Euro Govt RV - The week ahead. James Rice Astor Ridge

Good Morning and Happy Monday – I’m OOO for the next two days but should be logged in remotely on and off. Let me know what you need and good luck this week

Some thoughts on the two weeks ahead – Monday 21st May to Friday 1st June (day before my birthday!)

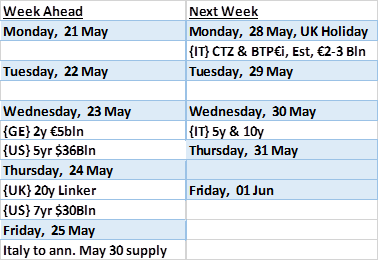

Supply – Issuance becomes a bit more of a snorathon, with US and Italy being the only interesting point to me!

Trades

1) –Italy 10s30s flat vs Core - anomalies & supply the kicker

Mechanics

Sell Btps 30y to buy old 26y

& 7% curve hedge -RX/+UB

Target entry: -10.25bp

Cix: 100 * ((YIELD[BTPS 4.75 44 Corp] - YIELD[BTPS 3.45 3/48 Corp]) - 0.07 * (YIELD[DBR 3.25 7/42 Corp] - YIELD[DBR 0.25 2/27 Corp]))

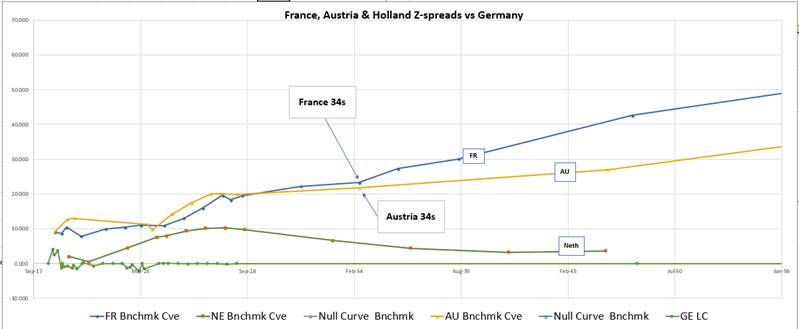

Z-Spreads vs Germany – Graph

2) Re-enter anomaly – Btps -36s +38s -47s

Mechanics

Btps: -36 +38 -47

Weighting: -1.34/ +2 / -0.66

Target Entry: +10bp

Cix: 200 * (YIELD[BTPS 2.95 9/38 Corp] - 0.67 * YIELD[BTPS 2.25 9/36 Corp] - 0.33 * YIELD[BTPS 2.7 3/47 Corp])

Z-Spread history

Trade 3

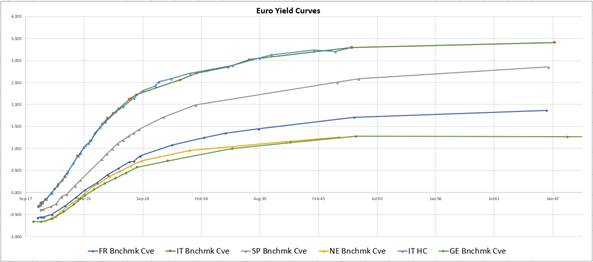

French 30 yr rich on the credit fly vs Germany & Italy

The widening of Italy appears to be idiosyncratic, but over the long haul Euro Stresses get represented in a widening of all issuers as ‘the Great Experiment’ comes under pressure

Mechanics

Short France 30y, Long Btps 30y & German 30y

Weighting: +1 / -0.25/ -0.75

Target Entry: pay the spread @ -15bp

Cix: 200 * (YIELD[FRTR 2 48 Corp] - 0.75 * YIELD[DBR 1.25 48 Corp] - 0.25 * YIELD[BTPS 3.45 48 Corp])

Check for optimum issue selection

Graph

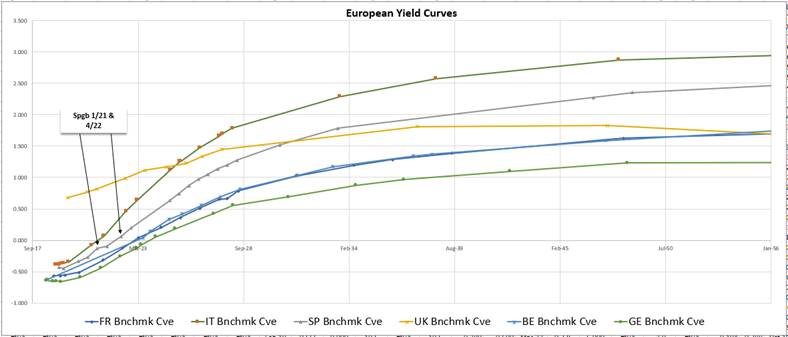

Long Term History – 5yr History of French 30y vs Germany and Italy using generics

RV0004P 30Y BLC Curncy - 0.75 * RV0002P 30Y BLC Curncy - 0.25 * RV0005P 30Y BLC Curncy

Model Trades update

- Belgium +27 -31 -37

Take profit…

200 * (YIELD[BGB 1 31 Corp] - 0.5 * YIELD[BGB 0.8 27 Corp] - 0.5 * YIELD[BGB 1.45 6/37 Corp])

- Spain 21s vs 22s & German curve Hedge – keep! – plenty more value left for 22s to cheapen – see z-spread graph above

100 * ((YIELD[SPGB 0.4 4/22 Corp] - YIELD[SPGB 0.05 1/21 Corp]) - 0.5 * (YIELD[DBR 1.5 2/23 Corp] - YIELD[BKO 0 3/20 Corp]))

- Italy 7y roll vs German contract hedge – keep – trade @ +9 to give at +6bp

100 * ((YIELD[BTPS 1.45 5/25 Corp] - YIELD[BTPS 1.45 11/24 Corp]) - 0.12 * (YIELD[DBR 0.25 2/27 Corp] - YIELD[DBR 1.5 2/23 Corp]))

- France 39s into Austria 24s as defensive anti-Italy play – keep

- UK +47 -57 +68 – keep, has a little further to go as concave bond shape vs swaps moves out to longer tenors

200 * (YIELD[UKT 1.75 57 Corp] - 0.5 * YIELD[UKT 1.5 47 Corp] - 0.5 * YIELD[UKT 3.5 68 Corp])

Default positions/views

- Trying to shorten up in weaker credit curves for equal z-spread vs

- Germany

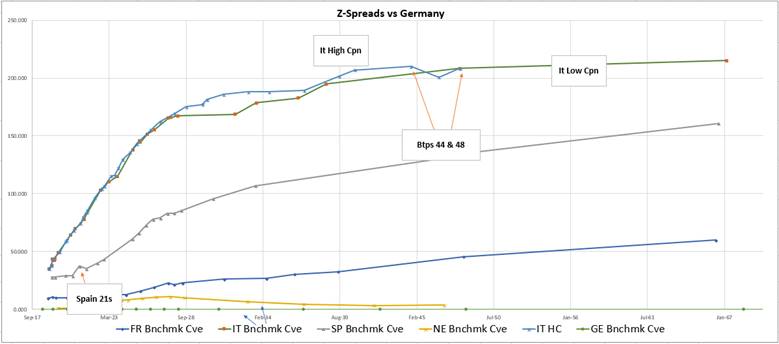

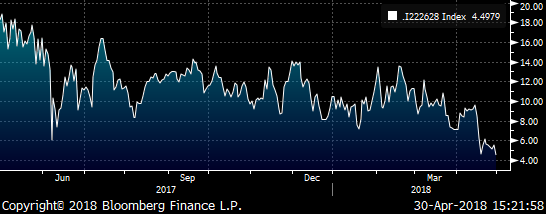

- Not fading Italy sell-off until the ratio of 2s10s Italy vs 2s10s Germany is greater than a FACTOR OF 2 - see graph

Cix: (RV0005P 10Y BLC Curncy - RV0005P 2Y BLC Curncy) / (RV0002P 10Y BLC Curncy - RV0002P 2Y BLC Curncy)

- Bias around being short supply points if rich

- Bias to buy supply point on day before the event if cheap

- Expect relative gradient’s of Euro curves to express credit worthiness – weaker credits steeper

- Stay informed of default behaviour of curves – long end flattening, performance of low coupons

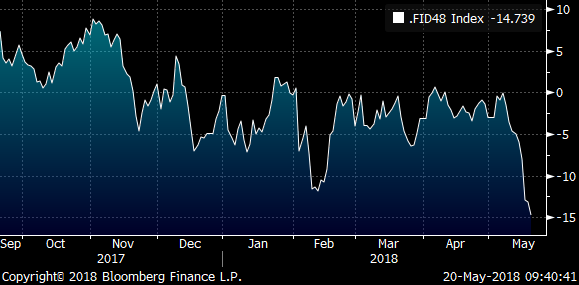

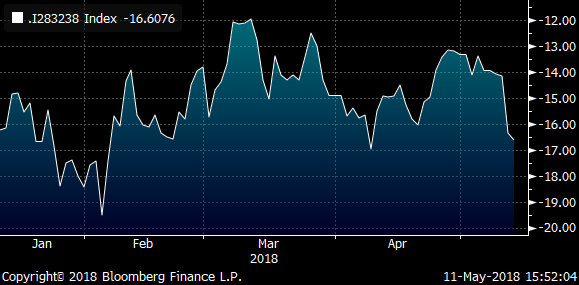

- Regressing swap spread pairs to the generic move in credit swap rates – as represented by IKM8 vs MMS – see graph

Cix: SP210[BTPS 4.75 9/28 Corp]

Let me know if there’s anything else you’d like to see

Speak soon

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Idea - France into Austria 2034s - James Rice, Astor Ridge

Austria 15y offers value vs France 15y tap point – (2034 maturities)

Trade Mechanics

- Buy €50k Ragb 2.4% 34, Sell €50k Frtr 5/34 1.25 34 @ -5bp

- Sell IK/ Buy RX futures € 2,5k/01 (-22 IK / + 18 RX)

Trade Levels

- Bond Yield Spread @ -4.9bp

- Structure @ -12.4bp

- Entry @ -12.5bp

- Add @ -11bp

- Target @ -15bp

- Stop @ -8.5bp

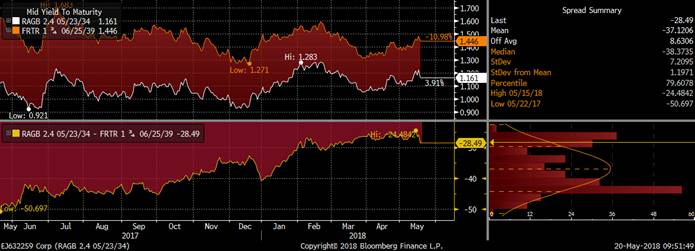

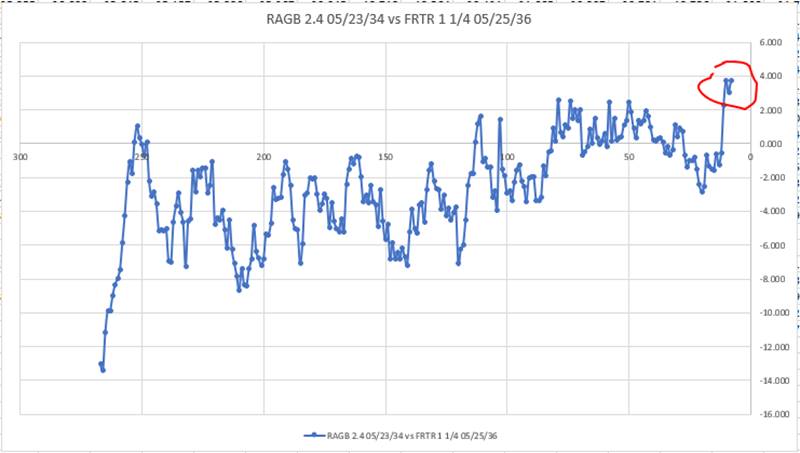

Trade History

100 * ((YIELD[RAGB 2.4 34 Corp] - YIELD[FRTR 1.25 34 Corp]) - 0.05 * (YIELD[BTPS 4.75 9/28 Corp] - YIELD[DBR 0.25 2/27 Corp]))

Rationale

- French 15yr looks rich on its curve – see Z-spread graph

- Trade is close to an extreme on history – see graph of simple yield spread between the bonds – Graph 2, bond yield spread

- French supply in the long end is due on June 7thand July 5th, it’s a possible tap issue (last reopened May 3rd €1,24 Bln, total issue size €5,6Bln – the prior 15yr, Frtr 31s was reopened in consecutive months in Jan & Feb 2016 at as similar stage and twice in the April 2016)

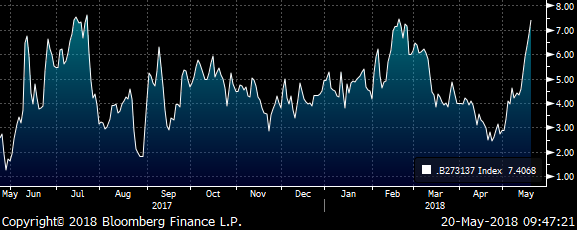

- On a regressed basis versus the relative swap spreads look stretched vs the Italian 10y futures swap spread (representing to generic credit component of curves) – (see graph, longer history of France 36s vs Ragb 34 spread of spreads)

- 10yr spread of Austria vs France – shows France as Rich vs regressed Italy / Germany – see Graph

- Rating differential – Austria S&P AA+/ Moody’s Aa1 (outlook stable), France S&P AA (stable) Moody’s Aa2 (positive)

Graphs

Graph 1, Z-Spread Graph

– European Core & semi – Core Z-spreads vs Germany

Graph 2, Bond Yield Spread

Graph 3, Regression of Austria/France 34s, Spread of Spreads (using Frtr 36s for longer history), regressed to the IK swap spread (as indicator of generic credit risk)

image009.png@01D3EC5A.1CBBD540">

image009.png@01D3EC5A.1CBBD540">

Graph , History of Austria vs France in 10y with 3% -ik/+rx hedge – France Rich

100 * ((YIELD[FRTR 2.75 27 Corp] - YIELD[RAGB 0.5 27 Corp]) - 0.03 * (YIELD[BTPS 4.75 9/28 Corp] - YIELD[DBR 0.25 2/27 Corp]))

Risks

- Continued Real Money Buying in Frtr 15y keeps it rich

- Austrian Finance Agency could tap the 2034s (next scheduled is June and July) – last tapped Jan 26th 2018, each auction is approx €1,2Bln of two issues

- The repo on the two dons becomes egregious

Carry and Roll

- Bond Carry & Roll -0.2bp / 3mo (-15bp repo spread)

- Futures hedge -0.3bp / 3mo (5% weighting)

Best

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: UKT 1F 71s Syndication Dominates Early Week UKT Trading

> Focus of the next couple days will be the market's preparation for tomorrow's UKT 1F 71s syndication. We still don't know how big the issue will be and the sprd it will be priced off the 68s, both factors that can affect demand aside from the obvious level of yields and curve valuations.

> From an outright perspective, the UKT 3H 68s have grinded cheaper over the last several sessions, knocking on 1.70% this am after an 8.5bps rally in late April. A push above 1.70% should mean more demand out of cash than on the curve...

> We're also keeping an eye on micro relationships like UKT 65-68s, UKT 57(60)-65-58 fly, UKT 49-55-60 fly, UKT 42-60s sprds, etc.

> Our natural inclination given the historical precedent here is to come out of the syndication long ultras (even if it isn't the 71s), however, we'll be mindful of location too. The market's done a pretty good job of cheapening 68s on the curve, for example, so another .1/.2 vs 65s is just 'gravy' here.

Stay tuned…

UKT 68s…

UKT 65-68s…

UKT 57-65-68 fly at the rich end of a narrow range…

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Week ahead, James Rice Astor Ridge

This week…

Radar Trades

Trade 1 – Italy cheap 7y supply

Structure

{IT} Italy -11/24 +5/25

&12% +OE/-RX, curve hedge

Current: @ +8.4bp

Enter: @ +9bp

Target: +7.5bp

Cix: 100 * ((YIELD[BTPS 1.45 5/25 Corp] - YIELD[BTPS 1.45 11/24 Corp]) - 0.12 * (YIELD[DBR 0.25 2/27 Corp] - YIELD[DBR 1.5 2/23 Corp]))

Trade 2 – Belgium 31s rich, bond repo was tight now easing but still looks like one of the richest 13yr bonds vol adjusted

Structure

{BE} -31 +33

&25% +RX/-UB, curve hedge

Current: @ -0.5bp

Enter: @ -0.5bp

Target: @ -4bp

Cix: 100 * ((YIELD[BGB 3 34 Corp] - YIELD[BGB 1 6/31 Corp]) - 0.25 * (YIELD[DBR 3.25 7/42 Corp] - YIELD[DBR 0.25 2/27 Corp]))

Trade 3 - Austria 10y cheap to France, France richening on the ‘blend’ (mix of Italy and Germany) as Italy widens, yet Austria has stayed soft

Structure

{AT} {FR} -5/27 +4/27

& 3% +IK/-RX

Current: @ -3.3bp

Enter: @ -4bp

Target: Flat

Cix: 100 * ((YIELD[FRTR 2.75 27 Corp] - YIELD[RAGB 0.5 27 Corp]) - 0.03 * (YIELD[BTPS 4.75 9/28 Corp] - YIELD[DBR 0.25 2/27 Corp]))

Trade 4 – Italy 32s rich

Structure

{IT} +IK -32 +38

Current: @ -16.7bp

Enter: @ -17.5bp

Target: @ -14bp

Cix: 200 * (YIELD[BTPS 1.65 3/32 Corp] - 0.5 * YIELD[BTPS 4.75 9/28 Corp] - 0.5 * YIELD[BTPS 2.95 9/38 Corp])

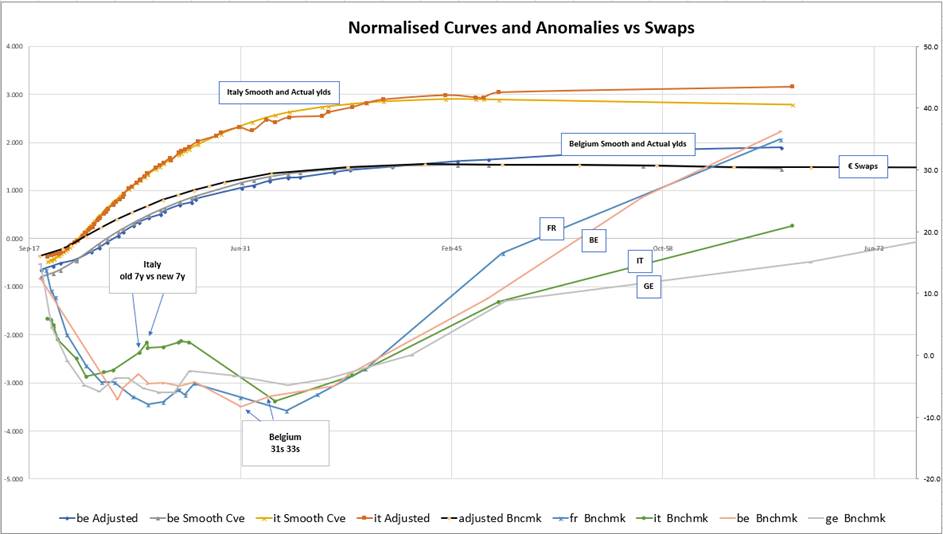

Main Euro Issuers ‘normalised’ spread to swaps

(*issuer curves are normalised based on a vol/gradient metric to make them comparable to € swaps)

Thanks for any feedback

Best,

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

£2.75bn 1f 2028 Auction -Not Cheap though chance to sell 4q27s into 28s!

The clock is ticking towards the £2.75bn 1f 28 auction which will take it over £8bn & encourage some accounts to include it especially as the 4q27s edges closer to falling out of the ctd basket,last contract for delivery decemeber & recently the spread has widened to just under 14bps,at this level worth owning some,especially with the mood in play for a flatter curve out of next weeks duration event : Entry 13.8bp Target 10bp Stop 16.5bp.

This marketing was prepared by George Whitehead, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

<< "The Past Is The Future Back To Basics" 02031434182-www.astorridge.com >>

£2.75bn 1f 2028 Auction -Not Cheap though chance to sell 4q27s into 28s!

The clock is ticking towards the £2.75bn 1f 28 auction which will take it over £8bn & encourage some accounts to include it especially as the 4q27s edges closer to falling out of the ctd basket,last contract for delivery decemeber & recently the spread has widened to just under 14bps,at this level worth owning some,especially with the mood in play for a flatter curve out of next weeks duration event : Entry 13.8bp Target 10bp Stop 16.5bp.

This marketing was prepared by George Whitehead, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

<< "The Past Is The Future Back To Basics" 02031434182-www.astorridge.com >>

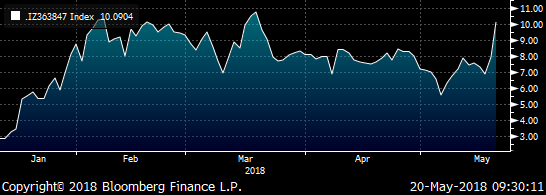

The week ahead - James Rice, Astor Ridge

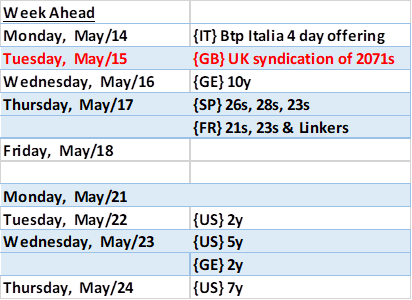

Some thoughts on the week(s) ahead particularly for the UK syndication in 2 weeks

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

![]()

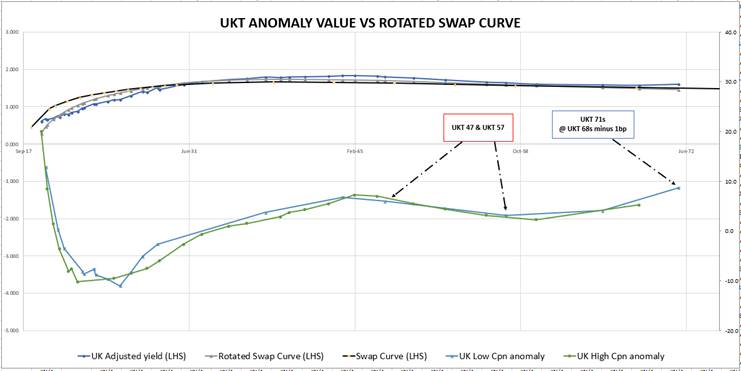

Most interesting event is the UK 2071 new ultra, week after next – at potentially more than $5bln this is one of the largest risk events in the UKT market

Barbell opportunity – short UKT 57s and long UKT 47s and the new issue via UKT 68s

Estimated set up details -coming week of May 14th

- UKT estimated coupon 1.625% (TBA), Maturity Date Oct/22/2071

- First Settle Date May/16/2018, Interest Accrual Date May/16/2018

- Flat to 1bp through the UKT 3.5% 2068

Analysis

- Typically we look at the Gilt curve versus swaps

- However the differential in the overall gradient of the swap curve vs the Bond curve can make it difficult to pick out value

- The UK curve is on average 62% steeper than the swap curve

- If we ‘rotate’ the swap curve to compensate for the broad differences in gradient we get a different metric

- We adjust for high/low coupons in bond value in a positive curve by subtracting Swap Spread and adding Z-Spread

- We now look at anomaly value in that framework

So to me, it seems that a possible end game is to end up with:

Bonds: +47 -57 +71

Weightings: +1/-2/+1

And the natural stepping stone is to do it via

Bonds: +47 -57 +68

and then bounce the 68s into the 71s at the time of pricing – timing is key

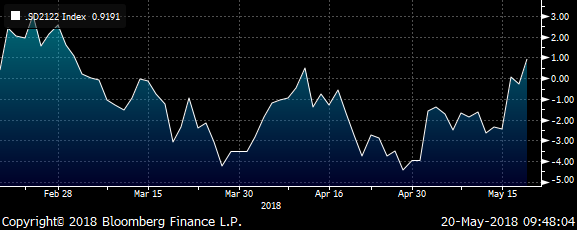

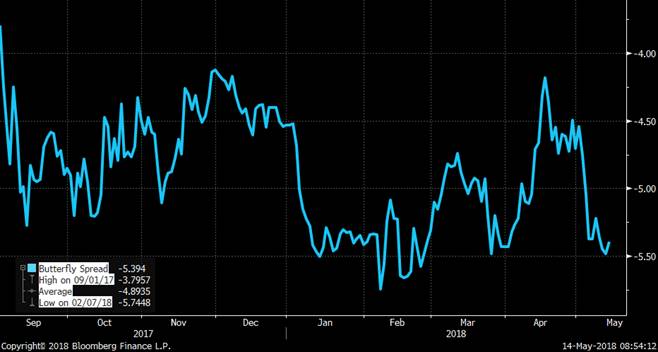

Index for 30s40s50s in UKT

Bonds: +47 -57 +68

Weightings: +1/-2/+1

200 * (YIELD[UKT 1.75 57 Corp] - 0.5 * YIELD[UKT 1.5 47 Corp] - 0.5 * YIELD[UKT 3.5 68 Corp])

Here’s how that index looks relative to swaps – is there an ‘edge’ vs generic swap market moves?

SP208 is the BBG field for Z-Spread

2 * (SP208[UKT 1.75 57 Corp] – 0.5 * SP208[UKT 1.5 47 Corp] – 0.5 * SP208[UKT 3.5 68 Corp])

Recently the UK 30s50s swap curve has normalised to around -13bp

This normalisation has been reflected in a cheapening of the 50yrs (68s) ahead of supply but not so much in the 57s, hence the desire either to see 47s57s steepen and/or 57s68s to re-flatten

UK Swaps 30s50s dis-inverting

I’ll send some more complete details next week but with a short week coming up this thing will be on us before we know it.

As for Austria, Nether and Germany etc there are some value anomaly situations – but historically we need a pull-back I think to have a better Sharpe ratio. That said the market seems in a value compression mode – witness the Spain 50y which looked ‘ok’ but went really well with out a huge RV pull-back – so am tempted to say that if something looks reasonable value but not amazing historically then have a little bit on to not miss the move – but with room to add

Best

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Taking Off RXM8 Longs, Eyeing Supply & Busy Data Calendar

Lots to talk about so let’s get cookin’…

MACRO…

- OIL remains on everyone’s radar given the headlines in the press this week: Iran allegedly cheating on nukes deal and Israel up in arms; Houthi rebels lobbing rockets into Saudi Arabia; Russia/OPEC sticking to production cut agreements; US inventories declining into summer driving season, etc. WTI is off the highs but only just at $67.70 a barrel vs $69.55 1yr highs. The correlation of oil prices to UST yields remains solid, remaining a focal point for the market.

- Politics continue to provide a rather unhealthy distraction for the markets as Italy’s post-election melee continues, Theresa May’s hold on her party looks more and more tenuous with Tory rebellions on the customs union brewing and Trump’s legal issues could worsen as Mueller threatened to subpoena him if he refuses an interview over the Russia meddling affair.

- Stocks have stabilized (AAPL posts some remarkable results along with a $100bln buyback) with the 200 day MA providing solid support for the S&P.

- Today’s FOMC meeting should be a non-event given the modest slowing in G-10 economic data since the last meeting, the rally in the USD and renewed curve flattening pressures. All told, one could argue the market’s already tightened for the Fed and we’d agree with El-Arian that the market’s earned a breather.

- UST qtrly refunding will be announced later today with most pundits expecting an additional $2bn 3yrs to $32bn, $1bn 10yrs to $25bn and $1bn 30yrs to $17bn which would make this the biggest refunding since the financial crisis. With 10yr notes still hovering up near 3% some would argue this is priced in – others think it just adds to the bearish tone. Also talk of a new 2-month t-bill out there. We’ll see.

EUROZONE...

- We're taking off our tactical RXM8 long now that the post- ECB month-end index flows that helped drive the move are behind us. The 20-Day MA level I highlighted as first key resistance held well and with the mkt dipping on the open (in response to USTs yesterday), the tone has shifted more neutral/bearish.

- Supply over the next two days is pretty chunky in Europe with Germany tapping 3bn OBL 177s today, Spain tapping their 1/21s, 4/28s and 7/66s and France tapping their 5/26s, 5/34s and 5/48s. It’s a good deal of risk for a market that has feels a bit toppy.

- The SPGB 7/66s have cheapened up nicely vs SPGB 46/48s into tomorrow’s tap, attracting tactical flattening interest which we think makes sense, particularly since our BTPS 48-67s flattener has held in well despite the 50yr supply.

- BTPS have been all over the map the last few days as 5-Star’s DiMaio threw PD under the bus late last week but his calls for June elections have been denied by the President. BTPS will remain volatile over the next few weeks, however, we think it’ll be tough for them to ignore the overall tone of EGB yields if they begin to rise.

- PMIs trickling in this morning, Spain 54.4 vs 54.1, Italy 53.5 vs 54.5, France 53.8 vs 53.4 and Germany on the way soon.

UK…

- What a tangled web they’ve weaved… Telegraph reports that Tory MP Rees-Mogg has a faction of 60 conservatives who are willing to take May to task for her flip flopping on the customs union and the Irish border issue. With the House of Lords calling for a Parliamentary vote on any Brexit plan (suggesting a Remain bias) and local elections tomorrow that have the Tories potentially losing more support, it’s no wonder Cable is under more pressure.

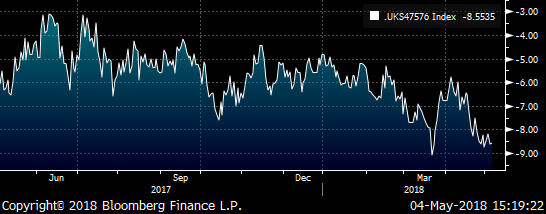

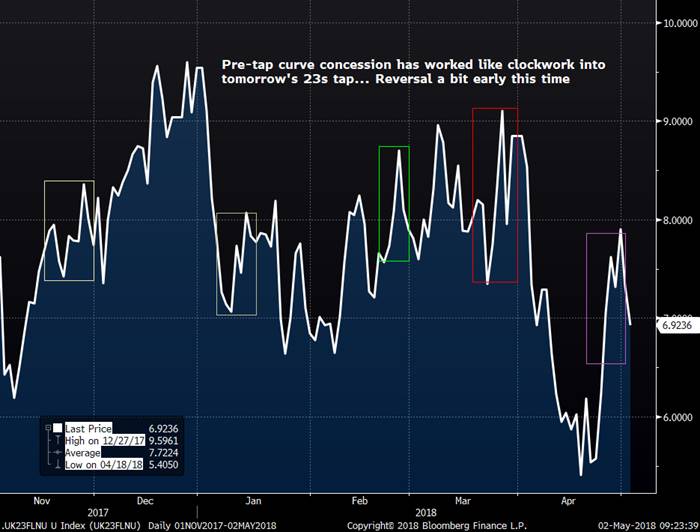

- UKT 0T 7/23s to be tapped tomorrow. We saw a push up to +8.1bps on the popular 7/22-7/23-9/24 fly briefly yesterday morning in response to more soft data before some chunky buying of the 23s took it back to the ~7.4bps area into the close. It’s opening at 7.0bps this morning and barring a breakdown of cable or some really nasty Brexit news, it looks to us like the pre-tap concession has likely run its course. Glad we could get a handful of clients back in at solid levels.

- Next week’s £2.75bn tap of the UKT 1F 10/28s has been confirmed. We’ll be back with more RV colour on this shortly.

- More significantly, however, is the DMO’s confirmation of the details of the new ultras syndication. We’ll be getting a syndicated October 2071 issue the week of May 14th which, given current 2068 yields, will likely be a 1.625% coupon. This maturity is a year or two shorter than initial market estimates but even a £4.75bln 2071 issue flat to the 2068s will be £19mm DV01 and if they use some of the unallocated cash to take it to £5.75bln that would be £21mm/bp – a ton of risk.

- Our UKT 49-55-60s fly is back to our inception level after richening to +5.8bps last week. We’re keeping a close eye on this one but from the price action so far this week, we think this -4.0/.1 area will hold, making this a good place to add.

- In addition, our UKT 37-47-68 fly has richened 1.2bps to 21.0bps over the last couple sessions. Still like this one.

- With the May meeting now pricing in 20% (or so) odds of a hike (and HSBC saying the MPC will be on hold until 2020!) the front-end appears pretty well anchored for now. This most recent rally has drained the front-end of much of it’s short base and given the shift in sentiment, we’re back to being more ‘prone’ to good news than bad. Trouble is, there hasn’t been any really good news for a few weeks now.

More to come…

Mark

Charts:

Stocks

Oil

RXM8

UKT 22-23-24 fly

UKT 37-47-68 67/100/33 weighted fly

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Wednesday 2nd May - Euro Govt Trade Ideas, James Rice Astor Ridge

Trade Idea

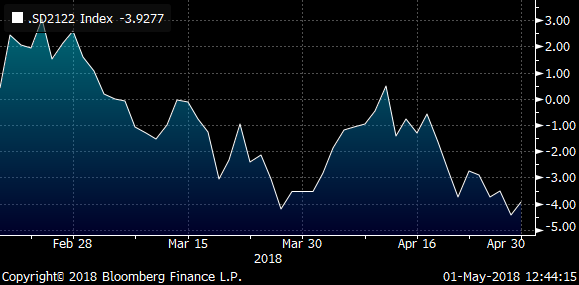

3y vs 4y Spain too flat versus the more credit worthy issuers

Sell Spain 0.4% Apr 22 to buy Spain 0.05% Jan 21 vs Germany or Swaps

Mechanics

- Buy €50k Spgb 0.05% Jan 21 (180,7MM), Sell €50k Spgb 0.4% (124,2MM), @ -19.5bp

- Sell €25k (1192 lots) DUM8 contracts, Buy €25k (408 lots) OEM8 contracts

- cix: 100 * ((YIELD[SPGB 0.4 4/22 Corp] - YIELD[SPGB 0.05 1/21 Corp]) - 0.5 * (YIELD[DBR 1.5 2/23 Corp] - YIELD[BKO 0 3/20 Corp]))

Levels

- Currently @ -3.9 bp

- Target @ +2 bp

- Expected Profit +5 bp

- Add @ -6.5 bp

- Stop @ -10 bp

Rationale

- Tomorrow brings a tap of the Spanish 0.05% 1/21 – the bond looks over discounted for supply during Golden Week and the May Day week

- When looking at lower credit quality issuers such as Spain vs Germany, their curves are typically steeper

E.g. (on average); Italy is approx. 75% steeper than Germany, Spain is 50% steeper than Germany, France is 15% steeper

- As a loose boundary condition is for a weaker credit issuer to be no flatter than the German curve

- The trade is also at an extreme vs swaps

Graphs

Graph 1 – CIX of total package

Graph 2 – Bond Yield Spread

Graph 3 – European Yield Curve, Spain Jan 21s highlighted

Graph 4 – Relative Swap Spreads

Carry & Roll (per 3mo, contract CTDs using implied repos)

- Spain Carry -1.3bp/3mo (15bp repo spread)

- Spain Roll -0.6bp/3mo

- German Hedge Carry +2.4bp (23bp implied repo differential, half PV01)

- German Roll +0.5bp (half PV01)

- Net Carry & Roll +1bp

Risks

- A continuing flattening of the Spanish curve Causes 4/22 to outperform

- An extreme flight to quality could cause the German curve to steepen

- The Spgb 4/22 trade more special on repo and richen further

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Italy 7yr trade idea - sell the 7y supply point

In Italy - 7 years are getting close to fair

I look at the following fly, but they all look similar showing 7yr as relatively rich

{IT} -6/21 +12/24 -ik

-.8/+2/-1.2

200 * (YIELD[BTPS 2.5 12/24 Corp] - 0.6 * YIELD[BTPS 4.75 9/28 Corp] - 0.4 * YIELD[BTPS 0.45 6/21 Corp])

which is on its lows - but also is below zero on Z-Spread too ...

2 * (SP208[BTPS 2.5 12/24 Corp] - 0.6 * SP208[BTPS 4.75 9/28 Corp] - 0.4 * SP208[BTPS 0.45 6/21 Corp])

So, unless the 7y & 8y sector in Italy catches a real flow based or index bid (as it has in Fr and Ge) then I think 7 yrs are a sell given that we get regular monthly supply - next due Fri 11th May

Am working on some structures to best capture that

Trade

He's one idea I like

{IT} +4/22 -3/26 +ik (9/28)

bit tight in structure but plays the fact that the high coupon mar 26 now look rich to the new issue 5/25s that will be tapped this month

200 * (YIELD[BTPS 4.5 3/26 Corp] - 0.33 * YIELD[BTPS 1.35 4/22 Corp] - 0.67 * YIELD[BTPS 4.75 9/28 Corp])

currently at +4.5bp, would do some here and add in 1bp to 1.5 bp time, target 9 bp for modest correction

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796