French Trade Opportunity

Trade Opportunity – Monday, 29th July 2018

|

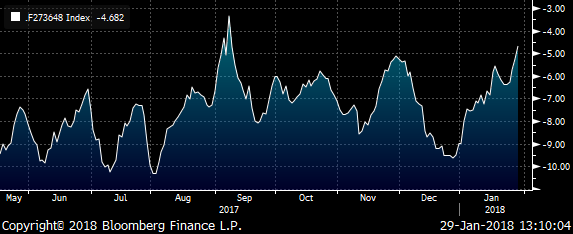

France – Frtr Tactical Auction Trade Trade Mechanics Buy €100k Frtr 1.25% 5/36 vs Sell €67k Frtr 2% 5/48 & Sell €33k Frtr 2.75% 10/27 (or OAT contracts) Weighting 0.66/2/1.34 Weighted as per fitted yield curve shape @ -4.7bp (current level) Trade History – BBG 200 * (YIELD[FRTR 1.25 36 Corp] - 0.33 * YIELD[FRTR 2.75 10/27 Corp] - 0.67 * YIELD[FRTR 2 5/48 Corp])

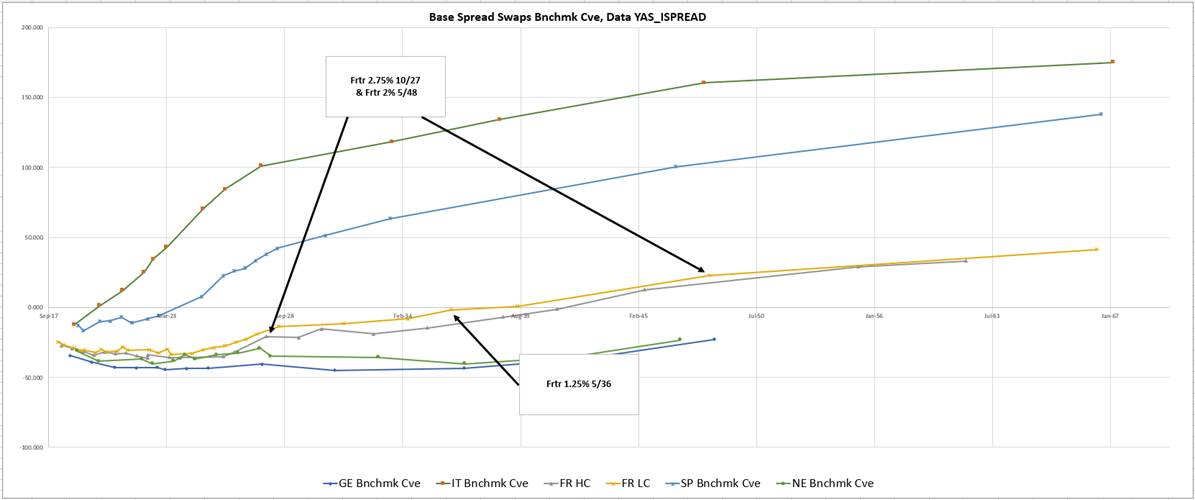

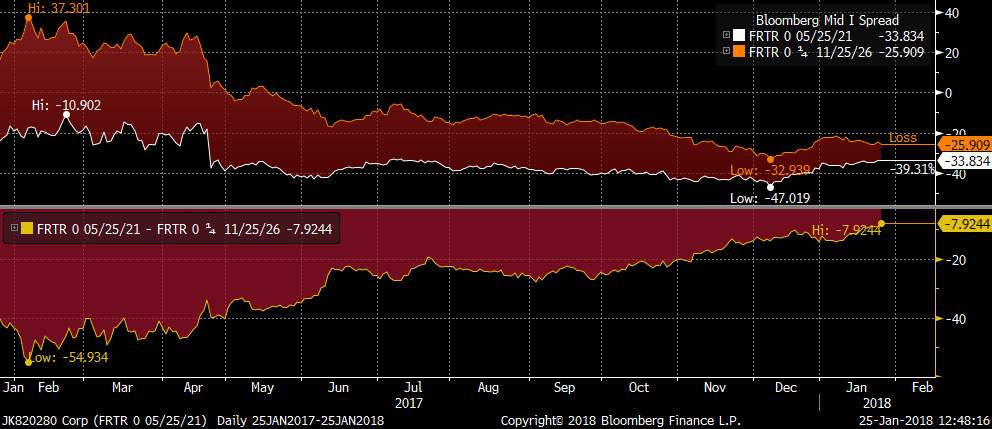

Trade RV – Frtr Relative Swap Spreads (Base Line is Germany)

Rationale

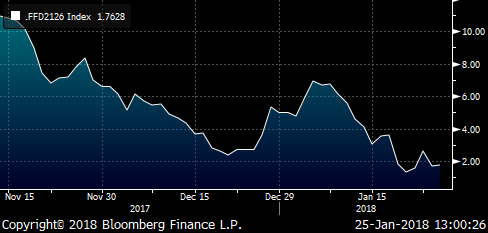

Vs Swaps – is there edge? Trade is approx -20bp vs relative to the Euro Swap Curves See recent history

SP210 is BBG code for swap spread

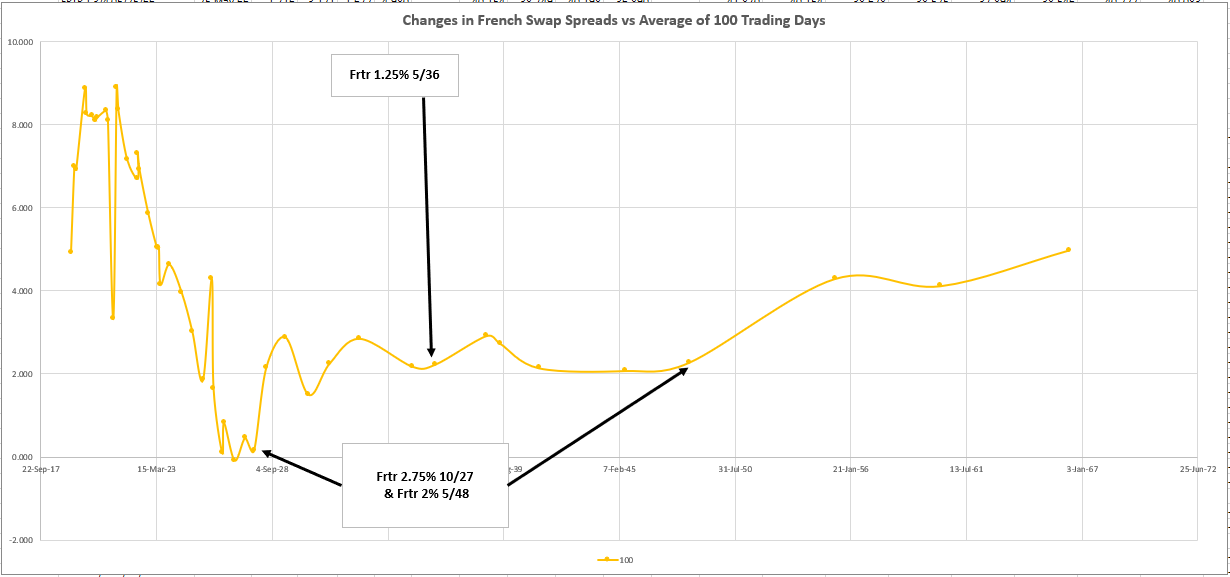

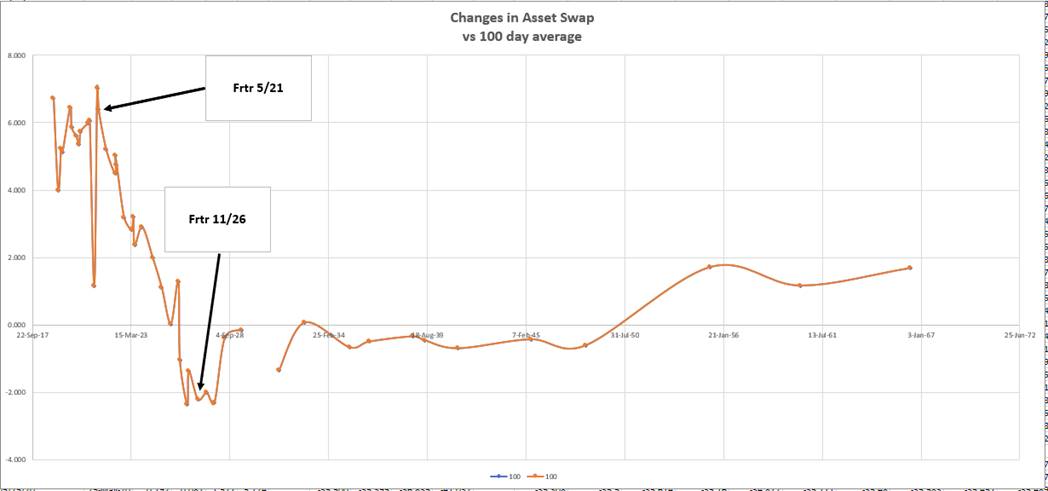

Curve Dynamic Changes in French Asset Swap levels vs the average of the last 100 trading days

Trade Details – receiving the spread

Carry & Roll

Risks

|

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

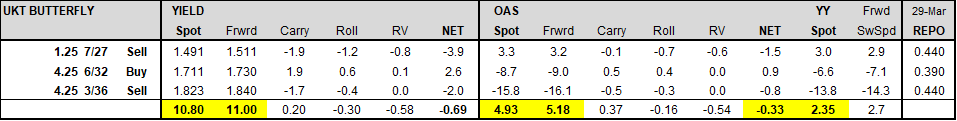

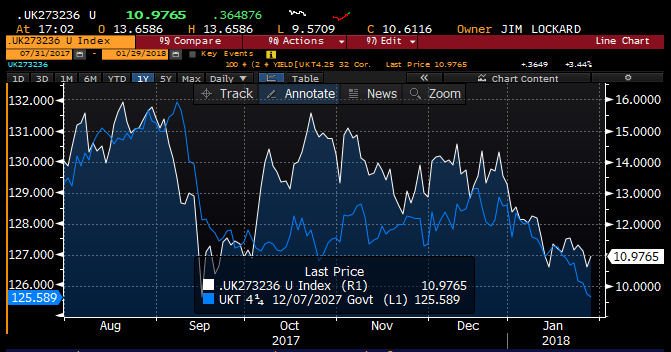

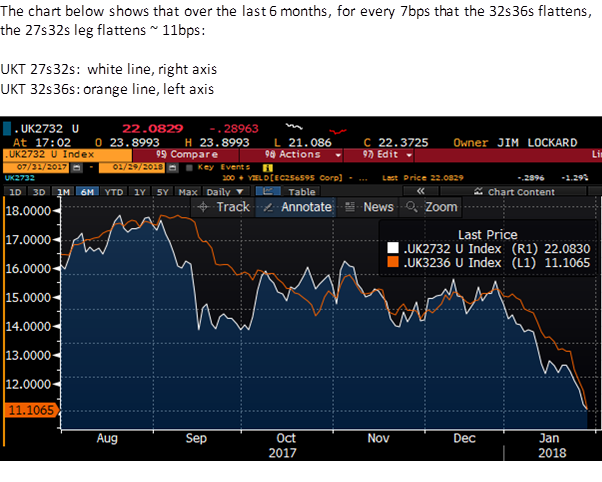

Sell belly of UKT 1q27-4q32-4q36

This is a trade we’ve been scaling into over the last week. There has been very poor dealer demand for the belly, increasing the charge for liquidity, as it is difficult to rely on screen prices.

However, dealer bias only increases our conviction in the trade, especially if there is an opportunity to fade any mechanical intraday richening which is not backed by apparent flows in the market.

Trade: Sell belly of UKT 1q27-4q32-4q36 bfly at 11.0 bps:

Target: +15.0 bps (4bps profit)

Stop: +9.0 bps (2bps loss)

Rationale:

Short term: the UKT 4.25 6/32 have recently performed on the curve into the the 22nd Jan coupon reinvestment (over £2bn paid in >15yr Gilts). Given UKT 32s represent the average duration of the FTSE All Stocks Gilt Index, they are a popular reinvestment vehicle for index managers. UK managers reinvest around the coupon date, while international index managers wait until month end, after which we would expect support for the UKT 32s to wane.

Intermediate term: The UKT 5 3/18 mature on 7th March (returning £18.4bn cash to the BoE); the APF will reinvest this across the curve in 3 buckets of over £6bn. The UKT 32s will be excluded as the BoE and APF already own 78% of the free float. Conversely, the BoE/DMO own almost none of the 1q27, 50% of the 4q36s, and only 7% of the 1T37s, leaving ample scope to purchase the 10yr and 20yr sectors. Moreover, as the UKT 32s roll down the curve, the UKT 4.5 9/34 will replace it as the neutral duration bond for the FTSE All Stocks Gilt Index later this year. The shift to the UKT 34s will be hastened by next month’s index extension, when all Gilt supply will be in longs and ultra longs (UKTi 36s, UKTi 48s syndication, and UKT 57s).

Positioning: Recent richening of UKT 32s to the curve appears to be driven by dealer anticipation of global month end rebalancing flows, which we would expect to dissipate later in the week.

RISKS: The trade has a steepening bias and is therefore at risk of richening during any sharp selloffs in the Gilt contract, when the 1q27s would be expected to lead the way down.

UKT 27s32s36s bfly vs UKT 4.25 12/27 (CTD) price:

Bfly – white line right axis

4q27 – blue line left axis

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Equities ..US stocks remain the most over bought BUT Europe STALLING, KEY monthly closes coming up. 29.1.2018

Equities ..US stocks remain the most overbought BUT Europe STALLING, KEY monthly closes coming up.

• US stocks remain the most over bought and many have recovered MORE than 200% of the 2008-2009 correction.

• The DOW and S&P have major RSI dislocations spread across monthly, weekly and daily durations! This is a DANGEROUS combination.

• Some RSI’s surpass 1950 and 1980 levels.

• US stocks highlight the most CONCERN.

I provide our research notification below for your convenience:

Research Unbundling:

Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

I also direct you to our disclaimer on our email footer:

This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

Many thanks,

Chris

How are we doing? Shadow Portfolio update

Portfolio P&L since 15th January: USD -149k, Ytd +53k

Summary: Quite a volatile past 48 hours for the portfolio, as the market took a strongly hawkish read of the ECB meeting. The curve resumed its bear-flattening, with the belly underperforming sharply. I stopped out of my EUR 2-5-10 after the meeting: the directional hedge proved inadequate to overcome the 5y-10y flattening. On a brighter note, the 1y3y/5y5y flattener (incepted last October) has had a great time. The other trades are still close to their opening levels, though the failure of the 1y1y/1y5y flattener to join the party is evidence that not all EUR flatteners are created equal.

The suddenness and strong directionality of the recent move on EUR 2-5-10 and 5-10-30 has put receiver flies on the radar: eg buy 1y10y receivers vs 1y5y and 1y30y, to play for a modest relief rally and subsequent retracement on the fly. I’ll be sending out a zero-cost structure on Monday, so watch this space.

Changes:

- Stopped out of the weighted EUR 2-5-10 fly for a loss

Portfolio since 28th Dec 2017:

|

Trade Idea |

Entered |

Level |

Size |

Status |

Exit/Current Level |

Exit Date |

P&L k USD |

|

US 2-10 steepener via CMS caps |

28-Dec-17 |

0 bp |

USD 25 k/bp |

CLOSED |

0 bp |

15-Jan-18 |

0 |

|

RX/UB ASW Box |

28-Dec-17 |

-6.1 bp |

EUR 50 k/bp |

OPEN |

-5.8 bp |

-17 |

|

|

EUR 1y3y/5y5y Mid-curve flattener |

28-Dec-17 |

13.7 bp |

EUR 20 k/bp |

OPEN |

28 bp |

356 |

|

|

GBP 1y1y1y MC Payer spread |

28-Dec-17 |

0.7 bp |

GBP 25 k/bp |

OPEN |

-0.5 bp |

-43 |

|

|

EUR 9m1y1y/9m1y5y Bear Flattener |

28-Dec-17 |

4.2 bp |

EUR 25 k/bp |

OPEN |

2.4 bp |

-56 |

|

|

Receive GBP/USD 5y5y xccy basis |

28-Dec-17 |

1 bp |

GBP 40 k/bp |

OPEN |

1.5 bp |

-28 |

|

|

EUR 2-5-10 weighted swap fly |

28-Dec-17 |

-28.1 bp |

EUR 40 k/bp |

CLOSED |

-25 bp |

25-Jan-18 |

-154 |

|

GBP 2y-10y Bull-steepener |

05-Jan-18 |

0 bp |

GBP 20 k/bp |

OPEN |

-0.2 bp |

-6 |

|

|

Total YTD |

53 |

||||||

|

Note on trade sizing: Each trade is sized to generate approx. USD 150k 2y 99% hist. VaR at inception with no netting |

|||||||

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

** BONDS UPDATE AS DAVOS DRAWS TO A CLOSE. Today could be a KEY REVERSAL day providing we get the appropriate closes.**

BONDS UPDATE AS DAVOS DRAWS TO A CLOSE. Today could be a KEY REVERSAL day providing we get the appropriate closes.

Bonds Pages 3-33

All parts of the US curve have yields above multi year trend lines.

US curves continue to struggle to find a base but the RSI’s remain VERY LOW. Ideally wait for the monthly closes to allow for COMPLETE confirmation.

Germany bonds are poised to BASE, subject to todays and monthly closes.

US 10 Breakevens have a LOFTY WEEKLY and DAILY RSI.

I provide our research notification below for your convenience:

Research Unbundling:

Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

I also direct you to our disclaimer on our email footer:

This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

Many thanks,

Chris

CHART OBSERVATIONS FX UPDATE AND EM BONDS.The USD DAILY RSI’s are stretched on many levels, it could be a KEY Friday.

• The USD DAILY RSI’s are stretched on many levels, it could be a KEY Friday.

•

I provide our research notification below for your convenience:

Research Unbundling:

Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

I also direct you to our disclaimer on our email footer:

This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

Many thanks,

Chris

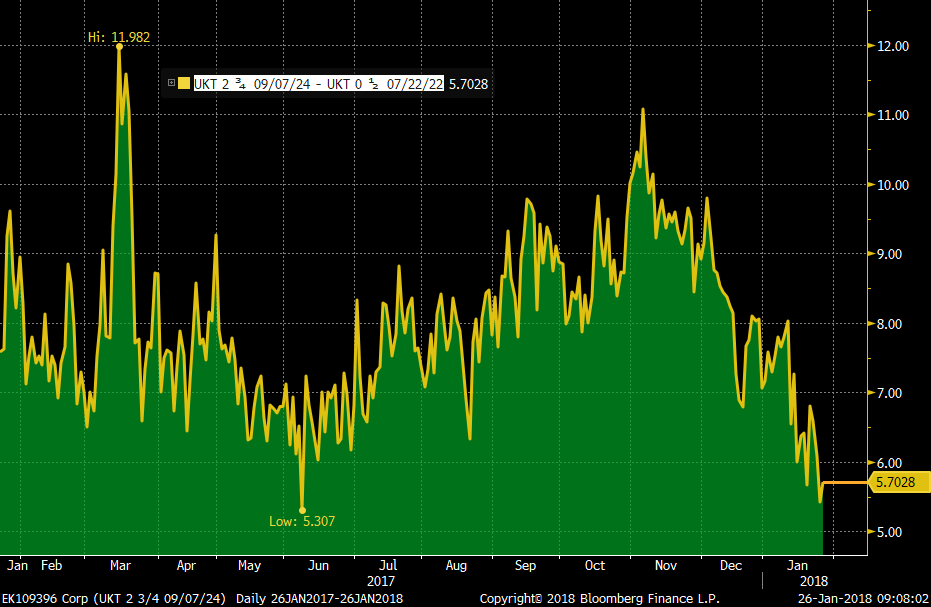

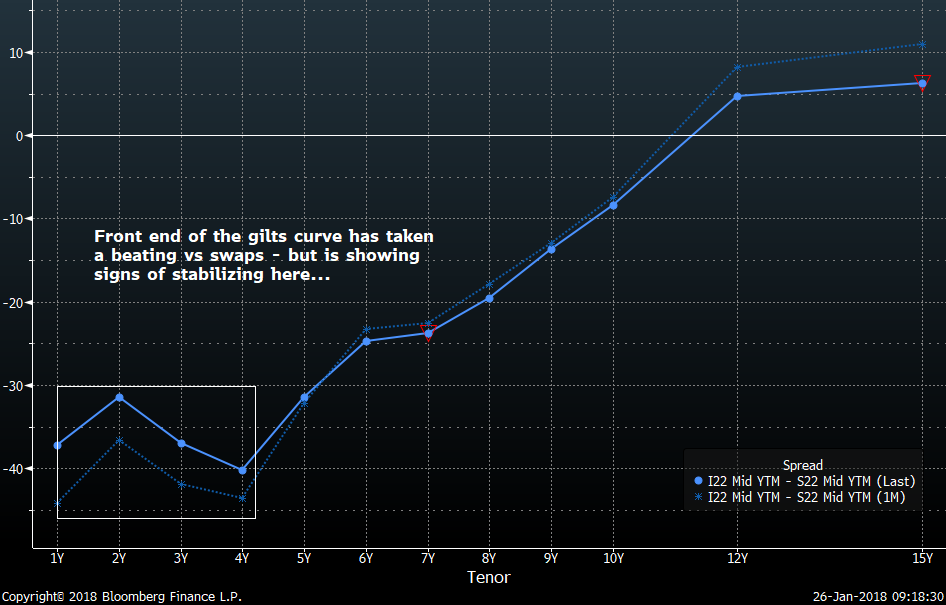

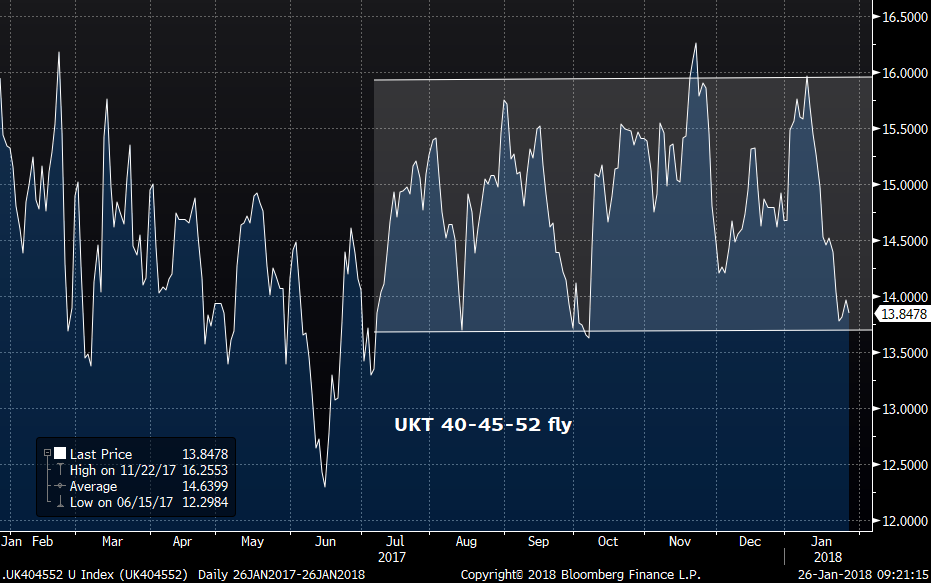

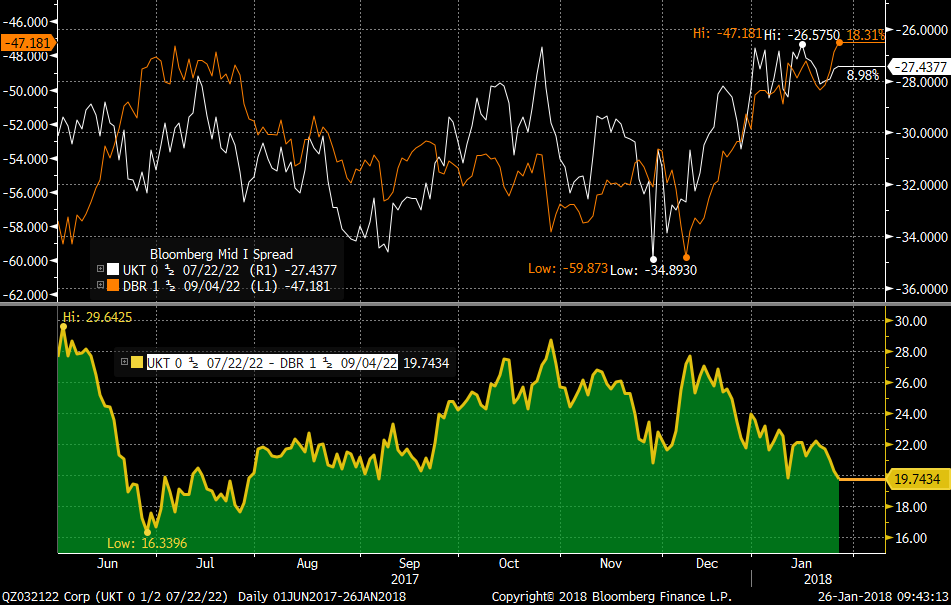

MICROCOSM: Gilts Update - Short-End Stabilizing w/charts

- UK...

Themes: Short end UKT MMS sprds stabilizing

20yr sector remains well bid, tracking GBP

Gilts outperforming DBRs, especially 5yrs – watch MMS box

- Front-end UKTs have stabilized vs swaps even with GBP hovering north of 1.42. A couple dealers are on board with our call that the worst is over here, not just from a positioning view but the wave of GBP corp/SSA issuance is likely to subside. The UKT 0H 7/22s are the focal point here as they're the first liquid point in the eligible basket of short gilts into the Mar APF. A simple expression that's at the sprd/box lows is buying UKT 0H 22s vs UKT 0T 23, the curve now 13.3bps and box ~6bps or even more pronounced is 0H 22 vs 2T 24, better roll and more extreme move. If you’re wary of steepeners given flattener momentum, look at selling UKT 2 25 vs buying UKT 0H 22 and UKT 4Q 27 – currently at 7mos lows. (see below)

- Our short UKT 3H 45 vs UKT 4Q 40 and UKT 3T 52 tactical fly is hovering at the bottom of its recent 2.5bps range. It’s a micro fly that trade that should cheapen if the curve steepens.

- The 20yr sector continues to trade very well, led by big extension trades out of 10s. With the only supply 10yrs and longer until fiscal year-end in the long-end (linker 48s, UKT 57s then 47s) and UKT 1T 37s yields 15bps cheaper than in mid-Dec, we expect to see continued buying of this area of the curve. It looks overdone but is likely to remain that way – buy this area on any dips. Chart below of 25/100/75 weighted fly shows sprd at extremes – but little sign of relenting as cable remains well bid. Unwinds of cable longs could prompt profit taking here.

- UKT 5yrs (7/22) are outperforming 5yr DBRs (9/22s) in this bear flattening move in DBRs, the yield spread tightening ~6bps since Wed. Given momentum in DBRS right now, this spread move could continue, especially if we’re right about UKT 7/22s (as above). That said, this is the tightest this box sprd vs MMS has been since August as the selloff in 5yr DBRs vs swaps has been remarkable, at ~13bps since mid-Dec. So, we like this tightener but admit location isn’t ideal.

Charts:

UKT 0H 7/22 MMS

UKT 7/22 vs UKT 9/24 MMS box

UKT 2 25 vs 0H 22 and 4Q 27

UKT 27-37-47 fly (25/100/75 weighting)

UKT 0H 7/22 vs DBR 1.5 9/22 MMS box

I’ll be in touch.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

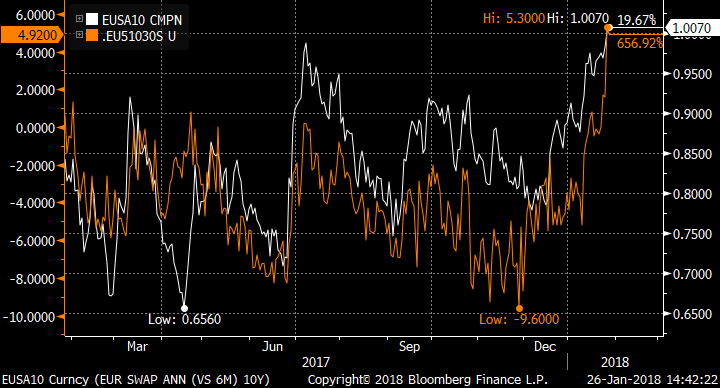

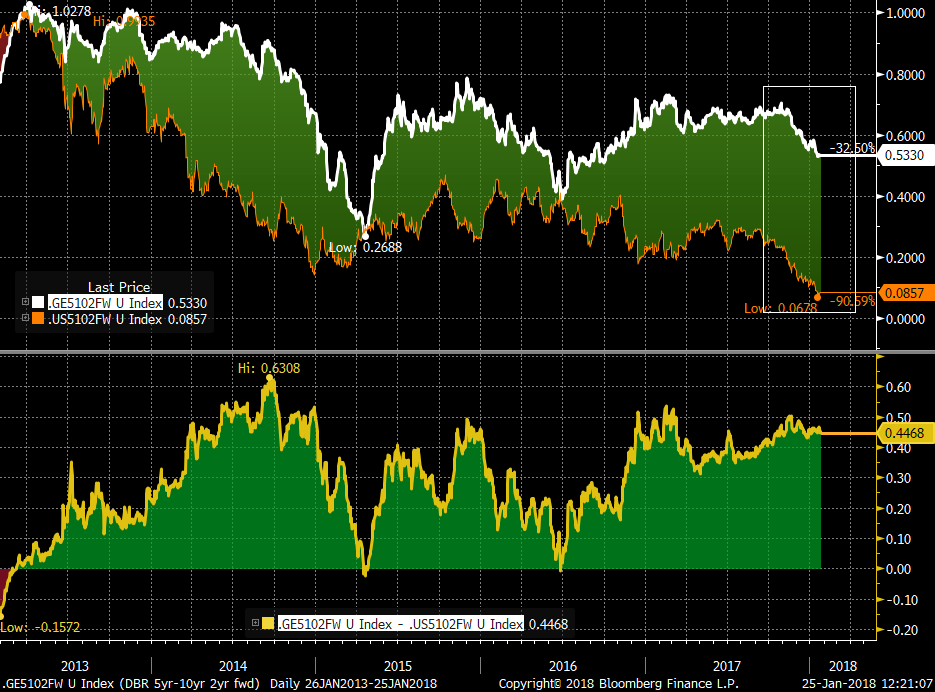

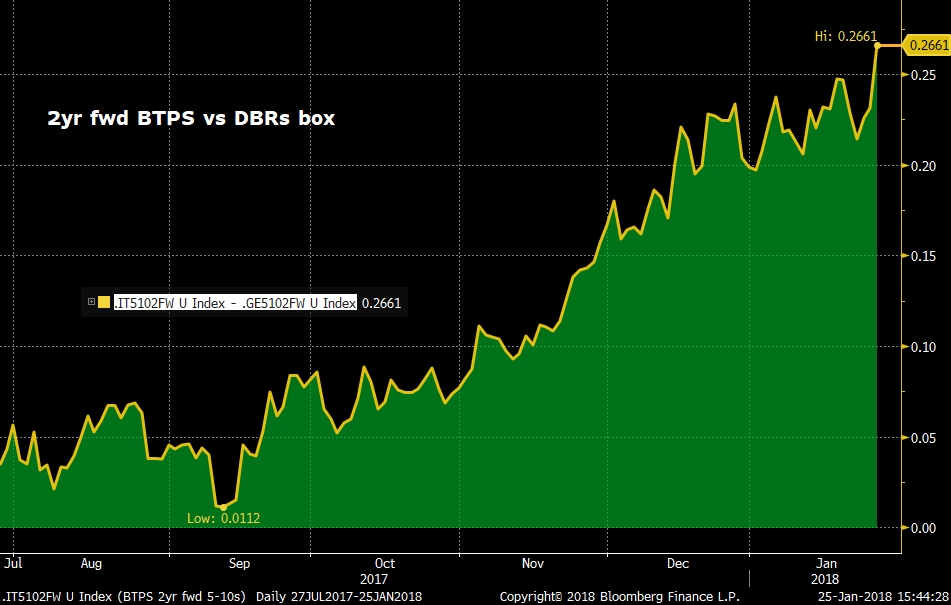

MACROCOSM: US, DBR and BTPS - a look at 2yr fwd 5-10s

- Thoughts post the ECB meeting…

Themes: DBRs into USTs positions – 5-10s

BTPS curve looking too steep vs DBRs here

5yr sector could have dangerous level of positioning

More flattening of the curve to come – but will it happen fast enough to pay for itself?

- Going into today’s meeting the market appeared to be expecting a neutral outcome: recognition of the Eurozone’s positive momentum balanced with disappointing inflation data and the stronger Euro’s tightening bias. That said, the growing chorus of strategists who think Draghi will set the table for a slowing of accommodation at the March meeting have been influencing market sentiment. This has begun to be reflected in the short end of the curve as evidenced by the ~15bps hike in the depo-rate priced in for Mar 2019, ~6 mos after the expected end of QE.

- With UST-DBR spreads in the belly of the curve at/near the recent wides (especially in 5yrs), we were tempted to buy USTs and sell DBRs, not just because the USD looks so technically oversold but because a sign that Europe will become better aligned with the US should mean higher DBR yields vs the US. Frankly, we couldn’t type fast enough to finish this note pre-ECB as EGBs have cheapened 3-5bps vs UST (10s). That’s a hiccup in what could be a far greater move though.

- We took a look at the UST 5-10s sprd vs the DBR 5-10s spread, both spot and 2yrs fwd (charts below, back 5yrs). We can see from the first chart that on a spot basis, DBR 5-10s has bear-steepened a bit to start the year while the UST curve has bear flattened, exacerbating the widening of USTs to DBRs in both 5s and 10s.

- In the second chart of the 2yr fwd 5-10s box, we can see that the DBR curve has flattened since the start of the year, reflecting the steepening of the eonia curve and the market’s view that in 2yrs time the ECB will be well into their rate hike cycle. With the UST 5-10s a mere 13bps flatter than spot (21.5 – 8.5), far less than the annual carry and roll of a 5-10s steepener, one could argue the market doesn’t expect the Fed to still be hiking in 2yrs time. With the funds target current 1.5% and inflation barely 2%, one could argue the Fed could be done raising rates by the end of 2018 so, the UST forwards are perhaps even a touch too flat.

- There are two questions here: Should the 2yr forward 5-10s sprd run out of room to flatten if/when the spread gets to zero? And secondly, Will the 2yr fwd DBR 5-10s sprd accelerate flatter, dragging the spot curve with it?

- The answers appear to be ‘probably’ and ‘yes’ respectively, judging by the market reaction to the ECB. In order for these curves to align more closely we’ll need a sign that the first rate hike could come sooner than later but we’ll also need a sign that market positioning is so offsides that the spot spread volatility will be high enough to compensate us for the negative carry in the flattener. Given the tone of the market for the last few weeks, the market doesn’t appear to have too many trapped longs on a broad basis, especially with the ECB’s PSPP program still at it, even if it’s a scaled back version.

- However, many of the EGB longs are currently in the 5yr sector, reflecting the weight of 10yrs+ supply in January, the shape of the curve, etc. So, while there may not be a duration- driven need to sell, there could be a rates policy reason that could spark 5 vs 7/10s flattening moves, in sympathy with the moves seen in the US and UK.

- The bull in the china shop here is Italy. The BTPS-DBRs 5-10s box is at extremes both spot and forward, despite an almost 30bps tightening of BTPS-DBR 10yr sprds since the start of the year. This highlights the weight of positions in the 5yr sector of the BTPS curve and their vulnerability to a big selloff and secondly, the relative cheapness of 10yr BTPS vs core (and even Spain here) that could prompt a bull flattening move if the election result is tamer than expected. We have seen some interest in this box trade which should reach a crescendo into the pricing of the new BTPS 10yr/Feb 1 C&R flows.

- The answers appear to be ‘probably’ and ‘yes’ respectively, judging by the market reaction to the ECB. In order for these curves to align more closely we’ll need a sign that the first rate hike could come sooner than later but we’ll also need a sign that market positioning is so offsides that the spot spread volatility will be high enough to compensate us for the negative carry in the flattener. Given the tone of the market for the last few weeks, the market doesn’t appear to have too many trapped longs on a broad basis, especially with the ECB’s PSPP program still at it, even if it’s a scaled back version.

Thanks – I’ll be in touch.

Mark

![]() image009.jpg@01D28D1B.42BD95C0">

image009.jpg@01D28D1B.42BD95C0">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: Trade examples

From: James Rice

Sent: 25 January 2018 13:21

To: David Sansom <David.Sansom@astorridge.com>;; Jean-Francois Lucas <Jf.lucas@astorridge.com>;; Justin Knight <Justin.knight@astorridge.com>;; George Whitehead <George.Whitehead@astorridge.com>;; Mark Funsch <mark.funsch@astorridge.com>;; Robert Baida <robert.baida@astorridge.com>;; Jim Lockard <Jim.lockard@astorridge.com>;; John Wentzell <John.wentzell@astorridge.com>;

Subject: Trade examples

Trade Example – Thursday, 25th July 2018

Any comments please?

|

France – 3y vs 9y steepener vs Germany Trade Mechanics Buy €100k Frtr 0 5/21 vs Sell €100k Frtr 0.25% 11/26 Vs €80k -DUA / +RXA @ 0bp (using 2nd CTD, for history) See Trade Details below for execution levels using schzte CTD Trade History – BBG ( using 2nd CTD for longer history on the DUA CTD)

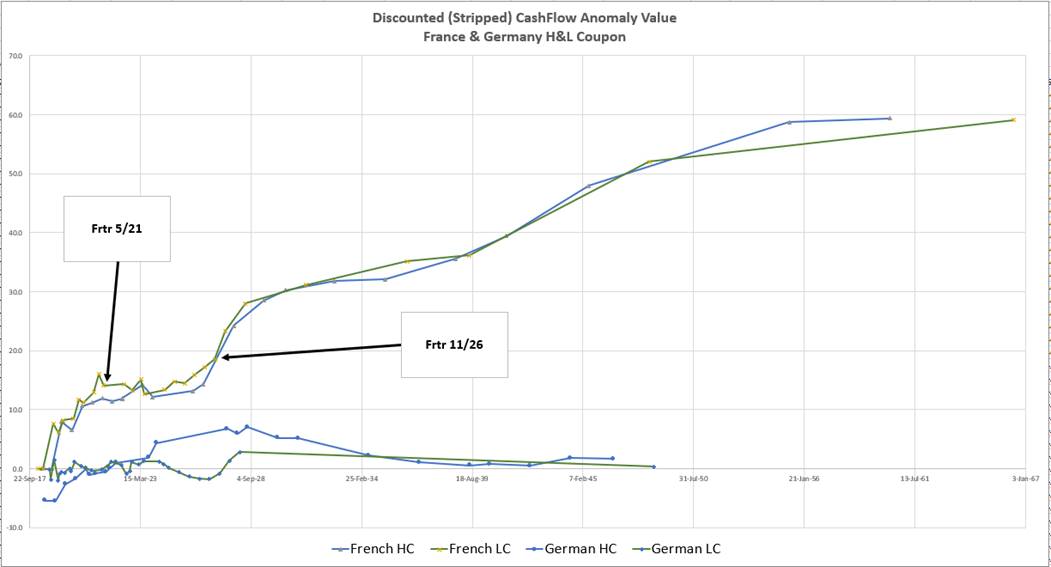

Trade RV – using smoothed French Anomalies vs Smooth Strip Curve

Rationale

Vs Swaps Trade is approx -8bp vs Swaps

Curve Dynamic Changes in French Asset Swap levels vs the average of the last 100 trading days

Trade Using the CTD of the Schatze (correct short end hedge bond but with limited history) Cix: 100 * ((YIELD[FRTR 0.25 11/26 Corp] - YIELD[FRTR 0 5/21 Corp]) - 0.8 * (YIELD[DBR 0.25 2/27 Corp] - YIELD[BKO 12/19 Corp]))

Trade Details – paying the spread

Carry & Roll

Roll +0.8bp

Carry 1.3bp/3mo (using CTD implieds) Risks

|

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EQUITIES : US stocks remain the most overbought since the 1950's and RSI extreme is now across MONTHLY, WEEKLY and DAILY durations.

EQUITIES

•US stocks remain the most over bought and many have recovered MORE than 200% of the 2008-2009 correction.

•The DOW and S&P have major RSI dislocations spread across monthly, weekly and daily durations! This is a DANGEROUS combination.

•Some RSI’s surpass 1950 and 1980 levels.

•US stocks highlight the most CONCERN.

23/01/2018 1 I provide our research notification below for your convenience:

Research Unbundling:

Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

I also direct you to our disclaimer on our email footer:

This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

Many thanks,

Chris