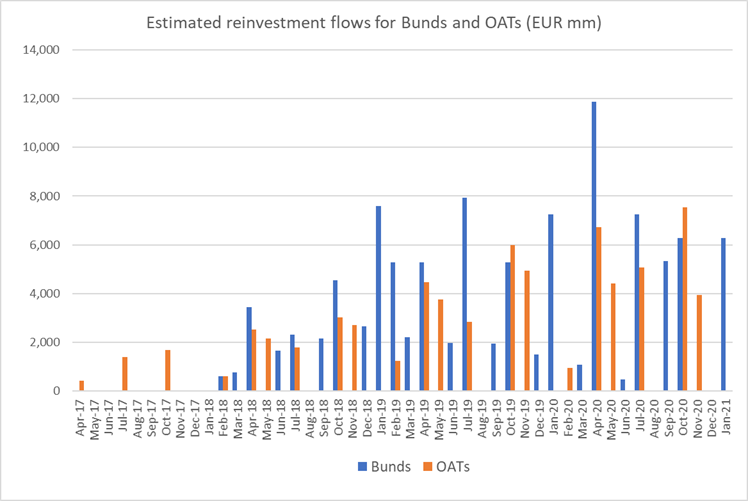

PSPP2 redemption/reinvestment flows for Bunds and OATs in 2019: Bunds should get a boost in Q1 19

Hi,

As many of you will know, I have been running my model for PSPP2 buying specifically for Germany (Bunds, KFW, Lander). After finally beating the French bond size data into submission, I have done the same with France (OATs, CADES & others).

What are the key observations, given my model estimates?

- The first 4 months of 2019 will see over EUR 20bn of Bund redemptions compared to just EUR 5.7bn for France.

- Taking 2019 as a whole, Bunds should see 18.1bn vs France’s 12.8bn. This is a ratio of 1.67 : 1. The capital key ratio is 1.27 : 1. This means that Germany will see considerably more buying relative to France than might be expected from the capital key.

- Bear in mind also that German purchases are likely more concentrated in specific issues (since the 33% ownership limit has been reached on many older issues). Currently purchases are being focused on the supply points: 5y, 10y and 30y.

- Ahead into 2020 the reinvestments are much closer to the capital key ratio.

Taken together, this suggests that Germany-France spreads should (all things being equal) come under widening pressure in 5y,10y and 30y sectors in the first quarter of next year.

Of most interest for the coming months is the pattern of redemption/reinvestment flows, and this is shown in the chart using last month’s data. Hence the redemption sizes will increase slightly as we still have three months of (reduced) purchases of new assets. I am assuming that government redemptions are reinvested into governments while agency/Lander debt is also reinvested in the same bond class.

And here are the numbers (as of end-Sept 18), with the annual totals. Bear in mind that the redemption can be reinvested over subsequent months, rather than immediately.

|

Month |

Bunds |

OATs |

|

Apr-17 |

- |

427 |

|

May-17 |

- |

- |

|

Jun-17 |

- |

- |

|

Jul-17 |

- |

1,389 |

|

Aug-17 |

- |

- |

|

Sep-17 |

- |

- |

|

Oct-17 |

- |

1,693 |

|

Nov-17 |

- |

- |

|

Dec-17 |

- |

- |

|

2017 Total |

- |

3,509 |

|

Jan-18 |

- |

- |

|

Feb-18 |

592 |

598 |

|

Mar-18 |

750 |

- |

|

Apr-18 |

3,446 |

2,522 |

|

May-18 |

- |

2,153 |

|

Jun-18 |

1,652 |

- |

|

Jul-18 |

2,312 |

1,777 |

|

Aug-18 |

- |

- |

|

Sep-18 |

2,164 |

- |

|

Oct-18 |

4,535 |

3,012 |

|

Nov-18 |

- |

2,712 |

|

Dec-18 |

2,659 |

- |

|

2018 Total |

18,111 |

12,775 |

|

Jan-19 |

7,596 |

- |

|

Feb-19 |

5,280 |

1,248 |

|

Mar-19 |

2,206 |

- |

|

Apr-19 |

5,280 |

4,453 |

|

May-19 |

- |

3,765 |

|

Jun-19 |

1,973 |

- |

|

Jul-19 |

7,920 |

2,847 |

|

Aug-19 |

- |

- |

|

Sep-19 |

1,937 |

- |

|

Oct-19 |

5,280 |

5,976 |

|

Nov-19 |

- |

4,948 |

|

Dec-19 |

1,485 |

- |

|

2019 Total |

38,957 |

23,236 |

|

Jan-20 |

7,260 |

- |

|

Feb-20 |

- |

959 |

|

Mar-20 |

1,079 |

- |

|

Apr-20 |

11,880 |

6,719 |

|

May-20 |

- |

4,419 |

|

Jun-20 |

482 |

- |

|

Jul-20 |

7,260 |

5,068 |

|

Aug-20 |

- |

- |

|

Sep-20 |

5,328 |

- |

|

Oct-20 |

6,270 |

7,530 |

|

Nov-20 |

- |

3,945 |

|

Dec-20 |

- |

- |

|

2020 Total |

39,558 |

28,638 |

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Quick oil chart : Oil is running into a DECENT headwind up here and close to breaching a 100 period moving average.

Quick oil chart : Oil is running into a DECENT headwind up here and close to breaching a 100 period moving average.

Oil has been mentioned a lot this week and chart wise it looks like we have hit DECENT resistance. The trend line 76.64 has offered sizeable resistance so now all about whether we close ABOVE or BELOW the 74.88 moving average. Any subsequent close sub the 50% ret 70.44 will confirm a TOP.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

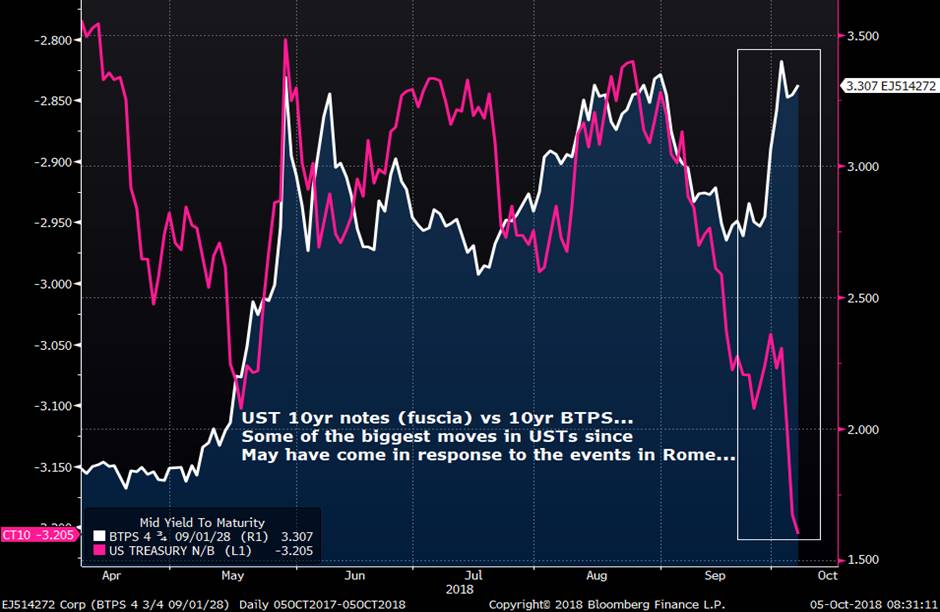

MACROCOSM: Quick Technicals Snapshot on PAYROLLS Day...

- Today’s release of the Sep US non-farm payrolls data is the main event, putting an exclamation point on what’s been another odd week in rates-land.

- Consensus for the NFP:

- Change in NFP Est +185k vs +201k last. The above-consensus ADP release on Wed (230k vs 184k w/5k upward revision) has the market pricing an upward surprise in.

- Jobless rate est 3.8% vs 3.9% last – will depend on movements in the size of the labor force though. Where are these people coming from?!

- Avg hrly earnings est .3% mom/2.8% yoy vs .4%/2.9% last.

- Change in NFP Est +185k vs +201k last. The above-consensus ADP release on Wed (230k vs 184k w/5k upward revision) has the market pricing an upward surprise in.

- As you know, leveraged players have been VERY SHORT the belly of the curve which, on paper means they’re doing very well of late. What’s interesting to us is this lopsided positioning has been the cause (in our view at least) of the bear-steepening of 5/10-30s this week. Basically, the market’s selling what they’re long now – ignoring the flattener-at-all-costs mantra – that also suggests a softer than consensus result could spark short covering in the belly that exacerbates this steepening bias. The 5-30s sprd has been capped by the 31.5bps level since early June, suggesting this is a key trigger for curve capitulations today.

- UST 10yr notes with NFP releases (Green flag, NFP were better than forecasts, red flag, worse). What we notice here – which isn’t a major surprise I suppose – is we’ve gone into many of the NFP days over the past year with 10yr note yields oversold (high) on momentum indicators like the RSI here. What’s troubling from a trading perspective is market reaction in many cases has been pretty muted - both rallies and selloffs are pretty benign even with fairly big misses. Could today be different? Well, yes, simply because positioning is shorter, yields are higher and sentiment has shifted into another gear. Plus, we’ve got a long weekend coming up and with Italy’s situation still an accident waiting for a microphone, not sure we want to carry a huge short into 3 days off.

UST 5-30s…

- Check this chart out… Talk about a roller coaster! Since May, flight to quality moves into 10yr USTs have been massive when BTPS have blown up, a far bigger influence on USTs than NFP numbers have been. This latest divergence (see chart below) is curious as the UST market has basically decided that the situation in Rome is no longer a cause for alarm. BTPS don’t think that, why should USTs?

More to come….

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Updated RATES Calendar - For Week of Oct 8-12

Please see attached PDFs….

Thanks

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

**** PLEASE READ MULTI ASSET UPDATE ***

MULTI ASSET UPDATE :

WEAK EURO

Bonds ARE currently rewriting history, they feel unbelievably THIN and DEFINITELY HARD to trade. Hence so far most recommendations have been via options.

The US curves have steepened on the bond downturn but am still unsure if this is the directional bias, but curves HAVE confirmed a BASE.

Other asset classes are behaving and trading in more of an orderly fashion, even ITALY hitting the 61.8% ret 3.394.

IT FEELS LIKE WE ARE COILING FOR AN EXPLOSIVE TIME is coming.

Topics PAGES

- CORE FX 02-13

- USD EM (Opportunities) 14-27

- Stocks 28-38

- Bonds 39-56

- US Curves 57-69

- Oil 70

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

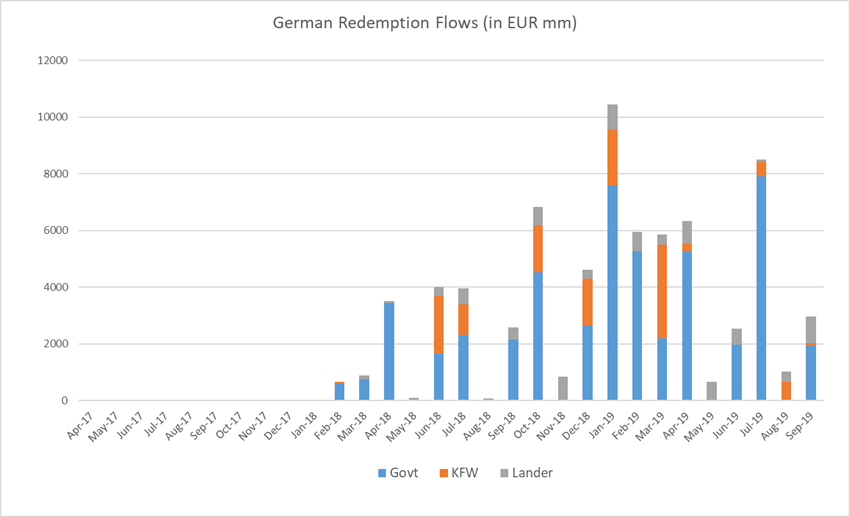

What has the Bundebank bought for PSPP2 in September? ML model results including future redemption estimates.

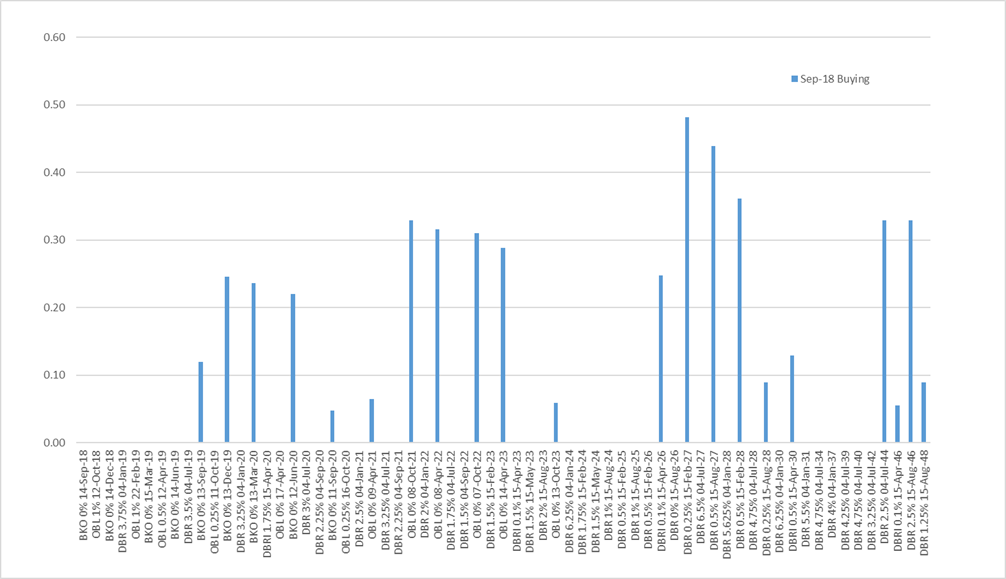

Here are the results of my Maximum Likelihood model for PSPP2 purchases in Germany for September. This month the model suggests strong buying in the 10y sector, with the remainder localized around 1y-2y, 5y and 30y (unsurprisingly, as these are the supply points where bonds have been in the programme for a shorter period).

The redemption flows for the first 3 months of 2019, when new purchases will have ceased, are substantial. For governments the model estimates redemptions of 7.6bn in January, 5.3bn in February and 2.2bn in March: an average of 5bn per month for the first quarter of 2019. As a consequence the ending of new purchases may hardly be noticed.

The estimated breakdown of purchasing for September across Govts, KFW and the Lander:

|

Category |

Notional |

WAM |

|

German Govt |

4.8 |

9.2 |

|

KFW |

1.2 |

6.0 |

|

Lander |

2.5 |

6.4 |

|

All Purchases |

8.5 |

7.9 |

Given the model, here’s a chart showing the estimated redemption flows for the year ahead:

And the numbers for that chart:

|

Redemptions |

||||

|

Govt |

KFW |

Lander |

Total |

|

|

Apr-17 |

0 |

0 |

0 |

0 |

|

May-17 |

0 |

0 |

0 |

0 |

|

Jun-17 |

0 |

0 |

0 |

0 |

|

Jul-17 |

0 |

0 |

0 |

0 |

|

Aug-17 |

0 |

0 |

0 |

0 |

|

Sep-17 |

0 |

0 |

0 |

0 |

|

Oct-17 |

0 |

0 |

0 |

0 |

|

Nov-17 |

0 |

0 |

0 |

0 |

|

Dec-17 |

0 |

0 |

0 |

0 |

|

Jan-18 |

0 |

5 |

0 |

5 |

|

Feb-18 |

592 |

83 |

0 |

674 |

|

Mar-18 |

750 |

0 |

151 |

901 |

|

Apr-18 |

3446 |

0 |

70 |

3516 |

|

May-18 |

0 |

0 |

97 |

97 |

|

Jun-18 |

1652 |

2036 |

329 |

4017 |

|

Jul-18 |

2312 |

1081 |

561 |

3954 |

|

Aug-18 |

0 |

0 |

71 |

71 |

|

Sep-18 |

2164 |

0 |

423 |

2587 |

|

Oct-18 |

4535 |

1650 |

643 |

6828 |

|

Nov-18 |

0 |

0 |

847 |

847 |

|

Dec-18 |

2659 |

1650 |

303 |

4612 |

|

Jan-19 |

7596 |

1980 |

880 |

10456 |

|

Feb-19 |

5280 |

0 |

676 |

5956 |

|

Mar-19 |

2206 |

3300 |

349 |

5855 |

|

Apr-19 |

5280 |

272 |

784 |

6336 |

|

May-19 |

0 |

0 |

664 |

664 |

|

Jun-19 |

1973 |

0 |

563 |

2536 |

|

Jul-19 |

7920 |

495 |

99 |

8514 |

|

Aug-19 |

0 |

660 |

369 |

1029 |

|

Sep-19 |

1937 |

78 |

951 |

2966 |

|

Oct-19 |

5280 |

1650 |

2179 |

9109 |

|

Nov-19 |

0 |

0 |

520 |

520 |

|

Dec-19 |

1485 |

0 |

574 |

2059 |

|

Jan-20 |

7260 |

3300 |

1870 |

12430 |

|

Feb-20 |

0 |

121 |

680 |

801 |

|

Mar-20 |

1079 |

0 |

1369 |

2447 |

|

Apr-20 |

11880 |

0 |

395 |

12275 |

|

May-20 |

0 |

0 |

388 |

388 |

|

Jun-20 |

482 |

1786 |

653 |

2922 |

|

Jul-20 |

7260 |

0 |

2186 |

9446 |

|

Aug-20 |

0 |

0 |

560 |

560 |

|

Sep-20 |

5328 |

0 |

957 |

6285 |

|

Oct-20 |

6270 |

495 |

942 |

7707 |

|

Nov-20 |

0 |

0 |

1125 |

1125 |

|

Dec-20 |

0 |

0 |

783 |

783 |

|

Jan-21 |

6270 |

3630 |

1102 |

11002 |

For the model itself, here are the estimates for the buying of German Governments in September:

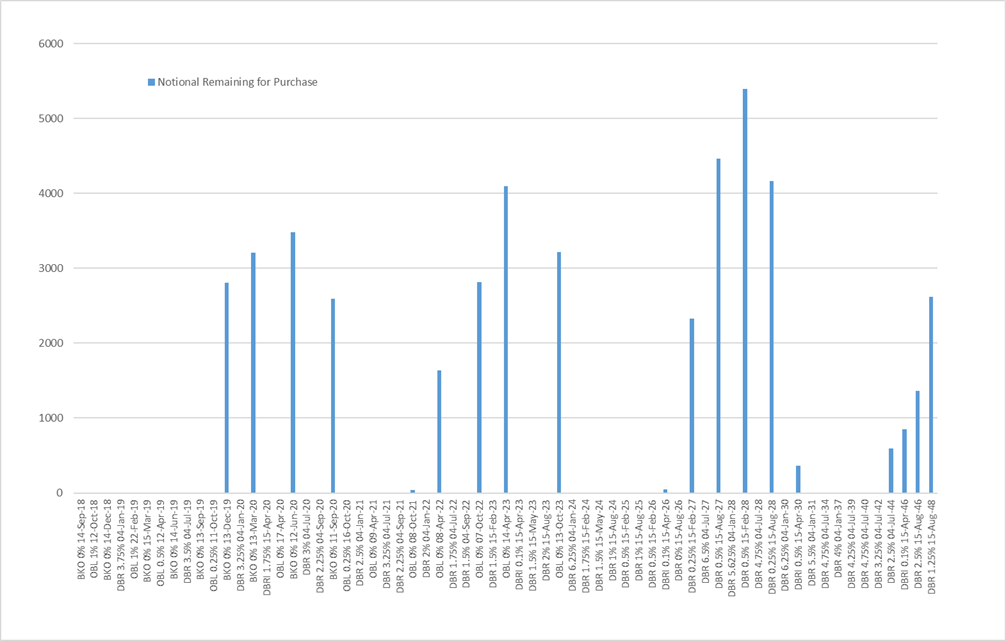

This chart shows the remaining notional available for purchase by the programme given the estimated buying to date and the notional limits in place.

Finally, here’s the issue by issue breakdown of how much of each government bond my model estimates that the Bundesbank has bought:

|

Bond |

Opened |

O/S (bn) |

Purchasable |

Market Yield |

Purchased |

% Purchased |

Remaining |

Margin of Error |

MV Remaining |

Sep-18 Buying |

|

DBR 3.75% 04-Jan-17 |

Nov-06 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.75% 24-Feb-17 |

Jan-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 10-Mar-17 |

Feb-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 07-Apr-17 |

May-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 16-Jun-17 |

May-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-17 |

May-07 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 15-Sep-17 |

Aug-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 13-Oct-17 |

Sep-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 15-Dec-17 |

Nov-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4% 04-Jan-18 |

Nov-07 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 23-Feb-18 |

Jan-13 |

0.0 |

0.0 |

|

0.6 |

|

0.0 |

+/- 3% |

0.0 |

0.0 |

|

BKO 0% 16-Mar-18 |

Feb-16 |

0.0 |

0.0 |

|

0.8 |

|

0.0 |

+/- 4% |

0.0 |

0.0 |

|

OBL 0.25% 13-Apr-18 |

May-13 |

0.0 |

0.0 |

|

1.3 |

|

0.0 |

+/- 3% |

0.0 |

0.0 |

|

OBLI 0.75% 15-Apr-18 |

Apr-11 |

0.0 |

0.0 |

|

2.1 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

BKO 0% 15-Jun-18 |

May-16 |

0.0 |

0.0 |

|

1.7 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-18 |

May-08 |

0.0 |

0.0 |

|

2.3 |

|

0.0 |

+/- 2% |

0.0 |

0.0 |

|

BKO 0% 14-Sep-18 |

Aug-16 |

0.0 |

0.0 |

2.2 |

0.0 |

+/- 2% |

0.0 |

0.0 |

||

|

OBL 1% 12-Oct-18 |

Sep-13 |

17.0 |

0.0 |

-0.688 |

4.5 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

BKO 0% 14-Dec-18 |

Nov-16 |

13.0 |

0.0 |

-0.602 |

2.7 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

DBR 3.75% 04-Jan-19 |

Nov-08 |

24.0 |

0.0 |

-0.733 |

7.6 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

OBL 1% 22-Feb-19 |

Jan-14 |

16.0 |

0.0 |

-0.659 |

5.3 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 15-Mar-19 |

Mar-17 |

13.0 |

0.0 |

-0.644 |

2.2 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

OBL 0.5% 12-Apr-19 |

May-14 |

16.0 |

0.0 |

-0.631 |

5.3 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 14-Jun-19 |

May-17 |

13.0 |

0.0 |

-0.619 |

2.0 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

DBR 3.5% 04-Jul-19 |

May-09 |

24.0 |

0.0 |

-0.638 |

7.9 |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

|

BKO 0% 13-Sep-19 |

Aug-17 |

13.0 |

0.0 |

-0.633 |

1.9 |

|

0.0 |

+/- 2% |

0.0 |

0.1 |

|

OBL 0.25% 11-Oct-19 |

Sep-14 |

16.0 |

5.3 |

-0.617 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 13-Dec-19 |

Nov-17 |

13.0 |

4.3 |

-0.618 |

1.5 |

35% |

2.8 |

+/- 2% |

2.8 |

0.2 |

|

DBR 3.25% 04-Jan-20 |

Nov-09 |

22.0 |

7.3 |

-0.697 |

7.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 13-Mar-20 |

Feb-18 |

13.0 |

4.3 |

-0.599 |

1.1 |

25% |

3.2 |

+/- 2% |

3.2 |

0.2 |

|

DBRI 1.75% 15-Apr-20 |

Jun-09 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 17-Apr-20 |

Jan-15 |

20.0 |

6.6 |

-0.609 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 12-Jun-20 |

May-18 |

12.0 |

4.0 |

-0.578 |

0.5 |

12% |

3.5 |

+/- 3% |

3.5 |

0.2 |

|

DBR 3% 04-Jul-20 |

Apr-10 |

22.0 |

7.3 |

-0.601 |

7.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-20 |

Aug-10 |

16.0 |

5.3 |

-0.576 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 11-Sep-20 |

Aug-18 |

8.0 |

2.6 |

-0.553 |

0.0 |

2% |

2.6 |

+/- 7% |

2.6 |

0.0 |

|

OBL 0.25% 16-Oct-20 |

Jul-15 |

19.0 |

6.3 |

-0.564 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.5% 04-Jan-21 |

Nov-10 |

19.0 |

6.3 |

-0.552 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 09-Apr-21 |

Feb-16 |

21.0 |

6.9 |

-0.509 |

6.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.1 |

|

DBR 3.25% 04-Jul-21 |

Apr-11 |

19.0 |

6.3 |

-0.474 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-21 |

Aug-11 |

16.0 |

5.3 |

-0.450 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Oct-21 |

Jul-16 |

19.0 |

6.3 |

-0.441 |

6.2 |

99% |

0.0 |

+/- 1% |

0.0 |

0.3 |

|

DBR 2% 04-Jan-22 |

Nov-11 |

20.0 |

6.6 |

-0.403 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Apr-22 |

Feb-17 |

18.0 |

5.9 |

-0.365 |

4.3 |

72% |

1.6 |

+/- 1% |

1.7 |

0.3 |

|

DBR 1.75% 04-Jul-22 |

Apr-12 |

24.0 |

7.9 |

-0.336 |

7.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 04-Sep-22 |

Sep-12 |

18.0 |

5.9 |

-0.313 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 07-Oct-22 |

Jul-17 |

17.0 |

5.6 |

-0.285 |

2.8 |

50% |

2.8 |

+/- 2% |

2.8 |

0.3 |

|

DBR 1.5% 15-Feb-23 |

Jan-13 |

18.0 |

5.9 |

-0.242 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 14-Apr-23 |

Feb-18 |

16.0 |

5.3 |

-0.200 |

1.2 |

23% |

4.1 |

+/- 2% |

4.1 |

0.3 |

|

DBRI 0.1% 15-Apr-23 |

Mar-12 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-23 |

May-13 |

18.0 |

5.9 |

-0.206 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2% 15-Aug-23 |

Sep-13 |

18.0 |

5.9 |

-0.169 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 13-Oct-23 |

Jul-18 |

10.0 |

3.3 |

-0.124 |

0.1 |

3% |

3.2 |

+/- 7% |

3.2 |

0.1 |

|

DBR 6.25% 04-Jan-24 |

Jan-94 |

10.3 |

3.4 |

-0.105 |

3.4 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.75% 15-Feb-24 |

Jan-14 |

18.0 |

5.9 |

-0.089 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-24 |

May-14 |

18.0 |

5.9 |

-0.058 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-24 |

Sep-14 |

18.0 |

5.9 |

-0.021 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-25 |

Jan-15 |

23.0 |

7.6 |

0.041 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-25 |

Jul-15 |

23.0 |

7.6 |

0.091 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-26 |

Jan-16 |

26.0 |

8.6 |

0.151 |

8.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.1% 15-Apr-26 |

Mar-15 |

14.0 |

4.6 |

|

4.6 |

99% |

0.1 |

+/- 1% |

0.1 |

0.2 |

|

DBR 0% 15-Aug-26 |

Jul-16 |

25.0 |

8.3 |

0.212 |

8.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.25% 15-Feb-27 |

Jan-17 |

26.0 |

8.6 |

0.267 |

6.3 |

73% |

2.3 |

+/- 1% |

2.3 |

0.5 |

|

DBR 6.5% 04-Jul-27 |

Jul-97 |

11.2 |

3.7 |

0.252 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Aug-27 |

Jul-17 |

25.0 |

8.3 |

0.323 |

3.8 |

46% |

4.5 |

+/- 1% |

4.5 |

0.4 |

|

DBR 5.625% 04-Jan-28 |

Jan-98 |

14.5 |

4.8 |

0.315 |

4.8 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-28 |

Jan-18 |

21.0 |

6.9 |

0.383 |

1.5 |

22% |

5.4 |

+/- 1% |

5.5 |

0.4 |

|

DBR 4.75% 04-Jul-28 |

Oct-98 |

11.3 |

3.7 |

0.368 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.25% 15-Aug-28 |

Jul-18 |

13.0 |

4.3 |

0.443 |

0.1 |

3% |

4.2 |

+/- 6% |

4.1 |

0.1 |

|

DBR 6.25% 04-Jan-30 |

Jan-00 |

9.3 |

3.1 |

0.451 |

3.1 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.5% 15-Apr-30 |

Apr-14 |

12.1 |

4.0 |

|

3.6 |

91% |

0.4 |

+/- 2% |

0.4 |

0.1 |

|

DBR 5.5% 04-Jan-31 |

Oct-00 |

17.0 |

5.6 |

0.525 |

5.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-34 |

Jan-03 |

20.0 |

6.6 |

0.700 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4% 04-Jan-37 |

Jan-05 |

23.0 |

7.6 |

0.793 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-39 |

Jan-07 |

14.0 |

4.6 |

0.853 |

4.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-40 |

Jul-08 |

16.0 |

5.3 |

0.862 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 3.25% 04-Jul-42 |

Jul-10 |

15.0 |

5.0 |

0.927 |

5.0 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.5% 04-Jul-44 |

Apr-12 |

25.0 |

8.3 |

0.997 |

7.7 |

93% |

0.6 |

+/- 1% |

0.8 |

0.3 |

|

DBRI 0.1% 15-Apr-46 |

Jun-15 |

8.0 |

2.6 |

|

1.8 |

68% |

0.8 |

+/- 2% |

1.1 |

0.1 |

|

DBR 2.5% 15-Aug-46 |

Feb-14 |

25.5 |

8.4 |

1.025 |

7.1 |

84% |

1.4 |

+/- 1% |

1.8 |

0.3 |

|

DBR 1.25% 15-Aug-48 |

Sep-17 |

10.5 |

3.5 |

1.064 |

0.8 |

24% |

2.6 |

+/- 2% |

2.7 |

0.1 |

|

Italic = index-linked |

Total |

47.5 |

4.8 |

|||||||

|

Yield below Depo Rate |

||||||||||

|

Yield above Depo Rate |

Bund WAM |

9.1 |

Any questions? More than happy to run you through the numbers in detail.

Best wishes

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

**** MULTI ASSET UPDATE : Its been a TOUGH few weeks with some of the market CALLS but slowly they are ALL coming together. ****

Not sure if this update is becoming too frequent but given a lot of the components are moving I think its worthwhile.

It’s been a TOUGH few weeks with some of the market CALLS but slowly they are ALL coming together.

BEWARE, THE PERFECT STORM has potential.

The bond yield lower story was definitely “on the ropes” but now has potential.

IT FEELS LIKE WE ARE COILING FOR AN EXPLOSIVE TIME.

Italy hits the 61.8% ret 3.396

Topics PAGES

- CORE FX 02-13

- USD EM (Opportunities) 14-26

- Stocks 27-37

- Bonds 38-56

- US Curves 57-69

***** I am more than happy to have a call and walk through the above piece and its opportunities. *****

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

*** PLEASE READ **** MULTI ASSET UPDATE-What a difference 24 hours makes : The “EXPLOSIVE” quarter end is here, we just have to CAPITALISE on the openings.

**********I would not normally send a multi asset update following yesterdays piece but todays LATE QUARTER activity is KEY !!!!!!!!!!! ************

**********THIS IS A PRO-FOUND STATEMENT DAY!************

We are getting the EXPLOSIVE quarter end the charts had been looking for, the day isn’t over yet and this KICK STARTS the LOWER YIELD CALL, WEAKER EURO and hopefully WEAKER STOCKS. DON’T IGNORE today, many levels to watch for.

MULTI ASSET UPDATE-What a difference 24 hours makes :

The “EXPLOSIVE” quarter end is here, we just have to CAPITALISE on the openings.

ITALY has shifted the spotlight on the EURO as on the week it has FAILED!

I have only included charts I think PROMINENT for today’s reversal.

*********AM HAPPY TO DISCUSS ANY ASPECTS OF THIS PIECE.********

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

*****POST FED MULTI ASSET UPDATE : I THOUGHT IT BEST TO UPDATE ALL ASCPECTS OF THE MARKETS POST THE FED. *****

**IDEALLY THIS IS WORTH DISCUSSION SO FEEL FREE TO SHOUT FOR A CALL.**

POST FED MULTI ASSET UPDATE :

I THOUGHT IT BEST TO UPDATE ALL ASCPECTS OF THE MARKETS POST THE FED. EM HAS DONE VERY WELL AND DO WE NOW GET A US BULL STEEPENER.

AM HAPPY TO DISCUSS ANY ASPECTS OF THIS PIECE.

THE EXPECTATION IS AN “EXPLOSIVE” END TO THE MONTH AND QUARTER END WITH FEW POSITIONED FOR WHAT MIGHT HAPPEN.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

PRE FED BOND UPDATE : DO KEEP AN OPEN MIND. MANY DAILY YIELD RSI’s MATCH THE MAY 2018 DROP, COINCIDING WITH THE TOP OF RANGES!

BOND UPDATE :

DO KEEP AN OPEN MIND. MANY DAILY YIELD RSI’s MATCH THE MAY 2018 DROP, COINCIDING WITH THE TOP OF RANGES!

This has been a massive NEMESIS of mine, BUT and not to be sounding like a broken record BEWARE YIELDS may still DROP, violently! MOST daily RSI’s are at May levels where yields STALLED previously, so the top of the yield range MAY HOLD!

That said this is the LAST LOCATION to see US yields STALL, therefore a week to LOAD UP on UPSIDE BOND PLAYS or VOL increase.

** TRADE IDEAS **

Previous trades

Buy RXV8 162.50/163.50 Call spread @ 3 ticks 5 Delta (Now offered @ 1.0).

Buy RXV8 162.00/163.00 Call spread @ 5 ticks 8 Delta (Now offered @ 1.0).

NEW trades

Buy RXX8 160.50/161.50 Call spread @ 17 tics Bund ref 159.18 (Now @5)

Buy TYX8 120.00/121.00 Call spread @ 9 tics TYN8 ref 119-06 (Now @4)

Buy TYX8 120.50/121.50 Call spread @ 5 tics TYN8 ref 119-06 (Now @1)

Buy FVX8 113.25/113.75 Call spread @ 4 tics FVN8 ref 112-20+ (Now @2)

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris