Trades & Fades - some Euro RV stuff on My Radar

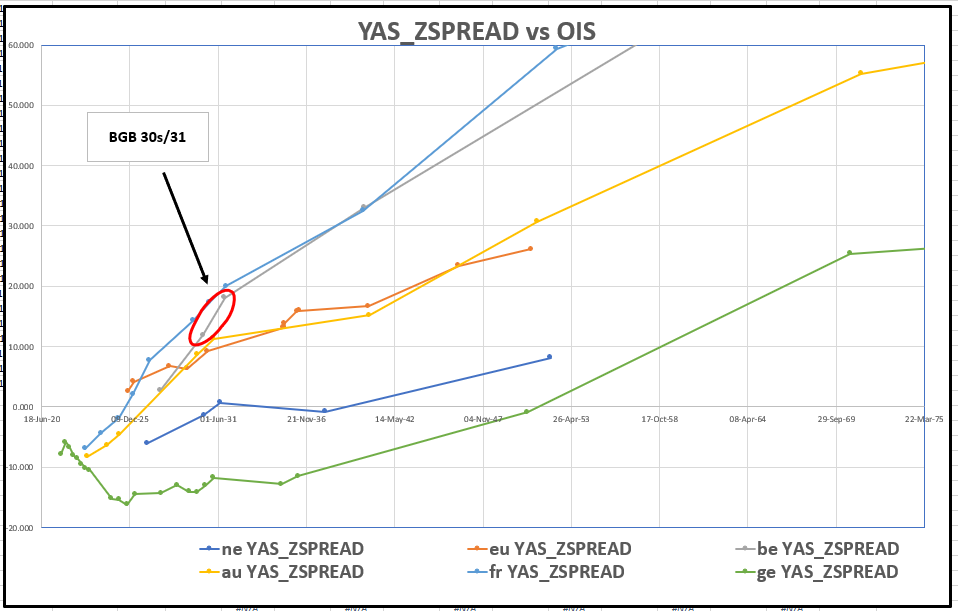

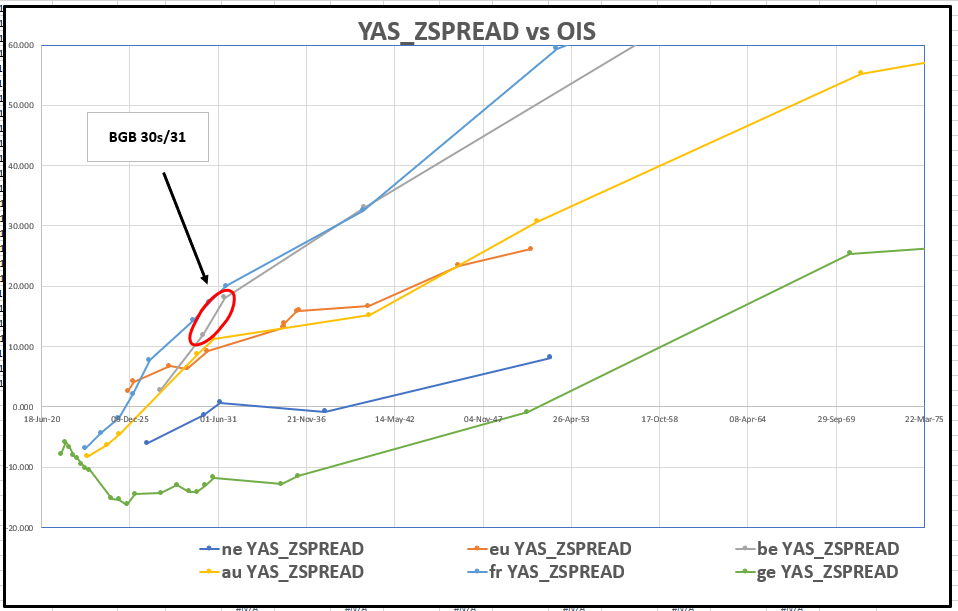

Belgium flattener -9y +10y

Trade

Sell Bgb June 30

Buy Bgb Oct31 (otr 10y)

vs OIS

Rationale

- Belgium 30s31s is one of the widest, steepest semi-core spreads vs OIS in more recent issues

- Current 10y is €8bln, the old 10y is €15Bln, could add which might be a headwind

- Las tap of BGB 30s was in August of 2020

CIX: 1 * (SP210[BGB 0 10/22/31 Corp] - SP210[BGB 0.1 06/22/30 Corp])

(vs Libor)

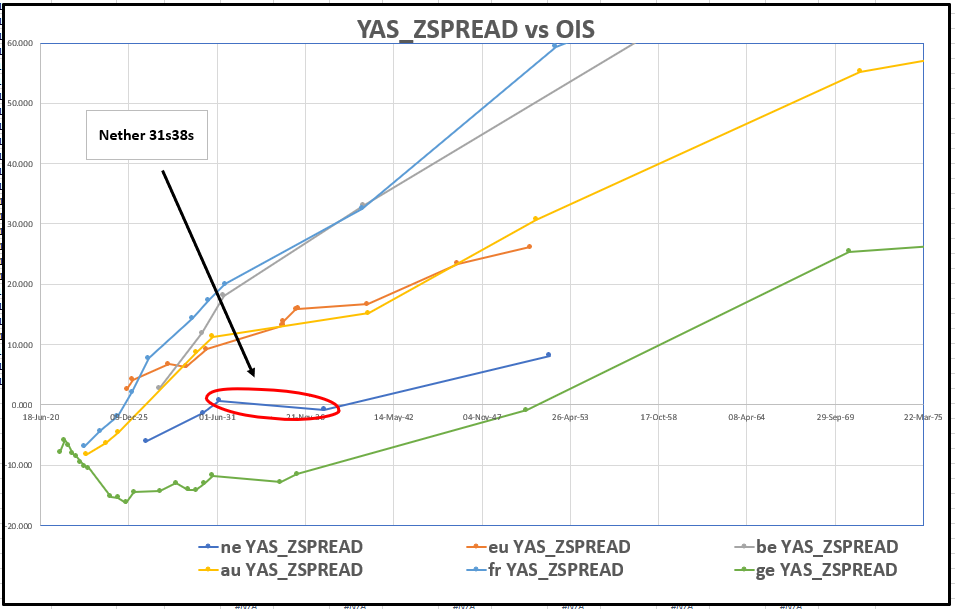

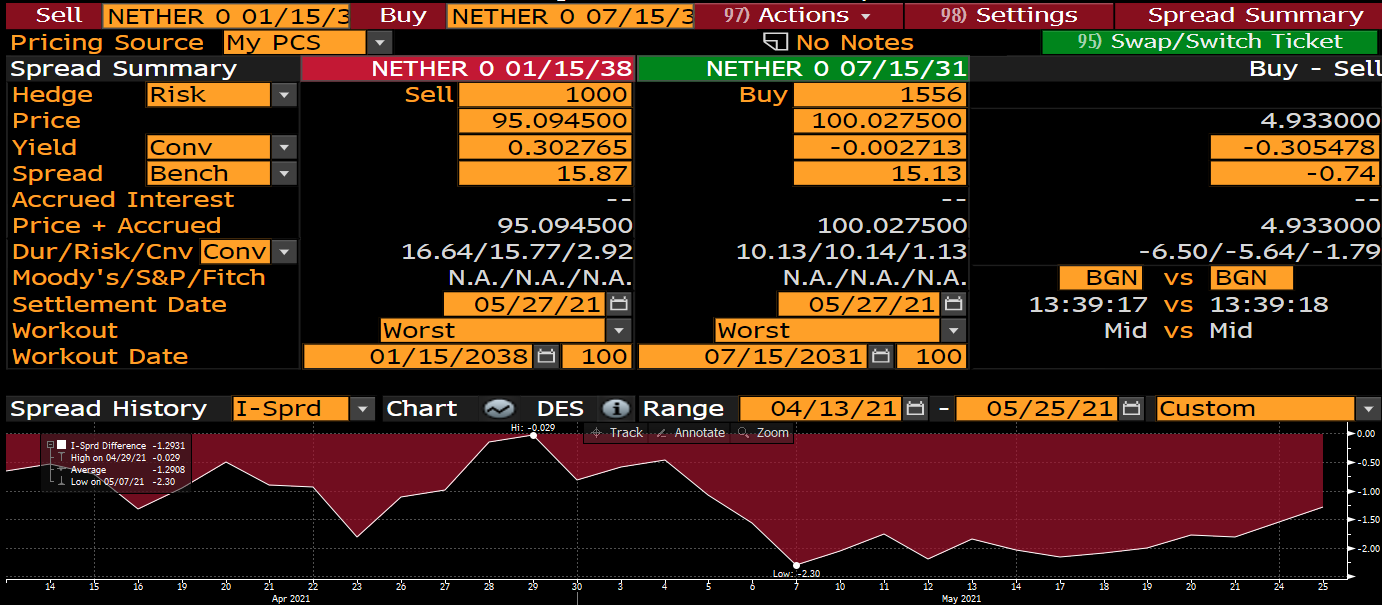

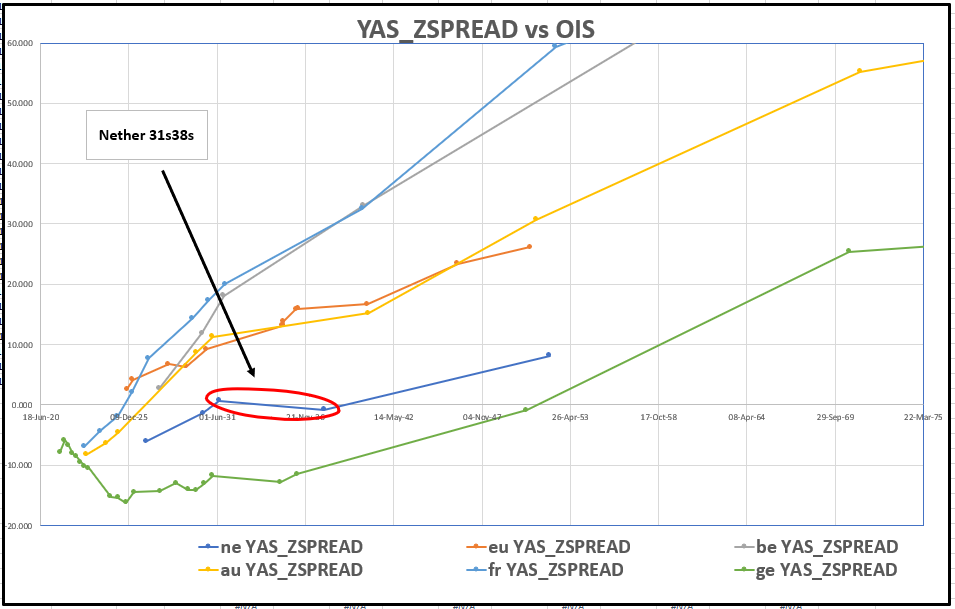

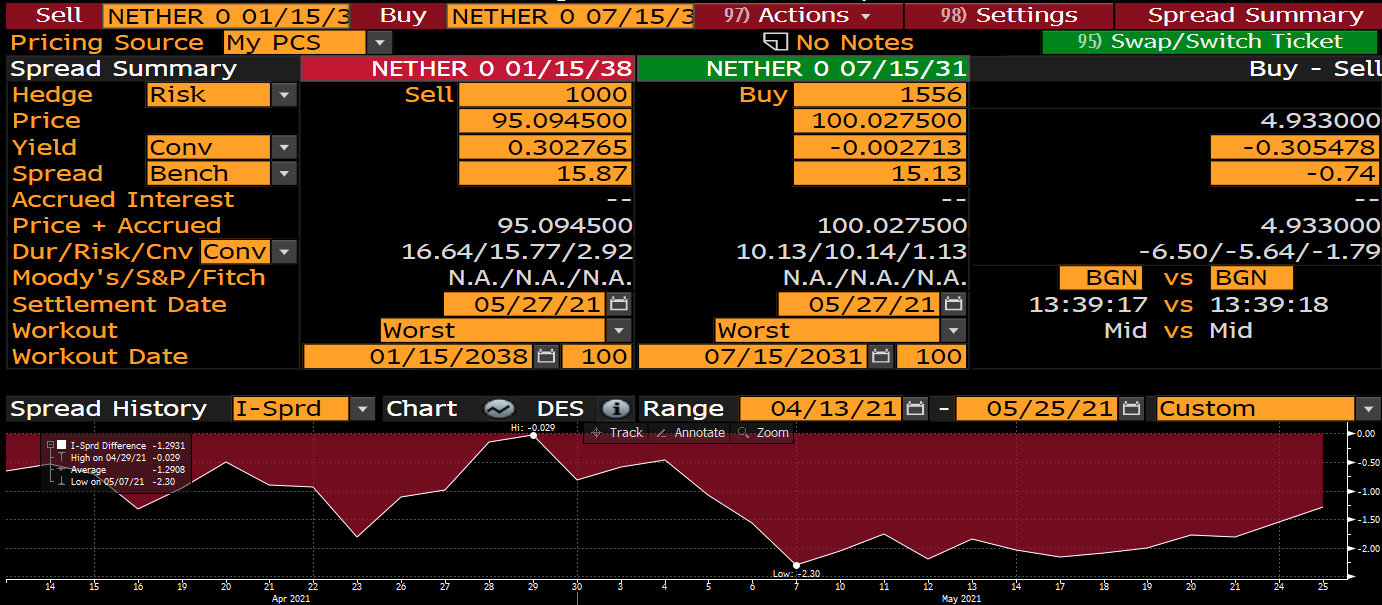

Nether 31s 38s steepener vs OIS

-0.5bp vs OIS, currently +1.5bp on Z

Entry @ Flat and add @ +0.75bp

Rationale

- Recent re-flattening of 10s30s Germany vs swaps has dragged the 10s15s & 10s20s curve flatter in Core – the value is worth fade in Dutch 38s which are only €6yds in size and should get tapped along with Nether 31s, which is the current 10y

- This is the antithesis of the Belgium flattener – whereas in the recent FI sell-off the 5s10s got steepened, similarly 10s cheapened vs 15s on the move causing the 10y to be idiosyncratically cheap

BBG History vs Swaps…

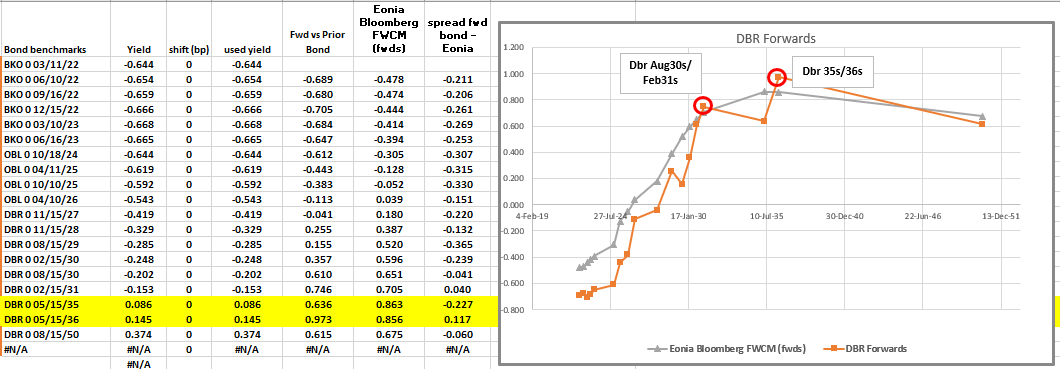

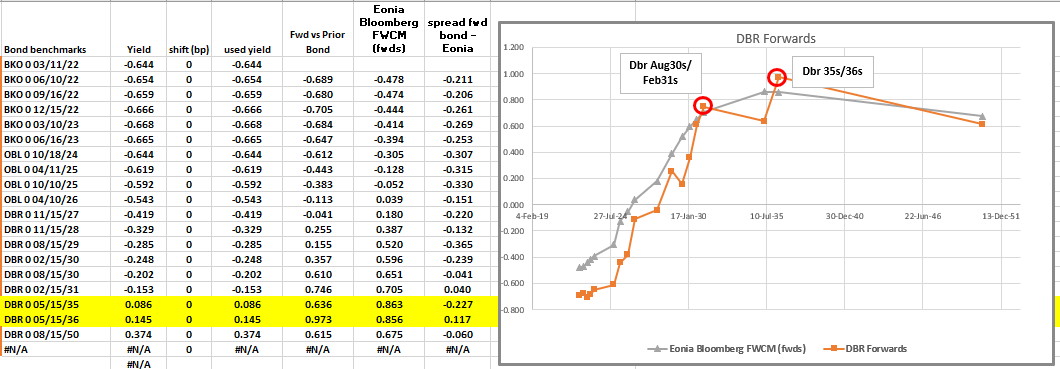

German 15y supply – new issue cheap

But like the roll -35s +36s: @ +5.8bp

with the recent sell-off in swap spreads, the same yield spread in bonds produces a cheaper ‘forward’ vs Eonia / Libor

So for example in spread contraction for high quality issuer such as Germany, I would expect anomalously cheap bonds to compress to the curve as a result of swap related activity

The best anomaly in Germany, of more liquid issues vs Eonia is -Dbr35 +Dbr36

To capture the FORWARD vs Eonia we should alter the hedge to be..

Sell 95% May35 vs Eonia

Buy 100% May36 vs Eonia

So all duration matched but less of the 35s short than one might expect

Here’s how that looks vs OIS -

(P2509[DBR 0 05/15/36 Corp] - 0.95 * P2509[DBR 0 05/15/35 Corp])

IF WE CAN GET THIS @ > +1BP INTO TOMORROW’S SUPPLY I THINK IT MAKES A LOT OF SENSE

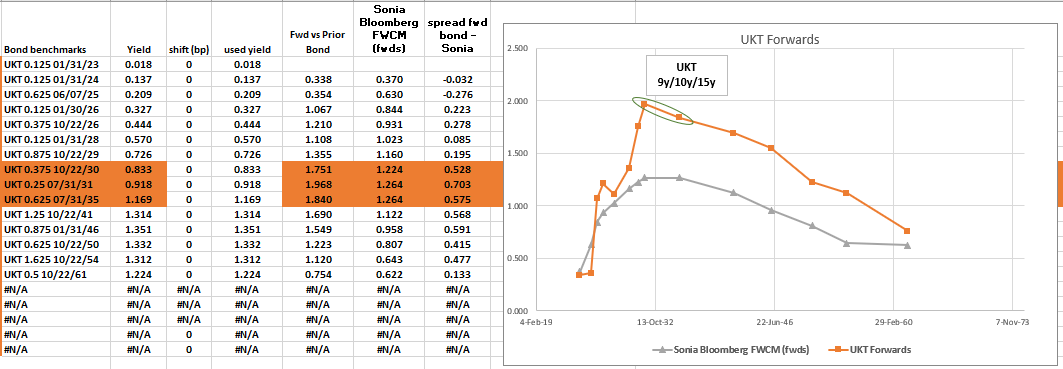

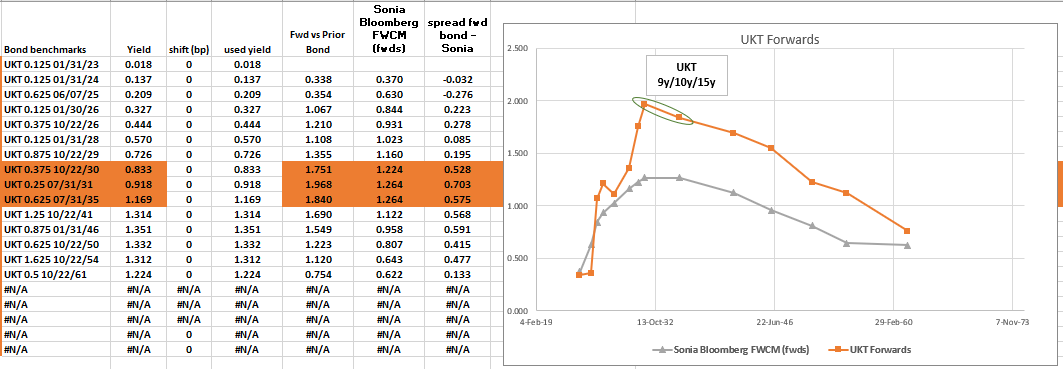

UK

Short 9y: 90%

Long 10y (on the run): 100%

Short 15y: 10%

Weighted Fly +10.3bp, enter here

On forwards this looks pretty compelling, the 9y1y is on a precipice waiting to roll down the curve – it’s these distortions that pretty much set the condition at which tap issues find a RM bid

Rationale

- On the runs cheapen to a point where they are not just ‘fair’ – but their forward rate, the metric by which a cash for cash investor might see value, is appealing in the context of the curve of implied forward rates

- The roll on the 9y1y rate in Bonds – is elevated vs Sonia ( it always is to some degree) – but here the 10y5y looks a reasonable hedge

UK forwards with Sonia

BBG History

2 * (YIELD[UKT 0.25 07/31/31 Corp] - 0.1 * YIELD[UKT 0.625 07/31/35 Corp] - 0.9 * YIELD[UKT 0.375 10/22/30 Corp]) * 100

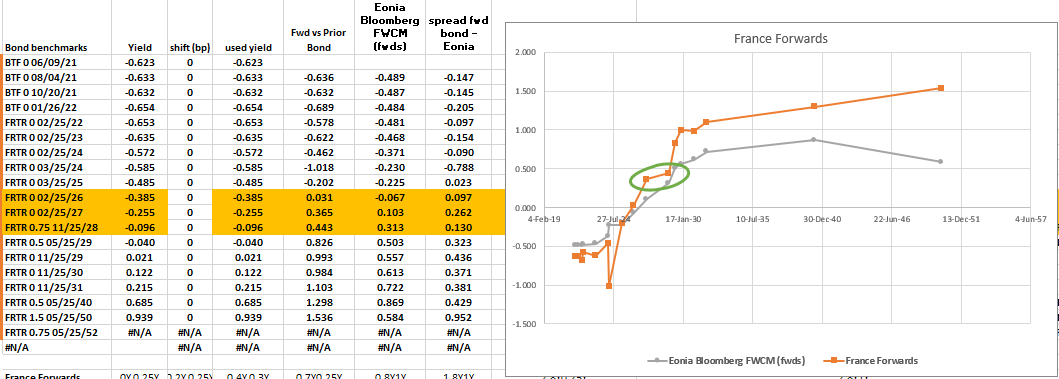

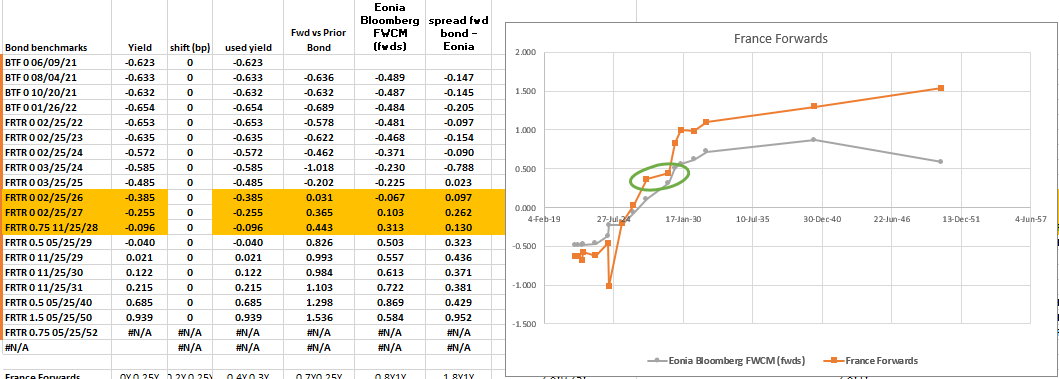

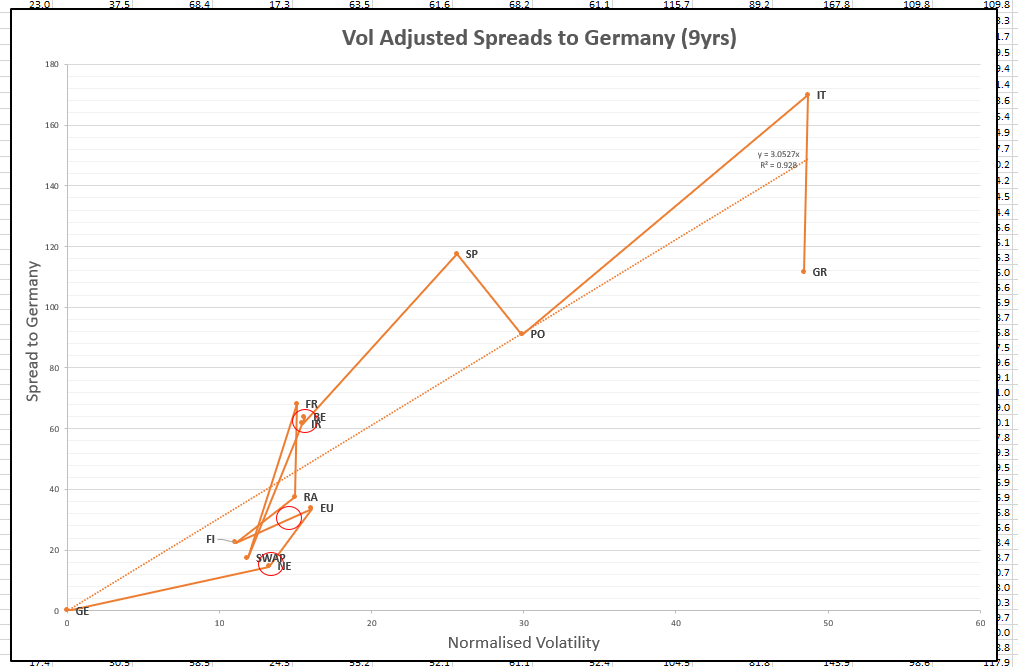

Long On The Run 5yr France vs old 5y and 8y

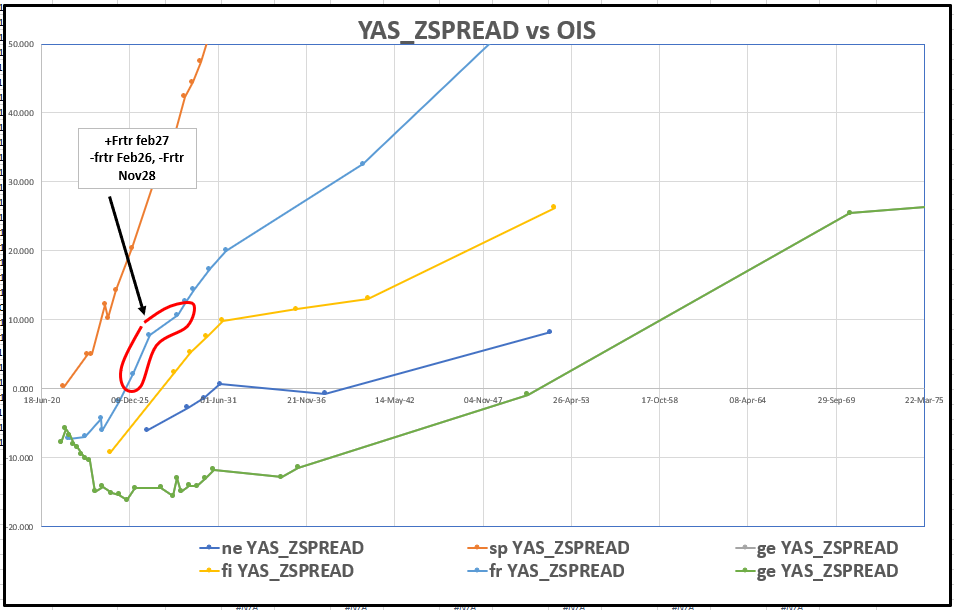

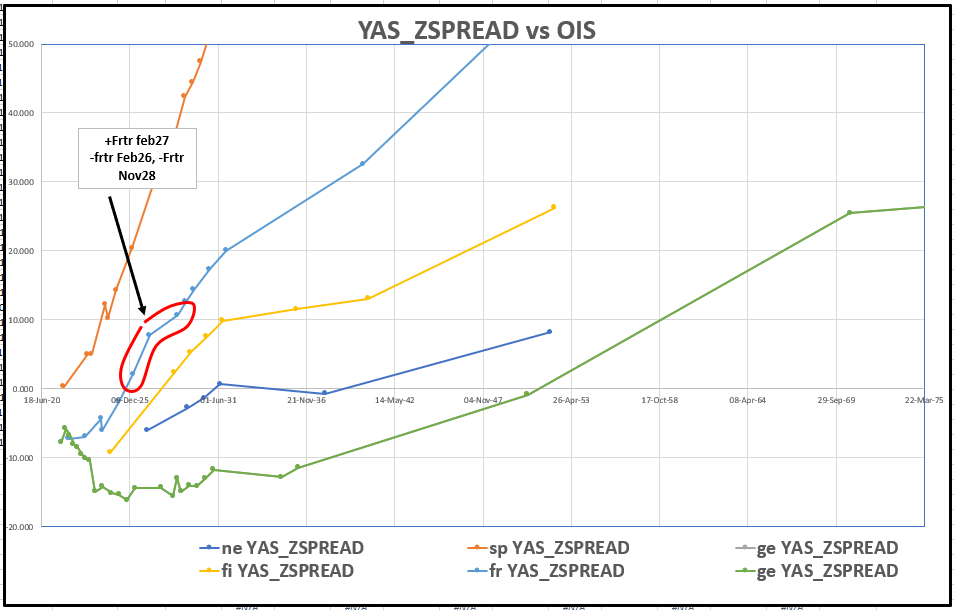

If we look at Z-Spreads vs OIS we can see how the new issue discount in Frtr Feb27 causes a ‘bowing out’ of the curve

(2*yield[FRTR 0 02/25/27 Govt] - yield[FRTR 0.75 11/25/28 Govt] - yield[FRTR 0 02/25/26 Govt])*100

On forwards it just looks wrong – forwards rise, the level off – overly informed and a result of supply nothing more

Best Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades - some Euro RV stuff on My Radar

Belgium flattener -9y +10y

Trade

Sell Bgb June 30

Buy Bgb Oct31 (otr 10y)

vs OIS

Rationale

- Belgium 30s31s is one of the widest, steepest semi-core spreads vs OIS in more recent issues

- Current 10y is €8bln, the old 10y is €15Bln, could add which might be a headwind

- Las tap of BGB 30s was in August of 2020

CIX: 1 * (SP210[BGB 0 10/22/31 Corp] - SP210[BGB 0.1 06/22/30 Corp])

(vs Libor)

Nether 31s 38s steepener vs OIS

-0.5bp vs OIS, currently +1.5bp on Z

Entry @ Flat and add @ +0.75bp

Rationale

- Recent re-flattening of 10s30s Germany vs swaps has dragged the 10s15s & 10s20s curve flatter in Core – the value is worth fade in Dutch 38s which are only €6yds in size and should get tapped along with Nether 31s, which is the current 10y

- This is the antithesis of the Belgium flattener – whereas in the recent FI sell-off the 5s10s got steepened, similarly 10s cheapened vs 15s on the move causing the 10y to be idiosyncratically cheap

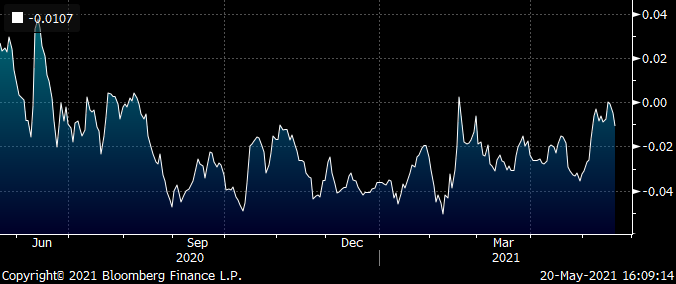

BBG History vs Swaps…

German 15y supply – not a buy quite yet!!!

But like the roll -35s +36s: @ +5.8bp

with the recent sell-off in swap spreads, the same yield spread in bonds produces a cheaper ‘forward’ vs Eonia / Libor

So for example in spread contraction for high quality issuer such as Germany, I would expect anomalously cheap bonds to compress to the curve as a result of swap related activity

The best anomaly in Germany, of more liquid issues vs Eonia is -Dbr35 +Dbr36

To capture the FORWARD vs Eonia we should alter the hedge to be..

Sell 95% May35 vs Eonia

Buy 100% May36 vs Eonia

So all duration matched but less of the 35s short than one might expect

Here’s how that looks vs OIS -

(P2509[DBR 0 05/15/36 Corp] - 0.95 * P2509[DBR 0 05/15/35 Corp])

IF WE CAN GET THIS @ > +1BP INTO TOMORROW’S SUPPLY I THINK IT MAKES A LOT OF SENSE

UK

Short 9y: 90%

Long 10y (on the run): 100%

Short 15y: 10%

Weighted Fly +10.3bp, enter here

On forwards this looks pretty compelling, the 9y1y is on a precipice waiting to roll down the curve – it’s these distortions that pretty much set the condition at which tap issues find a RM bid

Rationale

- On the runs cheapen to a point where they are not just ‘fair’ – but their forward rate, the metric by which a cash for cash investor might see value, is appealing in the context of the curve of implied forward rates

- The roll on the 9y1y rate in Bonds – is elevated vs Sonia ( it always is to some degree) – but here the 10y5y looks a reasonable hedge

UK forwards with Sonia

BBG History

2 * (YIELD[UKT 0.25 07/31/31 Corp] - 0.1 * YIELD[UKT 0.625 07/31/35 Corp] - 0.9 * YIELD[UKT 0.375 10/22/30 Corp]) * 100

Long On The Run 5yr France vs old 5y and 8y

If we look at Z-Spreads vs OIS we can see how the new issue discount in Frtr Feb27 causes a ‘bowing out’ of the curve

(2*yield[FRTR 0 02/25/27 Govt] - yield[FRTR 0.75 11/25/28 Govt] - yield[FRTR 0 02/25/26 Govt])*100

On forwards it just looks wrong – forwards rise, the level off – overly informed and a result of supply nothing more

Best Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

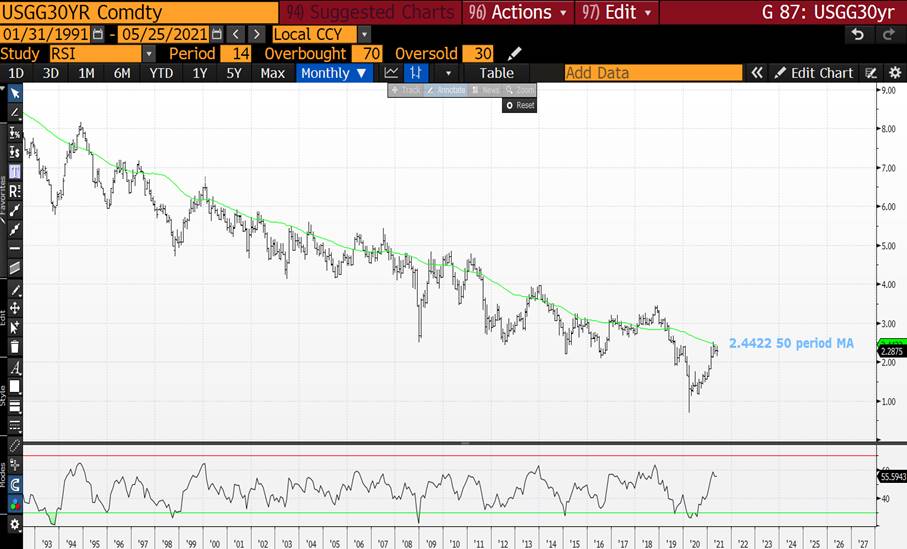

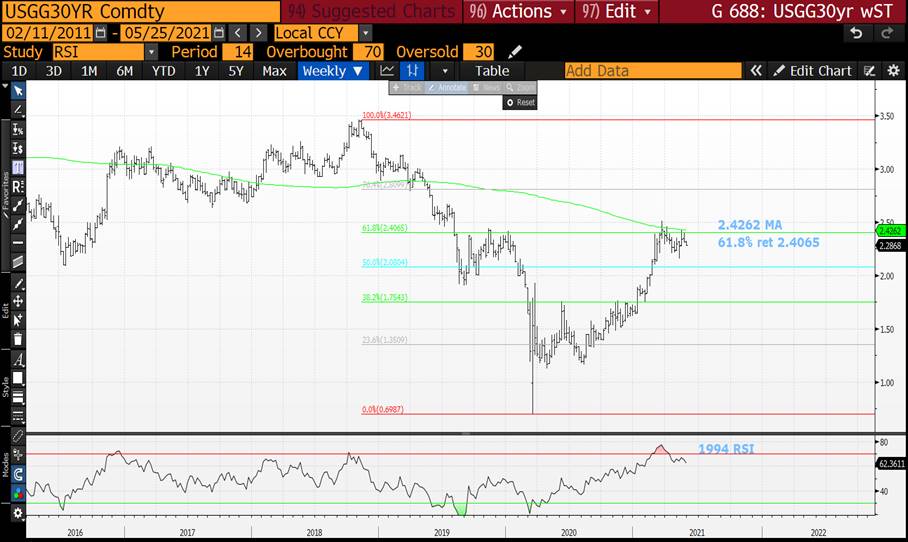

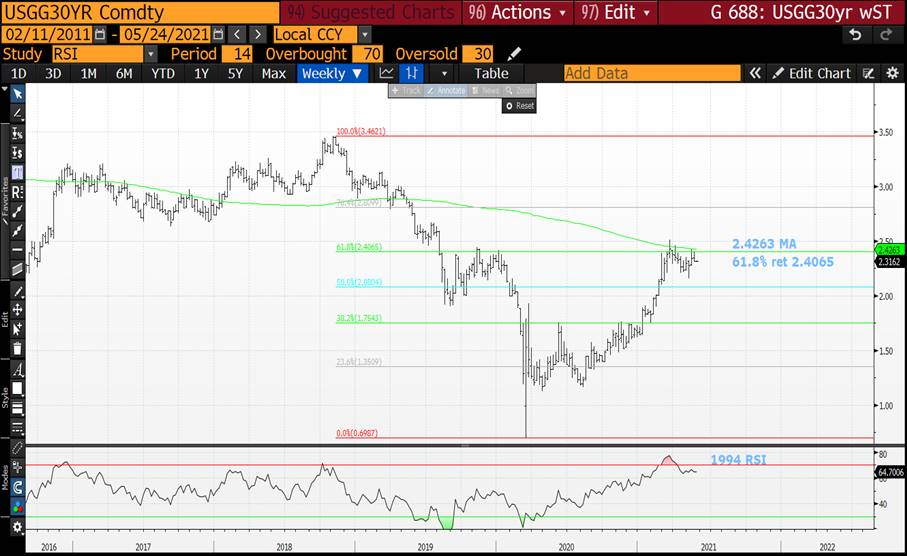

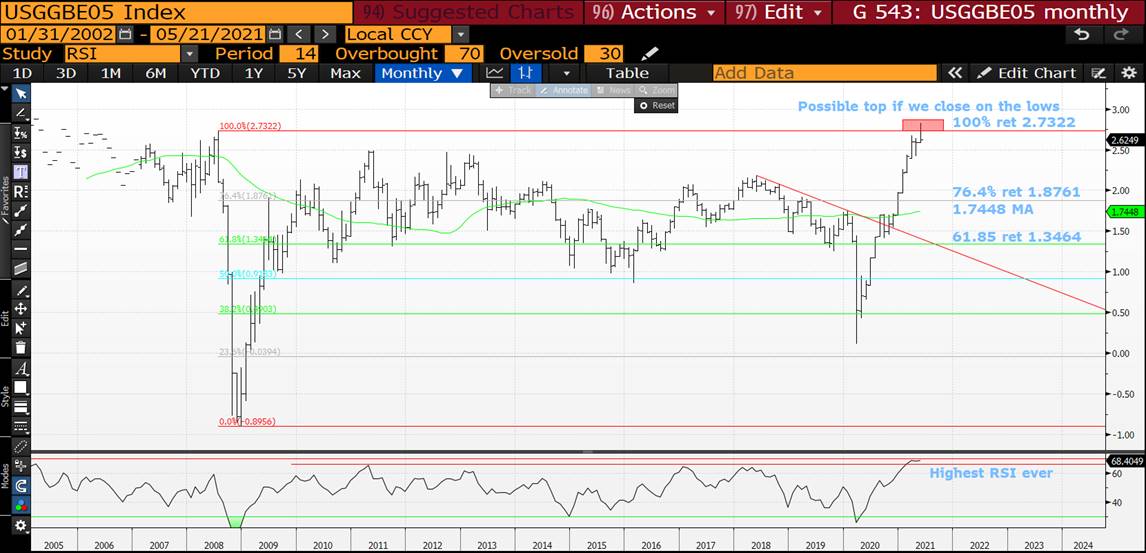

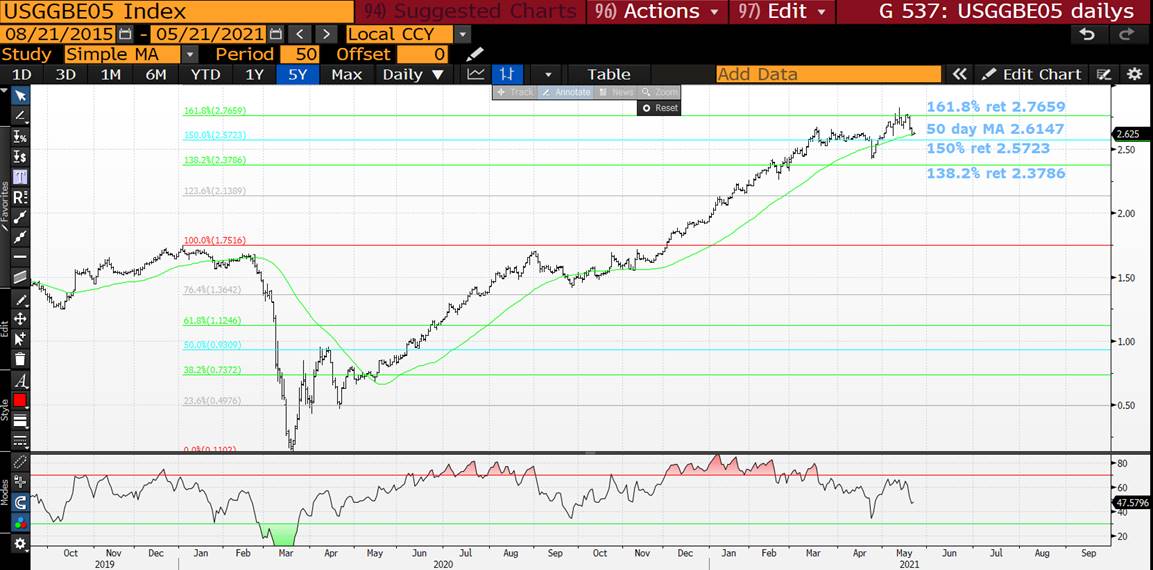

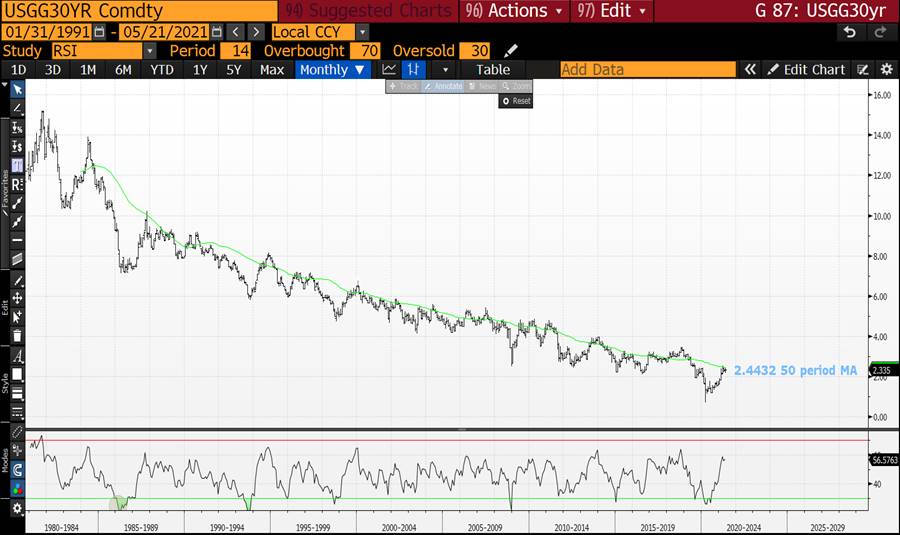

BOND UPDATE : ALL BOND YIELD RESISTANCES CONTINUE TO HOLD WITH THE IDEAL CLOSE THIS WEEK BEING SUB THE NON-FARM YIELD LOWS.

BOND UPDATE : ALL BOND YIELD RESISTANCES CONTINUE TO HOLD WITH THE IDEAL CLOSE THIS WEEK BEING SUB THE NON-FARM YIELD LOWS. ADDITIONALLY FLATTER US CURVES WILL HELP AS THEY TOO HAVE A VERY LONG WAY TO GO TECHNICALLY.

THE MONTHLY RSI DISLOCATIONS REMAIN AND SOME KEY LEVELS ARE APPROACH IN EQUITIES.

GERMAN DBR 2046'S HAVE HELD A 200 WEEKLY MOVING AVERAGE 151.903 WITH AN RSI DISLOCATION NEVER SEEN BEFORE, COULD BE THE ONE TO WATCH.

US 5YR YIELDS HAVE REJECTED THE MULTIYEAR 23.6% RET 0.8737 ON ITS LATEST BOUNCE.

SPECIAL MENTION TO THE US 30YR YIELD CHART FAILING SO MANY PROFOUND LEVELS.

GET READY TO PARTY LIKE 1994! THE HISTORICAL-TECHNICAL PICTURE HIGHLIGHTS A SWATHE OF 1994 RSI EXTENSIONS WHICH ARE VERY OBVIOUSLY EXCEPTIONAL!

ESSENTIALLY THESE TECHNICAL DISLOCATIONS ARE HISTORICALLY UNSUSTAINABLE.

US BOND AND SWAP CURVES CONTINUE TO "SCREAM" FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS "OUT OF LINE" WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BOND UPDATE : LAST WEEK ALL MAJOR BOND YIELD RESISTANCE “HELD” SO HOPEFULLY THIS WEEK SEES YIELDS HEAD LOWER.

BOND UPDATE : LAST WEEK ALL MAJOR BOND YIELD RESISTANCE “HELD” SO HOPEFULLY THIS WEEK SEES YIELDS HEAD LOWER.

THE MONTHLY RSI DISLOCATIONS REMAIN AND SOME KEY LEVELS ARE APPROACH IN EQUITIES.

GERMAN DBR 2046’S HAVE HELD A 200 WEEKLY MOVING AVERAGE 151.901 WITH AN RSI DISLOCATION NEVER SEEN BEFORE, COULD BE THE ONE TO WATCH.

US 5YR YIELDS HAVE REJECTED THE MULTIYEAR 23.6% RET 0.8737 ON ITS LATEST BOUNCE.

SPECIAL MENTION TO THE US 30YR YIELD CHART FAILING SO MANY PROFOUND LEVELS.

GET READY TO PARTY LIKE 1994! THE HISTORICAL-TECHNICAL PICTURE HIGHLIGHTS A SWATHE OF 1994 RSI EXTENSIONS WHICH ARE VERY OBVIOUSLY EXCEPTIONAL!

ESSENTIALLY THESE TECHNICAL DISLOCATIONS ARE HISTORICALLY UNSUSTAINABLE.

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trades & fades from the weekend - James & Will @ Astor Ridge

Just some thoughts on the markets and the moves of late…

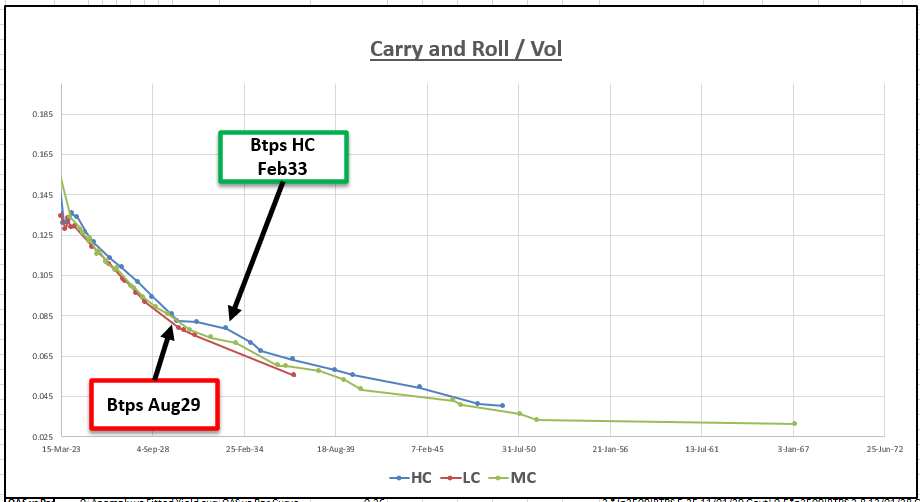

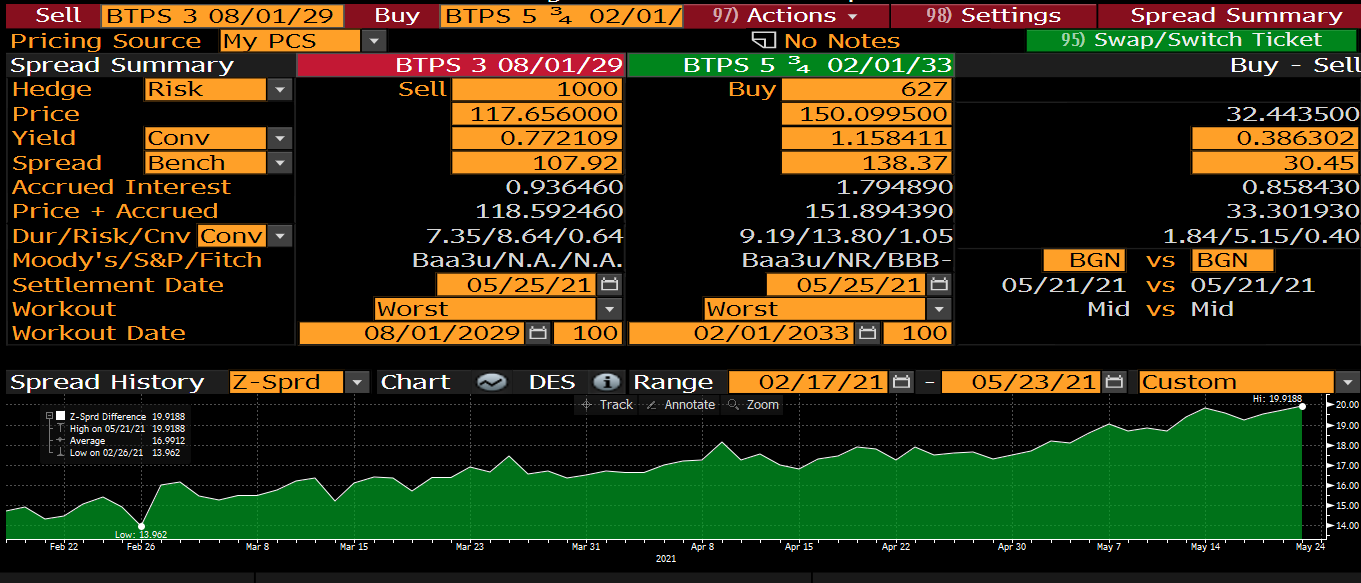

Italy 5s10s too steep when compared to 2s30s…

100 * ((RV0005P 10Y BLC Curncy - RV0005P 5Y BLC Curncy) - 0.33 * (RV0005P 30Y BLC Curncy - RV0005P 2Y BLC Curncy))

Also true when I look vs OIS as well

100 * (((RV0005P 10Y BLC Curncy - EUSWE10 Curncy) - (RV0005P 5Y BLC Curncy - EUSWE5 Curncy)) - 0.33 * ((RV0005P 30Y BLC Curncy - EUSWE30 Curncy) - (RV0005P 2Y BLC Curncy - EUSWE2 Curncy)))

So am thinking of doing the straight flattener in something like 5s10s, but am gonna use vol adjusted Carry and Roll to pick the points…

On Z-sprd it looks good…

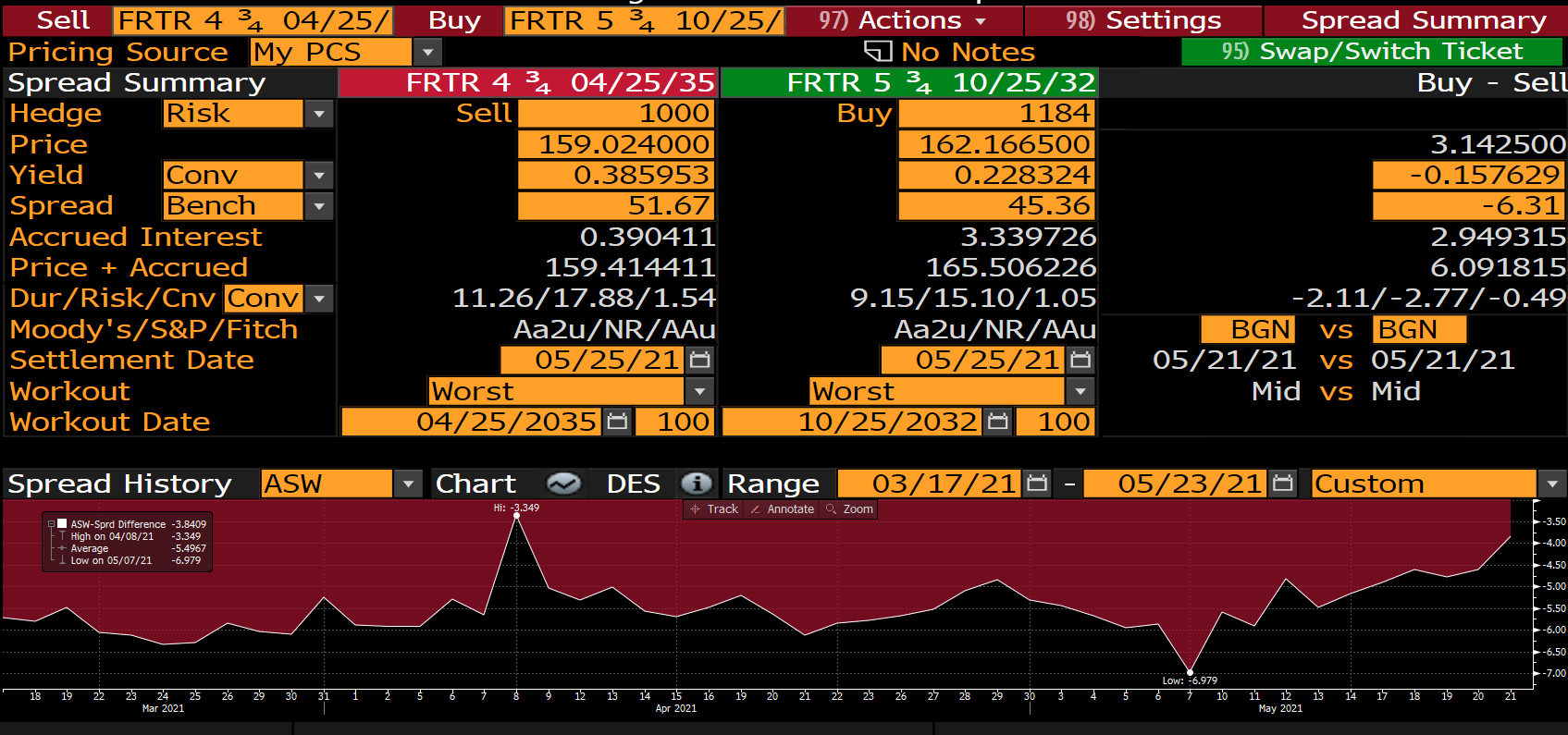

In France – if you think we should see continued spread widening in a possible continued tapering move..

Then the old HC apr35 still look rich and the HC Oct32 have already cheapened to reflect the Frtr Nov31, new cheap 10y…

We see Low Coupon 9yrs as having cheapened too much given the context of the curve – if you feel that Italy could bounce here then this segment should be the Major beneficiary – also like the short in the high coupon Aug34 - - this is also a solid High into low coupon type of risk

Buy Btps Aug30 vs wings….

200 * (yield[BTPS 0.95 08/01/30 Govt]-0.5*yield[BTPS 0.95 09/15/27 Govt]-0.5*yield[BTPS 5 08/01/34 Govt])

Or even Long Aug30 and short old 15yr and Old 5y

(2 * YIELD[BTPS 0.95 08/01/30 Corp] - YIELD[BTPS 1.45 03/01/36 Corp] - YIELD[BTPS 0.35 02/01/25 Corp]) * 100

In the UK am seeing a similar feature in old 20yrs UKT 37s – I see they have cheapened a fair bit – but imho – they're not cheap

Ukt 37s vs old 10y and old 30y

(2 * YIELD[UKT 1.75 09/07/37 Corp] - YIELD[UKT 0.625 10/22/50 Corp] - YIELD[UKT 0.375 10/22/30 Corp]) * 100

But vs OIS…

(2 * P2509[UKT 1.75 09/07/37 Corp] - P2509[UKT 0.625 10/22/50 Corp] - P2509[UKT 0.375 10/22/30 Corp])

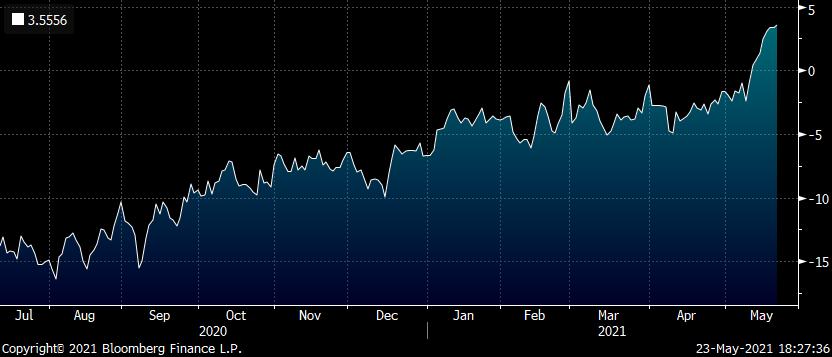

But as an anomaly vs the fitted curve….

So am guessing that receiving the 20y swap point in Sonia looks good

2 * BPSW20 Curncy - BPSW10 Curncy - BPSW30 Curncy

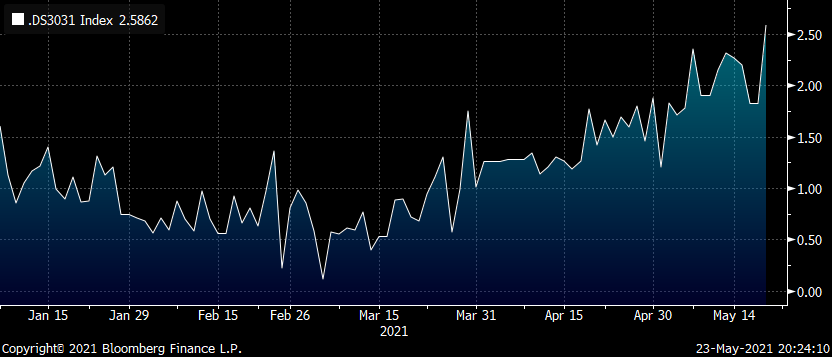

In Germany we have a little squeeze going on in the RXA CTD – I think as the primary means of delta expression there are probably many shorts that are exogenous to Bund RV

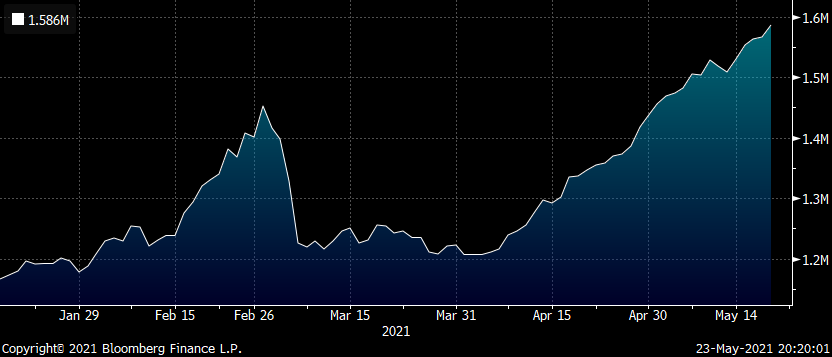

Here's the total combined Open interest of Mar + June + Sep altogether….

It's climbing

PR016[RXM1 Comdty] + PR016[RXH1 Comdty] + PR016[RXU1 Comdty]

So ultimately the trade I wanna mutate into is -Dbr feb30 +Dbr Feb31

Dbr feb30 drop out of the basket, but it seems like there's a squeeze situation developing. My sense is the CTA's rolling the front month will cause it to divorce from the cash market

So my plan is to

1) sell gross basis of CTD vs Front month (downside is it collapses into delivery for a bit of funding cost

2) if futures squeeze versus all cash then we sell our futures and buy the Outgoing 10y (had its last tap this week) and get into this trade at much better levels by dint of the futures leg…

-feb30 +feb31 vs OIS

(P2509[DBR 0 02/15/31 Corp] - P2509[DBR 0 02/15/30 Corp])

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

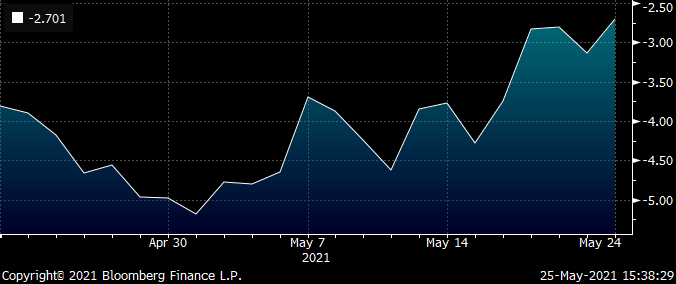

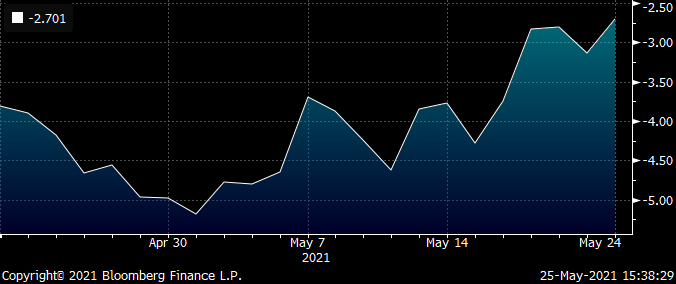

US BREAKEVENS : NEXT WEEK COULD BE HUGE IF BREAKEVENS CONTINUE THIS “GRIND” LOWER INTO MONTH END.

US BREAKEVENS : NEXT WEEK COULD BE HUGE IF BREAKEVENS CONTINUE THIS “GRIND” LOWER INTO MONTH END. THESE WONT BE SHORT-TERM MOVES, SOME BIG TOPS WILL GO IN!

FOR THE FIRST TIME IN A WHILE WE HAVE FINALLY SEEN A DECENT REVERSAL ON THE MONTH, HOPEFULLY WE CLOSE THE MONTH AT THE LOWS.

30YR BREAKEVEN PUNCHED THROUGH AND SUBSEQUENTLY REJECTED THE MULTI YEAR 76.4% RET 2.3360.

5YR BREAKEVENS HAVE REJECTED THE HIGH SET IN 2008.

**ALL 3 DURATIONS OF CHARTS HAVE RSI’S THAT COMPLIMENT EACH OTHER ACROSS THE BREAKEVEN CURVE.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BOND UPDATE : BOND YIELDS PERSIST IN REJECTING “ALL THE RIGHT” MOVING AVERAGE YIELD LEVELS!

BOND UPDATE : BOND YIELDS PERSIST IN REJECTING “ALL THE RIGHT” MOVING AVERAGE YIELD LEVELS!

THE MONTHLY RSI DISLOCATIONS REMAIN AND SOME KEY LEVELS ARE APPROACH IN EQUITIES.

GERMAN DBR 2046’S HAVE HELD A 200 WEEKLY MOVING AVERAGE 151.780 WITH AN RSI DISLOCATION NEVER SEEN BEFORE, COULD BE THE ONE TO WATCH.

US 5YR YIELDS HAVE REJECTED THE MULTIYEAR 23.6% RET 0.8737 ON ITS LATEST BOUNCE.

SPECIAL MENTION TO THE US 30YR YIELD CHART FAILING SO MANY PROFOUND LEVELS.

GET READY TO PARTY LIKE 1994! THE HISTORICAL-TECHNICAL PICTURE HIGHLIGHTS A SWATHE OF 1994 RSI EXTENSIONS WHICH ARE VERY OBVIOUSLY EXCEPTIONAL!

ESSENTIALLY THESE TECHNICAL DISLOCATIONS ARE HISTORICALLY UNSUSTAINABLE.

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

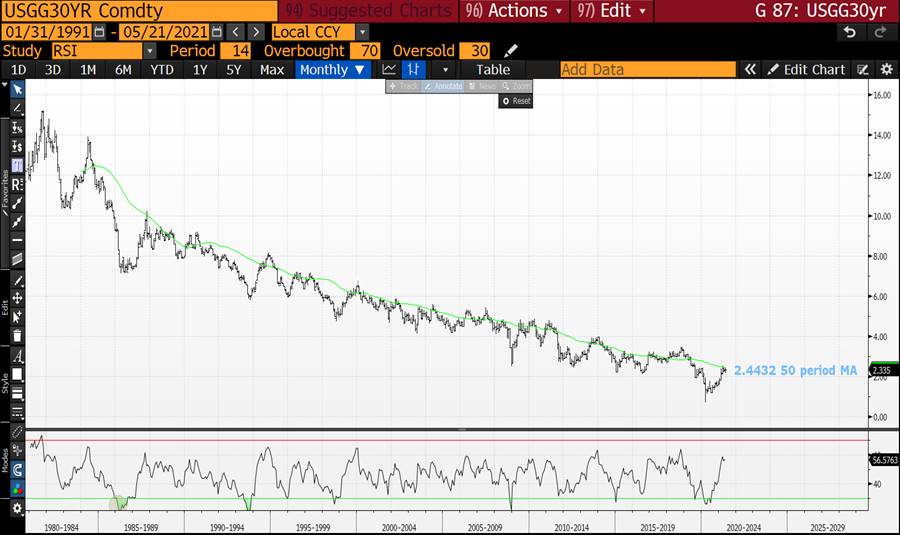

Vol Adjusted swap spreads in Europe

Just updated my sheet – plotting swap spread vs vol

Am looking at -Neth + France in 30yrs s as decent – with no other credit hedge

Same in 9yrs

When I look at Finland on a vol hedged credit fly with France and Germany – I wanna sell it from a value perspective, but looking at history not here – maybe in 3bp time…

1 * (YIELD[RFGB 1.375 04/15/47 Corp] - 0.65 * YIELD[DBR 1.25 08/15/48 Corp] - 0.35 * YIELD[FRTR 0.75 05/25/52 Corp])

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

US BREAKEVENS : BREAKEVENS HAVE MADE NUMEROUS ATTEMPTS TO “TOP OUT” AND WE MIGHT FINALLY BE HERE.

US BREAKEVENS : BREAKEVENS HAVE MADE NUMEROUS ATTEMPTS TO “TOP OUT” AND WE MIGHT FINALLY BE HERE. THIS COULD BECOME A VERY KEY SET OF MONTHLY CLOSES!

FOR THE FIRST TIME IN A WHILE WE HAVE FINALLY SEEN A DECENT REVERSAL ON THE MONTH, HOPEFULLY WE CLOSE THE MONTH AT THE LOWS.

30YR BREAKEVEN PUNCHED THROUGH AND SUBSEQUENTLY REJECTED THE MULTI YEAR 76.4% RET 2.3360.

5YR BREAKEVENS HAVE REJECTED THE HIGH SET IN 2008.

**ALL 3 DURATIONS OF CHARTS HAVE RSI’S THAT COMPLIMENT EACH OTHER ACROSS THE BREAKEVEN CURVE.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

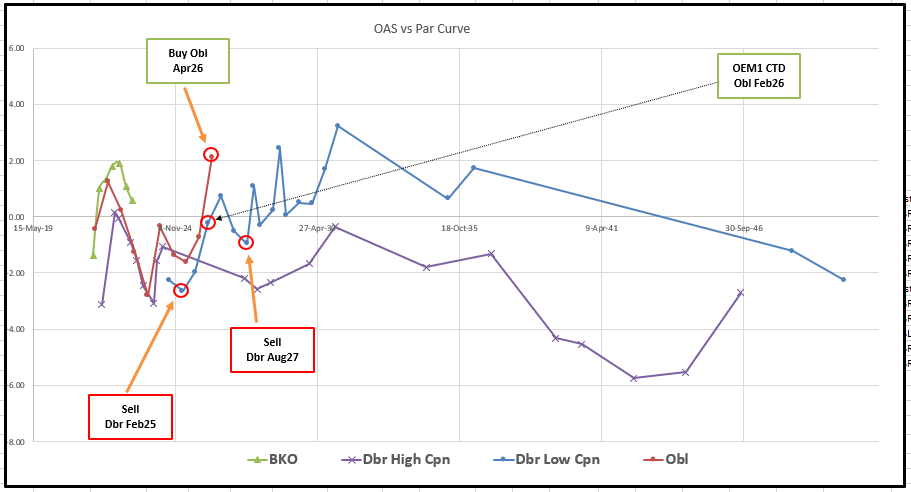

German Obl trade for Delivery

CTAs rolling Bobl shorts could cause squeeze – cheap bonds in the basket will get a boost

Trade

Buy €200MM Obl 0% Apr26 (€100,5k /01)

Sell €129MM Dbr 0.5% Feb25 (€50,1k /01)

Sell €77,2MM 0.5% Dbr Aug27 (€50,4k /01)

Levels

Current: +1.8bp

Enter: +1.5bp (33% risk)

Add: +2.25bp (67% risk)

Graph:

Rationale

- Our Open Interest indicator suggests speculative shorts in the OE contract – (CTD Feb26)

- The CTAs may well roll early and will care less about the RV and want to run their short into back months (CTD Obl Apr26)

- however the Apr26 has already been pushed to cheap on the curve – we feel this is at its limit and could well richen versus the wider curve – in short both front month AND back month will richen in a bobl delivery squeeze

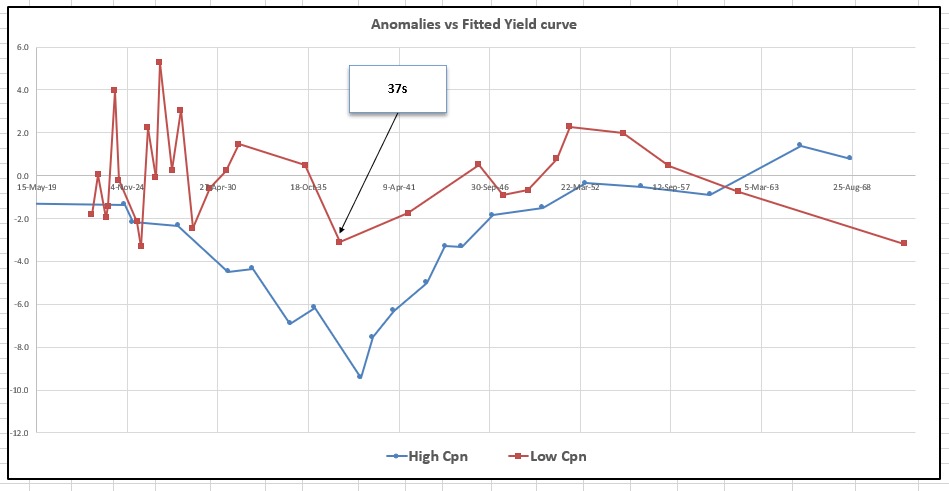

- The OEM1 CTD, Dbr Feb26 bond is a touch cheap to the ‘Fair’ Low Coupon Bund curve – The OEU1 CTD, Obl Apr26 is cheap full stop

- We believe the dynamic could be; OEM1 richens most, followed by Dbr Feb 26 with some basis lag, followed by OBL Apr26. The off the run longer and shorter bonds 4y to 7yrs could get left behind

- Risk-Adjusted, the best way to play any move would be to be long the Apr26 and short the old Feb25 and Aug27

- The Obl Apr26 has its last tap on 2nd June. After which the BUBA will switch to a new Oct26 5yr Bond starting on July 7th

Curve value

– to correctly value bonds on the curve, we discount the cash-flows versus a smooth zero curve. The result gives us the following graph of anomalies

Carry & Roll

Carry: -0.3bp /3mo @-5bp repo spread

Roll: +0.2bp /3mo (not including any resumption zero anomaly value for given issue type: obl/dbr)

Risk

Sharpe Ratio: +0.74 (90 calendar, 65 trading days to be long the belly – so the trade has performed with low var)

Var

Risk Measures:

5th Worst Day over 90 days: 0.6 bp

2.3 times Vol of 2yr of Data: 0.6 bp

1 unit of normalised risk = 0.6bp (for our model portfolio of trades)

Risks

- The Old Dbr 25s and 27s get even richer

- A squeeze in the roll does not impact the off the runs but causes the back month and the apr26 to get even cheaper – see this as unlikely since we see rich/cheap as asymmetrical around fair – bond scan only get ‘so’ cheap but are almost unbounded in how rich they can be

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796