MICROCOSM: SPAIN Breaking Richer vs France/Italy... Quick colour

Eurozone...

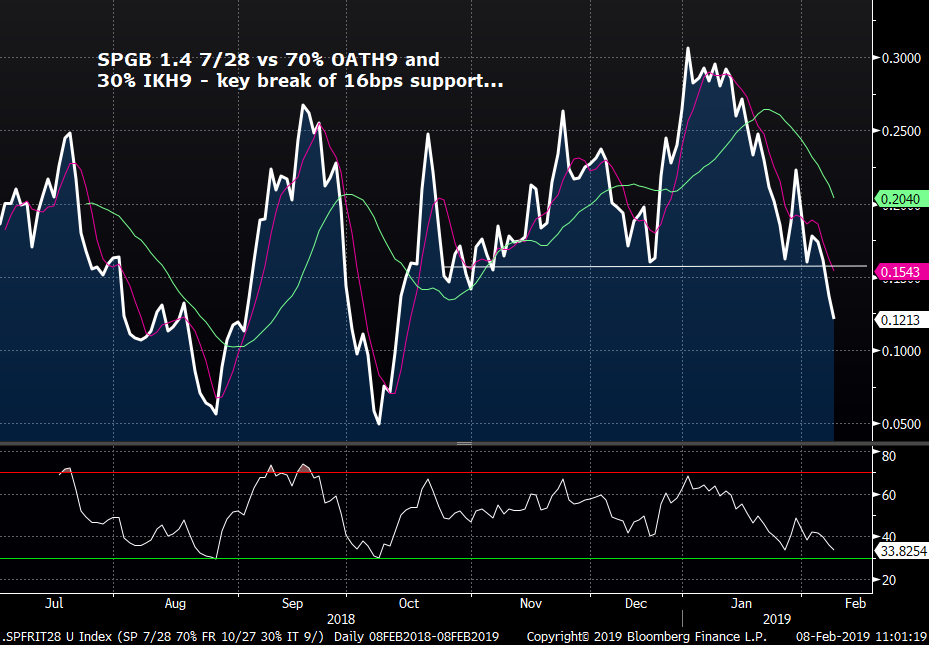

> OATs coming under some pressure with the potential non-comp of €2.25bn today after yesterday's supply (option expires at 3:30pm today) and the new 30yr stories out there.

> Along with that BTPS have been all over the map since yesterday given the downgrades of their growth estimates and renewed jitters over their budget outlook. Throw in the feud with France and we've got a recipe for profit taking across the curve.

> Spain, by contrast, has been relatively stable. No fireworks post their auction yesterday and few big supply concerns for now.

> Throw these three into a blender and we get MORE OUTPERFORMANCE of Spain on the blend vs France and Italy. Our long SPGB 7/28s vs OATH9 and IKH9 blend (70/100/30 wtd) is now 12.4bps mid, a clean break of the 16bps support that held on the chart since Nov. This is in line with our expectations (as per my note this week – see attached), although it's happening at an accelerated pace into week's end. Next big stop is the 5bps level from Aug/Oct which might require renewed selling in BTPS to get there...

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: More Technicals Toolkit > Gilts Volume at Price Rundown

GILTS...

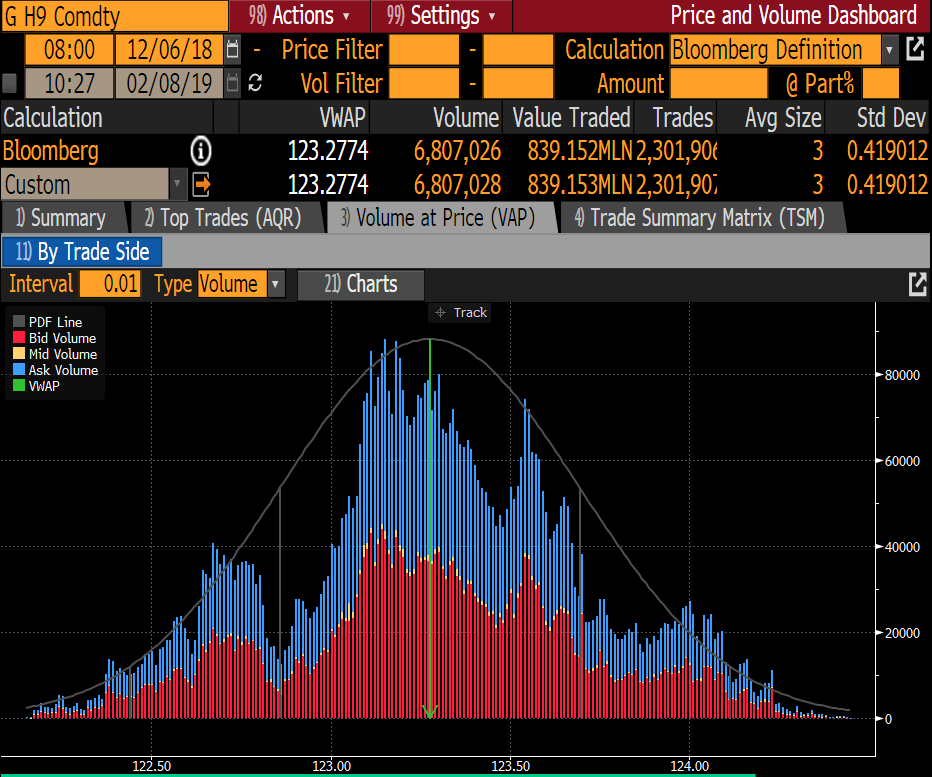

> G H9 volume at price chart back to Dec 6th...

The market's currently in relatively uncharted territory with small volumes which we'd expect given the re-test of highs that didn't last long the first two tests in mid Dec and early Jan.

> Interesting though that the volume isn't significant until we get all the way down to 123.65 which also coincides with the 5 day MA.

> The rise in open interest since mid-Dec is interesting because this chart says that most of those new positions were established at lower levels than here. Broadly speaking, this means the market doesn't get too jittery until their entry levels which appear to be in the 123.45-65 zone - which is also why that's an important initial support.

> It ALSO means that the market won't try as hard to defend positions north of that level which could make price action more erratic.

In other words, don't get married to your longs OR shorts!

Bollingers…

Best,

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS... When Doves Cry... TECHNICALS

GILTS... Quick technicals/ valuations reality check:

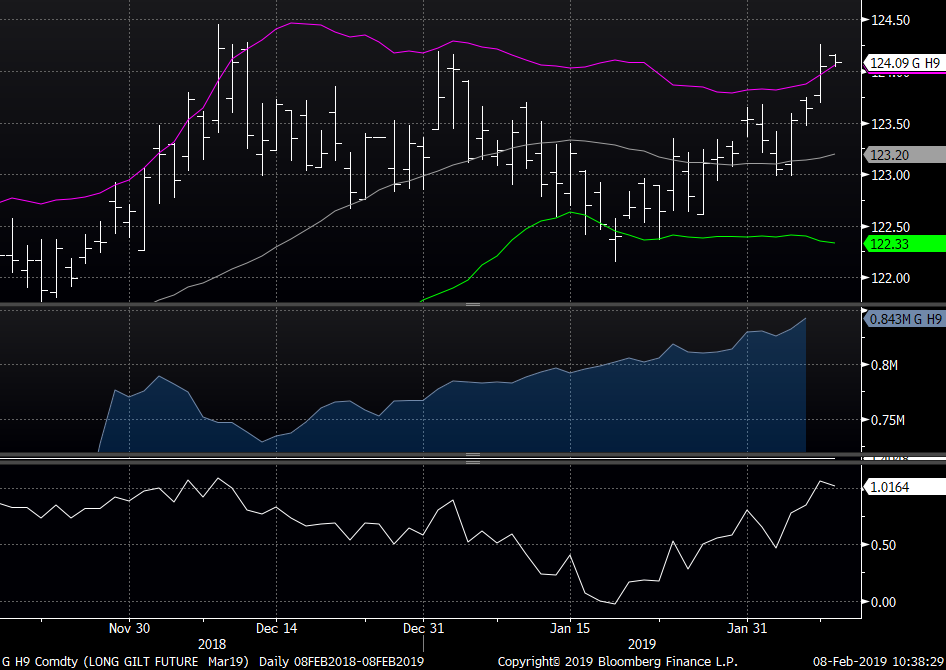

> G H9 technicals turned more bullish into the close yesterday from the post-MPC 'head fake' where we rejected the initial test of the Dec-Jan highs.

> The candlestick chart below shows that the 'body' (open vs close) recovered much of the day's range to post a strong close above 124.00.

> The 'trouble' now is this am's open at 124.15 attracted moderate selling with today's low just below last night's close. We can also see that open interest continues to climb higher into this rally.

> So, we're watching last night's 124.05 close, the 124.26 highs and the 123.77 open yesterday, followed by the 123.67 5 day MA as first key support.

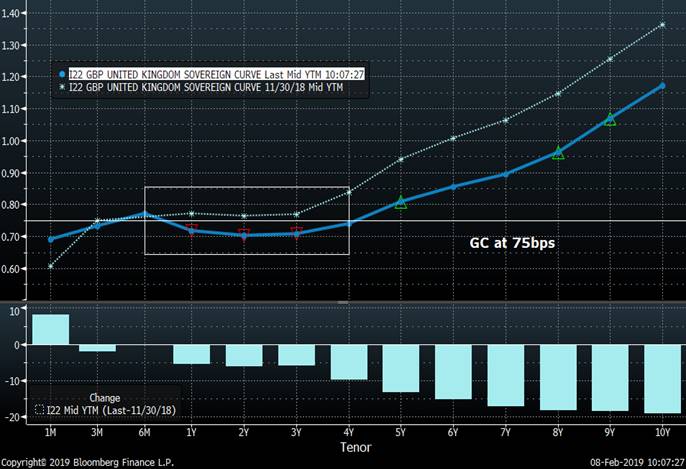

> In the SHORT END we've got O/N Sonia at .706, O/N GC around 75bps. Consensus expectations for Sonia at the end of 2019 is 1.10% vs 80bps now and 2020 is 1.50%, 60 basis points HIGHER than current levels at 90bps.

> The short end of the gilts curve from UKT 2 20 to 0H 22s trades rich to GC at 75bps and the 0T 23 (still the benchmark 5yr) are a whopping 5bps cheap. So, one can understand the temptation to either fade the rally or, throw in the towel and put on the flattener. The trouble is, those flatteners have come a LONG way now.

> The moral of this story is, ANYTHING can happen in this new dovish CB/Brexit regime. However! We mustn't lose sight of the what we're pricing in and where positions are heaviest. We have seen a mix of trades over the last couple days with a bias towards fading this richening. Concerns remain about the long end’s valuations now, with the ratio of cash for cash extensions into issues like the 57s (which will be tapped soon) looking a tad steamy now (see chart below – a declining ratio means longer issue is richening).

UKT 1H47 vs UKT 1T57 price ratio…

We’ll be in touch…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

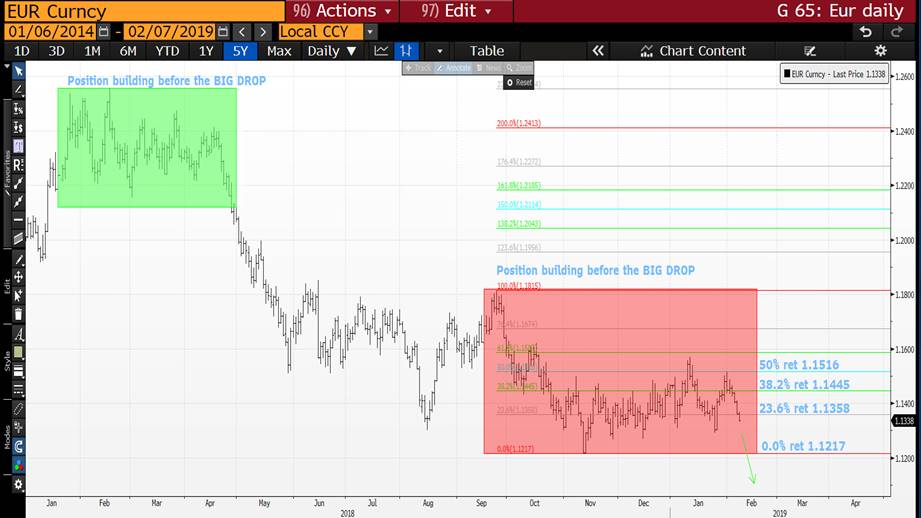

USFS 10-20 WHAT NEXT The theme continues! STILL TIME TO RELOAD or ADD as we HEAD LOWER AGAIN. The recent bounce has been POOR.

USFS 10-20 WHAT NEXT : The theme continues! **STILL TIME TO RELOAD or ADD as we HEAD LOWER AGAIN.** The recent bounce has been POOR.

Similar to other markets we have witnessed ONLY a SLIGHT recovery. If IN the original trade (inception 3.3299) certainly add here OR initiate a new trade with stop above last months high 3.0074.

**Speak to David Sansom re any trade discussion on this idea, NEW OR ADDING. **

Above all this is a long term trade hence don’t be afraid to sell new LOWS.

This chart corelates well with the outright yield charts which ALSO predict a move LOWER.

My BIG worry is that if equities fail then yields plummet and the RE ENTRY is missed.

This will be a big trade as it 100% endorses the YIELD LOWER call.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Today's BREXIT BARRAGE... Tsk Tsk Tusk!

Seems there’s still a bit of sensitivity around Tusk’s ‘Hell’ comments amid stalled talks…

BBG: Brexit Deadlock Continues as EU Rebuffs Theresa May’s Demands

BBG: Brexit Bulletin: No Breakthrough in Sight

BBG: Bemused World Doesn’t Know What to Make of Brexit Britain

BBG: Germany’s Scholz Says Finance Must Prepare for No Deal Brexit

BBG: Hammond Tells Public to ‘Hold Their Nerve’ Over No-Deal Brexit

FT: Sajid Javid: I’ve never called myself ‘The Saj’

FT: Ingram Pinn’s illustration of the week: A special place in hell

FT: UK draws up secret plan to boost economy after no-deal Brexit

FT: Jeremy Corbyn’s shift on Brexit heightens Labour tensions

TEL: Theresa May set to meet Irish PM Varadkhar for talks on backstop

TEL: May faces three simple choices: betray Northern Ireland, your people, or exit without a deal

TEL: Our PM has become engulfed in lies, pantomime and post-truth, but it won’t stop us leaving the EU

BBC: Brexit: May says she can get deal through with binding changes

BBC: Brexit: ‘More talks’ pledge helps May in perception war

BBC: Brexit: EU’s Guy Verhofstadt welcomes Corbyn’s offer to Theresa May

Enjoy!

Best,

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

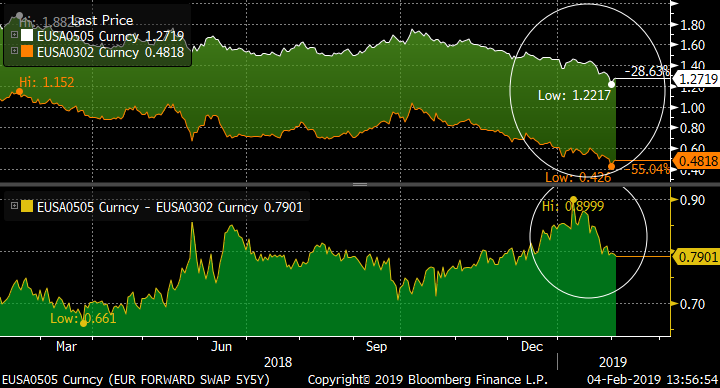

MULTI ASSET UPDATE ...We continue to be in a HEIGHTENED state of alert especially relating to Europe.

MULTI ASSET UPDATE :

We continue to be in a HEIGHTENED state of alert especially relating to Europe. The EURO is now a concern as we lean toward a break of the 1.1241 multiyear 50% ret. Bond yields continue to POINT lower and STOCKS a pain, but poised to FAIL. A very busy period forecast.

Bond yields : These continue to forecast lower yields especially in the US as we persist in failing multiyear moving averages and previous closes. The acceleration of the drop will be the painful addition.

US Curves : If yields stall, buy BACK END steepeners, 5-30 or 10-30 given their resilience previously. In general the RSI dislocation prefer steepeners across the board.

Equities : These are a pain currently as they are bouncing further than anticipated but overall many charts remain TERMINAL. Multi year tops are in.

FX : It’s not all about the USD, far from it given Brexit, Europe and EM. The USD has to take a back seat this time. The EURO is back in focus as we lean toward a breach of the all important 1.1241 50 % ret. EM should be a big winner this year given many have multi year tops.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Today's BREXIT BARRAGE... Stopping the Backstop...?

BBG: Brexit Bulletin: Bracing for Impact

BBG: Brexit or Not, Britain’s Real Economic Threat Is Here to Stay

BBG: May Heads to Northern Ireland in Her Search for a Brexit Answer

BBG: Brexit Agreement Reached to Bolster London Derivatives Clearing

FT: Bank of England ‘paralysed’ on rate by Brexit uncertainty

FT: Nissan’s Sunderland U-turn is all about the EU – but not Brexit

BBC: PM to secure Brexit deal that ‘commands broad support’

BBC: Brexit: EU digs heels in over deal

TEL: Business Secretary faces backlash after secret £80m Brexit sweetener he offered to Nissan is leaked

TEL: Brexit Latest News: Theresa May promises deal that honours commitments to Northern Ireland

TEL: Chris Grayling: Blame Brussels, not Britain, if we crash out of the EU without a deal

TEL: David Trimble to launch legal challenge against Theresa May’s Brexit deal in new few days

Onwards and upwards!

M

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade: EUR tactical zero-cost bear-steepeners on 3y2y/5y5y

Bottom line: For the next month, the risk events for the EUR curve will likely come from internal politics (BREXIT, Italy etc) or global moves (eg US/China trade). In both cases, the ECB is likely side-lined (the next GC meeting is not until 7th March) and the curve should hold the recent bull-flattening/bear-steepening mode as long rates drive. The levels of implied volatility on EUR mid-curves do not yet reflect this, hence it is possible to set zero-cost bear-steepeners (on EUR 3y2y vs 5y5y) which should be well-protected in a continued rally.

Trade:

Sell EUR 500mm 1m3y2y mid-curve payer atmf (k=0.50%)

Buy EUR 205mm 1m5y5y mid-curve payer atmf (k=1.282%)

Net premium take-out of EUR 25k (0.25bp running) mid indic.

Equivalent to EUR 100k/bp of the underlying at expiry

Forward curve strike at 78.2bp vs spot at 78.7bp

Rationale: I wrote in my last piece (“Regime change? Has the dynamic flipped on the EUR curve”) that the EUR curve has flipped almost seamlessly between bull-steepening and bull-flattening as the market rapidly re-assessed the prospects for ECB rate action. The chart shows the spread of the 3y2y and 5y5y forward rates. In the last month, the curve mode has been clear: the curve has flattened sharply as rates have headed lower.

This trade is a tactical position for a near-term sell-off (coming for example from a US-China trade accord) sending medium-term rates higher, while the outlook for the ECB is unchanged. Usually the relative implied volatility levels on mid-curves mirror the directionality of the curve, but currently the implied vol on 3y2y tails is higher than on 5y5y. Hence it is possible to construct zero/negative cost bear-steepeners. Should the recent curve mode be validated, one would expect the relative volatilities to adjust to reflect this.

Using mid-curve payers eliminates losses if both 3y2y and 5y5y rates rally. The ATMF strikes on both forwards are 2bp and 1.5bp higher than spot on 3y2y and 5y5y respectively, making the trade marginally positive carry/roll by 0.5bp over the 1m term.

The risk comes from the possibility of a flip back to a bear-flattening dynamic. However a 1m horizon today would expire just before the next ECB meeting on 7th March, which reduces the scope for the ECB to regain its driving seat on the curve (unless the minutes of the Jan meeting reveal a surprise hawkish element, which was not evident from the press conference or statement).

So, what do you think?

Best

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE...

BBG: Nissan Deals Brexit Blow to Britain as May Starts Work on Plan B

BBC: Brexit: Talks on backstop ‘alternative arrangements’

BBC: Brexit: Theresa May ‘determined’ to leave EU in March

BBC: Brexit: John McDonnell rejects any funds deal for votes

FT: Nissan U-turn is a no-deal Brexit ‘warning sign’ says Clark

FT: Banks fret over investor inaction over Brexit

FT: Varadkar beset by backstop worries as Brexit no-deal risk rises

FT: Theresa May is warned of ‘trouble ahead’ by Tory Eurosceptics

FT: The EU should listen to Theresa May to get the deal over the line

FT: Munchau: How to play a winning Brexit game

TEL: Backstop: The politics and economics of Brexit’s most important, but most eminently solvable, riddle

TEL: Rebel Labour MPs ‘plan breakaway party’ as anger grows over Jeremy Corbyn’s leadership

TEL: Fragile Tory truce over Brexit starts to crack as Eurosceptics suspect backstop back-pedalling

TEL: Brexit deal could see UK economic growth hit 1.5pc, says EY Item Club

TEL: With just 53 days to go, Britain still needs to know what Brexit will look like

Enjoy!

M

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Astor Ridge Rates Data, Supply and Events Calendars - Feb 4-8

Astor Ridge Rates Data, Supply and Events calendars for week of Feb 4-8...

Highlights:

> US refunding dominates supply while China talks continue. Powell speaking on Thurs.

> Eyes on Europe re: supply and Brexit...

> UK's got the 2041 syndication, BoE meeting and more Brexit!

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796