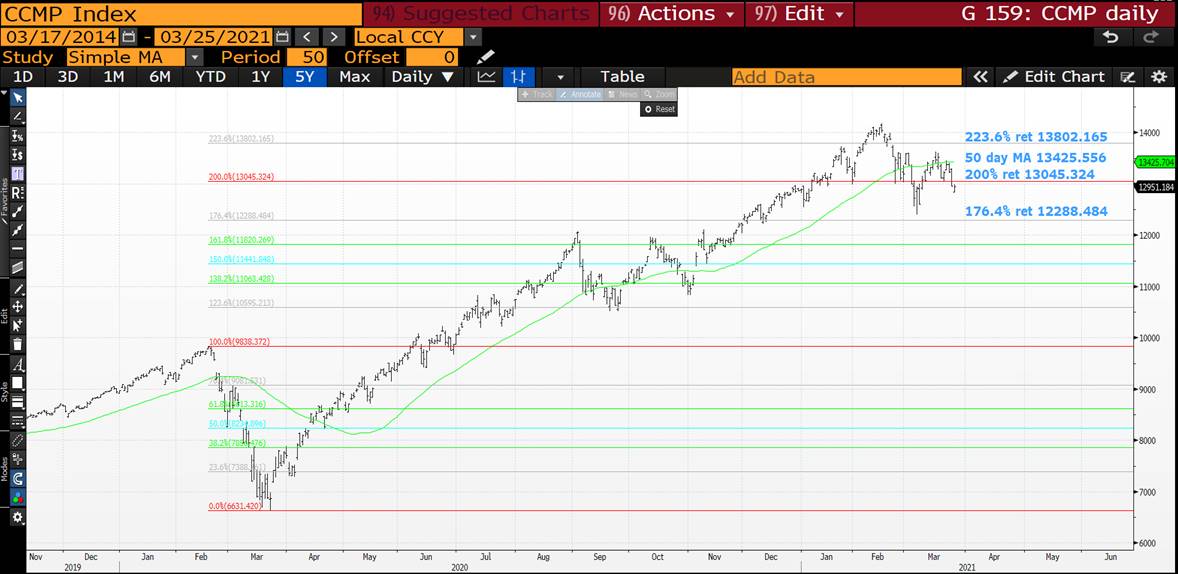

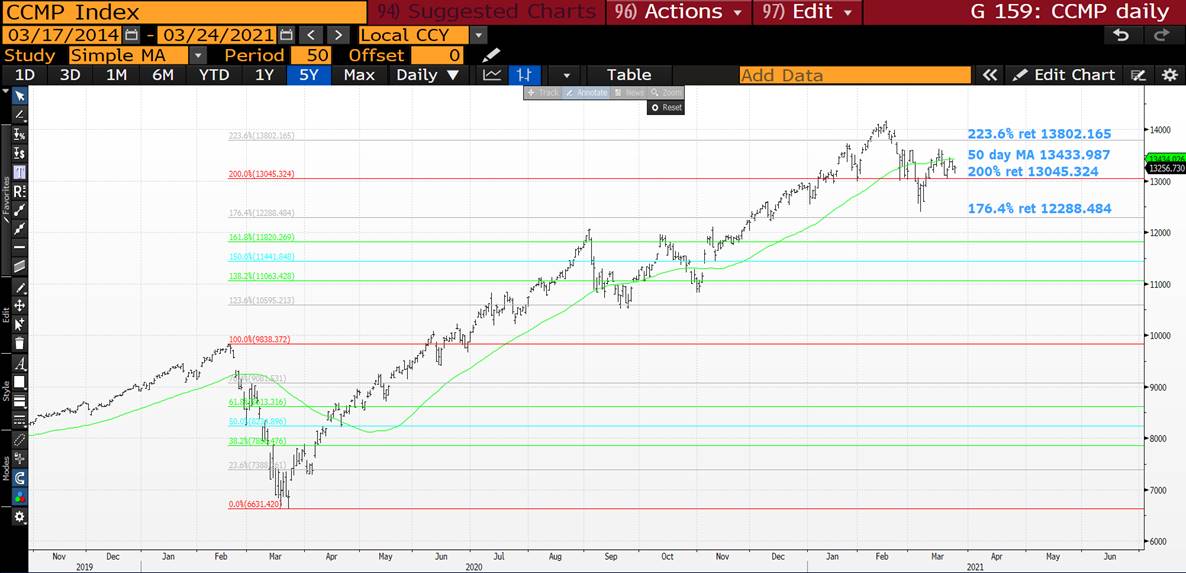

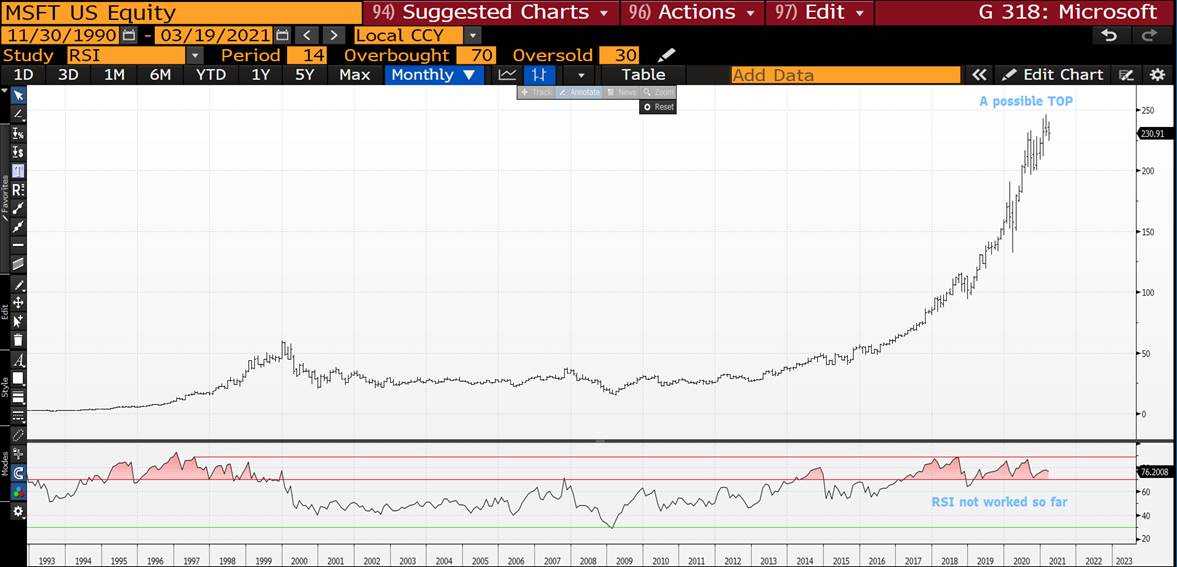

STOCKS : THESE ARE BEGINNING TO SHOW SIGNS OF FATIGUE AS IS BITCOIN, TECHNICALLY-HISTORICALLY WE COULD BE FORMING SOME MAJOR TOPS.

STOCKS : THESE ARE BEGINNING TO SHOW SIGNS OF FATIGUE AS IS BITCOIN, TECHNICALLY-HISTORICALLY WE COULD BE FORMING SOME MAJOR TOPS.

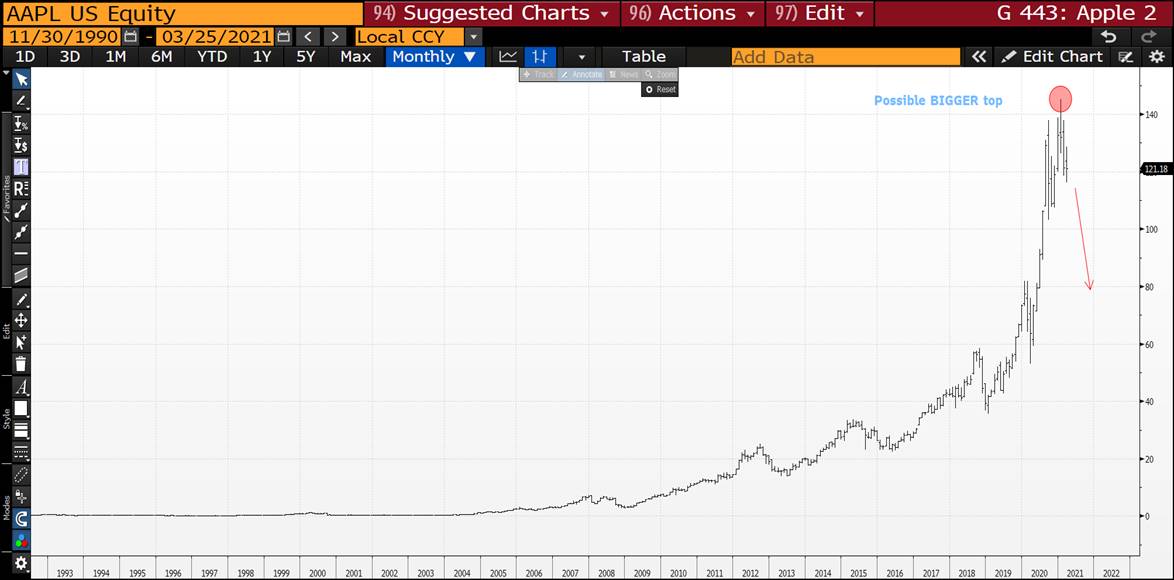

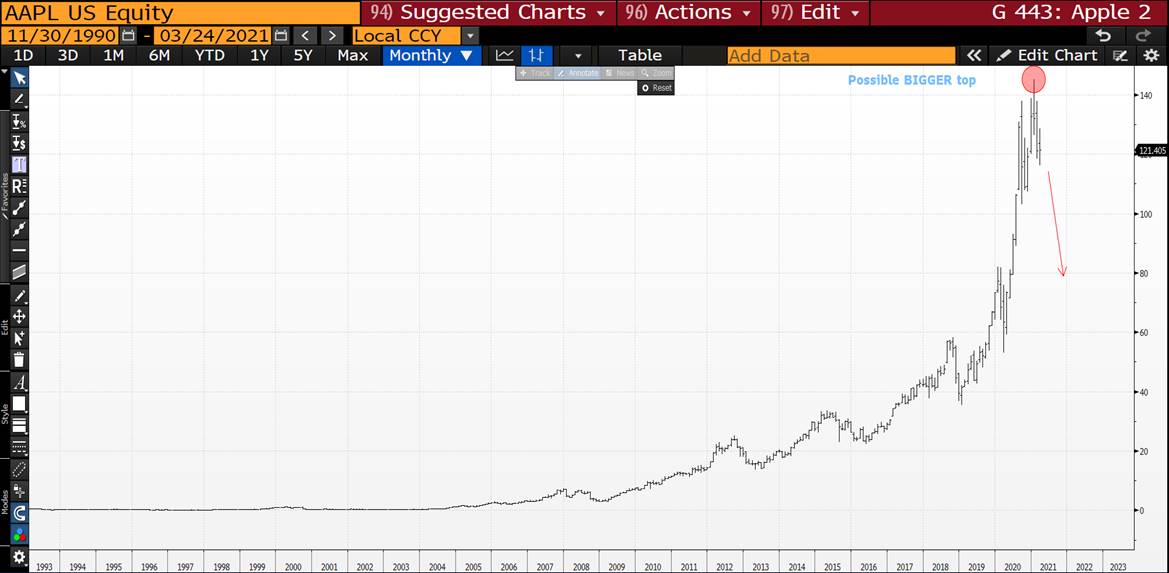

APPLE IS OF MAJOR CONCERN GIVEN IT CLEARLY FLAGGED A TOP 2 MONTHS AND IS CLOSE TO THIS MONTHS LOWS ALREADY!

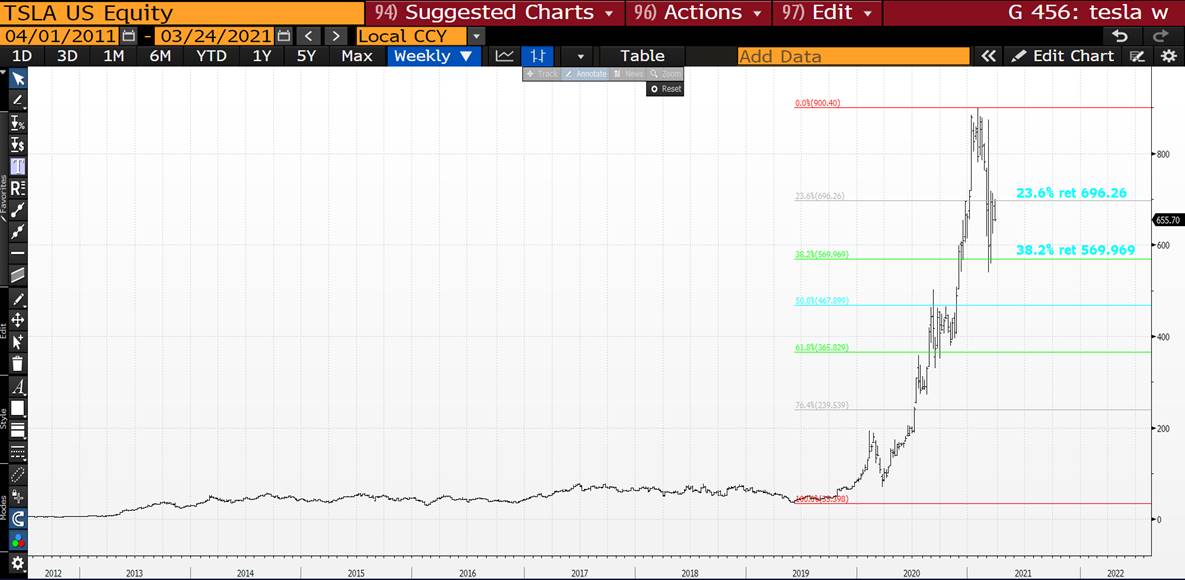

THE SINGLE STOCKS ARE MORE OF A CONCERN AS THERE IS SO MUCH OF A MISREPRESENTATION IN SOME OF THE VALUATIONS.

"THE MOST WIDELY HELD STOCKS AT MUTUAL AND HEDGE FUNDS IN 4Q 2020 WAS MICROSOFT, AMAZON AND FACEBOOK". ALL OBVIOUSLY VERY OVER EXTENDED.

TESLA, AMAZON AND APPLE ARE WORTH MORE THAN THE FINANCIALS, ENERGYAND METALS SECTORS COMBINED.

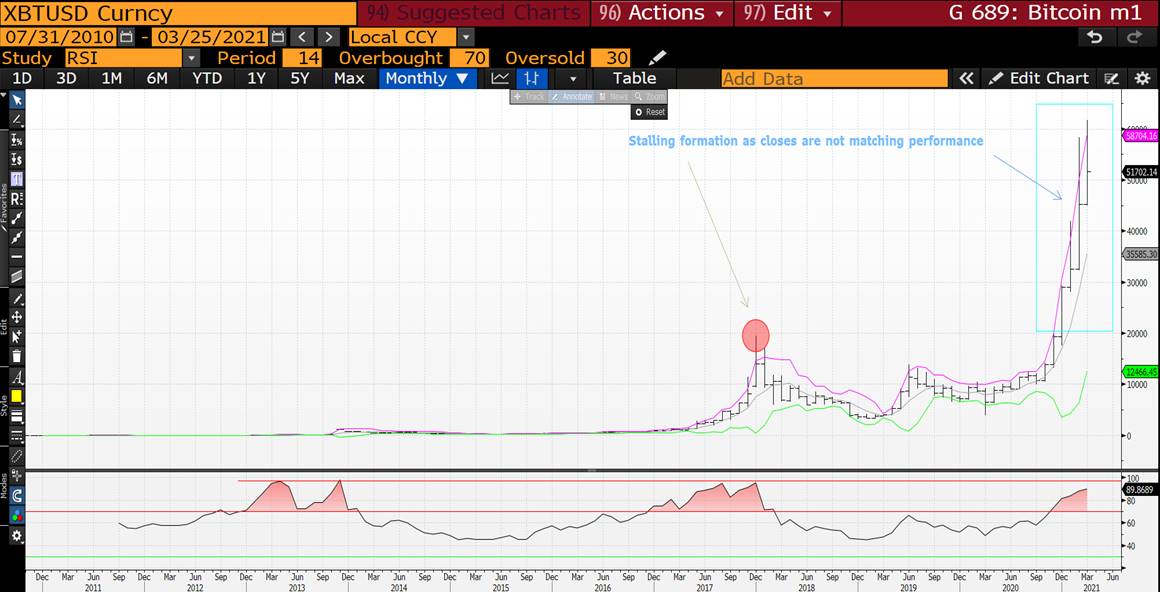

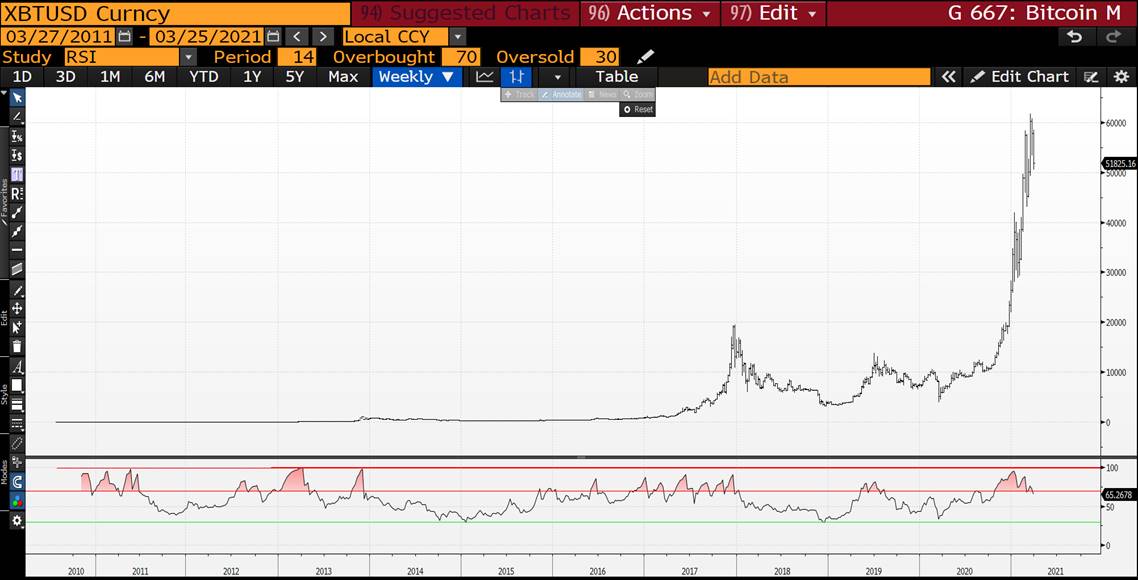

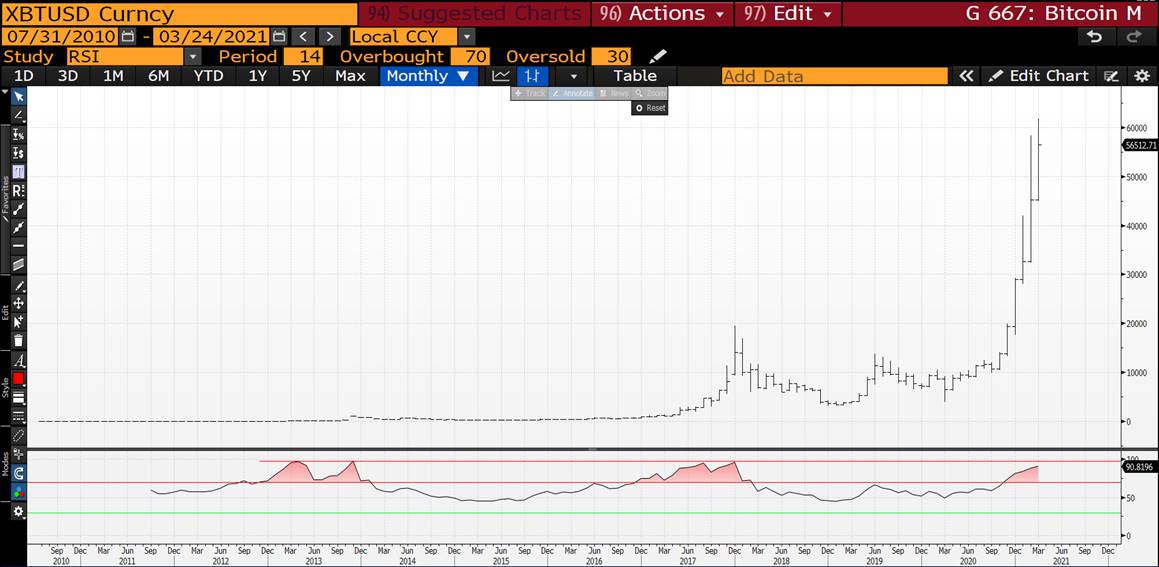

I HAVE ADDED BITCOIN GIVEN A POSSIBLE TECHNICAL TOP.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

STOCKS : THIS WILL BE A VERY KEY MONTH FOR EQUITY CLOSES ESPECIALLY IF AT THIS MONTHS LOWS.

STOCKS : THIS WILL BE A VERY KEY MONTH FOR EQUITY CLOSES ESPECIALLY IF AT THIS MONTHS LOWS.

APPLE IS OF MAJOR CONCERN GIVEN IT CLEARLY FLAGGED A TOP 2 MONTHS AND IS CLOSE TO THIS MONTHS LOWS ALREADY!

THE SINGLE STOCKS ARE MORE OF A CONCERN AS THERE IS SO MUCH OF A MISREPRESENTATION IN SOME OF THE VALUATIONS.

"THE MOST WIDELY HELD STOCKS AT MUTUAL AND HEDGE FUNDS IN 4Q 2020 WAS MICROSOFT, AMAZON AND FACEBOOK". ALL OBVIOUSLY VERY OVER EXTENDED.

TESLA, AMAZON AND APPLE ARE WORTH MORE THAN THE FINANCIALS, ENERGYAND METALS SECTORS COMBINED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

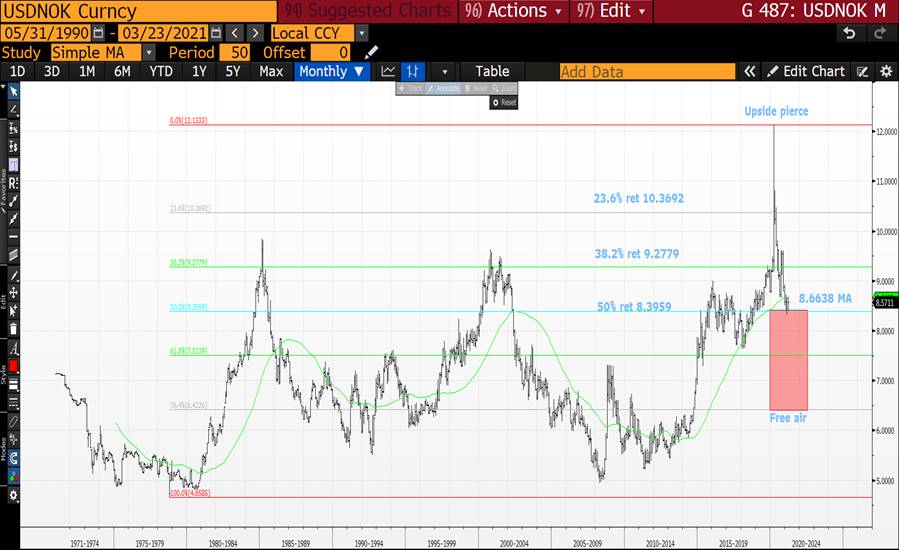

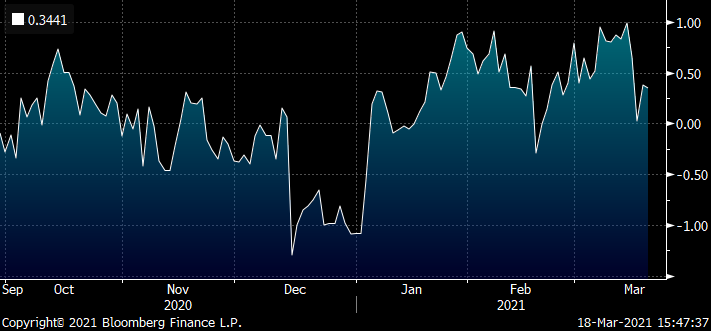

FX UPDATE : THE USD IS HOLDING IN WELL ON MANY CROSSES WHICH PREVIOUSLY MEANT TECHNICALLY BONDS SHOULD RALLY.

FX UPDATE : THE USD IS HOLDING IN WELL ON MANY CROSSES WHICH PREVIOUSLY MEANT TECHNICALLY BONDS SHOULD RALLY. THIS RELATIONSHIP IS HIGHLIGHTED ON PAGE 15.

TOO MANY GOOD LEVELS ARE HOLDING.

ALL CROSSES HAVE FALLEN SHY OF THE MAJOR "FREE AIR" LEVELS, KEY LEVELS HAVE HELD.

IF THE USD HOLDS THEN BOND YIELDS SHOULD FALL.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

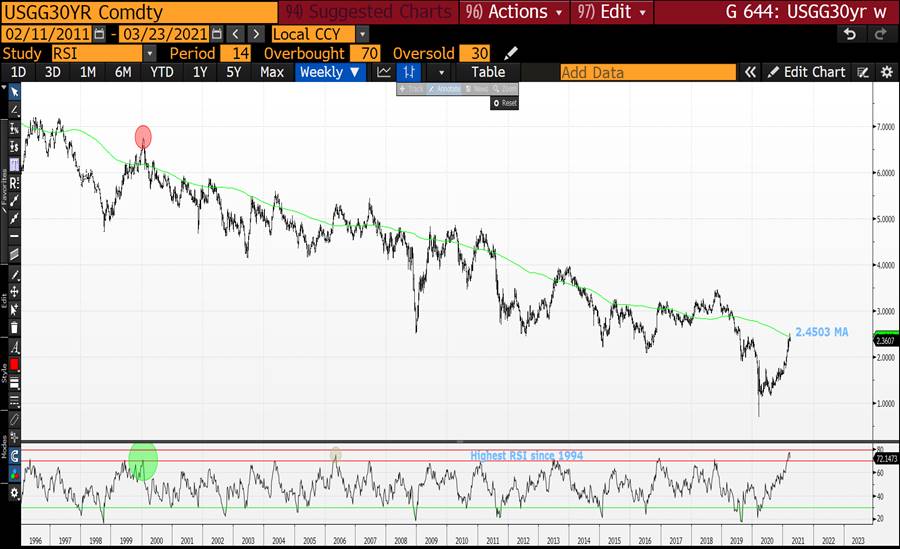

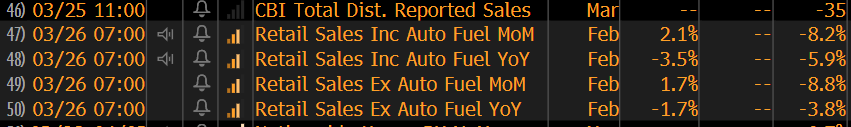

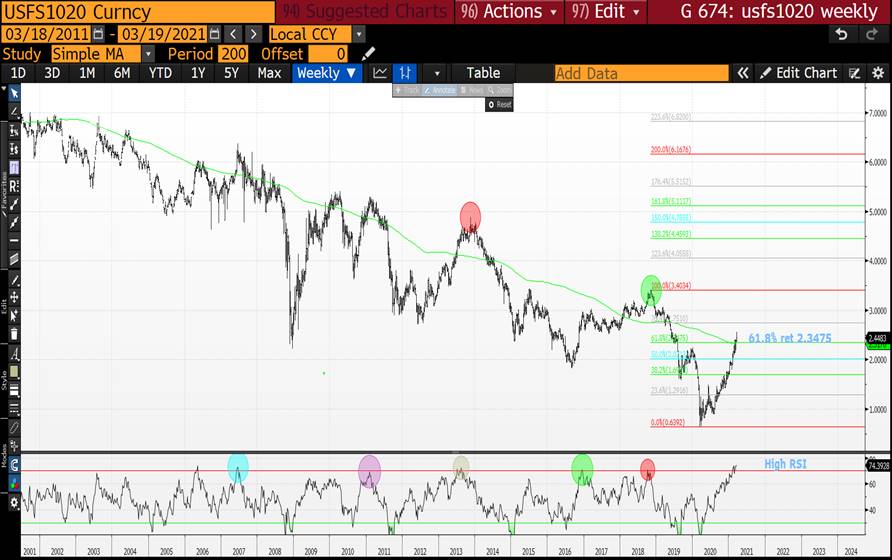

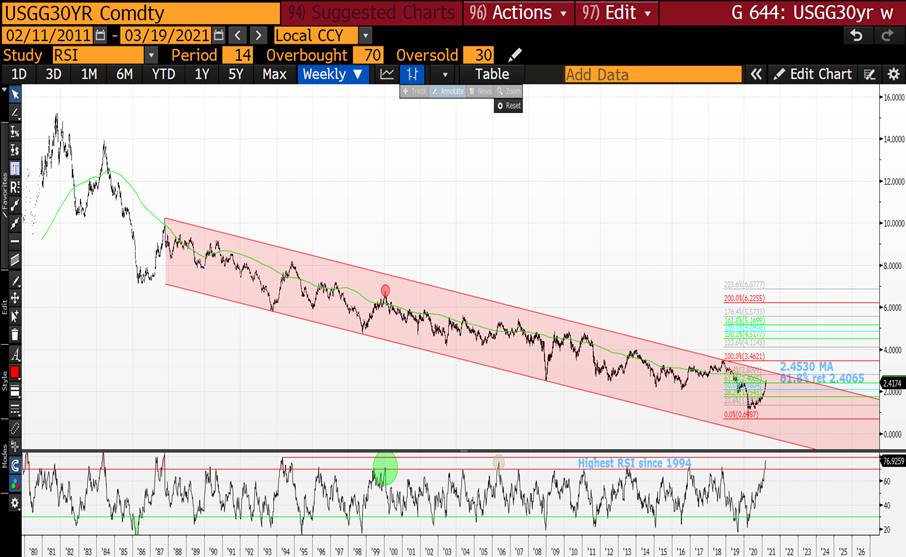

BOND UPDATE : YESTERDAYS “SLIGHT” YIELD FALL HAS STARTED TO “ESTABLISH” SOME NEAR PERFECT REJECTION FORMATIONS ASSISTED BY THE 1994 RSI’S.

BOND UPDATE : YESTERDAYS “SLIGHT” YIELD FALL HAS STARTED TO “ESTABLISH” SOME NEAR PERFECT REJECTION FORMATIONS ASSISTED BY THE 1994 RSI’S.

IF YIELDS FALL THEN THE CURVES WILL FLATTEN GIVEN THEY HAVE 2008 RSI DISLOCATIONS.

GET READY TO PARTY LIKE 1994! THIS IS A CRUCIAL MONTH WITH IMPLICATIONS FOR THE NEXT QUARTER. WE HAVE SEEN YIELDS RISE NOW FOR MANY WEEKS BUT AS MENTIONED PREVIOUSLY THE HISTORICAL-TECHNICAL PICTURE HIGHLIGHTS A SWATHE OF 1994 RSI EXTENSIONS, THUS THE BOND BOUNCE “IF” CONFIRMED WILL BE FASTER AND MORE SUSTAINED THAN PEOPLE EXPECT. 1994 RSI EXTENSIONS ARE VERY OBVIOUSLY EXCEPTIONAL!

ESSENTIALLY THESE TECHNICAL DISLOCATIONS ARE HISTORICALLY UNSUSTAINABLE.

US 30YR YIELDS HAVE SEVERAL WEEKS TEASING THE 200 PERIOD WEEKLY MOVING AVERAGE 2.4503.

US 10YR YIELD RSI DISLOCATION IS THE MOST SINCE “1994”!

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

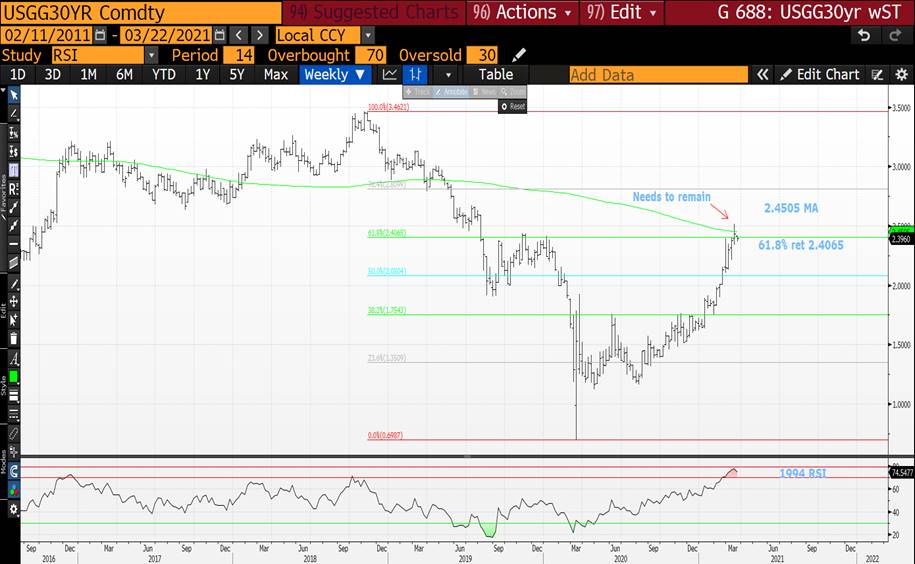

BOND UPDATE : LAST WEEKS YIELD HIGHS PLACED POTENTIAL “TOP” MARKERS IN THE SAND, IDEALLY YIELDS STALL FROM HERE ON IN.

BOND UPDATE : LAST WEEKS YIELD HIGHS PLACED POTENTIAL “TOP” MARKERS IN THE SAND, IDEALLY YIELDS STALL FROM HERE ON IN.

GET READY TO PARTY LIKE 1994! THIS IS A CRUCIAL MONTH WITH IMPLICATIONS FOR THE NEXT QUARTER. WE HAVE SEEN YIELDS RISE NOW FOR MANY WEEKS BUT AS MENTIONED PREVIOUSLY THE HISTORICAL-TECHNICAL PICTURE HIGHLIGHTS A SWATHE OF 1994 RSI EXTENSIONS, THUS THE BOND BOUNCE “IF” CONFIRMED WILL BE FASTER AND MORE SUSTAINED THAN PEOPLE EXPECT. 1994 RSI EXTENSIONS ARE VERY OBVIOUSLY EXCEPTIONAL!

ESSENTIALLY THESE TECHNICAL DISLOCATIONS ARE HISTORICALLY UNSUSTAINABLE.

US 30YR YIELDS HAVE SEVERAL WEEKS TEASING THE 200 PERIOD WEEKLY MOVING AVERAGE 2.4505.

US 10YR YIELD RSI DISLOCATION IS THE MOST SINCE “1994”!

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

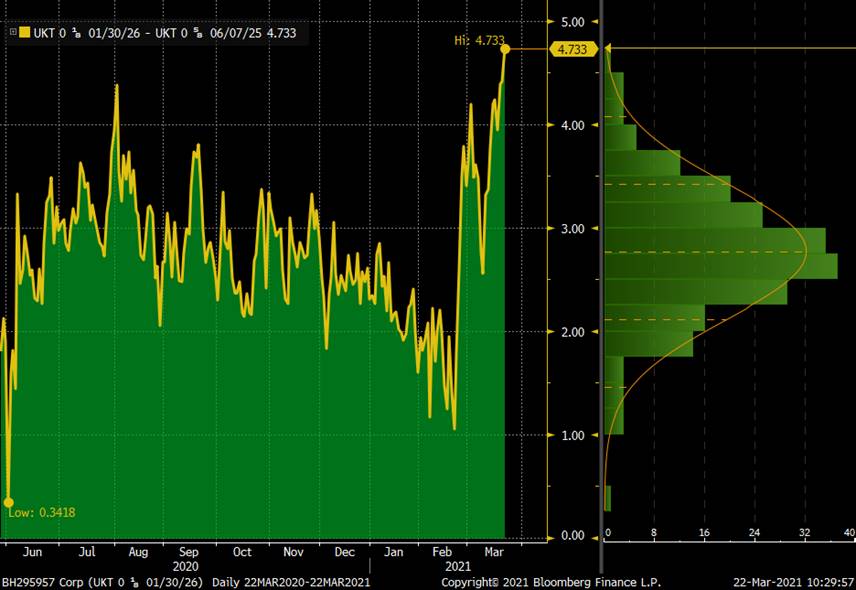

MICROCOSM: GILTS > Quick Rundown - Data, Supply, Curve and Qtr-End - IDEAS

Morning…

- Weekend news centered on talk of further lockdown in Europe as Covid-cases remain higher than hoped and vaccination efforts stumble. Talk of travel restrictions from UK to Europe this summer (despite end of UK restrictions) adding to bullish tone in rates.

- GILTS This Week - Qtr-end, light supply, busy data calendar, 3 APFs and scattered repo richness...

- Technically we have 8 more days before qtr-end but we'd expect, given the mayhem this qtr's seen, that dealers will look to lighten up on positions earlier than usual this time. With a light auction calendar of just £2.25bn 1T49s tomorrow and a paltry £350mm linker 56s on Wednesday to finish up the qtr, there is little reason for dealers to carry big positions this week unless they're planning to unload them into one of the 6 APFs this week and next.

- Mid-late last week, we saw a surge in repo bids for selected issues, most of them in the 3-7yr bucket. This was accompanied by a richening of gilts general collateral which closed at/near zero having hovered around O/N Sonia levels of +5bps for most of the last 6mos. While these weren't necessarily headline-grabbing events, per se, bids of -13/-14 bps for the UKT 0F25s and other older, more seasoned issues, drove a richening of these issues vs MM OIS to their richest-ever levels. This has also put a pressure on GEMMs who are asked to offer more of issues that they're already short, exacerbated by a dearth of supply in this sector of just 1 auction of the new 0R26s and one tap of the 0E24s in March. This repo bid wasn't evident in the newer, low-coupon issues like the 0E26s or 0R26s, which helped to drive a steepening of spreads like 0F25s-0E26s and/or 0F25-0R26s to levels that overshot where the correlation to the curve moves said they should. By Friday afternoon, the 0F25-0E26 yield spread traded as wide as +12.5bps – a new wide and a rather tempting fade given this is only a 6mo gap. We were on the right track, as the spread is now +12.0bps, but had liquidity been better than .4bp from mid, we would have been much more involved.

The question now becomes, "How does repo trade into quarter-end?".

We're assuming this repo bid is driven by the dealer community trying to cover shorts, rather than clients demand for collateral, simply because it's happening in a bullish move for the underlying issues. From a positioning standpoint, the sharp richening of issues like the 0F25s vs swaps reflect not only the temptation of a repo bid but buyers of the underlying gilts given their attractive C&R and overall curve steepening bias. Clients might want to take profits into qtr-end if their curve view shifts, or is if these spreads to swaps stretch much more. That said, the first auction in April is the first tap of the new 0R26s on the 7th, followed by the 0E24s on Apr 20th – very unlikely to meet all the short-end demand for paper, especially since the 0E24s aren't even eligible for QE.

In this case, the simplest trade here is to be long the 0E26s within the sector. At current repo levels, APF ineligibility and worsening liquidity within the sector, there's little upside to sticking with these richer issues. On the other side, a persistent repo bid raises the odds that the 0E26s will catch-fire in repo too, richening back to the curve in line with their neighbours. If the market dumps their longs into qtr-end, the GEMMs will cover their shorts and the repo bid fades.

This AM's levels:

ON TN at Zero

0F25s -0.14 -0.15 decent volume 1.4bn in ON market

0E26s 0 -0.04 decent volume

0R26s -0.02- 0 barely trades

1Q27s -0.12 -0.14 decent volume

UKT 0F25-0E26 flattener vs MM SONIA

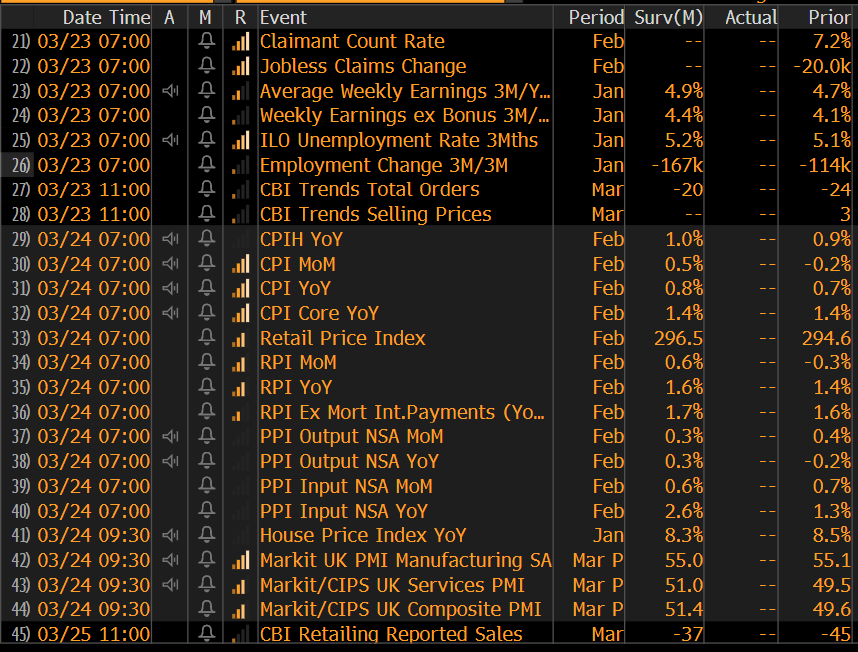

- DATA! On of the biggest weeks for UK data in about a month. Here's the BBG rundown:

The UK's current lockdown is its longest yet when it'll be completed. The last MPC meeting made mention of a lively debate between the hawks and the doves. While there is little argument that 2H21 will show stronger growth than 1H21, the path there could be a bit bumpy. In addition, the market's fixation on inflation and the spike in breakevens suggests heightened sensitivity to softer inflation numbers than expected.

- The Long-End of the Gilts Curve… Considering how much paper the UK issues in the long-end of their curve, one would be justified in wondering how the curve could be flattening due to supply constraints, especially considering the bear steepening we've seen from 2yrs-15yrs. Like it or not, tomorrow's 1T49s tap is simply not enough to satiate demand for long gilts until the April 7th tap of the new UKT 0.875 46s, especially with THREE more 20y+ APFs to come between now and then. The US curve remains a barometer for the long-end of the UK and the UST 10-30s spread has also been flattening sharply, now +70.9bps having peaked at +86bps in early March. With a ton of UST 2yrs, 5yrs and 7yrs coming this week, this flattening bias isn't likely to change much barring some shockingly weak US data this week (Home sales, durables, PMIs, GDP, personal spending, U of Mich all on tap this week!).

Last week we recommended getting long the 0F50s vs the 1T49s as their cycle is over and we've seen a modest .3bp flattening which we expect to continue. The 1F54s tap last week was a tad sloppy but appeared to clear ok. We're seeing some flattening interest out of 49s into 54s which has been a slow grind but we're .9bps flatter since late last week and see more to come as the Z-sprd corrects.

1T49-1F54 Z-zprd

- Random RV:

- UKT 0R30s have caught fire lately, our 0R30-4H34 sprd steepening 2bps in Z-sprd and 2.3bps vs MM Sonia. Considering how poorly the 10yr sector has traded lately, this is news. 0R30s still have £7.7bn APF room left (vs 1.47bn for 29s) so they'll remain on our radar.

Want a bullish trade? 0S29-0R30-4T30 fly – buying 0R30s. This is VERY well correlated with 5y5y SONIA and is showing signs of topping out…

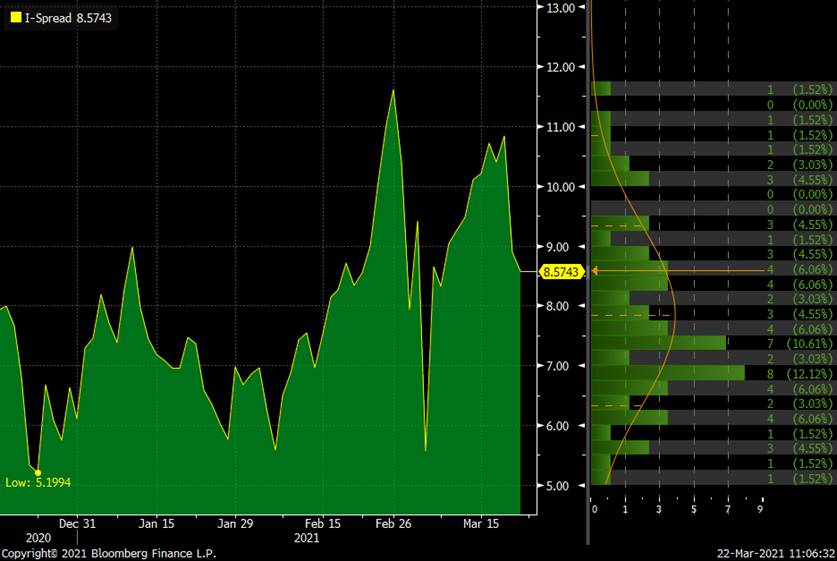

- UKT 4T30-0F35-1Q41 fly looks cheaper on a relative basis than more obvious flies like the 3-10-30 or 2-10-30, driven largely by struggles in the 35s taps. No UKT 0F35s until Apr 21st, however, and a lot of wood to chop before then, including 4 mediums APFs.

We'll be in touch to discuss.

Thanks,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades, Movers & Shakers, James & Will @Astor Ridge

Things we're looking at

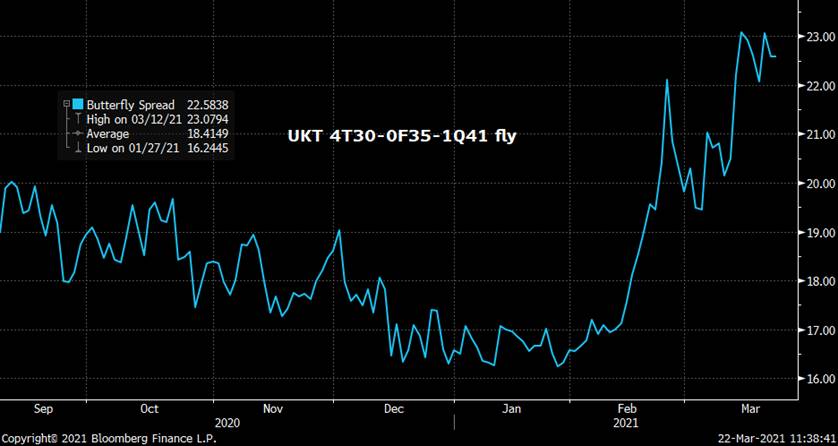

There is a chance Ireland comes with a 15y – last taps were 10y & 30y and we have Belgian supply on Monday (5y, 10y & 20y) which has pushed the longer tenors cheaper

Trade:

Belgium/Ireland 15y switch

Sell Irish 15y to buy Belgium 15y – solid roll over next few yrs plus supply dynamic. Hidden value in the high coupon Belgium 35s

Lvl: -4.8bp

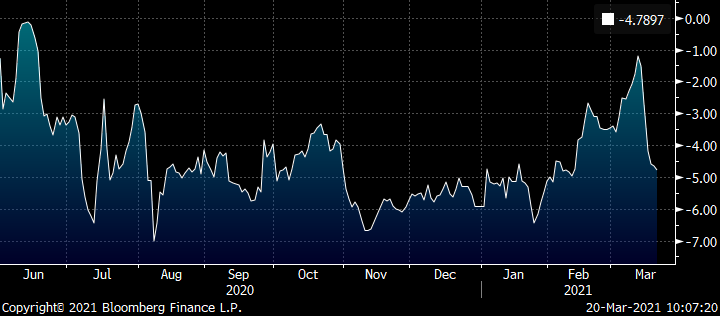

Here's European, semi-core Z-Spreads to demonstrate

Trade:

Ireland / EU 5y switch

Sell Irish May 26, Buy EU Nov25

On Z or vs MMS: -1.5bp (Z)

Prospect of a possible 5.5 y EU bond leaves us looking to sell rich 5.5 yrs – Ireland trades rich there and is compressed to the semi core curves – but this would leves us switching nov25 into a possible syndic 5.5y EU bond and the prospect of then having..

-5.3y Irish vs +5.5y EU for a pickup, AA+ into AAA

downside is that EU is an ongoing issuer – but this is at a point where I think RM might switch – just because there's PEPP doesn't mean Ireland richens forever?

Graph of Z-Spreads

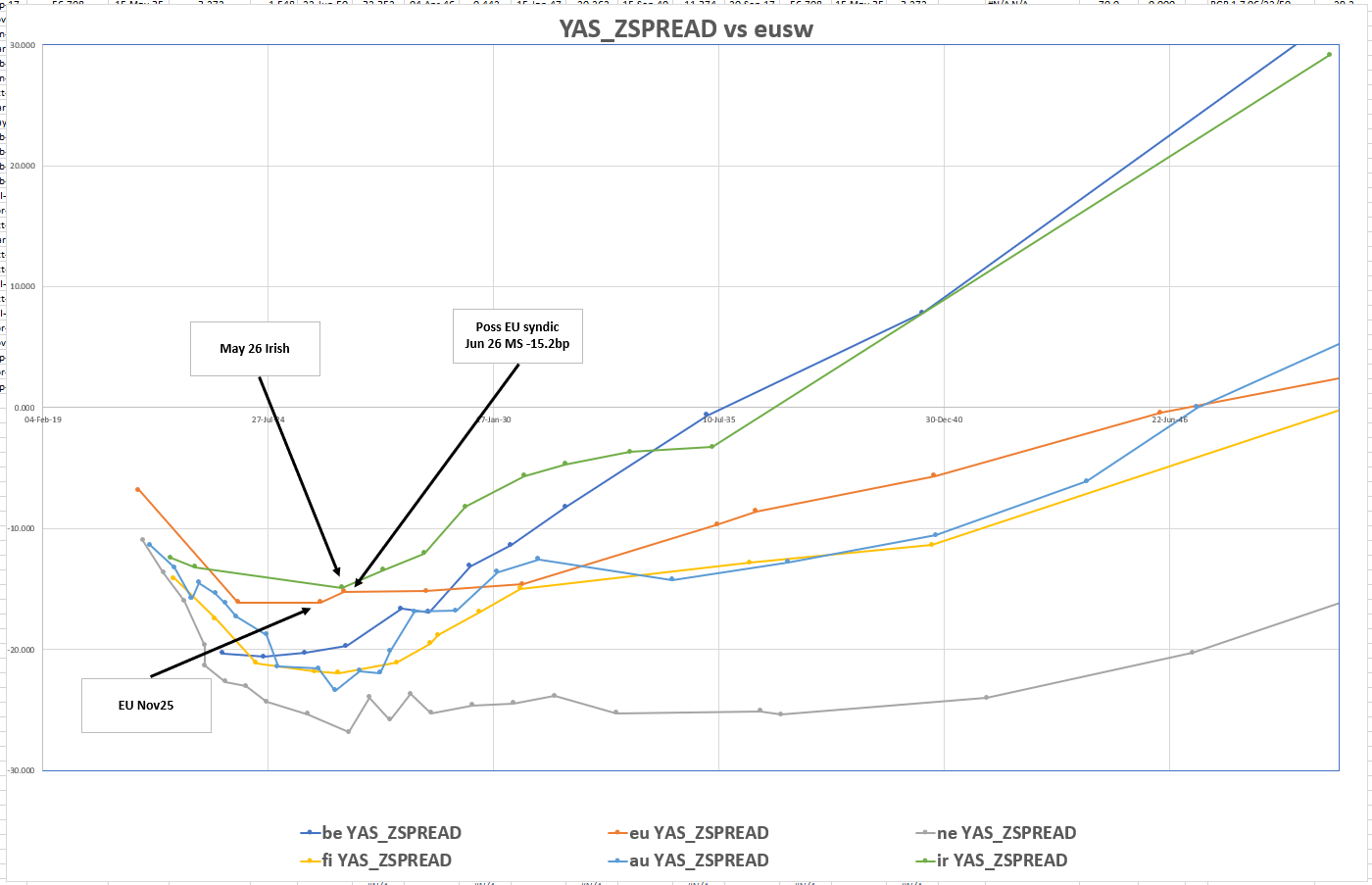

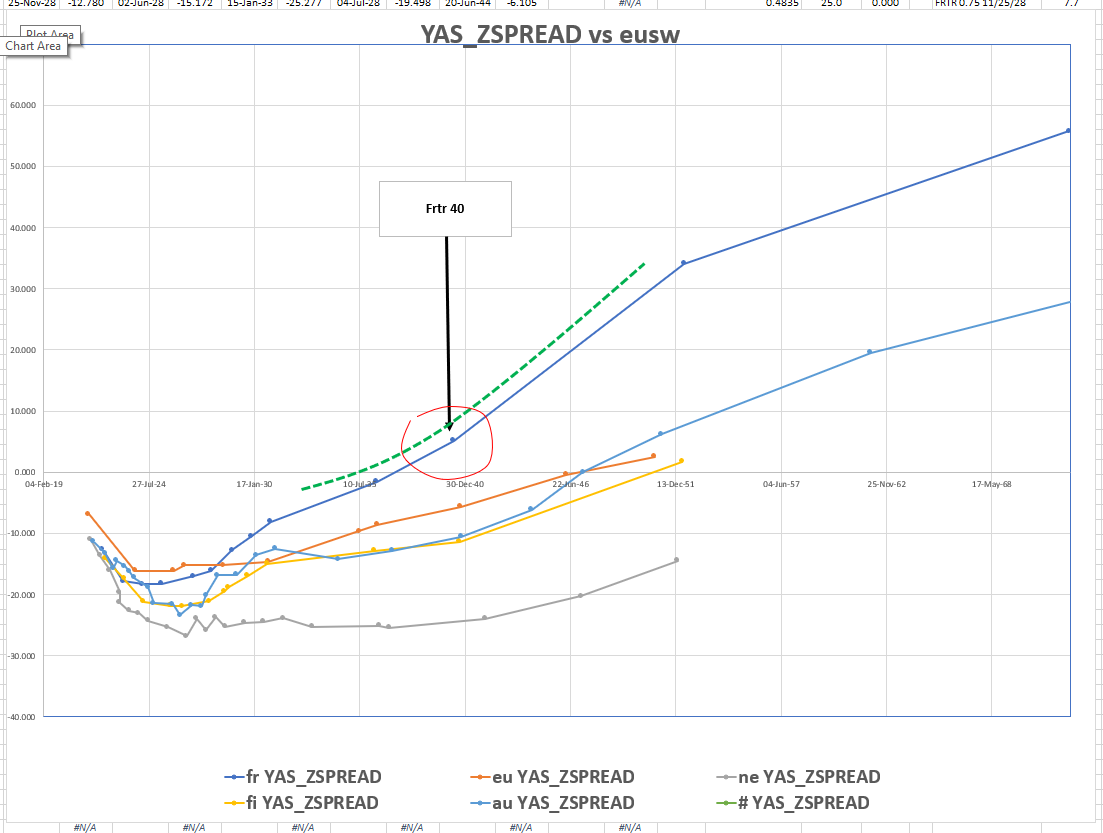

French 20y Dragged rich by recent 23y Green Bond

Trade

Sell Frtr 20y vs 10y and old 30y

Weights: +.3 / -1 / +.7 (all x2)

Levels

Enter: -4.75bp (33% risk)

Add: -5.75bp (balance if risk)

Target: > -1bp

Stop: -8.5bp

BBG history

WE see 20y Europe and particularly France as being rich vs 10s and 30s

Here we have chosen to buy the French 10y which should go off the run in the next few cycles and the old Frtr 30y which still has a relatively high coupon (1.5%) and is inside the PEPP envelope

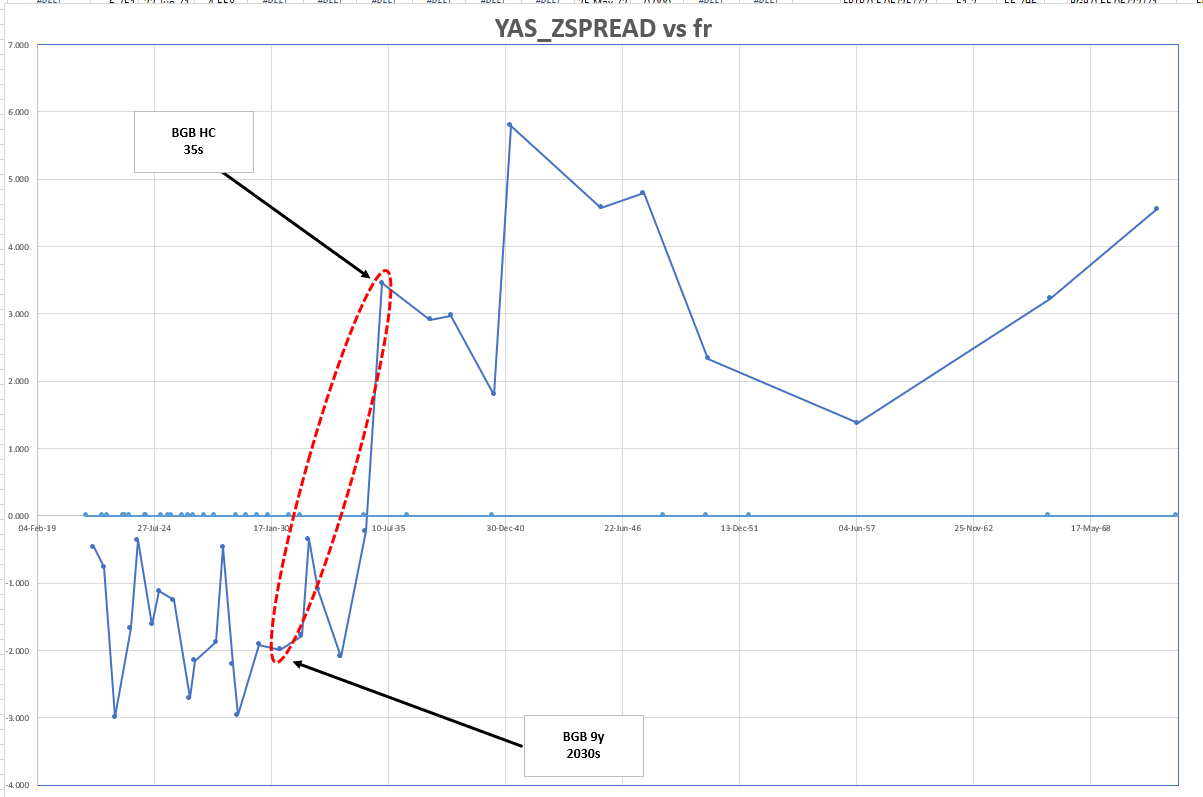

Here's how Z-spreads look in Europe with Frtr 40s highlighted…

At some point we should see a tap of the 20y Btps 1.8% Mar41

Long end 20y vs 30y has steepened in the last few sessions, in part during the pricing of the new Greek 30y

Trade

Sell Btps 1.8% Mar41

Buy Btps 2.45% Sep33 & Btps 3.85% Sep49

Looking to cover this around zero at a supply point

weights: +.3 / -1 / +.7 (all x2)

Graph:

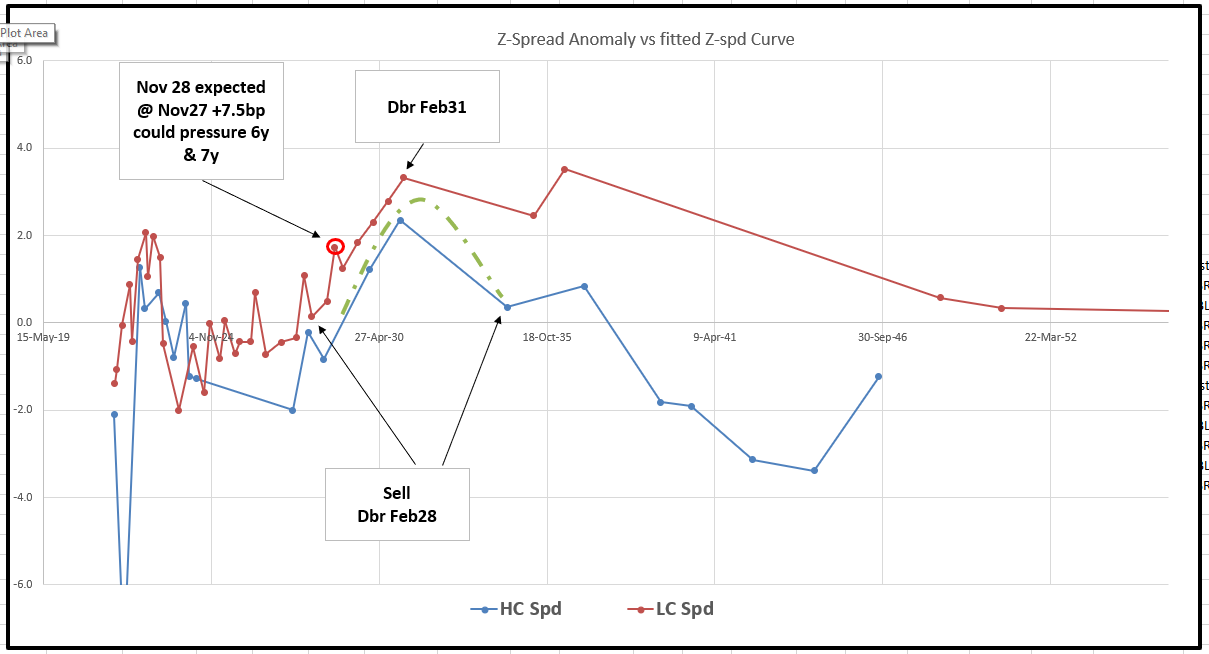

New German 7y on 27th April

Want to get short expensive, old 7y

New 10y on the 16th June, last tap on current 10y is May

Kicker / Fade

Still looking for forward rate steepeners so want to be long a bullet short wings – on the run 10y is cheap and forms our bullet

Trade:

Dbr Feb31

Sell Dbr Feb28 & Sell Dbr Jul34

Levels

+12.75bp (25%) Risk

+15bp (25% Risk)

+18bp (50% Risk)

we've really scaled this one back in terms of levels – only because we need to be at +18bp to be close to our boundary condition where the curve is so steep 7s10s and so flat 10s14s such that forward Rate Shoots up and then levelsout

So this is a bit of a structure we're gonna trade around until the new 10y in June and we don't want to be too deep into this too early. Want to be happy to add and similarly we want to have SOME of the trade on going into the 7y

As always, we use history to evaluate risk but it tells us precious little about value

"1 Future Good, 2 Futures Better"

- Eric Arthur Blair, Bond RV punter

We're seeing the French 2.75 Oct27 richen up on the curve – nominally on BBG it's listed as the current 7y

In fact the -Frtr Oct27 vs +OAT Nov30 is pretty steep – we're a fan of the French credit here and as a corollary we like flatteners in France vs Germany

Put 'em together and what have you got…?

-Frtr Oct27, +Frtr nov30

& 50% +OE/-RX

… Two Bonds & a futures curve trade

Looking for 1.5 bp correction

Or more if I can get in @ > +19bp or am in for the longer play in being long France vs Germany (≈ flattener Fr vs Ge)

Alternatively…..

If you're not so sure about the credit and were lucky enough to get short Feb28 Austria (Ragb 0.75% Feb28) from last week – then we really like

-Frtr Oct27 into +Ragb Feb28

And hence mutate our 7s9s flattener in Austria (ragb28s +Ragb30) by doing this….

-Frtr Oct27 +Ragb 28….

Have a fantastic week

Look forward to trading soon

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

STOCKS : THIS IS A KEY MONTHLY CLOSE FOR ALL OF THE MAJOR STOCKS BELOW GIVEN THE EARLY BOUNCE HAS ABATED.

STOCKS : THIS IS A KEY MONTHLY CLOSE FOR ALL OF THE MAJOR STOCKS BELOW GIVEN THE EARLY BOUNCE HAS ABATED. IF THESE STOCKS CLOSE AT OR NEAR THE CURRENT LOWS MANY WILL FORM A VERY LONG TERM TOP TECHNICALLY AND CERTAINLY HISTORICALLY.

APPLE IS OF MAJOR CONCERN GIVEN IT CLEARLY FLAGGED A TOP 2 MONTHS AND IS CLOSE TO THIS MONTHS LOWS ALREADY!

THE SINGLE STOCKS ARE MORE OF A CONCERN AS THERE IS SO MUCH OF A MISREPRESENTATION IN SOME OF THE VALUATIONS.

"THE MOST WIDELY HELD STOCKS AT MUTUAL AND HEDGE FUNDS IN 4Q 2020 WAS MICROSOFT, AMAZON AND FACEBOOK". ALL OBVIOUSLY VERY OVER EXTENDED.

TESLA, AMAZON AND APPLE ARE WORTH MORE THAN THE FINANCIALS, ENERGYAND METALS SECTORS COMBINED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

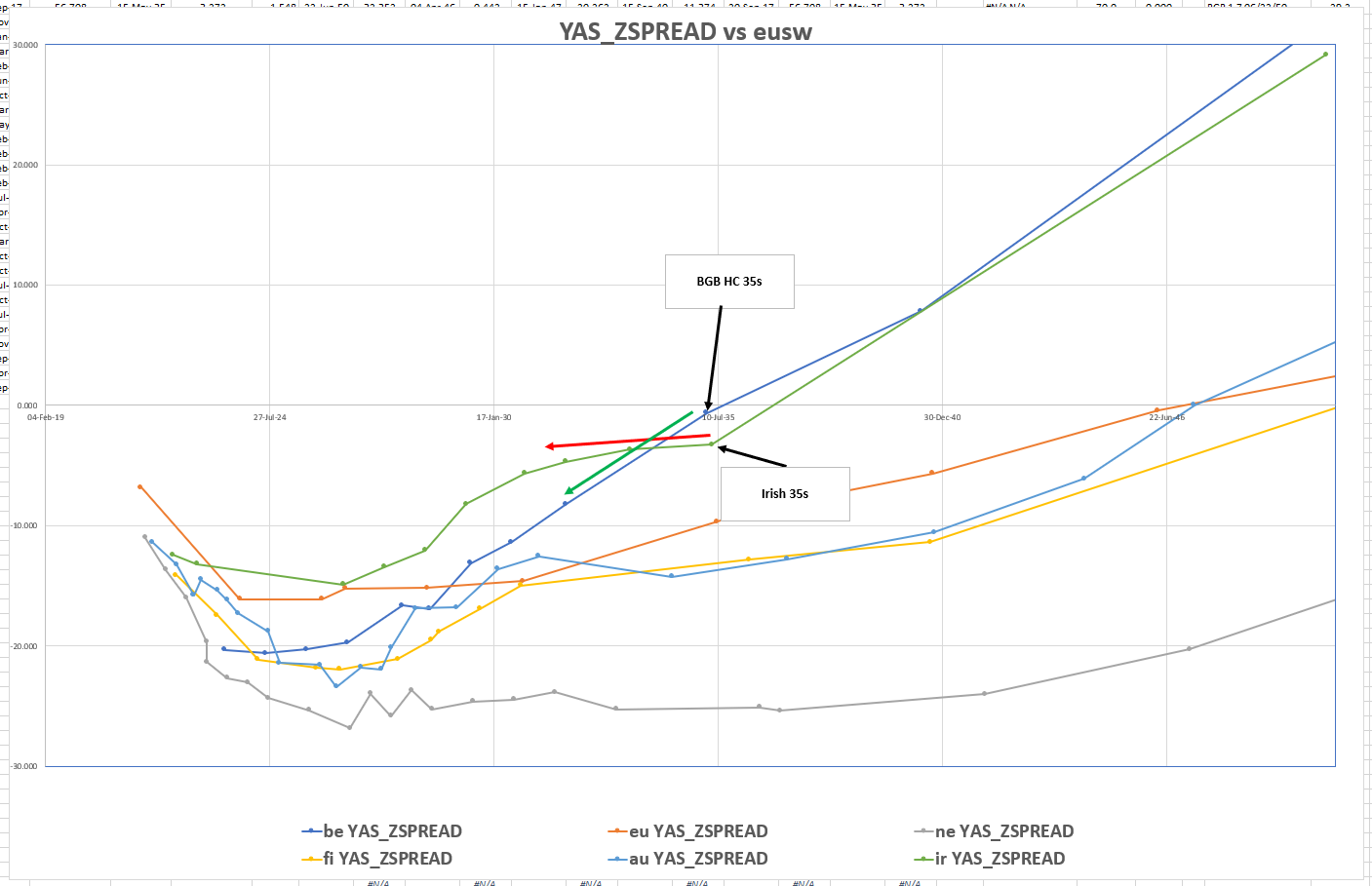

Trades & Fades. Movers & Shakers - Will & James at Astor Ridge

Belgium Supply next week 5y, 10y and 20y

Our fade is to always be trying to buy Belgium as a credit vs France or in a more micro sense a flattener in Belg vs France

this is how Belgium vs France looks on relative Z-Spreads

For the best roll we like long 15y Belg vs short 9y relative to France

We're hoping that the issuance in the 20y cheapens the old high coupon 15y

We are looking at

-9y Belg +14y Belg

Vs

35% of (+OATA -Frtr 20y)

100 * ((YIELD[BGB 5 03/28/35 Corp] - YIELD[BGB 0.1 06/22/30 Corp]) - 0.35 * (YIELD[FRTR 0.5 05/25/40 Corp] - YIELD[FRTR 2.5 05/25/30 Corp]))

Lvl: +10.3 bp

We're Looking for +11.3 for 35s to be almost as cheap as any other Belgium long tenor but still have the best roll as a box vs the 9y

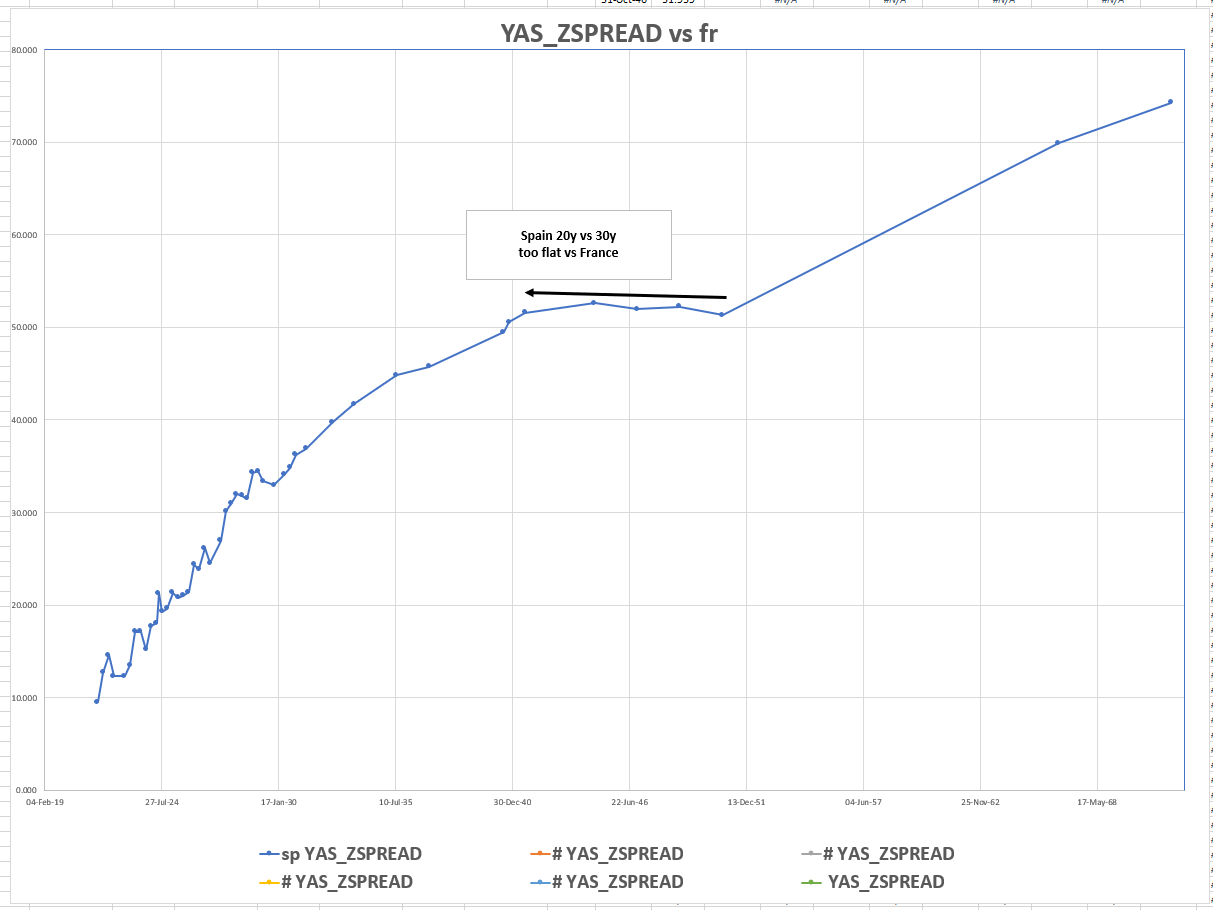

We're also watching Spain 20y vs 30y steepenenr relative to France

Have sympathy with both side of that trade but the illiquidity means we'er looking for another 1bp to get in

100 * ((YIELD[SPGB 1 10/31/50 Corp] - YIELD[SPGB 1.2 10/31/40 Corp]) - 1 * (YIELD[FRTR 0.75 05/25/52 Corp] - YIELD[FRTR 0.5 05/25/40 Corp]))

Graph of Spain on Z-Spread vs France

On our Radar is the Expensive , relatively low coupon Aug30 – all these itlaian 10 – 15y should get a shot at being CTD into IK

But Btps Dec30 is shorter in modified duration vs Aug30 & is equally cheap for delivery on a contract trading so far above par

So if Aug 30 never gets a shot at being CLEAR CTD, the only downside in being short this bond is its low coupon – which we can ameliorate somewhat buy buying the longer LC apr31 or ineed the very low coupon Aug31

Strat: We want to sell Aug30 vs its neighbours when rich and accumulate dec30 vs neighbours when cheap

2 * (yield[BTPS 0.95 08/01/30 Govt]-0.7*yield[BTPS 1.35 04/01/30 Govt]-0.3*yield[BTPS 0.9 04/01/31 Govt])*100

Level – I want to see this lower to pay this structure – something like -0.5bp to start

This will be a key theme for IKZ1 going forward

Btps -jun25 +jun26 -jun27

Looking for that to be a touch cheaper over quarter end – long slightly lower coupon in the belly than the wing average

2 * (yield[BTPS 1.6 06/01/26 Govt]-0.5*yield[BTPS 1.5 06/01/25 Govt]-0.5*yield[BTPS 2.2 06/01/27 Govt])*100

Has cash-flow value

Best

Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

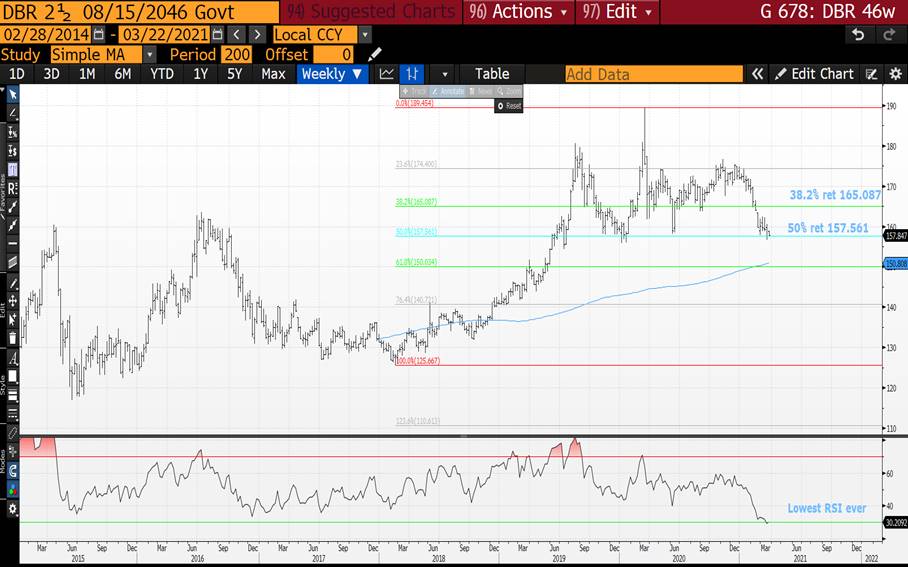

BOND UPDATE : GET READY TO PARTY LIKE 1994! THIS IS A CRUCIAL WEEK AND MONTH FOR THE NEXT QUARTER.

BOND UPDATE : GET READY TO PARTY LIKE 1994!

THIS IS A CRUCIAL WEEK AND MONTH FOR THE NEXT QUARTER. WE HAVE SEEN YIELDS RISE NOW FOR MANY WEEKS BUT AS MENTIONED PREVIOUSLY THE HISTORICAL-TECHNICAL PICTURE HIGHLIGHTS A SWATHE OF 1994 RSI EXTENSIONS, THUS THE BOND BOUNCE "IF" CONFIRMED WILL BE FASTER AND MORE SUSTAINED THAN PEOPLE EXPECT. 1994 RSI EXTENSIONS ARE VERY OBVIOUSLY EXCEPTIONAL!

ESSENTIALLY THESE TECHNICAL DISLOCATIONS ARE HISTORICALLY UNSUSTAINABLE.

IT HAS AND IS A PAINFUL WAIT BUT ACCORDING TO THE RSI DISLOCATIONS IT "WILL HAPPEN"! THESE SIGNALS WONT ABATE.

US 30YR YIELDS HAVE SEVERAL WEEKS TEASING THE 200 PERIOD WEEKLY MOVING AVERAGE 2.4530.

US 10YR YIELD RSI DISLOCATION IS THE MOST SINCE "1994"!

US BOND AND SWAP CURVES CONTINUE TO "SCREAM" FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS "OUT OF LINE" WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris