BOND UPDATE : BOND YIELDS HAVE ONCE AGAIN RECOGNISED THE STEADFAST MOVING AVERAGE RESISTANCE ACROSS MANY DURATIONS OF CHARTS.

BOND UPDATE : BOND YIELDS HAVE ONCE AGAIN RECOGNISED THE STEADFAST MOVING AVERAGE RESISTANCE ACROSS MANY DURATIONS OF CHARTS. IDEALLY WE NEED YIELDS TO HEAD LOWER INTO THE WEEK END.

GERMAN DBR 2046'S HAVE HELDW A 200 WEEKLY MOVING AVERAGE 151.665 WITH AN RSI DISLOCATION NEVER SEEN BEFORE.

US 5YR YIELD HAS FAILED AGAINST ITS MULTIYEAR 23.6% RET 0.8737.

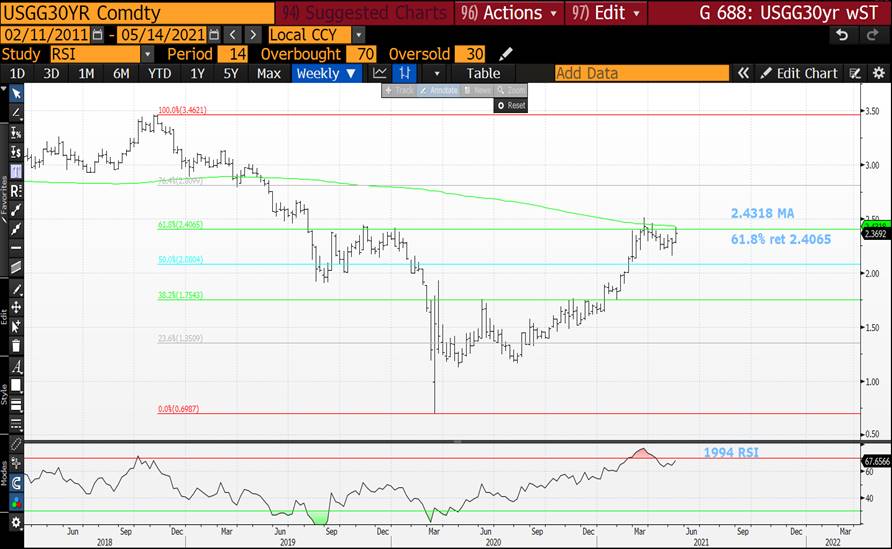

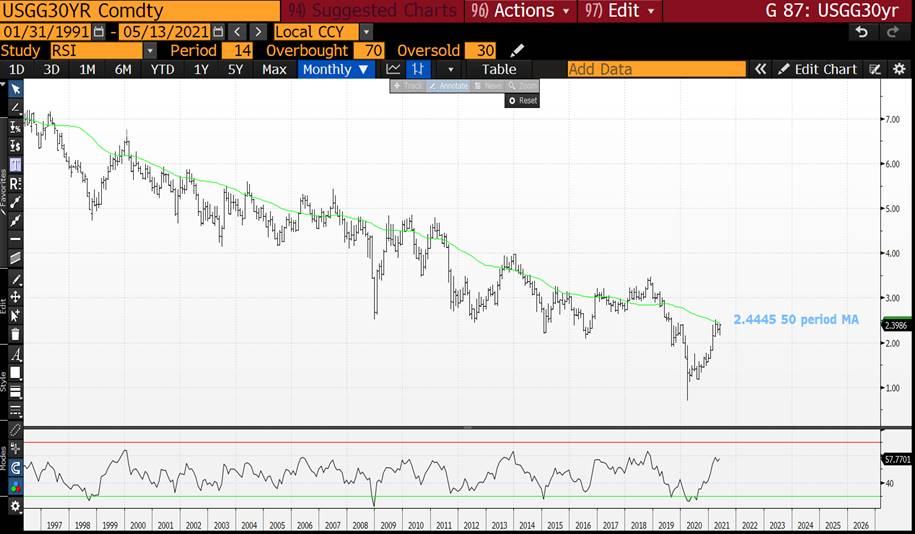

SPECIAL MENTION TO THE US 30YR YIELD CHART FAILING SO MANY PROFOUND LEVELS.

GET READY TO PARTY LIKE 1994! THE HISTORICAL-TECHNICAL PICTURE HIGHLIGHTS A SWATHE OF 1994 RSI EXTENSIONS WHICH ARE VERY OBVIOUSLY EXCEPTIONAL!

ESSENTIALLY THESE TECHNICAL DISLOCATIONS ARE HISTORICALLY UNSUSTAINABLE.

US BOND AND SWAP CURVES CONTINUE TO "SCREAM" FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS "OUT OF LINE" WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

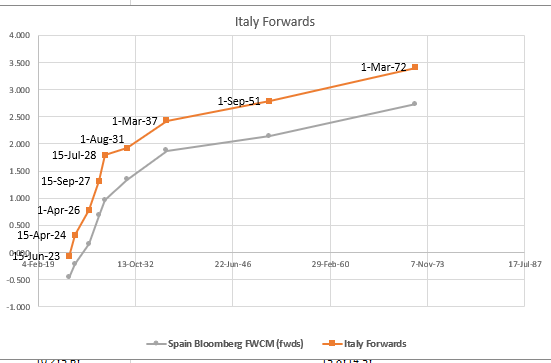

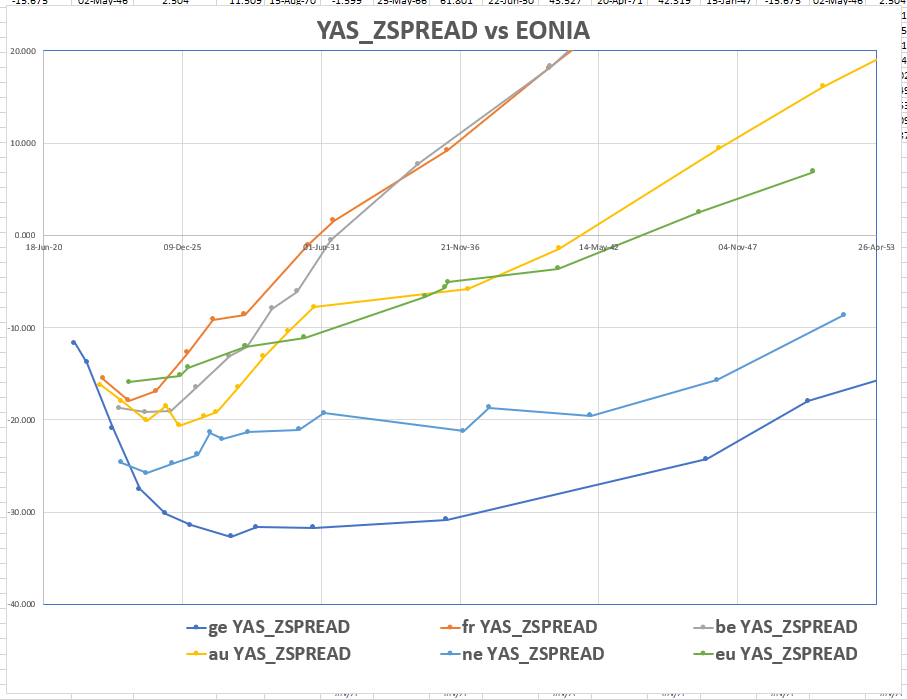

ITALY 50Y vs 30y

Am getting more and more convinced there could be appetite for 50y Italy

Here's 30y20y Italy vs the same fwd in Eonia…

Using BBG Spline fit

Unless we get more PEPP – then I can see how we get a widening in Italy and flattening in the back end as Italy has to finally come back to the market (if PEPP is exhausted)

In my thinking, PEPP will only cover prior transgressions – and won't support on-going fiscal laxity – and as such they have to come to the market like never before – the convexity / low coupon argument of Italian 72s means I'm starting to really like the 50y Italy

Further more in my regression basis (using 67s) it hasn't really moved vs 30y

(YIELD[BTPS 2.8 67 Corp] - 0.904 * YIELD[BTPS 2.45 50 Corp] - 0.41) * 100

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

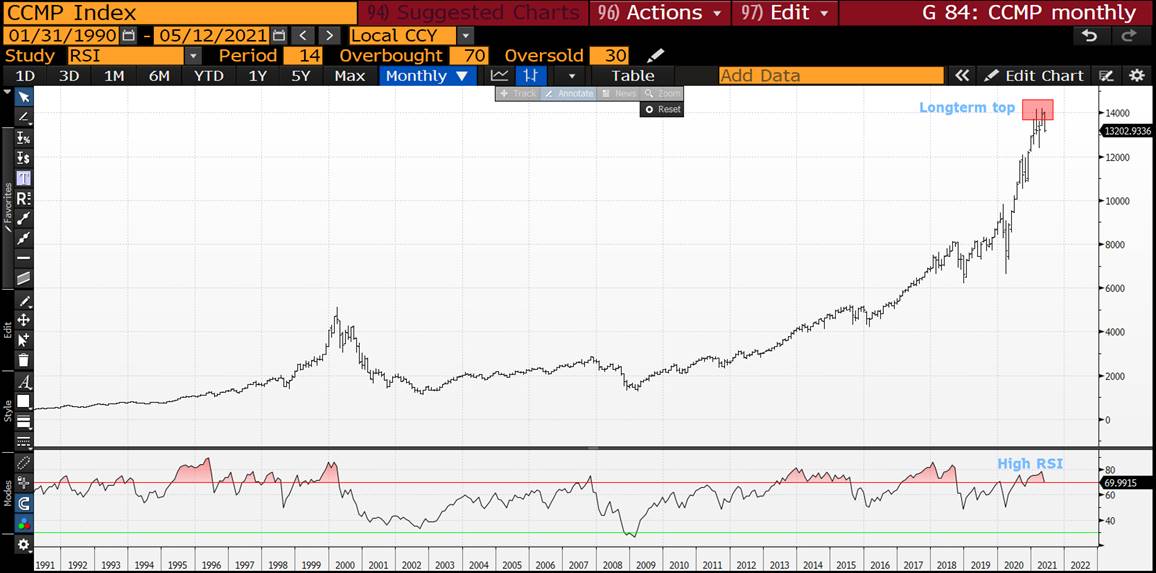

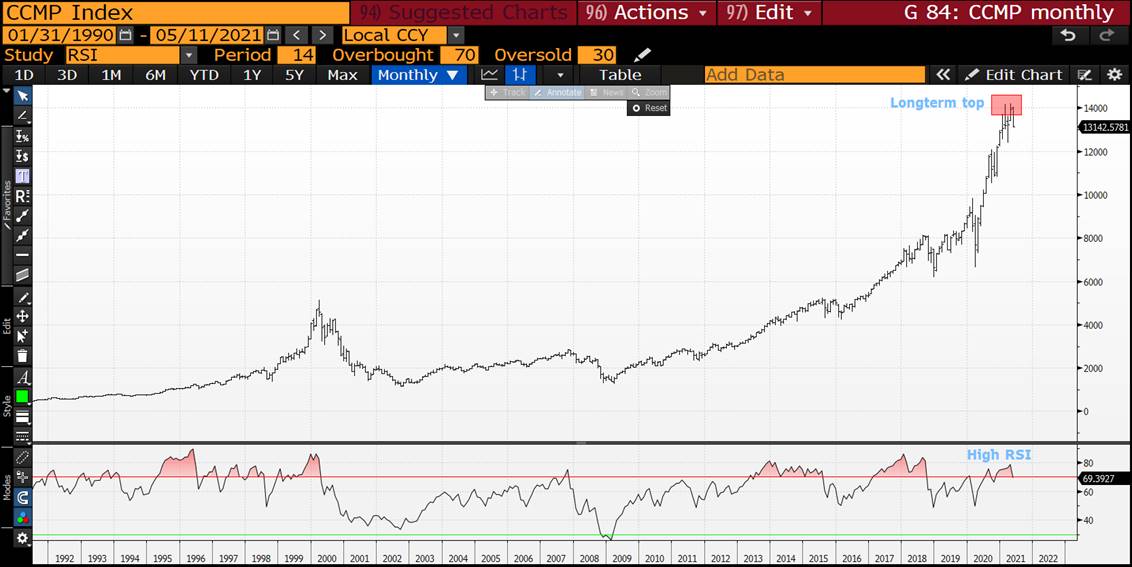

STOCKS : CAN WE CAPITALISE ON YESTERDAYS LOSES! WE NEED TO GIVEN BOND YIELD RESISTANCE LEVELS.

STOCKS : CAN WE CAPITALISE ON YESTERDAYS LOSES? GIVEN BOND YIELDS ARE HITTING RESISTANCE THEN STOCKS NEED TO FAIL AGAIN TODAY!

THE NASDAQ IS NOW SUB ITS 50 & 100 DAY MOVING AVERAGES, A BREACH OF THE

MULTI-YEAR 200% RET 13045.324 WILL BE EXTREMLY HELPFUL.

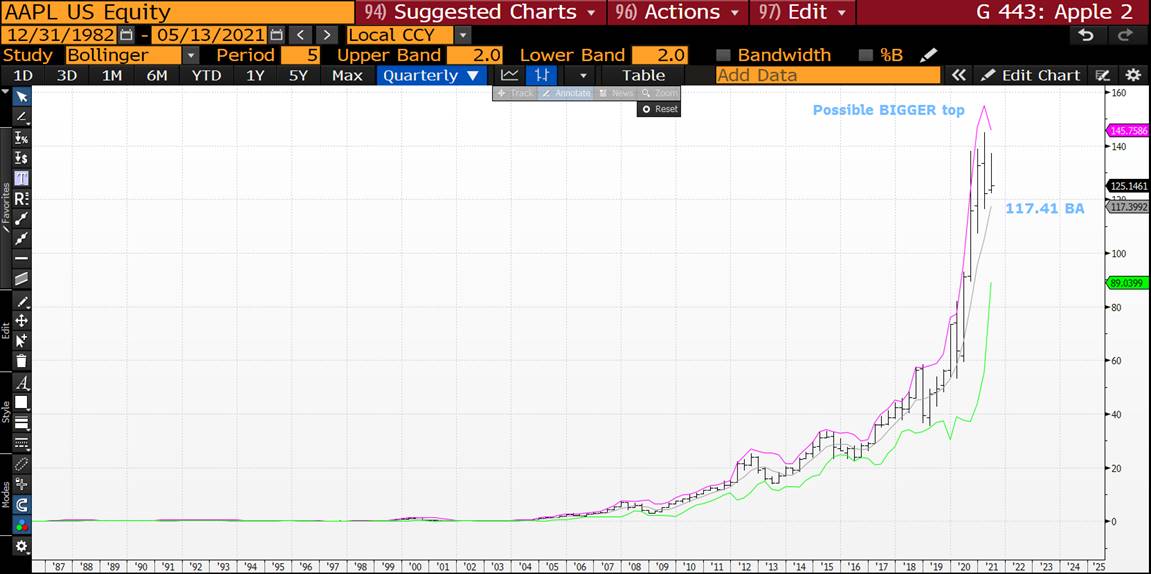

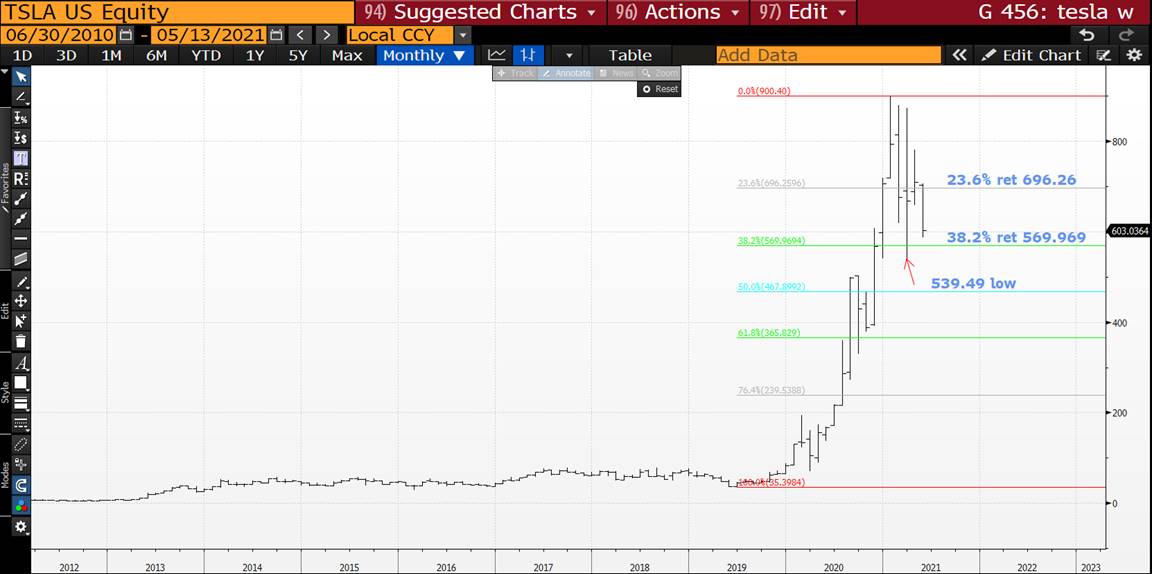

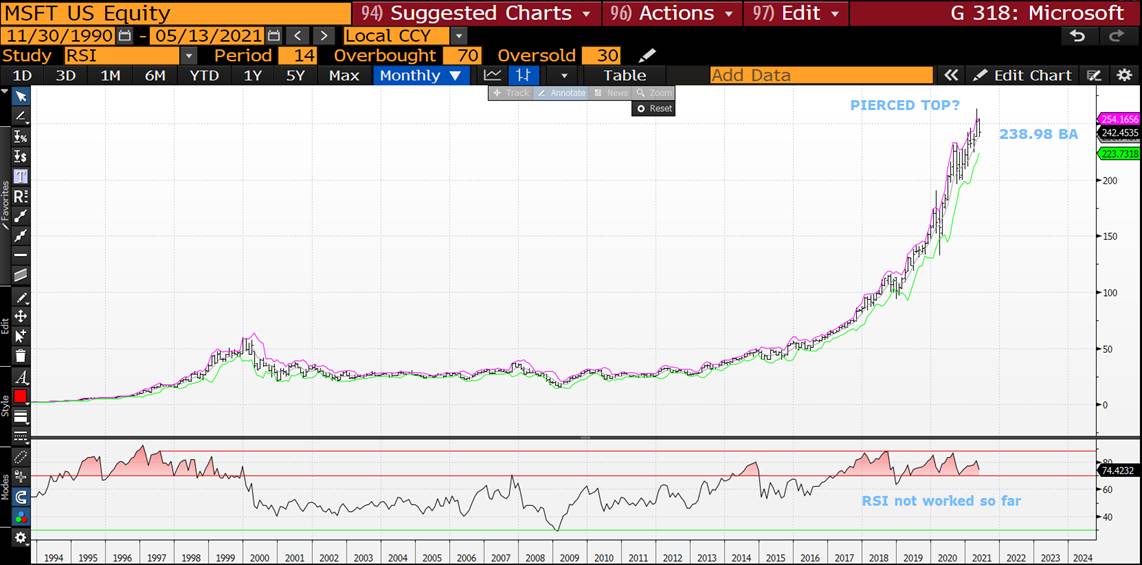

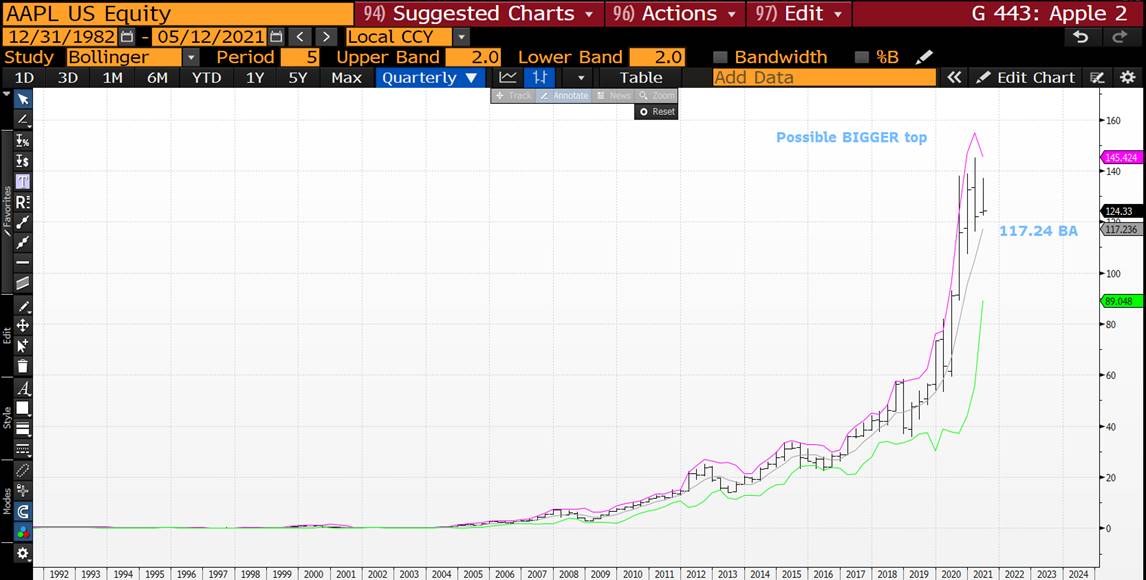

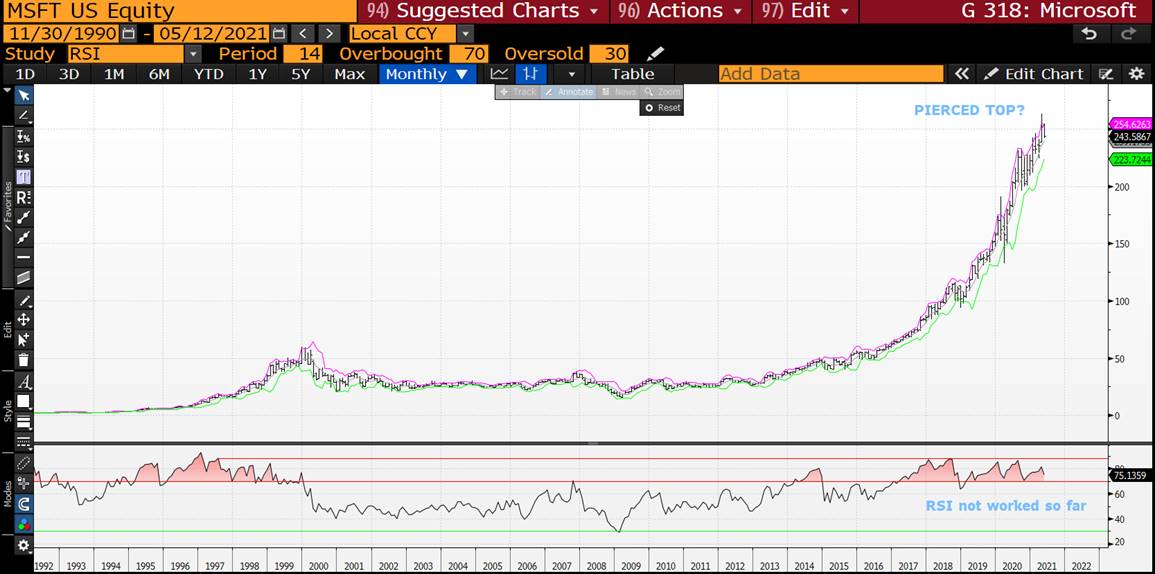

EQUITIES REMAIN A "MAJOR" CONCERN WITH MANY SINGLE STOCKS GENERATING LONGTERM "TOPS". IT ALSO BEGS THE QUESTION, HOW DOES THAT EFFECT BOND YIELDS?

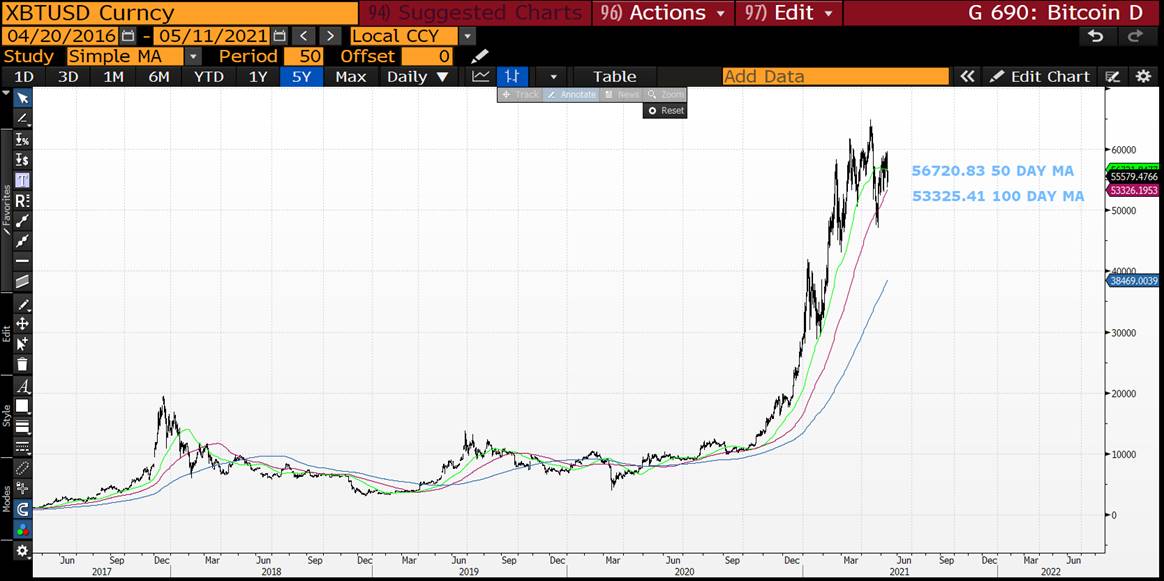

BITCION IS BELOW ITS 50 & 100 DAY MOVING AVERAGES.

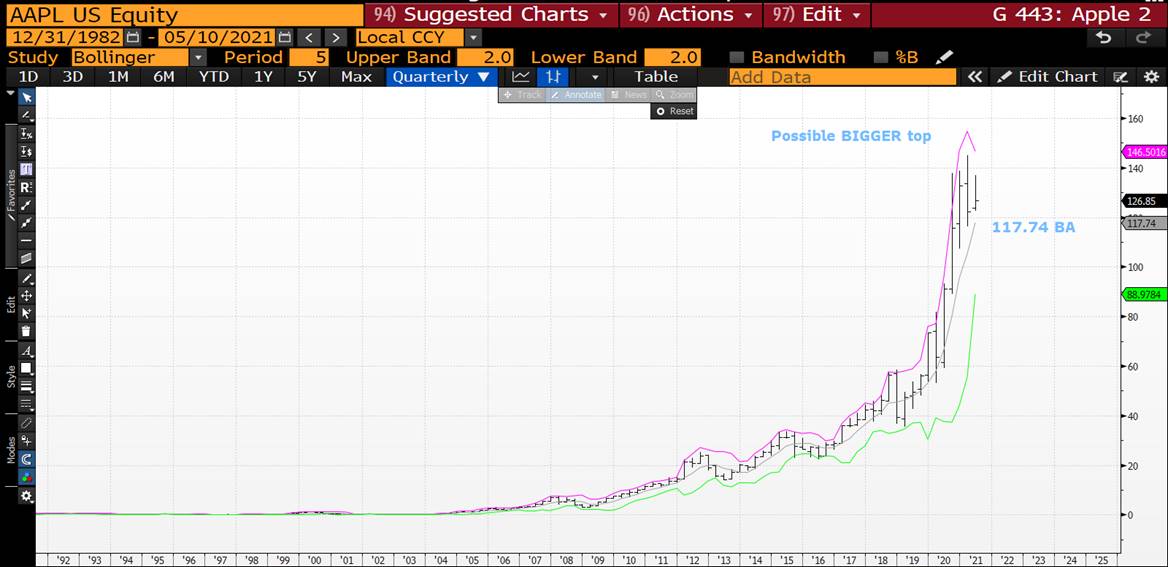

APPLE IS OF MAJOR CONCERN GIVEN IT CLEARLY FLAGGED A TOP 2 MONTHS AND IS CLOSE TO THIS MONTHS LOWS ALREADY! TESLA HAS ALREADY BREACHED LAST MONTHS LOW!

"THE MOST WIDELY HELD STOCKS AT MUTUAL AND HEDGE FUNDS IN 4Q 2020 WAS MICROSOFT, AMAZON AND FACEBOOK". ALL OBVIOUSLY VERY OVER EXTENDED.

TESLA, AMAZON AND APPLE ARE WORTH MORE THAN THE FINANCIALS, ENERGYAND METALS SECTORS COMBINED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BOND UPDATE : DESPITE A NASTY STOCK FALL BONDS YIELDS HAVE RISEN BUT “ONLY” BACK TO SOLID RESISTANCE.

BOND UPDATE : DESPITE A NASTY STOCK FALL BONDS YIELDS HAVE RISEN BUT “ONLY” BACK TO SOLID RESISTANCE. MANY OF THE STOCK TOPS ARE HERE FOR SOME TIME!

GERMAN DBR 2046’S ARE SITTING ON A 200 WEEKLY MOVING AVERAGE 151.663 WITH AN RSI DISLOCATION NEVER SEEN BEFORE.

US 5YR YIELD IS STRUGGLING AGAINST A MULTIYEAR 23.6% RET 0.8737.

SPECIAL MENTION TO THE US 30YR YIELD CHART FAILING SO MANY PROFOUND LEVELS.

GET READY TO PARTY LIKE 1994! THE HISTORICAL-TECHNICAL PICTURE HIGHLIGHTS A SWATHE OF 1994 RSI EXTENSIONS WHICH ARE VERY OBVIOUSLY EXCEPTIONAL!

ESSENTIALLY THESE TECHNICAL DISLOCATIONS ARE HISTORICALLY UNSUSTAINABLE.

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

To Serve

Hi,

Just touching base

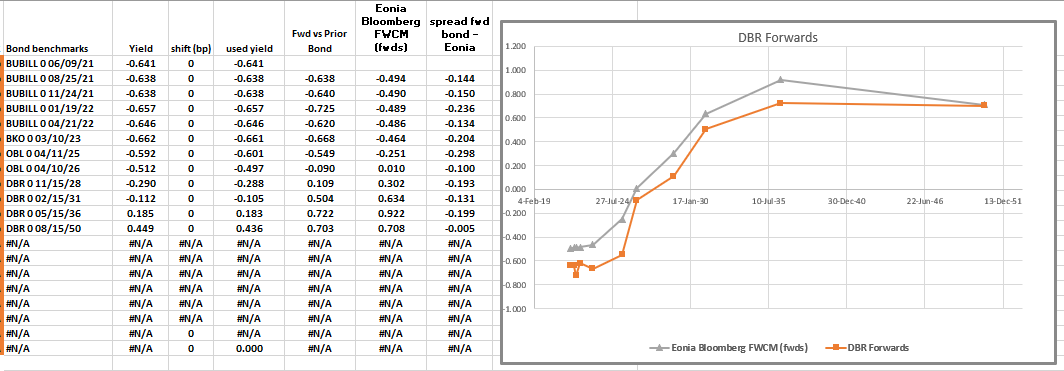

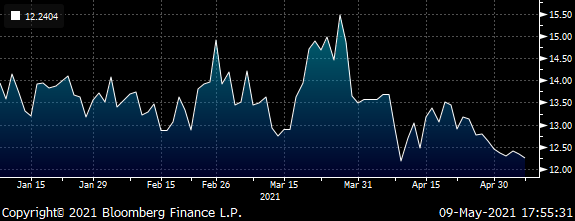

Swap spreads have been hit pretty hard of late… in Germany

(EUSA10 Curncy - RV0002P 10Y BLC Curncy) * 100

I though it might be handy to re-iterate how forwards in Germany look vs the Eonia curve…

Bond Yields modified to create Par equivalent bonds

What I think happens is that any sense of Taper or just plain higher rates forces bonds to cheapen more than swaps

So spreads narrow to Eonia and 'Bor – but it doesn't stop them being a boundary condition – wherever the Bond curve is steep relative to Swaps

, the forwards will be cheap to Eonia – coupled with the narrowing move then those fwds may be cheap to Eonia

The natural reaction of the market then is to compress rich vs cheap bonds – to cause the on-the-run vs off-the-run spread to reduce

Just a thought – let me know, agree, disagree or meh…

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

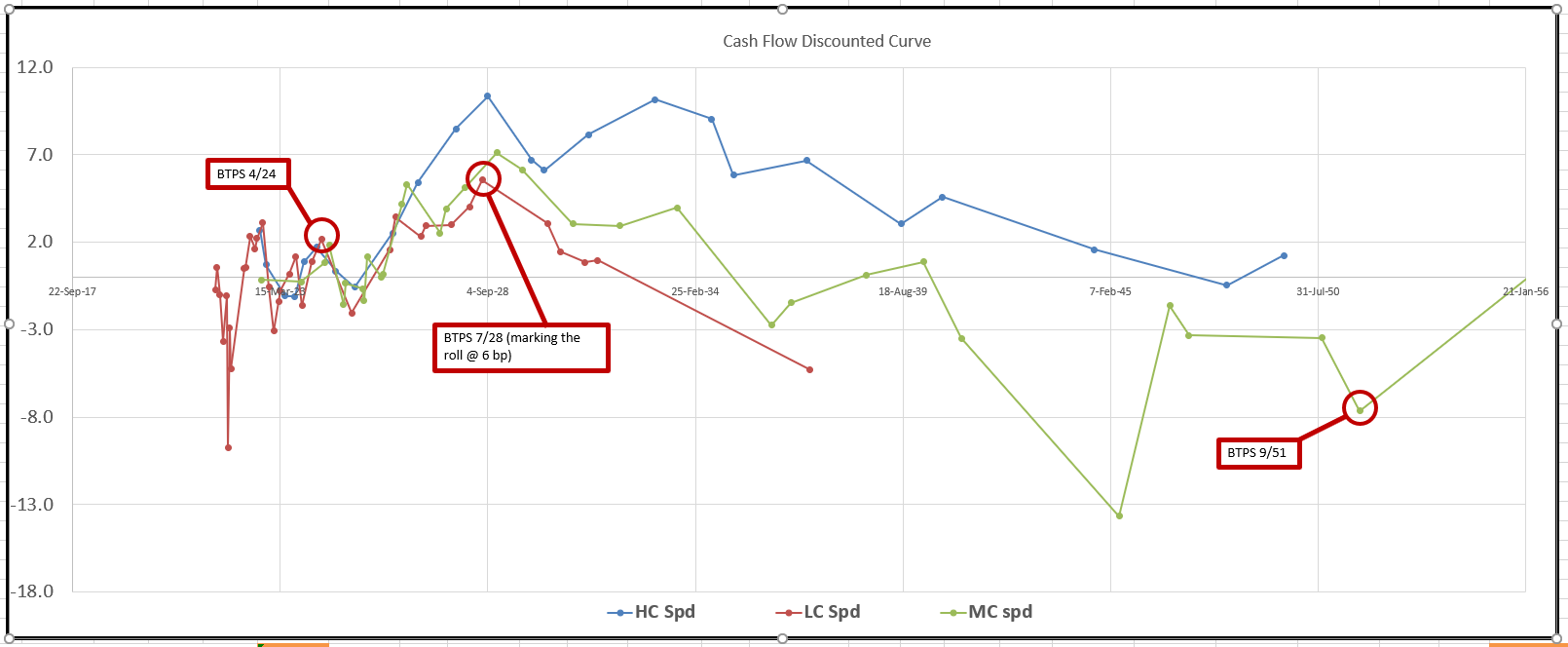

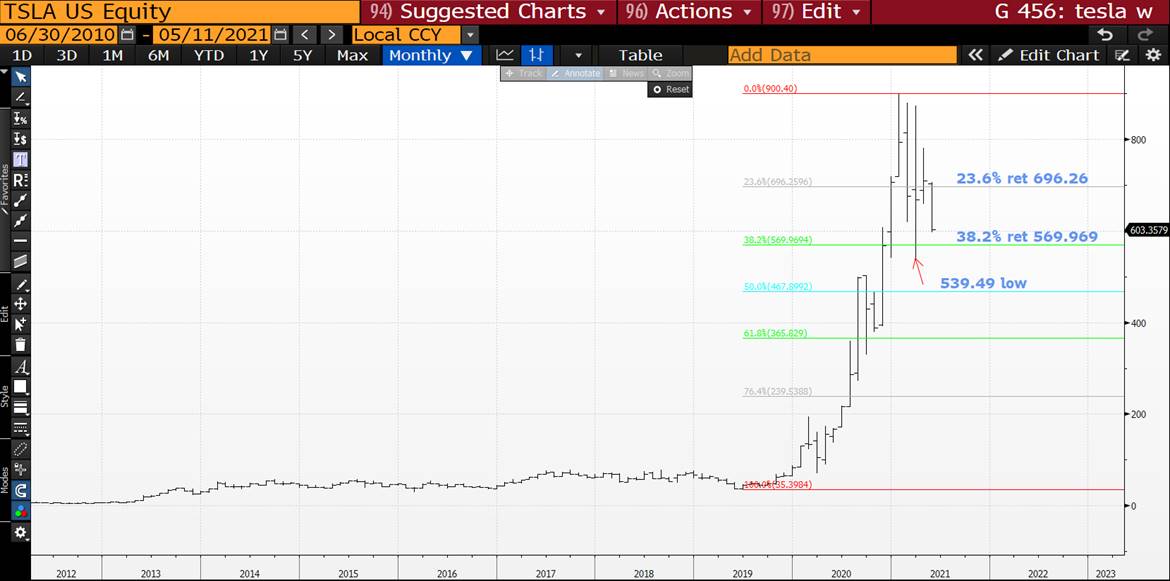

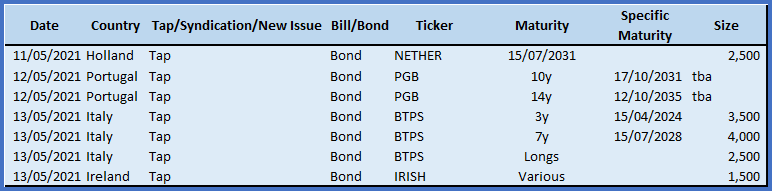

Italy auction preview

Italy to tap 3 lines tomorrow

15-4-2024 in 3bn

15-7-2028 in 4.5bn (new issue)

01-9-2051 in 1.75bn

- As we said yesterday this is a decent test for BTPs. The cheapening in France has left semi-core spreads cheap both vs Bunds and Swaps (albeit the swap moves are broadly tracking the outright), leaving Italian spreads vulnerable on a cross market basis should semi-core widen further

- That said we are at key levels of 1% in 10y and 2% in 30y. Is it enough though? With PEPP easing being rapidly priced in and stocks at pre-pandemic levels do we need Italian yields another 50 basis points higher?

Apr-2024

- It's the cheap on the run in the front end, but we have at least 2 more taps to go until we get a new one

- The bonds rolls nicely enough into the BTS contract, but without a further concession we don't really feel there is enough of an angle to get very excited

Jul-2028

- We are marking this roll at 6 bp vs the 3/28, and anything further North of this looks appealing in our view to roll out of 1/27, 6/27 or 9/27

- In addition, the shape of the forwards curve should see continued demand for steepening trades vs. the back end given how cheap the 7y point looks vs 15y+ tenors

Sep-2051

- Once again this sector isn't offering any obvious value. Italy Germany 10/30 box is at quite benign levels and the bond isn't particularly cheap on the roll

Italy vs Germany Generic 10/30 Box (BBG RV Series)

So in short unless we get some bond specific concessions into the supply then aside from the structural cheapness of the 7y point this supply is very much a test of risk appetite for Italy at these higher yield levels.

![]()

Will Scott

O: +44 (0) 203 – 143 - 4171

M: +44 (0) 789 – 441 - 7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: US: 60 Rumson rd, rumson, nj 07760

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

STOCKS : EQUITIES REMAIN A “MAJOR” CONCERN WITH MANY SINGLE STOCKS GENERATING LONGTERM “TOPS”.

STOCKS : EQUITIES REMAIN A “MAJOR” CONCERN WITH MANY SINGLE STOCKS GENERATING LONGTERM “TOPS”.

IT ALSO BEGS THE QUESTION, HOW DOES THAT EFFECT BOND YIELDS?

BITCION IS EDGING TOWARD A MAJOR DECISION AS IT FLIRTS WITH THE 100 DAY MOVING AVERAGE 53570.00.

SINGLE STOCKS ARE BEGINNING TO SHOW SIGNS OF FATIGUE, TECHNICALLY-HISTORICALLY WE COULD BE FORMING SOME MAJOR TOPS.

APPLE IS OF MAJOR CONCERN GIVEN IT CLEARLY FLAGGED A TOP 2 MONTHS AND IS CLOSE TO THIS MONTHS LOWS ALREADY! TESLA HAS ALREADY BREACHED LAST MONTHS LOW!

THE SINGLE STOCKS ARE MORE OF A CONCERN AS THERE IS SO MUCH OF A MISREPRESENTATION IN SOME OF THE VALUATIONS.

“THE MOST WIDELY HELD STOCKS AT MUTUAL AND HEDGE FUNDS IN 4Q 2020 WAS MICROSOFT, AMAZON AND FACEBOOK”. ALL OBVIOUSLY VERY OVER EXTENDED.

TESLA, AMAZON AND APPLE ARE WORTH MORE THAN THE FINANCIALS, ENERGYAND METALS SECTORS COMBINED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

STOCKS : EQUITIES COULD BE IN FOR A “ROUGH RIDE” WITH MANY SINGLE STOCKLS GENERATING LONGTERM “TOPS”.

STOCKS : EQUITIES COULD BE IN FOR A “ROUGH RIDE” WITH MANY SINGLE STOCKLS GENERATING LONGTERM “TOPS”.

BITCION IS ABOUT TO MAKE A MAJOR CHOICE AS IT IS TESTING ITS 100 DAY MOVING AVERAGE 53325.41.

SINGLE STOCKS ARE BEGINNING TO SHOW SIGNS OF FATIGUE, TECHNICALLY-HISTORICALLY WE COULD BE FORMING SOME MAJOR TOPS.

APPLE IS OF MAJOR CONCERN GIVEN IT CLEARLY FLAGGED A TOP 2 MONTHS AND IS CLOSE TO THIS MONTHS LOWS ALREADY! TESLA HAS ALREADY BREACHED LAST MONTHS LOW!

THE SINGLE STOCKS ARE MORE OF A CONCERN AS THERE IS SO MUCH OF A MISREPRESENTATION IN SOME OF THE VALUATIONS.

“THE MOST WIDELY HELD STOCKS AT MUTUAL AND HEDGE FUNDS IN 4Q 2020 WAS MICROSOFT, AMAZON AND FACEBOOK”. ALL OBVIOUSLY VERY OVER EXTENDED.

TESLA, AMAZON AND APPLE ARE WORTH MORE THAN THE FINANCIALS, ENERGYAND METALS SECTORS COMBINED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BOND UPDATE : NON-FARM LEFT PARTIAL OBSTRUCTIONS BUT REMEMBER WE HAVE NEW MONTHLY YIELD LOWS WHILST RSI DISLOCATIONS REMAIN STEADAST.

BOND UPDATE : NON-FARM LEFT PARTIAL OBSTRUCTIONS BUT REMEMBER WE HAVE NEW MONTHLY YIELD LOWS WHILST RSI DISLOCATIONS REMAIN STEADAST.

THE PATH LOWER HAS SO MUCH "TO RUN" ESPECIALLY LOOKING AT THE MONTHLY RSI CHARTS.

SPECIAL MENTION TO THE US 30YR YIELD CHART FAILING SO MANY PROFOUND LEVELS.

GET READY TO PARTY LIKE 1994! THE HISTORICAL-TECHNICAL PICTURE HIGHLIGHTS A SWATHE OF 1994 RSI EXTENSIONS WHICH ARE VERY OBVIOUSLY EXCEPTIONAL!

ESSENTIALLY THESE TECHNICAL DISLOCATIONS ARE HISTORICALLY UNSUSTAINABLE.

US 30YR YIELDS HAVE HIT THE 50 PERIOD MONTHLY MOVING AVERAGE 2.4423(PAGE 9).

US 10YR YIELD RSI DISLOCATION IS THE MOST SINCE "1994"!

US BOND AND SWAP CURVES CONTINUE TO "SCREAM" FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS "OUT OF LINE" WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trades and Fades - Euro RV themes

We put together some thoughts on how Z-Spreads work and how we can improve on that analysis

Overview

The thing about banging your head against a wall, is it's lovely when you stop

It's been a super tough few weeks – I feel like I've been fighting the paradigm change. Now I'm starting to think about the obvious trades that jump on the back of the moves we've seen this yr without giving too much away for following the trend

- Equities Bullish in every scenario!!!! – despite disappointing payrolls, equities continue to rally. We think it's time to set some value markers where we start leaning into this one. We are hoping to see truly ridiculous expectations for the path of rates and want the firepower to argue with those. We need to be sure we hedge the directionality though

- CTAs short – Short FI seems to be the growing consensus – doesn't make it wrong but it does make it crowded. CTAs often roll early as they don't like going to delivery – that means front months can richen and back months and/or cash could cheapen – we look how to play that

- Spreads wider – we're thinking about how cheaper outright levels will attract RM buyers of previously unloved segments of the curve – such as 50 yrs

- Bond Curves steep vs Swaps – as Credit and risk-free bond curves out-steepen the Eonia curve, we go looking for value in boundary conditions

Supply

· Plus possibly new RFGB 10y, DBR Green 30y and (seems unlikely) BTP 30y tap. I say unlikely just because we have long end schedule already next week, but the sizes announced Monday will give us a better idea of the odds.

· Note the Italy should be a new 7y (tbc Monday) after the 3/28 was tapped via syndication

Fades

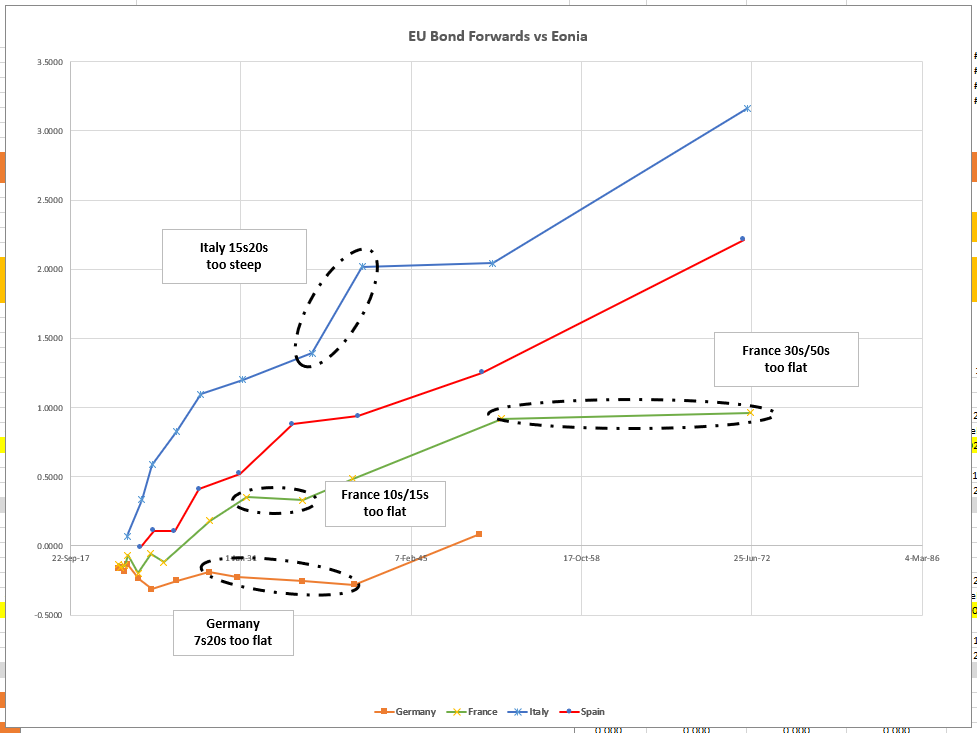

Consider relative Forward Rates vs Eonia in the Major European curves…

This guides us to our main Fades at the moment

Graph of: BOND Forwards NOT yields – so it tells us points where the curve slope is wrong….

1.

Despite the curve steepening recently – we think this one keeps flattening – barring an issuance 'blip' – it just looks wrong and with the ik/rx spead widening – any increase in credit fears could flatten the back end

(P2509[BTPS 3.1 03/01/40 Corp] - P2509[BTPS 2.25 09/01/36 Corp])

P2509 = OIS

2.

(p2509[FRTR 0.5 05/25/72 Govt] - p2509[FRTR 0.75 05/25/52 Govt])*100

3.

French 10s15s too flat – there's a very good reason this one has been blown out of the water – we think it keeps going…

(P2509[FRTR 1.25 05/25/36 Corp] - P2509[FRTR 2.5 05/25/30 Corp])

4.

German 7s20s too flat – I like this one – its got a bit of tapering in it – as the 20years are high coupon – but to me the high coupons stop being bought when they get rich – but of course – rich isn't when Z-Spread says so – it's when Cash-flow discounting says so – love to run through this one with you

(p2509[DBR 3.25 07/04/42 Govt] - p2509[DBR 0 02/15/30 Govt])

For choice – given the robust nature of stocks and the nature that rates will be kept on hold for longer – then my conclusion is they go up harder, faster later. So I like the steepeners and they have only just started their move

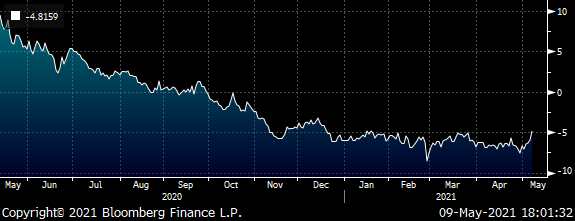

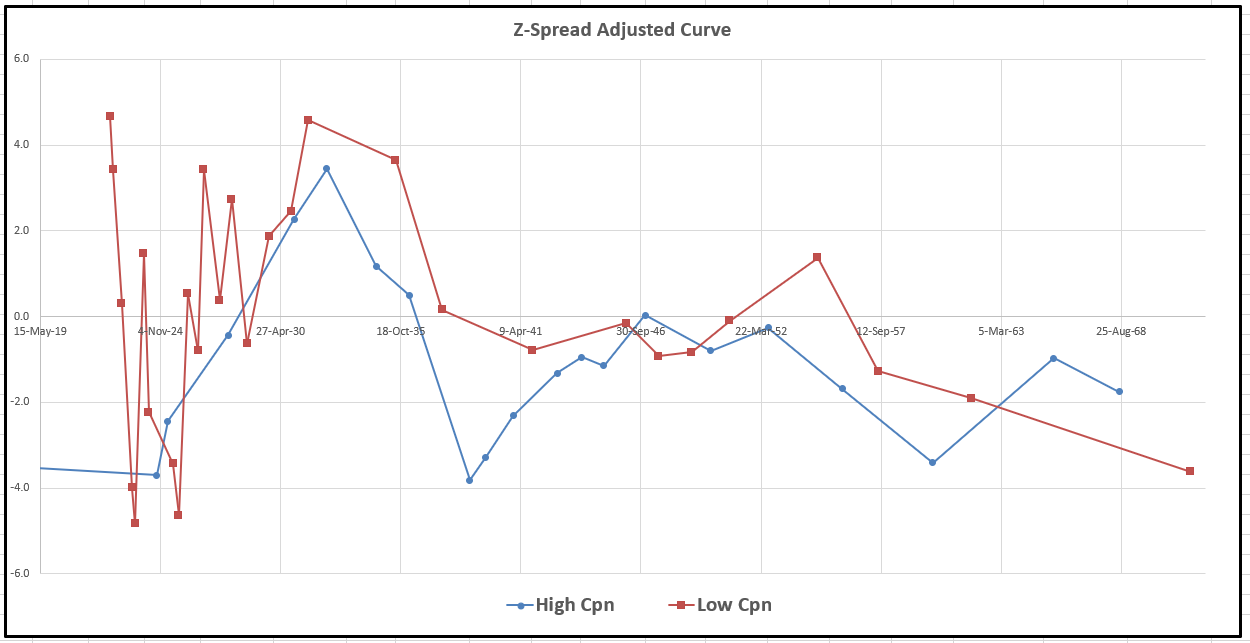

Z-Spreads

I'll be honest I got really tired of looking at the markets in terms of yield curve and Z-Spread and running into trades that didn't turn. What's more, even using something like Z-Spread, we seem to still get caught in negative carry trades.

Gimme a couple of seconds and I'll try explain what I'm thinking…

Z-spread basically adds a spread to the swap curve to figure out the 'average spread' of a bond's cashflows over its life time. In that way, we think we've factored in coupon and the appropriate rate for all the cash flows. That's true but only to some degree..

Here's the rub…

when we look at these credit issuers, even France or Germany the Z-spread isn't constant over tenor

Italian Z-spreads are :

47bps in 5yrs

79bps in 10yrs

&

143bps in 30yrs

So really we shouldn't be valuing all the cashflows in a 30yr at the average of 143bps vs OIS

We should value the front cashflows closer to 47bps,

Then, if we do that, the 5 to 10y cashflows need to be valued at even higher spreads than 79bps and so on, so that the whole thing balances out

Why? How wrong is it? Does it matter?

If your book feels like a graveyard of poor location and negative carry think about this…

Why is this deficient vs using Z-Spread? We're just adding a spread, right? That's fine, we're just shifting the curve?

Well, the real issue comes when the swap curve and the bond curve are different slopes. It's more important when we compare Italy or France vs Eonia or UK Gilt curve vs Sonia. We are assuming that the slope of the swap curve must be the same as that in the bond curve – plus some spread. And you know what? It just ain't so…

So what we might need is a forward Z-Spread curve for the whole tenor range – a set of Z-spreads applicable for every cashflow, not an average from now to a certain point

But just how is wrong is our current analysis ? And how do we fix it?

So here's how we went to look at things right now – we draw a graph of the Z-Spreads of Various European Government Bond Curves

With an assortment of High and Low coupons in the benchmarks, we're told by the mathematicians that we have fully adjusted for the coupon differences – but in reality only in so far that we have added a z-spread to the curve to make the PV of each bond equal to the market price. But we're making the assumption of a broad shift of the average spread, over the lifetime of a bond gives us a complete picture of the bond's value in the context of other issues

If we were to fit a Smooth Curve to these values (kind of removing the generic swap curve shape) and looked at the anomaly values vs this curve, we'd get something like this for the UK Curve

Graph 1 - Bond Anomalies using Z-Spread

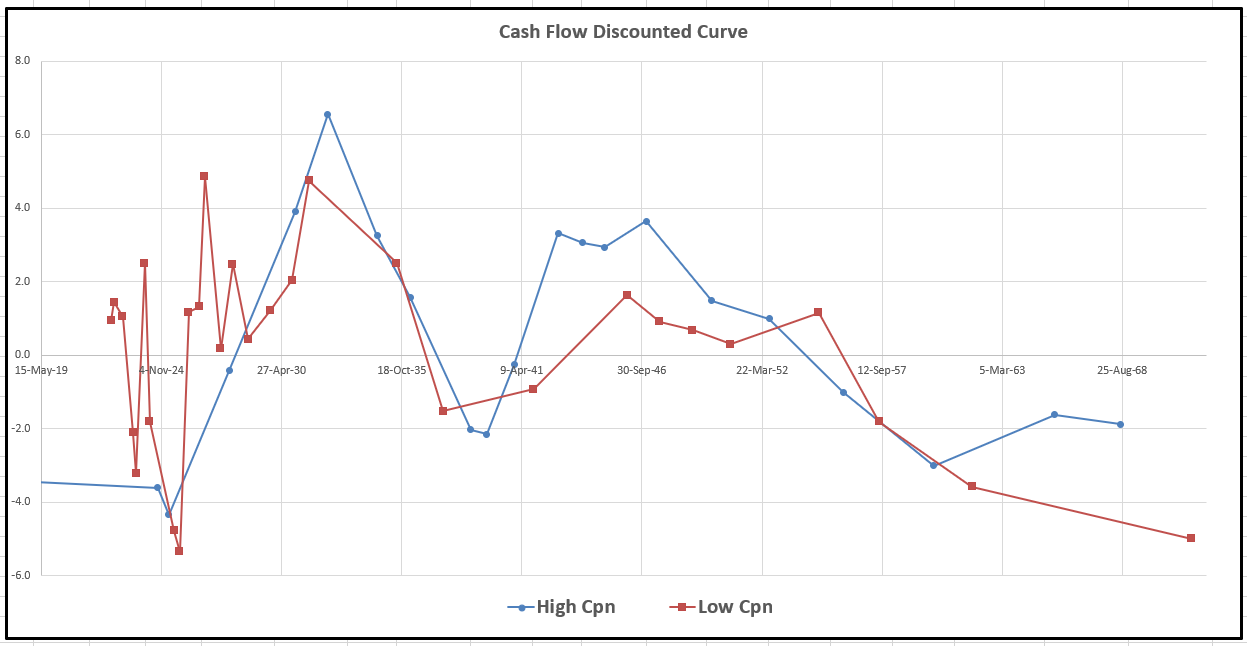

But in reality if we use a different Z-Spread for each tenor and cashflow for each bond we are using a much more accurate value of each cashflow in the context of the curve and the value of bonds is different

Graph 2 – bond Anomalies using Cash Flow discounting

~Let me know if you'd like me to highlight some of these bonds or indeed other curves

This is a subtle but very different description of Bond RV

For example

- a lot of the high coupons in the 15y - 20y are no richer than the low coupons

- the 32s are a very cheap bond – the excess slope of Bonds vs Sonia is the only way to truly reveal that

- the mid high coupon 25yrs have real value

We believe that this method is a much better indicator of Rich/Cheap and stops the casual observer falling into the crowded trades. It helps explain some of the more puzzling, persistent anomalies – and this is essential in picking RV trades that have long term real value as a tailwind as well as the optical value offered up by simply looking at yields and Z-spreads

We want to use this to help the process of issue selection and give the trades the highest chance of reversal

So what we need is a forward Z-Spread curve for the whole tenor range – a set of Z-spreads applicable for every cashflow, not an average from now to a certain point

Luckily this is none other than:

- deriving a smooth zero curve

- PV all the cashflows of each bond at the appropriate rate

- Comparing the Market price to the theoretical (expressed as BP Rich/Cheap)

There is a trick here to derive this which we can happily run through with you

"Does it matter? I mean, this only counts if you hold the bonds to maturity, right?"

Not sure what to say about that comment other than, if you think that's true then why even look at yield!!!

Of course it matters – RV is about entry, exit and carry. And your exit depends on the next guy's valuation and so on – until ultimately all valuations project far into the distance in assessing value. And if this is a better metric of value then ultimately we have to reference it

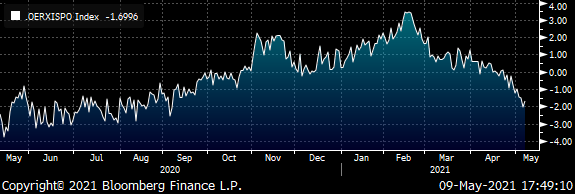

Bond and Swap curves are changing relative shape a lot at the moment – check out oe/rx vs Eonia…

This issue is becoming more significant as the curves change shape at different rates

RXAISPO Comdty - OEAISPO Comdty

So please forgive us, if we try to find trades that make sense in both spheres of reference. It's just that we observe too many people fighting the intrinsic value of a bond vs its neighbors by relying solely on Z-Spread

Best

Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796