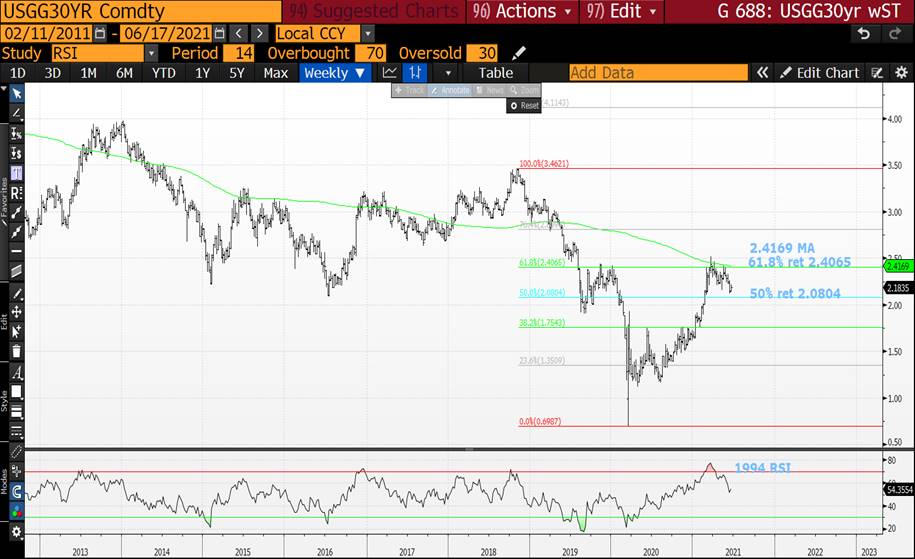

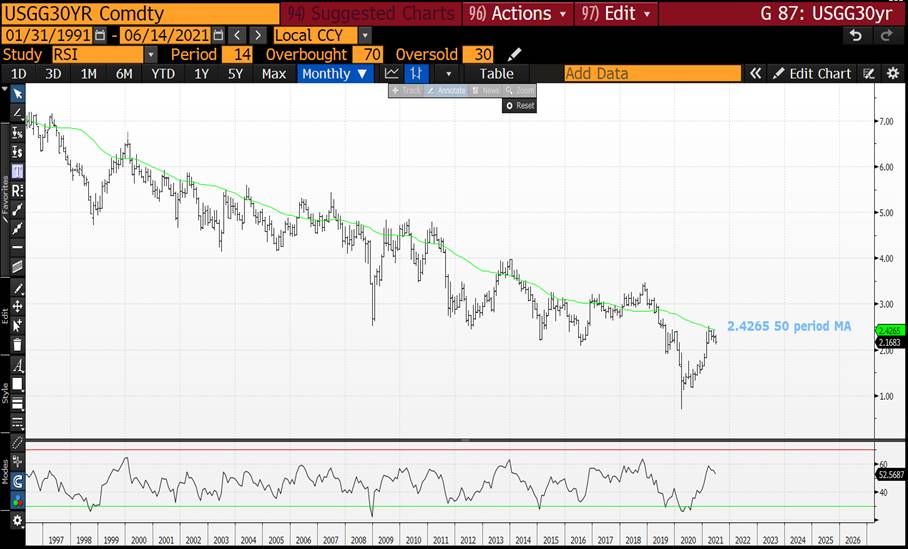

BOND UPDATE : WE HAVE WITNESSED “SUBSTANTIAL” MOVES OF LATE RESULTING IN SOME “VERY” DISLOCATED RSI’S, WE NEED TO ADDRESS THOSE FIRST

BOND UPDATE : WE HAVE WITNESSED “SUBSTANTIAL” MOVES OF LATE RESULTING IN SOME “VERY” DISLOCATED RSI’S, WE NEED TO ADDRESS THOSE FIRST. IT IS WORTH LOOKING AT THE DAILY RSI’S ON CURVES, 102030 FLY AND YIELDS AS SOME ARE EXTENDED TO A 1994 STATUS.

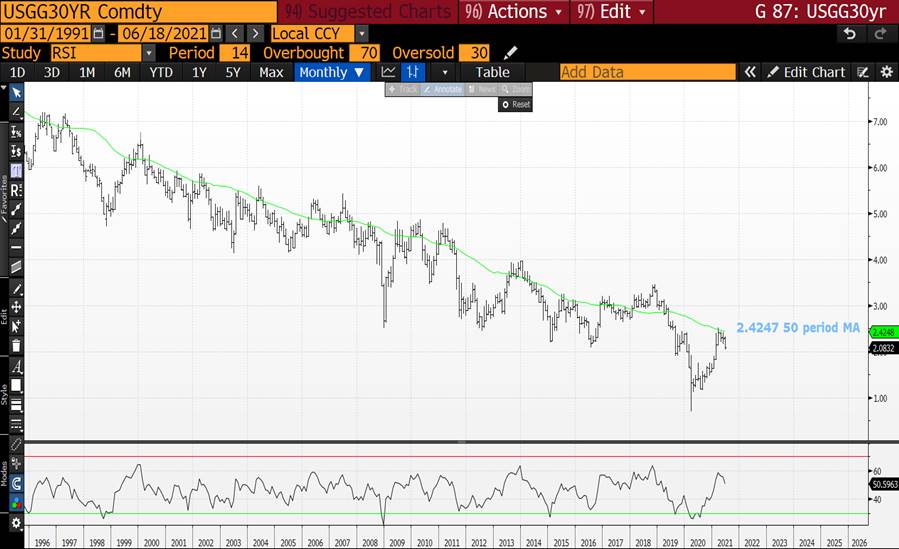

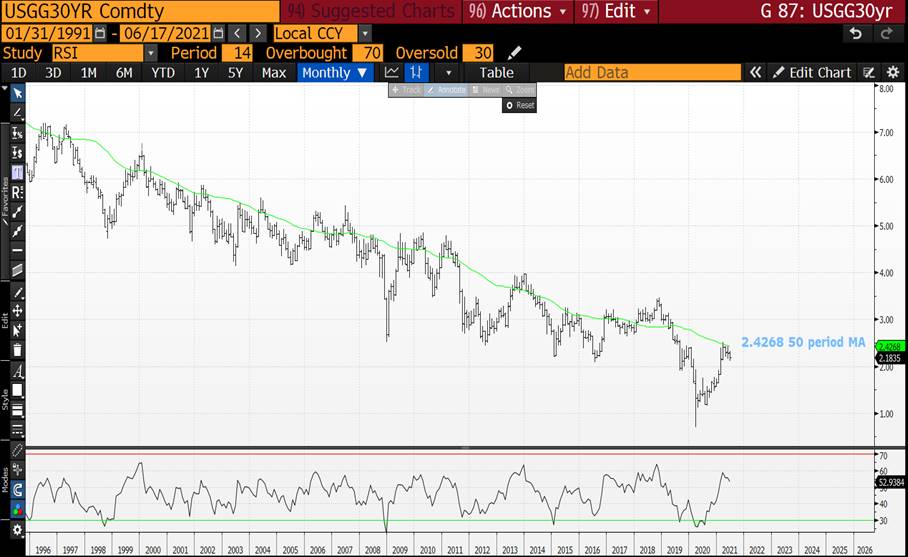

THE 30YR BOND YIELD STANDS OUT AS IT HAS HIT ITS 200 DAY MOVING AVERAGE 1.9202 (PAGE 13).

BOND YIELDS HAVE BOUNCED HOWEVER ALL MONTHLY RSI CHARTS CONTINUE TO CALL FOR “LOWER” YIELDS.

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trades & Fades - James & will at Astor Ridge

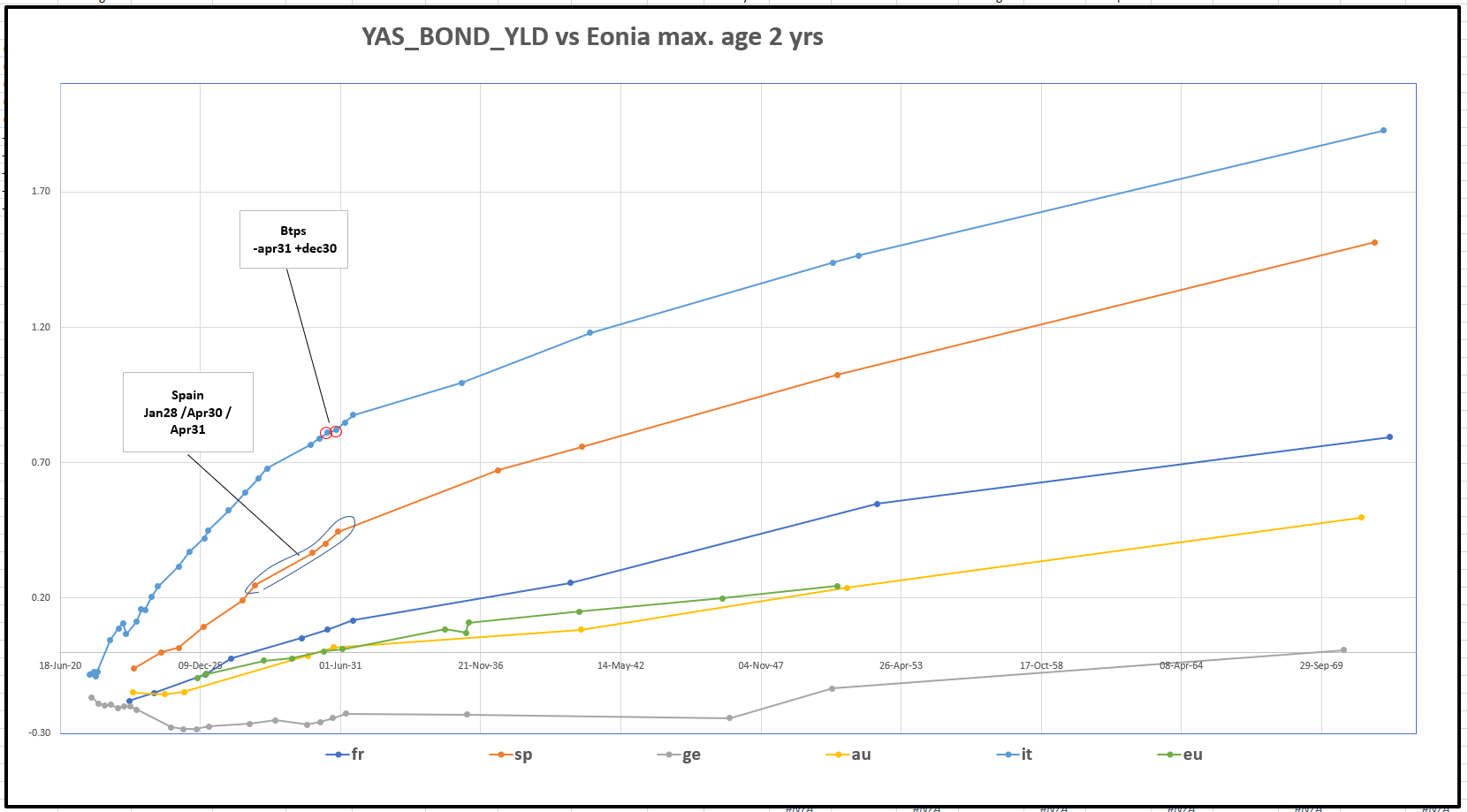

BTPS double deliverable vs double old 10y steepener

- Btps Dec30 get to be CTD twice over – Aug30 never make it

- Btps Apr31 are rich and not the lowest coupon in the neighbourhood

- Looking at the curve that spread is too flat

Trade:

Sell Btps Apr31 buy Btps Dec30 vs OIS

Chart:

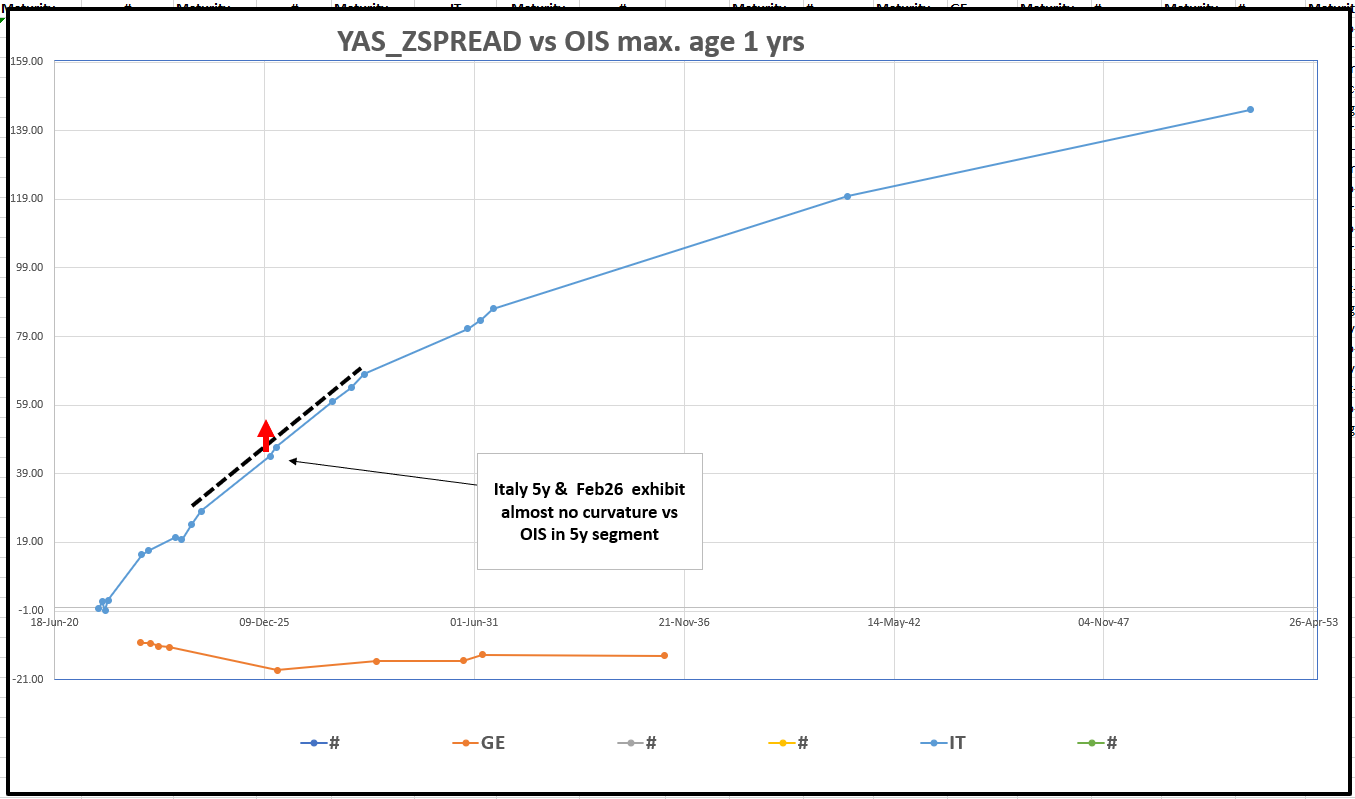

Z-spread

Rumours of a Spanish 10y abound – the Apr31 has always traded poorly – its low coupon belies poor carry. That said, I wanna come out of any cheapening in Spain 10y with …

Trade – Short 9y Spain vs 7s and 10s

Short Spain Apr30

Long 7y and 10y

Outright or OIS, depending on timeframe

Cix:

(P2509[SPGB 0.5 04/30/30 Corp] - 0.3 * P2509[SPGB 0 01/31/28 Corp] - 0.7 * P2509[SPGB 0.1 04/30/31 Corp])

See graph of OIS spreads (above) for first trade level

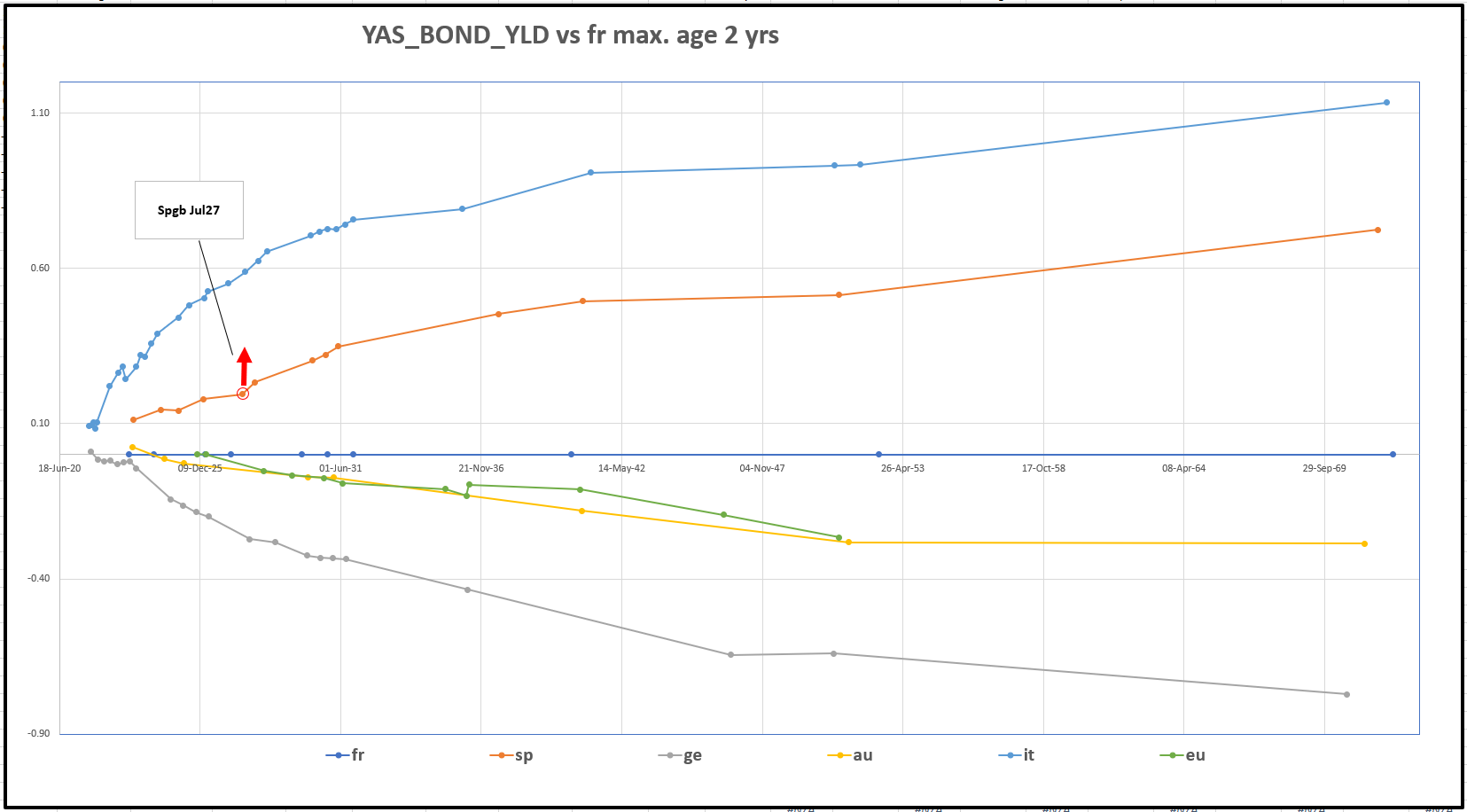

Sell Spain 7y with a net delta long, vs France and Italy

Trade:

Short Spain Jul 27

Long Btp old 7y and France May27

Nett Delta 10% Long

Graph

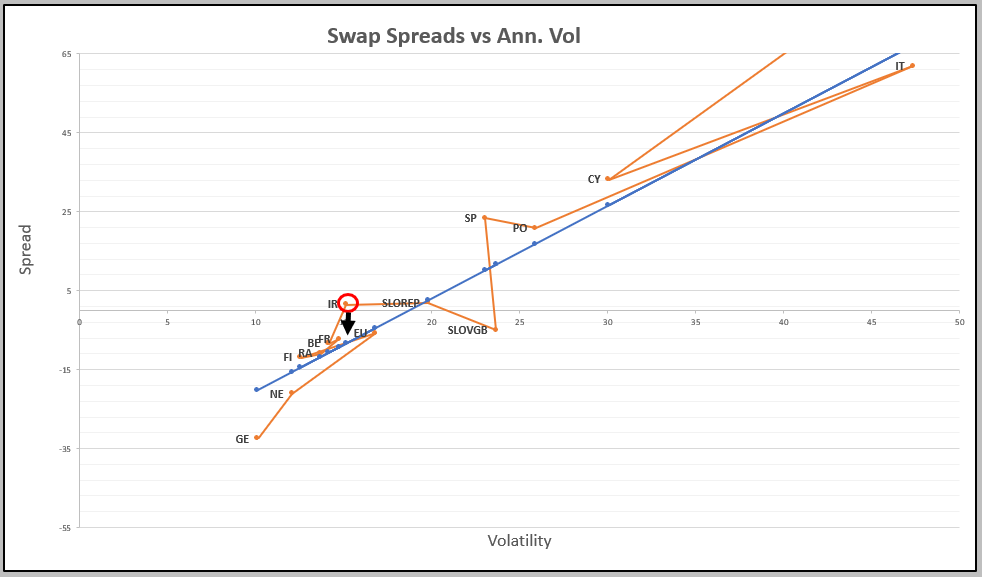

Spain has had a huge comeback since the 50y syndication at the beginning of the yr – and rightly so we think, our swap spread vs vol metric showed it as cheap earlier in the year vs its peer group of similar volatility

Now Spain has come back a long way – and in particular we se the old 7y Jul27 as a rich despite being a recent issue (Mar 2020)

We asked the computer to be Short Spain vs France And Italy – we then asked it to reduce the variance of your portfolio – so that vol of changes of the portfolio is minimalised. This is equivalent to hedging spread and outright, optimally at the same time – because the two are correlated (not orthogonal) we must calculate these numbers simultaneously

Cix:

200 * (YIELD[SPGB 0.8 07/30/27 Corp] + -0.3 * YIELD[BTPS 0.95 09/15/27 Corp] + -0.6 * YIELD[FRTR 1 05/25/27 Corp])

Give me a call if you want to run through the Sharpe and return numbers – I like this trade if Spain gets any political weakness or indeed they try and come with a 10y syndic while Italy and Stocks are under pressure

Here's how Spain, Italy and other Credits look with France as a Baseline…

On our Radar

We're watching the ongoing cheapening of the French credit vs other – the notorious Blend!

Here's is the 'Blend' in constant Maturity Bond Format

100 * (RV0004P 10Y BLC Curncy - 0.25 * RV0005P 10Y BLC Curncy -0.75 * RV0002P 10Y BLC Curncy)

France – 25% Italy and – 75% Germany

On a 5y History – we're heading to the highs (France cheap) that occurred just prior to Macron's election. Am starting to think that after the regional elections this weekend gone and Presidential elections not until April 2022 this Cheapening seems overly cautious. With the ECB in firm support stance – this implies a widening of the credit and a steepening of the curve, which we have already witnessed. Indeed the prescient cheapening of the 30y point seemed to only be sustainable if another part of the curve cheapened further and that seems to be the 10y

In the meantime – I think the new 5y is sooo cheap – I don't mind jumping on the bandwagon and doing a steepener => +5y – 7y vs OIS but if this thing keeps going we have to go the other way……

So, at some point I want to start thinking about French flatteners – where the implied forward rates are just plain gaga – because everyone trading that stuff fixates on History without thinking about value.

The edge condition has to be French forwards being closer to Spain anywhere on the curve

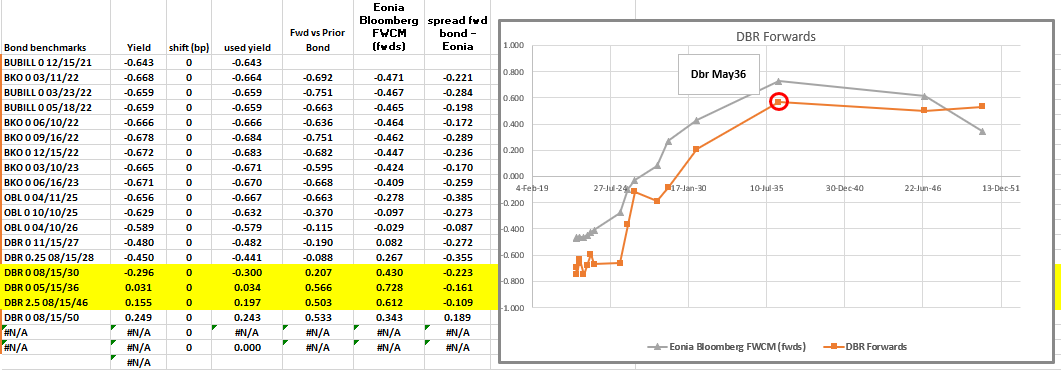

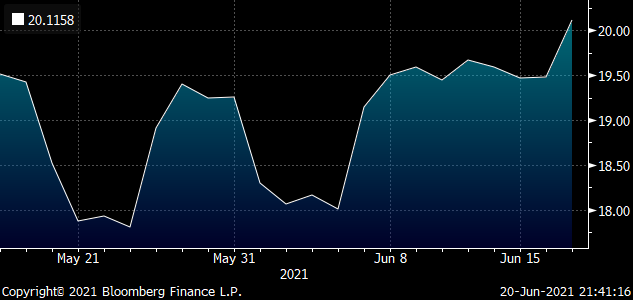

15 Yr Germany cheap vs RX and UB – supply this week

Here's the history using the old 15 (May35) vs OIS

Slight mis-weighting and Delta (10%)

cix: 2*(p2509[DBR 0 05/15/35 Govt ] + -0.55 * p2509[DBR 2.5 08/15/46 Govt] + -0.35 * p2509[BJ948280 Corp])

On the basis of the forwards curve we see the CURRENT 15y here

Cix:

(2 * YIELD[DBR 0 05/15/36 Corp] - YIELD[DBR 2.5 08/15/46 Corp] - YIELD[BJ948280 Corp]) * 100

History

Levels

I think we have small here at this level (+20.2bp, 20%), so as not to miss it and we get truly involved at

@ +25bp – don't care if it's never been there – trying not to let history tell me what a trade is actually worth!!!

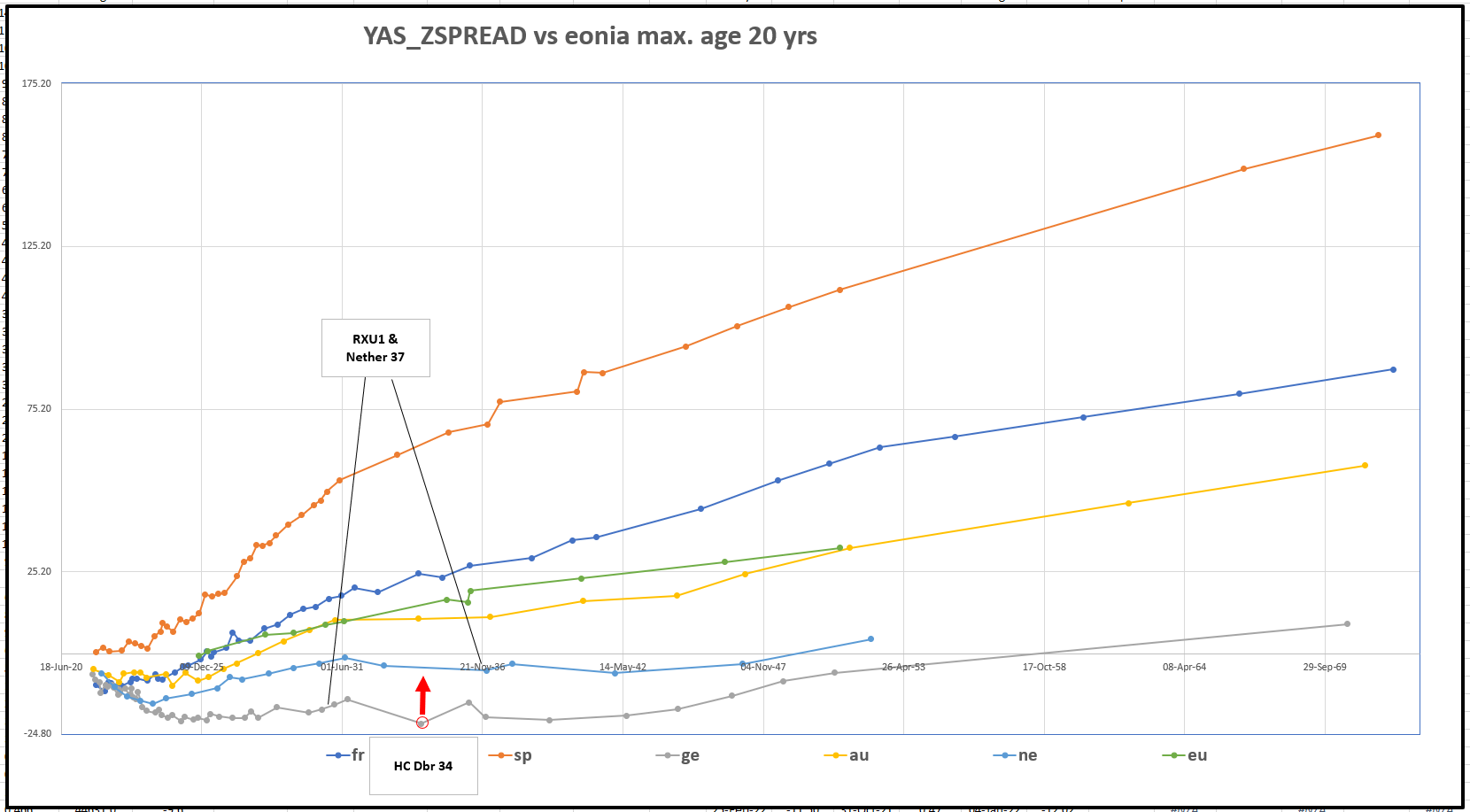

Widening Credit Spreads have flushed the Nether Baby out with the bath water

Nether has cheapened with sympathy to the semi-core – but our vol analysis and it's strong rating means it really should behave more like its peer, Germany. Any widening is a buying opportunity

There's a tap of the old High coupon 37s in Holland – so keeping it vs high coupons to some extent…

Trade

Sell High coupon Dbr 34

Buy RXU1 & Nether 37…

Levels: -14bp & -16bp

200 * (YIELD[DBR 4.75 07/04/34 Corp] + -0.5 * YIELD[NETHER 4 01/15/37 Corp] + -0.5 * YIELD[BJ948280 Corp])

How Relative Z-spreads look…

That's got a bit of credit buying (buying nether 50% vs Germany) and a bit of tapering obviously (nett short high coupons)

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

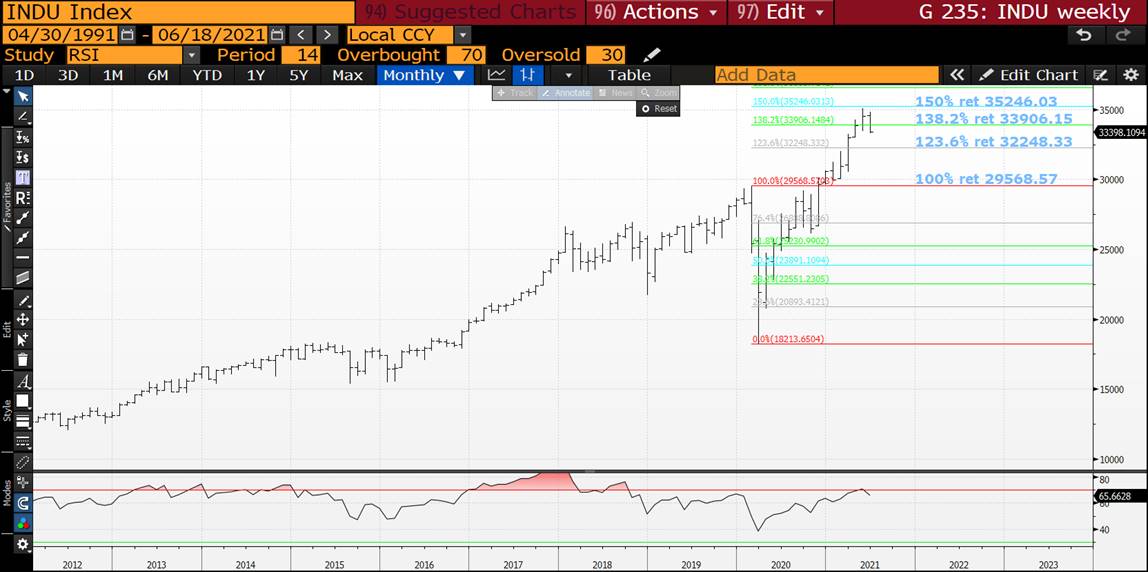

STOCKS : WE HAVE SEEN MAJOR MARKET MOVES RELATING TO 1994,2000,2004, 2008 RSI DISLOCATIONS, THEN SURELY STOCKS MUST SUFFER AT SOME STAGE.

STOCKS : WE HAVE SEEN MAJOR MARKET MOVES RELATING TO 1994,2000,2004, 2008 RSI DISLOCATIONS, THEN SURELY STOCKS MUST SUFFER AT SOME STAGE.

BITCION CONTINUES TO SUFFER ESPECIALLY GIVEN IT HAS JUST FAILED ITS 200 DAY MOVING AVERAGE 43311.34. B of A Fund Manager Survey Says `Long Bitcoin' Most Crowded Trade

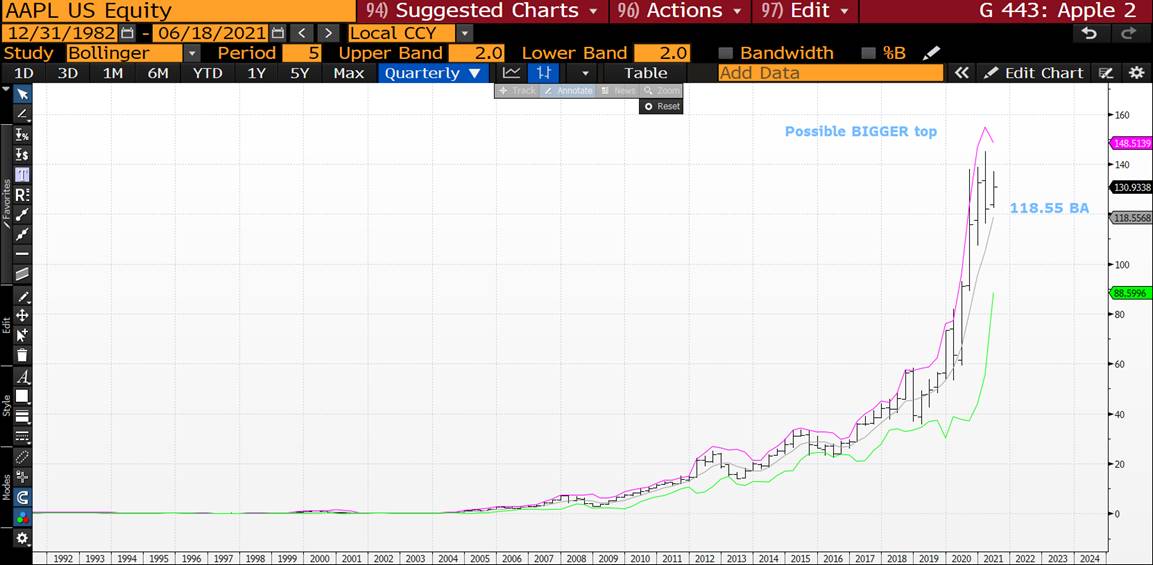

APPLE IS OF MAJOR CONCERN GIVEN IT CLEARLY FLAGGED A TOP 2 MONTHS AND IS CLOSE TO THIS MONTHS LOWS ALREADY! TESLA HAS HELD BUT REMAINS IN TROUBLED WATERS.

"THE MOST WIDELY HELD STOCKS AT MUTUAL AND HEDGE FUNDS IN 4Q 2020 WAS MICROSOFT, AMAZON AND FACEBOOK". ALL OBVIOUSLY VERY OVER EXTENDED.

TESLA, AMAZON AND APPLE ARE WORTH MORE THAN THE FINANCIALS, ENERGYAND METALS SECTORS COMBINED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

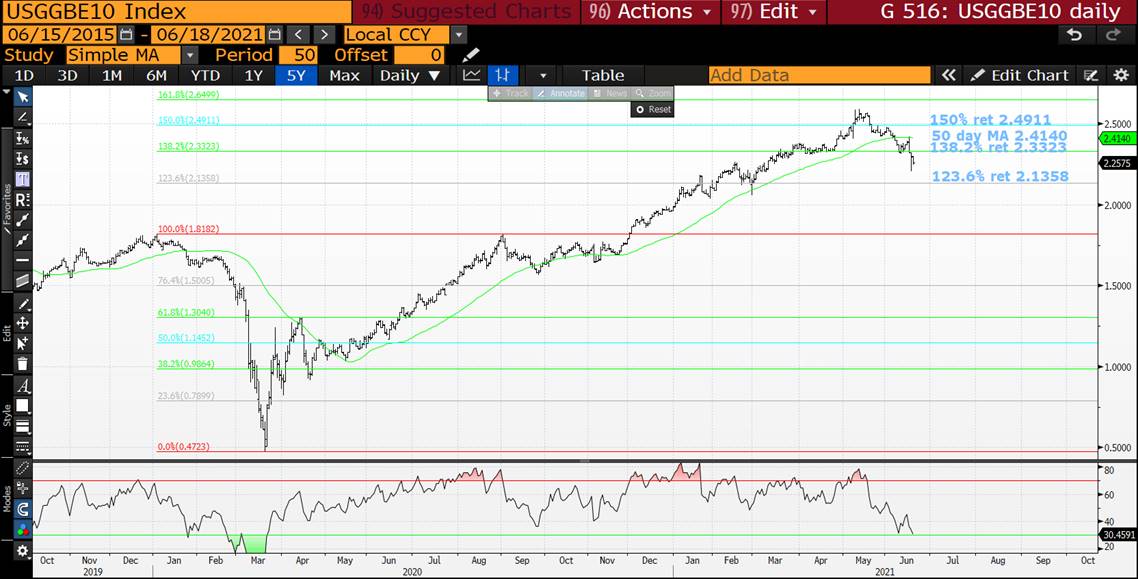

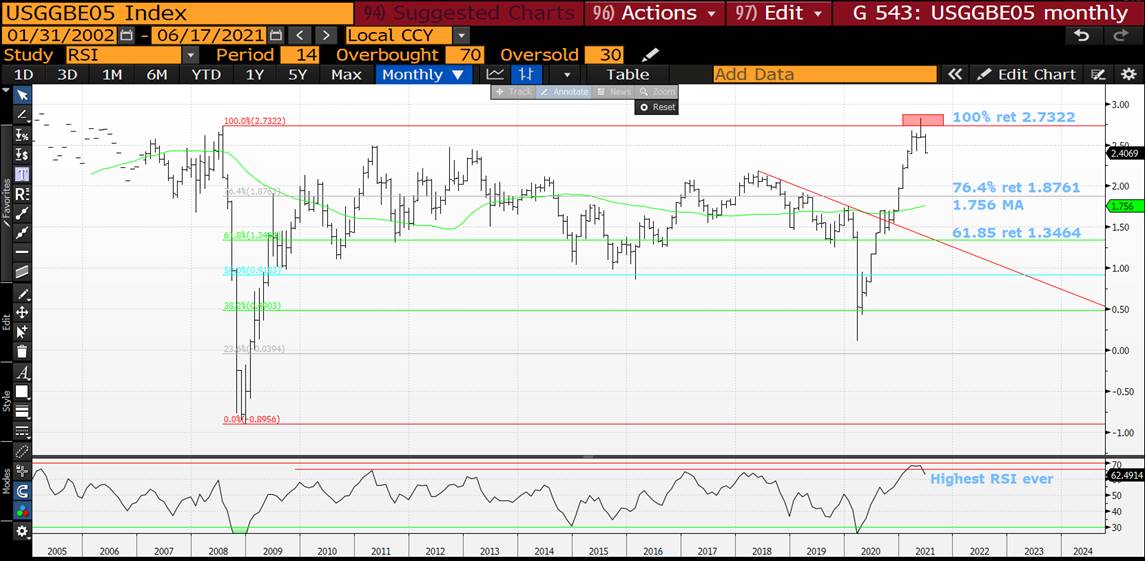

US BREAKEVENS : WE ARE NOW ON A VERY LONG-TERM MOVE LOWER WITH “TOPS” INITIATED ACROSS ALL DURATIONS.

US BREAKEVENS : WE ARE NOW ON A VERY LONG-TERM MOVE LOWER WITH “TOPS” INITIATED ACROSS ALL DURATIONS.

THE DAILY RSI’S ARE LOW THUS MAY BE TO BE “WORKED OFF” BEFORE THE NEXT LEG LOWER.

BREAKEVENS HAVE CONFIRMED SOME “MAJOR” LONGTERM TOPS, TOPS FOR MANY YEARS TO COME! ONE OTHER THING TO NOTE IS NEARLY ALL CHARTS TRADE IN A VERY TECHNICAL FORMAT.

30YR BREAKEVEN HAVE REJECTED THE MULTI YEAR 76.4% RET 2.3360 WITH A 2004 MONTHLY RSI, THUS A “VERY BIG” STATEMENT.

ALL DURATIONS HAVE NOW BREAHCED THEIR 50 DAY MOVING AVERAGES!

**ALL 3 DURATIONS OF CHARTS HAVE RSI’S THAT COMPLIMENT EACH OTHER ACROSS THE BREAKEVEN CURVE.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BOND UPDATE : WE HAVE WITNESSED SOME “SUBSTANTIAL” MOVES THIS WEEK WHICH WILL SET THE TONE FOR SOME TIME TO COME.

BOND UPDATE : WE HAVE WITNESSED SOME “SUBSTANTIAL” MOVES THIS WEEK WHICH WILL SET THE TONE FOR SOME TIME TO COME.

IT IS NOW WORTH LOOKING AT THE DAILY RSI’S ON CURVES AND 102030 FLY GIVEN THEY ARE OVER EXTENDED.

BOND YIELDS HAD AN INTERUPTED MOVE SO THEIR DAILY RSI’S ARE “UNEFFECTED”.

BOND YIELDS HAVE BOUNCED HOWEVER ALL MONTHLY RSI CHARTS CONTINUE TO CALL FOR “LOWER” YIELDS.

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

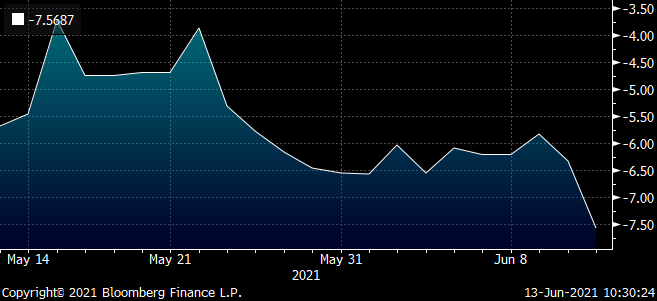

US BREAKEVENS : FED NIGHT WAS A “MASSIVE HELP” IN ENDORSING THE LONGTERM TOP RSI DISLOCATIONS, WE HAVE NOW FORMED SOME LONGTERM “TOPS”.

US BREAKEVENS : FED NIGHT WAS A “MASSIVE HELP” IN ENDORSING THE LONGTERM TOP RSI DISLOCATIONS, WE HAVE NOW FORMED SOME LONGTERM “TOPS”.

BREAKEVENS AS POISED TO CONFIRM SOME “MAJOR” LONGTERM TOPS, TOPS FOR MANY YEARS TO COME! ONE OTHER THING TO NOTE IS NEARLY ALL CHARTS TRADE IN A VERY TECHNICAL FORMAT.

30YR BREAKEVEN HAVE REJECTED THE MULTI YEAR 76.4% RET 2.3360 WITH A 2004 MONTHLY RSI, THUS A “VERY BIG” STATEMENT.

5YR AND NOW 10YR BREAKEVENS HAVE BREACHED THEIR 50 DAY MOVING AVERAGES.

**ALL 3 DURATIONS OF CHARTS HAVE RSI’S THAT COMPLIMENT EACH OTHER ACROSS THE BREAKEVEN CURVE.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

**POST FED** BOND UPDATE : THE FED LAST NIGHT ADDRESSED “MANY” OF THE WANTING LONGTERM RSI DISLOCATIONS, NAMELY THE US CURVES AND 102030 FLY.

BOND UPDATE : THE FED LAST NIGHT ADDRESSED “MANY” OF THE WANTING LONGTERM RSI DISLOCATIONS, NAMELY THE US CURVES AND 102030 FLY.

BOND YIELDS HAVE BOUNCED HOWEVER ALL MONTHLY RSI CHARTS CONTINUE TO CALL FOR “LOWER” YIELDS.

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

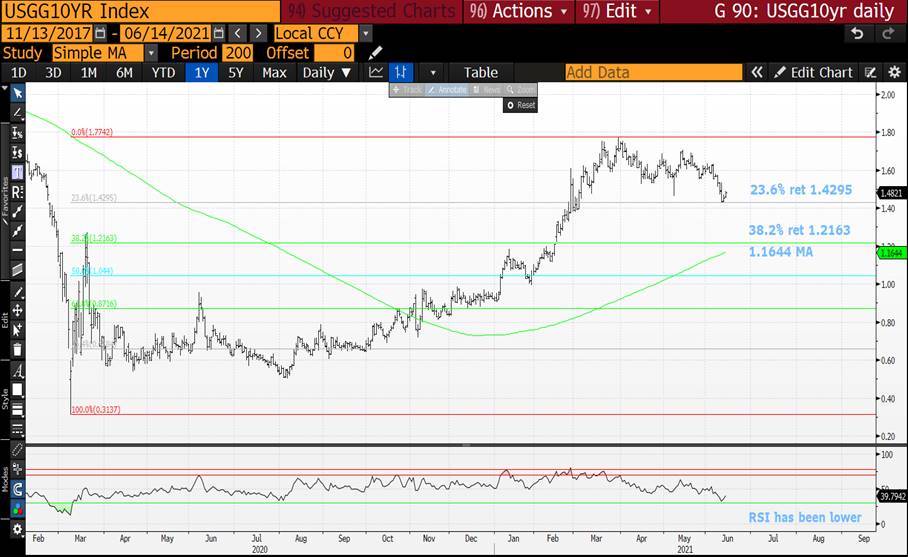

BOND (SHORT-TERM) UPDATE : LONGTERM YIELD CALL REMAINS THE SAME (YIELDS LOWER) BUT SHORT TERM IT APPEARS WE DO NEED A PAUSE.

BOND (SHORT-TERM) UPDATE : LONGTERM YIELD CALL REMAINS THE SAME (YIELDS LOWER) BUT SHORT TERM IT APPEARS WE DO NEED A PAUSE.

US 10YRS HAVE HIT RESONABLE SUPPORT AT A 23.6% RET 1.4295 AND RSI HAS BASED, THE RSI HAS BEEN LOWER BEFORE SO WORTH BEARING IN MIND.

US CURVES REMAIN ON A VERY BIG FLATTENING BIAS THUS THIS IS ONLY A "PAUSE".

DBR 46'S ARE TEMPORARILY STALLING AT THEIR 50% RET 157.561 DESPITE THE RSI ONLY MARGINALLY LOFTY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trades & Fades - James & will @ Astor Ridge

Fades post the ECB

- Keep trying to buy older bonds that are in the PEPP – or perhaps recent issues that are at the end of their tap cycle – Dbr Feb31, Bgb Oct31

- Fed and other reaction functions have become 'punch bowl' – the Fed will be slow to remove the punch bowl from the party. Therefore the reaction function is more swingeing when it comes – Look for very steep forward curves (pay flat or inverted) in longer tenors – beyond the point of expected inflation rises

- Value will out – implied bond forwards are steep then suddenly flat as a result of the anomalies – and if we can hold the structures via repo – then the cash of bonds should normalise in most market shifts

- Bond curves should not be as 'straight' as OIS curves – higher risk credit curves such as Spain and Italy should be steeper and therefore more curved than OIS curves – In particular we look at 3s-5s-7s vs OIS in Spain and Italy and

Trade

Italy –

Sell rich 5yrs

vs cheap 5y and 7y

vs OIS

Call for bonds and Levels

CIX:

2 * (p2509[BTPS 0.5 02/01/26 Govt]-0.6*p2509[BTPS 0 04/15/24 Govt]-0.4*p2509[BTPS 0.5 07/15/28 Govt])

Graph: (on yield)

Bonds with more history: (on OIS)

2 * (P2509[BTPS 0.5 02/01/26 Corp] - 0. * P2509[BTPS 0 01/15/24 Corp] - 0.5 * P2509[BTPS 0.95 09/15/27 Corp])

Rationale

- The knee jerk reaction to the ECB was to buy bellys in Europe – but there is almost no curvature in Italy vs the less Risky OIS curve

Graph of Italy Z-Spreads vs OIS

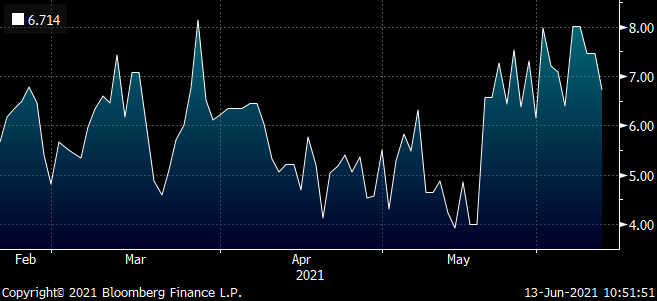

- The removal of curvature in Italy has outpaced the contraction of IKA invoice spreads – as Italy recovers yes the curve flattens and straigtens – but in 5ys it seems like we have all 'run to the other side of the ship'

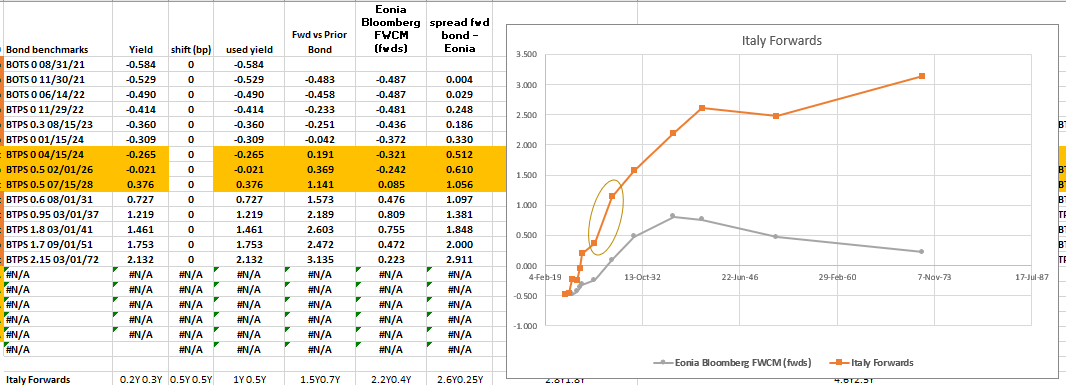

Graph of Constant Maturity Bond Italy/OIS invoice spreads: 100 * ( EUSWE10 Curncy -RV0005P 10Y BLC Curncy)

- The tap 3y (apr24) and 7y (jul28) are cheap, the old 5y Feb26 are a recent issue (issue Date: Sep2020) but rich

- Carry is only -0.2bp /3mo @ 5bp repo spread

- 5 yr Supply is expected at the end of the month

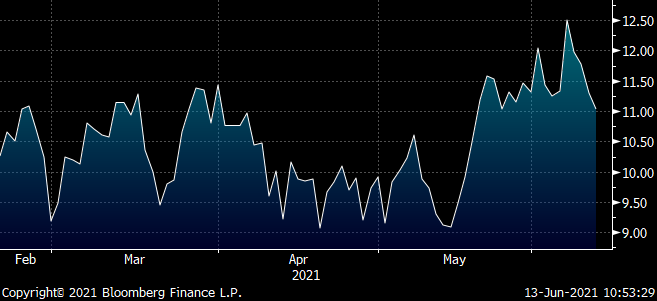

- Italian forwards confirm that 3y2y vs 5y2y (proxy for the fly) are too steep – the belly should cheapen

Italy 10y Btps Aug31 goes off the run and should richen more – old 10y roll too steep vs 10s/15s steepener

Has super low coupon – in any down trade this bond could vanish into sub-par buying before others

Buy Italy Btps Aug31

vs

Sell mis-weighted Btps Apr31 and Btps Mar36

Call for weightings

Graph vs ois

Graph in yield space

Rationale

- The Btps Aug31 now goes off the run with the advent of the new Btps Dec31 – with no more taps the street float should diminish as any PEPP buying might soak up the bond

- Aug31 still looks cheap and rolls well – plus has the added benefit of the lowest coupon (0.6%) and trading sub par

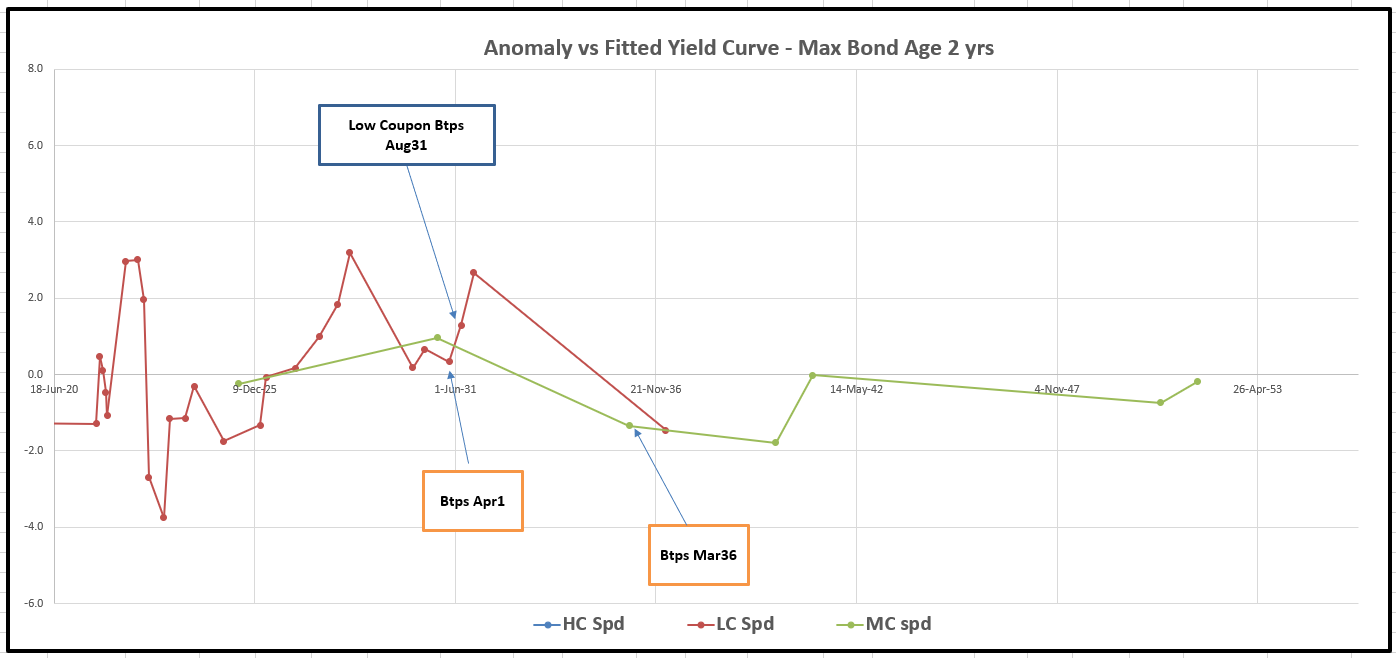

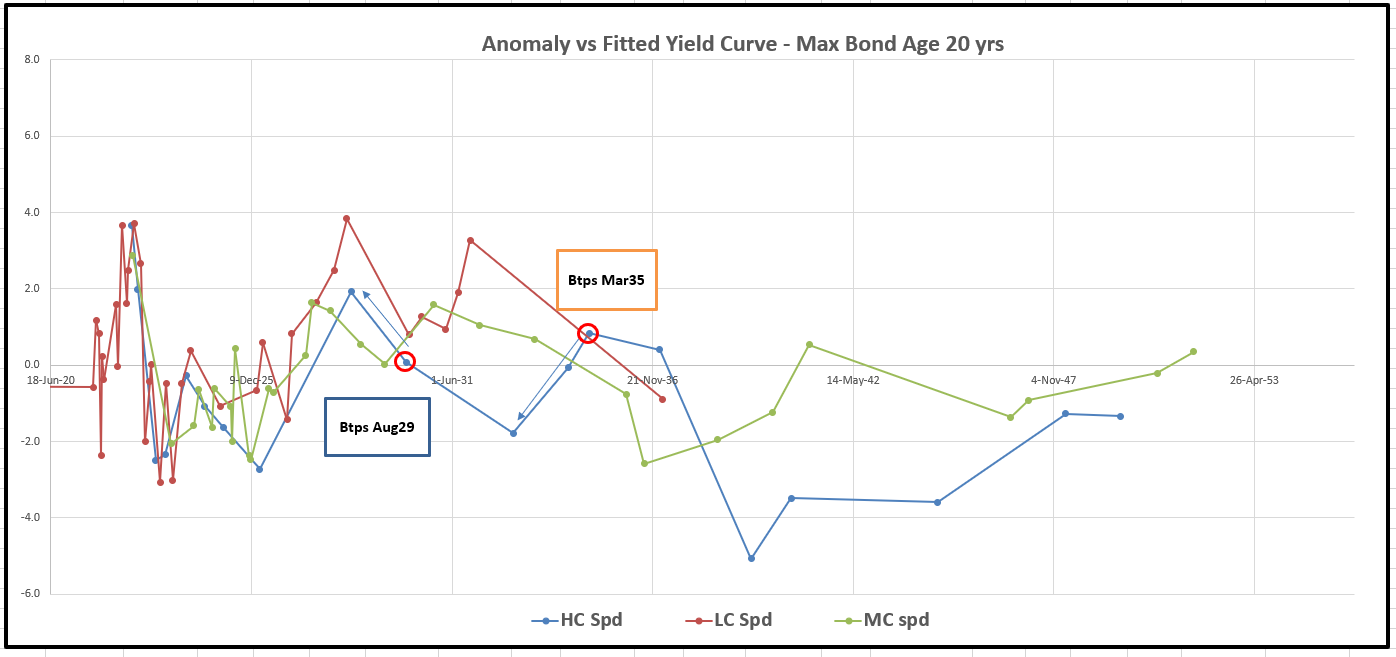

Graph of Btp Anomalies vs fitted curve

- The Mar36 is a more benign old 15y inhabiting a rich sector & gaining its bid via empathy from the sub-par on run 15y Mar37

Italian off the run 8s 15s flattener

Italian Curve was expected to flatten as the 'big call' from IB's a the beginning of the year

If the first rule of Fight club is 'we do not talk about tapering'…

Then we could see both a compression of invoice spreads and a re-flattening of the curve over the next few months

Trade

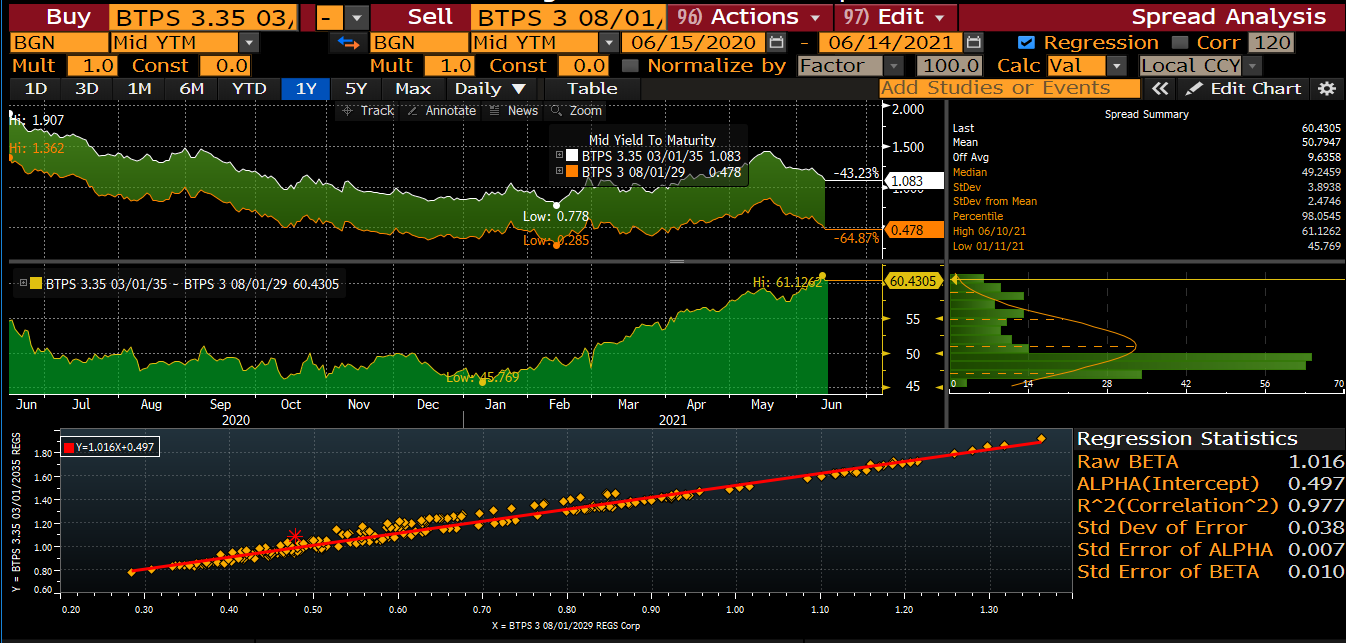

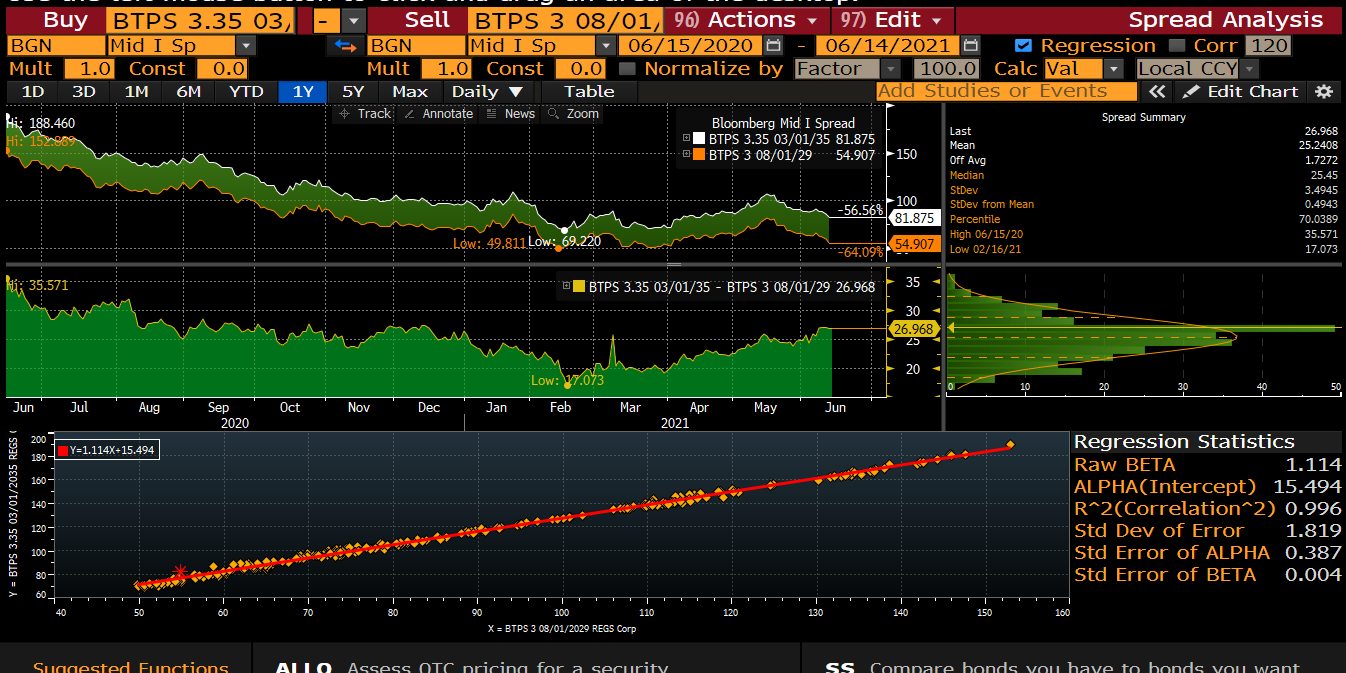

Sell Btps Aug29 to buy Btps Mar35

Regression stats for yield

Regression stats vs Swaps

The old 8yr surfs to the cheaper 7y sector

The Mar35s are a cheap bond when viewed form a cash flow perspective – the steep curve favours the longer, medium to high coupon bonds as their shorter modified duration vs 15y low coupons gives them better carry

Graph of Anomalies vs fitted Yield Curve

A similar feature persists in the French Curve

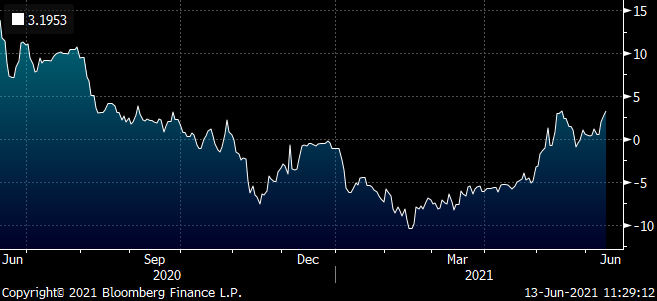

Flattener old 7s vs 30y

7yr Spreads have recovered largely from the recent sell off, 30yrs have not

On our radar is the increased gradient in spreads from 7y France to 30y – talk of a more imminent new French 30y, as telegraphed in the Annual Supply briefing and a need to Hedge the NGEU supply (3 new issues in July) has forced the French curve out to steep levels

7 yr spreads have recovered, but 30y hasn't

Orange Line on the top graph is 7y spread

White Line (goes a long way!) is the 30y spreads

So..

Trade Structure

Deriving the sensitivities to each, from looking at changes in swap spread levels going back 1 yr…

We would actually trade these with a 25% spread beta

Long 100 units of 30y Spreads, & short 75 units of 7y spreads

So a net long of OAT spreads of 25%

And the residual looks like this…

One to keep an eye on this one – both for the dynamic to ignite change and/or the level at which the value is so strong we can hold this for a long period – any thoughts? Gimme a shout!

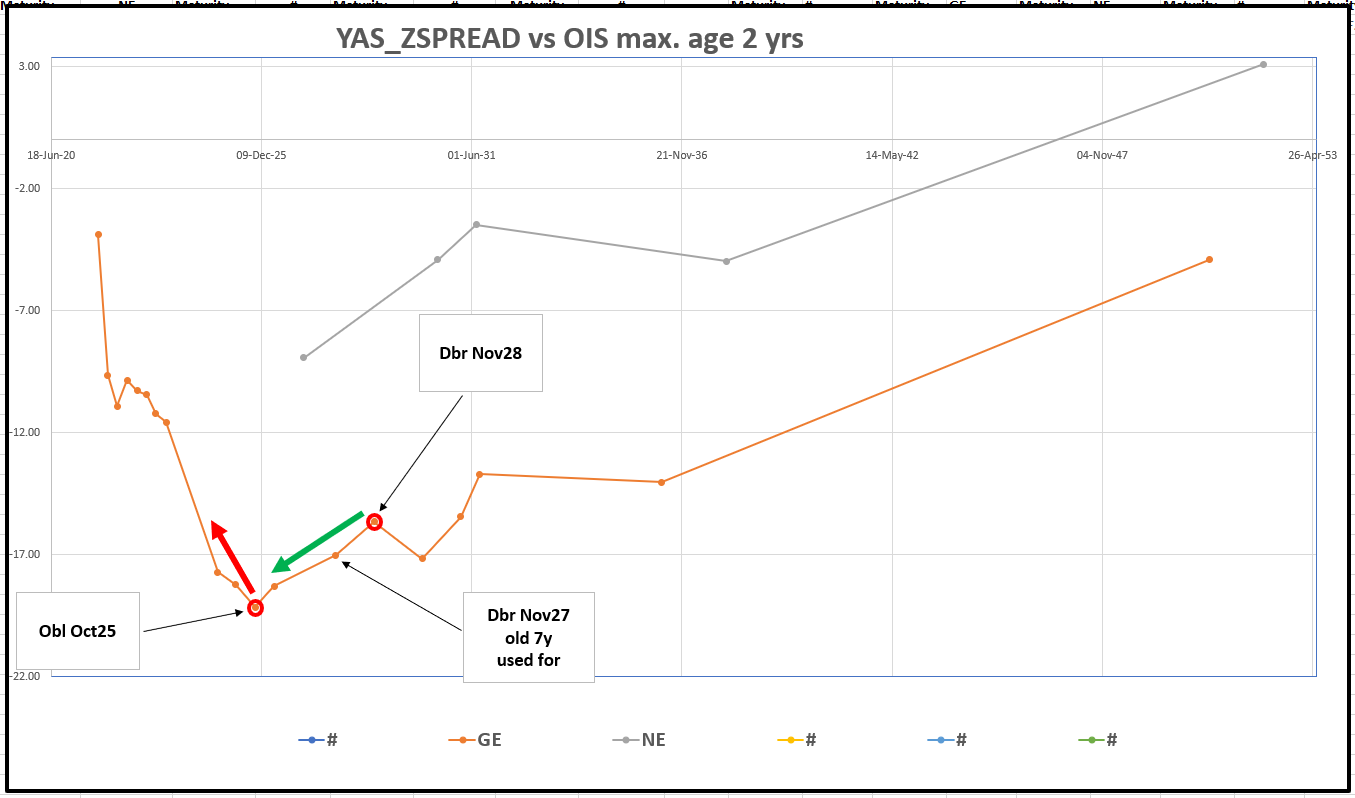

German old 5s vs 7s too steep – great roll trade vs OIS

We highlighted before the rally that 5s10s was too steep vs 2s30s

This has started to re-balance

We're running short the old 5y vs the OEU1 contract (ctd Apr26) – that's worked for a good 1.5bp and now we like to increase our flatteners out of the Oct25 with an OIS hedged 5s7s flattener

Here's the history using the old 7y (nov27) – for more history…

It's a bit 6 of one / half a dozen of the other as top whether we extend out of Obl Oct25 into Old 7y Nov2q7 or the Cheaper on the run 7y Nov28 – the nov28 keep being tapped until November this yr

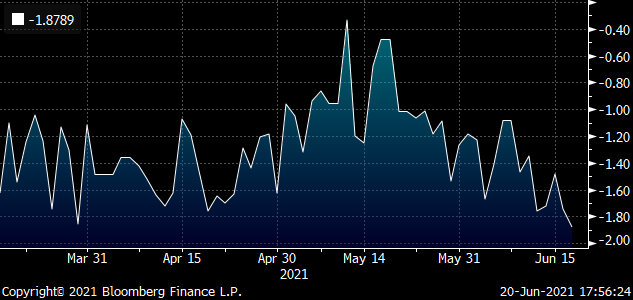

German Z-Spreads: Bonds younger than 2yrs

alternatively we can mutate what we have on and sell the OEU1 to buy Nov28

It's basically a bullish structure – As for delta, although the US looks the wrong side of fair historically, I feel that Germany has some work to do – purely based on the historical, 65day Sharpe Ratio. If vol drops falls over Summer , we'll probably narrow the ranges over which we trade the outright – basically we might still buy Europe but am starting to get Bearish for the U.S.

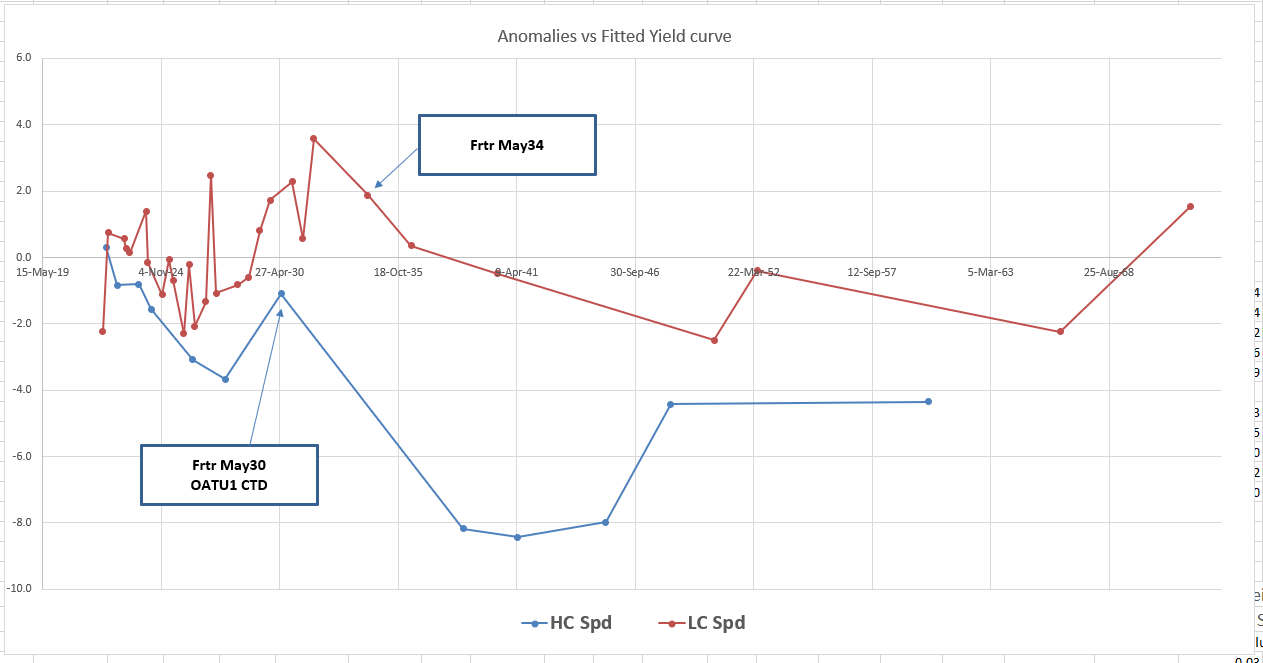

On my Radar – Oat May34 basis

-OATU1 +Frtr 1.5% May34

+35.5bp

Thinking about the value way to control the steepening but statistically this looks good – any thoughts gimme a call – it has been a perennial leveraged short and it now rolls to the very cheap supply point in France – personally I think that cheapness in cheap 10y Europe could diminish over the summer – the supply dunamic swongs the other way – with the PEPP still running and a more bullish tone to the markets we could see this 9s10s flatten and that could have a knock on effect to 9s into old 13y

In value Terms…

French Rich/Cheap vs Fitted yield Curve

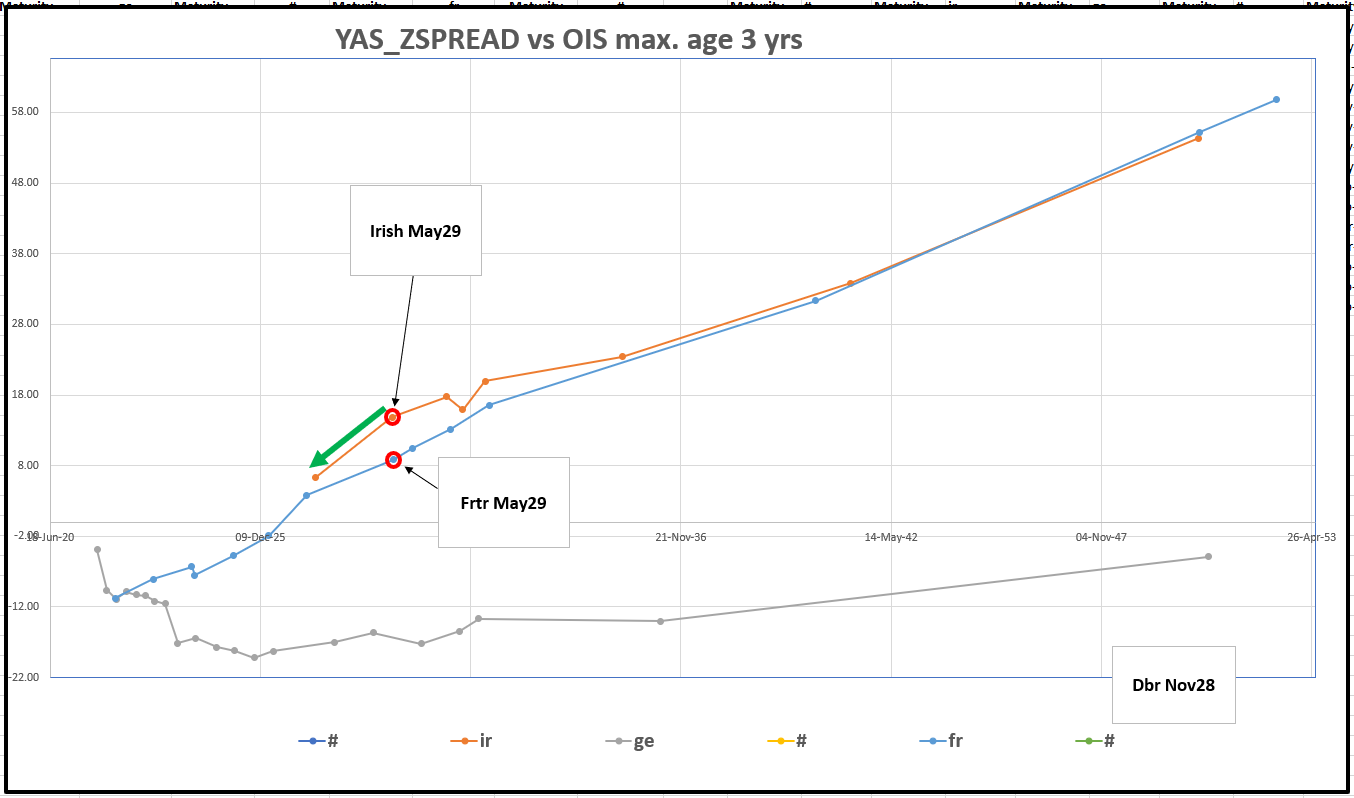

Irish May29 Best Buy in cheap, small issuer vs France – favoured by the PEPP

I would have expected a contraction in the Irish / France spread as invoice spreads re-traced – elsewhere Ireland trade pretty tight to the French Curve – if you'e systemtaically looking to favour the smaller issuers that the PEPP just can't get enough of then this is an opportunity

France into Ireland – 2029s

Under our Vol analysis we plot Swap Spreads as a function of Vol - a

Although Ireland is a slightly weaker issuer it trades with a similar vol – due to the compression of the perceived credit – a result of PEPP buying into a favourable capital key

We think the issuer could normalise and more profoundly in the 8yr tenor

Vols on changes vs Swaps, 120 days history – 9yr tenor

If you'd like to see the UK trades and many more please give Will and I a shout

Have a solid week

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Quick Note

Carl – I was just running some regressions on Italian OIS spreads on the weekend

Constrained to:

issues under 4yrs

Removing 0.5% of published bd/offer from the residual – to remove impossible anomalies

Min# 1.9 standard deviations

These filters are pretty powerful and the only trade that came up was

-Btps Aug29 +Btps Aug30

I know we'd spoken about how the Aug30 would never get CTD status and look relatively rich

But this simple spread trade might be a way to spread shorts around a bit – and indeed it moves the short into Aug29 which is closer to the Jul28 which is becoming a long concentration point

Jut a though and purely a historical chart trade rather than stuffed full of mean reverting value

Best

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796