****BOND and US CURVE MONTHLY UPDATE : The US 5YR some KEY over bought yield charts as this has made all the running. 1.2.2018.**

BONDS UPDATE : Yields have continued to rise as stocks dipped in January BUT US 5yr yields are pushing some MAJOR monthly RSI dislocations.

The curves are also pushing similar OVERSOLD situations.

All parts of the US curve have yields above multi year trend lines BUT the 5yr is now TOO EXTEND. See pages 11-15.

US curves continue the struggle to find a base but the RSI’s are now VERY LOW.

Germany bonds are struggling to base despite the RSI’s.

US 10 Breakevens have a LOFTY WEEKLY and DAILY RSI.

I provide our research notification below for your convenience:

Research Unbundling:

Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

I also direct you to our disclaimer on our email footer:

This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

Many thanks,

Chris

How are we doing? Shadow portfolio update

Portfolio P&L since 26th January: USD -151k, Ytd -98k

Summary: Once again, my portfolio has suffered from market moves around an ECB meeting. The sell-off worked well one of my EUR bear-flatteners, but not the other: the difference being that the winning trade was focused further out in forward space, while the losing one suffered from the relative lack of movement of rate closer into spot. I have closed out both: the winning trade (1y3y/5y5y) has had a great run from its initial inception at the start of November last year, but we’ve seen a pause in the flattening so I am booking the profit; while on the losing trade (1y1y/1y5y) I’ve had a rethink on the EUR curve dynamic and want to avoid the front of the curve now as the betas are changing. Elsewhere, the general rally has provoked a sharp move in the GBP short-end: 2y1y is up around 40bp from the start of the year: that wasn’t my call, and the exposure on the 1x2 1y1y1y mid-curve payer spread is just too great now (even though it has 9 months left to run) as the at-the-money has already reached the high strike.

In terms of open trades, the RX/UB box has tightened this week as the 10y sector led the sell-off, but it’s a longer-term view so I am holding it. The GBP/USD 5y5y xccy basis has returned to positive territory as the USD FX has weakened, and I’m slightly offside, but again the long-term chart is optimistic for a reversal. The GBP bull-steepener on 2y-10y is unchanged.

One new trade: a EUR 2y2y/5y10y bull-steepener to play for a relief rally after the bearish moves of the past week, and a reversal of the bear-flattening.

Looking ahead the USD curve is firmly on my radar. The USD 2-10, 1y fwd is equivocating: the price action has been range-bound in January, and the short-term 20-day moving average is trending higher. Intra-day the curve has breached the 50-day MVA. We have the US Treasury quarterly refunding next week, we should get some indications of where the curve is headed from here, and that may be the time to pull the trigger on steepeners.

Changes:

- Closed EUR 1y3y/5y5y mid-curve flattener for profit

- Closed GBP 1y1y1y MC payer spread for loss

- Closed EUR 9m1y1y/1y5y flattener for loss

- Opened EUR 2y2y/5y10 bull-steepener

Portfolio since 28th December 2017

|

Trade Idea |

Entered |

Level |

Size |

Status |

Exit/Current Level |

Exit Date |

P&L k USD |

|

US 2-10 steepener via CMS caps |

28-Dec-17 |

0 bp |

USD 25 k/bp |

CLOSED |

0 bp |

15-Jan-18 |

0 |

|

RX/UB ASW Box |

28-Dec-17 |

-6.1 bp |

EUR 50 k/bp |

OPEN |

-4.8 bp |

-80 |

|

|

EUR 1y3y/5y5y Mid-curve flattener |

28-Dec-17 |

13.7 bp |

EUR 20 k/bp |

CLOSED |

29 bp |

31-Jan-18 |

380 |

|

GBP 1y1y1y MC Payer spread |

28-Dec-17 |

0.7 bp |

GBP 25 k/bp |

CLOSED |

-1 bp |

31-Jan-18 |

-60 |

|

EUR 9m1y1y/9m1y5y Bear Flattener |

28-Dec-17 |

4.2 bp |

EUR 25 k/bp |

CLOSED |

0 bp |

30-Jan-18 |

-130 |

|

Receive GBP/USD 5y5y xccy basis |

28-Dec-17 |

1 bp |

GBP 40 k/bp |

OPEN |

2 bp |

-57 |

|

|

EUR 2-5-10 weighted swap fly |

28-Dec-17 |

-28.1 bp |

EUR 40 k/bp |

CLOSED |

-25 bp |

25-Jan-18 |

-154 |

|

GBP 2y-10y Bull-steepener |

05-Jan-18 |

0 bp |

GBP 20 k/bp |

OPEN |

0.1 bp |

3 |

|

|

EUR 2y2y/5y10y Bull-Steepener |

30-Jan-18 |

0 bp |

EUR 25 k/bp |

OPEN |

0 bp |

0 |

|

|

Total YTD |

-98 |

||||||

|

Note on trade sizing: Each trade is sized to generate approx. USD 150k 2y 99% hist. VaR at inception with no netting |

|||||||

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: SPGB and FRTR Supply This AM... Quick color

Just under the wire!

Quick color > SPGB supply at 9:30am

> Broadly speaking, Spanish bonos performance since mid-Dec has been extraordinary, accelerating richer post their Fitch upgrade. So, from a cross mkt basis vs other EGBs, it's tough to suggest they look 'cheap' s/term.

> SPGB .05 21 - This is a domestics driven issue where they park cash and with its yield at its highest since Oct, it will go fine.

> SPGB 2.15 10/25 - We like this issue on the curve (as per our note on Tues) and expect it to be well supported given the cash flows into SPGBs we've seen. The 24-25-26 fly we recommended has richened about a bp so not quite as juicy as we'd like but we still think the issue's relatively cheap, especially if the flattening momentum wanes a bit.

> SPGB 4.7 41s - The 'fly' vs FRTR 4/41s and BTPS 9/40s has richened ~70+bps since mid-Dec and 10-30s. Cheap, no? But they rarely tap these off the run issues without knowing there's an audience out there.

Quick color > FRTR Supply at 9:50am...

> After a remarkable performance in Q4, OATs have been pretty quiet to start the year. The Japanese buying that drove much of the tightening (by their own account) has largely been absent as issuance has kicked in, the mkt has sold off and sister markets like SPGBs have taken the spot light. This am's long-end supply adds a big chunk of duration into a market lacking C&R flows.

> FRTR 5/28s > This issue has underperformed on the curve over the past week, as 10-30s has pancaked 12bps post the ECB meeting and almost 20bps since the start of Jan. This flattening move is directional as 23-28-48 has shot cheaper in this selloff (overdone on any momentum indicator) which could attract some interest for those who think rates are too cheap. The lower beta version of this dip buying is to buy the FRTR 5/28s vs FRTR 5/30s, currently at the 2018 lows at 11.8bps. We'd expect decent support at these levels.

> FRTR 34s > new 15yr coming. This is a sector that goes from fair to rich, rarely cheap. The 1.25% cpn matches the 36s and at +16.5bps vs the 31s, that puts them about 9bps rich vs the 36s. So, at roughly 5bps a year between the 31s and 36s, that seems about fair-ish. The auction format adds a bit more risk to the event and, as above, 10-15/20s has flattened and 28-36-48s is at its 2018 lows at 12.8bps, 4+bp richer in the last week. So, this isn't compelling to me on an RV basis, unless you want them vs 48s or on sprd to SPGBs.

> FRTR 1.75 66s > 48s-66s has flattened 1.2bps in the last 2 days to 13.6bps, flattest since Oct. Small tap, should go ok given tightening of SPGBs and BTPS to FRTRs.

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Equities ..A potential GLIMMER of a TOP which the monthly closes should clarify. 31.01.2018

• This is one of the first month where the closes MIGHT actually create a TOP.

• US stocks remain the most over bought and many have recovered MORE than 200% of the 2008-2009 correction.

• The DOW and S&P have major RSI dislocations spread across monthly, weekly and daily durations! This is a DANGEROUS combination.

• Some RSI’s surpass 1950 and 1980 levels.

• US stocks highlight the most CONCERN.

I provide our research notification below for your convenience:

Research Unbundling:

Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

I also direct you to our disclaimer on our email footer:

This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

Many thanks,

Chris

Spain 25s 27s steepener vs Swaps - amended

Tuesday 30th Jan 2018

Spanish Supply – Thursday 1st Feb – Spgb 2.15% Oct 25

|

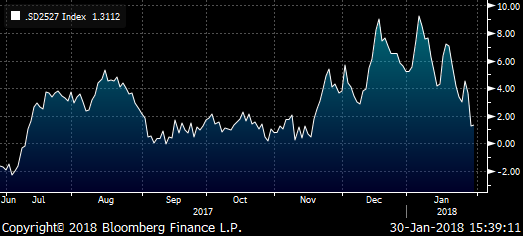

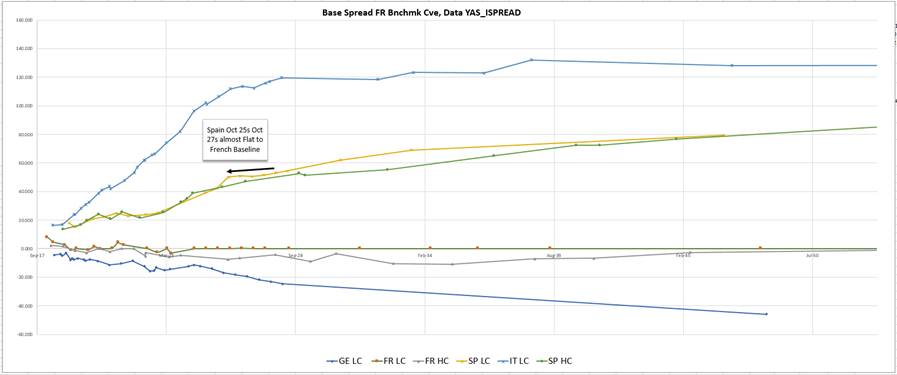

Spain – Steepener Oct/25 vs Oct/27 Trade Mechanics Structure 1 Sell €100k Spgb 1.45% 10/27 & Buy €100k Spgb 2.15% 10/25 vs MMS Or Structure 2 Buy €100k Spgb 1.45% 10/27 & Sell €100k Spgb 2.15% 10/25 vs Frtr Flattener €100k Frtr 5/25 vs Oat contracts currently @ +1.3bp 100 * ((YIELD[SPGB 1.45 10/27 Corp] - YIELD[SPGB 2.15 10/25 Corp]) - (YIELD[FRTR 2.75 10/27 Corp] - YIELD[FRTR 0.5 5/25 Corp])) Trade RV – using French Curve as Base Line we plot other European curves to look for anomalies

Rationale

Low Friction Structure vs Swap

Trade Details vs Swap

Carry & Roll

+0.4bp/3mo

Risks

|

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 60 Cannon Street, London, EC4N 6NP

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 207 - 002 - 1336

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

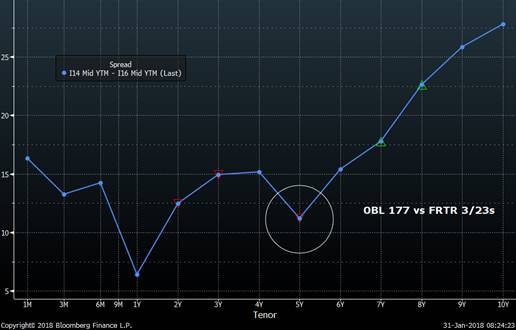

MICROCOSM: New OBL 177s > Should See Solid Demand

- OBL 177s Auction today... Quick thoughts:

- 4bln expected, roll vs OBL 176s quoted +9.75bps.

- Since the start of January the OBL 176s have cheapened 18bps in yield, 6.5bps vs swaps and 11.5bps vs 10s (in the last week).

- With the roll here, this will be the first OBL auction with a positive yield since Sep 2015 which coincides with a large index extension in Germany of .21yrs today. At the margin both of these factors should be supportive for demand today, however, indexes that add issues on settlement date won't include these new 177s in January (they settle Feb 2).

- As for the roll, +9.75bps is a smidge cheap (maybe .5bp) on the OBL curve but less supportive when we compare them to higher cpn old DBRs where spreads are roughly the same.

- At 4bln this auction should see solid demand. There should be interest in flatteners, dealers will see this as a good oppty to pad their auction stats and the positive yield is an obvious attraction into index needs.

- We expect to see interest to sell FRTR 0 3/23s to buy these new OBL 177s. The FRTR 3/23 vs DBR 2/23 sprd trades at ~16.5bps this am. Two months longer into these OBL 177s and that sprd collapses to around 11.5bps, making it one of the tightest sprds to DBRs on the curve... Similarly, 5yr sector NETHER issues like NETHER 1.75 7/23s could be candidates to sell into these OBL 177s with the yield sprd likely to be inside of 8bps even with a higher cpn and 3 months longer maturity.

OBL 176 vs swaps

OBL 176 Yields w/OBL 177s level noted

FRTR curve vs DBR curve to 10yrs

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

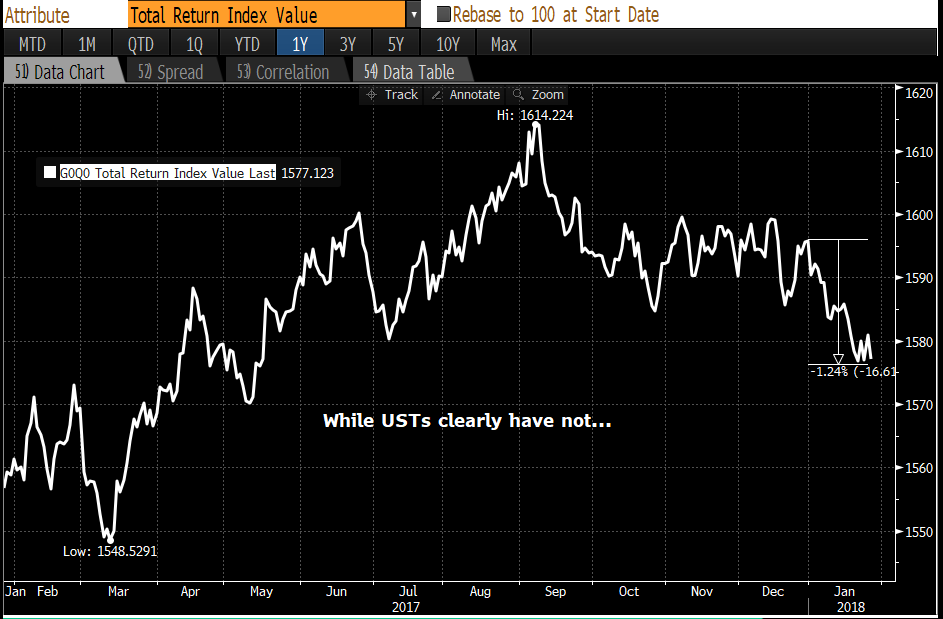

TACTICAL UST LONG Into Month-End > S&P vs UST Index

Trade Idea: Buy T 2.25 11/24 (TYH8) vs sell T 1.75 5/22 (FVH8) and T 2.25 8/27 (UXYH8) at +12.6bps, targeting +9.5bps, stop 13bps.

- The sharp divergence between equities and fixed income this month sets off alarm bells for multi-asset pensions and asset managers. Credit Suisse research (among others) estimates that there could be a total of $24bln worth of equities ($12bln in S&Ps et al, $9bln in international and $3bln in emerging market) that will be sold to move into fixed income by month-end.

- While there are a myriad number of potential homes in fixed income for these flows (USTs, corps, MBS, DBRs, etc etc), we are taking the simple view that the back-up in UST yields to their cheapest levels since April 2014 will attract ample buying interest (at least initially). This isn’t likely to be a ‘lay-up’, however, as Wednesday also coincides with Yellen’s final FOMC meeting where a number of dealers (including GS in this am’s BBG article) think the tone of the statement will be more upbeat than usual, raising fears of a more aggressive path of rate hikes than the current 3 X 25bps priced in. We’re less inclined to jump on that bandwagon as Powell is just getting started and UST rates/curve are already at extremes.

- The modified duration of most UST agg indices, after Wednesday’s .05yr index extension, will be ~6.25yrs. This coincides with 7yr issues from the T 2.125 11/24 to the current T 2.5 1/25 benchmark. We’ve observed across many sovereign curves that the issue/sector closest to the mod duration of the index outperforms the curve when there is significant demand, a reflection of the needs of passive investors. This UST maturity coincides with the CTD into TYH8, a point of huge liquidity on the UST curve.

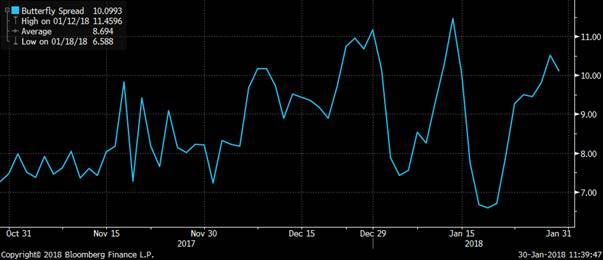

- From an RV perspective, the curve from 6yrs-7yrs is very flat, separated by barely 2bps in yields and MMS space. As this is a tactical, micro, short-horizon position, we are less concerned with roll-down and carry as we are with the location of the fly vs its wings. In this position, the 5yr-7yr leg has remained relatively steep while the 7yr-10yr has flattened back to the mid Jan lows. Given the legs are ~+18bps and ~-6.5bps, this position has an embedded flattening bias which, with the FED likely to remain at worst neutral on Wednesday, makes sense to us. As tempting as it is to put on a steepener here, we’ve seen too many train wrecks of late trying to fade the flattening move. These issues are the current March CTDs which also offers the option to execute some or all of the position in futures rather than cash. The chart below shows the fly is back to a level that has held since September, despite the market’s gyrations. If ~2bps isn’t worth your trouble then look at the short leg and put on the flattener where we’d expect to see more movement, especially in a month-end rally.

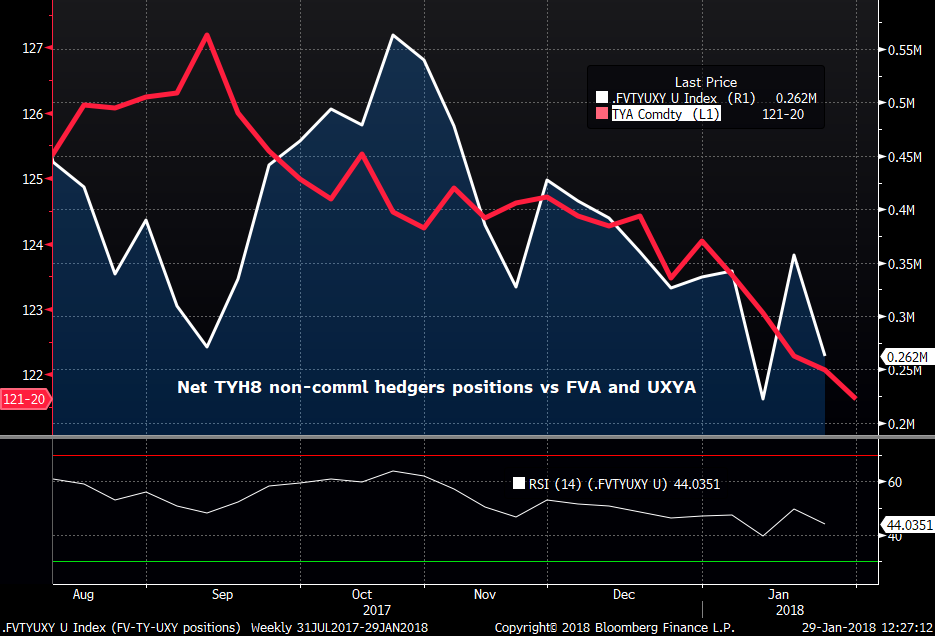

- Lastly, positioning data in the most recent CFTC futures report shows non-commercial hedgers have increased net shorts in TYH8 (-28.6k) while reducing FVH8 shorts (51.2k) and increasing UXYH8 longs (14.4k). This is the equivalent of an increase in market shorts in T 2.25 11/24s of 3.6bln while FVH8 shorts have declined by 4bn (11/24 equiv) and UXYH8 longs increased by +2.7bln. The chart below illustrates this growing imbalance and is reflected in market levels of TYH8. So, it’s reasonable to expect that a bounce in the market would result in TYH8 short covering vs at least the longer leg of this fly where the position looks most overdone.

Charts:

S&Ps up 7.75% this month, a total return of 25.4%.

UST Agg index has had a total return of -1.25% this month…

T 5/22-11/24-8/27 fly

I’ll be in touch.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: International Flows Data in GBP > Gilts RV Implications

Non-Resident purchases of gilts data reported this morning...

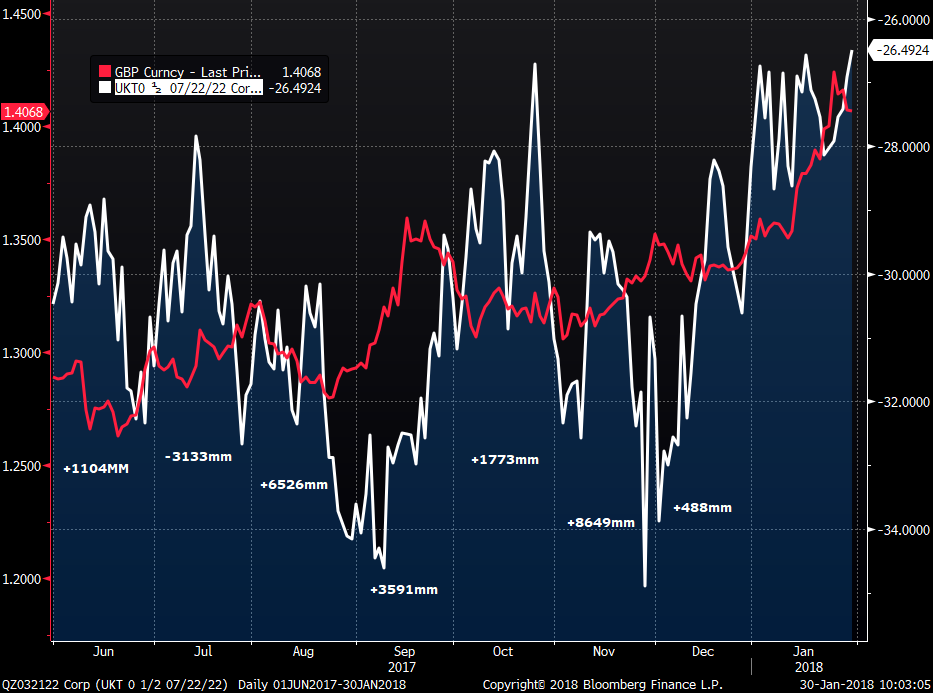

Here's an interesting graph of UKT 0H 7/22 MMS sprds with GBP overlaid and monthly purchases data indicated...

We can see a rather high correlation of these flows and the level of rates/spreads in gilts. With GBP making new med-term highs and 2-5yr UKTs cheapening sharply vs swaps in January, we can expect low/negative intl flows in gilts this month.

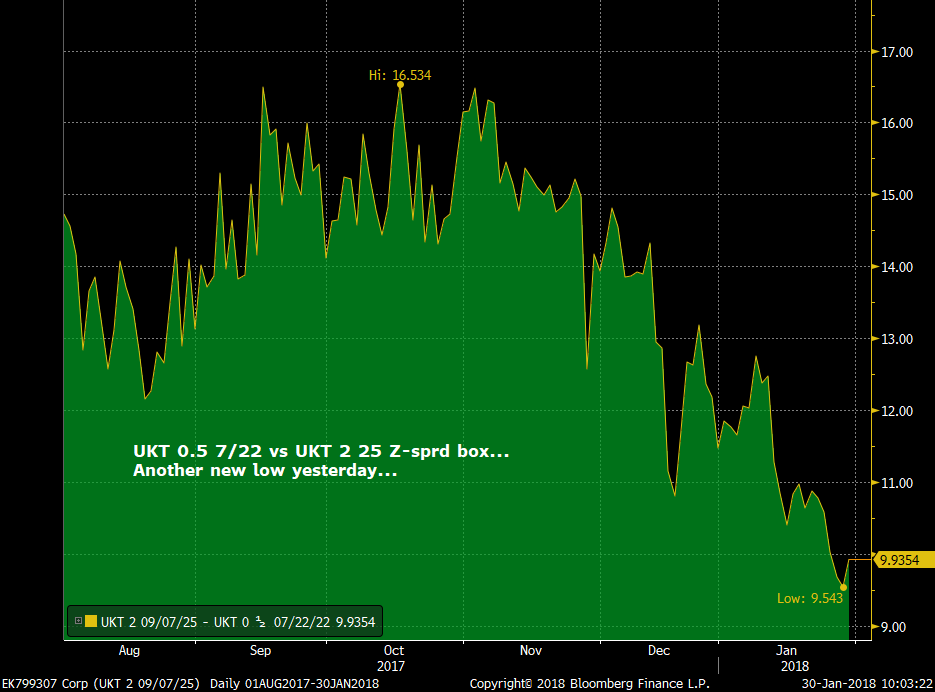

Much of the front-end activity in UKTs is driven by central banks who are not necessarily as nimble as HFs or banks when it comes to changing their currency allocations. That said, once they are done, they have a 'clean slate' into the following month. So, some Feb stability in advance of the March APF reinvestments could, in theory, drive a round of short covering from leveraged accts. Location is very tempting for outright longs vs swaps or MMS steepener boxes like UKT 7/22 vs UKT 9/25s which made new lows yesterday.

More to come…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: SPGB 10/25s Are Cheap Into Tap > Trade Ideas

Trade Ideas:

- Bullish Credit: SPGB 2.15 10/25 vs SPGB 1.5 4/27 steepener against BTPS 2 12/25 into BTPS 2.2 6/27s flattener box

- Bullish Credit: Long SPGB 2.15 10/25 vs SPGB 2.75 10/24 and SPGB 1.3 10/26 as butterfly

- Bearish Credit: SPGB 2.15 10/25 vs SPGB 1.5 4/27 steepener against FRTR 1 11/25 into FRTR 1 5/27 flattener box

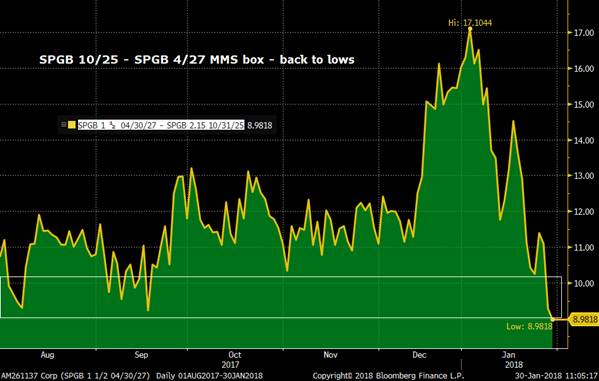

- Bearish Credit: SPGB 2.15 10/25 vs SPGB 1.5 4/27 MMS box

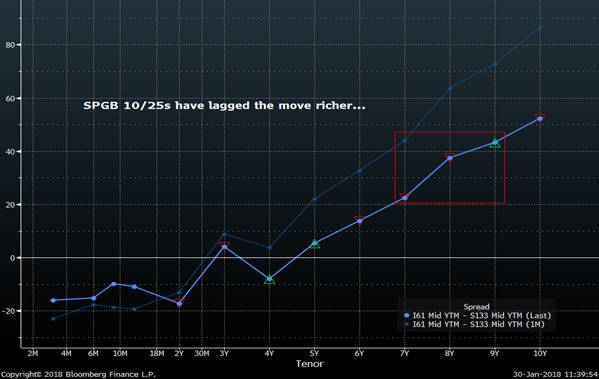

- With SPGBs very well bid since the start of January, the challenge is finding an issue/sector that’s not already rich. The SPGB 2.15 10/25s, tapped on Thursday, have lagged much of this move tighter/flatter and look primed to come back into line once the taps are out of the way. While we have a constructive view of Bonos medium-term, we are also mindful of how aggressive SPGBs have tightened this year and there are likely those who would be keen to take profits and/or oppose this momentum. So, we offer a handful of permutations above that we like from a location & macro perspective.

- Bullish Credit: SPGB 2.15 10/25 vs SPGB 1.5 4/27 steepener against BTPS 2 12/25 into BTPS 2.2 6/27s flattener box

BTPS have cheapened sharply vs SPGBs over the last few weeks, accelerating post-Spain’s ratings upgrade. While the March election in Italy looms over the BTPS market over the next 6 weeks, there are those who think current spreads to SPGBs are too wide. This box should work well if BTPS sprds to SPGBs compress from here. Liquidity would likely be best between today and tomorrow as cash flows are supportive for both markets.

- Bullish Credit: Long SPGB 2.15 10/25 vs SPGB 2.75 10/24 and SPGB 1.3 10/26 as butterfly

This is a plain-vanilla fly that isolates the cheapness of the 10/25s. (Charts below)

- Bearish Credit: SPGB 2.15 10/25 vs SPGB 1.5 4/27 steepener against FRTR 1 11/25 into FRTR 1 5/27 flattener box

The chart below shows that the SPGB sprd has flattened sharply, now almost flat the OATs. This has been a ‘boundary condition’ (one of Mr Rice’s favourite expressions) for this spread since August and looks like an interesting way to fade this flattening move.

- Bearish Credit: SPGB 2.15 10/25 vs SPGB 1.5 4/27 MMS box

Similar reasoning as the OATs version with better liquidity and less balance sheet.

SPGB 0-10yrs vs EONIA – richened over the past month but SPGB 10/25s have lagged.

SPGB 10/25-4/27 vs BTPS 12/25-6/27 box – SPGBs far flatter now than BTPS curve

Same as above, different way to illustrate it. BTPS steep vs SPGBs

SPGB 10/25-4/27 vs FRTR 11/25-5/27 box – Spain has snapped flatter, now back to almost flat vs OATs.

SPGB 25-27 MMS box has made new lows this week…

SPGB 10/24-10/25-10/26 fly

Would love to hear your thoughts…

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Btps Trade

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796