Quick oil chart : Cover any SHORT exposure.

Quick oil chart : Cover any SHORT exposure.

We have witnessed a major drop post hitting the multi-year trend line but now is the time to cover all short exposure. The RSI is now TOO low.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Equities : European equities are sitting on VERY WELL DEFINED monthly support BUT the daily horizon is BLEAK once again.

Equities : European equities are sitting on VERY WELL DEFINED monthly support BUT the daily horizon is BLEAK once again. Many remain below trend friend

50 or 100 day moving average.

US stocks look inviting but the NASDAQ remains wounded and weak.

Overall I still favour a MAJOR DROP and the daily scenario is helping that view.

Positions :

** New position **

Buy Dec Nikkei 19000 puts @ 75 (Now 38).

Buy DAX OCT 12000-11800 Put spread 35.00 (Now 191.5) FLAT.

Buy FTSE OCT 7350 – 7250 Put spread 23.5 (Now 99.0) FLAT.

It is worth taking some time to look at the top formations on many charts especially the US given it had the most OBLIQUE RSI’s.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

FX UPDATE EURO : A very KEY close coming up as we approach the 1.1301 low. The USD poised for a MAJOR POP!

Worth a quick DOWNSIDE play for the weekend .. BUY the EURO DEC 11200- 11100 put spread 15 tics.

- EURO : A very KEY close coming up as we approach the 1.1301 low.

- The USD poised for a MAJOR POP!

- Don’t get caught out as the EURO is flagging up a MAJOR news event weekend!

- MANY USD-EM crosses now have SIZEABLE long-term tops formed. I think it is a combination of EM relief that the Turkey-Argentina situation is improving and the DXY losing momentum, more bias on the former for influence.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Astor Ridge - Rates Data/Supply & Events Calendars for Week of Nov 12th

Pls see attached…

The timing of the Brexit talks over the next couple weeks remain fluid although there is mention of a cabinet meeting on Tuesday.

Best,

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

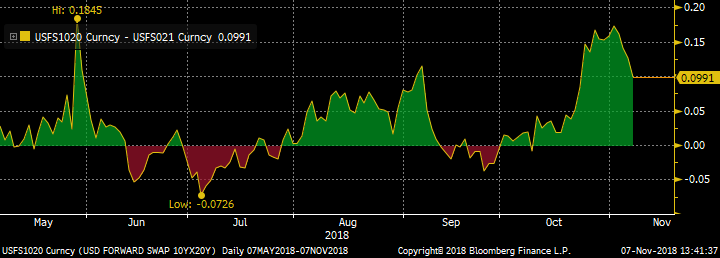

Trades: The USD 10y20y forward swap rate is at multi-year technical levels.

Bottom line: USD 10y20y is at fascinating technical levels and makes a good candidate for a duration long in the US

Trades:

- Simply receive USD 10y20y

- Mid-curve receiver spreads/ladders on 10y20y with 6m or 1y expiries

- Receiver USD 10y20y vs paying EUR 10y20y

See below for candidate structures.

Rationale: I don’t usually take technical analysis as my starting point, but a hat-tip to my colleague Chris Williams for the monthly chart of the USD 10y20y (20y rate, 10y forward) below. He has highlighted the powerful technical signals of the current level, in terms of RSI and 100-month moving average, using data stretching back to 1996.

The technical observations are timely as I am on the lookout for a place to receive on the USD curve. The results of yesterday’s US Mid-term elections have delivered a small Democratic majority in the House of Representatives: my high-level view is that this reduces the chances of further tax cuts and some of the more expansive spending plans for Defence (and certain building projects in the border zone). As a consequence changes on both sides of the budget look more positive in terms of the budget deficit, and lessens somewhat my fears of a ramping of long-end Treasury supply. This allows me to consider trades with a 10-30 flattening exposure, such as receiving 10y20y. Recall that the 10y20y forward rate is essentially one-part 30y outright plus 0.5-part 10y-30y curve: hence a reduction in the prospects for 10-30 steepening make this more of an essentially bullish trade (cf 5y5y, which is equal parts direction and curve).

How best to position for a failure of 10y20y at the 100-month moving average?

Simply receiving the 10y20y forward outright has the merit of ample liquidity and may act as a hedge to portfolios with more bearish positioning at the short end. The US 10y20y rate has got slightly ahead of Fed expectations over the past 6 months: the chart shows the residual of the regression between 10y20y and the 2y1y rate. On this basis, 10y20y looks around 10bp too high given the market’s pricing for short rates (R^2 of 83%). Being long 10y20y rolls negatively by 1.4bp over the first year, but does, of course, offer a long convexity exposure to compensate for this. A hedged spread using realized betas would be 1:1.08 DV01 of 10y20y: 2y1y.

For a non-linear payoff, look at mid-curve receivers on 10y20y as spread structures (or perhaps conditional curve trades vs short rates). The next chart shows the Fibonacci retracement levels for 10y20y, which gives us some idea of where to set breakeven points for receiver spread structures. Within the past six months the low has been in the 2.90% region, while further back the 2.60% level has been a strong support. The first retracement from current levels is around 3.00%, and would be target for a failure of 10y20y to breach the 100-month moving average.

This receiver ladder structure costs around 1.5bp running (mid indic):

Buy 90mm 1y10y20y receiver k=3.30%

Sell 90mm 1y10y20y receiver k=3.05%

Sell 90mm 1y10y20y receiver k=2.85%

(with Atmf = 3.33%)

The structure makes money with 10y20y at expiry from 3.285% to 2.615%, with the maximum P&L of 23.5bp between 3.05% and 2.85%. A break below the 2.615% level would start to incur losses. The trade is short gamma at inception, and slightly long the market.

On a shorter horizon with tighter strikes, this ladder costs 0.5bp running (mid indic)

Buy 90mm 6m10y20y receiver k=3.30%

Sell 90mm 6m10y20y receiver k=3.15%

Sell 90mm 6m10y20y receiver k=3.00%

(with Atmf = 3.34%)

and makes the largest P&L of 14.5 bp on a move to between 3.15% and 3%. The trade starts to lose money at 2.85% (a rally of 50bp in 10y20y over 6m).

Zero-cost 1x2 structures for comparison are (indicatively):

3m10y20y 3.30% / 3.15%, breakeven at 3%

6m10y20y 3.30% / 3.10%, breakeven at 2.90%

1y10y20y 3.30% / 3%, breakeven at 2.70%

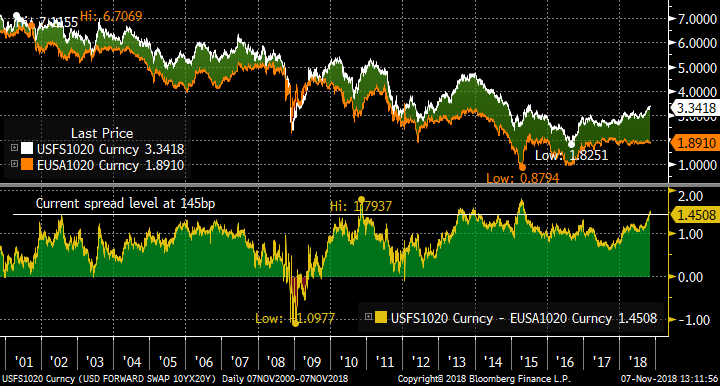

Another way to approach the USD 10y20y is in comparison to the EUR 10y20y as in the chart below. The spread is pushing on its highest levels for some time and exceeded only by the period leading into the start of the ECB’s QE (and the substantial flattening of EUR 10y-30y): a situation unlikely to be repeated. Again, the simplest way is to receive USD 10y20y vs paying EUR 10y20y. Given the higher volatility of US rates (and the recent comatose price action in EUR 10y20y) this is essentially a proxy for receiving USD 10y20y outright.

There are many ways to skin a cat … if a different expression fits your needs better please let me know and we can investigate.

Best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MULTI ASSET UPDATE : HIGH ALERT! This week could be VERY decisive if we continue the Friday reversals. **MARKETS TO WATCH THE EURO AND STOCKS.**

MULTI ASSET UPDATE : HIGH ALERT! This week could be VERY decisive if we continue the Friday reversals. **MARKETS TO WATCH THE EURO AND STOCKS.**

The EURO continues to fail and FRIDAYS reversal is no exception, leaving the momentum to breach the all-important 1.1301 previous low. We are close to a MAJOR FREE FALL and Friday has helped.

**Trade idea BUY Euro Dec 11100.00 puts @15 ticks, stop 1.1470 and ADD below 1.1301.**

EM BONDS continue to do well and many USD crosses well on the way to major drops. One new EM bond contender is INDIA as the cross is topping. These views are NOW very much for the long-term, especially if US yields STALL.

EQUITIES ** THE WEEKS BIG WORRY** We are sitting on KEY levels and just about holding last month’s lows, A LOT to watch! Should last month’s lows be breached do expect us to emulate Octobers range.

**Trade idea BUY DAX DEC 11300-11200 put spread 33.0 ticks Stop above 117.00 and ADD sub 11400.**

CORE BONDS are the LEAST favoured market given the yields and inability for a fully functional market. Of late European markets have claimed MANY victims, it does feel we are void of market depth and position belief. The US remains a VERY short market and one aided by the latest yield POP, my argument is it won’t last if stocks break given the US back end appeal. ALSO ALL monthly and quarterly RSI’s remain steadfastly overbought. We may STALL if equities have that ONE LAST BOUNCE.

US CURVES continue to steepen in the back end and show little signs of giving up the BULL STEEPENER bias, that said this whole yield-curve directional view NEEDS discussion.

Positions :

**Buy US 2-30 entry 36.418 now 51.855**

**Buy US 10-30 entry 14.426 now 22.871**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

What has the Bundesbank bought for PSPP2 in October? ML model results including future redemption estimates.

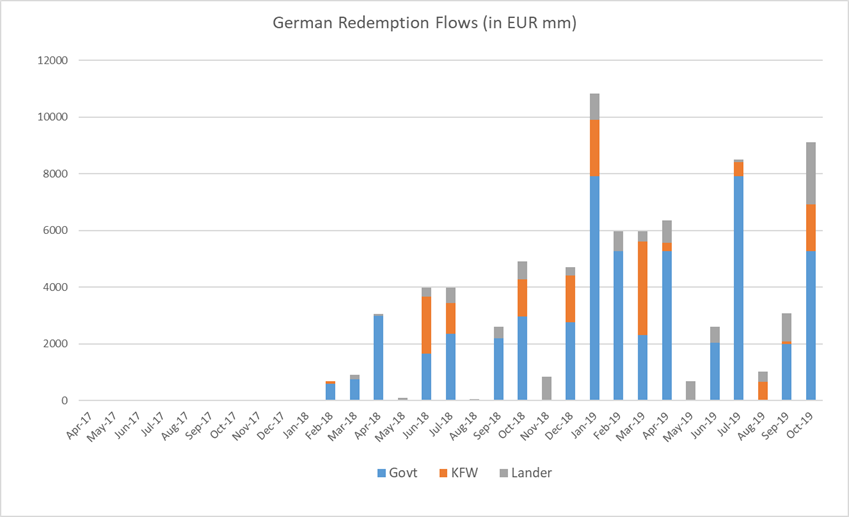

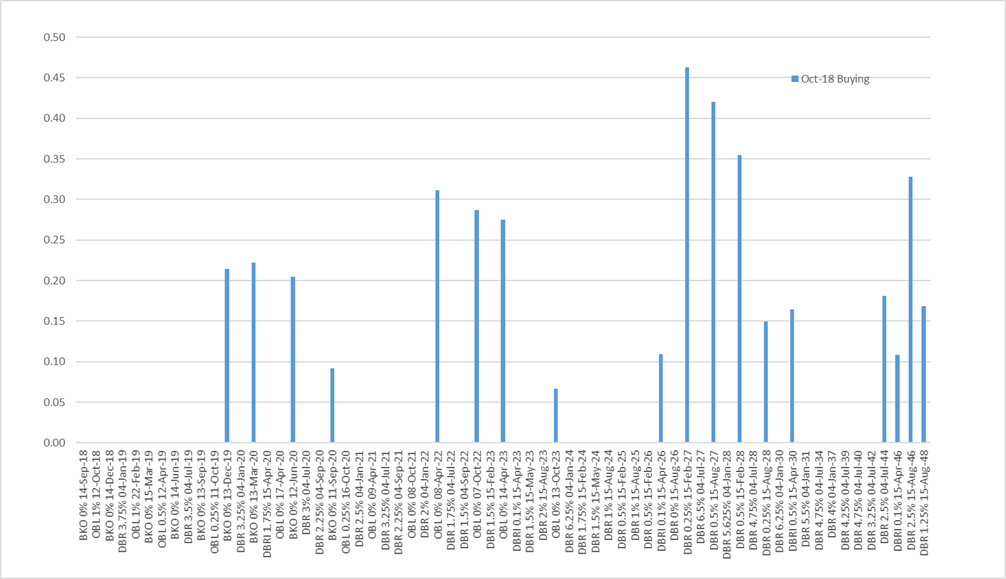

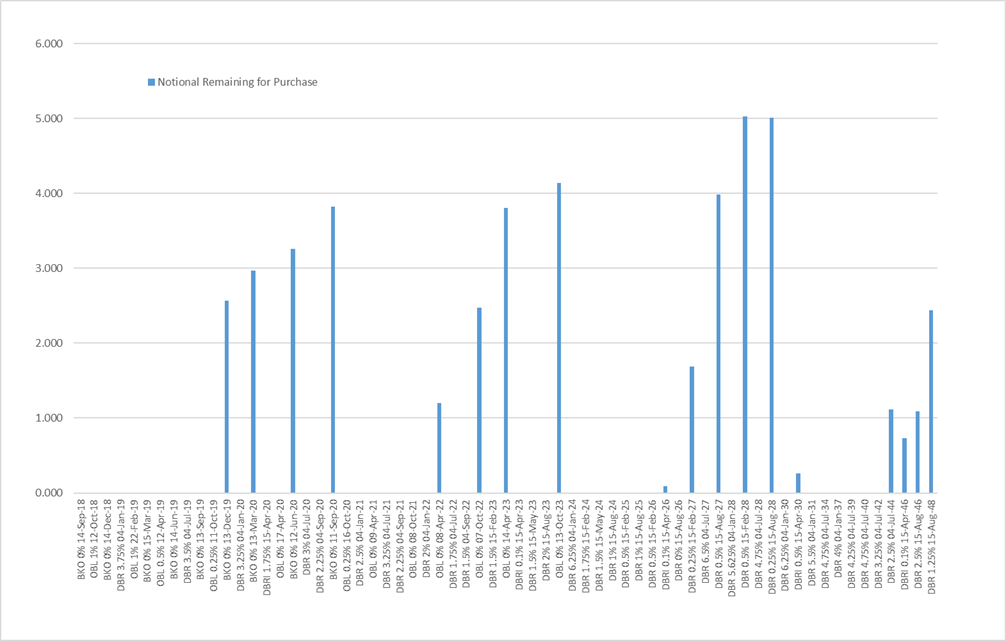

Here are the results of my Maximum Likelihood model for PSPP2 purchases in Germany for October. Once again, the model suggests strong buying in the 10y sector, with the remainder localized around 1y-2y, 5y and 30y (unsurprisingly, as these are the supply points where bonds have been in the programme for a shorter period).

To recap: the redemption flows for the first 3 months of 2019, when new purchases will have ceased, are substantial. For governments the model estimates redemptions of 7.6bn in January, 5.3bn in February and 2.2bn in March: an average of 5bn per month for the first quarter of 2019.

The estimated breakdown of purchasing for September across Govts, KFW and the Lander:

|

Category |

Notional |

WAM |

|

German Govt |

4.1 |

10.1 |

|

KFW |

1.4 |

6.2 |

|

Lander |

2.1 |

7.6 |

|

All Purchases |

7.5 |

8.7 |

Given the model, here’s a chart showing the estimated redemption flows for the year ahead:

And the numbers for that chart:

|

Redemptions |

||||

|

Govt |

KFW |

Lander |

Total |

|

|

Apr-17 |

0 |

0 |

0 |

0 |

|

May-17 |

0 |

0 |

0 |

0 |

|

Jun-17 |

0 |

0 |

0 |

0 |

|

Jul-17 |

0 |

0 |

0 |

0 |

|

Aug-17 |

0 |

0 |

0 |

0 |

|

Sep-17 |

0 |

0 |

0 |

0 |

|

Oct-17 |

0 |

0 |

0 |

0 |

|

Nov-17 |

0 |

0 |

0 |

0 |

|

Dec-17 |

0 |

0 |

0 |

0 |

|

Jan-18 |

0 |

6 |

0 |

6 |

|

Feb-18 |

606 |

82 |

0 |

688 |

|

Mar-18 |

763 |

0 |

150 |

913 |

|

Apr-18 |

2989 |

0 |

63 |

3051 |

|

May-18 |

0 |

0 |

95 |

95 |

|

Jun-18 |

1668 |

2002 |

327 |

3996 |

|

Jul-18 |

2367 |

1069 |

549 |

3985 |

|

Aug-18 |

0 |

0 |

65 |

65 |

|

Sep-18 |

2202 |

0 |

414 |

2616 |

|

Oct-18 |

2966 |

1304 |

649 |

4919 |

|

Nov-18 |

0 |

0 |

853 |

853 |

|

Dec-18 |

2766 |

1650 |

304 |

4720 |

|

Jan-19 |

7917 |

1980 |

930 |

10828 |

|

Feb-19 |

5280 |

0 |

692 |

5972 |

|

Mar-19 |

2306 |

3300 |

374 |

5980 |

|

Apr-19 |

5280 |

289 |

792 |

6361 |

|

May-19 |

0 |

0 |

684 |

684 |

|

Jun-19 |

2045 |

0 |

571 |

2616 |

|

Jul-19 |

7920 |

495 |

99 |

8514 |

|

Aug-19 |

0 |

660 |

370 |

1030 |

|

Sep-19 |

2009 |

80 |

991 |

3081 |

|

Oct-19 |

5280 |

1650 |

2190 |

9120 |

For the model itself, here are the estimates for the buying of German Governments in October:

This chart shows the remaining notional available for purchase by the programme given the estimated buying to date and the notional limits in place.

Finally, here’s the issue by issue breakdown of how much of each government bond my model estimates that the Bundesbank has bought:

|

Bond |

Opened |

O/S (bn) |

Purchasable |

Market Yield |

Purchased |

% Purchased |

Remaining |

Margin of Error |

MV Remaining |

Oct-18 Buying |

|

DBR 3.75% 04-Jan-17 |

Nov-06 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.75% 24-Feb-17 |

Jan-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 10-Mar-17 |

Feb-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 07-Apr-17 |

May-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 16-Jun-17 |

May-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-17 |

May-07 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 15-Sep-17 |

Aug-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 13-Oct-17 |

Sep-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 15-Dec-17 |

Nov-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4% 04-Jan-18 |

Nov-07 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 23-Feb-18 |

Jan-13 |

0.0 |

0.0 |

|

0.6 |

|

0.0 |

+/- 3% |

0.0 |

0.0 |

|

BKO 0% 16-Mar-18 |

Feb-16 |

0.0 |

0.0 |

|

0.8 |

|

0.0 |

+/- 3% |

0.0 |

0.0 |

|

OBL 0.25% 13-Apr-18 |

May-13 |

0.0 |

0.0 |

|

1.3 |

|

0.0 |

+/- 3% |

0.0 |

0.0 |

|

OBLI 0.75% 15-Apr-18 |

Apr-11 |

0.0 |

0.0 |

|

1.6 |

|

0.0 |

+/- 3% |

0.0 |

0.0 |

|

BKO 0% 15-Jun-18 |

May-16 |

0.0 |

0.0 |

|

1.7 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-18 |

May-08 |

0.0 |

0.0 |

|

2.4 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

BKO 0% 14-Sep-18 |

Aug-16 |

0.0 |

0.0 |

|

2.2 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

OBL 1% 12-Oct-18 |

Sep-13 |

0.0 |

0.0 |

3.0 |

0.0 |

+/- 1% |

0.0 |

0.0 |

||

|

BKO 0% 14-Dec-18 |

Nov-16 |

13.0 |

0.0 |

-0.646 |

2.8 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

DBR 3.75% 04-Jan-19 |

Nov-08 |

24.0 |

0.0 |

-0.961 |

7.9 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

OBL 1% 22-Feb-19 |

Jan-14 |

16.0 |

0.0 |

-0.754 |

5.3 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 15-Mar-19 |

Mar-17 |

13.0 |

0.0 |

-0.744 |

2.3 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

OBL 0.5% 12-Apr-19 |

May-14 |

16.0 |

0.0 |

-0.725 |

5.3 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 14-Jun-19 |

May-17 |

13.0 |

0.0 |

-0.694 |

2.0 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

DBR 3.5% 04-Jul-19 |

May-09 |

24.0 |

0.0 |

-0.677 |

7.9 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 13-Sep-19 |

Aug-17 |

13.0 |

0.0 |

-0.677 |

2.0 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

OBL 0.25% 11-Oct-19 |

Sep-14 |

16.0 |

0.0 |

-0.677 |

5.3 |

|

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 13-Dec-19 |

Nov-17 |

13.0 |

4.3 |

-0.686 |

1.7 |

40% |

2.6 |

+/- 2% |

2.6 |

0.2 |

|

DBR 3.25% 04-Jan-20 |

Nov-09 |

22.0 |

7.3 |

-0.792 |

7.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 13-Mar-20 |

Feb-18 |

13.0 |

4.3 |

-0.696 |

1.3 |

31% |

3.0 |

+/- 2% |

3.0 |

0.2 |

|

DBRI 1.75% 15-Apr-20 |

Jun-09 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 17-Apr-20 |

Jan-15 |

20.0 |

6.6 |

-0.701 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 12-Jun-20 |

May-18 |

12.0 |

4.0 |

-0.667 |

0.7 |

18% |

3.3 |

+/- 2% |

3.3 |

0.2 |

|

DBR 3% 04-Jul-20 |

Apr-10 |

22.0 |

7.3 |

-0.679 |

7.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-20 |

Aug-10 |

16.0 |

5.3 |

-0.655 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 11-Sep-20 |

Aug-18 |

12.0 |

4.0 |

-0.622 |

0.1 |

3% |

3.8 |

+/- 2% |

3.9 |

0.1 |

|

OBL 0.25% 16-Oct-20 |

Jul-15 |

19.0 |

6.3 |

-0.632 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.5% 04-Jan-21 |

Nov-10 |

19.0 |

6.3 |

-0.621 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 09-Apr-21 |

Feb-16 |

21.0 |

6.9 |

-0.572 |

6.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 3.25% 04-Jul-21 |

Apr-11 |

19.0 |

6.3 |

-0.544 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-21 |

Aug-11 |

16.0 |

5.3 |

-0.519 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Oct-21 |

Jul-16 |

19.0 |

6.3 |

-0.505 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2% 04-Jan-22 |

Nov-11 |

20.0 |

6.6 |

-0.468 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Apr-22 |

Feb-17 |

18.0 |

5.9 |

-0.424 |

4.7 |

80% |

1.2 |

+/- 1% |

1.2 |

0.3 |

|

DBR 1.75% 04-Jul-22 |

Apr-12 |

24.0 |

7.9 |

-0.396 |

7.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 04-Sep-22 |

Sep-12 |

18.0 |

5.9 |

-0.370 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 07-Oct-22 |

Jul-17 |

17.0 |

5.6 |

-0.345 |

3.1 |

56% |

2.5 |

+/- 1% |

2.5 |

0.3 |

|

DBR 1.5% 15-Feb-23 |

Jan-13 |

18.0 |

5.9 |

-0.297 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 14-Apr-23 |

Feb-18 |

16.0 |

5.3 |

-0.259 |

1.5 |

28% |

3.8 |

+/- 2% |

3.8 |

0.3 |

|

DBRI 0.1% 15-Apr-23 |

Mar-12 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-23 |

May-13 |

18.0 |

5.9 |

-0.260 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2% 15-Aug-23 |

Sep-13 |

18.0 |

5.9 |

-0.222 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 13-Oct-23 |

Jul-18 |

13.0 |

4.3 |

-0.173 |

0.2 |

4% |

4.1 |

+/- 4% |

4.2 |

0.1 |

|

DBR 6.25% 04-Jan-24 |

Jan-94 |

10.3 |

3.4 |

-0.158 |

3.4 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.75% 15-Feb-24 |

Jan-14 |

18.0 |

5.9 |

-0.138 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-24 |

May-14 |

18.0 |

5.9 |

-0.104 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-24 |

Sep-14 |

18.0 |

5.9 |

-0.067 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-25 |

Jan-15 |

23.0 |

7.6 |

-0.002 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-25 |

Jul-15 |

23.0 |

7.6 |

0.049 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-26 |

Jan-16 |

26.0 |

8.6 |

0.115 |

8.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.1% 15-Apr-26 |

Mar-15 |

14.5 |

4.8 |

|

4.7 |

98% |

0.1 |

+/- 1% |

0.1 |

0.1 |

|

DBR 0% 15-Aug-26 |

Jul-16 |

25.0 |

8.3 |

0.183 |

8.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.25% 15-Feb-27 |

Jan-17 |

26.0 |

8.6 |

0.243 |

6.9 |

80% |

1.7 |

+/- 1% |

1.7 |

0.5 |

|

DBR 6.5% 04-Jul-27 |

Jul-97 |

11.2 |

3.7 |

0.231 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Aug-27 |

Jul-17 |

25.0 |

8.3 |

0.304 |

4.3 |

52% |

4.0 |

+/- 1% |

4.1 |

0.4 |

|

DBR 5.625% 04-Jan-28 |

Jan-98 |

14.5 |

4.8 |

0.296 |

4.8 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-28 |

Jan-18 |

21.0 |

6.9 |

0.366 |

1.9 |

27% |

5.0 |

+/- 1% |

5.1 |

0.4 |

|

DBR 4.75% 04-Jul-28 |

Oct-98 |

11.3 |

3.7 |

0.352 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.25% 15-Aug-28 |

Jul-18 |

16.0 |

5.3 |

0.428 |

0.3 |

5% |

5.0 |

+/- 3% |

4.9 |

0.1 |

|

DBR 6.25% 04-Jan-30 |

Jan-00 |

9.3 |

3.1 |

0.440 |

3.1 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.5% 15-Apr-30 |

Apr-14 |

12.1 |

4.0 |

|

3.7 |

93% |

0.3 |

+/- 2% |

0.3 |

0.2 |

|

DBR 5.5% 04-Jan-31 |

Oct-00 |

17.0 |

5.6 |

0.511 |

5.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-34 |

Jan-03 |

20.0 |

6.6 |

0.695 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4% 04-Jan-37 |

Jan-05 |

23.0 |

7.6 |

0.793 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-39 |

Jan-07 |

14.0 |

4.6 |

0.853 |

4.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-40 |

Jul-08 |

16.0 |

5.3 |

0.860 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 3.25% 04-Jul-42 |

Jul-10 |

15.0 |

5.0 |

0.927 |

5.0 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.5% 04-Jul-44 |

Apr-12 |

26.5 |

8.7 |

0.992 |

7.6 |

87% |

1.1 |

+/- 1% |

1.5 |

0.2 |

|

DBRI 0.1% 15-Apr-46 |

Jun-15 |

8.0 |

2.6 |

|

1.9 |

72% |

0.7 |

+/- 1% |

0.9 |

0.1 |

|

DBR 2.5% 15-Aug-46 |

Feb-14 |

25.5 |

8.4 |

1.023 |

7.3 |

87% |

1.1 |

+/- 1% |

1.5 |

0.3 |

|

DBR 1.25% 15-Aug-48 |

Sep-17 |

10.5 |

3.5 |

1.060 |

1.0 |

30% |

2.4 |

+/- 2% |

2.6 |

0.2 |

|

Italic = index-linked |

Total |

47.2 |

4.1 |

|||||||

|

Yield below Depo Rate |

||||||||||

|

Yield above Depo Rate |

Bund WAM |

10.1 |

Any questions? More than happy to run you through the numbers in detail.

Best wishes

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GBP Front-End Head Scratchers... Some Quick Charts

- We had a nice call on gilts on Tuesday, looking for a pre-MPC meeting pullback from overbought technicals (see attached). SONIA 1y1y has corrected 10bps, 4Q27-1F28 has flattened .75bp (last 1F 28 tap of 2018 coming on Tuesday) and UKT 21-23-25 fly is ~2bps cheaper. (Our 20-21s steepener is about .7 steeper mid-mid, a slow burner). In light of the stalemate in the Brexit talks, the correction in rates was about as much we could have hoped for, although a rebound in stocks hasn’t hurt our cause.

- Yesterday’s MPC meeting/QIR was roughly as we expected. If you ‘read between the waffling’ about the potential outcomes of Brexit and their expected policy response, what was clear to us is given a choice, they’d like to continue their slow and steady rate hikes. Our market barometers haven’t changed – GBP, SONIA 1y1y and UKT 4Q 27s on the curve – and each of them flashed signs that the market’s pricing of the Brexit outcome was not only overly negative but is not in line with the MPC’s outlook. That still tilts the market’s response unevenly, suggesting positive Brexit headlines will be more bullish than ‘more of the same’ will be bearish.

- While messing around with some charts I found a couple rather odd divergences that have made forecasting the GBP front-end more challenging than usual. We can attribute this wobble to a Brexit-Fog but worth pointing out nonetheless.

- GBP vs SONIA 1Y1Y.

This a 1yr history of Cable vs SONIA 1y1y. We can see the correlation was high from the Nov-May, however, Brexit driven GBP shorts were contrary to market pricing and MPC policy outlook. While the last couple months have been more in line with historical correlations, this chart illustrates how much catching up GBP should do if Brexit is resolved positively.

- SONIA 1Y1Y vs FTSE 100…

This is an odd one – the white line is the FTSE which has bounced nicely off the lows and helped to drive a correction in SONIA. What’s interesting here is this SONIA line well correlated to stocks but inversely! So, stocks rally and the market prices in a dovish MPC? Hmmmm…

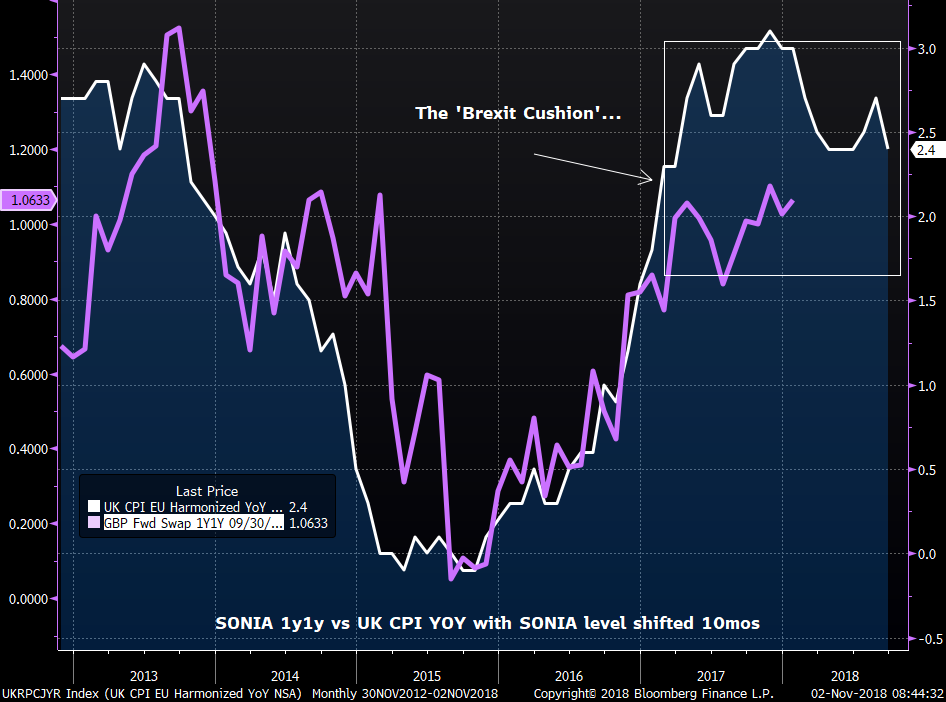

- UK CPI YOY vs SONIA 1Y1Y (shifted 10mos)…

Now, this chart makes some sense! The MPC has an inflation fighting mandate – inflation rises and they raise rates! What’s interesting here is not only the 10 month lag (which seems a bit long to me) but also the divergence between the two since late 2016 – the Brexit Cushion – which one would expect to be closed. If it was up to the MPC, it would be some time in the next 9mos.

More to come!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Curves have steepened nicely and most BACK END ones have confirmed a BASE by breaching 100 day moving averages.

- Curves have steepened nicely and most BACK END ones have confirmed a BASE by breaching 100 day moving averages.

- All CURVES have hit the MULTI YEAR 76.4% retracements.

- The FRONT END CURVES still seem to be struggling to base?!

- I have been advocating steepeners in the back end and suggest taking 50% of any positions off.

**Buy US 2-30 entry 36.418 now 52.247, sell stop 26.oo ** REDUCE position by 50%

**Buy US 10-30 entry 14.426 now 24.594 sell stop 11.oo **REDUCE position by 50%

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Equities : The BIG question is DO THEY HOLD, the answer is I think so but not for long.

Equities : The BIG question is DO THEY HOLD, the answer is I think so but not for long.

There should be some reprieve BUT equities are now VERY MUCH DAMAGED GOODS.

Another factor is the US markets have performed MUCH better that EUROPE thus have a potentially HARDER FALL. See the EXTENDED retracements.

Positions :

** New position **

Buy Dec Nikkei 19000 puts @ 75 (Now 140).

Buy DAX OCT 12000-11800 Put spread 35.00 (Now 191.5) FLAT.

Buy FTSE OCT 7350 – 7250 Put spread 23.5 (Now 99.0) FLAT.

It is worth taking some time to look at the top formations on many charts especially the US given it had the most OBLIQUE RSI’s.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris