MICROCOSM: The Long GILTS Conundrum & UKT 1T49s Preview

Given the richening in the long-end over the last two days, it appears demand for tomorrow’s 1T49s tap will go fine.

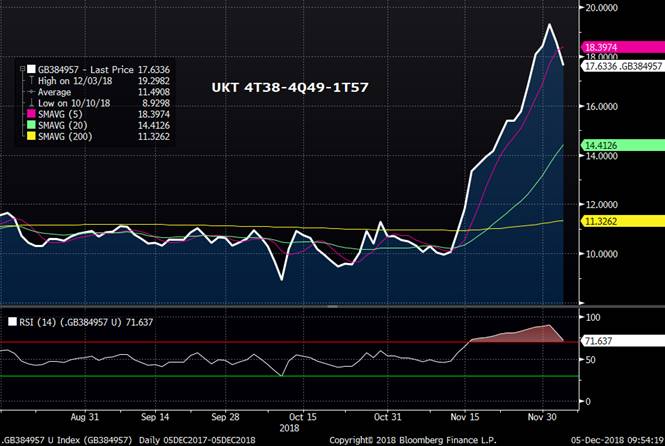

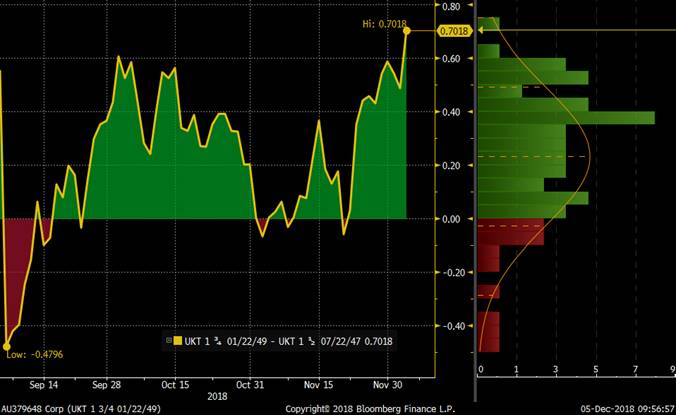

Have a look at the 38-49-57s flies below and/or the very-micro 1H47-1T49 flattener… See below pls.

GILTS...

UKT 27-47 spread is now 3.5bps flatter on thin volumes with G H9 off 26 ticks. Long linkers have given back a bit of yesterday's big rally, the UKTi 47s 2bps cheaper.

The long-end remains the gilts market's achilles heel right now. While improved fundamentals have drained some of the long-end demand from pensions in H2’18, we agree with the conclusions of some strategists that there is still enough pent-up demand out there to support long-yields if the fundamental picture argues the long-end makes sense again.

There are many cross currents to wade through:

1) Credit-related worries if Brexit falls apart and Labour gets in, leading to a downgrade of the UK’s sovereign rating and fiscal decline.

2) Pensions remain largely sidelined amidst the uncertainty (notwithstanding the assumed demand from the BT ruling yesterday).

3) We've got a £1.75bn tap of the UKT 1T 49s tomorrow which is anyone's guess how it will fare. (see below)

4) Coupon flows of ~£1.6bn support the long-end Friday which at the very least could mop up some of the 49s supply.

5) Long-gilts have cheapened on every metric we observe, to oversold levels we haven't seen in years. Yesterday's ~10bps snap flatter in illiquid markets was a good indicator of how the mkt is positioned now.

6) Cable is literally sitting on support levels that have held since Jun '17 and is clearly a driver for UKT demand too.

7) And lastly, long gilts supply, even with tomorrow's 49s tap (more on this below) is relatively light with 37s Jan 22, 57s Feb 21 and more 49s Mar 14.

UKT 1T49s Preview

Tomorrow’s tap is £1.75bn which is smaller than they could have brought and is perhaps a reflection of the DMO’s realization that long-end demand is tepid at best right now.

The £1.75bn takes the issue to a mere ~£4.25bn and won’t be tapped again until March next year. This is a good-news/bad-news for the issue – fewer of them to go around than expected short term but the issue will be tapped well into 2020 at this pace.

The UKT 1T49s have a longer duration than the UKT 4Q55 and are trading +1.9bps cheap to the UKT 4Q 49s (richer the last 2 days) and ~3.4bps cheap vs 1H47s and 4Q49s on the fly – at the recent wides.

Want a proxy for the UKT 27-47s steepening that is still near it’s cheapest levels?

Buy the UKT 1T49s vs 4T38s and 1T57s which is only a bp off it’s cheapest levels since the 1T49s were first auctioned. If you want to avoid the 1T49s, the 4Q49s look just as good.

1T49 vs 4T38 and 1T57

UKT 1H 47 vs UKT 1T49

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

PSPP2: What do we estimate that Germany has bought in November '18?

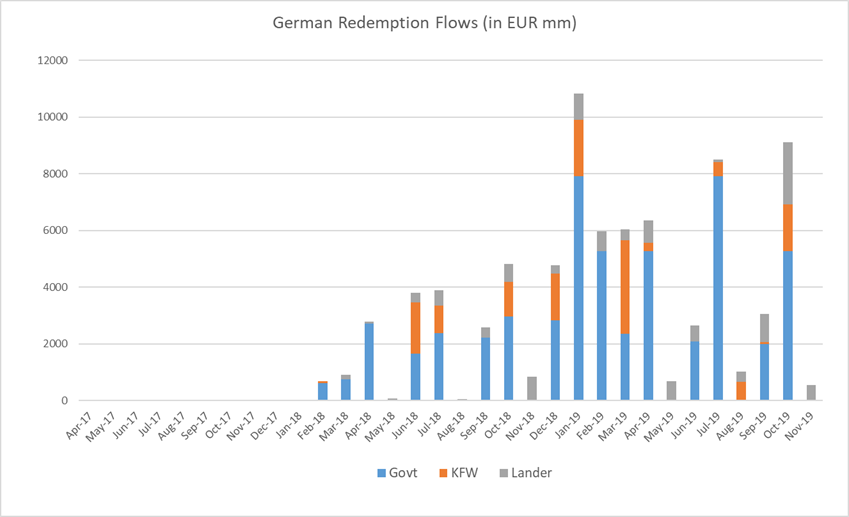

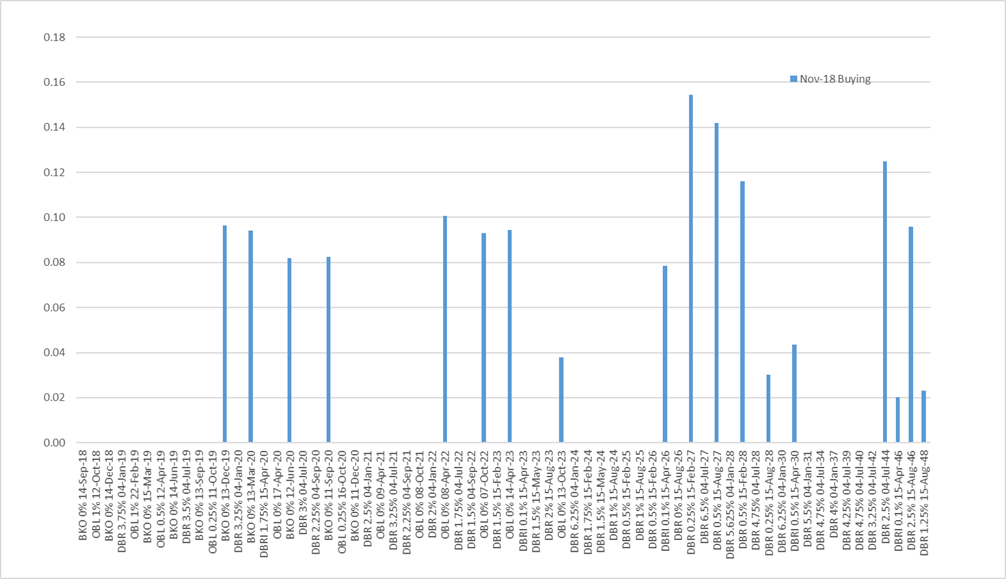

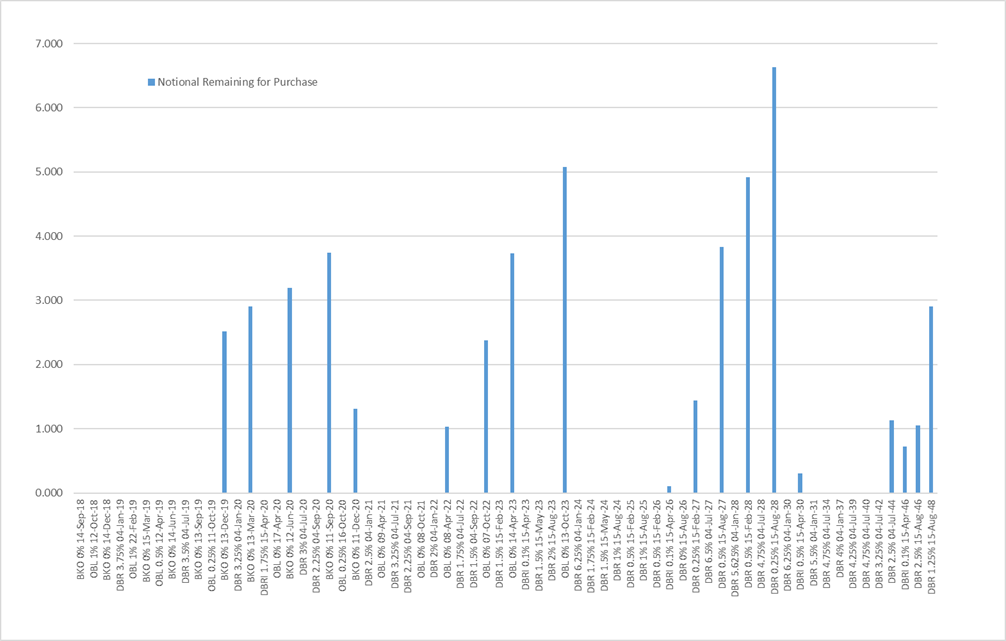

Here is the November update to my PSPP2 model for the purchasing of German bonds. The buying this month has been reasonably balanced across the available issues, concentrated in the 2y,5y,10y and 30y sectors.

At the forthcoming ECB meeting on 13th Dec, the GC is expected to confirm the end to net purchases of government bonds going forward. Thereafter all the purchases will come from the reinvestment of maturing issues. There are two areas on which we could get more information:

1. How the ECB will re-balance the portfolios to adjust to the new Capital Key (which is increasing for Germany and falling for Italy, to take two examples), and over what timescale this could happen.

2. Whether the ECB will interfere in the investment decisions of the Central Banks by issuing guidelines to length the duration of purchases (the “twist”). While some speakers seem to have floated this idea (eg Praet), others seem to have rejected the principle (eg Coeure). It seems that the barrier to this kind of action is high, not least because purchasing decisions have been pretty much a matter for each CB (which knows its market, the segmentation, and the liquidity available), and the market neutrality has hitherto been the main ECB guideline.

The estimated breakdown of purchasing for November across Govts, KFW and Lander:

|

Category |

Notional |

WAM |

|

German Govt |

1.5 |

9.0 |

|

KFW |

0.5 |

6.5 |

|

Lander |

1.2 |

5.8 |

|

All Purchases |

3.2 |

7.4 |

Given the model, here’s a chart showing the estimated redemption flows for the year ahead:

And the numbers for that chart:

|

Redemptions |

||||

|

Govt |

KFW |

Lander |

Total |

|

|

Apr-17 |

0 |

0 |

0 |

0 |

|

May-17 |

0 |

0 |

0 |

0 |

|

Jun-17 |

0 |

0 |

0 |

0 |

|

Jul-17 |

0 |

0 |

0 |

0 |

|

Aug-17 |

0 |

0 |

0 |

0 |

|

Sep-17 |

0 |

0 |

0 |

0 |

|

Oct-17 |

0 |

0 |

0 |

0 |

|

Nov-17 |

0 |

0 |

0 |

0 |

|

Dec-17 |

0 |

0 |

0 |

0 |

|

Jan-18 |

0 |

6 |

0 |

6 |

|

Feb-18 |

610 |

82 |

0 |

692 |

|

Mar-18 |

762 |

0 |

145 |

906 |

|

Apr-18 |

2732 |

0 |

64 |

2796 |

|

May-18 |

0 |

0 |

87 |

87 |

|

Jun-18 |

1669 |

1806 |

322 |

3797 |

|

Jul-18 |

2386 |

970 |

542 |

3898 |

|

Aug-18 |

0 |

0 |

65 |

65 |

|

Sep-18 |

2216 |

0 |

381 |

2597 |

|

Oct-18 |

2977 |

1217 |

629 |

4823 |

|

Nov-18 |

0 |

0 |

835 |

835 |

|

Dec-18 |

2828 |

1650 |

301 |

4779 |

|

Jan-19 |

7920 |

1980 |

925 |

10825 |

|

Feb-19 |

5280 |

0 |

691 |

5971 |

|

Mar-19 |

2368 |

3300 |

369 |

6038 |

|

Apr-19 |

5280 |

280 |

789 |

6349 |

|

May-19 |

0 |

0 |

691 |

691 |

|

Jun-19 |

2082 |

0 |

572 |

2654 |

|

Jul-19 |

7920 |

495 |

99 |

8514 |

|

Aug-19 |

0 |

660 |

369 |

1029 |

|

Sep-19 |

2001 |

75 |

977 |

3054 |

|

Oct-19 |

5280 |

1650 |

2190 |

9120 |

|

Nov-19 |

0 |

0 |

563 |

563 |

|

Dec-19 |

1777 |

0 |

577 |

2355 |

|

Jan-20 |

7260 |

3300 |

1967 |

12527 |

|

Feb-20 |

0 |

149 |

721 |

870 |

|

Mar-20 |

1382 |

0 |

1369 |

2751 |

|

Apr-20 |

11880 |

0 |

482 |

12362 |

|

May-20 |

0 |

0 |

414 |

414 |

|

Jun-20 |

770 |

1935 |

706 |

3411 |

|

Jul-20 |

7260 |

0 |

2342 |

9602 |

|

Aug-20 |

0 |

0 |

561 |

561 |

|

Sep-20 |

5498 |

0 |

1050 |

6548 |

|

Oct-20 |

6270 |

495 |

1071 |

7836 |

|

Nov-20 |

0 |

0 |

1154 |

1154 |

|

Dec-20 |

7 |

0 |

813 |

820 |

|

Jan-21 |

6270 |

3630 |

1130 |

11030 |

For the model itself, here are the estimates for the buying of German Governments in Novermber:

This chart shows the remaining notional available for purchase by the programme given the estimated buying to date and the notional limits in place.

Finally, here’s the issue by issue breakdown of how much of each government bond my model estimates that the Bundesbank has bought:

|

Bond |

Opened |

O/S (bn) |

Purchasable |

Market Yield |

Purchased |

% Purchased |

Remaining |

Margin of Error |

MV Remaining |

Nov-18 Buying |

|

DBR 3.75% 04-Jan-17 |

Nov-06 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.75% 24-Feb-17 |

Jan-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 10-Mar-17 |

Feb-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 07-Apr-17 |

May-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 16-Jun-17 |

May-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-17 |

May-07 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 15-Sep-17 |

Aug-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 13-Oct-17 |

Sep-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 15-Dec-17 |

Nov-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4% 04-Jan-18 |

Nov-07 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 23-Feb-18 |

Jan-13 |

0.0 |

0.0 |

|

0.6 |

|

0.0 |

+/- 4% |

0.0 |

0.0 |

|

BKO 0% 16-Mar-18 |

Feb-16 |

0.0 |

0.0 |

|

0.8 |

|

0.0 |

+/- 3% |

0.0 |

0.0 |

|

OBL 0.25% 13-Apr-18 |

May-13 |

0.0 |

0.0 |

|

1.3 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

OBLI 0.75% 15-Apr-18 |

Apr-11 |

0.0 |

0.0 |

|

1.4 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

BKO 0% 15-Jun-18 |

May-16 |

0.0 |

0.0 |

|

1.7 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-18 |

May-08 |

0.0 |

0.0 |

|

2.4 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

BKO 0% 14-Sep-18 |

Aug-16 |

0.0 |

0.0 |

|

2.2 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

OBL 1% 12-Oct-18 |

Sep-13 |

0.0 |

0.0 |

|

3.0 |

|

0.0 |

+/- 1% |

0.0 |

0.0 |

|

BKO 0% 14-Dec-18 |

Nov-16 |

13.0 |

0.0 |

-0.661 |

2.8 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

DBR 3.75% 04-Jan-19 |

Nov-08 |

24.0 |

0.0 |

-1.025 |

7.9 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

OBL 1% 22-Feb-19 |

Jan-14 |

16.0 |

0.0 |

-0.785 |

5.3 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 15-Mar-19 |

Mar-17 |

13.0 |

0.0 |

-0.734 |

2.4 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

OBL 0.5% 12-Apr-19 |

May-14 |

16.0 |

0.0 |

-0.720 |

5.3 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 14-Jun-19 |

May-17 |

13.0 |

0.0 |

-0.675 |

2.1 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

DBR 3.5% 04-Jul-19 |

May-09 |

24.0 |

0.0 |

-0.680 |

7.9 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 13-Sep-19 |

Aug-17 |

13.0 |

0.0 |

-0.662 |

2.0 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

OBL 0.25% 11-Oct-19 |

Sep-14 |

16.0 |

0.0 |

-0.677 |

5.3 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 13-Dec-19 |

Nov-17 |

13.0 |

4.3 |

-0.667 |

1.8 |

41% |

2.5 |

+/- 2% |

2.5 |

0.1 |

|

DBR 3.25% 04-Jan-20 |

Nov-09 |

22.0 |

7.3 |

-0.735 |

7.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 13-Mar-20 |

Feb-18 |

13.0 |

4.3 |

-0.671 |

1.4 |

32% |

2.9 |

+/- 2% |

2.9 |

0.1 |

|

DBRI 1.75% 15-Apr-20 |

Jun-09 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 17-Apr-20 |

Jan-15 |

20.0 |

6.6 |

-0.679 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 12-Jun-20 |

May-18 |

12.0 |

4.0 |

-0.675 |

0.8 |

19% |

3.2 |

+/- 2% |

3.2 |

0.1 |

|

DBR 3% 04-Jul-20 |

Apr-10 |

22.0 |

7.3 |

-0.677 |

7.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-20 |

Aug-10 |

16.0 |

5.3 |

-0.675 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 11-Sep-20 |

Aug-18 |

12.0 |

4.0 |

-0.647 |

0.2 |

5% |

3.7 |

+/- 3% |

3.8 |

0.1 |

|

OBL 0.25% 16-Oct-20 |

Jul-15 |

19.0 |

6.3 |

-0.651 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 11-Dec-20 |

Nov-18 |

4.0 |

1.3 |

-0.616 |

0.0 |

1% |

1.3 |

+/- 27% |

1.3 |

0.0 |

|

DBR 2.5% 04-Jan-21 |

Nov-10 |

19.0 |

6.3 |

-0.645 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 09-Apr-21 |

Feb-16 |

21.0 |

6.9 |

-0.611 |

6.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 3.25% 04-Jul-21 |

Apr-11 |

19.0 |

6.3 |

-0.588 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-21 |

Aug-11 |

16.0 |

5.3 |

-0.569 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Oct-21 |

Jul-16 |

19.0 |

6.3 |

-0.555 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2% 04-Jan-22 |

Nov-11 |

20.0 |

6.6 |

-0.530 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Apr-22 |

Feb-17 |

18.0 |

5.9 |

-0.503 |

4.9 |

83% |

1.0 |

+/- 1% |

1.0 |

0.1 |

|

DBR 1.75% 04-Jul-22 |

Apr-12 |

24.0 |

7.9 |

-0.475 |

7.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 04-Sep-22 |

Sep-12 |

18.0 |

5.9 |

-0.454 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 07-Oct-22 |

Jul-17 |

17.0 |

5.6 |

-0.436 |

3.2 |

58% |

2.4 |

+/- 1% |

2.4 |

0.1 |

|

DBR 1.5% 15-Feb-23 |

Jan-13 |

18.0 |

5.9 |

-0.396 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 14-Apr-23 |

Feb-18 |

16.0 |

5.3 |

-0.367 |

1.5 |

29% |

3.7 |

+/- 2% |

3.8 |

0.1 |

|

DBRI 0.1% 15-Apr-23 |

Mar-12 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-23 |

May-13 |

18.0 |

5.9 |

-0.366 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2% 15-Aug-23 |

Sep-13 |

18.0 |

5.9 |

-0.336 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 13-Oct-23 |

Jul-18 |

16.0 |

5.3 |

-0.290 |

0.2 |

4% |

5.1 |

+/- 5% |

5.2 |

0.0 |

|

DBR 6.25% 04-Jan-24 |

Jan-94 |

10.3 |

3.4 |

-0.278 |

3.4 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.75% 15-Feb-24 |

Jan-14 |

18.0 |

5.9 |

-0.268 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-24 |

May-14 |

18.0 |

5.9 |

-0.232 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-24 |

Sep-14 |

18.0 |

5.9 |

-0.201 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-25 |

Jan-15 |

23.0 |

7.6 |

-0.139 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-25 |

Jul-15 |

23.0 |

7.6 |

-0.086 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-26 |

Jan-16 |

26.0 |

8.6 |

-0.021 |

8.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.1% 15-Apr-26 |

Mar-15 |

14.5 |

4.8 |

|

4.7 |

98% |

0.1 |

+/- 1% |

0.1 |

0.1 |

|

DBR 0% 15-Aug-26 |

Jul-16 |

25.0 |

8.3 |

0.042 |

8.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.25% 15-Feb-27 |

Jan-17 |

26.0 |

8.6 |

0.098 |

7.1 |

83% |

1.4 |

+/- 1% |

1.5 |

0.2 |

|

DBR 6.5% 04-Jul-27 |

Jul-97 |

11.2 |

3.7 |

0.087 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Aug-27 |

Jul-17 |

25.0 |

8.3 |

0.158 |

4.4 |

54% |

3.8 |

+/- 1% |

4.0 |

0.1 |

|

DBR 5.625% 04-Jan-28 |

Jan-98 |

14.5 |

4.8 |

0.152 |

4.8 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-28 |

Jan-18 |

21.0 |

6.9 |

0.222 |

2.0 |

29% |

4.9 |

+/- 1% |

5.1 |

0.1 |

|

DBR 4.75% 04-Jul-28 |

Oct-98 |

11.3 |

3.7 |

0.211 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.25% 15-Aug-28 |

Jul-18 |

21.0 |

6.9 |

0.284 |

0.3 |

4% |

6.6 |

+/- 4% |

6.6 |

0.0 |

|

DBR 6.25% 04-Jan-30 |

Jan-00 |

9.3 |

3.1 |

0.305 |

3.1 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.5% 15-Apr-30 |

Apr-14 |

12.1 |

4.0 |

|

3.7 |

92% |

0.3 |

+/- 2% |

0.4 |

0.0 |

|

DBR 5.5% 04-Jan-31 |

Oct-00 |

17.0 |

5.6 |

0.379 |

5.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-34 |

Jan-03 |

20.0 |

6.6 |

0.570 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4% 04-Jan-37 |

Jan-05 |

23.0 |

7.6 |

0.676 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-39 |

Jan-07 |

14.0 |

4.6 |

0.741 |

4.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-40 |

Jul-08 |

16.0 |

5.3 |

0.748 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 3.25% 04-Jul-42 |

Jul-10 |

15.0 |

5.0 |

0.814 |

5.0 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.5% 04-Jul-44 |

Apr-12 |

26.5 |

8.7 |

0.879 |

7.6 |

87% |

1.1 |

+/- 1% |

1.6 |

0.1 |

|

DBRI 0.1% 15-Apr-46 |

Jun-15 |

8.0 |

2.6 |

|

1.9 |

73% |

0.7 |

+/- 2% |

0.9 |

0.0 |

|

DBR 2.5% 15-Aug-46 |

Feb-14 |

25.5 |

8.4 |

0.909 |

7.4 |

88% |

1.1 |

+/- 1% |

1.5 |

0.1 |

|

DBR 1.25% 15-Aug-48 |

Sep-17 |

12.0 |

4.0 |

0.945 |

1.1 |

27% |

2.9 |

+/- 2% |

3.1 |

0.0 |

|

Italic = index-linked |

Total |

50.9 |

1.5 |

|||||||

|

Yield below Depo Rate |

||||||||||

|

Yield above Depo Rate |

Bund WAM |

9.1 |

If you would like more details of this model, please get in touch!

Best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

**PLEASE READ** EQUITIES SPECIAL : Yesterdays TRUMP TRADE FIX defused pretty quickly thus the perceived BOUNCE has already gone “wanting”. The timing could not be more critical given our location.

Equities SPECIAL : Yesterdays TRUMP TRADE FIX defused pretty quickly thus the perceived BOUNCE has already gone “wanting”. The timing could not be more critical given our location.

DAX page 3 highlights the NEXT step is very defined and close to confirmation. I still believe weaker stocks will drive a further bond yield drop!

Overall I still favour a MAJOR DROP and the daily scenario could help that view this week.

Positions :

** New position **

Buy Dec Nikkei 19000 puts @ 75 (Now 6).

Buy DAX OCT 12000-11800 Put spread 35.00 (Now 191.5) FLAT.

Buy FTSE OCT 7350 – 7250 Put spread 23.5 (Now 99.0) FLAT.

It is worth taking some time to look at the top formations on many charts especially the US given it had the most OBLIQUE RSI’s.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

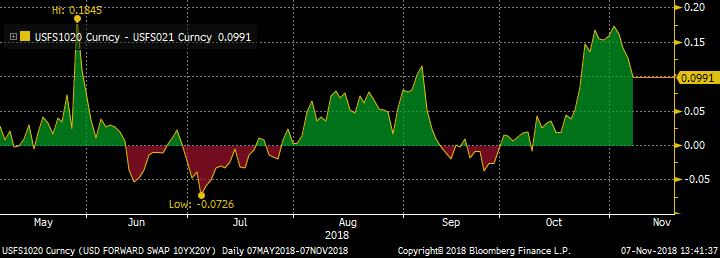

USFS 10-20 UPDATE : We have a near perfect chart formation on the monthly, we kissed the multi year moving average 3.3563 and closed at the lows. The TOP is ETCHED in history!

USFS 10-20 : We have a near perfect chart formation on the monthly, we kissed the multi-year moving average 3.3563 and closed at the lows. The TOP is ETCHED in history!

The HISTORICAL opportunity remains, only the SIXTH time in 18 years hence needs discussion.

The daily has now produced an oversold situation but am very sure that will be eradicated soon.

Target wise this should run for a many months but initial support should be the 38.2% ret 2.9840. Don’t lose the position for short term gain.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

NEW MONTH MULTI ASSET UPDATE : Bond yields closed the month with a significant reversal and rejection of the highs. Equities, a key start to the month as much of Europe has held its “LAST LINE” of SUPPORT.

MULTI ASSET UPDATE : Bond yields closed the month with a significant reversal and rejection of the highs. Equities, a key start to the month as much of Europe has held its “LAST LINE” of SUPPORT.

The EURO has gone into a HOLDING PATTERN but sub 1.1500 furthers the negative outlook.

**Trade idea BUY Euro Dec 11100.00 puts @15 ticks, and ADD below 1.1301 NOW 0.5

EM BONDS continue to do well and many USD crosses close to major drops. USD MXN and USD ZAR poised for some big breaks lower.

EQUITIES ** ARE THEY ABOUT TO HAVE A CORRECTIVE BOUNCE?**

We have opened above the VERY LAST levels of support, so for the moment its looks likely we’ll have a corrective bounce. Technically any bounce needs to be CLOSELY monitored as the bigger picture has already forecast a TOP.

**Trade idea BUY DAX DEC 11300-11200 put spread 33.0 ticks and ADD sub 11400. NOW 22.5**

CORE BONDS : Bonds are now back in the limelight given the MONTHLY REVERSAL. All longer duration charts have many RSI’s at 1984, 1982 extremes. We could soon see a lot lower yields especially if the US 10 yr breaks 2.9853!

US CURVES continue to steepen in the back end and show little signs of giving up the BULL STEEPENER bias, that said this whole yield-curve directional view NEEDS discussion. The STEEPENING continues.

Positions :

**Buy US 2-30 entry 36.418 now 48.259**

**Buy US 10-30 entry 14.426 now 28.684**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Astor Ridge Updated Supply/Data/Events Calendars for Week of Dec 3rd

Please see attached PDFs…

If you find these useful but have suggestions on how to improve them, I am all ears…

Have a good weekend.

Best,

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

THE US HAS A BIG MOVE COMING ! TECHNICAL VIEW UPDATE - US vs AUD and US vs EU SWAPS : This along with the previous chart package (USFS10-20) tells me SOMETHING EXPLOSIVE is going to happen, it all points to the US for that element.

I have had numerous discussions with REAL MONEY this week about the EXPLOSIVE US market potential, these charts highlight that potential.

TECHNICAL VIEW UPDATE for US vs AUD and US vs EU SWAPS : This along with the previous chart package (USFS10-20) tells me SOMETHING EXPLOSIVE is going to happen, it all points to the US for that element. Again we have had movement on the original levels, now awaiting next month for additional confirmation of an EXTREME.

** HAPPY to discuss all aspects of these charts. David Sansom will help express these into optimum trade packages, but seems the original USFS10-20 remains the likely contender. I appreciate AUD is a tough trade liquidity wise but some of the US-EU spreads are worth discussion.**

The US continues to be where the OPPORTUNITY is.

US verses AUD have some decent extensions and previous levels to work from. Interestingly there are many FAMILIAR RSI extensions dating back to 1997 and 2006 AGAIN.

**The 5yr AUD-US looks the most attractive technically given the extreme ties in with the previous high.*

I have also included the US versus EU swaps, they don’t have the same extensions but helps the argument for the US being the opportunity.

The only FLAW in the argument is the EVER trending market and LAME weekly RSI’s, BUT an EXTREME and REVERSAL are close.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

USFS 10-20 We have formed a top and could be well on the way to a VERY long-term rejection of the HISTORICAL moving average!

** Certainly worth repricing David’s original idea or an alternative if the confirmation arises. ** HAPPY to DISCUSS

USFS 10-20 We have formed a top and could be well on the way to a VERY long-term rejection of the HISTORICAL moving average!

The HISTORICAL opportunity remains, only the SIXTH time in 18 years hence needs discussion.

** There may be a good chance to get this position on next month given we’ll know more, whilst attaining confirmation. OVERALL this is a RARE scenario. **

Target wise this should run for a many months but initial support should be the 38.2% ret 2.9840. Don’t lose the position for short term gain.

The RSI also extends to the weekly denoting a very long term opportunity is here.

David’s previous ideas around the trade.

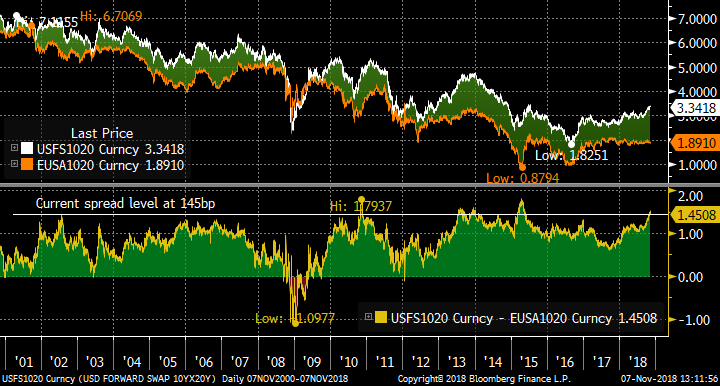

Bottom line: USD 10y20y is at fascinating technical levels and makes a good candidate for a duration long in the US

Trades:

- Simply receive USD 10y20y

- Mid-curve receiver spreads/ladders on 10y20y with 6m or 1y expiries

- Receiver USD 10y20y vs paying EUR 10y20y

See below for candidate structures.

Rationale: I don’t usually take technical analysis as my starting point, but a hat-tip to my colleague Chris Williams for the monthly chart of the USD 10y20y (20y rate, 10y forward) below. He has highlighted the powerful technical signals of the current level, in terms of RSI and 100-month moving average, using data stretching back to 1996.

The technical observations are timely as I am on the lookout for a place to receive on the USD curve. The results of yesterday’s US Mid-term elections have delivered a small Democratic majority in the House of Representatives: my high-level view is that this reduces the chances of further tax cuts and some of the more expansive spending plans for Defence (and certain building projects in the border zone). As a consequence changes on both sides of the budget look more positive in terms of the budget deficit, and lessens somewhat my fears of a ramping of long-end Treasury supply. This allows me to consider trades with a 10-30 flattening exposure, such as receiving 10y20y. Recall that the 10y20y forward rate is essentially one-part 30y outright plus 0.5-part 10y-30y curve: hence a reduction in the prospects for 10-30 steepening make this more of an essentially bullish trade (cf 5y5y, which is equal parts direction and curve).

How best to position for a failure of 10y20y at the 100-month moving average?

Simply receiving the 10y20y forward outright has the merit of ample liquidity and may act as a hedge to portfolios with more bearish positioning at the short end. The US 10y20y rate has got slightly ahead of Fed expectations over the past 6 months: the chart shows the residual of the regression between 10y20y and the 2y1y rate. On this basis, 10y20y looks around 10bp too high given the market’s pricing for short rates (R^2 of 83%). Being long 10y20y rolls negatively by 1.4bp over the first year, but does, of course, offer a long convexity exposure to compensate for this. A hedged spread using realized betas would be 1:1.08 DV01 of 10y20y: 2y1y.

For a non-linear payoff, look at mid-curve receivers on 10y20y as spread structures (or perhaps conditional curve trades vs short rates). The next chart shows the Fibonacci retracement levels for 10y20y, which gives us some idea of where to set breakeven points for receiver spread structures. Within the past six months the low has been in the 2.90% region, while further back the 2.60% level has been a strong support. The first retracement from current levels is around 3.00%, and would be target for a failure of 10y20y to breach the 100-month moving average.

This receiver ladder structure costs around 1.5bp running (mid indic):

Buy 90mm 1y10y20y receiver k=3.30%

Sell 90mm 1y10y20y receiver k=3.05%

Sell 90mm 1y10y20y receiver k=2.85%

(with Atmf = 3.33%)

The structure makes money with 10y20y at expiry from 3.285% to 2.615%, with the maximum P&L of 23.5bp between 3.05% and 2.85%. A break below the 2.615% level would start to incur losses. The trade is short gamma at inception, and slightly long the market.

On a shorter horizon with tighter strikes, this ladder costs 0.5bp running (mid indic)

Buy 90mm 6m10y20y receiver k=3.30%

Sell 90mm 6m10y20y receiver k=3.15%

Sell 90mm 6m10y20y receiver k=3.00%

(with Atmf = 3.34%)

and makes the largest P&L of 14.5 bp on a move to between 3.15% and 3%. The trade starts to lose money at 2.85% (a rally of 50bp in 10y20y over 6m).

Zero-cost 1x2 structures for comparison are (indicatively):

3m10y20y 3.30% / 3.15%, breakeven at 3%

6m10y20y 3.30% / 3.10%, breakeven at 2.90%

1y10y20y 3.30% / 3%, breakeven at 2.70%

Another way to approach the USD 10y20y is in comparison to the EUR 10y20y as in the chart below. The spread is pushing on its highest levels for some time and exceeded only by the period leading into the start of the ECB’s QE (and the substantial flattening of EUR 10y-30y): a situation unlikely to be repeated. Again, the simplest way is to receive USD 10y20y vs paying EUR 10y20y. Given the higher volatility of US rates (and the recent comatose price action in EUR 10y20y) this is essentially a proxy for receiving USD 10y20y outright.

There are many ways to skin a cat … if a different expression fits your needs better please let me know and we can investigate.

Best wishes,

Chris and David

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: Q1 '19 GILTS Supply Calendar Just Released... Details Below

|

|

AUCTION AND SYNDICATION PROGRAMMES |

The UK Debt Management Office (DMO) announces that in the period January-

March 2019 it plans to hold nine outright gilt auctions and one index-linked

gilt syndication in the final quarter of FY 2018-19, as set out below:

(a) Auctions:

AUCTION DATE (10:30am) GILT DETAILS ANNOUNCED (3:30pm)

2019

Tue 8 Jan 1 5/8% Treasury Gilt 2028 Fri 28 Dec

Thu 17 Jan 1% Treasury Gilt 2024 Tue 8 Jan

Tue 22 Jan 1 3/4% Treasury Gilt 2037 Tue 15 Jan

Thu 14 Feb 1 5/8% Treasury Gilt 2028 Tue 5 Feb

Thu 21 Feb 1 3/4% Treasury Gilt 2057 Tue 12 Feb

Tue 26 Feb 0 1/8% Index-linked Treasury Gilt 2028 Tue 19 Feb

Wed 6 Mar 1% Treasury Gilt 2024 Tue 26 Feb

Thu 14 Mar 1 3/4% Treasury Gilt 2049 Tue 5 Mar

Tue 26 Mar 0 1/8% Index-linked Treasury Gilt 2048 Tue 19 Mar

[* subject to confirmation]

b) Planned Index-linked Syndicated Offering (subject to market and demand

onditions):

DATE GILT FURTHER DETAILS ANNOUNCE

Late Jan/mid Feb 0 1/8% Index-linked Treasury Gilt 2041 around two weeks in advance

|

(c) Gilt tenders: |

|

The DMO is open to receiving any representations from market participants |

|

about demand for a gilt tender, or gilt tenders, in the period December 2018 - |

|

March 2019. Views on particular gilts to issue and the timing of any such |

|

tenders would be welcome. The DMO would aim to announce the date, the choice of |

|

gilt to be sold and the maximum size of any gilt tender at least two business |

|

days in advance. |

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

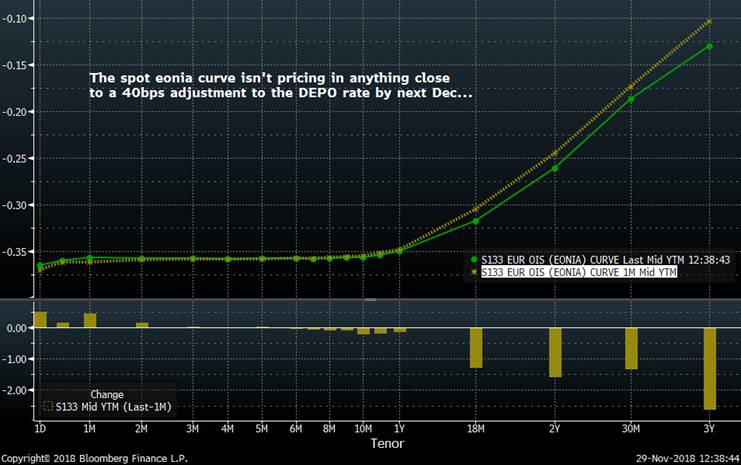

MACROCOSM: Technicals > EGBs - German Bunds Closing in on BIG Yield Level...

- Here’s a snapshot of the current state of the EGB market as we head into a couple very important weeks that could determine how the markets trade in H1’19.

- Short Rates

When polling our dealer-friends for their call on the likely path of short rates in Europe, the consensus – with a handful of more dovish strategists – is for two hikes of the depo rate starting in Sep ’19 that will take the depo rate back close to zero by the end of the year. The Sep date not only gives the ECB time to see how the economy fares after QE is suspended at the end of 2018 but also leaves ample time for the results of May’s Parliamentary elections and any market impact they have to play out. What’s curious, however, is the market’s struggling to price this in as EONIA is dragged richer in the face of Brexit/Italy driven FTQ flows.

EONIA Curve

EONIA 1y1y rallying sharply of late, back to overbought levels and sitting on 200 day MA.

EUR Fra-OIS tightening back in as Italy settles down…

- Intermediates

We’re back to a BIG level for 10yr bunds which has held since June ’17.

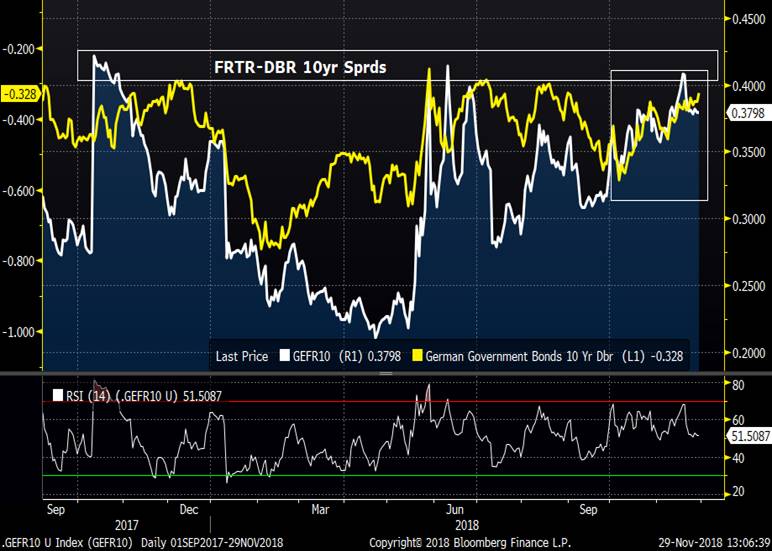

UST-DBR 10yr sprd…

OATs have also rallied back sharply, especially in Yen terms. These lofty valuations are likely to impair demand out of Japan given their historical biases.

The correlation of outright DBR 10yr yield level to DBR-FRTR spreads has been more loose over the last year than one would think. In Q4 it’s been high, however, suggesting if DBR 10yrs fail at this 30bps yield level again, it should prompt a tightening of DBR-FRTR levels that remain pinned to the 15mo wides.

Italy remains a major focus, especially into year-end. Positioning still feels short to us (5yrs and longer) so a sharp tightening of IKA invoice spreads into an illiquid year-end market wouldn’t surprise us.

On a ‘pound for pound’ risk basis, the compression of high vs low cpn BTPS spreads has been a better trade over the last few weeks than RXZ8 into IKZ8. The BTPS 1.6 6/26 into BTPS 4.5 3/26 still looks a bit wide given where other spreads are…

- Sister Markets

Eurostoxx

Trade weighted Euro – still elevated even after recent correlation… What happens if Trump makes good on his car-tax?

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796