Daily Japan - 15th March 2018

Summary:

Another lacklustre day in JGBs despite the last 20years auction of the fiscal year which went well, averaging 0.543% and a btc of 4.47 times, the lowest yield since November 2016. This had a small flattening impact on the curve with 20yrs still being the best carry & roll point on the curve outperforming.

Currently no further fall out from the political ‘School’ scandal (heavily discounted sale of public land to an Abe family acquaintance) although Minister of Finance ASO is not expected to attend the G20 meeting on the 19/20th as people call for his head. At the moment everybody is focusing on the Ministry of Finance which is accused of doctoring documents and if ASO needs to fall on his sword the knives will then quickly turn on ABE which could prove to be the start of something much bigger.

Worth a mention was the large buying of Foreign Bonds by Japanese investors in the last week. I assume a combination of $/Y trading round 105.50 and 10yrs USTs @ 2.90% must have been the catalyst for some ‘unhedged buying’ as the ‘cost of funding USD purchases’ is still prohibitively high.

With the end of the fiscal year only 2weeks away we need to start thinking what domestic investors are likely to be looking to do in April. Traditionally they are large sellers of JGBs to realise profits early for the new f/year and whilst I don’t think they are sitting on huge amounts of pnl on their JGB portfolios I do think this trend will continue.

Investing in EGBs will most probably be high on their list as well (hedged and unhedged) whilst any investments in USTs is most likely to be on an unhedged basis due to continuous high hedging cost as the FED continues to push rates higher.

Please see below how much more attractive it is for a domestic investor to buy hedged Bunds & Oats compared to hedged USTs.

We are now at yield levels that the whole JGB yield curve yields LESS than 10yrs France hedged back into JPY.

10yrs USTs hedged back into JPY

10yrs Bunds hedged back into JPY

10yrs OATs hedged back into JPY

Jscc/Lch basis: unchanged across the curve.

Daily Closes:

|

Jgb Close |

Change on day |

High |

Low |

||||

|

150.76 |

+9 |

150.77 |

150.69 |

||||

|

|

|

|

|

|

|

||

|

Jgb |

Change on day |

Swaps Jscc |

Change on day |

||||

|

2yrs |

-0.145 |

+0.5 |

0.04875 |

-0.125 |

|||

|

5yrs |

-0.105 |

unch |

0.1075 |

-0.375 |

|||

|

7yrs |

-0.065 |

-0.5 |

0.16375 |

-0.375 |

|||

|

10yrs |

0.04 |

-0.5 |

0.26375 |

-0.5 |

|||

|

20yrs |

0.54 |

-0.5 |

0.63375 |

-0.875 |

|||

|

30yrs |

0.75 |

unch |

0.81125 |

-0.75 |

|||

|

40yrs |

0.895 |

+0.5 |

0.89875 |

-0.75 |

|||

|

|

Daily JGBs & Nikkei graphs:

MoF Flow of funds data:

Big week of buying of foreign bonds by domestic investors!

- Japanese investors bought 1.1t yen ($10.3b) in overseas bonds and notes

- Japanese investors sold 23b yen in overseas stocks

- Foreign investors bought 486b yen in Japanese bonds

- Foreign investors sold 432.5b yen in Japanese stocks

Supply next 5 days:

- 16th of March – 1yr Tbill auction

- 20th of March – Liquidity auction

- 22nd of March – 3mth Tbill auction

BoJ Rinbans next 5 days:

- 16th March – Up to 1year, 10-25yrs & 25yrs+

- 19th March - 1-3yrs, 3-5yrs & 5-10yrs

- 22nd of March - 5-10yrs, 10-25yrs & 25yrs+

- 23rd of March - 1-3yrs & 3-5yrs

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Jean-Francois Lucas

O: +44 (0) 203 - 143 - 4175

M: +44 (0) 7493 026514

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Jean-Francois Lucas. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: Trade - Spain 30y Roll 46s 48s

Spanish Trade – Long end Roll too steep, Spanish Rating Update due shortly from Standard and Poor’s

Trade Mechanics

- Sell Spgb 2.9% Oct 46

- Buy Spgb 2.7% Oct 48

- €50k/DV01, €23MM into €23MM

Levels

- Current @ +9.4 bp

- Enter @ +9 bp

- Add @ +11 bp

- Target @ +6 bp

- Stop @ +14 bp

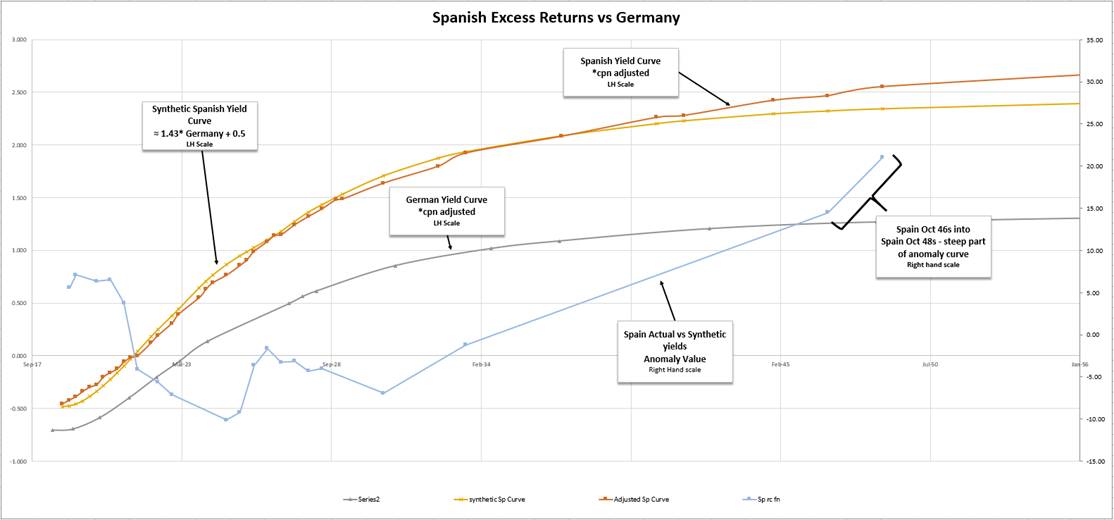

Spanish excess returns vs Germany

- We create a Synthetic Spanish yield curve by plotting its excess returns vs the German curve.

- Simply, the Spanish Curve is approximated by: ‘German Curve * 1.43 + 0.525’ – best fit

- Segments of the Spanish curve have a gradient of approx. 1.43 times the gradient of the German Curve

- We plot the difference between our synthetic and actual Spanish yields

- One of the steepest parts of the Spanish curve (Actual vs Synthetic) is Oct 2046 vs Oct 2048s

Yield curves are coupon adjusted to compensate for the value of high vs low cpns in a steep yield curve, ceteris paribus

Rationale

- The Spanish F.I. market has recovered its losses from the Catalonia Separation issues prevalent Q4 last year (see Graph of Spain vs France hedged with 50% -ik/+rx)

- S&P next Rating Publication Date due shortly – 23rd March 2018

- In an improving environment for Spanish credit – I am would favour flatteners vs other top rated countries (e.g. Germany)

- The model of excess returns does highlight the long standing steepness in long and ultra-tenors

- The syndication spread came at approx 11-12bp, but we believe this was an erroneous comparison to 46s 48s in Italy. Firstly Btps 46s is an anomalously rich bond for its coupon status, secondly generally as a weaker issuer the Italian curve is thematically steeper than Spain ( approx 20%). The fitted curve for Italy suggests that a fair value for Btps 46 vs 48 spread should be <3bp, (44’s vs 48s is 4bp!). Hence as a credit comparison if Spain were to be 20% flatter then this spread could also be <3bp

- As a syndication and further tap bond , one could argue that the 48s could remain cheap – yet we see no signs of that in the recently syndicated 2028 10y bond, indeed the issuer has empirically re-tapped older high and low coupon issues as market demand has arisen – the prior 46s was re-opened three times in the four months after its syndication in early 2016 and the spread remained in a 1.7bps range – see Graph

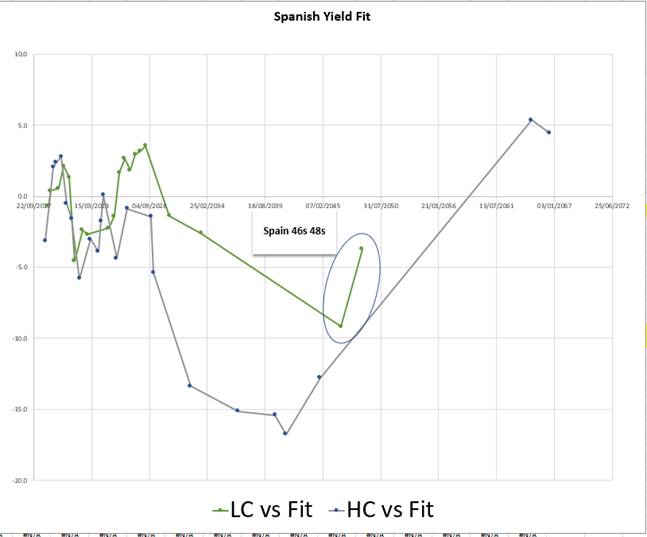

- Even when we fit a curve to include the cheaper Spanish Ultras (>30yrs) we still see that the 46s 48s spread is too steep in that context – see graph

Graph of Spain vs France hedged with 50% -ik/+rx

Spain as an credit play in the context of if Italy, France and Germany has returned to the levels pre-Catalonia crisis of Q2 and Q3 2017

(+Spain vs -France) plus 50% of (Short Italy vs Long Germany)

100 * ((YIELD[SPGB 1.5 4/27 Corp] - YIELD[FRTR 2.75 10/27 Corp]) - 0.5 * (YIELD[BTPS 4.75 9/28 Corp] - YIELD[DBR 0.25 2/27 Corp]))

Graph of old 30y spread during re-issuance after syndication – historically spread not severely impacted by further taps

Graph of Anomalies on the Spanish Yield Curve – despite steep gradient of 30s50s the 46s 48s spread still appears steep

Risks

- The 2046s stay rich

- The 2048s stay offered as a potential tap bond

- A significant steepening in all European yield curves causes the relative value of this trade to diminish

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

'Abexit' fears send chill through Tokyo stock market

Worries over political risk recall 1998 government collapse amid 'lost decade'

Mio Tomita, Nikkei Staff Writer March 14, 2018 06:44 JST

Private school operator Moritomo Gakuen is suspected of having benefited from a sweetheart land deal courtesy of Abe's government to build this elementary school near Osaka. (Photo by Konosuke Urata)

Private school operator Moritomo Gakuen is suspected of having benefited from a sweetheart land deal courtesy of Abe's government to build this elementary school near Osaka. (Photo by Konosuke Urata)

TOKYO -- International investors with long memories fear the scandal engulfing Japan's Finance Ministry threatens the political future of Prime Minister Shinzo Abe, recalling the setback to economic reforms that followed the downfall of a Japanese government two decades ago.

Kyoya Okazawa at BNP Paribas in Hong Kong has been fielding questions from investors who want to know whether the prime minister might have to resign in an "Abexit," and how such turmoil would affect the government's nomination of Haruhiko Kuroda for a second term as Bank of Japan governor.

Jesper Koll at WisdomTree Japan has been similarly inundated by phone calls since the end of last week.

The Nikkei Stock Average gained 0.6% Tuesday to close at 21,968. But the yen's recent appreciation and escalating trade frictions between the U.S. and other big economies seem to be keeping Tokyo shares from performing as strongly as their counterparts on Wall Street and elsewhere.

And with the Finance Ministry having admitted to altering documents regarding the sale of state-owned land to private school operator Moritomo Gakuen, more investors are looking to lock in paper gains on Japanese shares soon, Koll said. Questions over the sale have dogged Abe's government, which is suspected of favoring the patriotism-promoting educator, but the latest revelations have put his finance minister, Taro Aso, in what some see as an untenable position.

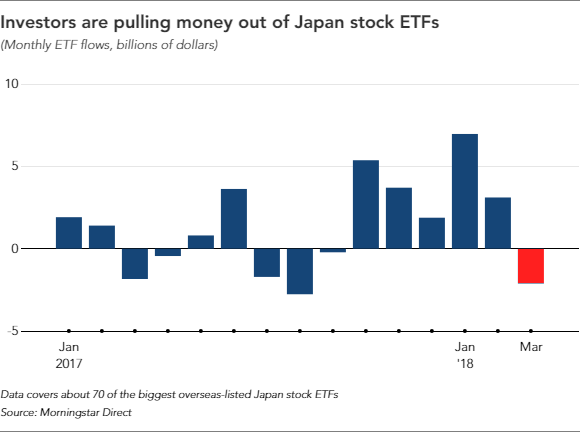

A combined $2.1 billion has flowed out of about 70 Japan-focused exchange-traded stock funds in overseas markets this month, data from fund tracker Morningstar Direct shows.

Investors remember the political upheaval that struck Japan in 1998. A bribery scandal involving wining and dining of Finance Ministry officials at a restaurant employing scantily clad waitresses led to the downfall of then-Prime Minister Ryutaro Hashimoto's government, putting on hold efforts to reform Japan's bureaucracy and clean up bad loans from the bubble era.

Economic stagnation resulted after false assumptions that Japan's financial crisis was over and the economy had entered a period of self-sustaining growth, Koll said, adding that many investors worry history will repeat itself.

"The main reason investors have held out hope for Abenomics is that the government, the Finance Ministry and the BOJ have worked in sync on policy," BNP Paribas' Okazawa said, referring to Abe's pro-growth policies.

After 1998, Japanese fiscal and monetary policy were out of step, and the country failed to overcome deflation. In light of this, "investors with deeper understanding of Japan are less likely to bet on an optimistic scenario" now, Okazawa said.

Japanese companies and financial institutions are in robust health today, unlike 20 years ago, making any political turmoil unlikely to produce a swift economic slump. But with a rising yen and trade disputes creating uncertainty for the economy, investors "are prone to shed Japanese equity risk in reaction to negative news," Shinichi Ichikawa of Credit Suisse Securities said.

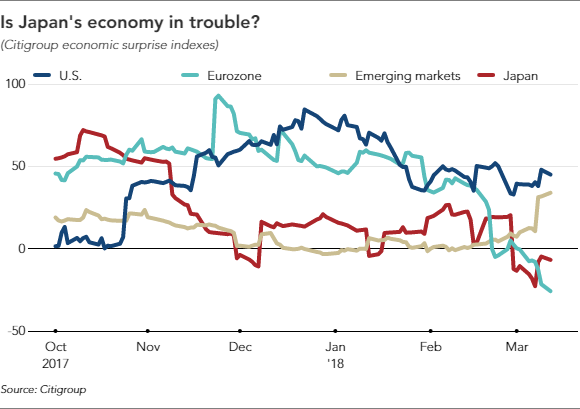

Citigroup's economic surprise index, a barometer of how data over the past three months compared with market expectations, shows that Japan's fundamentals are falling short of analyst projections.

"Until the excessively high hopes are corrected, the stock market is unlikely to have a full-fledged rebound," Ryota Sakagami of JPMorgan Securities said.

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Jean-Francois Lucas

O: +44 (0) 203 - 143 - 4175

M: +44 (0) 7493 026514

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Jean-Francois Lucas. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

SPECIAL REPORT MAJOR POSITION OPPORTUNITIES for the NEXT 2-3 YEARS!

• I have sent a lot of updates lately as I believe we are at levels that will formulate 2 to 3 year opportunities.

• I have also had numerous discussions about these opportunities and many agree something BIG is looming. They personally are struggling with the catalyst.

• Hopefully a more simplified selection of the RARE CHART DISLOACATIONS will help portray the TECHNICAL opportunities.

• I will be more than happy to discuss and ways to implement the VIEWS.

• Whilst compiling this I noticed the relevance of 200 period MOVING AVERAGE on monthly horizons.

BOND MARKETS

• The US is the PROMINENT set of charts in this space with 5yr and Curves taking precedent.

• US 5yr yield expectations are historically stretched. NUMEROUS times we have seen yields DROP from this RSI dislocation!

• US curves are basing for a MAJOR steepening that could last for many years.

US CURVES

• US curves have been a great flattening trade for many but that CYCLE looks about to change and I suggest it coincides nicely with the 5yr EXTREME.

• So many of the charts portray an oversold scenario and a TARGET 61.8% ret to breach.

• Each chart has its merits but all VERY similar MULTI YEAR DISLOCATION.

STRONGER USD

It has been suggested that if I technically like US yields LOWER then the USD should rally.

• The next series of charts do hint that and USDCAD has already made a decision already.

EQUITIES

• This is the most difficult subject of all to discuss without raising peoples pulse rate. Everyone still wants to “BUY THE DIP” BUT some quarterly European charts are TERMINAL!

• The US continues to grind higher but the over stretch is wrong.

• European equities could have a good old fashion “washout”. I am old enough to remember bonds UP stocks DOWN.

• **It hasn’t been talked about but many European stock markets have made NEW LOWS already. A negative situation indeed.**

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4174

Mobile: +44 (0) 7980708683

Email: chris.williams@astorridge.com

Web: www.AstorRidge.com

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

CHART OBSERVATIONS FX UPDATE 13.03.2018

• FX is another MIXED BAG of signals.

• The EUR USD remains very sideways but my BIAS is for the EUR lower.

• DXY isn't far off forming a BASE.

• EURGBP starting to confirm a major move lower.

• USD CAD well on its way to a long term bounce.

• Turkish and Russian bonds close to VALUE.

• ** HAPPY TO DISCUSS ANY CHARTS **

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4174

Mobile: +44 (0) 7980708683

Email: chris.williams@astorridge.com

Web: www.AstorRidge.com

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

Equitie UPDATE.. European daily charts are TREADING WATER whilst the US has rallied. I feel ALL STOCKS HEAD LOWER and hopefully that starts TODAY..12.03.2018

• European daily charts are TREADING WATER whilst the US has rallied. I feel ALL STOCKS HEAD LOWER and hopefully that starts TODAY.

• A VERY MIXED BAG of charts, HOWEVER some QUARTERLY EUROPEANS are TERMINAL , CAC, FTSE and especially DAX.

MANY bounces have been VERY LAME.

• US stocks remain the most over bought and many have recovered MORE than 200% of the 2008-2009 correction.

• The DOW and S&P have major RSI dislocations spread across monthly, weekly and daily durations! This is a DANGEROUS combination.

• Some RSI’s surpass 1950 and 1980 levels.

• US stocks highlight the most CONCERN.

• ** HAPPY TO DISCUSS ANY CHARTS **

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4174

Mobile: +44 (0) 7980708683

Email: chris.williams@astorridge.com

Web: www.AstorRidge.com

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

***BOND UPDATE. Germany bonds to rally WHILST the US curve remains a LONTERM STEEPENER 12.03.2018.***

BONDS UPDATE :

KEEP an eye on GERMANY this week : Providing it can maintain steady gains then this should lead to a more major BOND BOUNCE. We have NEW years highs on schatz! Should we achieve additional highs across the rest of the curve then this will KICK START many of the WEEKLY and MONTHLY RSI dislocations.

The next BIG TRADE is US STEEPENERS : As mentioned before many RSI’s are WAY over sold and the recent POP to the 61.8% rets served to recognise the BIG BREAK level. If we close above any of the 61.8% rets this should TRIGGER a sustained long-term steepening.

1) Yields are close to breaching levels where we will see a MAJOR DROP

2) (US 5yr and UK 10yr). ALL durations are stretched, quarterly, monthly, weekly and daily… this is RARE!

3) Looking at the previous Equity piece, European stocks look a LONGTERM failure thus I firmly believe this mean BONDS rally.

3) Germany 26’s bonds based well as do the FUTURES post yesterdays intraday REVERSAL.

4) UK yields have a LOFTY RSI and UKTI POISED to bounce. UK 10yr all eyes on a continued breach of 1.489 (10yr Gilts).

5) US 10 Breakevens have a LOFTY WEEKLY and DAILY RSI.

6) Nearly ALL US curves rejected the recent steepening BIAS at MAJOR MULTI YEAR 61.8% ret, the RSI’s remain low however. If the 61.8% ret’s are breached we steepen in a BIG WAY.

** US curves will be a BIG trade once the 61.8% retracements are breached. **

• ** HAPPY TO DISCUSS ANY CHARTS **

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4174

Mobile: +44 (0) 7980708683

Email: chris.williams@astorridge.com

Web: www.AstorRidge.com

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

Kuroda recommits to stimulus in long struggle with deflation

Breaking mindset on prices is no easy task, BOJ chief warns ahead of second term

Nikkei Staff Writers March 10, 2018 06:17 JST

Bank of Japan Gov. Haruhiko Kuroda at a news conference at the bank's headquarters in Tokyo on March 9. (Photo by Akira Kodaka)

Bank of Japan Gov. Haruhiko Kuroda at a news conference at the bank's headquarters in Tokyo on March 9. (Photo by Akira Kodaka)

TOKYO -- Bank of Japan Gov. Haruhiko Kuroda reaffirmed his commitment again Friday to the central bank's easy-money policy as he nears the end of his first term without achieving his goal of 2% inflation.

Kuroda gave a news conference after the BOJ policy board, at the last meeting of the current leadership, voted to maintain current stimulus policies. He has been asked by the government to serve a second five-year term, starting in April, with two new deputy governors.

"Dispelling the deflationary mindset is taking time, and this is why we have been unable to realize the 2% price stability target," Kuroda told reporters at the bank's headquarters in Tokyo.

Several factors hit Japan that stifled a rise in prices during Kuroda's first term, from plunges in crude oil prices to the hiking of the consumption tax rate to 8% in 2014. But he cited consumer sentiment as an even greater force. Seemingly endless deflation has kept consumers from even imagining higher prices, and that attitude is preventing prices from rising in reality, he believes.

Breaking such a mindset is taking longer than Kuroda expected, and the BOJ has decided to keep stimulus measures in place for the long haul. The central bank initially bolstered its Japanese government bond purchase program and took other quantitative easing steps. But facing speculation about the limitations of the bond-buying program, the bank introduced a policy overhaul with yield-curve control in September 2016. That was "an important change," Kuroda said Friday, while pledging to "persistently continue with easing."ee also

The BOJ believes that, if it keeps the current extremely loose monetary policy in place, prices will eventually rise 2%. The gap between the Japanese economy's demand and its potential supply capabilities has improved, Kuroda pointed out, noting that businesses have started raising wages and prices more seriously. This will lead to a 2% inflation rate by around fiscal 2019, he predicted.

"We see no changes to the economy's strong fundamentals," he said.

Financial markets saw an exodus from risky assets in February, depressing stocks around the world. But the Japanese economy's foundation remains solid, Kuroda said, describing corporate earnings outlooks as "robust." Asked about the yen's possible rise in light of the U.S. administration's protectionist moves, the governor said he does not expect "protectionism to spread globally."

Looking ahead to his second term, Kuroda emphasized the central bank's commitment to its easy-money policy. "This is not the time to have any concrete debate on an exit," he said.

If there is speculation that the BOJ might be moving to normalize its policy, the yen might keep strengthening, squeezing profits at exporters. Earnings deterioration probably would discourage employers from raising wages, further stalling any inflation trend. "If the momentum [for inflation] is not maintained, we'll consider additional easing," Kuroda said.

Waseda University professor Masazumi Wakatabe is an outspoken proponent of aggressive monetary easing.

Waseda University professor Masazumi Wakatabe is an outspoken proponent of aggressive monetary easing.

At the same time, however, the longer the BOJ keeps its loose policy, the more it is expected to pay attention to the policy's side effects, including a profit squeeze at financial institutions. While shooting down speculation about normalization, Kuroda suggested that tweaking its policy of guiding short-term interest rates to minus 0.1% and long rates around 0% might be an option separate from a debate on an exit. Lifting the nominal interest rate if the inflationary trend picks up "would be theoretically possible," he stated, leaving wiggle room for a policy adjustment.

Kuroda is to begin his second five-year term April 9, assuming the Diet approves his reappointment. To replace Deputy Governors Hiroshi Nakaso and Kikuo Iwata, the government has nominated Waseda University professor Masazumi Wakatabe and BOJ Executive Director Masayoshi Amamiya.

Wakatabe, an outspoken reflationist, told a parliamentary committee at his confirmation hearing that further easing was an option. But such a path is risky given the likely side effects. This means the Kuroda-led BOJ cannot afford to either scale down or expand its stimulus program -- and thus is entering its second five-year term with few options on the table.

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Jean-Francois Lucas

O: +44 (0) 203 - 143 - 4175

M: +44 (0) 7493 026514

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Jean-Francois Lucas. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Italy Trade 10s15s flattener & German vol weighted hedge

Italian 10s15s flattener with German vol. weighted hedge on the radar

Mechanics

- Buy Italy 15y, Btps 2.45% 9/33

- Sell Italy old 10y, Btps 2.2% 6/27

€50k/01

- Hedge curve with Eurex contracts +RX/-UB

€50k/01

Levels

- Current: @ -2bp

- Entry: @ 0bp, based around timing of next Thursday’s tap of 9/33

- Target: -8bp

- Add: +2bp

- Stop: +5bp

History

- Cix:

100 * ((YIELD[BTPS 2.45 9/33 Corp] - YIELD[BTPS 2.2 6/27 Corp]) - 1 * (YIELD[DBR 3.25 7/42 Corp] - YIELD[DBR 0.25 2/27 Corp])) - Bloomberg graph

Rationale

- The notion of excess returns indicates that on average the Italian Curve is 1.74 times steeper that the German Curve (see Graph)

- On that metric versus German the 6/27 vs 9/33 spread is historically steep, despite a flattening in Germany (see Graph)

- Using vol. based hedging we can use RX and UB futures to hedge to the exposure to the risk free-rate – N.B. we hedge 10s15s Italy 1:1 vs the German futures – the Italy component is a smaller duration gap than Germany, but we expect Italy to be 1.74 times more volatile than Germany currently, hence a 1:1 ratio

Graph of Curves

Germany, Italy and Synthetic Italy (Synth Italy ≈ 1.74 * Germany + 0.88)

..idr1015

..idr1015

Correlations/Regression

- Is this trade correlated to the Italy/German spread?

1y history Trade Index vs ik/rx spread

Correlation -0.74, r2 0.56: implying this trade would at the margin, favour a spread widening

Carry & Roll

- Italian leg

Carry /3mo: -1.4bp

Roll /3mo: -2.7bp

- German leg

Carry /3mo: +0.7bp

Roll /3mo: +2.4bp

Nett carry and roll /3mo: -1bp

Risks

- The German curve flattens ahead of Italy

- A further spread narrowing of It/Ge could cause the Italian curve to steepen ahead of Germany

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Italy Trade 7s 10s 15s - vol. weighted

Any thoughts please?

Italy Trade – Friday 3rd September

Trade – Italy, Sell 10y, Buy 7y & 15y, vol. weighted

Mechanics

- Sell: old 10y Btps 2.05% 8/27

- Buy: new Btps 1.45% 5/25 & Btps 2.45% 9/33

- Weighting: +1.2/-2/+0.8

- Cix: 200 * (YIELD[BTPS 2.05 8/27 Corp] - 0.6 * YIELD[BTPS 1.45 5/25 Corp] - 0.4 * YIELD[BTPS 2.45 9/33 Corp])

Trade levels – using the new 7y

- Current fly value: @ +1.7bp using new issue 7y

- First entry, pay spread @ +1.7bp

- Add: @ flat

- Target: @ +5bp

- Stop: @ -2.5bp

History – using the old 7y

- Using the older 1.5% 6/25 for history on the 7y portion

Cix used in graph

200 * (YIELD[BTPS 2.05 8/27 Corp] - 0.6 * YIELD[BTPS 1.5 6/25 Corp] - 0.4 * YIELD[BTPS 2.45 9/33 Corp])

Rationale

- Italian curve has a consistent gradient to the German curve of 1.75 times

- On that mapping, the old 10y point looks fairly priced and will have on the run, 10y supply at the eom (Feb 28s – Weed 28th March)

- The new 7y and that sector looks cheap

- The curve weightings of 60% short leg and 40% long leg are designed to insulate the structure from the higher volatility in the longer leg versus the short

- We see that long

Curves

Graph of German and Italian Benchmark Curves, also Synthetic Italian Curve

Synthetic Italian curve = German Curve * 1.76 + 0.87

Carry and Roll – (using 10bp spread)

- Carry /3mo: -1.6bp

- Roll /3mo: -0.1bp

Risks

- A continued rally in Italy causes the 10y to richen beyond the wings

- A rally in the German 10y point versus 7s and 15s, causes a removal of curvature in all other European curves

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796