****PLEASE READ ..PRE NON FARM BOND UPDATE. Key levels to watch for post NF given yesterdays MAJOR reversal in GERMANY. 09.03.2018.***

BONDS UPDATE : Yesterdays German and UK bond bounce established some pretty MAJOR bollinger downside pierces, all we need post NON FARM (NF) is NEW weekly highs. Should we achieve new highs then this will KICK START many of the WEEKLY and MONTHLY RSI dislocations.

The RIGHT CLOSES and this could be the start of a SUSTAINED BOND rally ACROSS the board.

A VERY IMPORTANT POST NON FARM CLOSES so initial reaction MIGHT not be the first to respond to.

1) Yields are close to breaching levels where we will see a MAJOR DROP

2) (US 5yr and UK 10yr). ALL durations are stretched, quarterly, monthly, weekly and daily… this is RARE!

3) Looking at the previous Equity piece, European stocks look a LONGTERM failure thus I firmly believe this mean BONDS rally.

3) Germany 26’s bonds based well as do the FUTURES post yesterdays intraday REVERSAL.

4) UK yields have a LOFTY RSI and UKTI POISED to bounce. UK 10yr all eyes on a continued breach of 1.489 (10yr Gilts).

5) US 10 Breakevens have a LOFTY WEEKLY and DAILY RSI.

6) Nearly ALL US curves rejected the recent steepening BIAS at MAJOR MULTI YEAR 61.8% ret, the RSI’s remain low however. If the 61.8% ret’s are breached we steepen in a BIG WAY.

** US curves will be a BIG trade once the 61.8% retracements are breached. **

• ** HAPPY TO DISCUSS ANY CHARTS **

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4174

Mobile: +44 (0) 7980708683

Email: chris.williams@astorridge.com

Web: www.AstorRidge.com

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

CHART OBSERVATIONS FX UPDATE

• FX is another MIXED BAG of signals.

• The EUR USD remains very sideways but the BIAS is for a lower EUR.

• DXY isn't far off forming a sizeable longterm BASE.

• EURGBP starting to confirm a major move lower.

• USD CAD well on its way to a long term bounce.

• Turkish and Russian bonds close to VALUE.

•

• ** HAPPY TO DISCUSS ANY CHARTS **

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4174

Mobile: +44 (0) 7980708683

Email: chris.williams@astorridge.com

Web: www.AstorRidge.com

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

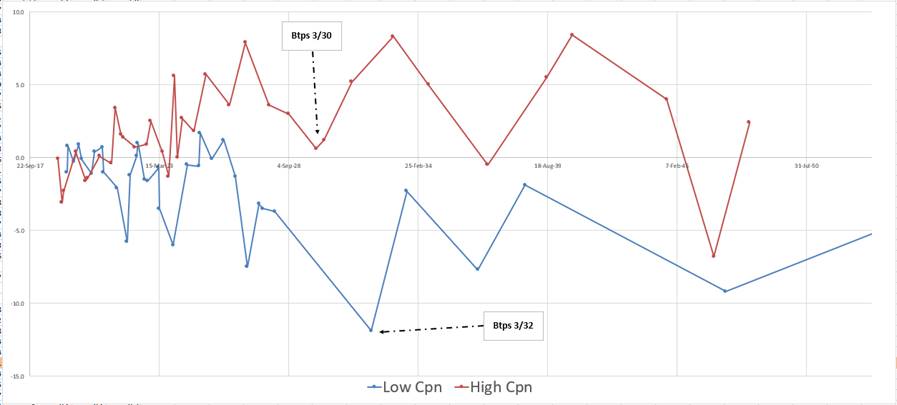

Italian Default Hedged RV

Gents at Nektar, any thoughts most welcome

Italian Default Hedged RV – Thursday 8th March

Buy Btps 3.5% 3/30 vs MMS

Sell Btps 1.65% 3/32 – excess to duration (default weighted), vs MMS 1.39 times short

Bloomberg History

Cix:

+SP208[BTPS 3.5 3/30 Corp] - 1.39 * SP208[BTPS 1.65 3/32 Corp]

N.B. code sp208 is the Bloomberg field for Bond vs MMS

Levels:

Target entry: @ -31.5bp

Add: @ -26.5bp

Target Exit: -37.5bp

Stop: -23bp

Rationale:

- The notion of default trading is still present in the Italian yield curve: in both the increasing yields spreads to swaps with tenor and the apparent richness of lower coupon/lower price issues vs high coupon bonds

- Generally the tenor curve and the pricing of anomalies can be well described by a contingent default model

- We can construct portfolios whose proceeds are generally insulated from a default event or spread widening

- This hedging methodology generates mean reverting series over some periods as the market adjusts for expected return and expected probability of default

- The potential advent of a 15y – 20y tap next Thursday from Italy should have a more negative impact for on the run, low coupon bonds

Analysis

- A full default model, with contingent probability of default of Italy vs Germany is beyond scope here

- Let’s look at the default process though – HC/LC anomalies AND the tenor curve of Italy both contain information about the expected probability of Italian default over time

- In default, a bond is typically marked down from its dirty price to an ‘all in price’: in this instance we have used 35 pts – typically default models use numbers between 30 and 40 points

- Let’s look at the two issues here, in the default scenario they get marked down to 35 points. That event generates different amounts of cash. So rather than hedging according to the duration, we have to back out a mismatched duration hedge, such that the nett cash loss on each bond, in the default scenario, is the same

|

Issue |

Dirty Price |

Duration |

Nominal Posn (MM) |

Proceeds |

Price loss to Recovery (35%) |

Position loss to 35% Recovery (MM) |

Posn duration |

|

BTPS 3 1/2 03/01/30 |

112.30 |

10.99 |

1.00 |

112.30 |

77.30 |

77.30 |

10.99 |

|

BTPS 1.65 03/01/32 |

91.14 |

11.07 |

-1.38 |

-125.49 |

56.14 |

-77.30 |

-15.24 |

|

Duration Ratio |

1.39 |

10.99 / 15.24 |

- So using the Price loss to Recovery column, we can generate two nominal positions that would have equal and offsetting cash losses under default. We then have to look at the relative durations of those positions to calculate our duration mis-weighting

- We then use swaps as an independent hedge for each leg, to neutralise risk-free rate exposure

Carry & Roll

- The characteristics of roll and carry will be slightly different from duration matched trades as the whole trade is hedged with swaps to be duration matched – but the amounts of the btps are not duration offsetting relative to each other

- 3/32s vs swaps position (scaled 1.39 times ,spread of 10bp)

Carry/3mo: -4.2bp

Roll/3mo: -1bp

3/30s vs swaps position

Carry/3mo: +3.8bp

Roll/3mo: +1.1bp

- Nett R&C -0.3bp/3mo

Italian RV – Anomalies to the Bloomberg Cubic Spline Curve

Risks

- The high coupon 3/32 stays persistently rich even account in a narrowing swap spread environment for Btps

- The Btps 3/30 gets cheaper as it approaches the delivery basket

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

**Equitie UPDATE . A VERY mixed set of conflicting set of charts, some are TERMINAL on paper . 08.03.2018**

• A VERY MIXED BAG of charts, HOWEVER some QUARTERLY EUROPEANS are TERMINAL , CAC, FTSE and especially DAX.

• US stocks may need one more POP to the highs first, others like DOW and NASDAQ look positive.

** SEE DAX CHART PAGE 11! **

• MANY bounces have been VERY LAME.

• US stocks remain the most over bought and many have recovered MORE than 200% of the 2008-2009 correction.

• The DOW and S&P have major RSI dislocations spread across monthly, weekly and daily durations! This is a DANGEROUS combination.

• Some RSI’s surpass 1950 and 1980 levels.

• US stocks highlight the most CONCERN.

• ** HAPPY TO DISCUSS ANY CHARTS **

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4174

Mobile: +44 (0) 7980708683

Email: chris.williams@astorridge.com

Web: www.AstorRidge.com

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

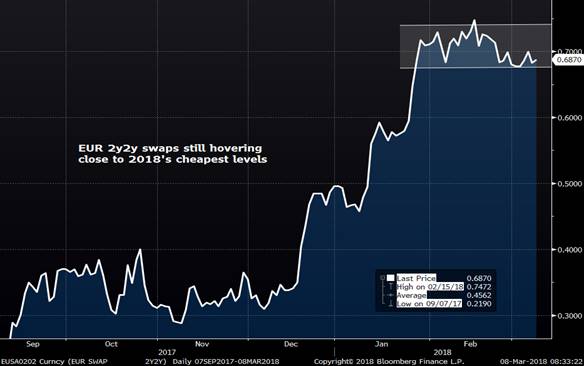

MACROCOSM: Quick Thoughts Into Today's ECB Meeting w/charts

- ECB Meeting Today - Quick Colour

- We've been leaning dovish on EUR rates for the last few weeks with the economic data showing signs of plateauing and with the Italian election result inconclusive and a potential trade war brewing, that seems even more justified now.

- From the newswires and opinions of our favourite strategists it appears our take on the ECB has become the consensus view into today's meeting. The collective message is ‘What’s the hurry?’.

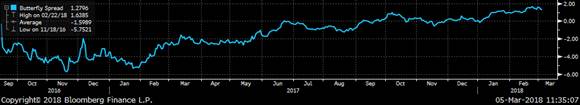

- With EUR 2y2y still hovering just under 70bps and DBR 2-5-10s only 4bps off its late Jan cheapest levels (even with an 11bps rally in DBR 10yrs) market pricing suggests the ECB is merely delaying the inevitable hawkish shift and is unwilling to price in a more dovish stance.

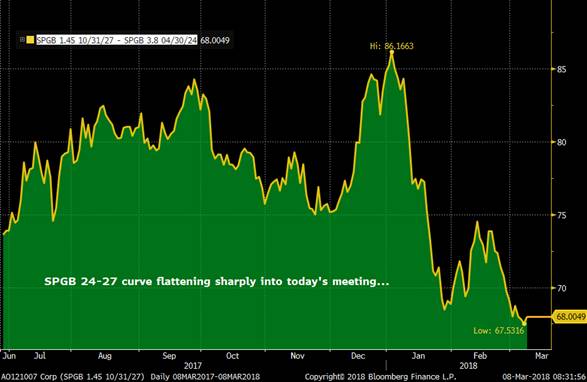

- Clearly, the star of the EGB market over the last few weeks has been Spanish Bonos, tightening sharply to OATs/DBRs over the past week. In addition, our attached note from late last week (MACROCOSM: Euroland Rates A Tough Short Into April) highlighted the wave of coupon and redemption flows that should lend a tailwind to the EGB mkt as we head into April.

- Observations on spreads/curves:

- The 5yr sector on most curves (especially core) remain at the cheaper side of fair but unless there’s a meaningful shift in the view on the timing of a hike (either much sooner or much later), 5yrs are likely to stay that way for the time being.

- On some curves – notably, SPGBs – 5/7s into 10s has flattened sharply, the SPGB 4/24-10/27 spread making new lows this week, revealing a growing concentration of longs in the 9-10yr point on the curve. Given the 10yr’s significance as a liquidity point on most EGB curves (largely due to the futures contracts in GE/FR/IT) this bull flattening isn’t surprising but also bears close monitoring as it could present a ‘powder keg’ if sentiment turns bearish.

- The 10-30s sprds on most curves have been remarkably stable for the past couple weeks after a sharp flattening to start 2018. On one hand, one would have expected a bull steepening of 10-30s given demand for 10s vs the belly, however, index extensions were large in Feb and long end supply well absorbed.

- A ‘status quo’ ECB today means the trend is our friend, look for more flattening in the belly and for off the run issues that have lagged the moves (like the BTPS 3.5% 3/30s we like) to show signs of life.

- The 5yr sector on most curves (especially core) remain at the cheaper side of fair but unless there’s a meaningful shift in the view on the timing of a hike (either much sooner or much later), 5yrs are likely to stay that way for the time being.

We’ll be back with more….

Mark

EUR 2y2y

SPGB 4/24-10/27

EUR 2-5-10 swaps

SPGB 10/27s vs IKA and OATA – taking back cheapening in Feb

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

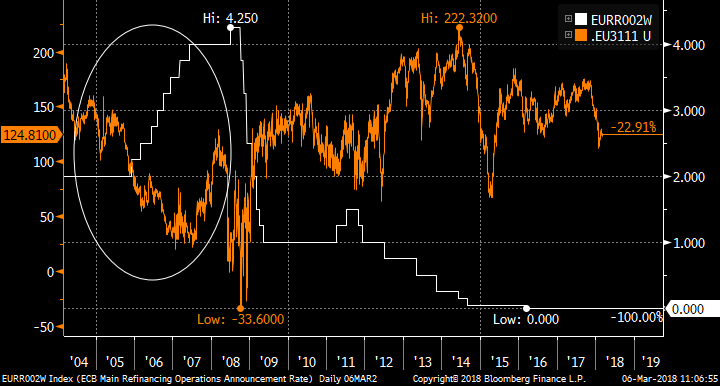

Trade: A tactical proposal to re-enter EUR flatteners ahead of Thursday's ECB

Summary: I’m making a highly tactical case to be in flattening positions over this week’s ECB meeting. For the past two meetings the market has taken a bearish read of ECB statements, triggering moves higher in short rates. Recent comments from the more hawkish Governing Council members have done nothing to suggest this view is misplaced. I have a long-term flattening view, so this may be the best opportunity to reset that after the re-steepening of early Feb.

Trade:

Pay EUR 1bn 3y1y

Recv EUR 123mm 10y10y

EUR 100k/bp equivalent.

Enter at 124bp. Near-term target 114bp. Stop 127bp. Rolldown of -3.5bp over one month.

Rationale: My underlying view is that the EUR curve should bear-flatten as the ECB moves towards an exit from QE (or at least new purchases) and the eventual raising of rates. The chart shows the long history of the 3y1y/10y10y spread (orange) together with the ECB target rate. Back in 2005, the curve flattened in anticipation of rising rates, and continued to flatten as the first hikes took place. The difference in tenors between 3y1y and 10y10y has been chosen deliberately to highlight the move: short rates react much more rapidly to central bank action while long-term rate expectations are slower to respond.

In recent months (again perhaps unsurprisingly) ECB meetings and minutes releases have coincided with bearish moves in rate expectations. Even though at first read the statement and minutes have not been particularly hawkish, the market has taken them as a green light to re-assess the future path of rates.

This table shows the change in rates between the day before and the day after recent ECB events. The biggest movers have, on average, been the 3y1y moving higher while 10y10y and 10y20y moved lower. Even on the release of the Jan minutes in February, where the market took a bullish tone, the 3y1y rate rallied less than the 10y10y rate and the curve still flattened.

|

|

|

Spot |

|

|

|

Fwds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Event |

|

2y |

5y |

10y |

30y |

1y2y |

1y5y |

1y10y |

1y30y |

2y2y |

2y5y |

2y10y |

2y30y |

1y1y |

2y1y |

3y1y |

4y1y |

2y3y |

5y5y |

10y10y |

10y20y |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

14-Dec-17 |

Meeting |

2.8 |

0.4 |

-2.0 |

-4.7 |

0.6 |

-0.8 |

-2.4 |

-5.2 |

0.2 |

-1.3 |

-3.0 |

-5.5 |

0.2 |

1.2 |

-0.4 |

-0.3 |

-0.2 |

-3.5 |

-6.1 |

-6.9 |

|

11-Jan-18 |

Minutes |

1.9 |

6.4 |

4.1 |

0.7 |

6.8 |

6.4 |

3.5 |

-0.4 |

8.2 |

6.6 |

2.9 |

-0.6 |

3.9 |

10.1 |

9.3 |

8.2 |

8.0 |

4.4 |

-2.6 |

-2.9 |

|

25-Jan-18 |

Meeting |

2.4 |

6.9 |

3.1 |

-4.4 |

4.9 |

7.6 |

2.1 |

-4.7 |

9.3 |

8.0 |

1.3 |

-5.2 |

2.2 |

7.3 |

13.5 |

10.7 |

9.8 |

0.6 |

-9.6 |

-9.2 |

|

22-Feb-18 |

Minutes |

0.1 |

-4.3 |

-4.1 |

-6.0 |

-1.9 |

-3.9 |

-4.9 |

-4.5 |

-3.6 |

-5.0 |

-5.4 |

-4.6 |

-0.3 |

-3.5 |

-3.2 |

-7.5 |

-4.3 |

-8.0 |

-4.4 |

-4.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Average |

1.8 |

2.4 |

0.3 |

-3.6 |

2.6 |

2.3 |

-0.4 |

-3.7 |

3.5 |

2.1 |

-1.0 |

-4.0 |

1.5 |

3.8 |

4.8 |

2.8 |

3.3 |

-1.7 |

-5.7 |

-5.9 |

Focusing on the 3y1y/10y10y spread:

|

3y1y / 10y10y |

|

|

14-Dec-17 |

-5.7 |

|

11-Jan-18 |

-12.0 |

|

25-Jan-18 |

-23.2 |

|

22-Feb-18 |

-1.3 |

The simplest way to position for a repeat of this move would be to pay the 3y1y vanilla rate and receive 10y10y.

Too speculative? All feedback welcome!

Best

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

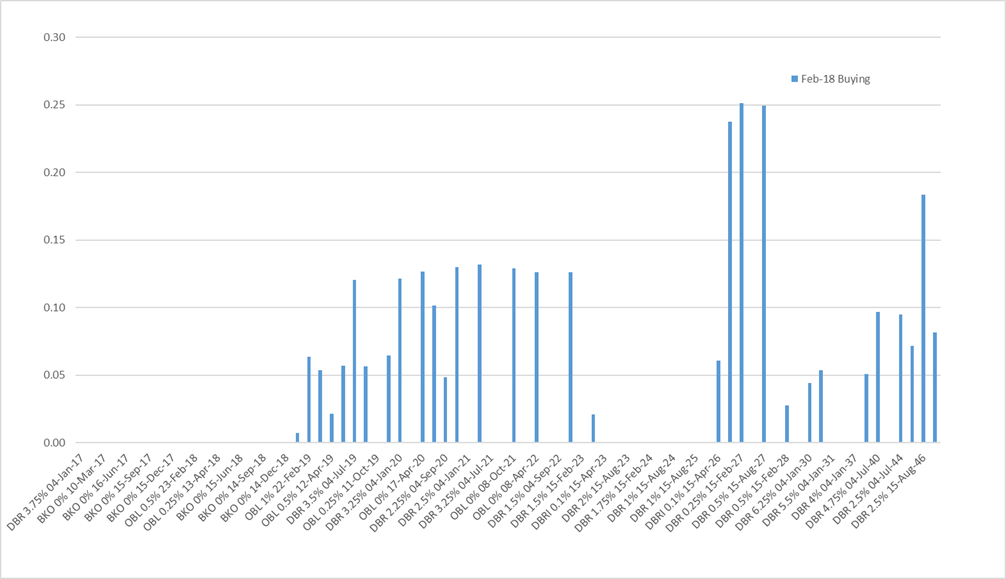

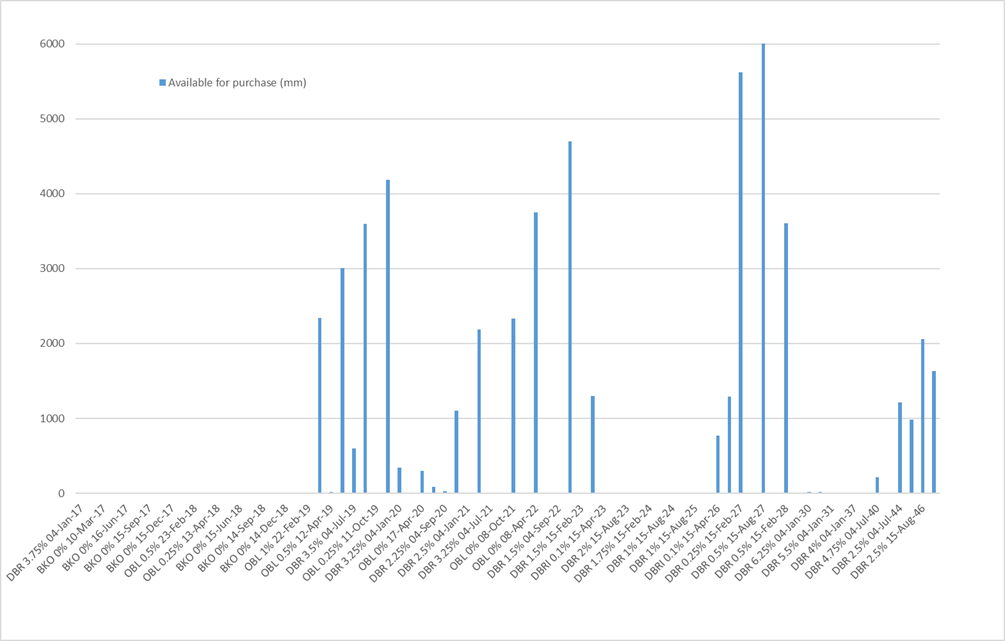

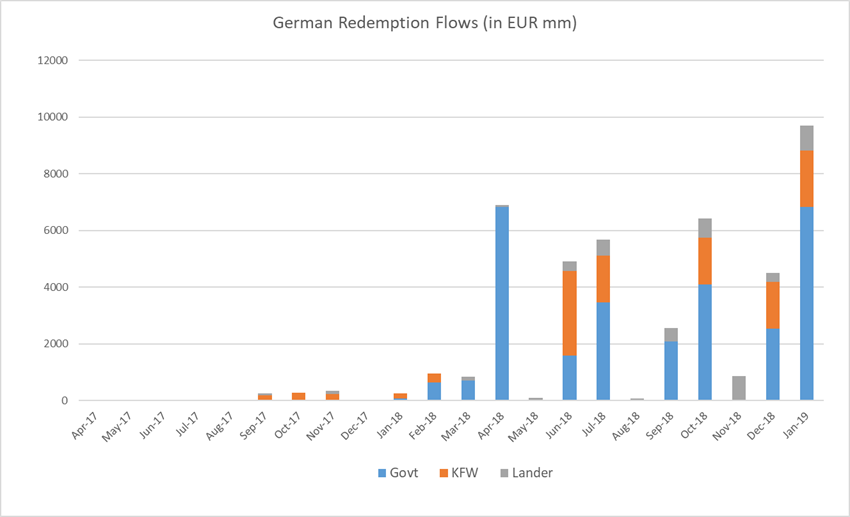

PSPP2 data for Germany suggests a significant lengthening of purchases in February

I’ve put today’s PSPP2 data for Germany through my Maximum Likelihood Model, and here are the main conclusions:

- A significant increase in the WAM of Germany buying in February, up from 6.3y to 9.1y;

- A larger than usual buying of Lander paper (up to an estimated 2.2 bn vs 1.3bn previously);

- Thus the percentage on non-Bund purchases was 48% (from 34% in Jan);

- I estimate an extra 0.96bn of buying from redemption flows in Feb (in Bunds and KFW);

- The largest buying came in the Aug-26, Feb-27 and Aug-27;

- More buying of Bunds in 10y and 30y sectors;

- The new Bobl Apr-23 which was issued in February was bought (it appeared in the repo list) though my model only suggests 20mm of buying.

The model’s results in detail:

The estimate for the WAM for purchases in January for the various categories of paper are as follows:

|

Category |

Notional |

WAM |

|

German Govt |

3.0 |

9.3 |

|

KFW |

0.6 |

9.4 |

|

Lander |

2.2 |

8.7 |

|

All Purchases |

5.8 |

9.1 |

The per-issue charts for monthly purchases, and available notional left to purchase:

Given the model’s estimates for purchasing, here is how I see the redemption flows in Bunds currently. Numbers for Mar-19 onwards will continue to rise as more purchases are made.

|

Redemptions |

||||

|

Govt |

KFW |

Lander |

Total |

|

|

Apr-17 |

0 |

0 |

0 |

0 |

|

May-17 |

0 |

0 |

0 |

0 |

|

Jun-17 |

0 |

0 |

0 |

0 |

|

Jul-17 |

0 |

0 |

0 |

0 |

|

Aug-17 |

0 |

0 |

0 |

0 |

|

Sep-17 |

2 |

189 |

78 |

269 |

|

Oct-17 |

7 |

279 |

0 |

286 |

|

Nov-17 |

0 |

231 |

123 |

354 |

|

Dec-17 |

0 |

0 |

0 |

0 |

|

Jan-18 |

82 |

185 |

0 |

267 |

|

Feb-18 |

653 |

311 |

0 |

964 |

|

Mar-18 |

708 |

0 |

144 |

852 |

|

Apr-18 |

6832 |

0 |

78 |

6910 |

|

May-18 |

0 |

0 |

106 |

106 |

|

Jun-18 |

1593 |

2970 |

342 |

4905 |

|

Jul-18 |

3457 |

1650 |

581 |

5688 |

|

Aug-18 |

0 |

0 |

85 |

85 |

|

Sep-18 |

2088 |

0 |

473 |

2561 |

|

Oct-18 |

4108 |

1650 |

668 |

6426 |

|

Nov-18 |

0 |

0 |

867 |

867 |

|

Dec-18 |

2540 |

1650 |

324 |

4514 |

|

Jan-19 |

6840 |

1980 |

892 |

9712 |

|

Feb-19 |

5210 |

0 |

629 |

5839 |

|

Mar-19 |

1948 |

3300 |

302 |

5550 |

|

Apr-19 |

5260 |

274 |

753 |

6287 |

|

May-19 |

0 |

0 |

558 |

558 |

|

Jun-19 |

1281 |

0 |

487 |

1768 |

|

Jul-19 |

7324 |

495 |

96 |

7915 |

|

Aug-19 |

0 |

660 |

332 |

992 |

|

Sep-19 |

695 |

0 |

623 |

1318 |

|

Oct-19 |

5280 |

1650 |

1863 |

8793 |

|

Nov-19 |

0 |

0 |

349 |

349 |

|

Dec-19 |

101 |

0 |

493 |

594 |

|

Jan-20 |

6920 |

3300 |

1568 |

11789 |

|

Feb-20 |

0 |

7 |

592 |

599 |

|

Mar-20 |

0 |

0 |

1285 |

1285 |

|

Apr-20 |

11577 |

0 |

98 |

11675 |

|

May-20 |

0 |

0 |

330 |

330 |

|

Jun-20 |

0 |

1650 |

535 |

2185 |

|

Jul-20 |

7176 |

0 |

1497 |

8673 |

|

Aug-20 |

0 |

0 |

471 |

471 |

|

Sep-20 |

5252 |

0 |

696 |

5948 |

|

Oct-20 |

5165 |

495 |

520 |

6180 |

|

Nov-20 |

0 |

0 |

1063 |

1063 |

|

Dec-20 |

0 |

0 |

741 |

741 |

|

Jan-21 |

6270 |

3630 |

928 |

10828 |

Or, in chart form:

Finally, here are the per-issue estimates for Bunds:

|

Bond |

Opened |

O/S (bn) |

Purchasable |

Market Yield |

Purchased |

% Purchased |

Remaining |

Margin of Error |

MV Remaining |

Feb-18 Buying |

|

DBR 3.75% 04-Jan-17 |

Nov-06 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.75% 24-Feb-17 |

Jan-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 10-Mar-17 |

Feb-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 07-Apr-17 |

May-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 16-Jun-17 |

May-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-17 |

May-07 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 15-Sep-17 |

Aug-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

+/- 72% |

0.0 |

0.0 |

|

OBL 0.5% 13-Oct-17 |

Sep-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

+/- 31% |

0.0 |

0.0 |

|

BKO 0% 15-Dec-17 |

Nov-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4% 04-Jan-18 |

Nov-07 |

0.0 |

0.0 |

|

0.1 |

|

0.0 |

+/- 8% |

0.0 |

0.0 |

|

OBL 0.5% 23-Feb-18 |

Jan-13 |

0.0 |

0.0 |

0.7 |

0.0 |

+/- 3% |

0.0 |

0.0 |

||

|

BKO 0% 16-Mar-18 |

Feb-16 |

13.0 |

0.0 |

-0.750 |

0.7 |

0.0 |

+/- 5% |

0.0 |

0.0 |

|

|

OBL 0.25% 13-Apr-18 |

May-13 |

17.0 |

0.0 |

-0.837 |

2.1 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

OBLI 0.75% 15-Apr-18 |

Apr-11 |

15.0 |

0.0 |

4.7 |

0.0 |

+/- 1% |

0.0 |

0.0 |

||

|

BKO 0% 15-Jun-18 |

May-16 |

14.0 |

0.0 |

-0.707 |

1.6 |

0.0 |

+/- 3% |

0.0 |

0.0 |

|

|

DBR 4.25% 04-Jul-18 |

May-08 |

21.0 |

0.0 |

-0.710 |

3.5 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

BKO 0% 14-Sep-18 |

Aug-16 |

13.0 |

0.0 |

-0.683 |

2.1 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

OBL 1% 12-Oct-18 |

Sep-13 |

17.0 |

0.0 |

-0.687 |

4.1 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

BKO 0% 14-Dec-18 |

Nov-16 |

13.0 |

0.0 |

-0.682 |

2.5 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

DBR 3.75% 04-Jan-19 |

Nov-08 |

24.0 |

0.0 |

-0.717 |

6.8 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

OBL 1% 22-Feb-19 |

Jan-14 |

16.0 |

0.0 |

-0.696 |

5.2 |

|

0.0 |

+/- 1% |

0.0 |

0.1 |

|

BKO 0% 15-Mar-19 |

Mar-17 |

13.0 |

4.3 |

-0.673 |

1.9 |

45% |

2.3 |

+/- 2% |

2.4 |

0.1 |

|

OBL 0.5% 12-Apr-19 |

May-14 |

16.0 |

5.3 |

-0.671 |

5.3 |

100% |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

BKO 0% 14-Jun-19 |

May-17 |

13.0 |

4.3 |

-0.652 |

1.3 |

30% |

3.0 |

+/- 2% |

3.0 |

0.1 |

|

DBR 3.5% 04-Jul-19 |

May-09 |

24.0 |

7.9 |

-0.665 |

7.3 |

92% |

0.6 |

+/- 1% |

0.6 |

0.1 |

|

BKO 0% 13-Sep-19 |

Aug-17 |

13.0 |

4.3 |

-0.652 |

0.7 |

16% |

3.6 |

+/- 3% |

3.6 |

0.1 |

|

OBL 0.25% 11-Oct-19 |

Sep-14 |

16.0 |

5.3 |

-0.626 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 13-Dec-19 |

Nov-17 |

13.0 |

4.3 |

-0.623 |

0.1 |

2% |

4.2 |

+/- 14% |

4.2 |

0.1 |

|

DBR 3.25% 04-Jan-20 |

Nov-09 |

22.0 |

7.3 |

-0.622 |

6.9 |

95% |

0.3 |

+/- 1% |

0.4 |

0.1 |

|

DBRI 1.75% 15-Apr-20 |

Jun-09 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 17-Apr-20 |

Jan-15 |

20.0 |

6.6 |

-0.546 |

6.3 |

95% |

0.3 |

+/- 1% |

0.3 |

0.1 |

|

DBR 3% 04-Jul-20 |

Apr-10 |

22.0 |

7.3 |

-0.533 |

7.2 |

99% |

0.1 |

+/- 1% |

0.1 |

0.1 |

|

DBR 2.25% 04-Sep-20 |

Aug-10 |

16.0 |

5.3 |

-0.503 |

5.3 |

99% |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

OBL 0.25% 16-Oct-20 |

Jul-15 |

19.0 |

6.3 |

-0.474 |

5.2 |

82% |

1.1 |

+/- 1% |

1.1 |

0.1 |

|

DBR 2.5% 04-Jan-21 |

Nov-10 |

19.0 |

6.3 |

-0.444 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 09-Apr-21 |

Feb-16 |

21.0 |

6.9 |

-0.393 |

4.7 |

68% |

2.2 |

+/- 1% |

2.2 |

0.1 |

|

DBR 3.25% 04-Jul-21 |

Apr-11 |

19.0 |

6.3 |

-0.355 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-21 |

Aug-11 |

16.0 |

5.3 |

-0.316 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Oct-21 |

Jul-16 |

19.0 |

6.3 |

-0.298 |

3.9 |

63% |

2.3 |

+/- 1% |

2.4 |

0.1 |

|

DBR 2% 04-Jan-22 |

Nov-11 |

20.0 |

6.6 |

-0.256 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Apr-22 |

Feb-17 |

18.0 |

5.9 |

-0.206 |

2.2 |

37% |

3.8 |

+/- 2% |

3.8 |

0.1 |

|

DBR 1.75% 04-Jul-22 |

Apr-12 |

24.0 |

7.9 |

-0.190 |

7.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 04-Sep-22 |

Sep-12 |

18.0 |

5.9 |

-0.143 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 07-Oct-22 |

Jul-17 |

17.0 |

5.6 |

-0.115 |

0.9 |

16% |

4.7 |

+/- 2% |

4.7 |

0.1 |

|

DBR 1.5% 15-Feb-23 |

Jan-13 |

18.0 |

5.9 |

-0.053 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 14-Apr-23 |

Feb-18 |

4.0 |

1.3 |

-0.002 |

0.0 |

2% |

1.3 |

+/- 27% |

1.3 |

0.0 |

|

DBRI 0.1% 15-Apr-23 |

Mar-12 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-23 |

May-13 |

18.0 |

5.9 |

-0.004 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2% 15-Aug-23 |

Sep-13 |

18.0 |

5.9 |

0.047 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 6.25% 04-Jan-24 |

Jan-94 |

10.3 |

3.4 |

0.096 |

3.4 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.75% 15-Feb-24 |

Jan-14 |

18.0 |

5.9 |

0.126 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-24 |

May-14 |

18.0 |

5.9 |

0.162 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-24 |

Sep-14 |

18.0 |

5.9 |

0.199 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-25 |

Jan-15 |

23.0 |

7.6 |

0.262 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-25 |

Jul-15 |

23.0 |

7.6 |

0.314 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-26 |

Jan-16 |

26.0 |

8.6 |

0.386 |

8.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.1% 15-Apr-26 |

Mar-15 |

13.0 |

4.3 |

|

3.5 |

82% |

0.8 |

+/- 2% |

0.9 |

0.1 |

|

DBR 0% 15-Aug-26 |

Jul-16 |

25.0 |

8.3 |

0.451 |

7.0 |

84% |

1.3 |

+/- 1% |

1.2 |

0.2 |

|

DBR 0.25% 15-Feb-27 |

Jan-17 |

26.0 |

8.6 |

0.508 |

3.0 |

35% |

5.6 |

+/- 2% |

5.5 |

0.3 |

|

DBR 6.5% 04-Jul-27 |

Jul-97 |

11.2 |

3.7 |

0.512 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Aug-27 |

Jul-17 |

25.0 |

8.3 |

0.568 |

0.9 |

11% |

7.3 |

+/- 2% |

7.3 |

0.2 |

|

DBR 5.625% 04-Jan-28 |

Jan-98 |

14.5 |

4.8 |

0.569 |

4.8 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-28 |

Jan-18 |

11.0 |

3.6 |

0.623 |

0.0 |

1% |

3.6 |

+/- 20% |

3.6 |

0.0 |

|

DBR 4.75% 04-Jul-28 |

Oct-98 |

11.3 |

3.7 |

0.607 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 6.25% 04-Jan-30 |

Jan-00 |

9.3 |

3.1 |

0.700 |

3.0 |

99% |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

DBRI 0.5% 15-Apr-30 |

Apr-14 |

9.5 |

3.1 |

|

3.1 |

99% |

0.0 |

+/- 1% |

0.0 |

0.1 |

|

DBR 5.5% 04-Jan-31 |

Oct-00 |

17.0 |

5.6 |

0.774 |

5.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-34 |

Jan-03 |

20.0 |

6.6 |

0.942 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4% 04-Jan-37 |

Jan-05 |

23.0 |

7.6 |

1.028 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-39 |

Jan-07 |

14.0 |

4.6 |

1.093 |

4.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.1 |

|

DBR 4.75% 04-Jul-40 |

Jul-08 |

16.0 |

5.3 |

1.109 |

5.1 |

96% |

0.2 |

+/- 1% |

0.4 |

0.1 |

|

DBR 3.25% 04-Jul-42 |

Jul-10 |

15.0 |

5.0 |

1.175 |

5.0 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.5% 04-Jul-44 |

Apr-12 |

23.5 |

7.8 |

1.225 |

6.5 |

84% |

1.2 |

+/- 1% |

1.6 |

0.1 |

|

DBRI 0.1% 15-Apr-46 |

Jun-15 |

7.0 |

2.3 |

|

1.3 |

57% |

1.0 |

+/- 2% |

1.2 |

0.1 |

|

DBR 2.5% 15-Aug-46 |

Feb-14 |

23.0 |

7.6 |

1.242 |

5.5 |

73% |

2.1 |

+/- 1% |

2.7 |

0.2 |

|

DBR 1.25% 15-Aug-48 |

Sep-17 |

5.5 |

1.8 |

1.280 |

0.2 |

10% |

1.6 |

+/- 6% |

1.6 |

0.1 |

|

Italic = index-linked |

Total |

56.2 |

3.0 |

|||||||

|

Yield below Depo Floor |

||||||||||

|

Yield above Depo Floor |

Bund WAM |

9.3 |

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND and US CURVE MONTHLY UPDATE. European bond yields falling. I remain positive toward a US curve steepening despite last months reversal.. 05.03.2018.

BONDS UPDATE : European bond yields falling and US yet to follow.

For me the yield drop is a bigger association with a FAILING stock market.

1) Yields are close to breaching levels where we will see a MAJOR DROP (US 5yr and UK 10yr). ALL durations are stretched, quarterly, monthly, weekly and daily… this is RARE!

2) Looking at the previous Equity piece, European stocks look a LONGTERM failure thus I firmly believe this mean BONDS rally.

3) Germany 26’s bonds have based well.

4) UK yields have a LOFTY RSI and UKTI POISED to bounce. UK 10yr all eyes on a breach of 1.489 (10yr Gilts).

5) US 10 Breakevens have a LOFTY WEEKLY and DAILY RSI.

6) Nearly ALL US curves rejected the recent steepening BIAS at MAJOR MULTI YEAR 61.8% ret, the RSI’s remain low however. If the 61.8% ret’s are breached we steepen in a BIG WAY.

** US curves will be a BIG trade once the 61.8% retracements are breached. **

Bond markets : Yields are finally stalling against the backdrop of many dislocated RSI’s. The closes are important prequal to the end of the month.

US BONDS : All US yields are now above multi year trendlines but daily RSI’s are lofty, especially the 5yr sector. The US 5yr is a special case as the RSI is dislocated on a monthly and quarterly period.

US curves look to have found a BASE against the historically LOW RSI’s but have nearly ALL stalled at the multiyear 61.8% ret, its worth waiting for the monthly closes.

Europe is a very mixed bag and PERIPHERAL markets void of REAL MONEY positioning. It has become a bit of a HEDGE FUND CHOP FEST.

• ** HAPPY TO DISCUSS ANY CHARTS **

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4174

Mobile: +44 (0) 7980708683

Email: chris.williams@astorridge.com

Web: www.AstorRidge.com

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

:Tomorrow-£2.25bn UKT 1.5% 2047 Issue Cheap to 45s & 49s -Last tap??

Tomorrow sees the UK DMO offer a tap of £2.25bn ukt 1.50% 2047s which with the Global rout in Government bonds sees the issue at a healthy discount to par which appeals to an International audience & a good window to clean up old issues into this bond,which is likely the last tap as the isssue size goes above £24bn & it is time to launch a new 2048 in the new financial year. The expression I like for tomorrow is selling 3h45s & 4q49s which has ground to the richest level since 47s with the benefits of awith extra duration.. Entry:+1bp.. Target -4bps. Stop +3bps.

This marketing was prepared by George Whitehead, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

<< "The Past Is The Future Back To Basics" 02031434182-www.astorridge.com >>

BOND and US CURVE MONTHLY UPDATE. European bond yields falling. For me the yield drop is a bigger association with a FAILING stock market. . 02.03.2018.

BONDS UPDATE : European bond yields falling and US yet to follow.

For me the yield drop is a bigger association with a FAILING stock market.

1) Yields are close to breaching levels where we will see a MAJOR DROP (US 5yr and UK 10yr). ALL durations are stretched, quarterly, monthly, weekly and daily… this is RARE!

2) Looking at the previous Equity piece, European stocks look a LONGTERM failure thus I firmly believe this mean BONDS rally.

3) Germany 26’s bonds have based well.

4) UK yields have a LOFTY RSI and UKTI POISED to bounce. UK 10yr all eyes on a breach of 1.489 (10yr Gilts).

5) US 10 Breakevens have a LOFTY WEEKLY and DAILY RSI.

6) Nearly ALL US curves rejected the recent steepening BIAS at MAJOR MULTI YEAR 61.8% ret, the RSI’s remain low however. If the 61.8% ret’s are breached we steepen in a BIG WAY.

• ** HAPPY TO DISCUSS ANY CHARTS **

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4174

Mobile: +44 (0) 7980708683

Email: chris.williams@astorridge.com

Web: www.AstorRidge.com

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris