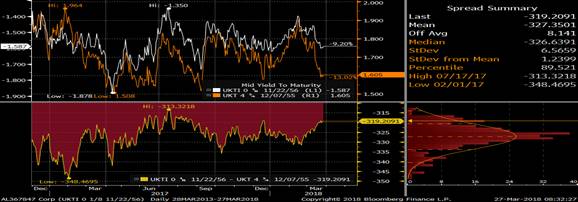

: UKTI 2056 Auction-Buy On Breakevens!!!Less RPI Debt Next year!

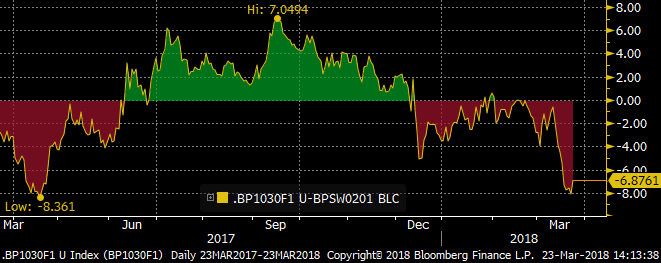

The DMO will hold the last auction at 10-30 for the 2017/2018 Financial year with a small £600 million UKTI 0.125% 2056s . The sector has recently been unwanted with the commodity status for Super-long Conventionals with no syndicated deal for that sector since Sep 2017,though the same applies to Linkers with no ultra-long Linker supply since July 2017 & the Treasury reducing next years RPI issuance ,so I expect a good reception. Breakevens look the best expression with the spread vs 4q55s close to a 2 year tight & knowing the calendar for April/June includes a 1t2057 auction for April 10th & a new Syndicated 2070/2073 issue for mid to late May. Entry around current levels: -3.195 Target:-3.33 Stop:3.10.

This marketing was prepared by George Whitehead, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

<< "The Past Is The Future Back To Basics" 02031434182-www.astorridge.com >>

EQUITY UPDATE We have come along way but on many chart durations REMAIN weak and HOLED BELOW THE WATER LINE.

We have come a long way but on many chart durations REMAIN weak and HOLED BELOW THE WATER LINE. We will be going lower for some time. The NASDAQ IS NOW close to EMULATING the 2000 DROP (see page 20).

We still need weaker closes into month end BUT nearly all quarterly and monthly charts are now TERMINAL!

German and UK bonds are helping the cause given they are posting NEW JUNE highs everywhere.

As mentioned I still fancy an old fashioned stocks DOWN bonds UP.

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

•

• UK: 14-16 Dowgate Hill, London EC4R 2SU

• US: 245 Park Ave, 39th Floor, NY, NY, 10167

• Office: +44 (0) 203 143 4174

• Mobile: +44 (0) 7980708683

• Email: chris.williams@astorridge.com

• Web: www.AstorRidge.com

•

• • I provide our research notification below for your convenience:

• •

• • Research Unbundling:

• •

• • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

• •

• • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

• •

• •

• •

• • I also direct you to our disclaimer on our email footer:

• • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

• •

• • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

• •

• • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

• •

• •

• • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

• •

• • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

• •

• • Many thanks,

• •

• • Chris

BOND UPDATE Sentiment remains positive for German and UK bonds but currently need to work off some of the HIGH daily RSI’s. 26.03.2018.

BONDS UPDATE :

Sentiment remains positive for German and UK bonds but currently need to work off some of the HIGH daily RSI’s. The US yields now look to have PEAKED post Mr Powell (see page 11).

The next BIG TRADE is US STEEPENERS : As mentioned before many RSI’s are WAY over sold and the recent POP to the 61.8% rets served to recognise the BIG BREAK level. If we close above any of the 61.8% rets this should TRIGGER a sustained long-term steepening.

1) Yields are close to breaching levels where we will see a MAJOR DROP

2) (US 5yr and UK 10yr). ALL durations are stretched, quarterly, monthly, weekly and daily… this is RARE!

3) Looking at the previous Equity piece, European stocks look a LONGTERM failure thus I firmly believe this mean BONDS rally.

3) Germany 26’s bonds based well as do the FUTURES post yesterday’s intraday REVERSAL.

4) UK yields have a LOFTY RSI and UKTI POISED to bounce. UK 10yr all eyes on a continued breach of 1.489 (10yr Gilts).

5) US 10 Breakevens have a LOFTY WEEKLY and DAILY RSI.

6) Nearly ALL US curves rejected the recent steepening BIAS at MAJOR MULTI YEAR 61.8% ret, the RSI’s remain low however. If the 61.8% ret’s are breached we steepen in a BIG WAY.

** US curves will be a BIG trade once the 61.8% retracements are breached. **

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

•

• UK: 14-16 Dowgate Hill, London EC4R 2SU

• US: 245 Park Ave, 39th Floor, NY, NY, 10167

• Office: +44 (0) 203 143 4174

• Mobile: +44 (0) 7980708683

• Email: chris.williams@astorridge.com

• Web: www.AstorRidge.com

•

• • I provide our research notification below for your convenience:

• •

• • Research Unbundling:

• •

• • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

• •

• • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

• •

• •

• •

• • I also direct you to our disclaimer on our email footer:

• • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

• •

• • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

• •

• • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

• •

• •

• • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

• •

• • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

• •

• • Many thanks,

• •

• • Chris

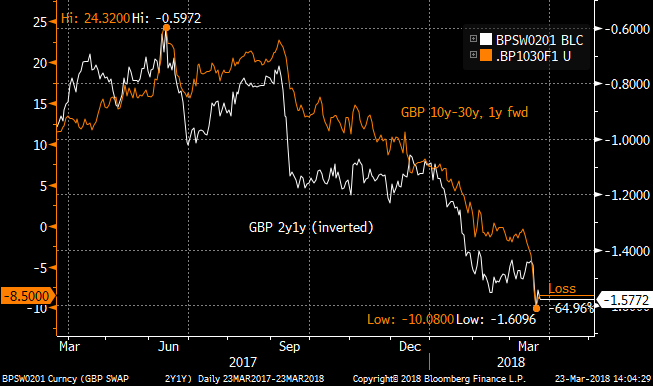

Portfolio update: Closing out GBP/USD 2y-10y, 1y fwd box trade for profit

There’s been a quick bounce in the level of the GBP/USD 2y-10y, 1y fwd box trade, as the Sterling curve has flattened rapidly, while in recent days the US curve flattening has stalled. The original target was flat, but I’m booking the quick profit of 14.5 bp here. I am holding the CMS cap version of this trade on a long-term view.

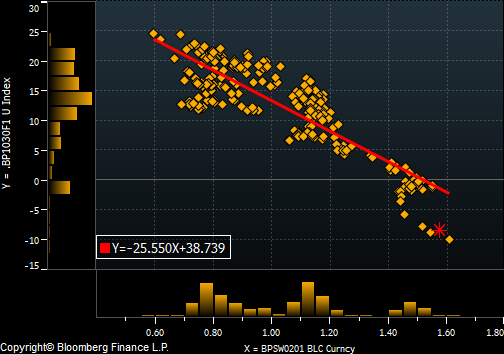

Part of the reason for the tactical profit take is that the GBP curve may have got ahead of itself: eg the GBP 10-30 curve which has been in focus, having again flattened hard in the Gilt market. The chart shows the inverse relationship between 10y-30y (in this case 1y fwd) and the 2y1y forward rate (which acts as a proxy for MPC rate-hike expectations). Hence the 10-30 curve has been bear-flattening, which is in line with my trade themes above.

The regression between 10-30, 1y fwd and 2y1y has an R^2 of 77%.

And this is the residual of the relationship, suggesting that the 10-30 flattening has been more aggressive than indicated by the changes in short-term rate expectations. The Gilt market has been the driver as 30y paper has gone missing into fiscal year-end. The minutes of the last DMO meeting showed that dealers were petitioning for long-end paper, and Friday’s auction schedule announcement showed that the long auctions had been moved a week earlier than usual. Interestingly the relationship held up well through yesterday’s MPC meeting, and the residual moved off the -8bp extreme.

One structure then to capture this dislocation is to:

Pay 100k/bp 10y-30y, 1y fwd

Pay 25k/bp 2y1y fwd rate

To position for a re-steepening of 10y-30y relative to short-rate expectations.

Best wishes

David

Original write-up from 21st Feb:

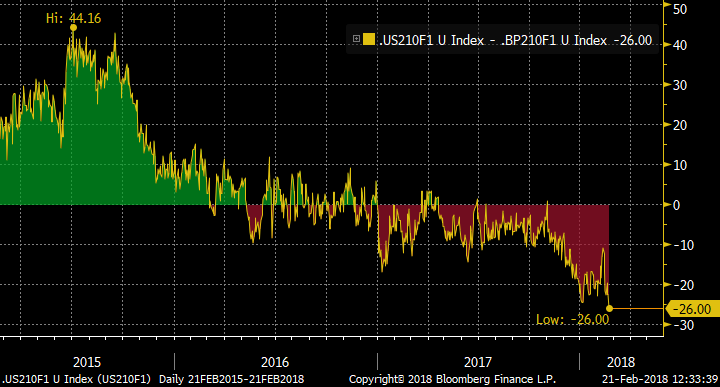

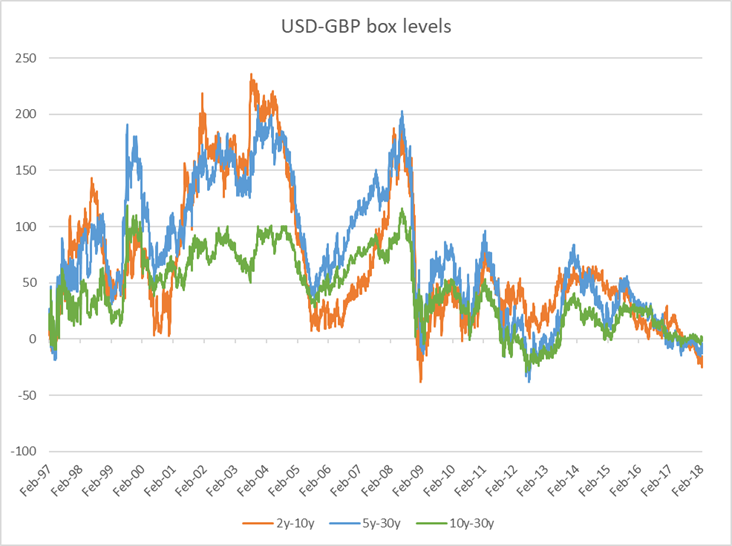

Bottom line: The US curve (however it is viewed) is at, or close to its flattest for the last 20 years, as the Fed hikes rates. At the same time, though the GBP curve has flattened somewhat it is still significantly steeper than before the financial crisis of 2008, despite the market pricing hikes from the MPC. Thus in isolation we would independently favour a steepener in the US and a flattener in the UK. Given the relatively high realized correlation between the US and UK on certain curve sectors, there is a good case to be made for looking at the box trade.

Trade(s):

In vanilla swaps:

Recv USD 525mm 1y2y

Pay USD 116mm 1y10y

Pay GBP 365mm 1y2y

Recv GBP 77mm 1y10y

Equivalent to USD 100k/bp on the box

Enter at -25.5bp. Target flat (0bp). Stop at -32bp. Rolldown over first 3m: -0.8bp.

In CMS spread caps:

Buy USD 1bn 1y expiry CMS 10y-2y cap atmf + 5bp (k=25.1bp)

Sell GBP 718mm 1y expiry CMS 10y-2y cap atmf + 10bp (k=54.8bp)

For zero cost (indicative mid)

Forward entry at -29.7bp.

The chart:

Rationale: The market is pricing two to three more hikes from the FOMC over the next 12 months. Over the same period, the MPC is forecast to hike once or maybe twice. For the ECB, the EONIA market is not even pricing one hike.

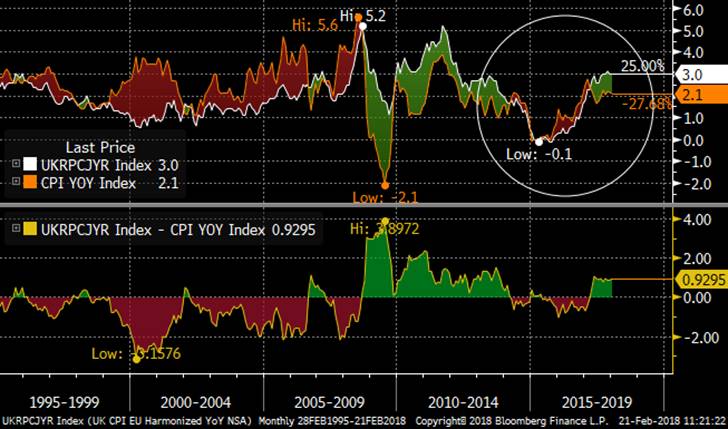

This chart shows the CPI history of the US and UK. The reflation in the UK since 2015 is matching, if not outpacing the US, and on this metric the MPC looks to be a little late to the hiking party. Of course, the elephant in the room is BREXIT with all its associated uncertainties: a ill-controlled departure from the EU could weaken Sterling and import further inflation while the apparent contraction in the labour force (from falling numbers of EU nationals) could continue to push wages higher. Or not, if some accommodation is thrashed out with the EU 27. That is not to say the US does not have inflationary pressures of its own, from rising wages to possible increased infrastructure (and other) spending.

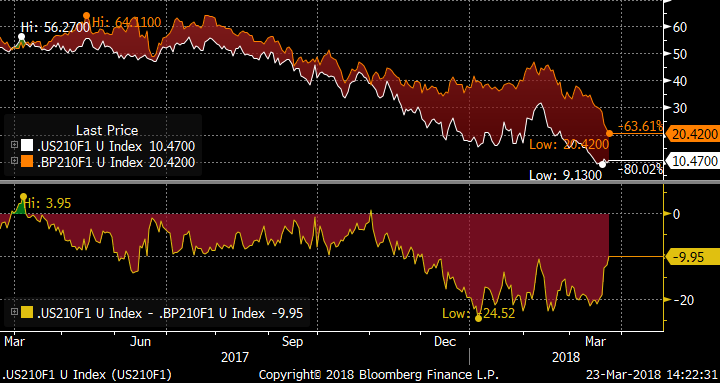

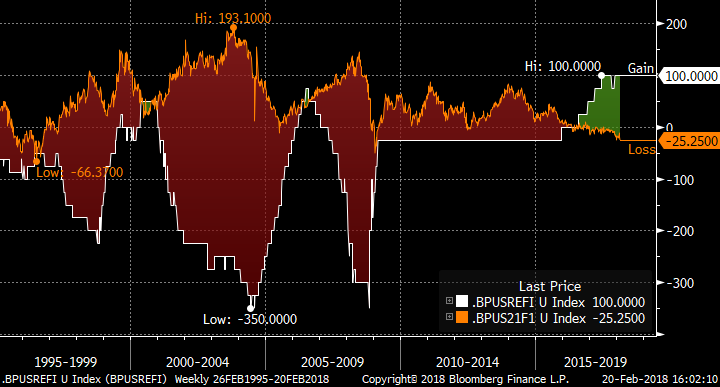

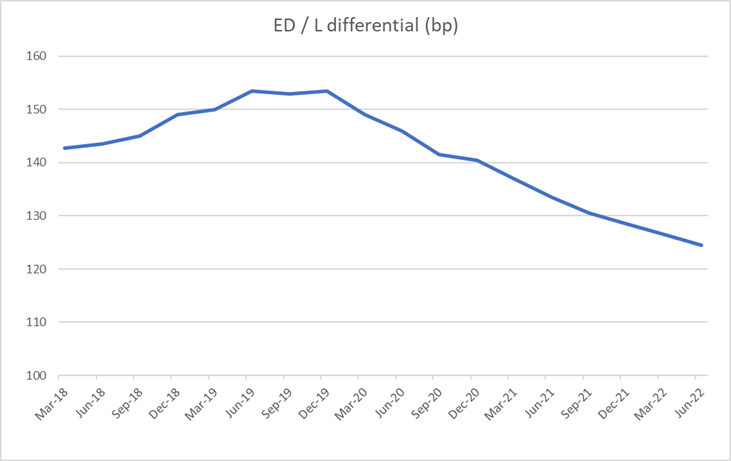

The next chart shows the differential between US and UK refi rates, overlaid with the history of the US-GBP 2y-10y, 1y forward curve box. The policy rate spread, at 100bp is the highest for the last 20 years. Beneath this is the spread between the Eurodollar and Short Sterling strips, which shows the rate differential forecast to increase to 150bp by Q2 19 before starting to narrow gradually. Effectively the market is pricing that the Fed will be pretty done a year to 18 months from now, while the BoE will still be on a hiking path (albeit a shallow one). The empirical history of the curve box from the 2004 – 2006 period saw the US curve flattening faster than the GBP in the early stages of the hiking cycle, before the box sharply changed direction in early ’06 as the MPC vacillated between cutting and hiking. It was at this point that the UK curve started flattening in earnest. Even though the short rate differential between the Fed and BoE was still widening, the box level rose.

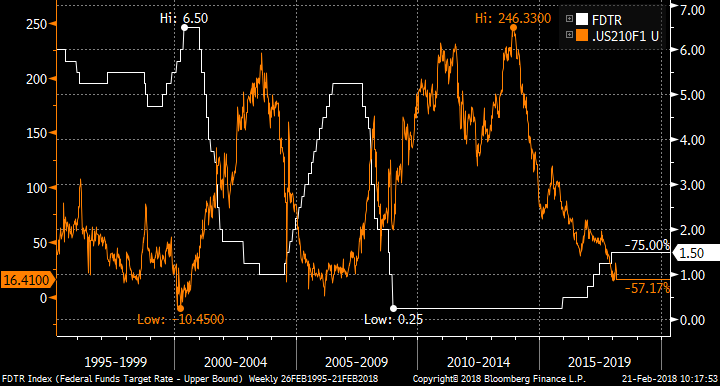

Taking each country in turn, this chart shows the US side of things: the Fed target rate vs USD 2y-10y, 1y fwd. The ’04-’06 period in the US saw the curve flattening classically as the belly of the curve could not keep pace with rising short rates. This process continued until roughly halfway through the hiking cycle, which is arguably where we are in the current cycle with another 4 or so hikes to come as priced by the market. Having flattened to its lows in the 10bp area, the curve held within a choppy range for the next 18 months. Thus the argument for the present day is that, given the forward curve is back to the previous cycle lows and the hiking cycle has matured, the next move from the US curve will be sideways, if not steeper. This is before an increasing US bond term premium is factored in.

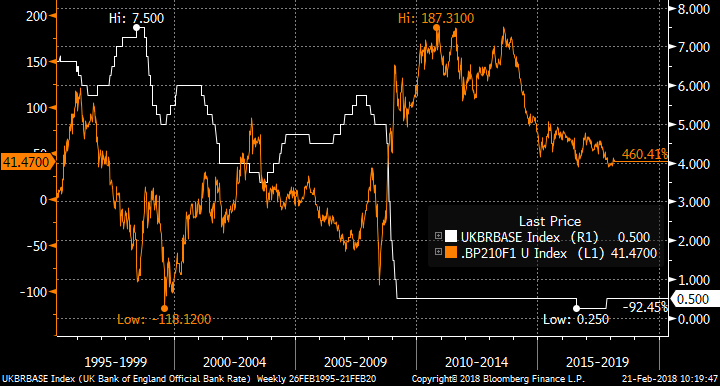

The corresponding chart for the UK shows a curve that has yet to embrace the prospect of a tightening rate cycle. The GBP 2y-10y, 1y forward curve is close to its local lows since 2008 (though has steepened back a shade in the past month), but well above the flat/inverted levels observed before the financial crisis. It is fair to note that the term premium in the UK should be higher now given the fog of BREXIT, but we have yet to see the degree of flattening associated with the MPC’s previous hiking period in ’04 to ’07.

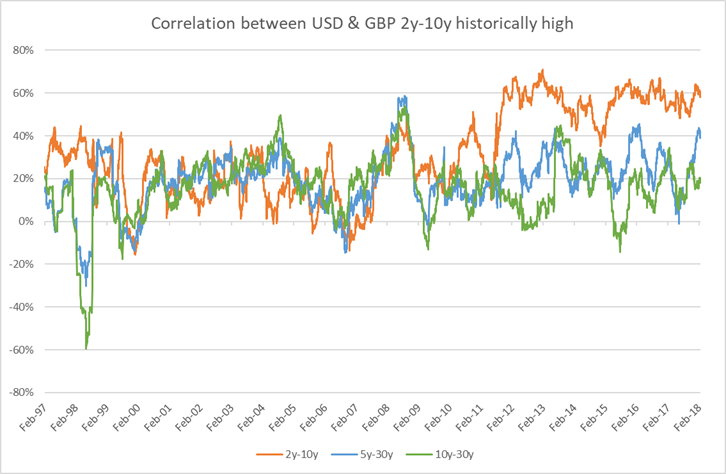

Why have I focused on 2y-10y and not other curve segments? The next chart shows three candidate box trades (2-10y, 5y-30y and 10y-30y). All three are very low levels historically. However at around 23bp inverted (on the spot 2y-10y), this sector looks the most stretched compared to the previous range.

There is another reason to prefer 2y-10y for the box. This chart shows the rolling realized 6m correlation between various USD and GBP curve sectors. While 5y-30y and 10y-30y correlations have remained in the 20-year range, the 2y-10y curves have become more correlated since 2011. Correlation is key on cross-market trades, otherwise the box is simply two orthogonal curve trades.

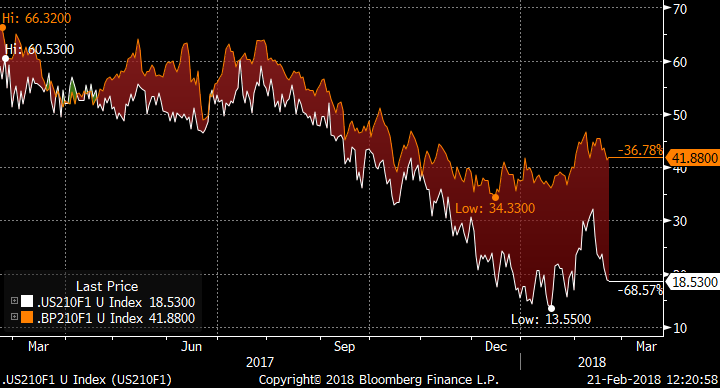

This correlation is visible in the recent history of the US/GBP 2y-10y, 1y forward curves.

An alternative way to vanilla swaps is to use CMS spread options. Re-visiting the recent history of the 2y-10y, 1y forward curves, the box has been directional in terms of curve as the US leg has been more volatile than the GBP side: heading lower as curves flattened. Thus it is interesting to look at the expression via CMS spread caps, buying a USD cap and selling the GBP. If the US curve continues to flatten, with the GBP curve following, then both options expire out of the money. On a steepening move, empirically we might expect the US curve to steepen more than the GBP and so the USD cap would prove to be more valuable than the GBP one.

The other reason to express the trade via caps rather than floors is that GBP curve implied volatility is higher than in USD, which is the opposite of relative realized volatilities (see table). The 1y expiry offers the greatest implied volatility pick-up in bp/y.

|

2y-10y implied volatility |

Realized Vol |

||||

|

3m |

6m |

1y |

2y |

3m |

|

|

USD |

39 |

38 |

37 |

35 |

36 |

|

GBP |

41 |

41 |

40 |

37 |

33 |

|

Ratio USD/GBP |

0.95 |

0.93 |

0.93 |

0.95 |

1.08 |

This differential allows us to improve the entry level on the box versus the vanilla swap structure. As usual, I like to have the option that I am short slightly out-of-the-money compared to the atmf, so this structure is approximately zero cost (mid):

Buy USD 1bn 1y expiry CMS 10y-2y cap atmf + 5bp (k=25.1bp)

Sell GBP 718mm 1y expiry CMS 10y-2y cap atmf + 10bp (k=54.8bp)

Thus the forward entry is at -29.7bp (indicative), beating the vanilla trade by 4bp.

I look forward to any and all comments you might have!

Best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EQUITY UPDATE. Yesterdays SELL OFF marks a "C" change. Most quarterly and monthly charts TERMINAL ..23.03.2018

Yesterday saw a MAJOR drop and although many daily RSI’s are over sold this whole episode marks a MAJOR “C” change. We will be going lower for some time. The NASDAQ IS NOW close to EMULATING the 2000 DROP (see page 20).

We still need weaker closes into month end BUT nearly all quarterly and monthly charts are now TERMINAL!

German and UK bonds are helping the cause given they are posting NEW JUNE highs everywhere.

As mentioned I still fancy an old fashioned stocks DOWN bonds UP.

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

•

• UK: 14-16 Dowgate Hill, London EC4R 2SU

• US: 245 Park Ave, 39th Floor, NY, NY, 10167

• Office: +44 (0) 203 143 4174

• Mobile: +44 (0) 7980708683

• Email: chris.williams@astorridge.com

• Web: www.AstorRidge.com

•

• • I provide our research notification below for your convenience:

• •

• • Research Unbundling:

• •

• • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

• •

• • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

• •

• •

• •

• • I also direct you to our disclaimer on our email footer:

• • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

• •

• • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

• •

• • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

• •

• •

• • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

• •

• • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

• •

• • Many thanks,

• •

• • Chris

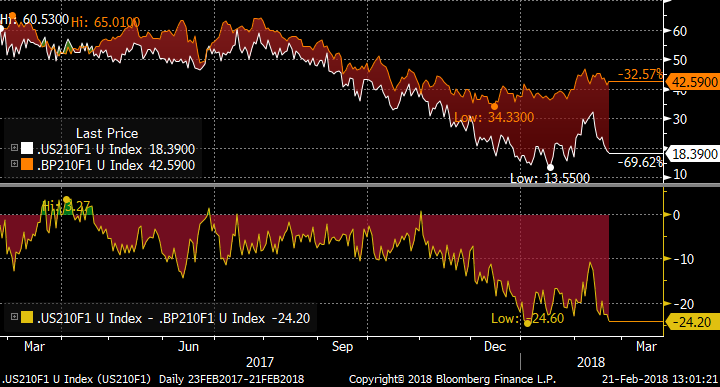

Daily Japan - 23rd March 2018

Summary:

Jgbs finish the day stronger (+9sen) and the curve flattener, with outperformance of swaps, whilst Nikkei collapses 1000pts (-4.5%) closing just 350pts off the domestic investors key September Book closing levels as markets react to Trump announcement that the US will impose Trade tariffs on China!

With $/Yen trading at 104.80, a level not seen since 2016 and some investors suggesting that now 100.00 is in sight, positions in unhedged foreign bond portfolios are looking ugly and with the recent correction in equities one has to question whether there is enough profit to off-set against these potential losses with only 1 week to go before year end.

MoF weekly flow of funds data indicates that domestic investors have been selling equities whilst increasing foreign bond investments. (Unfortunately break down of sectors and whether hedged/unhedged is not yet available)

National Core CPI halfway to BoJ’s target of 2% printing at 1%(yoy) for Febuary suggesting that Kuroda and his team still have a lot to do, and with FX moving back to 2016 level it will not be helpful.

We have had various officials over the last 2 days stating that the BoJ can Not Buy Foreign Bonds to weaken the Yen which is the start of another round of FX Verbal intervention in my opinion.

*ASO:BOJ BUYING FOREIGN BONDS SEEN AS FX INTERVENTION,SO IS HARD

What to do as a Japanese investors in this low domestic yield environment when the JPY continues to appreciate and equities look weak is starting to become very difficult.

EGB hedged back into JPY still seem to represent the best investment although no doubt some will see the USD weakness as a long term buying opportunity.

No doubt some funds will be re-invested into ever stable low yielding Jgbs but does that make long term sense?

More to be revealed on that front in the next few weeks as Life Insurance companies start to publish their investment plans for next fiscal year.

Jscc/Lch basis: unchanged curve.

Daily Closes:

|

Jgb Close |

Change on day |

High |

Low |

||||

|

150.99 |

+9 |

151.06 |

150.97 |

||||

|

|

|

|

|

|

|

||

|

Jgb |

Change on day |

Swaps Jscc |

Change on day |

||||

|

2yrs |

-0.16 |

unch |

0.0425 |

-0.375 |

|||

|

5yrs |

-0.125 |

-1 |

0.09 |

-0.625 |

|||

|

7yrs |

-0.08 |

-1 |

0.14125 |

-0.75 |

|||

|

10yrs |

0.015 |

-2 |

0.23625 |

-1 |

|||

|

20yrs |

0.515 |

-2 |

0.5825 |

-1.875 |

|||

|

30yrs |

0.735 |

-1.5 |

0.765 |

-2.375 |

|||

|

40yrs |

0.88 |

-1.5 |

0.85 |

-2.625 |

|||

|

|

Daily JGBs & Nikkei graphs:

MoF Flows of Funds Data:

- Japanese investors bought 853.8b yen ($8.1b) in overseas bonds and notes

- Japanese investors sold 386.1b yen in overseas stocks

- Foreign investors sold 352.3b yen in Japanese bonds

- Foreign investors sold 1.2t yen in Japanese stocks

Supply next 5 days:

- 27th of March – 40yrs auction

- 28th of March – 2years auction

BoJ Rinbans next 5 days:

- 28th of March - 10-25yrs & 25yrs+

- 30th of March - 1-3yrs, 3-5yrs & 5-10yrs

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Jean-Francois Lucas

O: +44 (0) 203 - 143 - 4175

M: +44 (0) 7493 026514

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Jean-Francois Lucas. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND UPDATE. Germany has rallied driven by CTA demand. US 5yr has an innoucuous PIERCE that might be SIGNIFICANT SEE page 11. . 22.03.2018.

BONDS UPDATE :

Germany continues to trade well despite the HIGH daily RSI, CTA’s continue to ADD on the trend. The US yields now look to have PEAKED post Mr Powell (see page 11).

The next BIG TRADE is US STEEPENERS : As mentioned before many RSI’s are WAY over sold and the recent POP to the 61.8% rets served to recognise the BIG BREAK level. If we close above any of the 61.8% rets this should TRIGGER a sustained long-term steepening.

1) Yields are close to breaching levels where we will see a MAJOR DROP

2) (US 5yr and UK 10yr). ALL durations are stretched, quarterly, monthly, weekly and daily… this is RARE!

3) Looking at the previous Equity piece, European stocks look a LONGTERM failure thus I firmly believe this mean BONDS rally.

3) Germany 26’s bonds based well as do the FUTURES post yesterdays intraday REVERSAL.

4) UK yields have a LOFTY RSI and UKTI POISED to bounce. UK 10yr all eyes on a continued breach of 1.489 (10yr Gilts).

5) US 10 Breakevens have a LOFTY WEEKLY and DAILY RSI.

6) Nearly ALL US curves rejected the recent steepening BIAS at MAJOR MULTI YEAR 61.8% ret, the RSI’s remain low however. If the 61.8% ret’s are breached we steepen in a BIG WAY.

** US curves will be a BIG trade once the 61.8% retracements are breached. **

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

•

• UK: 14-16 Dowgate Hill, London EC4R 2SU

• US: 245 Park Ave, 39th Floor, NY, NY, 10167

• Office: +44 (0) 203 143 4174

• Mobile: +44 (0) 7980708683

• Email: chris.williams@astorridge.com

• Web: www.AstorRidge.com

•

• • I provide our research notification below for your convenience:

• •

• • Research Unbundling:

• •

• • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

• •

• • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

• •

• •

• •

• • I also direct you to our disclaimer on our email footer:

• • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

• •

• • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

• •

• • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

• •

• •

• • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

• •

• • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

• •

• • Many thanks,

• •

• • Chris

MICROCOSM: Gauging Impact on Spanish Bonos of a S&P Ratings Boost

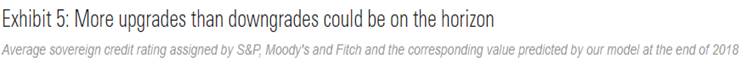

- Back on Jan 24th I wrote a quick note on the pending SPGB 4/28s with a CRUDE approximation of where a EGB issuer should trade relative to their peers based on their long-term sovereign rating (attached). While there are plenty of idiosyncrasies that can complicate these estimates (politics, QE, global economic trends, etc) we think the impact of a ratings upgrade on end-user demand can be strong enough to drive significant outperformance of one issuer versus another, just as a downgrade could have an adverse one. The closer an issuer’s ratings get to AAA, the deeper the pockets of potential investors like central banks and sovereign wealth funds.

- Combing through the available research on the ratings outlook in Europe paints a fairly uniformly optimistic outlook. The bar chart below, borrowed from our friends at GS, shows improvements not only for Spain (more below) but for Ireland, Italy, Belgium, Finland and Austria. The notable exceptions are France, which is expected to stay put at AA and Portugal which could see a downgrade in their view.

- Spain’s long-term rating is widely expected to be upgraded by S&P tomorrow from BBB+ to A- given their positive outlook on the credit. With Moody’s and Fitch’s outlook for Spain both ‘Stable’ now, this could be it for 2018 unless there’s a change in outlook at their next reviews. The ‘How long is a piece of string?’ question is whether this ratings upgrade is fully priced into SPGB spreads to other EGBs like France’s OATs.

- If we use our back of the envelope guide to EGB spreads as measured by their ratings (see attached), tomorrow’s move to A- would take Spain’s average rating to four notches below France (AA > AA- > A+ > A > A-). The current spread between SPGB 1.4 4/28 and FRTR .75 5/28s is about +50bps which implies 12.5bps per notch – pretty close to our ‘model’.

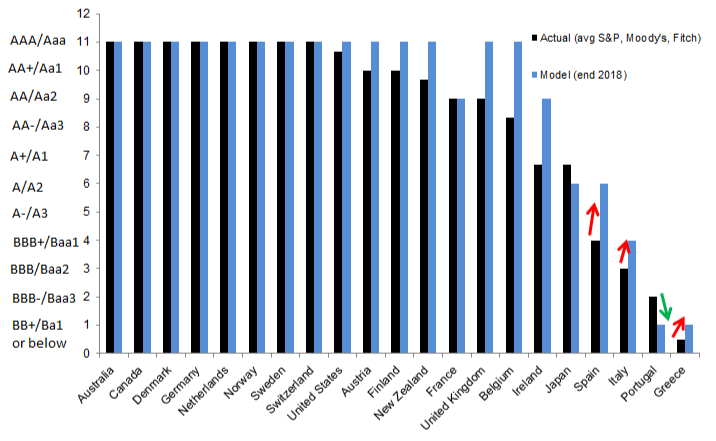

- The chart of our SPGB 10/27s vs IKA and OATA blend below shows that SPGBs were tightening sharply into the Jan 19th Fitch upgrade to A- but just kept going into the end of January. This richening had something to do with the pending Italian elections but regardless, the market saw significant further buying versus its primary ‘competitors’ within the EGB mkt. Now it gets interesting. With this ‘fly’ back to its richest levels there are some important considerations to bear in mind:

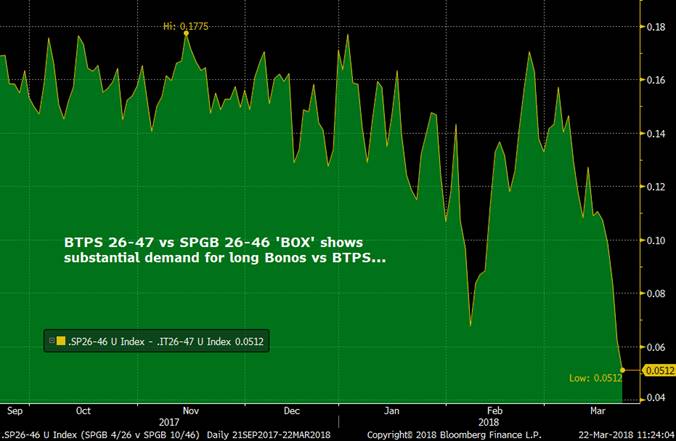

- Positioning in SPGBs is long here, especially versus BTPS and to a lesser extent OATs. That said, according to dealers, the demand seen of late (especially in the long end) has largely been international players, not domestics who tend to have stronger hands. If S&P disappoints in some fashion, profit taking flows could be rather large.

- Demand for SPGBs out of Japan, as a percentage of EGB demand, rose in early 2018. EGBs hedged back into JPY still look more attractive than USTs and UKTs and with Japan’s new fiscal year just around the corner, we should see renewed demand for all EGBs but especially SPGBs given their improved aggregate credit rating.

- April is a HUGE month for coupon and redemption flows in France which also leads to a larger than average index extension at months-end. Unless France’s AFT decides to lay a big syndicated deal on the market (as they’ve done in April before), it’s safe to assume OATs will be well supported on balance. This could help prevent SPGBs from tightening much vs OATs, especially in the belly of the curve.

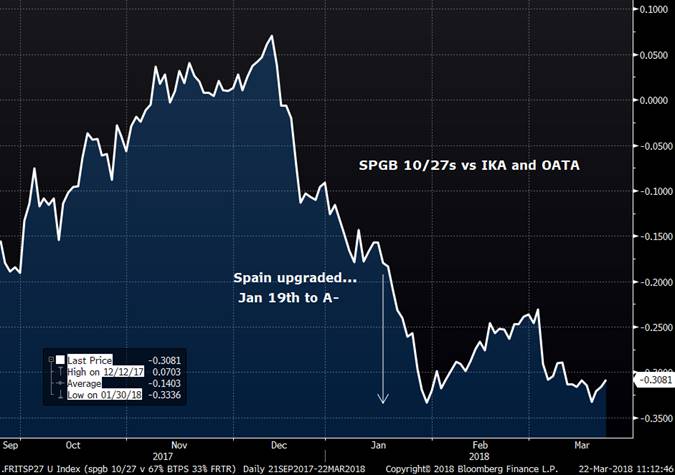

- BTPS spreads to SPGBs remain elevated, even with BTPS trading very well despite the political stalemate in Rome. While Italy’s credit outlook isn’t nearly as rosy as Spain’s, it seems logical to expect profit taking on a SPGB driven further widening from here. After all, if GS is right, Italy’s rating should end the year just 2 notches below Spain’s which, we would argue, makes BTPS look awfully cheap at ~+60bps-plus in 10yrs.

- Long Spain has been ‘En Fuego!’ in March with 10-30s flattening sharply vs Italy. This could persist but would suggest the market’s already placed their bets on a Spanish upgrade.

SPGB 10/27s vs OATA and IKA Blend

- Bottom-line is, in my view, there is a good deal less ‘juice’ in SPGBs now than there was back in January when SPGBs began their epic quest tighter. Unless S&P maintains a positive outlook, implying further 2018 upgrades, it feels like this move is largely priced in. Demand out of Japan could help tighten spreads some more vs OATs but closing in on the +40bps level in 10yrs would be stretching things in my view and worth a fade back into the ‘wings’ of the blend.

We’ll be in touch.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EQUITY UPDATE. STOCKS are close to some MAJOR free fall levels. Daily durations persist in making new lows. ..22.03.2018

Stocks although quiet have steadily been making lows, only niggle is a week remains till month end. Therefore negative performance needs to be maintained!

I am nervous that month end is not upon us but equally happy with the TERMINAL aspect of many quarterly charts.

German and UK bonds are helping the cause given they are posting NEW JUNE highs everywhere. As mentioned I still fancy an old fashioned stocks DOWN bonds UP.

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

•

• UK: 14-16 Dowgate Hill, London EC4R 2SU

• US: 245 Park Ave, 39th Floor, NY, NY, 10167

• Office: +44 (0) 203 143 4174

• Mobile: +44 (0) 7980708683

• Email: chris.williams@astorridge.com

• Web: www.AstorRidge.com

•

• • I provide our research notification below for your convenience:

• •

• • Research Unbundling:

• •

• • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

• •

• • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

• •

• •

• •

• • I also direct you to our disclaimer on our email footer:

• • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

• •

• • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

• •

• • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

• •

• •

• • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

• •

• • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

• •

• • Many thanks,

• •

• • Chris

Daily Japan - 22nd March 2018

Summary:

Another particularly dull day in fixed income in Japan with Jgbs closing slightly higher(+3sen) after yesterday’s Bank Holiday whilst Nikkei plays catch up and rallies +211pts(+1%) despite the stronger JPY following the FOMC signalling just another 2 rate hikes during 2018, although it was a very close call.

Only 6 business days left before financial year end making cash flows very subdued with swaps outperforming in a bullish flattening trend.

Cross currency basis has snapped in over 10bps in the last 24hrs with a large Japanese securities firm speculating that a domestic investor liquidated a large USD position and repatriated funds home therefore needing to pay the basis.

With the attractiveness of EGBs yields hedged back into JPY and USTs outright compared to JGBs I continue to expect to see domestic investor shift into foreign bonds as soon as we start the new fiscal year especially with any risks that FED’s Powell would be very hawkish having faded.

10yrs Bunds back into JPY yielding 0.84%

10yrs OATs back into JPy yielding 1.075%

10yrs USTs unhedged yielding 2.86%

Compared to 20yrs JGBs yielding 54bps!

Being SHORT Jgbs into the start of the new fiscal year is starting to make sense to me and I would favour the 20yrs point which I believe is still a sector that some of the Mega Banks hold and have some unrealised PNL which could be realised early on into April.

Jscc/Lch basis: unchanged curve.

Daily Closes:

|

Jgb Close |

Change on day |

High |

Low |

||||

|

150.90 |

+3 |

150.95 |

150.87 |

||||

|

|

|

|

|

|

|

||

|

Jgb |

Change on day |

Swaps Jscc |

Change on day |

||||

|

2yrs |

-0.16 |

-0.5 |

0.04625 |

unch |

|||

|

5yrs |

-0.115 |

unch |

0.09625 |

-0.375 |

|||

|

7yrs |

-0.065 |

unch |

0.14875 |

-0.625 |

|||

|

10yrs |

0.035 |

umch |

0.24625 |

-0.875 |

|||

|

20yrs |

0.535 |

+0.5 |

0.6125 |

-1 |

|||

|

30yrs |

0.75 |

unch |

0.79 |

-1 |

|||

|

40yrs |

0.895 |

unch |

0.8775 |

-1 |

|||

|

|

Daily JGBs & Nikkei graphs:

Press News:

- Japan firms see no BOJ tightening until 2019 or beyond 2020 - Reuters poll

https://uk.finance.yahoo.com/news/japan-firms-see-no-boj-tightening-until-2019-231148971--business.html

Supply next 5 days:

- 27th of March – 40yrs auction

- 28th of March – 2years auction

BoJ Rinbans next 5 days:

- 23rd of March - 1-3yrs & 3-5yrs

- 28th of March - 10-25yrs & 25yrs+

- 30th of March - 1-3yrs, 3-5yrs & 5-10yrs

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Jean-Francois Lucas

O: +44 (0) 203 - 143 - 4175

M: +44 (0) 7493 026514

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Jean-Francois Lucas. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796