MACROCOSM: Jan US Payrolls - Quick Rundown

NF Payrolls... Mixed...

> Jan payrolls rose 304k but there was a net downward revision of 133k between Oct-Dec.

> Jobless rate rose to 4.004%, highest since June last year as household employment fell 251k and the labor force dipped 11k. Pool of available labor rose 168k, however.

> Avg hrly earnings up just .1, well below the .3 ests and .4 last month. Fell from 3.34% to 3.18% YOY.

> Avg duration of jobless fell to 20.5 from 21.8, lowest reading in years. This seems to suggest that if you’ve got the skills in demand, you have no problem finding a job.

> Not in labor force fell a whopping 639k – shutdown driven one would think.

On balance, this is a tough report to read much from, especially given the uncertain net impact of the govt shutdown during the survey period. This nebulous reading helps explain why TYH9 has recovered from the initial post-release selloff, now only 3/32 lower on the day.

Best,

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... 'Disorderly Exit' fears growing...

May’s digging deep into her handbag for something to sweeten the pot for Labour. Let the horse-trading commence!

BBG: Brexit Bulletin: Could She Pull it Off?

BBG: Dublin is Bursting at the Seams

BBG: May Sets Out to Win Labour Rebels’ Support Over Brexit Deal

BBG: U.K. Lays Ground for Brexit Delay as Parliament Holiday Canceled

BBG: Brexit Overshadows Review Meant to Herald the End of U.K. Austerity

FT: Brexit-blemished UK assets look cheap – but investors are wary

FT: Will the UK’s jobs boom survive Brexit?

FT: UK faces daunting task to meet Brexit deadline

TEL: German anger builds over dangerous handling of Brexit by EU ideologues

TEL: ECJ will block lawsuits against Britain for not paying Brexit bill after no deal

TEL: Could the EU force Britain to pay the £39bn Brexit bill after no deal? And would it cost even more?

TEL: Sajid Javid admits Brexit may be delayed as clock ticks for May

TEL: If Theresa May is robust with Brussels now, she may finally be able to get Brexit right

Sorry for late arrival… busy morning!

Best

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... No one said it would be easy...

This could get uglier folks…

TEL: This ‘unicorn’ could make the backstop vanish, but Parliament needs to stick to its guns

TEL: Theresa May toys with Labour customs compromise as her Brexiteer pitch unravels

TEL: No-deal Brexit would push Europe back into deep-recession, with explosive consequences

TEL: Oliver Robbins warned Theresa May against Tory plan to go back to Brussels and renegotiate deal

TEL: Brussels orders Britain to pay £39bn Brexit bill even if there is no deal

BBG: Brexit Bulletin: Europe Says No

BBG: EU Ready to Push U.K. Near Point of No-Return on Brexit, Diplomats Say

BBG: Jeremy Corbyn Is Worse Than a ‘No-Deal’ Brexit

BBG: U.K. Auto Investment Drops Almost 50% as Brexit Chills Spending

BBG: Labour’s ‘Fraying’ Brexit Compromise Shows May a Path to Victory

FT: The EU cannot rescue Britain from Brexit chaos

FT: May considers extra spending to woo Labour MPs

BBC: Brexit: Backstop is ‘part and parcel’ of the deal, says Barnier

BBC: Brexit: A staring match of one against 27

BBC: How ready is UK government for a no-deal Brexit?

BBC: Coveney warns Brexit deal bid is ‘running out of road’

Tip of the iceberg!

Best,

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

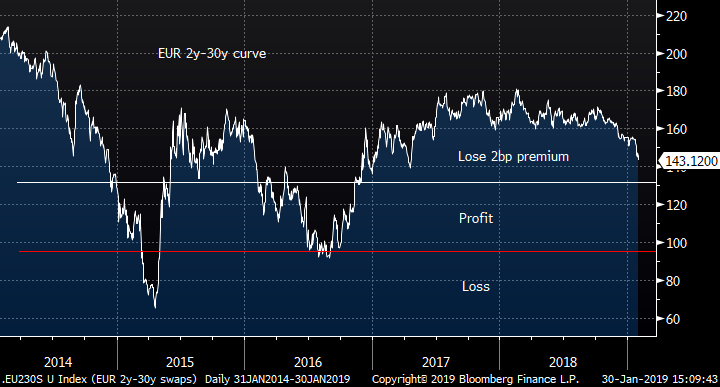

Regime change? Has the dynamic flipped on the EUR curve ...

Bottom line: I’m going to advance the case that the ECB is missing the boat on significant rate hikes (beyond getting the deposit rate to flat). The European economy is facing multiple domestic and global challenges, and the sharp repricing of the FOMC curve is further constricting the ECB’s room for manoeuvre. My view is that there is now an asymmetry in the outlook that strongly favours continued flattening of the EUR curve. On the same theme, the volatility on long tails (eg 10y20y) has been suppressed and should outperform.

Trade 1: EUR 1x2 Floor spread on 30-2

Buy EUR 1bn 1y SL cap on CMS 30-2 atmf (k=134bp)

Sell EUR 2bn 1y SL cap on CMS 30-2 atmf-20bp (k=114bp)

for an upfront premium of 2bp.

Trade 2: Buy Vol on EUR 10y20y vs 2y1y

Sell EUR 994mm 1y expiry mid-curve straddles on 2y1y atmf (k=0.364%)

Buy EUR 69mm 1y expiry mid-curve straddles on 10y20y atmf (k=1.602%)

For zero cost, delta-hedged

Equivalent to 100k/bp on 2y1y vs 110k/bp on 10y20y

(or DV01 neutral weighting for a premium take out of 3.3bp)

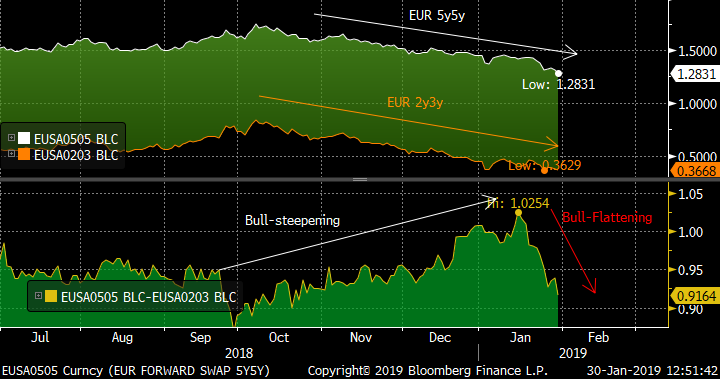

Rationale: At the start of the year I published a trade idea suggesting EUR 2y3y vs 5y5y bear-flatteners. In the event this trade has performed in the rally as the flattening has outweighed the fall in rates. However the price action of the last week (following the ECB meeting) has flipped the curve directionality directly from bull-steepening to bull-flattening (without any intervening bear periods). This represents an abrupt shift from the short end driving the curve to the long end making the running.

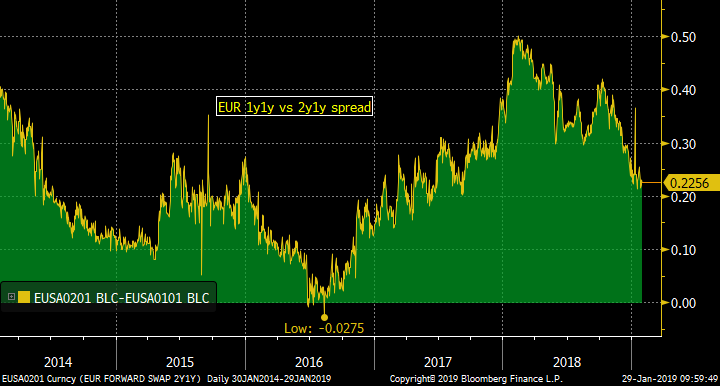

As a barometer of ECB rate hike expectations consider the EUR 1y1y/2y1y curve. The first chart shows that the market’s pricing of an ECB hiking path that peaked in Feb 2018 at 50bp. Subsequently this spread halved to its current value, driven in large part by the reassessment of the prospects for the US Fed and the lacklustre nature of the German economic outlook. Should we see a reversal to neutral sentiment, the short-term move could be a steepening but if the economic picture improves (eg a US-China and US-EU trade deal, and a non-catastrophic BREXIT resolution) then ECB hikes come back onto the table and the classical bear-flattening could resume. This is why I see the prospects for large flattening moves to be significantly better than for steepeners.

Looking more closely at the last fortnight, I’ve highlighted the recent January ECB meeting. The ECB has for some time had an “Autumn ‘19” timescale for the first hike pencilled into the diary. On the basis of the short-end slope of the curve, it is hard to see any major repricing following the meeting. If anything 2y1y sold off slightly in the aftermath.

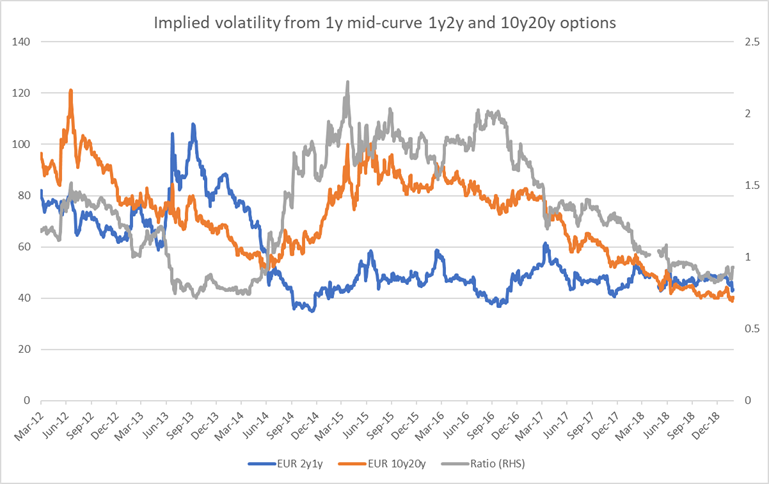

To illustrate how the short-end has been driving the curve in the last two years, this is the history of the market implied vols of 1y mid-curve options on EUR 1y2y and 10y20y forward rates, and the ratio of the two. Since 2017 the implied volatility on 10y20y tails has been falling steadily, while that on 2y1y has remained rangebound. The ratio of the two volatilities is at 0.91 close to the low of the past five years. On this basis, 10y20y vol looks cheap to 2y1y.

Source: CitiVelocity

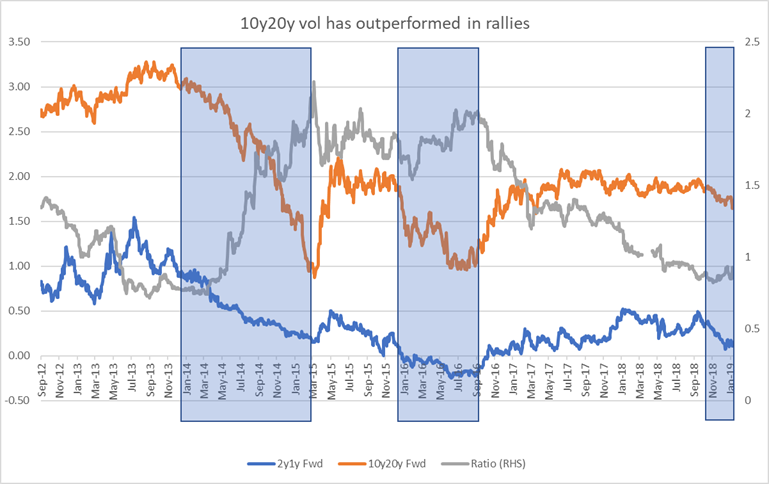

To explore this further, I’ve overlaid the actual forward rates on the ratio of the implied volatilities. I’ve highlighted three periods: the first when the prospect of QE from the ECB went from a possibility to an actuality from Jan 2014 to Feb 2015 and the curve flattened dramatically; the second in Jan-Sep ’16 as long rates rallied but already suppressed depo rate expectations had nowhere to go; and finally the recent situation where short rates have been leading the way, but even so 10y20y vol has begun to outperform 2y1y. Should the European outlook weaken further, the long-end once again has much more scope to rally, especially if speculation grows that QE could be reinvigorated in some form (note that I am not saying that QE would regain the pace of 2016 as Germany simply does not have the paper to buy, but it could return to the 2018 levels).

Source: CitiVelocity

So, in essence I have two trades: flatteners on the EUR curve, and buying of mid-curve gamma on 10y20y vs 2y1y. Taking each in turn:

1. EUR flatteners: the issue here is that flatteners like 2y1y/10y20y are painful in terms of negative roll-down (given that the EUR short-rate curve is still upward-sloping). One way to mitigate this is to look at CMS floors on 2y-30y, with a 1y expiry in a 1x2 structure (as the atmf rolls away from the strike, the out-of-the-money option loses value more rapidly than the at-the-money in the first 6 months).

Buy EUR 1bn 1y SL cap on CMS 30-2 atmf (k=134bp)

Sell EUR 2bn 1y SL cap on CMS 30-2 atmf-20bp (k=114bp)

for an upfront premium of 2bp.

The reason to chose the -20bp strike is that the trade makes money in a flattening move if the curve doesn’t flatten through the 2016 low of around 94bp. I am not overly concerned about the 2015 low as that was the limit of the QE effect on the curve, and I don’t see us revisiting that situation (as sovereigns have now adapted by issuing more long-dated paper, taking the opportunity to extend the duration of their debt).

How does the rolldown look? This is how the PV of the structure evolves as we roll down the rate and vol surfaces. The trade has positive net rolldown over the first 6 months, which offsets some of the upfront premium cost. Thereafter the out-the-money leg starts to become valueless so the PV change comes from the negative theta of the atm option.

PV change

Entry 0bp

1m +0.25bp

3m +0.75bp

6m +0.5bp

9m -0.25bp

11m -1.25bp

2. Buying mid-curve vol on 10y20y versus 2y1y. The trade here is to simply:

Sell EUR 994mm 1y expiry mid-curve straddles on 2y1y atmf (k=0.364%)

Buy EUR 69mm 1y expiry mid-curve straddles on 10y20y atmf (k=1.602%)

For zero cost, delta-hedged

Equivalent to 100k/bp on 2y1y vs 110k/bp on 10y20y

(or DV01 neutral weighting for a premium take out of 3.3bp)

There a plenty of ways to skin the cat of this view … so would love to hear your thoughts on alternative expressions!

Best wishes

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Crunch-Time for Gilts... Rates Rundown...

- You’ve got this am’s Brexit Barrage so you know what’s going on in Westminster but what’s the response in the gilts/GX market?

- Here’s a snapshot of moves in the UK since last Friday’s close:

Jan 25 Now Comment

G H9 122.79 123.14 Muted but cautious response to Brady’s amendment passing.

Sonia 1y1y .9743 .9333 We’ve pushed the next 25bp hike back to 2yrs from now again.

Cable 1.3196 1.3109 Bit of profit taking after a nice rally we think.

G H9 inv sprd 24.25 25.50 Modest bounce back to mid range.

UKT 2-10s 52.25 50.70 Bull flattening

UKT 2-10-30 +1.7bp -.75bp Modest bullish reaction.

US-UK 10yr 145bp 145bp Unched!

GE-UK 10yr 111.25bp 107.1bp Well off the 98bps Jan 9 lows but bullish move nonetheless.

- The point of the snapshot above is that the market’s response to the latest developments is a collective ‘So, what?’. The good news is Parliament agreed on a plan that, if approved by Juncker and co, would be passed by the government. The bad news is the EU has been steadfast in their insistence that the deal won’t be reopened for negotiation (at least in public), so there’s no guarantee they’ll budge and, as we know, the clock is ticking.

- And there’s another head scratcher we’d love an answer to. Parliament, in theory at least, has committed themselves, both publicly and privately, to avoiding a no-deal outcome at all costs (hence, Corbyn’s agreement to help May fashion a deal). But they also rejected Cooper’s amendment to extend Article 50 and they’ve basically given May 2 weeks to come up with ‘legally binding changes’ to the Irish backstop that Tusk said weren’t on the table. Talk about a game of ‘chicken’ with the UK’s future.

- The next supply in the UK is on Feb 14th, what’s likely to be the last tap of the UKT 1F 28s before they’re replaced by a new 2029 issue in Q1 2019/20. In the attached note ‘GILTS RV Update – Leaning Bearish, I highlighted a handful of factors that could/should contribute to higher UKT yields. While I was a tad early on the broader view, the observations and positions we highlighted still hold water. Even with SONIA rebounding, 2-7yr gilts have under performed swaps (ois and libor) with 3yr/4yr vs 7/8yr flattening. And the UKT 1F 28s have now taken hold of the status of ‘fulcrum’ of the 10yr sector, leading the 10yr sector richer or cheaper as yields fall or rise. That adds an element of directionality to any curve/yield concession for the 28s into their tap in a couple weeks. Given the recent cheapening of the 4Q27s on the curve, there’s little juice in many 8-11yr RV trades, although any meaningful cheapening of the 28s into their tap will be snapped up ahead of the APF demand and their CTD status into G M9. In addition, despite the bullish tone of the market of late, our UKT 26-27 steepener continues to grind wider.

- At this point, the short to medium term picture in the UK becomes less clear. Here’s why:

- The divergence between Cable and G H9 won’t last forever and longs will need to stand their ground amidst some very tense talks.

- The gilts market ALWAYS rallies into the APF reinvestment operations and the one in March is a big one with about £18.5bn to spend. That influence won’t prevent a sell-off if the Brexit outcome dictates rates are too low, however, it could put a lid on how big a move we get.

- Gilts supply next fiscal year is set to grow by £16bn vs 2018/19 (given what we know now) which will weigh on the market medium term and could grow if Hammond’s promise of a fiscal bail-out post Brexit is needed. That would steepen the curve massively.

- The CPI/RPI fiasco is still bubbling below the surface which could come to light post-Brexit.

- So, while we maintain a relatively sanguine view of the Brexit outcome (naïve, gullible or misguided perhaps?) with a bias towards higher rates, we are mindful of the potential for a return of the volatility we saw last October and November.

I’ll be in touch to discuss.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

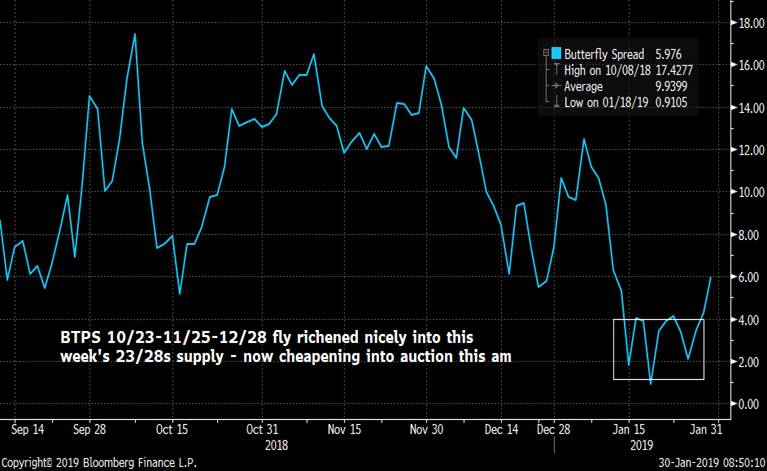

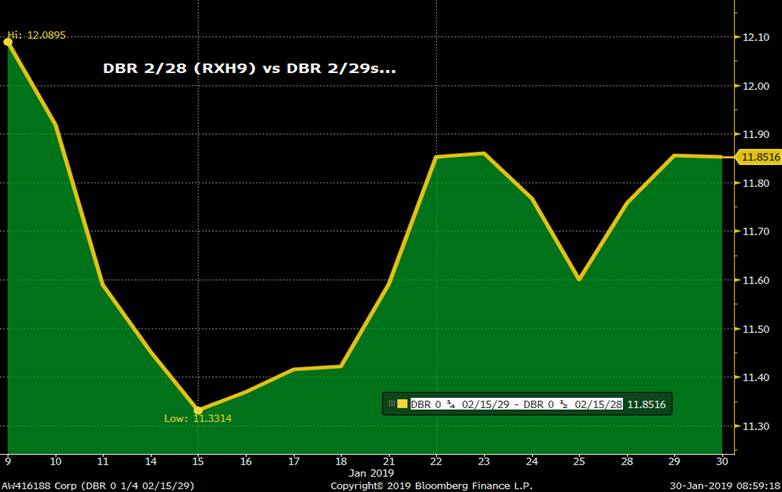

MACROCOSM: Market Absorbs a Ton of UST and EGB Supply Without a Hitch

- In the attached supply calendar we highlighted the wave of sovereign and supra supply in the US and Europe scheduled for this week, much of it on Monday and Tuesday. Aside from what’s listed we also had a surprise EUR 5bn BGB 2050s syndicated deal (11 of their 28 bln scheduled for this year is already done), the rumoured Austria 10yr deal came (5bn at -19 vs swaps) and KFW brought 5bn 5yrs. Throw in a 2.5bn 5yr Greece deal and you’d expect that the market would have built in a hefty concession somehow, yields or spreads. While we still have 3bn DBR 2/29s and 5.25bn BTPS (23s and 28s) this morning, we’ve still managed to devour a ton paper already this week.

- Well, take a look at the charts below. RXH9 prices are saying ‘Bring it on!’ although RXA invoice spreads have dipped in sympathy with the bid in periphs.

- BTPS have held in very nicely vs DBRs, despite this am’s EUR 5.25bn 23s and 28s…

- TYH9 has consolidated this week around the 121-16 > 122-00 area into this week’s supply. FOMC meeting today looming large even though most expect them to continue to preach a wait and see view…

Even the UST curve has barely budged, 2-5-10s richening into this week and 5-10s range bound…

- BTPS supply this am has prompted some movement in the 10/23-11/25-12/28 (5-7-10) fly, richening to 6mos ‘highs’ before cheapening yesterday pm and this am into the supply. This fly could cheapen further from here, back to the 8/9 area.

- The DBR 8/28-2/29 roll has steepened into this am’s tap which should attract some forward roll interest given the large index extension in Germany tomorrow of .22yrs. There are a bunch more taps of the DBR 2/29s to come, however, this is an easy, low risk way to grab a bit more risk for EGB players. The DBR 8/28s won’t be CTD into RXU9 so less risk of them vanishing. We’d also expect some interest to buy the DBR 2/29s basis vs RXH9.

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... Progress...?

May vs Tusk & Juncker… again.

BBG: Brexit Bulletin: A Fleeting Victory

BBG: May Wins Backing to Reopen Brexit Deal as EU Prepares to Dig In

BBG: Brussels Edition: The Irish Candidate

BBG: Brexit Will Probably Split BOE Policy Makers on How to Respond

BBG: Theresa May’s Disastrous Dithering

BBG: U.K. Parliament Rips Up Theresa May’s Brexit Deal

FT: Parliamentary backing sets May on Brexit collision course with EU

FT: The votes: Theresa May wins out on (most of) her Brexit plan B

FT: UK slow making progress to replace EU’s global deals before Brexit

FT: Brexit delivers government contract ‘bonanza’ for consultants

FT: Brussels rules out backstop renegotiation – for now

FT: Brexit timeline: key dates in UK’s divorce from EU

TEL: What next for the Brexit deal? How the Brady amendment vote will shape negotiations

TEL: Door shuts as EU doubts Theresa May’s powers of persuasion

And so it goes…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EQUITIES SPECIAL : We are at a KEY JUNCTURE, so its DECISION time.

EQUITIES SPECIAL : We are at a KEY JUNCTURE, so its DECISION time.

Equities remain damaged goods but need to further that statement via weak closes on Thursday. Currently we are holding but performance is POOR and the DAILY RSI’s HIGH.

Trade ideas running and STILL time.

Buy Dax FEB 10400-10300 put spread @ 21.1 Now 3.2

Buy EStox FEB 2900-2800 put spread @ 12.7 Now 1.5

Buy Ftse Mar 6600-6500 put spread @25.0 Now 27.0

Although no NEW monthly lows we haven’t rallied MUCH. It’s a matter of TIME before stocks head lower AGAIN!

Equities REMAIN very damaged goods! Europe is in a terminally bad way whilst the US is close to confirming the 10 year “RALLY” is over.

DAX page 2 remains OUTSIDE a significant and LONG STANDING channel.

Overall I still favour a MAJOR DROP and this weeks close is KEY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Today's BREXIT BARRAGE... Another Brick in The Wall...?

Today’s got the potential to be another big day on the road to Brexit with significant amendments to the Brexit legislation likely to be tabled…

BBG: Brexit Bulletin: A Fork in the Road

BBG: May Faces Losing Control Over Brexit Despite Gamble on Backstop

BBG: Some EU States Are Weighing Conditions for Brexit Extension, Sources Say

BBG: Brussels Edition: Brexit Blues

BBG: How Parliament Is Trying to Control Brexit and What It Means

FT: Theresa May seeks to split Tory hardliners with bid to amend Brexit backstop

FT: Can the Brexit backstop be renegotiated?

FT: Brexit: the key amendments by MPs to May’s deal

FT: MPs line up against no-deal Brexit ahead of Commons vote

FT: MPs’ chance to take control of Brexit

TEL: Brexit latest news: Theresa May’s Plan B in chaos amid open revolt from Tory Brexiteers

TEL: Brexit explained: All your questions answered about the UK leaving the EU

TEL: Brexit latest odds: Best bets on how (and if) Brexit will happen

TEL: Brexit and the Irish border explained: why the headache is not going away any time soon

TEL: Theresa May’s draft Brexit withdrawal agreement – read in full

TEL: Brexit deal: What time does Parliament vote on Theresa May’s Plan B today?

TEL: John Bercow warned ‘history will judge him’ if he snubs amendment to save Theresa May’s Brexit deal

BBC: Brexit: Will MPs find agreement in their plans?

Enjoy!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Today's BREXIT BARRAGE... 'Same as it Ever Was'

Some good articles ahead of tomorrow’s Parliamentary vote…

BBG: Brexit Bulletin: Changing Direction?

BBG: Parliament to Challenge May for Brexit Power in Crucial Votes

BBG: How the U.K. Parliament Is Trying to Seize Control of Brexit

BBG: Brexit ‘Game of Chicken’ Played Before Crucial Week for Votes

BBG: May Heads Into Crucial Vote Seeking Common Ground: Brexit Update

FT: How will the EU respond to a request to delay

FT: MPs should take a ‘no-deal’ Brexit option off the table

FT: Ireland dashes May’s hopes of breaking Brexit stalemate

TEL: Theresa May’s Brexit deal: how the impossible parliamentary maths breakdown

TEL: The five key Brexit amendments that could radically alter Theresa May’s plan

TEL: How a second Brexit referendum could work: the question, when it will happen and who would win

TEL: No deal vs no Brexit: How Britain could end up staying in the EU after all

TEL: Delaying Brexit would open up a new can or worms for our economy

BBC: Brexit: May urged to secure backstop concessions from EU

Enjoy…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796