New Italian syndicated 15y - Btps Mar 35 - James Rice, Astor Ridge

Errata apologies – amended fly levels

Levels

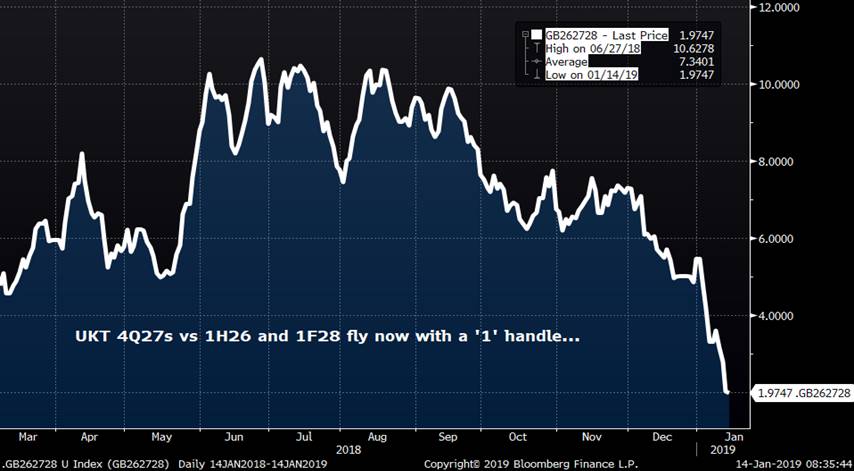

Weighted Fly currently @ 7.3bp – (2 X middle minus weighted wings, -1.5 / +2 / -0.5)

Enter: @ +7.3bp

Add: @ 10.5 bp

Exit: @ Flat bp

Stop: @ +13 bp

Syndication today in New Italian 15yr – priced at +18bp over Btps sep33

Btps March 2035

Coupon – TBA

Could present value opportunities versus high coupon curve

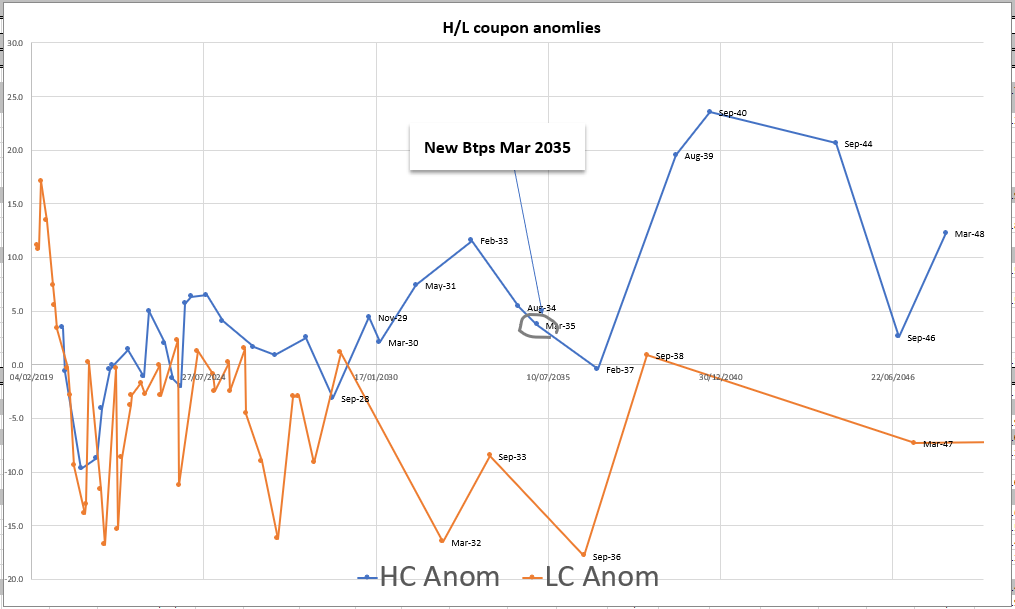

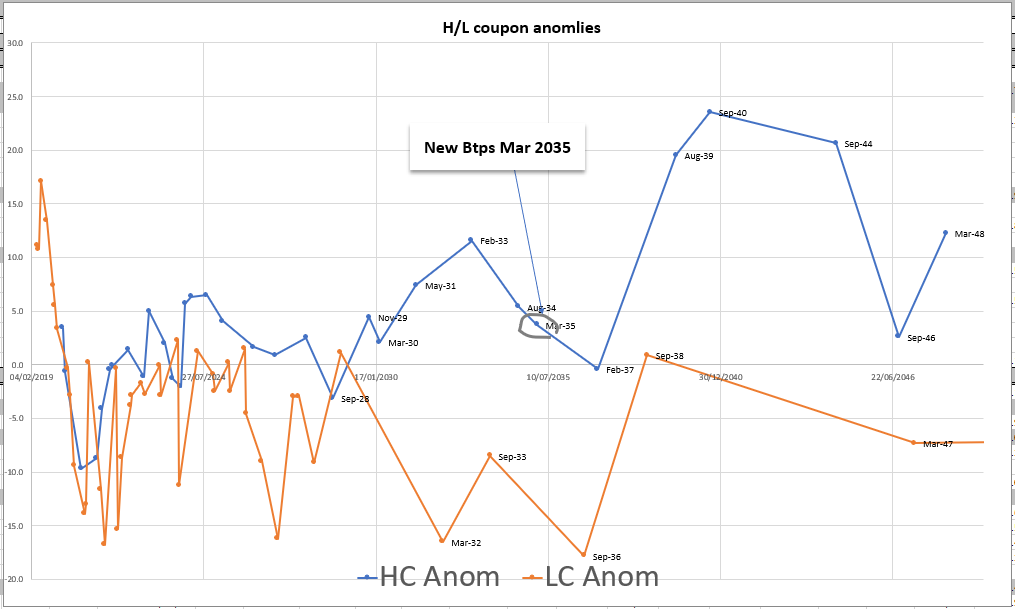

Italian Anomaly Values

Graph – of Value vs Fitted Italian Curve

*Yields adjusted partially for coupon in a steep curve by subtracting swap spread and adding z-spread

Trade Mechanics

Buy New Btps mar 2035, €100k

Sell Btps 5% Aug 34, €75k

Sell Btps 4% Feb 37, €25k

Levels

Weighted Fly currently @ 0bp – (2 X middle minus weighted wings, -1.5 / +2 / -0.5)

Enter: @ Flat

Add: @ +3bp

Exit: @ -5bp

Stop: @ +6bp

Trade Rationale

· New issues trade cheap on the curve – see graph above – the bond is cheap to the high coupon curve (curve avg. coupon is 3.06%)

· With a medium coupon (expected approx. 3.35%) the bond has cashflow value in a steep curve

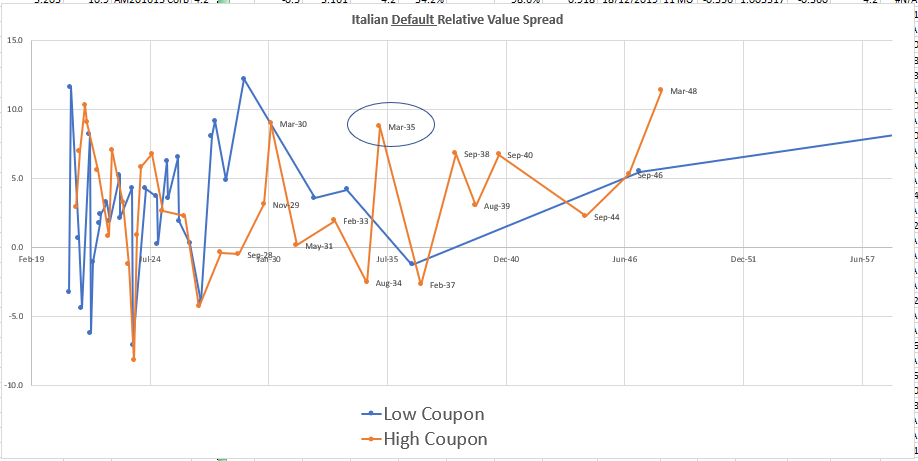

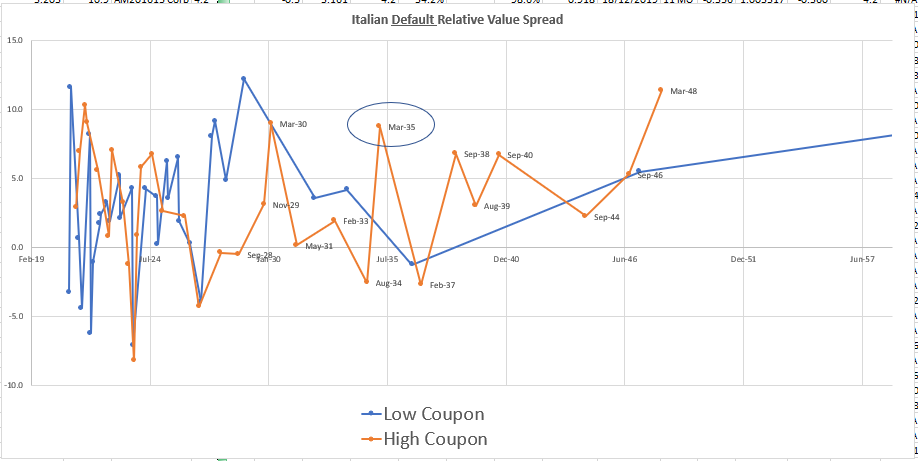

· As a medium coupon bond the Btps mar35 have reasonable default value – see default anomalies (estimated from expected coupon and accrued details)

· High into medium coupon bonds at Flat is also optically getting the default option on Italy for little premium (just the carry)

Default Anomalies

Graph of default anomalies as implied by the generic shape of the Italian curve vs Eonia and various H/L coupon differentials

Carry and Roll

Carry: TBA – given unknown coupon – expect small negative

Roll: -0.1bp /3mo

Risks

- The Feb 37 med coupon stay bid

- The new tap bond 2035s remain cheap

- The trade stays constant in yield spread and the trade loses small over time in carry

Let me know your thoughts

Thanks

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

New Italian syndicated 15y - Btps Mar 35 - James Rice, Astor Ridge

Syndication today in New Italian 15yr – priced at +18bp over Btps sep33

Btps March 2035

Coupon – TBA

Could present value opportunities versus high coupon curve

Italian Anomaly Values

Graph – of Value vs Fitted Italian Curve

*Yields adjusted partially for coupon in a steep curve by subtracting swap spread and adding z-spread

Trade Mechanics

Buy New Btps mar 2035, €100k

Sell Btps 5% Aug 34, €75k

Sell Btps 4% Feb 37, €25k

Levels

Weighted Fly currently @ 0bp – (2 X middle minus weighted wings, -1.5 / +2 / -0.5)

Enter: @ Flat

Add: @ +3bp

Exit: @ -5bp

Stop: @ +6bp

Trade Rationale

· New issues trade cheap on the curve – see graph above – the bond is cheap to the high coupon curve (curve avg. coupon is 3.06%)

· With a medium coupon (expected approx. 3.35%) the bond has cashflow value in a steep curve

· As a medium coupon bond the Btps mar35 have reasonable default value – see default anomalies (estimated from expected coupon and accrued details)

· High into medium coupon bonds at Flat is also optically getting the default option on Italy for little premium (just the carry)

Default Anomalies

Graph of default anomalies as implied by the generic shape of the Italian curve vs Eonia and various H/L coupon differentials

Carry and Roll

Carry: TBA – given unknown coupon – expect small negative

Roll: -0.1bp /3mo

Risks

- The Feb 37 med coupon stay bid

- The new tap bond 2035s remain cheap

- The trade stays constant in yield spread and the trade loses small over time in carry

Let me know your thoughts

Thanks

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

***MULTI ASSET UPDATE*** : DESPITE THE ASIAN STOCK BOUNCE US AND EUROPEAN STOCKS REMAIN IN THE DANGER ZONE, ALL DAILY CHARTS CONTINUE TO “FAIL” THE 50 DAY MOVING AVERAGES.

MULTI ASSET UPDATE : DESPITE THE ASIAN STOCK BOUNCE US AND EUROPEAN STOCKS REMAIN IN THE DANGER ZONE, ALL DAILY CHARTS CONTINUE TO “FAIL” THE 50 DAY MOVING AVERAGE. BOND YIELDS ARE IN A SIMILAR SITUATION AT OR SUB LAST MONTHS CLOSES. ITS ALL ABOUT TO GET VERY SERIOUS!

If the prediction is right then here are several trades to put on-discuss.

Buy Dax FEB 10400-10300 put spread @ 21.1 (Now 17)

Buy E Stox FEB 2900-2800 put spread @ 12.7 (Now 9.2)

Buy GOLD (XAU) @ 1292.39 stop 1268.00 and target a push to the previous highs 1365.00

Look to position in the USFS10-20 as it is ready to continue lower. David Sansom happy to discuss.

US Curves seem to favour a BULL STEEPENER in the BACK END on previous yield drops. If not into a steepener then the US 2-30 would be a good late trade.

Equities : European equities CONTINUE to be the one to watch as many are PEAKING today aided by numerous 50 day moving average resistance. Should we head lower then it will launch the next MAJOR wave of liquidation. FTSE a KEY CHART (Page 26).

Bond yields : These have done VERY little since the Non-Farm number and should stall along with equities, many have only managed to rally to last quarter-month closes. If we fail here it will be a dramatic follow through.

FX : The DXY has breached the 50% ret 95.859 moving average-retracement so a KEY signal for USD weakness (Page 8). This should represent BEST in the long favour USD EM shorts. Also as a by product USD CNH is testing a KEY 100% ret 6.7850.

US Curves If yields do stall then look to buy a BACK END steepener, 5-30 or 10-30 given their resilience previously. The back end steepener seems to now have a proven BULL STEEPENER BIAS.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: Gilts - Tidying Up Before the Meaningful Vote... Quick Comment

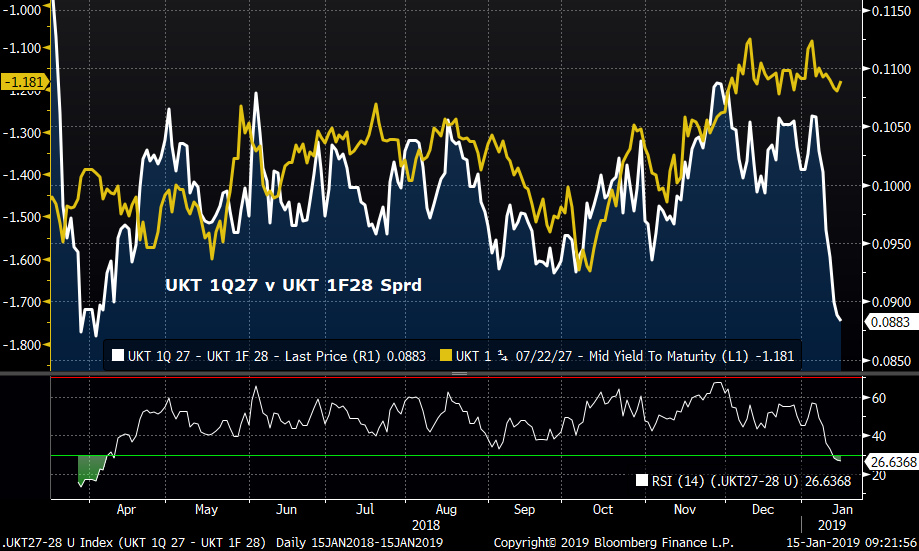

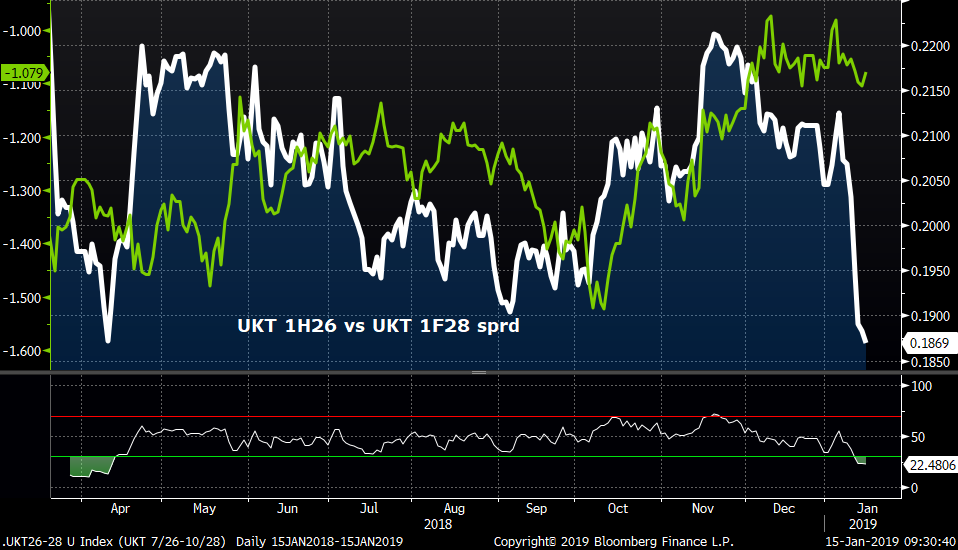

GILTS... 1Q27-1F28 and 1H26-1F28 spreads…

> Into the last tap of the 1F28s we highlighted the +10.5bps area as a good place to add to 27-28 flatteners, leap frogging over the 4Q27s. Along the same lines, we also advocated a 26-28 flattener in the +21.25bps area.

> To be frank, our recommendations fell on deaf ears as most clients preferred to remain short the 4Q27s. While the 4Q27-1F28 sprd has flattened more than the 1Q27 version by ~.5bp since Jan 4, the flattening vs the 1Q27s has been significant, taking the sprd back to levels seen briefly last March, when 1Q27 yields were 20bps higher and the 1F28s were just getting going. More importantly, the low cpn 26/27-28 versions aren’t complicated by the machinations of the 4Q27s falling out of the gilts basket, making them a more ‘pure’ call on the gilts curve.

> The chart below shows how both spreads have completely detached from any directionality as the 28s create their own orbit in a bull-flattening move.

> Our concerns, as we head into the 'Meaningful Vote' is the 1F28s are now a crowded long, held by the majority of our clients in various fashions. If, by some shock outcome, gilts sell-off sharply, we'd expect these sprds to re-steepen. In other words, if you've had the flattener on vs 4Q27 and/or 1Q27 and 1H26s, we think it's time to take 1/2 the posn off and book some nice profits. Conversely, these steepeners also look like good tactical bearish positions if you need that exposure.

Best,

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: NEW BTPS 15yr Benchmark...! Some Quick Pre-Syndication Comments

BTPS... NEW 15yr!

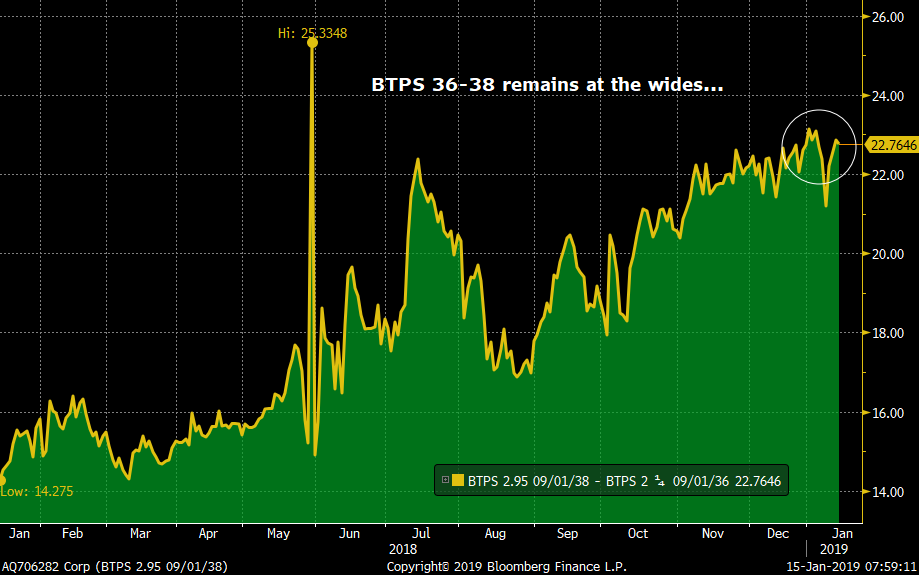

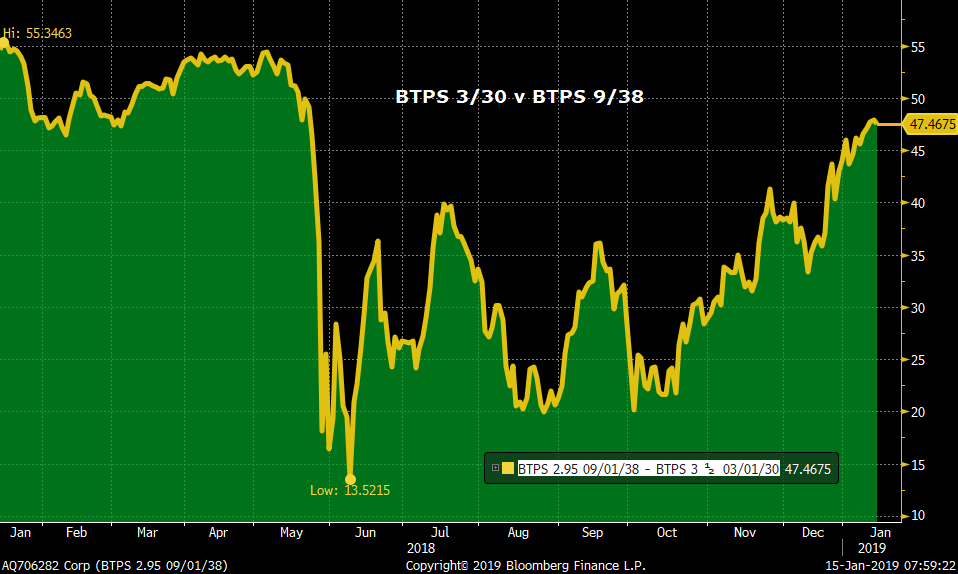

> The main event in the Eurozone today is the BTPS 3/35s syndication.

> We expect price talk to be released early this am (probably before 9am). As outlined in our preview from last week (attached), we expect the new issue to be spread off the current 15yr, the BTPS 2.45 9/33s and should come with a coupon in the 3.25%-3.40% range.

> The big questions are how generous will they be with the spread AND how big a deal will it be? Our analysis took a look at the current spread of neighbouring issues with similar coupons (3.5 30s and 2.95 38s) and came to the conclusion that, in order to make them cheap enough to the curve it'd have to be around +19bps to the BTPS 9/33s. Anything tighter than that would put them richer than the 9/38s (an old 20yr) which look cheap to us here.

> The primary reason the BTPS 9/38s traded cheap for much of the first 6mos post pricing was the Italian Tsy got a bit ambitious, bringing EUR 9bn of the issue. We're hoping they don't make the same mistake this time, capping the deal at Eur 7bn.

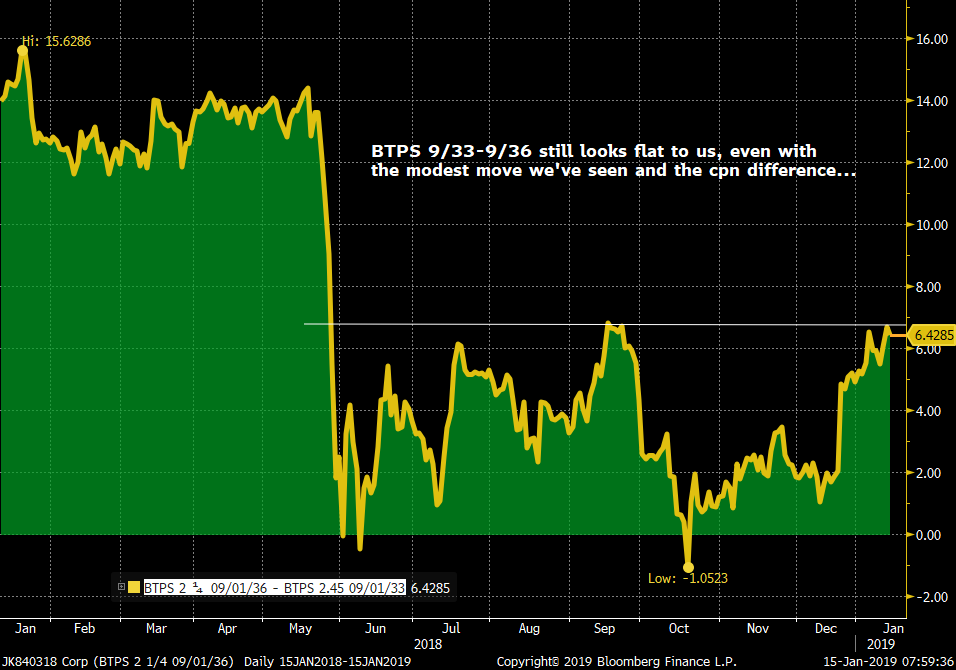

> From an RV perspective, the BTPS curve remains steep in the 10yr-30yr sector with the 15yr lagging in anticipation of this deal. The BTPS 36-38 spread remains at the wides (see below), as does the BTPS 30-38s (see charts below). The BTPS 9/33 vs 3/30 and 2/37 fly we mentioned has richened 2.2bps since last week but remains at the cheap end of it’s range. Lastly, the BTPS 9/33-9/36 steepener is a smidge wider but still looks too flat to us which could become glaringly obvious if they bring the new 3/35s at a generous spread, even factoring in the 100bps+ cpn difference.

We’ll be in touch post spread announcement…

Best,

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

USFS 10-20 WHAT NEXT :***** TIME TO RELOAD or ADD as we HEAD LOWER AGAIN.******* Similar to other markets we have witnessed ONLY a slight recovery, only to last months close.

USFS 10-20 WHAT NEXT : TIME TO RELOAD or ADD as we HEAD LOWER AGAIN. Similar to other markets we have witnessed ONLY a slight recovery, only to last months close. If you the original trade (inception 3.3299) certainly add here, if not enter the trade with a stop (ON ALL) above this month high 2.9644.

**Speak to David Sansom re any trade discussion on this idea, NEW OR ADDING. **

Above all this is a long term trade hence don’t be afraid to sell new LOWS.

This chart corelates well with the outright yield charts which ALSO predict a move LOWER.

My BIG worry is that if equities fail then yields plummet and the RE ENTRY is missed.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

EQUITIES SPECIAL : “LETS GET READY TO RUMBLE”. The latest bounce is starting to WANE and this could SNOWBALL into the next bigger capitulation.

EQUITIES SPECIAL : “LETS GET READY TO RUMBLE”. The latest bounce is starting to WANE and this could SNOWBALL into the next bigger capitulation. We are failing MANY daily 50 day moving averages and Europe will lead the way.

Trade ideas running and STILL time.

Buy Dax FEB 10400-10300 put spread @ 21.1 Now 19.2

Buy E Stox FEB 2900-2800 put spread @ 12.7 Now 10.2

Although no NEW monthly lows we haven’t rallied MUCH. It’s a matter of TIME before stocks head lower AGAIN!

Equities REMAIN very damaged goods! Europe is in a terminally bad way whilst the US is close to confirming the 10 year “RALLY” is over.

DAX page 2 remains OUTSIDE a significant and LONG STANDING channel.

Overall I still favour a MAJOR DROP and this weeks close is KEY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: BREXIT > What a Long, Strange Trip It's Been... Pre-Vote Snapshot of the UK

- Here in London, tomorrow’s Parliamentary vote on Theresa May’s much-derided deal will dominate the newswires and the markets focus. We thought it timely to provide an update on the latest news, where we’ve been and thoughts on where we’re headed.

- A snapshot of today’s headlines:

- FT: May to warn Eurosceptics that MPs could ‘block Brexit’ https://www.ft.com/content/99879042-1714-11e9-9e64-d150b3105d21

- FT: Plan B options narrow ahead of historic vote https://www.ft.com/content/57258d66-15a8-11e9-a581-4ff78404524e

- BBC: Theresa May says no Brexit more likely than no deal https://www.bbc.co.uk/news/uk-politics-46856149

- BBC: Brexit: What's next if MPs reject May's deal? https://www.bbc.co.uk/news/uk-politics-46858903

- TEL: What time is the Brexit ‘meaningful vote’ in Parliament tomorrow, and what will happen if Theresa May’s deal is rejected?

- FT: May to warn Eurosceptics that MPs could ‘block Brexit’ https://www.ft.com/content/99879042-1714-11e9-9e64-d150b3105d21

- CITI’s Daily ‘What’s Priced In’ report is a favourite of mine. Here’s what’s priced in for the UK:

![]()

![]()

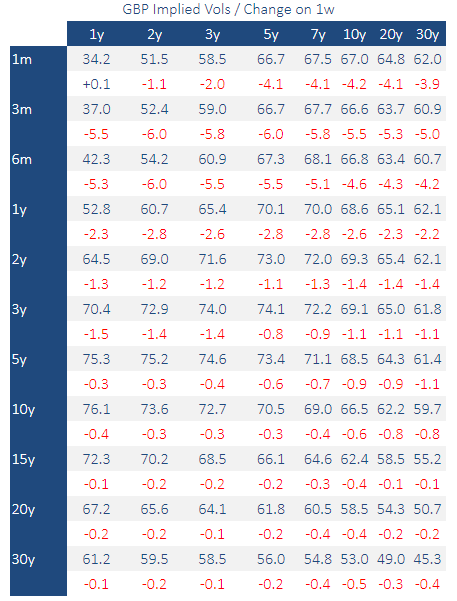

- What, me worry? GBP rates vol markets have seen considerable unwinds of ‘Armageddon’ trades as a no-deal scenario becomes less likely (at least in terms of the news flow last week). As a result, vol has taken a substantial hit into tomorrow’s vote.

Change on the week (borrowed from CITI):

- Charts of major & minor UK markets over the last year…

The FTSE was dragged lower by G-10 market moves but remains over 11% lower than the May highs nonetheless…

Cable’s support at the 1.25 level was tested in earnest into year-end and remains a key trigger for additional losses if breached. The post-Brexit vote lows of 1.20 would be broadly considered the ‘first stop’ but from there it’s uncharted territory. Given the sense of urgency to avoid a ‘no-deal’ outcome, some pundits argue another test of 1.20 would be a buying opportunity.

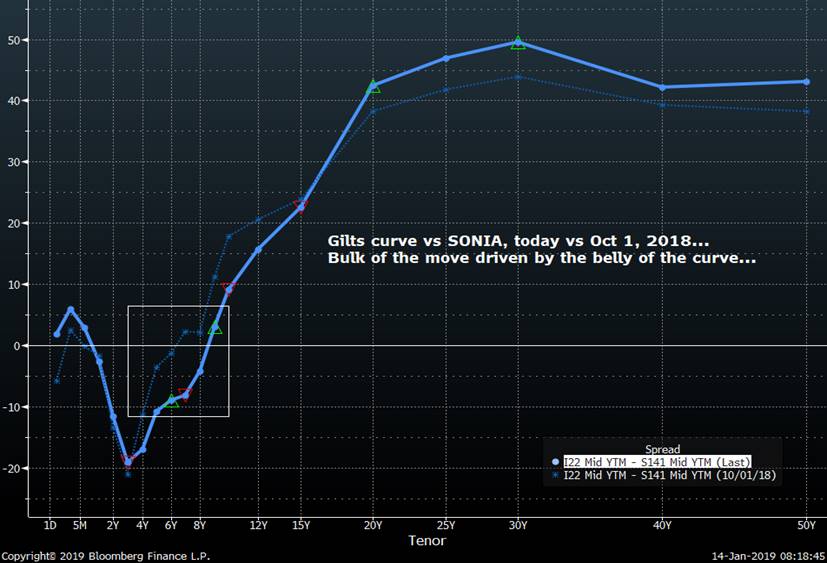

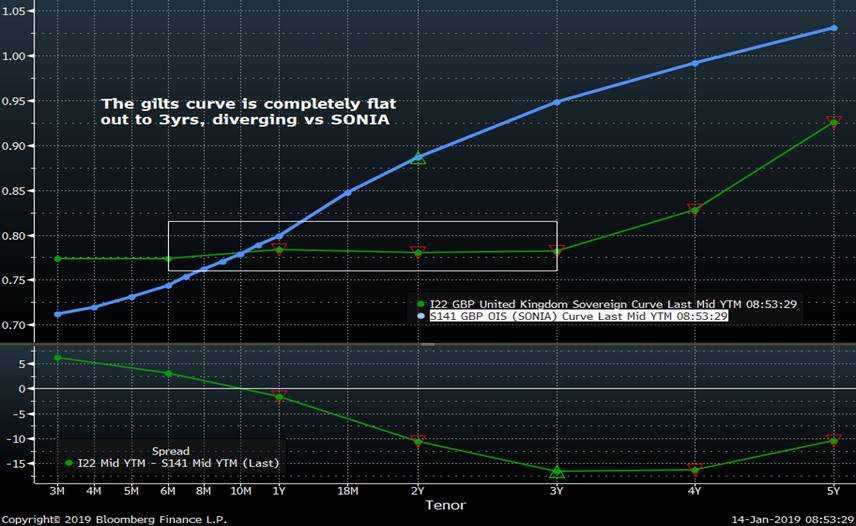

Gilts curve vs SONIA since Oct 1, 2018 (before the Brexit outlook deteriorated)…

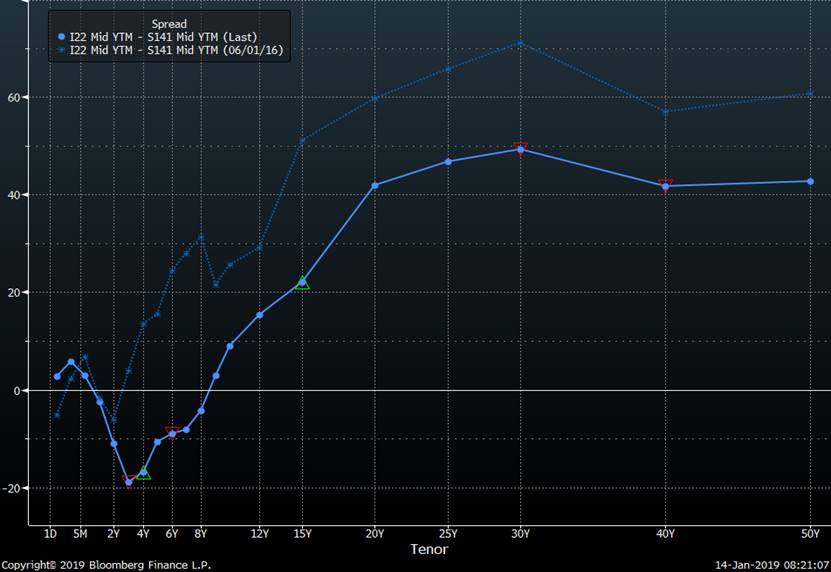

And today vs June 1, 2016…

SONIA has been a roller-coaster ride over the past couple years with Brexit fears battling with inflationary pressures in determining the rates outlook for the MPC. Despite all the volatility, 1y1y SONIA has traded in a 30bps range for most of the last year and is about 8bps off the recent ~90bps floor into today.

UKT 2-5-30 fly vs UK CPI YOY. I’ve shifted the CPI data forward by 275 days to show how well correlated the curve ultimately is – only with a considerable delay. In other words, if we remove the BREXIT fears from the equation, the 2-5-30s fly should be a lot cheaper.

UKT 4Q27s have been battered on the curve on their way to relinquishing their CTD status into G M9… Cheapest this fly has ever been…

The short-end of the GILTS curve is completely flat, looking rich to SONIA here…

- Sentiment… We head into tomorrow’s vote with the market ‘walking on eggshells’. On the one hand, mounting efforts to avoid a no-deal Brexit outcome provide some comfort that a complete implosion in the UK markets is less likely. On the other hand, there have been NO indications of what an alternative deal would look like if/when May’s deal is rejected. Does this shift in the outlook raise the odds of another referendum and hence, higher odds of no Brexit at all? Hard to argue it doesn’t. So, while the balance back in Oct/Nov priced in a 33% no deal/33% Brexit/33% remain outlook, it seems we’re shifting more to 20%/40%/40% odds. One could argue CABLE and VOL has gotten the joke and is trading as such but the rates market still looks a tad rich, especially in the front-end. Balance sheet is a royal pain, making steepeners there a bit painful to put on, however, they’re clearly pricing in a BAD outcome here. We have a tap of the UKT 1 4/24s this week too which we’re not priced for yet in our view. So, on balance, we’re leaning neutral/bearish here, sellers into strength in 2-5yr sector of the curve.

We’ll be in touch to discuss.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Astor Ridge - Updated Data/Supply and Events Calendars - Week of Jan 14-18

Supply calendar is a shadow of this week’s deluge…

Parliament vote on May’s deal on Tuesday will paralyze gilts early week…

Another busy week for Fed speakers…

Pls see attached.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EQUITIES SPECIAL : ON HIGH ALERT AS ITS NOW OR NEVER! I mentioned equity concerns yesterday and overnight we have done little to negate that. This could be a VERY conclusive close this week, if LOWER!

EQUITIES SPECIAL : ON HIGH ALERT AS ITS NOW OR NEVER!

I mentioned equity concerns yesterday and overnight we have done little to negate that. This could be a VERY conclusive close this week, if LOWER!

Trade ideas running from yesterday and STILL time.

Buy Dax FEB 10400-10300 put spread @ 21.1 Now 18

Buy E Stox FEB 2900-2800 put spread @ 12.7 Now 9

DAX page 2 remains OUTSIDE a significant and LONGSTANDING channel.

Although no NEW monthly lows we haven’t rallied MUCH. It’s a matter of TIME before stocks head lower AGAIN!

Many daily charts are testing reliable 50 day moving averages.

Equities REMAIN very damaged goods! Europe is in a terminally bad way whilst the US is close to confirming the 10 year “RALLY” is over.

Overall I still favour a MAJOR DROP and this weeks close is KEY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris