UKT 20s40s flattener

UKT 20s50s curve has disinverted over the last month due to 1) Italy FTQ flows, 2) International RM shifting out of UK long end into US/EUR, and 3) Concession and digestion of the recent 71s Syndication

It’s time to fade this with one of the following flatteners:

Selling 37s has the advantage of the upcoming 20 June tap, but has more punitive carry (so best for a short term tactical trade into July coupon flows).

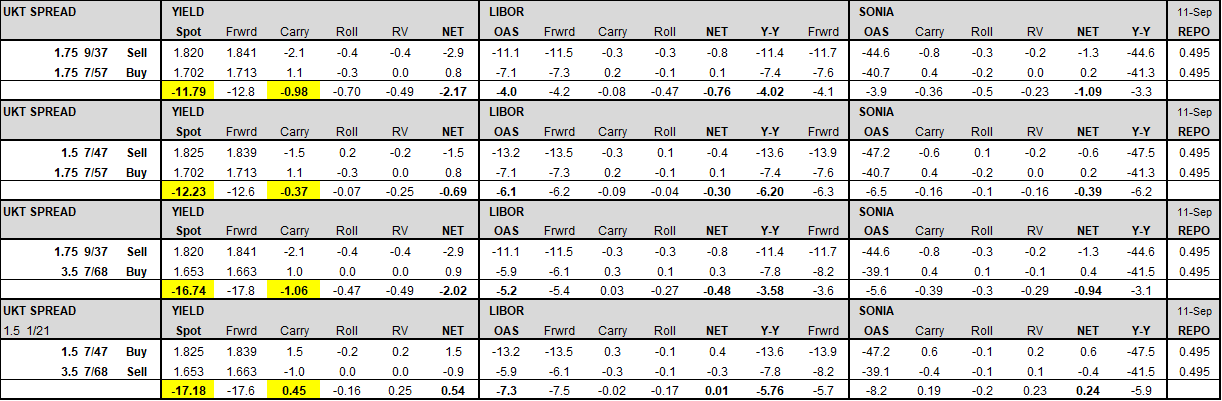

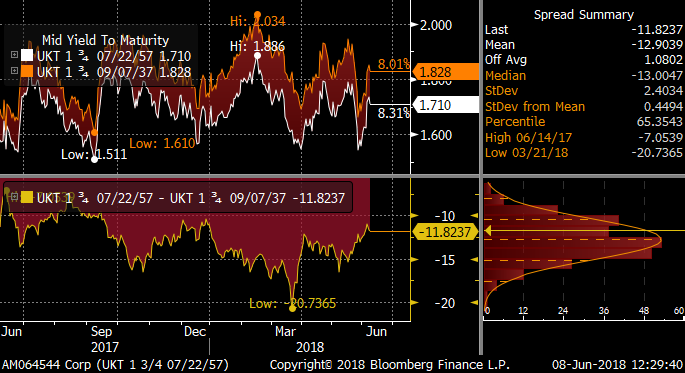

From a risk reward standpoint, the best (and most liquid) expression is the UKT 37s57s flattener @ -12.0 bps:

TARGET:

1st – 16 (+4bps)

2nd – 20 (+8bps)

STOP:

10 (-2 bps)

RATIONALE:

- For the past few years ultras have richened into June month end rebalancing / window dressing (although June ‘16 was somewhat magnified by Brexit).

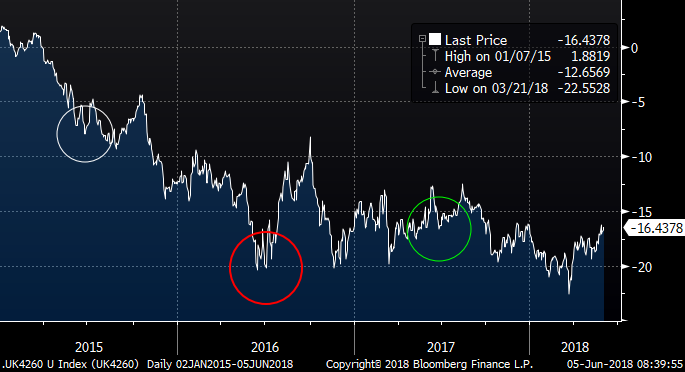

UKT 42s60s Curve:

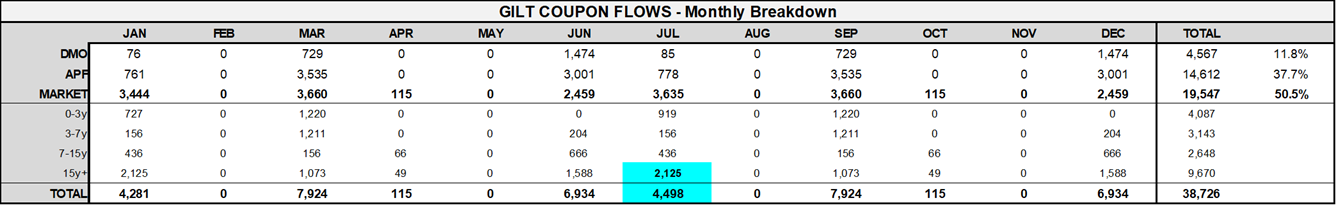

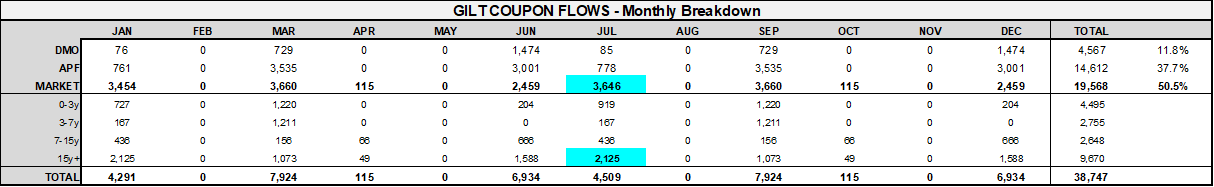

- In addition, the 22 July coupon payment (~ 8 July ex-dividend date) will also be well distributed in the long end.

£4.5bn coupon payments (£3.6bn privately held), of which £2.1bn (58%) are in the 15+yr basket:

- Looking at 42s60s implied forward rate, we are near the range highs:

- Outright 50yr yields tell a similar story:

- The supply calendar also favours 20s50s flatteners – we have 20yr supply in 12 days, while there is no ultra long supply after the 19 July auction of the 57s:

20 June – 28s Linker (10yr)

26 June – 37s Auction (20yr)

3 July – 28s Auction (10yr)

19 July – 57s Auction (40yr)

24 July – 24s Auction (New 5yr)

8 Aug - 28s Auction (10yr)

21 Aug – 28s Linker (10yr)

6 Sep - 24s Auction (New 5yr)

11 Sep – 49s Auction (New 30yr)

20 Sep – 28s Auction (10yr)

25 Sep – 48s Linker (30yr)

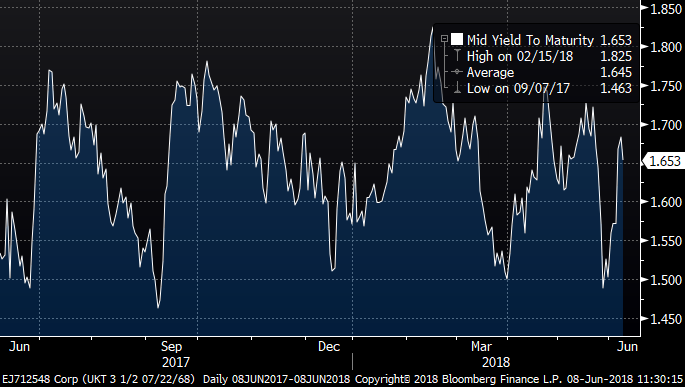

- Bond Selection – 37s and 47s stand out as rich on curve, while 57s and 68s stand out as cheap:

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

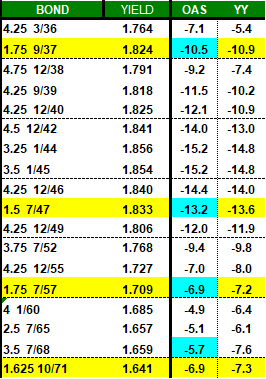

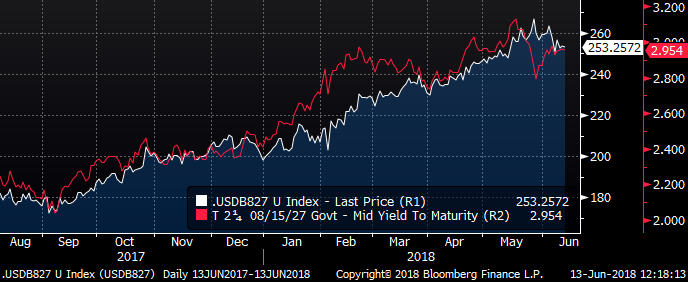

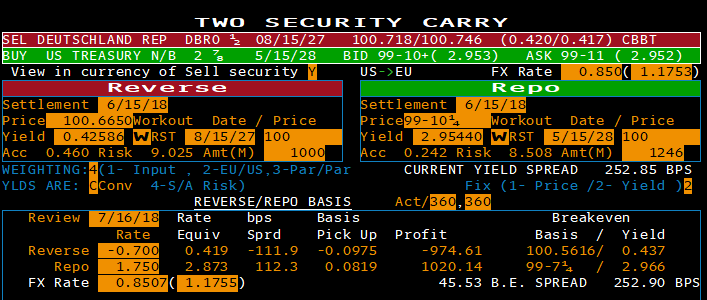

UST-DBR spread - Set to Narrow?

Trade:

Buy UST 10yr (T2.875 5/15/28) vs sell DBR 0.5 8/27 (CTD) or RXU8 @ +253 bps

History: T2.25 8/27 vs DBR 0.5 8/27:

Target: 233 bps (20bp profit)

Stop: 263 bps (10bp loss)

RATIONALE:

With risk of a less hawkish Fed at today’s FOMC meeting, and a less dovish ECB at tomorrow’s ECB meeting, the continuous widening of the UST-DBR spread may be set for a correction.

The spread is already 13 bps off its Italy blowout highs, when 10yr DBR yields briefly touched 19 bps.

Even with a more hawkish than expected Fed, there should be enough flattening pressure on UST 2s10s to keep 10yr yields from rising much further.

The UST-DBR 10yr spread has been driven by UST 10yr yields, as DBR 10yrs remain in a holding pattern:

1mo carry is flat assuming 245 bps repo spread (-.70 vs 1.75):

========================================================================================

USD-EUR 10y spread in rates is also at very attractive entry levels, just off its recent highs:

While this spread is less susceptible to flight to quality risk in DBRs, it does not benefit as much from the taper or conclusion of PSPP which may be discussed at the ECB meeting tomorrow.

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

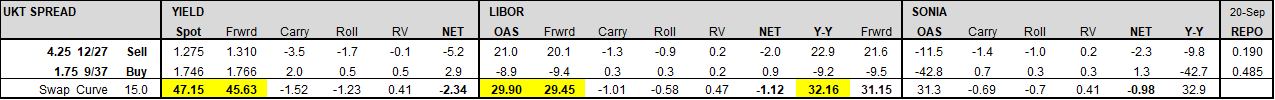

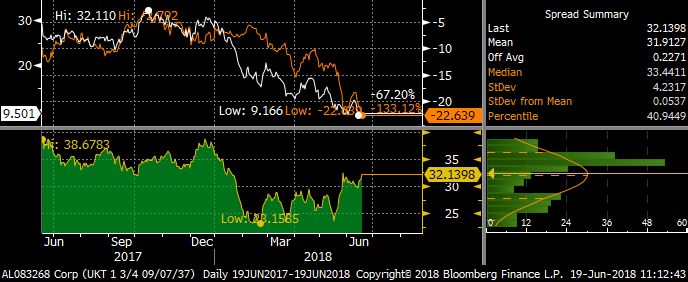

UKT 27s37s MMS flattener

Trade:

Sell UKT 4q 27 vs buy UKT 1T37 on YY ASW @ +32 bps:

Target: 26 bps (+6bp)

Stop: 35 bps (-3bp)

Rationale:

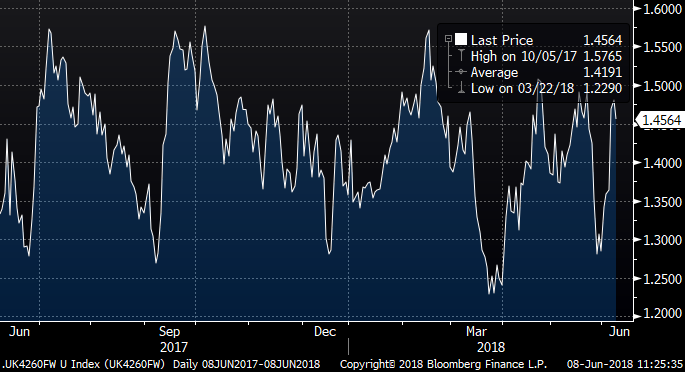

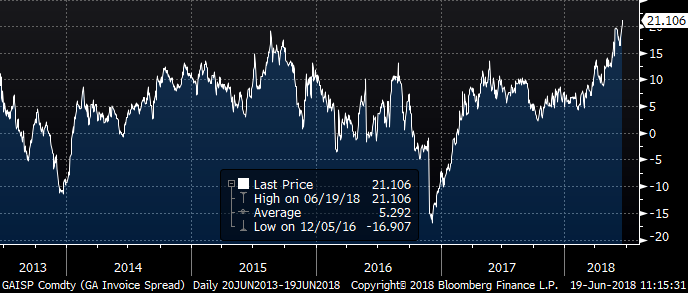

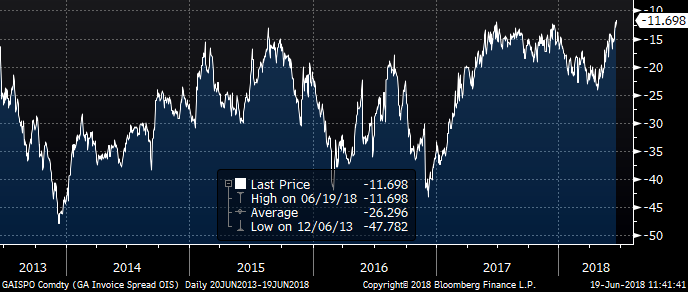

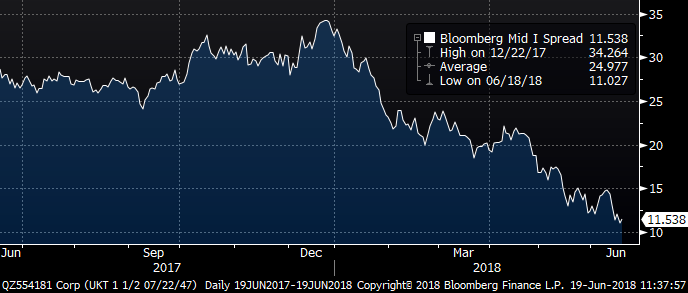

The 4q27s YY ASW (= Gilt invoice spread) is on 5yr highs on recent FTQ flows:

In addition, the Gilt-Sonia invoice spread, at -11.5 bps, has little scope to richen much further (given GC = Sonia flat) :

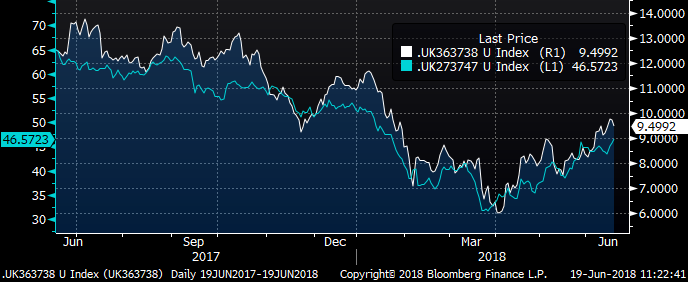

Moreover, the 1T37s have cheapened on the curve approaching next week’s 37s tap:

White line – UKT 36s37s38s micro fly (right axis)

Blue line – UKT 4q27s37s47s macro fly (left axis)

The long end has also steepened into the approaching 60yr Cambridge issuance.

We expect June quarter end rebalancing flows to favour the long end.

Moreover, the upcoming 22 July coupon payments are heavily skewed to 15yr+ paper.

£4.5bn coupon payments (£3.6bn privately held), of which £2.1bn (58%) are in the 15+yr basket:

Finally, the trend for long end YY ASW richening has been relentless this year:

30yr (UKT 1.5 7/47) YY ASW:

This has the longer term effect of compressing/flattening the YY ASW spread curve.

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EQUITY UPDATE. All eyes on the DAX and DOW as it looks poised to confirm a MAJOR LONGTERM top 19.06.2018

Equities :

These may still hold a surprise or two given many long-term charts are topping!

Dax is one of the MOST over stretched European markets but does need to close the end of the quarter SUB 12611 bollinger average.

FTSE is currently a very positive chart but that will change on a close sub the 123.6% ret 7531.00.

US stocks continue to grind higher this DESPITE ALL quarterly and monthly RSI’s being 1896, 1999 and 2000 extensions.

** EQUITIES remain part of a BIGGER STOCKS down BONDS higher call, so not to be over looked especially if the EURO JOINS IN!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

French anomaly idea

Small Micro RV in France – French curve generally too steep vs Germany – this one has issue selection and carry characteristics that favour it over others

Best

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

** PLEASE READ ** BONDS and EURO UPDATE Yields to continune lower as we APPROACH one of the BIGGEST confirmation's. 19.06.2018

BONDS and EURO UPDATE : YIELDS TO CONTINUE LOWER as we APPROACH one of the BIGGEST confirmation quarter ends.

We are gradually forming some of the MOST bearish yield charts in MANY years!

Chart 3 US 30yr yield, DOES HISTORY REPEAT ITSELF, IF so yields are one way for a long while.

European bonds have been all failing 50 day moving averages, thus confirming the bigger yield lower CALL.

EURO : If we produce a NEW low then the FALL will accelerate!

**LIQUIDITY : NOT TO BE OVERLOOKED**

Liquidity certainly does now seem to be an issue as Italy remains void of any decent cash flow and the futures ranges are extensive on light volume.

I don’t normally venture outside the technical space BUT to me a major concern is LIQUIDITY and lack of it, certainly if another Italian situation arises. Most orders now are generated or routed via a system, markets are made-quoted by a system. None of these have been really tested in a 2007 type situation, DESPITE many RSI’s predicating a REPEAT. Last week proved liquidity in Italy to be appalling due to circuit breakers and management reluctant to quote on MTS-Tradeweb.

IT can be argued, “there is still futures” BUT some contracts are NOW made up of 75-90% ALGOS, this is not a good statistic, especially when they were ABSENT post the big USD SWISS move. Also margin increases are possible. This lends itself toward MORE OPTION plays, achieving longevity on IDEAS and not get stopped on an illiquid blow out.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

EQUITY UPDATE. VERY sideways of late BUT Europe looks like moving lower for the rest of the week complimenting the longer-term call!

Equities :

VERY sideways of late BUT Europe looks like moving lower for the rest of the week complimenting the longer-term call!

Dax is one of the MOST over stretched European markets but does need to close the end of the quarter SUB 12611 bollinger average.

FTSE is currently a very positive chart but that will change on a close sub the 123.6% ret 7531.00.

US stocks continue to grind higher this DESPITE ALL quarterly and monthly RSI’s being 1896, 1999 and 2000 extensions.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trade: EUR 2y1y/5y5y bull-steepener via mid-curves

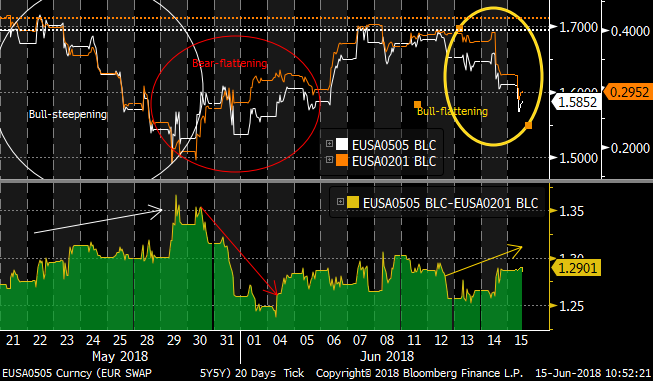

Bottom line: Yesterday’s ECB meeting put rate hikes on the table, albeit still some way off and the market for short rates will now be more volatile as opinions on the timing of hikes ebbs and flows. In the past month, the EUR rates market has been driven first by Italy and then by the ECB’s announcements (and fears), and the curve has shown a bull-steepening / bear-flattening dynamic as short rates lead. However this is not reflected yet in the implied volatility market (though this is changing), which opens up the (fast-disappearing) opportunity to set conditional trades on attractive terms. Here I am suggesting a 2y1y/5y5y bull-steepener via mid-curve receivers, partly for the rolldown and partly for increased Italy tension or a continuation of the market’s bullish response to the ECB. It’s also worth considering the straddle version of the trade if you don’t have a directional bias.

Trade:

Buy EUR 990mm 3m2y1y mid-curve receiver atmf (k=0.382%)

Sell EUR 160mm 3m5y5y mid-curve receiver atmf (k=1.617%)

for zero-cost indicative

Spot references:

2y1y: 0.287%

5y5y: 1.573%

Underlying DV01:

2y1y: EUR 100k/bp

5y5y: EUR 76k/bp

Net Delta at inception: EUR 14k/bp long the market

Alternative: Buy mid-curve straddles instead of receivers

Rationale: The ECB has given us a roadmap for the coming year: new purchases to be wound down from September to December; and no rate rises before next summer. The street is predicting the first hike between Sept and Dec 2019. From now on, short rates in Europe are increasing “in play”, as the ECB becomes the centre of attention (rather than more global forces which swing the longer end of the curve).

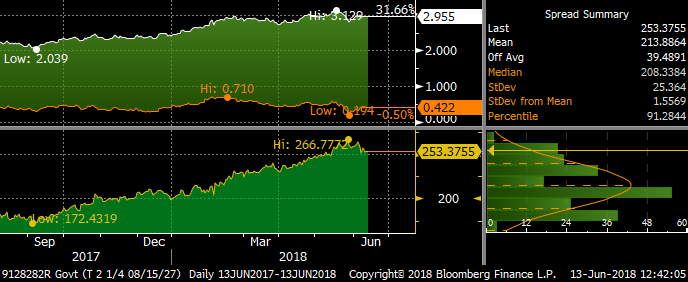

Spread of EUR 2y1y and 5y5y rates:

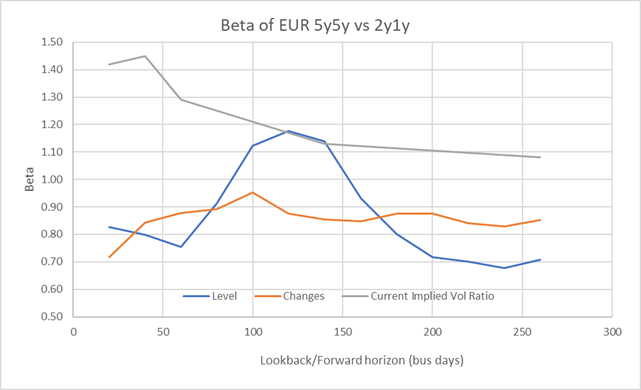

This is apparent in the relative changes in implied volatility, where the ratio of implied volatilities on shorter tails has increased relative to longer tails. However the ratios of implied volatilities are still running higher than the observed realized betas between the two rates. The chart shows the realized beta for EUR 5y5y vs 2y1y (both on levels and daily changes) for different look-back periods. The past few months have seen a decline of the realized beta, especially when compared to the current levels of forward-looking implied volatilities.

Empirically we have seen the bull-steepening / bear-flattening dynamic in recent events: during the recent Italy scares and in the aftermath of yesterday’s ECB meeting.

The mismatch with the relative levels of implied volatility allows us to construct zero-cost curve trades with an over-weighted nominal of the short rate tail compared to simple DV01 weighting of the underlying. The table shows different expiries for a 2y1y/5y5y mid-curve bull-steepener.

|

Expiry |

ZC DV01 ratio |

2y1y Roll* |

5y5y Roll* |

Net Roll (bp)* |

|

1m |

1.42 |

3.1 |

-1.4 |

2.1 |

|

3m |

1.29 |

9.5 |

-4.4 |

6.1 |

|

6m |

1.13 |

18.8 |

-8.6 |

11.2 |

|

1y |

1.08 |

36.2 |

-16.1 |

21.3 |

*Positive roll-down for receivers; negative for payers

Why have I chosen 2y1y and 5y5y? At the short end, the alternative would be 1y1y tails, however the current 1y1y is only 6bp or so above its lows of the past calendar year, whereas 2y1y is around 24bp above: ie there is more downside room in rates in a rally for 2y1y. The implied volatility in mid-curves peaks around the 3y1y rate (which is perhaps not surprising), so buying 3y1y tails is not attractive in terms of entry point. Conversely for the longer rate the higher the implied vol (and cost) the better, and 5y5y implied vol is some 5bp/y above 10y10y. Of course, I’m happy to look at other combinations upon request!

Why a 3m expiry? The largest roll-down protection comes with longer expiries, but the relative roll compared to the horizon term is reduced. The shorter expiries have a better DV01 ratio: ie you get relatively more of the receiver you are long than the one you are short. A 3m horizon is thus the compromise, and takes us just past the 13-Sept ECB date, so covers the next two meetings.

Risks: As in all conditional curve trades, the primary risk is that the dynamic of the curve changes from bull-steepening to bull-flattening. This might occur if for example there was a US-led rally, while the EUR economic outlook remained unchanged. However, as we have seen in the Italy crisis, the market views the ECB as sensitive to the economic outlook (be it the threat from tariffs, or political risk), so a weaker global growth outlook should also dent expectations for ECB action.

An alternative trade is to focus more on the low realized ratio versus the implied, and buy straddles rather than receivers. This allows you to benefit if my view that we stay in a bear-flattening/bull-steepening regime proves correct, regardless of whether the market raises or lowers expectations of ECB moves.

Would love to hear your thoughts!

Best wishes,

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

** PLEASE READ ** BONDS and EURO UPDATE Yields to continue lower DEPSITE quarter end confirmation. Euro performance and close key

BONDS and EURO UPDATE Yields to continue lower DEPSITE quarter end confirmation.

I might be tempting fate by sending this update before Mr Draghi has finished BUT the markets are SHAPING up for continued lower YIELDS and EURO!

Chart 3 DOES HISTORY REPEAT ITSELF.

European bonds have been all failing 50 day moving averages.

**LIQUIDITY : NOT TO BE OVERLOOKED**

Liquidity certainly does now seem to be an issue as Italy remains void of any decent cash flow and the futures ranges are extensive on light volume.

I don’t normally venture outside the technical space BUT to me a major concern is LIQUIDITY and lack of it, certainly if another Italian situation arises. Most orders now are generated or routed via a system, markets are made-quoted by a system. None of these have been really tested in a 2007 type situation, DESPITE many RSI’s predicating a REPEAT. Last week proved liquidity in Italy to be appalling due to circuit breakers and management reluctant to quote on MTS-Tradeweb.

IT can be argued, “there is still futures” BUT some contracts are NOW made up of 75-90% ALGOS, this is not a good statistic, especially when they were ABSENT post the big USD SWISS move. Also margin increases are possible. This lends itself toward MORE OPTION plays, achieving longevity on IDEAS and not get stopped on an illiquid blow out.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

US CURVES : The TREND flatter continues despite some ONE OFF MONTHLY RSI's and has become a TRADE to watch. Here are some levels of note.

US CURVES : The TREND flatter continues despite some ONE OFF MONTHLY RSI's and has become a TRADE to watch. Here are some levels of note.

All monthly durations have MULTI year over sold signals it’s just that we have lacked a similar formation on the daily charts.

At some stage this will steepen but do think it has something to do with the US 5yr re-entering the multi-year channel 2.7687.

I still think this will be a BULL STEEPENER, correlation isn’t great having made this statement BUT preciously it took time to change the yield direction.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris