EQUITY UPDATE PRE-FED : The longer-term charts STILL maintain HIGH and very DISLOCATED RSI’s. It is decision time for European stocks post the latest bounce, MANY need to fail their current levels into quarter end.

Equities : The longer-term charts STILL maintain HIGH and very DISLOCATED RSI’s. It is decision time for European stocks post the latest bounce, MANY need to fail their current levels into quarter end.

A good time to get short if not already as the stop is tight.

** Buy DAX OCT 12000-11800 Put spread 35.00 (Now 23.0).

** Buy FTSE OCT 7350 – 7250 Put spread 23.5 (Now 14.5). Could sell FTSE with a stop above the 7531 level.

One thing to point out is “BLOCKCHAIN”, this could affect valuations going forward of MANY multinationals especially TECH. (AIRBNB, UBER etc).

Nasdaq daily : We NEED to fail FROM HERE, we are outside the channel but realistically need to breach the TREND FRIEND moving average 7899.

We do now have more fundamentals looming as Mr Trump has the TECH sector in his SIGHTS. Only a matter of time!

US stocks continue to grind higher this DESPITE ALL quarterly and monthly RSI’s being 1896, 1999 and 2000 extensions. We now have a MARKED disparity with the US, how long can it LAST?

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Three: that's the magic number. Time-sensitive OTC trade ideas in EUR, USD and GBP

Hello … here are three trades (one each in EUR, USD and GBP) that are interesting me right now. I’ve kept the write-ups brief, but they will give a flavour of my thinking. All are very timely given Draghi’s comments in Europe, the imminent FOMC meeting and the ultra-long supply coming in the UK over the next week or so. All and any comments welcome as usual!

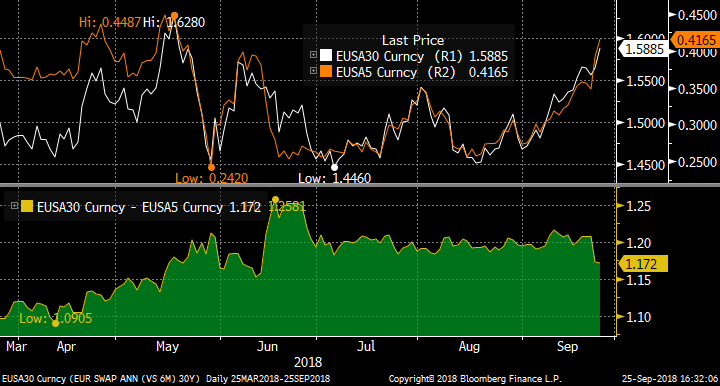

1. EUR: Buy 1m5y straddles, sell 1m30y straddles: Changing ECB expectations will drive the curve in the near-term

Buy EUR 203mm 1m5y atmf straddle (k=0.443%)

Sell EUR 42.2mm 1m30y atmf straddle (k=1.595%)

Strike entry at 115.2 bp vs 117.1 spot

For a premium of 0.4bp running (mid indic)

EUR 100k/bp equivalent at expiry

The recent Draghi comments on a “vigorous pick-up in underlying inflation” yesterday (Monday) drove a sharp sell-off in EUR rates. Praet’s attempt to dampen the market’s hawkish reading have not stemmed the move, with 2y1y almost 10bp higher than Friday’s close. The belly of the curve has underperformed as 5y/10y rates have led the way, with the 5y-30y spot curve bear-flattening and taking it out of the becalmed directionless range of the summer.

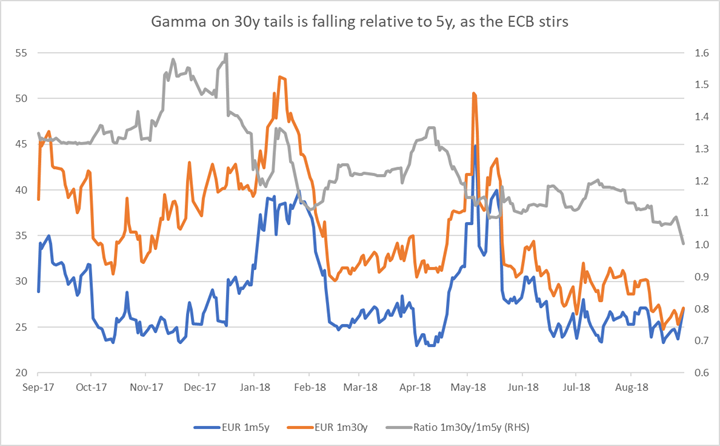

The theme of this trade is therefore momentum-based: in the near-term, ECB speculation will continue to increase the volatility of 5y rates compared to 30y. The chart shows how gamma on 30y tails is still decreasing, while 5y gamma has found a floor.

Source: CitiVelocity

So with 5y leading 30y, I see the curve bull-steepening back in a relief rally, or bear-flattening further if the hiking genie escapes from the bottle. Either way, the trade then is to buy 1m5y straddles, funded by selling 1m30y. The 1-month expiry takes us up to the next ECB meeting on 25th October, and spans the next release of the ECB minutes.

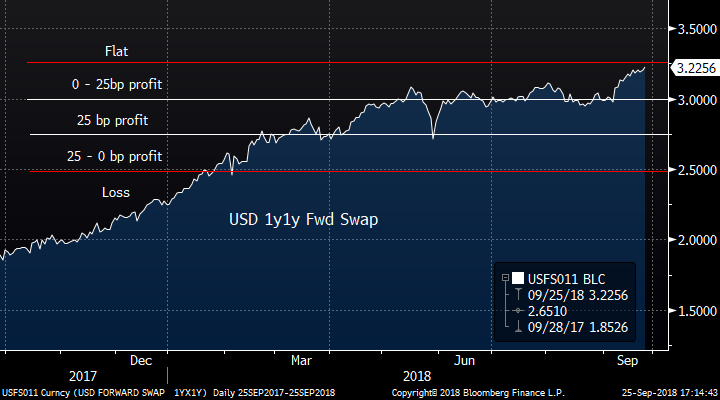

2. USD: Buy 1y1y1y receiver ladders: Position for a modest reduction in Fed expectations

Buy USD 1.05bn 1y1y1y mid-curve receiver k=3.25%

Sell USD 1.05bn 1y1y1y mid-curve receiver k=3.00%

Sell USD 1.05bn 1y1y1y mid-curve receiver k=2.75%

Atmf at 3.23%

For premium take out of 1bp running (mid indic)

USD 100k/bp equivalent at expiry

In the past month the market has added almost another 25bp hike to the terminal rate for US Libor, which had been stalled at 3%. The US economy is doing fine, so I am not saying this is unwarranted, but it does make me look for low-cost trades for a mild reversal. This suggests mid-curve receiver ladders, with relatively wide strikes. There are numerous combinations of expiry, forward rate and strikes, but as an example, I’ve priced 1y expiry ladders on 1y1y fwd with 25bp strike intervals.

The bottom line is that as long as the 1y1y rate in a year’s time expires above 2.50% (ie fewer than three hikes have been taken out of the Fed hiking path) the trade at least nets the premium taken out at inception, with a maximum profit of 25bp. In the meantime, if expectations remain steady the trade will show positive mark-to-market as the out-of-the-money strikes become less valuable. The risk is that there is a catastrophic reversal in the fortunes of the US economy and the Fed only hikes once or even reverses course.

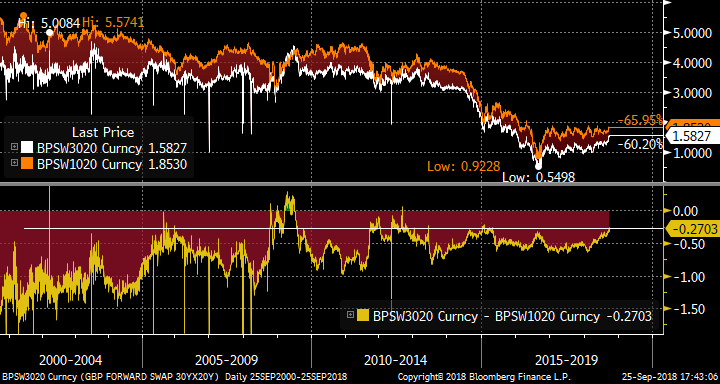

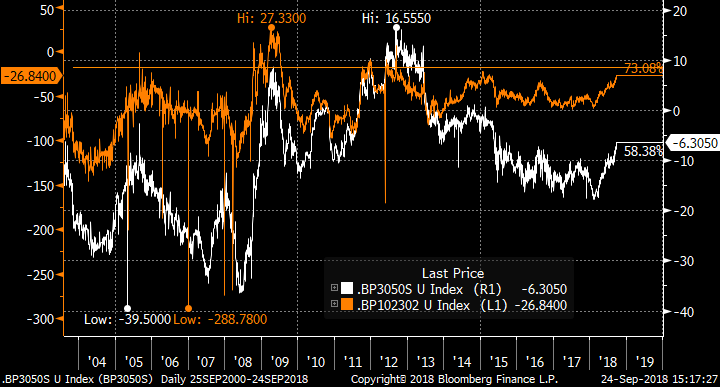

3. GBP: Flattener on 10y20y/30y20y in swaps: Forthcoming ultra-long supply will be well-received at these yield levels

Pay GBP 68mm 10y20y fwd swap (20y rate, starting in 10y)

Recv GBP 90.5mm 30y20y fwd swap (20y rate, starting in 30y)

at -26.5bp

DV01 of EUR 100k/bp

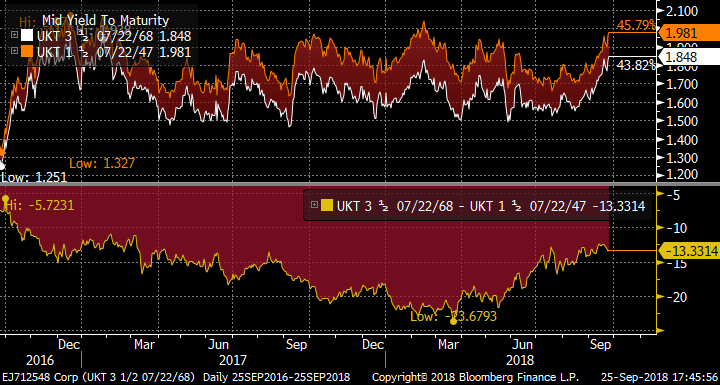

As I mentioned in my latest portfolio update, the steepening of the 30y-50y sector of the UK curve has pushed the 30y20y forward rate to its historical highs (absent ‘08/’09). This is tied up inextricably with the forthcoming ultra-long supply.

Chart of the spread (yellow) of the 10y20y / 30y20y rates in GBP:

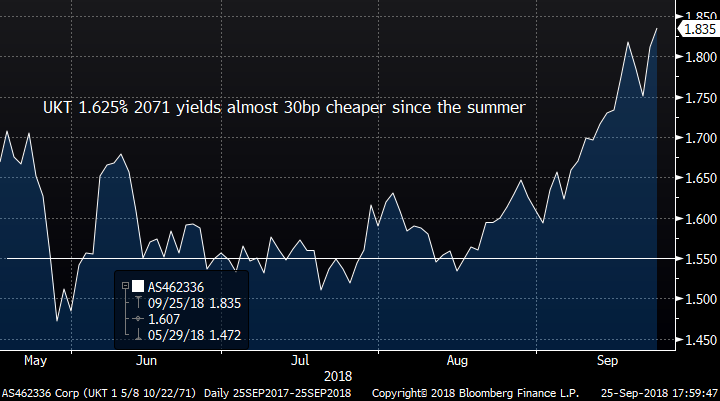

The steepening is closely connected to the UKT 30y – 50y Gilt curve, as we approach the re-opening syndication of the UKT 1.625% 2071 conventional Gilt on or around 9th October (our estimate). Before that we the possible sale by Prudential of 33NC13 and 50NC30 paper, maybe as early as tomorrow (Weds) and the size of these books will be a good guide to ultra-long demand. Our anticipation is that the 71 supply will be oversubscribed by real-money investors given the high absolute yield levels after a 30bp sell-off since the summer.

UK 30y-50y conventional Gilt curve has been steepening into the supply event, and yields are now close to their historic peaks:

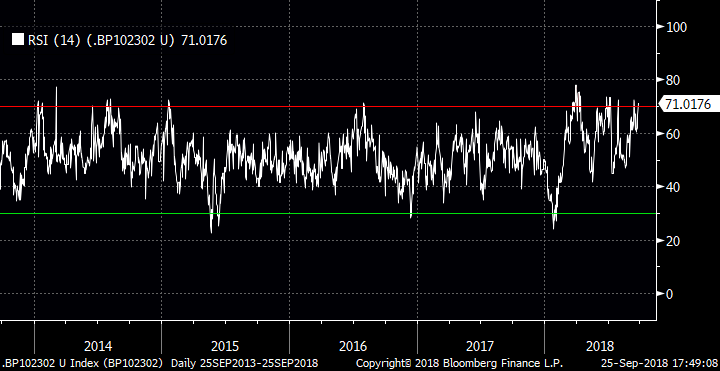

For the technically-minded, the RSI of the 10y20y/30y20y is into overbought territory (thanks to Chris Williams for this observation).

If any, or all of these trades are of interest, please get in touch!

Best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

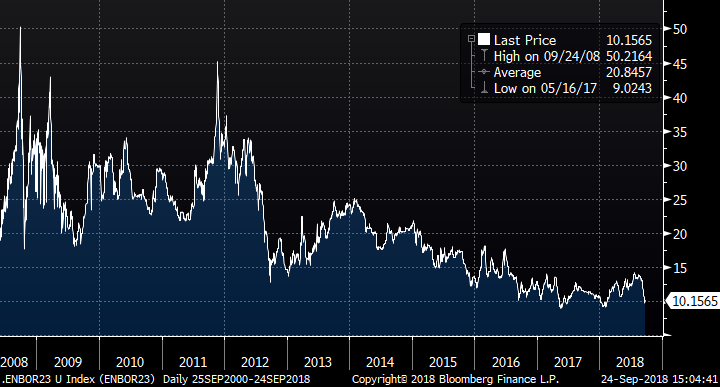

US CURVES AHEAD OF THE FED : EXPECT THE UNEXPECTED! ALL US curves have BASICALLY HELD in some way shape or form, that despite various outright shifts.

US CURVES AHEAD OF THE FED : EXPECT THE UNEXPECTED!

ALL US curves have BASICALLY HELD in some way shape or form, that despite various outright shifts. We continue to have significantly extended LOW RSI’s and HOLD the MULTI YEAR 76.4% retracements.

The FED should give us the next set of clarity but FORM a situation where CURVES generally steepen?

** BIG question is, the charts are looking for a BASE and SUSTAINED steepeners, DOES that mean yields have to head LOWER?! Chart 14.

It is a TOUGH call on market direction BUT the TECHNICAL CURVE STEEPENER seems likely!

The BACK END US CURVE seems the most OPTOMISTIC for a steepener so ADDING 2 new positions.

**Buy US 2-30 curve at 36.418, sell stop 26.oo and ADD above 51.00** NOW 39.939.

**Buy US 10-30 curve at 14.426, sell stop 11.oo and ADD above 21.00** NOW 13.275.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

EM to the RESCUE! MANY USD-EM crosses now have SIZEABLE long-term tops forming. I think it is a combination of EM relief that the Turkey-Argentina situation is improving and the DXY losing momentum, more bias on the former for influence.

- EM to the RESCUE!

- MANY USD-EM crosses now have SIZEABLE long-term tops forming. I think it is a combination of EM relief that the Turkey-Argentina situation is improving and the DXY losing momentum, more bias on the former for influence.

- Positions :

- December 107.00 Puts for 35.0 ticks (Now 1.50/2.00).

- October 112.50 Puts for 17.0. (Now 0.00/1.00).

- **POSITION CLOSED SHORT DATED PUTS say EUR USD SEP 1.1400 Puts 21.0/22.0 Currently (116.0/118.0) Ref Sep future 1.1361, take 50% profit on the position.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Shadow OTC Portfolio 24th Sept

YTD P&L: USD +1148k

Summary: The portfolio P&L has edged ahead since the last update (13th Sept) as today’s Draghi comments send short-dated EUR rates higher, helping the EUR 1x2 payer spread on 3y2y. The GBP curve has steepened a shade, and I am closing out the GBP 2y-10y vs USD CMS Caps trade for a loss: the USD strike is well out of the money, while the GBP strike (which I am short) is getting uncomfortably close. As a new trade I have added a long in EUR 2y3y 6s3s basis vs 5y5y (see previous write-up).

Other trades on the radar:

I’m certainly not alone in nothing the wide SEK/EUR spread in forward space (eg 1y2y). This widened out on the latest Riksbank comments, making the spread attractive given the very sizeable rolldown. Having peaked at 24bp, this spread has come back to 21.5 so it looks like I have missed the boat on this for now.

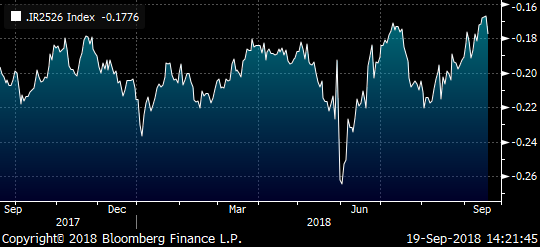

Elsewhere, EONIA-BOR basis has come in sharply, taking forwards (eg 2y3y in the chart) down to revisit the lows since the GFC. I’m not in a huge rush to get long here, preferring to revisit if the basis touches 9bp.

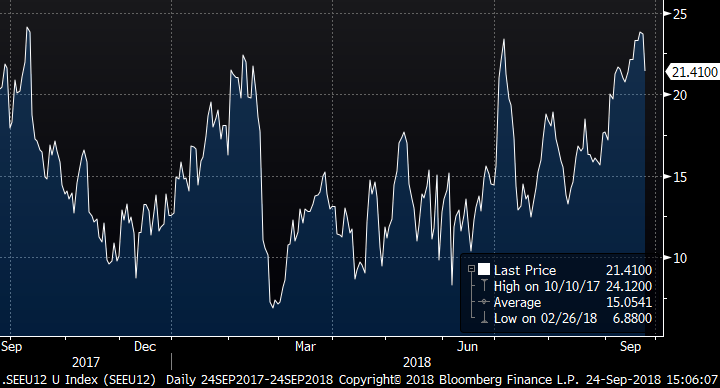

The long-end of the GBP curve has been getting some attention, as the 30y-50y spread in swaps steepens. We have the UKT 1f 71s syndication on the horizon (probably on Tues 9th Oct) which could prove the catalyst for a reversal, given the relatively high absolute yield on the bond. The swap curve is still steepening: I’ve been tracking the 10y20y / 30y20y spread (orange line in chart) which is more leveraged version (currently around -27bp): if this move continues (to say -20bp) before the syndication I’d be looking at the flattener (not least for the positive convexity).

Changes:

- Closed GBP vs USD CMS 10-2 cap spread for 3bp loss

- Opened EUR 6s3s 2y3y vs 5y5y basis spread

|

Trade Idea |

Entered |

Level |

Size |

Status |

Exit/Current Level |

Exit Date |

P&L k USD |

|

US 2-10 steepener via CMS caps |

28-Dec-17 |

0 bp |

USD 25 k/bp |

CLOSED |

0 bp |

15-Jan-18 |

0 |

|

RX/UB ASW Box |

28-Dec-17 |

-6.1 bp |

EUR 50 k/bp |

CLOSED |

-5.2 bp |

06-Mar-18 |

-56 |

|

EUR 1y3y/5y5y Mid-curve flattener |

28-Dec-17 |

13.7 bp |

EUR 20 k/bp |

CLOSED |

29 bp |

31-Jan-18 |

380 |

|

GBP 1y1y1y MC Payer spread |

28-Dec-17 |

0.7 bp |

GBP 25 k/bp |

CLOSED |

-1 bp |

31-Jan-18 |

-60 |

|

EUR 9m1y1y/9m1y5y Bear Flattener |

28-Dec-17 |

4.2 bp |

EUR 25 k/bp |

CLOSED |

0 bp |

30-Jan-18 |

-130 |

|

Receive GBP/USD 5y5y xccy basis |

28-Dec-17 |

1 bp |

GBP 40 k/bp |

CLOSED |

6.4 bp |

28-Feb-18 |

-297 |

|

EUR 2-5-10 weighted swap fly |

28-Dec-17 |

-28.1 bp |

EUR 40 k/bp |

CLOSED |

-25 bp |

25-Jan-18 |

-154 |

|

GBP 2y-10y Bull-steepener |

05-Jan-18 |

0 bp |

GBP 20 k/bp |

CLOSED |

2.5 bp |

31-May-18 |

66 |

|

EUR 2y2y/5y10y Bull-Steepener |

30-Jan-18 |

0 bp |

EUR 25 k/bp |

CLOSED |

4 bp |

05-Mar-18 |

123 |

|

USD 2y-10y, 1y fwd steepener |

02-Feb-18 |

22 bp |

USD 25 k/bp |

CLOSED |

20.5 bp |

21-Feb-18 |

-38 |

|

GBP/USD 2y-10y 1y fwd Swaps |

21-Feb-18 |

-25.5 bp |

GBP 25 k/bp |

CLOSED |

-10.8 bp |

23-Mar-18 |

521 |

|

GBP 2y-10y vs USD CMS Caps |

21-Feb-18 |

0 bp |

GBP 25 k/bp |

CLOSED |

-3 bp |

24-Sep-18 |

-99 |

|

EUR 3y1y/10y10y flattener |

06-Mar-18 |

124 bp |

EUR 25 k/bp |

CLOSED |

120 bp |

08-Mar-18 |

123 |

|

EUR CMS 10-5 collar |

06-Mar-18 |

0.5 bp |

EUR 40 k/bp |

OPEN |

-0.3 bp |

-38 |

|

|

GBP 10-30 vs 2y1y |

27-Mar-18 |

29 bp |

GBP 40 k/bp |

CLOSED |

33.8 bp |

09-Apr-18 |

271 |

|

EUR 3y1y/5y5y bear steepener |

12-Apr-18 |

0 bp |

EUR 40 k/bp |

CLOSED |

0 bp |

14-Jun-18 |

0 |

|

GBP/USD 2y-10y, 1m Floors |

20-Apr-18 |

0.6 bp |

GBP 25 k/bp |

CLOSED |

0 bp |

21-May-18 |

-20 |

|

EUR 2y1y/10y10y Bear Flattener |

20-Apr-18 |

-0.5 bp |

EUR 25 k/bp |

CLOSED |

4 bp |

04-Jun-18 |

132 |

|

EUR 2y1y/5y5y Bull Steepener |

17-Jun-18 |

0 bp |

EUR 40 k/bp |

CLOSED |

4 bp |

13-Sep-18 |

187 |

|

EUR 3y2y 1x2 Midcurve Payers |

27-Jun-18 |

0 bp |

EUR 25 k/bp |

OPEN |

5.4 bp |

159 |

|

|

GBP 6m2y1y Payer Ladder |

28-Aug-18 |

2.5 bp |

GBP 20 k/bp |

OPEN |

2.9 bp |

11 |

|

|

GBP 3m CMS 10-2 Cap Fly |

28-Aug-18 |

4.5 bp |

GBP 25 k/bp |

OPEN |

7.5 bp |

99 |

|

|

EUR 6m 2y3y/5y5y Bull Steepener |

30-Aug-18 |

-1.25 bp |

EUR 25 k/bp |

OPEN |

-0.7 bp |

16 |

|

|

USD 2y-30y / 5y-10y Steepener |

11-Sep-18 |

0 bp |

USD 50 k/bp |

OPEN |

-0.6 bp |

-30 |

|

|

EUR 6s3s 2y3y vs 5y5y |

11-Sep-18 |

0 bp |

EUR 250 k/bp |

OPEN |

0.1 bp |

-20 |

|

|

Total YTD |

1148 |

||||||

|

Note on trade sizing: Each trade is sized to generate approx. USD 150k 2y 99% hist. VaR at inception with no netting |

|||||||

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Italy trade idea - James Rice @ Astor Ridge

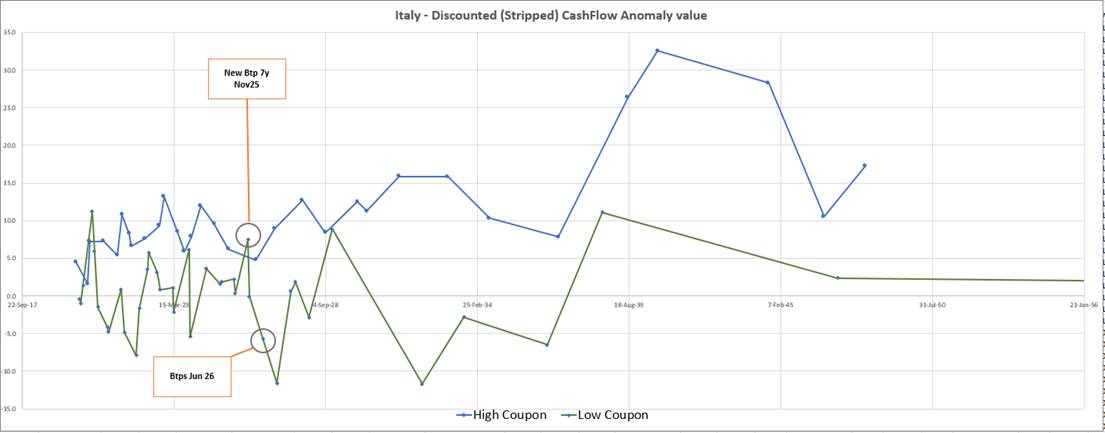

Trade idea – New Italian 7y Btps 2.5% Nov 25, cheap given medium coupon

One of the classic issues with Bond RV is ‘clean up on aisle 3’. By that, I mean finding value ways to absorb new supply as the marginal buyer when RM is somewhat absent from the market

Trade Mechanics

Buy €100,0MM Btps 2.5 Nov25 – Dv01 €64,7k/01

Sell €102,6MM Btps 1.6 Jun26 – Dv01 €68,6k/01

non duration neutral (≈6% diff) to compensate for curve and coupon diff

Actual yield spread: @ 2.1bp

Weighted index/spread: Nov25 – 1.06*Jun26 @ -12.4bp

Trade History – using dec25 instead of nov25 (new issue)

YIELD[BTPS 2 12/01/25 Corp] - 1.06 * YIELD[BTPS 1.6 06/01/26 Corp]

Rationale

- The trade evolved by stringing together two different trades –

- selling Btps 1.6% Jun26 to buy Btps 4.5% Mar26

– but then additionally

2) selling Btps 4.5% Mar26 to buy Btps 2.5% Nov25

- The new 7y Btps Nov25 is cheap on the curve based on its cashflows (vs smoothed strip curve) – see Italian Bonds vs Fitted Strip Curve

- The new 7y Btps Nov25 also has a lower coupon than similar maturity, richer issues – it embodies a default option at a lower cost than the higher coupons

- The low coupon 1.6% Jun 26 is rich after accounting for its lower coupon

- The duration difference is based on a 200 day regression to compensate for the directionality and coupon difference in how the more seasoned bonds trade

Graphs

Italian Bonds vs Smoothed Strip Curve – cash flows discounted at unique Italian discount rates

High coupons, when correctly valued by stripping their constituent cash-flows, trade cheaper than the low coupons. When a low coupon is cheaper, we are truly buying the default option at zero cost

Carry & Roll: /3mo

Carry: Flat (non-Duration neutral)

+0.7bp (Duration)

Roll: +0.2bp (non-Duration neutral)

+0.4bp (Duration)

Risks

- The modality of the curve and high coupon effects changes the correct hedge ratio away from 6%

- The Jun26 stay rich as a low coupon

- The Nov25 as an ongoing tap bond remain cheap

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Today's Technicals Rundown > Fri Sep 21st

US:

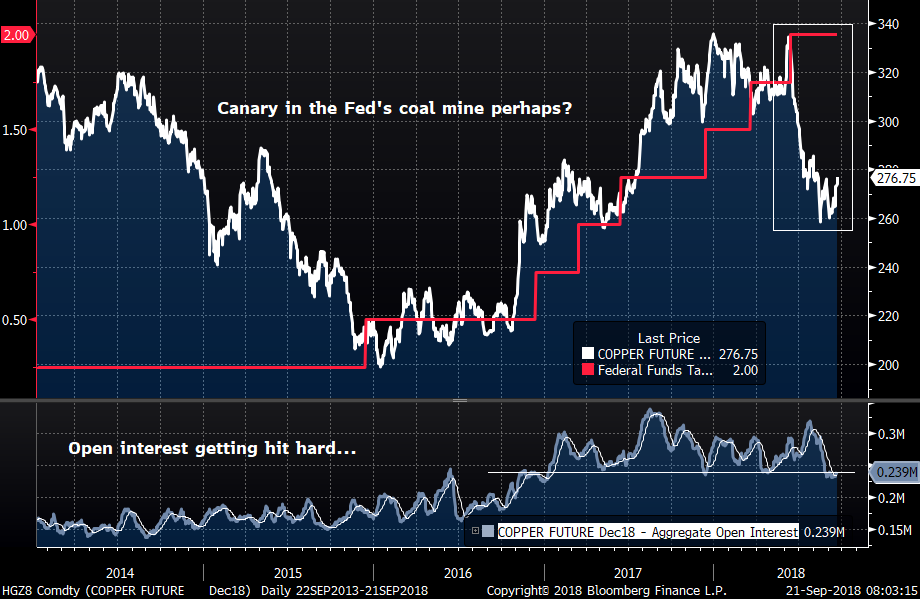

We were talking about copper this morning, about how it’s vital for the production of electric cars. As an industrial metal, demand for copper is considered a key barometer of economic momentum, especially in manufacturing. The chart below is a simple daily copper chart going back 5yrs (white line) with the Fed Funds target rate overlaid (red). We can see that the bottoming of copper back in early 2016 coincided with the first rate hike following the financial crisis which accelerated from Oct ’16 onwards.

Following the last rate hike copper got clobbered, retracing over 50% of the rally since 2016. We can debate the root cause of this pullback, however, one could argue that this stalling of demand for copper could have a bearing on the FED’s decision to continue to raise rates well into 2019.

EUROPE:

BTPs… If you’ve been involved in BTPS over the last several months, you’re probably well aware of the mayhem going on in the IKA contract and the current CTD, the BTPS 4.85 9/28s. In a nutshell, the supply of repo for the BTPS 9/28s has basically vanished over the past 6 weeks, due in part to a shortage of collateral. There’s a debate raging on the source of that shortage – official or private – but needless to say, it has crated havoc with the BTPs contract and, by extension, impaired liquidity dramatically across the curve. This is an interesting chart brought to my attention yesterday by a pal of mine, illustrating just how nuts this has become. This is about as tight as a BTPS fly gets at 2/28-9/29-12/28 – it shows that the BTPS 9/28s have richened 14bps since late August, dealing a blow to IKZ8 shorts. This is far from over…

UK:

We’ve been leaning a bit more hawkish/bearish/flattener than the consensus lately and it’s been well timed. While we maintain that bias on a medium term basis, given our hopes (prayers…?) of a positive outcome for Brexit, we are also mindful of not only the hurdles ahead (talks this week in Austria still showing deep divisions), we are also mindful of the significance of overcooked momentum and positioning. With the 10yr supply out of the way and no supply longer than 5yrs until the syndicated tap of the UKT 10/71s in early October (we’re thinking the 9th), the market could see a bounce from this key support level.

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

**PLEASE READ ** Presentation : I have put this together for a client, it is MULTIASSET and TIES in MANY aspects so well WORTH A READ and DISCUSSION.

This encompasses CORE FX, EM FX, BONDS, US CURVES, EQUITIES AND COMMODITIES

The THEMES to take away are :

LESS USD emphasis to a degree.

BIG, WEAKER USD vs EM trades.

BOND YIELDS hitting previous yield highs and DAILY calling for a STALL.

US CURVES a BARGAIN historically and should steepen! I still favour a BULL STEEPENER if yields STALL.

STOCKS IN EUROPE failing but US STOCKS a PUZZLE given the HISTORICAL RSI dislocations.

And COMMODITIES pretty neutral with SMALL positive BIAS.

ONCE read and digested am more than happy to follow up with a call.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

US CURVE UPDATE : US curves have seen a SET BACK but many remain on major RSI dislocation and CURRENTLY surviving recent lows.

US CURVES :

US curves have seen a SET BACK but many remain on major RSI dislocation and CURRENTLY surviving recent lows.

They seem to be waiting for the next YIELD DROP.

The BACK END US CURVE seems the most OPTOMISTIC for a steepener so ADDING 2 new positions.

**Buy US 2-30 curve now at 36.418, sell stop 26.oo and ADD above 51.00** NOW 35.357.

**Buy US 10-30 curve now at 14.426, sell stop 11.oo and ADD above 21.00** NOW 14.034.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

**PLEASE READ ***BOND UPDATE : We are currently at the LAST and VITAL level of YIELD resistance, its DECISION TIME. If the LEVEL holds then we ALSO need to see yields drop into quarter end.

BONDS : We are currently at the LAST and VITAL level of YIELD resistance, its DECISION TIME. If the LEVEL holds then we ALSO need to see yields drop into quarter end.

Although a tall order there is enough TRUMP-TRADE tensions to make things happen, IT WILL BE EXPLOSIVE.

The US yield chart RSI’s are VERY similar to those of the US STOCK, ALL at 1984, 2000, 2007 levels and REFUSNG to BUDGE! That said this is the LAST LOCATION to see US yields STALL, therefore a week to LOAD UP on UPSIDE BOND PLAYS or VOL increase.

It is NOW possible to include RSI’s on DAILY charts given we finally have EXTREMES.

** TRADE IDEAS **

Previous trades

Buy RXV8 162.50/163.50 Call spread @ 3 ticks 5 Delta (Now offered @ 1.0).

Buy RXV8 162.00/163.00 Call spread @ 5 ticks 8 Delta (Now offered @ 1.0).

NEW trades

Buy RXX8 160.50/161.50 Call spread @ 17 tics Bund ref 159.18

Buy TYX8 120.00/121.00 Call spread @ 9 tics TYN8 ref 119-06

Buy TYX8 120.50/121.50 Call spread @ 5 tics TYN8 ref 119-06

Buy FVX8 113.25/113.75 Call spread @ 4 tics FVN8 ref 112-20+

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris