Trades & Fades, Will & James @Astor Ridge

Overview

- Consensus is Bearish (Higher Rates)

This is a strong consensus - We saw the exact reverse of this in January when the same strategists were calling for lower rates forever! Don’t mind a tactical long here?...

- Some thoughts towards Tapering – although not discussed at the ECB meeting

- Base Case is curve should be steep – we look for forward rate steepeners where that’s not priced in

- ECB can’t control longer dated spreads and curve without PEPP increase

Our feeling is that QE bonds are sustained by the rate at which they are drained less so by the absolute amount – like an addict chasing ever higher highs, some of these rich bonds are unsustainable once the music stops

- Semi-Core Bonds start to converge in credit terms around the 2y & 3y point.

At slightly longer tenors the credit differentials offer roll opportunities.

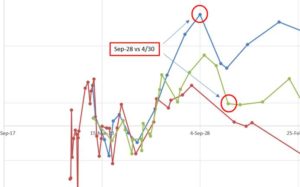

Trade – German 10s 13s steepener vs swaps

Sell HC Dbr 4.75% 7/34

Buy Dbr 0% Feb31

VS OIS

Trade: +11.5bp

Target:

History

Curve View

Rationale

- On most forms of analysis the 10y points looks oversold vs shorter and longer tenors (curve fit, forward rates, relative OIS spreads)

- In the context of the rest of Europe this trade feels like it should be steeper given that longer tenors experience more directionality

- Although there’s a notion that PEPP could buy more of the high coupon in a sell-off there are loose boundary conditions for ECB buying – they don’t just buy bonds off the face of the planet – when implied forward rates from the 10y to the 13y are flat -then we think that’s enough for buying to focus on other tenors/issues

- There is an implicit anti PEPP component, which is overpriced in Germany unlike High coupons in almost all the other European Markets

- Just one more tap left in Dbr Feb31 before we get a new Dbr Aug31 issue – May 19th

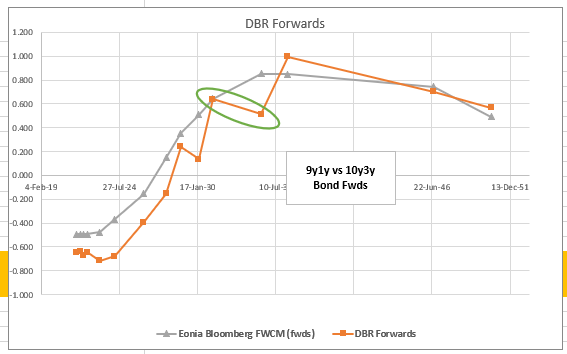

Fwd rates…

- Even if we remove some of the directionality by weighting the trade as two forwards (10y3y in bonds vs 10y3y Eonia) the trade still looks good..

(0.8 * P2509[DBR 0 02/15/31 Corp] - P2509[DBR 4.75 07/04/34 Corp])

* OIS spreads weighted as a forward trade

(Bbg Field P2509: Matched maturity swap yield from the overnight index swap (OIS) curve using OIS dual curve discounting, minus the yield to maturity of the bond.)

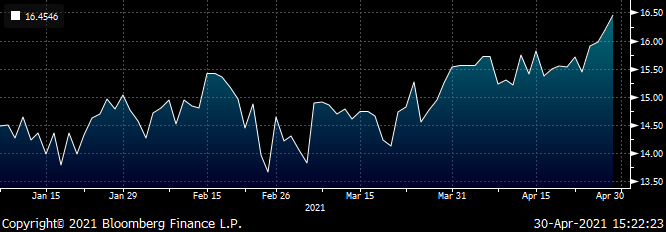

Looking at the Obl Futures – buy either for a contract squeeze

June CTD – Dbr 0.5% Feb26

Sep CTD - Obl 0% Apr26

- I see both bonds as fair/cheap

- IF CTAs roll early, I wanna be long front months but back months are cheap

- Sell off the run 4y vs Jun or Sep CTD

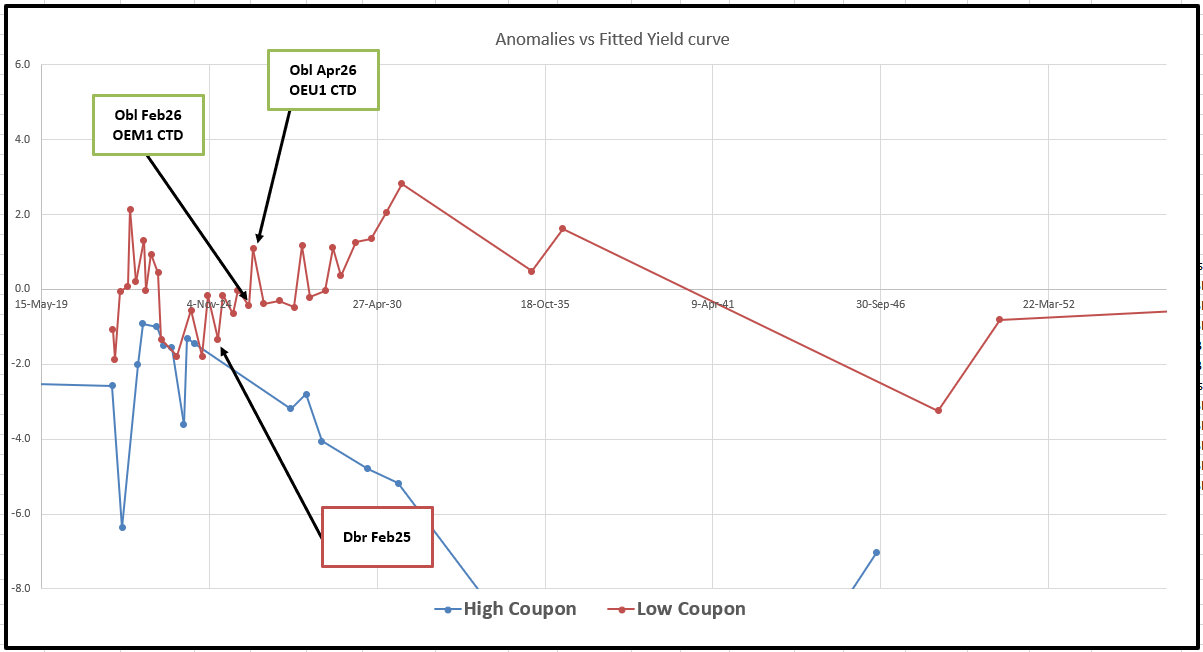

Graph of Yield Anomaly vs Fitted Curve

- If we buy the roll we might catch the front bond richening, but we’ll be forcing the back month (apr26 into an even cheaper level – already cheap on the curve)

- In turn that will cause switch activity because the off the runs will look even richer

- So concatenating those two trades I like Front month vs Dbr Feb25

- I like the fact that the CTD is an OLD issue Dbr (better placed, less float, harder to recycle for delivery, will probably gets scarce and tight on repo over the delivery period in June)

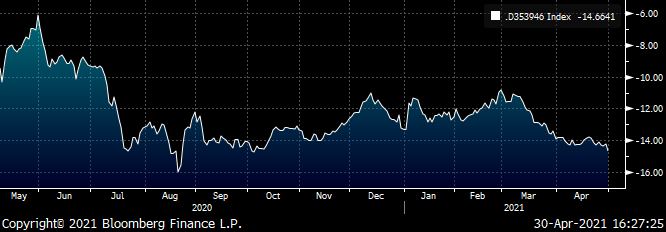

History vs OIS..

Levels

Entry +0.2bp

Target: -1.5bp

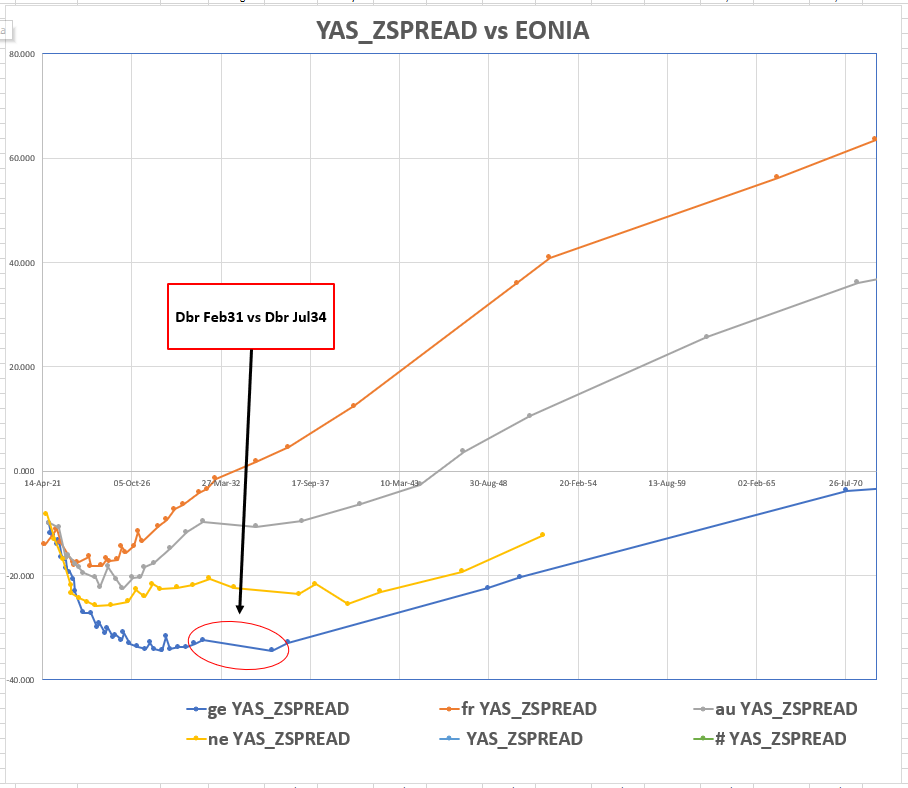

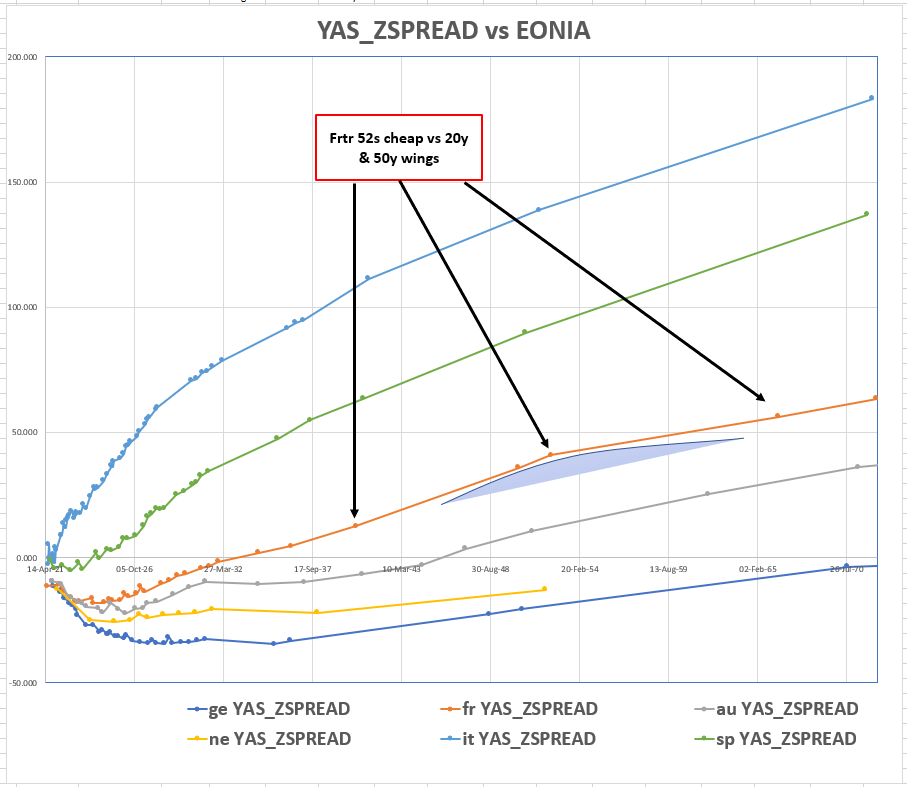

French Supply Trade

-20y +30y -50y fly

Today France announced the supply for next Thursday

€10 – 11Bln of Nov31, May40 & May52

Trade

Buy Frtr 52 in any discount into supply vs

Sell Frtr 40 & Frtr 66

BBG History

200 * (YIELD[FRTR 0.75 05/25/52 Corp] - 0.5 * YIELD[FRTR 0.5 05/25/40 Corp] - 0.5 * YIELD[FRTR 1.75 05/25/66 Corp])

Levels

Enter: +21.5

Target: < -17bp, Long term based on forward rates

- May40 are a rich 20y whose Low coupon means they carry poorly – on Cash Adjusted Spread we see them as rich – sustained somewhat by they very sought after Gerrn 39s and 44s

- May52 are the on the run 30y that go into the PEPP (<31yrs) next month and look cheap vs 20y and 50y in the context of other European 20s30s50s structures – see Graph of Z-Spreads vs Eonia

Movers and Shakers – some stuff we’ve been watching

Short Irish 35s vs Belg 35s – decent credit / value trade – hits first Target: -7.9bp

Long Italy 20y vs 15s and 30s – mis-weighted keeps working – cut it way too soon!!!!!

2 * (YIELD[BTPS 3.1 03/01/40 Corp] - 0.7 * YIELD[BTPS 0.95 03/01/37 Corp] - 0.3 * YIELD[BTPS 1.7 09/01/51 Corp]) * 100

Getting interested again in +dbr35/–Dbr39/ +UBA

Have Fun

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

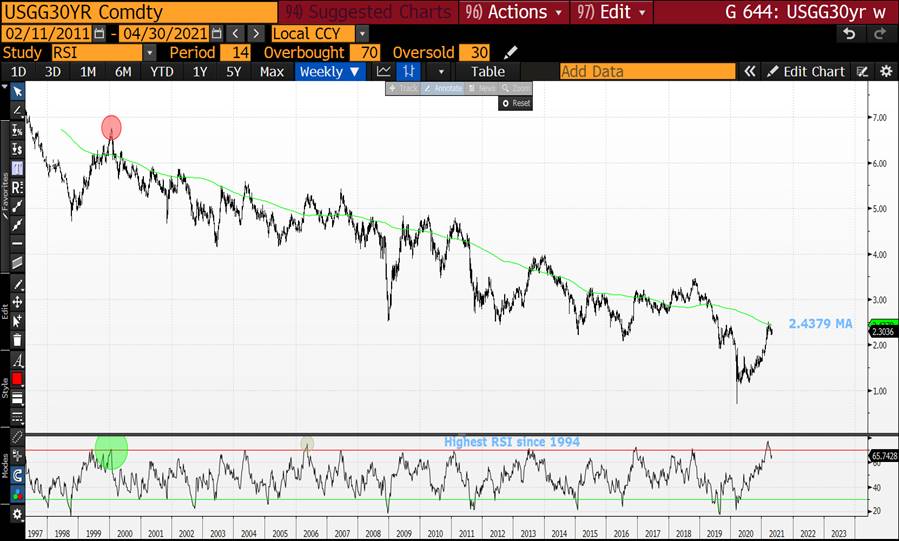

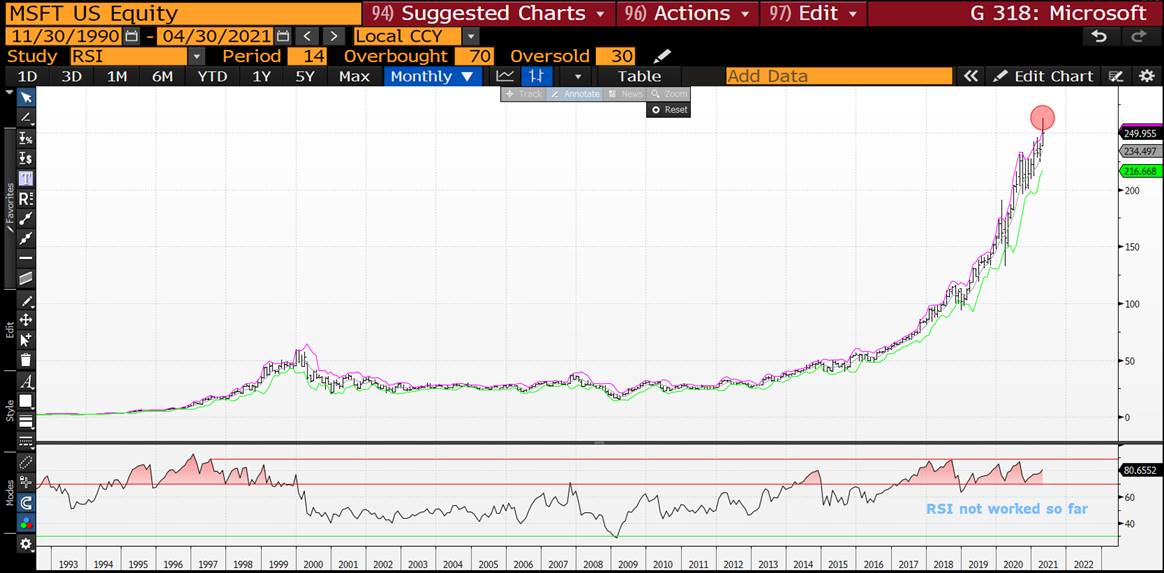

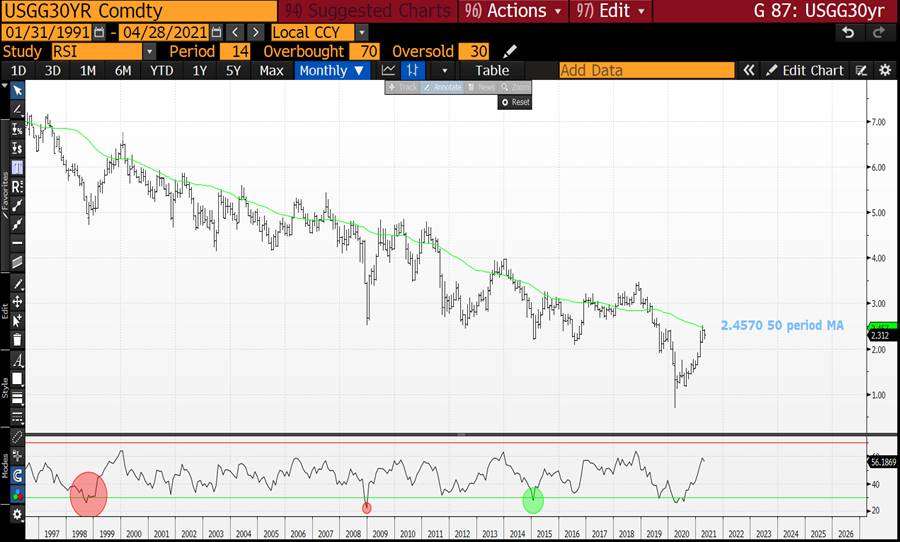

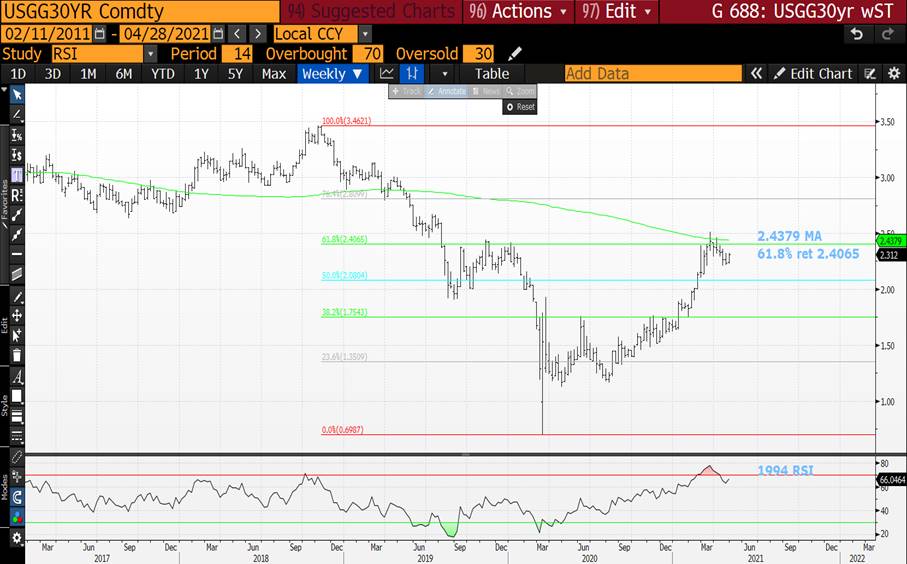

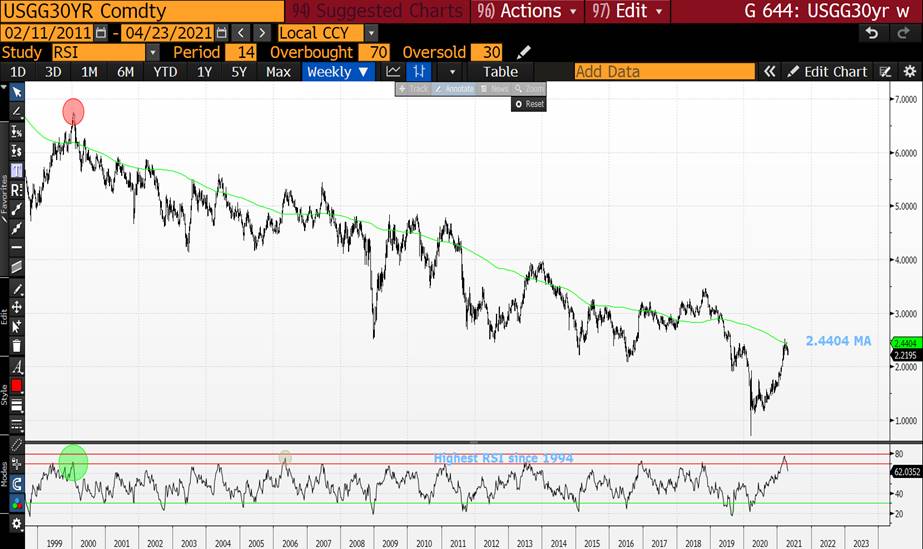

BOND UPDATE : NOT THE MOST LIVELY OF MONTHS BUT THE MONTHLY AND WEEKLY RSI’S PERSIST IN CALLING FOR LOWER YIELDS.

BOND UPDATE : NOT THE MOST LIVELY OF MONTHS BUT THE MONTHLY AND WEEKLY RSI’S PERSIST IN CALLING FOR LOWER YIELDS.

THERE HAS BEEN LITTLE OR NO DISSIPATION OF THE RSI EXTENSIONS.

SPECIAL MENTION TO THE US 30YR YIELD CHART FAILING SO MANY PROFOUND LEVELS.

GET READY TO PARTY LIKE 1994! THE HISTORICAL-TECHNICAL PICTURE HIGHLIGHTS A SWATHE OF 1994 RSI EXTENSIONS WHICH ARE VERY OBVIOUSLY EXCEPTIONAL!

ESSENTIALLY THESE TECHNICAL DISLOCATIONS ARE HISTORICALLY UNSUSTAINABLE.

US 30YR YIELDS HAVE HIT THE 50 PERIOD MONTHLY MOVING AVERAGE 2.4568 (PAGE 9).

US 10YR YIELD RSI DISLOCATION IS THE MOST SINCE “1994”!

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

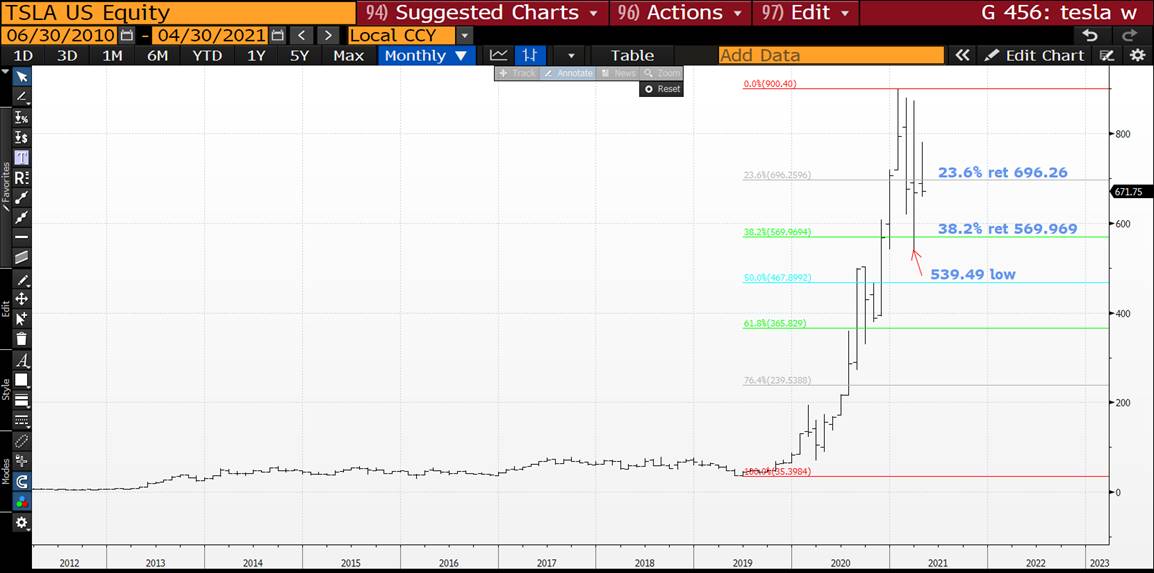

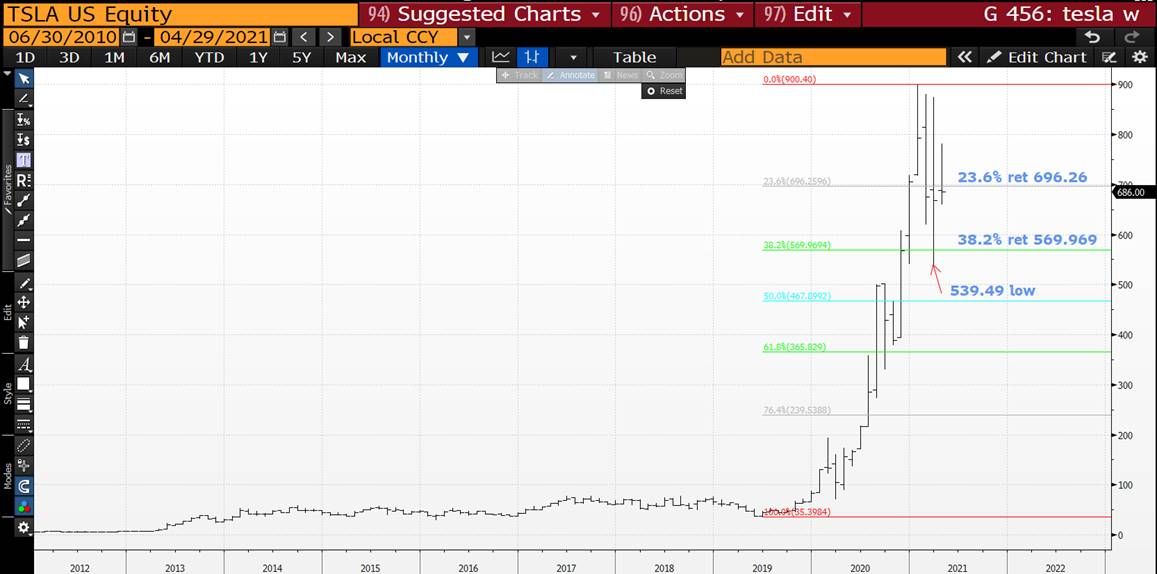

STOCKS : EQUITIES COULD BE FORMING MAJOR TOPS THIS MONTH ALONG WITH BITCOIN IF IT CONTNUES TO FAIL IT’S 50 DAY MOVING AVERAGE 56912.35.

STOCKS : EQUITIES COULD BE FORMING MAJOR TOPS THIS MONTH ALONG WITH BITCOIN IF IT CONTNUES TO FAIL IT’S 50 DAY MOVING AVERAGE 56912.35.

SINGLE STOCKS ARE BEGINNING TO SHOW SIGNS OF FATIGUE, TECHNICALLY-HISTORICALLY WE COULD BE FORMING SOME MAJOR TOPS.

APPLE IS OF MAJOR CONCERN GIVEN IT CLEARLY FLAGGED A TOP 2 MONTHS AND IS CLOSE TO THIS MONTHS LOWS ALREADY!

THE SINGLE STOCKS ARE MORE OF A CONCERN AS THERE IS SO MUCH OF A MISREPRESENTATION IN SOME OF THE VALUATIONS.

“THE MOST WIDELY HELD STOCKS AT MUTUAL AND HEDGE FUNDS IN 4Q 2020 WAS MICROSOFT, AMAZON AND FACEBOOK”. ALL OBVIOUSLY VERY OVER EXTENDED.

TESLA, AMAZON AND APPLE ARE WORTH MORE THAN THE FINANCIALS, ENERGYAND METALS SECTORS COMBINED.

I HAVE ADDED BITCOIN GIVEN A POSSIBLE TECHNICAL TOP. THIS COULD BE A KEY TIME FOR THE DAILY CHART TO FAIL ITS 56912.35 50 DAY MOVING AVERAGE.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

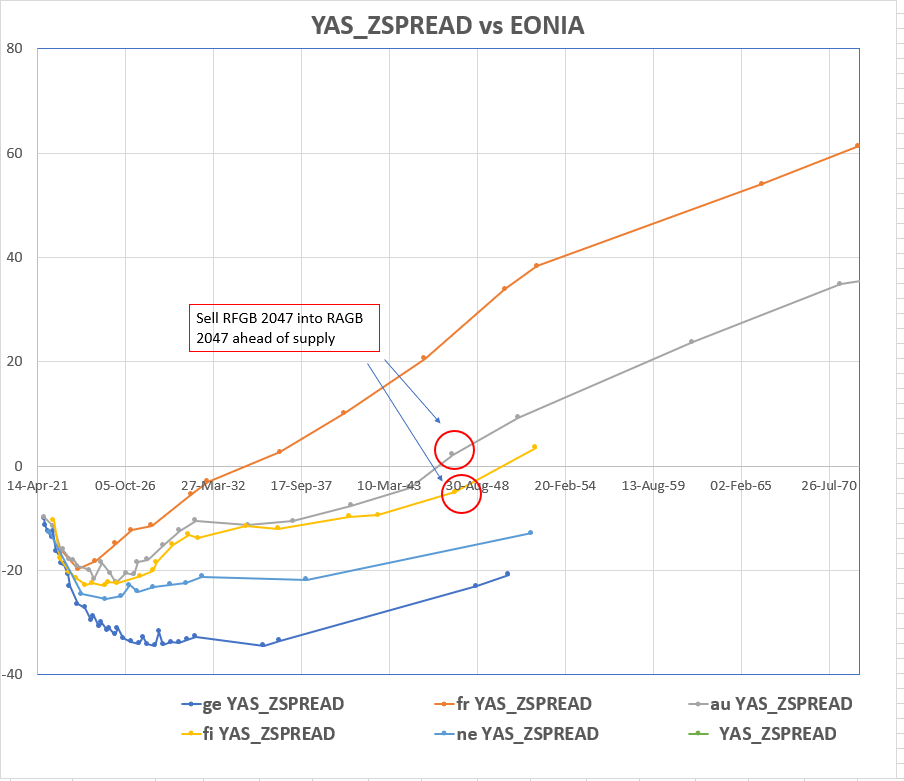

Austrian Supply - Will and James at Astor Ridge

Austria to tap 2/31 & 2/47 next week

RAGB 2/31

- Cross market Austria is looking a little rich, specifically in 10y space

- RAGB 2/30 vs 2/31 roll conversely looking on the cheap side, but we are seeing a general cheapening of 10y rolls on the back of the overall market selloff

- In addition we think the 2/30 (old 10y) is also a cheap bond, so if anything would look to buy either of the 10y bonds vs shorter issues (4/27, 2/29) as something more structural if we get a 10y specific cheapening

- Consequently we would look to buy a cheapening in 10y space rather than getting short a rich-ish issue into supply, especially given the small size

- Obviously in an ideal world we would see a further 0.5-1 bp cheapening into supply, but this is what is on our radar and likely the expression that dealers will also choose

RAGB 2/47

- Generally, but especially after the supply concession, RAGB 25y trades a little cheaper than other curves in the sector

- RAGB 2/47 has seen some concession vs Buxl, but with the direction of travel for spreads a little uncertain at this point we think there are 2 trades worth looking at:

Trade 1: Sell RFGB 4/47 -> RAGB 2/2047 to pick 7 basis points.

- 25y sector trades much cheaper than other sectors (RFGB 9/40 vs RAGB 10/40 is only 3 bp for instance), as can be seen from the below

Trade 2: Sell RAGB 10/40 -> RAGB 2/47 on asw to pick 9.5 bp

- Arguably this trade is not quite there yet, but at 10bp it looks pretty compelling, so we would do a little bit here with a view to adding at steeper levels

![]()

Will Scott

O: +44 (0) 203 - 143 - 4800

M: +44 (0) 789 – 441 -7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

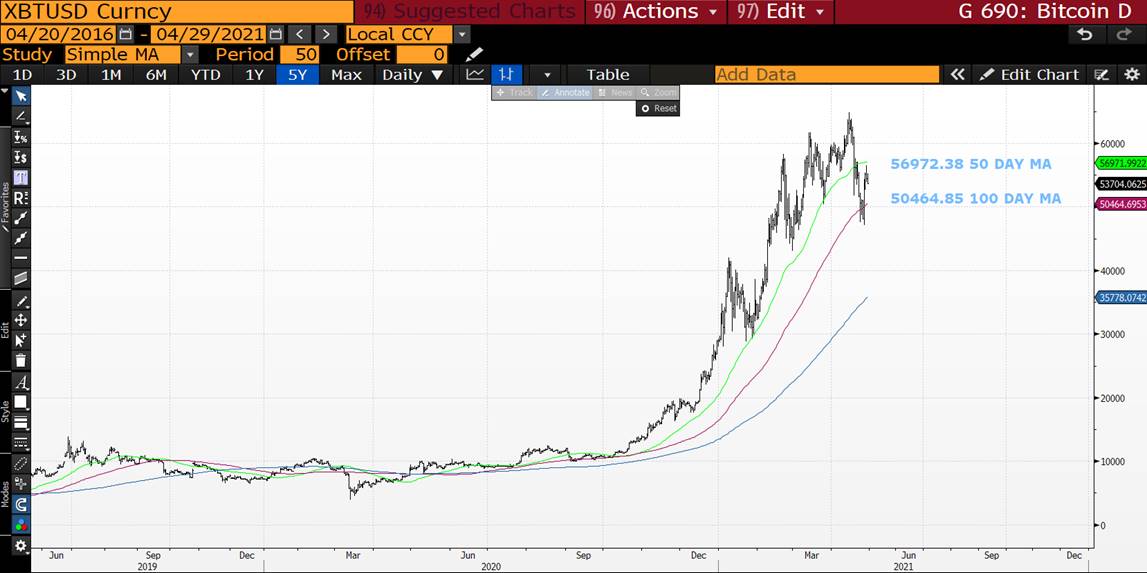

STOCKS : EQUITIES ARE POISED TO STALL AGAIN ALONG WITH BITCOIN, FAILING A 50 DAY MOVING AVERAGE 56972.38.

STOCKS : EQUITIES ARE POISED TO STALL AGAIN ALONG WITH BITCOIN, FAILING A 50 DAY MOVING AVERAGE 56972.38. THERE WILL BE A LOT TO DO TOMORROW TO IMPACT THE MONTHLY AND WEEKLY TREND-CLOSES.

SINGLE STOCKS ARE BEGINNING TO SHOW SIGNS OF FATIGUE, TECHNICALLY-HISTORICALLY WE COULD BE FORMING SOME MAJOR TOPS.

THE SINGLE STOCKS ARE MORE OF A CONCERN AS THERE IS SO MUCH OF A MISREPRESENTATION IN SOME OF THE VALUATIONS.

"THE MOST WIDELY HELD STOCKS AT MUTUAL AND HEDGE FUNDS IN 4Q 2020 WAS MICROSOFT, AMAZON AND FACEBOOK". ALL OBVIOUSLY VERY OVER EXTENDED.

TESLA, AMAZON AND APPLE ARE WORTH MORE THAN THE FINANCIALS, ENERGYAND METALS SECTORS COMBINED.

I HAVE ADDED BITCOIN GIVEN A POSSIBLE TECHNICAL TOP. THIS COULD BE A KEY TIME FOR THE DAILY CHART TO FAIL ITS 56972.38 50 DAY MOVING AVERAGE.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trades and Fades - Focus On Boxes - Will and James @ Astor Ridge

Overview

- The market, for now, is firmly in bearish mode. Granted, we saw the exact reverse of this in January when the same strategists were calling for lower rates forever, but given the relative steepness of the 5-10 sector in EGB space it makes sense to take a closer look at value vs. Eonia/Swaps over the next month or so at least

- The risk on rally and the assumed decline in Covid cases in Europe (although not globally) have understandably led to modestly higher core rates

- This in turn leads to assumptions of any eventual withdrawal of stimulus and leaves us thinking about the impact on both spreads and both curve shapes

- Our base case is that the ECB will to everything it can to keep front end rates as low as possible for the foreseeable future

- What the ECB can't control without increasing the PEPP is the direction of travel for longer dated spreads and curve

- Consequently we favour shorter dated flatteners vs eonia and longer dated credit steepeners vs Eonia

- As you will see from the below trades it is harder to construct a steepener with good entry levels than flatteners, but that doesn't mean they aren't worth entertaining

- Note: we have used Euribor boxes where there is no Eonia history

Let us know what you think.

Will and James

Flatteners:

Sell SPGB 4/25 vs Buying 7/26 Eonia Box

Sell DBR 2/25 vs Buying DBR 2/26 (OBL CTD) Eonia Box

Sell FRTR 5/27 vs 11/28 Eonia Box

Sell Nether 7/25 vs 1/27 Euribor Box

Steepeners:

Buy FRTR 2/27 vs 5/28 Eonia Box

Buy SPGB 7/26 vs selling 4/27 Eonia Box

Buy RFGB 9/30 vs Selling 4/31 Euribor Box

Buy BTPS 9/28 vs BTPS 8/30 Eonia Box

BOND UPDATE : A TESTING DAY WHERE YIELDS “NEED” TO END THE DAY LOWER, THAT SAID ALL MONTHLY RSI REMAIN HIGH AND CALLING FOR LOWER YIELDS!

BOND UPDATE : A TESTING DAY WHERE YIELDS “NEED” TO END THE DAY LOWER, THAT SAID ALL MONTHLY RSI REMAIN HIGH AND CALLING FOR LOWER YIELDS!

SPECIAL MENTION TO THE US 30YR YIELD CHART FAILING SO MANY PROFOUND LEVELS.

GET READY TO PARTY LIKE 1994! THE HISTORICAL-TECHNICAL PICTURE HIGHLIGHTS A SWATHE OF 1994 RSI EXTENSIONS WHICH ARE VERY OBVIOUSLY EXCEPTIONAL!

ESSENTIALLY THESE TECHNICAL DISLOCATIONS ARE HISTORICALLY UNSUSTAINABLE.

US 30YR YIELDS HAVE HIT THE 50 PERIOD MONTHLY MOVING AVERAGE 2.4570 (PAGE 9).

US 10YR YIELD RSI DISLOCATION IS THE MOST SINCE “1994”!

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

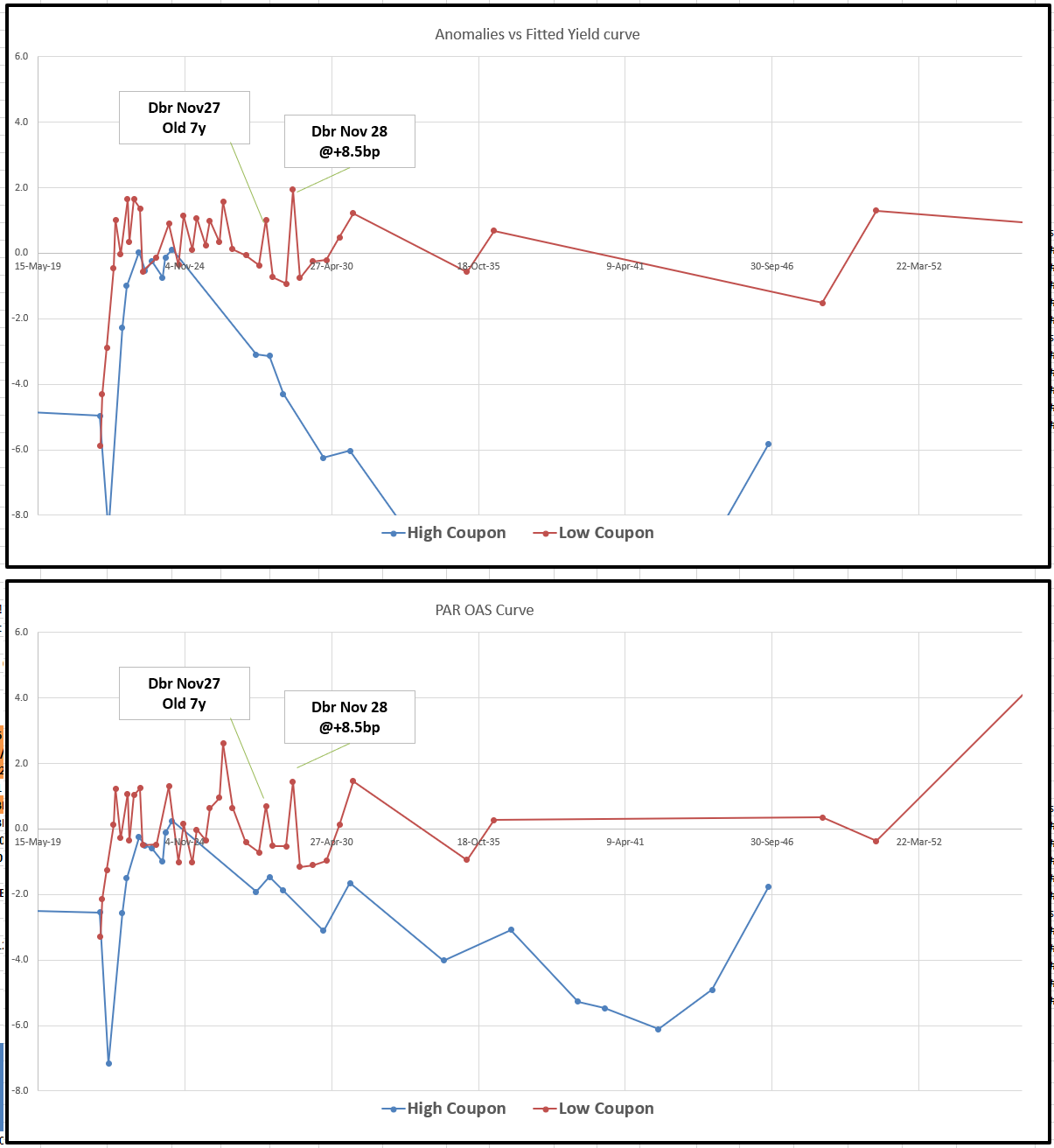

New Germs 7y and German 10y still cheap

Tomorrow brings a new German 7y – this is only the second issue on what is a more recent tenor for German issuance

Dbr 0% Nov28

Mid-market indicated +8.5bp vs outgoing dbr 0% Nov27

Here's how we see value vs

i) top graph, vs simple fitted yield curve

ii) second graph, va Par bond OAS curve

Pretty similar to be honest – both fits are centred through the low coupon bonds

In short – it's yield looks appealing

On a discounted cash-flow curve (PAR OAS) I'd like it a little cheaper

At anything north of +9bp we'd actually like to have the tight anomaly -dbr 0.35% Feb29 and long this bond – as it's a cheap bond in a rich sector and then trad ethe hedge if it cheapens vs wider issuers

Additionally we still like the on the run 10y vs selling old 8y Germany and old German HC 34s

Sell Dbr 0.25% Feb29 and Dbr 4.75% 34vs

Buy Dbr Feb31

Lvl: +7.5bp

Add: +8.5bp

Target: +4.5bp

This has a little bit of everything

- short the forthcoming 7y segment on the front leg

- Long the cheap rolldown 10y

- Short the old HC 34s – genuinely rich and HCs could ease in a taper tantrum

Cix:

200 * (YIELD[DBR 0 02/15/31 Corp] - 0.5 * YIELD[DBR 0.25 02/15/29 Corp] - 0.5 * YIELD[DBR 4.75 07/04/34 Corp])

Graph

If we can get any of this of for you, please give us a shout

Best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Vol adjusted Spreads to Germany - James & Will @ Astor Ridge

Taking a quick look at 'how credits trade' in Europe

A while back we decided to re-vamp how we look at different Euro Issuers

Two parts

1) 'How it Trades' – looking at a vol adjusted – spread to Germany model

2) a Rating / Spread to Germany model

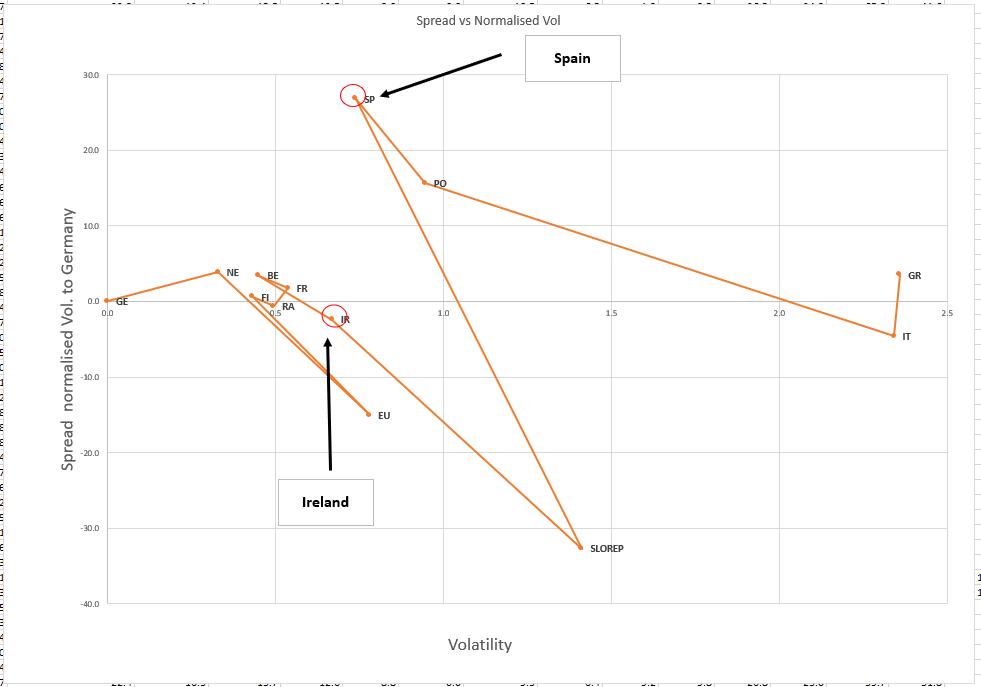

1 'How it Trades'

The PEPP and investor credit preference force issuers to trade away from simple credit valuation metric

We plot the spread to Germany (relative z-spread) vs the vol of their spread. We're trying to model how the reduced vol as the Pepp scoops up an issue makes them trade like better names

Here's 9 years - we choose 9years as there are CTDs and lots of history

In this instance Spain over the last few months has a vol similar to that of Ireland. As such it 'trades' better. Ireland for the same vol offers a much narrower spread. This methodology of var based returns is the very essence of RM so maybe it helps us understand the point at which the PEPP runs into the boundary condition at which RM will let it have as much of any given name

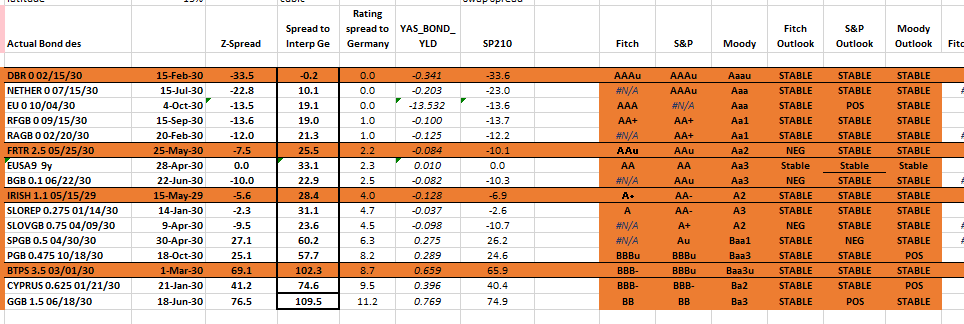

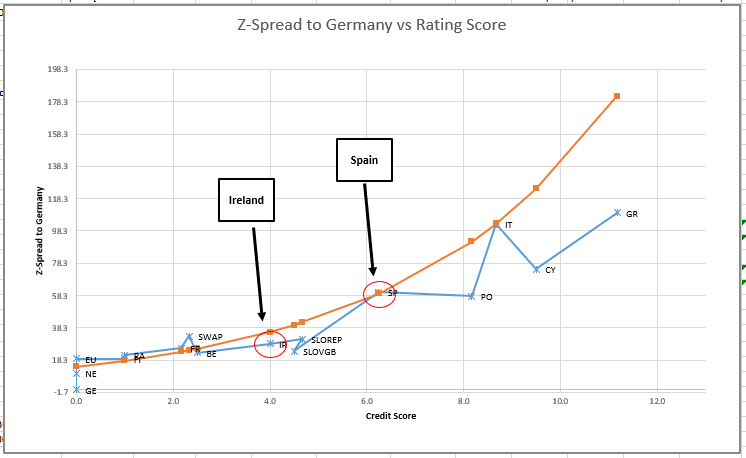

2 Rating / Spread to Germany model

Here we're looking at the spread to Germany vs the rating score of the issuer. The score is made out of the current rating from Fitch / Moody's and S&P plus the near term outlook

And we can graph Spread vs Rating score

We have drawn a curve through the major credit issuers – France / Spain / Italy

So as opposed to 'how it trades' – here we're looking at absolutes and we see that the smaller issuers trade through the fit

Results -

there's a whole bunch more analysis to do and we can do much more but there are some stand out thoughts. If I'm looking for trades that makes sense from both perspectives, I'm thinking that despite being favoured by the PEPP, Ireland and Slorep look rich

Also EU has had a greater spread vol of late – so yes it's cheap as a triple AAA but it's not stable and that's borne out by method 1

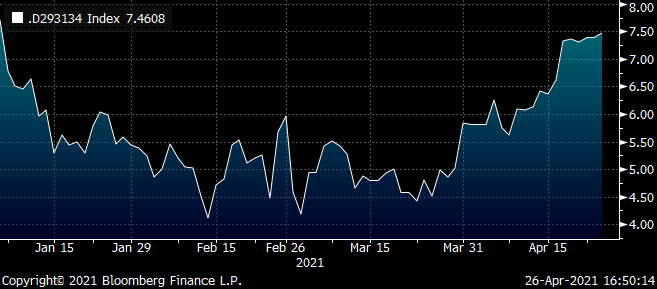

Relative Swap Spreads

Ireland into Spain vs MMS

(sp210[SPGB 0.5 04/30/30 Govt]-sp210[SLOREP 0.275 01/14/30 Govt])

Let me know if you have any questions on the other issuers

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND UPDATE : NEW YIELD LOWS THIS LATE IN THE WEEK WILL OPEN THE “FLOOD GATES” PUTTING YIELDS INTO FREEFALL, THE RSI DISLOCATIONS REMAIN STEADFAST.

BOND UPDATE : NEW YIELD LOWS THIS LATE IN THE WEEK WILL OPEN THE “FLOOD GATES” PUTTING YIELDS INTO FREEFALL, THE RSI DISLOCATIONS REMAIN STEADFAST.

IT STILL LOOKS LIKE STOCK FAILURE WILL BE THE ACCELERANT AIDED BY STOPS IN BOND MARKETS. CONTINUED FOCUS ON US CURVES 5-30 ESPECIALLY TO FUTHER FLATTEN.

SPECIAL MENTION TO THE US 30YR YIELD CHART FAILING SO MANY PROFOUND LEVELS.

GET READY TO PARTY LIKE 1994! THE HISTORICAL-TECHNICAL PICTURE HIGHLIGHTS A SWATHE OF 1994 RSI EXTENSIONS WHICH ARE VERY OBVIOUSLY EXCEPTIONAL!

ESSENTIALLY THESE TECHNICAL DISLOCATIONS ARE HISTORICALLY UNSUSTAINABLE.

US 30YR YIELDS HAVE HIT THE 50 PERIOD MONTHLY MOVING AVERAGE 2.4551 (PAGE 9).

US 10YR YIELD RSI DISLOCATION IS THE MOST SINCE “1994”!

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris