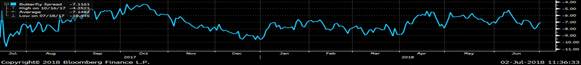

: Gilts 1t57s Looking cheap especially vs 4q49s & 2h65s..

With the recent revaluation of super-long Gilts on the curve the next auction issue 1.75% 2057s are getting to cheap levels on flies with the expression I like,vs 4q49s,there is a new Jan 2049 issue due to be launched via Auction in September & the longer wing 2h65s which will lose out to 2071s for duration & convexity funds with 3h68s likely to get protection from Income funds,currently all eyes on next weeks Linker 2041 syndication it may be worth looking at 1t57s & Personally I would expect them to be richer into the actual auction on the 19th July. Fly chart below- Entry anywhere close to -3bps target 7.5.. Stop 2. Carry & Roll:-0.3p for 3mths..  Please call if you agree or disagree

Please call if you agree or disagree

This marketing was prepared by George Whitehead, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

<< "The Past Is The Future Back To Basics" 02031434182-www.astorridge.com >>

BONDS and EURO UPDATE : PRE NON FARM levels to watch for, realistically though I regard the number as a NEWS event to prompt change/yields lower. Please open attachment

BONDS and EURO UPDATE : PRE NON FARM levels to watch for, realistically though I regard the number as a NEWS event to prompt change/yields lower.

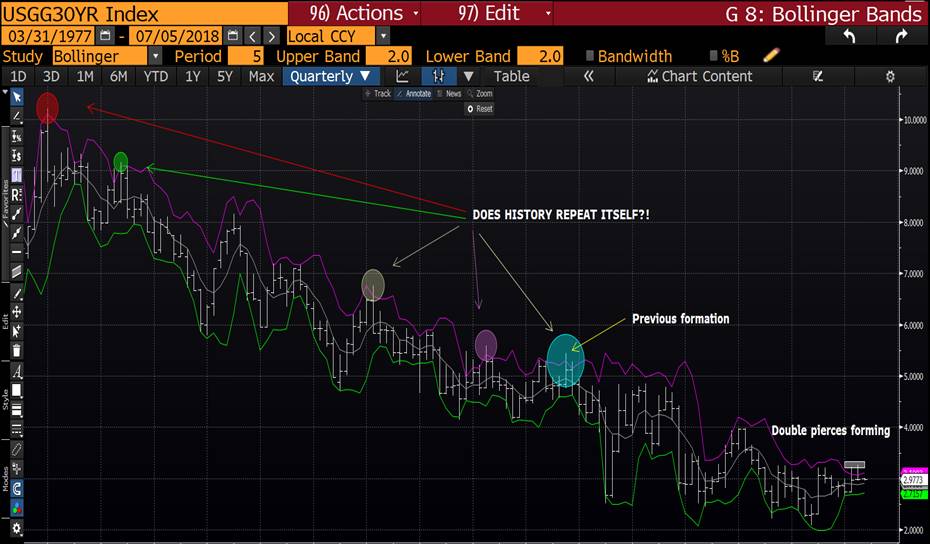

As LABOURED previously the “writing is on the wall” ALREADY relating to direction, ALL warnings signs emanate from MONTHLY and QUARTERLY charts, that won’t change.

The new month means many upside pierces are now ETCHED in history and some are now sub multi year MOVING AVERAGES.

Chart 3 US 30yr yield, DOES HISTORY REPEAT ITSELF, IF so yields are one way for a long while.

**LIQUIDITY : NOT TO BE OVERLOOKED**

Liquidity certainly does now seem to be an issue as Italy remains void of any decent cash flow and the futures ranges are extensive on light volume.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

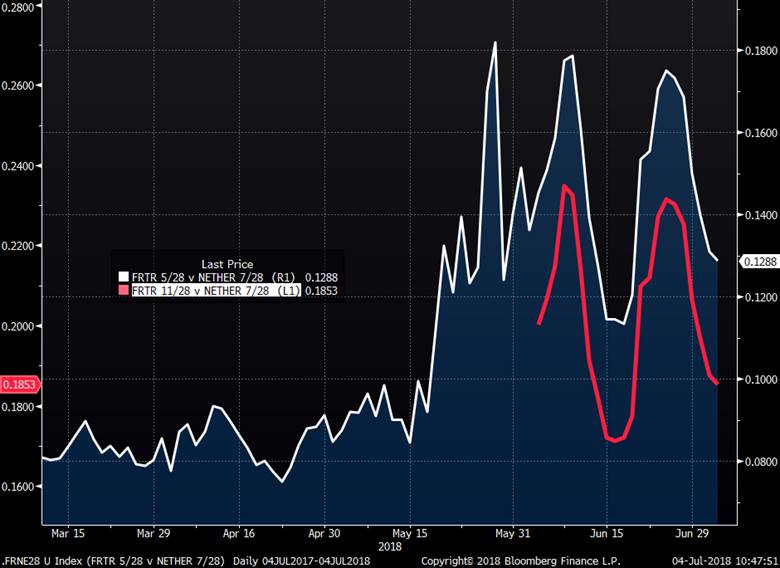

MICROCOSM: Tactical Trade Idea - Long FRTR 11/28 vs NETHER 7/28s

TRADE IDEA: Buy FRTR 11/28s vs NETHER 7/28s @+18bps or better, targeting +13bps, stop at +20bps.

OR Buy the FRTR 11/28s basis vs OATU8 given current steep levels (details below) for lower-beta alternative.

OATs and DSLs...

- Back on June 1st I recommended a FRTR 5/28-5/48 flattener boxed vs NETHER 7/28-1/47 (attached) given the widening of OATs and seasonals that support OATS into July.

- The chart below shows that the trade worked, tightening about 4.5bps before chopping around over the next few weeks, now 39.3bps vs inception at +42bps. Compared to how the OATs 10-30s box has traded vs DBRs and/or swaps, one could argue there’s still some juice left in the OATs flattener vs NETHER. The problem is the OATs curve has already pancaked and the auction calendar, especially after tomorrow, doesn’t cooperate. If we’re right about this tactical 28s trade, we could see better entry levels for the box by this time next week.

- At the last tap of the NETHER 1/24s we saw a nice cheapening of the issue on the curve into the tap (which coincided with some overall sprd widening) and in the ensuing couple weeks they richened 8+bps vs OEU8 and RXU8.

- Over the next week we have a tap of the FRTR 11/28s (tomorrow) and next Tuesday a tap of the NETHER 7/28s. With cash flows very supportive this week we expect this week's supply to be well supported, especially given the benign market conditions and supportive seasonals.

- The FRTR 11/28 vs NETHER 7/28s sprd has narrowed 4.8bps from the recent wides, now ~18.6bps mid. The question now becomes, in the current mkt, is the next 5bps tighter or wider in light of the supply calendar and cash flows? We think the next 5bps in this sprd is TIGHTER, looking for a move to +13bps with a stop at +20bps vs our +18bps inception. We look for the bulk of this move to occur in the next 4-5 sessions.

- If you’d prefer to avoid cross market trades and want to dial-down the risk given the recent volatility in intra EGB spreads, then take a look at the buying the FRTR 11/28s basis vs OATU8 (or even FRTR 5/28s). Both yield spreads vs the FRTR 2.75 10/27s CTD have steepened over the past week but are showing signs of topping out in the last 24hrs. This version is more ‘pure OATs auction play’ that has a 1.0-1.5bps profit target that could rise if the curve flattening bias of late accelerates.

- Charts and original trade idea below.

FRTR 5/28 v NETHER 7/28 and FRTR 11/28 vs NETHER 7/28

FRTR 10/27 vs FRTR 5/28 (white) and vs FRTR 11/28 (much shorter history)

Will be in touch.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

SPECIAL PIECE PLEASE READ UPDATE An increased number of elements are confirming we are close to the MAJOR STORM actually BREAKING. 04.07.2018

**An increased number of elements are confirming we are close to the MAJOR STORM actually BREAKING. Whilst the EURO is a KEY element, now yield charts are poised for a significant break lower.

Liquidity is now becoming a RARE commodity and will be a MAJOR ADD to the impending troubles.

So many charts replicate 2007 scenarios.**

I think SOME EM benefits, Brazil have already been favoured.

The views expressed in this piece are ALL based upon HISTORICAL reaction to the LOCATION we are at NOW. The charts used are also of long-term duration thus these signals wont be eroded for some time, hence the WORRY.

The MAIN contributors are US yield charts, LOWER yield forecasts with the back drop of the HIGHEST yield RSI expectations. The EURO and EUROPE is a massive concern and I still have equities as a WORRY.

I think SOME EM benefits.

The dark clouds are forming and may soon become ONE. Liquidity will form another leg to this drama given the high level of mechanisation, with this comes circuit breakers, limits and the OFF button.

I HOPE THIS PROMOTES SOME DISCUSSION and am happy to discuss trade ideas. We will forward our own ideas over the lead up to the month end. This is a MASSIVE QUARTER end. I think SOME EM benefits.

I guarantee these views won’t sit right with many BUT worth noting historically.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

FX UPDATE The USD has had a period of strength but seems to be taking “time out”.. 03.07.2018

- FX UPDATE : The USD has had a period of strength but seems to be taking “time out”.

- The EURO has opened at the close of the last quarter 1.1684 and key that it heads lower from here!

- USD EM has seen many BLOW OUT scenarios but a TOP might be in for USD BRL.

USD CAD continues a SLOW but effective GRIND.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

FW: Gilts-£2.5bn 1f28 Auction-Cheap vs surrounding Issues-Cross Market Risky!!

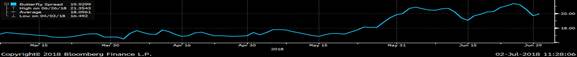

The clock is ticking towards the £2.5bn re-opening of 1f2028s which will take the issue size to over £10.5bn & with 2 more scheduled auctions this Qtr 16bn+ by the end of September so the issue is likely to become the UK 10year benchmark at the end of July. As UKT 4q27s have come out on repo post march futures delivery the spread to 1f28s has narrowed to 15bps,which still looks attractive. I prefer buying 1f28s in a rich bucket & yields at precariously low levels by selling 4q27s into 1f28s & 1q27s which enhances some value into the 25th July BOE £955mill reinvestment by owning 2 of the 4 eligible issues availabe for the BOE to buy with 2 25 & 1h26s both looking richer & 4q27s excluded as the BOE own over 70% of the freefloat- Bfly chart below-entry anywhere close to +20..target +16.. stop + 22.5..  Generally the street is recommending buying gGlts vs Bunds which may look attractive though with uncertainty over trade & Brexit I'm not a fan of cross market trades in this precarious environment.

Generally the street is recommending buying gGlts vs Bunds which may look attractive though with uncertainty over trade & Brexit I'm not a fan of cross market trades in this precarious environment.

This marketing was prepared by George Whitehead, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

<< "The Past Is The Future Back To Basics" 02031434182-www.astorridge.com >>

Equities : They went out on or near their lows so continue to be a help in the BIGGER picture storm that is BREWING.

Equities : They went out on or near their lows so continue to be a help in the BIGGER picture storm that is BREWING.

I still see these as eventually having a good old fashioned “WASHOUT”. Similar to so many bond yield charts, equities have the SAME long-term OVERBOUGHT RSI signals. Only a matter of time.

The difficulty is what will cause the FAIL, I think its trade wars and the TECH sector losing its shine.

Dax is one of the MOST over stretched European markets but does need to close the end of the quarter SUB 12611 bollinger average.

ASIA is also the one to watch as that is starting to make moves.

FTSE is currently a very positive chart but that will change on a close sub the 123.6% ret 7531.00.

US stocks continue to grind higher this DESPITE ALL quarterly and monthly RSI’s being 1896, 1999 and 2000 extensions.

** EQUITIES remain part of a BIGGER STOCKS down BONDS higher call, so not to be over looked especially if the EURO JOINS IN!

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

US CURVES : Buy either a US 5-30 or 10-30 steepener! The stop is cheap. These curves FINALLY seem to be HOLDING, as we gain MORE confirmation of long-term lower yields. BULL STEEPENERS.

US CURVES : Buy either a US 5-30 or 10-30 steepener! The stop is cheap.

These curves FINALLY seem to be HOLDING, as we gain MORE confirmation of long-term lower yields. BULL STEEPENERS.

We continue to edge flatter BUT now at a slower RATE.

All monthly durations have MULTI year over sold signals it’s just that we have lacked a similar formation on the daily charts.

At some stage this will steepen but do think it has something to do with the US 5yr re-entering the multi-year channel 2.7847.

I still think this will be a BULL STEEPENER, correlation isn’t great having made this statement BUT preciously it took time to change the yield direction.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Correction: July-Gilt trades..3-7yr..7-15 yr..15+....Please call or ask for more details...

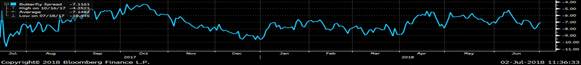

July starting with a risk off whimper & UK Manufacturing PMI strong to help the Interest bears after Fridays small upward revision to GDP & August still likely to see a 25bp fine tuning hike. Trades I like For July: 3-7 year maturities-3 big index events for this bucket-1q18 £36bn redemption-£33bn x-Boe reinvestment roughly-1t19 go under 1 year maturity & count as cash for most accounts & 0.75%/7/23 go under 5 years maturity with these events I still see the 7 /23s as the cheapest issue & main benificiary in this bucket I like either a 7/22-7/23 extension trade or the fly selling 7/22s & 9/24s with no supply until the 24th July in this bucket: fly graph below: entry here-7bps or better target for July new tight 2bps or maybe zero..stop 8.5.. Carry & roll flat  7-15 year Bucket we start supply with £2.5bn 1.625% 2028 auction tomorrow. A cheap issue in a rich bucket ,outright the whole sector rich-on the curve I like 1f28s vs 4q27s & on flies a variety with the best expression selling uk4q27 into 1q27ss & 1f28s though has moved away & is likely to benefit in the 7-15 year bucket with the BOE reinvestment & you then own 2 out of 4 of the eligible issues with this expression :history below: Entry +20bps or better .....target 16.5..stop 22... Carry & roll -0.1bp for 3 months

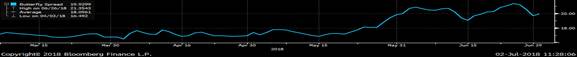

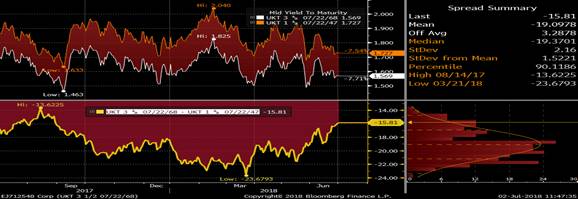

7-15 year Bucket we start supply with £2.5bn 1.625% 2028 auction tomorrow. A cheap issue in a rich bucket ,outright the whole sector rich-on the curve I like 1f28s vs 4q27s & on flies a variety with the best expression selling uk4q27 into 1q27ss & 1f28s though has moved away & is likely to benefit in the 7-15 year bucket with the BOE reinvestment & you then own 2 out of 4 of the eligible issues with this expression :history below: Entry +20bps or better .....target 16.5..stop 22... Carry & roll -0.1bp for 3 months  15+ Bucket: The curve starts the new quarter at it's flattest disinverted level for some time & I still favour flattening trades,either from the now rich 1t37s into 3h68s or 30 year into 50 year-1h47/4q49s into 3h68s with the seasonals favouring a flattening move with the coupons in July favouring longs too. UK1.50% 2047/UK 3.50% 2068 Chart below:entry here -15.8 ..target -21 stop 13.25....carry & roll -0.2bp for 3months.

15+ Bucket: The curve starts the new quarter at it's flattest disinverted level for some time & I still favour flattening trades,either from the now rich 1t37s into 3h68s or 30 year into 50 year-1h47/4q49s into 3h68s with the seasonals favouring a flattening move with the coupons in July favouring longs too. UK1.50% 2047/UK 3.50% 2068 Chart below:entry here -15.8 ..target -21 stop 13.25....carry & roll -0.2bp for 3months.  Finally Supply for July is tomorrow £2.5bn 1f28s,next Tuesday 10th a likely £5bn UKTI 0.125%/8/2041 Syndicated deal.The 19th July £2.25bn 1.75% 2057s & the only other Gilt supply in July on the 24th a new 4/2024 issiue which should be around £2.75bn notione,after the main index events which favour 5year & shorter.

Finally Supply for July is tomorrow £2.5bn 1f28s,next Tuesday 10th a likely £5bn UKTI 0.125%/8/2041 Syndicated deal.The 19th July £2.25bn 1.75% 2057s & the only other Gilt supply in July on the 24th a new 4/2024 issiue which should be around £2.75bn notione,after the main index events which favour 5year & shorter.

This marketing was prepared by George Whitehead, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

<< "The Past Is The Future Back To Basics" 02031434182-www.astorridge.com >>

July-Gilt trades..3-7yr..7-15 yr..15+....Please call or ask for more details...

July starting with a risk off whimper & UK Manufacturing PMI strong to help the Interest bears after Fridays small upward revision to GDP & August still likely to see a 25bp fine tuning hike. Trades I like For July: 3-7 year maturities-3 big index events for this bucket-1q18 £36bn redemption-£33bn x-Boe reinvestment roughly-1t19 go under 1 year maturity & count as cash for most accounts & 0.75%/7/23 go under 5 years maturity with these events I still see the 7 /23s as the cheapest issue & main benificiary in this bucket I like either a 7/22-7/23 extension trade or the fly selling 7/23s & 9/24s with no supply until the 24th July in this bucket: fly graph below: entry here-7bps or better target for July new tight 2bps or maybe zero..stop 8.5.. Carry & roll flat  7-15 year Bucket we start supply with £2.5bn 1.625% 2028 auction tomorrow. A cheap issue in a rich bucket ,outright the whole sector rich-on the curve I like 1f28s vs 4q27s & on flies a variety with the best expression selling uk4q27 into 1q27ss & 1f28s though has moved away & is likely to benefit in the 7-15 year bucket with the BOE reinvestment & you then own 2 out of 4 of the eligible issues with this expression :history below: Entry +20bps or better .....target 16.5..stop 22... Carry & roll -0.1bp for 3 months

7-15 year Bucket we start supply with £2.5bn 1.625% 2028 auction tomorrow. A cheap issue in a rich bucket ,outright the whole sector rich-on the curve I like 1f28s vs 4q27s & on flies a variety with the best expression selling uk4q27 into 1q27ss & 1f28s though has moved away & is likely to benefit in the 7-15 year bucket with the BOE reinvestment & you then own 2 out of 4 of the eligible issues with this expression :history below: Entry +20bps or better .....target 16.5..stop 22... Carry & roll -0.1bp for 3 months  15+ Bucket: The curve starts the new quarter at it's flattest disinverted level for some time & I still favour flattening trades,either from the now rich 1t37s into 3h68s or 30 year into 50 year-1h47/4q49s into 3h68s with the seasonals favouring a flattening move with the coupons in July favouring longs too. UK1.50% 2047/UK 3.50% 2068 Chart below:entry here -15.8 ..target -21 stop 13.25....carry & roll -0.2bp for 3months.

15+ Bucket: The curve starts the new quarter at it's flattest disinverted level for some time & I still favour flattening trades,either from the now rich 1t37s into 3h68s or 30 year into 50 year-1h47/4q49s into 3h68s with the seasonals favouring a flattening move with the coupons in July favouring longs too. UK1.50% 2047/UK 3.50% 2068 Chart below:entry here -15.8 ..target -21 stop 13.25....carry & roll -0.2bp for 3months.  Finally Supply for July is tomorrow £2.5bn 1f28s,next Tuesday 10th a likely £5bn UKTI 0.125%/8/2041 Syndicated deal.The 19th July £2.25bn 1.75% 2057s & the only other Gilt supply in July on the 24th a new 4/2024 issue which should be around £2.75bn notione,after the main index events which favour 5year & shorter.

Finally Supply for July is tomorrow £2.5bn 1f28s,next Tuesday 10th a likely £5bn UKTI 0.125%/8/2041 Syndicated deal.The 19th July £2.25bn 1.75% 2057s & the only other Gilt supply in July on the 24th a new 4/2024 issue which should be around £2.75bn notione,after the main index events which favour 5year & shorter.

This marketing was prepared by George Whitehead, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

<< "The Past Is The Future Back To Basics" 02031434182-www.astorridge.com >>