On my Radar

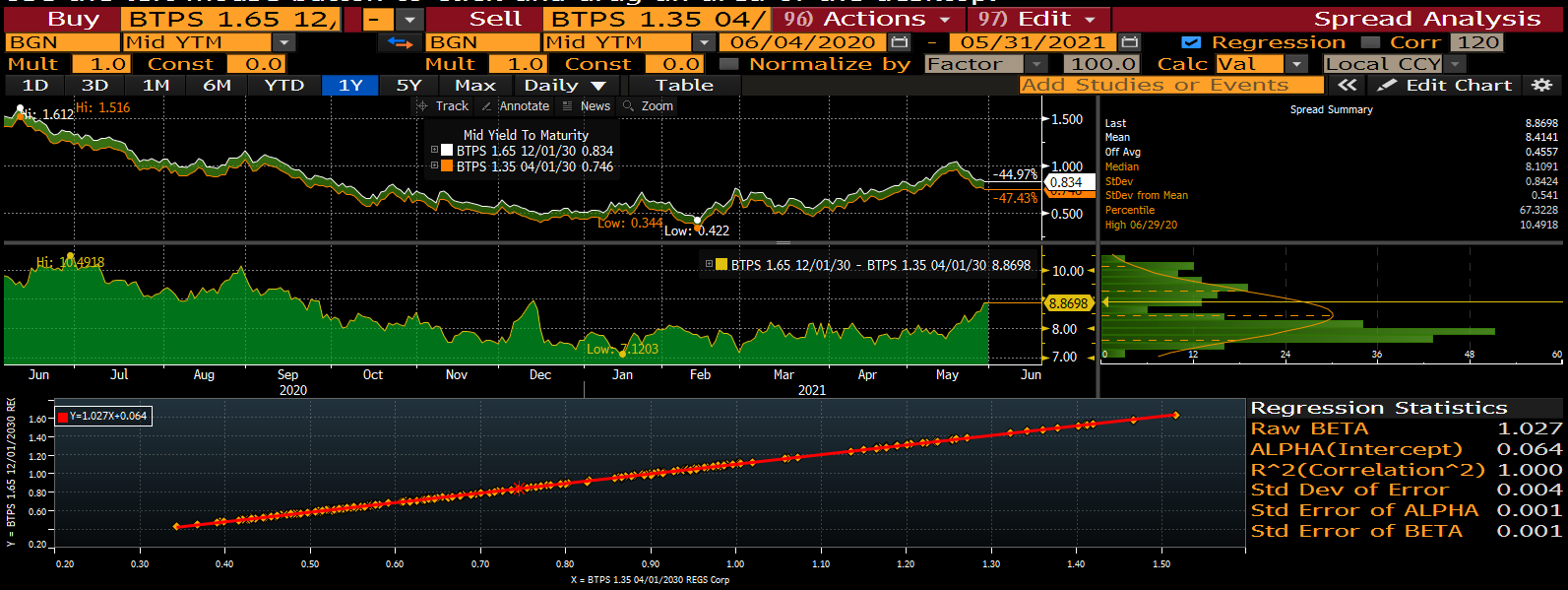

Btp 10y roll widens out – capturing that value…

Trade

Buy Btps Aug31

Sell Btps apr31 and Btps Mar37

Weightings

(-.8 / 1 / -.2) X 2

CIX

Yield: 200 * (yield[BTPS 0.6 08/01/31 Govt]-0.9*yield[BTPS 0.9 04/01/31 Govt]-0.1*yield[BTPS 0.95 03/01/37 Govt])

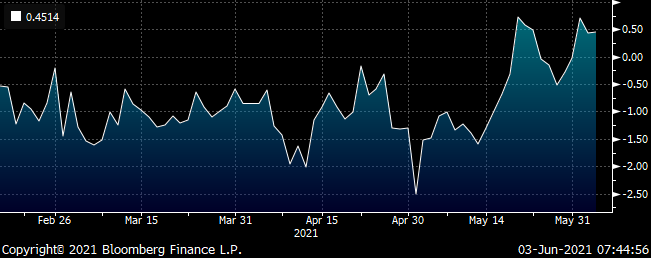

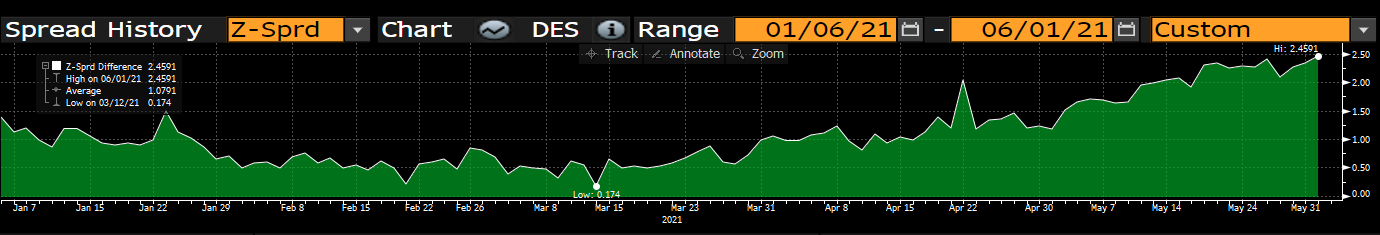

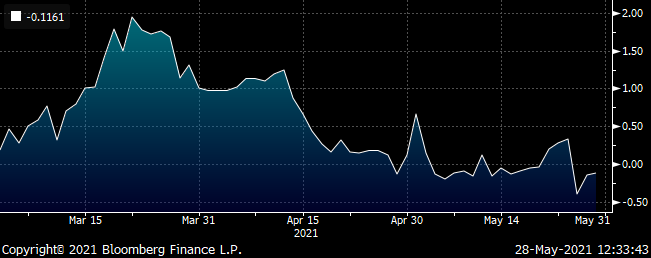

Graph

CIX

OIS: 2 * (P2509[BTPS 0.6 08/01/31 Corp] - 0.9 * P2509[BTPS 0.9 04/01/31 Corp] - 0.1 * P2509[BTPS 0.95 03/01/37 Corp])

Graph

Rationale

- Btps 10y roll has widened

- We have a better metric for valuing different coupons – OAS VS par Curve

- Btps Aug31 are close to the boundary of cheap to Medium coupons

- Btps Apr31 are richer, but a higher coupon (0.9% vs 0.6%)

- Btps Mar37 are not as low coupon as the on Btps Aug31 and are rich on the curve – revealed more completely when we perform OAS vs PAR curve

Risks

- On the run 10y remains cheap

Btp 10y has widened out to +5.5bp

On normal curve fitting the bond looks cheap

The problem with that methodology is it doesn't reveal the bonds true value in terms of cash-flows. All cashflows are discounted at the same rate when we use yield – in that sense it's an average. In the same way that swap traders don't use average returns but use forwards to compute value, the same applies to bonds

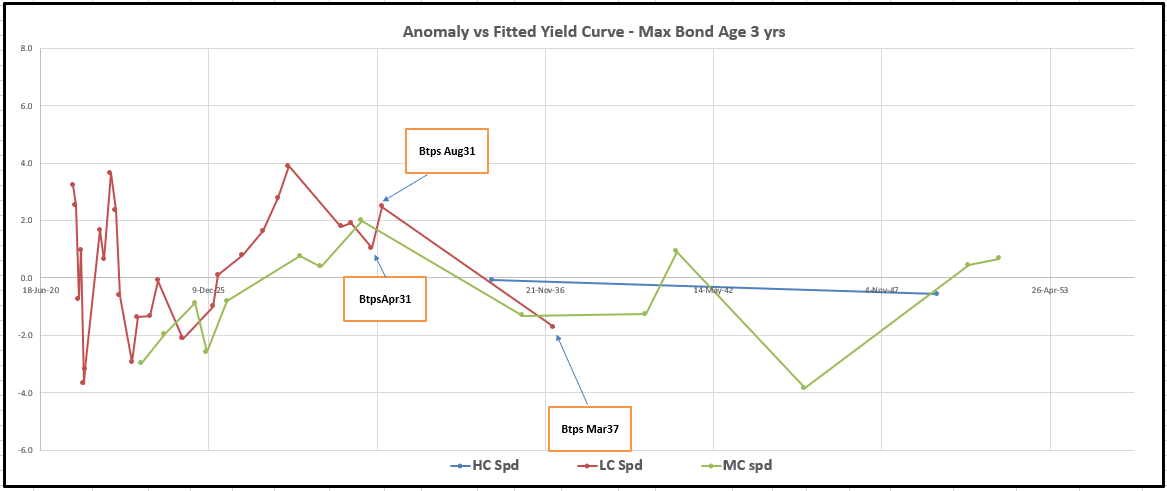

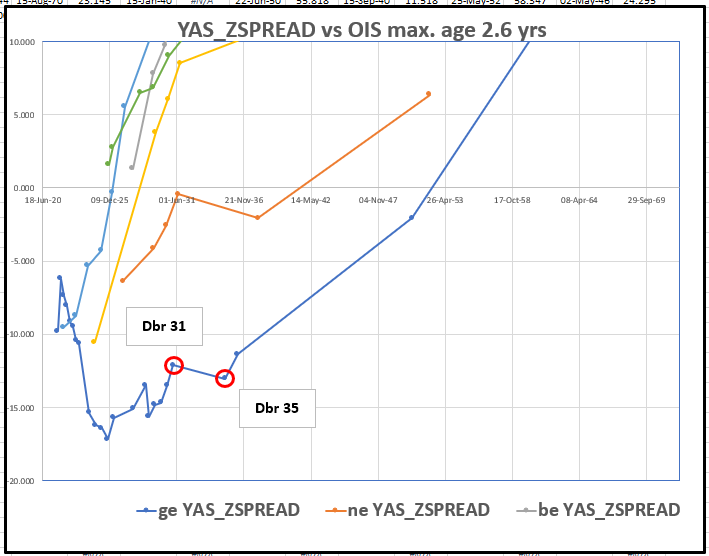

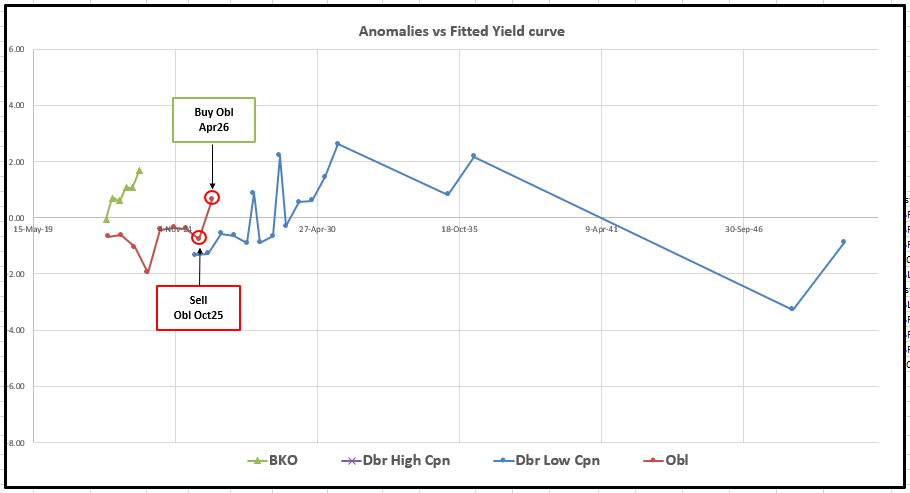

Here's how recent (max age 3yrs) bond anomalies look

This analysis leads us to want to buy the Low coupons

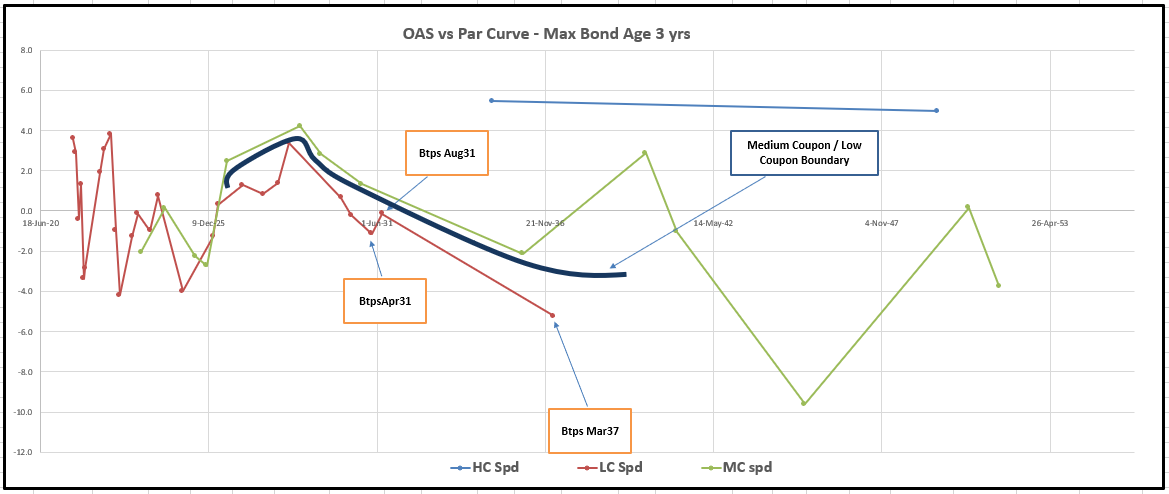

But what is we discount all the cashflows at different rates – at rates appropriate for each tenor of the Italian curve? The we see that in a steep curve the low coupons, with a longer modified duration are not so attractive

- Note this does not include Hazard rate analysis on the probability of default – it's relevant – but don't worry, we're gonna get that option for close to zero premium

if we

- Discount all cashflows using smooth zero curve

- Subtract the theoretical value from the bond Market Value and calc the number of basis points rich/cheap

Now look at Bond anomalies in this method

Under this analysis all bonds are more correctly valued (PV'd) and we can now see that Low coupons are 'bounded' by medium coupons

'Low coupons rarely trade cheaper than medium and high coupons – but only under full cash-flow discounting' *

- Again note – we're setting aside the default value of low price vs high price which his a benign issue here

So now we know when to buy these low coupons vs Medium coupons – if we buy them at the same cashflow value , we're actually getting them at truly the same discounted rich/cheap – and this is a much stronger boundary for trading on the runs vs off the runs

Extracting value

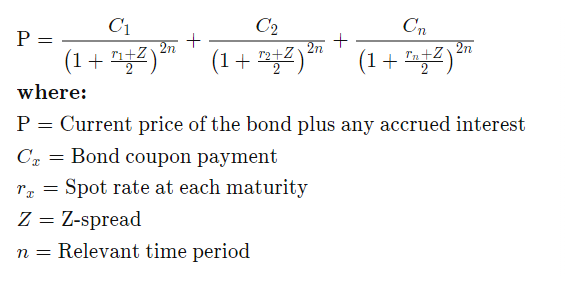

Is this method any better than Z-Spread ?

- Yes, here's the equation for Z-Spread – Source: Investopedia

As a metric it's trying to calculate the 'average' spread (Z) of a bonds cashflows to a given curve (usually swaps)

And there' the rub – it's ok, but flawed – when the swap curve and bonds curves are very different gradients or the credit risk is very low in short bonds but much higher in longer ones, - then the idea of an 'average' spread is

just plain insufficient

Again, we need to think about a Z-Spread curve of forwards, smoothed over time – and that's what OAS vs Par curve discounting does – creates a smooth, fitted Zero Curve over a Tenor range and properly evaluates each cash-flow – No 'averaging' here – when we do that we lose texture and we lose sight of the boundary conditions because we don't really know if a bond is rich or cheap, because our averaging is just a second rate method

How do we use it?

Going forward you wanna know whether UKT 1fe 28 is truly rich?

You want to understand why the low coupon 30y rolls always seem to trade steep ?

You want to know why Frtr May31 , old 15yr never quite falls back into the curve ?

You want to see why High coupon France and Spain trade so far through the on the runs in the long end?

You want to know whether UKT 38s are truly rich or why UKT 32s seem so well bid?

If you'd like to see some of your bonds under this new lens to help clarify whether we have OAS value on our side or the neg carry is trying to tell us something that we haven't fully calculated – we're here to run that analysis and show stuff that makes sense in both a traditional and an advanced framework – as such these trades should work more quickly and our entry levels better set

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

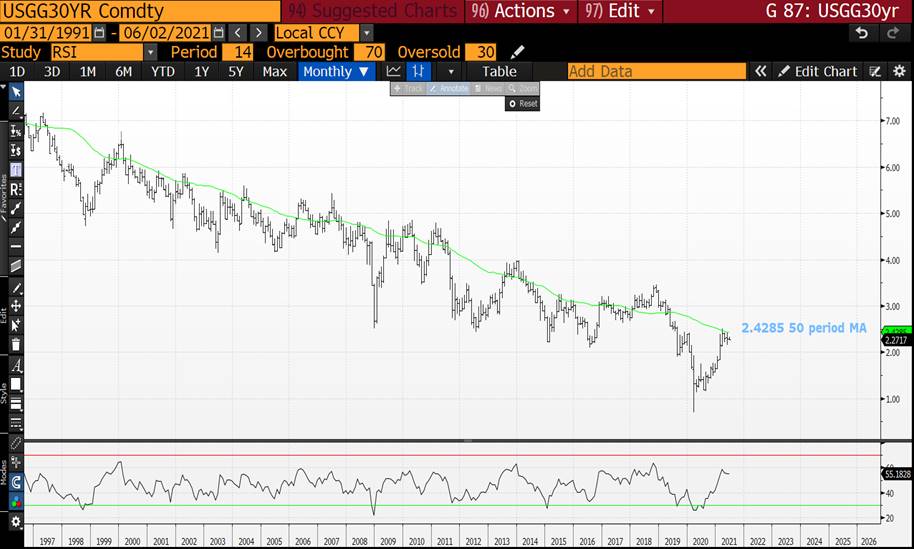

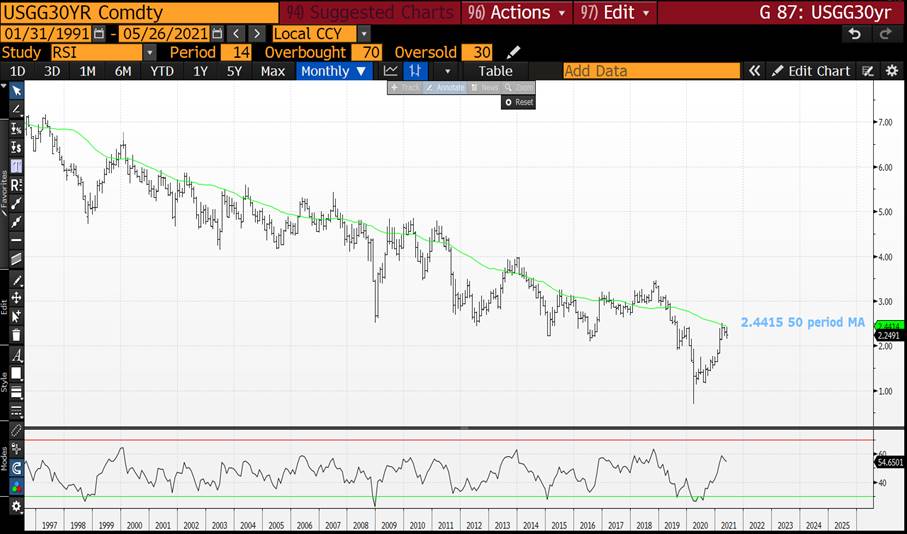

BOND UPDATE : CHART WISE-HISTORICALLY YIELDS WILL HEAD LOWER, MONTHLY RSI’S REMAIN LITTLE CHANGED.

BOND UPDATE : CHART WISE-HISTORICALLY YIELDS WILL HEAD LOWER, MONTHLY RSI’S REMAIN LITTLE CHANGED.

THEY CONTINUE TO CALL FOR LOWER YIELDS, GERMANY IS A NEAR PERFECT EXAMPLE!

ALL WEEKLY CHART LOOK CONGESTED BUT MORE IMPORTANTLY CONTINUING TO FAIL KEY RESISTANCE LEVELS.

*****NON-FARM WILL BE THE KEY FOCUS ON THE WEEK**** WILL SEND AN UPDATE POST NON-FARM.

THE MONTHLY RSI DISLOCATIONS REMAIN AND SOME KEY LEVELS ARE APPROACH IN EQUITIES.

US 5YR YIELDS HAVE REJECTED THE MULTIYEAR 23.6% RET 0.8737 ON ITS LATEST BOUNCE.

THE US 30YR YIELD CHART IS FAILING SO MANY PROFOUND LEVELS AND HOPEFULLY THIS MONTHS NON-FARM WILL HELP.

GET READY TO PARTY LIKE 1994! THE HISTORICAL-TECHNICAL PICTURE HIGHLIGHTS A SWATHE OF 1994 RSI EXTENSIONS WHICH ARE VERY OBVIOUSLY EXCEPTIONAL!

ESSENTIALLY THESE TECHNICAL DISLOCATIONS ARE HISTORICALLY UNSUSTAINABLE.

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Supply Preview - "It's a bit cheap" - but for how long?

Market somewhat distracted by the futures rolls today, but we go out higher as we head into supply tomorrow despite a pretty decent chunk of issuance ahead.

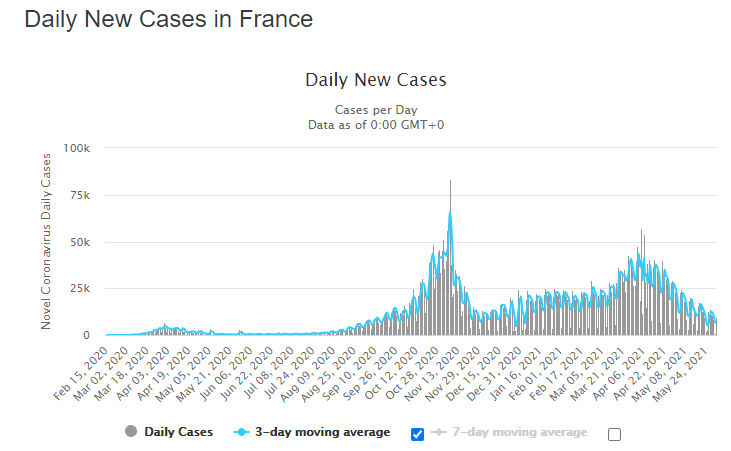

In fact it really is caveat emptor out there as we have a lot of supply next week as we head into the ECB meeting, and despite recent price action there is definitely room for some disappointment for the doves given vaccination numbers and case counts

Tomorrow's supply aside next week brings 7y Bunds, 10y Holland, 3y & 10y Austria, 30y Bund, 3y,7y & 30y Italy, Ireland (TBA) and possibly Portugal and Spanish 10y syndication? (pause for breath)

Week after next we could well see more EU issuance following on from their planned investor call next week. Starting to have conversations about how that will impact the market going forward

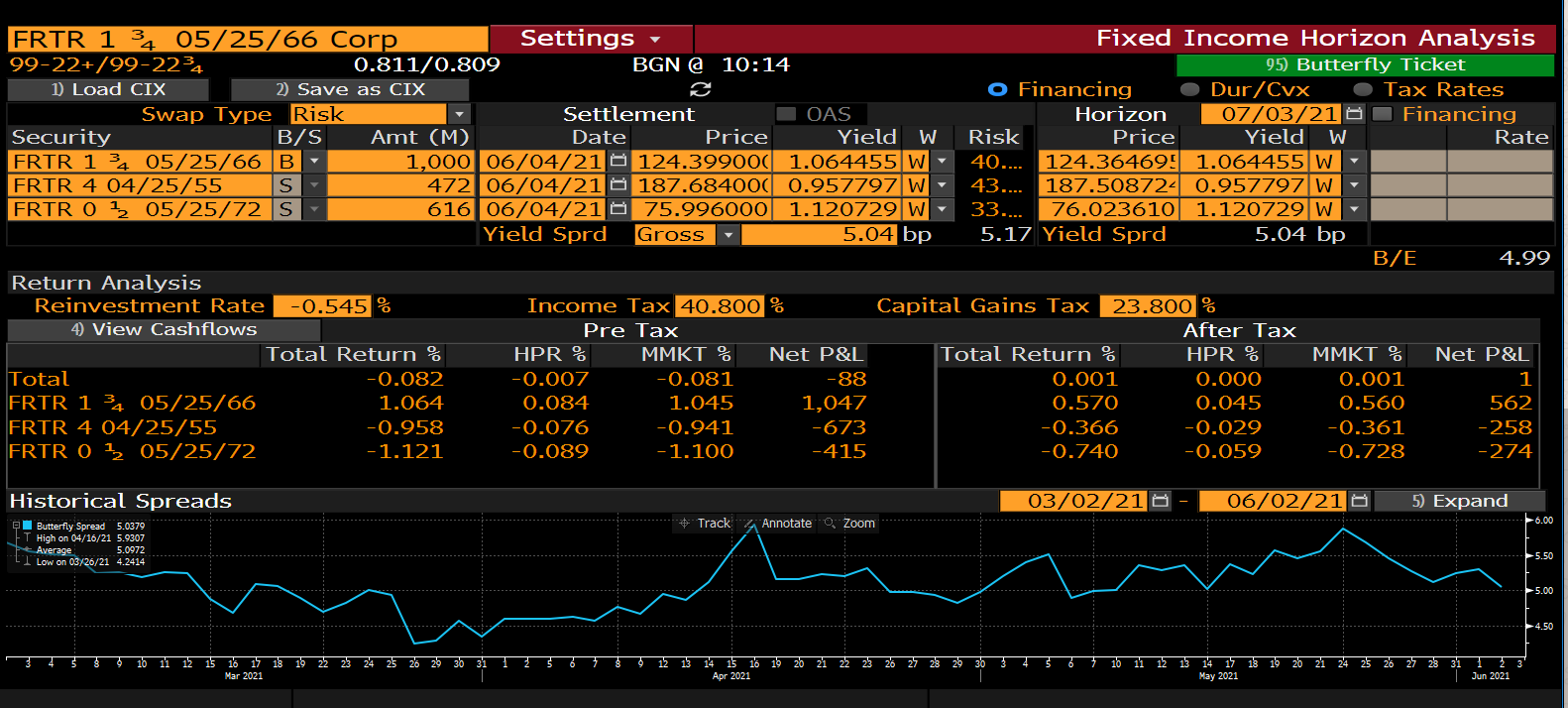

France

France to auction 11/31, 6/44, 4/55 & 5/72 tomorrow in up to 11bn. That's a decent chunk of duration.

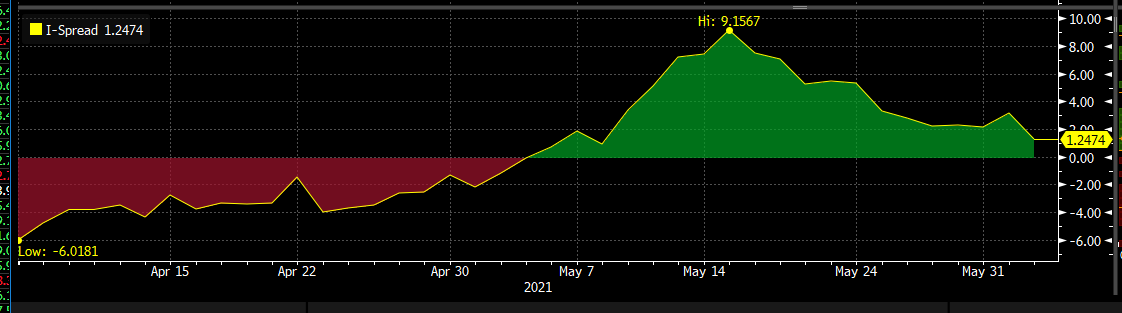

France still looking cheap on a cross market basis as spreads have pretty much retraced in unison over the past couple of week, but have done a huge amount of work vs swaps now:

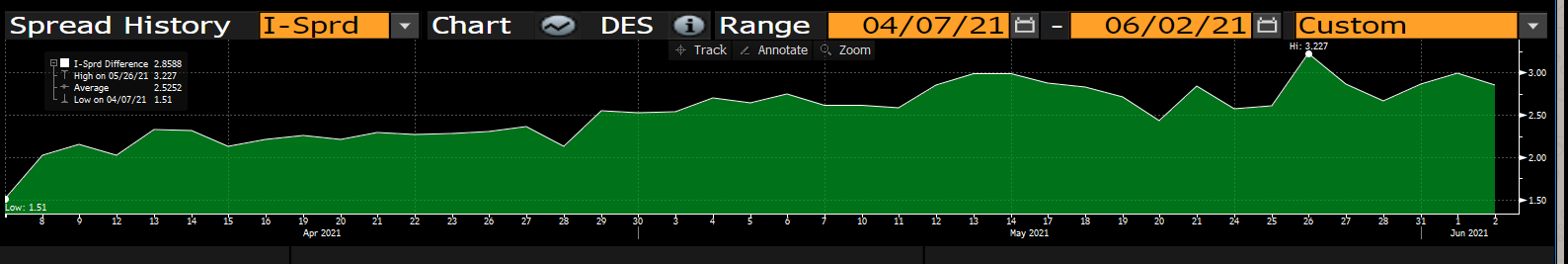

FRTR 11/31 swap spread

We prefer to take the 11/31 down on the 10y roll as we regard it as a soft bullish structure:

Anything above 3.0 basis points on MMS worth a look:

Moving to the longer end the box to Germany has steepened out somewhat, but we don't see it as quite steep enough yet:

Similarly, whilst there has been some degree of concession in the longer bonds, the reality is that it has been pretty minimal:

Buy FRTR 4/55 vs FRTR 2067 & 2072

Would love to see this down at 4.5, but I won't hold my breath

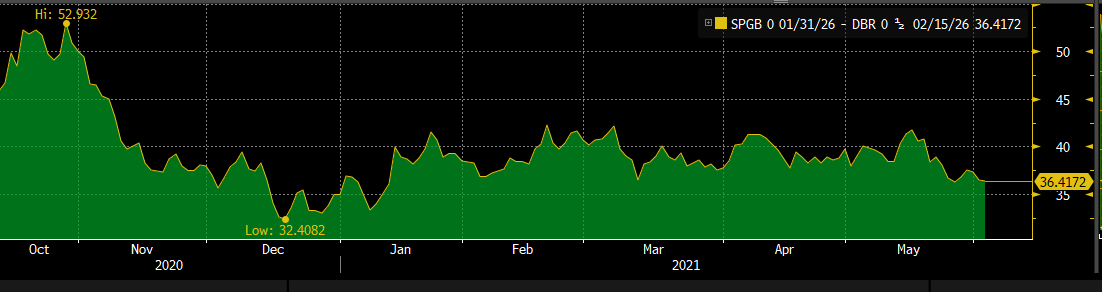

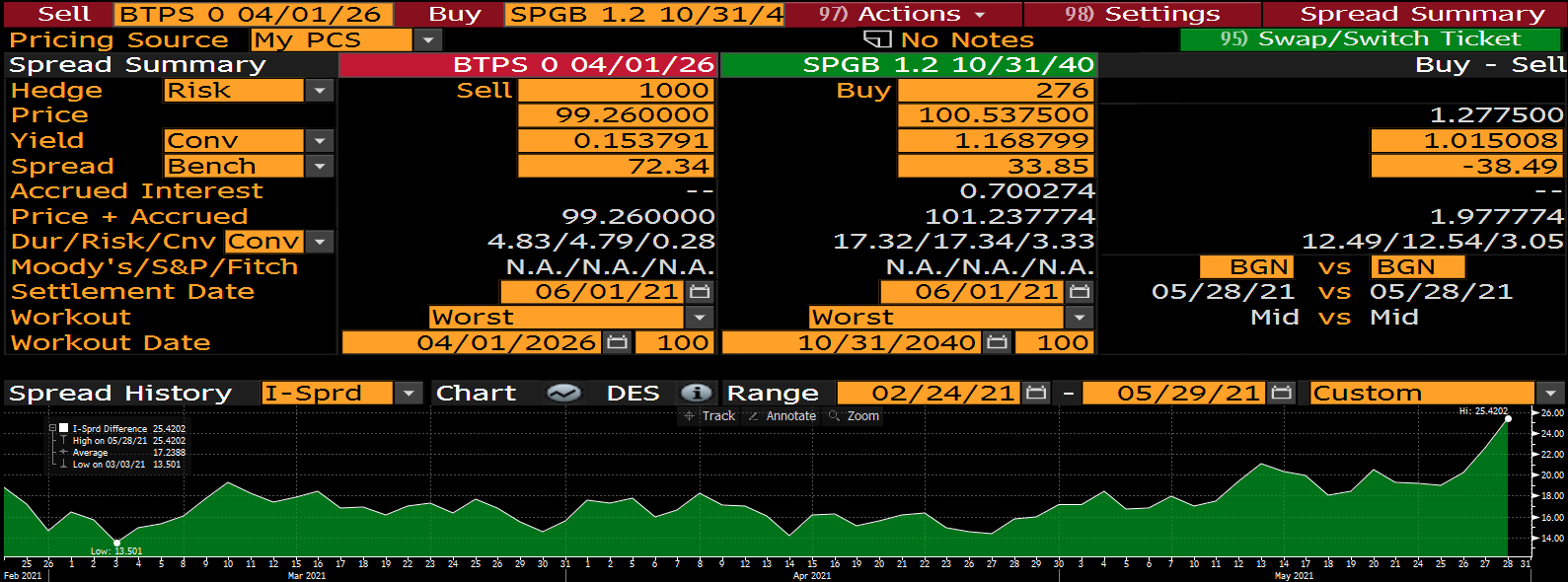

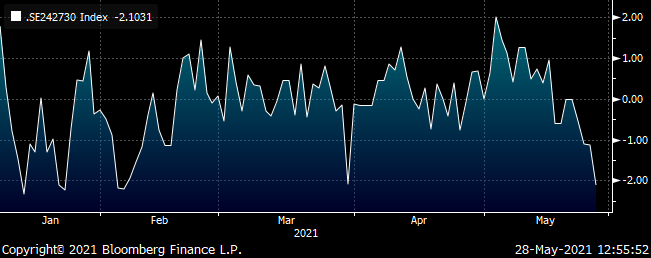

Spain

- Frankly the jury is out on Spain and from the conversations we have had recently we could put together a pretty decent tug of war team on both sides

- Spain to tap 26s, 27s & 40s

- The general spread compression has left Spain looking rich to Bunds, but perhaps a touch cheap x-mkt in the 5y sector

- SPGB 10/40 we like owning on a Blend vs DBR & BTPS (50/50)

- Graph below shows Spread of Spreads SPGB 10/40 vs DBR 8/46 vs BTPS 4/37

(SP210[SPGB 1.2 10/31/40 Corp] - 0.5 * SP210[DBR 2.5 08/15/46 Corp] - 0.5 * SP210[BTPS 0.95 03/01/37 Corp])

Have a good evening

![]()

Will Scott

O: +44 (0) 203 – 143 - 4171

M: +44 (0) 789 – 441 - 7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: US: 60 Rumson rd, rumson, nj 07760

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

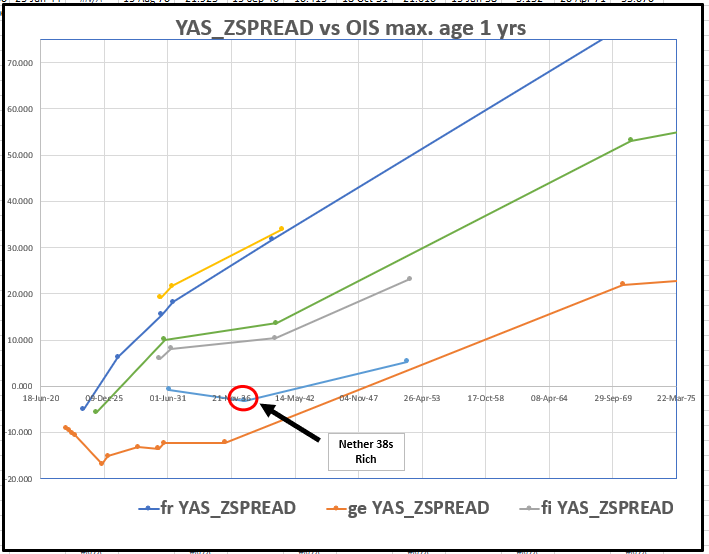

Holland 38s stand out as rich 30y, with Q3 tap potential

Let’s focus on bonds that are recent (max age 1y) – to avoid PEPP Landmines

Trade:

Sell Nether 38s, Buy Nether 31s and Nether 52

- Nether 38s are one of the richest 20y bonds - €6bln issue, expect a tap in Q3

- Nether 31s are to be tapped on Tuesday (currently €8.4bln expect tap of €2.5bln) – target size would be around €14bln as per the prior Nether 203

- Trade looks good on History in both Yield and Swap Space

- Trade in Yield Space creates infeasible rate expectations

Yield graph

200 * (YIELD[NETHER 0 01/15/38 Corp] - 0.5 * YIELD[NETHER 0 07/15/31 Corp] - 0.5 * YIELD[NETHER 0 01/15/52 Corp])

Swap Spread Graph

2 * (SP210[NETHER 0 01/15/38 Corp] - 0.5 * SP210[NETHER 0 07/15/31 Corp] - 0.5 * SP210[NETHER 0 01/15/52 Corp])

Euro Z-Spreads to Eonia (max issue age 1yr)

Carry & Roll

Carry: -0.1bp /3m @5bp repo spread

Roll: +0.3bp /3m

Sharpe Ratio

-0.66, 35 days History

Downsides

Further taps are not forthcoming in the Nether 38 and they richen

The 10y and the 30y cheapen further

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades - James & Will at Astor Ridge

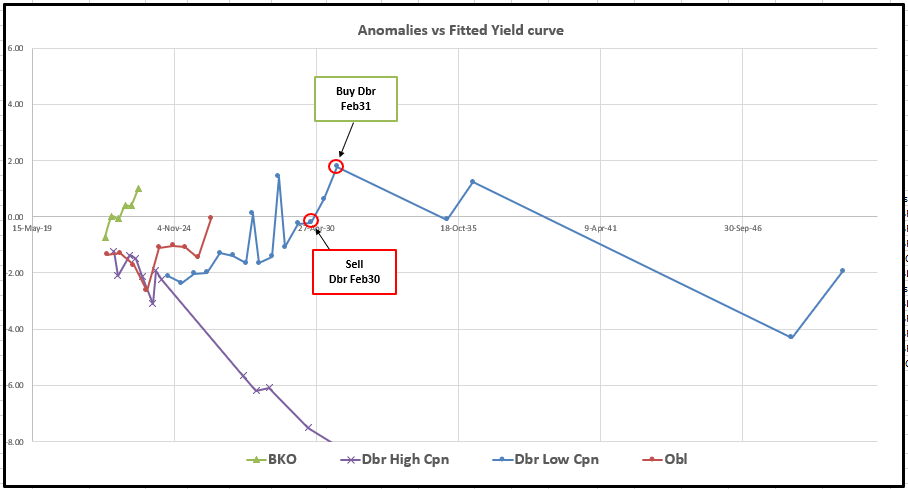

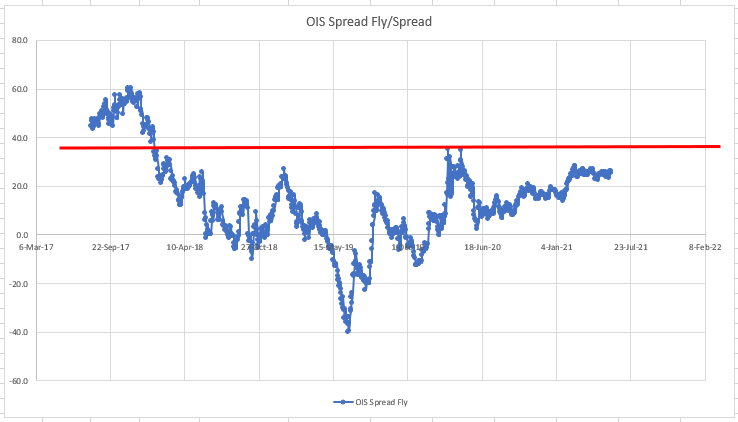

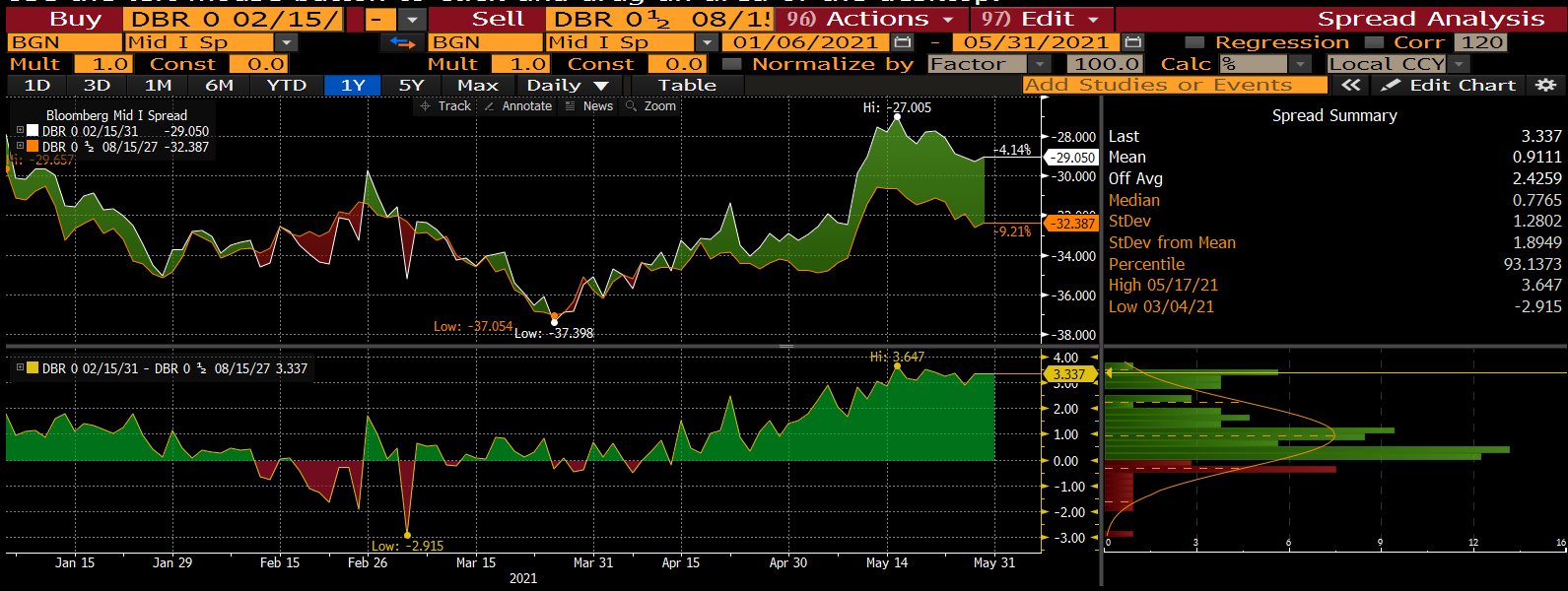

Trade: Preparing for 9s10s flattener in Germany

sell RXM1 basis @ -0.01

RXM1 – June Bund contract

Last trade: June 8th

Delivery: June 10th

Seems to me that there's a solid short base in RXM1 that's against a wider array if 'things' in terms of assets allocation. AS we role those shorts the front month will richen most, followed by the CTD and then other deliverables

The structure I like is selling the CTD Feb30 vs buying the outgoing 10y Dbr Feb31…

But prepping for this during Roll time until the Delivery Date can be a bit like picking up pennies in front of a steam roller

My prep is sell the Dbr Feb30 basis vs the front month and suck up some negative carry – what I'm hoping for is the basis gets a bit more negative as RXM1 gets richer vs everything and then I can sell RXM1 to buy Dbr Feb31 at much better terms, leaving me with

-Dbr Feb30 +Dbr Feb31 (vs OIS)

Here's the Z-Spread History

The downside is we simply take delivery for a small loss and manage the duration tail risk if the contract doesn't richen further and we don't get to mutate the trade into the Bond/Bond spread

Pay old 15y Germany vs 10y and 30y

- Essentially there's little to no curvature in the German curve in comparison to the Eonia curve and other European issuers – generally the 15y-20y tenors seems to be well sought after and in Nether and Germany that's particularly the case

Germany: +15y vs -10y and -30y

Issue selection: Dbr May35s rich, Dbr Feb31 cheap and Dbr Aug50 serve as an anchor

Trade CIX

2 * (SP210[DBR 0 05/15/35 Corp] - 0.5 * SP210[DBR 0 02/15/31 Corp] - 0.5 * SP210[ZR097974 Corp])

Need another 1bp on the middle (X2 on the fly calc) – so on hold for that one – let us know if you want a shout when it gets there

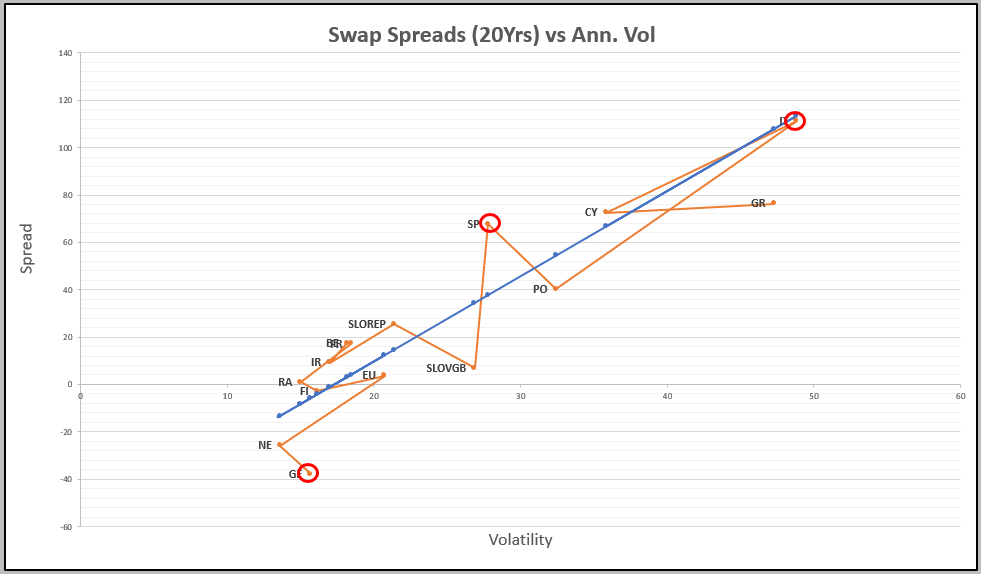

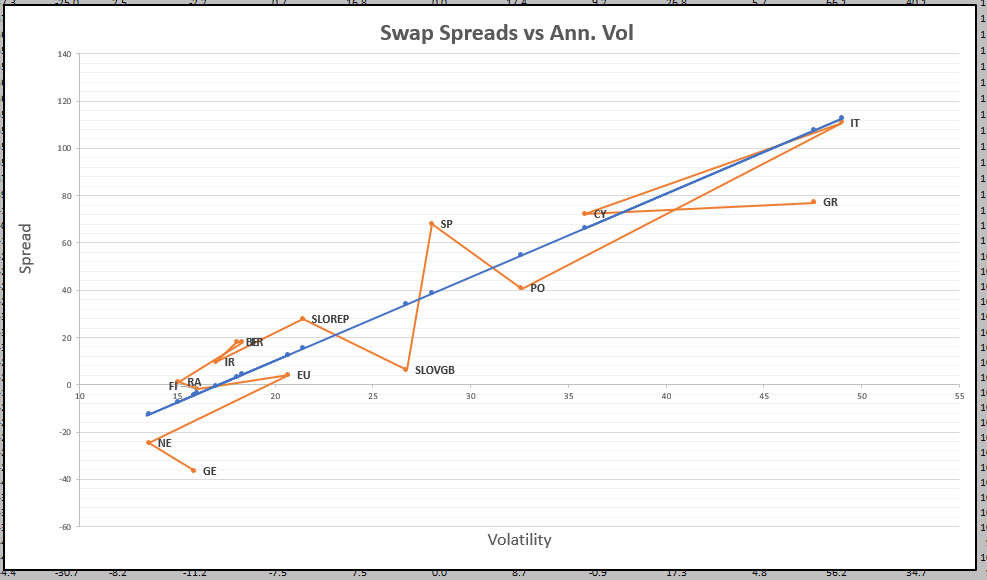

Buy Spanish 20y, Supply on Thursday

Vs Germany and Italy 20y

– looking at Euro Swap Spreads vs a Vol weighting in 20yrs – here's how we see Spread to Swaps vs Vol (on changes of spread to swaps)

Spain looks to be 10 – 20 bp cheap based on the regression of 'how the credit trades'

Running a regression on 20y Spain vs 50/50 weighting of Germany and Italy in Constant Maturity Bonds, I get that we are

@ +25.4bp – see Graph below of

The old high from last March is about +35bp at which point Spain was being unduly influenced by the wash out in Italian credit due to Covid

If that's our worst case then I like 255 of my risk here and another 75% closer to those levels – either we get to add or we take a turn on a more modest size, so scale accordingly

CMB/OIS SPREAD (vs EONIA) Long Spain 20y vs Germany and Italy

Germany – Last tap of Obl Apr26s and they become CTD to OEU1

Buy Obl Apr26 & Sell the old 5y Obl 0% Oct25…

Vs Swaps…

BBG History

As anomalies

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND UPDATE ...NEW MONTH AND LITTLE CHANGED ON THE MONTHLY RSI’S I.E. THE CONTINUE TO CALL FOR LOWER YIELDS, GERMANY IS A NEAR PERFECT EXAMPLE!

BOND UPDATE : NEW MONTH AND LITTLE CHANGED ON THE MONTHLY RSI’S I.E. THE CONTINUE TO CALL FOR LOWER YIELDS, GERMANY IS A NEAR PERFECT EXAMPLE! ALL WEEKLY CHART LOOK CONGESTED BUT FAILING KEY RESISTANCE LEVELS.

*****NON-FARM WILL BE THE KEY FOCUS ON THE WEEK****

THE MONTHLY RSI DISLOCATIONS REMAIN AND SOME KEY LEVELS ARE APPROACH IN EQUITIES.

US 5YR YIELDS HAVE REJECTED THE MULTIYEAR 23.6% RET 0.8737 ON ITS LATEST BOUNCE.

THE US 30YR YIELD CHART IS FAILING SO MANY PROFOUND LEVELS AND HOPEFULLY THIS MONTHS NON-FARM WILL HELP.

GET READY TO PARTY LIKE 1994! THE HISTORICAL-TECHNICAL PICTURE HIGHLIGHTS A SWATHE OF 1994 RSI EXTENSIONS WHICH ARE VERY OBVIOUSLY EXCEPTIONAL!

ESSENTIALLY THESE TECHNICAL DISLOCATIONS ARE HISTORICALLY UNSUSTAINABLE.

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Further thoughts for the week ahead

Spoken to a lot of clients over the last few weeks in a real attempt to understand why we're not doing any business

In short as Dan says, a lot of the trades that the market seems to offer that have both value AND statistical/historical are minutiae – tiny trades where after friction there's maybe less than 1 to 1.5 bp and to be honest unless that reasonable for the Var it makes no sense at all

SO – Strategy

- cut down the issues to more recent ones – less than 2 yrs since issuance – less likely to be gobbled up by PEPP

- remove shorter than 4years – just too sheet intensive

- look at cross market spreads

- use OIS / Swap Spreads as a normalisation

- Look for true correlations

- Dilute the result by the quality of the r2 – if it's not well correlated it's ok but that needs to be factored

- Remove more bid offer – up to 60% of the published bid offer so that we don't obsess about proximate trades unless we can cross some spreads

Trades that get suggested….

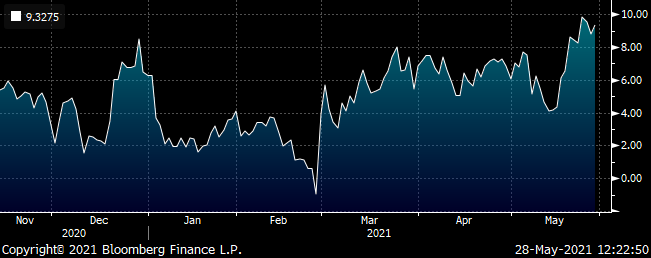

Sell 5y Italy into 20y Spain

We have just had supply in the 5y and the 20y is coming in Thursday – I see Spain 20y as cheap vs the 30y – (OIS spread is almost as flat as France)

As a credit , as you know I see it as having a little extra spread given its VAR

Swaps Spreads vs Vol of Swap Spreads (120 Trading Days, Tenor – 20yrs, Vol. annualised vol on changes)

Cix of Spanish swap Spreads vs Germany and Italy – note there is a residual invoice spread of 30%

(SP210[SPGB 1.2 10/31/40 Corp] - 0.25 * SP210[DBR 4.75 07/04/40 Corp] - 0.45 * SP210[BTPS 1.8 03/01/41 Corp])

Or even a single spread regression to Italy of..

Long 100% Spanish 20y swap spread – short 50% Italy 20y spread

sp210[SPGB 1.2 10/31/40 Govt]-0.5*sp210[BTPS 1.8 03/01/41 Govt]

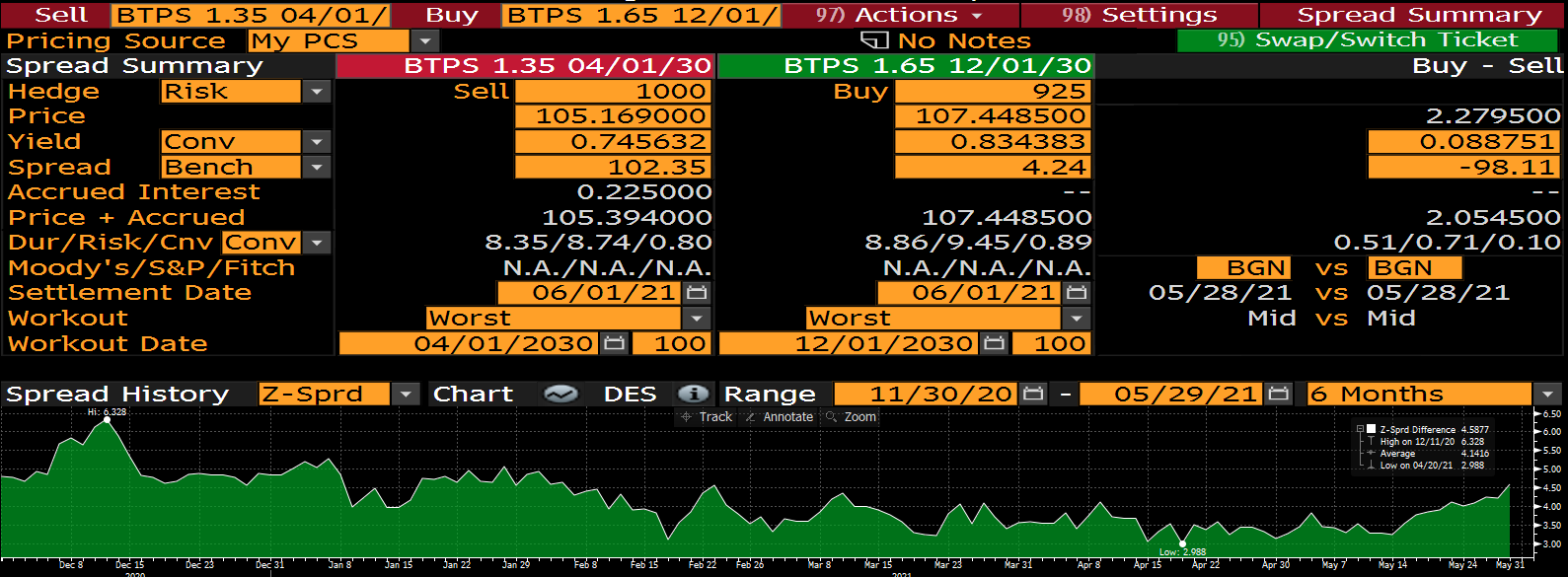

Sell Btps Apr30 into Btps Dec30

Essentially this is IKU1 CTD in IKZ1 CTD

On Z… in graph below (BBG)

For anyone overly concerned about being long IKU1 this is an interesting piece of diversity to the portfolio, the next LC along, Aug30 which have cheapened recently – Aug30 don't get a clear shot at CTD status and Dec30 are a better buy imho – Aug30 actually longer in Modified duration than the Dec30 – and it's that property that dominates delivery in Z1 (when a futures price is a long way from PAR)

So to me – if I've rolled my ik longs in Sep – but am short Aug30, then I'd do this switch above. Any sell-off in IkU1 would be more damaging for the Sep CTD and if Aug30 catch a bid I can see Dec30 responding in a similar fashion so it offer value protection and the kicker of being the next CTD

And on a regression of yiel d here's how the trade looks..

Seeing Germany 5s 10s as historically steep – I like the Dbr Feb31 but the Apr26, although a tap bond also seem cheap

Am tempted to fade that with something like…

-Dbr Aug27 into Dbr Feb31 – although the age of the shorter bond is of some concern, I cant see it as able to roll anywhere – indeed this stuff does cheapen (even older bunds) when they get to the 5y point

Will call to catch up – have a fab weekend

Knowing me, good chance I'll be in on Monday

PPS the output is close on ..

UKT -50 +UKT 54

-bgb 30 +nether 52

Back any Spanish back end vs 5-7y Btps

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades

Nic – just a quick update on some small bits and bobs I'm looking at

If you have a sec can run through

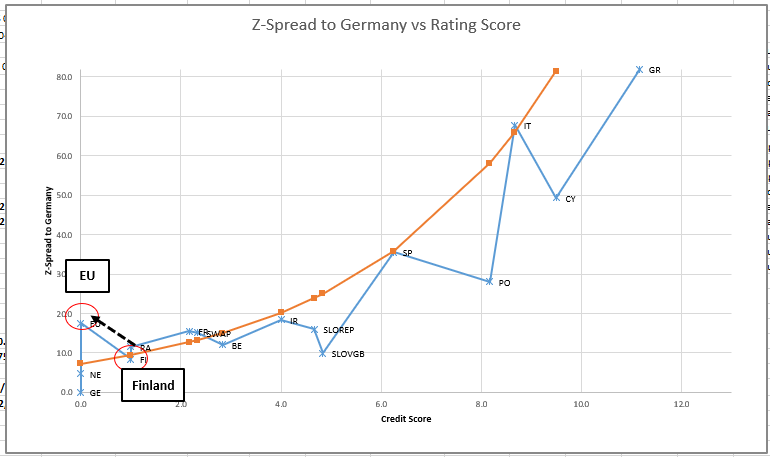

Sell Finland Apr26 to buy EU Mar26

on Z spread..

On Spread to Interpolated Germany vs Credit Rating this looks reasonable and we see diminished risk to the EU name in sub 6yrs despite the prospect of July issuance in NGEU

Sell Germany old 15y

Sell Dbr May35

Buy Dbr Feb31 and Dbr May36

Weighting

2 X ( 0.2 / 1 / 0.8)

Cix:

200 * (yield[DBR 0 05/15/35 Govt]-0.2*yield[DBR 0 02/15/31 Govt]-0.8*yield[DBR 0 05/15/36 Govt])

The Edge vs OIS

2 * (p2509[DBR 0 05/15/35 Govt]-0.2*p2509[DBR 0 02/15/31 Govt]-0.8*p2509[DBR 0 05/15/36 Govt])

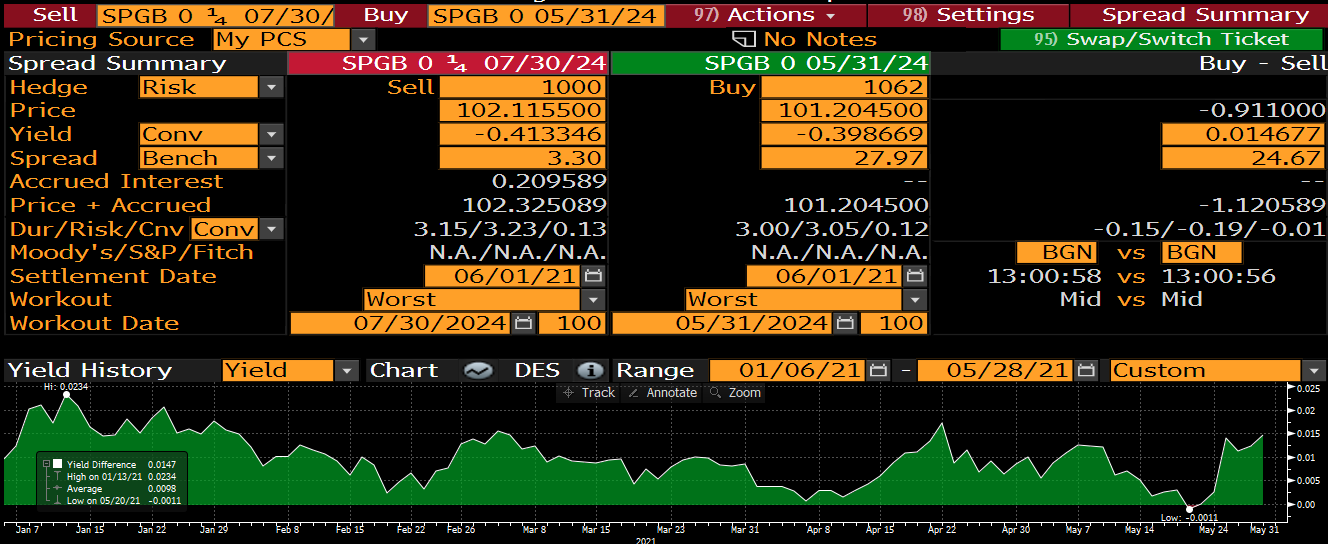

Spain

Sell Spgb jul27

Buy Spgb May24 & Spgb Oct30

Vs OIS

2 * (P2509[SPGB 0.8 07/30/27 Corp] - 0.5 * P2509[SPGB 0 05/31/24 Corp] - 0.5 * P2509[SPGB 1.25 10/31/30 Corp])

Spain

-Spgb Jul24 +Spgb May24

+1.4bp

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

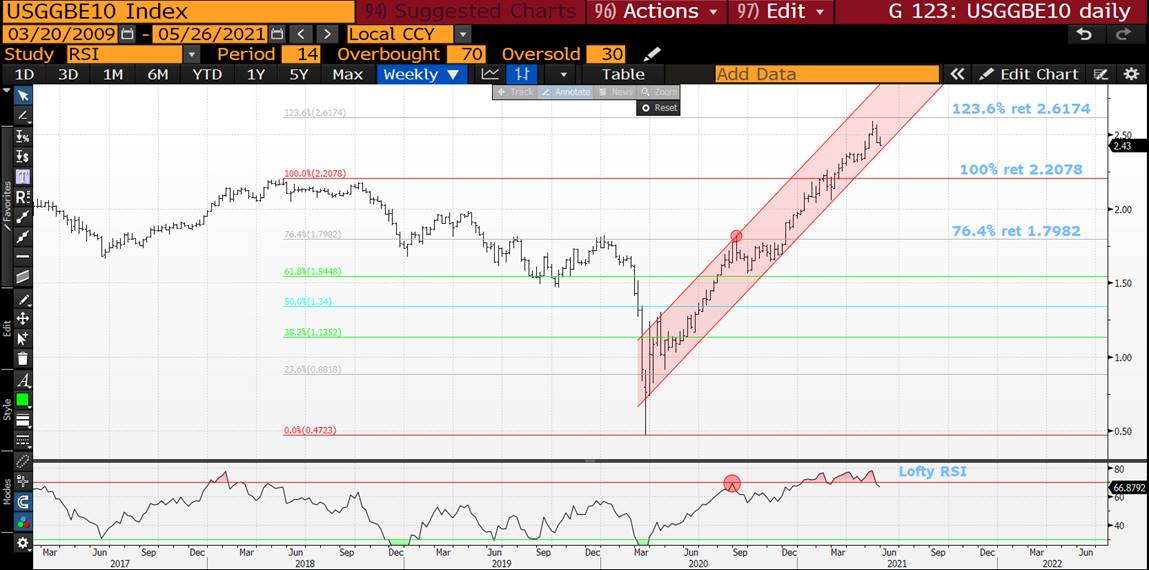

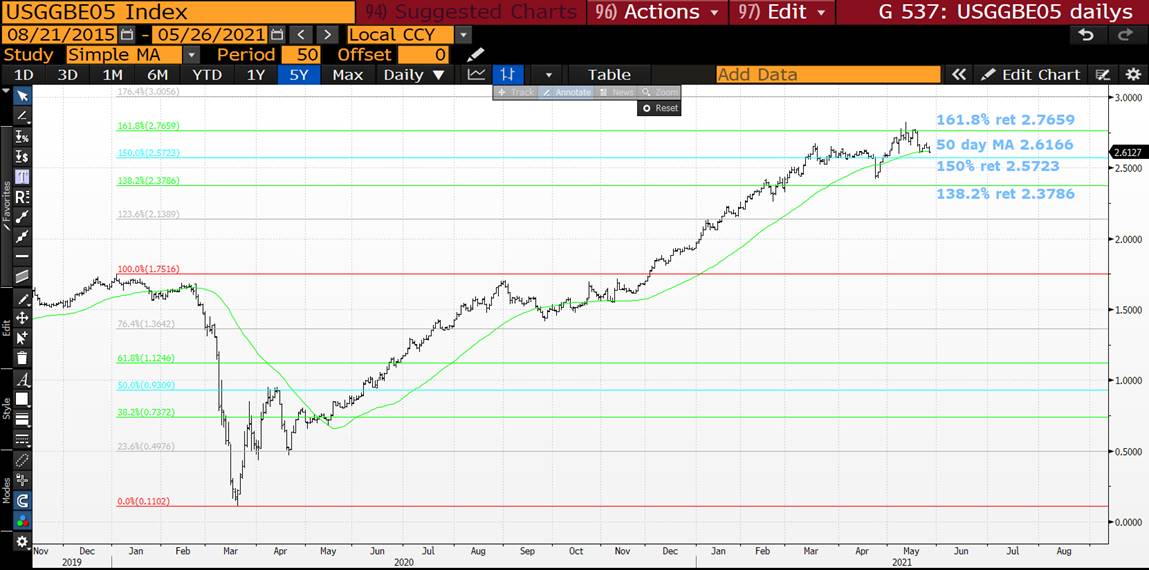

US BREAKEVENS : WE ARE “NUDGING” EVER LOWER INTO MONTH END POISED TO FORM SOME MULTI-YEAR TOPS IF THE RSI’S ARE TO BE BELIEVED.

US BREAKEVENS : WE ARE “NUDGING” EVER LOWER INTO MONTH END POISED TO FORM SOME MULTI-YEAR TOPS IF THE RSI’S ARE TO BE BELIEVED.

MUCH AS I AM NOT A MASSIVE FAN OF CHANNELS ALL 3 WEEKLY CHARTS ARE POISED TO BREACH THE BOTTOM CHANNEL SUPPORT.

30YR BREAKEVEN PUNCHED THROUGH AND SUBSEQUENTLY REJECTED THE MULTI YEAR 76.4% RET 2.3360.

5YR BREAKEVENS HAVE REJECTED THE HIGH SET IN 2008.

**ALL 3 DURATIONS OF CHARTS HAVE RSI’S THAT COMPLIMENT EACH OTHER ACROSS THE BREAKEVEN CURVE.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BOND UPDATE : WE ARE MAKING STEADY PROGRESS TOWARD THE NON-FARM YIELD LOWS WHILST GERMANY 46’S SEEM TO HAVE A LONGTERM BASE IN PLACE

BOND UPDATE : WE ARE MAKING STEADY PROGRESS TOWARD THE NON-FARM YIELD LOWS WHILST GERMANY 46’S SEEM TO HAVE A LONGTERM BASE IN PLACE.

ADDITIONALLY FLATTER US CURVES WILL HELP AS THEY TOO HAVE A VERY LONG WAY TO GO TECHNICALLY.

THE MONTHLY RSI DISLOCATIONS REMAIN AND SOME KEY LEVELS ARE APPROACH IN EQUITIES.

US 5YR YIELDS HAVE REJECTED THE MULTIYEAR 23.6% RET 0.8737 ON ITS LATEST BOUNCE.

THE US 30YR YIELD CHART IS FAILING SO MANY PROFOUND LEVELS, WE JUST NEED TO CLOSE SUB THE NON-FARM LOW.

GET READY TO PARTY LIKE 1994! THE HISTORICAL-TECHNICAL PICTURE HIGHLIGHTS A SWATHE OF 1994 RSI EXTENSIONS WHICH ARE VERY OBVIOUSLY EXCEPTIONAL!

ESSENTIALLY THESE TECHNICAL DISLOCATIONS ARE HISTORICALLY UNSUSTAINABLE.

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris