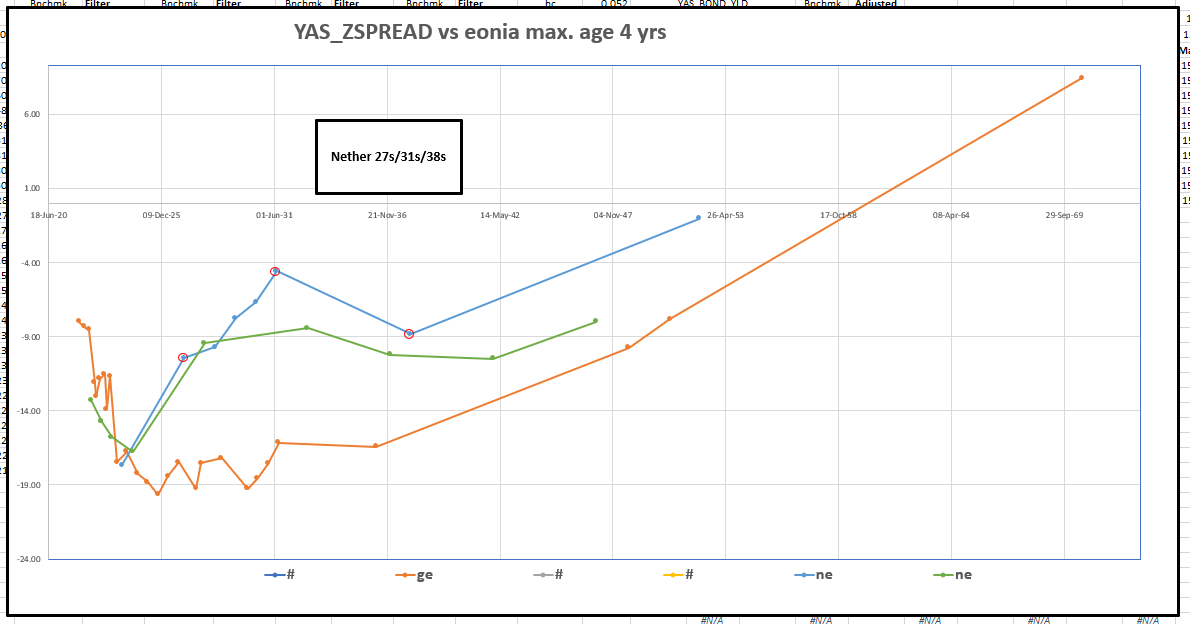

+PC3 in Nether

Looking at Nether vs Europe in Z-spread space – the 10y point is quite pointedly high

Orange – Germany

Blue - Nether Recent Issues

Green – Nether High coupons

From history…

I force the regression to be Duration Matched

buy Nether 31 vs sell jan27 and jan38

-0.4 / 1 / -0.6 (all x2 to normalise vs 1/2/1 flys)

cix: 2 * (YIELD[NETHER 0 07/15/31 Corp] + -0.6 * YIELD[NETHER 0 01/15/38 Corp] + -0.4 * YIELD[NETHER 0 01/15/27 Corp])

Graph…

Levels

Am thinking here – or perhaps 1bp cheaper want to have some of this – essentially PC3 (curvature) long

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Spanish 30y supply

Spanish 30y – my preference on any further steepening is to do look at Spgb 9s20s curve

Makes me like Spain -9y +20y on regression – see 20y as a bit cheaper

-Apr30 (90%) +oct40 (100%)

net delta long 10%

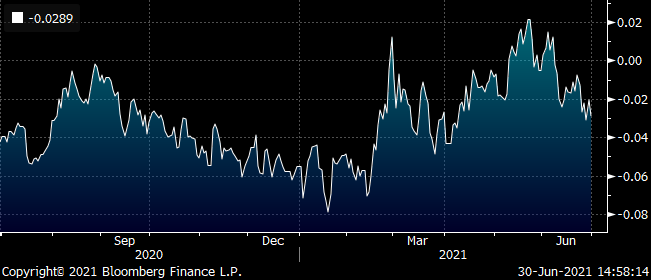

index looks like this

100 * ((YIELD[SPGB 1.2 10/31/40 Corp] - 0.9 * YIELD[SPGB 0.5 04/30/30 Corp]))

Anything over 88 looks decent discount given the current vol

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

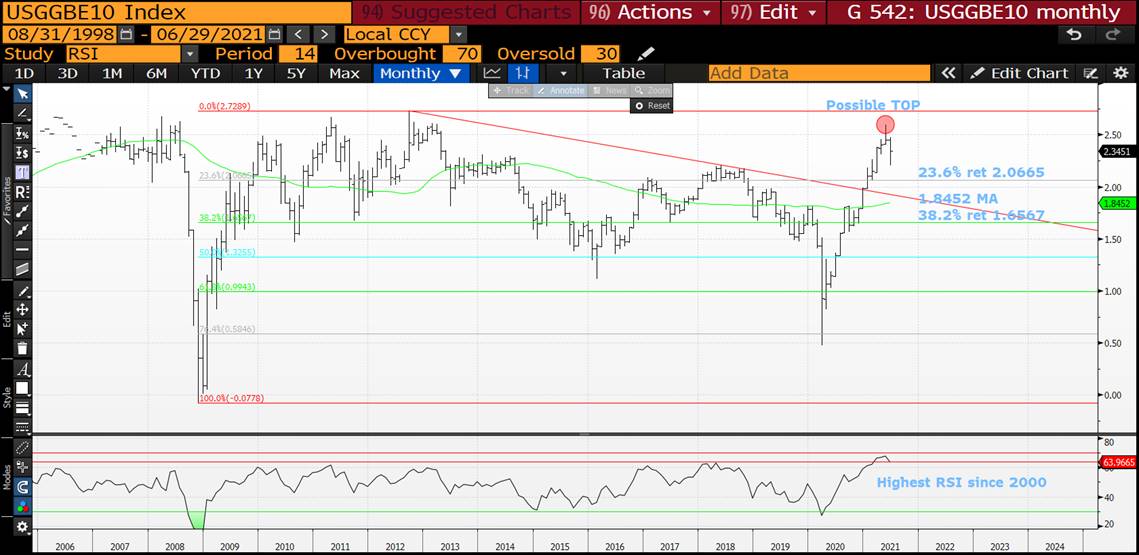

Auction Preview - Spain

Spain to tap the following bonds tomorrow:

0% 1/26

1.4% 4/2028

1% 10/2050

Total size is 4-5bn

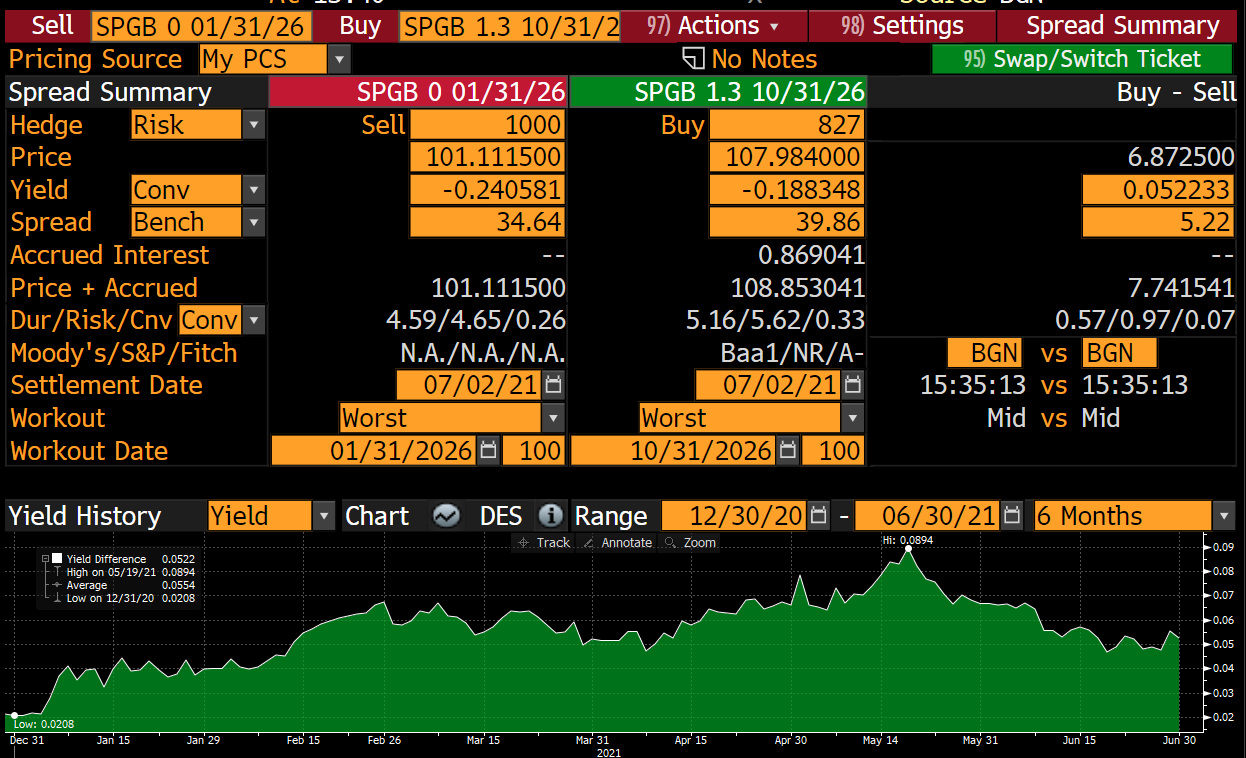

SPGB 1/26

- 1/26 is cheap and on the run.

- Still a good few taps to go

- At these levels we don't mind some steepening gaps in the front end

Trade: Buy SPGB 1/26 vs Selling SPGB 10/26

And on z-spread:

SPGB 4/28

- Frankly there are cheaper bonds to buy, so we will leave this one alone

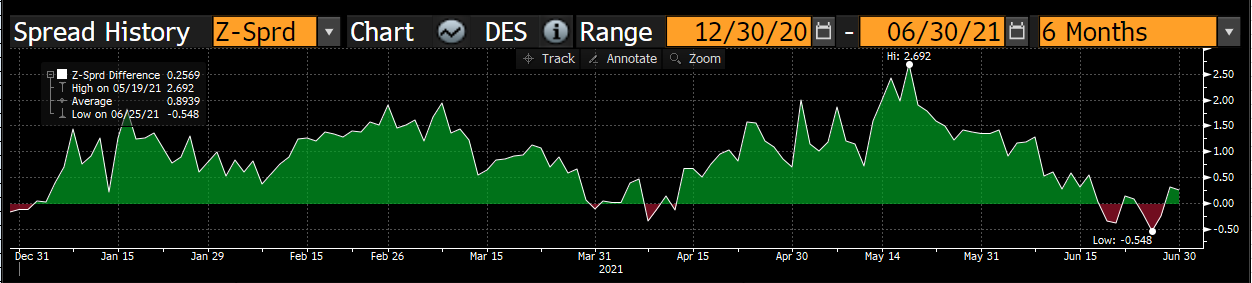

SPGB 10/50

- Long end Spain has lagged the tightening seen in other issuers, most notably France

- There is an argument that the 10/50 should be well supported into year end given that the Tesoro has only got room for one more syndication and it looks highly likely that will be a 20y Green bond.

- Conversely France will be syndicating a new 30y any time from the beginning of July onwards

Sell FRTR 5/50 -> SPGB 10/50

- If you don't like the credit risk then a little IK/RX should do the trick as Italy has done well recently

- Note also that Spain has a 22bn redemption at the end of the month

![]()

Will Scott

O: +44 (0) 203 – 143 - 4171

M: +44 (0) 789 – 441 - 7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: US: 60 Rumson rd, rumson, nj 07760

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

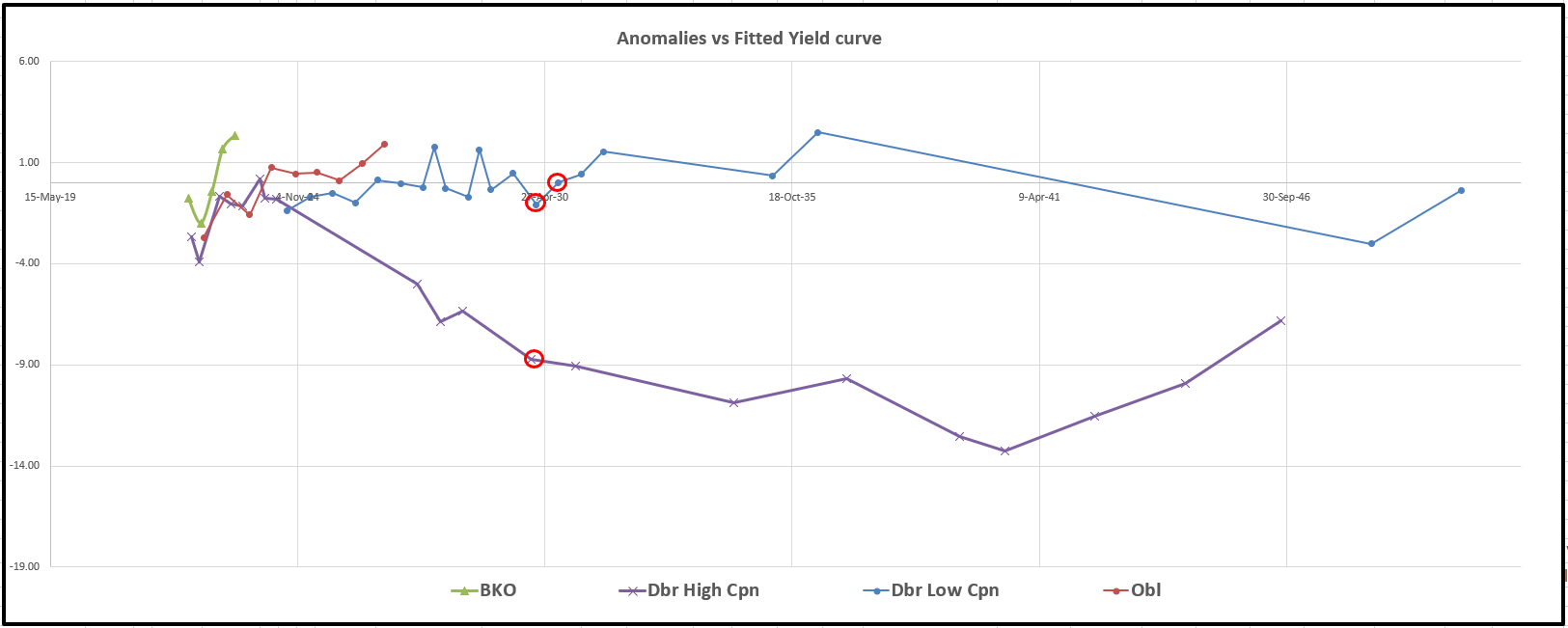

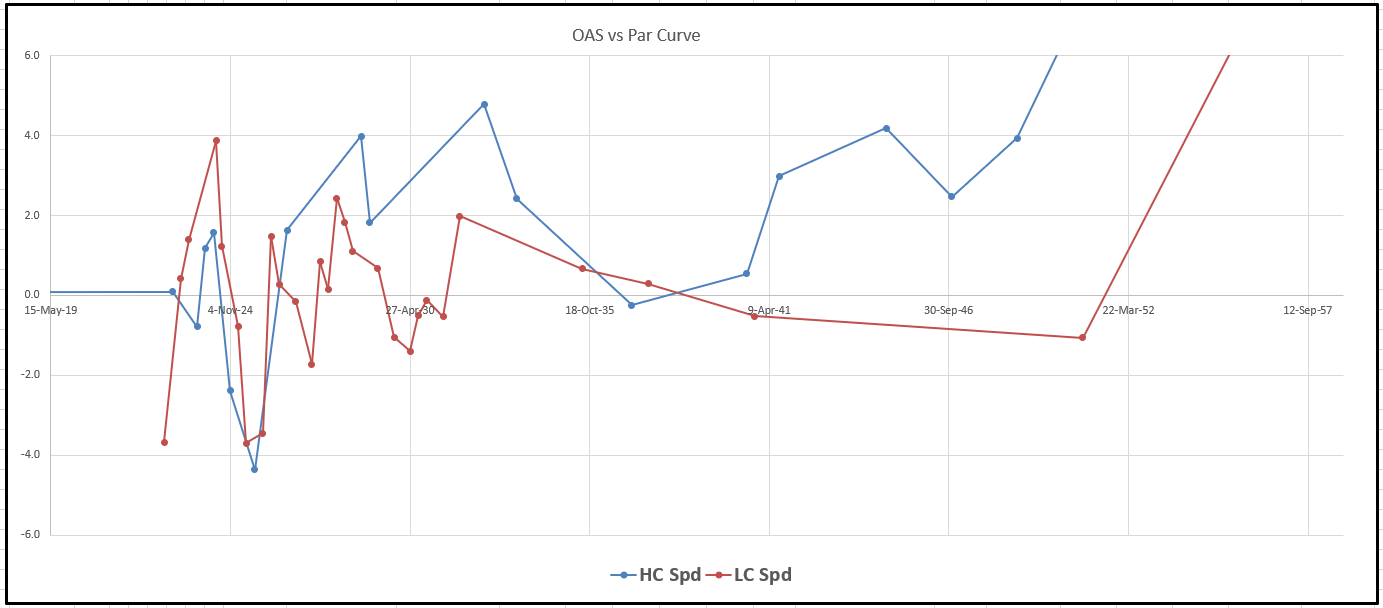

High coupons rich in Europe?....

Why is a rich bond rich to us?

'Cos to someone else it's cheap

Generally, The high coupons throughout Europe trade on lower yields vs their interpolated par-bond, local equivalents

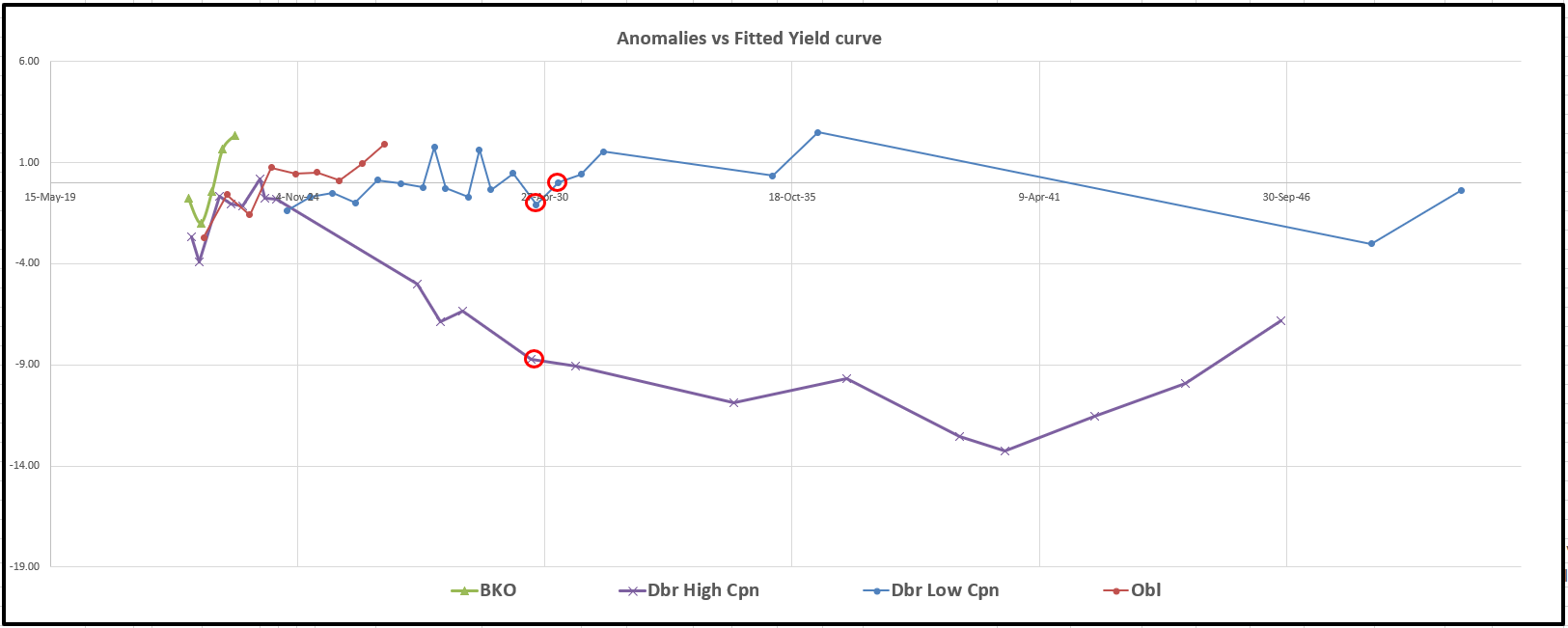

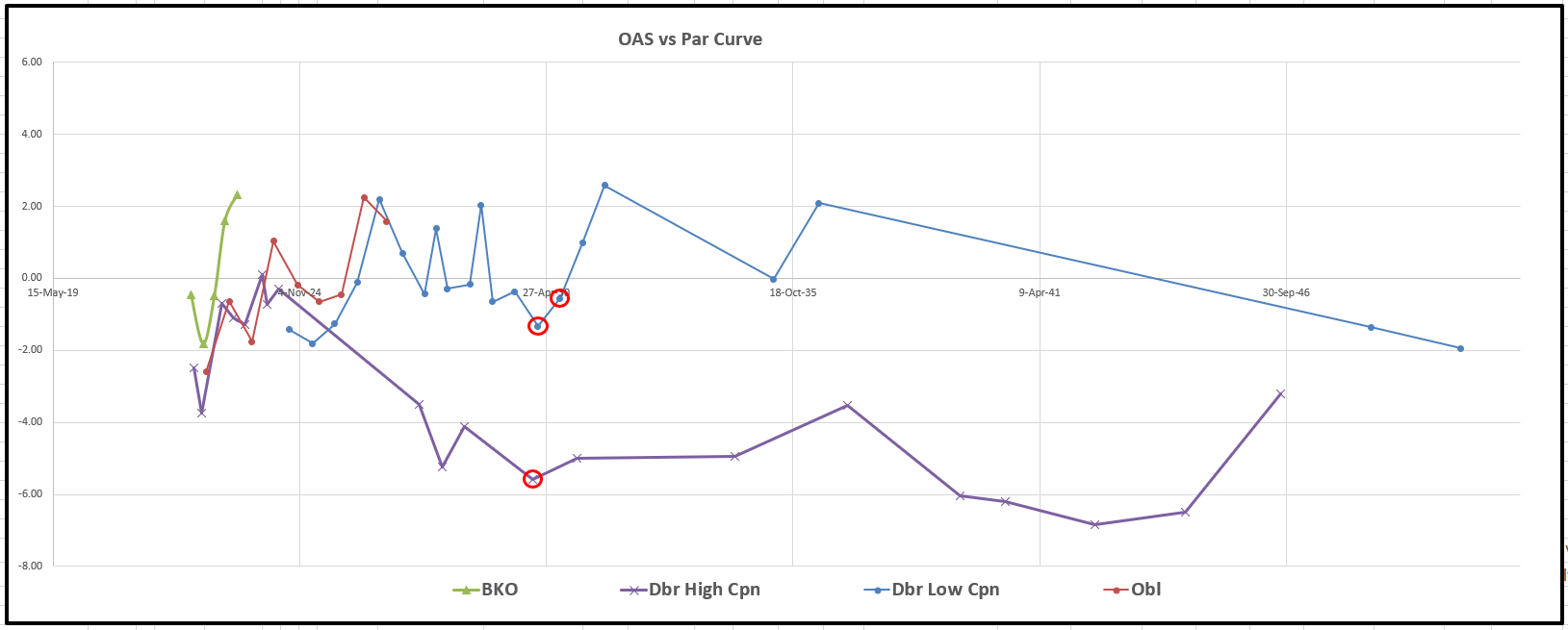

Germany – High vs Low Coupon anomalies

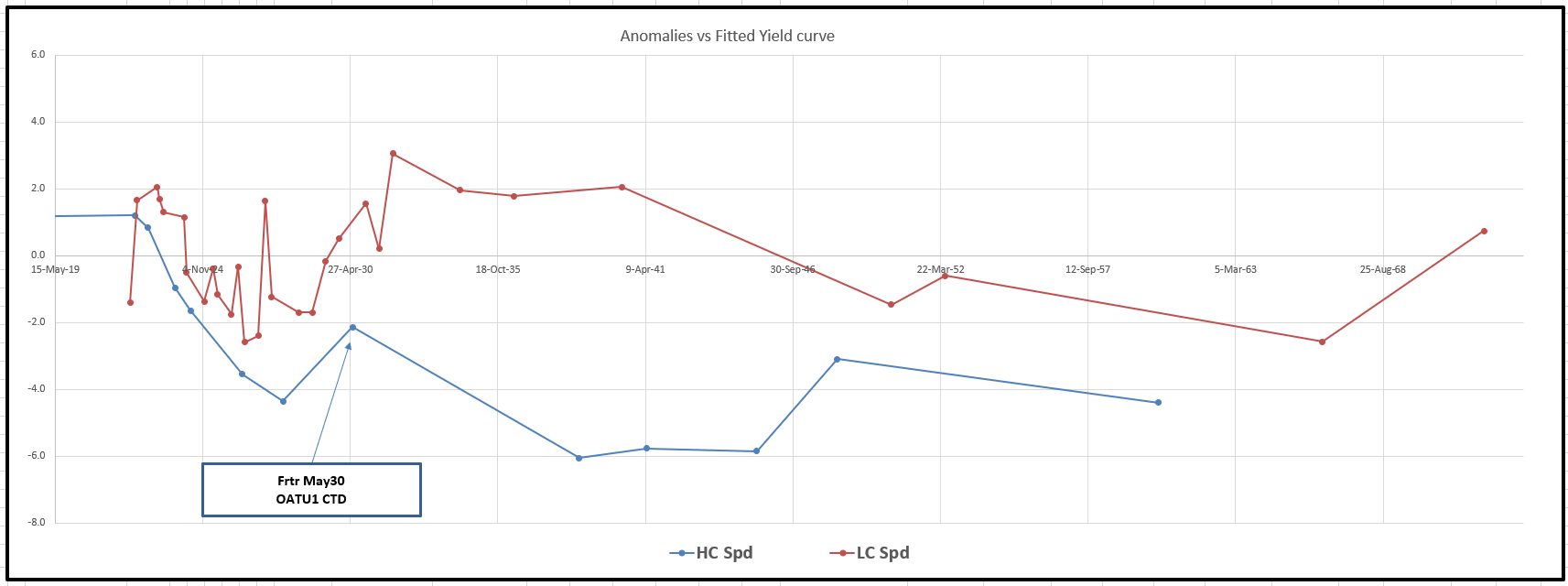

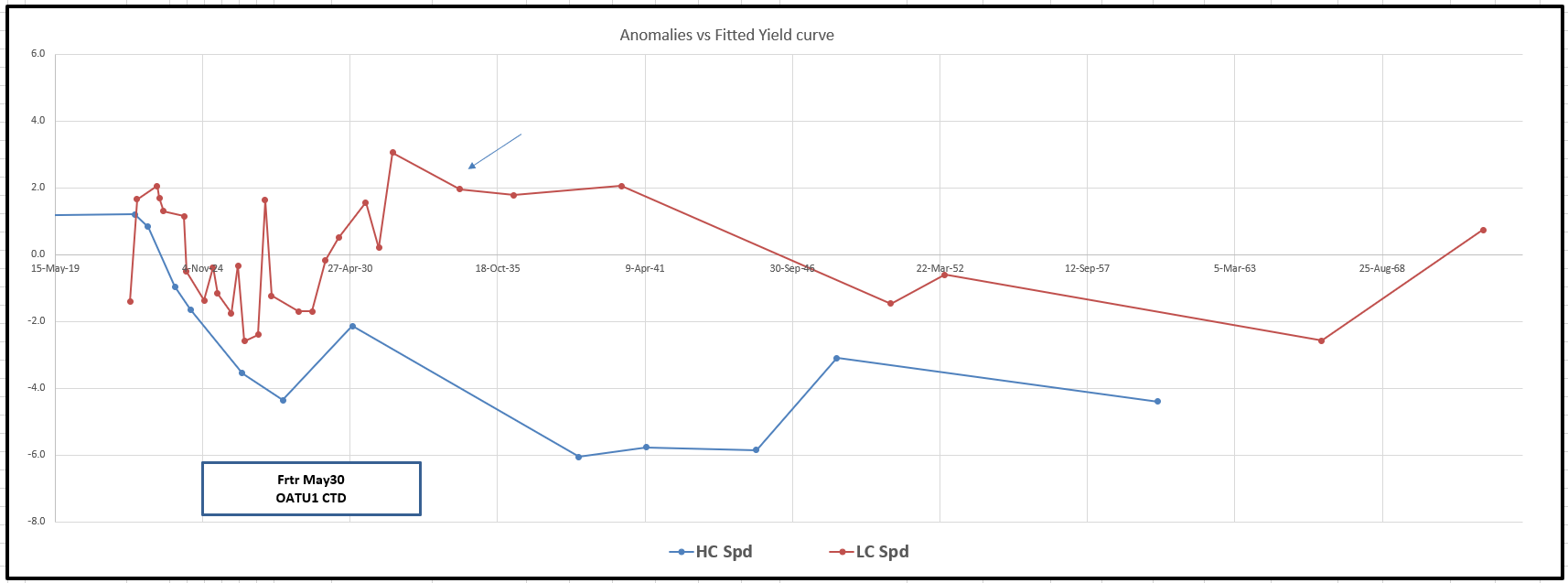

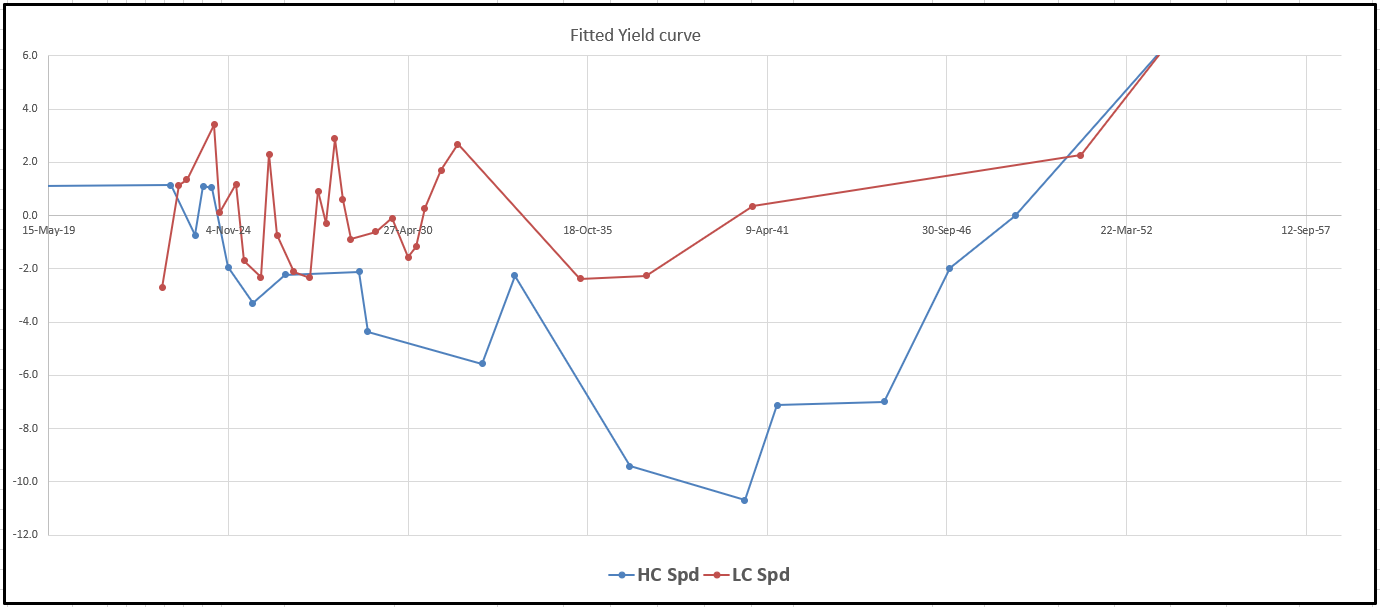

France – High vs Low Coupon anomalies

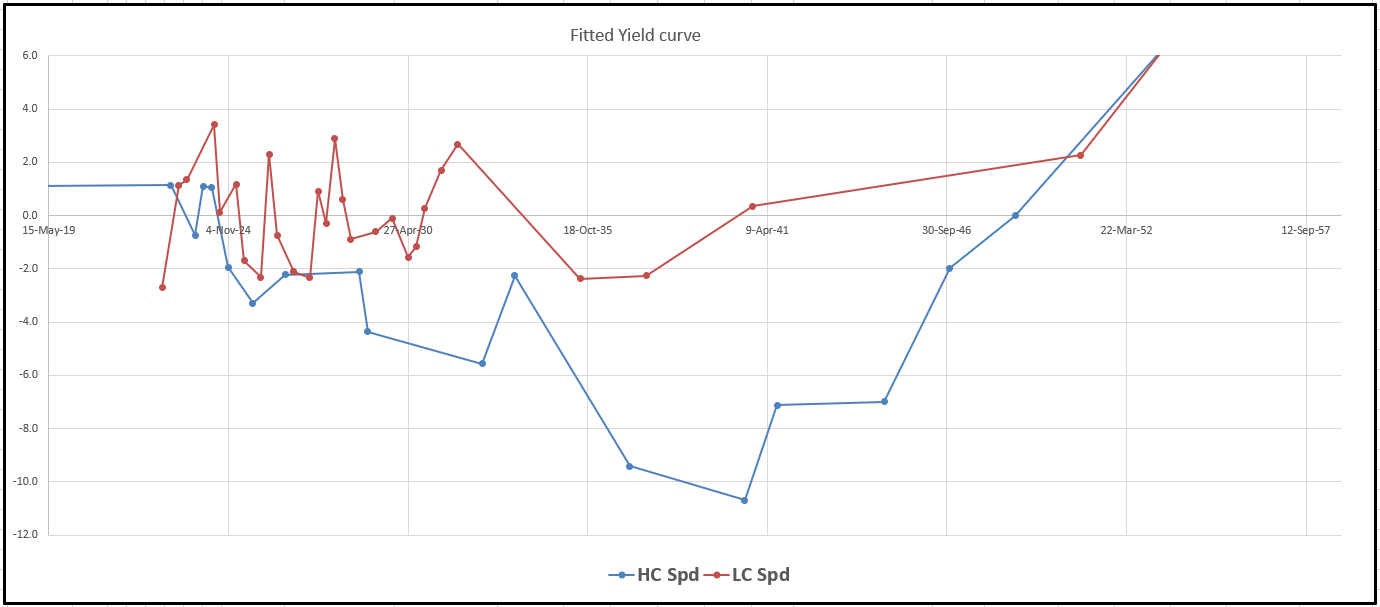

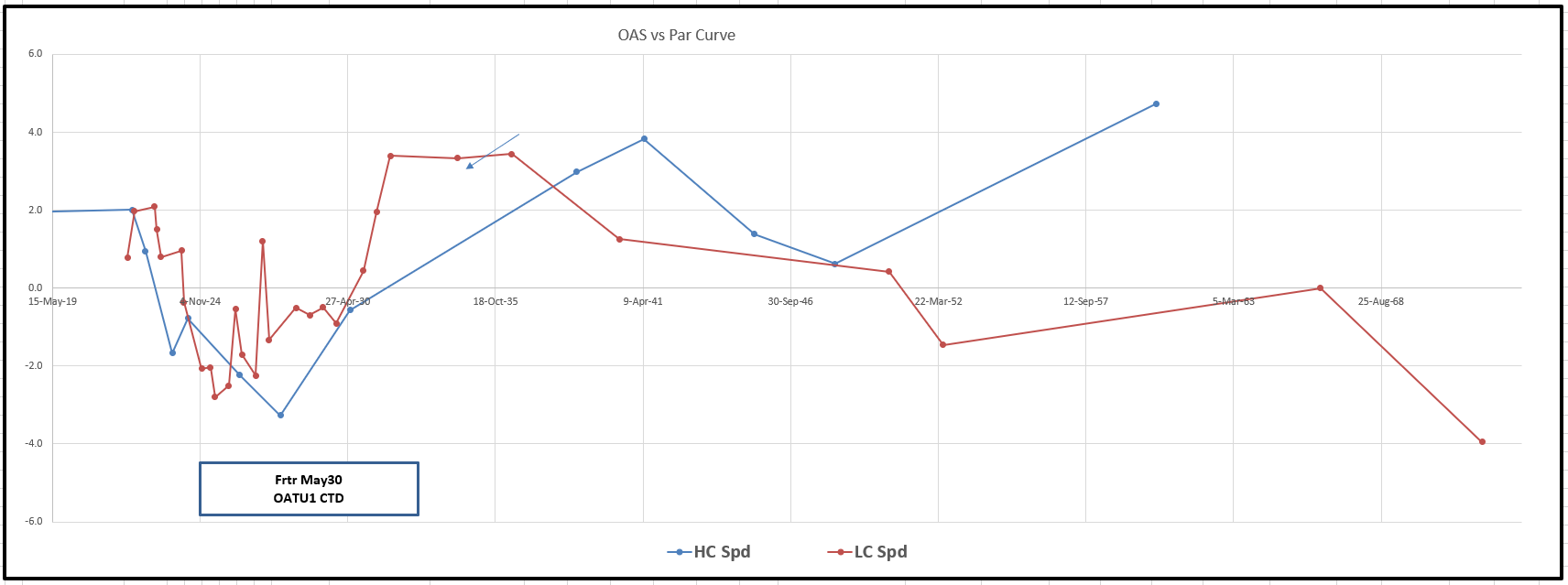

Spain - High vs Low Coupon anomalies

But this belies a problem that even Z-Spreads doesn't fully reveal – that High Coupon, low Modified Duration bonds in a steep yield curve have a lot more 'value' than is show by looking at the yield anomaly versus a fitted yield curve

We really need to Discount all the cashflows of each bond vs a fitted, smooth zero curve to extract a value of the high coupons vs low coupons.

When we do this we get a starkly different contrasting perspective of value in these issuers – and it's even more pointed in curves that are very steep vs the swaps curve – in that situation Z-Spread I woefully inadequate as it ascribes an 'average' spread to swaps of the bond's cashflows. Yet in credit risky issuers, particularly in the presence of PEPP – the spread to swaps of earlier cashflows is dramatically lower than later ones – so that means that high coupons are worth far more than even Z-spreads would display because we get our yield via earlier cashflows

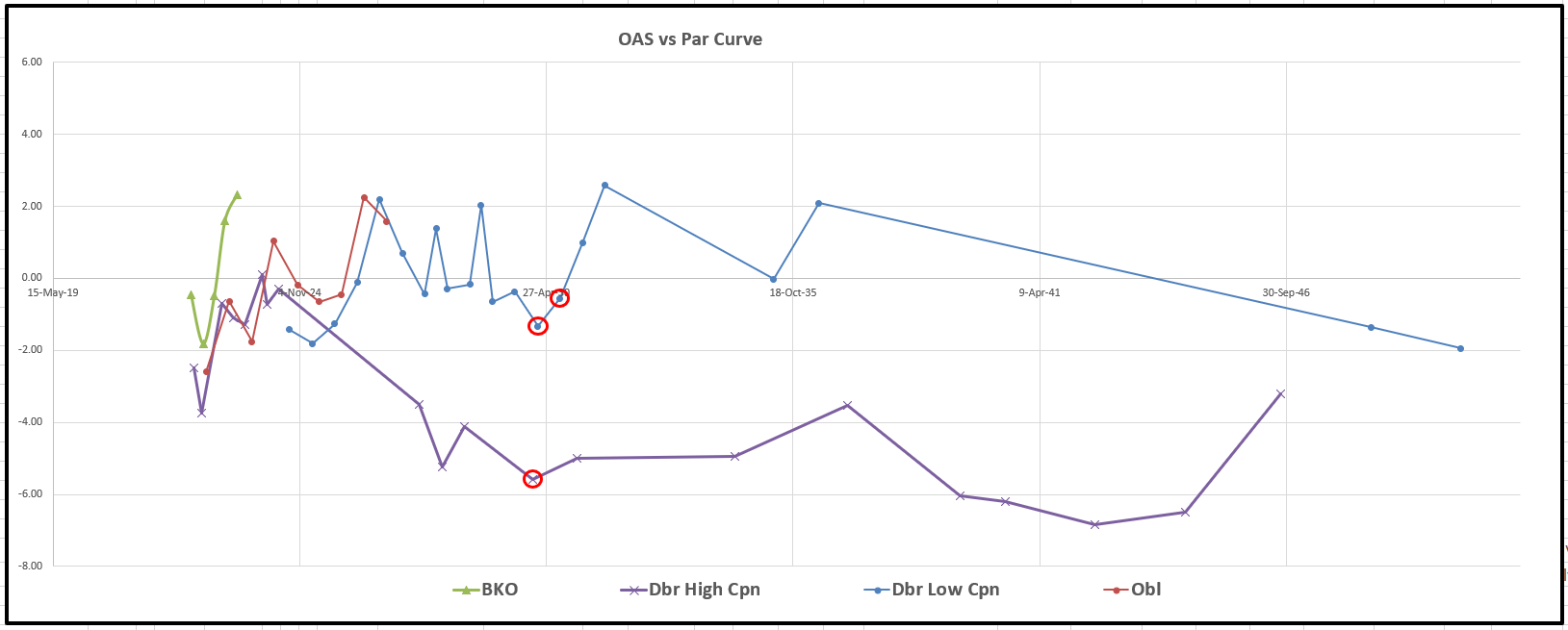

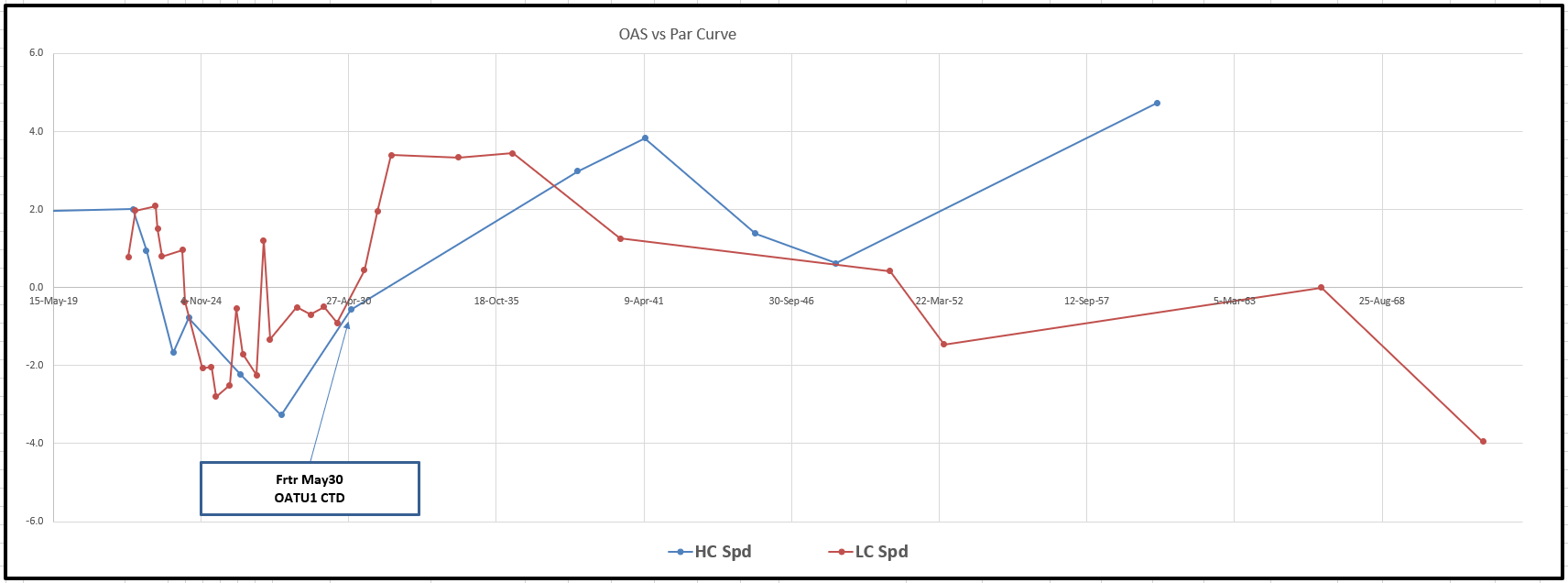

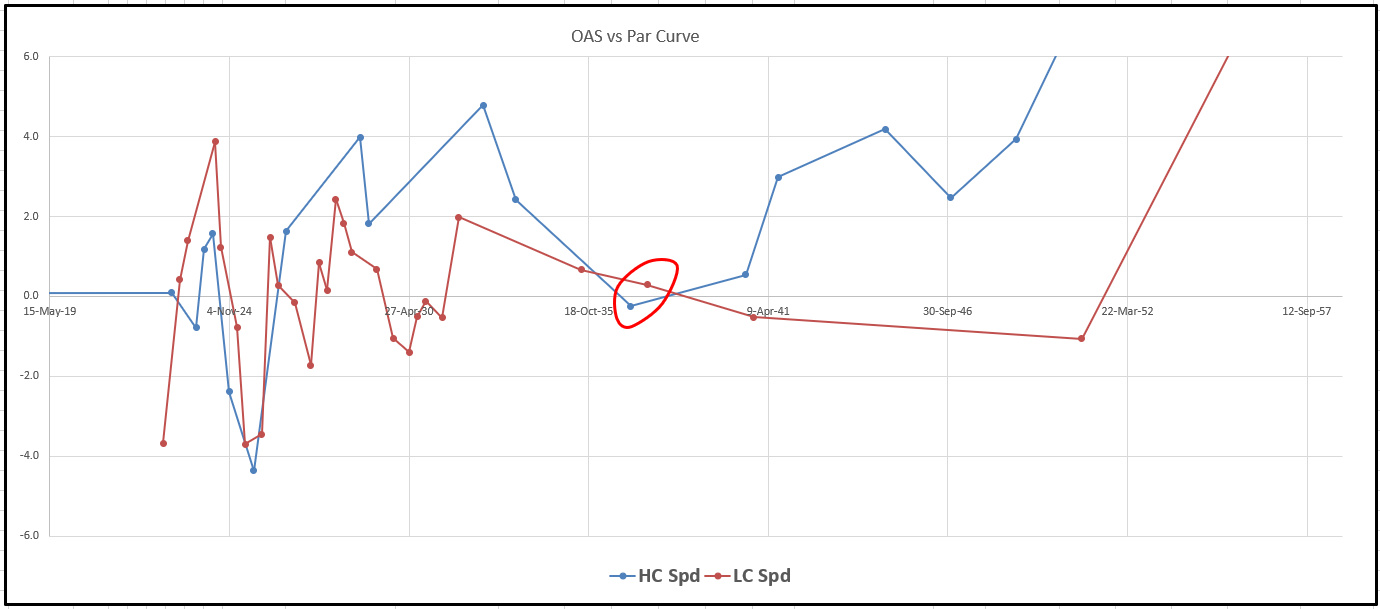

So now – take a look at how these curves look when we use a smoothed fitted zero curve for each of the issuers

Germany – High vs Low Coupon anomalies using OAS - the bonds are still rich – Dbr 6.25 Jan30 highlighted along with Dbr feb30 & Dbr Aug30 (CTD to RXU1)

France – High vs Low Coupon anomalies using OAS, generally high coupon France is not rich in the longer tenors. The exception being Frtr oct27. The May30 CTD to the OAT has 'hidden' cheapness that could cause it to squeeze like Oct27 and Apr26 did when they dropped out of the basket

Spain – High vs Low Coupon anomalies using OAS. Because of the steep curve and the very High coupons – the Spanish high coupons are still not rich except jan37

Conclusions

Spain High coupons

The only truly expensive Spanish high coupon is Spgb jan37 +13.8bp

-spgb jan37 +Spgb jul37 is the best high into low coupon trade

German High coupons – Dbr 6.25 1/30 are now finally, rich both on true value and on location vs History

-dbr 6.25 1/30 +dbr 0 Aug30 (CTD to RXU1)

Frtr May30 – high coupon CTD that rolls out of the basket and could richen dramatically..

We need to accumulate this thing as it could go missing after Sep delivery

Buy Frtr May30 vs Frtr May40 and Frtr Oct 27

weights: -0.7 / +1 / -0.3 (all x2 to compare with standard flys)

cix:

2*(yield[FRTR 2.5 05/25/30 Govt ] + -0.35 * yield[FRTR 0.5 05/25/40 Govt] + -0.75 * yield[FRTR 2.75 10/25/27 Govt])

I think this keeps going and is a real risk of richening further – I think I should have some but always be overjoyed to add at a much better location should the market afford such

Best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

High coupons rich in Europe?....

Why is a rich bond rich?

'Cos to someone it's cheap

Generally, The high coupons throughout Europe trade on lower yields vs their interpolated par-bond, local equivalents

Germany – High vs Low Coupon anomalies

France – High vs Low Coupon anomalies

Spain - High vs Low Coupon anomalies

But this belies a problem that even Z-Spreads doesn't fully reveal – that High Coupon, low Modified Duration bonds in a steep yield curve have a lot more 'value' than is show by looking at the yield anomaly versus a fitted yield curve

We really need to Discount all the cashflows of each bond vs a fitted, smooth zero curve to extract a value of the high coupons vs low coupons.

When we do this we get a starkly different contrasting perspective of value in these issuers – and it's even more pointed in curves that are very steep vs the swaps curve – in that situation Z-Spread I woefully inadequate as it ascribes an 'average' spread to swaps of the bond's cashflows. Yet in credit risky issuers, particularly in the presence of PEPP – the spread to swaps of earlier cashflows is dramatically lower than later ones – so that means that high coupons are worth far more than even Z-spreads would display because we get our yield via earlier cashflows

So now – take a look at how these curves look when we use a smoothed fitted zero curve for each of the issuers

Germany – High vs Low Coupon anomalies using OAS - the bonds are still rich – Dbr 6.25 Jan30 highlighted along with Dbr feb30 & Dbr Aug30 (CTD to RXU1)

France – High vs Low Coupon anomalies using OAS, generally high coupon France is not rich in the longer tenors. The exception being Frtr oct27. The May30 CTD to the OAT has 'hidden' cheapness that could cause it to squeeze like Oct27 and Apr26 did when they dropped out of the basket

Spain – High vs Low Coupon anomalies using OAS. Because of the steep curve and the very High coupons – the Spanish high coupons are still not rich except jan37

Conclusions

Spain High coupons

The only truly expensive Spanish high coupon is Spgb jan37 +13.8bp

-spgb jan37 +Spgb jul37 is the best high into low coupon trade

German High coupons – Dbr 6.25 1/30 are now finally, rich both on true value and on location vs History

-dbr 6.25 1/30 +dbr 0 Aug30 (CTD to RXU1)

Frtr May30 – high coupon CTD that rolls out of the basket and could richen dramatically..

We need to accumulate this thing as it could go missing after Sep delivery

Buy Frtr May30 vs Frtr May40 and Frtr Oct 27

weights: -0.7 / +1 / -0.3 (all x2 to compare with standard flys)

cix:

2*(yield[FRTR 2.5 05/25/30 Govt ] + -0.35 * yield[FRTR 0.5 05/25/40 Govt] + -0.75 * yield[FRTR 2.75 10/25/27 Govt])

I think this keeps going and is a real risk of richening further – I think I should have some but always be overjoyed to add at a much better location should the market afford such

Best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

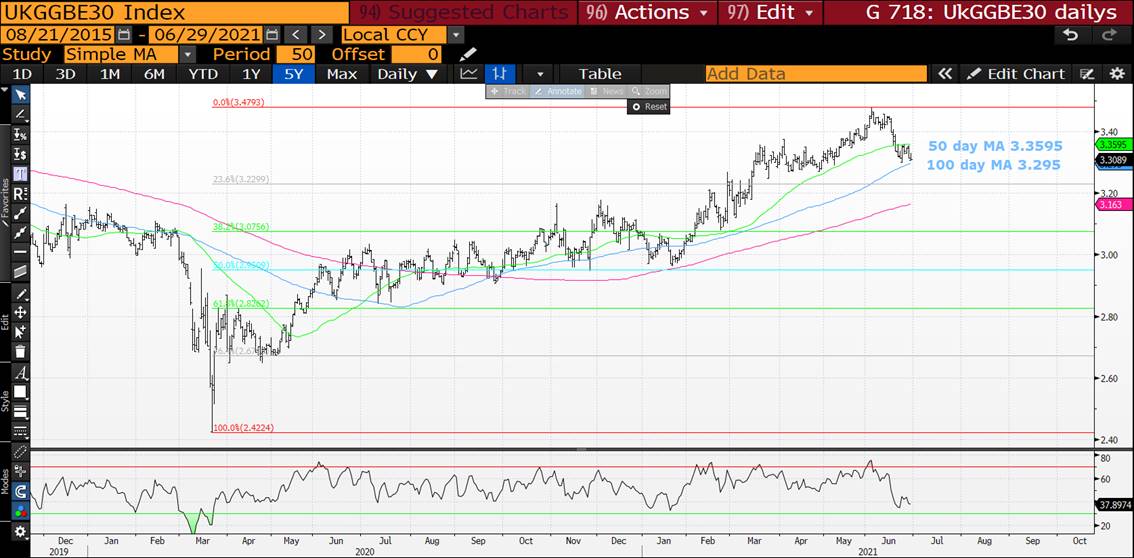

BOND UPDATE : IDEALLY BOND YIELDS FALL HARD TODAY INTO MONTH END GIVEN THIS IS THE “TREND”. THIS MONTH NO MAJOR LEVELS HAVE BEEN BREACHED TO OPPOSE IT.

BOND UPDATE : IDEALLY BOND YIELDS FALL HARD TODAY INTO MONTH END GIVEN THIS IS THE “TREND”. THIS MONTH NO MAJOR LEVELS HAVE BEEN BREACHED TO OPPOSE IT.

ADDITIONALLY BOND YIELD DAILY RSI’S DON’T HAVE THE SAME DISCLOCATIONS AS THE CURVE THUS CAN MOVE LOWER WITH EASE.

THE 30YR BOND YIELD STANDS OUT AS IT HAS HIT ITS 200 DAY MOVING AVERAGE 1.9442 HOWEVER WE ARE SUB THE “CROSSING” 50-100 DAY MOVING AVERAGES (PAGE 13).

BOND YIELDS HAVE BOUNCED HOWEVER ALL MONTHLY RSI CHARTS CONTINUE TO CALL FOR “LOWER” YIELDS.

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

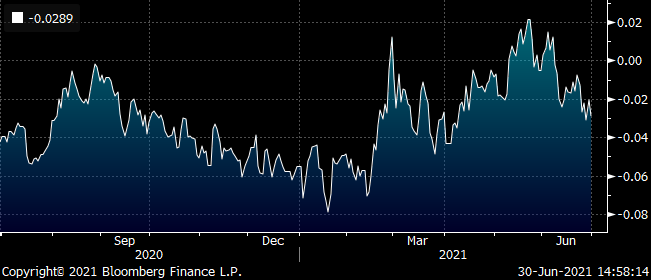

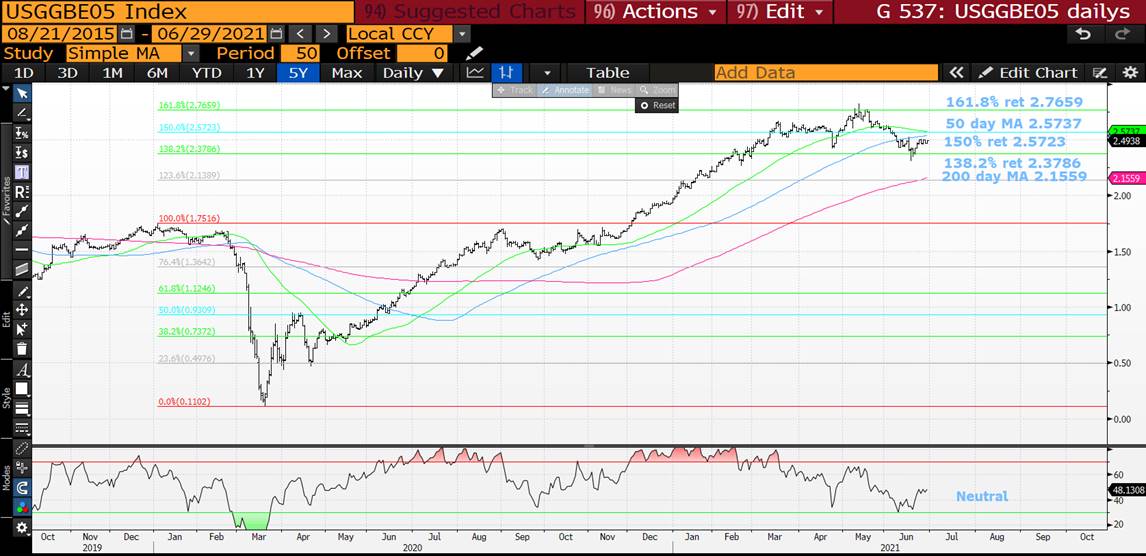

UK BREAKEVENS : THESE LOOK TO BE HEADING LOWER GIVEN THE DAILY CHARTS ARE SUB THEIR 50 DAY MOVING AVERAGES.

UK BREAKEVENS : THESE LOOK TO BE HEADING LOWER GIVEN THE DAILY CHARTS ARE SUB THEIR 50 DAY MOVING AVERAGES.

OBVIOUSLY NOT THE SAME RSI EXTENSION AS THE US BUT GREAT TECHNICAL FAILURE ON CHART 1, THE UK 30YR.

ALL DAILY CHARTS ARE SUB THEIR 50 DAY MOVING AVERAGES.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

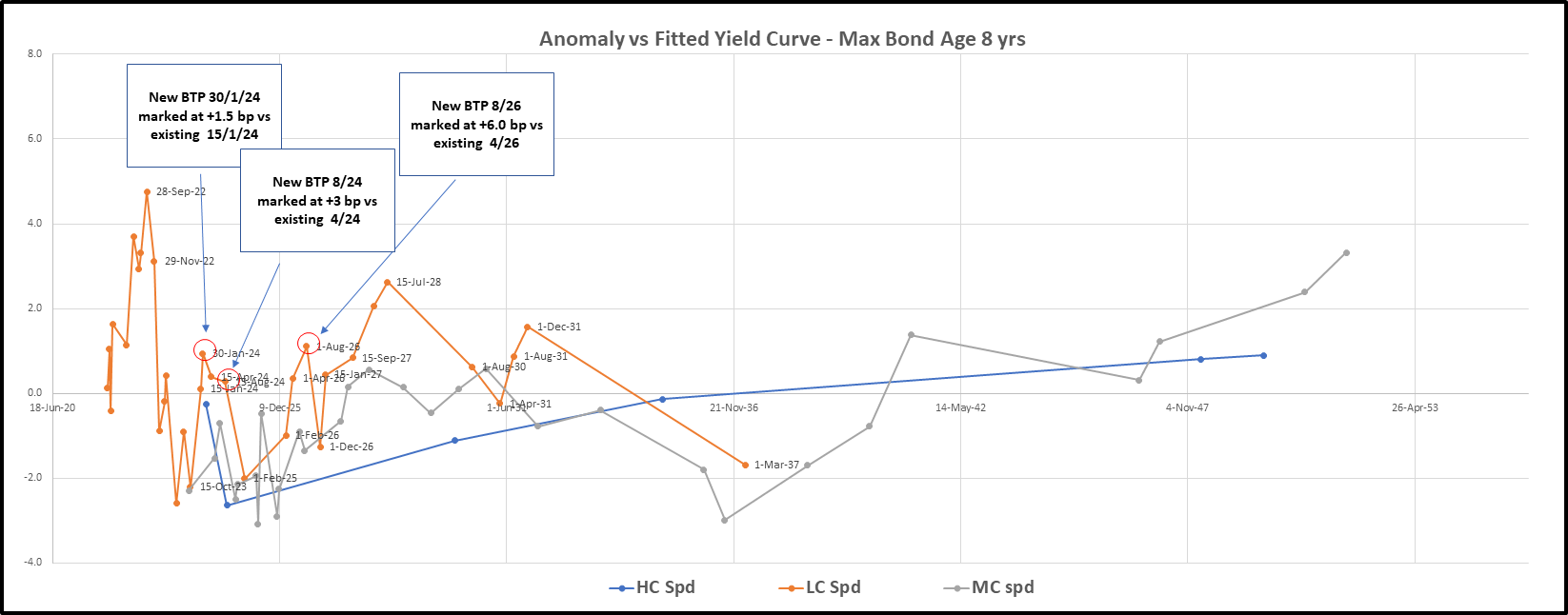

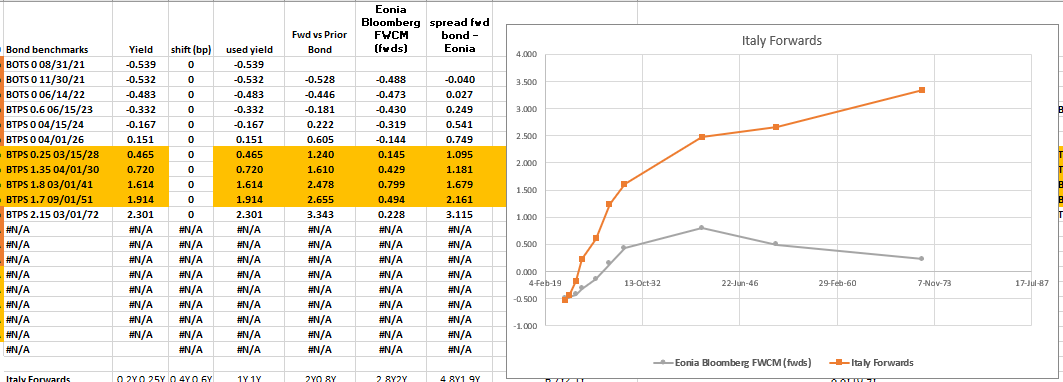

New front end BTP issues coming up / Q3 (assumed) supply calendar

Italian Q3 supply released last Friday gives us a slight shake up to front end issuance. Unexpected extra tap of the 11/22, longer than expected replacement of that bond (1/24) plus new 3y & 5y

We have put the new issues in our forward curves to get an estimated spread and then put the new issues into our curve fit.

- Lot of potential congestion in the 2024 sector – could put pressure on BTS & 2025 paper over the course of the quarter

- Also makes the 4/26 (tapped tomorrow) look like a better potential long than the 8/26 on our models

Just thoughts for now as the bonds don't even exist yet, but worth having in the back pocket . Calendar (indicative and our guesses) below

The structural anomalies within the curve are:

- Buy 11/22 vs selling BTSU1

- Buy 3/28 vs selling 1/27 or 9/27

- Buy 4/26 vs 12/26

![]()

Will Scott

O: +44 (0) 203 – 143 - 4171

M: +44 (0) 789 – 441 - 7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: US: 60 Rumson rd, rumson, nj 07760

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

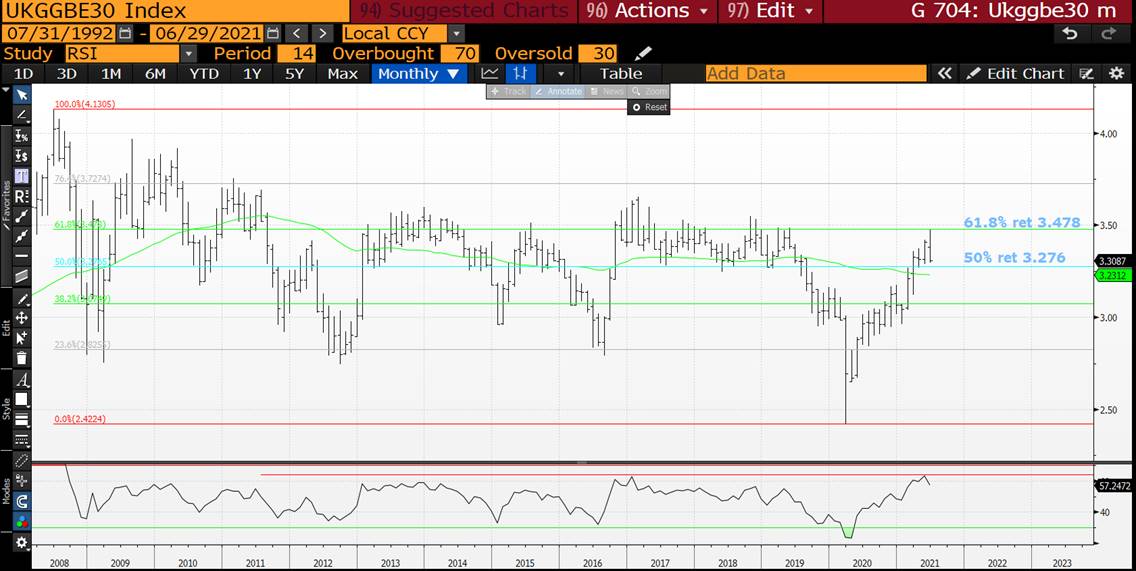

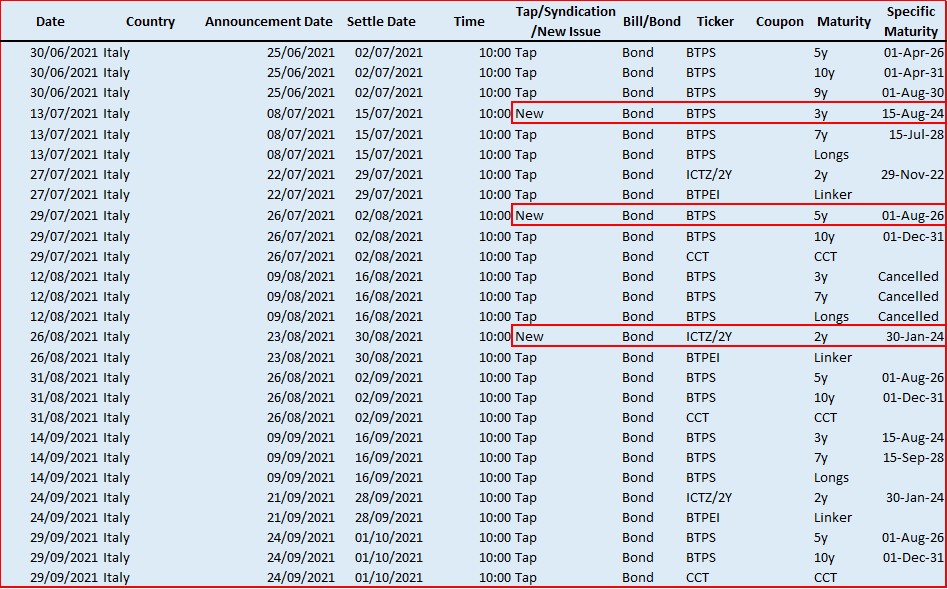

US BREAKEVENS : IDEALLY WE HEAD LOWER INTO MONTH END TO VINDICATE THE DISLOCATED MONTHLY RSI’S AND ALLOW THE 50-100 DAY MOVNING AVERAGES “TO CROSS”.

US BREAKEVENS : IDEALLY WE HEAD LOWER INTO MONTH END TO VINDICATE THE DISLOCATED MONTHLY RSI’S AND ALLOW THE 50-100 DAY MOVNING AVERAGES “TO CROSS”.

REMEMBER TECHNICALLY-HISTORICALLY WE WILL “NOT” BE SEEING THESE HIGHS FOR MANY YEARS TO COME (SEE MONTHLY CHARTS)!

BREAKEVENS HAVE CONFIRMED SOME “MAJOR” LONGTERM TOPS, TOPS FOR MANY YEARS TO COME! ONE OTHER THING TO NOTE IS NEARLY ALL CHARTS TRADE IN A VERY TECHNICAL FORMAT.

30YR BREAKEVEN HAVE REJECTED THE MULTI YEAR 76.4% RET 2.3360 WITH A 2004 MONTHLY RSI, THUS A “VERY BIG” STATEMENT.

ALL DURATIONS HAVE NOW BREAHCED THEIR 50 DAY MOVING AVERAGES!

**ALL 3 DURATIONS OF CHARTS HAVE RSI’S THAT COMPLIMENT EACH OTHER ACROSS THE BREAKEVEN CURVE.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Italy 7s 10s 30s

Trade: +old 7y -ik +30y

Weights: 0.9 / 1 / 0.2 (all x2)

Net delta: 10%

CIX: 200*(yield[BTPS 1.35 04/01/30 Govt ] + -0.2 * yield[BTPS 2.45 09/01/50 Govt] + -0.9 * yield[BTPS 0.25 03/15/28 Govt])

Graph:

Here's how Italian forwards look

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796