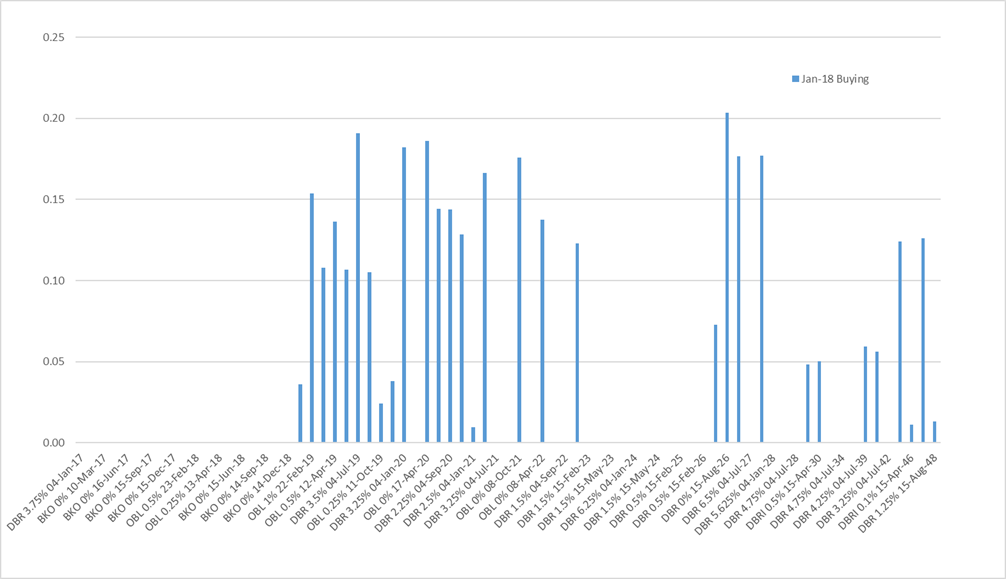

PSPP2 buying of Germany in Jan-18. Buying rates outside of "high redemption" months should have diminishing impact?

The PSPP2 data for January was out yesterday, and here are the results of my Maximum Likelihood model that estimates how the purchases have been made

- The estimated monthly WAM of purchases of Bunds in January under the reduced purchasing rate is 6.5 years, compared to 5.9 years in December.

- As in previous months, buying in the 10y sector has been limited to the on-the-run issues

- The model suggests that there still has not been any significant buying of the on-the-run 30y

- The percentage of non-Bund purchases in January was 34%, similar to December (30%)

- Redemption reinvestment flows are estimated at EUR 480mm in January

- The largest estimated single purchase was 203mm of the Aug-26, or just 10mm per day. Compare this to the volume of say 500k RX contracts daily, which is 5bn. As purchases in 10y and 30y concentrate more in the on-the-run, liquid issues it suggests PSPP2 will have a diminishing impact there. At the same time, “high redemption” months should see a greater relative impact from Buba buying: eg April when over twice the amount of German paper will need to be bought compared to March, IF all the redeemed principals are invested promptly.

The model’s results in detail:

The estimate for the WAM for purchases in January for the various categories of paper are as follows:

|

Category |

Notional |

WAM |

|

German Govt |

3.4 |

6.6 |

|

KFW |

0.4 |

7.5 |

|

Lander |

1.3 |

5.3 |

|

All Purchases |

5.0 |

6.3 |

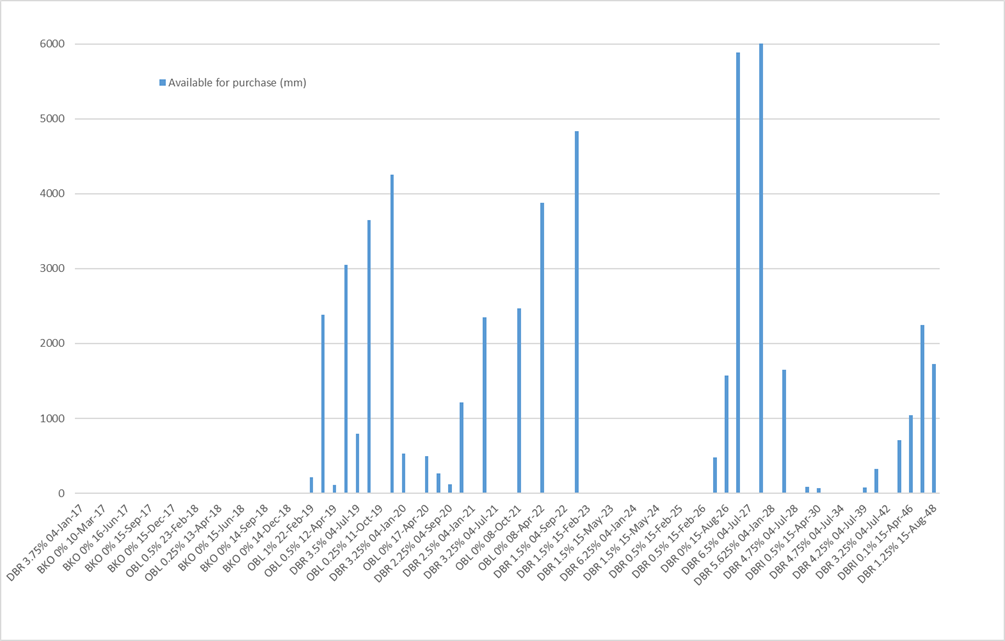

The per-issue charts for monthly purchases, and available notional left to purchase:

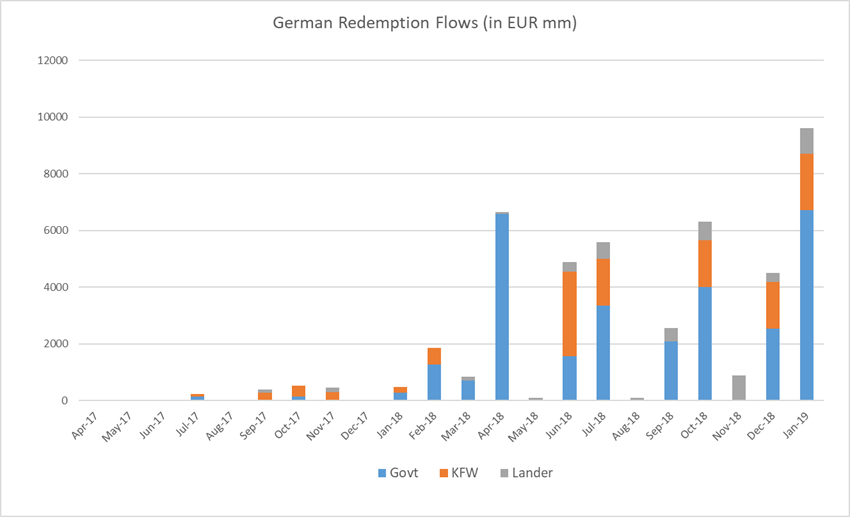

Given the model’s estimates for purchasing, here is how I see the redemption flows in Bunds currently. Numbers for Feb-19 onwards will continue to rise as more purchases are made.

|

Redemptions |

||||

|

Govt |

KFW |

Lander |

Total |

|

|

Apr-17 |

0 |

0 |

0 |

0 |

|

May-17 |

0 |

0 |

0 |

0 |

|

Jun-17 |

0 |

0 |

0 |

0 |

|

Jul-17 |

142 |

88 |

0 |

230 |

|

Aug-17 |

0 |

0 |

0 |

0 |

|

Sep-17 |

2 |

273 |

124 |

399 |

|

Oct-17 |

155 |

369 |

0 |

523 |

|

Nov-17 |

0 |

296 |

167 |

462 |

|

Dec-17 |

0 |

0 |

0 |

0 |

|

Jan-18 |

272 |

209 |

0 |

480 |

|

Feb-18 |

1269 |

588 |

0 |

1857 |

|

Mar-18 |

700 |

0 |

136 |

836 |

|

Apr-18 |

6592 |

0 |

71 |

6662 |

|

May-18 |

0 |

0 |

108 |

108 |

|

Jun-18 |

1572 |

2970 |

340 |

4882 |

|

Jul-18 |

3346 |

1650 |

592 |

5588 |

|

Aug-18 |

0 |

0 |

90 |

90 |

|

Sep-18 |

2087 |

0 |

478 |

2566 |

|

Oct-18 |

4000 |

1650 |

665 |

6315 |

|

Nov-18 |

0 |

0 |

881 |

881 |

|

Dec-18 |

2534 |

1650 |

326 |

4510 |

|

Jan-19 |

6727 |

1980 |

913 |

9621 |

|

Feb-19 |

5062 |

0 |

630 |

5693 |

|

Mar-19 |

1909 |

3300 |

300 |

5509 |

|

Apr-19 |

5170 |

273 |

751 |

6194 |

|

May-19 |

0 |

0 |

556 |

556 |

|

Jun-19 |

1237 |

0 |

496 |

1733 |

|

Jul-19 |

7127 |

495 |

96 |

7719 |

|

Aug-19 |

0 |

660 |

330 |

990 |

|

Sep-19 |

644 |

0 |

608 |

1252 |

|

Oct-19 |

5278 |

1650 |

1861 |

8790 |

|

Nov-19 |

0 |

0 |

341 |

341 |

|

Dec-19 |

38 |

0 |

493 |

530 |

|

Jan-20 |

6726 |

3300 |

1562 |

11588 |

|

Feb-20 |

0 |

0 |

592 |

592 |

|

Mar-20 |

0 |

0 |

1284 |

1284 |

|

Apr-20 |

11388 |

0 |

79 |

11467 |

|

May-20 |

0 |

0 |

330 |

330 |

|

Jun-20 |

0 |

1650 |

528 |

2178 |

|

Jul-20 |

6994 |

0 |

1460 |

8454 |

|

Aug-20 |

0 |

0 |

470 |

470 |

|

Sep-20 |

5158 |

0 |

687 |

5845 |

|

Oct-20 |

5056 |

495 |

499 |

6050 |

|

Nov-20 |

0 |

0 |

1062 |

1062 |

|

Dec-20 |

0 |

0 |

741 |

741 |

|

Jan-21 |

6270 |

3630 |

910 |

10810 |

Or, in chart form:

Finally, here are the per-issue estimates for Bunds:

|

Bond |

Opened |

O/S (bn) |

Purchasable |

Market Yield |

Purchased |

% Purchased |

Remaining |

Margin of Error |

MV Remaining |

Jan-18 Buying |

|

DBR 3.75% 04-Jan-17 |

Nov-06 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.75% 24-Feb-17 |

Jan-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 10-Mar-17 |

Feb-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

OBL 0.5% 07-Apr-17 |

May-12 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

BKO 0% 16-Jun-17 |

May-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-17 |

May-07 |

0.0 |

0.0 |

|

0.1 |

|

0.0 |

+/- 7% |

0.0 |

0.0 |

|

BKO 0% 15-Sep-17 |

Aug-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

+/- 58% |

0.0 |

0.0 |

|

OBL 0.5% 13-Oct-17 |

Sep-12 |

0.0 |

0.0 |

|

0.2 |

|

0.0 |

+/- 8% |

0.0 |

0.0 |

|

BKO 0% 15-Dec-17 |

Nov-15 |

0.0 |

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

0.0 |

|

DBR 4% 04-Jan-18 |

Nov-07 |

0.0 |

0.0 |

0.3 |

0.0 |

+/- 5% |

0.0 |

0.0 |

||

|

OBL 0.5% 23-Feb-18 |

Jan-13 |

17.0 |

0.0 |

-0.556 |

1.3 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

BKO 0% 16-Mar-18 |

Feb-16 |

13.0 |

0.0 |

-0.567 |

0.7 |

0.0 |

+/- 4% |

0.0 |

0.0 |

|

|

OBL 0.25% 13-Apr-18 |

May-13 |

17.0 |

0.0 |

-0.652 |

2.0 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

OBLI 0.75% 15-Apr-18 |

Apr-11 |

15.0 |

0.0 |

4.6 |

0.0 |

+/- 1% |

0.0 |

0.0 |

||

|

BKO 0% 15-Jun-18 |

May-16 |

14.0 |

0.0 |

-0.658 |

1.6 |

0.0 |

+/- 3% |

0.0 |

0.0 |

|

|

DBR 4.25% 04-Jul-18 |

May-08 |

21.0 |

0.0 |

-0.683 |

3.3 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

BKO 0% 14-Sep-18 |

Aug-16 |

13.0 |

0.0 |

-0.653 |

2.1 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

OBL 1% 12-Oct-18 |

Sep-13 |

17.0 |

0.0 |

-0.695 |

4.0 |

0.0 |

+/- 1% |

0.0 |

0.0 |

|

|

BKO 0% 14-Dec-18 |

Nov-16 |

13.0 |

0.0 |

-0.662 |

2.5 |

0.0 |

+/- 2% |

0.0 |

0.0 |

|

|

DBR 3.75% 04-Jan-19 |

Nov-08 |

24.0 |

0.0 |

-0.719 |

6.7 |

|

0.0 |

+/- 1% |

0.0 |

0.0 |

|

OBL 1% 22-Feb-19 |

Jan-14 |

16.0 |

5.3 |

-0.700 |

5.1 |

96% |

0.2 |

+/- 1% |

0.2 |

0.2 |

|

BKO 0% 15-Mar-19 |

Mar-17 |

13.0 |

4.3 |

-0.694 |

1.9 |

44% |

2.4 |

+/- 2% |

2.4 |

0.1 |

|

OBL 0.5% 12-Apr-19 |

May-14 |

16.0 |

5.3 |

-0.697 |

5.2 |

98% |

0.1 |

+/- 1% |

0.1 |

0.1 |

|

BKO 0% 14-Jun-19 |

May-17 |

13.0 |

4.3 |

-0.667 |

1.2 |

29% |

3.1 |

+/- 2% |

3.1 |

0.1 |

|

DBR 3.5% 04-Jul-19 |

May-09 |

24.0 |

7.9 |

-0.673 |

7.1 |

90% |

0.8 |

+/- 1% |

0.9 |

0.2 |

|

BKO 0% 13-Sep-19 |

Aug-17 |

13.0 |

4.3 |

-0.620 |

0.6 |

15% |

3.6 |

+/- 2% |

3.7 |

0.1 |

|

OBL 0.25% 11-Oct-19 |

Sep-14 |

16.0 |

5.3 |

-0.615 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

BKO 0% 13-Dec-19 |

Nov-17 |

13.0 |

4.3 |

-0.584 |

0.0 |

1% |

4.3 |

+/- 10% |

4.3 |

0.0 |

|

DBR 3.25% 04-Jan-20 |

Nov-09 |

22.0 |

7.3 |

-0.595 |

6.7 |

93% |

0.5 |

+/- 1% |

0.6 |

0.2 |

|

DBRI 1.75% 15-Apr-20 |

Jun-09 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 17-Apr-20 |

Jan-15 |

20.0 |

6.6 |

-0.522 |

6.1 |

93% |

0.5 |

+/- 1% |

0.5 |

0.2 |

|

DBR 3% 04-Jul-20 |

Apr-10 |

22.0 |

7.3 |

-0.497 |

7.0 |

96% |

0.3 |

+/- 1% |

0.3 |

0.1 |

|

DBR 2.25% 04-Sep-20 |

Aug-10 |

16.0 |

5.3 |

-0.470 |

5.2 |

98% |

0.1 |

+/- 1% |

0.1 |

0.1 |

|

OBL 0.25% 16-Oct-20 |

Jul-15 |

19.0 |

6.3 |

-0.445 |

5.1 |

81% |

1.2 |

+/- 1% |

1.2 |

0.1 |

|

DBR 2.5% 04-Jan-21 |

Nov-10 |

19.0 |

6.3 |

-0.408 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 09-Apr-21 |

Feb-16 |

21.0 |

6.9 |

-0.350 |

4.6 |

66% |

2.4 |

+/- 2% |

2.4 |

0.2 |

|

DBR 3.25% 04-Jul-21 |

Apr-11 |

19.0 |

6.3 |

-0.308 |

6.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.25% 04-Sep-21 |

Aug-11 |

16.0 |

5.3 |

-0.263 |

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Oct-21 |

Jul-16 |

19.0 |

6.3 |

-0.242 |

3.8 |

61% |

2.5 |

+/- 1% |

2.5 |

0.2 |

|

DBR 2% 04-Jan-22 |

Nov-11 |

20.0 |

6.6 |

-0.198 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 08-Apr-22 |

Feb-17 |

18.0 |

5.9 |

-0.148 |

2.1 |

35% |

3.9 |

+/- 2% |

3.9 |

0.1 |

|

DBR 1.75% 04-Jul-22 |

Apr-12 |

24.0 |

7.9 |

-0.127 |

7.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 04-Sep-22 |

Sep-12 |

18.0 |

5.9 |

-0.091 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

OBL 0% 07-Oct-22 |

Jul-17 |

17.0 |

5.6 |

-0.053 |

0.8 |

14% |

4.8 |

+/- 3% |

4.8 |

0.1 |

|

DBR 1.5% 15-Feb-23 |

Jan-13 |

18.0 |

5.9 |

-0.004 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.1% 15-Apr-23 |

Mar-12 |

16.0 |

5.3 |

|

5.3 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-23 |

May-13 |

18.0 |

5.9 |

0.045 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2% 15-Aug-23 |

Sep-13 |

18.0 |

5.9 |

0.095 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 6.25% 04-Jan-24 |

Jan-94 |

10.3 |

3.4 |

0.145 |

3.4 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.75% 15-Feb-24 |

Jan-14 |

18.0 |

5.9 |

0.168 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1.5% 15-May-24 |

May-14 |

18.0 |

5.9 |

0.207 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-24 |

Sep-14 |

18.0 |

5.9 |

0.243 |

5.9 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-25 |

Jan-15 |

23.0 |

7.6 |

0.320 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 1% 15-Aug-25 |

Jul-15 |

23.0 |

7.6 |

0.370 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-26 |

Jan-16 |

26.0 |

8.6 |

0.440 |

8.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBRI 0.1% 15-Apr-26 |

Mar-15 |

12.0 |

4.0 |

|

3.5 |

88% |

0.5 |

+/- 2% |

0.5 |

0.1 |

|

DBR 0% 15-Aug-26 |

Jul-16 |

25.0 |

8.3 |

0.505 |

6.7 |

81% |

1.6 |

+/- 1% |

1.5 |

0.2 |

|

DBR 0.25% 15-Feb-27 |

Jan-17 |

26.0 |

8.6 |

0.566 |

2.7 |

31% |

5.9 |

+/- 2% |

5.7 |

0.2 |

|

DBR 6.5% 04-Jul-27 |

Jul-97 |

11.2 |

3.7 |

0.583 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Aug-27 |

Jul-17 |

25.0 |

8.3 |

0.627 |

0.7 |

8% |

7.6 |

+/- 4% |

7.5 |

0.2 |

|

DBR 5.625% 04-Jan-28 |

Jan-98 |

14.5 |

4.8 |

0.639 |

4.8 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 0.5% 15-Feb-28 |

Jan-18 |

5.0 |

1.7 |

0.681 |

0.0 |

0% |

1.7 |

|

1.6 |

0.0 |

|

DBR 4.75% 04-Jul-28 |

Oct-98 |

11.3 |

3.7 |

0.686 |

3.7 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 6.25% 04-Jan-30 |

Jan-00 |

9.3 |

3.1 |

0.760 |

3.0 |

97% |

0.1 |

+/- 1% |

0.1 |

0.0 |

|

DBRI 0.5% 15-Apr-30 |

Apr-14 |

9.5 |

3.1 |

|

3.1 |

98% |

0.1 |

+/- 2% |

0.1 |

0.1 |

|

DBR 5.5% 04-Jan-31 |

Oct-00 |

17.0 |

5.6 |

0.832 |

5.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.75% 04-Jul-34 |

Jan-03 |

20.0 |

6.6 |

0.978 |

6.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4% 04-Jan-37 |

Jan-05 |

23.0 |

7.6 |

1.062 |

7.6 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 4.25% 04-Jul-39 |

Jan-07 |

14.0 |

4.6 |

1.130 |

4.5 |

98% |

0.1 |

+/- 1% |

0.1 |

0.1 |

|

DBR 4.75% 04-Jul-40 |

Jul-08 |

16.0 |

5.3 |

1.147 |

5.0 |

94% |

0.3 |

+/- 1% |

0.6 |

0.1 |

|

DBR 3.25% 04-Jul-42 |

Jul-10 |

15.0 |

5.0 |

1.215 |

5.0 |

100% |

0.0 |

+/- 0% |

0.0 |

0.0 |

|

DBR 2.5% 04-Jul-44 |

Apr-12 |

22.0 |

7.3 |

1.270 |

6.5 |

90% |

0.7 |

+/- 1% |

0.9 |

0.1 |

|

DBRI 0.1% 15-Apr-46 |

Jun-15 |

7.0 |

2.3 |

|

1.3 |

55% |

1.0 |

+/- 3% |

1.2 |

0.0 |

|

DBR 2.5% 15-Aug-46 |

Feb-14 |

23.0 |

7.6 |

1.290 |

5.3 |

70% |

2.2 |

+/- 1% |

2.9 |

0.1 |

|

DBR 1.25% 15-Aug-48 |

Sep-17 |

5.5 |

1.8 |

1.341 |

0.1 |

5% |

1.7 |

+/- 10% |

1.7 |

0.0 |

|

Italic = index-linked |

Total |

55.6 |

3.4 |

|||||||

|

Yield below Depo Floor |

||||||||||

|

Yield above Depo Floor |

Bund WAM |

6.5 |

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: .5 ye

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Reality Check Rattles the Market - Quick Thoughts... w/charts

- And here we thought stocks were bullet-proof, protected from the slings and arrows the rates and FX markets were enduring these last couple months. Yesterday’s selloff in the DOW was not only the biggest one day move in history, it was also the biggest momentum shift and one of the biggest events for the VIX.

DOW back 10yrs with 14 day RSIs… HUGE shift

Check this one out – this is the inverse VIX index

- The pop to 2.9% in last Friday’s YOY avg hrly earnings could prove temporary but its timing couldn’t have been worse for USTs and now, equities. Coming after a 13.5% one-month rise in 10yr note yields, the NFP data drove a move to new 4-year highs which finally got the attention of the equity market. Pick your favourite stocks vs bonds barometer and it becomes glaringly obvious that bonds are starting to look more attractive vs stocks than they’ve been in quite a while.

- This morning’s BBG article quoting Paul Tudor Jones is worth a mention too:

“We are replaying an age-old storyline of financial bubbles that has been played many times before,” Jones, founder of Tudor Investment Corp., wrote in a Feb. 2 letter to clients seen by Bloomberg. “This market’s current temperament feels so much like either Japan in 1989 or the U.S. in 1999. And the events that have transpired so far this January make me feel more convinced than ever of this repeating history.”

- Question for you: You’re Jerome Powell and you’ve been chairman of the Fed for all of 2 days and the Dow has it’s biggest one day sell-off in history. You’ve got Tudor-Jones in one ear telling you you’re behind the curve and in the other ear some of the biggest fund inflows into equities in history suddenly under a lot of water. Are you going to bang a hawkish drum and fan the flames of another 5-10% correction in the Dow? Probably not.

- All this volatility will make this week’s refunding all the more interesting. CFTC data tells us there are some chunky shorts out there, 5-10-30s has cheapened to levels not seen since 2014 (when the funds target was 25bps) as 5-10s widened 8.5bps and 10yr USTs are at +206bps vs DBRs after bouncing off 210bps resistance. Our hunch is after the melee we’ve seen over the last week, the market will be happy to cover a few shorts into this week’s supply, particularly if we can cheapen them back up a few more bps. The lower-beta 5-10-30s expression would be a good compromise for those who want to be involved but perhaps sleep better at night.

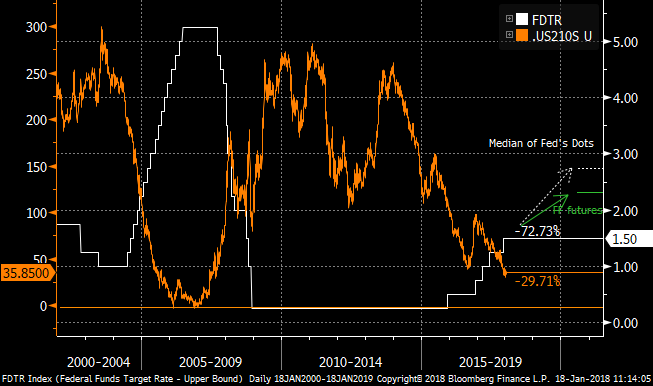

UST 5-10-30 vs Fed Funds target

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Equities ..A BROKEN market perhaps, daily RSI's low but maybe just a temporary reprieve. 5.2.2018

• We closed last week on the lows so let’s see if we follow through or the “DIP BUYERS” return?

• US stocks remain the most over bought and many have recovered MORE than 200% of the 2008-2009 correction.

• The DOW and S&P have major RSI dislocations spread across monthly, weekly and daily durations! This is a DANGEROUS combination.

• Some RSI’s surpass 1950 and 1980 levels.

• US stocks highlight the most CONCERN.

I provide our research notification below for your convenience:

Research Unbundling:

Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

I also direct you to our disclaimer on our email footer:

This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

Many thanks,

Chris

BOND and US CURVE MONTHLY UPDATE The US 5YR some KEY over bought yield charts 5.2.2018.

BONDS UPDATE : Yields continue to rise BUT US 5yrs are pushing some MAJOR RSI dislocations that won’t go AWAY. ALL durations are stretched, quarterly, monthly, weekly and daily… this is RARE!

All parts of the US curve have yields above multiyear trend lines BUT the 5yr is now TOO EXTEND. See pages 11-14.

US curves continue the struggle to find a base but the RSI’s are now VERY LOW.

Germany bonds are struggling to base despite the RSI’s.

US 10 Breakevens have a LOFTY WEEKLY and DAILY RSI.

I provide our research notification below for your convenience:

Research Unbundling:

Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

I also direct you to our disclaimer on our email footer:

This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

Many thanks,

Chris

MICROCOSM: Conflicting Signals In UK Amid Selloff w/charts

Gilts...

- Conflicting stories for gilts/ GBP in the press this am. On one hand, headlines like BBG's 'May Under Fire as Brexit Reality Sparks Conservative Civil War' are painting an ugly picture of the state of the UK govt which one would assume is bearish for cable and darkens the outlook for Brexit negotiations.

- On the other hand, there are the 'Carney Faces Up to Newly Hawkish Market as Bets on May Hike Grow' and 'BoE Forecasts May Pave the Way for Higher Interest Rate' articles which in theory should be keeping some pressure on the front-end.

- As we saw into the end of last week, the bear-flattening has its limits in both curve and outright yield terms. In other words, once major yield thresholds are broken, the selling becomes broad-based and duration is shed more aggressively, bear-steepening the curve. We saw evidence of this in the UST market too as 5-10s steepened 7bps last week as shorts in TYH8 grew while FVH8 declined.

- With the UKTi 48s coming tomorrow and the US quarterly refunding (3/10/30s) starting tomorrow, I think this bear-steepening in the UK (and US for that matter) can persist s/term. The UKT 0H 7/22 v UKT 2T 24 steepener has stalled at resistance around 21bps after a 1.5bps widening late last week. This looks like a key level before a move to 24bps. (we have seen interest in other versions of this theme)

Charts below.

UKT 0H 22 v UKT 2T 24 curve

G H8 are the most oversold they’ve been in over a year while open interest turns lower…

We’ll be in touch.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

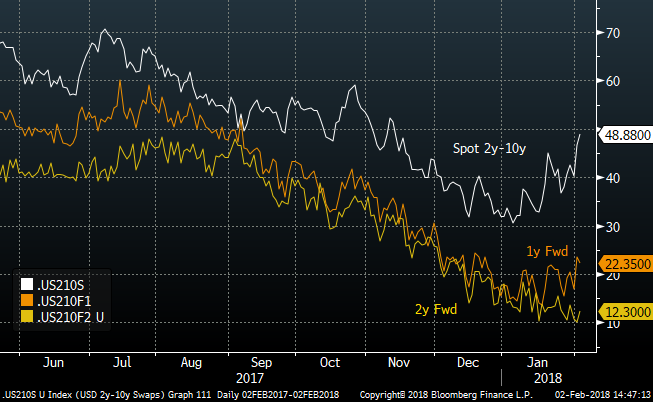

"The time has come", the Walrus said ... to scale in to USD steepeners on 2y-10y, 1y fwd

Bottom line: In my view it is time to scale into USD steepening positions. There are myriad combinations (see my previous note at the bottom of this one), but I will focus on 2y-10y in swaps as it most closely fits the bear-steepening dynamic that I see evolving as inflation picks up and Treasury issuance increases. We have the quarterly refunding next week, which could be a significant indication of the ongoing demand for US Treasuries, so my suggestion is to scale into the trade now and keep some ammunition for any re-flattening after the auctions.

Many people will already have some US steepening exposure in their book, so in some senses I am late to the party. For any that don’t have the exposure, or are looking to increase it, then this simple version is a candidate. As always, I’d love to hear if you agree, disagree or prefer a different expression!

Trade:

Pay USD 2y-10y, 1y fwd swap curve

Entry at 23bp vs spot at 50 bp.

Target 50bp, Stop at 10bp.

USD 2y-10y, 1y fwd in swaps

Rationale: There have been several events of note since I wrote two weeks ago that it was too early for USD steepeners:

- The State-of-the-Union address with the promise of a massive infrastructure programme;

- The TBAC report and the increase in Treasury issuance;

- A 20bp rise in 10y cash yields (from 19th Jan);

- A similar upward repricing of the market’s expectation of the terminal FF rate (proxy is H0 FF contract);

The spot USD 2y-10y curve in swaps has bear-steepened, as has the curve 1y forward. The 2y-10y, 2y fwd has yet to reflect the move in the shorter forwards.

Why 1y fwd? For the spot 2y-10y, the 100-day moving average has been breached. For the 1y fwd curve, the 50-day level has been crossed. For the 2y fwd curve, the current value has yet to break the 20-day moving average. The momentum on the spot curve is certainly supporting a further steepening, but entry levels are some 15bp above the flattest of the recent past. In contrast, the 2y fwd curve is pretty much at its lows and not far from the low of Feb-06. It is not highly scientific, but that points me to choose 2y-10y, 1y fwd: it is not the best level we have seen, but is showing momentum indicators that are pointing to steeper curves.

Best wishes,

David

As a recap, here’s what I sent out a fortnight ago, entitled: “So you want to put on a USD steepener? Still too early, as I see it.”

Writing as someone who spent most of 2017 looking for the US curve to steepen and was sorely disappointed, I am hesitant to revisit the topic. In retrospect, longer rates could not keep pace with the steady rise in short rates in response to Fed action. In this article, I’m proposing a checklist to assess the timing of various curve structures.

Executive Summary: There seems to be little to recommend steepeners yet on the USD curve. I’ve analysed a variety of common USD curve structures all of which dipped to their lows during the last Fed hiking cycle in 2004/2006. When I compare the levels today to that period, the vast majority of structures are still off those minima, and momentum indicators suggest they still have room to move lower. Most of the curves did not reach their lows until the hiking cycle was almost done: currently we are only halfway on this period of FOMC action. Added to that, the bulk also show a bear-flattening dynamic over the past 3 months (to a greater or lesser degree of statistical certainty) so given my bias is that US rates are heading higher in the short term it is hard to recommend steepeners yet. The rolldown is generally in your favour, but is not enough to compensate for the potential downside of early adoption. The possible exception is paying USD 2-5-10, 3m fwd, but that has already moved some way is rolldown negative.

In more detail:

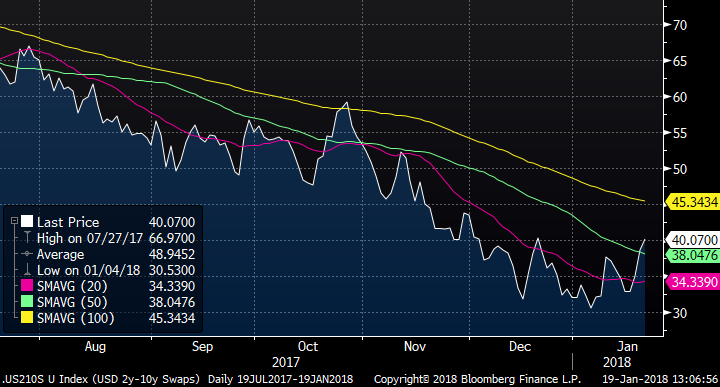

To set the scene, here’s a chart of the Fed Target Rate and the USD 2y-10y spot slope in swaps. I’ve annotated the chart with the Fed’s and the market’s projection of where the Fed rate is headed over the next two years. The market’s pricing sees the Fed Funds rate as topping out around 2.30% by Q1 2020 ie around three more 25bp hikes from here. On that basis we are roughly half-way through the hiking cycle (if not a little further advanced). At the same stage in the 2004/2006 period, the curve still had further to flatten, though the low was reached first around three hikes before the end of that cycle.

What checklist can we use to determine whether curve relationships have moved far enough?

I’ll use the basis USD 2y-10y swap curve as an example.

1. Where and, equally importantly, when was the minimum in the 2004-2006 cycle? The FOMC first hiked rates in June 2004 and announced what turned out to be the final hike in June 2006. Historically, the USD 2y-10y curve first hit its flattest at around 0bp. This happened around March 2006, so roughly 21 months into a 24 month or 87% of the period. Currently 2y-10y in swaps is 39bp, and it’s reasonable to suggest we are 50% through the current cycle (which I am suggesting started with the Dec-16 hike). On this basis, the spot 2y-10y curve has further to flatten.

2. Is the momentum for flattening showing any signs of relenting? During 2017, the flattening on 2y-10y was remorseless, as the market first unwound the post-Trump steepening (10y rates falling while 2y rates stable) and then priced Fed action which had 2y selling off faster than 10y. The chart for the last 6 months and the moving averages are shown in the chart. I’m using 20-, 50- and 100-day moving averages.

In general, a steepening move would see changes to moving averages in the following time order:

- The gap between the 20-day and 50-day moving averages reduces;

- The 20-day moving average bottoms out and starts to increase;

- The 20-day moving average crosses the 50-day.

As each condition is fulfilled the likelihood of a steepening increases. It’s a trading choice as to how aggressively to target the absolute low, rather than await further confirmation and miss the most extreme entry point. Inspection of the chart shows that the first condition is being satisfied (the moving 20- and 50-day averages are converging), and the second is also (just) being fulfilled. For an “early adopter” this might be sufficient to initiate a steepener, while others might wait for the two moving averages to cross.

3. Will the steepener make any money? Just because the curve has stopped flattening, it does not necessarily follow that the steepener will be a quick win. Back in 2006, the USD 2y-10y curve did bounce 25bp or so off its lows immediately after hitting the Mar-16 low (though it gave all those gains back over the next three months).

4. Is curve rolldown on your side, and is it significant? It is always preferable to have the rolldown on your side (even if the roll is not realized). The 3m fwd 2y-10y curve is 30bp compared to spot 2y-10y at 39bp, so a steepener set 3m fwd will have 9bp of apparent rolldown. To assess whether this roll is significant, we can look at the 3m realized volatility which is currently 2bp/day, or 16bp over a 3m horizon (assuming a normal distribution). As a quasi-Sharpe ratio this comes out at 56%. Whether this ratio is attractive is again a matter for the investor. Books could be written on whether rolldown actually materializes: the Fed hikes seem fairly baked-in, so the spot 2y rate could easily evolve to the 3m fwd market expectation, and the theoretical rolldown would not be captured.

5. What is the realized and anticipated directionality of the trade? The 10y rate has been lagging moves in short rates, and the curve has been bear-flattening. In the event of a large rally in long rates caused by global events, the curve could switch to bull-flattening; conversely increased Treasury supply expectations could drive a bear-steepening if 10y rates start to catch up. This is particularly relevant if you are looking to improve the risk/reward and entry level of the trade by using swaptions or mid-curves in a conditional structure.

Applying these metrics to a selection of US curve measures:

|

|

|

1. History |

2. Momentum |

3. Upside |

4. Rolldown |

5. Directionality |

||||

|

Curve Trade |

Current |

Minimum ’04-‘06 |

%age of ’04-’06 cycle |

Moving Averages |

Move from low (04/06) |

3m Rolldown |

Realized Daily Vol |

Rolldown Sharpe |

Recent Mode |

R2 vs long rate (3m) |

|

2y-5y, 3m fwd |

20 bp |

-3 bp |

86% |

üûû |

12 bp |

3 bp |

2.0 bp |

19% |

Bear flatten |

33% |

|

2y-10y, 3m fwd |

33 bp |

-4 bp |

86% |

üûû |

31 bp |

8 bp |

2.6 bp |

38% |

Bear flatten |

20% |

|

2y-30y, 3m fwd |

41 bp |

-6 bp |

86% |

üûû |

42 bp |

10 bp |

2.8 bp |

45% |

Bear flatten |

2% |

|

5y-10y, 3m fwd |

14 bp |

-2 bp |

86% |

üûû |

18 bp |

2 bp |

2.4 bp |

10% |

Bear flatten |

26% |

|

5y-30y, 3m fwd |

23 bp |

-2 bp |

86% |

üûû |

33 bp |

6 bp |

2.8 bp |

27% |

Bear flatten |

5% |

|

10-30y, 3m fwd |

8 bp |

-1 bp |

86% |

ûûû |

15 bp |

3 bp |

2.0 bp |

19% |

Bear flatten |

14% |

|

2y-10y, 1y fwd |

21 bp |

1 bp |

86% |

üûû |

29 bp |

3 bp |

2.4 bp |

16% |

Bear flatten |

36% |

|

2y-10y, 2y fwd |

16 bp |

0 bp |

86% |

üûû |

38 bp |

1 bp |

2.6 bp |

5% |

Bear flatten |

43% |

|

2y-10y, 5y fwd |

10 bp |

2 bp |

86% |

ûûû |

13 bp |

1 bp |

2.0 bp |

6% |

Bear flatten |

55% |

|

2y3y v 5y5y |

19 bp |

-2 bp |

86% |

üûû |

32 bp |

0 bp |

3.0 bp |

0% |

Bear flatten |

33% |

|

5y5y v 10y20y |

-1 bp |

0 bp |

87% |

ûûû |

12 bp |

1 bp |

2.3 bp |

5% |

Bear flatten |

76% |

|

2y1y v 3y1y |

5 bp |

0 bp |

62% |

üûû |

9 bp |

1 bp |

3.1 bp |

4% |

Bear flatten |

14% |

|

2-5-10, 3m fwd |

3 bp |

-10 bp |

64% |

üüü |

8 bp |

-4 bp |

3.5 bp |

-14% |

Bear steepen |

24% |

Do you agree with this methodology? Would love to hear your thoughts!

Best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 60 Cannon Street, London, EC4N 6NP

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 207 002 1346

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: The Buyers Strike In Rates Continues... Quick Colour

- The 2018 sell-off in rates, led by the UST market, has been remarkable in its magnitude and ferocity. To put into perspective, the last time USTs closed higher on two consecutive days was Dec 26-27 when TYH8 closed up ½ point. We could play ‘arm chair quarterback’ (with the Super Bowl this weekend) and debate whether this move was justified or not, but that would be futile. We’re where we are now and need to decipher whether this sell-off continues or whether a round of short covering is looming. Let’s look at some market barometers below.

- This TYH8 chart is illustrative. This is the most oversold TYA has been since Trump’s election win. In one regard, we could look at this latest move as a validation of the post-Trump selloff. What’s significant here is not just the oversold momentum but the almost 700k increase in TYH8 open interest since the last big selloff. (This pop in OI is has been replicated in FV too but not in US/WN.) With the Put/Call ratio still elevated across the curve (with some significant TY puts bought this am pre-NFP), one can assume this return to the highs in OI is the accumulation of new shorts by the spec set. So, even after a ~40bps selloff in 10yrs since the start of the year, the market’s still buying downside protection.

v This BBG article caught our eye this morning: “Bank of America Sell Signal Rings Louder on Record Equity Inflow”

“Investors poured $25.7 billion into equities in the week to Jan. 31, taking the total inflow for the year to a "remarkable" $102 billion, the bank said, citing EPFR Global data.” Even after the 2.2% ‘correction’ in S&Ps into month-end they are still up 5% year to date with the 20-day MA holding as support. The market is clearly making an expensive bet that the impact of the 14% cut in US corporate tax rates will be VERY good for earnings. With open interest mirroring the rates market – only this time they’re longs – one could argue there have been an extraordinary number of bullish bets being made that make these levels vulnerable to disappointment.

v What do USD forwards say? Spot 2-10s in swaps is currently 47bps and 17bps 2yrs forward. Since the Fed started their rate hike cycle in Dec 2015, there has been a mechanical rise in US short rates that has tracked the increase in the Fed Funds target (as one would expect). The chart below of 2yr fwd 2-10s (white line) compared to the FFT (inverted) illustrates this correlation nicely. With the forwards currently 40bps through spot, one could argue that they could flatten further with Fed Funds expected to rise 75bps this year and perhaps another 50-75bps next year.

The green line on the chart is US YOY CPI minus the Fed Funds target rate. The rise in the line from early 2015 to Q1 2017 reflected the long-overdue bounce in CPI back in line with the FOMC’s target rate, a surge that the FOMC must have welcomed given their decision to begin raising rates. What’s interesting on this chart is the convergence of the CPI-FDTR line to the forwards. With the spread currently 60bps (CPI 60bps higher than FDTR) and the market pricing in 3 25bps rate hikes this year, we will end the year with the funds target ~10-15bps higher than YOY CPI. Some dealers (like BARC) are forecasting a mid-year CPI blip up to 2.75% area but that’s not expected to last, fading back to 2.1% by year-end. So, if this year’s 75bps of hikes takes Fed Funds north of CPI, can the FOMC justify keeping their pedal to the metal for another 75bps in 2019 as some have forecasted? Perhaps this is why the forwards aren’t priced as aggressively as they could be. This could also be a reflection of market positioning as duration concerns have now cropped up, the UST 5-10-30s fly cheapening 12bps this month to overbought levels.

UST 5-10-30s

v Speaking of the forwards… The Fed’s rate hikes have forced short rates higher in the US, however, there are some (including yours truly) who think that 2y2y USD rates are looking rather tasty at 2.85% this morning, especially given our back of a cocktail napkin analysis above. This pop to new highs has coincided with a widening vs EUR 2y2y back close to the early 2017 wides, levels that provided significant resistance. Back in early 2017 when we last saw these levels, there was little talk of the end of ECB QE or a relenting of stimulative policies, however, this year it’s different. While the ECB did their best to present a balanced case at last week’s meeting, the market is still expecting a turn to a more hawkish bias in March or, at the latest June. Given the expectation that an ECB rate hike cycle would begin 6-9mos after the end of QE AND would be ‘measured’, there’s little reason to expect a dramatic shift in sentiment. However, short-end positioning in BKOs has already had a blood letting (invoice spreads 15bps cheaper since mid-Dec) and the 2y2y rate would be the ‘sweet spot’ for those looking to price in a rate hike cycle in Europe. The chart below illustrates how ‘out of whack’ this relationship is vs trade-weighted USD which could prove unrealistic given Coeure’s FX comments earlier this week.

v Emerging markets keep on truckin’, another sign of ‘exuberance’…? Chart below is of the EM corporates index spread to govts. This is 1yr of history but if we go back just 2yrs to Jan 2016, we’ll see a spread that was well north of 500bps. While the recent grind to new lows vs govts of 20bps since the start of January pales in comparison to the overall move, this is still a 10% outperformance in a month. In addition, there’s been a 26% increase in the market value of the index over that span. So, there’s still a ton of money going into EM equities (as above) but that demand is also replicated in EM rates where liquidity can be ‘challenging’ at best when the wheels fall off.

v We will resist the temptation to call the lows here, treacherous before a NFP release and given current momentum. However, we are mindful of the extremes the market is currently presenting us which, historically, have proven unsustainable without considerable catalysts.

I’d love to hear your thoughts.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

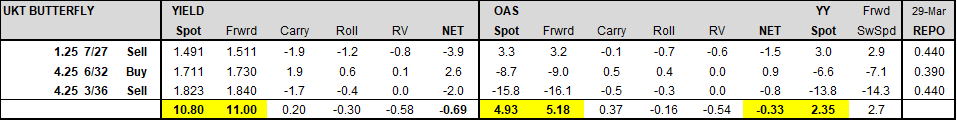

Sell belly of UKT 1q27-4q32-4q36

This is a trade we’ve been scaling into over the last week. There has been very poor dealer demand for the belly, increasing the charge for liquidity, as it is difficult to rely on screen prices.

However, dealer bias only increases our conviction in the trade, especially if there is an opportunity to fade any mechanical intraday richening which is not backed by apparent flows in the market.

Trade: Sell belly of UKT 1q27-4q32-4q36 bfly at 11.0 bps:

Target: +15.0 bps (4bps profit)

Stop: +9.0 bps (2bps loss)

Rationale:

Short term: the UKT 4.25 6/32 have recently performed on the curve into the the 22nd Jan coupon reinvestment (over £2bn paid in >15yr Gilts). Given UKT 32s represent the average duration of the FTSE All Stocks Gilt Index, they are a popular reinvestment vehicle for index managers. UK managers reinvest around the coupon date, while international index managers wait until month end, after which we would expect support for the UKT 32s to wane.

Intermediate term: The UKT 5 3/18 mature on 7th March (returning £18.4bn cash to the BoE); the APF will reinvest this across the curve in 3 buckets of over £6bn. The UKT 32s will be excluded as the BoE and APF already own 78% of the free float. Conversely, the BoE/DMO own almost none of the 1q27, 50% of the 4q36s, and only 7% of the 1T37s, leaving ample scope to purchase the 10yr and 20yr sectors. Moreover, as the UKT 32s roll down the curve, the UKT 4.5 9/34 will replace it as the neutral duration bond for the FTSE All Stocks Gilt Index later this year. The shift to the UKT 34s will be hastened by next month’s index extension, when all Gilt supply will be in longs and ultra longs (UKTi 36s, UKTi 48s syndication, and UKT 57s).

Positioning: Recent richening of UKT 32s to the curve appears to be driven by dealer anticipation of global month end rebalancing flows, which we would expect to dissipate later in the week.

RISKS: The trade has a steepening bias and is therefore at risk of richening during any sharp selloffs in the Gilt contract, when the 1q27s would be expected to lead the way down.

UKT 27s32s36s bfly vs UKT 4.25 12/27 (CTD) price:

Bfly – white line right axis

4q27 – blue line left axis

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

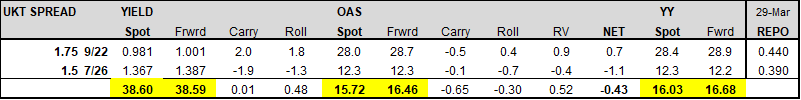

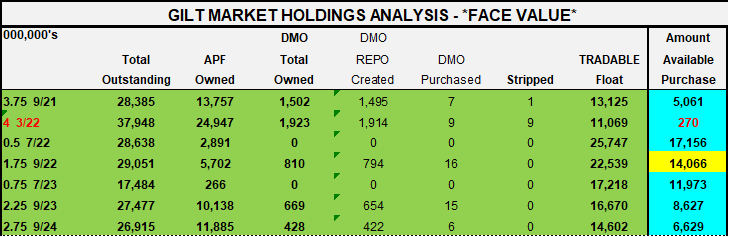

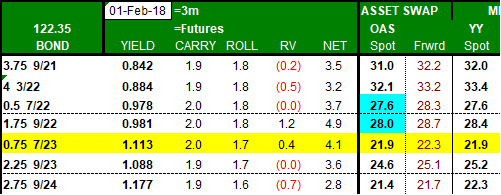

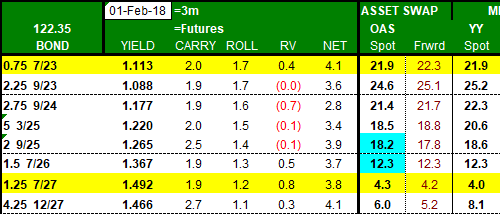

UKT 22s26s ASW Box Steepener into March Redemptions

Please distribute selectively given limited liquidity…

Trade: Buy UKT 1.75 9/22 vs Sell UKT 1.5 7/26 on MMS @ 16.5 bps:

Target: 22.0 bps (+5.5 bps)

Stop: 14.5 bps (-2.0 bps)

Rationale:

- The UKT 5 3/18 will be redeemed on 7th March, for £35bn (APF holds £15.8bn face = £18.4bn cash).

- £13bn face value of privately held bonds will likely be reinvested in the 0-5yr sector

- Historically, front end swap spreads richen vs long end spreads into redemptions (ceteris paribus)

- The 22s26s MMS is testing historic lows as we approach the redemption

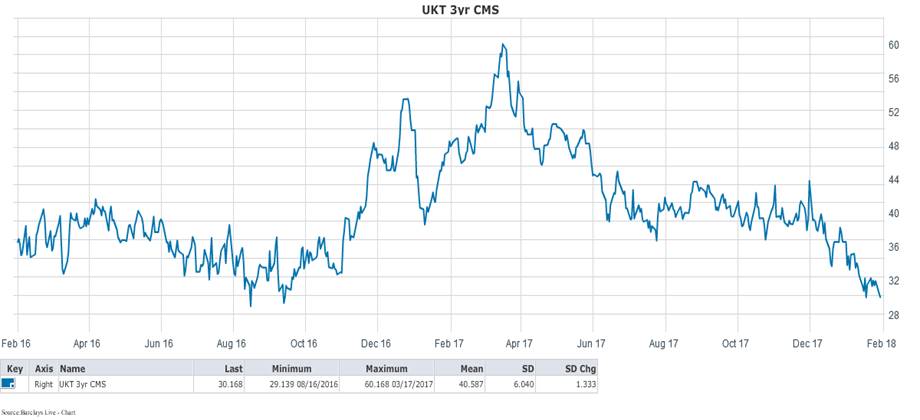

- UKT 3yr CMS is also testing 2yr historic lows:

Bond Selection:

UKT 1.75 9/22 still have plenty of scope to be purchased by the APF in the 3-7yr basket:

UKT 1.75 9/22 are also historically cheap on Z spread, nearly flat to 0.5 7/22:

Conversely, UKT 1.5 7/26 are at the rich end of the range vs its neighbours:

UKT 2 9/25- 1.5 7/26 - 4.25 12/27 bfly:

While the UKT 2 9/25 appear richer and roll better on Z spread, they are trading very special in repo (~ .10-.15 vs GC repo of 0.44):

RISKS:

More hawkish BoE: The recent MMS flattening has been driven by bear flattening of the UKT 5s10s curve; during this time 1y1y Sonia cheapened 18 bps:

If the market were to price in more than 2 hikes to 1.00 bank rate over next 2 years, front end Gilt yields @ 1.00 could become vulnerable.

Overall the 22s26s box is long tail risk, as any flight to quality would favour front end spreads, while a GBP selloff would pressure 10yr spreads.

For example, during the French elections the UKT 22s26s box peaked at 34 bps.

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Equities ..A poor close last month lets see if it follows through 1.2.2018

• We closed weak last month so lets see if we follow through or the “DIP BUYERS” return.

• US stocks remain the most over bought and many have recovered MORE than 200% of the 2008-2009 correction.

• The DOW and S&P have major RSI dislocations spread across monthly, weekly and daily durations! This is a DANGEROUS combination.

• Some RSI’s surpass 1950 and 1980 levels.

• US stocks highlight the most CONCERN.

• I provide our research notification below for your convenience:

•

• Research Unbundling:

•

• Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

•

• If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

•

•

•

• I also direct you to our disclaimer on our email footer:

• This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

•

• You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

•

• Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

• Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

• Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

• Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

• Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

•

•

• If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

•

• Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

•

• Many thanks,

•

• Chris

•

•