BOND and US CURVE MONTHLY UPDATE. Yields are topping out, especially the US!.. 26.2.2018.

BONDS UPDATE : US 5yr yield drop could be a BIG ONE.

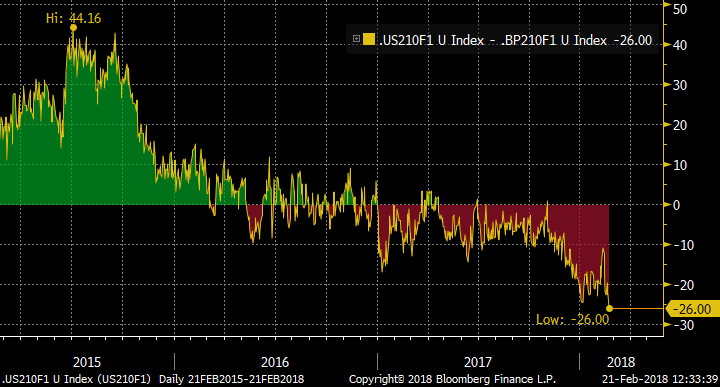

1) Yields are close to breaching levels where we will see a MAJOR DROP (US 5yr and UK 10yr). ALL durations are stretched, quarterly, monthly, weekly and daily… this is RARE!

2) Nearly ALL US curves rejected the recent steepening BIAS at MAJOR MULTI YEAR 61.8% ret, the RSI’s remain low however. If the 61.8% ret’s are breached we steepen in a BIG WAY.

3) Germany 26’s bonds are basing finally.

4) UK yields have a LOFTY RSI and UKTI POISED to bounce, all eyes on a breach of 1.489 (10yr Gilts).

5) US 10 Breakevens have a LOFTY WEEKLY and DAILY RSI.

Bond markets : Yields are finally stalling against the backdrop of many dislocated RSI’s. The closes are important prequal to the end of the month.

US BONDS : All US yields are now above multiyear trend lines but daily RSI’s are lofty, especially the 5yr sector. The US 5yr is a special case as the RSI is dislocated on a monthly and quarterly period.

US curves look to have found a BASE against the historically LOW RSI’s but have nearly ALL stalled at the multiyear 61.8% ret, its worth waiting for the monthly closes.

Europe is a very mixed bag and PERIPHERAL markets void of REAL MONEY positioning. It has become a bit of a HEDGE FUND CHOP FEST.

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4174

Mobile: +44 (0) 7980708683

Email: chris.williams@astorridge.com

Web: www.AstorRidge.com

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

BOND and US CURVE MONTHLY UPDATE. A VERY KEY week as YIELDS could TOP OUT and HEAD ALOT LOWER.. 23.2.2018.

BONDS UPDATE : YIELDS LOWER MAYBE?

1) Yields are close to breaching levels where we will see a MAJOR DROP (US 5yr and UK 10yr). ALL durations are stretched, quarterly, monthly, weekly and daily… this is RARE!

2) Nearly ALL US curves rejected the recent steepening BIAS at MAJOR MULTI YEAR 61.8% ret, the RSI’s remain low however. If the 61.8% ret’s are breached we steepen in a BIG WAY.

3) Germany 26’s bonds are basing finally.

4) UK yields have a LOFTY RSI and UKTI POISED to bounce, all eyes on a breach of 1.489 (10yr Gilts).

5) US 10 Breakevens have a LOFTY WEEKLY and DAILY RSI.

Bond markets : Yields are finally stalling against the backdrop of many dislocated RSI’s. The closes are important prequel to the end of the month.

US BONDS : All US yields are now above multiyear trendlines but daily RSI’s are lofty, especially the 5yr sector. The US 5yr is a special case as the RSI is dislocated on a monthly and quarterly period.

US curves look to have found a BASE against the historically LOW RSI’s but have nearly ALL stalled at the multiyear 61.8% ret, its worth waiting for the monthly closes.

Europe is a very mixed bag and PERIPHERAL markets void of REAL MONEY positioning. It has become a bit of a HEDGE FUND CHOP FEST.

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4174

Mobile: +44 (0) 7980708683

Email: chris.williams@astorridge.com

Web: www.AstorRidge.com

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

Equities We are close to a MAJOR statement being made if we close the week at the recent lows! IT'S DECISION TIME . 22.02.2018

It has been mentioned that I have been putting out a lot of updates recently, this is because I believe we are at a MULTI YEAR reversal location. If this week’s closes are poor then the IMPLICATIONS will be huge.

• We are close to a MAJOR statement being made should we close the week at the recent lows! Any such close will complement the ALREADY OVERSTRETCHED monthly’s. Tomorrow is MASSIVE!

• MANY bounces have been VERY LAME.

• ** SEE DAX CHART PAGE 10! **

• US stocks remain the most over bought and many have recovered MORE than 200% of the 2008-2009 correction.

• The DOW and S&P have major RSI dislocations spread across monthly, weekly and daily durations! This is a DANGEROUS combination.

• Some RSI’s surpass 1950 and 1980 levels.

• US stocks highlight the most CONCERN.

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4174

Mobile: +44 (0) 7980708683

Email: chris.williams@astorridge.com

Web: www.AstorRidge.com

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

FX UPDATE AND EM BONDS.The USD INDEX is FINALLY BASING especially on the monthly chart.. 21.02.2018

• The USD INDEX is FINALLY BASING especially on the monthly chart.

• EUR USD continues to cause heartache around its KEY retracement SUPPORT 1.2167.

• EUR GBP weekly is COILING for a major move.

• USD JPY hitting SUPPORT at the 61.8% ret 106.54.

• USD ZAR is now struggling to hold major support.

•

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

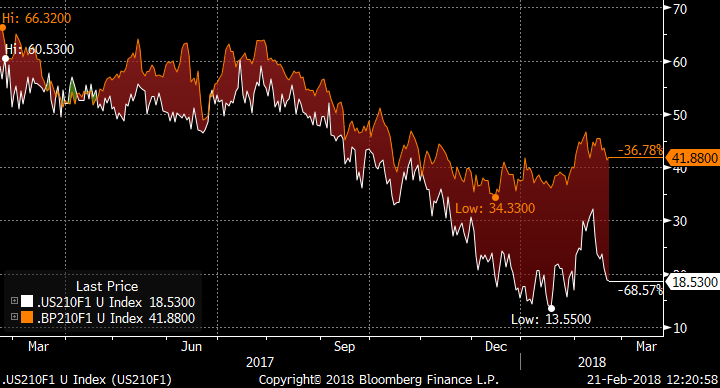

UK to play catch-up to the US? Trades on USD vs GBP 2y-10y curve box

Bottom line: The US curve (however it is viewed) is at, or close to its flattest for the last 20 years, as the Fed hikes rates. At the same time, though the GBP curve has flattened somewhat it is still significantly steeper than before the financial crisis of 2008, despite the market pricing hikes from the MPC. Thus in isolation we would independently favour a steepener in the US and a flattener in the UK. Given the relatively high realized correlation between the US and UK on certain curve sectors, there is a good case to be made for looking at the box trade.

Trade(s):

In vanilla swaps:

Recv USD 525mm 1y2y

Pay USD 116mm 1y10y

Pay GBP 365mm 1y2y

Recv GBP 77mm 1y10y

Equivalent to USD 100k/bp on the box

Enter at -25.5bp. Target flat (0bp). Stop at -32bp. Rolldown over first 3m: -0.8bp.

In CMS spread caps:

Buy USD 1bn 1y expiry CMS 10y-2y cap atmf + 5bp (k=25.1bp)

Sell GBP 718mm 1y expiry CMS 10y-2y cap atmf + 10bp (k=54.8bp)

For zero cost (indicative mid)

Forward entry at -29.7bp.

The chart:

Rationale: The market is pricing two to three more hikes from the FOMC over the next 12 months. Over the same period, the MPC is forecast to hike once or maybe twice. For the ECB, the EONIA market is not even pricing one hike.

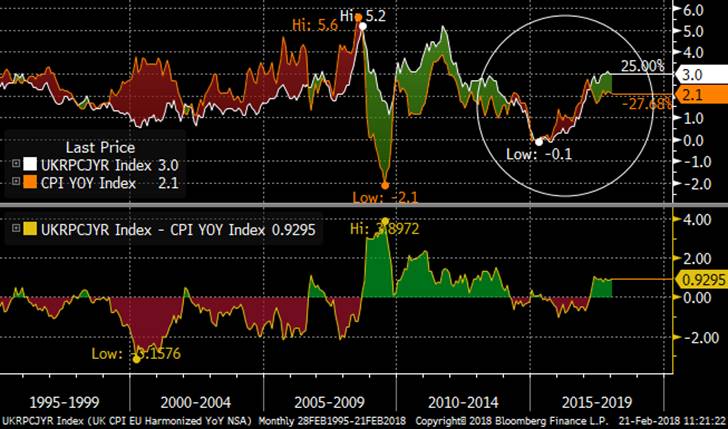

This chart shows the CPI history of the US and UK. The reflation in the UK since 2015 is matching, if not outpacing the US, and on this metric the MPC looks to be a little late to the hiking party. Of course, the elephant in the room is BREXIT with all its associated uncertainties: a ill-controlled departure from the EU could weaken Sterling and import further inflation while the apparent contraction in the labour force (from falling numbers of EU nationals) could continue to push wages higher. Or not, if some accommodation is thrashed out with the EU 27. That is not to say the US does not have inflationary pressures of its own, from rising wages to possible increased infrastructure (and other) spending.

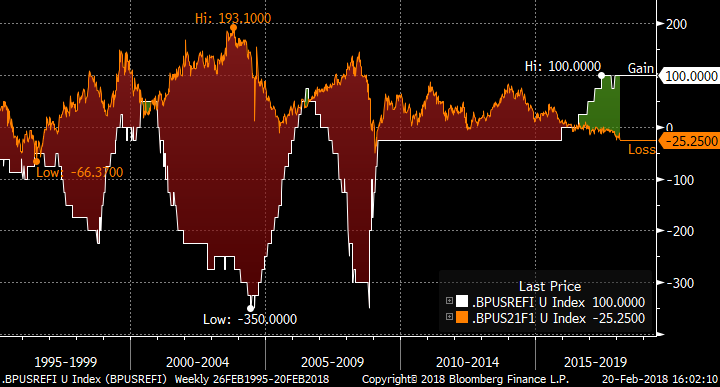

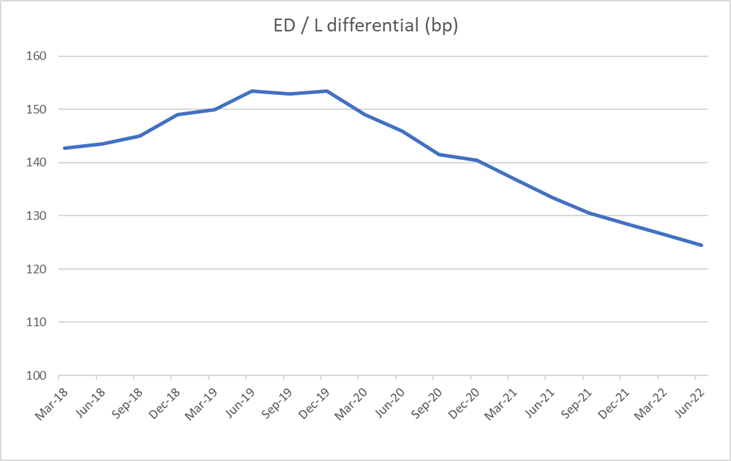

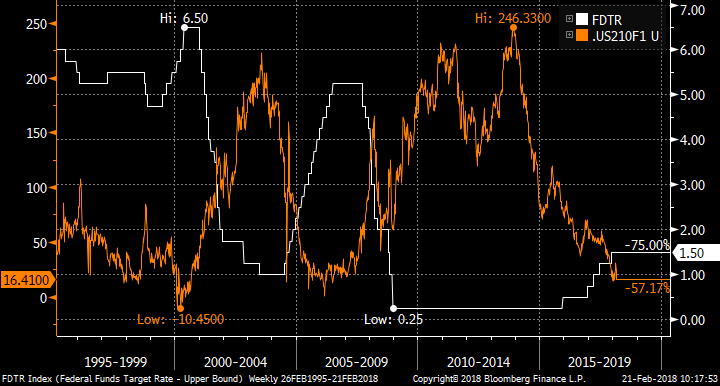

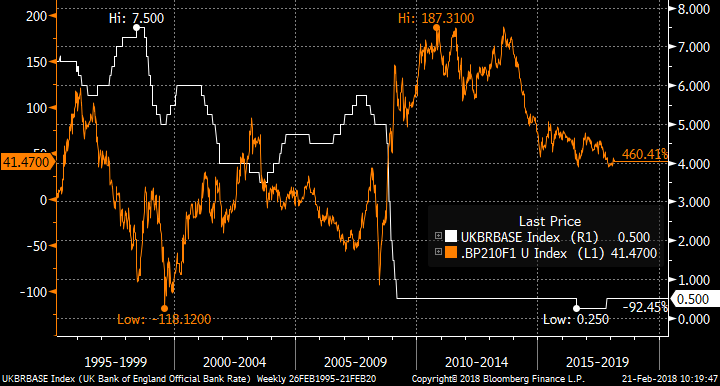

The next chart shows the differential between US and UK refi rates, overlaid with the history of the US-GBP 2y-10y, 1y forward curve box. The policy rate spread, at 100bp is the highest for the last 20 years. Beneath this is the spread between the Eurodollar and Short Sterling strips, which shows the rate differential forecast to increase to 150bp by Q2 19 before starting to narrow gradually. Effectively the market is pricing that the Fed will be pretty done a year to 18 months from now, while the BoE will still be on a hiking path (albeit a shallow one). The empirical history of the curve box from the 2004 – 2006 period saw the US curve flattening faster than the GBP in the early stages of the hiking cycle, before the box sharply changed direction in early ’06 as the MPC vacillated between cutting and hiking. It was at this point that the UK curve started flattening in earnest. Even though the short rate differential between the Fed and BoE was still widening, the box level rose.

Taking each country in turn, this chart shows the US side of things: the Fed target rate vs USD 2y-10y, 1y fwd. The ’04-’06 period in the US saw the curve flattening classically as the belly of the curve could not keep pace with rising short rates. This process continued until roughly halfway through the hiking cycle, which is arguably where we are in the current cycle with another 4 or so hikes to come as priced by the market. Having flattened to its lows in the 10bp area, the curve held within a choppy range for the next 18 months. Thus the argument for the present day is that, given the forward curve is back to the previous cycle lows and the hiking cycle has matured, the next move from the US curve will be sideways, if not steeper. This is before an increasing US bond term premium is factored in.

The corresponding chart for the UK shows a curve that has yet to embrace the prospect of a tightening rate cycle. The GBP 2y-10y, 1y forward curve is close to its local lows since 2008 (though has steepened back a shade in the past month), but well above the flat/inverted levels observed before the financial crisis. It is fair to note that the term premium in the UK should be higher now given the fog of BREXIT, but we have yet to see the degree of flattening associated with the MPC’s previous hiking period in ’04 to ’07.

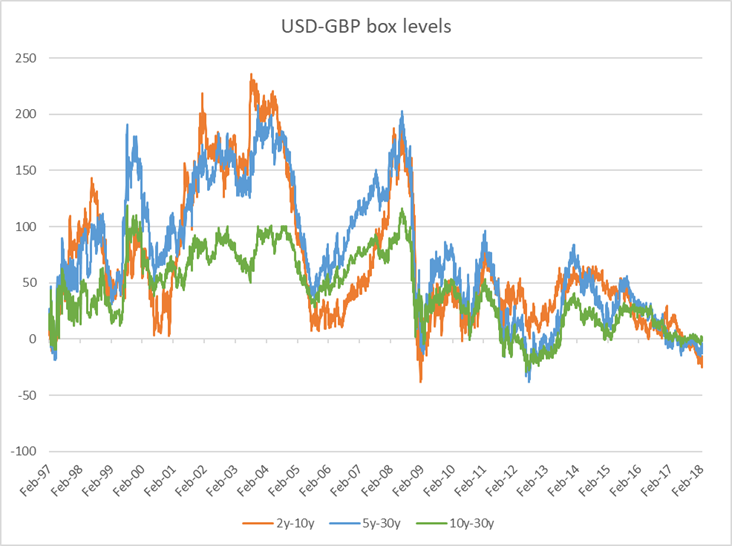

Why have I focused on 2y-10y and not other curve segments? The next chart shows three candidate box trades (2-10y, 5y-30y and 10y-30y). All three are very low levels historically. However at around 23bp inverted (on the spot 2y-10y), this sector looks the most stretched compared to the previous range.

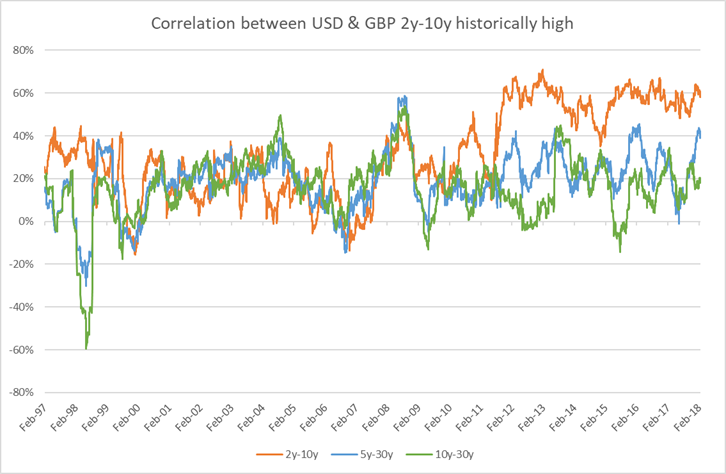

There is another reason to prefer 2y-10y for the box. This chart shows the rolling realized 6m correlation between various USD and GBP curve sectors. While 5y-30y and 10y-30y correlations have remained in the 20-year range, the 2y-10y curves have become more correlated since 2011. Correlation is key on cross-market trades, otherwise the box is simply two orthogonal curve trades.

This correlation is visible in the recent history of the US/GBP 2y-10y, 1y forward curves.

An alternative way to vanilla swaps is to use CMS spread options. Re-visiting the recent history of the 2y-10y, 1y forward curves, the box has been directional in terms of curve as the US leg has been more volatile than the GBP side: heading lower as curves flattened. Thus it is interesting to look at the expression via CMS spread caps, buying a USD cap and selling the GBP. If the US curve continues to flatten, with the GBP curve following, then both options expire out of the money. On a steepening move, empirically we might expect the US curve to steepen more than the GBP and so the USD cap would prove to be more valuable than the GBP one.

The other reason to express the trade via caps rather than floors is that GBP curve implied volatility is higher than in USD, which is the opposite of relative realized volatilities (see table). The 1y expiry offers the greatest implied volatility pick-up in bp/y.

|

2y-10y implied volatility |

Realized Vol |

||||

|

3m |

6m |

1y |

2y |

3m |

|

|

USD |

39 |

38 |

37 |

35 |

36 |

|

GBP |

41 |

41 |

40 |

37 |

33 |

|

Ratio USD/GBP |

0.95 |

0.93 |

0.93 |

0.95 |

1.08 |

This differential allows us to improve the entry level on the box versus the vanilla swap structure. As usual, I like to have the option that I am short slightly out-of-the-money compared to the atmf, so this structure is approximately zero cost (mid):

Buy USD 1bn 1y expiry CMS 10y-2y cap atmf + 5bp (k=25.1bp)

Sell GBP 718mm 1y expiry CMS 10y-2y cap atmf + 10bp (k=54.8bp)

Thus the forward entry is at -29.7bp (indicative), beating the vanilla trade by 4bp.

I look forward to any and all comments you might have!

Best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND and US CURVE MONTHLY UPDATE. Some yield charts close to breaking ALOT lower, coonfirmation needed though. UK breakevens have a downside pierce and should bounce. 21.2.2018.

BONDS UPDATE :

Yields are close to breaching levels where we will see a MAJOR DROP (US 5yr and UK 10yr). ALL durations are stretched, quarterly, monthly, weekly and daily… this is RARE!

Nearly ALL US curves rejected the recent steepening BIAS at MAJOR MULTI YEAR 61.8% ret, the RSI’s remain low however.

Germany bonds are struggling to base despite the RSI’s.

UK yields have a LOFTY RSI and UKTI POISED to bounce.

US 10 Breakevens have a LOFTY WEEKLY and DAILY RSI.

Bond markets : We continue to struggle especially in EUROPE and Germany struggling to base.

US BONDS : All US yields are now above multi year trendlines but daily RSI’s are lofty, especially the 5yr sector. The US 5yr is a special case as the RSI is dislocated on a monthly and quarterly period.

US curves look to have found a BASE against the historically LOW RSI’s but have nearly ALL stalled at the multiyear 61.8% ret, its worth waiting for the monthly closes.

Europe is a very mixed bag and PERIPHERAL markets void of REAL MONEY positioning. It has become a bit of a HEDGE FUND CHOP FEST.

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

New Spain 48s

Some thoughts on the Spanish 48 syndication

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Japan's FSA finds regional banks incurred losses on foreign bond investments -source - Reuters News

Japan's FSA finds regional banks incurred losses on foreign bond investments -source - Reuters News 20-Feb-2018 15:31:43 TOKYO, Feb 20 (Reuters) - Around 20 of Japan's regional banks lost money on their foreign bond investments amid the recent jump in U.S. long-term yields, an emergency review conducted by Japan's Financial Services Agency (FSA) showed, a source with direct knowledge of the matter told Reuters. The FSA is expected to ask banks to improve their performance, said the source, who is not authorised to discuss the matter publicly. Squeezed by shrinking local populations and the Bank of Japan's negative interest rate policy, many of these smaller banks have managed to stay in the black thanks to securities trading. However, their bond investments have taken a hit, and there are worries these banks could face more trouble ahead. The FSA has fretted for some time about the long-term health of regional banks, which hold about half the country's $4 trillion in outstanding bank loans. Over half of Japan's 100 or so regional banks lost money on their core lending and fees businesses in the year to March 2017, with profits falling faster than expected. (Full Story) The FSA conducted a similar investigation when U.S. yields rose after Donald Trump was elected president in 2016, and ordered some regional banks to improve their performance. U.S. Treasury yields have surged this year, with those of the benchmark 10-year note US10YT=RR rising to its highest in four years, on expectations the Federal Reserve could raise interest rates more than expected this year. The 20 or so banks the FSA inspected recently were the ones it singled out during its 2016 review as needing improvement. Finance Minister Taro Aso told a regular news conference on Tuesday that while some regional banks have incurred capital losses on their foreign bond investments, it has not reached a dangerous level.

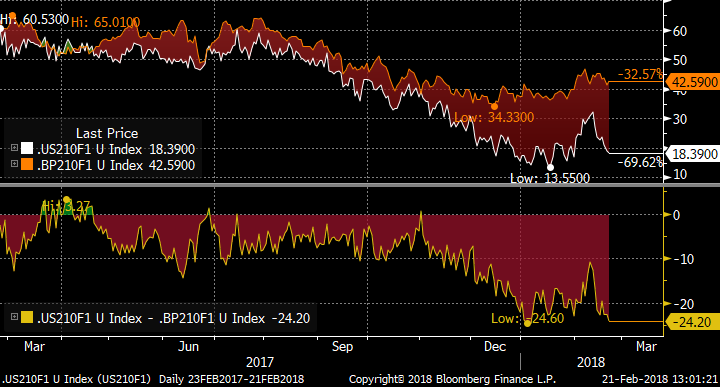

JGB TRADE IDEA; Buy belly of the 5s10s20s cash fly

Rational:

We are of the view that the BoJ is not in the process of tapering or changing its monetary policy any time soon.

CPI is still way off its 2% target.

Why take the risk when wages are not increasing and we will have another stab in the heart of inflation with Consumption Tax hike next year!?

Recent USD/JPY will not be supportive in attaining that CPI target soon either.

A small ‘fine tuning’ of its long end Rinbans early January had impact of moving USD/JPY 3%, can you imagine the damage to JGB holdings and Nikkei if real speculation of end of QE was in motion!

Japanese MoF was on wires overnight talking down Kuroda’s comments of 2% CPI being ‘close’ suggesting he was ‘taken out of context’.

Entry level -34bps

Target -38bps

Add -32bps

Reminder that BoJ’s current monetary policy is to target 10yrs yields between 0-10bps.

Each time we have seen 10yrs Jgbs move to 11bps it has conducted an “unlimited buying operation” preventing 10yrs yields to move higher.

We have a 10yrs auction on the 1st of Feb which will be a good opportunity for dealers and investors alike to pick up some 10yrs paper as close to 10bps as possible.

Jgb349 is trading -35bps on repo whilst 5s and 20s are GC.

Trade carries/rolls positively by 2.5bps for 6mths.

Fly has moved into the upper range of 1year range.

10yrs yields seems to have decorrelated from USD/JPY

Whilst traditionally, I have always favoured the 20yrs point of the JGB curve with its generous carry & roll, with it trading sub 60bps and with the steep JSCC/LCH curve (10bps in 20yrs) we have noted some 20yrs ASW profit taking which should also put pressure on 20yrs cash. Also as mentioned above the 10yrs point has cheapen enough for the fly to carry & roll positively.

Risk Scenario:

BoJ’s Kuroda is not re-appointed at Governor

BoJ continues its fine tuning of Rinbans and ends up spooking market.

PLEASE NOTE that fine tuning can be decided by the BoJ’s Daily Monitoring Team BUT a lifting of the FLOOR can ONLY be decided by the Board of the BoJ (next meeting 9th of March)

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Jean-Francois Lucas

O: +44 (0) 203 - 143 - 4175

M: +44 (0) 7493 026514

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Jean-Francois Lucas. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

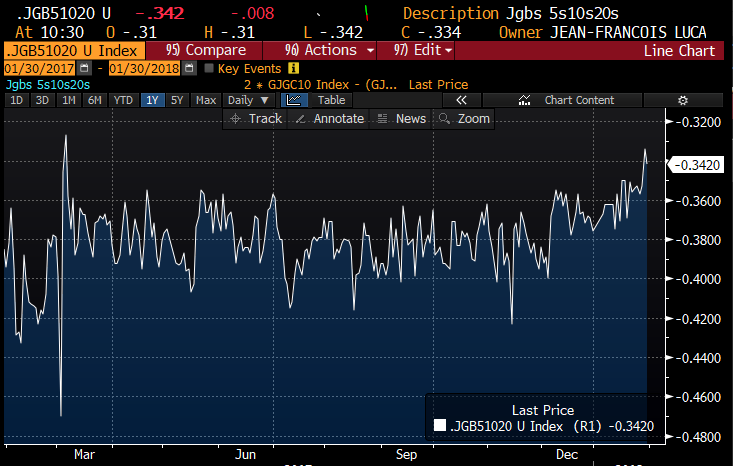

Daily Japan - 20th February 2018

Summary:

Quiet and dull day in low volumes for Jgbs closing 3sen weaker with Liquidity auction being a non-event.

Further to yesterday decent 428pts rally Nikkei lost 1% on profit taking.

Expect this trend to continue into any rally as domestics look to lock in profits ahead of F/Y end to offset against foreign bond holdings.

Tomorrow we have the BoJ Rinbans targeting 1-10yrs and all eyes will be on the 5-10yrs bucket and whether the BoJ sticks to its recently Yen450bln increased size or revert back to 410bln. We doubt the latter as with JPY finally coming off its recent highs I doubt BoJ will want to trigger another currency rally as was the case in early January when the long end rinbans had been reduced by as little as 20bln.

In respect to year end activity a story on Reuters suggesting FSA is looking into losses at Regionals (yet again) on foreign bond portfolios

“Japan's FSA finds regional banks incurred losses on foreign bond investments”.

Thursday will be the key event of the week, 20yrs auction, which despite the lowest yield this calendar year should be reasonably well supported as we continue to see buying of the long end from Lifers. The above stories of Regionals incurring losses of foreign bond portfolios will most also be supportive to long end as money gets shifted back home.

This auction will be followed by another long end Rinban and a large month end extension.

Jscc/Lch basis: unchanged across the curve.

Daily Closes:

|

Jgb Close |

Change on day |

High |

Low |

||||

|

150.72 |

-3 |

150.76 |

150.71 |

||||

|

|

|

|

|

|

|

||

|

Jgb |

Change on day |

Swaps Jscc |

Change on day |

||||

|

2yrs |

-0.155 |

unch |

0.0525 |

+0.125 |

|||

|

5yrs |

-0.10 |

unch |

0.1225 |

+0.125 |

|||

|

7yrs |

-0.04 |

+0.5 |

0.1850 |

+0.25 |

|||

|

10yrs |

0.06 |

+0.5 |

0.28875 |

+0.25 |

|||

|

20yrs |

0.565 |

+0.5 |

0.6550 |

+0.375 |

|||

|

30yrs |

0.785 |

unch |

0.83 |

+0.125 |

|||

|

40yrs |

0.92 |

unch |

0.9225 |

+0.125 |

|||

|

|

Daily JGBs & Nikkei graphs:

Supply next 5 days:

- 22nd February – 3mths Tbill auction

- 22nd February – 20yrs auction

BoJ Rinbans next 5 days:

- 21st February - 1-3yrs, 3-5yrs and 5-10yrs

- 23rd February - 1-3yrs, 3-5yrs, 10-25yrs & 25yrs+

- 26th February - 5-10yrs

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Jean-Francois Lucas

O: +44 (0) 203 - 143 - 4175

M: +44 (0) 7493 026514

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Jean-Francois Lucas. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796