MACROCOSM: Quick Eurozone/UK RV Thoughts

In no particular order…

BTPS...

> The pop higher in IKZ8 on the open has driven a bull steepening of the curve, led by the BTS contract. With 3/21-12/28s ~4bps steeper, our BTPS 23-25-27/28 bfiles are cheaper, back to last week's wides that prevailed into the pricing of the new BTPS 11/25s.

> Given the sizeable take-up in the BTPS 11/25s green shoes option (that took the outstanding notional to almost €4.9bln), we could see the 7yr sector languish a bit until dealers have lightened up. That said, the sector is still cheap in our view and if this bid in BTPS persists, we'd expect to see outright demand since the duration of most BTPS indexes is close to 7yrs. The new 11/25s have a mod dur of 6.43 while BAML's BTPS index is 6.31 (for ex).

> We're sticking with our constructive view here - adding to 7yr sector longs with a stop at 41bps and a target of 30bps (in the 23-25-27 version).

BELGIUM...

> Busy day for BGBs issuance with up to €3.9bln total of their BGB .2 23, .8 28, 1.6 47 and 2.25 57s on tap. Unless the is pre-funding for 2019, this is likely to be the last significant chunk of long BGBs this year.

> As a reminder, Belgium is rapidly closing in on their 2018 issuance target, all but finished with their 31bln needs after today's 3.9bln takes them to ~30bln.

> BGB-FRTR and BGB-NETHER sprds are probably the most common RV benchmarks for BGBs. Belgium has one of the longest YTD maturities of issuance in Europe at 14.6yrs but avg maturity of PSPP buying of 9.6yrs compensates for much of that.

> BGBs liquidity can be a challenge at times, limiting RV activity, however, it's never as bad as BTPS/SPGBs and at current spreads to core, there's ample juice to make them worthwhile.

> The 'obvious' trade, from both a liquidity and location standpoint is the simple short OATZ8 into BGB 6/28s sprd which remains elevated (see chart below). C&R flwos in OATs are big into late October so this is a 2-3 week trade.

> An alternative is NETHER 7/28s into BGB 6/28s although this sprd is 5bps off it's wides at +23bps this am.

> If u'd like more colour, pls let me know...

GILTS…

> Main event this week in the gilts market is the tap of the UKT 1F 10/28s which will take them up to around £16.5bln, about 2/3 of the way through their issuance cycle.

> As we highlighted last week, we continue to lean towards a flattening bias on the gilts curve and as the 10yr benchmark, these UKT 1F 10/28s could be an instrumental part of that view.

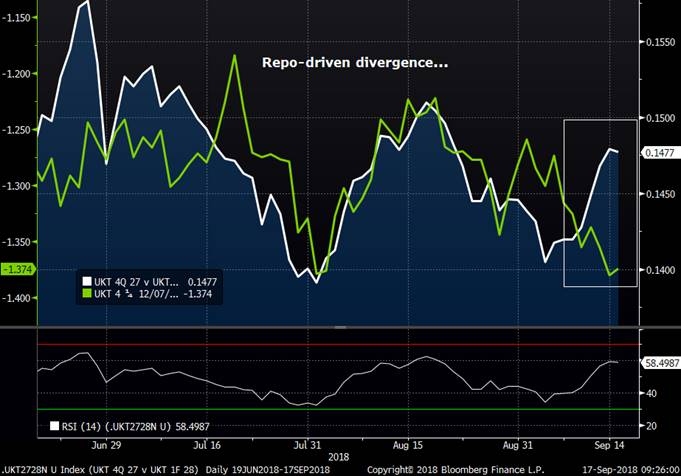

> The UKT 4Q 27 vs UKT 1F 10/28s roll has been a popular position with extension interest brisk in the +14.75-15.25bps range. With open interest in G U8 still huge at 91.5k, the market is concerned that this month’s delivery will dwarf the ~61.5k contracts delivered into G U7, putting pressure on UKT 4Q 27s repo levels. Considering tradeable float in the 4Q 27s is a mere £7.6bln after APF/DMO holdings and the ‘corridor’ between the DMO’s repo facility and base rates is 55bps post the last rate hike, the market has built a repo premium into the roll that supercedes the directionality this spread has exhibited over the past couple months (see chart below).

> UKT 4Q 27 repo opened at 45bps this am which is about 26bps through GC. If we assume that this repo bid could persist until the end of September, we can run the carry numbers until then. As you can see, even a 40bps+ differential until Oct 1 inly costs us .12bps over that span in negative carry which seems a small price to pay for the steeping we’ve seen in this spread, especially in light of the divergence vs yield levels. We expect to see good extension interest.

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

TECHNICAL VIEW : UKTI approaching multi year retracements and LOW RSI’s. Some back end LINKERS are approaching sizeable support and extended RSI’s.

UKTI approaching multi year retracements and LOW RSI’s.

Some back end LINKERS are approaching sizeable support and extended RSI’s.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

***** PLEASE READ ****BONDS and CURVES : Where does the LATEST yield rally STOP? Markets have sold considerably more than I have anticipated, with very little influence from other areas.

BONDS and CURVES : Where does the LATEST yield rally STOP?

Markets have sold considerably more than I have anticipated, with very little influence from other areas. It’s been a MONSTER liquidation BUT does that put us on a coarse for HIGHER yields? I still think NOT.

I have spent a lot of time discussing with REAL MONEY that this QUARTER END will be SPECTACULAR and LEAD US into a significant YEAR END!

The issue remains the QUARTERLY optimism toward LOWER yields.

US curves have also SET BACK but many remain on major RSI dislocation and CURRENTLY surviving recent lows. They seem to be waiting for the next YIELD DROP.

Am looking to ADD further OPTION ideas. The BACK END US CURVE seems the most OPTOMISTIC for a steepener so ADDING 2 new positions.

Positions :

Bunds have stalled but it’s time to BUY as the stop is tight and momentum for lower yields remains :

Ref RX Z8 160.41

Buy RXV8 162.50/163.50 Call spread @ 3 ticks 5 Delta (Now 0.0/2.0).

Or

Buy RXV8 162.00/163.00 Call spread @ 5 ticks 8 Delta (Now 1.0/2.0).

**Buy US 2-30 curve now at 36.418, sell stop 26.oo and ADD above 51.00**

**Buy US 10-30 curve now at 14.426, sell stop 11.oo and ADD above 21.00**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Equities : European equities continue SLIDE and no sign of any BASE, the picture looks BLEAK! The US markets will play CATCH UP in the end.

Equities : European equities continue SLIDE and no sign of any BASE, the picture looks BLEAK!

The US markets will play CATCH UP in the end.

** Buy DAX OCT 12000-11800 Put spread 35.00 (Now 82.0).

** Buy FTSE OCT 7350 – 7250 Put spread 23.5 (Now 44.5).

One thing to point out is “BLOCKCHAIN”, this could affect valuations going forward of MANY multinationals especially TECH. (AIRBNB, UBER etc).

We do now have more fundamentals looming as Mr Trump has the TECH sector in his SIGHTS. Only a matter of time!

US stocks continue to grind higher this DESPITE ALL quarterly and monthly RSI’s being 1896, 1999 and 2000 extensions. We now have a MARKED disparity with the US, how long can it LAST?

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

USD Curve: Opportunity for low-cost steepeners via CMS caps

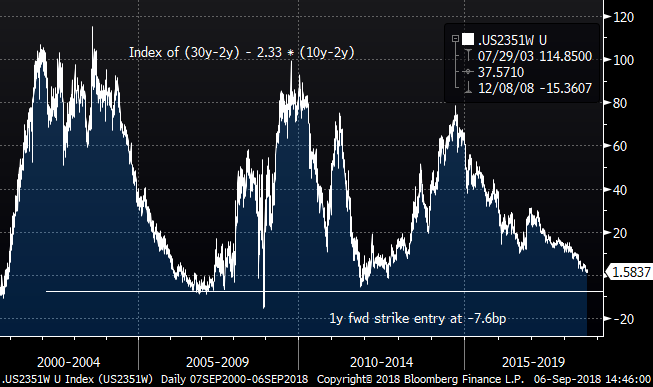

Bottom Line: This trade is a way of getting low-cost synthetic steepening exposure to the US curve without exposure to further flattening. The 2y-30y curve is unsurprisingly more volatile than the 5y-10y curve, but the market pricing of CMS spread options is out of line with the recent moves in the curve. Hence we can create a structure with a good correlation to the 2y-10y curve but at a significantly lower cost than buying an outright curve cap.

Trade:

Buy USD 1bn 1y-expiry Cap on CMS 30-2 atmf (k=+6.8bp)

Sell USD 2.33bn 1y-expiry Cap on CMS 10-5 atmf (k=+6.2bp)

For approx zero cost.

Index struck at -7.6bp vs spot index at +1.5bp.

Bloomi CIX: 100 * (USSW30 Curncy - USSW2 Curncy - 2.33 * (USSW10 Curncy - USSW5 Curncy))

Rationale: US curves are cyclically flat, and it is hard to look beyond steepeners as the way forward for the curve. The near-complete absence of term premium is out of kilter with the looming risks for the US and global economies: be they tariffs, EM weakness or growing deficits. However the history of the 2004-2007 period in US rates suggest that while curves may not flatten further from here, steepening is a slow-burn process. Forward curves are not meaningfully steeper than spot slopes so the roll-down benefits even on paper are not compelling.

In the best of all worlds I’d just like to own 1y caps on the 30y-5y CMS spread, but even though CMS spread vol is historically low these still cost around 17bp. Other alternatives are bull-steepeners through receiver swaptions, but the volatility surface is flattening and the bull/bear directionality is weakening, making the economics less attractive.

So the situation requires some creativity. In short, I am proposing buying CMS caps on the 2y-30y slope and a weighted amount of 5y-10y caps to generate a zero-cost structure. The current weighting (from cap pricing in the market) is a notional ratio of 30-2: 10-5 of 1:2.33. If I use this ratio in a CIX:

100 * (USSW30 Curncy - USSW2 Curncy - 2.33 * (USSW10 Curncy - USSW5 Curncy))

the result is in the chart. I have overlaid the US 2y-10y curve to show how the index is still steepens and flattens in line with the 2y-10y curve.

Or if you prefer, the two measures set 1y forward:

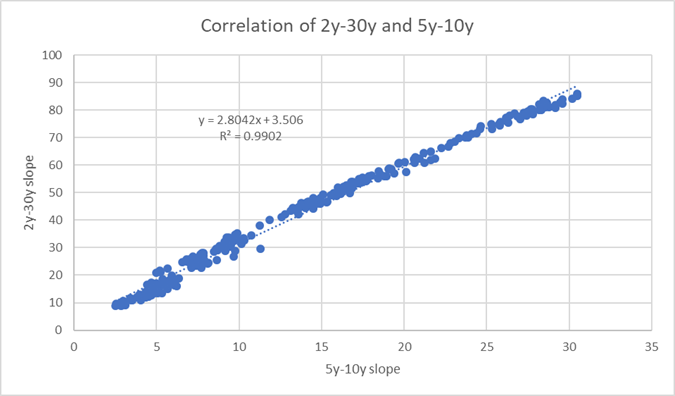

Why is this? Quite simply the realized beta between 2y-30y and 5y-10y is higher (at around 2.8x) than that given by the ratio of premia on the CMS caps. As a consequence a cap on 2y-30y can be fully funded by 5y-10y caps while retaining the steepening exposure. The chart shows the past year’s beta between the two curves.

Is this a free lunch? No. First, past regressions are not necessarily a guide for the future relative evolution of the curve sectors. Also, a large increase in volatility, with short rates anchored could lead to the 5y-10y sector steepening faster relative to 2y-30y than implied by the 2.33x weighting (cf 1-factor curve models). In addition, the CMS convexity adjustment is much larger for the Cap on 2y-30y than on 5y-10y. Thus the ATMF strike on the 1y cap on 2y-30y is around 4bp higher than the 2y-30y, 1y fwd spread in vanilla swaps. Thus the ATMF strikes put the index (2y-30y – 2.33x 5y-10y) at -7.6bp compared to -10bp using vanilla forwards. That said there is still positive roll to the spot index at +1bp. There is also the concern in the case of the 5y-10y cap that one is selling a historically cheap option, though in mitigation the same cheapness exists in the 2y-30y: the final chart at the bottom of this piece shows that the ratio of implied vols has been very constant.

One final aspect to being long the 2y-30y curve versus 5y-10y is the wildcard of increased 30y issuance. The US tax cuts have not been matched by spending curbs in the budget and Debt/GDP is increasing. It is not my central expectation, but I prefer to be long the tail risk of higher 30y rates rather than lower. As an aside, this is why I have avoided paying the 2y-10y-30y fly via spreads of caps (as it requires me to short the 10-30 cap).

I’d love to hear what you think … especially if I am missing something! I’ve added some background historical analysis of the US curve sectors below.

Best wishes,

David

Appendix: More detail on the evolution of 2y-30y and 5y-10y curves.

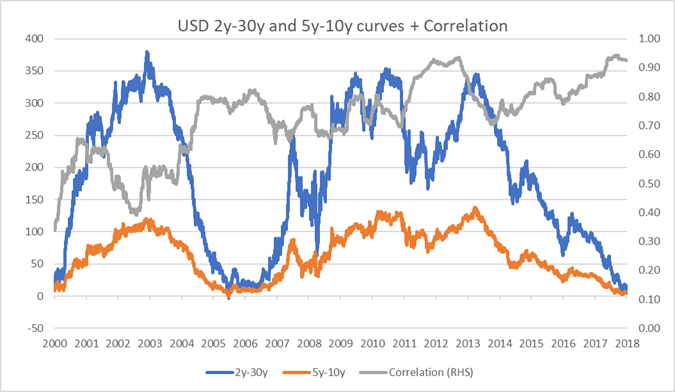

The following chart shows the USD 2y-30y slope and the intermediate 5y-10y slope. It is unsurprising that the two sectors are well correlated (on daily changes in slope, with a 1 year rolling window). It is also empirically apparent that correlation increases as curves flatten.

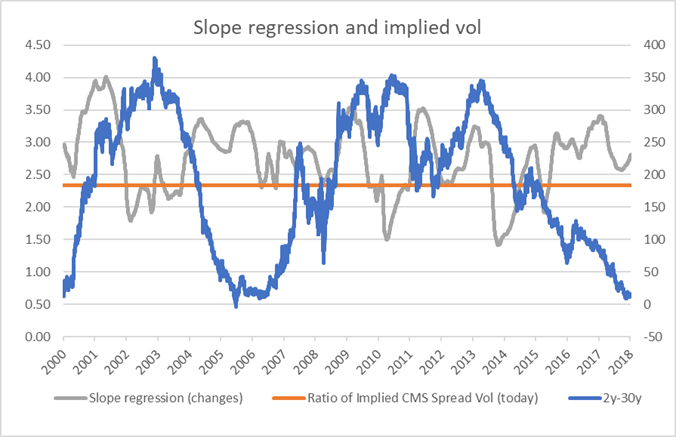

The next chart shows the historical regression of changes in the 2y-30y and 5y-10y curves. The 20-year average regression is around 2.8 (ie daily changes on 2y-30y are, on average 2.8 times those on 5y-10y). The current historical regression of the past 1 year of data is shown together with the current ratio of the implied vol from the market (the orange horizontal line).

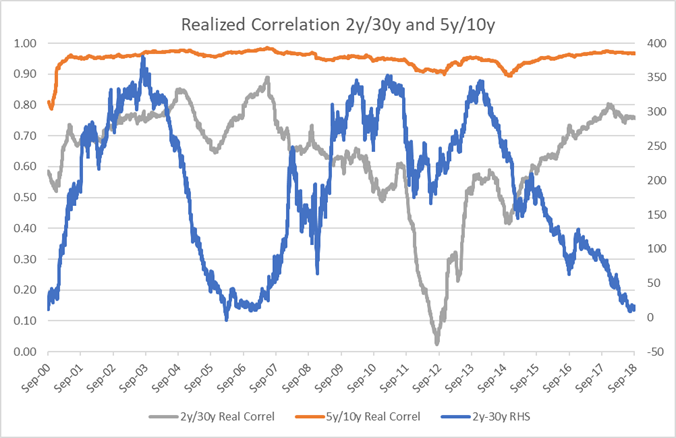

When it comes to CMS spread options, the valuations are based on the implied volatilities of the two legs, and the correlation between them. Generally the implied correlation in the option market is very close to the realized correlation for the same horizon. The chart leads to two (again not counterintuitive) observations that the correlation between 2y and 30y rates is much lower and more variable than that between 5y and 10y rates. Currently the 2y/30y correlation has locally peaked towards the high of the historical range.

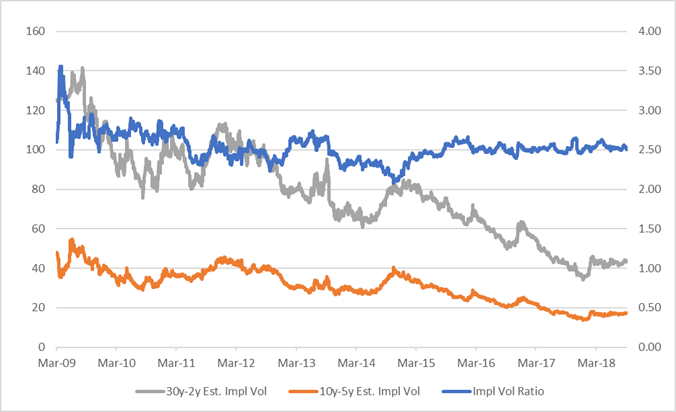

Finally, here is the estimated history of the 30y-2y and 10y-5y implied curve volatilities, using implied volatilities on the vanilla swaptions (1y2y, 1y5y etc) and the historical realized correlation. The ratio of implied volatilities has been remarkably stable for the past two years as vol has subsided.

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

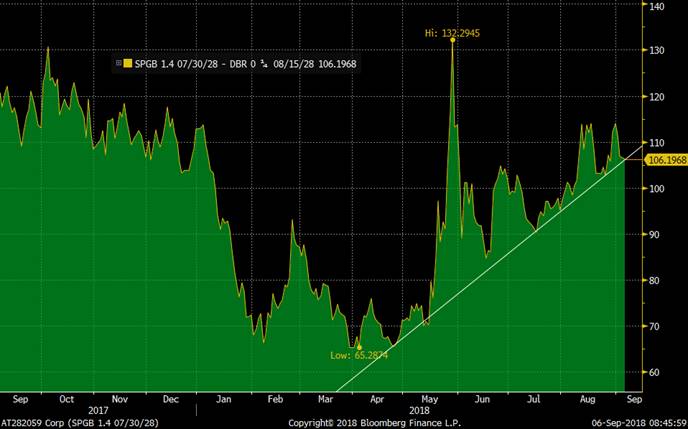

MICROCOSM: Spain Kicks off Busy AM for EGB/UKT Supply

SPAIN

- Broadly speaking, SPGBs are at a crossroads within the EGB universe.

- On the bearish side, their performance has been a ~40% beta of the moves in BTPS which leaves 10yr spreads to DBRs 40bps wider than their April lows. Concerns about EM contagion persist (with Spanish banks exposure to Turkey sizeable), even with positive noises out of Rome on their budget talks. Despite positive supply-driven seasonals in August, there was little sign of pent-up demand for Bonos.

- On the bullish side, Spain is in solid shape relatively speaking. After today’s taps they'll have just €26.6bn left to auction this year (7 auctions of EUR 3.8bln per auction) and at 12.5yrs their issuance has been one of the longest in Europe. After today’s 2048s tap they’ll have issued ~14.5bln 30yrs, the most in Europe, suggesting the ‘heavy lifting’ in SPGBs issuance has been completed and could leave them to focus on shorter issues like their 7yr (just 4bn YTD). With EUR 20.4bln redemptions and PSPP buying of around 2.5bln per month between now and Dec, net SPGBs supply for the remainder of the year will be slightly negative.

- As those who’ve tried to trade BTPS in the last three months will tell you, liquidity is just awful now. The shenanigans in IKU8/BTPS 9/28s have not only impaired liquidity across the BTPS curve but they've forced long term ‘non-predatory’ investors to the sidelines. Given a green light, those investors would jump at the chance of grabbing BTPS at current spreads to DBRs, however, DiMaio and Salvini have done little to earn their trust just yet. This leaves Spanish Bonos as the next best thing if one wants to make a ‘risk-on’ bet. Liquidity isn’t stellar in Bonos but it’s better than BTPS and they’ll certainly be less volatile.

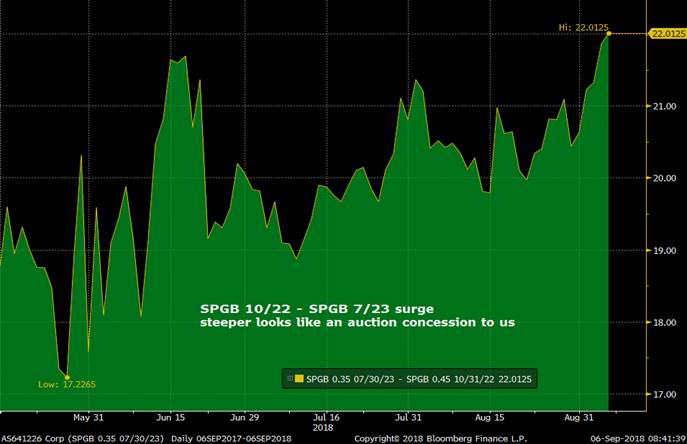

- SPGB .35 7/23s – Expecting ~1bln tap this am to take them to ~8.2bln outstanding, about half-way through their issuance cycle. The 5yr sector of the SPGB curve looks cheap into this am’s tap, the SPGB 1/21-7/23-4/25 fly back near recent wides. In addition, the SPGB .45 10/22 into SPGB .35 7/23 roll is at its wides (both yield and MMS box) at +22bps/11bps mid into this am’s tap. Given the equivalent spread in BTPS has flattened 10bps in the last 10 days, one could argue this spread is here because of this supply. Expect solid demand here.

SPGBs 1/21-7/23-4/25 fly – 7/23s cheap here

- SPGB 1.4 7/28s – Expecting 1.5-2.0bln to take them to 11.5-12.0bln. On a micro basis, the SPGB 10/27-7/28 sprd is back to its wides at +13.9bps mid and 10yr Spain remains near its wides vs 10yr BGBs, having retraced vs OATs into this am’s supply. SPGB 1.4 7/28 yield levels are within 1.5bps of their cheapest since first issued which should tempt real money.

SPGB 7/28 v BGB 6/28

- SPGB 2.7 10/48s – expecting 1.5-2.0bln to take them to ~9.0-9.5bln. This issue looks on the richer side of fair on the SPGB curve, showing little sign of any concession into this am’s tap. The SPGB 48-66s sprd, for example, hasn’t budged since the 48s tap was announced, stuck in a 27.5-28.0bps sprd ad infinitum. They are around 2.60% in outright yield, their cheapest level since mid-July so perhaps that’ll encourage demand. Cross market demand is probably where these 48s make most sense. Not for the faint hearted given liquidity constraints in some of these names but the IRISH 45s vs SPGB 48s, BGB 47s into SPGB 48s and FRTR 48s into SPGB 48s are all at/near their respective wides. Of these, we’d lean towards the OATS version given better liquidity and location.

FRTR 48s into SPGB 48s

Will be in touch!

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Equities : Further DECLINES in Europe as talk of German Banks being removed from various indices. The picture looks BLEAK and TOP IS IN!

I have updated Equities again given the new lows in some European markets.

Equities : Further DECLINES in Europe as talk of German Banks being removed from various indices. The picture looks BLEAK and TOP IS IN!

The US markets will play CATCH UP in the end.

** Buy DAX OCT 12000-11800 Put spread 35.00 (Now 63.0).

** Buy FTSE OCT 7350 – 7250 Put spread 23.5 (Now 31.3).

One thing to point out is “BLOCKCHAIN”, this could affect valuations going forward of MANY multinationals especially TECH. (AIRBNB, UBER etc).

We do now have more fundamentals looming as Mr Trump has the TECH sector in his SIGHTS. Only a matter of time!

US stocks continue to grind higher this DESPITE ALL quarterly and monthly RSI’s being 1896, 1999 and 2000 extensions. We now have a MARKED disparity with the US, how long can it LAST?

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Equities : Europe is in SERIOUS TROUBLE and close to a FAR BIGGER DROP. Surely the US market should be concerned, although performance remains positive the RSI’s remain steadfast at 2000 and 2007 dislocation.

Equities : Europe is in SERIOUS TROUBLE and close to a FAR BIGGER DROP.

Surely the US market should be concerned, although performance remains positive the RSI’s remain steadfast at 2000 and 2007 dislocation.

** Buy DAX OCT 12000-11800 Put spread 35.00 (Now 52.5).

** Buy FTSE OCT 7350 – 7250 Put spread 23.5 (Now 27.5).

One thing to point out is “BLOCKCHAIN”, this could affect valuations going forward of MANY multinationals especially TECH. (AIRBNB, UBER etc).

We do now have more fundamentals looming as Mr Trump has the TECH sector in his SIGHTS. Only a matter of time!

US stocks continue to grind higher this DESPITE ALL quarterly and monthly RSI’s being 1896, 1999 and 2000 extensions.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

***SPECIAL PIECE ***US CURVES : TIME TO HAVE THAT CONVERSATION ABOUT STEEPENERS! The charts below go a long way to highlighting a multi-year BASE, this should not be overlooked even if “technicals” aren't your thing.

US CURVES : TIME TO HAVE THAT CONVERSATION ABOUT STEEPENERS!

The charts below go a long way to highlighting a multi-year BASE, this should not be overlooked even if “technicals” aren't your thing.

We are VERY close to confirming an END TO THE US FLATTENER!

It will be one long steepener for many years to come, THUS requires plenty of discussion.

The back end curves 5-30 and 10-30 have BASED already and close to MAJOR confirmation.

ALL daily RSI’s remain NEUTRAL and hence have been left off.

I still think this will be a BULL STEEPENER, correlation isn’t great having made this statement BUT preciously it took time to change the yield direction.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

• FX UPDATE : The EURO looks to be failing post a period of consolidation similar to early 2018! AUD USD TRIGGERS stops having breached sizeable support at 0.7190.

- I know this follows yesterday’s update BUT the EURO and AUD are up for a BIG BREAK LOWER.

- FX UPDATE : The EURO looks to be failing post a period of consolidation similar to early 2018!

AUD USD TRIGGERS stops having breached sizeable support

at 0.7190.

USD EM has now become a frustration given the EM side has weakened and continues to do so.

- Positions :

- December 107.00 Puts for 35.0 ticks (Now 12.00/13.00).

- October 112.50 Puts for 17.0. (Now 15.00/16.00).

- **POSITION CLOSED SHORT DATED PUTS say EUR USD SEP 1.1400 Puts 21.0/22.0 Currently (116.0/118.0) Ref Sep future 1.1361, take 50% profit on the position.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris