim Yong Kim on February 1, not even halfway ...

36) OPM: Operating Status Current Status - Friday, March 15, 2019

Washington, DC Area Applies to: Friday, March 15, 2019 Status: Open Federal offices in the Washington, DC area are OPEN.

First Word FX News Foreign Exchange

37) Morgan Stanley Sees Just Two Key Growth Areas for Asset Managers

Global asset managers may struggle with growth in coming years, but China should provide some opportunities as it continues to open up to foreign investors and alternative assets offer potential, according to Morgan Stanley. To keep gaining share, asset managers should look to the Asian nation as regulatory changes will lead to revenue growth in the long term, Morgan Stanley analysts led by Betsy Graseck wrote in a report dated March 14, using research from ...

38) N. Korea Says Kim Jong Un Rethinking Launch, Test Moratorium: AP

North Korean Vice Foreign Minister Choe Son Hui said Kim Jong Un would decide soon whether to keep talking with the U.S. and maintaining his moratorium on missile launches and nuclear tests, AP reports. * U.S. threw away a golden opportunity at the Hanoi summit, Choe told a meeting of diplomats and foreign media in Pyongyang on Friday * Choe said North Korea has no intention of compromising or continuing talks unless the U.S. takes measures that are commensurate to ...

39) Yen, Swiss Catch Haven Bids, Tight Stops Triggered, Traders Say

Swiss franc and Japanese yen were bought as haven bids after Tass reported that North Korea may suspend denuclearization talks with the U.S., Asia-based FX traders say. * Near to market USD/CHF sell stops under 1.0030 have been cut, now down 0.2% to 1.0020 versus 1.0019/41 range * JPY was bought against dollar as long liquidation post Bank of Japan policy decision accelerates; spot down 0.1% to 111.58 * NOTE: North Korea’s leader Kim Jong Un will make an ...

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... From the ridiculous to the sublime...

This week in Parliament reminds me of this famous scene from Ghostbusters:

https://www.youtube.com/watch?v=O3ZOKDmorj0

BTW – The Telegraph and the FT are subscription services, as we know, but many of their articles on Brexit are available through your BBG terminal. Happy reading!

TEL: Theresa May to hold third ‘meaningful vote’ on her Brexit deal after MPs vote to extend Article 50

TEL: MPs quit Corbyn front bench amid ‘spineless’ Labour’s second referendum shambles

TEL: The Geoffrey Cox legal advice that Theresa May hopes will save her Brexit deal

TEL: Why Hammond’s Brexit war chest is smaller than it looks

TEL: Theresa May fights off Remainer attempt to seize control of Brexit by just two votes

BBC: March Brexit almost certainly out of reach

BBC: Brexit: May to try to persuade MPs for third time to back deal

BBC: Brexit: MPs vote by a majority of 211 to seek delay to EU departure

FT: UK Parliament votes overwhelmingly to seek Brexit delay

FT: Brexit delay but May is still fighting for her deal

FT: Business highlights worries over Brexit delay

BBG: Theresa May Wins U.K. Parliament’s Backing for Her Plan to Delay Brexit

BBG: Brexit Has Turned Into a Bad Monte Python Skit

BBG: The 310 Miles Breaking Brexit

BBG: Theresa May: The Servant Prime Minister

Enjoy!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Vive La France! Time to TAKE PROFITS...

Eurozone... Vive la France!

> Updating last Wed's 'MICROCOSM: Get Long OATs Into Great Seasonals...' ideas (see attached)

> OATM9 has rallied 3 points so far in March, taking 10yr yields down to levels not seen since late 2016. The FRTR .75 11/28s remain pinned to their richest level and have shown little sign of relenting.

> As the rundown stated, C&R flows into Apr/May are huge which helps drive a seasonal outperformance of OATs vs other EGB names. That said, THESE MOVES SELDOM HAPPEN in a STRAIGHT LINE! And momentum indicators are flashing 'hit the bid!' right now.

> FRTR 5/28 v NETHER 7/28 is now +17.1bps mid - TAKE PROFITS on 1/2 our position and move stop to +18bps. The 17bps level was my initial target (+5.2bps locked in).

> FRTR 5/28-DBR 2/28 sprd has posted a similar performance, now +36.4bps, new lows for this move. Taking profits on 1/2 our position and moving stop to +37bps. That's a 6+bp profit.

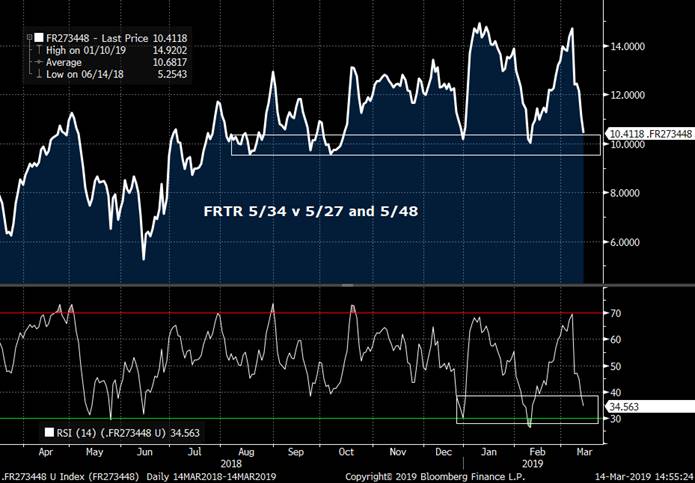

- FRTR 5/27-5/34-5/48 fly… It’s richened from +14.2bps to +10.4bps. Again, we’re booking profits on ½ this position since the +10bps support level has proven a key level since October. We’ll move our stop to +11.4 and will target +9 on the balance.

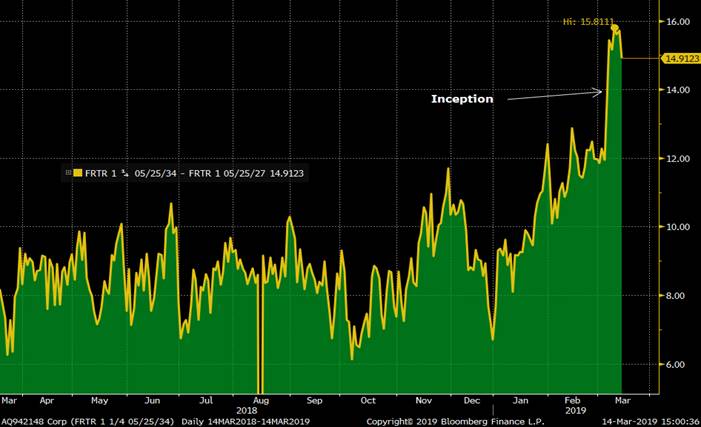

- FRTR 5/27 into FRTR 5/34 MMS flattener… The only ‘stinker’ of the 4 of them as we’re now 2.2bps underwater. That said, the spread appears to be turning here and given my short-term bias, I like adding to the trade at these levels for a move back to the +11/12 area.

NEW POSITION!

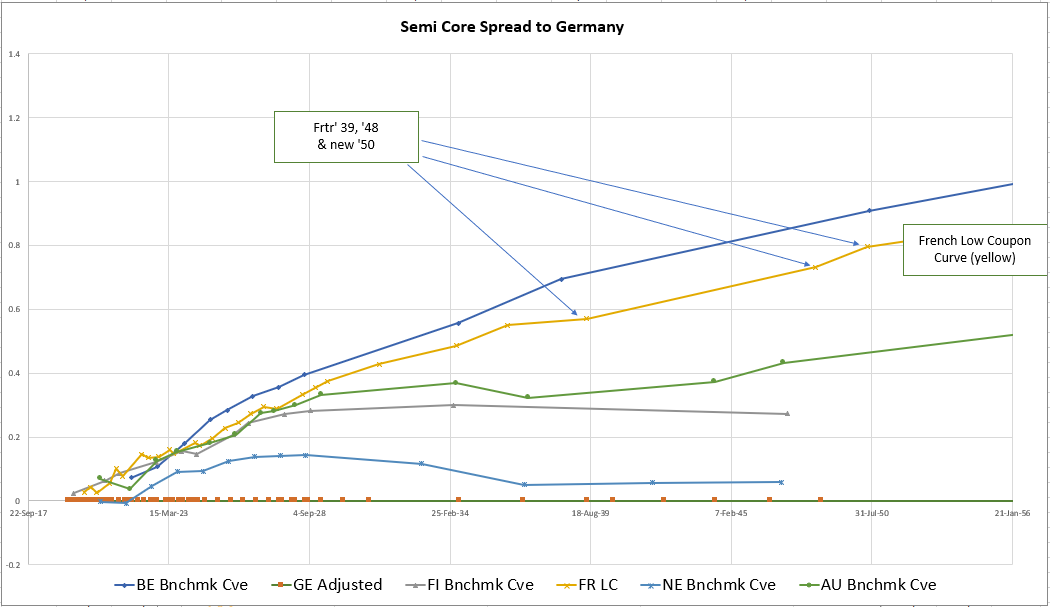

- As an extension of the view above that these strategies are due for a breather, take a look at these BLENDS, buying NETHER vs DBR/FRTR and NETHER vs DBR/BGB. We can see in each of the charts below that the retracement of NETHER from the richening into 2019 has been sharp, making NETHER look cheap on a s/term basis.

The NETHER 7/27 vs DBR 2/27 and FRTR 10/27 blend in a 1-2-1 weighting. We can see that momentum on this fly has come a long way from rich back to cheap. The last time RSIs were this cheap, the fly snapped back 12bps over the next month. While that seems unlikely right now, this blend does exhibit a mean reverting bias over time.

Two newer versions that we like, take advantage of the shift to new CTDs in RXM9 and OATM8 which can help with liquidity.

NETHER 7/28 vs DBR 2/28 (RXM9) and FRTR 5/28 (OATM9) looks attractive here, despite the modest curve flattening bias embedded here.

Alternatively, if you’d like to avoid shorting OATs given their seasonals outlook, take a look at swapping BGBs for FRTRs, this version a 60/100/40 weighting to adjust for the wider spread of BGBs than OATs.

I’ll call to discuss.

Thanks

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

French Trade - exploiting steep France 20s30s vs Germany

Trade – France 20s30s flattener, hedged vs +RX/-UB

Mechanism

- Sell €50k Frtr 1.75% 39, €26,2MM

- Buy €50k Frtr 2% 48, €19,7MM (possibly also use new cheaper frtr ’50)

- & Buy €10k RXM9 (69 cts), Sell €10k UBM9 (27 cts)

Cix: 100 * ((YIELD[FRTR 2 05/25/48 Corp] - YIELD[FRTR 1.75 06/25/39 Corp]) - 0.2 * (YIELD[DBR 2.5 07/04/44 Corp] - YIELD[DBR 0.5 02/15/28 Corp]))

Levels

- Current: @ +16.3 bp

- Target: @ +13.5 bp

- Stop: @+18 bp

Rationale

- Euro Curves are similar shapes. Typically weaker credits are thematically steeper

- The French curve is on average 55% steeper than the German curve. (*regression France & German Curve Benchmark Yields vs Tenor)

- In certain areas the French slope is exaggerated – that’s where we can observe true anomalies that are excessive to the general context

Graph of France 20s 30s vs Germany

- Thematically the 10s30s French curve is at a recent steep vs Germany – this is the best value ‘fade’ of that theme

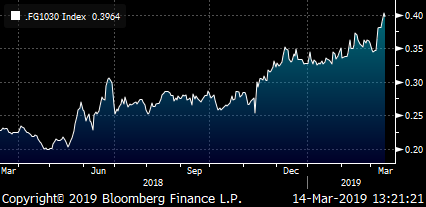

See graph of generics 1030s Box Fr v Germany

Cix: (RV0004P 30Y BLC Curncy - RV0004P 10Y BLC Curncy) - (RV0002P 30Y BLC Curncy - RV0002P 10Y BLC Curncy)

CMS France 10s30s minus CMS 10s30s Germany

Carry & Roll – net roll & carry, Nett -1.2bp /3mo

- French C&R: Carry -0.3bp, Roll -1.4bp /3mo (5bp repo spread)

- German Hedge Carry: Carry 0bp, Roll +0.5bp /3mo (even implied repo spread)

Risks

- French long end continues to underperform – on further supply

- French 20y increases its anomaly on the curve

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

CORE BOND YIELDS : IF in doubt send a yield update, lower yields STILL. Despite a marginal bounce in yields, most yield highs established Tuesday remain in tack.

CORE BOND YIELDS : IF in doubt send a yield update, lower yields STILL. Despite a marginal bounce in yields, most yield highs established Tuesday remain in tack. Hopefully yields tail off and head lower into the week end, this despite what most believe to be a POSITIVE equity performance.

The long-term quarterly-monthly charts continue to forecast MUCH lower yields and the daily are merely dictating that PACE.

On paper the quarterly and monthly charts are obvious, its MUCH lower yields. We are failing MANY RARE 50 and 100 period moving averages aided by RSI dislocations that date back to 1980’s. The formations are staggering given the previous upsets in and around 2000 - 2007.

It seems from a chart perspective everyone is convinced rates are going MUCH HIGHER based on the HISTORICAL RSI dislocations. Expectation and positioning is way too optimistic.

The weekly charts are more optimistic for a HOLD but daily negate that almost instantly.

Daily charts have persisted in remaining sub numerous 200 day moving averages, so ideally it’s all a matter of time.

Germany and UK also point to lower yields, whilst Italy close to a MAJOR breach.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Today's BREXIT BARRAGE... 'Slip slidin' away...'

Busy day in the press!

TEL: MPs to vote on delaying Brexit for three months

TEL: How likely is a delay to Brexit? Latest odds on how (and if) Brexit will happen

TEL: Can Article 50 be revoked and what would it mean to cancel Brexit?

TEL: Brexit extension: What time is the Article 50 vote tonight and will Brexit be delayed?

TEL: What Brexit means for EU holiday home owners

BBG: Brexit Heads for Delay as May Tries to Scare Up Support for Deal

BBG: Brexit Bulletin: Losing Control

BBG: Brexit Delay Adds Another Dimension to U.K. Economy

BBG: Brussels Edition: Who calls the shots?

FT: Theresa May issues ultimatum after MPs ditch no-deal Brexit

FT: Pound falls from 9 month high as Brexit drama rumbles on

FT: Will Northern Ireland dissidents be able to exploit Brexit chaos?

FT: Greece maps the long way back to a Brexit deal

FT: How pro-EU MPs humbled May on no-deal Brexit

FT: May could be losing her way to Brexit victory

BBC: Brexit: MPs to vote on delaying leaving the EU

BBC: Brexit: How can Article 50 be extended?

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

TECHNICAL SWAPS IDEAS : DAVID SANSOM AND I have been working on utilising TECHNICALS on SWAP ideas and here are 3 we have found. The USFS 10-20 was advocated a while ago.

TECHNICAL SWAPS IDEAS : DAVID SANSOM AND I have been working on utilising TECHNICALS on SWAP ideas and here are 3 we have found. The USFS 10-20 was advocated a while ago.

Here are 3 very technical interpretations of various swap ideas which myself and David Sansom have been working on. All have decent dislocations and thus the stops are cheap on all.

TRADE 1 USFS 10-20 WHAT NEXT : **STILL TIME TO RELOAD or ADD as we HEAD LOWER AGAIN.**

This seems to be on the move lower again in a similar style to the move lower in bond yields.

Above all this is a long term trade hence don’t be afraid to sell new LOWS.

This chart corelates well with the outright yield charts which ALSO predict a move LOWER.

My BIG worry is that if equities fail then yields plummet and the RE ENTRY is missed.

Trade 2 EU 2-10

A simple chart highlighting a hit of a trend line from 2008 and RSI last seem in September 2014. Sadly this has breached the trend line but for those who still believe the RSI dislocation then a stop sub the 50% ret 69.500 might suit.

Trade 3 EU HICP ZC swaps

Again a simple chart and significant historical history well worth a look as it is complimented by NUMEROUS technical factors. We are building a BASE but sadly little else, hopefully we head higher soon.

**Speak to David Sansom re any trade discussion on this idea, NEW OR ADDING. **

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Today's BREXIT BARRAGE... No Surprise But Still Disappointing...

BBG: U.K. Weighs No-Deal Brexit Vote as May Is Thrown Into Crisis

BBG: Theresa May Loses Voice, Vote and Possibly Job

FT: Power over Brexit slips from May’s damaged hands

FT: UK outlines tariff plan to limit no-deal Brexit damage

FT: Pound holds losses after Theresa May’s Brexit deal is defeated

BBC: Brexit: MPs to vote on 29 March no-deal exit from EU

BBC: Brexit: What happens now?

BBC: Brexit: EU points finger at UK for Theresa May’s deal defeat

TEL: No deal Brexit: What time is the vote and what will happen?

TEL: What happens next now the Brexit deal has been rejected? All the options explained

TEL: No deal Brexit latest odds tracker: Best bets on how (and if) Brexit will happen

TEL: What ‘no deal’ Brexit really means, and how it might affect daily life in the UK

TEL: The EU must shoulder its share of the blame for the Brexit imbroglio

TEL: Why extending Article 50 could be inevitable – and the consequences of delaying Brexit

Stay tuned!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

CORE BOND YIELDS : HEADING LOWER STILL ENDORSED BY TODAYS INTRADAY REVERSALS. SOME MAJOR DAILY REVERSALS WORTH MENTIONING.

CORE BOND YIELDS : HEADING LOWER STILL ENDORSED BY TODAYS INTRADAY REVERSALS. SOME MAJOR DAILY REVERSALS WORTH MENTIONING.

Despite little activity in equities bond yields continue to want to head lower, continually aided by numerous 1982-1984 dislocated RSI’s. A key week for yields to FALL FURTHER.

On paper the quarterly and monthly charts are obvious, its MUCH lower yields. We are failing MANY RARE 50 and 100 period moving averages aided by RSI dislocations that date back to 1980’s. The formations are staggering given the previous upsets in and around 2000 - 2007.

It seems from a chart perspective everyone is convinced rates are going MUCH HIGHER based on the HISTORICAL RSI dislocations. Expectation and positioning is way too optimistic.

The weekly charts are more optimistic for a HOLD but daily negate that almost instantly.

Daily charts have persisted in remaining sub numerous 200 day moving averages, so ideally its all a matter of time.

Germany, Italy and UK also point to lower yields.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Today's BREXIT BARRAGE... But is it enough...?

BBG: May Strikes New Brexit Deal With the EU, Asks Parliament to Back It

BBG: This is What’s in Theresa May’s New Brexit Deal With the EU

BBG: Juncker Warns ‘It Is this Deal, or Brexit May Not Happen at All’

BBG: Pound Set for Wild Brexit Ride: Strategists See Possible Range of 10%

BBG: May’s Brexit Deal Lets Parliament Pick Its Poison

FT: May agrees revised Brexit deal with Juncker

FT: Breaking down the ‘last push’ to get May’s deal over the line

FT: Tory sceptics reserve judgement on May’s revised Brexit deal

BBC: Brexit: MPs to vote on Theresa May’s deal

BBC: Big Brexit vote: What do I need to know?

BBC: Brexit: Will May’s changes to her deal satisfy the Brexiteers?

TEL: Theresa May and Jean-Claude Juncker agree ‘legally-binding assurances on Irish backstop’

TEL: Second meaningful vote on Theresa May’s Withdrawal deal

TEL: William Hague: Brexit is there on the table. Take it and run, while there’s still a chance

TEL: Theresa May’s Brexit deal: how the maths behind Parliament’s factions break down

TEL: Revealed: Nigel Farage met Donald Trump and asked him to back a no-deal Brexit

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796