Equities : An update despite some markets being closed. THIS is the WEEK we need to MOVE. IT'S DECISION TIME . 19.02.2018

• A significant number of monthly charts look negative but the weekly time horizon is where confirmation is NOW REQUIRED. WE need FAILURE this week or else!

• US stocks remain the most over bought and many have recovered MORE than 200% of the 2008-2009 correction.

• The DOW and S&P have major RSI dislocations spread across monthly, weekly and daily durations! This is a DANGEROUS combination.

• Some RSI’s surpass 1950 and 1980 levels.

• US stocks highlight the most CONCERN.

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

•

FX UPDATE AND EM BONDS. USD JPY should BASE here whilst the USD INDEX struggles to HOLD. 19.02.2018

FX UPDATE AND EM BONDS

• The USD INDEX is STRUGGLING to BASE especially on the monthly chart.

• EUR USD continues to cause heartache holding its KEY retracement SUPPORT 1.2167.

• EUR GBP weekly is COILING for a major move.

• USD JPY hitting SUPPORT at the 61.8% ret 106.54.

• USD ZAR is now struggling to hold major support.

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

•

FX UPDATE AND EM BONDS

• The USD INDEX is STRUGGLING to BASE especially on the monthly chart.

• EUR USD continues to cause heartache holding its KEY retracement SUPPORT 1.2167.

• EUR GBP weekly is COILING for a major move.

• USD JPY hitting a 61.8% ret 106.54.

• USD ZAR is now struggling to hold major support.

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

•

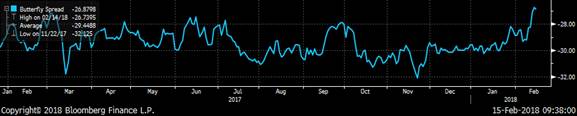

Gilts-£2.25bn ukt 1.75% 2057 Auction..Nervous caution..

The clock is ticking towards the largest conventional DV01 event since the 2065 Syndication at around £6mill a bp & the appetitie for supr-longs seems to have waned,hardly a surprise with CPI 3%/RPI 4% & 3h68 yd@1.835%, so today's event may see a late concession or face a big tail. As mentioned the curve 30/50s has started to disinvert & with the upcoming x-div period for March & September issue with 2039s the longest going x I would expect to see further dis-inversion/steepening into monthend & as QE starts mid march with cash outweighing supply significantly.. All the above aside Gilts have fallen yields have caught up more with fundamentals & although the best terms are past to sell 60/65s & 68s into 57s there are other expressions which may see a smoother process. The trade I like here is selling ukt3h45s into uk4q36s & uk 1t57s with 30 year supply scheduled in March & no more Conventional 20yr or 40 year until April ,chart below:

Entry anywhere close to -27bps..

target -32. Stop -24. Good luck with the supply !

This marketing was prepared by George Whitehead, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

<< "The Past Is The Future Back To Basics" 02031434182-www.astorridge.com >>

Equities ..The monthly picture is bearish BUT we have some MAJOR daily OVERSOLDS. 14.02.2018

• With the latest selloff in European stocks the monthly picture now looks worrying.

• US stocks remain the most over bought and many have recovered MORE than 200% of the 2008-2009 correction.

• The DOW and S&P have major RSI dislocations spread across monthly, weekly and daily durations! This is a DANGEROUS combination.

• Some RSI’s surpass 1950 and 1980 levels.

• US stocks highlight the most CONCERN.

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

•

BOND and US CURVE MONTHLY UPDATE..US yields remain quiet but CURVES have all stalled at multiyear retracements. 14.2.2018.

BONDS UPDATE :

Currently a quiet environment but US 5yr yields are close to confirming a MAJOR TOP. ALL durations are stretched, quarterly, monthly, weekly and daily… this is RARE!

Most US curves have steepened and what's VERY interesting is that MANY have stalled at the SAME multi year 61.8% retracement, implying a very technical BIAS.

Germany bonds are struggling to base despite the RSI’s.

UK yields have a LOFTY RSI.

US 10 Breakevens have a LOFTY WEEKLY and DAILY RSI and a TOP forming.

Bond markets : We continue to struggle especially in EUROPE and Germany struggling to base.

US BONDS : All US yields are now above multiyear trend lines but daily RSI’s are lofty, especially the 5yr sector.

US curves look to have found a BASE against the historically LOW RSI’s but given we have had this signal previously its worth waiting for the monthly closes.

Europe is a very mixed bag and PERIPHERAL markets void of REAL MONEY positioning. It has become a bit of a HEDGE FUND CHOP FEST.

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

•

•

How are we doing? Shadow portfolio update

Portfolio since 1st Feb: USD +256k, Ytd +158k

Summary: It’s been an interesting fortnight since the last update, with an impressive equity sell-off and significant swings on bond yields. The portfolio has benefited from the long-awaited steepening of the US curve, as the market wakes up to the prospects of higher deficits, higher inflation and a possible Fed response. This is the effect that I played for right at the start of the Trump presidency, but which failed to materialize (to the detriment of my 2017 P&L) until last week. However the steepening has not been whole-hearted, so it is a little early to see it as a trend for a wholesale repricing of term premia. The moving-average indicators support holding the US 2y-10y, 1y fwd trade for now, however it might be worth considering using some of the positive P&L to pay the premium for conditional curve trades.

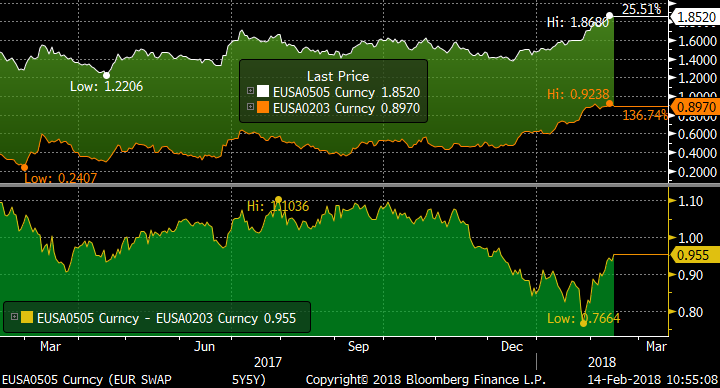

Elsewhere, the EUR forward curve is still a conundrum. My bull-steepening exposure is making some money from the steepening part and roll-down, though clearly this is unlikely to be held to expiry. Over the longer term, my macro view is for bear-flattening as the ECB moves towards ending new PSPP2 purchases and then rate hikes (in 2019?), but that dynamic is the opposite of what is happening now. The chart is EUR 2y3y vs 5y5y, which has steepened as the belly has underperformed in the sell-off.

Looking back (a long way) to the last ECB hiking cycle (circled in the chart) we should expect 2y3y/5y5y to flatten … though even in that cycle the curve was somewhat schizophrenic in the 12 months leading up to the first actual hike. The steepening of 2y3y/5y5y at the start of 2005 (1st hike in November later that year) is reminiscent of what we are seeing now. So the bottom line is that eventually the bear-flattener will be the right trade, but there’s no rush as the entry level is improving almost daily. Another one for the momentum indicators, but if the spread reaches 100bp (currently 95) it will be hard to ignore.

On other trades, the RX/UB box is be-calmed and slightly offside. I’d look to add if the box touches -4bp again. The GBP/USD 5y5y xccy basis remains elevated and has spent longer in positive territory than on previous spikes. The 5y-10y spot curve is steepening, as the 5y basis falls faster than the 10y. It’s a hold for now, but may be a slow burn to profitability.

|

Trade Idea |

Entered |

Level |

Size |

Status |

Exit/Current Level |

Exit Date |

P&L k USD |

|

US 2-10 steepener via CMS caps |

28-Dec-17 |

0 bp |

USD 25 k/bp |

CLOSED |

0 bp |

15-Jan-18 |

0 |

|

RX/UB ASW Box |

28-Dec-17 |

-6.1 bp |

EUR 50 k/bp |

OPEN |

-5.1 bp |

-64 |

|

|

EUR 1y3y/5y5y Mid-curve flattener |

28-Dec-17 |

13.7 bp |

EUR 20 k/bp |

CLOSED |

29 bp |

31-Jan-18 |

380 |

|

GBP 1y1y1y MC Payer spread |

28-Dec-17 |

0.7 bp |

GBP 25 k/bp |

CLOSED |

-1 bp |

31-Jan-18 |

-60 |

|

EUR 9m1y1y/9m1y5y Bear Flattener |

28-Dec-17 |

4.2 bp |

EUR 25 k/bp |

CLOSED |

0 bp |

30-Jan-18 |

-130 |

|

Receive GBP/USD 5y5y xccy basis |

28-Dec-17 |

1 bp |

GBP 40 k/bp |

OPEN |

2.9 bp |

-104 |

|

|

EUR 2-5-10 weighted swap fly |

28-Dec-17 |

-28.1 bp |

EUR 40 k/bp |

CLOSED |

-25 bp |

25-Jan-18 |

-154 |

|

GBP 2y-10y Bull-steepener |

05-Jan-18 |

0 bp |

GBP 20 k/bp |

OPEN |

0.1 bp |

3 |

|

|

EUR 2y2y/5y10y Bull-Steepener |

30-Jan-18 |

0 bp |

EUR 25 k/bp |

OPEN |

2 bp |

62 |

|

|

USD 2y-10y, 1y fwd steepener |

02-Feb-18 |

22 bp |

USD 25 k/bp |

OPEN |

31.1 bp |

226 |

|

|

Total YTD |

158 |

||||||

|

Note on trade sizing: Each trade is sized to generate approx. USD 150k 2y 99% hist. VaR at inception with no netting |

|||||||

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FX UPDATE AND EM BONDS. The EURO a sideways struggle whilst the USD INDEX is potentially basing. 13.02.2018

• The USD INDEX has potential to BASE especially on the weekly chart.

• EUR USD is at KEY retracement SUPPORT 1.2167.

• EUR GBP weekly is COILING for a major move.

• USD JPY at the bottom end of the recent range.

• USD ZAR is also poised to recover.

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

•

•

Equities ..The monthly picture is bearish BUT we have some MAJOR daily OVERSOLDS. 12.02.2018

• Are stocks HOLED below the water line and slowly sinking? The big problem with this statement is that we really need to see the monthly closes, which is a long way off. This week’s settlements may offer a few hints to straddle the time gap.

• US stocks remain the most over bought and many have recovered MORE than 200% of the 2008-2009 correction.

• The DOW and S&P have major RSI dislocations spread across monthly, weekly and daily durations! This is a DANGEROUS combination.

• Some RSI’s surpass 1950 and 1980 levels.

• US stocks highlight the most CONCERN.

I provide our research notification below for your convenience:

Research Unbundling:

Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

I also direct you to our disclaimer on our email footer:

This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

Many thanks,

Chris

BOND and US CURVE MONTHLY UPDATE..No MAJOR changes, the RSI dislocations REMAIN. 12.2.2018.

BONDS UPDATE :

Little change to the BOND YIELD charts despite the MANY RSI dislocations. ALL durations are stretched, quarterly, monthly, weekly and daily… this is RARE!

All parts of the US curve have yields above multiyear trend lines BUT the 5yr is now TOO EXTEND. See pages 11-14.

US curves continue the struggle to find a base but the RSI’s are now VERY LOW.

Germany bonds are struggling to base despite the RSI’s.

UK yields have a LOFTY RSI.

US 10 Breakevens have a LOFTY WEEKLY and DAILY RSI.

I provide our research notification below for your convenience:

Research Unbundling:

Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

I also direct you to our disclaimer on our email footer:

This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

Many thanks,

Chris