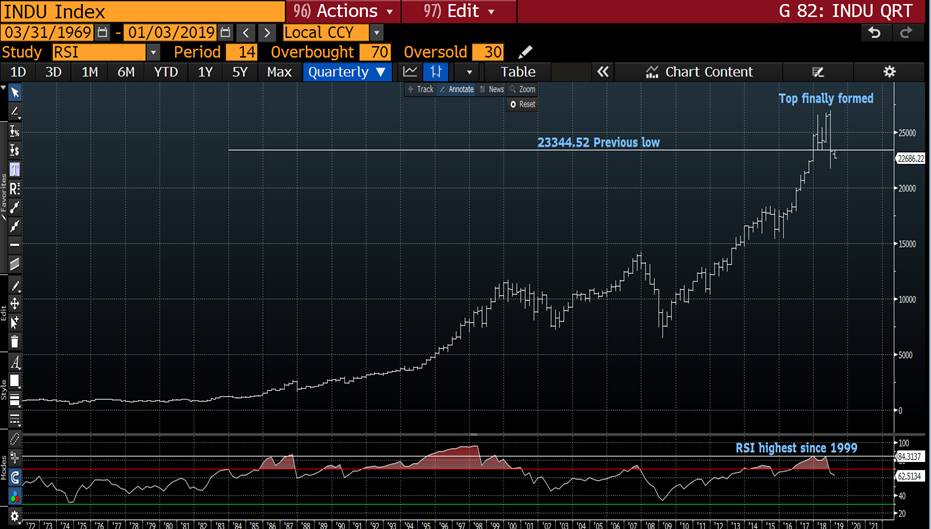

MULTI ASSET UPDATE : BIG TRADE DAY. I might be early but if right, then STOCKS are poised for the next MAJOR LEG LOWER as are YIELDS. Will update and chase ideas if stocks FAIL.

MULTI ASSET UPDATE : BIG TRADE DAY. I might be early but if right, then STOCKS are poised for the next MAJOR LEG LOWER as are YIELDS.

Many daily charts are FLAGGING up sizeable resistance at numerous 50 day moving averages.

An ideal entry point for trades given the long-term horizon and trends REMAIN in play.

If the prediction is right then here are several TRADES to put on-discuss.

Buy Dax FEB 10400-10300 put spread @ 21.1

Buy E Stox FEB 2900-2800 put spread @ 12.7

Buy GOLD (XAU) @ 1292.39 stop 1268.00 and target a push to the previous highs 1365.00

Look to position in the USFS10-20 as it is ready to continue lower. David Sansom happy to discuss.

US Curves seem to favour a BULL STEEPENER in the BACK END on previous yield drops.

Equities : European equities CONTINUE to be the one to watch as many are PEAKING today aided by numerous 50 day moving average resistance. Should we head lower then it will launch the next MAJOR wave of liquidation. FTSE a KEY CHART (Page 24).

Bond yields : These have done VERY little since Fridays number and should stall along with equities, many have only managed to rally to last quarter-month closes. If we fail here it will be a dramatic follow through.

FX : The DXY has breached the 50% ret 95.859 moving average-retracement so a KEY signal for USD weakness (Page 8). This should represent BEST in the long favour USD EM shorts. Also as a by-product USD CNH is testing a KEY 100% ret 6.7850.

US Curves If yields do stall then look to buy a BACK END steepener, 5-30 or 10-30 given their resilience previously.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: BTPS 15yr Syndication Imminent? Trade Ideas In Anticipation...

THE TRADES:

We need to answer a few questions:

What spread level to the BTPS 9/33s do we think a new 15yr needs to come at to attract ample demand?

What are new 15yr buyers likely to sell to buy this new issue?

How best to position for this deal in anticipation of a curve/spread concession?

We’ll answer them below.

Recap of a quick note I posted in our chat yesterday pm…

BTPS...

> Ok, we got the Italy 15yr syndication announcement (well, more like an unofficial ‘sources’ comment) but it raises more questions than it answers. Despite the ambiguity of the situation, most dealers/clients expect the deal to be announced early next week for Tues/Wed pricing. Friday’s 3yr, 10yr and 30yr size will be around 6.5bn, smaller than initially expected, we assume in anticipation of the 15yr deal.

1) What's the maturity? Our guess is 2035, largely because it's the only maturity in the sector not already taken and it gives them ample time to build the issue. The last few 15yr & 20yr benchmarks were Sep maturities but the 15yr sector is becoming a bit crowded and it might be time for another March issue. For the sake of consistency we’ll assume another Sep maturity.

2) How about a coupon? With issues from 2033 to 2036 ranging from a 3.26 to 3.44, there's a window there but a 3.3% cpn is closer to the low cpns than the higher ones, we're thinking 3.25% at a nice discount.

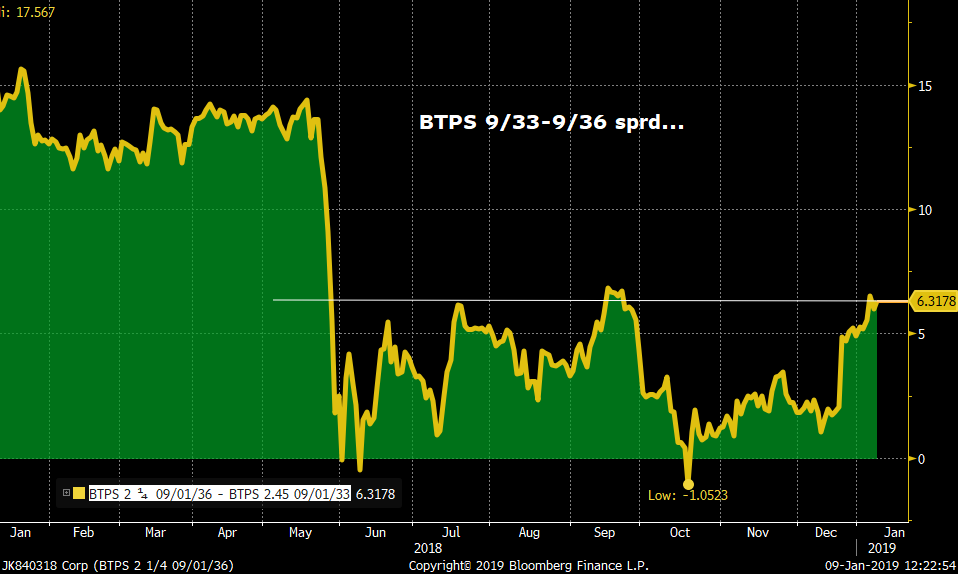

3) The trouble with this is the BTPS 2.45 9/33 (current 15yr) vs BTPS 2.25 36s spread is only 6bps. How much interest are they likely to drum-up for a €6-8bn syndicated deal at +5bps to the 33s...? The BTPS 2.45s 9/33 came at +18bps over the BTPS 3/32s! So, with this in mind, what would u rather own, a new 2035 issue that they'll have to price fairly generously or a 2036 issue that's likely to be at least 8bps richer than the new issue? Seems to me the BTPS 33-36 spread is way too flat...

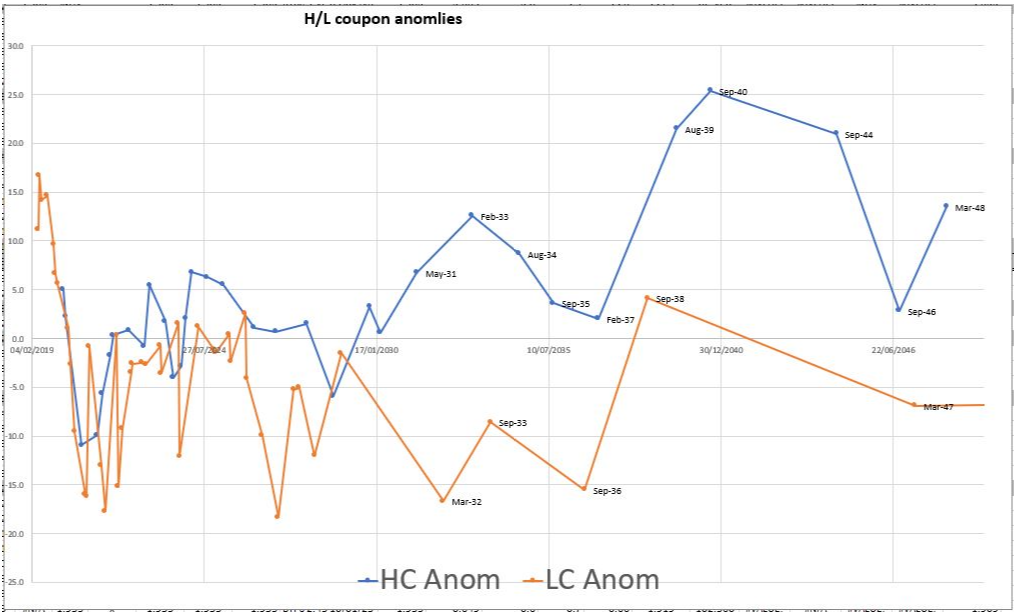

Let’s dig a bit deeper. Here’s a chart my pal James monitors that shows the potential anomalies along a fitted BTPS curve, separated by low and high coupons. You can see we’ve inserted a BTPS 9/35 issue on the curve where we think it should come relative to it’s neighbours.

Some observations:

- Even after the tightening of BTPS spreads from the wides, the high cpn issues still trade cheap to the fitted curve although there’s considerable variability among both.

- The BTPS 1.65 32, BTPs 2.45 9/33 and BTPS 2.25 36 issues are the richest in the sector, a reflection of their coupons but also how crowded the sector is with higher cpns.

- Take a look at the BTPS 3.5 3/30 and BTPS 2.95 9/38s. They trade at the same rich/cheap level vs our fitted curve and given our anticipation of a 3.25% cpn, we would expect that a new BTPS 3.25% 3/35 issue would trade right around the same level on the curve, making them the defacto ‘wings’ in any fly against the new issue. In order to make them cheap enough vs similarly specc’d issues, a new BTPS 3.25% 9/35 would need to come at +19bps to the BTPS 2.45 9/33s.

- Interestingly, the BTPS 4 37s remain a sticky issue on the curve, trading richer to our model than the much smaller coupon BTPS 2.95 38s do.

- At the other end of the spectrum, the BTPS 5 9/40 trade very cheap to the curve, the 36s vs 40s yield sprd within just 3bps of it’s all-time wides at +42.2bps.

- Spreading a new BTPS 3.25% (or higher) 9/35 issue against the benchmark BTPS 2.45 9/33, an 80bps coupon difference, will likely prove different for the performance of the new 15yr issue than the same 80bps cpn difference between the BTPS 1.65 32 and the BTPS 2.45 9/33s, simply because even at 2.45%, the coupon of the 9/33s is far smaller than their high coupon neighbours. A 3.25% area coupon puts this new issue in ‘limbo’ which suggests to us that demand will hinge on how generous the Tesoro wants to be and where it comes vs the 3/30s and 9/38s.

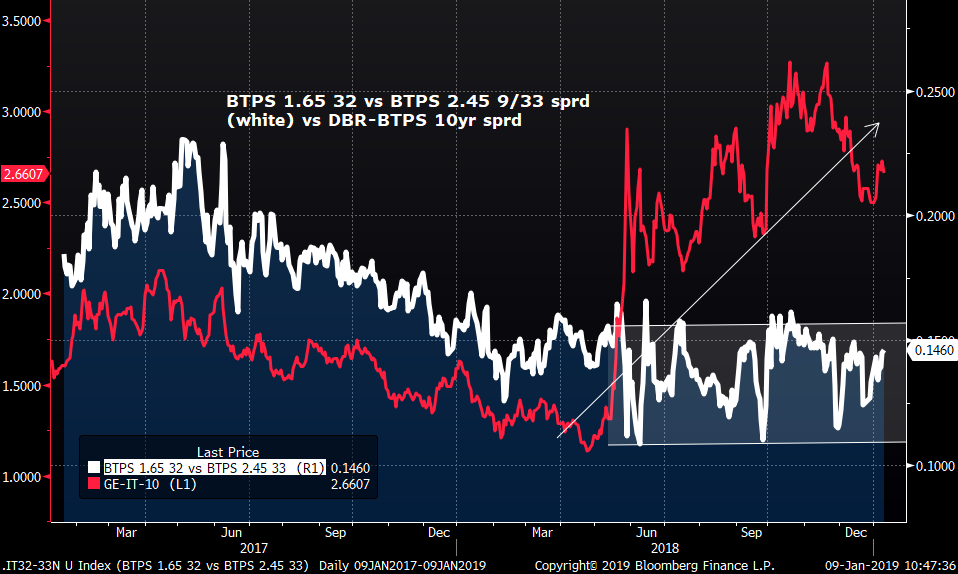

We can see the sensitivity of the 32-33 sprd to BTPS sprds has been small compared to sister spreads.

Last few 15yr and 20yr syndications:

Mar 2015 BTPS 1.65 3/32 15yr +10bps vs BTPS 3.5 3/30 (+2yr difference) 8.0bn now 21.9bn

Apr 2016 BTPS 2.25 9/36 20yr +39bps vs BTPS 1.65 3/32 (+4.5yr difference) 6.5bn now 14.9bn

Jan 2017 BTPs 2.45 9/33 15yr +18bps vs BTPS 1.65 3/32 (+18mo difference) 6.0bn now 15.9bn

Jan 2018 BTPS 2.95 9/38 20yr +16bps vs BTPS 2.25 9/36 (+2yr difference) 9.0bn* now 13.4bn

** At the time, the 9bn syndication size was too much for the market, contributing to its underperformance on the curve for most of 2018.

Conclusions: There are several ways to skin this Gatto…

- The ‘middle of the road’ coupon we’ll likely get will complicate pricing. Sell a low cpn against them and you are taking a view on DBR-BTPS spreads and vice-versa if we sell high cpns against them.

- They have struggled to perform this year but it’s hard to argue the BTPS 2.95 9/38s aren’t cheap on the curve here.

- Conversely, the BTPS 2.25 9/36s (another 20yr) trade over 20bps through them and just 6bps cheap to the BTPS 9/33s.

- The BTPS 2/45 9/33s aren’t very cheap on the curve, however, they’ve cheapened vs the sector in anticipation of this deal.

- BTPS 4 37s have been perennially rich (for a higher cpn) but could struggle vs this new 15yr if they bring them cheap enough.

TRADES:

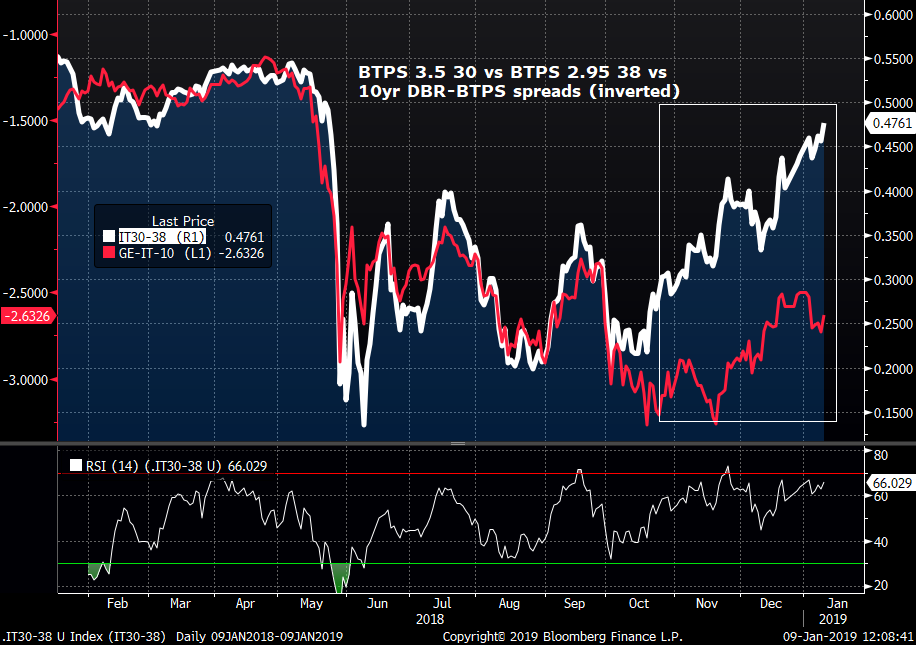

BTPS 2.25 9/36 vs BTPS 2.95 9/38 flattener at +21bps, targeting 17bps, stop at 23bps.

BTPS 3.5 30 vs BTPS 2.95 9/38 flattener at +46.5bps, targeting +35bps, stop at +51bps.

This curve had been well correlated to an inverse DBR-BTPS 10yr spread from Jan-Oct, breaking down when issuance slowed into year—end, vol declined and the widening spread to DBRs reversed. This sector looks very steep here, due in part to the anticipation of this 15yr supply in our view.

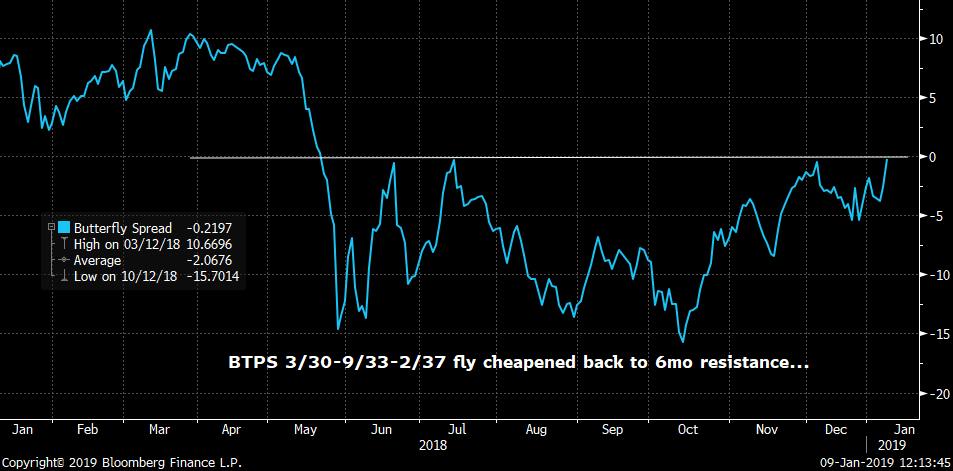

Buy BTPS 9/33 vs BTPS 3.5 30 and BTPS 4 37 at the -1.5bps level. Considerable cheapening of 15bps since October, back to a level that has held since June.

BTPS 9/33-BTPS 9/36 steepener… Testing top of the range at +6.3bps mid.

I’ll be in touch to discuss.

Thanks

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

TECHNICAL VIEW of US vs AUD swaps and Europe vs US UPDATE : Initial send 8th November 2018.Some good returns from the inception location and it looks like we are about to capitalise on that.

TECHNICAL VIEW of US vs AUD swaps and Europe vs US UPDATE : Initial send 8th November 2018.

Some good returns from the inception location and it looks like we are about to capitalise on that.

Previous comment.

I have looked at US verses AUD and we have some decent extensions and previous levels to work from. Interestingly there are many FAMILIAR RSI extensions dating back to 1997 and 2006 AGAIN.

The 5yr AUD-US looks the most attractive technically.

Inception

Currently

I have also included the US versus EU swaps, they don’t have the same extensions but helps the argument for the US being the opportunity.

The only FLAW in the argument is the EVER trending market and LAME weekly RSI’s, BUT an EXTREME and REVERSAL are close.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

PSPP2 ... So long, farewell, auf wiedersehen, adieu ....

So long, farewell, auf wiedersehen, adieu ....

This will likely be the last of my model updates on PSPP2 and German buying, having started the updates in November 2016. I hope you have found the information and analysis useful, and many thanks to those who have given me feedback and advice on the model over the past two years!

New purchases in the ECB’s public sector QE programme ended last month. Around the last ECB meeting, two modifications were made to the reinvestment programme: the intention to adjust each country’s holdings to converge with the new Capital Key allocations; and allowing each central bank greater flexibility over the timeframe in which they reinvest redemption cash.

Taken together, the two changes constitute a challenge to my PSPP2 model. The major issue is that we cannot easily predict how much reinvestment is made in a given month. Thus trying to extract information from the scant data provided by the ECB will be more complicated, absent any further clarification (such as a breakdown of what is held in cash, and what in bonds). As such, this publication of my Maximum Likelihood model could well be the last, unless I start to make assumptions about how long the Bundesbank will hold redemption cash before spending it.

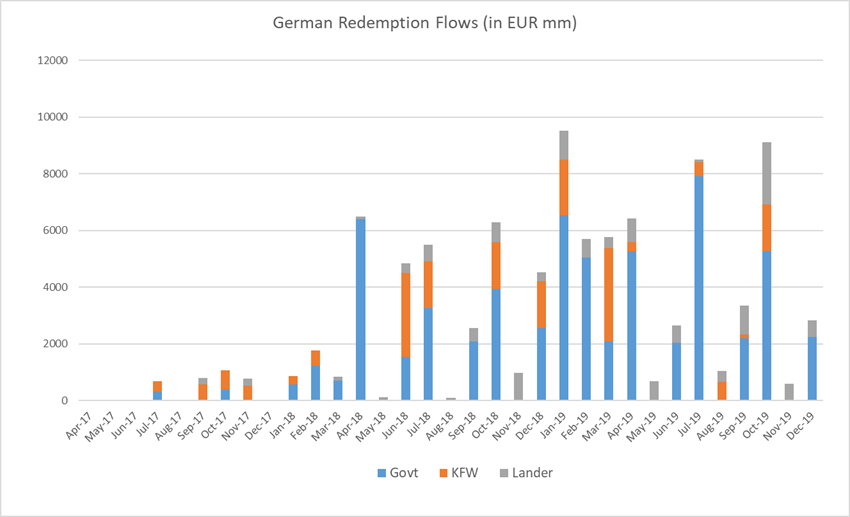

Previously, the heavy redemption profile of Germany’s PSPP2 holdings compared to those of France over the first months of 2019 strongly favoured Bunds. With the new widening of the reinvestment window, this effect should be reduced, if not completely eliminated, and will likely be overshadowed by fluctuating sentiment on the political situation in France.

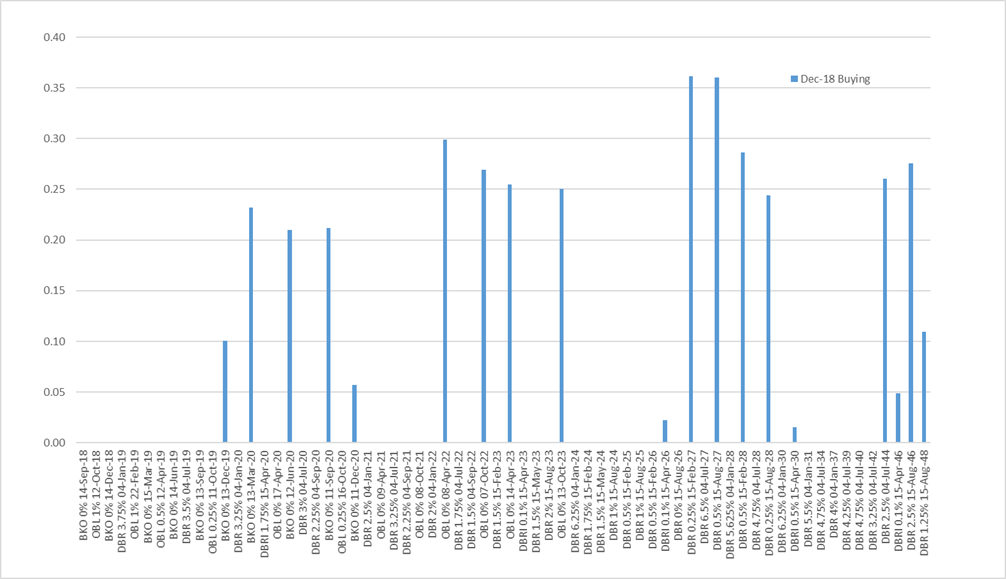

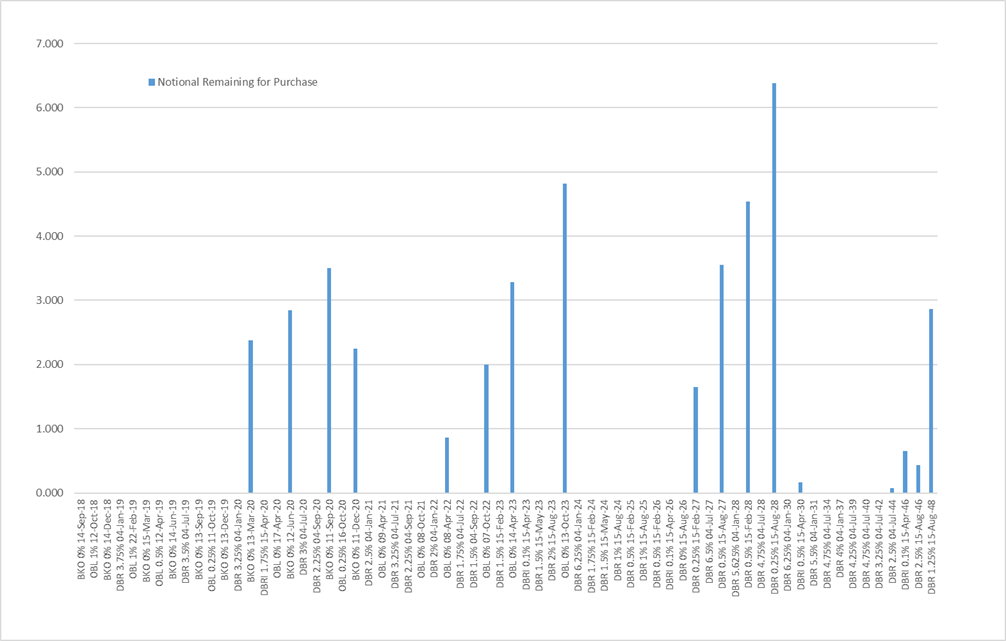

So, here are the (possibly final) results from my model for December 18: the general conclusions have not changed. The bonds that are available to purchase are increasingly concentrated at the supply points of 2y, 5y, 10y and 30y with only the more recent off-the-runs having any capacity for further buying. Beyond the 10y sector, the 2048 will be the main bond, though taps of the 2044 (Apr) and 2046 (Feb and Jun) and will provide some additional room until the new 2050 is launched in August (when it will be just under 31y to maturity). Capacity is greater in the 10y sector (with the new 10y, 2029 being launched tomorrow).

The estimated breakdown of purchasing for December across Govts, KFW and Lander:

|

Category |

Notional |

WAM |

|

German Govt |

4.0 |

9.0 |

|

KFW |

1.1 |

5.3 |

|

Lander |

2.8 |

5.4 |

|

All Purchases |

7.9 |

7.2 |

Given the model, here’s a chart showing the estimated redemption flows for the year ahead:

And the numbers for that chart:

|

Redemptions (EUR mm) |

||||

|

Govt |

KFW |

Lander |

Total |

|

|

Apr-17 |

0 |

0 |

0 |

0 |

|

May-17 |

0 |

0 |

0 |

0 |

|

Jun-17 |

40 |

0 |

0 |

40 |

|

Jul-17 |

326 |

364 |

0 |

690 |

|

Aug-17 |

0 |

0 |

0 |

0 |

|

Sep-17 |

0 |

564 |

235 |

799 |

|

Oct-17 |

401 |

661 |

0 |

1063 |

|

Nov-17 |

0 |

531 |

250 |

781 |

|

Dec-17 |

0 |

0 |

0 |

0 |

|

Jan-18 |

575 |

297 |

0 |

872 |

|

Feb-18 |

1236 |

531 |

0 |

1767 |

|

Mar-18 |

699 |

0 |

142 |

841 |

|

Apr-18 |

6411 |

0 |

86 |

6497 |

|

May-18 |

0 |

0 |

115 |

115 |

|

Jun-18 |

1541 |

2970 |

338 |

4849 |

|

Jul-18 |

3258 |

1650 |

582 |

5490 |

|

Aug-18 |

0 |

0 |

95 |

95 |

|

Sep-18 |

2086 |

0 |

483 |

2569 |

|

Oct-18 |

3941 |

1650 |

711 |

6303 |

|

Nov-18 |

0 |

0 |

974 |

974 |

|

Dec-18 |

2554 |

1649 |

330 |

4532 |

|

Jan-19 |

6530 |

1980 |

1017 |

9527 |

|

Feb-19 |

5040 |

0 |

675 |

5715 |

|

Mar-19 |

2083 |

3300 |

385 |

5769 |

|

Apr-19 |

5280 |

321 |

829 |

6430 |

|

May-19 |

0 |

0 |

683 |

683 |

|

Jun-19 |

2045 |

0 |

600 |

2645 |

|

Jul-19 |

7920 |

495 |

99 |

8514 |

|

Aug-19 |

0 |

660 |

396 |

1056 |

|

Sep-19 |

2196 |

132 |

1032 |

3360 |

|

Oct-19 |

5280 |

1650 |

2195 |

9125 |

|

Nov-19 |

0 |

0 |

605 |

605 |

|

Dec-19 |

2256 |

0 |

578 |

2833 |

For the model itself, here are the estimates for the buying of German Governments in December:

This chart shows the remaining notional available for purchase by the programme given the estimated buying to date and the notional limits in place.

Finally, here’s the issue by issue breakdown of how much of each government bond my model estimates that the Bundesbank has bought:

|

Bond |

Opened |

O/S (bn) |

Purchasable |

Market Yield |

Purchased |

% Purchased |

Remaining |

Margin of Error |

MV Remaining |

Dec-18 Buying |

|

DBR 3.75% 04-Jan-17 |

Nov-06 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.75% 24-Feb-17 |

Jan-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 10-Mar-17 |

Feb-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 07-Apr-17 |

May-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 16-Jun-17 |

May-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

+/- 12% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-17 |

May-07 |

0.0 |

0.0 |

|

0.3 |

|

0.0 |

+/- 5% |

0.0 |

0.0 |

|

BKO 0% 15-Sep-17 |

Aug-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 13-Oct-17 |

Sep-12 |

0.0 |

0.0 |

|

0.4 |

|

0.0 |

+/- 3% |

0.0 |

0.0 |

|

BKO 0% 15-Dec-17 |

Nov-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4% 04-Jan-18 |

Nov-07 |

0.0 |

0.0 |

|

0.6 |

|

0.0 |

+/- 4% |

0.0 |

0.0 |

|

OBL 0.5% 23-Feb-18 |

Jan-13 |

0.0 |

0.0 |

|

1.2 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

BKO 0% 16-Mar-18 |

Feb-16 |

0.0 |

0.0 |

|

0.7 |

|

0.0 |

+/- 4% |

0.0 |

0.0 |

|

OBL 0.25% 13-Apr-18 |

May-13 |

0.0 |

0.0 |

|

1.9 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

OBLI 0.75% 15-Apr-18 |

Apr-11 |

0.0 |

0.0 |

|

4.5 |

|

0.0 |

+/- 1% |

0.0 |

0.0 |

|

BKO 0% 15-Jun-18 |

May-16 |

0.0 |

0.0 |

|

1.5 |

|

0.0 |

+/- 4% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-18 |

May-08 |

0.0 |

0.0 |

|

3.3 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

BKO 0% 14-Sep-18 |

Aug-16 |

0.0 |

0.0 |

|

2.1 |

|

0.0 |

+/- 3% |

0.0 |

0.0 |

|

OBL 1% 12-Oct-18 |

Sep-13 |

0.0 |

0.0 |

|

3.9 |

|

0.0 |

+/- 1% |

0.0 |

0.0 |

|

BKO 0% 14-Dec-18 |

Nov-16 |

0.0 |

0.0 |

2.6 |

0.0 |

+/- 2% |

0.0 |

0.0 |

||

|

DBR 3.75% 04-Jan-19 |

Nov-08 |

0.0 |

0.0 |

6.5 |

0.0 |

+/- 1% |

0.0 |

0.0 |

||

|

OBL 1% 22-Feb-19 |

Jan-14 |

16.0 |

0.0 |

-0.548 |

5.0 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

BKO 0% 15-Mar-19 |

Mar-17 |

13.0 |

0.0 |

-0.587 |

2.1 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

OBL 0.5% 12-Apr-19 |

May-14 |

16.0 |

0.0 |

-0.617 |

5.3 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 14-Jun-19 |

May-17 |

13.0 |

0.0 |

-0.624 |

2.0 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

DBR 3.5% 04-Jul-19 |

May-09 |

24.0 |

0.0 |

-0.599 |

7.9 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 13-Sep-19 |

Aug-17 |

13.0 |

0.0 |

-0.613 |

2.2 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

OBL 0.25% 11-Oct-19 |

Sep-14 |

16.0 |

0.0 |

-0.609 |

5.3 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 13-Dec-19 |

Nov-17 |

13.0 |

0.0 |

-0.607 |

2.3 |

|

0.0 |

+/- 1% |

0.0 |

0.1 |

|

DBR 3.25% 04-Jan-20 |

Nov-09 |

22.0 |

7.3 |

-0.713 |

7.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 13-Mar-20 |

Feb-18 |

13.0 |

4.3 |

-0.607 |

1.9 |

45% |

2.4 |

+/- 1% |

2.4 |

0.2 |

|

DBRI 1.75% 15-Apr-20 |

Jun-09 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 17-Apr-20 |

Jan-15 |

20.0 |

6.6 |

-0.603 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 12-Jun-20 |

May-18 |

12.0 |

4.0 |

-0.624 |

1.1 |

28% |

2.8 |

+/- 1% |

2.9 |

0.2 |

|

DBR 3% 04-Jul-20 |

Apr-10 |

22.0 |

7.3 |

-0.619 |

7.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-20 |

Aug-10 |

16.0 |

5.3 |

-0.631 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 11-Sep-20 |

Aug-18 |

12.0 |

4.0 |

-0.606 |

0.5 |

12% |

3.5 |

+/- 3% |

3.5 |

0.2 |

|

OBL 0.25% 16-Oct-20 |

Jul-15 |

19.0 |

6.3 |

-0.603 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 11-Dec-20 |

Nov-18 |

7.0 |

2.3 |

-0.581 |

0.1 |

3% |

2.2 |

+/- 11% |

2.3 |

0.1 |

|

DBR 2.5% 04-Jan-21 |

Nov-10 |

19.0 |

6.3 |

-0.640 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 09-Apr-21 |

Feb-16 |

21.0 |

6.9 |

-0.592 |

6.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 3.25% 04-Jul-21 |

Apr-11 |

19.0 |

6.3 |

-0.578 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-21 |

Aug-11 |

16.0 |

5.3 |

-0.560 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Oct-21 |

Jul-16 |

19.0 |

6.3 |

-0.551 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2% 04-Jan-22 |

Nov-11 |

20.0 |

6.6 |

-0.539 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Apr-22 |

Feb-17 |

18.0 |

5.9 |

-0.508 |

5.1 |

86% |

0.9 |

+/- 1% |

0.9 |

0.3 |

|

DBR 1.75% 04-Jul-22 |

Apr-12 |

24.0 |

7.9 |

-0.483 |

7.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 04-Sep-22 |

Sep-12 |

18.0 |

5.9 |

-0.463 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 07-Oct-22 |

Jul-17 |

17.0 |

5.6 |

-0.449 |

3.6 |

64% |

2.0 |

+/- 1% |

2.0 |

0.3 |

|

DBR 1.5% 15-Feb-23 |

Jan-13 |

18.0 |

5.9 |

-0.411 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 14-Apr-23 |

Feb-18 |

16.0 |

5.3 |

-0.382 |

2.0 |

38% |

3.3 |

+/- 1% |

3.3 |

0.3 |

|

DBRI 0.1% 15-Apr-23 |

Mar-12 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-23 |

May-13 |

18.0 |

5.9 |

-0.385 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2% 15-Aug-23 |

Sep-13 |

18.0 |

5.9 |

-0.354 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 13-Oct-23 |

Jul-18 |

16.0 |

5.3 |

-0.318 |

0.5 |

9% |

4.8 |

+/- 4% |

4.9 |

0.3 |

|

DBR 6.25% 04-Jan-24 |

Jan-94 |

10.3 |

3.4 |

-0.281 |

3.4 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.75% 15-Feb-24 |

Jan-14 |

18.0 |

5.9 |

-0.288 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-24 |

May-14 |

18.0 |

5.9 |

-0.253 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-24 |

Sep-14 |

18.0 |

5.9 |

-0.225 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-25 |

Jan-15 |

23.0 |

7.6 |

-0.164 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-25 |

Jul-15 |

23.0 |

7.6 |

-0.117 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-26 |

Jan-16 |

26.0 |

8.6 |

-0.058 |

8.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.1% 15-Apr-26 |

Mar-15 |

14.5 |

4.8 |

|

4.8 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0% 15-Aug-26 |

Jul-16 |

25.0 |

8.3 |

-0.004 |

8.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.25% 15-Feb-27 |

Jan-17 |

26.0 |

8.6 |

0.052 |

6.9 |

81% |

1.6 |

+/- 1% |

1.7 |

0.4 |

|

DBR 6.5% 04-Jul-27 |

Jul-97 |

11.2 |

3.7 |

0.046 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Aug-27 |

Jul-17 |

25.0 |

8.3 |

0.106 |

4.7 |

57% |

3.5 |

+/- 1% |

3.7 |

0.4 |

|

DBR 5.625% 04-Jan-28 |

Jan-98 |

14.5 |

4.8 |

0.105 |

4.8 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-28 |

Jan-18 |

21.0 |

6.9 |

0.171 |

2.4 |

34% |

4.5 |

+/- 1% |

4.7 |

0.3 |

|

DBR 4.75% 04-Jul-28 |

Oct-98 |

11.3 |

3.7 |

0.171 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.25% 15-Aug-28 |

Jul-18 |

21.0 |

6.9 |

0.234 |

0.5 |

8% |

6.4 |

+/- 4% |

6.4 |

0.2 |

|

DBR 6.25% 04-Jan-30 |

Jan-00 |

9.3 |

3.1 |

0.258 |

3.1 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.5% 15-Apr-30 |

Apr-14 |

12.6 |

4.1 |

|

4.0 |

96% |

0.2 |

+/- 0% |

0.2 |

0.0 |

|

DBR 5.5% 04-Jan-31 |

Oct-00 |

17.0 |

5.6 |

0.321 |

5.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-34 |

Jan-03 |

20.0 |

6.6 |

0.508 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4% 04-Jan-37 |

Jan-05 |

23.0 |

7.6 |

0.611 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-39 |

Jan-07 |

14.0 |

4.6 |

0.677 |

4.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-40 |

Jul-08 |

16.0 |

5.3 |

0.683 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 3.25% 04-Jul-42 |

Jul-10 |

15.0 |

5.0 |

0.744 |

5.0 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.5% 04-Jul-44 |

Apr-12 |

26.5 |

8.7 |

0.812 |

8.7 |

99% |

0.1 |

+/- 0% |

0.1 |

0.3 |

|

DBRI 0.1% 15-Apr-46 |

Jun-15 |

8.0 |

2.6 |

|

2.0 |

75% |

0.7 |

+/- 2% |

0.8 |

0.0 |

|

DBR 2.5% 15-Aug-46 |

Feb-14 |

25.5 |

8.4 |

0.841 |

8.0 |

95% |

0.4 |

+/- 1% |

0.6 |

0.3 |

|

DBR 1.25% 15-Aug-48 |

Sep-17 |

12.0 |

4.0 |

0.876 |

1.1 |

28% |

2.9 |

+/- 2% |

3.2 |

0.1 |

|

Italic = index-linked |

Total |

43.6 |

4.0 |

|||||||

|

Yield below Depo Rate |

||||||||||

|

Yield above Depo Rate |

Bund WAM |

9.0 |

With best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

UPDATE US-UK break-even and the spread of both. ONLY technical observations given the extremes we are at.

UPDATE US-UK break-even and the spread of both. ONLY technical observations given the extremes we are at.

The BEST chart is the US-UK 30yr breakeven spread (below) only twice since 2008 has the RSI been so dislocated.

The US weekly RSI’s stand out as extremes and tend to be the major driver of spread wideness.

AS WITH EVERYTHING IT SEEMS THE EXPLOSIVE FACTOR AND EXTREME IS IN THE US.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Bund and TY downside just in case. Quick trade protection for the week incase of a yield pop.

Bund and TY downside just in case.

I have been deliberating whether to suggest protection given the overall view for US yields is VERY negative, however we seem to be struggling at these yields.

The longer-term charts continue to forecast lower yields going forward BUT it might be worth putting on some protection if yields should bounce.

There is further reluctance to put on protection given the POOR bounce in equities, just depends on personal preference for a pop in yields.

The pop may only be this week hence Feb options seem the best opportunity.

Trade ideas

Feb Bund 162.50-161.50 put spread 14-15 currently Future 163.69 14 Delta

Feb 10yr 121.50-120.50 put spread 12-14 currently Future 121-30 24 Delta

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MULTI ASSET UPDATE : Fridays number caused a STIR but has it really changed anything? Stocks bounced BUT remain heavy and US yields ALREADY have NEW LOWS on the year.

PLEASE OPEN ATTACHMENT

MULTI ASSET UPDATE : Fridays number caused a STIR but has it really changed anything?

Stocks bounced BUT remain heavy and US yields ALREADY have NEW LOWS on the year. It looks like we need more price action before any of the trends of late are breached.

Equities : European equities are todays focus given their INABILITY to make use of Fridays gains. Failure here today we increase the chances of a MAJOR WASHOUT.

Bond yields : This market continues to call for MUCH LOWER yields especially as we have NEW YIELD lows on last month. Additionally we are sub many sizeable moving averages and RSI’s still remain hugely dislocated.

FX : The DXY is approaching a major test in the form of the 50% ret 95.859 moving average-retracement.

The recent USD weakness has allowed many USD EM crosses to define their long-term move lower.

US Curves have huge historical dislocations and all point to a BULL STEEPENER in the back end, look to re-enter the 2-30 idea.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Updated Astor Ridge Data/Supply/Events Calendars for Jan 7-11

Happy New Year to you… Best of luck this year.

Please find updated calendars attached.

The year kicks off in earnest next week with a rather monstrous week of supply to digest, the renewal of Brexit talks, US meeting China and a barrage of Fed speakers.

Hope these calendars help.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

**PRE NON FARM BONDS AND EQUITIES This could be a VERY CRITICAL Non-Farm given the precarious location many markets are at. **

This could be a VERY CRITICAL Non-Farm given the precarious location many markets are at.

Most bond yields have posted NEW LOWS on last month and equities have failed MINIMAL retracements, the subsequent price action could be telling.

The charts should highlight some “WATCH FOR” critical levels.

REMAIN on high alert.

Equities : Blink and you’ll miss it. Stocks remain on high alert given ALL remain close to last month’s LOWS.

Equities REMAIN very damaged goods! Europe is in a terminally bad way whilst the US is close to confirming the 10 year “RALLY” is over.

BONDS

Bonds seem to be making up for lost ground, MANY YIELD charts have already printed NEW LOWS ON LAST MONTH! This obviously doesn’t bode well and should equities fail to it, will get MESSY.

German yields are finding yield support at the reliable trend channel 0.141.

Italy continues to CHOP around, doing it about the 200 day moving average 2.784.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

US-UK break-even and the spread of both UPDATE . ONLY technical observations given the extremes we are at.

US-UK break-even and the spread of both. ONLY technical observations given the extremes we are at.

The US weekly RSI’s stand out as extremes and tend to be the major driver of spread wideness.

AS WITH EVERYTHING IT SEEMS THE EXPLOSIVE FACTOR AND EXTREME IS IN THE US.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris