Trades for 2018: Long Bund spreads vs Buxls

Subject: Trades for 2018: Long Bund spreads vs Buxls

Re-send with improved PSPP2 buying chart (y-axis visibile!) Bottom line: German supply, and the stock available for PSPP2 purchasing should favour 10y over 30y and drive a steepening move in Bunds. At the same time, the 10-30 flattening in swaps has room to move further. Put together this suggests a 10y/30y box trade: buying 10y spreads vs 30y. Finally, being long RX spreads is something of an insurance play should either the Catalonia or Italian elections create uncertainty for the EU project.

Trade: Buy EUR 100k/bp RXH8 invoice spread Sell EUR 100k/bp UBH8 invoice spread Entry at -4.5 bp

Essentially flat carry/roll.

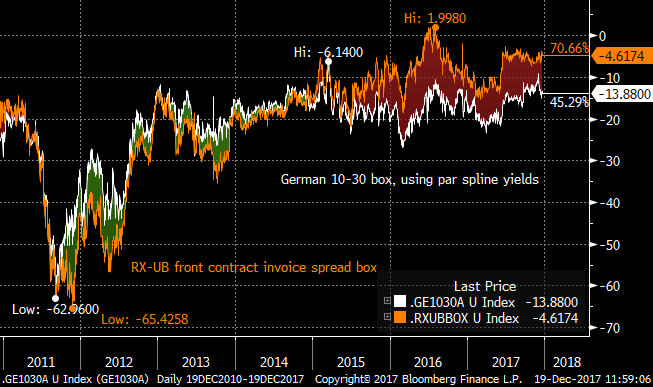

Rationale: Germany 30y paper is trading close to its richest levels vs 10y. The chart shows two expressions: the headline box of invoice spreads (RX vs UB) in orange, and the same box but using Bloomberg's par spline yields and 10y and 30y vanilla swap rates. This latter series takes out some of the roll anomalies as the contract CTD changes.

On these measures, Buxls are around 2-3bp off their richest levels of the past year. In January, the ECB cuts its PSPP2 purchasing amounts by 50% to 30bn. Comments from the "Northern European" block of ECB governors suggest that the extending new purchases beyond September (as opposed to principal reinvestment flows) will face stiff opposition. The PSPP2 programme has supported the long end of the curve, and allowed sovereigns to tap in that sector. The most recent German supply calendar is suggesting 16bn of 30y issuance in 2018, compared to 11bn in 2017, with the decision to tap the off-the-run 44s and 46s raising a few eyebrows.

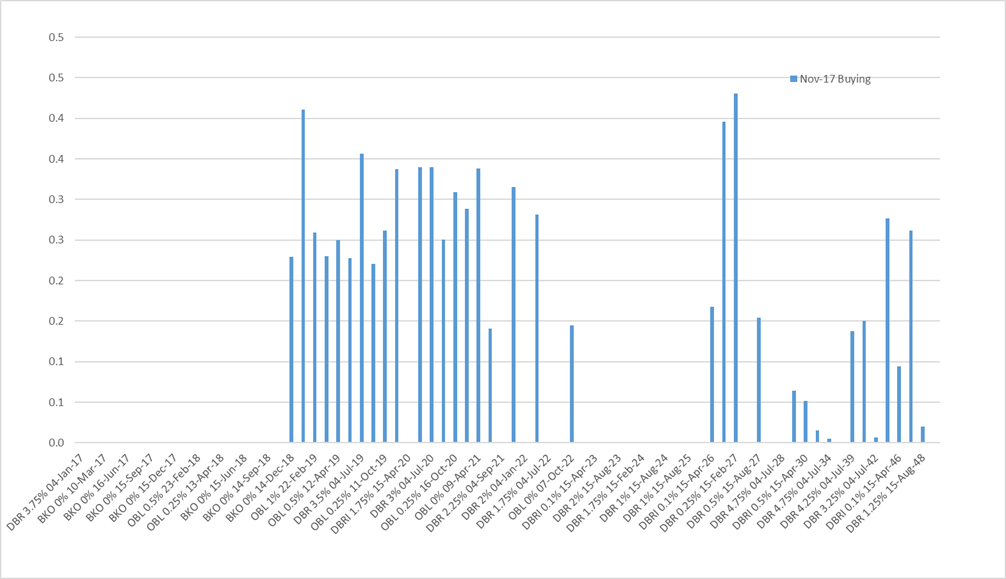

My PSPP2 model suggests that the Bundesbank has already purchased all, or nearly all of the 2042 paper available to it, so it is unclear that that particular issue (CTD in UBH8) can benefit much from purchasing for the next nine months. In contrast, I estimate the Buba bought 400mm of the Feb 2027 (CTD into RXH8) in November and still has over 6bn available for buying. Thus in the early months of 2018 I expect the 10y to receive greater support than the 30y CTD.

The PSPP2 estimate for November buying of Bunds:

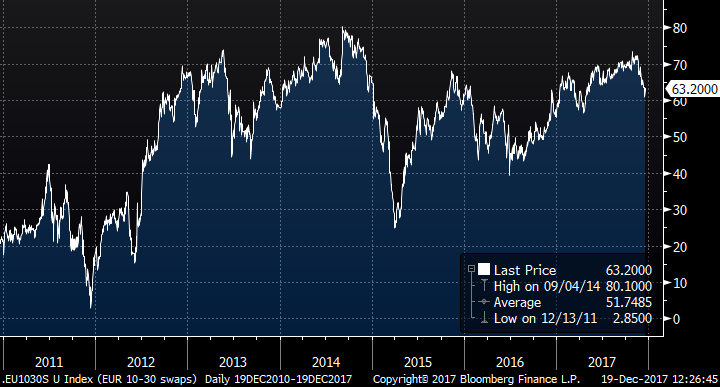

While I see potential for the 10y-30y curve in Germany to steepen (more long-end supply, more QE support in 10y), the EUR swap curve has the potential to flatten further. The apparent termination of the ESM long-end paying flows has been widely seen as one factor in this, though I favour bear-flattening moves in general across the swap curve as short-rate expectations (on a one-year horizon) become less well-anchored.

EUR 10y-30y in Swaps:

Finally, being long RX spread and short UB is a good insurance position should either the forthcoming Catalonia elections or next Spring's Italian elections create uncertainty around the political fortunes of the EU. In stressed times, 10y spreads have outperformed 30y as the increased risk premium steepens the ASW curve.

David Sansom

image001.jpg@01D21F13.B69A4950"/>

UK: 60 Cannon Street, London, EC4N 6NP US: 245 Park Ave, 39th Floor, NY, NY, 10167 Office: +44 (0) 207 002 1346 Mobile: +44 (0) 7976 204490 Email: david.sansom@astorridge.com<mailto:david.sansom@astorridge.com> Web: www.AstorRidge.com

This research was prepared by David Sansom. He is a consultant with Astor Ridge. A history of his research can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287 Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185 Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626 Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796