** PLEASE READ *** BOND YIELDS ARE BACK : MULTI ASSET UPDATE This week BOND YIELDS are back on the agenda especially as we are about to ETCH some very NEGATIVE closes and REVERSALS in stone on the month.

MULTI ASSET UPDATE : This week “BOND YIELDS” are back on the agenda especially as we are about to ETCH some very NEGATIVE CLOSES-REVERSALS, in stone on the month.

The EURO continues to remain heavy and sub 1.1500 furthers the negative outlook.

**Trade idea BUY Euro Dec 11100.00 puts @15 ticks, and ADD below 1.1301 NOW 2.

EM BONDS continue to do well and many USD crosses well on the way to major drops. The USD INR short is starting to develop as a sizeable top has been confirmed. USD TRY and USD ZAR about to stretch their legs.

EQUITIES ** ARE THEY ABOUT TO HAVE A CORRECTIVE BOUNCE?**

We CONTINUE to SIT and now HOLD on KEY support. Similar to the EURO its predominantly been a sideways couple of weeks, I would be remain cautious of ANY recoveries.

Should last month’s lows be breached do expect us to emulate Octobers range.

**Trade idea BUY DAX DEC 11300-11200 put spread 33.0 ticks and ADD sub 11400. NOW 39**

CORE BONDS : Bonds are now back in the limelight given the MONTHLY REVERSAL. All longer duration charts have many RSI’s at 1984, 1982 extremes. We could soon see a lot lower yields!

US CURVES continue to steepen in the back end and show little signs of giving up the BULL STEEPENER bias, that said this whole yield-curve directional view NEEDS discussion. The STEEPENING continues.

Positions :

**Buy US 2-30 entry 36.418 now 51.265**

**Buy US 10-30 entry 14.426 now 28.565**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

EURO SPECIAL : Through out 2018 the EURO has been a VERY LAME entity. We continue to have lacklustre rallies and lesser highs!

EURO SPECIAL : Throughout 2018 the EURO has been a VERY LAME entity. We continue to have lacklustre rallies and lesser highs!

If we breach 1.1301 and ultimately the multi-year 50% ret 1.1241 then it will be a VERY painful drop.

Position.

BUY the EURO DEC 11200- 11100 put spread 15 tics ( NOW 12 tics).

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MULTI ASSET UPDATE : Last week’s US holiday seems to have placed many longer term moves on PAUSE, for the moment. We still struggle with a weaker Euro whilst stocks might be seeking a reprieve, holding the last line of defence support.

MULTI ASSET UPDATE : Last week’s US holiday seems to have placed many longer term moves on PAUSE, for the moment. We still struggle with a weaker Euro whilst stocks might be seeking a reprieve, holding the last line of defence support.

Bonds VERY sideways.

The EURO continues to remain heavy and sub 1.1500 furthers the negative outlook.

**Trade idea BUY Euro Dec 11100.00 puts @15 ticks, and ADD below 1.1301 NOW 3.

EM BONDS continue to do well and many USD crosses well on the way to major drops. The USD INR short is starting to develop as a sizeable top has been confirmed. USD TRY and USD ZAR about to stretch their legs.

EQUITIES ** ARE THEY ABOUT TO HAVE A CORRECTIVE BOUNCE?**

We CONTINUE to SIT and now HOLD on KEY support. Similar to the EURO its predominantly been a sideways couple of weeks, I would be remain cautious of ANY recoveries.

Should last month’s lows be breached do expect us to emulate Octobers range.

**Trade idea BUY DAX DEC 11300-11200 put spread 33.0 ticks and ADD sub 11400. NOW 38**

CORE BONDS : Europe has rallied well driven by CTA’s who are now long. I still maintain any GREATER progress will come from OTHER market influence. They need to be driven.

US CURVES continue to steepen in the back end and show little signs of giving up the BULL STEEPENER bias, that said this whole yield-curve directional view NEEDS discussion.

Positions :

**Buy US 2-30 entry 36.418 now 48.530**

**Buy US 10-30 entry 14.426 now 25.050**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trade Radar: James Rice @Astor Ridge November 23rd

Trade Radar

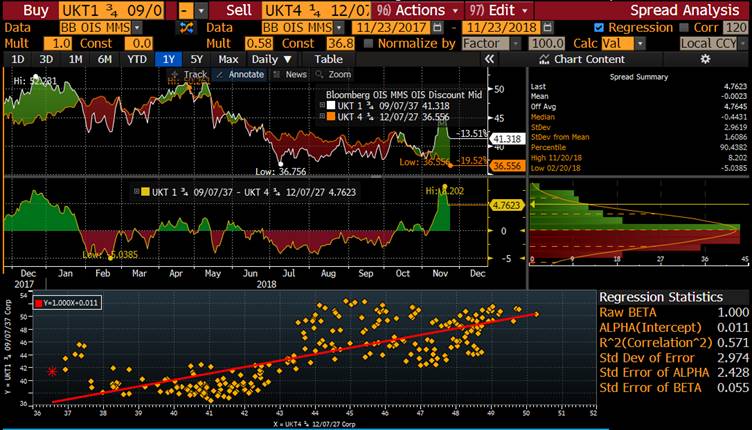

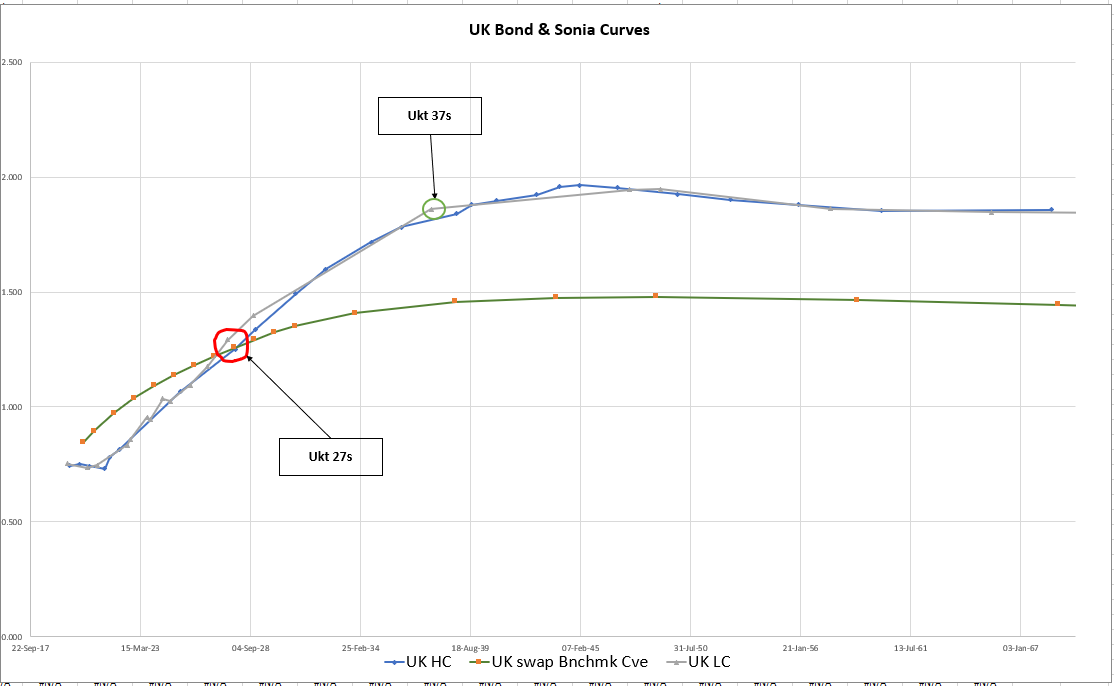

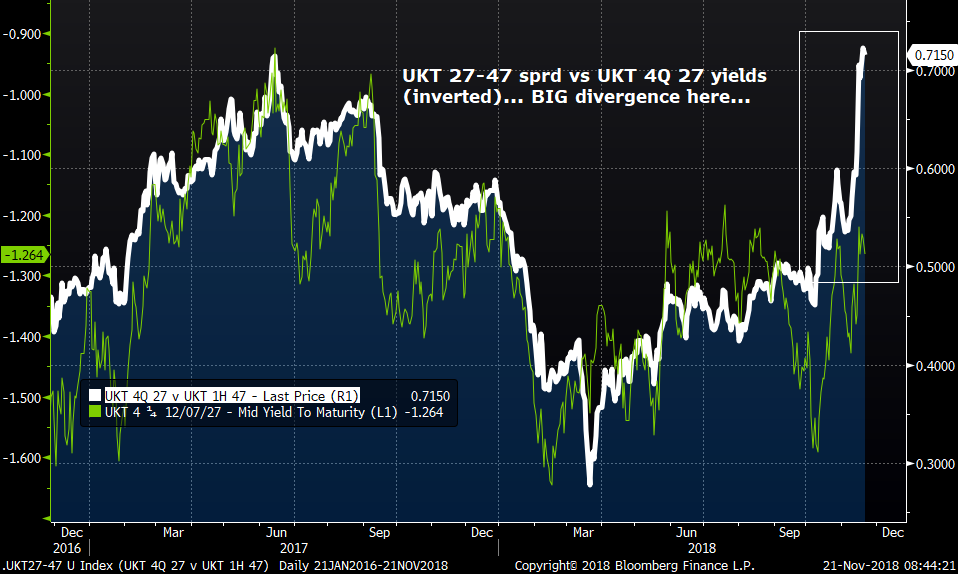

On my radar is the recent steepening & concomitant dis-inversion in the long end of the UK Gilt curve

This has been more pointed in the bond market expression than in swaps

UK 10s 20s vs swaps….

(UKT 27s vs UKT 37s vs OIS)

Graph 1 - UK Generics 10s 20s vs OIS

- Supply in 2037s have caused indigestion at the 20y point

- The natural hedge for dealers has been to sell the 10y

- Brexit concerns have caused the 10y Gilt future (CTD – UKT 4.25% 27 to out-perform)

- Consistently UK 10s20s is the steepest part of the curve relative to swaps – with the longer forward at a spread over Sonia and the shorter tenor below – the forward Sonia spread is a healthy positive

Trade mechanics:

Buy 6.4MM UKT 1.75% Sep/37 ( £10k/bp ), vs Pay Sonia Sep37

Sell 105 G Z8 Comdty, CTD 4.25% Dec/27 ( £10k/bp ), vs Rec Sonia Dec27

Weights: Risk weighted

Cix:

P2509[UKT 1.75 37 Corp] - P2509[UKT 4.25 12/07/27 Corp]

Current level: +42.3 bp

Entry Target: +44 bp

Stop: +50 bp

First Target: +35 bp

Graph 2:

– cix graph

Graph 3:

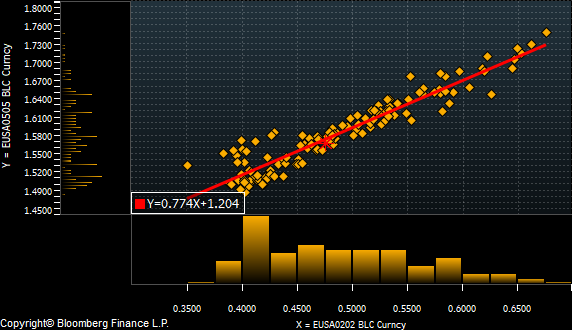

Regression of Ukt 37s OIS spread vs Ukt 27s OIS spread -

Beta – 58%

Intercept – 36.8

R^2 – 0.571

Residual is shown in middle graph

Rationale:

- 10yr plus tenors have steepened extraordinarily as Brexit fears have permeated the UK Bond market

- There is an overhang of the last supply in 37s – last re-opening mid-November

- The 27s37s curve in the UK is the most steep offering the best flattener vs the UK swap curve

- UKT 4q27s drop out of the back in June – on a z-spread basis they appear rich

- On a regressed basis the 37s look between 4 and 8 bp cheap vs a hedge of 58% of the 10yr spread

Graphs:

- UK Generics 10s 20s vs OIS

- CIX graph (as per 1)

- Graph of regression

- Graph of UKT Govt bond Curve and Sonia Curve

Graph 4:

Graph of UKT Bond Curve and Sonia Curve

Risks:

- Although the trade is curve hedged – the idiosyncratic move has been led by the bond market – if 10s30s continues to steepen that would probably NOT favour this 10s20s structure

- Continued supply in 37s could mean they do not outperform on this structure

- Sonia spreads in the 10y point continue to outperform all others in reaction to Brexit news

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

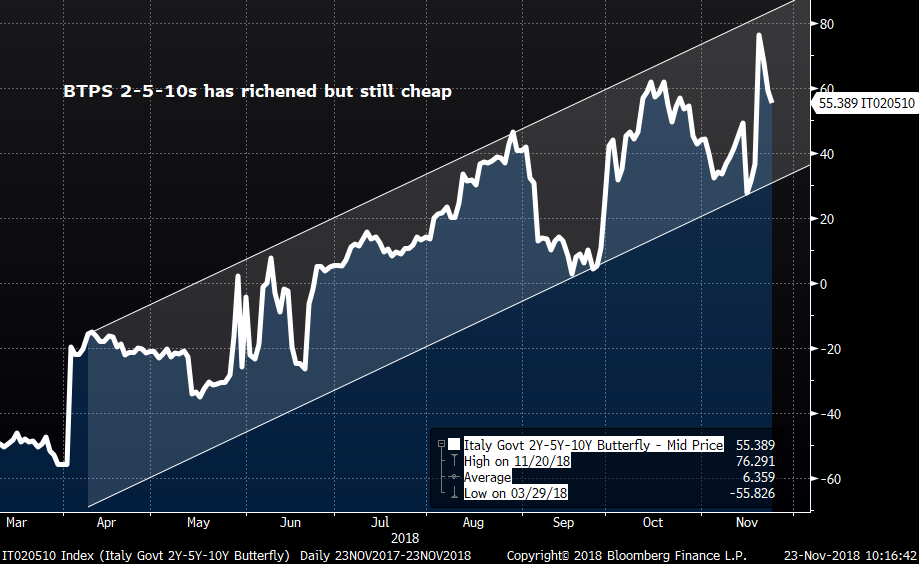

MICROCOSM: BTPS... Curve Whippy Amid Position Squaring in Illiquid Markets

BTPS…

> Some good colour from our dealers highlights the following:

1) No real news out of Rome this week but the tone of the discourse has shifted to a more conciliatory one with Tria, Savona, Salvini and even DiMaio showing a willingness to give ground.

2) BTPS Italia deal was a mess but it's behind us.

3) Supply is very light for the balance of the year (after next week assuming they cancel their Dec auctions as is norm) and there's a big C&R flow in Dec.

4) The steepening of the curve has been swift and sharp with light volumes of just just 28.5k BTSZ8 driving this am's 31 tick rally.

5) 6bn BOTS 6mo auction next week will be a touger pill to swallow with yields grinding close to zero again.

6) BTPS 2-5-10s has richened 19bps since Tues but is still 25bps cheaper than Nov 15th levels.

7) One dealer like selling BTS futures to buy 5yr BTPs as the juice gets squeezed out of short rates and accounts are forced to buy some duration.

8) Most agree the odds of a more significant snap tighter of 10yr BTPS vs DBRs are still low but liquidity will erode into year-end which raises the odds of extreme moves in BOTH directions.

BTSZ8 contracts have rallied to the contract highs as open interest declines, suggesting the short base is unwinding. We’re at a big resistance here which some think should prompt a flattening of the front-end, especially when we consider how steep the BTSZ8 CTD (BTPS 3.75 9/21) vs BTPS .95 3/1/23 is here…

BTPS 3/21 – BTPS 3/23

BTPS generic 2-5-10s

DBR-BTPS 10yr sprd

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Updated Data/Supply and Events Calendars for Week of Nov 26th.

Very busy week for US supply, European data and perhaps the UK’s Brexit talks.

I’ve made a few tweaks thanks to some constructive feedback. Hope they’re helpful.

Please see PDFs attached.

Have a great Thanksgiving All!

Best

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

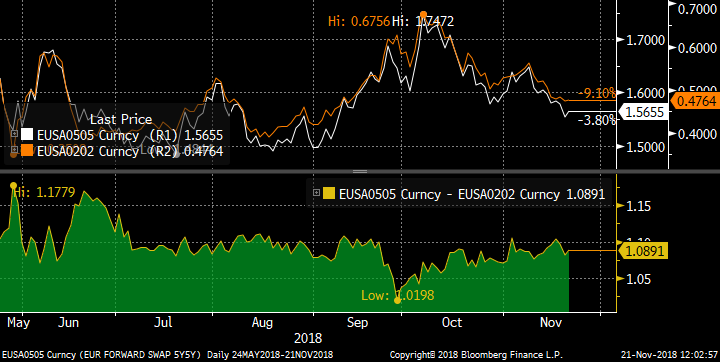

Trade: EUR Bull-Steepener 2y2y vs 5y5y

Bottom line: In uncertain times for the ECB outlook, I am looking at how best to harvest the rolldown at the front end of the EUR curve. With an equivocal political and economic outlook for the Eurozone, it is attractive to position for a slowdown in the rate of accommodation removal. I’ve spent some time below to identify what I see as the best non-linear combination for a bullish position.

Trade:

Buy EUR 500mm 6m2y2y mid-curve receiver atmf-5 (k=0.58%)

Sell EUR 210mm 6m5y5y mid-curve receiver atmf-5 (k=1.60%)

For premium take-out of 0.2bp running (indicative mid)

Forward curve strike at 102bp. Spot curve at 108.2bp

Rationale: This trade is primarily about roll-down: the difference between spot rates and the market’s pricing of forward rates. The ambiguous Eurozone economic data of late, coupled with the political situations of Italy and BREXIT, plays into the ingrained cautiousness of the ECB when it comes to removing accommodation. This is a scenario in which the steep EUR short-end curve starts to look over-optimistic in terms of the potential for rate hikes.

The highest annual roll-down on the EUR curve comes on forward rates such as 2y1y or 2y2y (at around 32bp over the first year), so as a starting point I want to be long 2y2y in some form. This suggests buying mid-curve receivers. The question is then how to fund this purchase? One route is the sell a receiver on some other forward tenor, creating a conditional curve trade.

The requirements for the short tenor are:

- significantly smaller roll-down than the long tenor

- that the implied volatility is similar (if not higher) to that of the long , to keep the upfront premium low (ideally negative);

- the short tenor has a decent correlation with the long tenor (over the option period);

- the beta between the short and long tenor is meaningfully less than 1;

- is a liquid mid-curve option tenor (eg the 10y1y forward might be attractive but likely has significant bid/offer in mid-curve options).

We can scan the vol/rate surface (using ATMF vol), for each of the liquid short candidate tenors, and classify each according to the above criteria. If a box is green, the tenor fits the bill for a particular check. The results for 3m, 6m and 1y expiries are shown in the three tables below. Cells in green show when a tenor meets the criterion. The only combination which combination which strictly satisfies all the criteria is 6m5y5y.

Having selected the tenor pair, then the final question is whether to set the strikes ATMF or OTM. There is more negative skew on OTM receiver strikes for 2y2y than for 5y5y, so the pricing improves by going OTM. However the likelihood of a sufficient rally to put the receivers in-the-money is reduced. From the scatter plot above, the downside deviations of the 5y5y rate from the regression line have not exceeded 5bp, so that would be a reasonable compromise on moneyness.

Strikes Premium (bp running)

6m2y2y/6m5y5y ATMF -0.04

6m2y2y/6m5y5y ATMF-5 -0.2

6m2y2y/6m5y5y ATMF-10 -0.3

6m2y2y/6m5y5y ATMF-20 -0.6

How does the trade roll, when we take the vol surface into account as well as rates?

Value (bp)

Inception 0

1m 0.8

2m 1.6

3m 2.4

4m 3.2

5m 3.9

Expiry 6.4

What are the risks? Clearly in a sustained sell-off, both strikes expire worthless. The main risk is that the curve bull-flattens, with long-rates leading the way. This is mitigated somewhat by setting the strikes out-of-the-money, as any event that drives the rally will also likely impact ECB expectations. An alternative that would contain this tail risk would be to buy a receiver spread on 2y2y (a/a-25) and sell a receiver spread on 5y5y (a/a-15), though this has a premium cost of 0.6bp (indicative mid), and would not reap the full rewards of a major dovish ECB move.

The tables in full:

|

Expiry |

3m |

|||

|

Rolldown |

Impl Vol |

|||

|

2y2y |

7.8 |

44.8 |

||

|

Net Rolldown |

Vol Diff |

R^2 |

Beta |

|

|

1y1y |

-0.6 |

-21.2 |

0.945 |

0.49 |

|

2y1y |

-0.6 |

-2.7 |

0.983 |

0.90 |

|

2y3y |

0.5 |

-0.4 |

0.997 |

1.04 |

|

3y1y |

0.7 |

4.6 |

0.988 |

1.11 |

|

3y2y |

1.0 |

2.1 |

0.987 |

1.11 |

|

5y5y |

3.8 |

-2.1 |

0.939 |

0.84 |

|

10y10y |

8.9 |

-11.6 |

0.716 |

0.47 |

|

10y20y |

8.9 |

-13.4 |

0.578 |

0.40 |

|

20y10y |

8.8 |

-14.3 |

0.348 |

0.30 |

|

Expiry |

6m |

|||

|

Rolldown |

Impl Vol |

|||

|

2y2y |

15.7 |

46.1 |

||

|

Net Rolldown |

Vol Diff |

R^2 |

Beta |

|

|

1y1y |

-1.2 |

-14.3 |

0.898 |

0.55 |

|

2y1y |

-0.9 |

-2.4 |

0.985 |

0.91 |

|

2y3y |

0.9 |

1.6 |

0.996 |

1.02 |

|

3y1y |

1.0 |

4.4 |

0.989 |

1.09 |

|

3y2y |

1.7 |

4.9 |

0.983 |

1.08 |

|

5y5y |

7.8 |

0.3 |

0.895 |

0.77 |

|

10y10y |

17.1 |

-9 |

0.679 |

0.44 |

|

10y20y |

17.2 |

-10.5 |

0.546 |

0.36 |

|

20y10y |

17.2 |

-12.1 |

0.303 |

0.26 |

|

Expiry |

1y |

|||

|

Rolldown |

Impl Vol |

|||

|

2y2y |

30.1 |

50.6 |

||

|

Net Rolldown |

Vol Diff |

R^2 |

Beta |

|

|

1y1y |

-3.4 |

-11.3 |

0.728 |

0.33 |

|

2y1y |

-2.3 |

-1.8 |

0.986 |

0.84 |

|

2y3y |

1.7 |

0.9 |

0.996 |

1.08 |

|

3y1y |

2.3 |

3.8 |

0.993 |

1.17 |

|

3y2y |

3.6 |

3.7 |

0.987 |

1.20 |

|

5y5y |

14.6 |

-0.7 |

0.863 |

0.86 |

|

10y10y |

32.7 |

-8.9 |

0.440 |

0.32 |

|

10y20y |

33.3 |

-10.2 |

0.231 |

0.21 |

|

20y10y |

33.7 |

-11.4 |

0.033 |

0.08 |

Any thoughts on the above? I look forward to hearing from you!

Best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MULTI ASSET UPDATE A week of further Equity decline and should be a massive worry as we are sitting on the LAST LINE of support in many cases.

MULTI ASSET UPDATE A week of further Equity decline and should be a massive worry given we are sitting on the LAST LINE of support in many cases. The Euro failing stanch 1.150 resistance.

The EURO remains heavy and unresponsive, poised to FAIL and FAIL in a big way. NEXT WEEK could really drop, providing 1.1400 isn’t breached.

**Trade idea BUY Euro Dec 11100.00 puts @15 ticks, and ADD below 1.1301 NOW 7.

EM BONDS continue to do well and many USD crosses well on the way to major drops. The USD INR short is starting to develop as a sizeable top has been confirmed. USD TRY and USD ZAR about to stretch their legs.

EQUITIES ** REMAIN in TROUBLE** We CONTINUE to SIT on the LAST KEY support and just about holding last month’s lows with LITTLE bounce-recovery this week! Similar to the EURO its predominantly been a sideways week, on a week when expectation has been for a major POP. Should last month’s lows be breached do expect us to emulate Octobers range.

**Trade idea BUY DAX DEC 11300-11200 put spread 33.0 ticks and ADD sub 11400. NOW 52.5.**

CORE BONDS : Europe has rallied well this week driven by CTA’s who are now long. I still maintain any GREATER progress will come from OTHER market influence. They need to be driven.

US CURVES continue to steepen in the back end and show little signs of giving up the BULL STEEPENER bias, that said this whole yield-curve directional view NEEDS discussion.

Positions :

**Buy US 2-30 entry 36.418 now 49.766**

**Buy US 10-30 entry 14.426 now 24.432**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

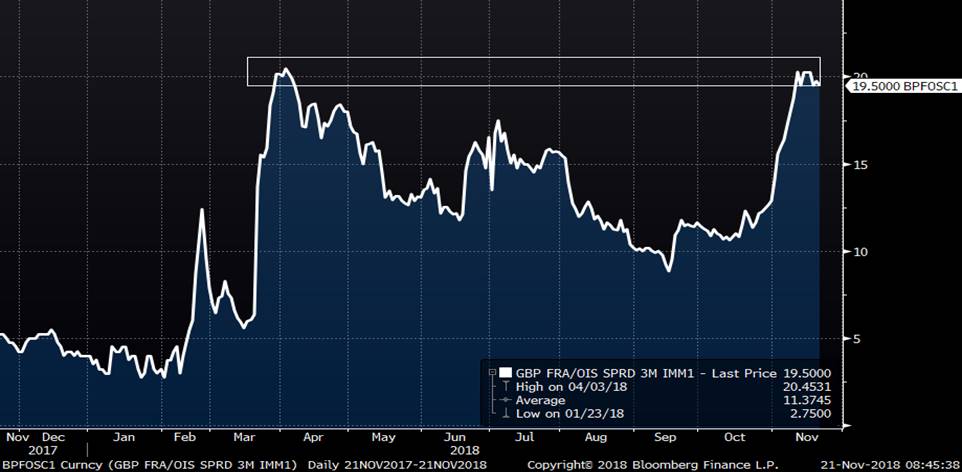

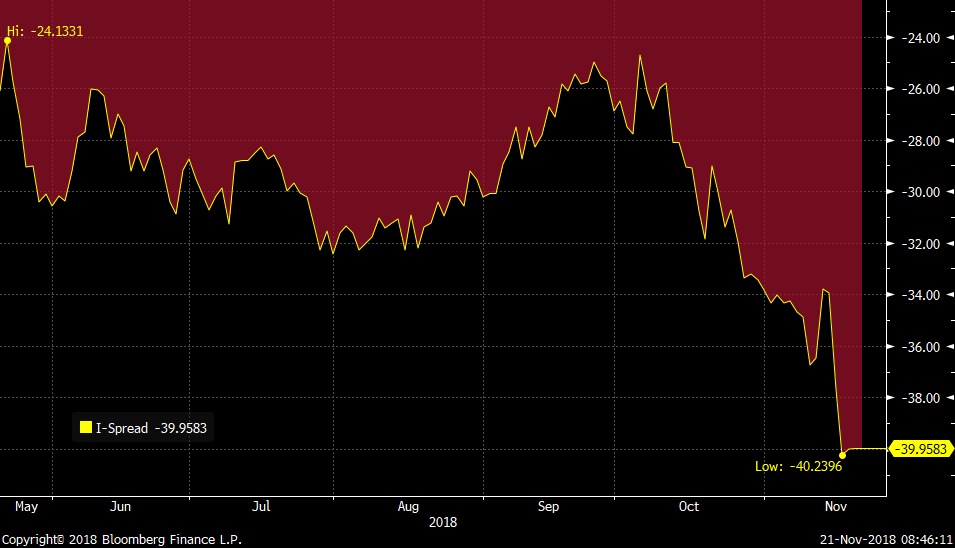

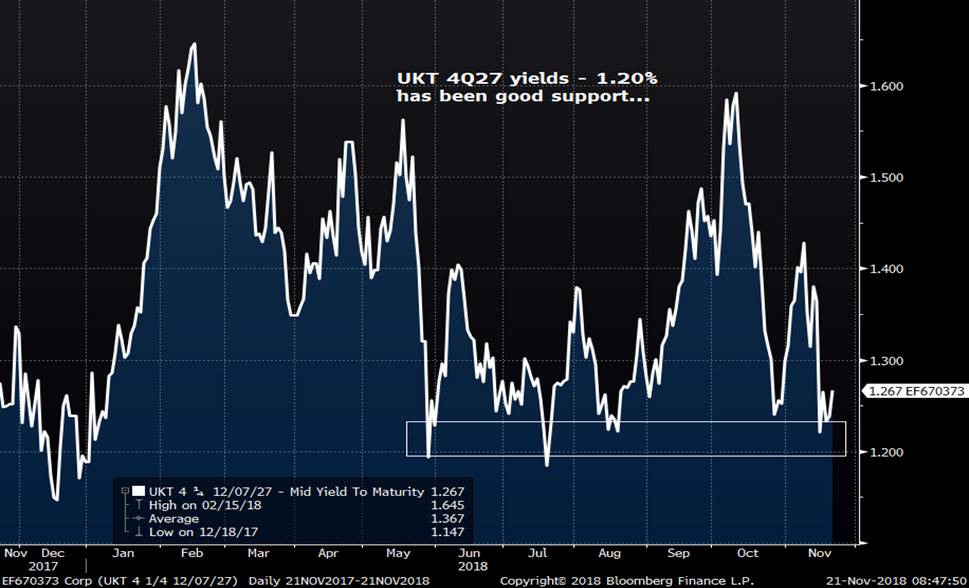

MICROCOSM: Quick Brexit GBP/Gilts Update w/Charts

GILTS/GBP Rundown:

> It seems BREXIT's not the only factor driving gilts these days given the early BTPS-driven bid to G Z8 yesterday and contnued concerns over the fate of the equity/oil and now corporate bond markets.

> That said. this am's Brexit news is pretty benign on balance. Rees-Mogg's challenge has gone nowhere, May's off to Brussels amid rumblings from both the DUP and some Europeans and the EU summit on Sunday is expected to happen barring a breakdown in talks.

> We're currently pricing in 88% of a 25bps hike in base rate by next Nov's MPC meeting with 1y1y SONIA about 6bps off the recent 94bps lows. Cable is 1.2815, also treading water just north of last week's 1.2725 lows and UKT 4Q27 yields are 1.267%, still contained by the 1.20% yield lows since early January. Lastly, despite this period of relative calm, UKT 4Q27-1H47 remains pinned to the steepest levels of the last few years at 71.6bps with evidence of lingering positions in last week's UKT 1T37s tap still weighing on the mkt.

> Positions:

UKT 9/22-9/24-7/26 hovering at -.25bp

UKT 9/25-12/27-12/30 fly -8.3bps.

UKT 7/26-12/27-10/28 fly -6.6bps

UKT 12/38-1/44-12/49 fly +14.15bps

UKT 1Q27-1F28 sprd 10.4bps

UKT 4Q27-1F28 sprd 14.4bps.

UKT 7/20-1/21 sprd 1.0bps.

TOP BREXIT Headlines...

> May heading to Brussels amid scramble to finalise Brexit deal

> Still time for nips and tucks to EU deal?

> Brexit: May gambles on last-minute dash to Brussels

> FT: May revives Irish border proposal to appease Eurosceptics

https://www.ft.com/content/34fcfce0-ecc9-11e8-8180-9cf212677a57

> FT: May set to flag impact of Brexit scenarios on economy

> FT: DUP insists it will ‘of course’ vote against May’s Brexit deal

> WSJ: Brexit & Beyond: Campaign to Oust Theresa May Fizzles—for Now

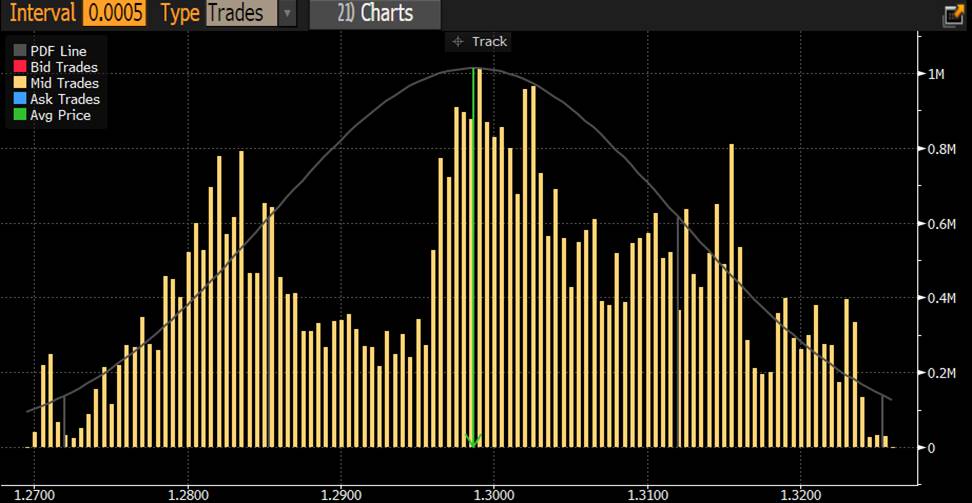

3mo GBP FRA-OIS sprds finally showing signs of topping out…

But the path of least resistance in UKT swap spreads remains richer as evidenced by this UKT 2T24 vs BBG I-sprd…

GBP volumes since Oct 1st show some reasonable positions at the 1.285 level but far more at richer levels which could spell trouble…

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

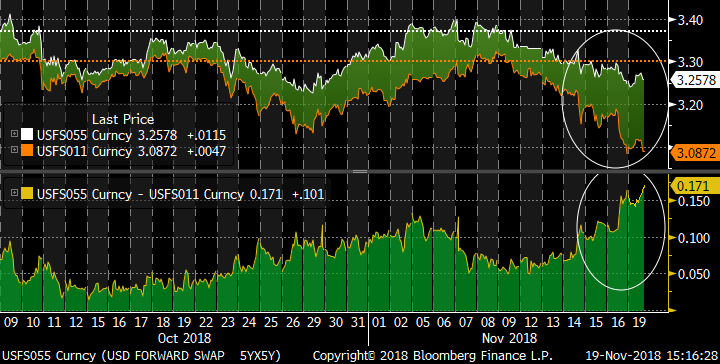

Trade: Tactical Bear-Flattener in USD after recent rally and curve steepening

Bottom line: A very simple proposition: the US curve has bull-steepened, giving the opportunity to fade via mid-curve payers.

Trade:

Buy USD 1,040mm 1m1y1y mc payer atmf+10bp (k=3.205%)

Sell USD 250mm 1m5y5y mc payer atmf+10bp (k=3.36%)

Expiry 20-Dec-18

For 0.4bp running net premium (mid)

Rationale: The recent bullish move in the US has confirmed the bull-steepening dynamic, as the chart shows.

Hence, any relaxing bearish reversal should trigger a re-flattening. The up-coming Fed events are the Minutes on 29th November and then the FOMC decision on 19th December, hence a 1-month expiry spans two risk events. The 1y1y/5y5y curve has steepened some 12bp from its flattest levels earlier in the month (9th November), so this is a reasonable target if we see a back-up in rates.

There is some negative skew on high-strike payers on 1y1y (while there is no skew to mention on 5y5y), hence moving the trade out-of-the-money improves the cost slightly (from 0.7bp for atm strikes to 0.4bp for atm+10bp strikes). Clearly, should the market take a bearish view on the Fed there is plenty of upside potential in 1y1y: around 20bp to the recent highs.

In a further rally, both legs expire worthless and the premium is sacrificed. The main risk is a sharp sell-off in 10y rates which is not matched by changing Fed expectations, however the market’s focus is very much on the Fed over the coming month (in addition you have some protection from the OTM strikes).

Any thoughts or comments?

Best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796