How are we doing? Shadow portfolio update

Portfolio since 14th Feb: USD -7k, Ytd +151k

Summary: It’s been a while since the last update, but neither I nor the markets have been idle. That said, the portfolio’s P&L is pretty much unchanged. Starting with the least successful trade, I stopped out of the GBP/USD 5y5y cross-currency basis trade which subsequently went further offside. The RX/UB invoice spread box, while up from its inception in December last year, finished down versus the 1st Jan mark: it was becalmed in a 3.5/5.5 bp range and had not exhibited any of the relative richening of Bunds that I had anticipated for the first quarter. I switched my outright USD steepening exposure into a box trade versus GBP in two versions (vanilla swaps and CMS caps) and that is working for now. The rally in EUR rates since mid-February worked well for the 2y2y/5y10y bull-steepener, for even though the curve did not steepen, the relative moneyness of the 2y2y leg ensured a gain. As a tactical bet on a hawkish ECB at the March meeting I set a 3y1y/10y10y flattener in swaps: this performed into the meeting and further after the initial announcement, however Draghi’s Q&A reversed sentiment and the trade gave back a lot (but not all) of the initial gains. Most recently I have added a 1y expiry EUR CMS 10-5 collar (selling 80bp cap to buy 33bp floor) as a long-term flattening position.

Changes:

- Closed USD 2y-10y, 1y fwd steepener and replaced with two versions of the cross-market GBP/USD 2y-10y box trade

- Stopped out of GBP/USD 5y5y xccy basis

- Closed RX/UB invoice spread box before contract roll

- Closed EUR 2y2y/5y10y bull-steepener

- Opened and closed EUR 3y1y/10y10y tactical flattener around the March ECB meeting

- Opened EUR CMS 10-5 collar flattener

|

Trade Idea |

Entered |

Level |

Size |

Status |

Exit/Current Level |

Exit Date |

P&L k USD |

|

US 2-10 steepener via CMS caps |

28-Dec-17 |

0 bp |

USD 25 k/bp |

CLOSED |

0 bp |

15-Jan-18 |

0 |

|

RX/UB ASW Box |

28-Dec-17 |

-6.1 bp |

EUR 50 k/bp |

CLOSED |

-5.2 bp |

06-Mar-18 |

-56 |

|

EUR 1y3y/5y5y Mid-curve flattener |

28-Dec-17 |

13.7 bp |

EUR 20 k/bp |

CLOSED |

29 bp |

31-Jan-18 |

380 |

|

GBP 1y1y1y MC Payer spread |

28-Dec-17 |

0.7 bp |

GBP 25 k/bp |

CLOSED |

-1 bp |

31-Jan-18 |

-60 |

|

EUR 9m1y1y/9m1y5y Bear Flattener |

28-Dec-17 |

4.2 bp |

EUR 25 k/bp |

CLOSED |

0 bp |

30-Jan-18 |

-130 |

|

Receive GBP/USD 5y5y xccy basis |

28-Dec-17 |

1 bp |

GBP 40 k/bp |

CLOSED |

6.4 bp |

28-Feb-18 |

-297 |

|

EUR 2-5-10 weighted swap fly |

28-Dec-17 |

-28.1 bp |

EUR 40 k/bp |

CLOSED |

-25 bp |

25-Jan-18 |

-154 |

|

GBP 2y-10y Bull-steepener |

05-Jan-18 |

0 bp |

GBP 20 k/bp |

OPEN |

0 bp |

0 |

|

|

EUR 2y2y/5y10y Bull-Steepener |

30-Jan-18 |

0 bp |

EUR 25 k/bp |

CLOSED |

4 bp |

05-Mar-18 |

123 |

|

USD 2y-10y, 1y fwd steepener |

02-Feb-18 |

22 bp |

USD 25 k/bp |

CLOSED |

20.5 bp |

21-Feb-18 |

-38 |

|

GBP/USD 2y-10y 1y fwd Swaps |

21-Feb-18 |

-25.5 bp |

GBP 25 k/bp |

OPEN |

-18.6 bp |

244 |

|

|

GBP 2y-10y vs USD CMS Caps |

21-Feb-18 |

0 bp |

GBP 25 k/bp |

OPEN |

1 bp |

35 |

|

|

EUR 3y1y/10y10y flattener |

06-Mar-18 |

124 bp |

EUR 25 k/bp |

CLOSED |

120 bp |

08-Mar-18 |

123 |

|

EUR CMS 10-5 collar |

06-Mar-18 |

0.5 bp |

EUR 40 k/bp |

OPEN |

0.1 bp |

-20 |

|

|

Total YTD |

151 |

||||||

|

Note on trade sizing: Each trade is sized to generate approx. USD 150k 2y 99% hist. VaR at inception with no netting |

|||||||

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Japan: LDP policy chief - BOJ should consider exit strategy from stimulus

Whilst I would generally take such comments with a pinch of salt they are worth noting as Kishida, the LDP policy chief, is a strong contender to succeed Prime Minister Abe as the next leader of the LDP. Any further fall out from the current "school scandal" could see him being propelled to power.

LDP policy chief - BOJ should consider exit strategy from stimulus: NHK

2018-03-21 10:07:15.329 GMT

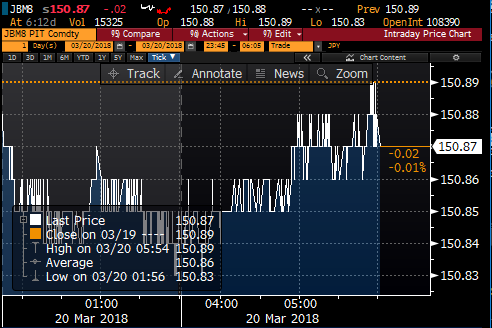

Daily Japan - 20th March 2018

Summary:

Another lacklustre day in Jgbland with futures trading in a 6sen range on only 15k contracts. We are 7 business days away from the new fiscal year and its fair to assume all the end of f/year booking keeping has now been done!

With FED’s Powell holding his first 2 days meeting(results expected 21/03 at 6pm) and a Bank Holiday tomorrow in Tokyo these were further reasons for investors to play the ‘wait & see’ game.

Today’s liquidity auction targeting 15.5-40yrs went and gone with not much follow thru’. With another 4 sets of Rinbans over 7 business days likely to be supportive to the market against that we only the 40yrs auction on the 27th to be a bit of a challenge although lack of inventory in that sector should be supportive. Net net don’t expect Jgbs to drift very far from these levels before books close completely.

I’m still of the opinion that early April should start to see some liquidating of Jgbs to realise some profits early on in the New f/year by Mega Banks with some proceeds being parked back into unhedged USTs whilst $/Y remains around these levels but also into EGBs hedged back into JPY which yield significantly more than any JGBs across the whole curve.

The Political “School scandal” is unlikely to go away in a rush but at the moment despite plunge in his popularity ratings Abe continues to deny any involvement or influence. One should keep a close ear to the ground on this topic as the demise of Abe could potentially mean the end of the Kuroda regime.

Jscc/Lch basis: more or less unchanged across the curve with very small steepening of the curve.

Daily Closes:

|

Jgb Close |

Change on day |

High |

Low |

||||

|

150.87 |

-2 |

150.89 |

150.83 |

||||

|

|

|

|

|

|

|

||

|

Jgb |

Change on day |

Swaps Jscc |

Change on day |

||||

|

2yrs |

-0.16 |

-0.5 |

0.04625 |

-0.125 |

|||

|

5yrs |

-0.115 |

unch |

0.10125 |

-0.125 |

|||

|

7yrs |

-0.065 |

unch |

0.15625 |

unch |

|||

|

10yrs |

0.035 |

umch |

0.2550 |

-0.125 |

|||

|

20yrs |

0.535 |

+0.5 |

0.6225 |

-0.25 |

|||

|

30yrs |

0.75 |

unch |

0.80 |

-0.25 |

|||

|

40yrs |

0.895 |

unch |

0.8875 |

-0.25 |

|||

|

|

Daily JGBs & Nikkei graphs:

Supply next 5 days:

- 22nd of March – 3mth Tbill auction

- 27th of March – 40yrs auction

- 28th of March – 2years auction

BoJ Rinbans next 5 days:

- 22nd of March - 5-10yrs, 10-25yrs & 25yrs+

- 23rd of March - 1-3yrs & 3-5yrs

- 28th of March - 10-25yrs & 25yrs+

- 30th of March - 1-3yrs, 3-5yrs & 5-10yrs

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Jean-Francois Lucas

O: +44 (0) 203 - 143 - 4175

M: +44 (0) 7493 026514

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Jean-Francois Lucas. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

US CURVE SPECIAL.. Curve ALERT, I think we STEEPEN from here and this is a BASE for MANY YEARS.. STOPS CHEAP. 19.03.2018

US CURVE SPECIAL. WE STEEPEN FROM HERE!

They have been on the RADAR for some time given most have MULTI YEAR RSI dislocations and ALL rejected major 61.8% retracements on the latest steepening. It is and will be the trade to be in for the next few years, just hard picking a base lately.

The BIGGEST issue is timing and location to PUT ON THE STEEPENER.

I actually think it’s TIME and most stops are cheap.

It’s also been mentioned it’s a BRAVE call so every reason to have a GO!

• ![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

•

• UK: 14-16 Dowgate Hill, London EC4R 2SU

• US: 245 Park Ave, 39th Floor, NY, NY, 10167

• Office: +44 (0) 203 143 4174

• Mobile: +44 (0) 7980708683

• Email: chris.williams@astorridge.com

• Web: www.AstorRidge.com

•

• • I provide our research notification below for your convenience:

• •

• • Research Unbundling:

• •

• • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

• •

• • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

• •

• •

• •

• • I also direct you to our disclaimer on our email footer:

• • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

• •

• • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

• •

• • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

• •

• •

• • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

• •

• • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

• •

• • Many thanks,

• •

• • Chris

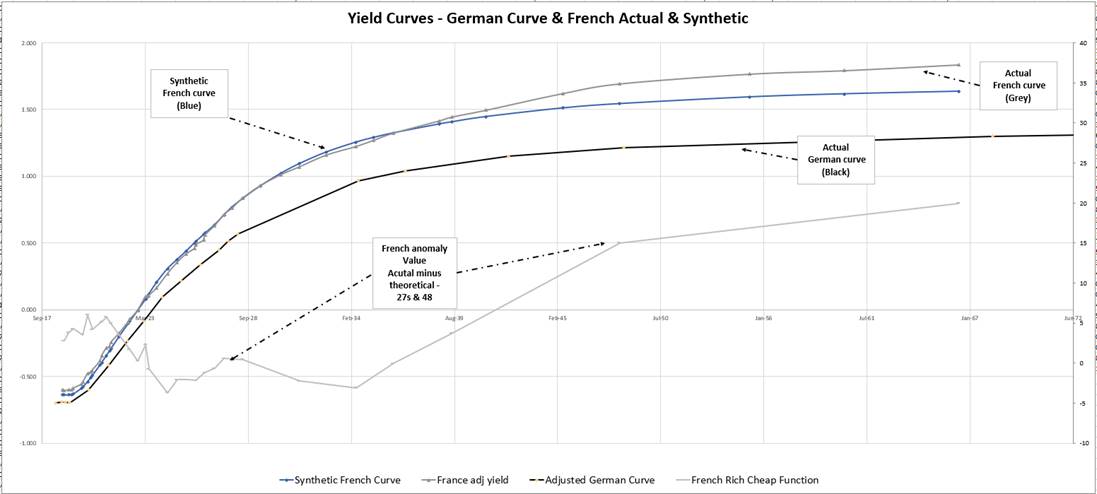

French 10s30s flattener vs Germany

Trade idea – Monday 19th March

French 10s30s flattener Box vs Germany

Trade Mechanics

- Buy 20,2MM Frtr 2% 5/48 vs sell 377 cts OAT Future €50k/01 (ctd Frtr 2.75 10/27)

- Sell 19,7MM Dbr 1.25% 8/48 vs buy 360 cts RXA futures €50k/01 (ctd Dbr 0.25% 2/27)

History

- Bloomberg History

- Cix:

100 * ((YIELD[FRTR 2 5/48 Corp] - YIELD[FRTR 2.75 10/27 Corp]) - 1.0 * (YIELD[DBR 1.25 8/48 Corp] - YIELD[DBR 0.25 2/27 Corp]))

Levels

- Entry: @ +19bp

- Add: @ +20.5bp

- Target: @ +16bp

- Stop: @ +23.5bp

Rationale

- We conflate the 0-10y French term structure with the German Yield curve to produce a synthetic French yield curve. With the French credit this tight, we would expect the gradient of the French 10s30s to more closely mirror that of Germany. See Graph below – the spread mapping in the long end is too wide for such a narrow credit

*Curves are normalised for H/L coupon feature by the diff between Swap spread and Z-spread

- The next long maturity supply in France will be on April 5th . Further supply in 48s is possible but we favour 15s and 20s as preferred choices. The 30y was last tapped end of February, taking it to >€18,45Bln in issue size. When the prior Frtr 5/45 reached €17,7Bln in issue size (January 2016) it wasn’t tapped again until the following May and after that only twice more.

- The Tresor has scope to tap the recently launched 15y Frtr 5/34. The prior 15y, Frtr 5/31 was tapped again the month after it was first launched (Sep/Oct 2015).

- The Tresor has also scope to tap the 20y bond. The Tresor announced it would continue to tap the 2039 ‘Green’ Bond during 2018 – it was last tapped Dec 2017. ‘AFT will also continue to tap the green bond first issued in January 2017 to meet market demand, up to the limit of eligible green expenditures for 2018’ - Indicative State financing programme for 2018, http://www.aft.gouv.fr/articles/indicative-state-financing-programme-for-2018_13109.html

- On balance, unless we see a significant cheapening of the French credit relative to Germany, in the current issuance environment, we could see the French 10s30s contract closer that of Germany

Carry and Roll

- French leg (8bp spread)

Carry -1.1bp /3mo

Roll -2.5bp /3mo

- German leg (14bp spread)

Carry +2bp /3mo

Roll +2.5bp /3mo

- Nett Carry and roll +0.9bp /3mo

Risks

- The 10y sector in France stays rich – possibly as a liquidity point in further tightening

- The German curve continues to out flatten the French curve

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EQUITY UPDATE. STOCKS continue to struggle and this NEEDS to persist daily, into monthend. LONGTERM charts remain OVER STRETCHED. ..19.03.2018

Stocks remain QUIET but that said they lack any kind of BOUNCE, especially in EUROPE.

I am nervous that month end is not upon us but equally happy with the TERMINAL aspect of many quarterly charts.

German and UK bonds are helping the cause given they are posting NEW JUNE highs everywhere. As mentioned I still fancy an old fashioned stocks DOWN bonds UP.

• ![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

•

• UK: 14-16 Dowgate Hill, London EC4R 2SU

• US: 245 Park Ave, 39th Floor, NY, NY, 10167

• Office: +44 (0) 203 143 4174

• Mobile: +44 (0) 7980708683

• Email: chris.williams@astorridge.com

• Web: www.AstorRidge.com

•

• • I provide our research notification below for your convenience:

• •

• • Research Unbundling:

• •

• • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

• •

• • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

• •

• •

• •

• • I also direct you to our disclaimer on our email footer:

• • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

• •

• • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

• •

• • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

• •

• •

• • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

• •

• • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

• •

• • Many thanks,

• •

• • Chris

FX UPDATE... USD strength filtering through many crosses now compliamenting the call for lower bond yields and weaker stocks.. 19.03.2018

• Throughout last week is had NUMEROUS conversations with REAL MONEY managers about the USD and its strength going forward.

• USD CAD has been a major call and bounced well from the moving average. This should persist now we are above the 1.300 level.

• The EURO is on the brink of a MAJOR statement should we breach the 1.2167.

• ![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

•

• UK: 14-16 Dowgate Hill, London EC4R 2SU

• US: 245 Park Ave, 39th Floor, NY, NY, 10167

• Office: +44 (0) 203 143 4174

• Mobile: +44 (0) 7980708683

• Email: chris.williams@astorridge.com

• Web: www.AstorRidge.com

•

• • I provide our research notification below for your convenience:

• •

• • Research Unbundling:

• •

• • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

• •

• • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

• •

• •

• •

• • I also direct you to our disclaimer on our email footer:

• • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

• •

• • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

• •

• • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

• •

• •

• • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

• •

• • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

• •

• • Many thanks,

• •

• • Chris

BOND UPDATE. Germany has rallied driven by CTA demand. The US has BASED on SUPPLY. 16.03.2018.

BONDS UPDATE :

Germany has traded well this week once Schatz initiated a new high earlier in the week, since then CTA’s have added Bobl and Bunds. Gilts FINALLY followed suit by breaching the 1.489 trend line. This will KICK START many of the WEEKLY and MONTHLY RSI dislocations.

The next BIG TRADE is US STEEPENERS : As mentioned before many RSI’s are WAY over sold and the recent POP to the 61.8% rets served to recognise the BIG BREAK level. If we close above any of the 61.8% rets this should TRIGGER a sustained long-term steepening.

1) Yields are close to breaching levels where we will see a MAJOR DROP

2) (US 5yr and UK 10yr). ALL durations are stretched, quarterly, monthly, weekly and daily… this is RARE!

3) Looking at the previous Equity piece, European stocks look a LONGTERM failure thus I firmly believe this mean BONDS rally.

3) Germany 26’s bonds based well as do the FUTURES post yesterdays intraday REVERSAL.

4) UK yields have a LOFTY RSI and UKTI POISED to bounce. UK 10yr all eyes on a continued breach of 1.489 (10yr Gilts).

5) US 10 Breakevens have a LOFTY WEEKLY and DAILY RSI.

6) Nearly ALL US curves rejected the recent steepening BIAS at MAJOR MULTI YEAR 61.8% ret, the RSI’s remain low however. If the 61.8% ret’s are breached we steepen in a BIG WAY.

** US curves will be a BIG trade once the 61.8% retracements are breached. **

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4174

Mobile: +44 (0) 7980708683

Email: chris.williams@astorridge.com

Web: www.AstorRidge.com

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

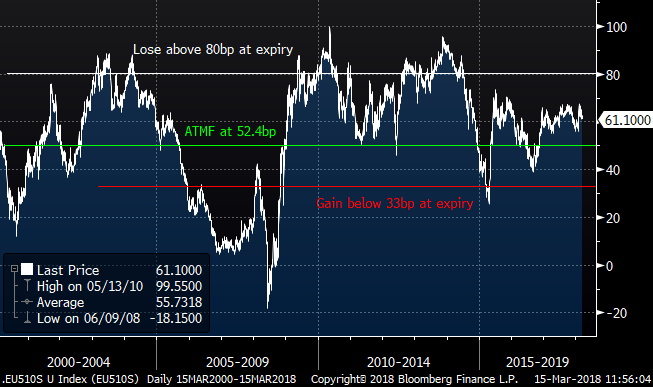

Trade: EUR flattener via CMS collars on 5y-10y

Bottom line: My previous piece on EUR 5-10-30 went through the reasons that I like EUR flatteners, this trade is another expression. The high skew on curve caps compared to floors offers an interesting risk/reward on a zero-cost structure.

Trade:

Buy EUR 1bn 1y floor on CMS 10-5 k=33bp

Sell EUR 1bn 1y Cap on CMS 10-5 k=80bp

for zero-cost (indicative mid)

equivalent to EUR 100k/bp of the 5y-10y curve.

Atmf at 52.4bp. Spot vanilla 5y-10y at 61bp.

Rationale: It won’t have escaped notice, but I like EUR flattening exposure, for all the reasons I have gone into previously. This collar structure is a more leveraged way to position for a flattening. The cap is struck 27.6bp OTM, while the floor that you are long is only 19.4bp OTM, due to the high skew on otm caps compared to floors (implied vol: 23.8 bp/y on the cap vs 18.6 on the floor). The curve will probably not steepen enough to reach the lower boundary, however the value of the structure will increase if the curve flattens.

The risk is that the curve steepens through 80bp at expiry. This would be a significant reversal in the current dynamic and require a move back to Jul-14 levels. One scenario could be a large sell-off in the US while Europe stagnates (and hence short rates do not join in the sell-off).

Love to hear your thoughts,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EQUITY UPDATE.... As stocks are a MAJOR ingredient in my “SPECIAL PIECE”, TODAY NEEDS weak CLOSES...15.03.2018

Apologies for yet another update BUT today is a major day for stocks to FAIL, all helping the SPECIAL REPORT piece yesterday.

As stocks are a MAJOR ingredient in my “SPECIAL PIECE”, TODAY

NEEDS weak CLOSES!

I am nervous that month end is not upon us but equally happy with the TERMINAL aspect of many quarterly charts. We just need to allay any fears today.

German and UK bonds are helping the cause given they are posting NEW JUNE highs everywhere. As mentioned I still fancy an old fashioned stocks DOWN bonds UP.

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4174

Mobile: +44 (0) 7980708683

Email: chris.williams@astorridge.com

Web: www.AstorRidge.com

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris