MICROCOSM: Time to Cover Some UKT 4Q27 Shorts.... Quick Update

GILTS...

> Modest dip in gilts as core rates react to overdone technicals. We'd expect some profit taking to emerge in some of the more curve sensitive posns we have on if this selloff gathers steam.

> Positions Update:

UKT 25-27-30 fly -7.45bp, cheapest since mid-Nov.

UKT 9/22-9/24-7/26 -.5bp mid, still reflecting bid in 5yr point.

UKT 26-27-28 fly -4.4bps, making another new 'low' as 27s cheapen further.

UKT 42-47-52 fly 7.8bps mid. Also doing well, even with half the street scrambling to cover shorts in 52s.

UKT 30-32-38 80/100/20 wtd fly 4.6bps mid - about unched. 4T30s still trade well.

UKT 38-44-49 fly 15.4bps mid - 44s still cheapest issue out there.

UKT 20-21 sprd -.17bp, still modestly inverted given rally in 1y1y SONIA back to .907bp.

UKT 7/26-10/28 now 20.5bp mid, little changed.

UKT 4Q27-1F28 12.45bp mid - holding.

UKT 4Q27-1Q27 now inside 2bps at 1.97bps mid, cheapest 4Q27s have been since late Feb last year.

We're staunch 4Q27s bears given all the dynamics we've been highlighting. With the market flashing 'LONG' here, the question now becomes, what are they most long now - G H9 or 1F28/1Q27s...? In other words, if the mkt turns, do 28s get hit too with a tap coming on Tuesday?

Time to lighten up a bit on some of our 4Q27s shorts here...

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

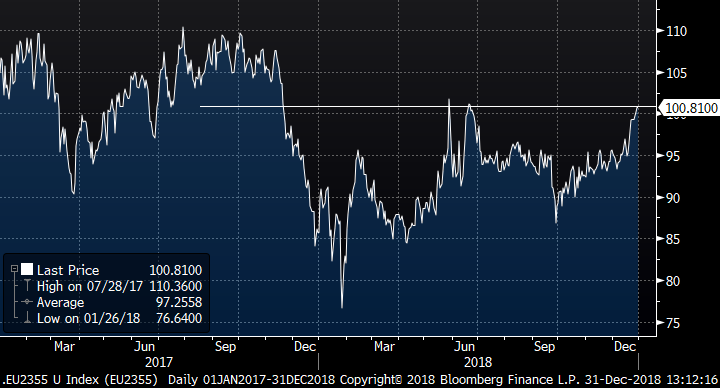

USFS 10-20 WHAT NEXT : Last months low RSI “HOLD” has been eroded and we have posted a NEW YEAR low. The implication therefore is we continue to head lower, presumably BOND yields too.

USFS 10-20 WHAT NEXT : Last month’s low RSI “HOLD” has been eroded and we have posted a NEW YEAR low. The implication therefore is we continue to head lower, presumably yields too. The danger is a REPLICATION of Decembers RANGE. That acceleration could be MESSY!

** If not in this trade already then this could be a good location, a stop above last months close-this month’s opening, say 2.810 avoiding the 50 day MA and 23.6% ret 2.8013. **

Above all this is a long term trade hence don’t be afraid to sell new LOWS.

Overall this chart corelates well with the outright yield charts which ALSO predict a move LOWER.

My BIG worry is that if equities fail then yields plummet and the RE ENTRY is missed. Therefore finding the bounce on this strategy might require a “SCALE IN” BUT significant ADD when 3.0648 failure confirmed. The STOP on any scale in could be just above the 61.8% ret 3.2744 on page 6.

This will be a big trade as it 100% endorses the YIELD LOWER call.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: First SPGB Supply of 2019 Should Find Good Support... Quick Rundown

SPAIN... First Supply of 2019

> €4-5bn nominals between .05 10/21, .35 7/23 and 1.4 7/28.

> Between the political rumblings of the past month and continued equity mkt wobbles, SPGBs have cheapened vs DBRs, about 10bps in 10yrs over the last week.

> Each of the issues being tapped today have cheapened nicely into today, either on the curve, vs DBRs/BTPS or vs swaps.

> The SPGB .05 10/21s are clearly the lowest cpn issue on the whole curve and at 4.5bln, will be tapped for until Apr/May. That said, the z-sprd box vs the SPGB .75 7/21s is back to the early Nov wides at +10.1bps and the yield sprd is 5.5bps steeper at 12.25bps mid, even with a bull flattening bias in EGBs into year-end.

SPGB .75 7/21 – SPGB .05 10/21 Z-sprd box. Last taps were Dec 5 and Nov 8th – both marked near-term wides.

> As with the 10/21s, the SPGB .4 4/22 vs SPGB .35 7/23 Z-sprd box is back to the Nov wides, now +18.4bps. This level held nicely in Nov and both of the last two taps marked the s/term cheaps on the sprd. SPGB 7/23s have cheapened vs OATs and BTPS over the past week and at 13.8bn, they’re closing in on their last tap.

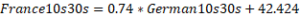

> SPGB 1.4 7/28s are just 4bps off their richest yield level since August. Were it not for RV implications, they would likely struggle this am. The SPGB 10/27-7/28 roll has widened back to the Jun-Jan wides at +7.6bps and IKH9 vs SPGB 1.4 28 sprds are at 121.5bps, their tightest level since these SPGB 7/28s were auctioned. If you've been waiting for a chance to put at BTPS-SPGB 10yr widener on, this is a good oppty...

BTPS 4.75 9/28 – SPGB 1.4 7/28 at new lows…

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

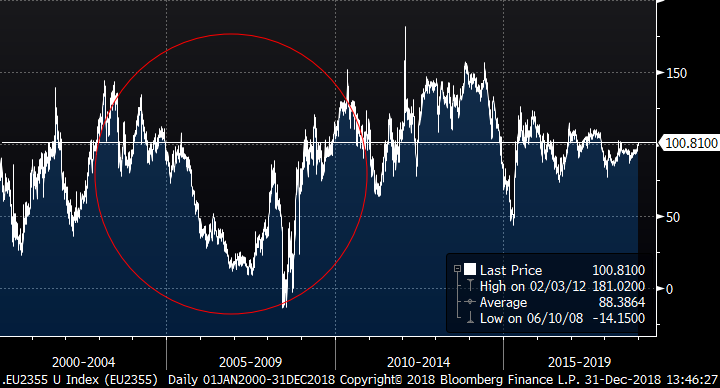

** PLEASE READ ** MULTI ASSET UPDATE : 2019 SO what's changed? VERY LITTLE thus remain on HIGH ALERT. Equities remain WEAK, close to last years lows and US yields sub critical long-term moving averages!

MULTI ASSET UPDATE : 2019 SO what's changed? VERY LITTLE thus remain on HIGH ALERT. Equities remain WEAK, close to last year’s lows and US yields sub critical long-term moving averages!

**I have added a few CHART driven predictions for 2019 on individual charts**

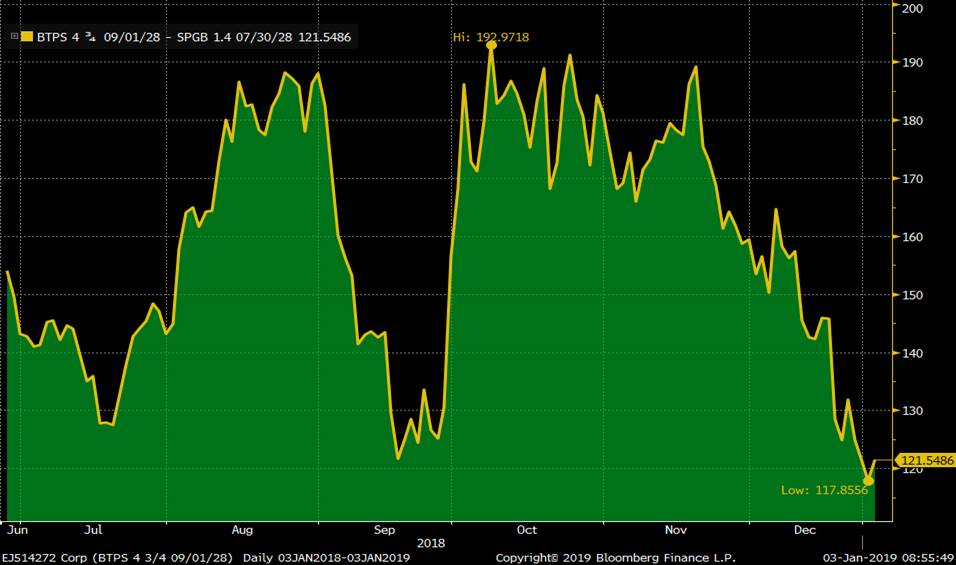

Equities continue to struggle especially in Europe with CHINA now failing a key 25194.20 multi-year moving average, i.e. not a good start. Bond yields in the US are suffering a similar fate i.e. close to last year’s lows and sub some major statement multiyear moving averages.

Stocks : They remain the GREATEST concern and driver, we have EUROPEAN TOPS and an OVER VALUED US market. Numerous US products have RSI dislocations not seen in years, notably TECH with an 18 year RSI extension. We have lost sight of value in this SECTOR. Too many have been sucked in to the VORTEX of a “MUST HAVE IN THE PORTFOLIO”, agreed the returns have been great but it’s time to seek VALUE.

Bond yields : This has been the eternal pain given ALL quarterly and monthly charts have been forecasting MUCH lower yields based on 1982, 1984 RSI dislocations. One recent example and trade idea the USFS10-20 swap, it helped endorse a lower yield environment ahead. Expectation for higher rates has gotten ahead of reality and the charts represent that. The latest chart updates shows potential for a MASSIVE snap back in yields over the next few months, I suspect aided by weaker stocks. Yields on paper should plummet, even though we have a lower BASE LINE YIELD VALUE.

FX : I still think this is not a PURE USD call, there are too many other global issues for it not to be. I feel the EURO is going to be a major CASUALTY soon. I am surprised the French situation has had so little impact but just like stocks the EURO is on the EGDE of a precipice, one nudge and it’s OVER.

US Curves have huge historical dislocations and all point to a BULL STEEPENER in the back end, look to re-enter the 2-30 idea.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Your starter for 2019: Bear-flatteners in EUR as a low-risk fade to the recent rally

Bottom line: The EUR curve has been bull-steepening, and 2y3y/5y5y is ending 2018 at its highs. Position for a reversal in ECB/Fed sentiment using mid-curve payers for a bear-flattener. This is a low-cost way to position for increased optimism for the economic outlook to start 2019.

Trade:

Buy EUR 330mm 6m2y3y mid-curve payer atmf (k=0.60%)

Sell EUR 210mm 6m5y5y mid-curve payer atmf (k=1.55%)

For zero cost (indicative mid)

Forward strike at 95bp vs spot 2y3y/5y5y at 101bp.

Rationale: For the last three months of 2018, the EUR curve (in forward space) as been bull-steepening, as short-rates rally in sympathy with the abrupt volte-face in Fed expectations across the Atlantic. At the same time, the fog of BREXIT and an apparent weakening of German manufacturing data have provoked a more dovish outlook for the ECB. It is not then a surprise that curve moves have been led by shorter rates. Set against this dovish reading, the ECB has ended new PSPP2 purchases and reiterated its policy of “patience, prudence and persistence”. Various speakers have re-affirmed “Autumn 2019” as the expectation for a first move in refi rates.

Thus the rally of EUR rates down to their YTD lows opens up the possibility of a reversal in sentiment, which would most likely come from either stronger US equity performance in 2019 or a non-apocalyptic resolution to the BREXIT question.

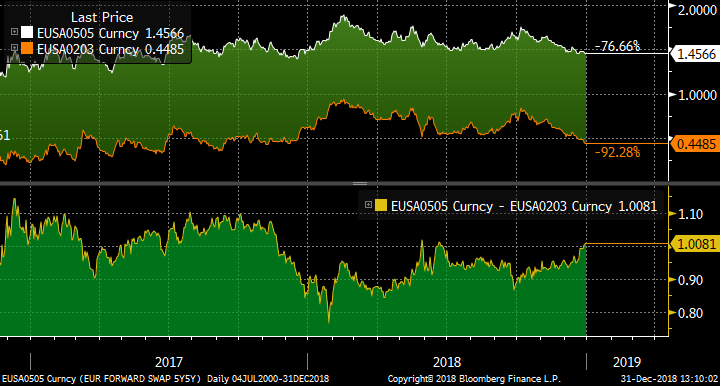

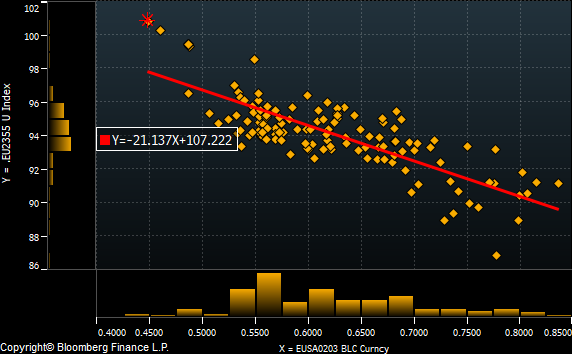

The first chart is the EUR 2y3y/5y5y spread of forward rates for the past 2y. We are at the steepest for the past year, and well above the economic cycles flattest lows that we saw in 2005 (second chart). Thus a flattener would be a consideration even in vanilla space, though with the attendant downside should the rally persist. Please see my previous pieces on why I have chosen the 2y3y/5y5y spread: in essence it is because that rate combination is reliably directional and the mid-curve implied volatilities are very close allowing a zero-cost structure.

A longer history, showing the pre-WFC levels of close to flat in 2005:

So, the level is interesting to set a flattener, but how directional is 2y3y/5y5y? The next chart shows the two separate forward rates and their spread. In the recent rally, the curve has steepened steadily by 10bp off its September low and even further off the 80bp from last January.

This is the scatter of the evolution of the 2y3y/5y5y spread compared to the 2y3y rate for the past 6 months. The curve has quite reliably bull-steepened and bear-flattened during this period.

In vanilla swap space, the flattener is a negative rolldown trade (around 3bp over the first 3m). However, the volatility surface rolldown mitigates this to only a 0.75bp rolldown over the first 3m for the mid-curve structure. Since both ATMF strikes are higher than spot, at expiry both options would expire worthless.

The main risk is that the directionality of the curve breaks down and we see bear-steepening. That is hard to envisage in the current circumstances where Central Banks are the main focus. In the interim the mark-to-market will follow the curve position: positive in a flattening, negative in a further steepening.

As always, I’d love to hear your thoughts, and please accept my Best Wishes for a prosperous 2019!

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

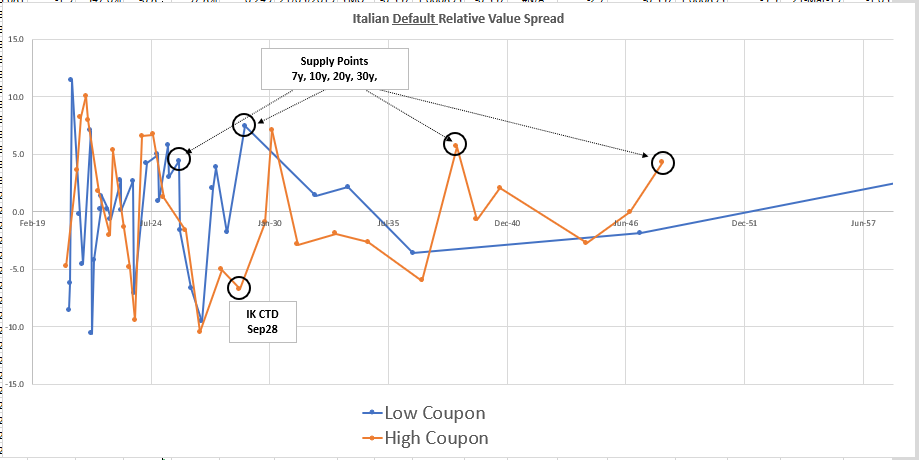

MICROCOSM: BTPS > 'You've Come a Long Way, Baby'

BTPS...

- 'You've come a long way, baby!'

- DBR-BTPS have corrected over 76bps from the Nov wides, closing in on the 38.2% retracement of the Apr-Nov move.

- As highlighted here the last few days, client flows remain two-way in 'RV' (we use the term loosely given the pain and suffering involved in getting anything done the past 2 weeks!), with some clients keen to jump on the spread tightener and others keen to put-on/add-to Hi-Lo cpn spread wideners. Interestingly, there are good versions of both wideners and narrowers on the curve right now, mostly created by bank-driven demand. Each of the current benchmarks across the curve trade on the cheaper side of fair (especially 3s, 5s and 7s), a reflection of the anticipated further taps and their ‘middle-ground’ coupons between the very low sub 1.5% and the higher 4%+ ones.

A couple examples…

- While it's a challenge to tell when 'enough is enough', we are sympathetic with the notion that the budget deal is a definite positive but it's just the beginning of a long journey towards a stronger economy, better run banks and political stability that will take all of 2019 and into 2020 to establish. That doesn't even take into account the uncertainty for BTPS now that PSPP is done and Italy's share of the cap key is smaller. The resumption of supply in Jan will be the first key litmus test for EGBs, especially OATs.

- So, given the sharp tightening of DBR—BTPS spreads, along with a rally in IKH9 that takes them well into o/bot RSIs, we are inclined to take profits on any tactical longs in BTPS here and given the richening we’ve seen in sov bonds overall, the absolute level of EGB yields looks overdone too.

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

So, farewell then 2018. The highs and lows of my shadow portfolio!

Shadow Portfolio P&L (as of 19th Dec): USD +1984k

As has been my custom, it’s time to do a roundup of the performance of my trade ideas for the past year.

Bottom Line: The final P&L came out at an Orwellian USD +1,984k, with a winner/loser ratio of 2.5:1. Given the repeated regime-shifts through the year, I’m happy enough to be in positive territory given that the bulk of my trades are based on relative value.

Synopsis: I carried several trades over from 2017 with mixed results: on the plus side the EUR 1y3y/5y5y curve flattened a little further, and I realized more of the intrinsic value (given the short payer was well OTM); set against that my selling of GBP/USD 5y5y xccy basis was the largest single loss of the year, when the ceiling at +2bp (which had held for an eternity) was breached and the spread never looked back (it’s close to +30 now!). As the year progressed I finally made some opportunistic money on USD steepeners, albeit boxed vs GBP. Into Q1-end in the UK, 10y-30y flattened sharply and fading that (weighted vs the short end) worked well. Thereafter it was a succession of modest gains on trades incepted during the summer. One slow-burn trade that went under the radar was an RV idea on the EUR 6s3s basis curve (2y3y / 5y5y flattener) which has worked steadily and I’m still holding. Within the last couple of months sentiment has changed sharply on the US, with Fed hike expectations getting slashed. As a consequence my mid-curve receiver ladder on 1y1y is well underwater, with the market close to the low strike, but I am holding for now. On the flip side, a departure from RV into an outright receive on USD 10y20y turned out to be well-timed as the market rallied 25bp (and more) and this became my best performing trade of the year (especially considering the one month holding period).

|

Trade Idea |

Entered |

Level |

Size |

Status |

Exit/Current Level |

Exit Date |

P&L k USD |

|

US 2-10 steepener via CMS caps |

28-Dec-17 |

0 bp |

USD 25 k/bp |

CLOSED |

0 bp |

15-Jan-18 |

0 |

|

RX/UB ASW Box |

28-Dec-17 |

-6.1 bp |

EUR 50 k/bp |

CLOSED |

-5.2 bp |

06-Mar-18 |

-56 |

|

EUR 1y3y/5y5y Mid-curve flattener |

28-Dec-17 |

13.7 bp |

EUR 20 k/bp |

CLOSED |

29 bp |

31-Jan-18 |

380 |

|

GBP 1y1y1y MC Payer spread |

28-Dec-17 |

0.7 bp |

GBP 25 k/bp |

CLOSED |

-1 bp |

31-Jan-18 |

-60 |

|

EUR 9m1y1y/9m1y5y Bear Flattener |

28-Dec-17 |

4.2 bp |

EUR 25 k/bp |

CLOSED |

0 bp |

30-Jan-18 |

-130 |

|

Receive GBP/USD 5y5y xccy basis |

28-Dec-17 |

1 bp |

GBP 40 k/bp |

CLOSED |

6.4 bp |

28-Feb-18 |

-297 |

|

EUR 2-5-10 weighted swap fly |

28-Dec-17 |

-28.1 bp |

EUR 40 k/bp |

CLOSED |

-25 bp |

25-Jan-18 |

-154 |

|

GBP 2y-10y Bull-steepener |

05-Jan-18 |

0 bp |

GBP 20 k/bp |

CLOSED |

2.5 bp |

31-May-18 |

66 |

|

EUR 2y2y/5y10y Bull-Steepener |

30-Jan-18 |

0 bp |

EUR 25 k/bp |

CLOSED |

4 bp |

05-Mar-18 |

123 |

|

USD 2y-10y, 1y fwd steepener |

02-Feb-18 |

22 bp |

USD 25 k/bp |

CLOSED |

20.5 bp |

21-Feb-18 |

-38 |

|

GBP/USD 2y-10y 1y fwd Swaps |

21-Feb-18 |

-25.5 bp |

GBP 25 k/bp |

CLOSED |

-10.8 bp |

23-Mar-18 |

521 |

|

GBP 2y-10y vs USD CMS Caps |

21-Feb-18 |

0 bp |

GBP 25 k/bp |

CLOSED |

-3 bp |

24-Sep-18 |

-98 |

|

EUR 3y1y/10y10y flattener |

06-Mar-18 |

124 bp |

EUR 25 k/bp |

CLOSED |

120 bp |

08-Mar-18 |

123 |

|

EUR CMS 10-5 collar |

06-Mar-18 |

0.5 bp |

EUR 40 k/bp |

OPEN |

0 bp |

-23 |

|

|

GBP 10-30 vs 2y1y |

27-Mar-18 |

29 bp |

GBP 40 k/bp |

CLOSED |

33.8 bp |

09-Apr-18 |

271 |

|

EUR 3y1y/5y5y bear steepener |

12-Apr-18 |

0 bp |

EUR 40 k/bp |

CLOSED |

0 bp |

14-Jun-18 |

0 |

|

GBP/USD 2y-10y, 1m Floors |

20-Apr-18 |

0.6 bp |

GBP 25 k/bp |

CLOSED |

0 bp |

21-May-18 |

-20 |

|

EUR 2y1y/10y10y Bear Flattener |

20-Apr-18 |

-0.5 bp |

EUR 25 k/bp |

CLOSED |

4 bp |

04-Jun-18 |

132 |

|

EUR 2y1y/5y5y Bull Steepener |

17-Jun-18 |

0 bp |

EUR 40 k/bp |

CLOSED |

4 bp |

13-Sep-18 |

187 |

|

EUR 3y2y 1x2 Midcurve Payers |

27-Jun-18 |

0 bp |

EUR 25 k/bp |

CLOSED |

4.9 bp |

09-Nov-18 |

139 |

|

GBP 6m2y1y Payer Ladder |

28-Aug-18 |

2.5 bp |

GBP 20 k/bp |

OPEN |

5.1 bp |

66 |

|

|

GBP 3m CMS 10-2 Cap Fly |

28-Aug-18 |

4.5 bp |

GBP 25 k/bp |

CLOSED |

8.1 bp |

09-Oct-18 |

118 |

|

EUR 6m 2y3y/5y5y Bull Steepener |

30-Aug-18 |

-1.25 bp |

EUR 25 k/bp |

CLOSED |

4.4 bp |

17-Dec-18 |

160 |

|

USD 2y-30y / 5y-10y Steepener |

11-Sep-18 |

0 bp |

USD 50 k/bp |

OPEN |

-2.1 bp |

-105 |

|

|

EUR 6s3s 2y3y vs 5y5y |

11-Sep-18 |

0 bp |

EUR 250 k/bp |

OPEN |

-1.2 bp |

357 |

|

|

EUR 1m5y vs 1m30y straddles |

30-Aug-18 |

0.4 bp |

EUR 40 k/bp |

CLOSED |

1.1 bp |

29-Oct-18 |

32 |

|

USD 1y1y1y Receiver Ladder |

11-Sep-18 |

-1 bp |

USD 25 k/bp |

OPEN |

-10.5 bp |

-238 |

|

|

GBP 10y20y/30y20y flattener |

11-Sep-18 |

-26.5 bp |

GBP 50 k/bp |

OPEN |

-25.5 bp |

-63 |

|

|

USD 10y20y receive |

07-Nov-18 |

3.35 % |

USD 25 k/bp |

CLOSED |

3.1 % |

05-Dec-18 |

575 |

|

USD 6m10y20y payer ladder |

12-Dec-18 |

0.2 bp |

USD 25 k/bp |

OPEN |

0.8 bp |

15 |

|

|

Total YTD |

1984 |

||||||

|

Note on trade sizing: Each trade is sized to generate approx. USD 150k 2y 99% hist. VaR at inception with no netting |

|||||||

I’ll be back later with my thoughts for 2019, and the positions with which to start 2019!

Best wishes for the festive season,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

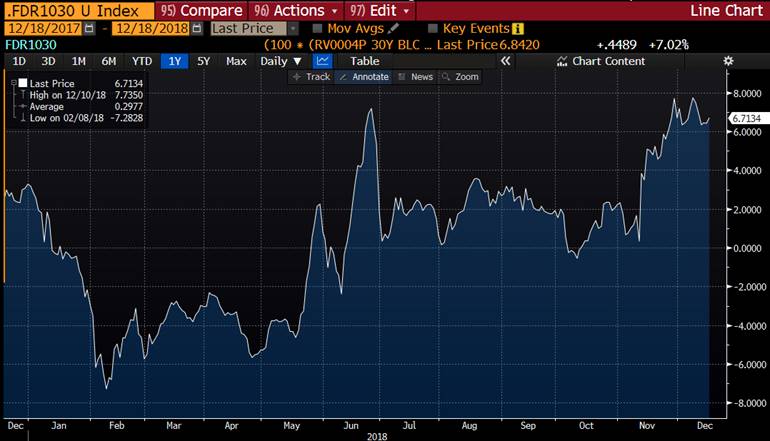

MICROCOSM: GILTS - The Train Keeps A Rollin'!

GILTS... The Train Keeps a Rollin'

- Here's a thought...

- The ONLY thing keeping the UKT 4Q27s from completely getting smoked on the curve right now is the 'vol component' embedded in them as CTD. In other words, with Brexit still a hot topic, there are G H9 buyers who own them because when things get ugly in Parliament, the G H9 contract is the only game in town (as we saw when 27-47s shot steeper in November).

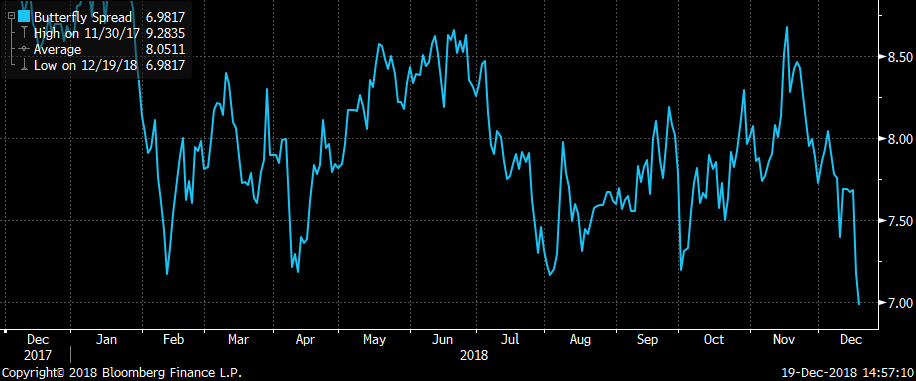

- See how the UKT 4Q27s have been trading the last three days? They're at new 'lows' vs both the 1Q27s and 1F28s for the last 9mos and G H9 invoice spreads have cheapened 2.5bps because the market knows that with Parliament on holiday from tomorrow until early January IT'S UNLIKELY we'll see anything MEANINGFUL on Brexit until 2019. So, a LONG VOL position of owning G H9 (or 4Q27s) suddenly looks less attractive, especially with the issue at GC in repo.

- What’s even MORE important here is the VALUE of our ‘vol’ position continues to ERODE because the directionality we’ve assumed is embedded in owning G H9 has been fading since G H9 became the front contract. (See bottom chart pls) Turn-off the lights on your way out please.

- So, while the market's been awaiting an 'inevitable' pullback in the 1H26s, 1Q27s and 1F28s to buy them against the 4Q27s, these trades have just continued to grind against the 4Q27s and barring a shock, are unlikely to reverse course soon. We are going to have a tap of the UKT 1F28s in January

1H26-4Q27-1F28

1H26-1Q27-4Q27

We’ll be in touch….

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

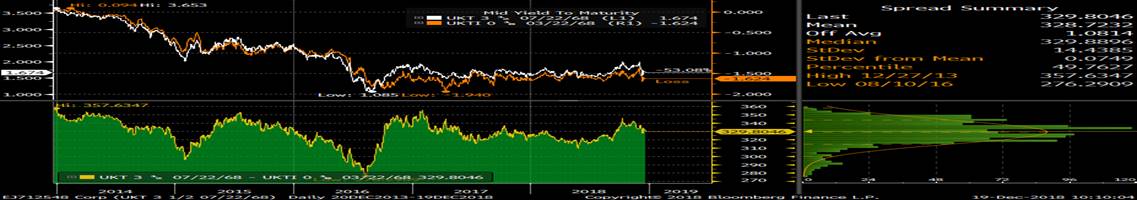

Gilts Super-Long RPI issues too rich on B/E & Vs FTSe div yd-time to fade??

Today's CPI came in around expectations with a softer outlook as Oil prices implode to start 2019 & after the recent fright to quality in RPI debt with a chance RPI issuance may be reduced in coming years looks fairly fully priced on Breakevens & vs the FTSE100 div yd. Next Quarter we get a Linker 2041 Syndicated reopening in late jan early feb for £3.565bn cash & there is £1.5bn unallocated which could boost the issue with large demand & 2 other Linker auctions of 26s & 36s ,following a FT LDI DB pension scheme conference early Dec it showed the demise of schemes & over half the £2trn DB schemes now either in buy in or Buyouts now could be the time to reduce duration either on the Linker curve early into the 2041s or for the brave a breakeven trade ukti 68s into the ever cheapening 3h68s,the de risking moves have pushed the FTSE100 div yd vs real yds to wide extremes below 3h68/ukti 68s on breakeven over 5 years & the UKTI 68s vs the FTSE100 div yd to show where we are & as mentioned the actual liabilities are moving shorter towards 25/40 year which should help either trade. UKTI 68/UKT 3h68s history back to 2014 :  UKFTSE100 div yd vs UKTI 68s back to 2014.

UKFTSE100 div yd vs UKTI 68s back to 2014.  Food for Thought Long yields too low & equities too cheap .On Breakeven same story both asset classes yields are looking too low though the breakeven looks more stretched with the level of real yields & maybe that is the next PPI for pensioners !!!

Food for Thought Long yields too low & equities too cheap .On Breakeven same story both asset classes yields are looking too low though the breakeven looks more stretched with the level of real yields & maybe that is the next PPI for pensioners !!!

This marketing was prepared by George Whitehead, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

<< "The Past Is The Future Back To Basics" 02031434182-www.astorridge.com >>

Trade Radar - James Rice @Astor Ridge, Dec 18

Trade Radar

A few trades on my radar coming into year end

As with all these structures @ year-end, timing is key. I tend to think that things have to look glaringly obvious and resist the temptation to go too early. That said scaling any trade into two or more pieces makes sense

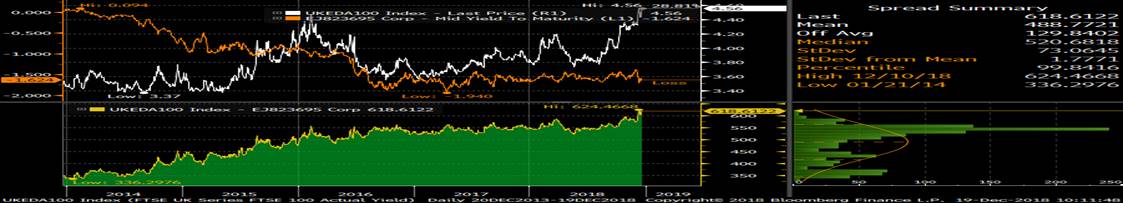

Theme, Italy Supply

– the only supply of any consequence left this year is the Italian 5y and 10y at year end, Friday December 28th

Since end of May this year, the Italian curve in shape and in coupon dynamic has become highly directional. In so much as the absolute level of the market is the dominant single factor in pricing relationships along the curve

A ‘Bond Default Model’ prices cashflows as contingent on whether the issuer survives to pay any liability or indeed a recovery event occurs. The level of Italian yields is a crude representation of the probability of default.

Using this method we get a much better prediction and understanding of Italian bond anomalies. Here’s how they look as of Dec 18th

Italian trading reduces into

- Trading these supply points as some homogenous curve

- Finding times when the supply bonds are simply at an extreme cheap to local non par issuers and capturing that difference

As you can see the Dec28 10y being tapped this month looks cheap

Given that contracts have now rolled to Mar (CTD Sep28), selling the contract (proxy Sep28) makes an interesting prospect to run the trade until March

The trade on my radar is

Sell Btps 4.75 Sep28, Buy Btps Dec28 close to supply

Timing: close to supply at year end

Currently level: +10bp

Entry: +9bp to +12bp depending on pricing close to the supply event

History (Bloomberg) :

For full details, let me know

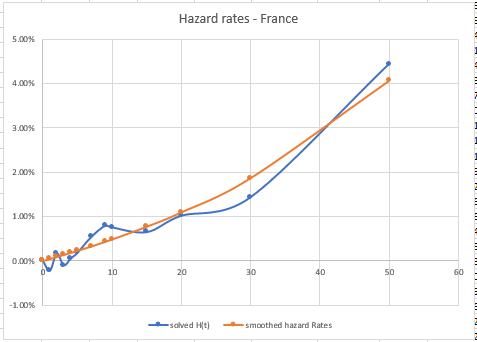

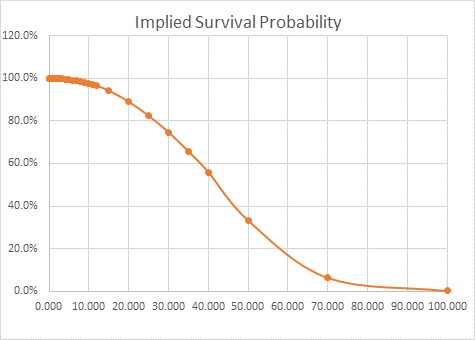

Theme,

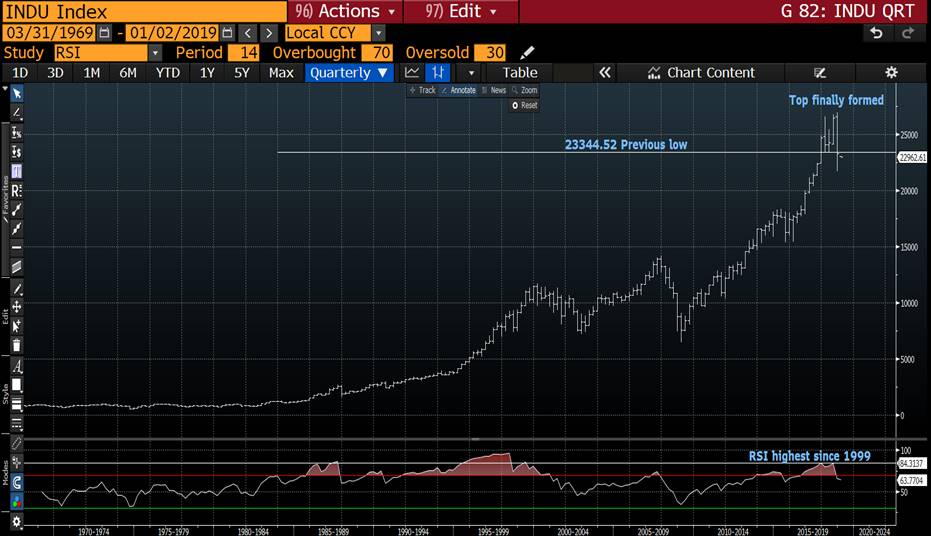

French Curve steep vs other core issuers

Trade:

Flattener 10s30s France

Steepener 10s30s Germany (74%)

Levels expressed in terms residual calculation below

Currently: +7.2bp

Entry: here

Exit: 0bp

Add: +12bp

Stop: +16bp

The Semi core issuer curves have steepened vs the German curve this year

See below France 10s30s vs Germany 10s30s

Generally the gradients of the Euro issuers tend to be a simple multiple of the more secure, richer issuers – in this case Germany. France is about 44% steeper than the German curve. A fear of reduced PSPP buying has led to this extreme state notable in the back end. It would imply an ever increasing prob of default of France relative to Germany in the long end. This contrasts with say Italy, where if default or Euro break down is expected, it’s expected to occur predominantly in the first ten years.

Over the long haul the regression of France 10s30s to Germany gives us France10s30s moving at 74% as fast as Germany10s30s

Therefore using that mechanism to tactically trade the dislocation…

![]()

So the residual looks as follows

From BBG

The heavy discounting of 30s and indeed 50yrs looks to have exaggerated fears of prob of default – as the Hazard Rate (the gradient of the probability of default) increases exponentially over time, which seems an incredibly over-informed perspective of the market

So much so, that the prob of default for 30y and 50y cashflows falls dramatically – and indeed these cashflows are so discounted that the bonds should start to exhibit ‘credit convexity’ – that state where long tenors start to outperform in any further spread widening

Again – we’re close, and If you’d like me to keep you posted on these and other ideas – please let me know

More to follow

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796