CORRECT ATTACHMENT .. sorry **PRE FED MULTI ASSET UPDATE .. HOLD ONTO YOUR CHRISTMAS HATS IT COULD BE A ROUGH RIDE. WE ARE ABOUT TO SEE THE MARKETS “STEP UP A GEAR” RATHER THAN HIBERNATE FOR CHRISTMAS AND NEW YEAR.**

**MULTI ASSET UPDATE : WE ARE ABOUT TO SEE THE MARKETS “STEP UP A GEAR” RATHER THAN HIBERNATE FOR CHRISTMAS AND NEW YEAR!**

PLEASE OPEN THE ATTACHMENT.

Equities again look abysmal and poised to free fall, yields similarly so aided by poor liquidity and EM on the rebound again. I would also re-enter any BULL STEEPENERS in the back end of the US curve especially US 2-30 given the stop is cheap based on a MULTI YEAR entry location! (Page 52).

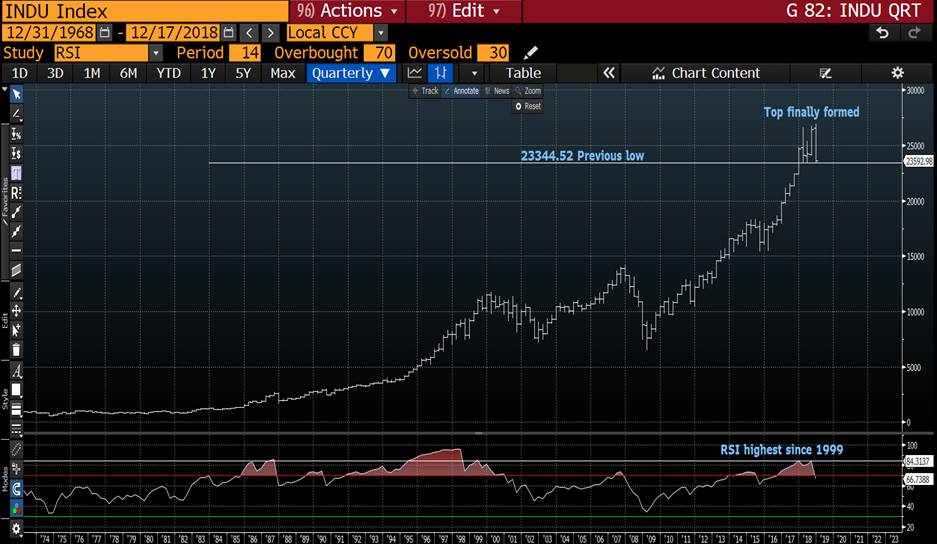

I have long mentioned the idea of a PERFECT STORM, we have had so many far reaching RSI dislocations that need addressing. It now finally looks like all these aspects are going to come together over the Christmas- New Year period.

Stocks : They remain the GREATEST concern and driver, we have EUROPEAN TOPS and an OVER VALUED US market. Numerous US products have RSI dislocations not seen in years, notably TECH with an 18 year RSI extension. We have lost sight of value in this SECTOR. Too many have been sucked in to the VORTEX of a “MUST HAVE IN THE PORTFOLIO”, agreed the returns have been great but it’s time to seek VALUE.

Bond yields : This has been the eternal pain given ALL quarterly and monthly charts have been forecasting MUCH lower yields based on 1982, 1984 RSI dislocations. One recent example and trade idea the USFS10-20 swap, it helped endorse a lower yield environment ahead. Expectation for higher rates has gotten ahead of reality and the charts represent that. The latest chart updates shows potential for a MASSIVE snap back in yields over the next few months, I suspect aided by weaker stocks. Yields on paper should plummet, even though we have a lower BASE LINE YIELD VALUE.

FX : I still think this is not a PURE USD call, there are too many other global issues for it not to be. I feel the EURO is going to be a major CASUALTY soon. I am surprised the French situation has had so little impact but just like stocks the EURO is on the EGDE of a precipice, one nudge and it’s OVER.

US Curves have huge historical dislocations and all point to a BULL STEEPENER in the back end, look to re-enter the 2-30 idea.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

**PRE FED MULTI ASSET UPDATE .. HOLD ONTO YOUR CHRISTMAS HATS IT COULD BE A ROUGH RIDE. WE ARE ABOUT TO SEE THE MARKETS “STEP UP A GEAR” RATHER THAN HIBERNATE FOR CHRISTMAS AND NEW YEAR.**

**MULTI ASSET UPDATE : WE ARE ABOUT TO SEE THE MARKETS “STEP UP A GEAR” RATHER THAN HIBERNATE FOR CHRISTMAS AND NEW YEAR!**

PLEASE OPEN THE ATTACHMENT.

Equities again look abysmal and poised to free fall, yields similarly so aided by poor liquidity and EM on the rebound again. I would also re-enter any BULL STEEPENERS in the back end of the US curve especially US 2-30 given the stop is cheap based on a MULTI YEAR entry location! (Page 52).

I have long mentioned the idea of a PERFECT STORM, we have had so many far reaching RSI dislocations that need addressing. It now finally looks like all these aspects are going to come together over the Christmas- New Year period.

Stocks : They remain the GREATEST concern and driver, we have EUROPEAN TOPS and an OVER VALUED US market. Numerous US products have RSI dislocations not seen in years, notably TECH with an 18 year RSI extension. We have lost sight of value in this SECTOR. Too many have been sucked in to the VORTEX of a “MUST HAVE IN THE PORTFOLIO”, agreed the returns have been great but it’s time to seek VALUE.

Bond yields : This has been the eternal pain given ALL quarterly and monthly charts have been forecasting MUCH lower yields based on 1982, 1984 RSI dislocations. One recent example and trade idea the USFS10-20 swap, it helped endorse a lower yield environment ahead. Expectation for higher rates has gotten ahead of reality and the charts represent that. The latest chart updates shows potential for a MASSIVE snap back in yields over the next few months, I suspect aided by weaker stocks. Yields on paper should plummet, even though we have a lower BASE LINE YIELD VALUE.

FX : I still think this is not a PURE USD call, there are too many other global issues for it not to be. I feel the EURO is going to be a major CASUALTY soon. I am surprised the French situation has had so little impact but just like stocks the EURO is on the EGDE of a precipice, one nudge and it’s OVER.

US Curves have huge historical dislocations and all point to a BULL STEEPENER in the back end, look to re-enter the 2-30 idea.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

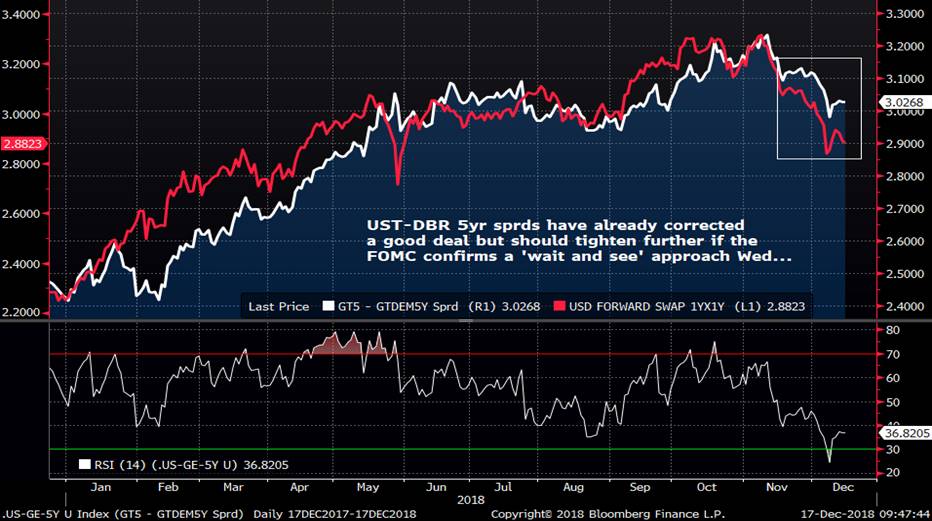

MACROCOSM: Further UST-DBR Spread Compression Looks Likely into FOMC Meeting...

MACRO...

> Handful of pundits are talking about the outlook for the US with the FOMC expected to hike Wednesday but take a 'wait and see' approach to further hikes in their statement. Given signs of slowing momentum across the G-10 and wobbles in major markets like equities, this seems the appropriate approach at this stage.

> While the European outlook is also muddied, 10yr DBRs are within a few bps of 2017's richest levels which leaves UST-DBR spreads still very wide, even after the spread compression over the last month.

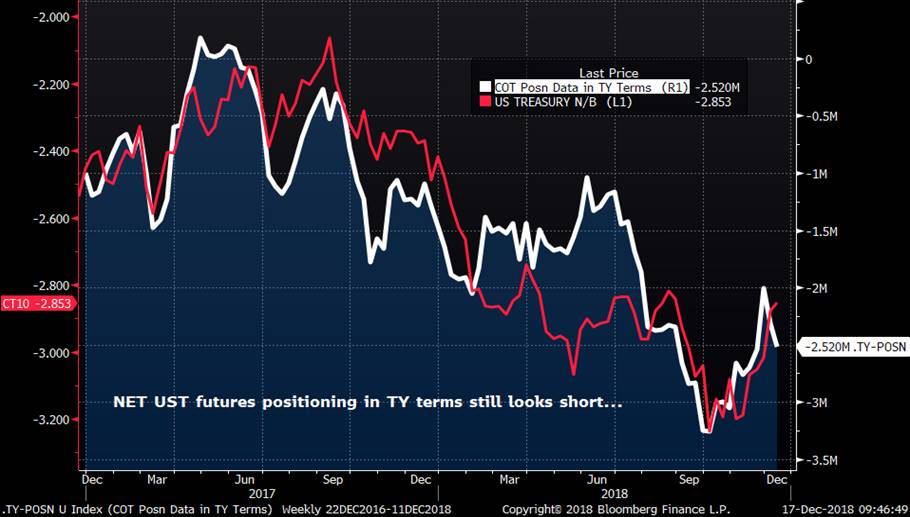

> Yes, the US supply outlook is worrying for UST longs, however, positioning across most UST contracts remains short, even after the recent rally, and a dovish FOMC outlook would likely drive further spread narrowing in relatively illiquid Dec markets.

> We like owning UST 5yrs vs OBLs into the FOMC meeting... The spread has compressed but it hasn’t kept up with the rally in USD 1y1y OIS…

Carry and Roll…

OBL 178s have carry and roll of about 3.7bps over 3mos

UST 2.875 11/23 have carry and roll of just 1.55bps over 3mos, however, if the FOMC’s stance shifts, we’d expect 2-5s to grind a bit steeper to reflect a more dovish FED which should improve the UST leg’s roll…

As this is a tactical trade into the FOMC, we’d expect this to be a 1 week horizon trade anyway.

I’ll be in touch.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Astor Ridge Events/Supply/Data Calendars Dec 17-31

Please see PDFs attached.

Since this covers the rest of December, these are the last calendars of 2018.

Enjoy!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

PLEASE READ **MULTI ASSET PRE-CHRISTMAS UPDATE : THE PERFECT STORM IS FINALLY HERE and the TIMING could not be worse!** It appears a lot of people are off next week so here are a few alarming market signals to watch for whilst liquidity wanes.

**MULTI ASSET UPDATE : THE PERFECT STORM IS FINALLY HERE and the TIMING could not be worse!**

As the Christmas break approaches and liquidity drains, timing could not be worse. EQUITIES look READY to FAIL and bond yields POISED to PLUMMET. Additionally the EURO which has lacked any kind of recovery is set to FREEFALL to 1.080.

I have long mentioned the idea of a PERFECT STORM, we have had so many far reaching RSI dislocations that need addressing. It now finally looks like all these aspects are going to come together over the Christmas- New Year period.

Stocks : They remain the GREATEST concern and driver, we have EUROPEAN TOPS and an OVER VALUED US market. Numerous US products have RSI dislocations not seen in years, notably TECH with an 18 year RSI extension. We have lost sight of value in this SECTOR. Too many have been sucked in to the VORTEX of a “MUST HAVE IN THE PORTFOLIO”, agreed the returns have been great but it’s time to seek VALUE.

Bond yields : This has been the eternal pain given ALL quarterly and monthly charts have been forecasting MUCH lower yields based on 1982, 1984 RSI dislocations. One recent example and trade idea the USFS10-20 swap, it helped endorse a lower yield environment ahead. Expectation for higher rates has gotten ahead of reality and the charts represent that. The latest chart updates shows potential for a MASSIVE snap back in yields over the next few months, I suspect aided by weaker stocks. Yields on paper should plummet, even though we have a lower BASE LINE YIELD VALUE.

FX : I still think this is not a PURE USD call, there are too many other global issues for it not to be. I feel the EURO is going to be a major CASUALTY soon. I am surprised the French situation has had so little impact but just like stocks the EURO is on the EGDE of a precipice, one nudge and it’s OVER.

US Curves have huge historical dislocations and all point to a BULL STEEPENER in the back end but having said that guessing direction based on a curve call has been choppy and tricky.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

EQUITIES SPECIAL : DON’T TAKE YOUR EYE OFF THE BALL! Most markets have shown minimal recovery and the daily formations are ALREADY ROLLING OVER!

Equities SPECIAL : DON’T TAKE YOUR EYE OFF THE BALL! Most markets have shown minimal recovery and the daily formations are ALREADY ROLLING OVER!

We have new monthly lows already so it really is a matter of TIME before stocks head lower AGAIN!

Equities REMAIN very damaged goods! Europe is in a terminally bad way whilst the US is close to confirming the 10 year “RALLY” is over.

DAX page 2 highlights the NEXT step is very defined and close to confirmation. I still believe weaker stocks will drive a further bond yield drop!

Overall I still favour a MAJOR DROP and the daily scenario could help that view this week.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

*** EM to the RESCUE AGAIN *** EM is now poised for its next bout of performance. Many EM have lost ground against the USD but chart wise this week looks like a return of EM strength is coming.

- EM is now poised for its next bout of performance. Many EM have lost ground against the USD but chart wise this week looks like a return of EM strength is coming.

- MANY USD-EM crosses now have SIZEABLE long-term tops formed. I think it is a combination of EM relief that the Turkey-Argentina situation is improving and the DXY losing momentum, more bias on the former for influence.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: Conte's Olive Branch Drives BTPS Spreads Tighter... Where now...?

BTPS...

> The announcement of a new 2.04% deficit target drove another sharp tightening move in BTPS which (as we can see from the DBR-BTPS 10yr sprd chart below) has taken us to s/term overbought levels and a critical technical support. (Please see this am’s BBG article below)

> Open interest in IKH9 has hovered around 400k, suggesting there’s still a solid short base and the BTPS curve has re-steepened sharply in sympathy with the move. Even though spreads have come a long way (10yr DBR-BTPS at 267 from 329 just 3 weeks ago) momentum feels like it they will tighten further still, especially in relatively illiquid December markets.

> High-Low BTPS coupons spreads (a barometer of the market’s assessment of default risk in Italy) which blew wider as DBR-BTPS spreads rose sharply have come crashing back to earth, especially in the belly of the curve where Italian banks are most active. The BTPS 5.5 9/22 vs BTPS 1.45 9/22 spread, for example, was as wide as 11.5bps on Oct 23rd and are now almost back top even yield and feel likely to return to the -5bps level that prevailed for until late May this year. (chart below)

> Draghi could hold the key at today's ECB meeting. If he leans dovish on the ECB's unwind of QE, C&R reinvestments and the timing of an eventual rate hike (inflation still soft and growth sputtering) we could see another nice tightening move. The market likes 'nice round #s' so +250bps looks like next big target sprd vs DBRs.

DBR-BTPS 10yr sprds…

BTPS 1.45 9/22 vs BTPS 5.5 9/22 – BIG move…

Italy Offers 2.04% Budget Deficit Target in EU Peace Gesture (1)

- European Commission had rejected budget with 2.4% deficit

- Premier Conte met EU commission chief Juncker in Brussels

By John Follain

(Bloomberg) --

Italian Prime Minister Giuseppe Conte proposed to cut the deficit target to 2.04 percent of output for next year in a significant concession to the European Commission.

Conte told reporters after meeting commission President Jean-Claude Junckerin Brussels that technical analyses had allowed the government to recover resources and lower the 2019 deficit from an initial 2.4 percent. The original number was rejected for being in breach of European Union rules.

“We are not betraying the trust of Italians and we respect the commitments made with the measures which have the most impact,” such as a lower retirement age and a citizen’s income for the poor, Conte said.

The offer now places the ball in the commission’s court, and follows a long tussle between Conte and Finance Minister Giovanni Tria on one side, and on the other the two euroskeptic deputy premiers: Matteo Salvini of the anti-migration League and Luigi Di Maio of the anti-establishment Five Star Movement.

Tria was scheduled to be in Brussels Thursday to guide the remaining phases of the talks on the new budget, his spokeswoman said.

Officials cautioned that there is more work to be done to satisfy EU regulations. Newspaper La Stampa cited an EU “source” as saying that there is “still a gap to bridge, hopefully we can do it with the work that will continue in the coming days.”

Salvini and Di Maio had insisted that their landmark election pledges should not be diluted or delayed.

Financial Markets

The budget tug-of-war has whipsawed financial markets amid concerns about the impact of the proposals on Italy’s sluggish economiy and its mountain of debt, which is the biggest in the euro area in real terms.![]()

Conte said the structural deficit would also fall, and added that “growth will be above our expectations.” He said he was working to avert an infringement procedure that could lead to fines, and called the negotiations “very fruitful.”

The government has said both the pension reform and the welfare benefits should start early next year, and Conte said they would begin “in the period we have set out.” He did not detail where the extra resources were found or how reforms would be tweaked.

Juncker’s commission sounded a similarly encouraging note. A spokesman said Juncker “listened attentively” to Conte, adding that good progress has been made and the commission would now assess the proposals.

The commission has repeatedly insisted that beyond a deficit reduction, what matters most is the impact reforms will have on Italy’s structural balance, which strips out one-off expenditures and the effects of the economic cycle.

Even a deficit of 2.04 percent may still not be low enough to avoid EU sanctions. It could increase tensions between Salvini and Di Maio, who will have less money to divvy up for their costly promises to voters.

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade: USD 10y20y forward sitting on technical levels again: position for a bounce

Bottom line: The USD 10y20y forward rate has rallied hard, and is once again sitting on interesting technical levels. An outright pay here is tempting, but instead I prefer to position for a moderate bounce via a mid-curve payer ladder. The upper bound of the ladder (at which P&L turns negative) is 3.50%, compared to the recent peak at 3.40%. The upfront premium is close to zero, with a maximum upside of 15bp at expiry.

Trade:

Buy USD 85mm 6m10y20y mid-curve payer atmf (k=3.05%)

Sell USD 85mm 6m10y20y mid-curve payer atmf+15 (k=3.20%)

Sell USD 85mm 6m10y20y mid-curve payer atmf+30 (k=3.35%)

For upfront premium of 0.2bp running (mid indic)

Atmf strike 3.05% vs spot 10y20y at 3.06%

Rationale:

There has been a substantial rally across the US curve. We highlighted the over-bought level on the 10y20y forward at the start of November, and the subsequent move has been dramatic. The 10y20y has fallen over 30bp, and has found a floor at 3.06%, the 76% retracement.

The daily RSI measure also indicates a strongly over-sold regime:

Since the rate peak there has been a substantial shift to dovish outlooks for the Fed, with the market pricing sharply reducing FOMC action in 2019. However, the downward rate movement looks technically oversold here, so this trade positions for a modest re-assessment of rates to the upside. The trade is short the market at inception, with a positive roll-down on the rate and vol surface of 3.5bp over the first three months of the trade.

As ever, I’d love to hear your thoughts!

Best wishes

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

PLEASE READ MULTI ASSET UPDATE : Bonds “MAYBE” taking a PAUSE here but that is WHOLLY dependent on STOCKS HOLDING! European yields are definitely oversold along with the USFS10-20 idea.

FEEL FREE TO ASK FOR A DISCUSSION.

MULTI ASSET UPDATE : Bonds “MAYBE” taking a PAUSE here but that is WHOLLY dependent on STOCKS HOLDING! European yields are definitely oversold along with the USFS10-20 idea.

The EURO continues to remain heavy and sub 1.1500 furthers the negative outlook.

**Trade idea BUY Euro Dec 11100.00 puts @15 ticks, and ADD below 1.1301 NOW 2.

EM BONDS These have lost a lot of ground this week so are now on watch re the bigger picture.

EQUITIES European equities have posted NEW LOWS on the month already thus don’t bode well, the US on the other hand is TRYING to formulate A HOLD. Bonds may assist this if yields RISE BUT do remember the DAMAGE is done for STOCKS.

**Trade idea BUY DAX DEC 11300-11200 put spread 33.0 ticks and ADD sub 11400. NOW 90**

**TAKE OFF POSITIONING**

CORE BONDS : Yields on many daily charts have dropped too far BUT that said they NEED stocks to HOLD to aid their cause.

US CURVES continue to WASH around and have become LESS of an outright trade.

Positions :

**Buy US 2-30 entry 36.418 now 39.368**

**Buy US 10-30 entry 14.426 now 26.093**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris