FW: Thoughts on RV - life cycle on new issues under PEPP

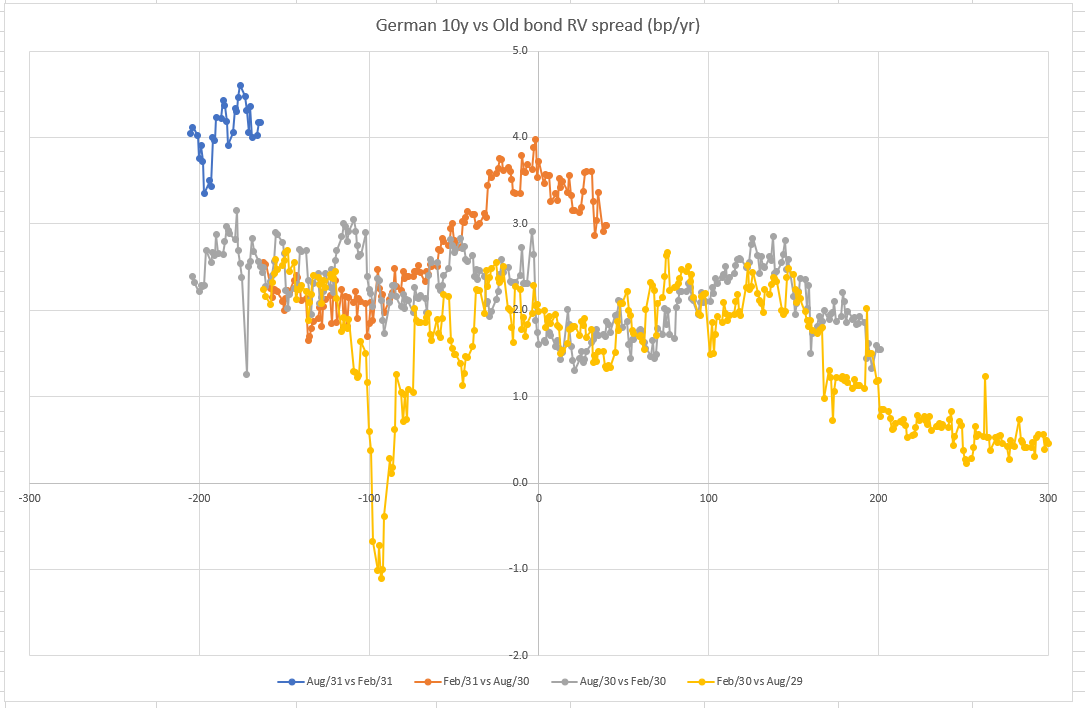

In brief – just some pictures – the thought process is that actually EGB issues are not going bid until they get to the end of their tap cycle and sometimes beyond

Let us know which particular issuers and tenors you'd like to see…

The Data on the graph is centred such that T=0 is the point at which the issue goes off the run (a newer issue has its first supply event)

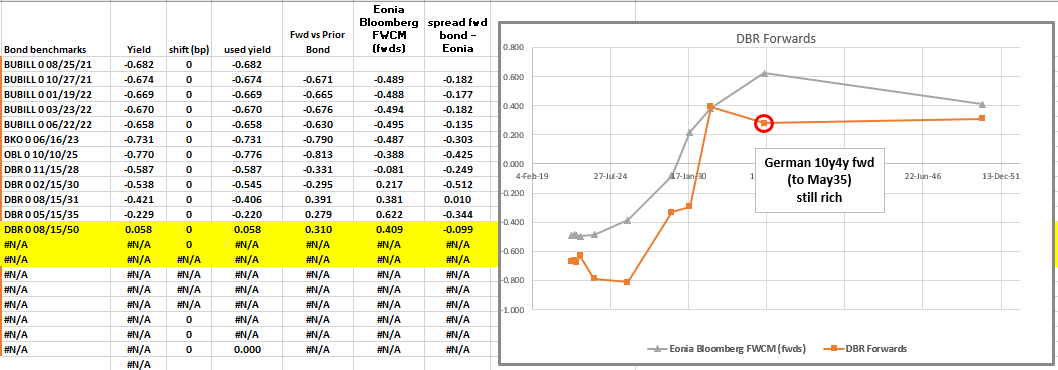

German 10y

|

Old Bond |

DBR 0 02/15/31 |

|

YLD_CNV_MID (%) |

-0.493 |

|

AMT_OUTSTANDING (Bln) |

25.0 |

|

Tenor at Issue: |

10.1 |

|

Tenor at last tap: |

9.7 |

|

Date of Last Tap: |

19-May-21 |

|

Cheapest date vs double prior issue: |

21-Jun-21 |

|

New/Recent Bond |

DBR 0 08/15/31 |

|

Amount issued vs Last Issue |

36% |

|

YLD_CNV_MID (%) |

-0.450 |

|

AMT_OUTSTANDING (Bln) |

9.0 |

|

Predicted Last Tap |

8-Nov-21 |

|

Expected Next Issue |

8-Jan-22 |

|

Current Tenor: |

10.0 |

|

Expected Cheapest Date: |

10-Feb-22 |

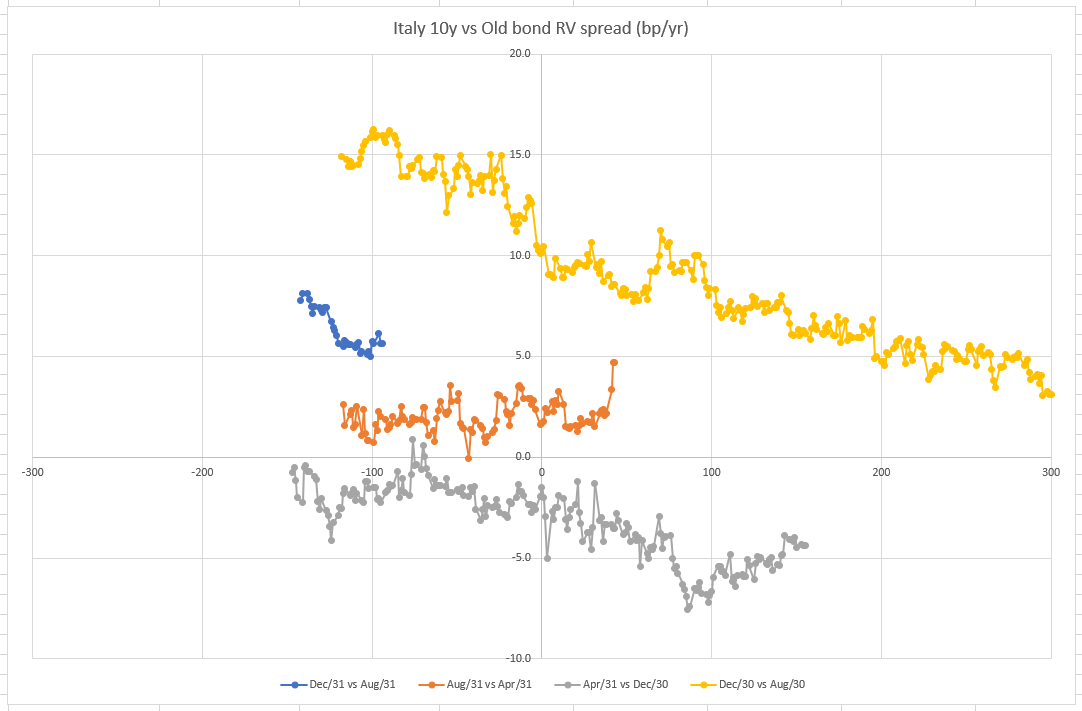

Italy 10y

|

Old Bond |

BTPS 0.6 08/01/31 |

|

YLD_CNV_MID (%) |

0.624 |

|

AMT_OUTSTANDING (Bln) |

20.3 |

|

Tenor at Issue: |

10.4 |

|

Tenor at last tap: |

10.2 |

|

Date of Last Tap: |

28-May-21 |

|

Cheapest date vs double prior issue: |

3-Jun-21 |

|

New/Recent Bond |

BTPS 0.95 12/01/31 |

|

Amount issued vs Last Issue |

49% |

|

YLD_CNV_MID (%) |

0.667 |

|

AMT_OUTSTANDING (Bln) |

10.0 |

|

Predicted Last Tap |

18-Sep-21 |

|

Expected Next Issue |

30-Oct-21 |

|

Current Tenor: |

10.3 |

|

Expected Cheapest Date: |

5-Nov-21 |

|

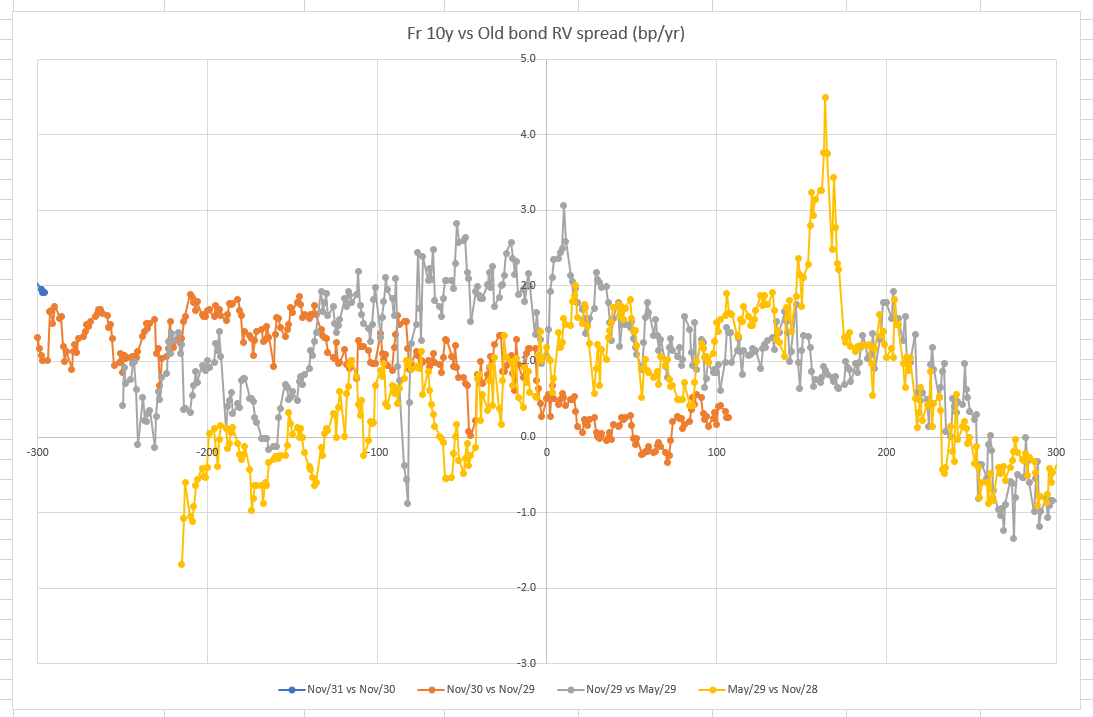

Fr 10y |

|

|

Old Bond |

FRTR 0 11/25/30 |

|

YLD_CNV_MID (%) |

-0.178 |

|

AMT_OUTSTANDING (Bln) |

48.3 |

|

Tenor at Issue: |

10.5 |

|

Tenor at last tap: |

9.4 |

|

Date of Last Tap: |

1-Jul-21 |

|

Cheapest date vs double prior issue: |

28-Jul-21 |

|

New/Recent Bond |

FRTR 0 11/25/31 |

|

Amount issued vs Last Issue |

55% |

|

YLD_CNV_MID (%) |

-0.084 |

|

AMT_OUTSTANDING (Bln) |

26.7 |

|

Predicted Last Tap |

23-Jun-22 |

|

Expected Next Issue |

20-May-22 |

|

Current Tenor: |

10.3 |

|

Expected Cheapest Date: |

16-Jun-22 |

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

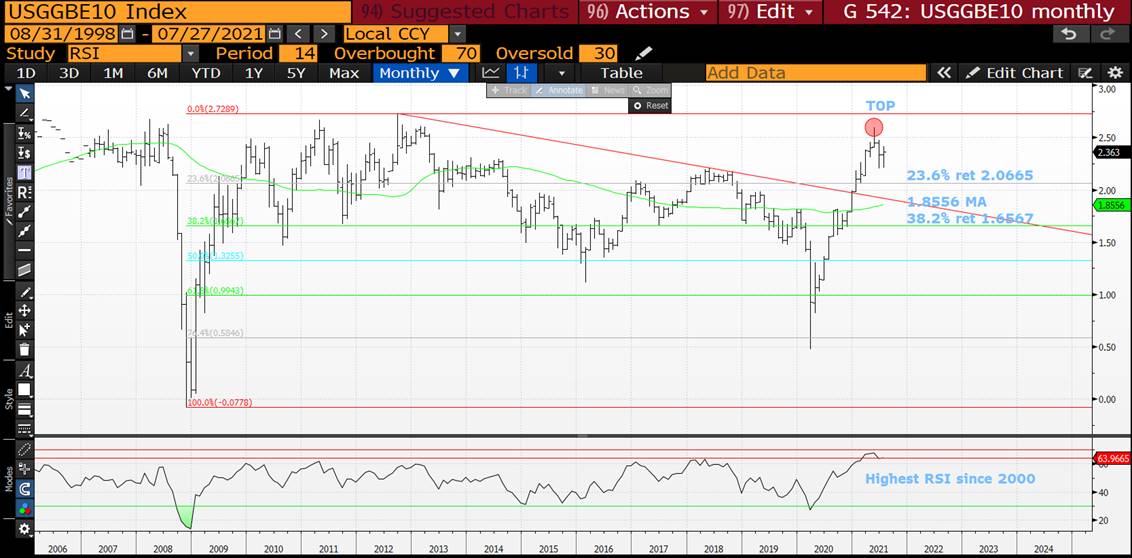

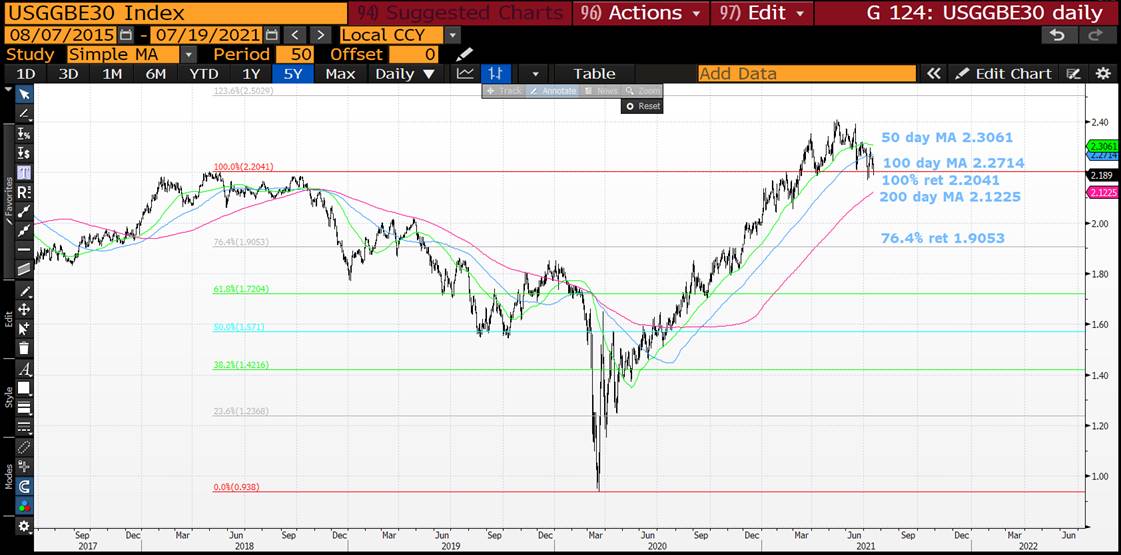

BOND UPDATE : PRE THE FED WE HAVE THE US 30YR YIELDS SUB THEIR 200 DAY MOVING AVERAGE AND 10YR BY A SMIDGE.

BOND UPDATE : PRE THE FED WE HAVE THE US 30YR YIELDS SUB THEIR 200 DAY MOVING AVERAGE AND 10YR BY A SMIDGE.

BASICALLY THE TECHNICAL CALL REMAINS FOR LOWER YIELDS SUBSTANTIATED BY A WEAK CLOSE FRIDAY.

CURVES SHOULD ALSO PERSIST IN TRENDING FLATTER AS MOST MONTHLY RSI ROLLED OVER FROM 2008-1994 DISLOCATIONS.

***BIG QUESTION IS IF YIELDS FALL SIGNIFICANTLY WHERE DOES THAT LEAVE STOCKS AND BREAKEVENS? BREAKEVENS TECHNICALLY-HISTORICALLY ARE ALSO FAILING ON "RARE" SEEN RSI DISLOCATIONS.***

US BOND AND SWAP CURVES CONTINUE TO "SCREAM" FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS "OUT OF LINE" WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

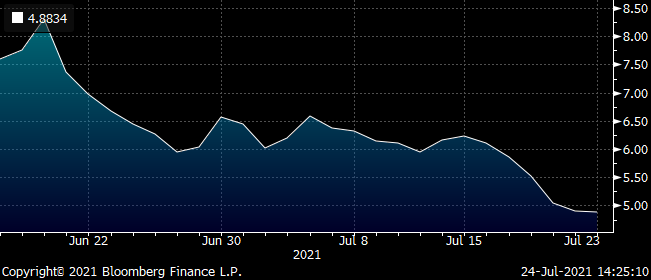

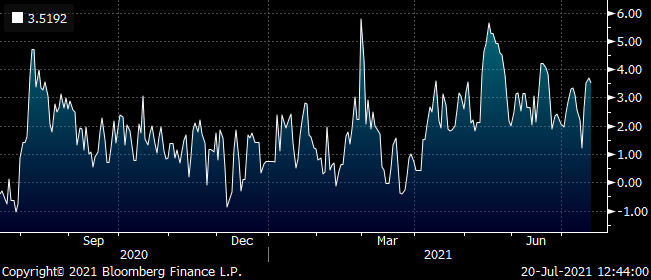

US BREAKEVENS : THESE “NEED” TO HEAD LOWER INTO MONTH END TO ENDORSE THE MONTHLY RSI EXTENSIONS LAST SEEN IN 2004, 2000-NEVER BEFORE WITNESSED!

US BREAKEVENS : THESE “NEED” TO HEAD LOWER INTO MONTH END TO ENDORSE THE MONTHLY RSI EXTENSIONS LAST SEEN IN 2004, 2000-NEVER BEFORE WITNESSED! THIS IS A “VERY” KEY CLOSE FRIDAY.

THE 50 AND 100 DAY MOVING AVERAGES OFFERING GOOD RESISTANCE CURRENTLY.

THESE WEEKLY RSI’S REPLICATE BOND YIELDS I.E. THEY ARE IN A NEUTRAL STATE.

*** SIMILAR TO THE BOND YIELD CHARTS THE 30YR BREAKEVEN IS TESTING IT 200 DAY MOVING AVERAGE 2.1358 AND WE CERTAINLY KNOW WHAT HAPPENED NEXT!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

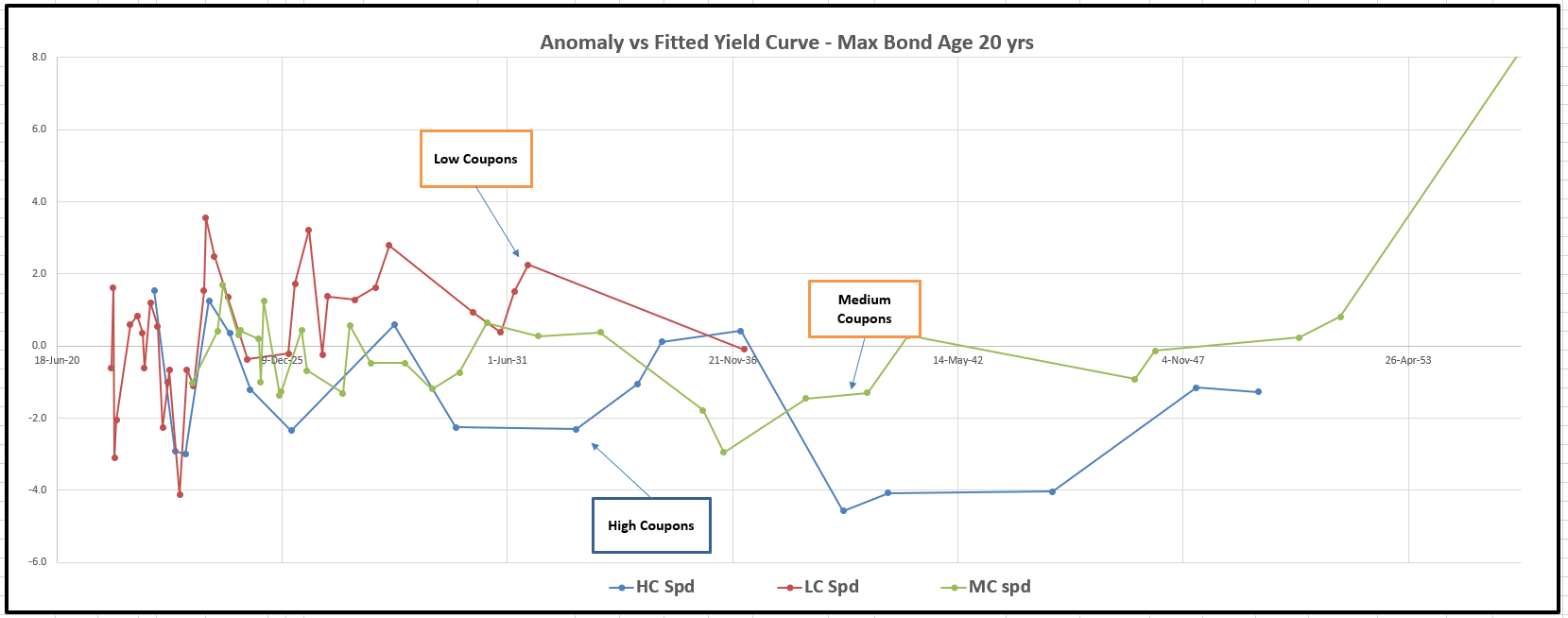

Low vs Med vs High Coupons in Italy

As per our conversation here's a Beta sheet for looking at anomalies in Italy – with the addition of using cash-flow discounting in the model (option 2)

All you need to do is toggle cell U57 between

1 = Yield Model

2= Cash Flow model

Please treat it with the usual disclaimers as it's a Beta version at the moment

It explains why the high coupon longer bonds seem to trade so rich in yield – they are still cheap using cash flow discounting method (which I hacked from the spline feed and the exponential spline field)

This is a proprietary model as such, so treat with caution but it probably better explains my thought process

If you find a trade that looks good with cell U57 =1 AND U57 = 2 then you're probably onto a winner!!!!

Best

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades - James & Will, Astor Ridge

A few things we’re looking at for the week ahead in Global RV

Germany to tap the 15y Dbr 0% May36 this week

Our Auction strategy analyser suggests this relatively new Tenor for Germany will keep getting cheaper and there’s no rush to buy…

Auction Strategy Output - Germany 15y

|

Old Bond |

DBR 0 05/15/35 |

|

YLD_CNV_MID (%) |

-0.229 |

|

AMT_OUTSTANDING (Bln) |

22.5 |

|

Tenor at Issue: |

15.0 |

|

Tenor at last tap: |

14.5 |

|

Date of Last Tap: |

28-Oct-20 |

|

Cheapest date vs double prior issue: |

22-Jul-21 |

|

New Bond |

DBR 0 05/15/36 |

|

Amount issued vs Last Issue |

58% |

|

YLD_CNV_MID (%) |

-0.167 |

|

AMT_OUTSTANDING (Bln) |

13.0 |

|

Announced Last Tap |

24-Nov-21 |

|

Expected Last Tap (based on prior): |

29-Oct-21 |

|

Current Tenor: |

14.8 |

|

Expected Cheapest Date: |

23-Jul-22 |

- Cheap now - On the Bloomberg fitted curve the cheapest point is the 10y NOT the 15y. That would imply there’s absolutely no rush to the 15y auction at this point in the cycle

- Fitted curve is not the only metric – although it’s cheap using the BBG exponential spline, that metric skewed by the High coupon German issues that continue get richer due to PEPP

- Buy it cheap on forwards – the best metric is not to rely on too many other complex metrics – let’s not go swap blind, or stare at High Coupon off the runs – when it’s too cheap vs 10s and 30s we should buy it BASED ON FORWARDS

Current Forward Rates (Bonds adjusted to be par bond equivalents)

So basically if we think we should buy the old 15y then we should buy it at cheap to the earlier forwards

We don’t get to that point for another 6bps!!! So forget it – like so many 15y points in Europe – they simply roll poorly and the 10y points are all so much cheaper

Trade Level – just not there yet – I’ll call you if it is… but we need forward steepeners

From the ECB this week - ECB comments about inflation

‘the Governing Council expects the key ECB interest rates to remain at their present or lower levels until it sees inflation reaching two per cent well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realised progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilising at two per cent over the medium term. This may also imply a transitory period in which inflation is moderately above target.'’

As a conclusion…

Am looking for longer tenor forward rate steepener – so actually it makes me continue to like buying 10y vs selling 9y and 15y

200 * (yield[DBR 0 08/15/31 Govt]-0.7*yield[DBR 0 02/15/30 Govt]-0.3*yield[DBR 0 05/15/35 Govt])

Which continues to do very well

Conclusion

15y not cheap enough in an acceptable structure

And as a short in a 7s 10s 14s structure the location isn’t great

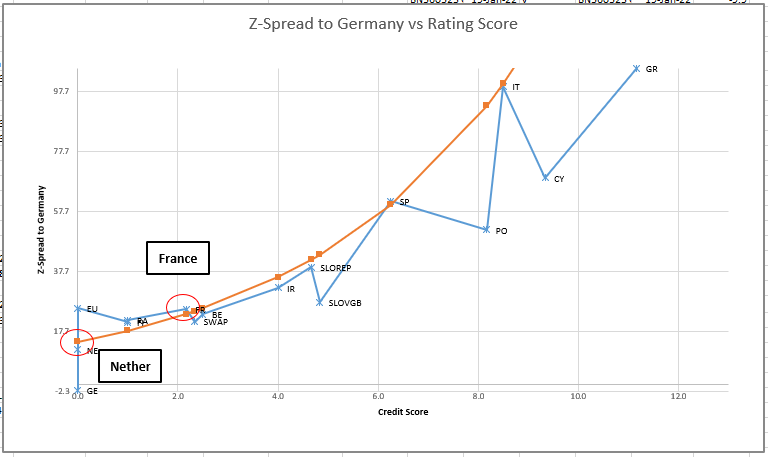

Holland cheap on ‘Credit Blend’ vs Other countries

- Holland is a Triple A issuer without the supply issues that say EU has – the next issue is set for 31st August according the DSL issuance calendar

Holland has drifted cheaper vs a regressed blend of Germany and France of late…

(regression of Changes

Trade

Nether Jul30 vs Regressed RXU1 & OATU1 – if you’d like the weightings pls ask

Levels

Enter: +9bp and +10g

Target +5.5bp

1 Bond plus two futures means lower friction costs than many of these credit flys

Country Spreads vs Rating – credit spread vs credit rating curve – slope is very flat in the better credits

If we plot ‘Spread to Germany’ vs ‘Rating Score’ (proprietary combination of Rating and Outlook amalgamated for three Rating Agencies)

we see the following

The spread curve is very flat in the short end – the relative give up from France to Holland is at it’s recent lows vs the spread of France to Germany

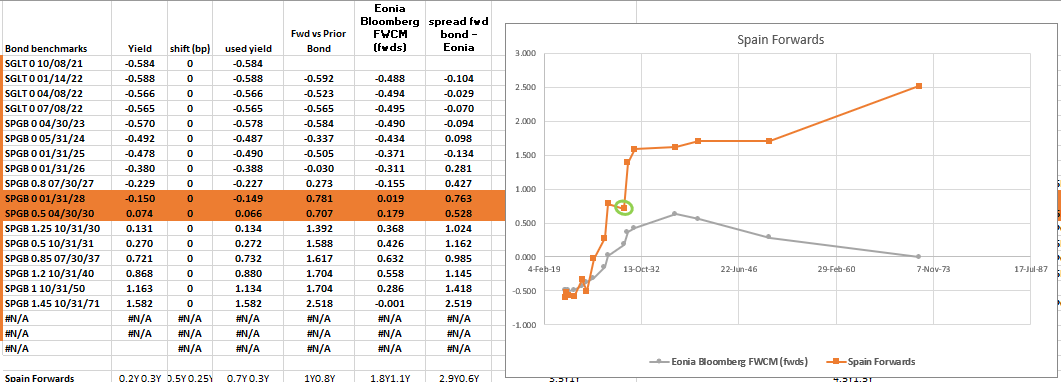

Spanish OIS spreads have richened significantly over the last 3 trading sessions

-SP210[ES0000012F76 Corp] (SP210 = swap spread)

We’re still looking for longer tenor steepeners, so maybe we can have a steepener vs Eonia that will benefit from a widening…

We see the forward from 7y Spain to 9y as one of the closest to Eonia…

Trade – Sell Spain 9y vs 7y vs OIS

Levels:

Current: -9.3bp

Enter: > -7bp

Bit optimistic – but at this level then that curve is just plain wring – and in the new paradigm of more ‘Macro’ levels for RV finding – that’s my entry point – if it doesn’t get there – then let everyone else make a giant horse race out of High Friction / Low Var RV

(P2509[SPGB 0.5 04/30/30 Corp] - P2509[SPGB 0 01/31/28 Corp])

Old 15y Italy rich vs On the run 15y and 10y

At first it that there’s no limit to how rich the highs coupons in Italy can get – in regular yield space we see the following: that the high coupons trade richest, the medium coupons trade better and the low coupons trade the worst

This can lead us to question our valuation strategy – we end up thinking there’s no limit to how cheap the low coupons can be

Italy high / Medium and Low coupons anomalies vs fitted Yield

Graph

It’s not we don’t know that gets us into trouble – it’s what we know for sure, that just ain’t so’ – Mark Twain

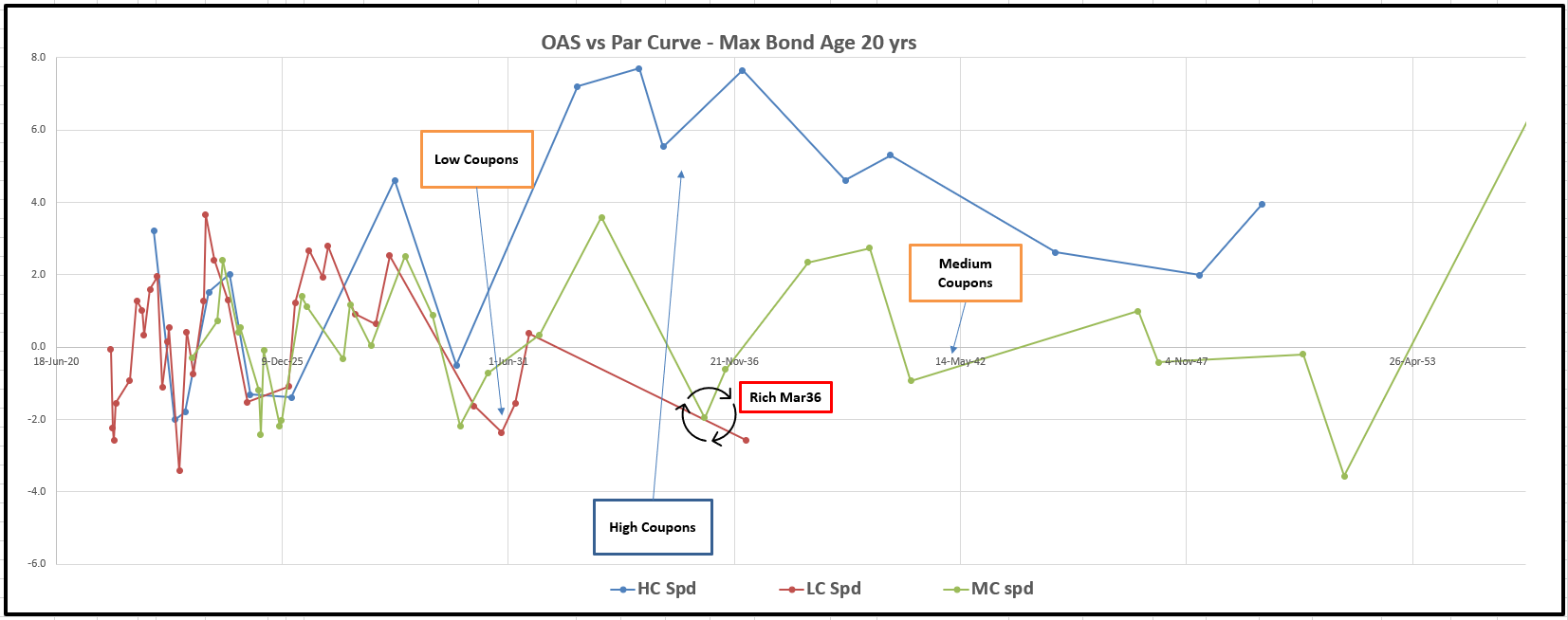

These high coupons have not ‘disappeared’ as we might conclude – it’s just that to a holder – they still aren’t rich – if you’re a cash investor – even if you’re the PEPP, you need a return on CASH, not on leverage– and so, in the context of Italian Govt Bonds, then we need to discount all the Cash-Flows versus a smooth zero curve in order to make proper comparisons

When we do that – IT ALL MAKES SENSE

Graph of anomalies using Cash-Flow discounting vs Smooth Zero Curve

Now we see that the market pricing much more sense – High coupons are still cheap to the Cash investor and low coupons are still rich (except in the sub10y sector where they are equal) – so a good trade is only where High or Medium coupons are rich on this fully adjusted metric – see Btps Mar36

So what’s a good trade? – so we want to sell rich bonds under this metric… and it’s best in a longer tenor where the probability of some risky event may still occur, such as a elections fears (Italy has had 66 Governments since WW2 – one every 1.14 yrs – google)

Highlighted on the graph is the genuinely rich 1.45% Mar36

Sell 1.45% Btps Mar36

Buy 0.95% Mar37 & Buy Btps 0.95% 12/31

cix:

(+2.0*yield[BTPS 1.45 03/01/36 Govt ]-0.3 * yield[ IT0005449969 Govt]-1.7 * yield[BTPS 0.95 03/01/37 Govt])*100

Here’s a fly using the Shorter Aug31 on the short wing for more history

(+2.0*yield[BTPS 1.45 03/01/36 Govt ]-0.3 * yield[IT0005436693 Govt]-1.7 * yield[BTPS 0.95 03/01/37 Govt])*100

Levels:

Current: -3.5bp

Enter: -3.25bp (25%)

Add: -4bp

Target: -1bp

Carry

So this IS a take out cash structure of approx 2% - so we cannot expect positive carry

@ flat repo spread it’s -0.2bp /3mo

@ -5bp repo spread it -0.4bp /3mo

Guess what else is truly rich? – IKU1, but that’s another story 😊

Best,

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND UPDATE SPECIAL : ALTHOUGH THE BOND YIELD DROP HAS STOPPED IT IS ONLY A “PAUSE” GIVEN THE TRAILING 50 AND 100 DAY MOVING AVERAGE RESISTANCE.

BOND UPDATE SPECIAL : ALTHOUGH THE BOND YIELD DROP HAS STOPPED IT IS ONLY A “PAUSE” GIVEN THE TRAILING 50 AND 100 DAY MOVING AVERAGE RESISTANCE.

THE SAME APPLIES TO THE CURVES THEY TOO ARE SUB ALL MAJOR MOVING AVERAGES AND TRENDING FLATTER.

***US 5YR HELD ITS 200 DAY MOVING AVERAGE 0.6163 YESTERDAY SO LETS SEE HOW LONG BEFORE IT IS RE BREACHED GIVEN IT TOOK 11 DAYS ON US 30YR AND 7 DAYS ON US10YR. ***

WE HAVE NOW BREACHED THE 200 DAY MOVING AVERAGES ON US 30 AND 10YR SO WE HAVE SIGNALLED THE START OF A VERY VERY “MAJOR” YIELD DROP. THIS IS CERTAINLY SOMETHING WORTH CONTEMPLATING LOOKING AT THE PREVIOUS OCCAISION THIS HAPPENED. WE ARE CLOSE TO REPLICATING 2018-2019 WHERE ALL CROSSED OVER THUS A SIGNIFICANT QUARTER-CLOSE!

THE LAST TIME THE 50-100-200 DAYS CROSSED WAS INITIATED IN EARLY 2019, THAT DROP DID NOT HALT UNTIL THE MOVING AVERAGES RE-CROSSED IN DECEMBER 2020!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

US BREAKEVENS : WE HAVE ARE NOW GENERATING A “VERY TERMINAL” FORMATIONS, WE WILL NOT SEE THESE HIGHS FOR MANY YEARS.

US BREAKEVENS : WE HAVE ARE NOW GENERATING A “VERY TERMINAL” FORMATIONS, WE WILL NOT SEE THESE HIGHS FOR MANY YEARS. THE HISTORICAL-TECHNICAL PICTURE LOOKS VERY”POOR-GLOOMY”. THE MONTHLY RSI ARE 2004, 2000 AND NEVER BEFORE WITNESSED!

A PRETTY NASTY REVERSAL ON THE MONTH NOW WITH “SIGNIFICANT” ROOM TO HEAD LOWER, CREATING A SERIES OF MULTI YEAR HIGHS!

THESE WEEKLY RSI’S REPLICATE BOND YIELDS I.E. THEY ARE IN A NEUTRAL STATE.

*** SIMILAR TO THE BOND YIELD CHARTS THE 30YR BREAKEVEN IS TESTING IT 200 DAY MOVING AVERAGE 2.1243 AND WE CERTAINLY KNOW WHAT HAPPENED NEXT!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BOND UPDATE SPECIAL : MANY HAVE ASKED OF LATE WHEN DO YIELD “STOP” FALLING AND RSI WISE WE HAVE ZERO NOTABLE DISLOCATIONS.

BOND UPDATE SPECIAL : MANY HAVE ASKED OF LATE WHEN DO YIELD “STOP” FALLING AND RSI WISE WE HAVE ZERO NOTABLE DISLOCATIONS.

THE US 5YR IS POISED TO JOIN OTHER PARTS OF THE CURVE AS IT APPROACHES ITS 200 DAY MOVING AVERAGE 0.6139. IT MIGHT BE WORTH REMEBERING BOTH THE US 30YR AND 10YR HELD THEIR 200 DAY MOVING AVERAGES FIRST TIME DOWN.

***CTA’S WILL PERSIST IN BUYING NEW BOND HIGHS ESPECIALLY GIVEN THE RSI DISLOCATIONS ARE LAME. BIG WORRY IS IF BREAKEVENS AND STOCKS FALL! ***

WE HAVE NOW BREACHED THE 200 DAY MOVING AVERAGES ON US 30 AND 10YR SO WE HAVE SIGNALLED THE START OF A VERY VERY “MAJOR” YIELD DROP.

THIS IS CERTAINLY SOMETHING WORTH CONTEMPLATING LOOKING AT THE PREVIOUS OCCAISION THIS HAPPENED. WE ARE CLOSE TO REPLICATING 2018-2019 WHERE ALL CROSSED OVER THUS A SIGNIFICANT QUARTER-CLOSE!

THE LAST TIME THE 50-100-200 DAYS CROSSED WAS INITIATED IN EARLY 2019, THAT DROP DID NOT HALT UNTIL THE MOVING AVERAGES RE-CROSSED IN DECEMBER 2020!

DBR 46 POISED TO BREACH ITS 200 DAY MOVING AVERAGE 163.74.

***BIG QUESTION “REMAINS” IS IF YIELDS FALL SIGNIFICANTLY WHERE DOES THAT LEAVE STOCKS AND BREAKEVENS? BREAKEVENS TECHNICALLY-HISTORICALLY ARE ALSO FAILING ON “RARE” SEEN RSI DISLOCATIONS.***

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

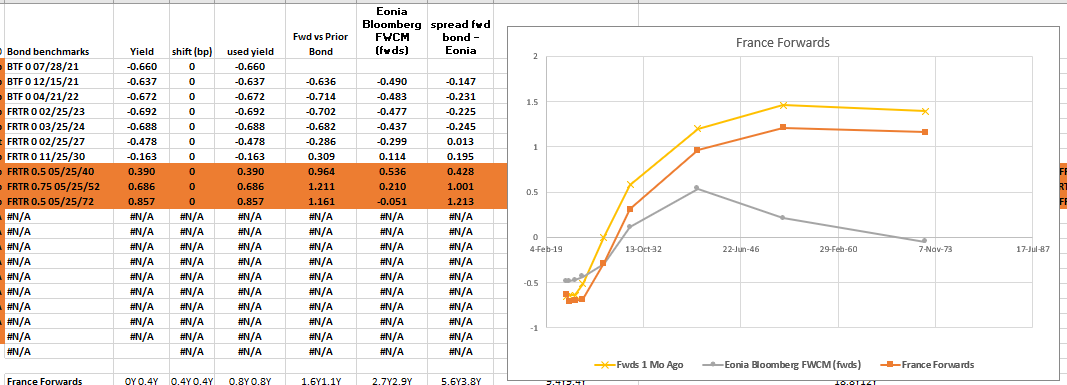

where we gonna remove curvature next?

I was just looking at French Forward rates after the rally in EGBs

And TBH there’s no stand out point that looks wholly wrong – so if we think about what actually happened in terms of Rate expectations we need top look at forward rates

Forwards

Forward give us a clearer view of the path of rates rather than looking at yields – which are an average return over the lifetime of a bond – rather than from Time A to Time B

Graph: French Forwards (actual bond Forwards, not CMB) Current vs 1 Month ago

From the Graph we’ve removed fwd yield across the board – in terms of forwards its been fairly orderly – although the scope to cut yields / forwards in the short end is fairly limited

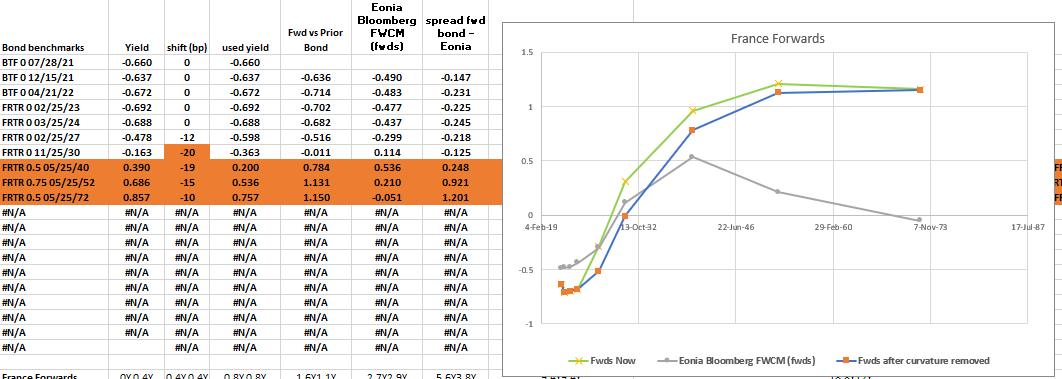

so to me it seems reasonable that if we reduce the extent and of hikes and push back their timing we could go this sort of curve shape….

Graph of Forwards for possible outcome in France

Green: forwards now

Blue: forwards after the following changes…

5y: -12bp

10y: -20bp

20y: -19bp

30y: -15bp

50y: -10bp

So what we’re saying is that for forwards to continue to represent a more accommodative stance wit ha delayed reaction function to a ‘2% target’ rather than ‘below 2%’ then I read that as aone similar to the road map change from the US last year

That in effect the target isn’t inflation perse – but it is it’s accumulation, its average or even its integral over time – as inflation (although I think they are loathed to admit it) is their way out

Corollary

So bullets in EGB in the 10y space could well continue to outperform 5s and 10s or even more extremely 2s and 50s

Lets take a look at RV in France – luckily the 10y trades cheap but counterintuitively we’re gonna buy an old, higher coupon issue – we’re gonna go for a bond that actually is cheap it just doesn’t seem so

it’s the Frtr 1.5% May31 €49,1Bln issue it came in 2015 as an original 15y bond – so it’s aged and it’s reasonable to assume it has both been stripped and it gets to be CTD to the OAT contract in December

finally I want to hedge my generic curve risk out using Eonia – there’s be nothing worse than being bullish at the top – or having a good idea at letting the macro moves sweep it away

So looking at

-Frtr May27 + Frtr May31 – Frtr May36

1 / 2 / 1 : all vs OIS

2 * (P2509[FRTR 1.5 05/25/31 Corp] + -0.5 * P2509[FRTR 1.25 05/25/36 Corp] + -0.5 * P2509[FRTR 1 05/25/27 Corp])

Lvls

Small just above here : +3.5bp

Full Add: > +4bp

target: < 0bp

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

US BREAKEVENS ...A PRETTY NASTY REVERSAL ON THE MONTH NOW WITH “SIGNIFICANT” ROOM TO HEAD LOWER, CREATING A SERIES OF MULTI YEAR HIGHS!

US BREAKEVENS : A PRETTY NASTY REVERSAL ON THE MONTH NOW WITH “SIGNIFICANT” ROOM TO HEAD LOWER, CREATING A SERIES OF MULTI YEAR HIGHS!

WE HAVE NOW SOME “LONGTERM” TOPS IN PLAY BUT IT IS IMPERATIVE THE LATEST BOUNCE STALLS HERE AT THE DAILY 50-100 DAY MOVING AVERAGES!

THESE WEEKLY RSI’S REPLICATE BOND YIELDS I.E. THEY ARE IN A NEUTRAL STATE.

THERE IS CHANCE WE DON’T SEE THESE “LEVELS” FOR MANY YEARS TO COME BASED ON THE HISTORICAL-TECHNICAL PICTURE.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris